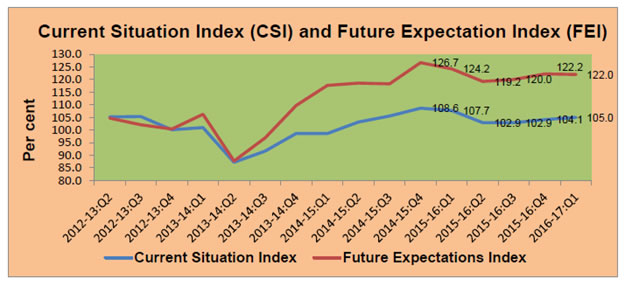

Consumers’ ‘current situation’ showed slight improvement in June 2016 but their ‘future expectations’ moderated marginally. This was revealed in the Reserve Bank of India’s Consumer Confidence Survey1 conducted during June 2016 covering around 5,200 respondents in six metropolitan cities, namely, Bengaluru, Chennai, Hyderabad, Kolkata, Mumbai and New Delhi. The Reserve Bank’s Consumer Confidence Survey provides current perceptions of the respondents on general economic conditions and own financial situation compared to the position one year ago and also their expectations on the same parameters a year ahead. The survey captures qualitative information on a three point scale, namely, improve, remain same or worsen. The salient findings of the survey are presented below: Highlights: I. Consumer confidence, as reflected in the Current Situation Index (CSI), improved in June 2016 mainly due to higher spending by the respondents. Future Expectations Index (FEI)2, however, moderated marginally in the current round of the survey as compared to the March 2016 round of the survey. II. The sentiment of the respondents in June 2016 round of the survey indicated deterioration in the general economic condition, as measured by net response, both for the current and one-year ahead period (Table 1). III. Current income also showed signs of weakening as compared to March 2016 round. However, optimism regarding one-year ahead income continued to be strong and remained above 50 per cent mark (Table 2). IV. The sentiment on spending, which had been declining since June 2015, showed signs of improvement in the current round. More than 80 per cent of the respondents reported increase in spending for the current and one-year ahead period (Table 3). V. More importantly, sentiment on current as well as future spending for non-essential items showed significant improvement during this round (Tables 4 and 5). VI. Current perception and future outlook for employment in June 2016 round remained almost similar to March 2016 round of the survey (Table 6). VII. As regards price levels and its rate of change (i.e. y-o-y inflation), both the current and the future sentiments showed deterioration in this round of the survey. (Tables 7 and 8).

| Table 1: Responses on Economic Conditions | | (Percentage responses) | | | Compared with 1-year ago | 1-year ahead | | Sep-15 | Dec-15 | Mar-16 | Jun-16 | Sep-15 | Dec-15 | Mar-16 | Jun-16 | | Improved/ Will improve | 36.5 | 38.0 | 39.9 | 40.2 | 47.7 | 51.0 | 54.6 | 54.2 | | Remained the same/ Will remain the same | 32.7 | 30.9 | 30.3 | 27.9 | 32.1 | 27.6 | 27.2 | 25.5 | | Worsen/ Will worsen | 30.9 | 31.1 | 29.8 | 31.9 | 20.3 | 21.4 | 18.2 | 20.4 | | Net Response | 5.6 | 7.0 | 10.1 | 8.2 | 27.4 | 29.6 | 36.4 | 33.8 |

| Table 2: Responses on Income | | (Percentage responses) | | | Compared with 1-year ago | 1-year ahead | | Sep-15 | Dec-15 | Mar-16 | Jun-16 | Sep-15 | Dec-15 | Mar-16 | Jun-16 | | Increased/Will Increase | 29.1 | 28.7 | 31.3 | 29.9 | 47.1 | 49.1 | 52.1 | 51.2 | | Remained the same/ Will remain same | 50.4 | 50.2 | 48.9 | 51.8 | 42.4 | 40.4 | 39.3 | 39.9 | | Decreased/ Will Decrease | 20.5 | 21.1 | 19.8 | 18.4 | 10.5 | 10.5 | 8.6 | 8.9 | | Net Response | 8.6 | 7.7 | 11.6 | 11.5 | 36.6 | 38.6 | 43.5 | 42.3 |

| Table 3: Responses on Spending | | (Percentage responses) | | | Compared with 1-year ago | 1-year ahead | | Sep-15 | Dec-15 | Mar-16 | Jun-16 | Sep-15 | Dec-15 | Mar-16 | Jun-16 | | Increased/ Will Increase | 81.0 | 78.7 | 78.0 | 82.7 | 80.9 | 79.3 | 78.5 | 82.2 | | Remained the same/ Will remain same | 10.7 | 9.8 | 9.9 | 8.4 | 11.2 | 10.1 | 10.6 | 10.2 | | Decreased/ Will Decrease | 8.2 | 11.5 | 12.1 | 8.8 | 7.9 | 10.6 | 11.0 | 7.6 | | Net Response | 72.8 | 67.2 | 65.9 | 73.9 | 73.0 | 68.6 | 67.5 | 74.6 |

| Table 4: Responses on Spending-Essential Items | | (Percentage responses) | | | Compared with 1-year ago | 1-year ahead | | Sep-15 | Dec-15 | Mar-16 | Jun-16 | Sep-15 | Dec-15 | Mar-16 | Jun-16 | | Increased/ Will Increase | 82.0 | 81.4 | 79.6 | 83.0 | 80.1 | 81.5 | 78.6 | 81.1 | | Remained the same/ Will remain same | 9.7 | 9.0 | 9.3 | 8.2 | 11.6 | 9.4 | 11.9 | 10.6 | | Decreased/ Will Decrease | 8.4 | 9.6 | 11.1 | 8.8 | 8.3 | 9.1 | 9.6 | 8.3 | | Net Response | 73.6 | 71.8 | 68.5 | 74.3 | 71.9 | 72.4 | 69.0 | 72.8 |

| Table 5: Responses on Spending-Non-Essential Items | | (Percentage responses) | | | Compared with 1-year ago | 1-year ahead | | Sep-15 | Dec-15 | Mar-16 | Jun-16 | Sep-15 | Dec-15 | Mar-16 | Jun-16 | | Increased/ Will Increase | 41.2 | 45.3 | 37.7 | 43.9 | 44.0 | 49.2 | 44.7 | 51.2 | | Remained the same/ Will remain same | 35.0 | 28.9 | 31.7 | 32.3 | 34.2 | 28.6 | 33.2 | 30.3 | | Decreased/ Will Decrease | 23.8 | 25.8 | 30.6 | 23.8 | 21.8 | 22.2 | 22.1 | 18.5 | | Net Response | 17.4 | 19.5 | 7.1 | 20.1 | 22.2 | 27.1 | 22.6 | 32.7 |

| Table 6: Responses on Employment | | (Percentage responses) | | | Compared with 1-year ago | 1-year ahead | | Sep-15 | Dec-15 | Mar-16 | Jun-16 | Sep-15 | Dec-15 | Mar-16 | Jun-16 | | (Improved/ Will Improve) | 31.9 | 34.0 | 34.3 | 35.6 | 47.1 | 51.6 | 50.4 | 51.1 | | (Remained Same/Will remain Same) | 34.8 | 34.7 | 31.1 | 28.7 | 33.4 | 29.8 | 31.4 | 29.6 | | (Worsen/ Will worsen) | 33.3 | 31.3 | 34.6 | 35.7 | 19.5 | 18.7 | 18.1 | 19.3 | | Net Response | -1.4 | 2.6 | -0.3 | -0.2 | 27.6 | 32.9 | 32.3 | 31.8 |

| Table 7: Responses on price level | | (Percentage responses) | | | Compared with 1-year ago | 1-year ahead | | Sep-15 | Dec-15 | Mar-16 | Jun-16 | Sep-15 | Dec-15 | Mar-16 | Jun-16 | | Gone up/ Will go up | 80.9 | 79.5 | 77.3 | 78.1 | 78.0 | 78.9 | 78.6 | 80.5 | | Remained almost Unchanged | 9.4 | 10.9 | 12.4 | 12.5 | 12.4 | 11.7 | 11.7 | 11.5 | | Gone down/ Will go down | 9.8 | 9.6 | 10.4 | 9.4 | 9.5 | 9.4 | 9.7 | 8.0 | | Net Response | -71.1 | -70.0 | -66.9 | -68.7 | -68.5 | -69.5 | -68.8 | -72.6 | | Note: Perceptions of increase in prices is considered to be negative sentiments and decrease in prices is considered to be positive sentiments. The net responses are therefore, negative. |

| Table 8: Responses on rate of change in price levels (Inflation) | | (Percentage responses) | | | Compared with 1-year ago | 1-year ahead | | Sep-15 | Dec-15 | Mar-16 | Jun-16 | Sep-15 | Dec-15 | Mar-16 | Jun-16 | | Gone up/ Will go up | 82.7 | 86.3 | 82.7 | 85.3 | 81.1 | 85.4 | 82.4 | 83.3 | | Remained almost Unchanged | 14.6 | 10.8 | 13.9 | 12.4 | 16.3 | 11.7 | 13.2 | 13.0 | | Gone down/ Will go down | 2.7 | 2.9 | 3.4 | 2.3 | 2.6 | 2.8 | 4.4 | 3.7 | | Net Response | -80.0 | -83.4 | -79.3 | -83.0 | -78.5 | -82.6 | -78.0 | -79.6 |

|  IST,

IST,