Table

III.42: Return on Bank Stocks vis-à-vis Other Sectoral Stocks

* | (Per

cent) | Year | | BSE | BSE | Sectoral

Indices | | | Sensex | 500 | | | | | | |

| | | | Bankex | FMCG | IT | PSU | Capital | Consumer |

| | | | | | | | Goods | Durables |

1 | | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

2002-03 | | -12.1 | -8 | 16.2 | -23.6 | -20.4 | 10.1 | 26.4 | -15.1 |

2003-04 | | 83.4 | 109.4 | 118.6 | 31.3 | 29.2 | 148.1 | 147.3 | 68.4 |

2004-05 | | 16.1 | 21.9 | 28.6 | 11.6 | 59.5 | 8.1 | 39.9 | 50.5 |

2005-06 | | 73.7 | 65.2 | 36.8 | 109.9 | 49.2 | 44.0 | 156.0 | 115.4 |

2006-07 | | 15.9 | 9.7 | 24.3 | -21.4 | 21.6 | -3.2 | 11.1 | 11.1 |

2007-08 | | 19.7 | 24.2 | 18.0 | 31.7 | -27.6 | 25.4 | 54.4 | 8.8 |

2008-09 (up to | December

08, 2008) | -41.4 | -45.9 | -38.0 | -15.5 | -32.7 | -37.6 | -53.4 | -56.1 |

* : Percentage variations

in indices measured on a point-to-point basis.

Source : Bombay

Stock Exchange Limited (BSE). | sector banks witnessed

handsome gains during 2007-08. Among public sector banks, the major gainers during

2007-08 were UCO Bank (72.7 per cent), State Bank of India (61.0 per cent), State

Bank of Travancore (58.8 per cent), Bank of India (50.7 per cent), State Bank

of Bikaner and Jaipur (49.3 per cent) and State Bank of Mysore (45.8 per cent)

(Table III.44). Among the private sector banks, the major

gainers during 2007-08 included Bank of Rajasthan (155.0 per cent), ING Vysya

Bank (94.7 per cent), Indusind Bank (87.6 per cent), Axis Bank (59.4 per cent),

South Indian Bank Ltd. (40.6 per cent) and HDFC Bank (39.0 per cent). However,

share prices of City Union Bank declined by 82.7 per cent during the year.

3.102 The price/earning (P/E) ratio of both public and private sector banks

showed wide variations. At end-March 2008, while the P/E ratio of public sector

banks ranged between 3.4 (Allahabad Bank) and 10.1 (State Bank of India), the

P/E ratio of private sector banks ranged between 6.8 (Federal Bank) and 52.7 (Centurion

Bank of Punjab Ltd., which was later merged with HDFC Bank in May 2008) (Table

III.44).

3.103 Bank stocks continued to constitute a significant

portion of market capitalisation of the Indian equity market with their share

increasing to 7.2 per cent at end-March 2008 from 6.8 per cent at end-March 2007.

The market capitalisation of bank stocks constituted 8.8 per cent of total market

capitalisation on December 03, 2008.The share of turnover of bank stocks in total

turnover also increased from 5.3 per cent during 2006-07 to 6.6 per cent during

2007-08 and further to 11.5 per cent during the current financial year (up to

December 03, 2008) (Table III.45).

Table

III.43: Performance of Bank Stocks - Risk and Return |

Indices | Returns* | Volatility@ |

| 2006-07 | 2007-08 | 2008-09# | 2006-07 | 2007-08 | 2008-09# |

1 | 2 | 3 | 4 | 5 | 6 | 7 |

BSE Bankex | 24.2 | 18.0 | -38.0 | 17.5 | 18.1 | 18.3 |

BSE Sensex | 15.9 | 19.7 | -41.4 | 11.1 | 13.7 | 19.0 |

* : Percentage variations in

indices on a point-to-point basis.

@ : Defined as coefficient of variation.

# : Up to December 08, 2008.

Source : Bloomberg. |

Table

III.44: Share Prices and Price/Earning Ratios of Bank Stocks at BSE

| Bank | End-March | Percentage | P/E

Ratio |

| Closing

Prices(Rs.) | Variation | (End-March) |

|

| (Per

cent) |

|

|

|

| 2006 | 2007 | 2008 | End-March | 2006 | 2007 | 2008 |

|

|

|

| 2008

over end- |

|

|

|

|

|

|

| March

2007 |

|

|

|

1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

Public Sector Banks | | | | | | | |

Allahabad Bank | 38.95 | 72.7 | 76.65 | 5.43 | 5.0 | 4.3 | 3.4 |

Andhra Bank | 80.8 | 76.05 | 74.1 | -2.56 | 8.1 | 6.8 | 6.1 |

Bank of Baroda | 230.3 | 215.4 | 283.9 | 31.80 | 10.1 | 6.9 | 6.7 |

Bank of India | 132 | 167.8 | 252.9 | 50.72 | 9.2 | 7.4 | 6.4 |

Bank of Maharashtra | 30.65 | 39.1 | 50.05 | 28.01 | 26.0 | 6.2 | 6.6 |

Canara Bank | 266.9 | 194.7 | 225.2 | 15.67 | 8.2 | 5.2 | 5.1 |

Corporation Bank | 381.7 | 288.9 | 283.05 | -2.02 | 12.3 | 8.0 | 5.4 |

Dena Bank | 36.4 | 35 | 50.85 | 45.29 | 20.3 | 5.0 | 4.0 |

Indian Overseas Bank | 96.95 | 103 | 135.2 | 31.26 | 6.7 | 5.6 | 6.1 |

Oriental Bank of Commerce | 232.85 | 187.55 | 176.65 | -5.81 | 7.4 | 8.1 | 5.3 |

Punjab National Bank | 471.2 | 471.65 | 508.15 | 7.74 | 10.3 | 9.2 | 7.3 |

Syndicate Bank | 89.35 | 63.95 | 75.05 | 17.36 | 8.7 | 4.3 | 4.5 |

Union Bank of India | 121.85 | 103.9 | 141 | 35.71 | 9.1 | 6.2 | 5.1 |

Vijaya Bank | 52.55 | 42.5 | 49.65 | 16.82 | 18.0 | 5.6 | 6.5 |

State Bank of India | 968.05 | 992.9 | 1598.85 | 61.03 | 11.6 | 8.2 | 10.1 |

State Bank of Bikaner and Jaipur | 4,164.35 | 3,348.00 | 4,998.00 | 49.28 | 14.4 | 5.5 | 7.9 |

State Bank of Mysore | 6,326.75 | 5,143.25 | 7,500.00 | 45.82 | 10.5 | 7.4 | 8.5 |

State Bank of Travancore | 4,151.95 | 3,008.35 | 4,775.95 | 58.76 | 8.0 | 4.6 | 6.2 |

UCO Bank | 26.55 | 21.4 | 36.95 | 72.66 | 10.8 | 5.4 | 7.1 |

Other Public Sector Banks | | | | | | | |

IDBI Bank Ltd. | 78.3 | 77.55 | 89.05 | 14.83 | 10.1 | 9.6 | 8.6 |

Private Sector Banks | | | | | | | |

Axis Bank | 356.35 | 490.15 | 781.15 | 59.37 | 20.5 | 20.0 | 22.5 |

Bank of Rajasthan Ltd. | 44.2 | 38.8 | 98.95 | 155.03 | 39.8 | 3.8 | 11.6 |

City Union Bank Ltd. | 112 | 161.45 | 27.9 | -82.72 | 4.8 | 5.4 | 8.9 |

Centurion Bank of Punjab Ltd. | 26.55 | 37.55 | 43.35 | 15.45 | 152.0 | 45.8 | 52.7 |

Dhanalakshmi Bank | 31.1 | 58.55 | 63.05 | 7.69 | 10.5 | 11.7 | 7.1 |

Federal Bank Ltd. | 201.65 | 215.55 | 216.3 | 0.35 | 7.7 | 6.3 | 6.8 |

ING Vysya Bank | 142.8 | 174.35 | 339.4 | 94.67 | 143.6 | 17.7 | 17.9 |

Indusind Bank Ltd. | 46.85 | 41.95 | 78.7 | 87.60 | 36.9 | 18.1 | 33.5 |

Jammu and Kashmir Bank Ltd. | 451.4 | 643.75 | 681.9 | 5.93 | 12.4 | 11.4 | 9.1 |

Karnataka Bank Ltd. | 100.15 | 171.05 | 199.95 | 16.90 | 6.9 | 11.7 | 10.0 |

Karur Vysya Bank Ltd. | 491.5 | 256.95 | 335.85 | 30.71 | 6.5 | 7.9 | 8.6 |

Kotak Mahindra Bank Ltd. | 278 | 479.65 | 628.55 | 31.04 | 72.7 | 28.9 | 21.1 |

South Indian Bank Ltd. | 61.65 | 99 | 139.2 | 40.61 | 8.5 | 6.7 | 7.4 |

HDFC Bank Ltd. | 773.5 | 949.4 | 1319.95 | 39.03 | 27.8 | 26.1 | 28.7 |

ICICI Bank Ltd. | 589.25 | 853.1 | 770.1 | -9.73 | 21.8 | 27.6 | 23.9 |

Yes Bank | 100.4 | 140.7 | 168.75 | 19.94 | 49.0 | 40.5 | 24.0 |

Source : BSE

and Bloomberg. |

Table

III.45: Relative Share of Bank Stocks -

Turnover and Market

Capitalisation | (Per

cent) | Year | Share

of turnover of bank stocks

in total turnover | Share

of capitalisation of

bank stocks in total

market capitalisation* |

1 | 2 | 3 |

2005-06 | 6.8 | 7.1 |

2006-07 | 5.3 | 6.8 |

2007-08 | 6.6 | 7.2 |

2008-09 | | |

(up to December 03, 2008) | 11.5 | 8.8 |

* : As at end-period. |

Note

:Data

for turnover and market capitalisation of banks relate to Bank Nifty Index of

NSE.

Source :National Stock Exchange of India Limited (NSE). |

Shareholding Pattern in Public Sector Banks

3.104 The process of diversification of ownership of public sector banks

made further progress during 2007-08. The number of public sector banks with private

shareholding up to 10 per cent declined from three at end-March 2007 to two at

end-March 2008, while those with more than 10 per cent and up to 20 per cent increased

from one to two (Table III.46 and Appendix

Table III.32).

3.105 The shareholding of foreign financial institutions

(FFIs) in Indian banks increased further during the year. While the FFIs shareholding

in public sector banks at end-March 2008 was broadly same as at end-March 2007,

it increased in the case of old as well as new private sector banks. In the case

of old private sectors banks, FFIs shareholding was more than 20 per cent in nine

banks at end-March 2008 as against four a year ago. In four new private sector

banks, FFI holding was more than 60 per cent as against three banks in the last

year (Table III.47).

Table

III.46: Private Shareholding in Public Sector Banks* |

(As at

end-March) | Category | 2007 | 2008 |

1 | 2 | 3 |

Up to 10 per cent | 3 | 2 |

More than 10 and up to 20 per cent | 1 | 2 |

More than 20 and up to 30 per cent | 3 | 3 |

More than 30 and up to 40 per cent | 3 | 3 |

More than 40 and up to 49 per cent | 11 | 11 |

-: Nil/negligible

*: Including

19 nationalised banks, State Bank of India and IDBI Bank Ltd. | 7.Technological

Developments in Banks

3.106 Technological developments and the

use of information technology (IT) have transformed the functioning of the financial

sector in the country. Banks in India have used IT not only to improve their own

internal processes but also to increase facilities and services to the customer.

Furthermore, the large scale increase in the number of transactions handled by

banks has enhanced the dependence of banking sector on modern technology, including

use of computers. Apart from reducing transactions costs, the use of technology

has also provided new avenues to banks to expand their outreach, especially in

the remote and rural areas.

Table

III.47: Foreign Financial Institutions (Non-resident) Shareholding in Indian Banks

| (As

at end-March) | (No.

of banks) | Category | Public

Sector Banks | New

Private Sector Banks | Old

Private Sector Banks |

| 2007 | 2008 | 2007 | 2008 | 2007 | 2008 |

1 | 2 | 3 | 4 | 5 | 6 | 7 |

Nil | 8 | 8 | - | - | 4 | 2 |

Up to 10 per cent | 5 | 5 | - | - | 9 | 2 |

More than 10 and up to 20 per cent | 13 | 13 | - | - | - | 2 |

More than 20 and up to 30 per cent | 2 | 2 | 1 | 1 | 1 | 4 |

More than 30 and up to 40 per cent | - | - | - | 1 | 1 | 2 |

More than 40 and up to 50 per cent | - | - | 1 | 1 | - | - |

More than 50 and up to 60 per cent | - | - | 3 | 1 | 1 | 2 |

More than 60 and up to 70 per cent | - | - | 2 | 4 | - | - |

More than 70 and up to 80 per cent | - | - | 1 | - | 1 | 1 |

Total | 28 | 28 | 8 | 8 | 17 | 15 |

3.107 The process of computerisation, which marked the starting

point of all technological initiatives, is reaching near completion for most of

the banks. Public sector banks continued to provide adequate resources for computerisation

and development of communication networks. The cumulative amount spent from September

1999 to March 2008 aggregated Rs.15,016 crore (Appendix Table III.33). A major

development during 2007-08 was a significant increase in coverage of the number

of branches providing core banking solution (CBS) from 22,804 at end-March 2007

to 35,464 at end-March 2008. In terms of percentage to total branches, the share

of branches under CBS increased to 67.0 per cent at end-March 2008 from 44.4 per

cent a year ago.At end-March 2008, the number of fully computerised branches was

93.7 per cent as against 85.6 per cent at end-March 2007 (Table

III.48).

Table

III.48: Computerisation in Public Sector Banks |

(As at

end-March) | (Per

cent of total bank branches) | Category | 2007 | 2008 |

1 | 2 | 3 |

Fully Computerised Branches

(i+ii) | 85.6 | 93.7 |

i) | Branches

Under Core Banking Solution | 44.4 | 67.0 |

ii) | Branches

already Fully Computerised # | 41.2 | 26.6 |

Partially Computerised Branches | 13.4 | 6.3 |

# : Other than branches under

Core Banking Solution. | 3.108 The total number of Nodes/PCs

in the computerised branches (fully and partially) increased by 61,437 during

2007-08 representing an increase of 11.1 per cent. Public Sector banks recorded

significant progress in fully computerising their branches. Of the twenty seven

public sector banks, 20 banks have computerised their branches fully, while 5

banks have computerised between 70 to less than 100 per cent of their branches.

Only two banks, viz., Punjab and Sind Bank and UCO Bank are yet to computerise

more than half of their branches (Table III.49).

3.109 During 2007-08, the total number of ATMs installed by the banks grew by

28.4 per cent to 34,789 at end-March 2008. While, the ATMs installed by foreign

banks and new private sector banks were nearly four and three times of their respective

branches, the ATM to branch ratio was much lower for public sector (41.2 per cent)

and old private sector banks (47.2 per cent) (Table III.50).

At individual bank level, the number of ATMs exceeded branches in respect of all

new private sector banks, except Centurion Bank of Punjab Ltd., which was later

merged with HDFC Bank Ltd. In the case of old private sector banks, the ATM to

branch ratio was less than 100 per cent for all banks barring two, viz.,

SBI Commercial and International Bank Ltd. and Karur Vysya Bank Ltd. As most foreign

banks operated with limited branches in urban and metropolitan areas, the number

of ATMs operated by them, in general, far exceeded the number of branches (Appendix

Table III.35).

Table

III.49: Computerisation of Branches -

Public Sector Banks |

(As

at end-March) | | (Number

of banks) | Extent

of Computerisation | 2007 | 2008 |

1 | 2 | 3 |

Nil | - | - |

Up to 10 per cent | - | 1 |

More than 10 and up to 20 per

cent | 1 | - |

More than 20 and up to 30 per

cent | 1 | - |

More than 30 and up to 40 per

cent | 1 | - |

More than 40 and up to 50 per

cent | 1 | 1 |

More than 50 and up to 60 per

cent | - | - |

More than 60 and up to 70 per

cent | 1 | - |

More than 70 and up to 80 per

cent | 1 | 1 |

More than 80 and up to 90 per

cent | 4 | 3 |

More than 90 and less than

100 per cent | 2 | 1 |

Fully Computerised | 15 | 20 |

Total* | 27 | 27 |

*: Excludes IDBI

Bank Ltd. |

Table

III.50:Branches and ATMs of Scheduled Commercial Banks |

(As

at end-March 2008) | Bank

Group | Number

of Bank/Branches | Number

of ATMs | Off-site | ATMs |

| | Rural | Semi- | Urban | Metro- | Total | On-site | Off-site | Total | ATMs

as | as

per- | | | | urban | | politan | | | | | percentage | centage

of | | | | | | | | | | | of

total | Branches |

| | | | | | | | | | ATMs | |

1 | | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 |

i) | Nationalised

Banks | 13,198 | 8,140 | 8,440 | 7,997 | 37,775 | 8,320 | 5,035 | 13,355 | 37.7 | 35.4 |

ii) | State

Bank Group | 5,328 | 4,545 | 2,820 | 2,421 | 15,105 | 4,582 | 3,851 | 8,433 | 45.7 | 55.8 |

iii) | Old

Private Sector

Banks | 808 | 1,498 | 1,270 | 874 | 4,450 | 1,436 | 664 | 2,100 | 31.6 | 47.2 |

iv) | New

Private Sector Banks | 223 | 870 | 1147 | 1285 | 3,525 | 3,879 | 5,988 | 9,867 | 60.7 | 279.9 |

v) | Foreign

Banks | 0 | 2 | 48 | 224 | 274 | 269 | 765 | 1,034 | 74.0 | 377.4 |

Total (i to v)

| 19,557 | 15,055 | 13,725 | 12,801 | 61,129 | 18,486 | 16,303 | 34,789 | 46.9 | 56.9 |

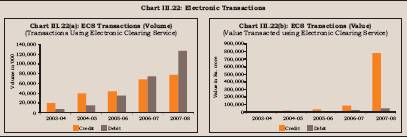

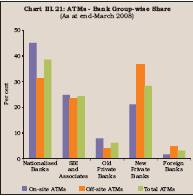

3.110 Of all the ATMs installed in the country at end-March 2008,

new private sector banks had the largest share in off-site ATMs, while nationalised

banks had the largest share in on-site ATMs (Chart III.21).

3.111

The use of electronic payments, both retail and card-based, increased in recent

years, reflecting the increased adoption of technology. The electronic payment

systems such as electronic clearing service (ECS) – both debit and credit,

national electronic funds transfer system (NEFT), card based payment (credit and

debit) are becoming increasingly popular as indicated by the increase in transactions

through retail electronic payment methods. Both the variants of ECS, i.e.,

ECS (credit) and ECS (debit) for direct credit such as salary and pension payments

and the other for direct debit such as collection of bills, insurance premia

and equated monthly installment payments of loans are being increasingly preferred.

ECS is now available at all bank branches at 70 centers. The volume of electronic

transactions increased by 41.4 per cent in 2007-08 as compared with 32.9 per cent

in the previous year.Transactions in terms of value increased by almost three

and half times during 2007-08 mainly on account of large increase in transactions

through ECS-credit (Table III.51).

Table

III.51: Transactions through Retail Electronic Payment Methods

| Type | Volume

of transactions | Growth

in volume | Value

of transactions | Growth

in value |

|

|

| (000's) |

| (per

cent) |

| (Rs.

crore) |

| (per

cent) |

|

| 2005-06 | 2006-07 | 2007-08 | 2006-07 | 2007-08 | 2005-06 | 2006-07 | 2007-08 | 2006-07 | 2007-08 |

1 |

| 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 |

1. | ECS-Credit | 44,216 | 69,019 | 78,365 | 56.1 | 13.5 | 32,324 | 83,273 | 7,82,222 | 157.6 | 839.3 |

2. | ECS-Debit | 35,958 | 75,202 | 127,120 | 109.1 | 69.0 | 12,986 | 25,441 | 48,937 | 95.9 | 92.3 |

3. | EFT/

NEFT | 3,067 | 4,776 | 13,315 | 55.7 | 178.8 | 61,288 | 77,446 | 1,40,326 | 26.4 | 81.2 |

4. | Credit

Cards | 156,086 | 169,536 | 228,203 | 8.6 | 34.6 | 33,886 | 41,361 | 57,984 | 22.1 | 40.2 |

5. | Debit

Cards | 45,686 | 60,177 | 88,306 | 31.7 | 46.7 | 5,897 | 8,172 | 12,521 | 38.6 | 53.2 |

Total | 285,013 | 378,710 | 535,309 | 32.9 | 41.4 | 1,46,381 | 2,35,693 | 10,41,990 | 61.0 | 342.1 |

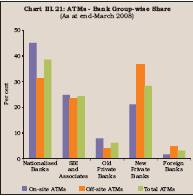

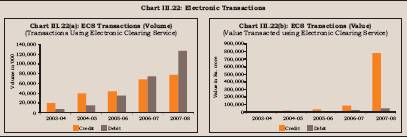

3.112 The use of ECS (credit) and ECS (debit), in particular, increased

sharply during 2007-08 [Chart III.22(a) and III.22(b)]. While

the ECS (credit) volumes increased by 13.5 per cent in 2007-08, value increased

by more than eight times. The substantial increase was due to the use of ECS for

refund of initial public offering (IPOs). The volumes under ECS (Debit), which

is mostly used for payment of utility bills and regular premia, increased

by 69.0 per cent in 2007-08 and by 92.3 per cent in value.

3.113 The

large value payment systems include the real time gross settlement (RTGS), Government

securities clearing and forex clearing. The RTGS has been working smoothly since

its operationalisation in March 2004. As at end-September 2008, 107 participants

(99 banks, 8 primary dealers, the Reserve Bank and the Deposit Insurance and Credit

Guarantee Corporation) were members of the RTGS system. The reach and utilisation

of the RTGS is consistently increasing. The bank/branch network coverage increased

to 51,095 branches at more than 10,000 centres leading to increased usage of this

mode of funds transfer (Chart III.23). The daily average volume

of transactions is 38,000 for about Rs.1,15,600 crore of which 30,900 transactions

for about Rs.69,123 crore pertain to customer transactions as at end-September

2008.

8.Regional Spread of Banking

3.114 The role of financial and banking services in the equitable growth

process is widely recognised. In this context, the availability of information

on regional spread of banking services is a pre-requisite for appropriate policy

formulation. It has been the endeavour of the Reserve Bank to enrich information

on the progress of banking services and operations across country.

Accordingly,

the Basic Statistical Return (BSR) system, which provides comprehensive information

on the banking operations across country, has been suitably modified recently

to take into account the changed requirements (Box III.3). Box

III.3: Basic Statistical Returns (BSR) System The Basic Statistical

Returns System (BSR) was introduced in December 1972 adapting the then existing

system of Uniform Balance Book (UBB). The UBB system of reporting, designed to

provide a detailed and up-to-date picture of the sectoral and regional flow of

bank credit, was introduced in December 1968 in the context of the setting up

of the National Credit Council with twin objectives of ensuring a steady flow

of information while minimising the reporting load on branches. The UBB proforma

collected account-wise information on credit limits sanctioned and advances outstanding

according to the type of account, type of borrower, occupation, purpose, security

and rate of interest charged on a monthly basis from all the bank offices. After

nationalisation of major Indian banks, the need was felt for comprehensive information

with a minimum time lag for policy purposes.The Reserve Bank of India constituted

a ‘Committee on Banking Statistics’ in April 1972 to look into various

aspects of statistical reporting by banks and make appropriate suggestions. The

overall pattern of the statistical reporting system envisaged by the committee,

was designated as Basic Statistical Returns (BSR) and was designed to provide

a steady flow of information without undue strain on banks. The Reserve Bank accepted

the recommendations of the committee and introduced BSR returns, as also constituted

a ‘Committee of Direction on Banking Statistics’ (CDBS) in the Reserve

Bank to have overall charge of the Basic Statistical Returns. The BSR system has

been improved from time to time, in view of the changes in banking environment

and in data requirements.

Currently, the BSR system has seven returns

encompassing data on deposits, credit, investment and employment in scheduled

commercial banks (SCBs), collected both on census and sample survey basis. Annual

BSR-1 return submitted by all the branches of SCBs (in two parts, viz.,

BSR 1A and 1B) collects comprehensive information on credit. BSR-1A seeks account

level data for credit accounts with credit limit above a cut-off level. The cut-off

limit is revised periodically. Currently the limit is Rs.2 lakh (since March 2000).It

collects information on various attributes of the account, like type of account,

organisation, occupation and interest rate, among others, besides information

on the district and population group of the place of utilisation of credit. Information

on place of utilisation of credit is useful for analysing the migration of credit

across different districts/States. The BSR-1B return collects branch level credit

data according to broad occupation groups. BSR-2 return, collected annually from

all offices of SCBs, pertains to deposits and employment. Data on deposits are

collected according to type of deposits, and those on term deposits by size, interest

rates and maturity (both original and residual). Employment data are obtained

category-wise. Gender-wise statistics on deposits, credit and employment are included

in BSR-1 and 2 returns. A Handbook of instructions relating to BSR-1 and 2 returns

has been prepared for use by the branches and is revised periodically. The results

of BSR-1 and 2 surveys are published annually. BSR-3 is a monthly return on advances

against security of selected sensitive commodities.BSR-4 is a sample survey on

ownership of deposits and includes data by type of deposits. The survey is conducted

on an annual basis to obtain estimates on ownership pattern of deposits according

to different economic sectors.Annual BSR-5 return relates to investment profile

of SCBs (excluding regional rural banks) by type of investment (dated securities

and others) as also investment in State-level securities. BSR-6 is quinquennial

sample survey of debits to deposit and credit accounts and provides data on turnover

rates for deposit/credit accounts of SCBs. The results of BSR-4 and 5 surveys

are released in the ‘Reserve Bank of India Bulletin’.The reference

date for BSR-1, 2, 4 and 5 returns is March 31 and for BSR-3, last Friday of the

month. BSR-6 survey covers April-March year data. BSR-7 is a quarterly return

as on March 31 and on last Friday of June, September and December, on aggregate

deposits and gross bank credit and submitted for all the branches of SCBs by the

bank’s head offices. Detailed tabulations covering geographical and spatial

distribution of deposits and credit, by different characteristics, viz.,

State/District/Centre, population group and bank group, based on this return are

published as a quarterly publication titled ‘Quarterly Statistics on Deposits

and Credit of Scheduled Commercial Banks’. A Master Office File on bank

offices serves as a repository of location and other details of all branches/offices

of banks. The BSR data based publications are accessible through the Reserve Bank’s

website, including user-friendly ‘Data Base on Indian Economy’ facility.

Major revisions in BSR-1 Return

The BSR-1 system has been

revised with effect from March 2008 to take into consideration the changes in

the banking/economic environment as well as to meet the emerging data requirements.The

occupation classification has been modified in line with updations in National

Industrial Classification (NIC)-2004 and proposed International Standard Industrial

classification (ISIC) rev. 4 (draft), 2007. The definition and concept of Small

Enterprises (SE), comprising small and micro enterprises engaged in manufacturing

and services, have been introduced in place of Small Scale Industries (SSI). The

kisan credit cards, general credit cards and other credit cards have been included

as the type of accounts along with the existing personal credit cards. The organisation

codes of the borrowers have been restructured. Financial and non-financial organisations

have been separately defined under public, private and co-operative sectors. Separate

codes have been included for self-help groups (SHGs)/micro-finance institutions

(MFIs).Loans to non-banking financial companies (NBFCs) have been classified based

upon on-lending to agriculture and allied activities, small and micro enterprises,

housing sector, educational purposes and other general purposes. A new characteristic

‘category of borrowers’, based on the size of the borrowing unit,

has been introduced in place of ‘nature of borrowal account’. A new

parameter ‘security pledged/guarantee status for loans’ has been introduced

to capture the secured/unsecured loans. Information on ‘fixed/floating rate

of interest on loans’ has also been included. The occupation/activity codes

in BSR-1B return have been modified in line with changes in BSR-1A return.

3.115

The total number of branches of SCBs (including RRBs and LABs) increased from

72,752 at end-June 2007 to 76,518 at end-June 2008, registering a growth of 5.2

per cent during the year. These comprised 31,127 rural branches, 17,858 semi-urban

branches and 27,533 urban and metropolitan branches. The share of rural branches

declined further to 40.7 per cent at end-June 2008 from 42.1 per cent at end-June

2007, while the shares of all other population groups increased. Nearly half (49.6

per cent) of the total branches of all bank groups are operated by nationalised

banks (including IDBI Bank Ltd.), followed by SBI and associates (19.9 per cent)

and RRBs (19.3 per cent). The share of branches operated by new private sector

banks increased to 4.9 per cent at end-June 2008 from 3.9 per cent at end-June

2007. While the share of branches operated by old private sector banks declined

marginally during 2007-08 to 5.9 per cent at end-June 2008, the number of their

branches increased across all population groups, reversing the trend observed

in the previous year. Foreign bank branches were mostly concentrated in the urban

and metropolitan areas with negligible presence in rural and semi-urban areas

(Chart III.24 and Appendix

Table III.36).

3.116

The top hundred centres arranged according to the size of deposits accounted for

69.7 per cent of total deposits, while the top hundred centres arranged according

to the size of bank credit accounted for 77.8 per cent of total bank credit at

end-March 2008. The shares of top hundred centres in total deposits and total

bank credit have increased in recent years and the increase has been relatively

sharper in the case of deposits (Table III.52).

Table

III.52: Share of Top Hundred Centres in | Aggregate

Deposits and Gross Bank Credit | (Per

cent) | End-March | Deposits | Credit |

| Offices | Amount | Offices | Amount |

1 | 2 | 3 | 4 | 5 |

2001 | 22.3 | 58.9 | 21.9 | 75.3 |

2002 | 22.5 | 59.1 | 22.1 | 77.0 |

2003 | 22.7 | 61.0 | 22.4 | 75.9 |

2004 | 23.1 | 63.6 | 22.9 | 75.5 |

2005 | 23.8 | 65.3 | 23.7 | 75.9 |

2006 | 24.2 | 67.0 | 24.0 | 76.5 |

2007 | 24.9 | 68.9 | 24.8 | 77.4 |

2008 | 25.7 | 69.7 | 25.6 | 77.8 |

Source : Basic

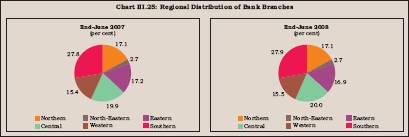

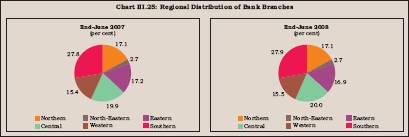

Statistical Return-7. | 3.117 The Southern region continued

to account for the largest percentage of existing bank branches during 2007-08,

followed by the Central, Northern, Eastern, and the Western regions (Chart

III.25). The share of North-Eastern region remained low at 2.7 per cent at

end-June 2008. During July 2007 to June 2008, most of the new branches were opened

in the Southern (1,147 or 29.9 per cent of incremental branches) and Central (854

or 22.3 per cent) regions. As the total number of bank branches expanded by 5.2

per cent during the 2007-08, the average population served by a single bank branch

declined to about 15,000 at end-March 2008 from about 16,000 at end-March 2007.

The decline was observed across all regions, barring Northern and Eastern regions

where it remained unchanged (Appendix

Table III.37).

3.118 An important factor in the geographical expansion

of banking services is the population size of residential settlements. Many small

residential settlements spread across country may not be able to sustain the business

operations of more than one bank branch in a financially viable manner. These

residential settlements/centres are often served by a single bank branch, i.e.,

single office banked centres (Box III.4). Thus, single office

banked centres have played an important role in the expansion of banking services

to a wider population, particularly in the remote areas. The advancement in technology

is, however, likely to change the typology of bank branch network in the country.

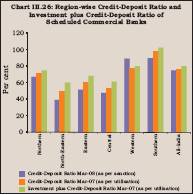

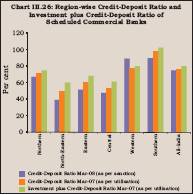

3.119 The all-India credit-deposit ratio (CDR) declined marginally to 74.2

per cent at the end-March 2008 from 75.0 per cent a year ago, reflecting some

deceleration in the overall credit growth. The CDR (as per sanction) as well as

investment plus credit to deposit ratio of the Southern region remained

higher than the all-India level.The CDR (as per sanction) for the Western region

was higher than all-India level, but investment plus credit to deposit

ratio was a shade below than the all-India level. Both the ratios for other regions

were below the all-India level (Chart III.26). As at end-March

2008, the CDR (as per sanction) was higher than all-India level in Rajasthan,

Chandigarh, Maharashtra, Andhra Pradesh, Karnataka and Tamil Nadu.The investment

plus credit-deposit ratio at end-March 2008 in these States (except Maharashtra)

and in Orissa, Gujarat, Dadra and Nagar Haveli, was higher than the all-India

level (Appendix Table III.38).

Box

III.4: Single Office Banked Centres As per the Basic Statistical

Return (BSR) system, a centre is defined as a revenue unit classified and delineated

by the respective State government, i.e., a revenue village/city/ town/municipality/municipal

corporation, etc. In general, a district consists of several centres.Accordingly,

if a centre has one or more offices of scheduled commercial banks is termed as

‘banked centre’. The banked centres are grouped into four population

groups based on the population of the centre as per decennial census data. The

total number of centres, served by scheduled commercial banks as on March 31,

2008 was 34,426.

An interesting attribute of any banked centre is the

number of bank offices located in it. As at end-March 2008, out of the 34,426

banked centres served by SCBs, 28,529 had only one bank office (‘single

office centres’), while 37 centres had 100 or more bank offices

(Table 1).

Table

1:Single Office Centres | (End-March) |

Item | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 |

1 | 2 | 3 | 4 | 5 | 6 | 7 |

Total number of | | | | | | |

banked centres | 35,257 | 35,036 | 34,816 | 34,511 | 34,399 | 34,426 |

Number of single | | | | | | |

office centres | 29,980 | 29,696 | 29,390 | 29,054 | 28,812 | 28,529 |

Share of single office | | | | | |

centres in total banked | | | | | |

centres (per cent) | 85.0 | 84.8 | 84.4 | 84.2 | 83.8 | 82.9 |

Source: Basic

Statistical Return (BSR)-7 | The number of single office centres

and share of single office centres in total banked centres has shown a decline

over the years. As on March 31, 2008 single office centres accounted for 38.3

per cent of bank offices, but accounted for 8.1 per cent of deposits and 7.0 per

cent of credit outstanding. Classification of banked centres according to population

sizeindicated that 91.5 per cent of single office centres belonged to the rural

population group. In rural areas, 84.9 per cent of the banked centres were single

office centres and collectively such centres accounted for 74.2 per cent of deposits

and 79.6 per cent of credit outstanding in rural areas. The 28,529 single-office

centres are spread across all 35 States/UTs. Among the States/UTs, the highest

number (4,283) of such centres was in Uttar Pradesh at end-March 2008.In Bihar,

Andhra Pradesh, West Bengal and Maharashtra, single office centres were in the

range of 2,027-2,309, while Karnataka, Tamil Nadu and Rajasthan each had more

than of 1,500 such centres.Delhi and Chandigarh had 61 and 12 single-office centres,

respectively, out of 69 and 14 banked centres, respectively.At end-March 2008,

615 districts out of the 621 districts in the country had ‘single-office

centres’. The 28,529 single-office centres showed a large variability, both

in terms of their outstanding deposits and outstanding credit as on March 31,

2008 (Tables 2). While some of the recently opened branches

are having low amount of business, others are functioning at highly specialised

centres or for special purposes. Typical examples are project sites, food credit

disbursing branches, etc.

Table

2: Distribution of Single Office Centres by | Deposit/Credit

Size | (Number

of branches) | Deposit/Credit

size class | Rural | Semi- | Total |

|

| urban |

|

Deposits | | | |

Less than Rs.2 crore | 1,483 | 45 | 1,528 |

Rs.2 crore to Rs.4 crore | 6,322 | 203 | 6,525 |

Rs.4 crore to Rs.5 crore | 3,143 | 139 | 3,282 |

Rs.5 crore to Rs.7.5 crore | 5,594 | 373 | 5,967 |

Rs.7.5 crore to Rs.10 crore | 3,237 | 333 | 3,570 |

Rs.10 crore to Rs.12.5 crore | 1,891 | 292 | 2,183 |

Rs.12.5 crore to Rs.15 crore | 1,176 | 208 | 1,384 |

Rs.15 crore to Rs.20 crore | 1,388 | 285 | 1,673 |

Above Rs.20 crore | 1,865 | 552 | 2,417 |

Total | 26,099 | 2,430 | 28,529 |

Credit | | | |

Less than Rs.2 crore | 5,875 | 237 | 6,112 |

Rs.2 crore to Rs.4 crore | 8,071 | 447 | 8,518 |

Rs.4 crore to Rs.5 crore | 2,632 | 197 | 2,829 |

Rs.5 crore to Rs.7.5 crore | 4,310 | 376 | 4,686 |

Rs.7.5 crore to Rs.10 crore | 2,169 | 338 | 2,507 |

Rs.10 crore to Rs.12.5 crore | 1,268 | 266 | 1,534 |

Rs.12.5 crore to Rs.15 crore | 678 | 186 | 864 |

Rs.15 crore to Rs.20 crore | 608 | 202 | 810 |

Above Rs.20 crore | 488 | 181 | 669 |

Total | 26,099 | 2,430 | 28,529 |

Source:

Basic Statistical Return (BSR)-7 | Foreign

Banks’ Operations in India

3.120 At end-June 2008, 30 foreign

banks were operating in India with 279 branches (Table III.53).These

banks originated from 21 countries.In addition, 41 foreign banks operated in India

through representative offices. During the period from July 2007 to June 2008,

approvals were given to 3 existing foreign banks to open 18 branches and to 11

foreign banks to open representative offices in India. Besides, an approval was

also given to one new foreign bank viz., JSC VTB Bank to open its maiden

branch in India.

3.121 Five foreign banks viz., Deutsche Bank

AG, Standard Chartered Bank, Barclays Bank PLC, Citibank N.A. and JSC VTB Bank

together set up 7 branches during July 2007 to June 2008.Besides, seven foreign

banks, viz., Woori Bank, First Rand Bank Ltd., Royal Bank of Canada,

Skandinaviska Enskilda Banken AG, Bayerische Landesbank AG, Westpac Banking Corporation

and HSH Nordbank AG opened seven representative offices in India during the same

period.

Indian Banks’ Operations Abroad

3.122

Indian banks continued to expand their presence overseas. Seventeen Indian banks

(12 from public sector and 5 from private sector) operated a network of 203 offices

(131branches, 22 subsidiaries, 7 joint venture banks and 43 representative offices)

abroad at end-June 2008.During the period between July 1, 2007 to June 30, 2008,

Indian banks opened 8 branches, 3 subsidiaries and 6 representative offices abroad.

Bank of Baroda continued to have largest overseas presence, followed by State

Bank of India and Bank of India (Table III.54).

9.Customer Service and Financial Inclusion

3.123 In recent years, the Reserve Bank has placed special emphasis on improving

the customer service and expanding the banking outreach to wider sections of the

society. Accordingly, it initiated several measures, including enhancing customer

protection and disclosure, code of ethics and grievance redressal, among others.

During 2007-08, the Reserve Bank further fine-tuned its guidelines for improving

customer service and expanding financial inclusion.

Table

III.53: List of Foreign Bank Branches

Operating in India - Country-wise |

(As at

end-June 2008) | Sr.

No | Name

of

Bank | Country

of

Incorporation | No.

of Branches

in India | 1 | 2 | 3 | 4 |

1 | ABN

-AMRO Bank N.V. | Netherlands

| 28 |

2 | Abu

Dhabi Commercial Bank Ltd. | UAE | 2 |

3 | AB

Bank Ltd. | Bangladesh | 1 |

4 | American

Express Banking Corporation | USA

| 1 |

5 | Antwerp

Diamond Bank N.V. | Belgium

| 1 |

6 | Bank

Internasional Indonesia | Indonesia

| 1 |

7 | Bank

of America | USA | 5 |

8 | Bank

of Bahrain & Kuwait BSC | Bahrain

| 2 |

9 | Bank

of Nova Scotia | Canada

| 5 |

10 | The

Bank of Tokyo- Mitsubishi UFJ Ltd. | Japan

| 3 |

11 | BNP

Paribas | France | 8 |

12 | Bank

of Ceylon | Sri Lanka | 1 |

13 | Barclays

Bank PLC. | United Kingdom

| 5 |

14 | Calyon

Bank | France | 5 |

15 | Citibank

N.A. | USA | 40 |

16 | Chinatrust

Commercial Bank | Taiwan

| 1 |

17 | Deutsche

Bank | Germany | 11 |

18 | DBS

Bank Ltd. | Singapore | 2 |

19 | HSBC

Ltd | Hong Kong | 47 |

20 | J.P.

Morgan Chase Bank N.A. | USA

| 1 |

21 | JSC

VTB Bank | Russia | 1 |

22 | Krung

Thai Bank Public Co. Ltd. | Thailand

| 1 |

23 | Mizuho

Corporate Bank Ltd. | Japan

| 2 |

24 | Mashreq

Bank PSC. | UAE | 2 |

25 | Oman

International Bank SAOG | Sultanate

of Oman | 2 |

26 | Shinhan

Bank | South Korea | 2 |

27 | Standard

Chartered Bank | United

Kingdom | 92 |

28 | Sonali

Bank Ltd. | Bangladesh | 2 |

29 | Societe

Generale | France | 2 |

30 | State

Bank of Mauritius | Mauritius

| 3 |

| Total | | 279 |

Note : The

JSC VTB Bank began its operation in India on April 25, 2008 and

American

Express Banking Corporation was issued banking licence dated February 27, 2008. |

Table

III.54: Overseas Operations of Indian Banks |

(Actually

Operational) | Name

of the Bank | Branch | Subsidiary | Representative | Joint

Venture |

| Total |

|

|

|

|

|

|

| Office | Bank |

|

|

|

|

|

| 2006-07 | 2007-08 | 2006-07 | 2007-08 | 2006-07 | 2007-08 | 2006-07 | 2007-08 | 2006-07 | 2007-08 |

| 1 |

| 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 |

I. | Public

Sector Banks | 116 | 121 | 19 | 19 | 26 | 28 | 7 | 7 | 168 | 175 |

| 1 | Allahabad

Bank | 1 | 1 | - | - | 1 | 1 | - | - | 2 | 2 |

| 2 | Andhra

Bank | - | - | - | - | 1 | 1 | - | - | 1 | 1 |

| 3 | Bank

of Baroda | 43 | 45 | 8 | 8 | 4 | 4 | 1 | 1 | 56 | 58 |

| 4 | Bank

of India | 22 | 23 | 2 | 3 | 3 | 4 | 1 | 1 | 28 | 31 |

| 5 | Canara

Bank | 2 | 2 | 1 | - | 1 | 1 | - | - | 4 | 3 |

| 6 | Indian

Bank | 3 | 3 | - | - | - | - | - | - | 3 | 3 |

| 7 | Indian

Overseas Bank | 6 | 6 | 1 | 1 | 2 | 3 | - | - | 9 | 10 |

| 8 | Punjab

National Bank | 1 | 2 | 1 | 1 | 4 | 3 | 1 | 1 | 7 | 7 |

| 9 | State

Bank of India | 33 | 33 | 6 | 6 | 7 | 7 | 4 | 4 | 50 | 50 |

| 10 | Syndicate

Bank | 1 | 1 | - | - | - | - | - | - | 1 | 1 |

| 11 | UCO

Bank | 4 | 4 | - | - | 2 | 2 | - | - | 6 | 6 |

| 12 | Union

Bank | 0 | 1 | - | - | 1 | 2 | - | - | 1 | 3 |

II. | New

Private Sector Banks | 9 | 10 | 3 | 3 | 13 | 15 | - | - | 25 | 28 |

| 13 | Axis

Bank | 3 | 3 | - | - | 1 | 2 | - | - | 4 | 5 |

| 14 | Centurion

Bank of Punjab Ltd. | - | - | - | - | 1 | - | - | - | 1 | - |

| 15 | HDFC

Bank Ltd. | - | - | - | - | 1 | 2 | - | - | 1 | 2 |

| 16 | ICICI

Bank Ltd. | 6 | 7 | 3 | 3 | 8 | 8 | - | - | 17 | 18 |

| 17 | IndusInd

Bank Ltd. | - | - | - | - | 2 | 2 | - | - | 2 | 2 |

| 18 | Federal

Bank Ltd. | - | - | - | - | - | 1 | - | - | - | 1 |

| Total | 125 | 131 | 22 | 22 | 39 | 43 | 7 | 7 | 193 | 203 |

-: Nil | | | | | | | | | | | |

Note:Data

for 2006-07 relate to end-August 2007 while that for 2007-08 relate to end-June

2008. | 3.124 The Reserve Bank has institutionalised the

offices of Banking Ombudsman (BO) at 15 centres across the country. BO offices

receive the complaints relating to grievances against commercial banks, regional

rural banks and scheduled primary co-operative banks. Complainants have the facility

to send the complaints by email, online or by post. The complaints are tracked

by BO offices by means of a complaint tracking software. During 2007-08, 47,887

complaints were received by 15 BO offices as against 38,638 complaints received

during 2006-07. All the complaints were collated and categorised into ten broad

heads, viz., deposit accounts, remittances, credit cards, loans/advances

(general and housing loan), charges without prior notice, pension, failure on

commitments made, direct selling agents (DSAs), notes and coins and others. The

maximum complaints were received in respect of credit cards across all bank groups,

barring nationalised and old private sector banks. This was followed by complaints

relating to failure on commitments made, deposit accounts, remittances and loans

and advances (general). A significant number of complaints also related to pension

(especially for public sector banks) and direct selling agents (especially for

new private sector banks). The number of complaints per office was low for all

bank groups barring foreign banks group (Table III.55 and

Appendix Table

III.39).

3.125 Region-wise, the maximum complaints during 2007-08

were received at New Delhi, thereby surpassing Mumbai as the centre with the largest

number of complaints. The number of complaints received in Chennai, Guwahati,

Bhubaneswar, Kolkata and Ahmedabad also increased sharply during 2007-08 (Table

III.56).

Table

III.55: Bank-Group-wise Complaints received at Banking Ombudsman Offices - 2007-08@ |

Nature

of complaint | Scheduled | Public | Nationalised | State | Private | Old | New | Foreign |

| Commercial | Sector | Banks | Bank | Sector | Private | Private | Banks |

| Banks@ | Banks |

| Group | Banks | Sector | Sector |

|

| (3+6+9) | (4+5) |

|

| (7+8) | Banks | Banks |

|

1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

Total Complaints Received

(1 to 10) | 45,772 | 25,694 | 12,163 | 13,531 | 13,950 | 929 | 13,021 | 6,128 |

1) | Deposit

Accounts | 5,500 | 2,866 | 1,685 | 1,181 | 2,113 | 140 | 1,973 | 521 |

2) | | Remittances | 5,077 | 3,422 | 1,713 | 1,719 | 1,330 | 97 | 1,233 | 315 |

3) | | Credit

Cards | 10,107 | 3,936 | 697 | 3,239 | 3,084 | 49 | 3,035 | 3,087 |

4) | | Loans/Advances

(a+b) | 5,773 | 3,740 | 2,147 | 1,593 | 1,550 | 154 | 1,396 | 483 |

| | a)

General | 5,042 | 3,348 | 1,929 | 1,419 | 1,290 | 131 | 1,159 | 404 |

| | b)

Housing Loans | 731 | 392 | 218 | 174 | 260 | 23 | 237 | 79 |

5) | | Charges

without Prior Notice | 3,700 | 1,659 | 815 | 844 | 1,618 | 111 | 1,507 | 423 |

6) | | Pension | 1,573 | 1,519 | 599 | 920 | 45 | 3 | 42 | 9 |

7) | | Failure

on Commitments Made | 6,222 | 3,521 | 1,805 | 1,716 | 2,145 | 193 | 1,952 | 556 |

8) | | Direct

Selling Agents | 3,044 | 1,902 | 979 | 923 | 801 | 37 | 764 | 341 |

9) | | Notes

and Coins | 133 | 91 | 47 | 44 | 30 | 5 | 25 | 12 |

10) | Others | 4,643 | 3,028 | 1,676 | 1,352 | 1,234 | 140 | 1,094 | 381 |

| | Memo

: | | | | | | | | |

| | Complaints

per Branch* | 0.7 | 0.5 | 0.3 | 0.9 | 1.7 | 0.2 | 3.7 | 22.1 |

@:Excluding RRBs and scheduled

primary co-operative banks.

*:As per number of branches excluding administrative

offices as at end-March 2008. | 3.126 In terms of the

Banking Ombudsman Scheme 2006 (as amended up to May 2007), bank customers and

banks can appeal to the Appellate Authority against the decisions given by Banking

Ombudsman. During 2007-08, 186 such appeals were received which include 17 appeals

against awards and 169 appeals against decisions of BO. The Reserve Bank has evaluated

the progress for improvement of customer services by various bank groups in some

centres (Box III.5)

Table

III.56: Region-wise Complaints received

at Banking Ombudsman

Offices | Sr.no. | Office | No.

of complaints received |

|

| 2006-07 | 2007-08 |

1 | 2 | 3 | 4 |

1 | Ahmedabad | 2,107 | 2,855 |

2 | Bangalore

| 2,406 | 2,975 |

3 | Bhopal

| 2,731 | 3,405 |

4 | Bhubaneswar

| 689 | 998 |

5 | Chandigarh

| 2,006 | 2,331 |

6 | Chennai | 2,387 | 4,545 |

7 | Guwahati | 170 | 282 |

8 | Hyderabad

| 2,767 | 2,843 |

9 | Jaipur | 2,976 | 3,369 |

10 | Kanpur

| 4,321 | 5,340 |

11 | Kolkata | 2,011 | 2,815 |

12 | Mumbai | 5,525 | 6,070 |

13 | New

Delhi | 5,481 | 6,742 |

14 | Patna

| 1,481 | 1,480 |

15 | Thiruvananthapuram | 1,580 | 1,840 |

| Total | 38,638 | 47,890 |

3.127 Financial Inclusion is delivery of banking services at an

affordable cost to the vast sections of disadvantaged and low-income groups who

tend to be excluded from the formal banking channel. The Reserve Bank has made

concerted efforts, particularly in recent years, to promote financial inclusion.

In November 2005, banks were advised to make available a basic ‘no-frills’

account with low or nil minimum balances as well as charges. In order to ensure

that persons belonging to low income group, both in urban and rural areas, do

not encounter difficulties in opening bank accounts, the know your customer (KYC)

procedure for opening accounts were simplified for those accounts with balances

not exceeding Rs. 50,000 and credits thereto not exceeding Rs. 1,00,000 in a year.

The simplified procedure allows introduction by a customer on whom full KYC drill

has been followed. Significant progress has been made in opening of ‘no-frills’

accounts by banks. Between end-March 2007 and end-March 2008, more than 9 million

new ‘no-frills’ bank accounts were opened by SCBs. Public sectors

banks accounted for bulk of these new ‘no-frills’ accounts due to

their vast branch network in rural and semi-urban areas (Table

III.57).

Box III.5: Customer Satisfaction Survey In

view of the importance given by the Reserve Bank on customer services of banks

and the recent initiatives in this respect, the Local Board (Southern Region)

desired that a survey should be conducted to evaluate the satisfaction level of

customer on various services rendered by the banks. Accordingly, Department of

Statistics and Information Management (DSIM), Chennai Regional Office conducted

a Customer Satisfaction Survey at four major districts of Tamilnadu, viz.,

Chennai, Coimbatore, Madurai and Tiruchirapalli, covering 2,800 customers from

149 bank branches selected using systematic sampling method (Table

1). Care was taken to adequately cover different types of customers across

different population groups. A detailed questionnaire used for the survey covered

various aspects such as: (a) demographic details of the respondents; (b) common

factors influencing satisfaction level such as branch infrastructure, working

hours, number of employees, etc.; and (c) specific banking services influencing

satisfaction level such as: (i) basic services like deposit and withdrawal; (ii)

loan facilities; (iii) payment and other similar services, etc. To measure

the satisfaction level, respondents were asked to rate their satisfaction level

with various services on a five-point scale from ‘Highly Dissatisfied’

to ‘Highly Satisfied’.

Branch-wise analysis showed

that only 68.5 per cent bank branches were under Core Banking Solution (CBS) and

the remaining were either under total branch automation or partial computerisation.

The overall average staff strength per branch is 15 and about 80 per cent of selected

branches’ staff strength was below the overall average. In all, nine bank

branches had received ISO 9000 certification, of which two branches were from

rural centre.

Table

1: Sample of the Survey | District | Rural | Semi- | Urban | Metro- | Total |

| | Urban | | Politian | |

1 | 2 | 3 | 4 | 5 | 6 |

Number

of Branches | | | | |

Chennai | - | - | - | 28 | 28 |

Coimbatore | 17 | 27 | 18 | - | 62 |

Madurai | 12 | 7 | 9 | - | 28 |

Tiruchirapalli | 13 | 9 | 9 | - | 31 |

Total | 42 | 43 | 36 | 28 | 149 |

Number

of Respondents | | | | |

Chennai | - | - | - | 597 | 597 |

Coimbatore | 280 | 425 | 382 | - | 1,087 |

Madurai | 249 | 141 | 180 | - | 570 |

Tiruchirapalli | 199 | 161 | 186 | - | 546 |

Total | 728 | 727 | 748 | 597 | 2,800 |

Analysis of the survey showed that courtesy and friendliness extended

by bank staffs in rural centres were rated better compared to semi-urban, urban

and metro centres. It was observed that bank staff knowledge on various banking

services and willingness to help customers was comparatively low in semi-urban

centres. Most of the respondents (87.5 per cent) were satisfied with the way bank’s

staff treat them and agreed that there was no discrimination based on caste, gender,

status, etc. Complaint handling and redressal mechanism were rated better

for private sector banks compared to other bank groups. Around 40 per cent respondents

were dissatisfied with services charges levied by banks.This factor showed the

least average satisfaction score. Respondents were, in general, satisfied with

bank’s responses to their telephonic queries and confidentiality and privacy

of their bank accounts maintained by the banks.

Survey showed that infrastructure

facility had the third lowest average rating among the common factors and around

40 per cent of the rural respondents were dissatisfied with infrastructure facilities.

Furthermore, nationalised banks were rated low on infrastructure facilities. In

general, respondents were satisfied with the overall operating of savings bank

accounts, while most of the respondents from public sector banks were satisfied

with the minimum balance requirement, around 25 per cent of respondents from private

sector banks and foreign banks were dissatisfied. The analysis indicated that

compared to public sector and foreign banks, private sector banks provide quick

and fast services to savings bank account holders. With regard to cheque collection,

most of the banks have introduced the drop box facility for depositing cheques

to avoid any time delay to their customers. Analysis showed that more than 75

per cent of urban and metropolitan respondents were satisfied with the drop box

facility. However, satisfaction was comparatively low in rural and semi-urban

centres. Few respondents were dissatisfied with commission/charges and processing

time taken for issuing a demand draft.

More than 75 per cent of the respondents

were satisfied with the credit card facility, but for interest rates. Around 44

per cent of the respondents, mostly from private sector and foreign banks, were

dissatisfied with interest rate applicable to credit cards. The Survey showed

that more than 85 per cent of the respondents were satisfied with ATM facility,

of which 35 per cent were highly satisfied. There were, however, many suggestions

from rural customers regarding the extension of ATM facility to them.

Regarding the loan facilities offered by the banks, respondents of SBI and associates

and private sector banks showed higher satisfaction level compared to nationalised

and foreign banks. It was observed that the proportion of respondents highly satisfied

with loan facilities from SBI and associates and private sector banks were 31

per cent and 43.9 per cent, respectively. In general, respondents had no complaints

against the procedural formalities followed in sanctioning and disbursement of

loans. Furthermore, 75.5 per cent of the respondents were satisfied with settlement

and recovery procedures followed by the banks.

Even though 88.1 per cent

of respondents had indicated that overall they were satisfied/highly satisfied

with banking services, in specific areas, respondents had expressed their dissatisfaction.

Furthermore, it was observed that respondents who took neutral stance (neither

satisfied nor dissatisfied) for all factors can be converted to a satisfied group

with some efforts. In general, the satisfaction level of rural customers was high,

which may be due to their lower expectations and awareness. Despite the fact that

advancements in IT and communication have enabled banks to offer better customer

services, such advancements have not reached all segments of customers, as there

are still some bank branches yet to be fully computerised. 10. Regional

Rural Banks

3.128 The regional rural banks (RRBs) were established

to combine the local feel and familiarity enjoyed by the co-operatives with the

degree of business organisation as well as the ability to mobilise deposits characteristic

of commercial banks. After the commencement of consolidation and amalgamation

process of RRBs initiated by the Government in September 2005, in terms of Section

23A of the Regional Rural Banks Act, 1976, the number of RRBs declined to 91 as

on March 31, 2008, (196 at end-March 2005) operating in 25 States across 586 districts

with a network of 14,790 branches. Consequent upon the amalgamation of 151 RRBs,

46 new amalgamated RRBs were formed besides 45 stand-alone RRBs. With further

amalgamation, and formation of a new RRB in the Union Territory of Puducherry,

the total number of RRBs, all over India, declined to 88 as on August 31, 2008

(including 45 amalgamated and 43 stand-alone).

Table

III.57: Number of No-frills Accounts

Opened by SCBs |

Bank Group | End-March | End-March | End-March |

| 2006 | 2007 | 2008 |

1 | 2 | 3 | 4 |

Public Sector Banks | 332,878 | 5,865,419 | 13,909,935 |

Private Sector Banks | 156,388 | 860,997 | 1,845,869 |

Foreign Banks | 231 | 5,919 | 33,115 |

Total | 489,497 | 6,732,335 | 15,788,919 |

Note : Data

are provisional. |

3.129 A number of policy initiatives

were taken by the Reserve Bank and NABARD to facilitate diversification of their

business operation into new areas (refer Chapter II). In order to facilitate RRBs

in becoming an important arm for financial inclusion in rural areas, the Government

reviewed the performance of RRBs on February 7, 2008. RRBs have been encouraged

to enhance their deposit base and increase credit-deposit ratio from the level

of 56 per cent at end-March 2006 by exploiting the emerging potential under both

priority and non-priority sector. Accordingly, the CD ratio of RRBs improved to

60.3 per cent at end-March 2008.

Recapitalisation of RRBs

3.130 It was announced in the Union Budget 2007-08 that the RRBs with negative

net worth would be recapitalised in a phased manner. The performance review of

all RRBs undertaken in July 2007 revealed that out of 96 RRBs (46 amalgamated

and 50 stand-alone), 29 (11 amalgamated and 18 stand-alone) had negative net worth

amounting to Rs.1,857 crore including the share capital as onMarch 31, 2007.After

July 2007, two RRBs with negative net worth were merged with two other RRBs of

the same State and sponsored by same banks, thus, resulting in formation of two

new entities with no negative net worth.As a result, the number of RRBs having

negative net worth declined to 27.The amount required for recapitalisation was

at Rs.1,796 crore.Of this, Rs.269 crore (15 per cent share), Rs.629 crore (35

per cent share) and Rs.898 crore (50 per cent share) was to be contributed by

the State Governments, sponsor banks, and by Government of India, respectively.

Five State Governments contributed their share in 10 RRBs in 2007-08, of which

7 RRBs got full share from all the three shareholders and 3 RRBs received contribution

partially by March 31, 2008. The rest of the RRBs are expected to get the recapitalisation

fund in 2008-09.

Financial Performance of RRBs

3.131 The

consolidated balance sheet of RRBs showed an increase of 16.8 per cent during

2007-08 as compared with 18.0 per cent in 2006-07 (Table III.58).On

the assets side, net advances of RRBs increased by 21.7 per cent during the period,

a more or less same growth as in the previous year.Among the major items on the

liabilities side, both deposits and borrowings increased by 19.2 percent each

during the year. Reflecting a relatively higher growth in advances, credit-deposit

ratio of RRBs increased to 60.3 percent at end-March 2008 from 58.3 per cent a

year ago.

Table

III.58: Regional Rural Banks: Consolidated Balance Sheet |

(Amount

in Rs. crore) | Item |

| March

31 | March

31 | Percentage

Variation |

|

| 2007 | 2008P | 2006-07 | 2007-08 |

|

|

|

| over | over |

|

|

|

| 2005-06 | 2006-07 |

1 |

| 2 | 3 | 4 | 5 |

Liabilities | | 1,05,768 | 1,23,541 | 18.0 | 16.8 |

Share Capital | | 196 | 196 | – | – |

Reserves | | 4,902 | 5,687 | 14.8 | 16.1 |

Share Capital Deposits | | 2,188 | 2,833 | 0.4 | 29.5 |

Deposits | | 83,144 | 99,095 | 16.6 | 19.2 |

Current | | 4,785 | 5689 | 21.0 | 18.9 |

Savings | | 46,112 | 53,370 | 20.6 | 15.7 |

Term | | 32,247 | 40,036 | 10.7 | 24.2 |

Borrowings | | 9,776 | 11,649 | 33.8 | 19.2 |

NABARD | | 7,567 | 8,350 | 20.1 | 10.4 |

Sponsor Bank | | 2030 | 3,250 | 116.8 | 60.1 |

Others | | 179 | 49 | 316.3 | -72.6 |

Other Liabilities | | 5,562 | 4,081 | 27.4 | -26.6 |

| | | | | |

Assets | | 1,05,768 | 1,23,541 | 18.0 | 16.8 |

Cash in Hand | | 1,216 | 1,412 | 17.7 | 16.1 |

Balances with RBI | | 4,886 | 7,164 | 38.8 | 46.6 |

Other Bank Balances | | 19,314 | 23,493 | 18.8 | 21.6 |

Other Investments | | 26,352 | 25,073 | 5.6 | -4.8 |

Loans and Advances (net) | 47,326 | 57,601 | 22.7 | 21.7 |

Fixed Assets | | 196 | 214 | 10.1 | 9.2 |

Other Assets# | | 6,478 | 8,584 | 24.2 | 32.5 |

Memorandum Items: | | | | | |

a. Credit-Deposit Ratio | | 58.3 | 60.3 | | |

b. Investment-Deposit Ratio | 54.9 | 45.2 | | |

c. (Credit+Investment)- | | | | | |

Deposit Ratio | | 104.3 | 106.4 | | |

| | | | | |

P: Provisional.

-: Nil/Negligible

#: includes accumulated loss.

Source : NABARD |

3.132 During 2007-08, 90 RRBs extended new loans (issued) to the

extent of Rs.38,464 crore to 9.3 million borrowers as against Rs.33,043 crore

during 2006-07 to 8.9 million borrowers. Of this, the share of priority sector

loans issued was 82.1 per cent. In terms of number of borrowers’ coverage,

the share of priority sector was 86.0 per cent to total loans issued during 2007-08.

As at end-March 2008, the outstanding advances of RRBs were Rs.59,751 crore and

the share of priority sector was 83.1 per cent (Table III.59).

The share of agricultural loans declined marginally to 55.4 per cent at end-March

2008 from 56.6 per cent a year ago.

Table

III.59: Purpose-wise Outstanding

Advances by RRBs |

(Amount in

Rs. crore) | Purpose/End-March | 2006 | 2007 | 2008P |

1 | 2 | 3 | 4 |

I. | Agriculture

(i to iii) | 21,509 | 27,452 | 33,112 |

| Per

cent to total loans outstanding | 54.2 | 56.6 | 55.4 |

| i.

Short-term loans (crop loans) | 13,877 | 18,707 | 22,644 |

| ii.

Term loans (for agriculture | | | |

| and

allied activities) | 7,632 | 8,745 | 10,468 |

| iii.

Indirect Advances | - | - | - |

II. | Non-agriculture

(iv to vii) | 18,204 | 21,041 | 26,639 |

| Per

cent to total loans outstanding | 45.8 | 43.4 | 44.6 |

| i.

Rural Artisans, etc. | 748 | 736 | 671 |

| ii.

Other Industries | 757 | 880 | 1276 |

| iii.

Retail Trade, etc. | 3,452 | 3,677 | 5,016 |

| iv.

Other purposes | 13,246 | 15,748 | 19,676 |

Total (I+II) | 39,712 | 48,493 | 59,751 |

Memo item: | | | |

a) | Priority

Sector | 32,177 | 39,852 | 49,650 |

b) | Non-priority

Sector | 7,535 | 8,641 | 10,101 |

c) | Share

of Priority Sector | 81.0 | 82.2 | 83.1 |

| (per

cent to Total) | | | |

P : Provisional. - : Nil/Negligible.

Source : NABARD. | 3.133

Aggregate income of RRBs during 2007-08 grew by 20.0 per cent on account of higher

interest as well as non-interest income. Growth in expenditure during the year

was relatively subdued on account of lower increase in interest expenditure and

wage bill. As a result, profitability of RRBs improved significantly during 2007-08.

Out of 90 RRBs, 82 RRBs earned a combined profit of Rs. 1,429 crore, whereas 8

RRBs incurred a combined loss of Rs. 55 crore in 2007-08. Thus, RRBs, as a group,

earned net profits of Rs. 1,374 crore during 2007-08 as compared with Rs. 625

crore in the previous year. The improvement in the financial performance of RRBs

is also reflected in the decline in NPAs ratios (both gross and net) during 2007-08.

While gross NPAs to total assets ratio declined to 5.9 per cent at end-March 2008

from 6.6 per cent a year ago, the net NPAs to assets ratio declined to 3.0 per

cent from 3.5 per cent a year ago (Table III.60).

3.134 The productivity of RRBs, both in terms of per branch and per employee,

showed further improvement during 2007-08 (Table III.61).

Most of the other financial ratios also showed improvement during the year.

11. Local Area Banks

3.135 There were four local

area banks (LABs) in the country at end-March 2008. During 2007-08, aggregate

assets of LABs increased by 32.2 per cent and deposits and gross advances by 32.4

per cent and 35.5 per cent, respectively. More or less similar growth rate was

observed across all LABs barring Krishna Bhima Samruddhi Local Area Bank

Ltd. that showed a significantly higher growth (Table III.62).

3.136 During 2007-08, the income of the LABs showed a large increase on account

of both interest and non-interest income. Growth rate in expenditure was also

significant as interest expenditure grew sharply. On the whole, the rise in income

was more than the rise in expenditure, resulting in higher operating and net profit

during 2007-08. The ratio of net profit to total assets was higher at 1.5 per

cent as compared with 1.2 per cent in the previous year even as the net interest

margin remained at the previous year’s level (Table III.63).

Table

III.60: Financial Performance of Regional Rural Banks |

(Amount

in Rs. crore) | Particulars | 2006-07 | 2007-08(P) | Variation |

| Loss | Profit | Total | Loss | Profit | Total | Col.

(7) over |

| Making | Making | RRBs | Making | Making | RRBs | Col.

(4) |

| [15] | [81] | [96] | [8] | [82] | [90] | Amount | Per

cent | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

A. | Income

(i+ii) | 997 | 6,666 | 7,663 | 316 | 8,879 | 9,195 | 1,532 | 20.0 |

| i) | Interest

income | 932 | 6,191 | 7,123 | 286 | 8,106 | 8,392 | 1,269 | 17.8 |

| ii) | Other

income | 65 | 475 | 540 | 30 | 773 | 803 | 263 | 48.7 |

B. | Expenditure

(i+ii+iii) | 1,298 | 5,740 | 7,038 | 365 | 7,401 | 7,766 | 728 | 10.3 |

| i) | Interest

expended | 589 | 3,127 | 3,716 | 191 | 3,873 | 4,064 | 348 | 9.4 |

| ii) | Provisions

and contingencies | 192 | 425 | 617 | 50 | 675 | 725 | 108 | 17.5 |

| iii) | Operating

expenses | 464 | 2,241 | 2,705 | 130 | 2,847 | 2,977 | 272 | 10.1 |

| | of

which : Wage Bill | 391 | 1,660 | 2,051 | 113 | 2,102 | 2,215 | 164 | 8.0 |

C. | Profit | | | | | | | | |

| i) | Operating

Profit/Loss | -56 | 1,298 | 1242 | -5 | 2,159 | 2,154 | 912 | 73.4 |

| ii) | Net

Profit/Loss | -301 | 926 | 625 | -55 | 1429 | 1374 | 749 | 119.8 |

D. | Total

Assets | 16,148 | 89,620 | 1,05,768 | 4,440 | 1,19,101 | 1,23,541 | 17,773 | 16.8 |

E. | Financial

Ratios @ | | | | | | | | |

| i) | Operating

Profit | -0.35 | 1.45 | 1.17 | -0.11 | 1.81 | 1.74 | - | - |

| ii) | Net

Profit | -1.86 | 1.03 | 0.59 | -1.24 | 1.2 | 1.11 | - | - |

| iii) | Income | 6.17 | 7.44 | 7.25 | 7.12 | 7.46 | 7.44 | - | - |

| | a)

Interest income | 5.77 | 6.91 | 6.73 | 6.44 | 6.81 | 6.79 | - | - |

| | b)

Other Income | 0.4 | 0.53 | 0.51 | 0.68 | 0.65 | 0.65 | - | - |

| iv) | Expenditure | 8.04 | 6.4 | 6.65 | 8.22 | 6.21 | 6.29 | - | - |

| | a)

Interest expended | 3.65 | 3.49 | 3.51 | 4.3 | 3.25 | 3.29 | - | - |

| | b)

Operating expenses | 2.87 | 2.5 | 2.56 | 2.93 | 2.39 | 2.41 | - | - |

| | of

which: Wage Bill | 2.42 | 1.85 | 1.94 | 2.55 | 1.76 | 1.79 | - | - |

| v) | Provisions

and contingencies | 1.19 | 0.47 | 0.58 | 1.13 | 0.57 | 0.59 | - | - |

| vi) | Gross

NPAs | | | 6.55 | | | 5.88 | - | - |

| vii) | Net

NPAs | | | 3.46 | | | 3.02 | - | - |

P : Provisional.

@: Ratios to total assets.

*: Before tax. Note: Figures in

brackets represent number of RRBs. Financial

performance analysis relates

to 90 RRBs (excluding the new RRB).

Source: NABARD. |

Table

III.61: Business and Financial Indicators of RRBs |

Indicator | 2001-02 | 2002-03 | 2003-04 | 2004-05 | 2005-06 | 2006-07 | 2007-08

(p) | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

No.of RRBs | 196 | 196 | 196 | 196 | 133

# | 96 # | 91# |

Net profit (Rs crore)* | 608 | 519 | 769 | 748 | 617 | 625 | 1374 |

Per Branch Productivity1 (Rs. crore) | 4.4 | 5.0 | 5.7 | 6.6 | 7.7 | 9.1 | 10.7 |

Per Employee Productivity2 (Rs. crore) | 0.9 | 1.0 | 1.2 | 1.4 | 1.6 | 1.9 | 2.3 |

Accumulated loss as percentage to assets | 4.7 | 4.4 | 3.9 | 3.5 | 2.9 | 2.5 | 2.1 |

Salary as percentage to Assets | 2.2 | 2.3 | 2.6 | 2.0 | 2.3 | 2.2 | 1.8 |

Financial Return3 (per cent) | 10.6 | 9.6 | 8.9 | 8.2 | 7.7 | 7.7 | 7.9 |

Financial Cost4 (per cent) | 6.8 | 6.1 | 5.4 | 4.6 | 4.1 | 4.0 | 4.2 |

Financial margin5 (per cent) | 3.8 | 3.5 | 3.5 | 3.6 | 3.6 | 3.7 | 3.6 |

Risk, operational and other cost (per cent) | 2.6 | 2.6 | 2.2 | 2.3 | 2.8 | 3.0 | 3.1 |

Net margin6 (per cent) | 1.2 | 0.9 | 1.3 | 1.3 | 0.8 | 0.7 | 0.6 |

* : Before

Tax

# : Reduction in number of RRBs was due to amalgamation, which began in

September 2005. Financial performance analysis relates to 90 RRBs (excluding the

new RRB).

Note : 1. Average level of business (in terms of

total deposits and gross advances) per branch during the reporting year.

2.

Average level of business (in terms of total deposits and gross advances) per

employee of RRBs during the year.

3. Percentage of total income from both

advances and investments against average working funds during the year.

4.

Percentage of total interest expended for deposits, borrowingsetc. against

average working funds during the year.

5. Difference between the financial

return and financial cost.

6. Difference between the financial margin and

risk, operational and other costs, plus miscellaneous income.

7. Data for

2007-08 are provisional.

Source : NABARD. |

Table

III.62: Profile of Local Area Banks |

(Amount in

Rs. crore) | Bank |

| Assets | Deposits | Gross

Advances |

| 2007 | 2008 | 2007 | 2008 | 2007 | 2008 |

1 | 2 | 3 | 4 | 5 | 6 | 7 |

Capital Local Area Bank Ltd. | 362 | 466 | 301 | 393 | 186 | 243 |

Coastal Local Area Bank Ltd. | 63 | 76 | 45 | 56 | 32 | 43 |

Krishna Bhima Samruddhi Local Area Bank

Ltd. | 49 | 81 | 27 | 43 | 30 | 52 |

Subhadra Local Area Bank Ltd. | 23 | 31 | 15 | 22 | 14 | 17 |

Total | 497 | 654 | 388 | 514 | 262 | 355 |

Source: Based

on off-site returns. |

Table

III.63: Financial Performance of Local Area Banks |

(As at end-March)

| (Rs.

crore) | Particulars | 2006-07 | 2007-08 | Variation

of Col.(3) over Col. (2) | | | | Absolute | Percentage |

1 | 2 | 3 | 4 | 5 |

A. | Income

(i+ii) | 46.3 | 68.2 | 21.8 | 47.1 |

| i) | | Interest

income | 37.4 | 54.9 | 17.5 | 46.7 |

| ii) | | Other

income | 8.9 | 13.3 | 4.4 | 49.0 |

B. | Expenditure

(i+ii+iii) | 40.5 | 58.3 | 17.8 | 43.9 |

| i) | | Interest

expended | 18.3 | 29.9 | 11.6 | 63.0 |

| ii) | | Provisions

and contingencies | 4.3 | 6.1 | 1.8 | 41.0 |

| iii) | | Operating

expenses | 17.8 | 22.3 | 4.5 | 25.1 |

| | | of

which : Wage Bill | 7.0 | 9.9 | 2.9 | 40.5 |

C. | Profit | | | | |

| i) | | Operating

Profit/Loss | 10.2 | 15.6 | 5.4 | 53.1 |

| ii) | | Net

Profit/Loss | 5.9 | 9.5 | 3.6 | 62.1 |

D. | Spread

(Net Interest Income) | 19.1 | 25.0 | 5.6 | 31.0 |

E. | Total

Assets | 496.4 | 653.5 | 157.1 | 31.7 |

F. | Financial

Ratios@ | | | | |

| i) | | Operating

Profit | 2.1 | 2.4 | | |

| ii) | | Net

Profit | 1.2 | 1.5 | | |

| iii) | | Income | 9.3 | 10.4 | | |

| iv) | | Interest

income | 7.5 | 8.4 | | |

| v) | | Other

Income | 1.8 | 2.0 | | |

| vi) | | Expenditure | 8.2 | 8.9 | | |

| vii) | | Interest

expended | 3.7 | 4.6 | | |

| viii) | | Operating

expenses | 3.6 | 3.4 | | |

| ix) | | Wage

Bill | 1.4 | 1.5 | | |

| x) | | Provisions

and Contingencies | 0.9 | 0.9 | | |

| xi) | | Spread

(Net Interest Income) | 3.8 | 3.8 | | |

Note:@ Ratios

to Total Assets.

Source:Based on Off-site returns. |

|

IST,

IST,