IST,

IST,

Monetary Policy Report - April 2018

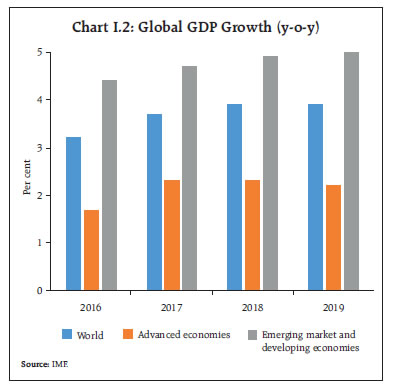

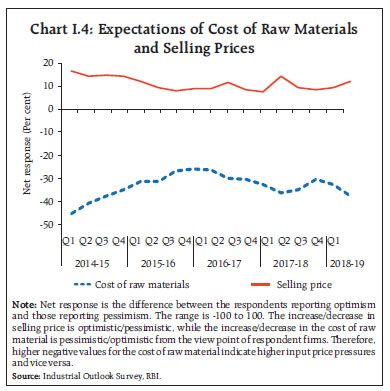

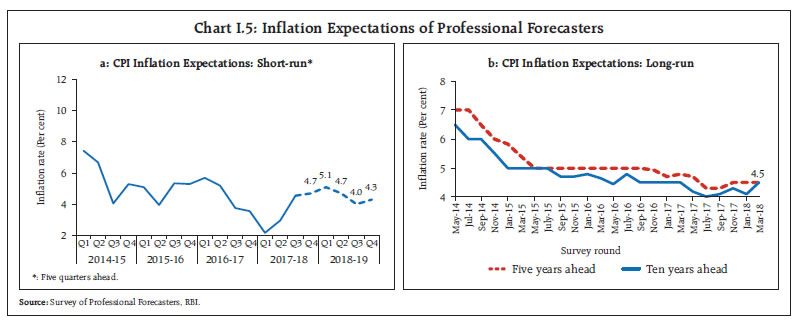

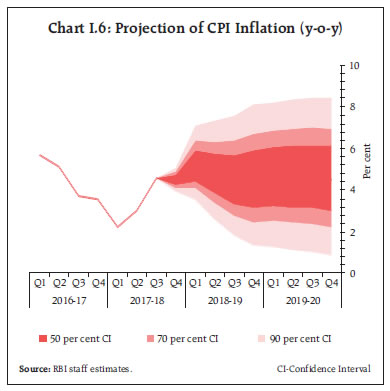

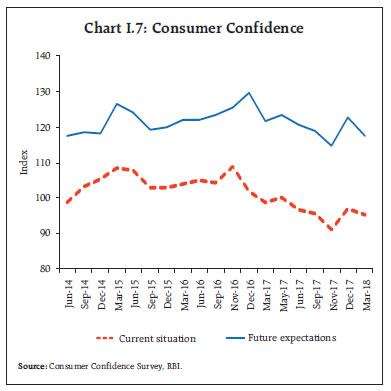

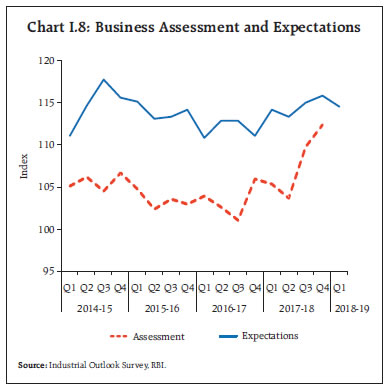

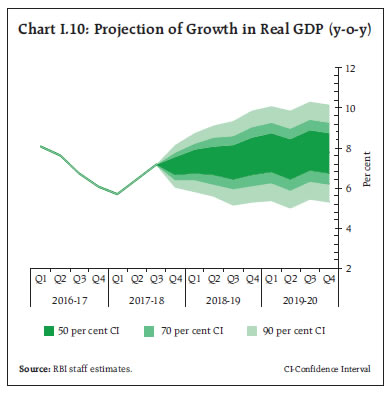

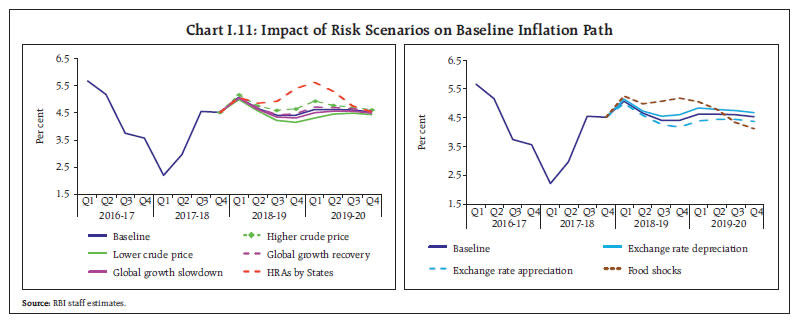

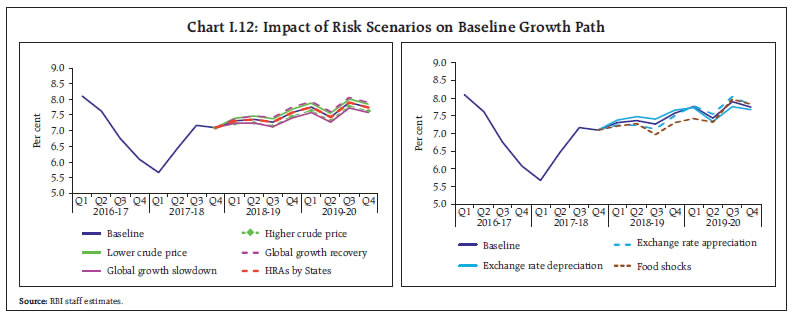

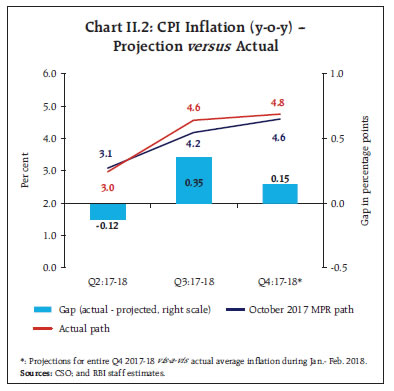

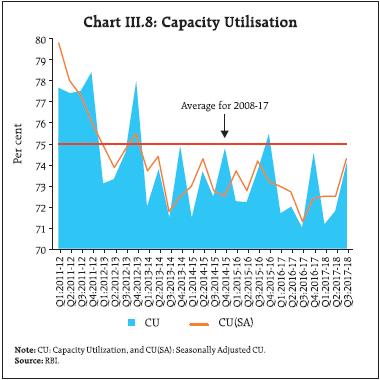

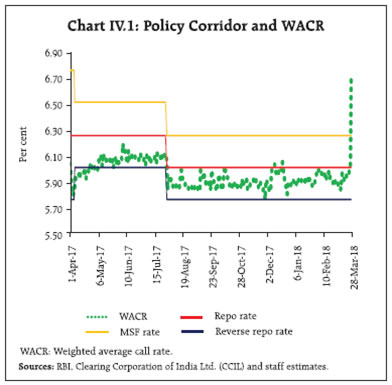

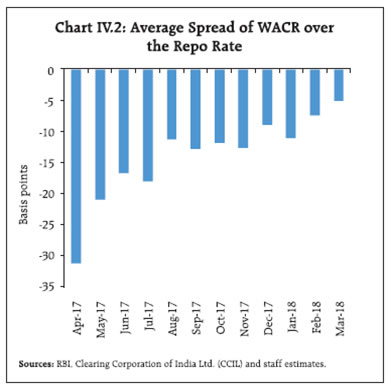

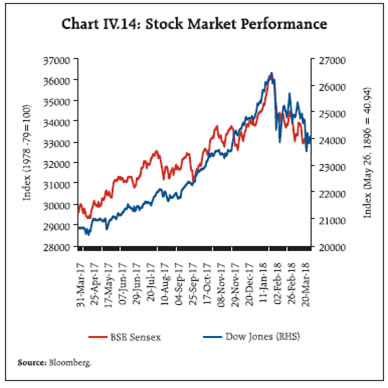

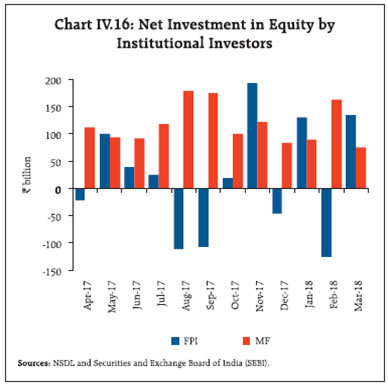

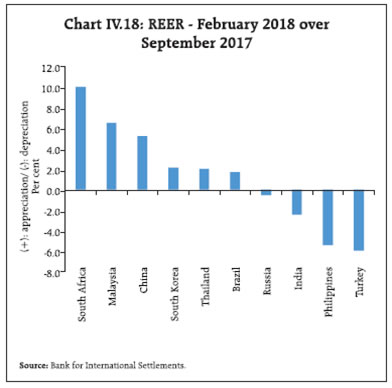

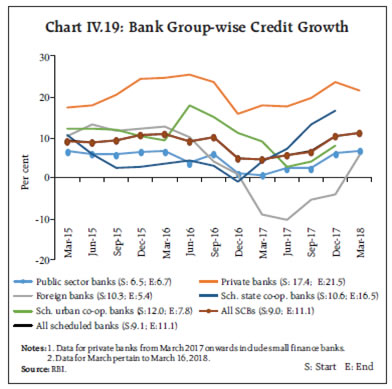

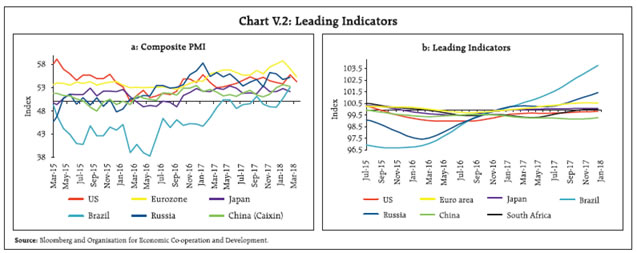

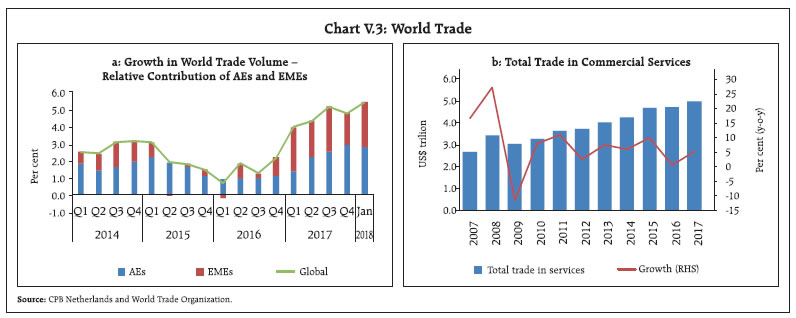

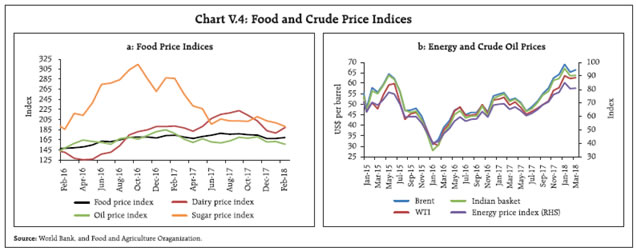

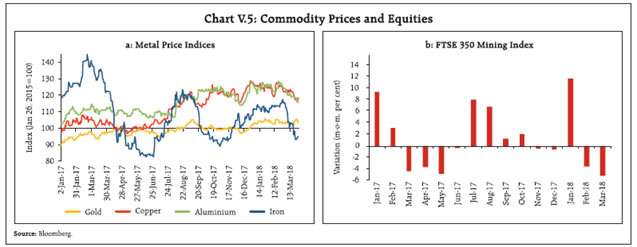

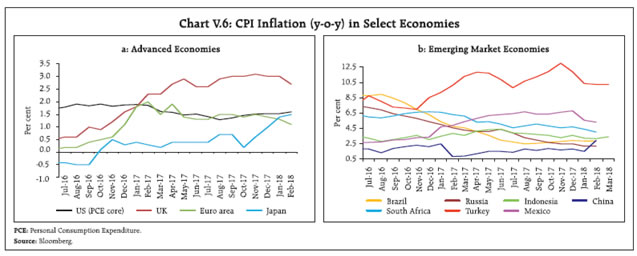

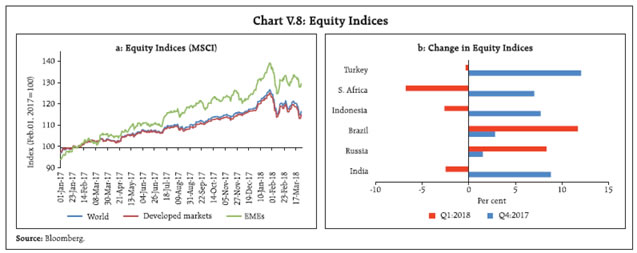

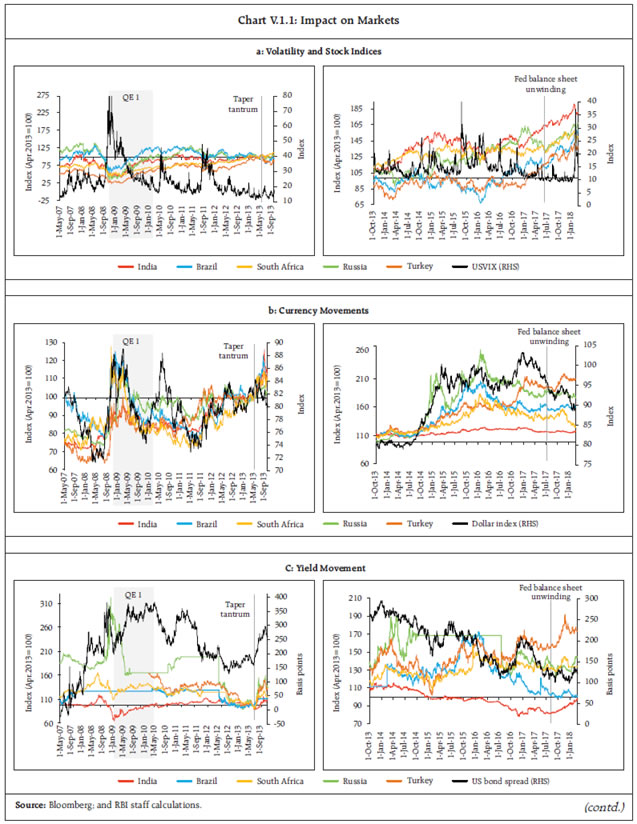

I. Macroeconomic Outlook Inflation is expected to firm up during the first quarter of 2018-19 before moderating in the remaining part of 2018-19 as the direct impact of the increase in house rent allowances for central government employees fades away, which has to be looked through. Economic activity is expected to accelerate with the strengthening of investment activity, supported by consumption demand and robust credit growth. The Monetary Policy Report (MPR) of October 2017 flagged significant shifts underway in the macroeconomic environment. Some of them have gained traction since then while others are incipiently in motion. Global economic activity has continued to strengthen and is becoming increasingly synchronised across regions. Global trade is outpacing demand after lagging behind for two years. Oil prices have firmed up again on the edge of a delicate demand-supply balance. Generally buoyant global financial markets have been interrupted by bouts of volatility triggered by several event-specific announcement effects, and most recently by reassessments of the pace of monetary policy normalisation in the US. Renewed fears of protectionism, retaliatory actions and trade wars pose a major challenge to the global economy, with implications for emerging market economies (EMEs), including India, that are participating in open international trade and relying on foreign capital flows to realise their developmental aspirations. After languishing for five consecutive quarters, economic activity in India is quickening, as estimates and high frequency as well as survey-based indicators etch out for the second half of 2017-18. Growth is strengthening and several elements are coming together to nurture this nascent acceleration: expectations of a record foodgrains output; strong sales growth by corporations; depleting finished goods inventories; and, restart of investment in fixed assets by corporations pointing to renewal of the capex cycle. Several services sectors, including the information technology sector in terms of its international competitiveness, have shown resilience. These are some of the developments that support brighter prospects for the Indian economy in 2018-19. A significant development has been that this time around, the step-up in growth is propelled by a revival of investment on the demand side and manufacturing on the supply side. This outlook will be lifted by tailwinds from remonetisation and implementation of Goods and Services Tax (GST). The path of inflation will likely be influenced by effects of the increase in house rent allowances (HRAs) for central government employees, which is purely statistical and has to be looked through to gauge true inflation developments. As this effect wanes, inflation could moderate in the remaining part of 2018-19 from an upturn in Q1 under the baseline assumptions. Fiscal slippages for 2017-18 and 2018-19, along with the postponement of the medium-term adjustment path, are a key risk to the growth and inflation outlook. Monetary Policy Committee: October 2017-February 2018 The Monetary Policy Committee (MPC) met in December 2017 and February 2018 in accordance with the pre-announced bi-monthly schedule. The MPC voted to keep the policy rate on hold in these meetings, maintaining its neutral stance of the fourth bi-monthly resolution of October 2017. The MPC’s resolutions as well as individual minutes and voting patterns reflected concerns about the changing inflation trajectory – upside risks to the inflation outlook from food and fuel prices, rising input cost conditions, fiscal slippages, and volatile global financial markets in its December resolution; and increase in HRAs by state governments, crude oil and other commodity prices, revisions to minimum support prices (MSPs) and fiscal slippages in its February resolution. The seasonal moderation in prices of vegetables and fruits, subdued capacity utilisation, and moderate rural real wage growth were seen as mitigating factors. Against this backdrop, the MPC voted in December by a majority of 5-1 to maintain status quo on the policy rate, while continuing with a neutral stance. As in the October meeting, one member voted for a rate cut to support economic activity. In February, the MPC persevered with status quo on the policy rate with a vote of 5-1 and a neutral stance, while reiterating its commitment to keep headline inflation close to 4 per cent on a durable basis. In view of several drivers of inflation firing at the same time and the upper tolerance band of inflation target under threat, one member voted for a 25 basis points (bps) increase in the policy rate to commence the withdrawal of accommodation. These subtle variations in voting patterns reflecting individual members’ views on the current and evolving macroeconomic outlook as well as policy preferences on the weights they assign to deviations of inflation and output from target/ potential are also observed in recent experiences of the MPCs in other countries (Table I.1). Macroeconomic Outlook Chapters II and III present macroeconomic developments during October 2017–March 2018 and also explain the reasons for deviations of actual outcomes of inflation and growth from staff’s projections in the October 2017 MPR. Turning to the outlook, the recent evolution of domestic and global macroeconomic developments warrant revisions in the baseline assumptions (Table I.2). First, crude oil prices (Indian basket) firmed up from US$ 56 a barrel in October 2017 to US$ 67 a barrel in January 2018 (Chart I.1). Thereafter, they have fluctuated between US$ 60 and US$ 67. With the Organisation of the Petroleum Exporting Countries (OPEC) extending production cuts through the end of 2018 and the drawdown of inventories to meet increasing demand, being buffeted somewhat by the response of US shale oil production, the baseline scenario assumes crude oil prices (Indian basket) to average around US$ 68 a barrel in 2018-19. Second, the exchange rate (Indian rupee vis-à-vis the US dollar) has exhibited two-way movements since October 2017. It appreciated till the early part of January 2018 on buoyant capital inflows and weakening of the US dollar. Subsequently, it depreciated from early February, following the release of stronger than expected US non-farm payrolls and wages data that fuelled expectations of a faster pace of interest rate increases by the US Federal Reserve and over concerns of the impact of higher crude oil prices on India’s trade deficit. By March, the exchange rate of the rupee was close to its October 2017 level. Third, the pace of global economic activity in 2017 turned out to be stronger than expected due to robust growth in the advanced economies (AEs) and significantly stronger growth in EMEs. Global growth is expected to accelerate further in 2018, benefitting from the boost to investment demand in the US from corporate tax cuts, robust recovery in the euro area and generally improved growth outlook in EMEs (Chart I.2). The sharp recovery in world trade is expected to sustain in 2018 and enlarge the prospects of another year of strong and resilient global activity. Headline CPI inflation reached a peak of 5.2 per cent in December 2017 (4.9 per cent, excluding the estimated impact of HRA for central government employees), reflecting an unseasonal spike in the prices of vegetables and the full impact of the central government implementing the 7th Central Pay Commission’s (CPC’s) HRA award. The delayed setting in of the seasonal food prices moderation took down headline inflation to 4.4 per cent in February (4.1 per cent, excluding the estimated impact of HRA for central government employees). It is likely that this softening will keep the reading for March benign before it reverses in April. The incidence and strength of this reversal will condition monetary policy responses in 2018-19. Turning to the outlook, inflation expectations of urban households remain elevated, according to the March 2018 round of the Reserve Bank’s survey.1 Inflation expectations three months ahead and a year ahead increased by 30 bps and 10 bps, respectively, from the previous round (December) to 7.8 per cent and 8.6 per cent, respectively. The proportion of respondents expecting the general price level to increase by more than the current rate declined for both three months and one year horizons (Chart I.3). Manufacturing firms polled in the Reserve Bank’s industrial outlook survey (March 2018) expected higher input price pressures in Q1:2018-19 due to rising cost of raw materials (higher negative values for cost of raw materials indicate higher input price pressures) (Chart I.4).2 Selling prices are also expected to increase, but not sufficient to protect profit margins. The Nikkei’s purchasing managers’ survey also indicates both input and output price pressures for manufacturing (March 2018) as well as services (February 2018) sectors. Professional forecasters surveyed by the Reserve Bank in March 2018 expect CPI inflation to firm up to 5.1 per cent in Q1:2018-19 and moderate thereafter to 4.3 per cent in Q4:2018-19 (Chart I.5).3 Their medium-term inflation expectations (5 years ahead) remained unchanged at 4.5 per cent, while longer-term inflation expectations (10 years ahead) increased by 40 bps to 4.5 per cent. Taking into account the initial conditions, signals from the forward looking surveys and estimates from structural and other models, CPI inflation is projected to pick up from 4.4 per cent in February 2018 to 5.1 per cent in Q1:2018-19 due to unfavourable base effects and then moderate to 4.7 per cent in Q2, and 4.4 per cent in Q3 and Q4, with risks tilted to the upside (Chart I.6). It may be noted that the direct impact of the increase in the HRA announced by the Central Government fades away fully by December 2018. The 50 per cent and the 70 per cent confidence intervals for inflation in Q4:2018-19 are 3.2-5.9 per cent and 2.5-6.7 per cent, respectively. Excluding the estimated impact of HRA for central government employees, CPI inflation would pick up from 4.1 per cent in February 2018 to 4.7 per cent in Q1:2018-19 and then moderate to 4.4 per cent in Q2, Q3 and Q4. For 2019-20, assuming a normal monsoon and no major exogenous/policy shocks, structural model estimates indicate that inflation will move in a range of 4.5-4.6 per cent. The 50 per cent and the 70 per cent confidence intervals for Q4:2019-20 are 3.0-6.1 per cent and 2.2-7.0 per cent, respectively. There are a number of upside risks to the baseline forecasts. Although the direct impact on headline inflation is statistical and should be looked through for policy purposes, second order effects of the expected increases in HRA, including by state governments, can impact inflation expectations. Other major risks to the inflation outlook are crude oil and other commodity prices, the proposed revisions to MSPs for kharif crops, and fiscal slippage at both the central and state levels. Going forward, economic activity is expected to gather pace in 2018-19, benefitting from a conducive domestic and global environment. First, the teething troubles relating to implementation of the GST are receding. Second, credit off-take has improved in the recent period and is becoming increasingly broad-based, which portends well for the manufacturing sector and new investment activity. Third, large resource mobilisation from the primary market could strengthen investment activity further in the period ahead. Fourth, the process of recapitalisation of public sector banks and resolution of distressed assets under the Insolvency and Bankruptcy Code (IBC) may improve the business and investment environment. Fifth, global trade growth has accelerated, which should encourage exports and reduce the drag from net exports. Sixth, the thrust on rural and infrastructure sectors in the Union Budget could rejuvenate rural demand and also crowd in private investment. Notwithstanding these salubrious developments, consumer confidence dipped in the March 2018 round of the Reserve Bank’s survey, with the respondents expecting a moderation over the year ahead in general economic conditions, employment situation and their income (Chart I.7).4 Overall sentiment in the manufacturing sector a quarter ahead also fell in the March 2018 round of the Reserve Bank’s industrial outlook survey under the weight of weaker prospects for production, order books, capacity utilisation, employment and profit margins (Chart I.8). However, surveys conducted by other agencies indicate an improvement in business confidence (Table I.3). Manufacturing and services sector firms in the Nikkei’s purchasing managers’ surveys (March 2018 and February 2018, respectively) are optimistic about the outlook a year ahead, driven by expansion plans and expected improvement in demand conditions. In the March 2018 round of the Reserve Bank’s survey, professional forecasters expected real gross domestic product (GDP) growth to pick up marginally from 7.2 per cent in Q3:2017-18 to 7.3 per cent in Q1:2018-19 and remain at 7.2 per cent in Q2-Q4 (Chart I.9 and Table I.4). Taking into account the baseline assumptions, survey indicators and model forecasts, real GDP growth is projected to improve from 6.6 per cent in 2017-18 to 7.4 per cent in 2018-19 – 7.3 per cent in Q1, 7.4 per cent in Q2, 7.3 per cent in Q3 and 7.6 per cent in Q4 – with risks evenly balanced around this baseline path.5 For 2019-20, the structural model estimates indicate real GDP growth at 7.7 per cent, with quarterly growth rates in the range of 7.4-7.9 per cent, assuming a normal monsoon, and no major exogenous/policy shocks (Chart I.10). Risks to the baseline growth scenario need to be monitored carefully. First, the uncertainty associated with the pace and timing of normalisation of monetary policy in the US and other major AE central banks has led to recurrent bouts of volatility in international financial markets which may have an adverse impact on capital flows and overall investment sentiment, including for EMEs through the “finance” channel. Second, protectionist measures in the US and the generalised threat of a trade war can exacerbate volatility in global financial markets, with spillovers to domestic financial markets and adverse implications for the growth outlook. Large revisions in past data on national accounts statistics also pose a challenge to forecasts (Box I.1). The baseline projections of growth and inflation presented in the preceding sections are based on assumptions set out in Table I.2. However, there are large uncertainties around these baseline assumptions, posing risks to the baseline projections. The projected paths of growth and inflation under plausible alternative scenarios are discussed below. (i) International Crude Oil Prices The dynamics of oil prices over the past six months highlight the volatility associated with the oil market. The baseline scenario assumes crude oil prices (Indian basket) to average around US$ 68 a barrel during 2018-19. Global growth has surprised on the upside in recent quarters. If these conditions persist, global crude oil demand and hence prices could edge higher. Assuming crude oil prices average around US$ 78 in this scenario, inflation could be higher by 30 bps over the baseline and growth weaker by around 10 bps. On the other hand, there could be downward pressures on international crude prices if global economic activity were to turn weaker than expected (for a variety of factors discussed later) or shale gas output is ramped up further in response to elevated crude oil prices or OPEC members produce more than their agreed shares. Should the Indian basket crude price fall to US$ 58 per barrel in this scenario, inflation could ease by around 30 bps below the baseline, with a boost of around 10 bps to real GDP growth (Charts I.11 and I.12).

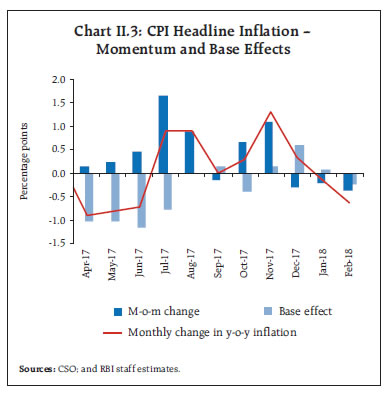

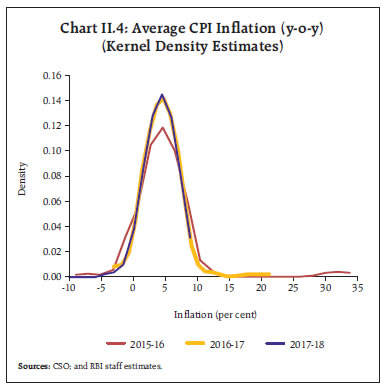

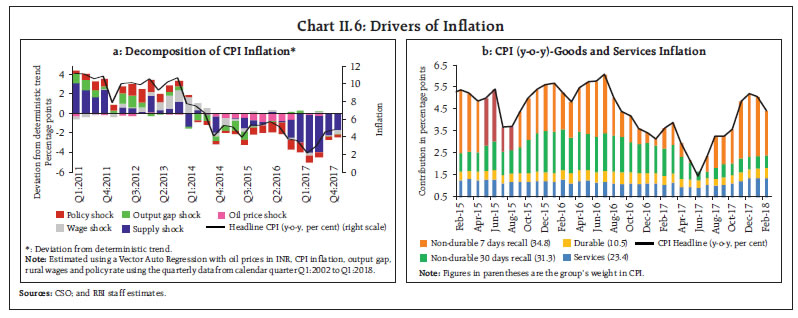

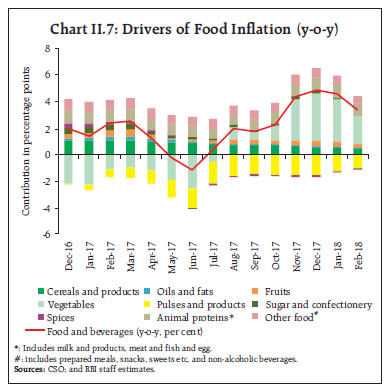

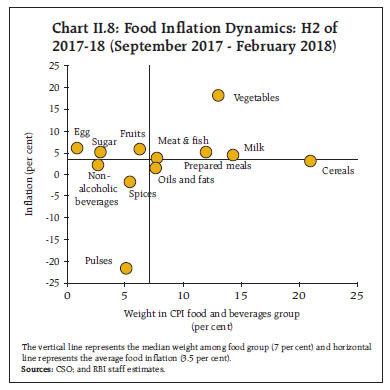

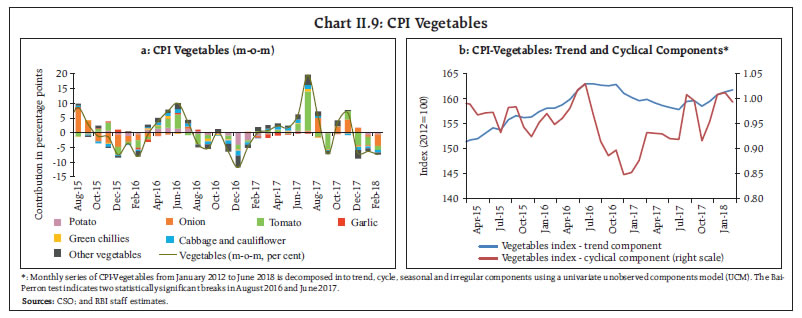

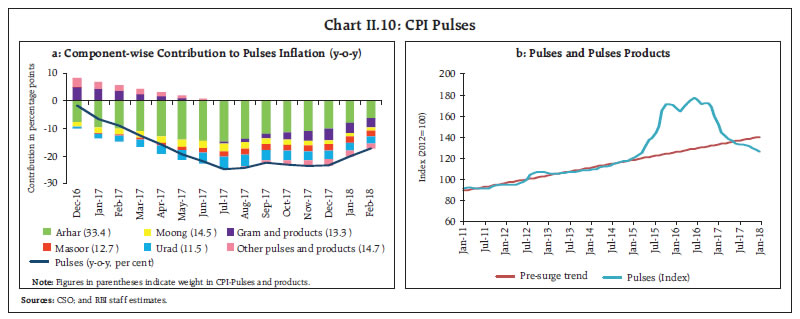

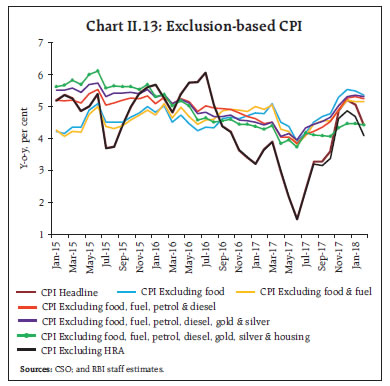

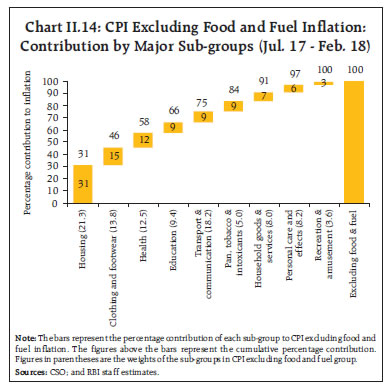

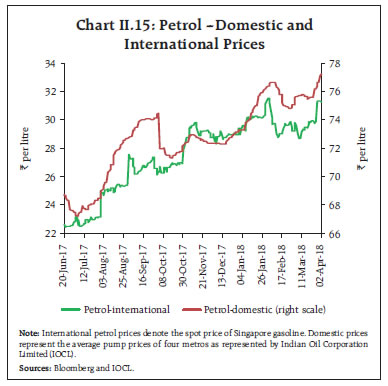

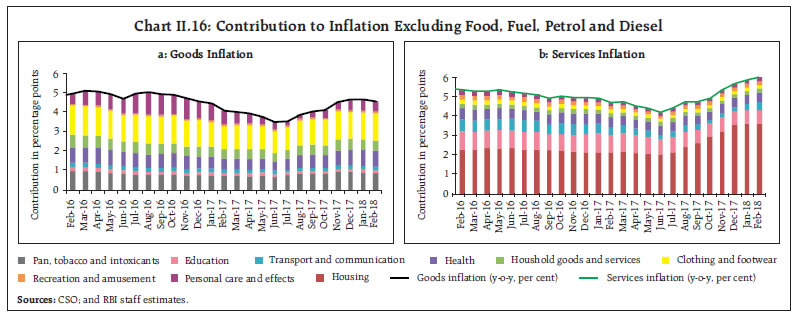

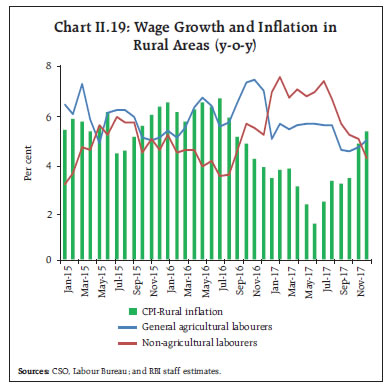

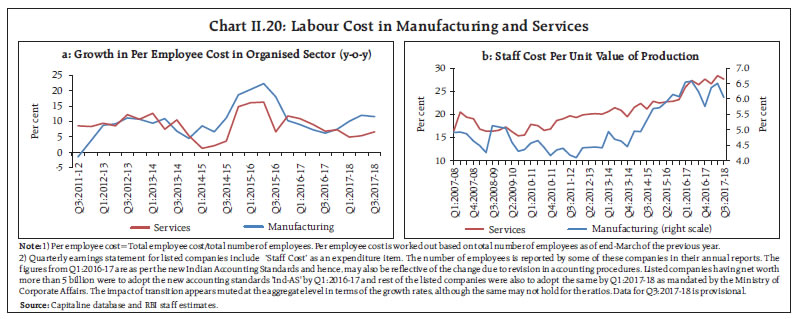

(ii) Global Growth The baseline scenario assumes global growth to gain upward momentum during 2018, buoyed by the boost to US investment demand from corporate tax cuts, strong activity in the euro area supported by accommodative monetary policy and improvement in growth prospects of EMEs. There are upside risks to the baseline with the synchronised cyclical rebound, revival of global trade and easy financing conditions reinforcing each other. If global growth turns out to be 50 bps over the baseline, it could strengthen domestic growth by 20 bps above the baseline and raise domestic inflation by around 10 bps. On the other hand, protectionist policies, continuing uncertainty associated with the pace and timing of normalisation of monetary policy in the US and other systemic central banks, and higher crude oil prices pose downside risks to global demand. In such a scenario, if global demand weakens by 50 bps vis-à-vis the baseline, domestic growth and inflation could be 20 bps and around 10 bps, respectively, below the baseline. (iii) House Rent Allowances – Implementation by States The increase in the HRA by the central government for its employees is reflected in the inflation data since July 2017. There remains uncertainty, however, about the magnitude and timing of implementation of the HRA award by the state governments for their employees and these are, therefore, not included in the baseline inflation path. Assuming that all state governments implement increases in pay and allowances of the same order as the central government during the course of 2018-19, CPI inflation could turn out to be around 100 bps above the baseline on account of the direct statistical effect of higher HRAs, with additional indirect effects emanating from higher demand and increase in inflation expectations. As noted earlier, monetary policy should look through the direct statistical effects, while being vigilant about indirect effects working through inflation expectations. (iv) Exchange Rate The exchange rate of the Indian rupee vis-à-vis the US dollar has moved in both directions in recent months. Changing market perceptions about the pace and timing of monetary policy normalisation in the US, along with domestic inflation, fiscal slippage and current account balance developments, have been important factors driving exchange rate movements in the recent period and are likely to remain so in the near-term. With economic activity gathering pace in the euro area, uncertainty surrounding normalisation plans of the European Central Bank is likely to add to financial market volatility. The US macroeconomic policy mix – easy fiscal policy in an environment when monetary accommodation is being withdrawn – can accentuate market volatility. Assuming a depreciation of the Indian rupee by around 5 per cent relative to the baseline, inflation could edge higher by around 20 bps and the boost to net exports could increase growth by around 15 bps. On the other hand, with growth picking up in recent months, sound domestic fundamentals and the various initiatives taken by the Government to boost investment, India may continue to be an attractive destination for foreign investment, which could put upward pressures on the currency. An appreciation of the Indian rupee by 5 per cent in this scenario could soften inflation by around 20 bps and reduce growth by around 15 bps in 2018-19. (v) Risks to Food Inflation The baseline projections of growth and inflation assume a normal south-west monsoon, which is supported by early signals of likely ENSO (El Nino – Southern Oscillation) neutral conditions. The India Meteorological Department (IMD) is yet to release its forecast on the south-west monsoon season for 2018. Given the sensitivity of the agricultural sector to rainfall conditions, the actual growth and inflation dynamics would critically depend on the progress of the monsoon. A deficient monsoon could lower overall GDP growth by around 20-30 bps in 2018-19. Furthermore, the Union Budget has proposed revised guidelines for arriving at the MSPs for kharif crops, although the details are not yet fully available. If the monsoon is deficient and the budget proposals on MSPs lead to higher food prices, headline inflation could rise above the baseline by around 80 bps. (vi) Fiscal Slippage The Central Government’s fiscal deficit for 2017-18 and 2018-19 is likely to be above initial expectations and the medium-term adjustment path has also been postponed. An empirical assessment presented in the MPR of October 2017 suggests that: (a) in India, causality runs from fiscal deficits to inflation; and (b) the impact of fiscal deficits on inflation is non-linear, i.e., higher the initial levels of the fiscal deficit and inflation, higher is the impact of an increase in the fiscal deficit on inflation. Given the present levels of the combined (centre and states) fiscal deficit, an increase in the fiscal deficit to GDP ratio by 100 bps could lead to an increase of about 50 bps in inflation. Apart from its direct impact on inflation, fiscal slippage has broader macro-financial implications, notably on economy-wide costs of borrowing which have already started to rise. These may feed into inflation and elevate it further. To summarise, aggregate demand is expected to improve in 2018-19, supported, inter alia, by the improving GST implementation, the recapitalisation of public sector banks and the resolution of distressed assets under the IBC. Rural and infrastructure sectors are identified as thrust areas in the Union Budget, which could energise aggregate demand. With the acceleration in global trade, the Indian economy could benefit from buoyant external demand. In addition to the usual monsoon related uncertainty, inflation faces upside risks from a variety of other sources, especially due to the oil prices, the fiscal slippage, and (the statistical effect from) the expected increases in HRAs by the state governments, The purely direct statistical impact of the HRA adjustment on CPI will be looked through while formulating monetary policy. Uncertainty over the pace and timing of monetary policy normalisation by the systemic central banks in advanced economies, protectionist tendencies and fears of a trade war pose significant risks to the baseline inflation and growth paths. 1 The Reserve Bank’s inflation expectations survey of households is conducted in 18 cities and the results of the March 2018 survey are based on responses from 5,150 households. 2 The March 2018 round results are based on responses from 1,250 companies. 3 25 forecasters participated in the March 2018 round of the Reserve Bank’s survey of professional forecasters. 4 The survey is conducted by the Reserve Bank in six metropolitan cities and the March 2018 round elicited responses from 5,297 respondents. 5 From this MPR onwards, growth in gross domestic product (GDP) will be used as the headline measure of economic activity. II. Prices and Costs Consumer price inflation rose sharply in Q3:2017-18, driven up by a spike in food prices and by the disbursement of enhanced house rent allowance (HRA) for central government employees, the latter alone contributing an estimated 35 basis points. It moderated somewhat in Q4 on a delayed seasonal easing of prices of vegetables. Industrial input costs increased through H2:2017-18, tracking movements in international commodity prices. Wage pressures have remained moderate in both the organised and rural sectors. The course of consumer price index (CPI) inflation in Q3 was significantly influenced by house rent allowance (HRA) increase for central government employees from July 2017, following the recommendations of the 7th central pay commission (CPC).1 The HRA impact contributed 35 basis points to the rise in headline inflation to its recent peak of 5.2 per cent in December, following the chain base method of compilation of the housing index in the CPI.2 Adjusted for the estimated HRA impact, headline inflation was 4.9 per cent in December. The HRA impact on inflation excluding food and fuel was even larger at around 75 basis points, adjusting for which it would have been lower at 4.4 per cent in December. Food inflation rose sharply in Q3 pushed by the unseasonal pick-up in prices of vegetables; and fuel inflation accelerated due to an uptick in inflation in liquefied petroleum gas (LPG), kerosene, coke and electricity. In Q4, headline inflation eased to 4.4 per cent by February 2018 with the seasonal softening in prices of vegetables. Excluding the HRA impact, headline inflation was 4.1 per cent and inflation excluding food and fuel remained unchanged at 4.4 per cent (Chart II.1). The MPR of October 2017 had projected CPI inflation to increase to 4.2 per cent in Q3 of 2017-18 and further to 4.6 per cent in Q4, based on a prognosis of unfavourable base effects and the play-out of the increase in HRA for central government employees. Actual inflation outcomes in Q3 were in alignment with the direction of the projected trajectory, but in levels, they turned out to be 35 basis points higher than forecast due to a combination of shocks. First, an unseasonal spike in the prices of onions and tomatoes during October-November 2017 caused prices of vegetables to soar, propelling inflation in this category to close to 30 per cent in December. Second, fuel inflation rose sharply during October-November on the back of an escalation in LPG prices. Third, international crude oil prices started firming up further from October. By end-December 2017, they were US$ 10 per barrel above the baseline assumption of US$ 55 per barrel. The pass-through to CPI inflation was, however, muted in Q3 due to excise duty cuts in early October and lagged mark-ups by oil marketing companies (OMCs). In Q4, most of the factors imposing these upward price pressures reversed. The winter downturn in prices of vegetables accentuated in January. Domestic LPG prices also eased in February, tracking international prices. As a result, the deviation between the actual and the projected inflation narrowed in Q4 to 15 bps (Chart II.2). The increase in HRA for central government employees, which became effective from July 2017 and continued to accumulate till December 2017, shaped the path of headline inflation during Q3, with unseasonal hardening of prices of vegetables, accentuating a spike to 4.9 per cent in November. While prices of vegetables did undergo a shallower than usual moderation in December, an unfavourable base effect came into play, pulling up inflation to a peak of 5.2 per cent in December. In Q4, headline inflation moderated with a fall in momentum due to a delayed but steep reversal in prices of vegetables (Chart II.3). The distribution of inflation across CPI groups in 2017-18 had striking similarities as well as divergences with last year’s experience. While median and modal inflation were similar, the continuing deflation in pulses gave the inflation distribution a considerable negative skew this year in contrast to the positive skew generated by high sugar and pulses inflation during 2016-17 (Chart II.4). Diffusion indices3 of price changes in CPI items suggest that on a seasonally adjusted basis, after an uptick in Q3:2017-18, the situation reversed in January-February, with the prices of a number of goods, particularly of food items, registering decline (Chart II.5). A historical decomposition4 of inflation shows that the persistent effect of favourable supply shocks, especially on food prices, provided a cushion in the first half of 2017-18. However, the positive supply shocks waned in the second half of the year vis-á-vis the first half. The lagged impact of the still negative output gap and moderation in nominal rural wages also contributed to lower inflation during this period, while the firming up of crude oil prices imparted upward pressure (Chart II.6a). Decomposing inflation into its goods and services components reveals that the pick-up in inflation from June to December 2017 and its reversal from January 2018 largely emanated from prices of non-durables, particularly perishables; while those of services registered a sustained increase, primarily due to increase in housing inflation from 4.7 per cent in June to 8.2 per cent in December and further to 8.4 per cent in February, reflecting the statistical effect of the HRA (Chart II.6b). Housing alone contributed over 90 per cent of the observed increase in services inflation during this period. Turning to the drivers of food inflation in the second half of the year, the food and beverages sub-group contributed around 40 per cent to overall inflation, up from just 12 per cent during the first half. Adequate buffer stocks kept inflation in cereals generally under check. With cereals inflation under check, the pick-up in food inflation was largely on account of prices of vegetables – specifically tomato and onion – and intermittent uptick in prices of animal protein-rich food items. Continued decline in prices of pulses exerted a strong downward pull. Inflation in processed food products also moderated due to, inter alia, downward revision in GST rates (Charts II.7 and II.8). Vegetables, which account for 13 per cent of the food group in CPI, were the principal drivers of food inflation. Price pressures in vegetables started building up from June 2017 following a fall in mandi arrivals, especially in onions and tomatoes (Chart II.9a). In the case of tomatoes, the upsurge in prices was so sharp that inflation in this category went up from (-)41 per cent in June 2017 to 119 per cent in November 2017 due to supply disruptions caused by adverse weather conditions – high temporal and spatial variability and delayed withdrawal of monsoon – and farmers’ agitation in parts of Maharashtra and Madhya Pradesh. While tomato prices recorded some contraction during August-September, the extended South-West monsoon in October in several important tomato-producing centres, especially in states like Karnataka, Andhra Pradesh, Telengana, Madhya Pradesh and Odisha, led to severe crop losses and tomato prices shot up again in November. Another driver was the inflation in onions, which rose from (-)14 per cent in April 2017 to 159 per cent in December. Again, while unfavourable weather was a factor, large procurement of onions by a few state governments was the principal cause of the price spike. Post-November 2017, onion and tomato prices plunged with the arrival of fresh winter crops. Supply management measures by the government, especially in case of onions, helped in easing prices. The minimum export price (MEP), which is the key supply management measure used by the government to contain onion price surges, was re-implemented during the year in November and set at US$ 850 per tonne. The State-owned canalising agency viz., Metals and Minerals Trading Corporation of India (MMTC), imported 2,000 tonnes of onions, while other agencies such as National Agricultural Cooperative Marketing Federation of India (NAFED) procured around 10,000 tonnes of onions directly from the farmers, and the Small Farmers’ Agri-Business Consortium (SFAC) bought around 2,000 tonnes of onions locally and supplied to the consumers. The central government also advised states to take measures by way of licensing, imposition of stock limits and movement restrictions to balance supplies. In response, onion prices softened and the government brought down the MEP to US$ 700 per tonne in January 2018 before withdrawing it completely in February 2018. In case of potatoes, delayed sowing in West Bengal – a key growing state – due to extended monsoon showers in October, induced price pressures. However, carry-over stocks from the previous crop reined them in. Analysis based on CPI data suggests that there is no significant difference in the m-o-m changes of prices of vegetables in urban and rural areas – the spike in prices of vegetables uniformly impacted rural and urban India5. Most of the demonetisation-induced fall in prices of vegetables reversed as is evident from the trend and cyclical components of CPI-Vegetables (Chart II.9b). The other food components that recorded uptick in prices, albeit unevenly, were protein-rich items such as egg, meat and fish. Inflation in egg prices jumped from 0.8 per cent in October to 9.3 per cent in December, pushed up by tighter supply conditions on account of reduced egg production by poultry farms at the time of the usual increase in winter demand. Pulses, with a weight of 5 per cent in the food group, contributed significantly to food inflation dynamics during the year. The contribution of pulses to overall inflation shifted from 6.0 per cent during 2016-17 to (-)19.0 per cent in 2017-18. At a granular level, the contribution of arhar in overall pulses inflation declined consistently from July 2017, while the contribution of gram prices, turned increasingly negative month after month till December 2017. With the production for pulses during 2017-18, as per the second advanced estimates, being marginally higher at 23.95 million tonnes (23.13 million tonnes in 2016-17), pulses prices have now fallen significantly below trend levels (Charts II.10a & b). Arhar and urad prices remain below their minimum support prices (MSPs) at the mandi level in the major producing states viz., Maharashtra, Madhya Pradesh, Gujarat, Uttar Pradesh and Karnataka reflecting the large gap in procurement relative to supply (Chart II.11). Corrective measures were initiated by the government during the course of the year such as removal of export ban on all pulses and an imposition of 60 per cent import duty on gram and 30 per cent import duty on masoor in order to support prices and provide some relief to farmers. Sugar and spices are the other items which played an important role in the overall moderation of food inflation. Inflation in sugar and confectionery, which was in double digits all through 2016-17 (averaging about 20 per cent), declined significantly during the year, largely due to measures facilitating imports and on expectations of higher domestic production (the sugarcane production for 2017-18, as per the second advanced estimates, is 353.2 million tonnes as against 306.1 million tonnes in 2016-17). With sugar prices easing rapidly, however, the central government has again raised the import duty on sugar to 100 per cent and re-imposed stockholding limits on sugar sales for February and March 2018. Prices of spices have moved into deflation since June 2017 on account of a fall in prices of dry chillies, turmeric, dhania, and black pepper. Fuel and light inflation, which was at 5.0 per cent in August 2017, touched 8.2 per cent in November 2017, the highest since September 2013 (Chart II.12) largely on account of a sustained increase in domestic prices of LPG – tracking rising international product prices – as well as due to rural fuel consumption items such as dung cake. Since the migration of subsidy payments on LPG to banks under the direct benefit transfer scheme, LPG prices track international prices closely. Administered kerosene also registered sustained price increases as OMCs raised prices in a calibrated manner. Fuel and light inflation since December has eased driven by the downturn in LPG inflation, reflecting international price movements, as well as on account of moderation in firewood and chips and dung cake inflation. Turning to the underlying inflation dynamics, CPI inflation excluding food and fuel edged up from the June 2017 trough of 3.8 per cent to 5.2 per cent in December and remained at that level during January- February 2018 – an increase of around 130 basis points between June and February (Chart II.13). The substantial increase largely reflected an increase in housing inflation (Chart II.14). Netting out the HRA impact, CPI inflation excluding food and fuel would have been 4.4 per cent – around 75 basis points lower than the observed print – during December 2017 to February 2018. Inflation in CPI excluding food and fuel, as also petrol and diesel, increased from June 2017 by 140 basis points to 5.3 per cent in February 2018. While the HRA impact explained much of this increase, petrol and diesel initially in Q3, had a dampening effect as much of the pass-through of surge in international crude oil price to domestic prices was delayed to the second half of January 2018. Furthermore, the excise duty cuts in early October 2017 by ₹2 per litre each for petrol and diesel also helped cushion the incremental impact of rising international crude prices (Chart II.15). Further, excluding the four volatile items – petrol, diesel, gold and silver – and housing, the inflation in February was 70 basis points lower at 4.4 per cent, and reflected the underlying inflation momentum in the second half of 2017-18. In H2:2017-18, both goods and services in CPI excluding food and fuel exhibited a rising inflation trajectory, notwithstanding some softening in case of goods in the recent months. For goods, inflation picked up across commodity groups: medicines under the health sub-group; clothing and footwear; pan, tobacco and intoxicants; and gold under the personal care and effects sub-group (Chart II.16a). Services inflation increased by 177 basis points over June (Chart II.16b), driven by housing sub-group due to the release of HRA from July 2017 under the recommendations of the 7th CPC. The contribution of transport services also edged up in recent months, as fuel prices were transmitted to increase in transportation fares. In contrast, communication services inflation has remained muted due to low cellular services inflation. Other Measures of Inflation Measures of inflation other than CPI remained moderate in Q3 and Q4:2017-18. Inflation in wholesale price index (WPI) that does not include services, the CPI for rural labourers (RL) and the agricultural labourers (AL), which do not have housing components, moved in tandem with headline CPI up to October. The gap between inflation in terms of the CPI for industrial workers (CPI-IW) and the headline CPI, which was wide since July 2017 after HRA was implemented, closed in January 2018. CPI-IW adjusts its housing index only twice a year – in January and July. Thus, the HRA impact was reflected only in January 2018. GDP and GVA deflators also remained lower than CPI in Q3 (Chart II.17a). After the June 2017 trough, inflation measured by trimmed means in the CPI hardened for the rest of 2017. Thereafter, all trimmed means, including the weighted median, edged down, reflecting, inter alia, the broad-based softening of food prices (Chart II.17b). Underlying cost conditions have mostly co-moved with measures of inflation, ticking up in H2:2017-18, notwithstanding some moderation in Q4. Y-o-y growth in farm input costs slipped temporarily into negative territory in January 2018 (Chart II.18). The rise in global crude oil prices and the hardening of metal prices fuelled the rise in input costs from August 2017 onwards and contributed to the turnaround in domestic non-farm input costs as they got passed on to inputs such as high speed diesel, aviation turbine fuel, naptha, bitumen, furnace oil and lube oils. Among other industrial raw materials, domestic coal inflation generally remained high during the year, tracking the surge in international coal prices and domestic supply shortages. However, inflation in other inputs depicted a mixed behaviour. In the case of oilseeds, inflation picked up during H2:2017-18, whereas in the case of fibres and paper and pulp, inflation moderated during the same period. Inflation in electricity, which carries a high weight in both industrial and farm inputs, rose during September-October 2017, but turned negative thereafter. Among other farm sector inputs, diesel prices increased sharply from August 2017, mirroring international prices, while prices of inputs such as tractors and fodder increased sharply in February 2018 after contracting in the preceding months. Fertiliser prices also recorded some upward pressure during December-February. Growth in rural wages largely moderated since August 2017 (Chart II.19). In general, nominal rural wages and inflation tend to move together. However, large supply shocks have caused a divergence between the two in the recent period (Box II.1). Staff costs in the organised manufacturing sector rose between Q3:2016-17 and Q2:2017-18, but moderated during Q3:2017-18. The y-o-y growth in per employee cost for the manufacturing sector moderated to 11.6 per cent during Q3:2017-18. Staff costs in the services sector continued to decelerate from Q4:2015-16 till Q1:2017-18 and rose thereafter to 6.6 per cent in Q3:2017-18 (Chart II.20). Based on responses of manufacturing firms covered in the Reserve Bank’s industrial outlook survey, the cost of raw materials is assessed to increase significantly in Q4:2017-18 in relation to the previous quarter. Firms expect the cost of raw materials to rise further in Q1:2018-19, and pass them on to selling prices due to pressure on their margins. The manufacturing purchasing managers’ index (PMI) suggests that input costs accelerated in the second half of 2017-18, registering their highest level in February in the past 12 months before edging down in March. The co-movement of output prices with input prices suggests that pricing power is returning. In PMI services, there was a sharp acceleration in input prices in Q3, with the input services price index reaching its highest level of 55.0 since October 2013. The prices of services continued to increase in Q3 and Q4, though its momentum moderated with the downward revision in GST rates for many services.

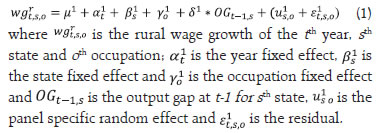

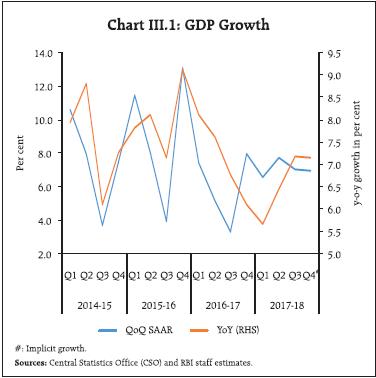

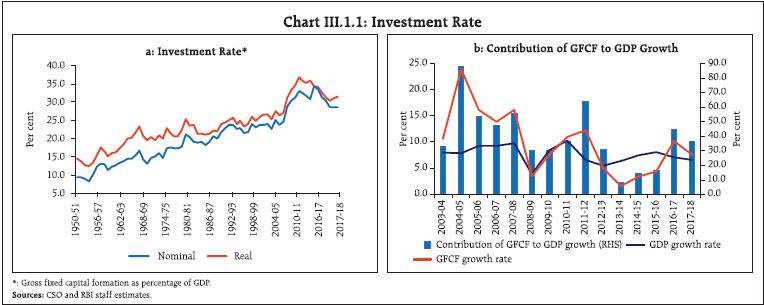

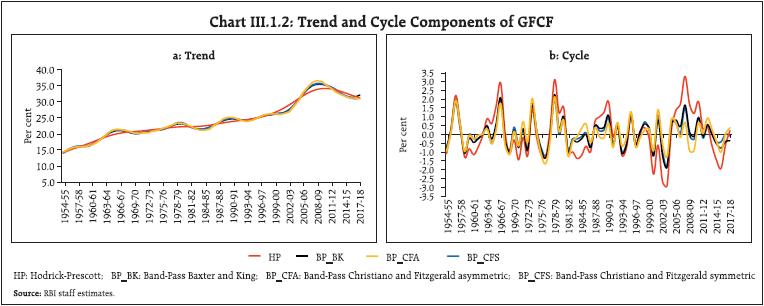

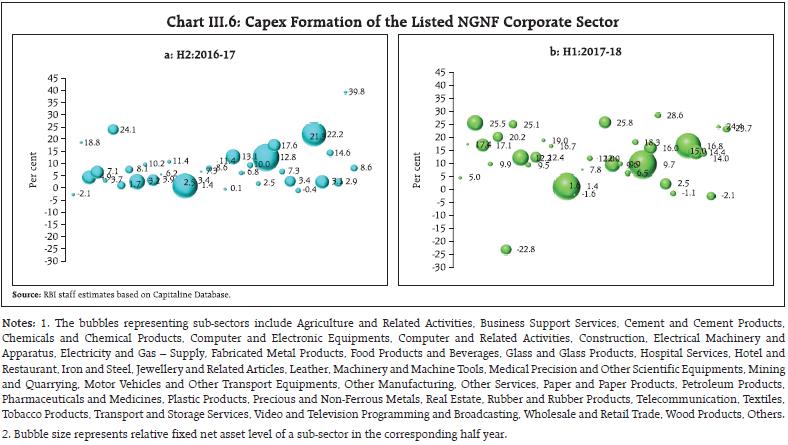

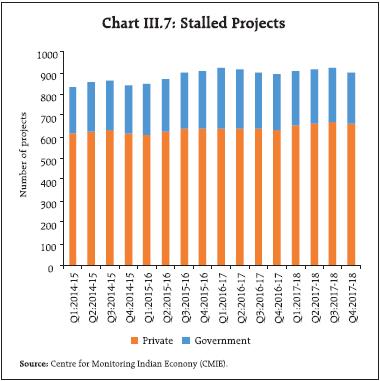

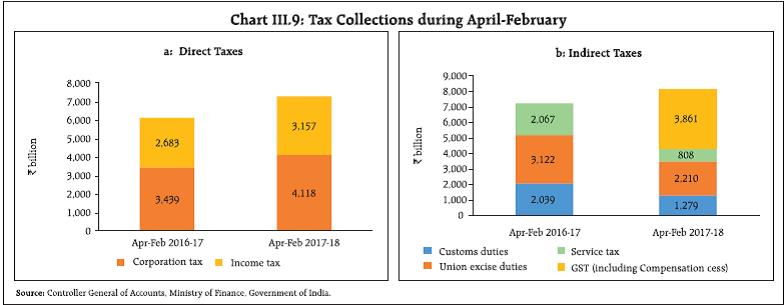

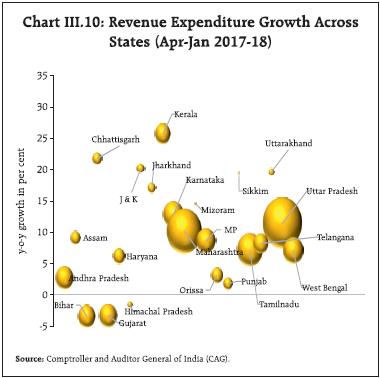

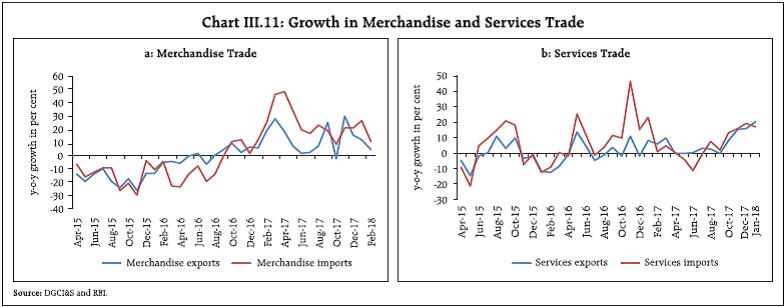

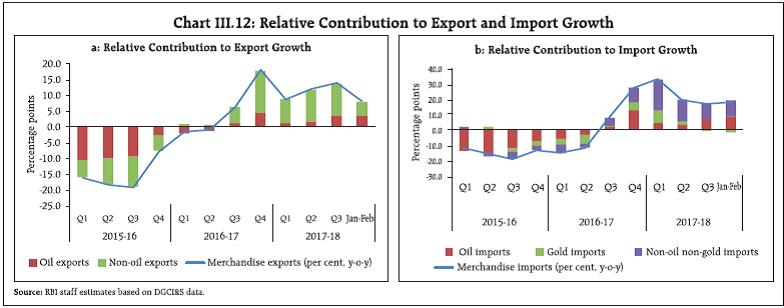

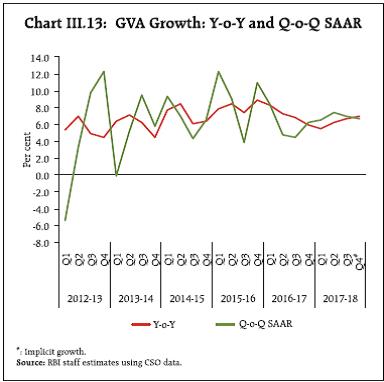

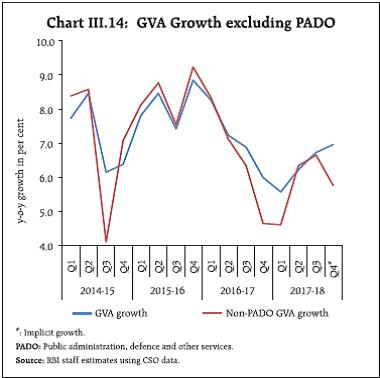

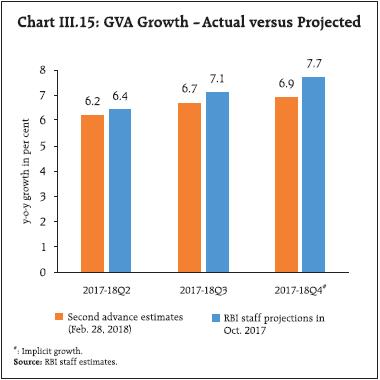

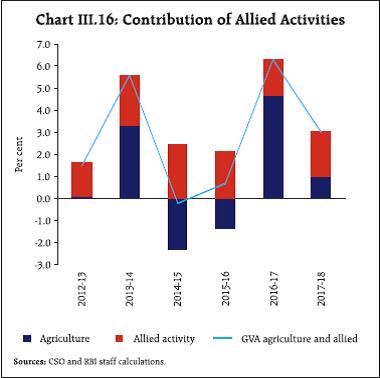

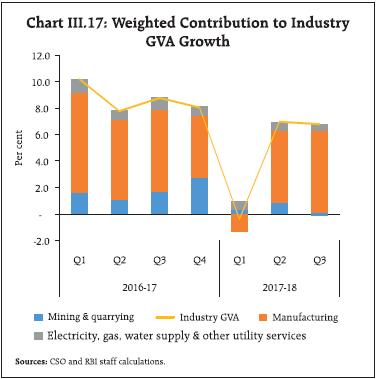

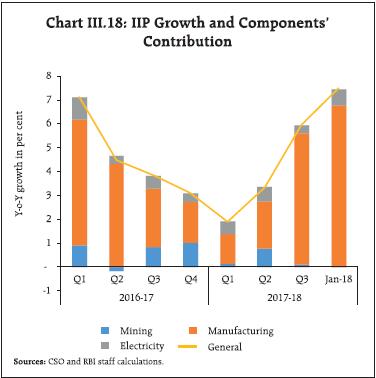

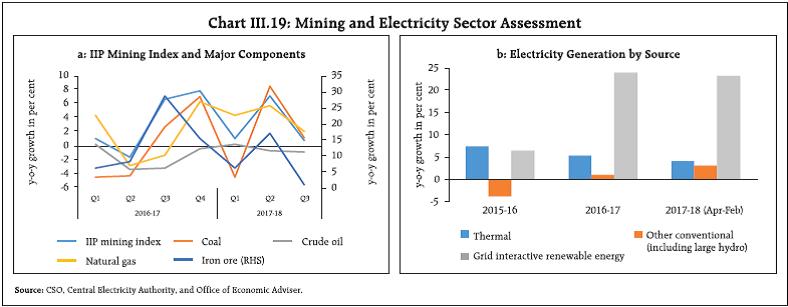

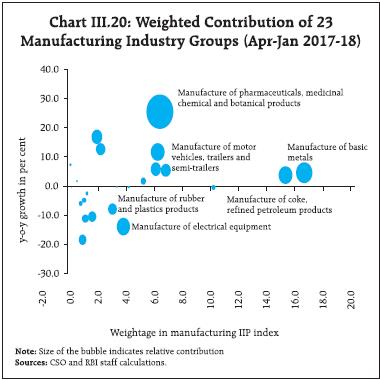

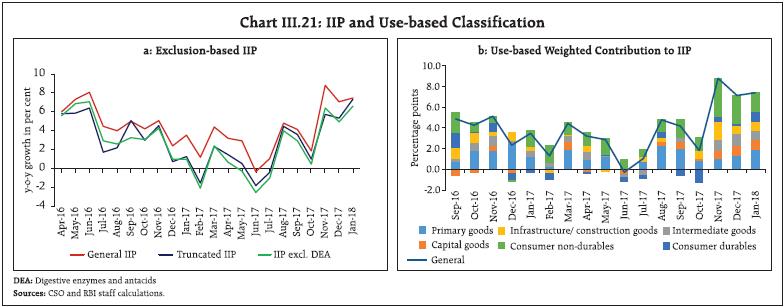

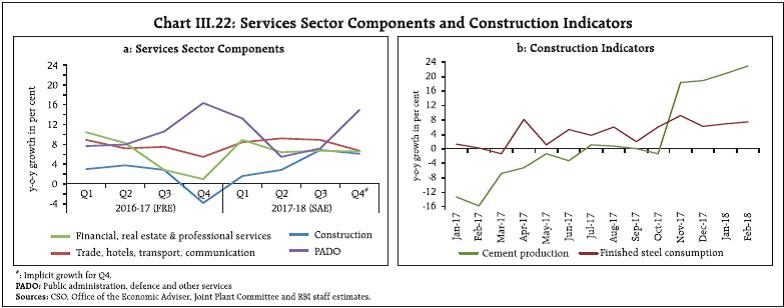

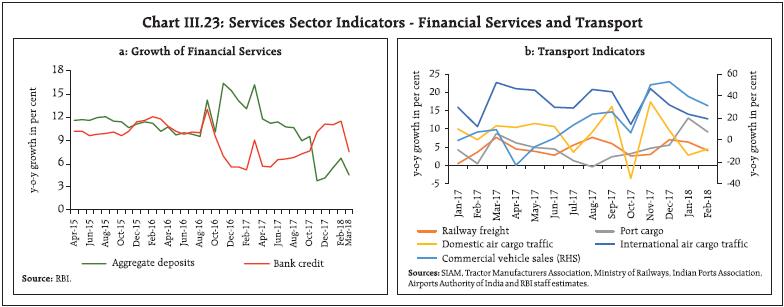

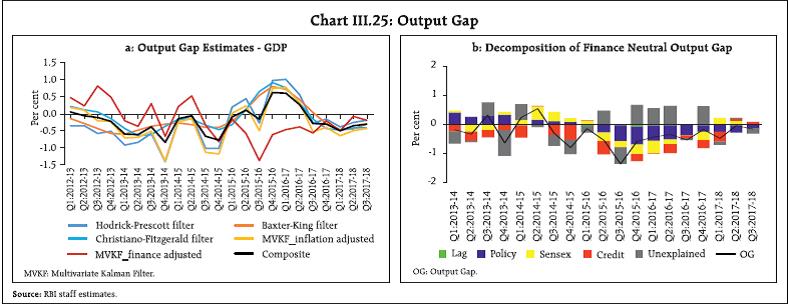

Going forward, a key risk to the inflation outlook is the risk of fiscal slippages in a scenario of rising aggregate demand. As noted in the MPC resolution of February 2018, apart from the direct impact on inflation, the fiscal risks could also engender a broader weakening of macro-financial conditions. The revised guidelines for arriving at the MSPs for kharif crops proposed in the Union Budget 2018-19, along with proposed increase in customs duty on a number of items, is likely to push-up inflation over the year. In addition, how various state governments implement and disburse HRA increases would have a considerable bearing on CPI housing inflation and consequently on the headline inflation trajectory, albeit statistically, during 2018-19; therefore, the latter should be looked through for monetary policy purposes, other than for their second-round effects. Although the central government's HRA effects on CPI inflation would gradually wane from July 2018, this moderating impact could be more than offset if several state governments simultaneously implement HRA increases in H2:2018-19 (Chapter 1). 1 Headline inflation is measured by year-on-year changes in all-India CPI Combined (Rural + Urban). 2 Das. P. (2018), “Impact of Increase in House Rent Allowance on CPI Inflation”, Mint Street Memo (forthcoming). 3 The CPI diffusion index, a measure of dispersion of price changes, categorises items in the CPI basket according to whether their prices have risen, remained stagnant or fallen over the previous month. A reading above 50 for the diffusion index signals a broad expansion or the extent of generalisation of price increases and a reading below 50 signals a broad-based decline in prices. 4 Historical decompositions are used to estimate the individual contribution of each shock to the movements in inflation over the sample period based on a Vector Auto Regression (VAR) with the following variables (represented as the vector Yt) - annual growth rate in crude oil prices in Indian Rupees, inflation, output gap measured using Hodrick–Prescott filter, annual growth rate in rural wages and the policy repo rate. The VAR can be written in companion form as: Yt = c + A Yt-1 + et ; where et represents a vector of shocks [oil price shock, supply shock (inflation shock), output gap shock, wage shock and policy shock]. Using Wold decomposition, Yt can be represented as a function of a deterministic trend and sum of all the shocks et. This formulation allows to decompose the deviation of inflation from the deterministic trend as the sum of contributions from various shocks. 5 Based on a t-test framework. 6 The state level output gap measure is as in Behera et al. (2017). 7 Ploughing/Tilling workers, Sowing, Harvesting/Winnowing/Threshing workers, General agricultural labourers including watering & irrigation workers etc., Carpenter, Electrician, Construction workers, LMV & Tractors drivers, Non-agricultural labourers (including porters, loaders). 8 Food, pan, tobacco and intoxicants, fuel, clothing and footwear and miscellaneous. 9 Wage inflation exhibited no statistically significant difference across different occupations and states expect for few cases. Similarly, price inflation also did not witness any stark heterogeneity across states, barring a few exceptions. However, the price inflation in all different sub-groups were significantly different. Both price inflation and wage inflation were significantly lower in 2016 and 2017 in comparison with 2015. III. Demand and Output Aggregate demand growth accelerated in H2:2017-18, supported mainly by an investment upturn, while consumption remained resilient. Aggregate supply conditions were buoyed by the robust performance of the manufacturing sector and the improvement in activity in the agriculture and services sectors. Domestic economic activity shrugged off the loss of speed that had characterised the period Q1:2016-17 to Q1:2017-18 and a turning point appears to have taken hold in Q2-Q3, with lead indicators pointing to further acceleration in Q4. In terms of aggregate demand, the drivers around this inflexion are shifting, with consumption-led growth of the recent past handing over the baton to investment, which had restrained growth since Q3:2016-17. At the same time, the strong impetus from fiscal spending during Q3:2016-17 to Q1:2017-18 appears to be waning and the rapid pace of import growth is sapping net external demand. On the supply side, the pickup in industrial output from Q2:2017-18 and the strengthening of construction activity in the services sector from Q1 are noteworthy. Meanwhile, agriculture and allied activities have turned out to be resilient to temporary weather disruptions in both kharif and rabi sowing seasons and going by recent estimates of foodgrains production, the outlook appears better than before. Aggregate demand appears to have regained traction in H2:2017-18 after a prolonged slackening that stretched up to a 13-quarter low in Q1:2017-18. Measured by y-o-y changes in real GDP at market prices, it accelerated to 7.2 per cent in H2:2017-18 from 6.1 per cent in the preceding half of the year and 6.4 per cent a year ago. The turnaround in Q2:2017-18 and the steady gathering of speed thereafter are largely benefitting from a favourable base effect – a low base level a year ago – rather than a quickening of momentum, since q-o-q seasonally adjusted annualised growth rate (SAAR) slowed in Q3 and flattened in Q4 (Chart III.1). For the year 2017-18 as a whole, however, the second advance estimates (February 2018) of the Central Statistics Office (CSO) indicate that the pace of expansion of aggregate demand is still slower than in the preceding year. Turning to the underlying drivers, there are small but noteworthy shifts underway. In terms of weighted contributions, the support to aggregate demand from private consumption is waning, supplanted by the burgeoning strength of capital formation after a prolonged hiatus (Table III.1). This is significant since the historical experience has been that changes in capital accumulation are associated with level and/or slope shifts in India’s growth cycle. A surge in imports led to a higher negative contribution of net exports, which dragged down the overall demand. These developments are discussed in detail in the rest of this chapter. III.1.1 Private Final Consumption Expenditure Private final consumption expenditure (PFCE) constituted 56.6 per cent of domestic demand in H2:2017-18, down from 57.5 per cent a year ago (Chart III.2). Short-term adverse effects of demonetisation and the implementation of the GST have taken their toll on output and employment in the unorganised sector, most vividly reflected in significant slowdown in exports of labour-intensive goods such as leather goods, textiles, jute manufactures, readymade garments. and sports goods (Chart III.3). Rise in global crude oil prices also appears to have contributed to the slowdown in private consumption. High frequency indicators of urban consumption present a mixed picture. While consumer durables production remained subdued during the larger part of 2017-18, domestic air passenger traffic, and passenger cars and utility vehicles sales showed robust growth (Chart III.4a). Going forward, urban consumption is expected to strengthen with the likely implementation of the award on salaries and allowances at the level of states and other public sector entities. A sharp growth in personal loan portfolios of commercial banks and the recent pick-up in vehicle loans also augur well for urban consumption (Chart III.4b). The turnaround in construction activity – an employment-intensive sector in H2:2017-18 (as detailed later in the chapter) should support rural consumption. Indicators of rural demand, viz., growth in sales of two-wheelers and tractors remained strong, particularly from Q2. The production of consumer non-durables has also recovered markedly (Chart III.5a). III.1.2 Gross Fixed Capital Formation A stark feature of India’s recent growth experience has been the protracted downturn in investment, however, a turnaround set in during Q2:2017-18. Gross fixed capital formation (GFCF) strengthened further to touch a six-quarter high in Q3. The share of gross fixed capital formation in GDP, which was trapped in a downturn from a high of 34.3 per cent in 2011-12 to 30.3 per cent in 2015-16, broke free and increased to 31.4 per cent in 2017-18. As alluded to earlier, this pick-up in the investment rate could be signalling a turning point in the cyclical component of growth oscillations in India and if sustained by a determined policy push, it could produce a level shift in the trajectory of the Indian economy (Box III.1). Capital goods production – a key element of investment demand – turned around in August 2017 and clocked a 19-month high in terms of growth rates in January 2018 (Chart III.5b). During 2017-18 so far (up to December), the construction of highway projects is on the rise and is expected to have improved further in Q4.