Report on Trend

and Progress of Banking in India, 2007-08 bank branch, designated

as the base branch. It was advised that the distance between the place of business

of a BC and the base branch, should not exceed 15 kms in rural/semi-urban/urban

areas and 5 kms in metropolitan centres. If need arose to relax the distance criterion,

the matter could be referred to the District Consultative Committee (DCC) of the

district concerned for approval. For relaxations covering adjoining districts

and for metropolitan areas, the respective SLBC would be the clearing agency.

DCCs/SLBCs would consider the requests on merit in respect of under-banked areas

or where the population was scattered over large area where the need to provide

banking services was imperative, but having a branch was not viable.

2.71 Furthermore, on August 27, 2008, SCBs, including RRBs and local area banks

were advised that they could engage companies registered under Section 25 of the

Companies Act, 1956, as BCs provided those companies were stand-alone entities

or not more than 10 per cent of their equity was held by NBFCs, banks, telecom

companies and other corporate entities or their holding companies. For engaging

Section 25 companies as BCs, banks had to strictly adhere to the distance criterion

of 15 kms/5 kms, as applicable, between the place of business of the BC and the

branch. The controlling authorities of banks should closely monitor the functioning

of business facilitators (BFs)/BCs during their periodic visits to the branches.

Banks were also advised to put in place an institutionalised system for periodically

reviewing the implementation of the BF/BC model at the board level.

Working

Groups on Improvement of Banking Services in Different States/Union Territories

2.72 The Reserve Bank had in the recent past constituted Working Groups to

suggest measures for improving the outreach of banks and their services, and promoting

financial inclusion in certain less developed States/ Union Territories, such

as Bihar, Uttarakhand, Chattisgarh, Himachal Pradesh, Jharkhand, Lakshadweep and

those in the North-Eastern Region, and for supporting the development plans of

these State Governments. These Groups made specific recommendations for strengthening

of financial institutions (FIs), improving currency and payment systems and for

revitalisation of the RRBs and UCBs in the respective regions. The Special Task

Force on North-Eastern Region (Chairperson: Smt. Usha Thorat), constituted in

May 2008 to give a fresh impetus for setting up of banking facilities in the regions

where perceived necessary as per public policy, was entrusted with,

inter alia, suggesting a mechanism for cost sharing among banks, State

Governments and the Reserve Bank for opening of branches/ currency chests and

extension of foreign exchange/Government business facilities at centres which

were found to be commercially unviable by banks. The Task Force picked up Meghalaya

as the first State for implementation of its decisions. The State Government has

agreed to the proposal of providing premises and necessary security arrangements

for the new branches. Similar mechanisms for other States, where requests have

been received, are under consideration.

Financial Inclusion Fund

(FIF) and Financial Inclusion Technology Fund (FITF)

2.73 In June

2006, the Government constituted the “Committee on Financial Inclusion”

(Chairman: Dr. C. Rangarajan). The Interim Report of the Committee had recommended

the establishment of two funds – the FIF for meeting the cost of developmental

and promotional interventions for ensuring financial inclusion and the FITF to

meet the cost of technology adoption. The Union Budget for 2007-08, announced

the constitution of the FIF and the FITF, with an overall corpus of Rs.500 crore

each with NABARD. For the year 2007-08, the Government fixed an initial contribution

of Rs.25 crore each in the two funds by the Central Government, the Reserve Bank

and NABARD in the ratio 40:40:20. Financial Literacy

2.74

Recognising lack of awareness about financial services as a major factor for financial

exclusion, the Reserve Bank has taken a number of measures towards financial literacy.

The Reserve Bank started “Project Financial Literacy” with the objective

of disseminating information regarding the central bank and general banking concepts

to various target groups such as school and college going children, women, rural

and urban poor, defence personnel and senior citizens. The target audience is

reached through banks, local government machinery and schools/colleges through

the use of pamphlets, brochures, films and also the Reserve Bank’s website.

The ‘For the Common Person’ link on the Reserve Bank’s website

facilitates access to information in Hindi, English and 11 regional languages.

2.75 A ‘Financial Education’ link, aimed at teaching basics of

banking, finance and central banking to children in different age groups, was

placed on the Reserve Bank’s website on November 14, 2007. The concepts

are explained in a simple and interesting way using comic book formats. The site

has films on security features of currency notes of different denominations and

an educative film to dissuade citizens from stapling notes. The site also has

a games section which aims at educating children through entertainment.

Credit Counselling Centres

2.76 The Working Group (Chairman: Professor

S.S. Johl) constituted by the Reserve Bank to suggest measures for assisting distressed

farmers had recommended financial and livelihood counselling as important for

increasing the viability of credit. Further, the Working Group constituted to

examine procedures and processes for agricultural loans (Chairman: Shri C.P. Swarnkar)

had also recommended that banks should actively consider opening of counselling

centres, either individually or with pooled resources, for credit and technical

counselling with a view to giving special thrust for credit delivery in the relatively

under-developed regions. In the light of the recommendations of these two Groups,

in May 2007, convenor banks of SLBCs were advised to set up a financial literacy-cum-counselling

centre in any one district on a pilot basis and extend it to all other districts

in due course, based on the experience gained. As reported by SLBC convenor banks,

as on July 31, 2008, 109 credit counselling centres had been set up/proposed to

be set up in 19 States, on a pilot basis. In accordance with the announcement

made in the Mid-term Review for 2007-08, the Reserve Bank placed on its website

a concept paper on ‘Financial Literacy and Credit Counselling Centres’

on April 3, 2008. Based on the feedback received, a model Scheme for Financial

Literacy and Credit Counselling Centres is being conceptualised.

Lead Bank Scheme

2.77 The Lead Bank Scheme, introduced in 1969,

was aimed at coordinating the activities of banks and other development agencies

for achieving the overall objectives of enhancing the flow of bank finance to

the priority sector and promoting banks’ role in the overall development

of the rural sector. Under the scheme, each district had been assigned to SCBs

to enable them to act as consortium leader to coordinate the efforts of banks

in the districts, particularly in matters such as branch expansion and credit

planning. During 2007-08 (July-June), the nine newly formed districts in six States

were assigned to various SCBs, viz., (i) Ramanagara and Chikballapur

in Karnataka to Canara Bank and Corporation Bank, respectively; (ii) Ariyalur

in Tamil Nadu to State Bank of India (SBI); (iii) Tapi in Gujarat to Bank of Baroda;

(iv) Pratapgarh in Rajasthan to Bank of Baroda; (v) Ramgarh and Khunti in Jharkhand

to Bank of India; and (vi) Alirajpur and Singrauli in Madhya Pradesh to Bank of

Baroda and Union Bank of India, respectively. The total number of districts covered

under Lead Bank Scheme, thus, went up to 617, as on June 30, 2008. 2.78

Pursuant to the announcement made in the Mid-term Review for 2007-08, a High Level

Committee (Chairperson: Smt. Usha Thorat) was constituted to review the Lead Bank

Scheme and improve its effectiveness, with a focus on financial inclusion and

recent developments in the banking sector. The Committee conducted ten meetings

up to June 30, 2008, with select banks, senior officers of certain State Governments,

representatives of micro finance institutions (MFIs)/non-government organisations

(NGOs), academicians of reputed educational institutions and others. A questionnaire

covering various aspects of the Lead Bank Scheme was forwarded to all the State

Governments and major banks. The Committee is expected to submit its report by

December 2008.

Government Sponsored Schemes

2.79 As the Government of India had decided to merge the Prime Minister’s

Rozgar Yojana (PMRY) with the Rural Employment Generation Programme (REGP)

to form a new scheme, all implementing banks were requested on March 5, 2008,

to take necessary steps to achieve all programme targets for 2007-08 and also

2006-07 (if any) and forward their final subsidy requirement for 2007-08 (if any),

latest by March 31, 2008. The Government announced the creation of Prime Minister’s

Employment Generation Programme, by merger of PMRY and REGP, on August 15, 2008.

2.80 In the 11th Meeting of Central Level Coordination Committee (CLCC) of

SGSY held on February 8, 2008, the representatives of the commercial banks and

State Governments agreed that training institutes such as the Rural Development

and Self-Employed Training Institutes (RUDSETIs) needed to be established for

assisting the beneficiaries of SGSY in capacity building and skill upgradation

to ensure the sustainability of the benefits of the scheme to the rural poor.

Accordingly, all SLBC/UTLBC convenor banks were advised in April 2008 to set up

one RUDSETI in all districts under their jurisdiction. It was decided in the twelfth

meeting of the CLCC of SGSY to prepare separate guidelines for establishment of

RUDSETI type institutions. The draft guidelines have since been framed by the

Ministry of Rural Development and are being finalised in consultation with the

Reserve Bank.

Self Employment Scheme for Rehabilitation of Manual

Scavengers (SRMS)

2.81 The National Scheme for Liberation and Rehabilitation

of Scavengers (NSLRS) was introduced in 1993 to liberate all scavengers and their

dependents from their hereditary and obnoxious occupation and engage them in alternative

and dignified occupations within a period of five years. In place of the NSLRS,

the Government of India approved a new and improved scheme named “Self Employment

Scheme for Rehabilitation of Manual Scavengers” (SRMS), aimed at rehabilitating

the remaining scavengers and their dependents by March 2009. Accordingly, public

sector banks were advised on April 15, 2008 to implement the new scheme as the

Government had stopped funding the NSLRS from 2005-06. The approved scheme contained

provisions for capital subsidy, concessional loans and capacity building for rehabilitation

of manual scavengers in alternative occupations. The scheme covered projects costing

up to Rs.5 lakh; the loan amount would be the remaining portion of the project

cost, after deducting the admissible capital subsidy. No margin money/promoter’s

contribution was required to be provided under the scheme. Both, term loan (up

to a maximum cost of Rs.5 lakh) and micro financing (up to a maximum of Rs.25,000)

would be admissible under the scheme. Micro financing would also be done through

SHGs and reputed NGOs. The rate of interest chargeable from the beneficiaries

would be: (a) 5.0 per cent per annum for projects up to Rs.25,000 (4.0 per cent

for women beneficiaries); and (b) 6.0 per cent per annum for projects above Rs.25,000.

The period of repayment of loan would be three years for projects up to Rs.25,000

and five years for projects above Rs.25,000. The moratorium period to start the

repayment of loan would be six months. Credit linked capital subsidy would be

provided upfront to the beneficiaries in a scaled manner.

Differential

Rate of Interest (DRI) Scheme

2.82 The Union Budget for 2007-08

proposed to raise the limit of the loans under the DRI scheme from Rs.6,500 to

Rs.15,000 and the limit of housing loans under the scheme from Rs.5,000 to Rs.20,000

per beneficiary. The Reserve Bank issued instructions to the effect in June 2007.

Furthermore, the Union Budget for 2008-09 proposed to raise the borrower’s

eligibility criteria for availing loans under the DRI Scheme. Accordingly, the

Reserve Bank advised banks in April 2008 that borrowers with annual family income

of Rs.18,000 in rural areas and Rs.24,000 in urban areas would be eligible to

avail of the facility as against the earlier annual income criteria of Rs.6,400

in rural areas and Rs.7,200 in urban areas. The target for lending under the DRI

scheme was maintained at 1.0 per cent of the previous year’s total advances. 5.

Prudential Regulation

2.83 The focus of the Reserve

Bank’s regulatory initiatives during 2007-08 continued to be on adopting

international best practices to the Indian conditions to ensure financial stability.

Measures were initiated that paved the way for smooth adoption of the Basel II

framework in India. Guidelines pertaining to the New Capital Adequacy Framework

(or the Revised Framework) were released and based on clarifications sought by

banks during the parallel run of the Revised Framework, a few amendments were

made to it. Guidelines for the Supervisory Review Process (SRP) or Pillar 2 of

the framework were also issued. The Reserve Bank broadened the means for banks

to raise capital to meet their regulatory requirements. In view of the turmoil

in the international financial markets, prudential regulation for off-balance

sheet exposure of banks was strengthened. Guidelines were also issued for a more

dynamic management of liquidity risk by banks, while the frequency of supervisory

reporting to the Reserve Bank was increased from monthly to fortnightly. Other

major initiatives taken during the year included the tightening of prudential

norms in relation to financing of projects by banks and issuance of letters of

comfort (LoCs) by them, modifications in the corporate governance norms relating

to nationalised banks and associate banks of the SBI and issuance of exhaustive

guidelines for enhancing the efficacy of the anti-money laundering (AML) and combating

financing of terrorism (CFT) initiatives.

2.84 A view has been expressed

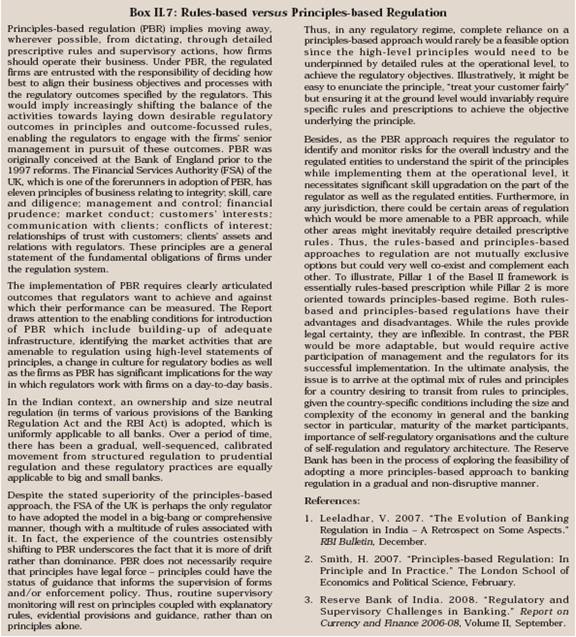

in certain quarters that the Indian regulatory framework should migrate to principles-based

regulation from the current rules-based approach. The merits of a principles-based

approach are that in a dynamic market context the principles-based approach to

regulation provides a more enduring regulatory option since the underlying principles

would not change with every new product whereas the detailed rules may have to

be constantly modified to address the unique features of market/product developments.

The approach, however, has its demerits as it places greater reliance on the discretion/

judgment of the supervisors and regulators in interpreting the broad principles

(Box II.7).

Capital Adequacy

Basel II - Implementation

2.85 Guidelines on the

Revised Framework, based on the Basel Committee on Banking Supervision (BCBS)

document “International Convergence of Capital Measurement and Capital Standards:

A Revised Framework” (June 2006), were issued on April 27, 2007. During

2007-08, significant progress was made towards implementation of the Basel II

as foreign banks operating in India and Indian banks having operational presence

outside India migrated to the Revised Framework with effect from March 31, 2008,

while all other commercial banks, except RRBs and local area banks, are required

to migrate to these approaches not later than March 31, 2009. Banks are required

to maintain a minimum capital to risk-weighted assets ratio (CRAR) of 9.0 per

cent on an ongoing basis. Pillar 2 Guidelines

2.86 The

‘International Convergence of Capital Measurement and Capital Standards’,

commonly known as the Basel II Framework, has three components or Pillars. Pillar

1 pertains to minimum capital requirements, Pillar 2 is the SRP and Pillar 3 relates

to market discipline. While the guidelines on Pillar 1 and Pillar 3 were issued

by the Reserve Bank in April 2007, the guidelines in regard to Pillar 2, which

comprises the SRP and the internal capital adequacy assessment process (ICAAP),

were issued in March 2008. In fact, it is Pillar 2 that makes the Basel II framework

more comprehensive in covering the various risks to which banks are exposed vis-à-vis

Basel I which addressed only the credit and market risks.

2.87 Pillar

2 requires banks to implement an internal process, viz., the ICAAP, for

assessing their capital adequacy in relation to their risk profiles as well as

a strategy for maintaining their capital levels. Pillar 2 also requires the supervisory

authorities to subject all banks to an evaluation process and to initiate such

supervisory measures on that basis, as might be considered necessary. The main

focus of Pillar 2 is on the establishment of suitable risk management systems

in banks and their review by the supervisory authority.

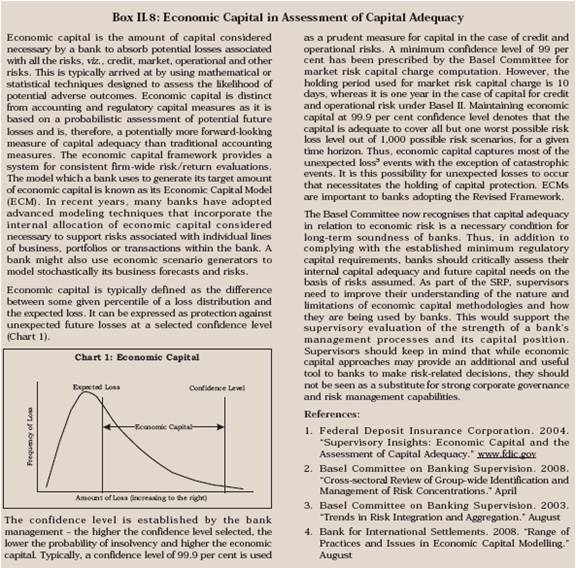

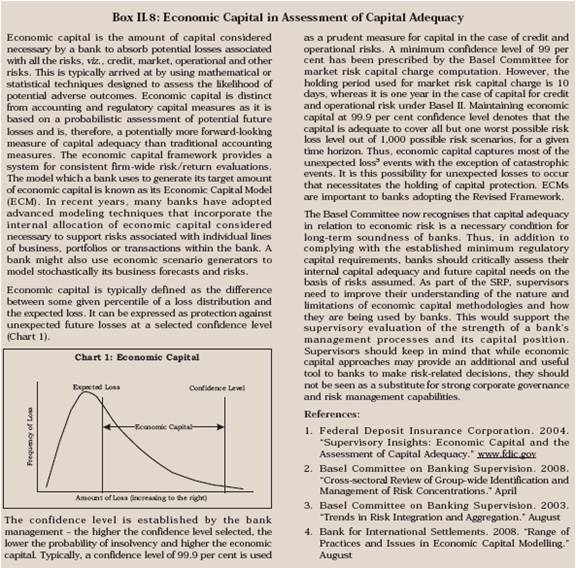

2.88 The Reserve

Bank will take into account the relevant risk factors and the internal capital

adequacy assessment of each bank to ensure that the capital held by a bank is

commensurate with the bank’s overall risk profile, because it is important

for a bank to maintain enough capital for all risks, as and when envisaged (Box

II.8). This would include, among others, the effectiveness of a bank’s

risk management systems in identifying, assessing/measuring, monitoring and managing

various risks including interest rate risk in the banking book, liquidity risk,

concentration risk and residual risk. 2.89 Holding additional capital becomes

necessary for banks, on account of both – the possibility of some underestimation

of risks under Pillar 1 and the actual risk exposure of a bank vis-à-vis

the quality of its risk management architecture. Pillar 2, therefore, includes:

(a) the risks that are not fully captured by the minimum capital ratio prescribed

under Pillar 1 (for example, credit concentration risk); (b) the risks that are

not at all taken into account by Pillar 1 (for example, interest rate risk in

the banking book); and (c) the factors external to the bank (for example, business

cycle effects). Another important aspect of Pillar 2 is the assessment of compliance

with the minimum standards and disclosure requirements of the more advanced approaches

available under Pillar 1, as and when these are permitted in a particular jurisdiction,

so as to ensure that these requirements are met, both as qualifying criteria and

on a continuing basis.

2.90

Over the last decade, a number of banks have invested resources in modeling the

credit risk arising from their significant business operations with a view to

assisting them in quantifying, aggregating and managing credit risk across geographic

and product lines. Risk management has become a more complex practice with the

evolution of credit risk models that provide decision makers with insight or knowledge

that would not otherwise be readily available, thus giving them a competitive

edge. The output of these models also plays an increasingly important role in

banks’ risk management and performance measurement processes, customer profitability

analysis, risk-based pricing, active portfolio management and capital structure

decisions (Box II.9).

Amendments to the New

Capital Adequacy Framework

2.91 With a view to ensuring smooth transition

to the Revised Framework and providing an opportunity to streamline their systems

and strategies, banks in India were advised by the Reserve Bank in May 2006, to

undertake a parallel run of the Revised Framework. In the light of clarifications

sought by banks during the course of implementation of the parallel run, the guidelines

were reviewed and the following amendments, inter alia, were introduced

on March 31, 2008:

(i) Innovative Perpetual Debt Instruments (IPDI) in

excess of 15 per cent of Tier 1 capital were allowed to be included in Tier 2

capital.

(ii) A bank’s aggregate investment in all types of instruments,

eligible for capital status of investee banks/FIs/NBFCs/ primary dealers (PDs)

should not exceed 10 per cent of the investing bank’s capital funds (Tier

1 plus Tier 2, after adjustments). Any investment in excess of this limit should

be deducted at 50 per cent from Tier 1 and 50 per cent from Tier 2 capital.

(iii) The direct loan/credit/overdraft exposure, if any, of banks to the

State Governments and the investment in State Government securities would attract

zero risk weight, while State Government guaranteed claims would attract 20 per

cent risk weight.

(iv) Consumer credit, including personal loans and

credit card receivables but excluding education loans, would attract a higher

risk weight of 125 per cent or more, if warranted by the external rating (or,

the lack of it) of the counterparty. As gold and gold jewellery are eligible financial

collateral, the counterparty exposure in respect of personal loans secured by

gold and gold jewellery would be worked out under the comprehensive approach.

The ‘exposure value after risk mitigation’ would attract a risk weight

of 125 per cent.

(v) In respect of credit transactions, haircut4 would

apply only to the eligible collateral but not to the credit exposure of the bank.

On the other hand, exposures of banks, arising out of repo-style transactions

would attract haircut.

(vi) In the case of loans collateralised by a

bank’s own deposits, even if the tenure of such deposits was less than three

months or deposits had maturity mismatch vis-à-vis the tenure

of the loan, the provisions regarding de-recognition of collateral would not be

attracted provided an explicit consent was obtained from the depositor (i.e.,

borrower) for adjusting the maturity proceeds of such deposits against the outstanding

loan or for renewal of such deposits till the full repayment of the underlying

loan.

(vii) The capital charge for equities would apply on their current

market value in a bank’s trading book.

(viii) The claims on non-scheduled

banks, which were deducted from capital, would be risk weighted from 100 per cent

to 625 per cent, depending on the CRAR of the institution concerned, with higher

risk weights prescribed for banks with lower CRAR. In the case of banks where

no capital adequacy norms were prescribed by the Reserve Bank, the CRAR was to

be notionally calculated, by obtaining the necessary information from the investee

banks, using the capital adequacy norms as applicable to commercial banks.

(ix) In view of excess volatility in the stock markets across the world,

equity was removed from the list of eligible financial collaterals.

(x)

Standard supervisory haircut provided for exposures and collaterals, which were

obligations of foreign central sovereigns/ corporates.

(xi) Capital adequacy

framework applicable for repo/reverse-repo style transactions was specified.

(xii) Detailed guidelines were incorporated for measuring the capital charge

for interest rate risk (specific risk) in debt securities and other interest rate

related instruments in the available for sale (AFS) and held for trading (HFT)

categories.

Enhancement

of Banks’ Capital Raising Options

2.92 In order to give a

wider choice of instruments for raising Tier 1 and Upper Tier 2 capital, the Reserve

Bank, in October 2007, enhanced banks’ capital raising options for meeting

the capital adequacy requirements by issuing guidelines pertaining to issue of

preference shares as part of the regulatory capital. Indian banks could issue

preference shares in Indian Rupees, subject to extant legal provisions. While

perpetual non-cumulative preference shares (PNCPS) would constitute Tier 1 capital,

perpetual cumulative preference shares (PCPS), redeemable non-cumulative preference

shares (RNCPS) and redeemable cumulative preference shares (RCPS) were allowed

as Upper Tier 2 capital.

Exposure Norms and Risk Weights

2.93 The exposure norms and risk weights for a few classes of loans extended

by banks were reviewed by the Reserve Bank during 2007-08. While risk weights

and norms for certain sectors such as education and housing were relaxed, money

lent by banks to mutual funds (MFs) was brought within the purview of limits imposed

on the capital market exposure of banks. Besides being a method of checking concentration

of credit, the exposure norms also help in channelising credit to the desired

sectors (Box II.10). The Reserve Bank also strengthened

prudential regulations for off-balance sheet exposure of banks in the wake of

the international financial turmoil.

Loans Extended by Banks to MFs

and Issue of Irrevocable Payment Commitments (IPCs)

2.94 As per

the extant guidelines, the aggregate capital market exposure of a bank in all

forms, both fund based and non-fund based, should not exceed 40 per cent of its

net worth, as on March 31 of the previous year. There were, however, no explicit

guidelines for extending loans and advances to MFs. The Annual Financial Inspection

reports of certain banks and an analysis of the consolidated prudential return

of some banks revealed that they had extended large loans to various MFs and had

also issued IPCs to the Bombay Stock Exchange (BSE) and the National Stock Exchange

(NSE) on behalf of MFs/foreign institutional investors (FIIs). These exposures

had, however, not been included by the banks for computation of their capital

market exposure. Accordingly, in December 2007, the Reserve Bank advised banks

to be judicious in extending loans to MFs and also ensure that these loans were

utilised for meeting only temporary liquidity needs of the MFs. Furthermore, these

loans should not exceed 20 per cent of the net asset of the scheme and their tenure

should not exceed six months. If such finance was extended to equity-oriented

MFs, it would be included in the capital market exposure of the bank. Also, IPCs

extended by banks would be included in computation of their capital market exposure

as they were in the nature of non-fund based credit facility for purchase of shares.

Banks were advised that entities such as FIIs were not permitted to avail of fund

or non-fund based facilities such as IPCs. Banks have been given a transition

period of one year (up to December 13, 2008) to comply with the above requirements.

Off-Balance

Sheet Exposures of Banks

2.95 The Reserve Bank has initiated several

steps in the recent past to strengthen the prudential framework in respect of

on-balance sheet exposures of banks. Such measures included additional risk weights

and provisioning requirements for exposures to specific sectors. In view of the

recent developments in the global financial markets, it was felt necessary to

review the current stipulations regarding conversion factors, additional risk

weights and provisioning requirements for specific off-balance sheet exposures

of banks and prescribe prudential requirements as appropriate. Accordingly, in

May 2008, the draft guidelines incorporating the required modifications were put

up on the Reserve Bank’s website for comments from the public. Based on

the feedback received, guidelines were issued in August 2008. These, among others,

included the following:

(i) For the purpose of exposure norms and capital

adequacy, banks shall compute their credit exposures and credit equivalent amounts,

respectively, arising on account of interest rate and foreign exchange derivative

transactions and gold using the current exposure method (CEM). (ii) The

credit conversion factors (CCFs) for market related off-balance sheet items applicable

to these transactions will be as under:

Residual Maturity | Credit

Conversion Factors | | Interest

Rate | Exchange Rate |

| Contracts | Contracts |

| | and

Gold | One year or less | 0.5

per cent | 2.0 per cent |

Between one year | | |

and five years | 1.0

per cent | 10.0 per cent |

More than five years | 3.0

per cent | 15.0 per cent |

(iii) Credit exposures computed as per the current

marked-to-market value of the contract arising on account of interest rate and

foreign exchange derivative transactions and gold shall also attract provisioning

requirement as applicable to loan assets in standard category.

(iv)

In respect of derivative transactions, any amount due to a bank, which remains

unpaid in cash for a period of 90 days from the specified due date for payment,

would be classified as a NPA as per the ‘prudential norms on income recognition,

asset classification and provisioning pertaining to advances portfolio’.

2.96 The issues regarding asset classification status of overdue payments

in respect of derivative transactions and restructuring of derivative contracts

were again examined in October 2008 and banks were advised to treat any receivables

representing positive mark-to-market value of a derivative contract, remaining

overdue for a period of 90 days or more, as NPA. They were required to extend

the principle of borrower-wise asset classification for all other funded facilities

granted to the client, and classify them also as NPA, as per the existing asset

classification norms. However, the principle of borrower-wise classification

needs to be confined only to the overdues arising from forward contracts, plain

vanilla swaps and options.

Risk Weight on Education and Housing Loan

2.97 In order to meet the regulatory requirements as per the Revised Framework,

‘education loans’ were classified as a part of ‘consumer credit’

for the purpose of capital adequacy, and accordingly attracted a risk weight of

125 per cent. Following a review of the risk weight for education loans, in January

2008, it was decided that education loans need not be classified as consumer credit

for the purpose of capital adequacy norms. Accordingly, the risk weight applicable

to education loans was stipulated at 100 per cent for banks under Basel I framework.

Under Basel II framework, such loans would be treated as a component of the regulatory

retail portfolio and would attract a risk weight of 75 per cent.

2.98

For the purpose of applying concessional risk weights for meeting capital adequacy

requirements under both Basel I and Basel II frameworks, in May 2008, the limit

of bank loans for housing was enhanced to Rs.30 lakh from Rs.20 lakh. Accordingly,

where the loan-to-value (LTV) ratio was less than 75 per cent, loans up to Rs.30

lakh would carry a risk weight of 50 per cent, whereas loans of higher amount

would attract a risk weight of 75 per cent. The risk weight in the case of other

loans, i.e., loans with LTV ratio of above 75 per cent, irrespective

of the size, would continue to be 100 per cent.

Para-Banking

Activities

2.99 The Reserve Bank has from time to time modified

the framework of rules/ regulations/instructions to the SCBs for allowing them

to undertake certain financial services or para-banking activities. Adequate safeguards

have been put in place to ensure that the financial services or para-banking activities

undertaken by banks are run on sound and prudent lines. In June 2007, guidelines

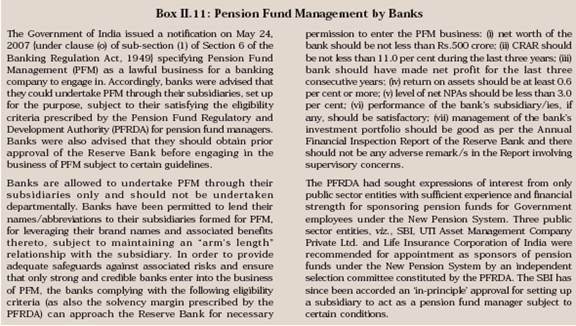

were issued for banks to act as pension fund managers (Box II.11).

Risk

Management

2.100 Risk management is a crucial element of the

banking business and it has assumed added significance in the context of the recent

global financial markets crisis. In view of the importance of risk management,

the Reserve Bank has from time to time issued various guidelines including those

on asset-liability management (ALM). While these serve as benchmarks for establishing

integrated risk management systems, banks have been given the freedom to develop

their own systems taking into account their type, size of operations and risk

perceptions. Several initiatives were taken during the year to strengthen risk

management systems in banks such as modification in the ALM guidelines. Banks

were also advised to avoid equity funding of projects. Comprehensive guidelines

were issued to banks to do a proper risk assessment and accounting for the LoCs

issued by them.

Role of Credit Rating Agencies (CRAs)

2.101 CRAs, specialising in analysing and evaluating the credit-worthiness of

corporate and sovereign issuers of debt securities, play a key role in financial

markets by helping to reduce the information asymmetry between lenders and investors

on the one side, and issuers on the other, about the credit-worthiness of companies/countries.

The global financial turmoil brought into sharp focus the role of CRAs in better

risk assessment and measurement.

2.102 The Reserve Bank has undertaken

a detailed process of identifying the eligible CRAs whose ratings may be used

by banks for assigning risk weights for credit risk. However, this accreditation

process is neither a regulatory prescription nor a supervisory requirement. It

has the limited purpose of using ratings for assigning risk weights within the

framework of Basel II. So far, four rating agencies (Credit Analysis and Research,

CRISIL, Fitch India and ICRA) have been granted accreditation on the basis of

six parameters viz., objectivity, independence, international access,

transparency, disclosure credibility and resources. Banks have to use the chosen

CRAs and their ratings consistently for each type of claim, for both risk weighting

and risk management purposes. Banks are not allowed to ‘cherry pick’

the assessments provided by different CRAs. Banks must disclose the names of the

CRAs that they use for the risk weighting of their assets, the risk weights associated

with the particular rating grades as determined by the Reserve Bank through the

mapping process for each eligible CRA as well as the aggregated risk weighted

assets as required. Further, in India, complex structures like synthetic securitisations

have not been permitted so far. As and when such products are to be introduced,

the Reserve Bank would put in place the necessary enabling regulatory framework

including calibrating the role of the rating agencies.

Liquidity

Management – Modification of ALM Guidelines

2.103 Guidelines

on ALM system issued in February 1999, covered, inter alia, interest

rate risk and liquidity risk measurement/ reporting framework and prudential limits.

Liquidity was tracked through traditional maturity or cash flow mismatches under

the extant guidelines. As a measure of liquidity management, banks were required

to monitor their cumulative mismatches across all time buckets in their statement

of structural liquidity by establishing internal prudential limits with the approval

of their boards/ management committees. As per the guidelines, in the normal course,

the mismatches (negative gap) in the time buckets of 1-14 days and 15-28 days

were not to exceed 20 per cent of the cash outflows in the respective time buckets.

2.104 During the period under review, the Reserve Bank fine-tuned the guidelines

for ALM in order to make liquidity management by banks more dynamic. Taking into

consideration the international practices in this regard, the level of sophistication

of banks and the need for a sharper assessment and better liquidity management,

it was decided that the 1-14 days time bucket be made more granular by splitting

it into three time bands, viz., day 1 (i.e., next day), 2-7

days and 8-14 days. Accordingly, in October 2007, banks were advised that the

net cumulative negative mismatches during the next day, 2-7 days, 8-14 days and

15-28 days should not exceed 5 per cent, 10 per cent, 15 per cent and 20 per cent

of the cumulative outflows, respectively, in order to recognise the cumulative

impact on liquidity. Banks were also advised to undertake dynamic liquidity management

and prepare the statement of structural liquidity on a daily basis. In the absence

of a fully networked environment, banks were allowed to compile the statement

on best available data coverage initially but were advised to make conscious efforts

to attain 100 per cent data coverage in a timely manner.

2.105 The statement

of structural liquidity was to be reported to the Reserve Bank, once a month,

as on the third Wednesday of every month. The frequency of supervisory reporting

of the structural liquidity position was increased to fortnightly, with effect

from April 1, 2008. Banks are now required to submit the statement of structural

liquidity as on the first and third Wednesday of every month to the Reserve Bank.

The due date of the submission of the statement is the seventh day from the reporting

date.

Project Finance Portfolio of Banks

2.106 At the

time of financing projects, banks generally adopt one of the following methodologies

for determining the level of promoters’ equity: (i) promoters bring their

entire contribution upfront before the bank starts disbursing its commitment;

(ii) promoters bring certain percentage of their equity (40-50 per cent) upfront

and the balance is brought in stages; and (iii) promoters agree, ab initio,

that they would bring in equity funds proportionately as the banks finance the

debt portion. It was observed that the last method had greater equity funding

risk. Accordingly, to contain this risk, the Reserve Bank advised banks in November

2007 to have a clear policy regarding the debt-equity ratio (DER) and to ensure

that infusion of equity/fund by the promoters is such that the stipulated level

of DER is maintained at all times. Furthermore, banks were asked to adopt funding

sequences so that the possibility of equity funding by them was obviated. Norms

Relating to Issuance of LoCs

2.107 It was observed that banks in

India were issuing LoCs to meet the requirements of overseas regulators while

seeking their approval for establishing subsidiaries/ opening branches in their

countries as also to support certain activities of their subsidiaries in India.

Such LoCs were intended to provide comfort to: (i) the overseas and the domestic

regulators that the parent bank would support its foreign/domestic subsidiaries

in case they face any financial problem in future; and (ii) the rating agencies

in India, which might be rating the issuances/ products of the bank’s Indian

subsidiaries, in regard to availability of the parental support to the subsidiary.

However, such LoCs entailed an element of contingent liability on the part of

the issuing banks which was not adequately captured under the extant regulatory

dispensation. Accordingly, the matter relating to issuance of LoCs on behalf of

a bank’s subsidiaries and in favour of overseas regulators was examined

by the Reserve Bank and the following prudential norms were laid down in this

regard in March 2008. One, every issuance of a LoC should be subject to prior

approval by the board of directors of the bank. The bank should lay down a well

defined policy for issuance of LoCs, including the indicative cumulative ceilings

up to which LoCs could be issued for various purposes. The policy must, inter

alia, provide that the bank would obtain and keep on record legal opinion

in regard to the legally binding nature of the LoC issued. An appropriate system

for keeping a record of all the LoCs issued should also be put in place. Two,

the bank should make an assessment, at least once a year, of the likely financial

impact that might arise from the LoCs issued by it and outstanding, in case it

is called upon to support its subsidiary in India or abroad, as per the obligations

assumed under the LoCs issued. Such an assessment should be made qualitatively

on a judgmental basis and the amount so assessed should be reported to the board,

at least once a year. As a first time exercise, such an assessment should be undertaken

in respect of all the outstanding LoCs issued and outstanding as on March 31,

2008 and the results placed before the board in the ensuing meeting. Such an assessment

should also form a part of the bank’s liquidity planning exercise. Three,

any LoC that is assessed to be a contingent liability of the bank by a rating

agency/auditors (internal or external)/internal inspectors/the Reserve Bank inspection

team, should be treated, for all prudential regulatory purposes, on the same footing

as a financial guarantee issued by the bank. Four, the bank should disclose full

particulars of all the LoCs issued by it during the year, including their assessed

financial impact, as also their assessed cumulative financial obligations under

the LoCs issued by it in the past and outstanding, in its published financial

statements, as part of the ‘notes to accounts’. Income

Recognition, Asset Classification and Provisioning

2.108 Over

the years, the prudential norms for provisioning have been revised to bring them

in conformity with the global best practices. In view of time overruns in infrastructure

projects, the Reserve Bank has fine-tuned asset classification norms for infrastructure

projects that are under implementation and involve time overrun. In May 2008,

the Reserve Bank modified the prudential norms on asset classification in respect

of infrastructure projects under implementation and which have been delayed on

account of legal and other extraneous reasons. Accordingly, it was decided that

in the case of infrastructure projects financed by banks post May 28, 2002, the

date of completion of the project should be clearly spelt out at the time of financial

closure of the project and if the date of commencement of commercial production

extends beyond a period of two years (as against the earlier norm of one year)

after the date of completion of the project, as originally envisaged, the account

should be treated as sub-standard.

The revised instructions came into

force with effect from March 31, 2008. NPA Management by Banks

2.109 The availability of information on a prospective borrower’s capacity

to repay a loan and past track-record are key variables in risk analysis and the

decision by a FI to grant credit. The availability of information on credit history

facilitates risk evaluation and thereby limits credit rationing practised by lenders.

An efficient system of credit information on borrowers is, thus, an important

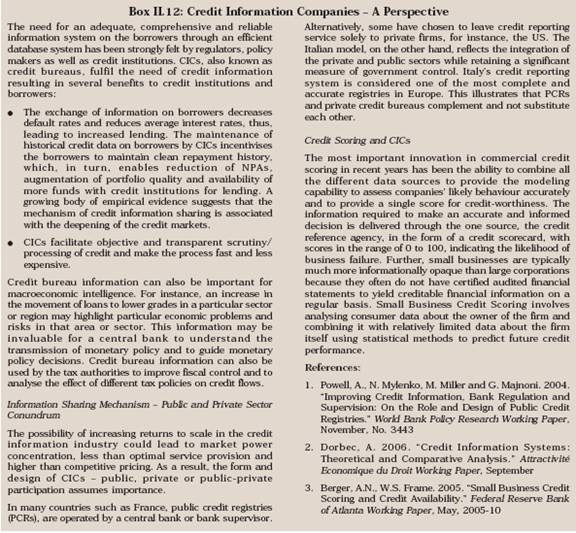

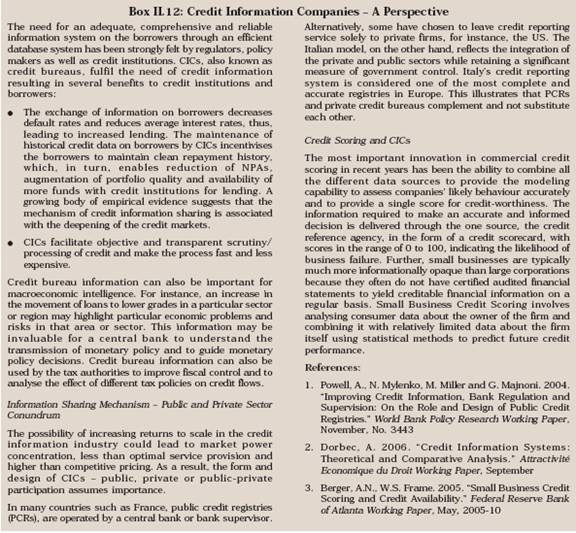

first step in improving the credit risk management (Box II.12).

2.110 In India, the regulations under the Credit Information Companies (Regulation)

Act, 2005 were notified in December 2006. In April 2007, the Reserve Bank invited

applications from companies interested in continuing/commencing the business of

credit information. The last date for submission of the applications was July

31, 2007 and 13 applications were received. An external High Level Advisory Committee

(Chairman: Dr. R.H. Patil) was set up by the Reserve Bank for screening the applications

and recommending the names of the companies to which certificates of registration

could be granted. After the announcement of the foreign direct investment (FDI)

policy for credit information companies (CICs) in March 2008, the processing of

applications has been taken up. Thus, soon new CICs will be authorised to commence

business which is expected to reduce information asymmetry and facilitate efficient

credit allocation and pricing while fostering a better credit culture.

2.111

In order to increase the options available to banks for resolving their NPAs and

to develop a healthy secondary market for NPAs, the Reserve Bank had issued guidelines

for purchase/sale of NPAs among banks in July 2005. In terms of these guidelines,

banks’ boards were required to lay down policies covering, among others,

valuation procedure to be followed to ensure that the economic value of financial

assets was reasonably estimated based on the assessed cash flows arising out of

repayment and recovery prospects. However, it was brought to the Reserve Bank’s

notice that in some cases, NPAs were sold for much less than the value of available

securities and no justification was given for sale below the economic value. Accordingly,

in October 2007, the Reserve Bank issued guidelines in terms of which banks should

work out the net present value (NPV) of the estimated cash flow associated with

the realisable value of the available securities net of the cost of realisation,

while selling NPAs. The sale price should generally not be lower than the NPV

arrived at in the manner described above. The same principle should be used in

the case of compromise settlements also. As the payment of the compromise amount

may be in instalments, the NPV of the settlement amount should be calculated and

this amount should generally not be less than the NPV of securities.

2.112 Further, in November 2007, banks were advised to invariably ensure that

once a case was filed before a court/debt recovery tribunal (DRT)/Board for Industrial

and Financial Reconstruction (BIFR), any settlement arrived at with the borrower

was subject to obtaining a consent decree from the court /DRT/BIFR concerned.

Corporate Governance

2.113 Corporate governance

is recognised as a crucial element for maintaining the stability and soundness

of the financial system. The Reserve Bank had prescribed the ‘fit and proper’

criteria for the elected directors of the boards of nationalised banks and associate

banks of the SBI in November 2007. This was in keeping with the ‘fit and

proper’ criteria that were prescribed for directors of private banks in

June 2004. In view of the vital role that banks can play in promoting the cause

of sustainable development (SD), the Reserve Bank, in December 2007, advised banks

on corporate social responsibility (CSR) and SD.

‘Fit and Proper’

Criteria for Elected Directors

2.114 The ‘fit and proper’

criteria for elected directors on the boards of nationalised banks and associate

banks of the SBI were brought into effect through two different notifications

in November 2007. According to the criteria laid down, the banks are required

to constitute a ‘nomination committee’ comprising a minimum of three

directors (all independent directors/non-executive directors) from amongst the

board of directors, one of whom is to be nominated as the chairman of the committee.

The board is also to decide the tenure of the nomination committee. The nomination

committee should determine the ‘fit and proper’ status of the existing

elected directors/proposed candidates based on broad criteria such as educational

qualification, experience, field of expertise, track record and integrity. Moreover,

candidates with adverse notice of any authority/regulatory agency or insolvency

or default of any loan from any bank or FI would be rendered unfit and improper

to be a director on the board of a bank. It is desirable that the board ensures

that the elected directors execute the deed of covenants as recommended by the

Dr.Ganguly Group, after the election and also every year as on 31st March. It

is also mandatory that all the elected directors furnish a simple declaration

every year as on 31st March that the information already provided by them has

not undergone any change and where there is a change, requisite details are furnished

by the directors forthwith. If there is any significant change, the nomination

committee should undertake the due diligence exercise afresh and examine the ‘fit

and proper’ status of the director. Revised Calendar of Reviews

2.115 With a view to reducing the burden on the boards as well as aligning

the reviews to present day concerns, the items to be submitted before the boards

of banks as part of the ‘calendar of reviews’ to be undertaken by

them were revised. The calendar outlines the critical minimum requirements of

review and the boards would have the discretion to prescribe additional reviews

to suit their requirements.

2.116 The calendar of reviews to be placed

before the board would be under the heads: (a) review of operations; and (b) review

of strategy. Banks were also advised that in every board meeting, separate time

slot should be allocated for taking up strategy review for business plan –

targets and achievements, review of non-fund business, human resource management,

training and industrial relations, new prospective business/product lines and

closure of existing business/product lines. Detailed report is to be placed before

the board only from the risk management committee. All other committees should

place only summary reports before the board. The board would review slippages

in asset classification in the borrowal accounts with outstanding of Rs.5 crore

and above and review NPA accounts which had registered recoveries of Rs.1 crore

and above. The revised schedule came into effect from June 1, 2008 for public

sector banks and from July 1, 2008 for private sector banks.

Corporate

Social Responsibility

2.117 At present, the world over, there is

an increasing awareness about CSR, SD and non-financial reporting (NFR). CSR entails

the integration of social and environmental concerns by companies in their business

operations as also in interactions with their stakeholders. SD essentially refers

to the process of maintenance of the quality of environmental and social systems

in the pursuit of economic development. NFR is basically a system of reporting

by organisations on their activities in this context, especially as regards the

triple bottom line, i.e., environmental, social and economic accounting.

The contribution of FIs including banks to SD is paramount, considering the crucial

role they play in financing economic and developmental activities of the world.

To raise the level of awareness and focus the attention of banks in India on this

issue, in December 2007, the Reserve Bank advised banks to put in place a suitable

and appropriate plan of action towards helping the cause of SD, with the approval

of their boards. In this context, a particular reference was drawn to the International

Finance Corporation’s principles on project finance (the Equator Principles)

and carbon trading. Further, banks/FIs were advised to keep themselves abreast

of the developments on an on-going basis and dovetail/modify their strategies/plans

in the light of such developments. Banks were also advised that the progress made

by them under the specified heads, could be placed in the public domain along

with their annual accounts.

KYC Guidelines and Anti-Money Laundering

Standards

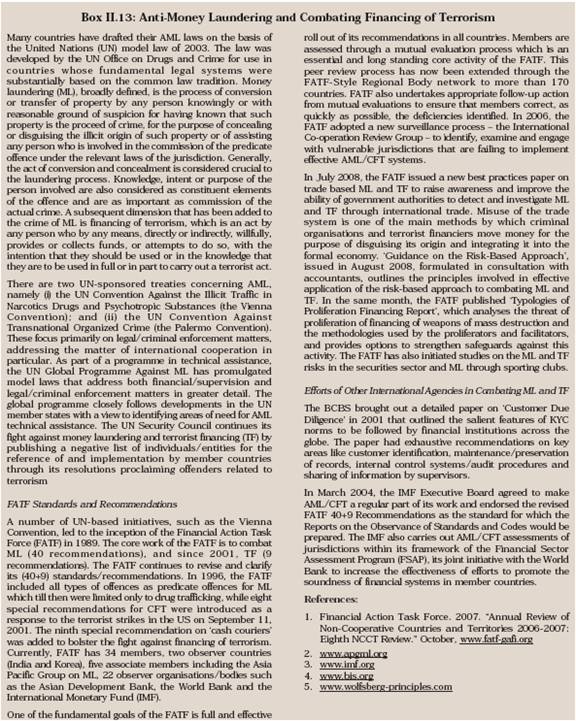

2.118 Money laundering and terrorist financing are

major threats to global financial systems and jurisdictions inasmuch as these

distort financial markets, provide unfair competition (a business supported by

illicit funds could compete unfairly against legitimate businesses), undermine

small economies, encourage corruption in the systems, lead to political instability

and become a source of finance for sabotage and destructive activities. As these

practices undermine national, social and economic interests, it is of utmost importance

to safeguard banking systems against the twin threat of money-laundering and terrorist

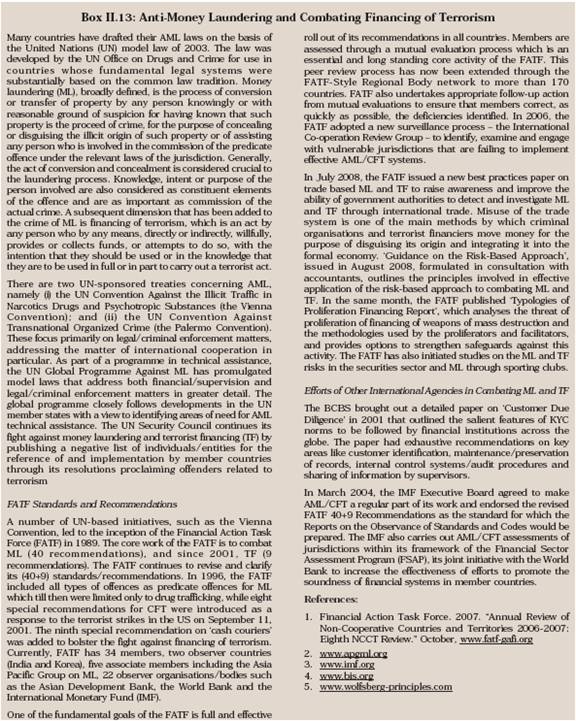

financing (Box II.13). 2.119 The Reserve Bank issued

revised KYC/ AML/CFT guidelines to banks in February 2008. Banks were advised

that customer identification means identifying the customer and verifying his/her

identity by using reliable and independent source documents, data or information

to the bank’s satisfaction. Banks are not to use the indicative list, as

prescribed by the Reserve Bank, of the nature and type of documents/information

that may be relied upon for customer identification, as an exhaustive list and

cite it to deny access to banking services to sections of the public. Banks have

been advised to perform a review of risk categorisation of their customers at

least once in six months and periodically update the customer identification data

(including photograph/s) after opening of the account. Banks are also to put in

place an adequate screening mechanism as an integral part of their recruitment/hiring

process of personnel. Banks were also advised to ensure that all existing account

holders and name/s of potential customers do not appear or are linked to any of

the entities or individuals included in the resolutions of the United Nations’

Security Council.

2.120 Following the emphasis placed on the need for

periodical review of risk categorisation, in May 2008, the Reserve Bank reiterated

the need for banks to undertake, inter alia, the following:

(i) Steps to ensure electronic filing of cash transaction report (CTR) and suspicious

transaction report (STR) to Financial Intelligence Unit – India (FIU-IND).

In case of branches that are not fully computerised, the principal officer should,

with the help of editable electronic utilities of CTR/STR made available by FIU-IND,

arrange to feed the data into an electronic file.

(ii) Put in place an

appropriate software application to throw alerts when transactions are inconsistent

with the risk categorisation and updated profile of the customers as it may help

in effective identification and reporting of suspicious transactions.

(iii) For all cash transactions where forged or counterfeit Indian currency notes

have been used as genuine, a reporting mechanism has been put in place to generate

counterfeit currency reports.

(iv) While banks are required to be guided

by the definition of ‘suspicious transactions’ as contained in Rule

2(g) of rules notified under Prevention of Money Laundering Act in July 2005 (instructions

in this regard were issued by the Reserve Bank in February 2006), banks should

make an STR, if they have reasonable grounds to believe that the transactions

involve proceeds of crime irrespective of the amount of the transactions. It has

also been clarified to banks to report attempted transactions in STRs, i.e.

transactions that are abandoned/ aborted by customers on being asked to furnish

some details.

Committee on Financial Sector Assessment

2.121 The FSAP is a joint IMF-World Bank initiative to provide member countries

with a comprehensive evaluation of their financial systems. The programme was

launched in 1999, partly in response to the Asian crisis and calls by the international

community for intensified co-operative efforts to monitor financial systems. The

FSAP aims at alerting national authorities to likely vulnerabilities in their

financial sectors and assist them in designing measures to reduce the vulnerabilities.

A range of financial soundness indicators and macro/financial stress tests are

used to analyse sectoral developments, risks and vulnerabilities. Given the current

ongoing crisis, the importance of FSAP has increased as the programme examines

the structural underpinnings of financial stability - systemic liquidity arrangements,

institutional and legal framework for crisis management and loan recovery, transparency,

accountability and governance structures.

2.122

India voluntarily participated as one of the earliest member countries in the

FSAP in 2001 and a self-assessment of all the areas of international financial

standards and codes was undertaken by a committee (Chairman: Dr. Y.V. Reddy).

Drawing upon the experience gained during the 2001 FSAP and recognising the relevance

and usefulness of the analytical details contained in the Handbook on Financial

Sector Assessment jointly brought out by the World Bank and the IMF, in September

2005, the Government of India, in consultation with the Reserve Bank, decided

to undertake a comprehensive self-assessment of the financial sector. Accordingly,

in September 2006, a Committee on Financial Sector Assessment (CFSA) was constituted

(Chairman: Dr. Rakesh Mohan).

2.123 The Annual Policy Statement for 2008-09

outlined the progress made by the CFSA. Since then, the reports of four Advisory

Panels constituted by the Committee covering assessment of financial stability

and stress testing, assessment of relevant international standards and codes as

applicable to financial regulation and supervision, institutions and market structure

and transparency standards were peer-reviewed by external experts in each relevant

area identified for the purpose. The CFSA also held a two-day seminar in June

and a one-day conference in July 2008 with the peer reviewers and Advisory Panel

members to discuss the major issues/recommendations of the various Panel reports.

The Panels have finalised their reports by appropriately incorporating the comments

of the peer reviewers. Simultaneously, the overview report of the CFSA is also

under preparation. It is expected that the four Advisory Panel Reports and the

overview report of the CFSA would be released by December 2008.

6. Supervision and Supervisory Policy

2.124

With a view to providing undivided attention to supervision of financial entities

under the purview of the Reserve Bank, the Board for Financial Supervision (BFS)

was constituted in November 1994. The BFS meets regularly and suggests measures

that enable effective handling of supervisory and regulatory issues by the Reserve

Bank. Some of the major issues dealt with by the BFS during 2007-08 included review

of the reports on Annual Financial Inspections of commercial banks, FIs, functioning

of UCBs, RRBs, non-banking FIs and PDs, periodical reports on critical areas of

functioning of banks such as reconciliation of accounts, frauds monitoring, overseas

operations and financial position of banks under monthly monitoring and crucial

regulatory and supervisory issues (refer Annex II.1). Effective supervision of

the financial sector has assumed added importance in the wake of the developments

in the international financial markets since August 2007 and the further downturn

that occurred in September 2008.

Cross-border Supervision

2.125 In terms of the announcement in the Mid-term Review for 2007-08, an

internal Working Group (Chairman: Shri S. Karuppasamy) was constituted in March

2008 to lay down the roadmap for adoption of a suitable framework for cross-border

supervision and supervisory co-operation with overseas regulators, consistent

with the framework envisaged in the BCBS. The Working Group studied cross-country

practices including the related legal issues and held discussions with select

banks on cross-border supervisory issues. The Group is expected to submit its

Report shortly. Consolidated Supervision and Financial Conglomerate

(FC) Monitoring Mechanism

2.126 In India, a FC Monitoring Mechanism

was implemented in June 2004 based on the recommendation of the Working Group

(Convenor: Smt. Shyamala Gopinath) on monitoring of systemically important financial

intermediaries. A FC is defined as a cluster of entities belonging to a Group6

which has significant presence in at least two financial market segments comprising

banking, insurance, MF, and deposit-taking and non-deposit taking NBFCs. The FC

monitoring framework rests on three components: (a) off-site surveillance through

receipt of quarterly returns; (b) review of the FC monitoring activities by the

Technical Committee which has members from the Reserve Bank, the Securities and

Exchange Board of India (SEBI) and the Insurance Regulatory and Development Authority;

and (c) half-yearly discussions with the chief executive officers of the major

entities of the FC in association with other principal regulators. The quarterly

reporting mechanism mainly focusses on monitoring of intra-group transactions

and exposures (ITEs) appearing in the books of the regulated entities. The intra-group

transactions are monitored with a view to tracking migration/transfer of ‘losses’,

detecting regulatory/supervisory arbitrage cases and identifying cases of non-compliance

with ‘arm’s length’ principles. The monitoring of ITEs also

helps tracking of build-up of large exposures across the group entities and to

outside counterparties and various markets.

2.127 Several initiatives

were taken during the course of the last year to strengthen the FC monitoring

mechanism for effective supervision of FCs. Banks were advised to put in place

a well-defined policy for issuance of LoCs on behalf of their subsidiaries. Banks

were also advised to record the intent of making investment in the subsidiary,

associate and joint ventures, including the length of time, for which such investments

were intended. In the absence of a record of such intent at the time of investment

by the board of the parent bank, the entity under reference would be consolidated

with the parent bank. Furthermore, it was decided that the activities which a

bank itself was not permitted to undertake as per the provisions of Banking Regulation

Act, 1949, could not be undertaken by entities in which the bank had significant

equity stakes.

2.128 Following a directive from the BFS, an Internal

Group was constituted in the Reserve Bank to prepare an Approach Paper on FC Supervision.

The Group has extensively studied the approaches followed for supervision of FCs

by the Joint Forum7 and the EU in general and the US, the Netherlands and the

UK in particular. The Approach Paper on the supervision of FCs is likely to be

finalised soon. SRP on Activities of the Trusts /Special Purpose Vehicles

(SPVs) set up by Banks

2.129 SPVs and trusts are set up by banks

to carry out a number of activities such as facilitating securitisation, asset

management and investing in other entities. These entities are generally unregulated

and are subject to inadequate independent board oversight. Besides, the downstream

activities of these entities are normally not captured in the financial statements

of the bank. As the activities of these entities could be a potential risk to

the parent bank and could also pose systemic risk, the need for placing them under

suitable supervisory oversight was felt. Pursuant to the announcement in the Annual

Policy Statement for the year 2008-09, a Working Group (Chairman: Shri S. Sen)

has been set up (with members from the Reserve Bank, commercial banks and a CRA)

to study and recommend a suitable supervisory framework for activities of SPVs/trusts

set up by banks.

Review of the Risk-based Supervision (RBS) Framework

2.130 RBS framework was introduced in India on a pilot basis in eight select

banks in 2003-04, which was extended to 15 banks in 2004-05, 19 banks in 2005-06

and 27 banks in 2006-07 concurrently with the CAMELS (capital adequacy, asset

quality, management, earnings, liquidity and systems and control) model of supervision.

Based on the feedback obtained from the pilot studies under RBS, it was decided

to revisit/review the framework to attune it to the latest regulatory and supervisory

developments. An Internal Group of the Reserve Bank studied the practices adopted

by the supervisors of various countries, viz., the US, the UK, Australia,

France, Hong Kong, Singapore, Thailand and Malaysia, among others. The

Group is preparing an appropriate framework with a view to integrating the RBS

system with the existing supervisory process and the Supervisory Review and Evaluation

Process under Pillar 2 of Basel II.

Overseas Operations of Indian

Banks – Review of Existing Off-site Monitoring Framework

2.131

In view of the rapid expansion of overseas operations, introduction of new products

and processes, increasing off-balance sheet exposures including derivative products,

the need was felt to review the reporting system for Indian banks that had presence

in foreign countries. Accordingly, an inter-departmental Group was constituted

to review the existing regulatory and supervisory framework for overseas operations

of Indian banks and recommend appropriate changes, including off-site reporting

systems. Certain Indian banks with large overseas presence were consulted by the

Group for this purpose. The Group is in the process of finalising its proposals

for a revised off-site surveillance mechanism.

Financial Stability

Forum (FSF) Report – Status

2.132 The FSF brought out a report

in April 2008 identifying the underlying causes and weaknesses in the international

financial markets in the wake of the crisis emanating from the US sub-prime mortgage

market. The Report, inter alia, contains proposals, to be implemented

by the end of 2008, for strengthening prudential oversight of capital, liquidity

and risk management, enhancing transparency and valuation, changing the role and

uses of credit ratings, strengthening the authorities’ responsiveness to

risk and implementing robust arrangements for dealing with stress in the financial

system. The Reserve Bank has already issued regulatory guidelines covering many

of these aspects, while in regard to others, actions are being initiated.

3 Unexpected loss is the potential for actual loss to exceed

the expected loss and is a measure of the uncertainty inherent in the loss estimate.

Expected loss is the anticipated average loss over a defined period of time. Expected

losses represent a cost of doing business and are generally expected to be absorbed

by operating income.

4 In the comprehensive approach,

while taking collateral, banks will need to calculate their adjusted exposure

to a counterparty for capital adequacy purposes in order to take account of the

effects of that collateral. Banks are required to adjust both the amount of the

exposure to the counterparty and the value of any collateral received in support

of that counterparty to take account of possible future fluctuations in the value

of either, occasioned by market movements. These adjustments are referred to as

‘haircuts’.

5 EDF calculation

is based on a company's current asset value, volatility of asset returns and the

market value of its equity.

6 An arrangement involving

two or more entities related to each other through any of the following relationships:

subsidiary - parent (defined in terms of AS 21), joint venture (defined in terms

of AS 23), associate (defined in terms of AS 27), promoter-promotee, a related

party (defined in terms of AS 18), common brand name, and investment in equity

shares 20 per cent and above. Group entity is any entity involved in the above

arrangement.

7 The Joint Forum was established in

1996 under the aegis of the BCBS, the International Organization of Securities

Commissions and the International Association of Insurance Supervisors to deal

with issues common to the banking, securities and insurance sectors, including

the regulation of FCs. The Joint Forum comprises an equal number of senior bank,

insurance and securities supervisors representing each supervisory constituency. |