IST,

IST,

Minutes of the Monetary Policy Committee Meeting, June 5 to 7, 2024

|

The forty ninth meeting of the Monetary Policy Committee (MPC), constituted under Section 45ZB of the Reserve Bank of India Act, 1934, was held during June 5 to 7, 2024. 2. The meeting was attended by all the members – Dr. Shashanka Bhide, Honorary Senior Advisor, National Council of Applied Economic Research, Delhi; Dr. Ashima Goyal, Emeritus Professor, Indira Gandhi Institute of Development Research, Mumbai; Prof. Jayanth R. Varma, Professor, Indian Institute of Management, Ahmedabad; Dr. Rajiv Ranjan, Executive Director (the officer of the Reserve Bank nominated by the Central Board under Section 45ZB(2)(c) of the Reserve Bank of India Act, 1934); Dr. Michael Debabrata Patra, Deputy Governor in charge of monetary policy – and was chaired by Shri Shaktikanta Das, Governor. 3. According to Section 45ZL of the Reserve Bank of India Act, 1934, the Reserve Bank shall publish, on the fourteenth day after every meeting of the Monetary Policy Committee, the minutes of the proceedings of the meeting which shall include the following, namely: 4. The MPC reviewed the surveys conducted by the Reserve Bank to gauge consumer confidence, households’ inflation expectations, corporate sector performance, credit conditions, the outlook for the industrial, services and infrastructure sectors, and the projections of professional forecasters. The MPC also reviewed in detail the staff’s macroeconomic projections, and alternative scenarios around various risks to the outlook. Drawing on the above and after extensive discussions on the stance of monetary policy, the MPC adopted the resolution that is set out below. Resolution 5. On the basis of an assessment of the current and evolving macroeconomic situation, the Monetary Policy Committee (MPC) at its meeting today (June 7, 2024) decided to: These decisions are in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth. Assessment and Outlook 6. Global economic activity is rebalancing and is expected to grow at a stable pace in 2024. Inflation has been moderating unevenly, with services inflation staying elevated and slowing progress towards targets. Uncertainty on the pace and timing of policy pivots by central banks is keeping financial markets volatile. Equity markets have touched new highs in both advanced and emerging market economies. Non-energy commodity prices have firmed up, while the US dollar and bond yields are exhibiting two-way movement with spillovers to emerging market currencies. Gold prices have surged to record highs on safe haven demand. 7. According to the provisional estimates released by the National Statistical Office (NSO) on May 31, 2024, real gross domestic product (GDP) growth in Q4:2023-24 stood at 7.8 per cent as against 8.6 per cent in Q3. Real GDP growth for 2023-24 was placed at 8.2 per cent. On the supply side, real gross value added (GVA) rose by 6.3 per cent in Q4:2023-24. Real GVA recorded a growth of 7.2 per cent in 2023-24. 8. Going forward, high frequency indicators of domestic activity are showing resilience in 2024-25. The south-west monsoon is expected to be above normal, which augurs well for agriculture and rural demand. Coupled with sustained momentum in manufacturing and services activity, this should enable a revival in private consumption. Investment activity is likely to remain on track, with high capacity utilisation, healthy balance sheets of banks and corporates, government’s continued thrust on infrastructure spending, and optimism in business sentiments. Improving world trade prospects could support external demand. Headwinds from geopolitical tensions, volatility in international commodity prices, and geoeconomic fragmentation, however, pose risks to the outlook. Taking all these factors into consideration, real GDP growth for 2024-25 is projected at 7.2 per cent with Q1 at 7.3 per cent; Q2 at 7.2 per cent; Q3 at 7.3 per cent; and Q4 at 7.2 per cent (Chart 1). The risks are evenly balanced. 9. Headline inflation has seen sequential moderation since February 2024, albeit in a narrow range from 5.1 per cent in February to 4.8 per cent in April 2024. Food inflation, however, remains elevated due to persistence of inflation pressures in vegetables, pulses, cereals, and spices. Deflation in fuel prices deepened during March-April, reflecting the cut in liquified petroleum gas (LPG) prices. Core (CPI excluding food and fuel) inflation eased further to 3.2 per cent in April, the lowest in the current CPI series, with core services inflation also falling to historic lows. 10. Looking ahead, overlapping shocks engendered by rising incidence of adverse climate events impart considerable uncertainty to the food inflation trajectory. Market arrivals of key rabi crops, particularly pulses and vegetables, need to be closely monitored in view of the recent sharp upturn in prices. Normal monsoon, however, could lead to softening of food inflation pressures over the course of the year. Pressure from input costs have started to edge up and early results from enterprises surveyed by the Reserve Bank expect selling prices to remain firm. Volatility in crude oil prices and financial markets along with firming up of non-energy commodity prices pose upside risks to inflation. Taking into account these factors, CPI inflation for 2024-25 is projected at 4.5 per cent with Q1 at 4.9 per cent; Q2 at 3.8 per cent; Q3 at 4.6 per cent; and Q4 at 4.5 per cent (Chart 2). The risks are evenly balanced.  11. The MPC noted that the domestic growth-inflation balance has moved favourably since its last meeting in April 2024. Economic activity remains resilient supported by domestic demand. Investment demand is gaining more ground and private consumption is exhibiting signs of revival. Although headline inflation is gradually easing, driven by softening in its core component, the path of disinflation is interrupted by volatile and elevated food inflation due to adverse weather events. Inflation is expected to temporarily fall below the target during Q2:2024-25 due to favourable base effect, before reversing subsequently. For the final descent of inflation to the target and its anchoring, monetary policy has to be watchful of spillovers from food price pressures to core inflation and inflation expectations. The MPC will remain resolute in its commitment to aligning inflation to the 4 per cent target on a durable basis. Accordingly, the MPC decided to keep the policy repo rate unchanged at 6.50 per cent in this meeting. The MPC reiterates the need to continue with the disinflationary stance, until a durable alignment of the headline CPI inflation with the target is achieved. Enduring price stability sets strong foundations for a sustained period of high growth. Hence, the MPC also decided to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns to the target, while supporting growth. 12. Dr. Shashanka Bhide, Dr. Rajiv Ranjan, Dr. Michael Debabrata Patra and Shri Shaktikanta Das voted to keep the policy repo rate unchanged at 6.50 per cent. Dr. Ashima Goyal and Prof. Jayanth R. Varma voted to reduce the policy repo rate by 25 basis points. 13. Dr. Shashanka Bhide, Dr. Rajiv Ranjan, Dr. Michael Debabrata Patra and Shri Shaktikanta Das voted to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns to the target, while supporting growth. Dr. Ashima Goyal and Prof. Jayanth R. Varma voted for a change in stance to neutral. 14. The minutes of the MPC’s meeting will be published on June 21, 2024. 15. The next meeting of the MPC is scheduled during August 6 to 8, 2024. Voting on the Resolution to keep the policy repo rate unchanged at 6.50 per cent

Statement by Dr. Shashanka Bhide 16. The macroeconomic environment was marked by a high growth rate of the economy and moderating inflation rate during 2023-24. The Provisional Estimates (PE) released by the National Statistics Office (NSO) on May 31, 2024, reinforce the previous growth assessment further. Real GDP growth for 2023-24 is now estimated at 8.2 per cent, following the growth rates of 7 per cent in 2022-23 and 9.7 per cent in 2021-22. While there have been significant fluctuations and differences between the macro estimates available at the time of April MPC meeting and the recent PE for sectoral growth rates and in the sources of aggregate demand on account of both external and domestic factors, the overall growth rate has remained strong, above the 7.6 per cent in the SAE. In the meantime, the headline inflation rate, year-on-year, is at 5.4 per cent for 2023-24 and 5 per cent in Q4: 2023-24. 18. In terms of real GVA, YOY growth of agriculture and allied activities dropped from 4.7 per cent in 2022-23 to 1.4 per cent in 2023-24. Industry GVA rose from (-)0.6 per cent in 2022-23 to 9.3 per cent in 2023-24, led by manufacturing. Although construction GVA increased by almost 10 per cent in 2023-24, growth of overall services sector GVA slowed to 7.9 per cent in 2023-24 from 9.9 per cent in the previous year. In all the three major production sectors, YOY growth rates are the same or higher in the PE as compared to the SAE for 2023-24. 19. Several indicators reflect continuation of growth momentum into 2024-25. At the global level, the world trade volume is expected to recover in 2024 with growth also expected to hold. In its April 2024 assessment, the IMF projected YOY growth in the world output at 3.2 per cent in 2024, the same as in 2023 and the growth of volume of world trade in goods and services at 3 per cent in 2024 as compared to 0.3 per cent in 2023. Trends in global PMIs suggest stronger growth prospects in the case of services as compared to manufacturing, with both in expansion zone from February to April 2024. 21. Indicators such as PMI for manufacturing and services have remained in the expansion zone during April-May. Non-food bank credit and GST collections expanded at double digit rates on a YOY basis, during April-May 2024. 22. RBI’s consumer confidence survey of urban households indicates cautious optimism. The survey conducted in May 2024, reflects expectation of an increase in both essential and non-essential expenditure one-year ahead. Changes in future sentiments on household income is modest, however, expectations regarding the general economic conditions and employment moderated on one-year ahead basis. 24. Investment demand indicators in the first two months of Q1, reflect a mixed picture. Steel consumption has increased at a strong growth of 9.6 per cent in April, while cement production remained muted at 0.6 per cent during the month. Imports of capital goods improved in April, YOY basis. The capital expenditure in the public sector is expected to provide support for investment demand as in the previous year. 25. The assessment of the growth prospects for 2024-25 are conditioned by the momentum that has been set by the performance in 2023-24 and several global and domestic factors. While positive aspects of the emerging macroeconomic conditions affecting economic growth in 2024-25 are significant, there are also the risks from adverse scenarios. The spillover effects of continuing international geopolitical conflicts, trade limiting policies across the world, extreme weather events affecting agricultural output pose these adverse conditions. 26. The Survey of Professional Forecasters conducted by the RBI in May 2024, provides a median forecast of real GDP growth of 6.8 per cent in 2024-25, revised upwards from 6.7 per cent in the previous round of the survey in March. Private Final Consumption Expenditure and Gross Fixed Capital Formation are the growth drivers in these projections. 27. In the April meeting of the MPC, the YOY real GDP growth for 2024-25 was projected at 7 per cent. Taking into account a normal monsoon and sustained momentum of investment, the GDP growth for 2024-25 has now been projected at 7.2 per cent. The quarterly growth rates for GDP are: 7.3 per cent in Q1, 7.2 per cent in Q2, 7.3 per cent in Q3 and 7.2 per cent in Q4. 28. The pace of decline in YOY headline CPI inflation rate in the recent period has been steady. It declined from 5.4 per cent in Q3: 2023-24 to 5 per cent in Q4. The rate declined from 5.1 per cent in January 2024 to 4.8 per cent in April. While the CPI inflation for fuel & light and the non-food and non-fuel categories remained well below 4 per cent, food inflation was above 7.5 per cent in Q4: 2023-24 and 7.9 per cent in April in the current year. A favourable monsoon assisting the recovery of agricultural growth and suitable supply management measures would be a key to moderating food inflation as the year progresses. 29. There are risks to anticipated decline in CPI inflation rate given the uncertainties of temporal and spatial distribution of the rainfall, weather conditions during the crop season and the spillover effects of international geopolitical conflicts. 30. Commodity price trends in the international markets present a mixed pattern. In the case of agricultural prices, in April and May, wheat prices have advanced, rice prices have remained firm and sugar and palm oil prices have shown decline. In the case of other commodities, energy prices have been volatile and metals have increased. Improving world manufacturing output, divergent weather conditions and uncertainties over the impact of the on-going geopolitical conflicts will continue to influence the world commodity prices in the short term. 31. The RBI’s inflation expectations survey of urban households conducted in the first fortnight of May 2024 reflects the current deceleration in the consumer prices but also points to moderate increase in expected inflation rate by 20 and 10 basis points over a short-term horizon of three months and one year, respectively. The early results from the ongoing enterprise surveys by the RBI for April-June point to rising input price pressures in 2023-24, particularly in services and infrastructure. Input price pressures are also followed by expectation of rise in selling prices by majority of the respondents in manufacturing, services and infrastructure sectors. 33. Taking into account these factors, the headline inflation rate has now been projected at 4.5 per cent in 2024-25, the same level as in the April MPC meeting. The quarterly projections are 4.9 per cent in Q1, declining to 3.8 per cent in Q2, rising to 4.6 per cent in Q3 and 4.5 per cent in Q4. The sharp decline in Q2: 2024-25 corresponds to the period when inflation rate was a high 6.4 per cent in 2023-24. 34. The headline inflation rate gradually moving to below 5 per cent mark in March and April, and projected at less than 4 per cent mark in Q2, marks an important macroeconomic condition that can support sustained growth. Clearly, the moderate inflation rate will have to be durable to be an effective condition for sustained growth. In this context, the policy would have to continue its focus on maintaining the inflation rate aligned to the target over the medium term. The rise in projected inflation rate above the 4.5 per cent mark in H2 of the financial year reflects the underlying price pressures, which if not addressed would not meet the policy goal. As a major part of these price pressures relate to food inflation, a watchful approach is appropriate to ensure that there are no spillovers of high food inflation to the prices of the other items in the consumption basket. As the aggregate output projections for 2024-25 reflect strong GDP growth, keeping the monetary policy focus on achieving the inflation target on a durable basis is appropriate at this juncture. Statement by Dr. Ashima Goyal 36. Indian growth has outperformed expectations once again, suggesting it has strong roots. Real policy rates near neutral, along with supply-side action, have been important in sustaining growth while bringing inflation towards target. As argued in earlier minutes, the neutral real policy rate (NIR) is around unity in Indian conditions of high unemployment and an ongoing transition to higher productivity employment1 . 37. Headline inflation has been around 5% since January this year while core inflation has been below 4% since December 2023. Volatile commodity prices, El Nino and heat waves have not been able to reverse the approach to target. The headline inflation projection of 4.5% for 2024-25 gives an average real repo rate of 2% implying that the real repo rate will be above neutral for too long if the repo rate stays unchanged. Falling inflation has raised real repo above unity. This will reduce real growth rate with a lag. Expected growth is around 7% in 2024-25 below the 8% achieved in 2023-242 . Status quoism is praised as being cautious. But if doing nothing distorts real variables it aggravates shocks instead of smoothing them and raises risk. 39. Inflation has come down in the past through supply side action and anchoring of inflation expectations with the NIR at neutral, without a large growth sacrifice. Why then would higher real policy rates be required now to fight inflation that is lower? The sacrifice ratio from NIR above neutral is very high when aggregate supply is elastic as it is in India. 40. Let us examine some common arguments made against cutting the repo rate. 41. First, the fear of recurrent supply shocks. The volatilities facing policy in April have moderated. Global uncertainties continue, but the world seems to have learnt to live with them. Output and trade growth is improving. Conflicts have been contained and international oil prices that are important for India are softening despite extension of OPEC oil cuts, pointing to a reduction in OPEC’s monopoly power. Although global commodity inflation is mixed, palm oil inflation, that affects many consumer goods costs in India, is softening. 42. The good monsoon predicted has already set in and will likely reduce food inflation. The elections are over. Results suggest political stability but also policy continuity rather than disruptive changes. India gets a credible opposition, which strengthens democracy. Even so, a conservative government with a good implementation record will return and is likely to continue with fiscal consolidation through a better composition of expenditure and other short and long-term cost reducing supply-side reforms. 43. In addition to a lower probability of a large supply shock, the experience of the past year shows supply shocks no longer have persistent effects on inflation or on inflation expectations. We have waited for one year to watch the impact of these shocks, now it is time to move on. Household inflation expectations have become much less volatile in the post-pandemic period, falling slowly along with inflation itself. Some anchoring seems to have made them immune to transient shocks. 44. Moreover, a durable approach to the inflation target is consistent with a transient rise in inflation. It is necessary to avoid the mistake of 2015 when international crude oil prices fell substantially but the fear that they would rise again prevented an adequate cut in the policy rate. Real interest rates rose substantially and hurt growth. 45. The second set of arguments is since growth is robust there is no need for a cut. But growth is below potential and may slow further since consumption remains weak. Increasing income and employment is the only sustainable way to bolster consumption, as well as private investment. Transfers from a small percentage cannot give prosperity to a billion people. Reducing unemployment is important for political and financial stability. Without a rise in productive employment, aggressive redistribution becomes more likely and may provoke a flight of wealth taking India back to the stagnant seventies. 46. But will lower repo rates raise already high personal credit growth too much? Over the last two years overall credit growth has been around 15% per annum. This implies a mild rise in credit ratios since nominal GDP growth is about 12%. Indian private credit ratios have to rise safely and steadily towards levels in peer countries, avoiding the type of debt explosion that accompanied Chinese growth. Seasonally adjusted monthly momentum in credit growth is slowing somewhat since January 2024 especially as sectoral prudential regulation moderates building up of excessive leverages. This regulation is preventive and reduces the need for monetary rate action that has broad effects4 . 47. Spreads are high in India. Average loan rates are in double digits. While risk-based pricing is required, a cut in repo rates will prevent retail interest rates rising to unbearable levels. There may be some stress in loans to self-employed. If leverage is rising, lower interest rates reduce costs and a possible indebtedness trap. Despite some initial reduction after a repo cut, rising loan demand and slower deposit growth will tend to raise both loan and deposit rates. 48. Third, is the belief, widespread in financial markets that India cannot cut before the US Fed. But the US has its own special problems that do not apply elsewhere. Many other central banks are cutting rates. The fall in India’s current account deficit, index inclusion and ratings upgrade add to the many reasons that make interest differentials with the US less important. India’s inflation differential with the US is also narrowing again. 49. Finally, let us turn to the mechanics of cutting and the communication around it. At present only small steps are required to align the repo with the fall in inflation so this should not be seen as the start of a rate cut cycle. Communication should make it clear that there is no softening path and forward-guidance remains data-determined. A neutral stance is appropriate since the rate can then move in either direction as required. 50. In line with the above reasoning, I vote for a 25 basis points cut to the repo rate and a change in the stance to neutral. Even with these changes, monetary policy would remain disinflationary towards bringing inflation credibly to the target. Statement by Prof. Jayanth R. Varma 51. In my statement for the last meeting (April 2024), I expressed concern about the growth sacrifice in 2024-25 induced by restrictive monetary policy. It now appears that the maintenance of restrictive policy for unwarrantedly long will lead to a growth sacrifice in 2025-26 as well. Professional forecasters surveyed by the RBI are projecting growth both in 2025-26 and in 2024-25 to be lower than in 2023-24 by more than 0.75%, and lower than the potential growth rate (of say 8%) by more than 1%. This is an unacceptably high growth sacrifice considering that headline inflation is projected to be only about 0.5% above target, and core inflation is extremely benign. 52. As I have stated in the last several meetings, the current real policy rate of around 2% (based on projected inflation) is well above the level needed to glide inflation to its target. I therefore vote to reduce the repo rate by 25 basis points, and to change the stance to neutral. Statement by Dr. Rajiv Ranjan 53. The arguments made in my last statement are still valid. In a transition phase, the role of the three Cs – Caution that entails conviction about durable alignment of inflation to the target with more incoming information; Consistency that rules out backpedalling; and Credibility that facilitates firm anchoring of expectations – is much more relevant. On the whole, we are broadly in a similar monetary policy setting as in the last two bi-monthly reviews. Growth continues to be robust and has surprised further on the upside. While core inflation has softened further, food inflation risks have remained elevated. 54. Our growth projection for 2024-25 has been revised upward for the following reasons. First, GDP recorded a strong momentum (quarter-on-quarter growth) of 7.8 per cent in Q4:2023-24 as against an average of 5.8 per cent during the corresponding quarters of the pre-COVID period (2012-13 to 2019-20). Even the momentum of gross value added (GVA) was strong at 5.7 per cent during Q4:2023-24 in comparison with the average momentum of 2.4 per cent during the same pre-COVID period. This strong momentum is likely to continue supporting growth in 2024-25. The available high frequency indicators for April-May exhibits optimism to sustain momentum. Second, private consumption which was trailing will now get impetus from rebound in rural demand on the back of expected above normal south-west monsoon and improving agriculture sector. Third, external demand is witnessing a turn around with improving outlook for global trade. In April, merchandise exports entered into positive territory and services exports posted robust double-digit growth. Moreover, KLEMS database available for 2021-22 shows that total factor productivity has improved significantly. Given further digitalisation and formalisation of the economy leading to higher productivity, along with favourable demography, rising labour force participation and accelerated capital formation seems to have led to higher potential growth as I have been highlighting in my last four statements. Perhaps lower pressures from core inflation and the lower current account deficit in a scenario of high growth could be a pointer to it. Of course, monetary policy along with lower input costs have been the main driver of core disinflation. 55. On the inflation front, headline and core inflation have moderated on anticipated lines. There is, however, little comfort in the near-term with inflation projected to remain sticky at around 4.9 per cent in Q1:2024-25 primarily due to the impact of unprecedented heat wave conditions on summer crop of vegetables and fruits; lower agricultural and horticulture production estimates; revision in milk prices across major cooperatives; and signs of a turnaround in commodity prices along with logistics and transportation costs. Food, with a weight of 45.9 per cent in CPI, contributed to three-fourths of the headline inflation in April 2024 compared to about 40 per cent a year ago. Discounting the likely one-off drop in inflation to below target rate in Q2:2024-25 due to favourable base effects, the ongoing disinflation process, though gradual, is expected to continue over the second half of 2024-25, with headline inflation projected at 4.5 per cent by Q4:2025-26. Realisation of a normal monsoon, particularly in terms of its spatial and temporal distribution, and the recharge of reservoirs would be critical for the continued disinflation in food and headline CPI. 56. Against this backdrop, let me elaborate more on why we cannot afford any misjudgement on our policy action at this stage. First, while we can draw some comfort from headline inflation running within the tolerance band successively for eight months in a row, we cannot drop our guard as the headline inflation is still not aligned to the target. Repeated incidence of food price shocks is delaying the final descent of inflation to the target. It is, however, encouraging that elevated food inflation over the last six months have not spilled over into core inflation, reflecting the gains from credibility of our maturing flexible inflation targeting framework. Nevertheless, given the large share of food in the household consumption basket, we need to stay vigilant to resist any such spill over and ensure that such price pressures are clearly dissipated. Any consideration on policy change has to factor in this aspect to avoid backpedalling in future5. 57. Second, there could be an argument that a pause for eight successive policies is a long pause. Let me emphasise, the inertia of inaction should not drive us to action. Rather the driving force should be the macroeconomic setting of growth and inflation. Clearly, the favourable growth-inflation balance and the outlook is pointing towards status quo. That said, even though the repo rate has been kept unchanged since February 2023, several policy actions on liquidity, transmission and communication have played out to stabilise the economy further. The views and assessment of all major stakeholders seem to be closely aligned towards no action at this stage. In any case, we do not face the kind of pressures being faced by some advanced economies which have gone for very restrictive policy settings in the current rate hike cycle. 58. Third, it is also being argued that with the fisc consolidating, monetary policy should be more growth supportive by easing policy rates. The counter argument is two-fold: (a) we need to see what drives fiscal consolidation – if it is largely driven by higher revenues including dividend, which is the case now, the adverse impact on growth may be non-existent. On the contrary, fiscal consolidation may actually be growth enhancing if it leads to improved country ratings, easing the financial conditions for the private sector and improving the overall sentiment. (b) More importantly, the best contribution that monetary policy can make to long-term growth is via price stability. In this context, I stand by what I said in my last minutes that we need to utilise the space provided by stronger growth to focus on inflation. 59. To sum up, our monetary policy actions should continue to be primarily guided by domestic macroeconomic conditions and the outlook. The growth-inflation mix at the current juncture allows us to move more cautiously on the inflation front. Hence, we should not waver from our focus on price stability6 which remains so important for our long term sustained growth outcome. Accordingly, I vote for status quo on rate and monetary policy stance in this policy. Statement by Dr. Michael Debabrata Patra 60. Economic activity in India is evolving broadly in line with the baseline projection. Prospects of a favourable monsoon should offset the slackening momentum that has become a typical feature of first quarter GDP outturns in the post-pandemic period. Domestic demand should continue to drive the economy, with private consumption receiving a fillip from the revival in rural spending. Corporate balance sheets are showing rising investments in fixed assets, which should find expression in a fuller capital spending upturn. With output in broad balance in relation to its potential, monetary policy can remain neutral to growth at this juncture and stay focused on aligning inflation to the target. That objective remains incomplete, which can undermine medium-term growth prospects. 61. The speed of the easing of inflation has been disappointing so far, even from a cross-country perspective. Food prices are persisting for too long as the principal impediment to a faster disinflation. The Indian economy remains hostage to intersecting food price shocks. Their repetitive occurrence calls for intensifying monetary policy vigil to ward off spillovers to other components of inflation and to expectations. This also warrants looking through the statistical soft patch in inflation’s trajectory that is anticipated during July-August 2024, while staying prepared to blunt the uptick that is expected from September. Food prices are holding back any consideration of possible changes in the monetary policy stance. Hence, I vote for keeping the policy rate and the stance of withdrawal of accommodation unchanged. Statement by Shri Shaktikanta Das 62. The global economy is resilient but is growing at a lower rate than its historical trend7. Inflation is easing unevenly across major economies. With varying growth-inflation dynamics across countries, the importance of domestic factors in policy making has come to the fore. Accordingly, there are initial signs of divergence on monetary policy actions across countries. 63. The Indian economy is growing at a healthy rate, averaging 8.3 per cent in the last three years. During 2023-24, the economy posted an impressive growth of 8.2 per cent despite continued global headwinds and weather vagaries. This was largely driven by domestic demand, especially investment activity. On the supply side, manufacturing and services provided major support to gross value added (GVA). 64. Domestic growth outlook for 2024-25 remains upbeat as economic activity continues to maintain momentum. South-west monsoon is expected to be above normal, boosting agricultural activity and supporting rural consumption. Buoyant services activity should sustain urban consumption. Business confidence remains strong across manufacturing, services and infrastructure sectors. Healthy balance sheets of banks and corporates and government’s capex thrust are expected to support investment activity. Projections of improvement in global trade by agencies8, when they materialise, will spur external demand. Considering these evolving dynamics, GDP growth projection for 2024-25 has been revised upward by 20 basis points to 7.2 per cent. When this happens, it will be the fourth consecutive year of 7.0 per cent or higher GDP growth. 65. Headline CPI inflation is moderating, but at a very slow pace. The last mile of disinflation is turning out to be gradual and protracted. Since the April 2024 MPC meeting, headline inflation moderated by around 30 basis points from 5.1 per cent in February 2024 to 4.8 per cent in April 2024. Inflation in CPI core (CPI excluding food and fuel) and its services sub-component were at historic lows in April 2024. Food inflation is the main factor behind the grudgingly slow pace of disinflation. Recurring and overlapping supply-side shocks continue to play an outsized role in food inflation. 67. The move towards an active disinflationary stance of monetary policy since the beginning of 2022-23 has helped to bring down inflation from its highly elevated levels, break the core inflation persistence and prevent inflation expectations from getting unanchored. The calibrated tightening by 250 basis points between May 2022 to February 2023 has achieved disinflation with minimal output sacrifice as growth remains strong. 68. The growth-inflation balance is moving favourably in line with our projections. Resilient growth creates space for monetary policy to focus unambiguously on inflation which remains well above the 4.0 per cent target. With persistently high food inflation, it would be in order to continue with the disinflationary policy stance that we have adopted. Any hasty action in a different direction will cause more harm than good. It is important that inflation is durably aligned to the target of 4.0 per cent. Price stability is the bedrock for high and sustainable growth. I, therefore, vote to keep the policy repo rate unchanged at 6.5 per cent and to continue with the stance of withdrawal of accommodation.

(Puneet Pancholy) Press Release: 2024-2025/539 [1] KLEMS data shows total factor productivity (TFR) for manufacturing and services increased at a higher pace during 2015-16 to 2019-20 (5 years) as compared to that during 2010-11 to 2014-15 (5 years). This helps absorb higher costs without requiring prices to rise and reduces the NIR despite higher growth. [8] The IMF has projected world trade volume growth to rebound from 0.3 per cent in 2023 to 3.0 percent in 2024. The World Bank projects world trade to grow by 2.3 per cent in 2024 as compared to 0.2 per cent in 2023. Similarly, OECD projects world trade to grow by 2.3 per cent during 2024 as compared to 1.0 per cent in 2023. The WTO in its April update, projected world merchandise trade volume growth for 2024 at 2.6 per cent following a contraction of 1.2 per cent in 2023. IMF and OECD trade data refer to goods and services; World Bank trade refers to goods and non-factor services while WTO trade data refers to goods (merchandise) only.

|

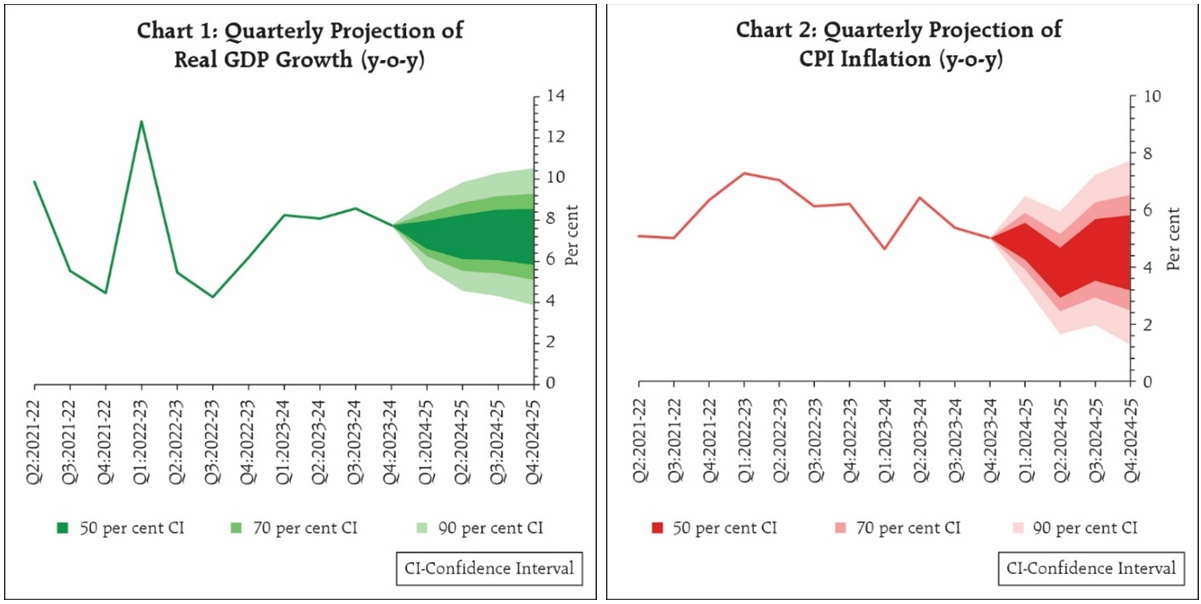

പേജ് അവസാനം അപ്ഡേറ്റ് ചെയ്തത്: