IST,

IST,

Policy Environment

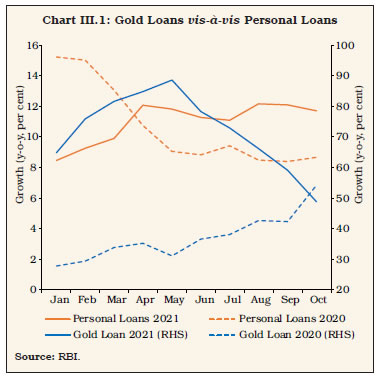

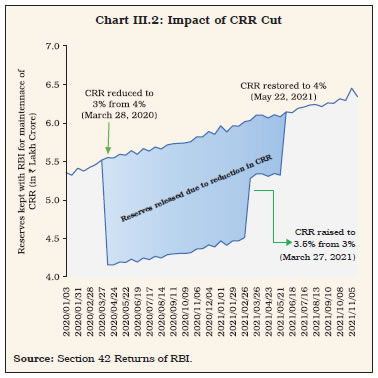

| The coordinated policy response of the Reserve Bank and the Government in 2020-21 helped in mitigating the impact of the pandemic on lives and livelihoods, kept financial markets and financial institutions functioning and the lifeline of finance flowing. With some of the Reserve Bank’s measures reaching pre-set sunset dates in 2021-22, liquidity has been wound down partly, while several regulatory measures have been realigned to avoid extended forbearance and risks to financial stability. As the economy revives, renewed focus may need to be placed on building up of adequate buffers and being vigilant of the evolving risks. 1. Introduction III.1 The Indian economy is rebounding strongly from the second wave of the pandemic catalysed by a sharp decline in infections and the speed and scale of inoculations under which more than half of the adult population has been fully vaccinated. With containment being eased and workplaces filling up, real gross domestic product (GDP) growth has surged to 13.7 per cent in the first half of 2021-22 and output has crossed pre-pandemic levels. Powered by a fiscal stimulus of the order of 8.7 per cent of GDP, liquidity infusions amounting to 8.7 per cent of GDP (of which 5.9 per cent was utilised) and policy rate cuts of 115 basis points (bps), the Indian economy was digging out of arguably one of the deepest recessions in the world during the first wave of the pandemic and a hesitant recovery was taking root in the second half of 2020-21 when it was interrupted by the swift and contagious onset of the second wave. In the event, the unprecedented policy response has mitigated the impact of the pandemic on lives and livelihoods, kept financial markets and financial institutions functioning and the lifeline of finance flowing amidst congenial monetary and financial conditions. This averted financial meltdowns, limited scarring and job losses and prevented severe supply and logistics disruptions from becoming binding constraints on economic and financial activity. III.2 Regulatory dispensations, and asset classification standstill including a temporary moratorium, reoriented restructuring/ resolution frameworks supplemented these efforts by limiting the loss of economic capital and easing liquidity and solvency stress. The overarching goal has been to maintain the soundness of the banking and financial system. These timely policy interventions helped alleviate stress experienced by individuals, MSMEs, corporates and lenders, and by keeping access to finance open on easy terms. In line with guidance from global standard-setting bodies like the Basel Committee on Banking Supervision (BCBS) and the Financial Stability Board (FSB), some implementation timelines for regulatory capital and liquidity were deferred. III.3 With some of the Reserve Bank’s measures reaching pre-set sunset dates, liquidity of the order of 2 per cent of GDP has been wound down, including special liquidity schemes for primary dealers (PDs), mutual funds (MFs) and non-bank financial companies (NBFCs) and large-scale purchases under the government securities acquisition programme (GSAP). The CRR reduction of 100 bps was restored to the pre-pandemic level of 4.0 per cent in two phases on March 27, 2021 and May 22, 2021. Several pandemic-time regulatory measures have been realigned to avoid extended regulatory forbearance and risks to financial stability. In 2021-22 so far, the Reserve Bank has engaged in rebalancing liquidity from passive absorption under fixed rate reverse repo under its liquidity adjustment facility (LAF) to market based reverse repo auctions while ensuring adequate liquidity in the system in consonance with an accommodative monetary policy stance to support growth. Concurrently, the Reserve Bank has ushered in major reforms, including scale-based regulation of NBFCs and revised guidelines on securitisation. The draft guidelines on review of credit default swaps (CDS) were issued for public comments. III.4 Against this backdrop, this chapter chronicles the monetary and liquidity measures in Section II. This is followed by an overview of the regulatory policy developments relating to scheduled commercial banks (SCBs), credit co-operatives and NBFCs during the period under review (2020-21 and 2021-22 so far) in Section III. The role of supervision in enforcement of regulatory policies and recent developments in this arena are covered in Section IV. Some new institutional developments have been covered in Section V. Policies relating to financial markets, foreign exchange, credit delivery and financial inclusion, and initiatives related to consumer protection are covered in Section VI, VII, VIII and IX, respectively. The Reserve Bank’s initiatives for enhancing the scope and reach of payments ecosystem while ensuring a safe and secure environment are set out in Section X. The chapter concludes with an overall assessment in Section XI. 2. Monetary Policy and Liquidity Management III.5 Complementing a 135 bps policy rate reduction during February 2019-February 2020 that took the cumulative policy rate reduction in the current easing cycle to 250 bps, the Reserve Bank employed the LAF corridor as a policy instrument, widening it asymmetrically by reducing the reverse repo rate cumulatively by 155 bps to 3.35 per cent during March-May 2020. Since May 2020, the policy rates have been on hold and an accommodative monetary policy stance with forward guidance that this stance will continue as long as necessary to revive and sustain growth on a durable basis and continue to mitigate the impact of COVID-19 on the economy, while ensuring that inflation remains within the target going forward, including in all its five meetings during the current financial year were maintained. III.6 In its April 2021 meeting, the monetary policy committee (MPC) noted that COVID-19 situation could dampen the prospect of contact-intensive sectors, restrain growth impulses and delay the return to normalcy. As such continued policy support was deemed necessary. In its June 2021 policy, the MPC acknowledged that rising international prices—especially of crude—along with logistic costs, had altered the near-term inflation outlook. However, the growth outlook was impacted by the second wave of COVID-19, necessitating policy support from all sides–fiscal, monetary and sectoral. In its August 2021 meeting, the MPC took the view that inflationary pressures during Q1:2021-22 were largely driven by adverse supply shocks, which were deemed to be transitory in nature. With a view to supporting the nascent and hesitant recovery, the MPC decided to keep the policy repo rate unchanged. In the October 2021 meeting, the MPC observed that the outlook for aggregate demand was progressively improving but was still below pre-COVID-19 levels and the recovery was uneven. The December 2021 MPC meeting was held against the backdrop of rising uncertainty amidst emergence of new COVID-19 mutations. The MPC decided to keep policy rates unchanged to nurture the slow pick-up in economic activity, till it becomes self-sustaining. III.7 In consonance with the accommodative monetary stance, the Reserve Bank kept banking system liquidity in large surplus, with daily net absorption under the LAF averaging ₹4.96 lakh crore through 2020-21 and ₹6.69 lakh crore during 2021-22 (up to December 22). The Reserve Bank injected ₹2.29 lakh crore in 2021-22 (up to December 17) through open market operations (OMOs), including G-SAP purchases, on top of ₹3.13 lakh crore through OMOs in 2020-21. During 2020-21, 19 auctions of simultaneous purchase and sale of government securities – operation twists (OTs) – were conducted, including one asymmetric OT on March 10, 2021 having a liquidity impact (purchase of ₹20,000 crore with sale of ₹15,000 crore). During 2021-22 so far (up to December 22), the Reserve Bank conducted three special OMOs (operation twists) involving the simultaneous purchase and sale of government securities of ₹40,000 crore (₹10,000 crore on May 6 and ₹15,000 crore each on September 23 and September 30) cumulatively. Providing forward guidance to market participants, the Reserve Bank emphasised that financial market stability and the orderly evolution of the yield curve were public goods, the benefits of which accrue to all stakeholders in the economy. III.8 Targeted liquidity measures to alleviate sector specific stress formed an important component of the Reserve Bank’s toolkit during the pandemic period. Targeted long-term repo operations (TLTRO) were augmented with the announcement of TLTRO 2.0 and ‘On tap TLTROs’1. To reduce the cost of funds of banks that had availed of LTRO and TLTRO, an option was given to them in September and November 2020 and again in December 2021 allowing a reversal of transactions before maturity and availing fresh funds at the reduced repo rate. Accordingly, banks repaid ₹1,23,572 crore of LTROs in September 2020 and cumulatively ₹39,782 crore of TLTROs by December 22, 2021. III.9 In H1:2021-22, an on-tap liquidity window of ₹50,000 crore with tenors of up to three years at the repo rate was opened (available till March 31, 2022) to boost provision of immediate liquidity for ramping up COVID-19 related healthcare infrastructure and services. Furthermore, it was decided to conduct special three-year long-term repo operations (SLTRO) of ₹10,000 crore at the repo rate for small finance banks (SFBs) to support small businesses, micro, small and medium enterprises (MSMEs), and other unorganised sector entities. A separate liquidity window of ₹15,000 crore was provided to alleviate stress in contact-intensive sectors (available till March 31, 2022) with tenors of up to three years at the repo rate. III.10 Amidst large surplus liquidity conditions, the Reserve Bank on January 8, 2021 embarked on steps to move towards normal liquidity management operations in a phased and calibrated manner and accordingly conducted five 14-day variable rate reverse repo (VRRR) auctions during January- March 2021. However, to meet any additional/unforeseen demand for liquidity and to provide flexibility to the banking system in their year-end liquidity management, two fine-tuning variable rate repo auctions of ₹25,000 crore each were conducted on March 26 and March 31, 2021 of 11-day and 5-day tenors, respectively. Furthermore, it was decided not to conduct the 14-day VRRR auction on March 26, 2021 to ensure the availability of ample liquidity for managing year-end requirements. III.11 The gradual normalisation of liquidity management operations in sync with the revised liquidity management framework instituted in February 2020 was a key feature of liquidity management during 2021-22. The surplus liquidity was mopped up through the overnight fixed rate reverse repo and the VRRR auctions of varying maturities under the LAF. Keeping in view the markets’ feedback and appetite for higher remuneration, the Reserve Bank enhanced the size of the fortnightly VRRR auctions in a phased manner. As a result, daily average absorption under fixed rate reverse repo window has come down considerably to ₹2.3 lakh crore in H2:2021-22 (up to December 22) compared to ₹4.6 lakh crore in H1:2021-22. Refinancing Facilities for All India Financial Institutions (AIFIs) III.12 On the back of ₹75,000 crore provided to AIFIs in 2020-21 as special refinance facilities to meet sectoral credit requirements, the Reserve Bank provided additional liquidity support of ₹66,000 crore for fresh lending during 2021-22 to AIFIs. This included a line of credit of ₹15,000 crore to EXIM Bank for a period of 90 days to enable it to avail a US dollar swap facility in May 2020, which was not availed (Table III.1a and III.1b). III.13 In sync with central banks, the world over, the Reserve Bank had also announced a moratorium on loans, special schemes for loan restructuring, asset quality standstill, restrictions on dividend pay-outs, zero risk weight on credit facilities covered by credit guarantee schemes backed by Government and increase in limit on banks’ exposure to a group of connected counterparties, most of which ran their course in 2020-21 itself. III.A Regulatory Policies for SCBs Resolution Framework for Covid-19 Stressed Assets III.14 A window for resolution of Covid-19 related stressed assets was announced on August 06, 2020, under the Prudential Framework for Resolution of Stressed Assets introduced a year earlier. It enabled implementation of a resolution plan (RP) in respect of eligible corporate exposures without change in ownership, and covered personal loans too, while classifying them as standard but subject to certain conditions. Rescheduling of payments, conversion of any interest accrued into another credit facility, sale of the exposures to other entities, change in ownership and restructuring were allowed in the RP. Borrowers classified as standard and not in default for more than 30 days with any lending institution as on March 1, 2020 and continued to be classified as standard till the date of invocation, were eligible for resolution under the framework. The resolution framework was required to be invoked till December 31, 2020, and the RP had to be implemented within 90 days for personal loans and 180 days for other eligible loans from the date of invocation. III.15 The recommendations of the Expert Committee (Chairperson: Shri K. V. Kamath) guided lending institutions while finalising RP in respect of eligible borrowers. The Expert Committee had recommended five financial parameters viz, total outside liability/adjusted tangible net worth; total debt/EBIDTA; current ratio; debt service coverage ratio (DSCR); and average debt service coverage ratio (ADSCR) for factoring into RPs implemented under the resolution framework. It had also recommended sector-specific thresholds for these ratios to act like floors or ceilings in respect of 26 sectors while the lending institutions could take these decisions in respect of other sectors. III.16 The implementation deadline of 180 days was still operational when the second wave of pandemic hit, obviating the need for a new restructuring scheme for large borrowers. However, a need was felt for a framework specifically aimed at individuals and small businesses. The Resolution Framework – 2.0 was issued on May 5, 2021, with focus on these borrowers, which permitted implementation of resolution plans without a downgrade in their asset classification (Table III.2). The facility could be invoked till September 30, 2021 while the implementation had to be completed within 90 days from the date of invocation. While all personal loans qualified for invocation, an aggregate exposure limit of ₹50 crore as on March 31, 2021 was set for small and individual owned businesses as well as MSMEs. Ex-gratia Payment of Difference between Compound Interest and Simple Interest III.17 On October 23, 2020, the Government announced a scheme for individual and MSME borrowers, envisaging ex gratia repayment of the difference between compound interest and simple interest to borrowers. The scheme provided relief to these borrowers with aggregate borrowing of up to ₹2 crore for the moratorium period, i.e. March 1, 2020 to August 31, 2020. Subsequently, the Hon’ble Supreme Court, vide its order dated March 23, 2021 directed the banks to reimburse the above difference to all borrowers. Loan-to-Value Ratio for Loans against Gold Ornaments and Jewellery III.18 On August 6, 2020 the loan-to-value ratio (LTV) for loans against gold ornaments and jewellery for non-agricultural end-uses was increased from 75 per cent to 90 per cent. This temporary provision, applicable till March 31, 2021, was aimed at providing a cushion to households, entrepreneurs and small businesses against the economic impact of the pandemic. Analysis suggests that the flagging personal loans segment in 2020-21 was buoyed by this measure (Chart III.1). Dividend Declaration by Banks III.19 The Reserve Bank had directed banks not to make any dividend payment on their equity shares from the profits pertaining to 2019-20. This helped in bolstering provisions, especially of private sector banks (PVBs), to absorb impending loan losses due to COVID-19 and conserve capital to support credit growth. The policy was reviewed for 2020-21 and banks were advised to ensure that they continue to meet the minimum regulatory capital requirements after dividend payment. Bank boards were urged to consider the current and projected capital position of the banks vis-à-vis the applicable capital requirements and the adequacy of provisions, taking into account the economic environment and the outlook for profitability while considering dividend payouts.  Maintenance of Cash Reserve Ratio (CRR) III.20 Based on a review of monetary and liquidity conditions banks were advised that the CRR - which was reduced to 3 per cent of their net demand and time liabilities (NDTL) effective from the reporting fortnight beginning March 28, 2020 - was restored to 4 per cent in two phases, viz., 3.5 per cent of NDTL effective from the reporting fortnight beginning March 27, 2021 and 4 per cent effective from the reporting fortnight beginning May 22, 2021 (Chart III.2).  Credit to MSME Entrepreneurs III.21 On February 5, 2021 banks were allowed to deduct the amount equivalent to credit disbursed to new MSME borrowers up to ₹25 lakh per borrower from their NDTL for calculation of CRR for the credit disbursed up to the fortnight ending October 1, 2021 in order to incentivise incremental credit flow to MSMEs. This exemption was further extended for credits disbursed up to the fortnight ending December 31, 2021. Statutory Liquidity Ratio (SLR) holdings in Held to Maturity (HTM) category III.22 The headroom available for banks for further investment in SLR securities under the HTM category was getting exhausted by June 2020 (Chart III.3). Faced with a large government borrowing programme, banks were permitted to exceed the HTM ceiling up to an overall limit of 22 per cent of NDTL (instead of 19.5 per cent) till March 31, 2023, provided such excess is on account of SLR securities acquired between September 1, 2020 and March 31, 2022. It was also decided that the enhanced HTM limit would be restored to 19.5 per cent in a phased manner, beginning from the quarter ending June 30, 2023.  Dipping in SLR for Marginal Standing Facility (MSF) Maintenance - Extension of Relaxation III.23 Banks were allowed to avail of funds under the MSF by dipping into SLR up to an additional one per cent of their NDTL, i.e., cumulatively up to three per cent of NDTL. This facility, which was initially available till June 30, 2020 was later extended in phases till March 31, 2021 providing comfort to banks on their liquidity requirements and also to enable them to meet their liquidity coverage ratio (LCR) requirements. A further extension of nine months, i.e., up to December 31, 2021 was granted to banks to avail of this facility. However, the normal dispensation is being restored and consequently, with effect from January 1, 2022, scheduled banks would be able to dip into the SLR up to two per cent of NDTL instead of three per cent for borrowing under the MSF. Deferment of last tranche of capital conservation buffer (CCB) III.24 The last tranche of 0.625 per cent of the CCB was scheduled to be implemented by March 31, 2020. In view of the ongoing stress on account of COVID-19 on bank balance sheets, its implementation was deferred till October 1, 2021. It has come into effect since then. Deferment in implementation of Net Stable Funding Ratio (NSFR) III.25 Similarly, in view of the ongoing stress on account of COVID-19, the implementation of NSFR guidelines was deferred till October 1, 2021 and has come into force since then. Regulatory Retail Portfolio – Revised Limit for Risk Weight III.26 The exposures included in the regulatory retail portfolio of banks attract a risk weight of 75 per cent. One of the four qualifying criteria for claims to be recognized as regulatory retail portfolio was a threshold of ₹5 crore of aggregate retail exposure to one counterparty. In order to reduce the cost of credit for this segment consisting of individuals and small businesses (i.e. with turnover of up to ₹50 crore), and in harmonisation with the Basel guidelines, this threshold was raised to ₹7.5 crore for all fresh as well as incremental qualifying exposures so as to expand credit flow to small businesses including MSMEs through reducing the capital requirement of banks on such loans. Rationalisation of Risk Weights for Individual Housing Loans III.27 As a countercyclical measure, it was decided to rationalise the risk weights for all new individual housing loans sanctioned between October 16, 2020 and March 31, 2022, irrespective of the amount (Table III.3). The revision in the risk weightage is intended to give a fillip to bank lending to the real estate sector. Streamlining of Opening of Current Accounts by Banks III.28 On August 6, 2020 restrictions were placed on banks for opening and operating current accounts and cash credit (CC) /overdraft (OD) facilities for borrowers. This policy was aimed at streamlining the use of multiple accounts by borrowers and containing diversion of funds. The policy prohibited banks from opening current accounts for customers who have availed credit facilities in the form of CC/OD from the banking system. All transactions of such borrowers would be routed through the CC/OD account alone. In case of customers who have not availed CC/OD facility from any bank, they may be allowed to open current accounts under certain conditions. III.29 Considering the operational constraints in implementation, the Reserve Bank eased restrictions on borrowers with exposure to the banking system of less than ₹5 crore. This is, however, subject to obtaining an undertaking from such borrowers that they will inform the bank(s) as and when the credit facilities availed by them from the banking system crosses the threshold. In respect of borrowers where exposure of the banking system is ₹5 crore or more, such borrower can maintain current accounts with any one of the banks with which it has CC/OD facility, provided that the bank has at least 10 per cent of the exposure of the banking system to that borrower. Transfer of Loan Exposures III.30 On September 24, 2021, the Reserve Bank harmonised the extant guidelines on transfer of loan exposures to make it consistent with the Insolvency and Bankruptcy Code (IBC) mechanism and extant regulatory framework on resolution of stressed assets. Loans that are in default are now permitted to be transferred to a wider universe of transferees. For loans that are not in default, the guidelines allowed transfer of loans through assignment, novation or loan participation contract. In case a loan in default is transferred, a cooling period of at least one year was mandated before the lending institution can again extend loan to the same borrower. In case the loan in default is transferred to an entity not regulated by the Reserve Bank, cooling period is of three years. The requirement of minimum holding period (MHP) for transfer of loans was simplified. A minimum retention requirement (MRR) of 10 per cent was prescribed for transfer of loans not in default where the acquiring lender is unable to perform due diligence at the individual loan level for more than one-third of the portfolio. For price discovery of loans in default, Swiss challenge method has been made mandatory, where the aggregate exposure of all lenders is ₹100 crore or more, as well as in cases where transfer of loan exposures is undertaken as a resolution plan under the Prudential Framework. Loan exposures classified as fraud were permitted to be transferred to asset reconstruction companies (ARCs) along with responsibilities of continuous reporting, monitoring, filing of complaints with law enforcement agencies and proceedings. The Reserve Bank, however, specified that transfer of such loan exposures to ARCs will not absolve the transferor from fixing staff accountability as required under the extant instructions on frauds. III.31 Given the tremendous growth in number, size and potential of ARCs for resolving stressed assets, a committee was constituted in April 2021 to undertake a comprehensive review of the working of ARCs and recommend suitable measures to meet the growing requirements of the financial sector (Box III.1). Securitisation of Standard Assets III.32 To develop a strong and robust securitisation market, the Reserve Bank simplified its structure and aligned existing guidelines with the Basel III guidelines on September 24, 2021. The directions permit only traditional securitisations i.e., securities issued by a special purpose entity (SPE) where the cash flows are from a pool of underlying loans acquired from a lender. Any transaction between an originator and an SPE should be ‘strictly on an arm’s length basis’. Furthermore, credit enhancement facilities may provide additional financial support for securitisation. III.33 It has simplified the requirements of MHP and MRR. Listing of securitisation notes, especially for residential mortgage-backed securities, is required when securities are sold to 50 or more investors. Further revisions include permission for single asset securitisation, concessional capital regime in case of simple, transparent and comparable (STC) securitisations, simplified instructions governing reset of credit enhancements and capital requirements in line with the Basel III norms, which also factor in seniority, thickness and maturity of the securitisation exposures held by lending institutions. Review of Extant Ownership Guidelines and Corporate Structure for Indian Private Sector Banks III.34 An Internal Working Group (IWG) was constituted by the Reserve Bank to review the extant guidelines on ownership and corporate structure for Indian private sector banks. Out of 33 recommendations made by the IWG, Reserve Bank has accepted 21 recommendations (some with partial modifications) and remaining 12 recommendations are under examination. The accepted major recommendations pertain to lock-in period for promoters’ initial shareholding, limits on shareholding of promoters in the long run and dilution requirements, cap on holding of non-promoters, pledge of shares by promoters during lock-in period, initial capital requirements, corporate structure – Non-operative Financial Holding Company (NOFHC), listing requirements and harmonisation of various licensing guidelines. Extension of Centralised KYC Registry (CKYCR) to Legal Entities (LEs) III.35 In terms of provisions of the Prevention of Money Laundering (Maintenance of Records) Rules, 2005 the Reserve Bank’s regulated entities (REs) have been uploading know your customer (KYC) data pertaining to all individual accounts, opened on or after January 1, 2017, on the CKYCR. Consequently, the use of this facility, especially in terms of uploads by RBI-REs has grown in leaps and bounds (Table III.4). III.36 As the CKYCR is now fully operational for individual customers, it has been extended to KYC data pertaining to Legal Entities (LEs) accounts opened on or after April 1, 2021 as well. Policy for Liquidity Management in RRBs III.37 Earlier, Regional Rural Banks (RRBs) had no access to the LAF/MSF window of the Reserve Bank as well as the call/notice money market. On December 4, 2020 the Reserve Bank granted them access to these facilities, subject to meeting certain eligibility criteria, to facilitate efficient liquidity management. Regulatory Framework for Safe Deposit Locker Facility III.38 Comprehensive revised instructions were issued for the safe deposit locker facility offered by banks on August 18, 2021. Enhanced standards of safety and security of lockers, detailed procedure for discharge of locker contents by breaking it open under various circumstances and alert facility through registered email / SMS for locker operation have been introduced. The banks have been made liable to the extent of 100 times the annual locker rent in case of negligence or fraud committed by the bank employees leading to loss of contents of the locker. III.B Regulatory Policies for Co-operative Banks Dual Control of Co-operative Banks and Amendment to the Banking Regulation (BR) Act, 1949 III.39 The Reserve Bank’s powers to regulate and supervise co-operative banks were limited due to non-applicability of certain statutory provisions of the Banking Regulation (BR) Act, 1949 on co-operative banks, which affected its ability to take necessary and timely corrective actions in case of irregularities/weaknesses in functioning of these banks. The amendment to the Act, carried out in 2020 sought to protect the interests of depositors and strengthen co-operative banks by improving governance framework and oversight by the Reserve Bank, while enabling better access to capital. The amendment came into force for urban co-operative banks (UCBs) with retrospective effect from June 29, 2020 and for State Co-operative Banks (StCBs) and District Central Co-operative Banks (DCCBs) with effect from April 1, 2021. III.40 The amended Section 3 of the BR Act, 1949 makes the provisions of the Act inapplicable to Primary Agricultural Credit Societies (PACS) or co-operative societies whose primary object and principal business is providing long-term finance for agricultural development, and do not use words “bank”, “banker” or “banking” in its name and do not act as drawee of cheques. The amendment of Section 45 of the Act enabled the Reserve Bank to reconstruct or amalgamate a bank, with or without implementing a moratorium, with the approval of the Central Government. The amendment also provides the Reserve Bank powers to supersede the Board of Directors of a co-operative bank in consultation with the state government concerned. The amendment to Section 56 of the Act will help in narrowing down the regulatory arbitrage between commercial banks and co-operative banks. Amalgamation of Cooperative Banks III.41 In the past, mergers and amalgamations between UCBs had to be approved by both the Reserve Bank and the respective Registrar of Co-operative Societies. Subsequent to the enactment of the Banking Regulation (Amendment) Act, 2020, the Reserve Bank received greater powers for sanctioning the process. Master directions in this regard were issued on March 23, 2021 specifying the necessary conditions for amalgamation, including, inter alia, approval of the proposal by two-thirds of board members of the concerned UCB. The criterion for consideration of the proposal by the Reserve Bank is based on whether the amalgamating bank assures to protect deposits of the amalgamated bank either through use of its own resources or through financial support from the state government. Incentives extended to the amalgamating bank include greater flexibility to close loss-making branches, open new branches and retention of authorised dealer (AD) -I licence of the amalgamated bank. With these guidelines, amalgamation process for UCBs is expected to be smoother and faster. Similarly, Reserve Bank on May 24, 2021 specified requirements and indicative benchmarks/ conditions for voluntary amalgamation of DCCBs with StCBs. III.C Regulatory Policies for Non-Bank Financial Companies (NBFCs) Scale-Based Regulatory Framework III.42 The Reserve Bank came out with a scale-based regulation framework for NBFCs following the principle of proportionality on October 22, 2021. The framework is based on a four-layered structure – base layer (NBFC-BL), middle layer (NBFC-ML), upper layer (NBFC-UL) and top layer, with a progressive increase in the intensity of regulation. The base layer consists of non-deposit taking NBFCs (NBFC-NDs) with asset size below ₹1,000 crore and certain other NBFCs engaged in specific activities. It aims at increasing transparency by way of greater disclosures and improved governance standards while not burdening them with higher level regulations. The middle layer mainly includes all deposit taking NBFCs and non-deposit taking NBFCs with asset size of ₹1,000 crore and above and some specialised NBFCs. Through this layer, the areas of arbitrage between banks and NBFCs—that were detrimental to orderly growth and systemic stability—were reduced. The upper layer will comprise of certain NBFCs specifically identified by the Reserve Bank based on a set of parameters and scoring methodology and will be subjected to enhanced regulatory rigour. The top layer of the pyramid has been proposed to remain empty unless the Reserve Bank takes a view that a specific NBFC lying in the upper layer poses systemic risk and needs to be subjected to higher and bespoke regulatory/ supervisory requirements. These guidelines would be effective from October 01, 2022. III.43 The framework prescribes Internal Capital Adequacy Assessment Process (ICAAP) to be made proportionate to the scale and complexity of operations. Currently, capital to risk weighted assets ratio (CRAR) requirement for NBFCs is 15 per cent of risk weighted assets (RWAs), without any bifurcation such as Common Equity Tier (CET) 1 or additional Tier I capital. In order to enhance the quality of regulatory capital, NBFC-UL will have to maintain CET- 1 capital of at least 9 per cent of RWAs. Further, large exposure framework has also been introduced for NBFC-UL. The extant credit concentration limits prescribed separately for lending and investments have been merged into a single exposure limit of 25 per cent for a single borrower and 40 per cent for a group of borrowers in case of NBFC-ML and NBFC-UL. These concentration limits will be determined with reference to the NBFC’s Tier 1 capital instead of their owned fund. The extant NPA classification norm has also been changed to the overdue period of more than 90 days for all categories of NBFCs and a glide path has been provided to NBFCs-BL to be achieved by March 31, 2026. Also, with a view to stem financial stability concerns, a ceiling of ₹1 crore per borrower has been put on financing of subscription to initial public offer (IPO). Furthermore, an enhanced governance framework for NBFCs in the middle and upper layers has been instituted. Special Liquidity Scheme (SLS) for non-bank financial companies (NBFCs) / housing finance companies (HFCs) III.44 In July 2020, the Government announced an SLS of ₹30,000 crore to address short-term liquidity concerns of NBFCs/HFCs. Under the scheme, a Special Purpose Vehicle (SPV) was set up to purchase investment grade commercial papers (CPs)/ non-convertible debentures (NCDs) of residual maturity up to 90 days issued by these institutions. The scheme permitted both primary and secondary market purchase of debt. NBFCs/HFCs were required to use the proceeds received under the SLS solely for extinguishing their existing liabilities. Under the SLS, ₹7,126 crores were disbursed, mainly via CPs, of which 53 per cent went to NBFCs and the rest to HFCs. Aligning Regulatory Framework for HFCs with NBFCs III.45 Consequent to the transfer of regulation of HFCs from National Housing Bank (NHB) to the Reserve Bank with effect from August 9, 2019, a revised regulatory framework was issued on October 22, 2020, to ensure smooth regulatory transition. The major changes in the regulatory framework were (a) clearly defining housing finance and principal business criteria for HFCs; (b) strengthening the capital base by increasing the net owned funds requirement from ₹10 crore to ₹20 crore; (c) restrictions on exposure to group companies engaged in real estate business to address concerns related to double lending and to ensure arm’s length relationship; (d) introduction of regulations on liquidity risk management framework and a liquidity coverage ratio (LCR); (e) guidelines on securitisation; (f) guidelines on outsourcing of financial services to address risks emanating from such activities; (g) regulatory guidance related to prudential aspects, particularly on provisioning and regulatory capital for Ind-AS implementing HFCs. Further work is underway for greater harmonisation to the extent possible. Lowering of Secured Debt Limit for NBFCs under SARFAESI Act III.46 On February 24, 2020, NBFCs with asset size of ₹100 crore and above were permitted to take recourse to the SARFAESI Act for enforcement of security interest in secured debts of ₹50 lakh and above. Subsequently, the Government further reduced the secured debt limit to ₹20 lakh and above on February 12, 2021. This is expected to improve the recoveries of NBFCs from small businesses and micro and small enterprises. Declaration of Dividend by NBFCs III.47 Considering the increasing significance of NBFCs in the financial system and their inter-linkages with different segments, guidelines on their dividend distribution were issued on June 24, 2021. The eligibility criteria for dividend pay-out was linked to their capital adequacy and net NPA levels, and a ceiling on the maximum dividend pay-out ratio was specified. III.48 The Reserve Bank endeavours to constantly improve the efficacy of its supervisory function, so that the resilience of the regulated entities can be enhanced. A calibrated supervisory approach is followed to bring in required modularity and scalability to better focus on risky practices and institutions and to deploy an appropriate range of tools and technology to achieve our supervisory objectives. The Board for Financial Supervision (BFS), constituted in November 1994, acts as the integrated supervisor for the financial system covering SCBs, AIFIs, Co-operative banks and NBFCs. During July 2020 to November 2021, 16 meetings of the BFS were held in which issues such as initiatives to improve supervisory functions, measures to strengthen off-site surveillance, on-site examination and skill development were discussed. The Board also reviewed supervisory initiatives during COVID-19 disruptions, enforcement policy for REs, revised norms on opening of current accounts by banks, revisions to the PCA framework for banks, new PCA framework for NBFCs, corporate insolvency regime and its implications for the Indian banking system, compliance to instructions on Society for Worldwide Interbank Financial Telecommunication (SWIFT) and data localization by banks. Appointment of Auditors in Regulated Entities III.49 The Reserve Bank issued guidelines for appointment of Statutory Central Auditors (SCAs)/Statutory Auditors (SAs) of SCBs (excluding RRBs), UCBs and NBFCs (including HFCs) in April 2021. This was the first time when such guidelines were prescribed for UCBs and NBFCs. The objective is to put in place ownership-neutral regulations, ensure independence of auditors, avoid conflict of interest in auditors’ appointments and improve the quality and standards of audit in the REs. The guidelines place greater responsibility on the Board/Audit Committee of the Board/Local Management Committee of REs, especially with respect to assessing and ensuring independence of auditors, their appointment, fixing remuneration and performance review. These guidelines will also ensure that appointments are made in a timely, transparent and effective manner. Revised Prompt Corrective Action (PCA) Framework for SCBs III.50 The Reserve Bank revised the Prompt Corrective Action (PCA) framework effective January 1, 2022. In contrast to the earlier framework issued in April 2017, a negative return on assets (RoA) will no longer be a trigger to initiate PCA. III.51 Lakshmi Vilas Bank, which was under PCA, was amalgamated with DBS Bank on November 27, 2020. Subsequent to capital infusion by the Government, the financial parameters of IDBI Bank and UCO Bank improved and they were taken out of the framework on March 10, 2021 and September 8, 2021, respectively. Similarly, Indian Overseas Bank was taken out of the framework on September 29, 2021. All these banks were allowed to start normal banking operations subject to certain conditions and continuous monitoring. Currently, only one public sector bank, viz. Central Bank of India, remains under PCA. Prompt Corrective Action (PCA) Framework for NBFCs III.52 Given the growing size and interconnectedness of NBFCs with other segments of the financial system, the Reserve Bank put in place a PCA framework for them on December 14, 2021. The PCA framework, which will strengthen the supervisory tools applicable to NBFCs, will come into effect from October 1, 2022, based on the financials at end-March, 2022. This will be applicable to all deposit taking NBFCs (excluding government NBFCs); and (ii) all non-deposit taking NBFCs in middle, upper and top layers (excluding NBFCs not accepting public funds; government companies; primary dealers; and HFCs). III.53 For NBFCs-D and NBFCs-ND (excluding core investment companies (CICs)), capital (CRAR and Tier I capital ratio) and asset quality (net NPA ratio) would be the key monitoring parameters. In case of CICs, leverage would be an additional parameter to track, apart from capital (adjusted net worth/aggregate risk weighted assets) and asset quality (Table III.5). The framework prescribes certain mandatory and discretionary actions such as restrictions on dividend distribution, requirement of promoters to infuse additional capital, reduction in leverage and concentration of exposures, restriction on branch expansion, capital expenditure, borrowings and staff expansion, among others. 5. New Institutional Developments National Asset Reconstruction Company Limited (NARCL) III.54 Despite several efforts, a substantial stock of legacy NPAs continue to be on the balance sheets of banks. As some large accounts are fragmented across various lenders, aggregation of bad assets leads to significant delays. NARCL, being incorporated by financial institutions only, will have the ability to aggregate bad loans from all members of the consortium. This would incentivise quicker resolution and help better value realisation. NARCL will initially acquire NPAs with total secured outstanding exposure of ₹500 crore and above, amounting to about ₹2 lakh crore. Following extant guidelines, it will acquire these assets through 15 per cent upfront payment in cash and 85 per cent in SRs. The SRs issued will be guaranteed by the government to cover the difference between the face value of SRs and actual realisation from their resolution process for upto five years. An amount of ₹30,600 crore has been earmarked for the purpose. III.55 The NARCL has been incorporated under the Companies Act and has been granted ARC licence by the Reserve Bank. NARCL is capitalised through equity contributions from banks/financial institutions (FIs), and it will also raise debt as required. PSBs and government owned FIs will hold a minimum of 51 per cent stake and the rest will be with the private sector. National Bank for Financing Infrastructure and Development (NABFID) III.56 Infrastructure financing gap is a persistent challenge. After facing stress on their exposures to the sector, banks turned risk averse and moderated their lending to this sector. The long gestation periods of infrastructure projects leading to asset liability mismatches was another concern that served as a disincentive for lending. In order to address this concern, the Government has paved the way for the establishment of a development finance institution (DFI) through enactment of National Bank for Financing Infrastructure and Development (NABFID) Act, 2021. Union Budget 2021-22 has budgeted ₹20,000 crores for it. NABFID has been entrusted with the task of co-ordinating with relevant stakeholders to facilitate long term infrastructure financing, including through development of debt and derivatives market. London Interbank Offered Rate (LIBOR) Transition - Review of Guidelines III.57 The planned LIBOR transition poses a challenge for banks and the financial system. To ensure a smooth transition for REs and financial markets, the Reserve Bank issued an advisory on July 8, 2021 encouraging banks and other REs to cease entering into new contracts that use LIBOR as a reference rate and instead adopt any widely accepted Alternative Reference Rate (ARR) as soon as practicable and in any event, no later than December 31, 2021. Regulatory changes have been made to make provision for use of ARRs in export credit, foreign currency non-resident (FCNR) (B) deposits, external commercial borrowings (ECBs) and trade credit (TC). To take into account differences in credit and term premia between LIBOR and the ARRs, the all-in-cost ceiling has been revised upwards by 100 bps for existing ECBs/TCs and by 50 bps for new ECBs/TCs. As the change in reference rate from LIBOR is a “force majeure” event, it has been clarified that changes in the terms of a derivative contract on its account would not be treated as restructuring. Money Market Regulations – Review of Guidelines III.58 The regulations for money market instruments were reviewed to bring in consistency across the markets and to expand its investor base. RRBs have been allowed to participate in the call, notice and term money markets and to issue Certificate of Deposits (CDs). Participants have been allowed to set their own lending limits in the call, notice and term money markets within extant prudential regulatory norms and CD issuers have been permitted to buy back CDs before maturity for greater flexibility in managing short-term liquidity. Relaxation in the period of parking of unutilised ECB proceeds in term deposits III.59 Borrowers are permitted to park unutilised ECB proceeds in term deposits with Authorised Dealer (AD) Category-I banks in India for a maximum period of 12 months. To provide relief to borrowers from COVID-19 related disruptions, a one-time relaxation was provided on April 07, 2021, allowing unutilised ECB proceeds drawn down on or before March 1, 2020 to be parked in term deposits with AD Category-I banks in India prospectively up to March 1, 2022. Export Data Processing and Monitoring System (EDPMS) Module for ‘Caution/De-caution Listing of Exporters’ – Review III.60 As part of automation of Export Data Processing and Monitoring System (EDPMS), the ‘Caution / De-caution Listing’ of exporters was automated in 2016. Accordingly, exporters were caution-listed automatically if any shipping bill against them remained outstanding for more than 2 years in EDPMS and no extension was granted for realisation of export proceeds against the outstanding shipping bill. Additionally, the normal system of caution-listing’, based on specific recommendations of AD banks before the expiry of two years, continued. In October 2020, system-based automatic caution-listing was discontinued. In order to make the system more exporter friendly and equitable, the Reserve Bank will continue with caution-listing based on the case-specific recommendations of AD banks. Reporting Rationalisation III.61 Considering the latest technological advancements as well as recent rationalisation of various notifications under Foreign Exchange Management Act (FEMA), 1999 regulations, a comprehensive review of the extant reporting requirements was undertaken. 67 returns were reviewed with respect to their relevance, mode of filing, format and frequency and 17 returns were discontinued with effect from November 13, 2020, thus reducing the cost of compliance for the reporting entities. 8. Credit Delivery and Financial Inclusion III.62 In pursuit of the goal of sustainable financial inclusion, the Reserve Bank has encouraged banks to adopt a structured and planned approach. The National Strategy for Financial Inclusion (NSFI) 2019-24 is aimed at accelerating the level of financial inclusion across the country in a holistic and systematic manner. In pursuance of the recommendations made in the NSFI, significant headway has been made on both the supply side and demand side of financial inclusion. On the supply side, provision of banking services to more than 99 per cent of the targeted villages within their 5 km radius and sensitisation of more than 1.91 lakh Business Correspondents (BCs) through conduct of about 32,000 programmes are the key achievements. On the demand side, enhanced financial literacy and consumer grievance redressal mechanisms are focus areas of NSFI. Against this backdrop, several policy measures were initiated during 2020-21 and the current financial year so far to ensure last mile access to financially excluded sections. Business Correspondent (BC) Model III.63 By end-March 2021, more than 95 per cent of the banking outlets in rural areas were operated by BCs. Given their role in effective delivery of financial services and furthering financial inclusion, a slew of initiatives viz. a BC Certification Programme, a Train the Trainers Programme for sensitizing bank officials, and a BC Registry Portal for having a repository of details about BCs were introduced by the Reserve Bank. In order to assess the efficacy of these initiatives, a study was undertaken by the Reserve Bank (Box III.2). Increase in limits for bank lending against Negotiable Warehouse Receipts (NWRs) / electronic Negotiable Warehouse Receipts (eNWRs) III.64 The priority sector lending (PSL) limit for loans against NWRs/eNWRs was enhanced from ₹50 lakh to ₹75 lakh per borrower to ensure greater flow of credit to farmers against hypothecation of agricultural produce and to encourage use of NWRs/eNWRs issued by regulated warehouses. The PSL limit backed by warehouse receipts other than NWR/eNWR will continue to be ₹50 lakh per borrower. Small Finance Banks (SFBs) Lending to NBFC-MFIs as Priority Sector Lending III.65 In view of the pandemic challenges and to address the liquidity concerns of smaller MFIs, fresh credit extended by SFBs to registered NBFC-MFIs and other MFIs (societies, trusts etc.) was allowed to be classified under priority sector lending (PSL), provided these institutions are members of the Reserve Bank recognized self-regulatory organization (SRO). The above benefit will be applicable to the MFIs having a gross loan portfolio of upto ₹500 crore as on March 31, 2021. Under the scheme, SFBs are permitted to lend upto 10 per cent of their total PSL portfolio as on March 31, 2021. Resolution of COVID-19 related stress of MSMEs III.66 A one-time restructuring of existing loans to MSMEs, which were in default but ‘standard’ as on January 1, 2019, was permitted without an asset classification downgrade. The restructuring was required to be implemented by March 31, 2020. The scheme was made available to MSMEs that qualify in terms of criteria such as a cap of ₹25 crore on total borrowings from banks and NBFCs and being GST-registered. Since then, the scheme has been extended thrice with the latest restructuring applicable to MSME accounts that were in default but ‘standard’ as on March 31, 2021. The restructuring of the borrower accounts had to be invoked by September 30, 2021. Furthermore, it was decided to enhance the cap on total borrowings from banks and NBFCs to ₹50 crore from ₹25 crore. The scheme helped relieve the stress of the MSME borrowers (Table III.6). III.67 Improvement in customer service and customer grievance redressal mechanisms in banks has been a major focus area of the Reserve Bank in recent years. III.68 To give the depositors easy and time bound access to their deposits to the extent of insurance cover, the Deposit Insurance and Credit Guarantee Corporation (DICGC) Act, 1961 was amended by the Parliament in August 2021 wherein DICGC will be liable to provide interim payment of deposit cover within 90 days of the date such liability arises. Further, DICGC was permitted to raise the deposit insurance premium up to the maximum limit of 0.15 per cent of total assessable deposits, subject to prior approval from the Reserve Bank. The DICGC was given powers to defer or vary the repayment period for the insured banks and charge penal interest of 2 per cent over the repo rate in case of a delay. The amendments to the Act came into force from September 1, 2021. Strengthening of Grievance Redressal Mechanism in Banks III.69 In order to strengthen the grievance redressal mechanism in banks, a comprehensive framework, envisaging annual assessment of customer service, was put in place on January 27, 2021. The major features of the framework are: (i) enhanced disclosures on customer complaints by banks; (ii) monetary disincentive for banks in the form of recovery of cost of redressal of complaints beyond a threshold; and (iii) intensive review of grievance redressal system of banks that fail to improve their mechanisms. III.70 Under the framework, banks identified as having persistent issues in grievance redressal would be subject to intensive review. Based on the review findings, a remedial action plan will be formulated and formally communicated to the bank for implementation within a specific time frame. In case no improvement is observed in the grievance redressal mechanism within the prescribed time, the bank will be subjected to corrective actions through appropriate regulatory and supervisory measures. Integration of the Ombudsman Schemes III.71 The primary responsibility for customer grievance redressal remains with the financial service providers. Complaints which are not resolved through this mechanism can be referred to the Reserve Bank’s Ombudsman or Consumer Education and Protection Cells (CEPCs). The erstwhile three ombudsman schemes were integrated into a single Reserve Bank – Integrated Ombudsman Scheme (RB-IOS), 2021 with effect from November 12, 2021 and additional features were added for making the ombudsman structure more customer friendly (Box III.3). RBI Retail Direct Scheme III.72 The Reserve Bank launched the ‘RBI Retail Direct’ Scheme on November 12, 2021 as a one-stop solution to facilitate investment in Government securities by individual investors. The scheme enables individuals to participate in primary issuance of government securities (G-Secs) in the non-competitive segment and to buy/sell G-Secs in the secondary market on the NDS-OM platform. 10. Payments and Settlement Systems III.73 The Reserve Bank has over the years encouraged greater use of electronic payments to achieve a “less-cash” society. The objective has been to provide payment systems that combine the attributes of safety, security, enhanced convenience and accessibility by leveraging on technological solutions that enable faster processing. Affordability, interoperability, customer awareness and protection have been the focus areas. Over the years, banks have been the traditional gateway to payment services. With fast paced technological changes, this domain is no longer the monopoly of banks. Entities such as non-banks, including Fintechs, Techfins and Bigtechs are cooperating as well as competing with banks, either as technology service providers or direct providers of digital payment services. The regulatory framework has encouraged diversified participation in the payments domain, while being mindful of ensuring consumer convenience, safety, security and systemic stability.

Enhancements to PPIs III.74 On May 19, 2021, the Reserve Bank mandated PPI interoperability, increased the maximum outstanding balance in PPIs to ₹2 lakh and permitted cash withdrawal from full-KYC PPIs. These measures are expected to lead to optimum utilisation of acceptance infrastructure, seamless customer experience and encourage non-bank PPI issuers to convert their offerings into full-KYC PPIs. Card transactions in Contactless mode – Relaxation in Requirement of Additional Factor of Authentication III.75 In 2015, the Reserve Bank permitted contactless transactions by using NFC-enabled EMV Chip cards without the need for additional factor of authentication for values up to ₹2,000 per transaction. Keeping the COVID-19 pandemic experience in view and given the sufficient protection available to users, it was decided to increase the per transaction limit to ₹5,000 with effect from January 1, 2021. Operationalisation of Payments Infrastructure Development Fund Scheme III.76 The Payments Infrastructure Development Fund (PIDF) Scheme intends to subsidise deployment of payment acceptance infrastructure in Tier-3 to Tier-6 centres with a special focus on north-eastern states. The target of the PIDF is to help deploy 10 lakh physical and 20 lakh digital acceptance devices every year in the target geography. The scheme was operationalised from January 01, 2021 for a period of three years. In August 2021, the scheme was expanded to include beneficiaries of the PM Street Vendor’s AtmaNirbhar Nidhi (PM SVANidhi Scheme) in Tier-1 and Tier-2 centres. As on November 30, 2021, the contribution to the scheme was ₹614 crore and 77.16 lakh payment acceptance devices have been deployed. Access for Non-banks to Centralised Payment Systems III.77 Direct access of non-banks to the Centralised Payment System (CPS) lowers the overall risk in the payments eco-system. It also brings in advantages to non-banks like reduction in cost of payments, minimising dependence on banks, reducing the time taken for completing payments and eliminating the uncertainty in finality of the payments as the settlement is carried out in central bank money. The risk of failure or delay in execution of fund transfers is also avoided when the transactions are directly initiated and processed by the non-bank entities. Keeping in mind these advantages, the Reserve Bank permitted authorised non-bank Payment System Providers (PSPs), viz. PPI issuers, card networks and White Label ATM operators to participate in the CPS as direct members from July 28, 2021. Tokenisation: Card transactions III.78 The Reserve Bank had issued a framework on card tokenisation services in January 2019. While initially limited to mobile phones and tablets, it was subsequently extended in August 2021 to cover other devices including Internet of Things (IoT). In September 2021, the scope of this framework was further extended by permitting card networks and card issuers to offer Card-on-File Tokenisation (CoFT) services. Additionally, the Reserve Bank advised that from July 1, 2022, no entity in the card transaction / payment chain, other than the card issuers and / or card networks, shall store the actual card data; and any such data stored previously will be purged. Reserve Bank Innovation Hub III.79 The Reserve Bank has set up Reserve Bank Innovation Hub (RBIH) as a company under section 8 of the Companies Act, 2013. The wholly owned subsidiary of the Reserve Bank has an independent board comprising eminent members from industry and academia to promote innovation across the financial sector by leveraging on technology and creating an environment which would facilitate and foster innovation. The role of the RBIH is to bring convergence among various stakeholders (viz., banking and financial sector, start-up ecosystem, regulators and academia) in the financial innovation space. It would also develop the required internal infrastructure to promote fintech research and facilitate continuous engagement with innovators and start-ups. III.80 The disruption in economic activity in the wake of the pandemic resulted in corporate and household sector stress and weakening of demand conditions. Through concerted efforts, the Reserve Bank and the Government managed to contain the risks to financial stability. As the economy revives, renewed focus may need to be placed on building up of adequate buffers and being vigilant of the evolving risks. The resolution framework was designed to minimise the risk of adverse selection. Higher provisioning requirements and stringent performance requirements for borrowers after the implementation of the resolution plan are expected to further dampen the impact of such risks. The trade-off between short-term liquidity and regulatory support to viable borrowers and medium-term macro-financial stability risks needs to be carefully balanced. Looking ahead, it is important for the credit cycle to gain traction and support the ensuing economic recovery. This will require policy initiatives that ensure effective risk management and sound corporate governance. The changing nature of banking—especially the increasing use of technology—presents challenges as well as opportunities for an inclusive and sound banking sector and the regulatory and supervisory function needs to keep pace. 1 To mitigate the adverse effects of the pandemic outbreak on financial conditions, effective March 27, 2020, the Reserve Bank conducted auctions of targeted term repos of up to three years tenor at a floating rate linked to the policy repo rate. Liquidity availed under the scheme by banks had to be deployed in investment grade corporate bonds, commercial papers (CPs), and non-convertible debentures (NCDs) over and above the outstanding level of their investments in these bonds. Further, starting from April 17, 2020, in order to channel liquidity to small and mid-sized corporates, including NBFCs and MFIs, it was decided to conduct TLTRO 2.0 at the policy repo rate for tenors up to three years. Furthermore, on October 9, 2020, it was decided to conduct on tap TLTRO with tenors of up to three years and banks were required to deploy these funds in debt-instruments issued by entities in specific sectors. The liquidity availed under the scheme could also be used to extend bank loans and advances to these sectors. |

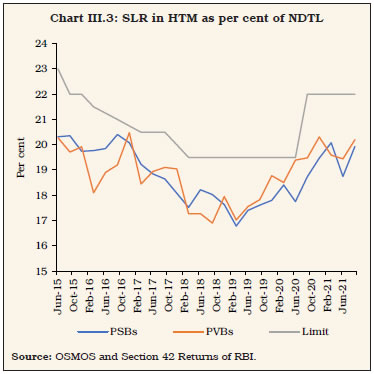

പേജ് അവസാനം അപ്ഡേറ്റ് ചെയ്തത്: