|

DRAFT FOR COMMENTS

RBI/2025-26/--

DOR.ACC.REC.No. /00-00-000/2025-26

XX, 2025

Reserve Bank of India (Payments Banks – Financial Statements: Presentation and Disclosures) Directions, 2025

In exercise of the powers conferred by Section 35A of the Banking Regulation Act, 1949, and all other provisions / laws enabling the Reserve Bank of India (‘RBI’) in this regard, RBI being satisfied that it is necessary and expedient in the public interest so to do, hereby, issues the Directions hereinafter specified.

Chapter I - Preliminary

A. Short title and commencement

1. These Directions shall be called the Reserve Bank of India (Payments Banks – Financial Statements: Presentation and Disclosures) Directions, 2025.

2. These Directions shall come into force with immediate effect.

B. Applicability

3. These Directions shall be applicable to Payments Banks (hereinafter collectively referred to as 'banks' and individually as a 'bank'), subject to licensing conditions and extant operating guidelines.

Chapter II - Balance Sheet and Profit and Loss Account

A. Format of the Balance Sheet and Profit and Loss Account

4. In terms of the provisions of Section 29 of the Banking Regulation Act, 1949, a bank shall in respect of all business transacted by it prepare a balance sheet and profit and loss account as on the last working day of the year or the period, as the case may be, in the Forms set out in the Third Schedule of the Banking Regulation Act, 1949. In exercise of the powers conferred by section 29(4) of the Banking Regulation Act, 1949, the Government of India has specified the Forms in the Third Schedule, vide notification S.O.240(E) dated March 26, 1992, published in the Gazette of India. These are reproduced in Annex I to these Directions.

B. Notes and instructions for compilation

5. A bank shall follow the general instructions for the compilation of balance sheet and profit and loss account as specified in subparagraph (1) below. A bank shall ensure strict compliance with the Accounting Standards notified under the Companies (Accounting Standards) Rules, 2021, as amended from time to time, subject to Directions / Guidelines issued by the RBI.

Note: Mere mention of an activity, transaction or item in instructions for compilation does not imply that it is permitted, and the bank shall refer to the extant statutory and regulatory requirements while determining the permissibility or otherwise of an activity or transaction.

(1) Instructions for compilation of balance sheet

| Item |

Sch |

|

Coverage |

Notes and instructions for compilation |

| Capital |

1 |

|

Nationalised Banks

Capital (Fully owned by Central Government) |

- |

| Banks incorporated outside India: Capital |

- |

Other Banks (Indian)

Authorised Capital

(__ shares of ₹ ___ each)

Issued Capital

(__ shares of ₹ ___ each)

Subscribed Capital

(__ shares of ₹ ___ each)

Called up Capital

(__ shares of ₹ ___ each)

Less: Calls unpaid

Add: Forfeited shares

Paid up Capital |

Authorised, Issued, Subscribed, Called-up capital shall be given separately. Calls in arrears will be deducted from Called-up capital while the paid-up value of forfeited shares shall be added thus arriving at the paid-up capital. Where necessary, items which can be combined shall be shown under one head, for instance ‘Issued and Subscribed Capital’.

Notes - General:

1. The changes in the above items, if any, during the year, say, fresh contribution made by Government, fresh issue of capital, capitalisation of reserves, etc. shall be explained in the notes.

2. Perpetual Non-Cumulative Preference Shares (PNCPS) included as part of Tier 1 regulatory capital shall be included here. |

| Reserves and Surplus |

2 |

(I) |

Statutory Reserves |

Reserves created out of the profits in compliance with section 17(1) (read with paragraph 13 of this Master Direction) or any other section of the Banking Regulation Act, 1949 shall be separately disclosed. |

| (II) |

Capital Reserves |

The expression ‘Capital Reserves’ shall not include any amount regarded as free for distribution through the Profit and Loss Account. Surplus on revaluation shall be treated as Capital Reserves. |

| (III) |

Share Premium |

Premium on issue of share capital shall be shown separately under this head. |

| (IV) |

Revenue and Other Reserves |

The expression ‘Revenue Reserve’ shall mean any reserve other than Capital Reserve. This item will include all reserves, other than those separately classified. The expression ‘reserve’ shall not include any amount retained by way of providing for depreciation, renewals or diminution in value of assets or retained by way of providing for any known liability. Investment Fluctuation Reserve shall be shown under this head. |

| (V) |

|

Includes balance of profit after appropriations. In case of loss the balance shall be shown as a deduction.

Notes - General:

Movements in various categories of reserves shall be shown as indicated in the schedule. |

| Deposits |

3 |

A.I) |

Demand Deposits |

|

| (i) |

From banks |

Includes all bank deposits repayable on demand. |

| (ii) |

|

Includes all demand deposits of the non-bank sectors.

Credit balances in overdrafts, deposits payable at call, overdue deposits, inoperative current accounts, matured time deposits, cash certificates and certificates of deposits, etc. shall be included under this category. |

| (II) |

Savings Bank Deposits |

Includes all savings bank deposits (including inoperative savings bank accounts) |

| B. i) |

Deposits of branches in India |

The total of these two items should match the total deposits shown in the balance sheet.

Notes - General:

1. Interest payable on deposits which is accrued but not due shall not be included but shown under other liabilities.

2. Deposits from a bank will include deposits from the banking system in India, Co-operative banks, Foreign banks which may or may not have a presence in India.

3. A bank shall disclose by way of a footnote to this schedule, the amount of deposits against which lien is marked out of the total deposits. (For current and previous year) |

| ii) |

Deposits of branches outside India |

| Borrowings |

4 |

(I) |

Borrowings in India |

|

| (i) |

RBI |

Includes repo, other borrowings or refinance obtained from RBI. |

| (ii) |

Other banks |

Includes repo, other borrowings or refinance obtained from banks (including Co-operative banks) and balances in Repo Account. |

| (iii) |

Other institutions and agencies |

Includes borrowing / refinance obtained from Export-Import Bank of India, NABARD and other institutions, agencies (including liability against participation certificates-without risk sharing, if any) and balances in Repo Account. |

| (II) |

Borrowings outside India |

Includes borrowings from outside India. |

| Secured borrowings included in above |

This item shall be shown separately. Includes secured borrowings / refinance in India and outside India. |

| |

|

Notes - General:

1. The total of I and II should match the total borrowings shown in the balance sheet.

2. Inter-office transactions shall not be shown as borrowings.

3. Refinance obtained by a bank from RBI and various institutions shall be shown under the head ‘Borrowings’. Accordingly, advances shall be shown at the gross amount on the asset side.

4. The following shall be included here:

a) Perpetual Debt Instruments

b) Tier 2 Capital Instruments / Upper Tier 2 Capital Instruments

c) Perpetual Cumulative Preference Shares (PCPS)

d) Redeemable Non-Cumulative Preference Shares (RNCPS)

e) Redeemable Cumulative Preference Shares (RCPS)

f) Subordinated Debt. |

| Other Liabilities and Provisions |

5 |

(I) |

Bills Payable |

Includes drafts, telegraphic transfers, traveller’s cheques, mail transfers payable, pay slips, bankers cheques and other miscellaneous items. |

| (II) |

Inter-office adjustments (net) |

The inter-office adjustments balance, if in credit, shall be shown under this head. The bank should first segregate the credit entries outstanding for more than 5 years in the inter-branch account and transfer them to a separate Blocked Account which should be shown under ‘Other Liabilities and Provisions - Others’. While arriving at the net amount of inter-branch transactions for inclusion here, or Schedule 11, as the case may be, the aggregate amount of Blocked Account should be excluded and only the amount representing the remaining credit entries should be netted against debit entries. Only net position of inter-office accounts shall be shown here. |

| (III) |

Interest accrued |

Includes interest accrued but not due on deposits and borrowings. |

| (IV) |

Others (including provisions) |

Includes net provision for income tax and other taxes like interest tax (less advance payment, tax deducted at source, etc.), deferred tax (if after netting as per AS 22 is a liability), floating provisions, contingency funds which are not disclosed as reserves but are actually in the nature of reserves, other liabilities which are not disclosed under any of the major heads such as unclaimed dividend, provisions and funds kept for specific purposes, unexpired discount, outstanding charges like rent, conveyance, etc. Aggregate Net Credit in the Clearing Differences transferred to a separate Blocked Account shall be shown here. Outstanding credit entries in nostro accounts transferred to Blocked Account shall also be shown here.

Notes - General:

1. For arriving at the net balance of inter-office adjustments all connected inter-office accounts shall be aggregated and the net balance only will be shown, representing mostly items in transit and unadjusted items.

2. The interest accruing on all deposits, whether the payment is due or not, shall be treated as a liability.

3. It is proposed to show only deposits under the head ‘deposits’ and hence all surplus provisions for contingency funds, etc. which are not netted off against the relative assets, shall be brought under the head ‘Others (including provisions)’.

4. Provisions towards Standard Assets shall not be netted from gross advances and shown separately as ‘Provisions against Standard Assets’ under ‘Others’ in Schedule 5 of the Balance Sheet.

5. Where any item under the ‘Others (including provisions)’ exceeds one percent of the total assets, particulars of all such items shall be disclosed in the notes to accounts. |

| ASSETS |

|

|

|

|

| Cash and balances with the RBI |

6 |

(I) |

Cash in hand (including foreign currency notes) |

Includes cash in hand including foreign currency notes. |

| (II) |

Balances with RBI

(i) in Current Account

(ii) in Other Accounts |

All type of reverse repos with the RBI including those under Liquidity Adjustment Facility shall be presented under sub-item (ii) ‘in Other Accounts’. |

| Balances with banks and money at call and short notice |

7 |

(I)

(i)

(a)

(b) |

In India

Balances with banks

in Current Accounts

in Other Deposit Accounts |

Includes all balances with banks in India (including Co-operative banks), except Money at Call and Short Notice as explained below.

Balances in current account and other deposit accounts shall be shown separately. |

(ii)

(a)

(b) |

Money at Call and Short notice

with other

institutions |

Includes the following if they are for original tenors up to and inclusive of 14 days:

(i) Money lent in the call / notice money market

(ii) Reverse Repo with banks and other institutions

The balances in Reverse Repo A/C shall be classified under Schedule 7 under item I (ii) a or I (ii) b as appropriate.

|

(II)

(i)

(ii)

(iii) |

Outside India

in Current Accounts

in Other Deposit Accounts

Money at Call and Short Notice |

Includes balances held outside India by the Indian branches of the bank.

The amounts held in ‘current accounts’ and ‘deposit accounts’ shall be shown separately.

‘Money at Call and Short Notice’ outside India includes deposits usually classified as per that foreign jurisdiction’s laws, regulations, or market practices as money at call and short notice where such money is lent. |

| Investments |

8 |

(I) |

Investments in India in |

|

| (i) |

Government securities |

Includes Central and State Government Securities and Government Treasury Bills. |

| (ii) |

Other Approved Securities |

Securities other than Government Securities, which have been specified by the RBI as ‘approved securities’ under section 5(a) of the Banking Regulation Act, 1949 shall be included here. |

| (iii) |

Shares |

Investments in shares of companies and corporations not included in item (ii) shall be included here. |

| (iv) |

Debentures and Bonds |

Investments in debentures (as defined by the Companies Act, 2013) and bonds of companies and corporations not included in item (ii) shall be included here. |

| (v) |

Subsidiaries and / or Joint Ventures |

- |

| (vi) |

Others |

Residual investments, if any, like mutual funds, gold, etc. |

| (II) |

Investments outside India |

|

| (i) |

Government Securities (including local authorities) |

All foreign Government Securities including securities issued by local authorities shall be classified under this head. |

| (ii) |

Subsidiaries and / or Joint ventures abroad |

- |

| (iii) |

Others investments |

All other investments outside India shall be shown under this head. |

| Advances |

9 |

A.(i)

(ii)

(iii) |

Bills purchased and discounted

Cash credits, overdrafts and loans repayable on demand

Term loans |

All interest-bearing loans and advances granted to bank’s own staff, in terms of the Operating Guidelines for Payments Banks dated October 6, 2016, as amended from time to time, shall be included here.

All loans to bank’s own staff in terms of the Operating Guidelines for Payments Banks dated October 6, 2016, as amended from time to time, repayable on demand and short-term loans with original maturity up to one year shall be classified under ‘Cash credits, overdrafts and loans repayable on demand’.

A ‘Term Loan’ is a loan which has a specified maturity and is payable in instalments or in bullet form. All Term Loans with maturity in excess of one year shall be classified under this category (i.e., A(iii)) whereas as explained above short term loans with original maturity up to one year shall be categorised as loans repayable on demand. |

| B.(i) |

Secured by tangible assets |

All advances or part of advances which are secured by tangible assets shall be shown here. |

| (ii) |

Covered by Bank / Government Guarantee |

- |

| (iii) |

Unsecured |

Total of ‘A’ should tally with total of ‘B’. |

C. (I)

(i)

(ii)

(iii)

(iv)

(II)

(i)

(ii)

(iii)

(iv)

(v) |

Advances in India

Priority Sectors

Public Sector

Banks

Others

Advances outside India

Due from banks

Due from others

Bills purchased and discounted

Syndicated loans

Others |

Notes - General:

The general instructions for advances granted to bank’s own staff, in terms of the Operating Guidelines for Payments Banks dated October 6, 2016, are as follows:

1. Advances shall be reported net of provisions made thereon (other than provisions towards Standard Assets). To the extent that Floating provisions have not been treated as Tier 2 capital, they shall also be netted off from advances.

2. Term loans reported shall not include loans repayable on demand.

3. Interest accrued but not due should not be reflected here. Instead, it shall be shown under ‘Interest accrued’ in other assets.

4. Reverse Repo with banks and other institutions having original tenors more than 14 days shall be shown under this Schedule under following head:

-

A.(ii) ‘Cash credits, overdrafts and loans repayable on demand’’

-

B.(i) ‘Secured by tangible assets’

-

C.(I).(iii) Banks (iv) ‘Others’ (as the case may be)

|

| Fixed Assets |

10 |

(I)

(i)

(ii)

(iii)

(iv) |

Premises

At cost as on 31st March of the preceding year

Additions during the year

Deductions during the year

Depreciation to date |

Premises, including land, wholly or partly owned by the bank for the purpose of business including residential premises shall be shown against ‘Premises’.

In the case of premises and other fixed assets, the previous balance, additions thereto and deductions therefrom during the year as also the total depreciation written off shall be shown. |

(II)

(i)

(ii)

(iii)

(iv) |

Other Fixed Assets (including furniture and fixtures)

At cost as on 31st March of the preceding year

Additions during the year

Deductions during the year

Depreciation to date |

Furniture and fixtures, vehicles and all other fixed assets shall be shown under this head. |

| Other Assets |

11 |

(I) |

Inter-office adjustments (net) |

The inter-office adjustments balance, if in debit, shall be shown under this head. Only net position of inter-office accounts shall be shown here. For arriving at the net balance of inter-office adjustment accounts, all connected inter-office accounts shall be aggregated and the net balance, if in debit only shall be shown representing mostly items in transit and unadjusted items. |

| (II) |

Interest accrued |

Interest accrued but not due on investments and advances and interest due but not collected on investments will be the main components of this item. As banks normally debit the borrowers’ account with interest due on the balance sheet date, usually there may not be any amount of interest due on advances. Only such interest as can be realised in the ordinary course shall be shown under this head. |

| (III) |

Tax paid in advance / tax deducted at source |

The amount of advance tax paid, tax deducted at source (TDS), etc. to the extent that these items are not set off against relative tax provisions shall be shown against this item. |

| (IV) |

Stationery and stamps |

Only exceptional items of expenditure on stationery like bulk purchase of security paper, loose leaf or other ledgers, etc. which are shown as quasi-asset to be written off over a period of time shall be shown here. The value shall be on a realistic basis and cost escalation shall not be taken into account, as these items are for internal use. |

| (V) |

Non-banking assets acquired in satisfaction of claims |

Immovable properties / tangible assets acquired in satisfaction of claims are to be shown under this head. |

| (VI) |

Others |

This will include items like claims which have not been met, for instance, clearing items, debit items representing addition to assets or reduction in liabilities which have not been adjusted for technical reasons, want of particulars, etc. Accrued income other than interest shall also be included here.

All non-interest-bearing loans and advances granted to the bank’s staff shall be reported here. Cash Margin Deposit with The Clearing Corporation India Limited (CCIL) shall be shown here.

Where any item under ‘Others’ exceeds one percent of the total assets, particulars of all such items shall be disclosed in the notes to accounts. |

| Contingent Liabilities |

12 |

(I) |

Claims against the bank not acknowledged as debts |

-- |

| (II) |

Liability for partly paid investments |

Liability on partly paid shares, debentures, etc. will be included in this head. |

| (III) |

Liability on account of outstanding forward exchange contracts |

Outstanding forward exchange contracts shall be included here. |

(IV)

(i)

(ii) |

Guarantees given on behalf of constituents

In India

Outside India |

- |

| (V) |

Acceptances, endorsements and other obligations |

-. |

| (VI) |

Other items for which the bank is contingently liable |

Arrears of cumulative dividends, bills rediscounted, commitments of underwriting contracts, estimated amount of contracts remaining to be executed on capital account and not provided for etc. are to be included here.

All unclaimed liabilities (where amount due has been transferred to the Depositors Education and Awareness Fund established under the Depositor Education and Awareness Fund Scheme 2014) shall be shown here.

When Issued (‘WI’) securities should be recorded in books as an off-balance sheet item till issue of the security. The off balance sheet net position in the ‘WI’ market should be marked to market scrip-wise on daily basis at the day’s closing price of the ‘WI’ security. In case the price of the ‘WI’ security is not available, the value of the underlying security determined as per extant regulations may be used instead. Depreciation, if any, should be provided for and appreciation, if any, should be ignored. On delivery, the underlying security may be classified in any of the three categories, viz; ‘Held to Maturity’, ‘Available for Sale’ or ‘FVTPL’, depending upon nature of contractual cash flow and the intent of holding, at the contracted price. |

| Bills for collection |

-- |

|

-- |

Bills and other items in the course of collection and not adjusted will be shown against this item in the summary version only. No separate schedule is proposed. |

(2) Instructions for compilation of profit and loss account

| Item |

Sch. |

|

Coverage |

Notes and Instructions for compilation |

| Interest earned |

13 |

(I) |

Interest / discount on advances / bills |

Includes interest and discount on all types of loans to its own employees out of the bank’s own funds. |

| (II) |

Income on investments |

Includes all income derived from the investment portfolio by way of interest / discount and dividend. Any discount or premium on the securities under HTM, debt securities under AFS and FVTPL (where contractual cash flow meets criterion for solely payment of principle and interest), shall be amortised over the remaining life of the instrument. The amortised amount shall be reflected in the financial statements under item II ‘Income on Investments’ of Schedule 13:‘Interest Earned’ with a contra in Schedule 8:’Investments’. |

| (III) |

Interest on balances with RBI and other Inter-bank funds |

Includes interest on balances with RBI and other banks, call loans, money market placements, etc. |

| (IV) |

Others |

Includes any other interest / discount income not included in the above heads. |

| |

|

Notes: General

The balances in Reverse Repo Interest Income Account shall be classified under Schedule 13 (under item III or IV as appropriate). |

| Other Income |

14 |

(I) |

Commission, Exchange and Brokerage |

Includes all remuneration on services such as commission on collections, commission / exchange on remittances and transfers, letting out of lockers, commission on Government business, commission on other permitted agency business including consultancy and other services, brokerage, etc., on securities. It does not include foreign exchange income.

Payments Banks shall disclose particulars of all such items in the notes to accounts wherever any item under this head exceeds one percent of total income. |

(II)

(III)

(IV) |

Profit on sale of investments

Less: Loss on sale of investments

Profit on revaluation of investments

Less: Loss on revaluation of investments

Profit on sale of land, buildings and other assets Less: Loss on sale of land, buildings and other assets |

Includes profit / loss on sale of securities, furniture, land and building, motor vehicles, gold, silver, etc. Only the net position shall be shown. If the net position is a loss, the amount shall be shown as a deduction.

The net profit / loss on revaluation of investments. Provision for non-performing investments (NPI) shall not be shown here and instead reflected under Provisions and Contingencies. |

| (V) |

Profit on exchange transactions

Less: Loss on exchange transactions |

Includes profit / loss on dealing in foreign exchange, all income earned by way of foreign exchange, commission and charges on foreign exchange transactions excluding interest which will be shown under interest head. Only the net position shall be shown. If the net position is a loss, it is to be shown as a deduction. |

| (VI) |

Income earned by way of dividend etc. from subsidiaries, companies, joint ventures abroad / in India |

|

| (VII) |

Miscellaneous income |

Includes income from bank’s properties, security charges, insurance etc. and any other miscellaneous income. In case any item under this head exceeds one percent of the total income, particulars shall be given in the notes. |

| Interest expended |

15 |

(I) |

Interest on deposits |

Includes interest paid on all types of deposits including deposits from banks and other institutions. |

| (II) |

Interest on RBI / inter-bank borrowings |

Includes discount / interest on all borrowings and refinance from RBI and other banks. |

| (III) |

Others |

Includes discount / interest on all borrowings / refinance from financial institutions. All other payments like interest on participation certificates, penal interest paid, etc. shall also be included here. |

| |

|

Notes: General

1. The balances in Repo Interest Expenditure Account shall be classified under Schedule 15 (under item II or III as appropriate).

2. While acquiring government and other approved securities, banks should not capitalise the broken period interest paid to seller as part of cost of the investment, but instead book it as an expense. |

| Operating Expenses |

16 |

(I) |

Payments to and provisions for employees |

Includes staff salaries / wages, allowances, bonus, other staff benefits like provident fund, pension, gratuity, liveries to staff, leave fare concessions, staff welfare, medical allowance to staff, etc. |

| (II) |

Rent, taxes and lighting |

Includes rent paid by the banks on buildings, municipal and other taxes paid (excluding income tax and interest tax), electricity and other similar charges and levies. House rent allowance and other similar payments to staff shall appear under the head ‘Payments to and provisions for employees’. |

| (III) |

Printing and stationery |

Includes books and forms and stationery items used by the bank and other printing charges which are not incurred by way of publicity expenditure. |

| (IV) |

Advertisement and publicity |

Includes expenditure incurred by the bank for advertisement and publicity purposes including printing charges of publicity material. |

| (V) |

Depreciation on bank’s property |

Includes depreciation on bank’s own property, cars and other vehicles, furniture, electric fittings, vaults, lifts, leasehold properties, non-banking assets, etc. |

| (VI) |

Directors’ fees, allowances and expenses |

Includes sitting fees, allowances and all other expenses incurred on behalf of directors. The daily allowance, hotel charges, conveyance charges, etc. which though in the nature of reimbursement of expenses incurred shall be included under this head. Similar expenses of Local Board members, committees of the Board, etc. shall also be included under this head. |

| (VII) |

Auditors’ fees and expenses (including branch auditors’ fees) |

Includes the fees paid to the statutory auditors and branch auditors for professional services rendered and all expenses for performing their duties, even though they may be in the nature of reimbursement of expenses. If external auditors have been appointed by banks themselves for internal inspections and audits and other services, the expenses incurred in that context including fees should not be included under this head but shall be shown under ‘other expenditure’. |

| (VIII) |

Law charges |

All legal expenses and reimbursement of expenses incurred in connection with legal services shall be included here. |

| (IX) |

Postage, Telegrams, Telephones, etc. |

Includes all postal charges like stamps, telephones, etc. |

| (X) |

Repairs and maintenance |

Includes repairs to bank’s property, their maintenance charges, etc. |

| (XI) |

Insurance |

Includes insurance charges on bank’s property, insurance premia paid to DICGC, etc. to the extent they are not recovered from the concerned parties. |

| (XII) |

Other expenditure |

All expenses other than those not included in any of the other heads like licence fees, donations, subscriptions to papers, periodicals, entertainment expenses, travel expenses, etc. shall be included under this head. In case any particular item under this head exceeds one percent of the total income, particulars shall be given in the notes. |

| Provisions and Contingencies |

|

|

|

Includes all provisions made for bad and doubtful debts, provisions for taxation, provisions for non-performing investments, transfers to contingencies and other similar items. |

C. Guidance on specific issues with respect to certain Accounting Standards

6. A bank shall also be guided by the following with respect to relevant issues in the application of certain Accounting Standards for the bank:

(1) Accounting Standard 5 - Net Profit or Loss for the Period, Prior Period Items and Changes in Accounting Policies

(i) The objective of this standard is to prescribe the classification and disclosure of certain items in the statement of profit and loss so that all enterprises prepare and present such a statement on a uniform basis.

(ii) Accordingly, this Standard requires the classification and disclosure of extraordinary and prior period items, and the disclosure of certain items within profit or loss from ordinary activities. It also specifies the accounting treatment for changes in accounting estimates and the disclosures to be made in the financial statements regarding changes in accounting policies.

(iii) Paragraph 4.3 of Preface to the Statements on Accounting Standards issued by the ICAI states that Accounting Standards are intended to apply only to items which are material. Since materiality is not objectively defined, it has been decided that all banks should ensure compliance with the provisions of the Accounting Standard in respect of any item of prior period income or prior period expenditure which exceeds one percent of the total income / total expenditure of the bank if the income / expenditure is reckoned on a gross basis or one percent of the net profit before taxes or net losses as the case may be if the income is reckoned net of costs.

(iv) Since the format of the profit and loss accounts of a bank prescribed in Form B under Third Schedule to the Banking Regulation Act, 1949 does not specifically provide for disclosure of the impact of prior period items on the current year’s profit and loss, such disclosures, wherever warranted, may be made in the ‘Notes on Accounts’ to the balance sheet of a bank.

(2) Accounting Standard 9 – Revenue Recognition

(i) Non-recognition of income by the bank in case of non-performing advances and non-performing investments, in compliance with the regulatory prescriptions of the RBI, shall not attract a qualification by the statutory auditors as this would be in conformity with provisions of the standard, as it recognises postponement of recognition of revenue where collectability of the revenue is significantly uncertain.

(3) Accounting Standard 11 - The Effects of Changes in Foreign Exchange Rates

AS 11 is applied in the context of the accounting for transactions in foreign currencies. The issues that arise in this context have been identified and a bank shall be guided by the following while complying with the provisions of the standard:

(i) Exchange rate for recording foreign currency transactions

(a) As per paragraphs 9 and 21 of the Standard, a foreign currency transaction shall be recorded, on initial recognition in the reporting currency, by applying to the foreign currency amount the exchange rate between the reporting currency and the foreign currency at the date of the transaction. A bank may face difficulty in applying the exchange rate prevailing at the date of the transaction in respect of the items which are not being recorded in Indian Rupees or are currently being recorded using a notional exchange rate.

(b) A bank, which is in a position to apply the exchange rate prevailing on the date of the transaction for recording the foreign currency transactions as required under AS 11 shall comply with the requirements. A bank, which has an extensive branch network, have a high volume of foreign currency transactions and is not fully equipped on the technology front shall be guided by the following:

(i) Paragraph 10 of the Standard allows, for practical reasons, the use of a rate that approximates the actual rate at the date of the transaction The Standard also states that if exchange rates fluctuate significantly, the use of average rate for a period is unreliable. Since the enterprises are required to record the transactions at the date of the occurrence thereof, the weekly average closing rate of the preceding week can be used for recording the transactions occurring in the relevant week, if the same approximates the actual rate at the date of the transaction. In view of the practical difficulties which a bank may have in applying the exchange rates at the dates of the transactions and since the Standard allows the use of a rate that approximates the actual rate at the date of the transaction, the bank may use average rates as detailed below:

(ii) FEDAI publishes a weekly average closing rate at the end of each week and a quarterly average closing rate at the end of each quarter for various currencies.

(iii) If the weekly average closing rate of the preceding week does not approximate the actual rate at the date of the transaction, the closing rate at the date of the transaction shall be used. For this purpose, the weekly average closing rate of the preceding week would not be considered approximating the actual rate at the date of the transaction if the difference between (A) the weekly average closing rate of the preceding week and (B) the exchange rate prevailing at the date of the transaction, is more than three and a half percent of (B).

(iv) A bank is encouraged to equip itself to record the foreign currency transactions at the exchange rate prevailing on the date of the transaction.

(ii) Closing rate

(a) Paragraph 7 of the Standard defines ‘Closing rate’ as the exchange rate at the balance sheet date.

(b) In order to ensure uniformity among banks, closing rate to be applied for the purposes of AS 11 (revised 2003) for the relevant accounting period would be the last closing spot rate of exchange announced by FEDAI for that accounting period.

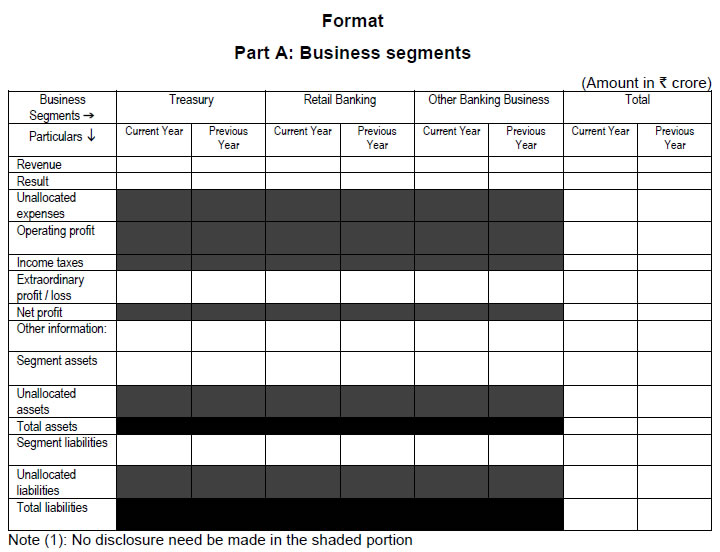

(4) Accounting Standard 17 – Segment Reporting

The indicative formats for disclosure under ‘AS 17 – Segment Reporting’ are as below.

Note (2):

a) The business segments will be ‘Treasury’, ‘Retail Banking’ and ‘Other banking operations’.

b) ‘A bank shall adopt their own methods, on a reasonable and consistent basis, for allocation of expenditure among the segments.

c) ‘Treasury’ shall include the entire investment portfolio.

d) Retail Banking shall include exposures which fulfil the four criteria of orientation, product, granularity, and low value of individual exposures for retail exposures laid down in Reserve Bank of India (Payments Banks – Prudential Norms on Capital Adequacy) Directions, 2025. Individual housing loans will also form part of Retail Banking segment for the purpose of reporting under AS-17.

e) Other Banking Business includes all other banking operations not covered under ‘Treasury, and 'Retail Banking' segments. It shall also include all other residual operations such as para banking transactions / activities.

f) Besides the above-mentioned segments, a bank shall report additional segments within ‘Other Banking Business’ which meet the quantitative criterion prescribed in the AS 17 for identifying reportable segments.

(5) Accounting Standard 18 – Related Party Disclosures

The manner of disclosures required by paragraphs 23 to 26 of AS 18 is illustrated as below. It may be noted that the format given below is merely illustrative in nature and is not exhaustive.

| (Amount in ₹ crore) |

| Items / Related Party |

Parent

(as per ownership or control) |

Key Management Personnel |

Relatives of Key Management Personnel |

Total |

| Borrowings# |

|

|

|

|

| Deposits# |

|

|

|

|

| Placement of deposits# |

|

|

|

|

| Advances# |

|

|

|

|

| Investments# |

|

|

|

|

| Non-funded commitments# |

|

|

|

|

| Leasing / HP arrangements availed# |

|

|

|

|

| Leasing / HP arrangements provided# |

|

|

|

|

| Purchase of fixed assets |

|

|

|

|

| Sale of fixed assets |

|

|

|

|

| Interest paid |

|

|

|

|

| Interest received |

|

|

|

|

| Rendering of services* |

|

|

|

|

| Receiving of services* |

|

|

|

|

| Management contracts* |

|

|

|

|

#The outstanding at the year end and the maximum during the year are to be disclosed

*Contract services etc. and not services like remittance facilities, locker facilities etc. |

Note:

i) Related parties for a bank are its parent, subsidiary(ies), associates / joint ventures, Key Management Personnel (KMP) and relatives of KMP. KMP are the whole-time directors for an Indian bank. Relatives of KMP would be on the lines indicated in Section 45S of the RBI Act, 1934

ii) The name and nature of related party relationship shall be disclosed, irrespective of whether there have been transactions, where control exists within the meaning of the Standard. Control would normally exist in case of parent-subsidiary relationship. The disclosures may be limited to aggregate for each of the above related party categories and would pertain to the year-end position as also the maximum position during the year.

iii) The Accounting Standards is applicable to all nationalised banks. The accounting standard exempts state-controlled enterprises i.e., nationalised banks from making any disclosures pertaining to their transactions with other related parties which are also state controlled enterprises. Thus, a nationalised bank need not disclose its transactions with the subsidiaries as well as the RRBs sponsored by it. However, it shall be required to disclose its transactions with other related parties.

iv) Secrecy provisions: If in any of the above category of related parties there is only one related party entity, any disclosure would tantamount to infringement of customer confidentiality. In terms of AS 18, the disclosure requirements do not apply in circumstances when providing such disclosures would conflict with the reporting enterprise’s duties of confidentiality as specifically required in terms of statute, by regulator or similar competent authority. Further, in case a statute or regulator governing an enterprise prohibits the enterprise from disclosing certain information, which is required to be disclosed, non-disclosure of such information would not be deemed as non-compliance with the Accounting Standards. On account of the judicially recognised common law duty of a bank to maintain the confidentiality of the customer details, it need not make such disclosures. In view of the above, where the disclosures under the Accounting Standards are not aggregated disclosures in respect of any category of related party i.e., where there is only one entity in any category of related party, a bank need not disclose any details pertaining to that related party other than the relationship with that related party.

(6) Accounting Standard 24 - Discontinuing operations

(i) This Standard establishes principles for reporting information about discontinuing operations.

(ii) Merger / closure of branches of a bank by transferring the assets / liabilities to the other branches of the same bank may not be deemed as a discontinuing operation and hence this Accounting Standard will not be applicable to merger / closure of branches of a bank by transferring the assets / liabilities to the other branches of the same bank.

(iii) Disclosures shall be required under the Standard only when: (a) discontinuing of the operation has resulted in shedding of liability and realisation of the assets by the bank or decision to discontinue an operation which will have the above effect has been finalised by the bank and (b) the discontinued operation is substantial in its entirety.

(7) Accounting Standard 25 – Interim Financial Reporting

(i) This Standard prescribes the minimum content of an interim financial report and the principles for recognition and measurement in a complete or condensed financial statements for an interim period.

(ii) The disclosures required to be made by listed banks in terms of the listing agreements would not tantamount to interim reporting as envisaged under AS 25 and as such AS 25 is not mandatory for the quarterly reporting prescribed for listed banks.

(iii) The recognition and measurement principles laid down under AS 25 shall however, be complied with in respect of such quarterly reports.

(8) Accounting Standard 26 – Intangible asset

(i) This Standard prescribes the accounting treatment for intangible assets that are not dealt with specifically in another accounting standard.

(ii) With respect to computer software which has been customised for the bank’s use and is expected to be in use for some time, the detailed recognition and amortisation principle in respect of computer software prescribed in the Standard adequately addresses these issues and may be followed by banks.

(iii) It may be noted that intangible assets recognised and carried in the balance sheet of a bank in compliance with AS 26 shall attract provisions of section 15(1) of the Banking Regulation Act 1949, in terms of which a bank is prohibited from declaring any dividend until any expenditure not represented by tangible assets is carried in the balance sheet.

(iv) A bank desirous of paying dividend while carrying any intangible assets in its books must seek exemption from section 15(1) of the Banking Regulation Act, 1949 from the Central Government.

(9) Accounting Standard 28 – Impairment of assets

(i) This standard prescribes the procedures that an enterprise applies to ensure that its assets are carried at no more than their recoverable amount.

(ii) It is clarified that the standard shall not apply to inventories, investments and other financial assets such as loans and advances and shall generally be applicable to a bank in so far as it relates to fixed assets.

(iii) The Standard shall generally apply to financial lease assets and non-banking assets acquired in settlement of claims only when the indications of impairment of the entity are evident.

Chapter III - Disclosure in Financial Statements – Notes to Accounts

7. A bank shall disclose information as specified in this chapter in the notes to accounts of the financial statements.

Explanation 1: These disclosures are intended only to supplement and not to replace disclosure requirements under other laws, regulations, or accounting and financial reporting standards.

Explanation 2: A bank is encouraged to make disclosures that are more comprehensive than the minimum required under these Directions, especially if such disclosures significantly aid in the understanding of the financial position and performance.

A. General

8. The items listed in these Directions shall be disclosed in the ‘Notes to Accounts’ to the financial statements. A bank shall make additional disclosures where material.

B. Presentation

9. In addition to the schedules to the balance sheet, a summary of ‘significant accounting policies’ and ‘notes to accounts’ shall be disclosed as separate Schedules.

C. Disclosure requirements

10. A bank shall, at the minimum, furnish the following information in the ‘notes to accounts’. The bank shall note that mere mention of an activity, transaction or item in the disclosure template does not imply that it is permitted, and the bank shall refer to the extant statutory and regulatory requirements while determining the permissibility or otherwise of an activity or transaction. The bank shall disclose comparative information in respect of the previous period for all amounts reported in the current period’s financial statements. Further, the bank shall include comparative information for narrative and descriptive information if it is relevant to understanding the current period’s financial statements.

(1) Regulatory capital

(i) Composition of regulatory capital

| (Amount in ₹ crore) |

| Sr. No. |

Particulars |

Current Year |

Previous Year |

| i) |

Common Equity Tier 1 capital (CET 1) (net of deductions, if any) |

|

|

| ii) |

Additional Tier 1 capital |

|

|

| iii) |

Tier 1 capital (i + ii) |

|

|

| iv) |

Tier 2 capital |

|

|

| v) |

Total capital (Tier 1+Tier 2) |

|

|

| vi) |

Total Risk Weighted Assets (RWAs) |

|

|

| vii) |

CET 1 Ratio (CET 1 as a percentage of RWAs) |

|

|

| viii) |

Tier 1 Ratio (Tier 1 capital as a percentage of RWAs) |

|

|

| ix) |

Tier 2 Ratio (Tier 2 capital as a percentage of RWAs) |

|

|

| x) |

Capital to Risk Weighted Assets Ratio (CRAR) (Total Capital as a percentage of RWAs) |

|

|

| xi) |

Leverage Ratio |

|

|

| xii) |

Amount of paid-up equity capital raised during the year |

|

|

| xiii) |

Amount of non-equity Tier 1 capital raised during the year, of which:

Give list* as per instrument type (perpetual non-cumulative preference shares, perpetual debt instruments, etc.). A bank shall also specify if the instruments are Basel II or Basel III compliant. |

|

|

| xiv) |

Amount of Tier 2 capital raised during the year, of which

Give list* as per instrument type (perpetual cumulative preference shares, debt capital instruments, etc.). A bank shall also specify if the instruments are Basel II or Basel III compliant. |

|

|

| * Example: A bank may disclose as under |

| |

Current year |

Previous year |

| Amount of non-equity Tier 1 / Tier 2 capital raised during the year of which: |

### |

### |

a) Basel II / III compliant instruments (specify the instrument issued)

b) Basel II / III compliant instruments (specify the instrument issued) |

###

### |

###

### |

(ii) Draw down from Reserves: Suitable disclosures mentioning the amount and the rationale for withdrawal shall be made regarding any draw down from reserves.

(2) Asset liability management

(i) Maturity pattern of certain items of assets and liabilities

| (Amount in ₹ crore) |

| |

Day 1 |

2 to 7 days |

8 to 14 days |

15 to 30 days |

31 days to 2 months |

Over 2 months and to 3 months |

Over 3 months and up to 6 Months |

Over 6 months and up to 1 year |

Over 1 year and up to 3 years |

Over 3 years and up to 5 years |

Over 5 years |

Total |

| Deposits* |

|

|

|

|

|

|

|

|

|

|

|

|

| Advances |

|

|

|

|

|

|

|

|

|

|

|

|

| Investments |

|

|

|

|

|

|

|

|

|

|

|

|

| Borrowings |

|

|

|

|

|

|

|

|

|

|

|

|

| Foreign Currency assets |

|

|

|

|

|

|

|

|

|

|

|

|

| Foreign Currency liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

(3) Investments

(i) Composition of investment portfolio

| (all amounts in ₹ crore) |

| |

Current Year |

Previous Year |

| HTM |

AFS |

FVTPL |

HTM |

AFS |

FVTPL |

| At cost |

Fair Value |

HFT |

non-HFT |

At cost |

Fair Value |

|

HFT |

non-HFT |

| I. Investments in India |

|

|

|

|

|

|

|

|

|

|

| (i) Government securities |

|

|

|

|

|

|

|

|

|

|

| (ii) Other approved securities |

|

|

|

|

|

|

|

|

|

|

| (iii) Shares |

|

|

|

|

|

|

|

|

|

|

| (iv) Debentures and Bonds |

|

|

|

|

|

|

|

|

|

|

| (v) Others |

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

|

|

|

|

|

|

|

|

| Less: Provisions for impairment / NPI |

|

|

|

|

|

|

|

|

|

|

| Net |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| II. Investments outside India |

|

|

|

|

|

|

|

|

|

|

| (i) Government securities (including local authorities) |

|

|

|

|

|

|

|

|

|

|

| (ii) Other investments |

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

|

|

|

|

|

|

|

|

| Less: Provisions for impairment / NPI |

|

|

|

|

|

|

|

|

|

|

| Net |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Total investments (I+II) |

|

|

|

|

|

|

|

|

|

|

(ii) Fair value hierarchy of investment portfolio measured at fair value on balance sheet

| (In ₹ Crore) |

| |

Current Year |

Previous Year |

| AFS |

FVTPL |

AFS |

FVTPL |

| Level 1 |

Level 2 |

Level 3 |

Total |

Level 1 |

Level 2 |

Level 3 |

Total |

Level 1 |

Level 2 |

Level 3 |

Total |

Level 1 |

Level 2 |

Level 3 |

Total |

| I. Investments in India |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (i) Government securities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (ii) Other approved securities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (iii) Shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (iv) Debentures and Bonds |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (v) Others |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| II. Investments outside India |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (i) Government securities (including local authorities) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (ii) Other investments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total investments (I+II) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(iii) Net gains / (losses) on Level 3 financial instruments recognised in AFS-Reserve and Profit and Loss Account

| |

Current Year |

Previous Year |

| Recognised in AFS-Reserve |

|

|

| Recognised in Profit and Loss Account |

|

|

Note: This disclosure shall exclude Level 3 assets where the valuation of the asset is the price declared by FBIL / FIMMDA for that asset.

(iv) Details of sales made out of HTM

Details of sales made out of HTM shall be disclosed in the notes to accounts of the financial statements as per the format mentioned below.

| (all amounts in ₹ crore) |

| |

|

Current Year |

Previous Year |

| A |

Opening carrying value of securities in HTM |

|

|

| B |

Carrying value of all HTM securities sold during the year |

|

|

| C |

Less: Carrying values of securities sold under situations exempted from regulatory limit* |

|

|

| D |

Carrying value of securities sold (D=B-C) |

|

|

| E |

Securities sold as a percentage of opening carrying value of securities in HTM (E=D÷A) |

|

|

| F |

Amount transferred to Capital Reserve in respect of HTM securities which were sold at a gain |

|

|

| *In any financial year, the carrying value of investments sold out of HTM shall not exceed five percent of the opening carrying value of the HTM portfolio. The five percent threshold referred to above shall exclude sale of securities in the situations given under the Reserve Bank of India (Payments Banks - Classification, Valuation and Operation of Investment Portfolio) Directions, 2025. |

(v) Movement of provisions for non-performing investments (NPIs) and investment fluctuation reserve

| (Amount in ₹ crore) |

| Particulars |

Current Year |

Previous Year |

|

i) Movement of provisions held towards NPIs

a) Opening balance

b) Add: Provisions made during the year

c) Less: Write off / write back of excess provisions during the year

d) Closing balance

ii) Movement of Investment Fluctuation Reserve

a) Opening balance

b) Add: Amount transferred during the year

c) Less: Drawdown

d) Closing balance

iii) Closing balance in IFR as a percentage of closing balance of investments in AFS and HFT category.

|

|

|

(vi) Non-SLR investment portfolio

(a) Non-performing non-SLR investments

| (Amount in ₹ crore) |

| Sr. No. |

Particulars |

Current Year |

Previous Year |

| a) |

Opening balance |

|

|

| b) |

Additions during the year since 1st April |

|

|

| c) |

Reductions during the above period |

|

|

| d) |

Closing balance |

|

|

| e) |

Total provisions held |

|

|

(b) Issuer composition of non-SLR investments

| (Amount in ₹ crore) |

| Sr. No. |

Issuer |

Amount |

Extent of Private Placement |

Extent of ‘Below Investment Grade’ Securities |

Extent of ‘Unrated’ Securities |

Extent of ‘Unlisted’ Securities |

| (1) |

(2) |

(3) |

(4) |

(5) |

(6) |

(7) |

| |

|

Current year |

Previous Year |

Current year |

Previous Year |

Current year |

Previous Year |

Current year |

Previous Year |

Current year |

Previous Year |

| a) |

PSUs |

|

|

|

|

|

|

|

|

|

|

| b) |

FIs |

|

|

|

|

|

|

|

|

|

|

| c) |

Banks |

|

|

|

|

|

|

|

|

|

|

| d) |

Private Corporates |

|

|

|

|

|

|

|

|

|

|

| f) |

Others |

|

|

|

|

|

|

|

|

|

|

| g) |

Provision held towards NPIs |

|

|

|

|

|

|

|

|

|

|

| |

Total |

|

|

|

|

|

|

|

|

|

|

Note:

1. For a bank, the Total under column 3 shall match with the sum of total of Investments included under the following categories in Schedule 8 to the balance sheet:

a) Investment in India in

i) Shares

ii) Debentures and Bonds

a. Subsidiaries and /or Joint Ventures

b. Others

b) Investment outside India in (where applicable)

i) Government securities (including local authorities)

ii) Subsidiaries and / or joint ventures abroad

iii) Other investments

2. Amounts reported under columns 4, 5, 6 and 7 above may not be mutually exclusive.

(vii) Repo transactions (in face value and market value terms)

| (Amount in ₹ crore) |

| |

Minimum outstanding during the year |

Maximum outstanding during the year |

Daily average outstanding during the year |

Outstanding as on March 31 |

| |

FV |

MV |

FV |

MV |

FV |

MV |

FV |

MV |

i) Securities sold under repo

a) Government securities

b) Corporate debt securities

c) Any other securities |

|

|

|

|

|

|

|

|

ii) Securities purchased under reverse repo

a) Government securities

b) Corporate debt securities

c) Any other securities |

|

|

|

|

|

|

|

|

Note:

(i) ‘FV’ means Face Value and ‘MV’ means Market Value.

(ii) The disclosure shall be as specified in Repurchase Transactions (Repo) (Reserve Bank) Directions, 2018 as amended from time to time. For ease of reference the disclosure template as on the date of issuance of this Master Direction has been reproduced here.

Government Security Lending (GSL) transactions (in market value terms)

As at … (current year balance sheet date)

| (Amount in ₹ crore) |

| |

Minimum outstanding during the year |

Maximum outstanding during the year |

Daily average outstanding during the year |

Total volume of transactions during the year |

Outstanding as on March 31 |

| Securities lent through GSL transactions |

|

|

|

|

|

| Securities borrowed through GSL transactions |

|

|

|

|

|

| Securities placed as collateral under GSL transactions |

|

|

|

|

|

| Securities received as collateral under GSL Transactions |

|

|

|

|

|

As at … (previous year balance sheet date)

| (Amount in ₹ crore) |

| |

Minimum outstanding during the year |

Maximum outstanding during the year |

Daily average outstanding during the year |

Total volume of transactions during the year |

Outstanding as on March 31 |

| Securities lent through GSL transactions |

|

|

|

|

|

| Securities borrowed through GSL transactions |

|

|

|

|

|

| Securities placed as collateral under GSL Transactions |

|

|

|

|

|

| Securities received as collateral under GSL Transactions |

|

|

|

|

|

Note: The disclosure shall be as specified in Reserve Bank of India (Government Securities Lending) Directions, 2023, as amended from time to time. For ease of reference the disclosure template as on the date of issuance of this Direction has been reproduced here.

(4) Asset quality

(i) Fraud accounts: A bank shall make disclose details on the number and amount of frauds as well as the provisioning thereon as per template given below.

| |

Current year |

Previous year |

| Number of frauds reported |

|

|

| Amount involved in fraud (₹ crore) |

|

|

| Amount of provision made for such frauds (₹ crore) |

|

|

| Amount of unamortised provision debited from ‘other reserves’ as at the end of the year (₹ crore) |

|

|

(5) Exposures

(i) Exposure to capital market

| (Amount in ₹ crore) |

| Particulars |

Current Year |

Previous Year |

| i) Direct investment in equity shares, convertible bonds, convertible debentures and units of equity oriented mutual funds the corpus of which is not exclusively invested in corporate debt; |

|

|

| ii) Other (please specify) |

|

|

| Total exposure to capital market |

|

|

(ii) Risk category-wise country exposure

| (Amount in ₹ crore) |

| Risk Category* |

Exposure (net) as at March…

(Current Year) |

Provision held as at March…

(Current Year) |

Exposure (net) as at March…

(Previous Year) |

Provision held as at March…

(Previous Year) |

| Insignificant |

|

|

|

|

| Low |

|

|

|

|

| Moderately Low |

|

|

|

|

| Moderate |

|

|

|

|

| Moderately High |

|

|

|

|

| High |

|

|

|

|

| Very High |

|

|

|

|

| Total |

|

|

|

|

| *Till a bank moves over to internal rating systems, it shall use the seven-category classification followed by Export Credit Guarantee Corporation of India Ltd. (ECGC) for the purpose of classification and making provisions for country risk exposures. ECGC shall provide to a bank, on request, quarterly updates of their country classifications and shall also inform banks in case of any sudden major changes in country classification in the interim period. |

Note: If a bank has no exposure to country risk in both the current and previous year, it may omit disclosure of the table while mentioning that it has no exposure to country risk.

(6) Derivatives

(i) Details of derivative portfolio

| (all amounts in ₹ crore) |

| |

Current year |

Previous Year |

| |

Level 1 |

Level 2 |

Level 3 |

Level 1 |

Level 2 |

Level 3 |

| Interest Rate Derivatives |

|

|

|

|

|

|

| MTM – Assets |

|

|

|

|

|

|

| MTM – Liabilities |

|

|

|

|

|

|

| Net Gain / Loss recognised in Profit &Loss Account |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Exchange Rate Derivatives |

|

|

|

|

|

|

| MTM – Assets |

|

|

|

|

|

|

| MTM – Liabilities |

|

|

|

|

|

|

| Net Gain / Loss recognised in Profit &Loss Account |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Other Derivatives (specify) |

|

|

|

|

|

|

| MTM – Assets |

|

|

|

|

|

|

| MTM – Liabilities |

|

|

|

|

|

|

| Net Gain / Loss recognised in Profit &Loss Account |

|

|

|

|

|

|

(ii) Forward rate agreement / Interest rate swap

| (Amount in ₹ crore) |

| Particulars |

Current Year |

Previous Year |

i) The notional principal of swap agreements

ii) Losses which would be incurred if counterparties failed to fulfil their obligations under the agreements

iii) Collateral required by the bank upon entering into swaps

iv) Concentration of credit risk arising from the swaps (for example, exposures to particular industries, or swaps with highly geared companies.)

v) The fair value of the swap book

(Note - If the swaps are linked to specific assets, liabilities, or commitments, the fair value shall be the estimated amount that the bank would receive or pay to terminate the swap agreements as on the balance sheet date. For a trading swap the fair value shall be its mark to market value) |

|

|

Note: Nature and terms of the swaps including information on credit and market risk and the accounting policies adopted for recording the swaps shall also be disclosed.

(iii) Exchange traded interest rate derivatives

| (Amount in ₹ crore) |

| Sr. No. |

Particulars |

Current Year |

Previous Year |

| i) |

Notional principal amount of exchange traded interest rate derivatives undertaken during the year (instrument wise) |

|

|

| ii) |

Notional principal amount of exchange traded interest rate derivatives outstanding as on 31st March ….(instrument wise) |

|

|

| iii) |

Notional principal amount of exchange traded interest rate derivatives outstanding and not ‘highly effective’ (instrument wise) |

|

|

| iv) |

Mark to market value of exchange traded interest rate derivatives outstanding and not ‘highly effective’ (instrument wise) |

|

|

(iv) Disclosures on risk exposure in derivatives

(a) Qualitative disclosures: A bank shall disclose its risk management policies pertaining to derivatives with particular reference to the extent to which derivatives are used, the associated risks and business purposes served. The disclosure shall also include:

(i) the structure and organisation for management of risk in derivatives trading,

(ii) the scope and nature of risk measurement, risk reporting and risk monitoring systems,

(iii) policies for hedging and / or mitigating risk and strategies and processes for monitoring the continuing effectiveness of hedges / mitigants, and

(iv) accounting policy for recording hedge and non-hedge transactions; recognition of income, premiums and discounts; valuation of outstanding contracts; provisioning, collateral and credit risk mitigation.

(b) Quantitative disclosures

| (Amount in ₹ crore) |

Sr.

No |

Particular |

Current Year |

Previous Year |

| Currency Derivatives |

Interest rate derivatives |

Currency Derivatives |

Interest rate derivatives |

| a) |

Derivatives (Notional Principal Amount) |

|

|

|

|

| b) |

Marked to Market Positions [1] |

|

|

|

|

| i) Asset (+) |

|

|

|

|

| ii) Liability (-) |

|

|

|

|

| d) |

Likely impact of one percentage change in interest rate (100*PV01) |

|

|

|

|

| e) |

Maximum and Minimum of 100*PV01 observed during the year |

|

|

|

|

[1] The net position shall be shown either under asset or liability, as the case may be, for each type of derivatives.

(7) Transfers to Depositor Education and Awareness Fund (DEA Fund)

| (Amount in ₹ crore) |

| Sr. No. |

Particulars |

Current Year |

Previous Year |

| i) |

Opening balance of amounts transferred to DEA Fund |

|

|

| ii) |

Add: Amounts transferred to DEA Fund during the year |

|

|

| iii) |

Less: Amounts reimbursed by DEA Fund towards claims |

|

|

| iv) |

Closing balance of amounts transferred to DEA Fund |

|

|

| A bank shall specify here that the closing balance of the amount transferred to DEA Fund, as disclosed above, are also included under 'Schedule 12 - Contingent Liabilities - Other items for which the bank is contingently liable' or 'Contingent Liabilities - Others,' as the case may be. |

(8) Disclosure of complaints

(i) Summary information on complaints received by a bank from customers and from the Offices of Ombudsman (previously office of banking ombudsman)

| Sr. No |

|

Particulars |

Current Year |

Previous Year |

| |

Complaints received by the bank from its customers |

| 1. |

|

|

|

|

| 2. |

|

|

|

|

| 3. |

|

Number of complaints disposed during the year |

|

|

| |

3.1 |

Of which, number of complaints rejected by the bank |

|

|

| 4. |

|

Number of complaints pending at the end of the year |

|

|

| |

Maintainable complaints received by the bank from Office of Ombudsman |

| 5. |

|

Number of maintainable complaints received by the bank from Office of Ombudsman |

|

|

| |

5.1. |

Of 5, number of complaints resolved in favour of the bank by Office of Ombudsman |

|

|

| |

5.2 |

Of 5, number of complaints resolved through conciliation / mediation / advisories issued by Office of Ombudsman |

|

|

| |

5.3 |

Of 5, number of complaints resolved after passing of Awards by Office of Ombudsman against the bank |

|

|

| 6. |

|

Number of Awards unimplemented within the stipulated time (other than those appealed) |

|

|

| Note: Maintainable complaints refer to complaints on the grounds specifically mentioned in Integrated Ombudsman Scheme, 2021 (Previously Banking Ombudsman Scheme, 2006) and covered within the ambit of the Scheme. |

(ii) Top five grounds of complaints received by the bank from customers

| Grounds of complaints, (i.e. complaints relating to) |

Number of complaints pending at the beginning of the year |

Number of complaints received during the year |

% increase / decrease in the number of complaints received over the previous year |

Number of complaints pending at the end of the year |

Of 5, number of complaints pending beyond 30 days |

| 1 |

2 |

3 |

4 |

5 |

6 |

| |

Current Year |

| Ground - 1 |

|

|

|

|

|

| Ground - 2 |

|

|

|

|

|

| Ground - 3 |

|

|

|

|

|

| Ground - 4 |

|

|

|

|

|

| Ground - 5 |

|

|

|

|

|

| Others |

|

|

|

|

|

| Total |

|

|

|

|

|

| |

Previous Year |

| Ground - 1 |

|

|

|

|

|

| Ground - 2 |

|

|

|

|

|

| Ground - 3 |

|

|

|

|

|

| Ground - 4 |

|

|

|

|

|

| Ground - 5 |

|

|

|

|

|

| Others |

|

|

|

|

|

| Total |

|

|

|

|

|

Note - As per Master List for identifying grounds of complaints as provided in Appendix 1 to circular CEPD.CO.PRD.Cir.No.01/13.01.013/2020-21 dated January 27, 2021 on ‘Strengthening the Grievance Redress Mechanism of Banks’.

| 1. ATM / Debit Cards |

2. Internet / Mobile / Electronic Banking |

3. Account opening / difficulty in operation of accounts |

4. Mis-selling / Para-banking |

| 5. Direct Sales Agents |

6. Pension and facilities for senior citizens / differently abled |

7. Levy of charges without prior notice / excessive charges |

8. Cheques / drafts / bills |

| 9. Non-observance of Fair Practices Code |

10. Exchange of coins, issuance / acceptance of small denomination notes and coins |

11. Staff behaviour |

12. Facilities for customers visiting the branch / adherence to prescribed working hours by the branch, etc |

| 13. Others |

(9) Disclosure of penalties imposed by the RBI

(i) Penalties imposed by the RBI under the provisions of the (a) Banking Regulation Act, 1949, (b) Payment and Settlement Systems Act, 2007 and (iii) Government Securities Act, 2006 (for bouncing of SGL) shall be disclosed in the ‘Notes to Accounts’ to the balance sheet in the concerned bank’s next Annual Report.

(ii) A bank shall make appropriate disclosures on the nature of the breach, number of instances of default and the quantum of penalty imposed.

(iii) The defaulting participant in a reverse repo transaction shall make appropriate disclosure on the number of instances of default as well as the quantum of penalty paid to the RBI during the financial year.

(10) Disclosures on remuneration

(i) A bank is required to make disclosure on remuneration of Whole Time Directors / Chief Executive Officers / Material Risk Takers on an annual basis at the minimum, in its Annual Financial Statements.

(ii) The bank shall make the disclosures in table or chart format and make disclosures for previous as well as the current reporting year.

(iii) Further, a bank (to the extent applicable), shall disclose the following information:

| Type of disclosure |

|

Information |

|

| Qualitative |

(a) |

Information relating to the composition and mandate of the Nomination and Remuneration Committee. |

|

| (b) |

Information relating to the design and structure of remuneration processes and the key features and objectives of remuneration policy. |

|

| (c) |

Description of the ways in which current and future risks are taken into account in the remuneration processes. It should include the nature and type of the key measures used to take account of these risks. |

|

| (d) |

Description of the ways in which the bank seeks to link performance during a performance measurement period with levels of remuneration. |

|

| (e) |

A discussion of the bank’s policy on deferral and vesting of variable remuneration and a discussion of the bank’s policy and criteria for adjusting deferred remuneration before vesting and after vesting. |

|

| (f) |

Description of the different forms of variable remuneration (i.e., cash and types of share-linked instruments) that the bank utilises and the rationale for using these different forms. |

|

| |

|

|

Current Year |

Previous Year |

Quantitative disclosures