IST,

IST,

I. Output

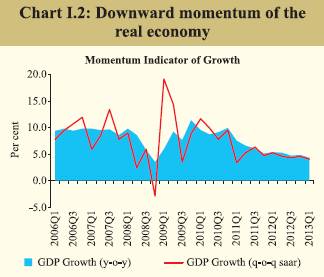

Growth in India, like in many other EMDEs, has slowed for over two years. The slowdown in India was led by domestic structural constraints, while global cyclical conditions added to the drag. However, as some of the structural constraints are starting to get addressed, activity levels could improve in H2 of 2013-14 and a moderate-paced economic recovery could start taking shape towards the end of the year. Better crop prospects due to a good monsoon, initiatives by the government to speed up project implementation and a pick-up in exports, along with a reduction in external imbalances has set the stage for recovery but sustained ground-level action, especially in expediting project implementation is needed to achieve a sustainable turnaround. Global growth likely to remain sluggish in the near term I.1 Global growth appears to be on a sluggish trail despite an improvement in Q2 of 2013 . The International Monetary Fund (IMF) in its World Economic Outlook in October 2013 revised global growth for 2013 downwards by 0.3 percentage points to 2.9 per cent. This downward revision is on account of slower growth in Emerging Market and Developing Economies (EMDEs), including in China and India. EMDEs growth projections have been lowered by 0.5 percentage points to 4.5 per cent, while the projections for Advanced Economies (AEs) stays at 1.2 per cent. I.2 Although both advanced and emerging economies face the challenge of slower growth, there was a distinct improvement in growth in the major advanced economies during Q2 of 2013. In Q2 of 2013, the US GDP grew at 2.5 per cent (seasonally adjusted annualised quarter-on-quarter growth rate, q-o-q saar), higher than 1.1 per cent in Q1 (Chart I.1a), due mainly to growth in exports and non-residential fixed investments on the one hand and a smaller decrease in federal government spending on the other. But the US shutdown for sixteen days might get reflected in lower GDP growth in Q4 of 2013. The imminent risks to the global economy from a possible US debt default have been deferred with the US Government signing a debt deal on October 17, 2013. However, issues for the sustainability of the US recovery going forward remained with headwinds to investment, slack labour market conditions and a possible rise in mortgage rates. I.3 Japan’s economy expanded for the third straight quarter in Q2 of 2013 at 3.8 per cent. UK showed improvements for the second consecutive quarter in Q2 of 2013, growing by 2.7 per cent as against 1.5 per cent in Q1. The euro area grew by 1.1 per cent (q-o-q saar) in the second quarter of 2013, helped by stronger growth in the two largest economies, Germany and France.

I.4 Among the EMDEs, China’s GDP in Q3 of 2013 went up by 9.1 per cent (q-o-q saar) as compared to 7.8 per cent in Q2 and 6.1 per cent in Q1. Brazil’s GDP growth at 6.0 per cent (q-o-q saar) for Q2 of 2013 turned out to be better than expected (Chart I.1b). With the Fed tapering plans getting delayed, the EMDEs need to prepare themselves in the interim for the challenges that may arise. I.5 The US labour market conditions still remain weak with unemployment rate dropped to 7.2 per cent in September 2013, though additional non-farm payroll employment at 148,000 was also weak. UK labour markets witnessed unemployment rate of 7.7 per cent during June-August, down by 0.1 percentage points from March-May 2013. In case of Japan, the unemployment rate increased to 4.1 per cent in August 2013 from 3.8 per cent in July 2013. The unemployment rate in the euro area also remained high and unchanged at 12.0 per cent in August 2013. The Indian economy faced broad-based slowdown during Q1 of 2013-14 I.6 The slowdown facing the Indian economy extended into 2013-14 with growth in Q1 of 2013-14 falling to a 17- quarter low of 4.4 per cent (Table I.1). The growth slowdown was broad-based reflecting moderation in the services and agricultural sectors, and contraction in the industrial sector. I.7 Since H2 of 2011-12, the seasonally adjusted annualised q-o-q saar growth rate has moved in line with declining trends in the year-on- year (y-o-y) GDP growth rate, confirming the downward momentum in the real economy (Chart I.2). The output gap also continued to be negative (Chart I.3). Supply constraints, high inflation, cyclical factors and low external demand contributed to this slowdown. Agriculture growth expected to be buoyant I.8 Agricultural production during 2013-14 is expected to record an above-trend growth (Table I.2). The first advance estimates of production of foodgrains have placed kharif foodgrains at 129.3 million tonnes, a 10.3 per cent jump over the first advance estimates of the previous year and 0.9 per cent growth over the fourth advance estimate. Oilseeds too are expected to show a substantial increase. I.9 A normal and evenly distributed southwest monsoon reinforced the possibility of a good crop. Rainfall during June-September 2013 was 6 per cent above normal. Thirty out of the 36 meteorological sub-divisions that constitute 86 per cent of the country’s area received normal or excess rainfall. Deficiency in rainfall was limited to areas in the East and North-East and in Haryana. Prospects for rabi crops are also good with water storage in the 85 major reservoirs as of October 17, 2013 being 16.3 per cent higher than last year’s level. The Reserve Bank’s production weighted rainfall index for foodgrains for the period stood at 102 per cent of the normal as compared to 87 per cent last year (Chart I.4). The same index for oilseeds (125), sugarcane (109) and cotton (126) was also higher. An improved kharif harvest is expected to help ease food price pressure. I.10 The current stock of rice and wheat at 53 million tonnes (mid-October 2013) is sufficient to meet buffer norms and requirements under the various poverty alleviation schemes (Chart I.5). These stocks can be utilised better in the short-run for price management keeping in view storage constraints that may emerge following another bumper crop. However, over the medium-term a reassessment of the food management strategy may be required keeping in view the expected higher off-take with the phased implementation of the National Food Security Act at the all-India level. Industrial activity continues to be constrained by supply bottlenecks I.11 The index of industrial production (IIP) for April-August 2013 grew marginally by 0.1 per cent. Contraction of the mining and manufacturing sectors has been the main factor in dampening the overall performance of industrial growth. Excluding capital goods and the mining sector, IIP grew by 0.5 per cent during the period (Chart I.6). Excluding volatile items such as ‘cable, rubber insulated’, ‘atrazin’, ‘vitamins’, ‘food processing machinery’, etc. truncated IIP (96 per cent of IIP) growth in April-August 2013 was negative at 0.9 per cent (Chart I.7). I.12 While the mining sector has been declining since 2011-12, the contraction in the manufacturing sector during April-August 2013 was driven primarily by declining outputs of industries like machinery and equipments; accounting and computing machinery; basic metals; fabricated metal products; radio, TV, communication equipments; and motor vehicles. The decline in the mining sector’s output, particularly coal, affected thermal power generation which decelerated to 1.8 per cent during April-August 2013 from 8.6 per cent last year. However, hydro-electricity generation is expected to be distinctly better this year with the replenishment of water in reservoirs. Hydropower has grown by 20.2 per cent y-o-y during April-August 2013. I.13 In terms of use-based industries, consumer durables and basic goods, which together have a 54 per cent weight in IIP, dragged its overall growth down (Table I.3). Core industries show some improvement over last two months I.14 Output of eight core industries improved consecutively for two months with a 3.7 per cent y-o-y growth in August 2013. The latest data shows a pick-up in core industries’ output led by steel, cement and electricity. However, on a year-to-date (YTD) basis, the growth of eight core industries decelerated to 2.3 per cent during April-August 2013 from 6.3 per cent in the corresponding period last year (Chart I.8). The deceleration in thermal electricity during April- August 2013 was reflected in a reduction in the all-India plant load factor (PLF) to 64.1 per cent from 69.8 per cent last year. Moderation in Capacity Utilisation I.15 Capacity utilisation (CU), as measured by the 22nd round of the Order Books, Inventories and Capacity Utilisation Survey (OBICUS) of the Reserve Bank, recorded seasonal decline in Q1 of 2013-14 over the previous quarter (http:// www.rbi.org.in/OBICUS22). There is a broad co-movement between CU and de-trended Index of Industrial Production (IIP) (Chart I.9). After a sequential increase in the previous two quarters, new orders declined in Q1 of 2013-14 both on a q-o-q sequential basis as well as on a y-o-y basis. Finished goods inventory to sales and raw material inventory to sales ratios increased in Q1 of 2013-14 and were higher than the previous year. Lead indicators portray a mixed picture on service sector growth I.16 The services sector grew at 6.2 per cent during Q1 of 2013-14 compared to 7.6 per cent during the same period last year. This was largely due to moderation in the growth of ‘construction’ and ‘trade, hotels, restaurant, transport and communication’ sectors. Developments in lead indicators of the services sector portray a mixed picture. Passenger and commercial vehicles sales and some segments of the aviation industry contracted even though indicators like tourist arrivals, railway freight revenue and steel production showed signs of improvement (Table I.4). The Reserve Bank’s services sector composite indicator, which is based on growth in indicators of construction, trade and transport and finance, showed a downturn in Q1 of 2013-14, but a modest pickup in July-August (Chart I.10). Employment Scenario remains weak in Q1 of 2013-14 I.17 As per the Labour Bureau survey in eight key sectors, moderation in employment generation that started in 2012 continued in Q1 of 2013-14 (Chart I.11). The decline in employment generation was particularly sharp for the IT/BPO sector, reflecting the global slowdown and rising protectionism. Sector-wise, except textiles and leather, no other sector showed any perceptible improvement in employment generation during Q1 of 2013 on a sequential basis. Moderate recovery expected during H2 mainly backed by pick-up in agriculture and exports I.18 The Indian economy is expected to perform better during H2 of 2013-14 on the back of a good monsoon which has boosted the kharif prospects. A good crop will have a positive impact on rural demand, which in turn may help in improving the subdued industrial and services sectors. Further, improved kharif harvest is also expected to help ease supply-side constraints and hence food price pressure. Exports have picked up with exchange rate adjustment though global growth remains slow. On the policy front, the government has started taking several policy initiatives in certain sectors, especially infrastructure, which are expected to improve the overall investment climate. However, these actions will take some time to translate into activity at the ground-level. Therefore, improvements in activity levels during H2 of 2013-14 are expected to stay modest though recovery could start shaping towards the end of the year if the current positive momentum is sustained. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

പേജ് അവസാനം അപ്ഡേറ്റ് ചെയ്തത്: