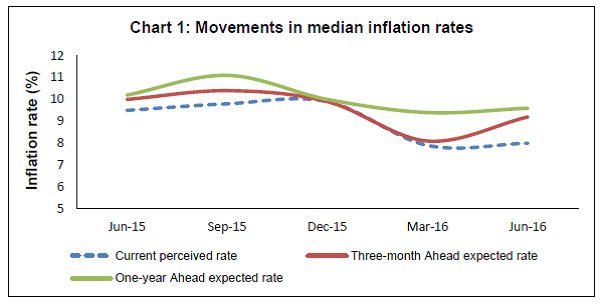

Households’ inflation expectations for the next three-month as well as for the next one-year period have risen. This was indicated in the inflation expectations survey conducted by the Reserve Bank of India in June 2016 (44th round). This survey is conducted by RBI at regular intervals and it provides useful directional information on near-term inflationary pressures and supplements other economic indicators. These expectations are formed by individuals based on their consumption basket and should not be treated as benchmark for official measure of inflation. The June 2016 round of survey was conducted across 18 cities among 5360 urban households from various categories (Table 1). Highlights: I. The proportion of respondents expecting general prices to rise by ‘more than current rate’ in the next three-month and one-year period has increased in June 2016 round compared to March 2016 round (Table 2). Similar sentiments prevailed across the selected product groups also. II. Three-month ahead median inflation rate increased sharply from 8.1 per cent to 9.2 per cent and one year ahead median inflation rate moved marginally from 9.4 per cent to 9.6 per cent between March 2016 and June 2016 rounds (Table 4 and Chart-1). III. Median inflation expectations rose across most of the categories, age-groups and cities.

| Table 1: Respondents’ Profile (Category): Share in Total Sample | | Category of Respondents | Share in Total (%) | Target Share (%) | | Financial Sector Employees | 10.0 | 10.0 | | Other Employees | 15.2 | 15.0 | | Self-employed | 19.9 | 20.0 | | Housewives | 29.2 | 30.0 | | Retired Persons | 10.1 | 10.0 | | Daily Workers | 9.8 | 10.0 | | Others | 5.8 | 5.0 | | Note: The above sample proportion is for June 2016 round |

| Table 2: Product-wise Expectations of Prices for Three-Month and One-Year Ahead | | (Percentage of respondents) | | Round No./survey period | 40 | 41 | 42 | 43 | 44 | 40 | 41 | 42 | 43 | 44 | | (Round ended) → | Jun-15 | Sep-15 | Dec-15 | Mar-16 | Jun-16 | Jun-15 | Sep-15 | Dec-15 | Mar-16 | Jun-16 | | Options: General | Three-Month Ahead | One-Year Ahead | | Prices will increase | 81.9 | 82.8 | 86.7 | 79.7 | 85.2 | 91.0 | 90.6 | 90.9 | 89.5 | 90.4 | | Price increase more than current rate | 34.5 | 36.3 | 35.7 | 31.4 | 37.7 | 41.2 | 43.6 | 41.6 | 37.4 | 44.8 | | Price increase similar to current rate | 25.3 | 21.2 | 29.5 | 26.4 | 28.7 | 29.3 | 23.8 | 28.5 | 31.6 | 27.6 | | Price increase less than current rate | 22.1 | 25.4 | 21.5 | 21.9 | 18.8 | 20.6 | 23.2 | 20.9 | 20.6 | 18.0 | | No change in prices | 13.4 | 12.3 | 9.0 | 16.6 | 11.4 | 5.8 | 5.5 | 5.6 | 7.5 | 6.3 | | Decline in price | 4.7 | 4.8 | 4.3 | 3.7 | 3.4 | 3.1 | 3.9 | 3.5 | 2.9 | 3.4 | | Options: Food Product | Three-Month Ahead | One-Year Ahead | | Prices will increase | 84.1 | 84.1 | 85.9 | 81.1 | 86.5 | 92.3 | 89.6 | 90.6 | 88.3 | 90.1 | | Price increase more than current rate | 35.2 | 37.5 | 34.9 | 30.3 | 38.3 | 39.5 | 42.8 | 41.2 | 34.7 | 44.7 | | Price increase similar to current rate | 26.8 | 23.2 | 30.1 | 29.0 | 29.3 | 31.0 | 24.2 | 29.2 | 32.8 | 28.4 | | Price increase less than current rate | 22.1 | 23.3 | 20.9 | 21.8 | 18.9 | 21.8 | 22.6 | 20.2 | 20.9 | 17.1 | | No change in prices | 11.1 | 10.4 | 8.8 | 14.3 | 9.1 | 5.0 | 6.1 | 5.6 | 8.5 | 5.5 | | Decline in price | 4.8 | 5.5 | 5.3 | 4.6 | 4.4 | 2.7 | 4.3 | 3.9 | 3.2 | 4.3 | | Options: Non-Food Product | Three-Month Ahead | One-Year Ahead | | Prices will increase | 76.8 | 73.5 | 74.3 | 70.8 | 72.7 | 86.2 | 82.8 | 81.9 | 81.4 | 82.5 | | Price increase more than current rate | 27.7 | 26.8 | 23.7 | 23.4 | 27.7 | 32.1 | 32.1 | 29.2 | 26.6 | 33.6 | | Price increase similar to current rate | 27.2 | 23.2 | 29.1 | 26.6 | 26.3 | 30.7 | 24.4 | 29.6 | 32.1 | 29.2 | | Price increase less than current rate | 21.8 | 23.5 | 21.5 | 20.8 | 18.6 | 23.5 | 26.3 | 23.1 | 22.7 | 19.7 | | No change in prices | 20.0 | 21.4 | 20.8 | 24.6 | 23.0 | 10.9 | 12.8 | 13.8 | 14.9 | 13.8 | | Decline in price | 3.2 | 5.2 | 5.0 | 4.6 | 4.4 | 2.9 | 4.4 | 4.3 | 3.7 | 3.7 | | Options: Household Durables | Three-Month Ahead | One-Year Ahead | | Prices will increase | 70.1 | 65.7 | 68.6 | 70.9 | 66.6 | 83.0 | 78.4 | 78.9 | 80.0 | 79.9 | | Price increase more than current rate | 26.0 | 24.6 | 22.1 | 22.5 | 26.3 | 32.4 | 32.0 | 29.2 | 28.7 | 34.1 | | Price increase similar to current rate | 24.9 | 19.1 | 26.3 | 27.0 | 23.4 | 28.9 | 22.8 | 29.4 | 30.2 | 27.3 | | Price increase less than current rate | 19.2 | 22.1 | 20.2 | 21.4 | 16.9 | 21.7 | 23.6 | 20.3 | 21.1 | 18.6 | | No change in prices | 22.9 | 25.0 | 22.5 | 20.5 | 25.7 | 12.2 | 14.7 | 14.0 | 13.7 | 14.2 | | Decline in price | 7.1 | 9.2 | 8.8 | 8.6 | 7.8 | 4.9 | 7.0 | 7.2 | 6.3 | 5.9 | | Options: Housing Prices | Three-Month Ahead | One-Year Ahead | | Prices will increase | 81.3 | 79.8 | 80.2 | 78.3 | 77.3 | 90.2 | 89.4 | 88.4 | 86.0 | 86.6 | | Price increase more than current rate | 42.8 | 42.2 | 39.9 | 40.7 | 43.8 | 50.1 | 52.4 | 48.7 | 47.8 | 52.2 | | Price increase similar to current rate | 23.9 | 20.3 | 25.1 | 22.7 | 20.6 | 24.5 | 19.2 | 24.9 | 24.2 | 21.8 | | Price increase less than current rate | 14.7 | 17.4 | 15.3 | 15.0 | 12.9 | 15.5 | 17.9 | 14.8 | 14.0 | 12.5 | | No change in prices | 14.0 | 14.2 | 13.3 | 14.8 | 16.2 | 6.5 | 6.2 | 6.9 | 8.1 | 8.5 | | Decline in price | 4.7 | 6.0 | 6.5 | 6.8 | 6.6 | 3.4 | 4.3 | 4.7 | 6.0 | 4.9 | | Options: Cost of Services | Three-Month Ahead | One-Year Ahead | | Prices will increase | 80.5 | 74.2 | 81.6 | 76.1 | 78.4 | 89.8 | 87.0 | 90.4 | 87.0 | 88.8 | | Price increase more than current rate | 33.5 | 31.5 | 35.9 | 29.6 | 33.7 | 39.1 | 40.3 | 42.0 | 37.4 | 42.8 | | Price increase similar to current rate | 27.6 | 20.5 | 27.2 | 26.8 | 26.9 | 30.2 | 22.1 | 28.6 | 29.5 | 28.5 | | Price increase less than current rate | 19.5 | 22.2 | 18.5 | 19.7 | 17.9 | 20.6 | 24.6 | 19.9 | 20.1 | 17.5 | | No change in prices | 17.6 | 22.4 | 15.4 | 20.2 | 19.0 | 8.2 | 9.8 | 7.0 | 10.0 | 8.5 | | Decline in price | 1.9 | 3.5 | 3.0 | 3.7 | 2.6 | 2.0 | 3.3 | 2.6 | 3.1 | 2.8 |

| Table 3: Households Expecting General Price Movements in Coherence with Movements in Price Expectations of Various Product Groups: Three-Month and One-Year Ahead | | (Percentage of respondents) | | Round No. | Survey period ended | Food | Non-Food | Households durables | Housing | Cost of services | | Three-months Ahead | | 40 | Jun-15 | 68.7 | 52.3 | 48.5 | 49.3 | 52.8 | | 41 | Sep-15 | 70.0 | 58.1 | 50.6 | 54.0 | 56.1 | | 42 | Dec-15 | 73.2 | 59.4 | 51.4 | 54.4 | 60.9 | | 43 | Mar-16 | 69.6 | 63.2 | 59.1 | 58.7 | 64.6 | | 44 | Jun-16 | 69.8 | 60.0 | 54.5 | 55.7 | 59.2 | | One-year Ahead | | 40 | Jun-15 | 71.0 | 63.3 | 59.4 | 59.6 | 62.9 | | 41 | Sep-15 | 70.3 | 59.5 | 55.4 | 60.8 | 60.6 | | 42 | Dec-15 | 77.8 | 63.9 | 60.2 | 61.6 | 67.2 | | 43 | Mar-16 | 73.1 | 67.4 | 66.6 | 63.9 | 69.2 | | 44 | Jun-16 | 74.7 | 64.5 | 60.6 | 61.5 | 65.9 |

| Table 4: Household Inflation Expectations – Current, Three-Month and One-Year Ahead | | Survey Round | Survey period Ended | Inflation rate in Per cent | | Current | Three-month Ahead | One-year Ahead | | Mean | Median | Std. Dev. | Mean | Median | Std. Dev. | Mean | Median | Std. Dev. | | 40 | Jun-15 | 9.9 | 9.5 | 4.0 | 10.1 | 10.0 | 4.4 | 10.7 | 10.2 | 4.4 | | 41 | Sep-15 | 10.4 | 9.8 | 4.3 | 10.6 | 10.4 | 4.3 | 11.2 | 11.1 | 4.5 | | 42 | Dec-15 | 10.5 | 9.9 | 4.2 | 10.5 | 9.9 | 4.1 | 10.7 | 10.0 | 4.3 | | 43 | Mar-16 | 8.9 | 7.9 | 4.4 | 8.8 | 8.1 | 4.6 | 9.7 | 9.4 | 4.6 | | 44 | Jun-16 | 8.8 | 8.0 | 4.4 | 9.7 | 9.2 | 4.4 | 10.0 | 9.6 | 4.7 |

| Table 5: Factors that Explain the Total Variability | | Round No. | Survey period ended | Current | Three-month Ahead | One-year Ahead | | 40 | Jun-15 | City, Category | City, Category, Age-Group | City, Category | | 41 | Sep-15 | City, Age-Group, Gender | City, Age-Group, Gender | City, Age-Group, Gender | | 42 | Dec-15 | City, Age-Group | City, Age-Group | City, Age-Group | | 43 | Mar-16 | City, Age-Group | City | City, Category | | 44 | Jun-16 | City, Age-Group, Category | City, Category | City, Category |

| Table 6 : Various Group-wise Inflation Expectations for June 2016 Survey Round | | | Current | Three-month Ahead | One-year Ahead | | Mean | Median | Std. Dev. | Mean | Median | Std. Dev. | Mean | Median | Std. Dev. | | Gender-wise | | Male | 8.9 | 8.1 | 4.3 | 9.7 | 9.3 | 4.4 | 10.0 | 9.6 | 4.6 | | Female | 8.6 | 7.7 | 4.5 | 9.6 | 9.1 | 4.5 | 9.9 | 9.5 | 4.8 | | Category-wise | | Financial Sector Employees | 8.4 | 7.7 | 4.1 | 9.2 | 8.7 | 4.1 | 9.5 | 9.1 | 4.4 | | Other Employees | 8.8 | 8.2 | 4.3 | 9.8 | 9.5 | 4.5 | 10.1 | 9.7 | 4.6 | | Self Employed | 9.1 | 8.6 | 4.4 | 9.8 | 9.4 | 4.5 | 10.1 | 9.8 | 4.7 | | Housewives | 8.6 | 7.7 | 4.4 | 9.6 | 9.1 | 4.5 | 10.0 | 9.5 | 4.7 | | Retired Persons | 9.3 | 8.1 | 4.6 | 10.1 | 9.6 | 4.6 | 10.4 | 9.8 | 4.6 | | Daily Workers | 8.7 | 7.9 | 4.5 | 9.8 | 9.2 | 4.5 | 10.0 | 9.5 | 4.8 | | Other category | 8.2 | 7.4 | 4.3 | 9.1 | 8.4 | 4.3 | 9.2 | 8.9 | 4.5 | | Age Group-wise | | Up to 25 years | 8.1 | 7.4 | 4.0 | 9.2 | 8.8 | 4.1 | 9.5 | 9.3 | 4.5 | | 25 to 30 years | 8.3 | 7.4 | 4.2 | 9.2 | 8.5 | 4.3 | 9.7 | 9.4 | 4.6 | | 30 to 35 years | 8.7 | 8.1 | 4.2 | 9.5 | 9.1 | 4.5 | 9.9 | 9.6 | 4.6 | | 35 to 40 years | 8.8 | 8.0 | 4.5 | 9.8 | 9.3 | 4.6 | 10.1 | 9.5 | 4.9 | | 40 to 45 years | 9.0 | 8.4 | 4.4 | 9.8 | 9.4 | 4.4 | 10.0 | 9.6 | 4.6 | | 45 to 50 years | 9.3 | 8.8 | 4.6 | 9.9 | 9.6 | 4.4 | 10.0 | 9.7 | 4.9 | | 50 to 55 years | 9.5 | 9.1 | 4.7 | 10.3 | 9.8 | 4.6 | 10.6 | 9.9 | 4.7 | | 55 to 60 years | 9.2 | 8.2 | 4.7 | 9.9 | 9.6 | 4.6 | 10.3 | 9.9 | 4.7 | | 60 years and above | 9.9 | 9.2 | 4.6 | 10.5 | 10.2 | 4.6 | 10.7 | 10.1 | 4.7 | | City-wise | | Ahmadabad | 13.4 | 16.0 | 4.1 | 13.7 | 16.2 | 4.4 | 14.1 | 16.2 | 3.9 | | Bengaluru | 5.0 | 5.1 | 2.8 | 5.7 | 5.2 | 3.3 | 5.1 | 4.4 | 3.5 | | Bhopal | 6.8 | 5.8 | 3.2 | 8.8 | 8.0 | 3.6 | 9.0 | 8.3 | 4.5 | | Bhubaneswar | 9.1 | 9.1 | 3.9 | 11.0 | 11.0 | 3.9 | 11.5 | 11.9 | 4.5 | | Chennai | 8.6 | 7.7 | 3.9 | 10.8 | 10.1 | 4.1 | 10.0 | 9.5 | 4.7 | | Delhi | 6.5 | 5.8 | 2.4 | 8.2 | 7.6 | 2.8 | 7.4 | 6.5 | 3.4 | | Guwahati | 14.0 | 16.2 | 4.5 | 14.0 | 16.2 | 4.7 | 13.9 | 16.2 | 4.5 | | Hyderabad | 7.1 | 6.5 | 2.8 | 6.9 | 6.5 | 2.9 | 9.0 | 8.7 | 2.8 | | Jaipur | 9.1 | 9.4 | 3.3 | 10.9 | 10.9 | 3.5 | 11.8 | 12.6 | 4.2 | | Kolkata | 11.7 | 10.6 | 4.2 | 11.9 | 12.6 | 4.8 | 12.5 | 14.3 | 4.4 | | Lucknow | 8.3 | 7.8 | 4.1 | 7.6 | 6.5 | 4.7 | 8.7 | 9.0 | 4.1 | | Mumbai | 7.8 | 7.1 | 3.5 | 8.9 | 8.1 | 3.6 | 8.3 | 7.7 | 3.7 | | Nagpur | 4.3 | 3.6 | 3.1 | 5.4 | 4.7 | 3.2 | 6.0 | 5.3 | 3.4 | | Patna | 9.0 | 8.7 | 1.5 | 10.1 | 10.0 | 1.5 | 10.9 | 10.8 | 2.0 | | Thiruvananthapuram | 11.5 | 12.7 | 4.9 | 10.0 | 10.3 | 5.2 | 11.3 | 12.1 | 5.0 | | Chandigarh | 12.3 | 13.3 | 4.1 | 12.4 | 14.1 | 4.6 | 14.2 | 16.0 | 3.5 | | Ranchi | 7.9 | 8.1 | 2.4 | 9.0 | 9.4 | 2.5 | 10.0 | 10.3 | 3.2 | | Raipur | 5.9 | 5.0 | 3.0 | 7.2 | 6.8 | 3.3 | 7.1 | 5.8 | 4.1 | | All | 8.8 | 8.0 | 4.4 | 9.7 | 9.2 | 4.4 | 10.0 | 9.6 | 4.7 |

| Table 7: Cross-tabulation of Current and Three-month Ahead Inflation Expectations: June 2016 | | (Number of respondents) | | | Three-month ahead inflation rate (per cent) | | Current inflation rate (per cent) | | <1 | 1-2 | 2-3 | 3-4 | 4-5 | 5-6 | 6-7 | 7-8 | 8-9 | 9-10 | 10-11 | 11-12 | 12-13 | 13-14 | 14-15 | 15-16 | >=16 | No idea | Total | | <1 | 17 | 16 | 9 | 2 | | | 1 | | | | | | | | | | | 4 | 49 | | 1-2 | 9 | 18 | 47 | 11 | 6 | 2 | 2 | | | | | | | | | | | 1 | 96 | | 2-3 | 2 | 10 | 21 | 42 | 42 | 12 | | 2 | 1 | | | | | | | | | | 132 | | 3-4 | | 4 | 9 | 26 | 63 | 57 | 19 | 8 | 2 | | 1 | | | | | | | 2 | 191 | | 4-5 | 4 | 10 | 26 | 25 | 77 | 106 | 151 | 69 | 18 | 22 | 7 | 1 | 3 | | 5 | 2 | | 11 | 537 | | 5-6 | 3 | 3 | 9 | 17 | 24 | 135 | 276 | 231 | 76 | 34 | 23 | 3 | 1 | | 2 | 2 | 1 | 15 | 855 | | 6-7 | 4 | 5 | 6 | 7 | 4 | 11 | 62 | 117 | 105 | 44 | 18 | 7 | 1 | 1 | 2 | 1 | 2 | 12 | 409 | | 7-8 | 4 | 2 | 2 | 12 | 3 | 5 | 6 | 49 | 128 | 129 | 53 | 12 | 9 | 3 | 2 | 3 | 2 | 4 | 428 | | 8-9 | | 3 | 5 | 6 | 6 | 6 | 8 | 4 | 32 | 141 | 105 | 28 | 9 | 9 | 3 | 8 | 3 | 4 | 380 | | 9-10 | 3 | 19 | 15 | 10 | 16 | 16 | 2 | 11 | 5 | 57 | 118 | 116 | 57 | 16 | 61 | 12 | 23 | 6 | 563 | | 10-11 | 1 | 3 | 6 | 3 | 7 | 12 | | 6 | 3 | 6 | 45 | 96 | 91 | 47 | 27 | 79 | 35 | 11 | 478 | | 11-12 | | | | | 1 | | | | | 1 | 2 | 6 | 20 | 24 | 15 | 6 | 11 | | 86 | | 12-13 | | | | | | | 1 | | | | 2 | 1 | 6 | 18 | 18 | 14 | 5 | | 65 | | 13-14 | | | | | | 1 | | | | | 2 | | 2 | 4 | 11 | 2 | 5 | | 27 | | 14-15 | | 2 | | 1 | 2 | 1 | | 1 | | 6 | 2 | | 2 | 1 | 22 | 23 | 64 | 3 | 130 | | 15-16 | 1 | 2 | 1 | | 2 | 2 | 1 | | 1 | 6 | 7 | 1 | 2 | 1 | 5 | 50 | 78 | 4 | 164 | | >=16 | 4 | 7 | 10 | 4 | 12 | 6 | 4 | 2 | 1 | 24 | 22 | 4 | 3 | 4 | 6 | 20 | 610 | 27 | 770 | | Total | 52 | 104 | 166 | 166 | 265 | 372 | 533 | 500 | 372 | 470 | 407 | 275 | 206 | 128 | 179 | 222 | 839 | 104 | 5360 |

| Table 8: Cross-tabulation of Current and One-year Ahead Inflation Expectations: - Jun 2016 | | (Number of respondents) | | | One-year ahead inflation rate (per cent) | | Current inflation rate (per cent) | | <1 | 1-2 | 2-3 | 3-4 | 4-5 | 5-6 | 6-7 | 7-8 | 8-9 | 9-10 | 10-11 | 11-12 | 12-13 | 13-14 | 14-15 | 15-16 | >=16 | No idea | Total | | <1 | 11 | 13 | 5 | 5 | 2 | 2 | | | | | | | | | | | | 11 | 49 | | 1-2 | 14 | 37 | 12 | 16 | 6 | 5 | 1 | 1 | | 2 | | | | | | | | 2 | 96 | | 2-3 | 1 | 20 | 37 | 13 | 16 | 18 | 13 | 4 | 5 | 1 | 1 | 1 | 2 | | | | | | 132 | | 3-4 | 1 | 4 | 27 | 65 | 25 | 28 | 13 | 9 | 6 | 6 | 2 | | 2 | 1 | | | 1 | 1 | 191 | | 4-5 | | 4 | 11 | 95 | 203 | 37 | 34 | 34 | 24 | 44 | 10 | 10 | 6 | | 1 | 6 | 10 | 8 | 537 | | 5-6 | 2 | 2 | 11 | 10 | 198 | 278 | 43 | 88 | 62 | 62 | 51 | 12 | 5 | 2 | 7 | 8 | 2 | 12 | 855 | | 6-7 | 1 | 1 | 4 | 3 | 4 | 56 | 111 | 36 | 41 | 45 | 33 | 16 | 15 | 7 | 8 | 12 | 4 | 12 | 409 | | 7-8 | | 6 | 2 | 1 | 3 | 4 | 42 | 125 | 32 | 58 | 48 | 20 | 15 | 14 | 24 | 20 | 10 | 4 | 428 | | 8-9 | | 2 | 4 | 2 | 3 | 4 | 6 | 35 | 95 | 16 | 68 | 35 | 18 | 14 | 27 | 29 | 10 | 12 | 380 | | 9-10 | 1 | 2 | 2 | 2 | 6 | 4 | 5 | 1 | 57 | 175 | 29 | 73 | 34 | 17 | 44 | 33 | 71 | 7 | 563 | | 10-11 | 1 | | 1 | 1 | 1 | 10 | 2 | 1 | 4 | 64 | 116 | 25 | 36 | 22 | 20 | 81 | 74 | 19 | 478 | | 11-12 | | | | | | 1 | | | | 1 | 18 | 18 | 3 | 9 | 10 | 8 | 18 | | 86 | | 12-13 | | | | | | | | 1 | | 1 | 1 | 13 | 16 | 2 | 13 | 6 | 8 | 4 | 65 | | 13-14 | | | | | | | | | 1 | | | 1 | 3 | 8 | 1 | 6 | 7 | | 27 | | 14-15 | | | | | 1 | 1 | | | | 2 | 1 | 1 | 2 | 13 | 40 | 17 | 49 | 3 | 130 | | 15-16 | | 1 | 1 | | 2 | 1 | | | 3 | 1 | 8 | 1 | 2 | 1 | 20 | 42 | 74 | 7 | 164 | | >=16 | 7 | | 2 | | 2 | 1 | 2 | 1 | 1 | 12 | 10 | 2 | 3 | 2 | 5 | 16 | 652 | 52 | 770 | | Total | 39 | 92 | 119 | 213 | 472 | 450 | 272 | 336 | 331 | 490 | 396 | 228 | 162 | 112 | 220 | 284 | 990 | 154 | 5360 | |

IST,

IST,