IST,

IST,

Supply of Banking Services and Credit Offtake: Evidence from Aspirational District Programme in the Eastern Area

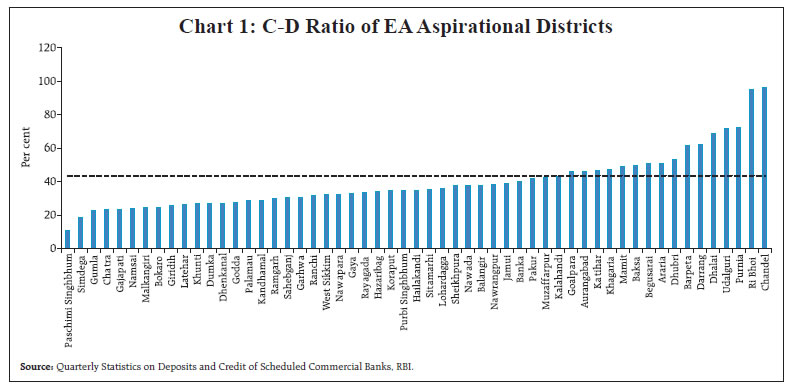

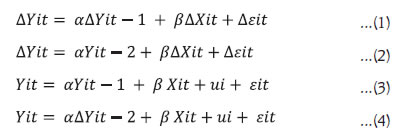

by Rakhe P. Balachandran^ and Barkha Gupta^ Despite being closer in economic backwardness, aspirational districts of Eastern Area display divergent levels of credit intermediation. We examine whether this trend is driven by supply of banking services or demand for banking services. By employing a system GMM framework, we find that ex-ante branch expansion plays a significant role in improving credit intermediation. Thus, the perceived low branch viability in the backward regions, due to low levels of economic activity, need not slow down the branch expansion of banks. The evidence suggests that branch expansion harnesses the hitherto untapped credit demand into the formal banking channels. Introduction Role of credit intermediation in economic growth is a well-established economic relationship in the literature. Hence, the expansion of financial intermediaries’ network assumes importance in furthering economic development of backward regions. Accordingly, the Reserve Bank of India has been pushing the branch network of banks to the hitherto unbanked/underbanked rural centres (URCs) by liberalizing its branch authorization policy. As per the extant policy, 25 per cent of the new banking outlets has to be opened in URCs in a year. Further, banks have to take necessary approvals before closing/shifting/merging a rural banking outlet. On the other hand, the aspirational districts programme (ADP) launched in 2018 by the government of India is an innovative approach to economic development of backward districts in India. These districts are selected based on eleven indicators of economic deprivation and backwardness in health, education, and infrastructure. However, despite being closer in backwardness, credit intermediation by banks, gauged through C-D ratio, is heterogeneous across these districts, thus, hazing the relationship between credit intermediation and economic growth. Even though, there are evidences in the literature that credit intermediation leads to economic growth, the reverse causality from economic growth to credit intermediation is also acknowledged in the literature. This motivates us to examine the leading factor impacting the credit intermediation of aspirational districts. Factors that drive C-D ratio in the eastern area aspirational districts are examined in a dynamic panel framework by employing a system GMM estimation. The endogeneity between credit intermediation and economic growth is effectively controlled for in a system GMM framework apart from taking care of the dynamic nature of variables. The endogeneity between credit intermediation and economic growth arises due to the tendency of banks to open more branches in regions that are bustling with economic activities, i.e., credit demand attracts higher supply of banking services. On the other hand, higher supply of banking services will enhance the credit intermediation through financing of economic activities, i.e., supply of banking services generates credit demand. The results, in this paper, suggest that the ex-ante expansion of branch network, significantly, improves credit intermediation in the backward regions. This substantiates the spirit and essence of the extant branch authorization policy of the Reserve Bank of India, dated May 18, 2017, in pushing the banks to open more branches in Tier 5 and Tier 6 URCs. Followed by introduction, features of ADP are presented in Section II. Section III presents literature review and, data sources and descriptive statistics are provided in Section IV followed by an identification strategy in Section V. Section VI presents regression results and Section VII concludes. II. The Aspirational Districts Programme Under ADP, convergence of central and state schemes, collaboration between stakeholders of development and competition among districts are envisaged to develop backward districts.1 The districts eligible for participation under ADP was selected through a transparent process. Eleven indicators spreading across four different domains such as deprivation, health and nutrition, education and infrastructure were used. Each indicator was assigned a weight to reflect the relative importance of the dimension captured by that indicator in the selection process. The indicators used, the dimension of the indicator, the data sources and the weights attached to the indicators are provided in Table 1. Further, States reviewed the list of districts to suggest any changes. The core strategy of the ADP envisages states as the main drivers of grass root development. The programme identifies the strengths of each district and tries to transform those strengths as a catalyst for the overall development of the district through involvement of various stakeholders and by consolidating the various state and central schemes in the identified areas. The ADP requires the districts to aspire to become the State’s best followed by the country’s best. This element is introduced in the ADP to inculcate competition on development among the districts. The ADP has five themes: (1) Health and Nutrition, (2) Education, (3) Agriculture and Water Resources, (4) Financial Inclusion and Skill Development, and (5) Basic Infrastructure. Each of these themes under the programme has been assigned a specific weight which roughly reflects the respective themes’ importance in the overall programme framework. The highest weight (30 per cent) has been assigned to two themes, viz., health and nutrition, and education, followed by agriculture and water resources (20 per cent). Next is basic infrastructure with a weight of 10 per cent. The least weight (five per cent) has been assigned to Financial Inclusion and Skill Development (Table 2). Across these five themes, 49 key performance indicators (KPIs) are identified based on 81 data points to closely monitor the progress made since the inception of the programme and has been disseminated through a dashboard. The indicators on financial inclusion track improvement made in opening accounts under Jan Dhan Yojana, participation in Central Government programmes such as Atal Pension Yojana and Pradhan Mantri Jeevan Jyoti Bama Yojana, and disbursement of Mudra loans. Notably, C-D ratio is not a KPI of the financial inclusion theme of ADP. However, some of the KPIs monitored under the financial inclusion theme such as disbursement of mudra loans may result in higher credit flow into these districts (Table 3). Further, some of the KPIs monitored under other themes of ADP such as “percentage increase in agricultural credit” and credit linkages with the banking system may also impact the C-D ratio of aspirational districts positively (Table 4). Moreover, overall rolling out of the ADP may also boost bank financing of various activities leading to higher credit flow into these districts through its focused attention on various areas. The relationship between economic growth and credit intermediation is highlighted as early as in 1930s, as financial intermediaries distribute the mobilized savings among needy firms, economic growth gains momentum. Further, many of the economic growth models, such as the Solow model, focus on the capital accumulation as the main driver of economic growth. Financial intermediaries enhance the mobilization of savings from economic agents having surplus to the borrowers and can enhance the saving rate in the economy by propagating the advantages of savings such as safety and interest income. A couple of studies has also confirmed the causal role played by the financial intermediation in inducing economic growth or any source of economic growth such as saving rates and capital accumulation (Jayaratne and Strahan, 1996; Demirguc-Kunt and Maksimovic, 1998; Rajan and Zingales, 1998; Beck et al., 2000; King and Levine, 1993; Levine, 1997; Beck and Levine, 2004). Further, a long run co-integrating relationship between financial development and economic growth is also confirmed (Bist and Robert, 2018). However, there is evidence that financial development beyond a threshold does not augur well for furthering economic growth. Thus, for each country, there exists an optimum level of financial development that accelerates economic growth (Shen and Lee, 2006; Law and Nirvikar, 2014; Arcand et al., 2012; Cecchetti and Kharroubi, 2012). The eastern area2 reports relatively lower financial development as compared to other regions of the country (RBIa, various years; RBIb, various years; Rajesh & Anwesha, 2019). The studies that highlight the challenges of financial development or credit intermediation of the eastern area are either confined to state-level analysis or primary survey-based analysis. These earlier studies bring a few broad issues and challenges to the forefront such as policies to increase income, to develop an industrial base and basic infrastructure, that needs to be taken care of for increasing the credit off-take in this region (Rajesh & Anwesha, 2019). As eastern area, comprising of both eastern and north-eastern regions, is one of the backward regions in India, a second set of studies investigated the role of microfinance in the credit intermediation or development of this region (Krishnankutty, 2011; Patikar and Haridev, 2012; Chanu and Shibu, 2014; Nath and Lijum, 2014; Deb and Santa, 2016; Das and Patnaik, 2015; Pal and Singh, 2019). These studies, in general, noted the scope of microfinance to improve credit off-take in this region. This study deviates from the existing literature by addressing a different question; Why do aspirational districts, despite being closer in backwardness, report divergent levels of credit intermediation, gauged through C-D ratio? The study addresses this question using data on 56 aspirational districts in the eastern region as these districts are categorised as backward by the Government under its ADP. The policy suggestions of the paper would contribute to an overall improvement of credit intermediation in the eastern area. The growing literature on aspirational districts of India would also benefit from the findings of this study. IV. Data and Descriptive Statistics For the econometric model, data are considered for the period between 2010-11 to 2019-20. The ADP was implemented during 2017-18. Hence, for the regression, the data have been confined to roughly ten years including both pre and post ADP. The data period has been limited to 10 years to prevent the problem of proliferation of instruments that happens in a system GMM framework as the number of instruments is quadratic in the number of time periods in this framework. Data are taken up to 2019-20 to avoid aberrations caused by the Covid-19 pandemic on credit intermediation. Data on credit, deposits and branches at the district level are sourced from the Basic Statistical Returns (BSR) of the RBI. These data include only commercial banks. District level credit and deposit data, including both commercial as well as cooperative banks, are available from the State Level Banker’s Committee (SLBCs) of various States. However, the state SLBCs could not provide data for the entire study period and thus the entire dataset has been sourced from BSR and pertains to commercial banks. The areas of the districts are sourced from the respective websites of the districts under study. Data on district domestic products are not available consistently for incorporation in the study. Hence, data on yield for major crop under cultivation has been taken from the Crop Production Statistics published by the Ministry of Agriculture & Farmers’ Welfare to proxy credit demand at the district level. C-D ratio across EA aspirational districts is distributed with a mean of 40 per cent and is fairly heterogeneous as is reflected through high standard deviation (Table 5). Moreover, a median of 35 per cent suggest that only a few districts lie towards the right of the mean and may have very high C-D ratios, while a bunch remain low performers with their C-D ratios being to the left of the mean. A similar trend could be seen for the credit per account as well as deposit per account with former having very high standard deviation. This suggests high heterogeneity among districts in terms of credit offtake. Looking at the area per branch and bank branch statistics, the variation among districts seems even stronger, suggesting high divergence in banking services penetration across the aspirational districts of the EA region. Agriculture dominates the economic activity of these districts as it is reflected through a mean share of more than 60 per cent of main workers in the agricultural sector. Furthermore, mean share of more than 50 per cent in loan accounts for agriculture suggests a strong dependency of households on this sector for their livelihood. The divergence in intensity of agricultural activity across these districts remain low as is suggested through negligible standard deviation in both yield as well as area share of the major crop of each district, thus suggesting a similar potential for credit demand across the aspirational districts of EA region. Several aspirational districts (39 as per the March 2020 data) report a lower C-D ratio than the eastern area average C-D ratio of 43.4 per cent3 (Chart 1). These districts belong to six eastern area states, viz., Jharkhand, Bihar, Odisha, Assam, Sikkim and Arunachal Pradesh. The state-wise distribution of aspirational districts shows that majority of the districts that report a lower C-D ratio than the eastern area average belongs to Jharkhand followed by Odisha (Table 6).  System GMM is a suitable framework to examine this issue as it effectively controls for the endogeneity between the supply of banking services and demand for banking services with the C-D ratio in a dynamic panel framework. The system GMM estimation contains equations in levels as well as in differences to model this relationship. It uses a stacked dataset which contains transformed observations (viz., variables in differences) as well as untransformed observations (variables in levels) for each district in the dataset. In the system GMM, level equations are instrumented using differenced variables and difference equations are instrumented using level variables. In mathematical form, the difference equation will take the form equation (1), where ΔΥit − 1 is instrumented using Υit − 2 as shown in equation (2). The level equation in the system GMM will take the form equation (3), where Υit − 1 is instrumented using ΔΥit − 2 as shown in equation (4).  The system GMM treats the entire equations as one relationship as essentially the dependent and independent variables are the same. Hence, parameters α and β are estimated using information contained in both the level as well as in the difference equations. The problem of endogeneity created due to the presence of individual effects ui in equation (4) is addressed through the cancelling effect of autoregressive decay α against the individual effect ui across the whole panel with a necessary condition α < 1, depending on the nature of the data generating process. In essence, the system should be stable and converging, for the system GMM estimations to be valid for interpretation (Roodman, 2009a). In the econometric model, dependent variable is the C-D ratio of the districts. Independent variables are area per bank branch in each district and yield of the major crop of the district under cultivation. While area per bank branch serves as a proxy for supply of banking services, yield of the major crop is taken as a proxy for demand of banking services. With most households being dependent on agricultural sector for their livelihood, the yield of the major crop in a way serves as a good indicator to gauge the extent of the economic activity in these districts and, therefore, the demand for credit. The regression results are provided in Table 7. The ordinary least squares (OLS) and least squares dummy variables (LSDV) estimations are conducted to arrive at the credible range of α in the system GMM estimation. While the OLS biases the coefficient upward because of the positive correlation between the lagged dependent variable and the error term, the LSDV biases the coefficient downward because of the negative correlation between the lagged dependent variable and the error term (Roodman, 2009b). Thus, the range provided by the OLS and LSDV estimates works as a credible range for α which can be utilised to ensure the correct specification of the model. The credible range of α estimated in the present study is 0.322 (LSDV estimate of α) to 0.601 (OLS estimate of α) (Bond, 2002). Since the upper value of this credible range is less than one, it is pointing to the existence of a converging and, thus, stable dynamic system, which is a necessary condition for the system GMM to be valid. While transforming the variables in their difference form, an orthogonal transformation is followed as it reduces the average of all future available observations from a given observation instead of deducting just one observation. This is theoretically sounder, especially when some observations are missing in the data. The results of System GMM provided in column 4 of the Table 7 provides the estimates after collapsing the instruments, which makes the number of instruments less than the number of groups in the panel data making it valid for interpretation. In this model, the estimated value of α at 0.432 falls within the credible range estimated by the OLS and LSDV estimates. The autocorrelation test as well as over-identification tests performs well indicating the credibility of the model in explaining the variations in the dependent variables. Overall, the model provides evidence for the prominent role played by the supply of banking services in driving credit to deposit ratio. The coefficient on the supply of banking services is negative and significant which shows that as the area served by one branch increases, the C-D ratio decreases. The demand for banking services captured through the yield of the major crop in the respective districts turn out to be insignificant. Thus, the results indicate that in the backward areas or hitherto unbanked and underbanked areas, opening of new branches harness demand for banking services. Albeit, unavailability of timeseries and district-wise data on other possible proxies of credit demand such as district domestic products and vehicle registrations, limits our ability to undertake further robustness checks. Credit intermediation by financing economic activities contributes to the economic development of a region. Yet, improving credit intermediation in the backward regions is slow. Government of India in 2018 selected 117 districts as aspirational based on indicators of social and economic backwardness. There are 56 aspirational districts in the eastern area. The level of credit intermediation, as gauged through C-D ratio, is divergent among these districts. This motivates to examine the reasons for the divergence in credit intermediation in these backward districts. The issue was analysed in a dynamic panel framework after controlling for the endogeneity between the supply of banking services and the demand for banking services with the C-D ratio. Supply of banking services is proxied using the average area served by a bank branch in a district. The demand for banking services is captured through the yield of the major crop of the districts. The regression results show that supply of banking services is the main factor that drives C-D ratio significantly in the aspirational districts of the eastern area. The results underline the importance of spreading the bank branch network into the interior areas of the country. The ex-ante spreading of bank branch network has the capability of harnessing hitherto unmet demand for credit as well as savings into the formal banking channels, thus, providing a boost to the C-D ratio. The financing of economic activities by the bank capital may, further, increase the demand for credit through positive externalities on economic development. Thus, the perceived low branch viability due to low banking business, in the backward regions, should not slow down the branch expansion process in these districts. References Arcand, J.L., Berkes, E., Panizza, U., (2012), ‘Too Much Finance?’, IMF Working Paper, 12/161. Arellano, M., and O. Bover, (1995), ‘Another look at the instrumental variable estimation of error-components models’, Journal of Econometrics, 68: 29–51. Arellano, M., and S. Bond. (1991), ‘Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations’, Review of Economic Studies, 58: 277–297. Beck T and Levine R., (2004), ‘Stock Markets, Banks and Growth: Panel Evidence’, Journal of Banking and Finance, 28(3): 423-442. Beck T, Levine R., Loayza N (2000), ‘Finance and sources of growth’, Journal of financial economics, 58(1-2): 261-300. Bist, Jagadish Prasad and Robert Read (Reviewing Editor), (2018), “Financial development and economic growth: Evidence from a panel of 16 African and non-African low-income countries”, Cogent Economics & Finance, 6:1. Blundell, R., and S. Bond. (1998), ‘Initial conditions and moment restrictions in dynamic panel data models’, Journal of Econometrics, 87: 115–143. Bond, S. (2002), ‘Dynamic panel data models: A guide to micro data methods and practice’, Working Paper CWP09/02, Cemmap, Institute for Fiscal Studies, Available at http://cemmap.ifs.org.uk/wps/cwp0209.pdf. Cecchetti, G., Kharroubi, E., (2012), ‘Reassessing the Impact of Finance on Growth’, BIS Working Papers No. 381, Bank for International Settlements. Chanu and Shibu, (2014), ‘MFIs of North East India: An Efficiency Analysis’, International Journal of Banking, Risk and Insurance, 2(2), pp: 46-53. Das and Patnaik, (2015), ‘Micro Finance in Eastern India: The Role Played by Regional Rural Banks’, Indian Journal of Finance, 9(11), pp: 45-59, November. Deb and Santa, (2016), ‘Financial Performance of Micro Finance Institutions in North East India. Pranjana: The Journal of Management Awareness’, 19(2), p47-57. Deb, Joyeeta; Kar, Santa, (2016), ‘Financial Performance of Micro Finance Institutions in North East India’, Pranjana: The Journal of Management Awareness, Vol. 19, Issue 2, p: 47-57. DemirguKc7-Kunt, A., Maksimovic, V., (1998), ‘Law, “finance, and “firm growth’, Journal of Finance, 53: 2107-2137. Government of India, (2021), ‘Crop Production Statistics for Selected States, Crops and Range of Year’, Available at https://aps.dac.gov.in/APY/Public_Report1.aspx Government of India, (2021), ‘National Family Health Survey – District Fact Sheets’. Available at http://rchiips.org/nfhs/ Jayaratne, J., Strahan, P., (1996), ‘The “finance-growth nexus: evidence from bank branch deregulation’, Quarterly Journal of Economics, 111: 639-670. King G.R. and Levine R, (1993), ‘Finance and Growth: Schumpeter might be Right’, Quarterly Journal of Economics, 108 (3): 717-737. Krishnankutty, (2011), ‘Role of Banks Credit in Economic Growth: A Study with Special Reference to North East India’, The Economic Research Guardian, 1(2). Law, Siong Hook and Nirvikar Singh (2014), ‘Does too much Finance Harm Economic Growth?’, Journal of Banking and Finance, 41: 36-44. Levine R. (1997), ‘Financial Development and Economic Growth: Views and Agenda’, Journal of Economic Literature, 35 (2): 688-726. Nath and Lijum, (2014), ‘Micro Finance in the North Eastern Region of India: Opportunities and Challenges (Special Focus on Arunachal Pradesh)’, Asian Journal of Research in Social Sciences and Humanities, 4(12), PP – 104-111. NITI Aayog, (2018), ‘Deep Dive: Insights from Champions of Change. The Aspirational Districts Dashboard’, Available at https://www.niti.gov.in/sites/default/files/2018-12/FirstDeltaRanking-May2018-AspirationalRanking.pdf NITI Aayog. (2018), ‘Transformation of Aspirational Districts’, Available at https://www.niti.gov.in/sites/default/files/2018-12/AspirationalDistrictsBaselineRankingMarch2018.pdf Official Websites of aspirational districts. Pal and Singh, (2019), ‘Do Socially Motivated Self-Help Groups Perform Better? Exploring determinants of micro-credit groups’ performance in Eastern India’, Annals of Public and Cooperative Economics, 92(4). Patikar and Haridev, (2012), ‘Need and Progress of Micro-Finance in North-East India: An Evaluation’, IASSI Quarterly, 31(2), Pp: 24-37. Rajan R. and Zingales L., (1998), ‘Financial Dependence and Growth’, American Economic Review, 88(3): 559-586. Rajesh, Raj and Anwesha Das. (2019), ‘Drivers of Credit Penetration in Eastern India’, RBI Monthly Bulletin, October. RBIa. (Various years), Basic Statistical Returns. RBIb. (Various years), Report on Trend and Progress of Banking in India. Roodman, D. M. (2009a), ‘A note on the theme of too many instruments’, Oxford Bulletin of Economics and Statistics, 71: 135–158. Roodman, D. M. (2009b), ‘How to do xtabond2: An introduction to difference and system GMM in Stata’, Stata Journal, 9(1):86-136. Shen C.H. and Lee CC, (2006), ‘Same Financial Development but Different Economic Growth – Why?’, Journal of Money, Credit and Banking, 38(7): 1907-1944. ^ The authors are from the Department of Economic and Policy Research, Kolkata. Authors are grateful to Shri Gunveer Singh, CGM, Kolkata for his comments. The views expressed in the article are those of the authors and do not represent the views of the Reserve Bank of India. 1 Initially, 117 districts were selected for the programme, however, West Bengal decided not to participate in the programme even though five districts were selected from West Bengal by the Central Government. 2 Eastern area, in this study, consists of West Bengal, Sikkim, Bihar, Jharkhand, Odisha, Assam, Arunachal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland, and Tripura. 3 End-March 2020 has been selected to avoid aberrations due to COVID-19. |

പേജ് അവസാനം അപ്ഡേറ്റ് ചെയ്തത്: