IST,

IST,

RBI WPS (DEPR): 05/2015 : Natural Interest Rate: Assessing the Stance of India’s Monetary Policy under Uncertainty

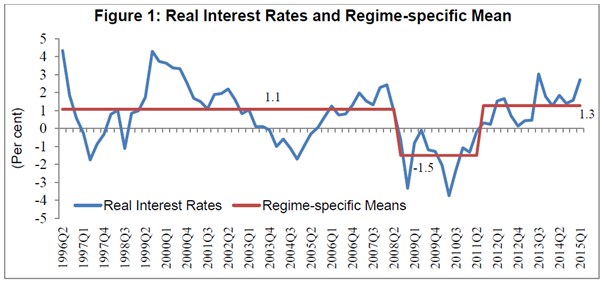

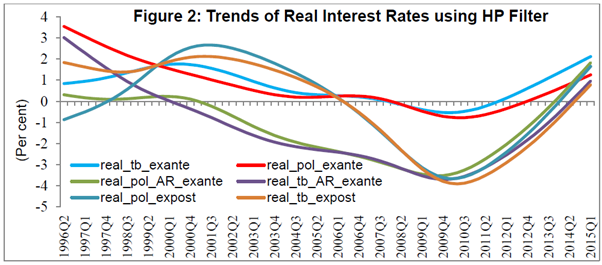

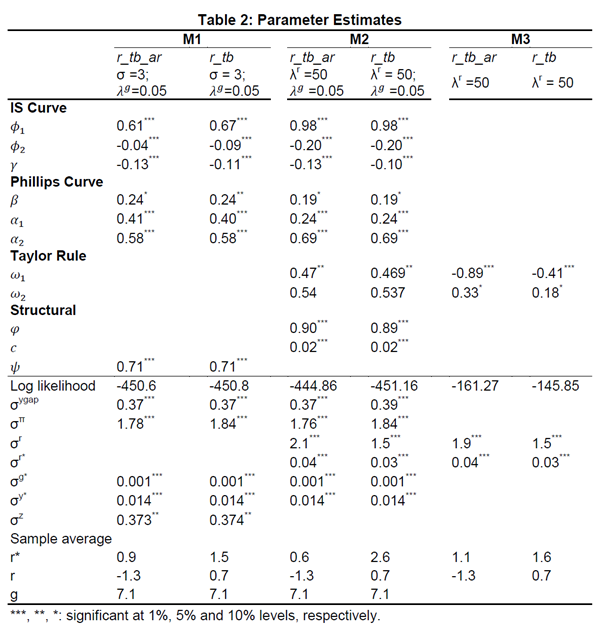

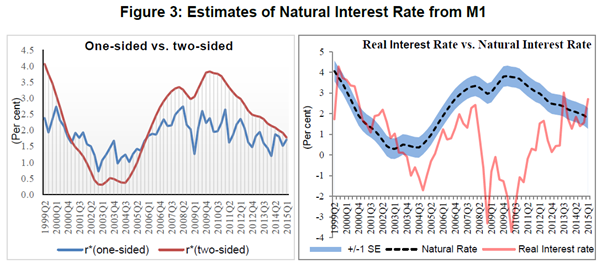

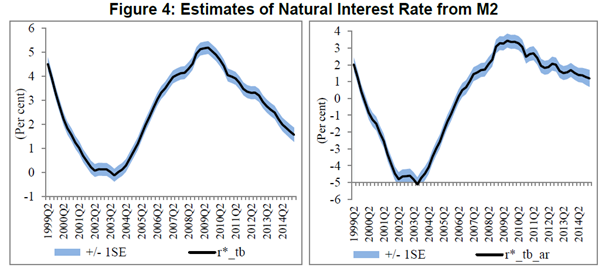

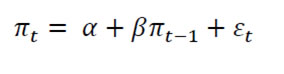

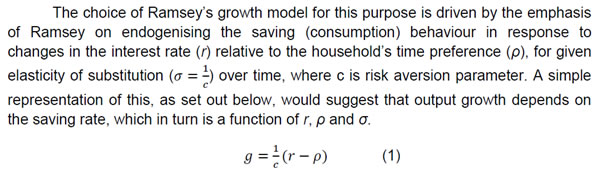

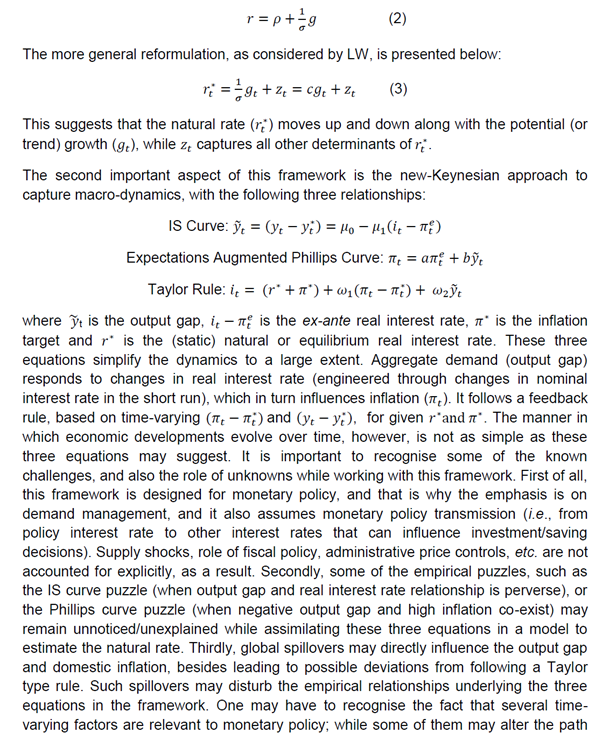

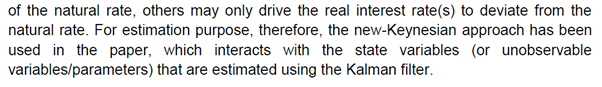

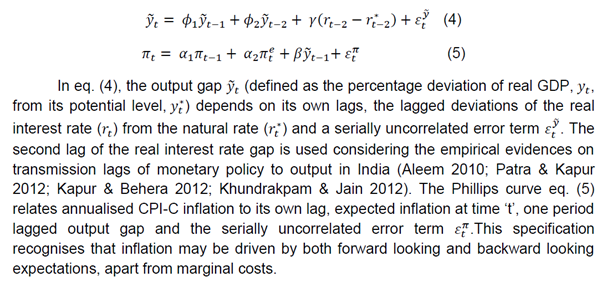

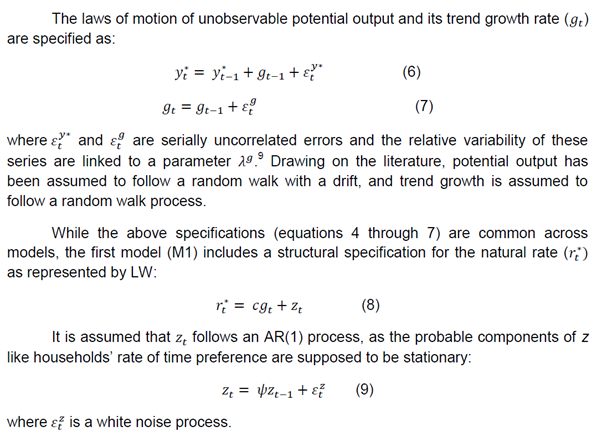

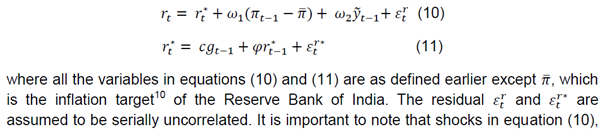

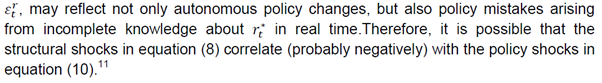

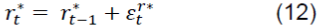

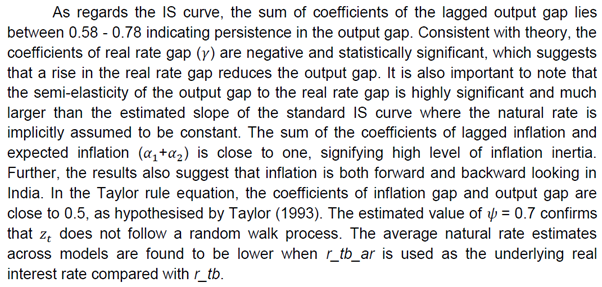

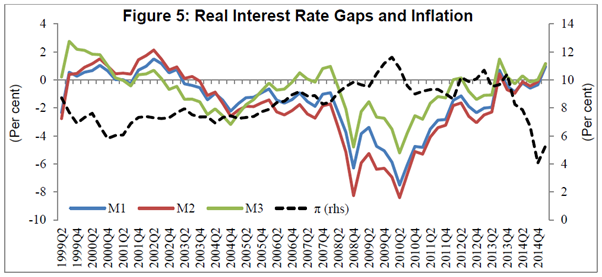

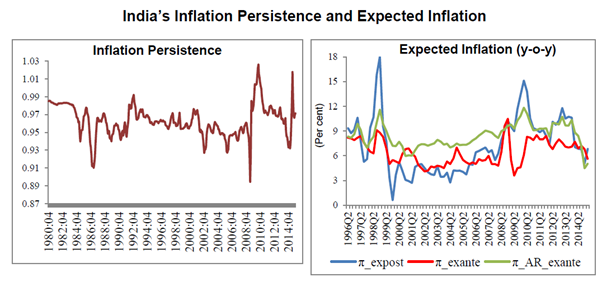

| RBI Working Paper Series No. 05 Abstract *The constant natural interest rate assumption implicit in Taylor type feedback rules to assess the stance of monetary policy could be misleading at times, particularly because of the time- varying nature of the natural interest rate. Literature suggests that natural rates of both advanced and emerging economies have been altered considerably in the post crisis period, reflecting a complex web of supply side, demand side, regulatory and global factors. Using a theoretical framework that combines the essence of Ramsay’s growth model and the New-Keynesian macro-dynamics, and applying the Kalman filter estimation technique, this paper finds that India’s natural real interest rate in Q4 of 2014-15 lied in a range of 0.6 per cent to 3.1 per cent, even though core estimates point to a narrower range of 1.6 per cent to 1.8 per cent. These estimates indicate that the real interest rate gap was negative in India for a major part of the last about ten years when CPI inflation was persistently high, implying that monetary policy stance of the Reserve Bank was largely accommodative rather than anti-inflationary. Key words: Natural Rate, Real Interest Rate, Monetary Policy Stance, New-Keynesian Framework, Kalman Filter, Time-varying Estimates. JEL Classification: E43, E52, E3, C32 I. Introduction The conduct of monetary policy has to often contend with uncertainties surrounding the evolution of the equilibrium real interest rate over time, and the associated risks of a monetary policy stance turning out to be either more accommodative or tight than what might have been originally intended1. After the global crisis, natural interest rates in both advanced and emerging economies have been estimated to have altered significantly, rendering the static natural rate assumption underlying a Taylor type feedback rule quite untenable for evaluation of the appropriateness of any monetary policy stance. In India, the Report of the Expert Committee to Review and Strengthen the Monetary Policy Framework (Chairman: Dr Urjit Patel) has recommended adoption of a simple policy rule defined in terms of a real policy rate which should be positive, on average, when inflation exceeds the inflation target, and the Monetary Policy Committee (MPC) should decide the magnitude by which it may be positive. This recommendation poses two research issues: (a) an assessment of the time-varying real equilibrium interest rate, particularly its level at the point in time when a monetary policy decision has to be taken, and (b) clarity on where the actual real interest rate should be relative to the estimated real equilibrium rate, so that appropriate changes in the nominal policy (repo) rate could ensure an appropriate real interest rate gap facilitating the attainment of an inflation trajectory consistent with the inflation target. When inflation exceeds the inflation target, normally, a positive (estimated) natural or equilibrium real interest rate would require an even higher actual real interest rate. The scope of this paper is limited only to the first research issue, because a range of estimates of the natural rate could be generated using different methodologies at any point in time, which in turn makes the second issue much more complex, and also highlights the importance of sound judgement in conducting monetary policy under uncertainty. Against this backdrop, Section-II encapsulates the theoretical debate on the determinants of the natural rate. A review of literature presented in Section-III sets out the range of possible estimates of the natural rate in the advanced and emerging economies. The theoretical framework used to estimate the natural rate for India is explained in detail in Section-IV. Estimated results for India are analysed in Section-V. Concluding observations are set out in Section-VI. II. Why the natural rate varies over time? The natural rate concept as enunciated by Wicksell (1898) was essentially the first policy rule to guide the conduct of monetary policy aimed at price stability, and it also offered the first major insight into how the transmission mechanism links money and credit to aggregate demand and inflation2. If the money rate or market rate of interest remains below the natural rate (of return on capital), that could stimulate aggregate demand and exert inflationary pressure. Planned investment would exceed planned saving, when market rate falls below the natural rate; the sensitivity of investment-saving gap to the interest rate gap (i.e., the difference between the market rate and natural rate) is the key to the transmission process, besides change in money and credit in the banking system in response to these gaps, consistent with the quantity theory of money. The central bank, given its ability to influence the market (or lending rate) through policy rate changes, can align money rate to the natural rate and thereby ensure price stability (Humphrey 1997). The real interest rate gap indicator advocated by Woodford (2000) following the “neo-Wicksellian” approach appears to work well in forecasting inflation, and also serves the purpose of evaluating the stance of monetary policy (Neiss & Nelson 2001) The natural rate as originally propounded by Wicksell (1898) for a closed economy referred to “…a certain rate of interest on loans which is neutral in respect to commodity prices (read as general price level in current situation) and tends to neither raise nor lower them”. For such a condition to be realized, the natural rate may have to be the rate at which desired savings equal desired investment; the rate that equals marginal productivity of capital; and also the rate that is consistent with price stability. In the modern day New-Keynesian monetary policy framework, the natural rate is generally equated with a real rate of interest that is consistent with zero output gap and stable inflation over the business cycle. This framework underpins the essence of the Wicksell argument that any change in the price level is caused by non-zero real interest rate gaps. The other important aspect of this framework is that it assumes prices to be sticky in the short-run (creating the role for monetary policy), and also allows for transitory shocks to aggregate demand and supply. Taking this into account, the natural rate is also interpreted as the real monetary policy rate that is “…consistent with the economy operating at the full potential once transitory shocks to aggregate supply or demand have abated” (Williams 2015). In its original formulation, it was seen as a time-varying concept: “… The natural rate is not fixed or unalterable in magnitude… In general, we may say, it depends on the efficiency of production, on the available amount of fixed and liquid capital, on the supply of labour and land, in short on all the thousand and one things which determine the current economic position of a community; and with them it constantly fluctuates” (Wicksell 1898). A complex web of factors drives the natural rate to move over time. A review of the literature on the subject would point to the roles of both supply side and demand side factors, besides certain global and financial factors, which seem to have been particularly emphasised after the global crisis. From the supply side, the natural rate is conditioned by structural determinants such as productivity, population growth and saving rate (or households’ time preference, as discussed in Section IV). An increase in potential growth is believed to improve the outlook for income growth, thereby stimulating propensity to consume and dampening propensity to save. This in turn leads to higher real interest rate (Mendes 2014; Garrison 2006). Higher potential growth may also brighten the investment outlook, thereby raising the demand for investment, and in turn, pulling up the real interest rate. Increase in potential growth, however, must lead to a permanent change in saving-investment behaviour to be able to alter the natural rate. If the existing capital stock becomes more productive, say due to technological progress, marginal productivity of capital may increase, encourage investment, and raise the natural rate. If the labour force growth increases – either due to higher population growth, favourable demography or improved labor force participation rate– more investment would be required to absorb the labour force, pushing up the natural rate (i.e., the rate at which potential growth is fully realised). In a study, based on data for Japan, it was found that a decline in the ratio of workers to total population due to population aging lowered the real interest rate. While total factor productivity was found to be the key driver of variations in real interest rate, demographic factor was quantitatively important in the long-run (Ikeda and Saito 2014). On the demand side, both fiscal policy and monetary policy may have some role in altering the time path of the natural rate. An expansionary fiscal policy could pose crowding-out pressures, impact the pace of growth in capital stock and raise the marginal product of private capital, leading in turn to higher real interest rate (Engen & Hubbard 2004). Higher sovereign debt should exert pressure on bond yields by raising default risk premium (Manasse et al. 2003). But, this may not happen in a phase of ultra-accommodative monetary policy coinciding with large scale fiscal stimulus. Moreover, high debt to GDP ratio and low yields in Japan has been a known puzzle in the context of the debate on sovereign debt and interest rate relationship. The fiscal deficit/ debt and interest rate relationship becomes somewhat tenuous under the assumption of Ricardian equivalence. If agents believe that they will have to pay for higher fiscal deficit of today with higher taxes in the future and accordingly save today to offset the public sector dis-saving, there may not be any lasting impact on the interest rate. Unlike fiscal policy, monetary policy normally should not be expected to influence the natural rate, it being neutral in terms of real effects in the medium to long run. As per the standard New-Keynesian macro dynamics underpinning the monetary policy framework of central banks, a central bank can influence real variables as long as nominal wages and prices are sticky in nominal terms in the short run, and therefore, monetary policy changes should not influence forward real interest rates at a horizon that is longer than the period over which wages and prices could adjust. In reality, however, monetary policy shocks seem to exert significant effects on forward real rates over longer time horizon. Estimates suggest that a 100 basis points (bps) increase in nominal yield could be associated with a 42 bps increase in ten year forward real rate (Hanson & Stein 2015). In a prolonged phase of ultra-accommodative monetary policy, with unconventional monetary policies aiming to depress term premium and risk premium for making such policies effective, it is possible that monetary policy may have a role in influencing the natural rate. Importantly, inflation risk premium can be influenced by central banks, given their focus on anchoring inflation expectation.3 But other factors may also alter the inflation premium. For example, a high fiscal deficit / unsustainable sovereign debt may increase the inflation premium demanded by investors. An inflation targeting framework can anchor inflation expectations only in an environment characterised by fiscal prudence. The natural rate concept inherently assumes an economy without financial frictions. But, in reality financial frictions influence investment and saving decisions. As highlighted by Amato (2005), there are four different ways in which financial frictions could influence the natural rate: (a) risk premia or credit rationing due to asymmetric information; (b) contractual imperfection (such as incomplete indexation); (c) exceptional errors of market participants; and (d) agency problem within the financial sector (such as short horizon of portfolio managers). Depending on the model assumptions (on whether or not financial markets are frictionless), the natural rate may react differently to aggregate shocks (Foire & Tristani 2008). Natural rate in an open economy context has to recognise the importance of real interest rate parity hypothesis, and also the easing of impediments to global convergence of real interest rates with progressive deepening of financial integration. Price arbitrage across similarly risky investment options may be driving this convergence. As highlighted by Rogoff (2006), “…globalization is weakening the grip of individual central banks over the trajectory of domestic real interest rates except at relatively short horizon”. Estimates for a panel of 22 OECD countries before the global crisis suggested that 48 per cent of variation in real rates was caused by global - not domestic - factors, and that the role of global factors may be rising (Brzoza-Brzezina & Cuaresma 2006). Global real interest rates have declined since 1991, with specific factors contributing to the decline in different phases (IMF 2014). During 1991-2000, inflation centric monetary policy, backed by fiscal consolidation shaped the evolution of the real rates, with the former keeping rates higher to ensure price stability in the early part and the latter subsequently driving the decline in real rates amid price stability. The decline in global real rates during 2001 to 2007 was driven by the global saving glut and portfolio shifts in favour of bonds (that depressed yields), while the post-crisis decline since 2008 reflects the sharp drop in investment demand, particularly in advanced economies (AEs). The role of deleveraging in the household and corporate sectors remains uncertain since overall leverage (including sovereign debt) has increased, but ultra-accommodative monetary policy would have dampened the impact of higher overall leverage on real interest rates. The IMF assessment suggests that the global financial crisis could keep investment demand depressed in the medium run – as has been the experience with past financial crises – but saving rates may recover, implying the possibility of low global real rates continuing for some time (IMF 2014). For the emerging economies, given the flexibility available to domestic economic agents to choose between financing from domestic markets and global markets, domestic saving-investment trends alone may not determine the domestic natural rate of interest. Several other factors may also be in play, whose ramifications may be hard to disentangle from the well-established determinants of the natural rate. Basel-III regulations, for example, may alter the demand for and supply of bonds and thereby alter yields. To meet the liquidity coverage ratio requirement, there could be a shift in the demand for sovereign bonds, covered bonds and high quality corporate bonds, which may alter yields and credit spreads. To meet the net stable funding ratio requirement, banks may have to look for more stable sources of funds, and the associated demand- when many banks compete in the term funding market- may drive up yields on bank bonds (Wellink 2011). Macro-prudential policies to tighten bank lending conditions, and put in place rules on currency mismatch/ foreign borrowings (which could limit the flexibility to choose between domestic vs. international market funding of domestic activities) could alter domestic interest rate (Turner 2014). At the other extreme, factors such as significant increase in life expectancy (changing households’ time preference and therefore the saving rate); increase in inequality (impacting the saving rate); sharp drop in relative price of capital goods (implying same rate of saving funding higher investment activity); and improved investment sentiment driving up the expected return from investment may also impact the trend of interest rates. The natural rate can change when the underlying determinants change. Among all possible determinants, some may be more permanent and others transitory, and importantly, some factors that just work towards pushing the actual real rates away from the natural rate may be wrongly viewed as determinants. Because of this uncertainty, estimated natural rates are generally data and methodology sensitive and they are best presented in the form of a plausible range (as discussed in Section-III). III. The Extent to which the Natural Rate may Vary Over Time: A Review of Empirical Literature The static natural rate assumption of the Taylor rule, and the near universal appeal of this rule as a convenient benchmark for assessing the stance of monetary policy, may create the perception that even if the natural rate varies over time, the magnitude of variations should not be much. A review of empirical estimates of the natural rate for both advanced and emerging economies, however, would throw some major surprises. For the US, it could range between 0 to 5 per cent, and for an emerging economy like Brazil it could range between 1 per cent and 11 per cent (for a review of cross-country estimates, please see Cuaresma et.al 2005 and Baksa et al 2013). Besides large variations over time, at a point in time also the range of estimates for a country could be wide, reflecting methodology and data used for estimation (besides one standard error band around each estimate)4. The uncertainty around estimated value(s) of natural rate has particularly been highlighted in the context of the Fed’s lift off from zero lower bound. Natural rate for the US economy is estimated to have declined from about 3.5 per cent in 1990 to about 2 per cent in 2007; it fell further by 2 percentage points during the recession years of 2008 and 2009. Since then, it is hovering around close to zero (Williams 2015). Forward looking assessments on the likely path of the natural rate going ahead - which is crucial to decisions on the Fed’s lift off -indicate two contrasting viewpoints. Summers (2014), on the ground of secular stagnation (i.e., a chronic case of excess saving over investment) argued that the US natural rate may continue to be around near zero, and therefore normalisation of monetary policy in the US may be delayed. In turn, Yellen (2015) was of the view that the real equilibrium rate in the US was already rising, and may continue to rise as headwinds recede, requiring timely normalisation of monetary policy. Available estimates of the natural rate for India also point to large shifts in its level after the global crisis, with different methodologies yielding varied results. Trend real policy rate (deflated by CPI inflation) derived from application of statistical filters (in particular Hodrick- Prescott) seems to have declined by more than 200 bps in India after the global crisis (Perrelli & Roache 2014). The IMF’s Regional Economic Outlook for Asia and the Pacific (2015) noted that neutral rates in Asian economies declined after the global crisis reflecting lower trend GDP growth at home and lower global neutral rate. It adopted three different methodologies (i.e., theoretical calibration, semi-structural model and extended Taylor rule), and all three estimates for India suggested decline in the natural rate after the global crisis (to about 2.5 per cent, 4 per cent and 1 per cent, respectively, for the three methodologies). While the IMF estimates pointed to positive values of the natural rate during both before and after the global crisis, estimates of Goyal & Arora (2013) indicated that the natural rate remained largely negative during periods of economic slowdown, and largely positive in the boom years. These estimates already point to a range of marginally negative to above 5 per cent for the natural rate of India when both pre-crisis and post crisis periods are taken together. Besides the choice of methodology, the underlying data on real interest rate depending on the choice of deflator could also be a source of variability in estimated natural rates. As highlighted by King & Low (2014), “… Reliable quantitative measures of inflation expectations are notoriously hard to come by and refer only to expectations over time horizons too short to be useful for analyzing saving and investment”. In the context of India, the occasional wide divergence between CPI and WPI inflation should not pose much of a challenge because saving and investment decisions are taken based on medium to long-term inflation expectations rather than observed ex-post gaps in WPI and CPI inflation trends in the short-run. Cash flows of corporates may be affected differently in the short-run depending on their sensitivity to WPI vis-à-vis CPI inflation. But what matters to monetary policy is to anchor inflation expectations of all agents in the economy around the inflation target, which is set out in terms of CPI-C inflation. For generating real policy rates, accordingly, CPI-C (back casted) data have been used in the following sections of the paper. IV. Data and Preliminary Analysis This paper uses quarterly time series data on real GDP (y), consumer price index (CPI-combined) inflation(π) and short-term nominal interest rates (91 day Treasury Bill yield and policy rate (i) covering the period 1996Q2–2015Q1 (overlapping with the availability of quarterly GDP data for India)5. Both GDP and CPI series are adjusted for seasonality using X-13ARIMA-SEATS. Data on India’s inflation expectations of households based on RBI’s survey results are not available for period prior to 2006. Therefore, one year ahead expected inflation data from the World Economic Survey (published by Ifo Institute, available in Datastream) have been used in this paper. Expected inflation is also constructed based on a rolling AR(1) model following the specification below:  where both α and β are allowed to vary over time to identify changing inflation persistence and structural shifts. The above specified equation is estimated using monthly data for the period January 1970 to March 2015, with a rolling window of 120 observations6. The estimated monthly data are then converted into a quarterly series taking average of 3 months. The ex-ante real interest rate (r) is obtained by deflating nominal interest rate (i) (quarterly average) with expected inflation (πe) for the same quarter. Four ex-ante real interest rate series are constructed using different combinations of πe and i: (i) survey based πe and policy rate (r_pol); (ii) survey based πe and treasury bill yield (r_tb); (iii) model based πe and policy rate (r_pol_ar); and (iv) model based πe and treasury bill yields (r_tb_ar). Two ex-post real interest rate series are also generated taking four quarters moving average of inflation, i.e., r_tb_expost (using treasury bill yields) and r_pol_expost (using policy rate). Thus, six alternative real interest rate variables have been used in the paper7. The natural interest rate is not directly observable and is generally estimated by application of different methods, given its importance to the conduct and assessment of monetary policy. In this paper, a structural macroeconomic model has been used that accounts for some of the major determinants of the natural rate set out in Section-II. The overall approach to model specification assimilates the essence of key theoretical arguments explained vividly by Laubach & Williams (2003)8. In essence, this framework allows combining robust theoretical relationships – as embodied in Ramsey’s growth model and the standard New-Keynesian (or neo-Wicksellian) approach to study many policy dynamics – with an estimation technique, the Kalman filter, which is considered generally suitable to model unobservable/unknown macro-dynamics.  If the time preference to consume today relative to tomorrow is high, r must exceed p to encourage saving today. The extent by which saving may increase will depend on the intertemporal elasticity of substitution. By rearranging eq. (1), one could establish why r and g may move together:   Before presenting three variants of state-space models used in the paper, a preliminary statistical analysis of the data on real interest rates and inflation is set out below. From Table 1, it could be observed that both mean and median of the real interest rates are quite different across various measures of real interest rates. In the ex-post case, the mean is negative while the median is positive. Also, the averages are positive when survey based πe is used and are negative where πe is model based. As argued in the literature, simple average of real interest can be used as a proxy for the natural rate where the determinants of the natural rate are constant over time. However, it is difficult to arrive at a representative level of the natural rate from these averages even when the determinants remain constant over time, because divergent averages may vary depending on inflation/inflation expectations assumed to derive the real rates. Inflation expectations that matter to saving/investment decisions must relate to medium/long-run, and one year ahead inflation expectations may not be relevant to an assessment of a rate that can equilibrate saving and investment. Any bias in estimating the real interest rate data used in a model could spillover to the estimated natural rate. One needs to recognise also that the real rates are quite volatile, as evident from their high standard deviations (and underlying inflation rates). A conventional approach often used to assess the time-varying natural rate is to identify structural breaks in the real interest rate series and then take the averages over different statistically earmarked structural regimes. This paper, accordingly, examines structural breaks in unconditional mean of the real interest rates using the methodology proposed by Bai & Perron (1998). For r_tb, two breaks are observed, i.e., in 2008Q3 and 2011Q3, which are also statistically significant. The means of the real interest rates for the regimes defined by the structural breaks relative to corresponding actual real rate are plotted in Figure 1, which suggests that the average real rate was 1.1 per cent during 1996Q2 to 2008Q2 and has hovered around 1.3 per cent since 2011Q3. During the period after the global crisis, reflecting the easy monetary policy stance and accommodation of fiscal stimulus, the average real interest rate was negative at about 1.5 per cent between 2008Q3 and 2011Q2. Another simple method often applied for assessing the changing level of the natural rate is use of univariate filters for extracting the trend from the real interest rate. In this paper, Hodrik-Prescott filter is applied on six different measures of real interest rates and the estimated trends are presented in Figure 2. While trends seem to be divergent (reflecting the divergence in deflators used in different real interest rates), one common feature seems to be the uptrend observed since 2010, broadly following the movements of actual real interest rates. The above mentioned two simple approaches to the natural rate may lack much analytical value in the absence of any explicit structural driving force behind the estimates. Moreover, most univariate filters may not reliably separate permanent and temporary fluctuations and may also suffer from end-point bias. Therefore, multivariate filters like the Kalman filter method, combined with a robust structural specification could be more representative of the economy in terms of capturing the impact of some of the major determinants of the natural rate. Three different variants of the structural approach used for estimating the natural rate are explained in brief below. Model Specifications To extract the natural interest rate from actual real interest rate by studying the dynamics in a model that combines Ramsey’s growth model and the New-Keynesian framework, two different specifications as adopted by LW have been used with suitable modifications to incorporate India specific characteristics. These two specifications include a backward looking IS curve and a hybrid Phillips curve, similar to the approach adopted by Gerlach & Smets (1999) and Smets (2002).   In the second model (M2), apart from equations (4) to (7), a Taylor rule specification is added. In a time-varying natural rate context, Trehan & Wu (2007) have showed that a simple Taylor rule is more robust to uncertainty about the trend growth rate as the policy mistakes made while measuring the change in trend growth gets offset by the accompanying mistake in measuring the change in the natural rate. The equations related to policy reaction and the time-varying natural rate under model M2 could be stated as:   Besides the above two models, a third model (M3) is also estimated having only the Taylor type policy reaction function as in equation (10) along with a random walk specification for the natural rate:  Three different model specifications outlined in the previous section have been written in state-space forms and the parameters are derived through maximum likelihood estimation using Kalman filter12. A direct estimation of the equations by using maximum likelihood approach often gives rise to the ‘pile-up problem’, as the contributions from variations in some of the variables used in estimation to overall variability in the data are relatively small (Me´sonnier & Renne 2007; Laubach & Williams 2003; Stock & Watson 1998; Stock 1994). Because of the pile-up problem, maximum likelihood estimates tend to be biased and the related standard deviations of the innovations are zero. To solve this problem, the sequential estimation procedure proposed by Stock & Watson (1998) has been applied. The following state-space specification is used in the estimation.   Adopting all the above mentioned calibrations, the parameter values are estimated separately using both r_tb and r_tb_ar.14 The estimation results presented in Table 2 show that all the parameters in Model 1(M1) and Model 2(M2) have expected signs and are also statistically significant, except for the coefficient of output gap in the Taylor rule equation. In Model 3(M3), the coefficient of inflation gap in the Taylor rule equation also does not have the expected sign though statistically significant.  It is possible to extract the paths of unobservable variables using Kalman filter within a model. Accordingly, time-varying estimates of the natural rate extracted from M1 and M2 are presented in Figures 3 and Figure 4, respectively. Figure 3 demonstrates both one-sided and two-sided estimates of the natural rate (left panel) along with smoothed estimates of the natural rate and actual real interest rates (right panel) based on r_tb. Both one-sided and two-sided estimates show that the natural rate was rising before the global crisis and has declined thereafter, broadly tracking the pattern of movements in potential growth. The natural rate appears to have fallen by about 200 bps in the post-crisis period. However, one-sided estimates are more volatile as compared with two-sided estimates, though both estimates are very similar towards the end of the sample period. The estimates over time moved in a wide range of 0.3 per cent to 4.1 per cent. The right panel in Figure 3 illustrates the natural rate with (+/-) one standard error bands, along with actual ex-ante real interest rates. The real interest rate gap (i.e., actual real interest rate minus the natural rate) appears to have been negative for a major part of the period since mid-2003, suggesting lack of anti-inflationary thrust in monetary policy. As per the insight from the simple Wicksellian policy rule, actual real interest rate must remain above the natural rate when inflation exceeds the target. Smoothed estimates of the natural rate from M2 using both ex-ante measures of real rates are plotted in Figure 4. Despite sizeable uncertainty surrounding the estimates of natural rate, their trends (as evident from models M1 and M2) are qualitatively similar. Both structural models suggest that estimates of the natural rate of interest in India currently (i.e., last quarter of 2014-15) may lie in the range of 1.6 per cent to 1.8 per cent, with one standard error band of about 50 bps. These core set of estimates relate to output gap derived from the new GDP and use of model estimated inflation expectations to arrive at the actual real interest rate. Incorrect estimation of the natural rate could lead to a period of either excessively tight or over-expansionary monetary policy. According to Orphanidies & Williams (2002), the welfare cost of underestimating the extent of mis-measurement in natural rate is much higher than overestimating it. To deal with the uncertainty about the level of the natural rate, central banks may generally talk about the level of interest rates that would broadly be neutral, instead of conveying any precise number (Chetwin & Wood 2013). Orphanides & Williams (2002) underscored the importance of an “inertial” policy rule, under which the current policy rate decision depends less on the uncertain estimate of the natural rate. Under uncertainty, strategies that do not rely much on estimates of the natural rate may tend to be more robust (Williams 2015). Blinder (1998) suggested that the natural rate is “...most usefully thought of as a concept rather than as a number, as a way of thinking about monetary policy rather than as the basis for a mechanical rule”. It has been argued that the policy rate can deviate from its natural level even when the inflation is stable and output gap is closed, in the presence of persistent headwinds or tailwinds. In particular, a non-neutral policy stance may be required to offset the effects of headwinds or tailwinds and keep inflation at target (Mendes 2014).  The estimates of natural rate for India are highly sensitive to the choice of methodology, the inflation target (4 per cent vs. 6 per cent), ex-post or ex-ante measures of real interest rate used in the model, GDP data (i.e., old base vs. new base), and the nominal rate of interest (i.e., policy repo rate vs. risk free 91-day TB yield) and accordingly, the range could be wider, from 0.6 per cent to 3.1 per cent in Q4 of 2014-15, as against the range of 1.6 to 1.8 per cent, presented earlier as the core set of estimates (Table 2). The appropriateness of a monetary policy stance relative to its stated ultimate goals is commonly assessed by comparing the nominal policy interest rate against a Taylor type rule guided interest rate path, which, however, implicitly assumes the underlying equilibrium real interest rate as constant. This paper uses findings of theoretical and cross-country empirical research to highlight that the equilibrium real interest rate may vary significantly over time, and importantly, the estimated equilibrium interest rate at any point in time may lie within a wide range, depending upon the choice of methodology, underlying assumptions and nature of data. In the post-crisis period, shocks to potential growth paths of countries and vastly altered monetary and fiscal conditions seem to have influenced the evolution of country specific natural rates, even as a complex web of supply side, demand side, regulatory and global factors continue to elude precise estimation of natural rates. This paper uses three alternative specifications of a model drawing on the Ramsey’s growth model and the New-Keynesian framework, and applies Kalman filter technique that is suitable for estimating unobservable components. Major findings of the paper suggest that: (a) the estimated natural interest rate in India is indeed time-varying; (b) the estimates are highly sensitive to the choice of methodology, the measure of inflation (both ex-ante and ex-post) used for deflating the nominal interest rate, and the nature of other data used in the model; (c) the estimated natural rate has declined after the global crisis; and (d) the real interest rate gap remained negative for a major part of the last about one decade or so, indicating that monetary policy stance of the Reserve Bank was largely accommodative, rather than anti-inflationary. The real interest rate gap has almost closed and turned marginally positive in the second half of 2014-15, reflecting the combined impact of inflation centric conduct of monetary policy and the decline in CPI-C inflation which has pushed up the actual real policy rate closer to the estimated natural rate. When inflation exceeds the inflation target, a monetary policy stance could be viewed as anti-inflationary only when monetary policy steers the nominal policy interest rate to ensure that the real interest rate gap turns positive and remains so until inflation is brought back to the target. The conduct of monetary policy under uncertainty is a complex challenge, and a very wide range for the estimated values of the natural rate at any point in time only highlights why a rigid emphasis on policy rules could entail the risk of large policy errors. For the core set of estimates generated in this paper, the range for the natural real interest rate in India for 2015 Q1 comes to 1.6 per cent to 1.8 per cent, with a standard error of 50 bps. When all estimates presented in the paper are seen together, the range looks wider at 0.6 per cent to 3.1 per cent. How should the conduct of monetary policy and its communication deal with the challenge posed by a time-varying natural rate, which may lie anywhere within a wide range at any point in time? There is no obvious answer to this question. One feasible way to deal with the challenge could be to only highlight uncertainty in policy communications instead of communicating precise estimates of the natural rate. Moreover, because of uncertainty, monetary policy response may have to be inertial, and not guided excessively by the path suggested by any policy rule. The policy error that may stem from following an imprecise estimate of the natural rate could be avoided by balancing insights from rules with discretion based on sound judgement. When inflation exceeds the inflation target, if a positive real interest rate gap could be hard to justify because of lack of consensus on the true value of the natural rate, then as a minimum the actual real policy interest rate must remain positive on average, as recommended by the Dr. Urjit Patel Committee Report. @ Harendra Kumar Behera is Assistant Adviser, Sitikantha Pattanaik is Director and Rajesh Kavediya is Assistant Adviser in the Monetary Policy Department of the Reserve Bank of India. * The views expressed in the paper are those of the authors and not of the institution to which they belong. 1 Equilibrium real interest rate, natural interest rate and neutral real interest rate are used interchangeably in this paper. 2 Thornton (1802) is often credited for providing the first rigorous and systematic analysis of the relationship between interest rates and inflation. 3 Nominal yield = real expected short rate+ real term premium + expected inflation + inflation risk premium (Imakubo & Nakajima 2015). 4 Estimated one standard error of 109 to 258 bps was reported by Laubach & Williams (2001). 5 In India, data on CPI-combined (CPI-C) are available since January 2010 and on CPI for Industrial Workers are available for a longer period; the CPI-C is backcasted by establishing a relationship between these two series for the common sample period. New GDP data [i.e. Gross Value Added (GVA), base year 2011-12] are available since 2011Q2 and GDP at factor cost data (base year 2004-05) are available for 1996Q2 – 2012Q3. Therefore, GVA data prior to 2011Q2 are back casted using splicing method. 6 Estimated inflation persistence (β) and estimated expected inflation are set out in Annex 1. 7 The natural rate concept in empirical literature generally relates to a short-term risk free interest rate. Therefore, besides policy repo rate, 91-day Treasury Bill rate has also been used. 8 Hereafter, all references to Laubach & Williams (2003) are represented as LW. 9 More details about λg are given in section V. 10 In India, according to Agreement on monetary policy framework (2015), the CPI-C inflation target for January 2016 is below 6 per cent, and 4 (+/-) 2 per cent for all subsequent years. For the purpose of estimating natural rate, both 6 per cent and 4 per cent targets have been used. 11 This is because a positive shock to the natural rate, which is not identified by the policy-maker in real time, will lead to a negative policy shock (Cour-Thimann, et al. 2006). 12 Given a set of measurement and transition equations, the Kalman filter provides the best linear unbiased estimate of the unobservable variables. A filtered estimate of these variables is one-sided when it uses information only up to time t, whereas a smoothed estimate is two-sided when it uses information from the whole sample. 13 This calibration is based on the estimated value of 2.2 - 3.0 by Kapoor & Ravi (2010) for India. The values of natural rate changed in the range of 1.4 to 2.2 for the final period when is recalibrated in the range of 2 to 4. 14 In modeling process, various specifications such as different lag structures are tested; but finally the lags are chosen by looking at their statistical significance. References Aleem, A. (2010). Transmission Mechanism of Monetary Policy in India. Journal of Asian Economics, 21, pp. 186–197. Amato, J. D. (2005). The Role of the Natural Rate of Interest in Monetary Policy. BIS Working Papers, No. 171, March. Bai, J., & Perron, P. (1998). Estimating and Testing Linear Models with Multiple Structural Changes. Econometrica, 66(1), pp.47 - 78. Baksa, D., Felcser, D., Horváth, A., Norbert, K. M., Köber, C., Krusper, B., Soós, G. D., & Szilágyi, K. (2013). Neutral interest rate in Hungary. Blinder, A. S. (1998). Central Banking in Theory and Practice. MIT Press, Cambridge, MA. Brzoza-Brzezina, M., & Cuaresma, J. C. (2007). Mr. Wicksell and the Global Economy: What drives real interest rates? Working Papers in Economics and Statistics, University of Innsbruck, url: http://ssrn.com/abstract=979907. Chetwin, W., & Wood, A. (2013). Neutral Interest Rates in the Post-crisis Period. url: http://www.rbnz.govt.nz/research_and_publications/analytical_notes/2013/an2013_07.pdf. Cour-Thimann, P., Rasmus, P., & Livio, S. (2006). The Output Gap and the Real Interest Rate Gap in the Euro area, 1960–2003. Journal of Policy Modeling, 28, pp. 775-790. Cuaresma, J. C., Gnan, E., & Ritzberger-Grünwald, D. (2005). The Natural Rate of Interest - Concepts and Appraisal for the Euro Area. Monetary Policy and the Economy, Q4/05, pp. 29-47. Engen, E. M., & Hubbard, R. G. (2004). Federal Government Debt and Interest Rates. NBER Macroeconomics Annual, Cambridge, Massachusetts: National Bureau of Economic Research, pp. 83-138. Foire, D.F., & Tristani, O. (2008). Credit and the Natural Rate of Interest. ECB Working Paper No. 889, April. Garrison, R. W. (2006). Natural and Neutral Rates of Interest in Theory and Policy Formulation. The Quarterly Journal of Austrian Economics, 9(4), pp. 57-68. Gerlach, S., & Smets, F. (1999). Output Gaps and Monetary Policy in the EMU Area. European Economic Review, 43(4-6), pp. 801–812. Goyal, A., & Arora, S. (2013). Estimating the Indian Natural Interest Rate and Evaluating Policy. IGIDR Working Paper, No. WP-2013-017, url: http://www.igidr.ac.in/pdf/publication/WP-2013-017.pdf. Hanson, S. G., & Stein, J. C. (2015). Monetary Policy and Long-term Real Rates. Journal of Financial Economics, 115, pp 429-448. Humphrey, T. M. (1975). Interest Rates, Expectations, and the Wicksellian Policy Rule. Working Paper 75-2, Federal Reserve Bank of Richmond, July, Humphrey, T. M. (1997). Fisher and Wicksell on the Quantity Theory. Federal Reserve Bank of Richmond Economic Quarterly, Fall, pp. 71–90. Ikeda, D., & Saito, M.(2014). The Effects Of Demographic Changes on the Real Interest Rate in Japan. Japan and the World Economy, November, 32, pp 37-48. Imakubo, K., & Nakajima, J. (2015). Estimating Inflation Risk Premia from Nominal and Real Yield Curves using a Shadow-Rate Model. Bank of Japan Working Paper Series, No.15-E-1, April. International Monetary Fund (2014). World Economic Outlook. Washington D.C., April. International Monetary Fund (2015). Regional Economic Outlook: Asia and Pacific. April. Kapoor, M., & Shamika, R. (2010). Elasticity of Intertemporal Substitution in Consumption (σ): Empirical Evidence from a Natural Experiment. url: http://ssrn.com/abstract=1673140. Kapur, M., & Behera, H. (2012). Monetary Transmission Mechanism in India: A Quarterly Model. RBI Working Paper Series, June. Khundrakpam, J. K., & Jain, R. (2012). Monetary Policy Transmission in India: A Peep Inside the Black Box. RBI Working Paper Series, June. King, M., & Low, D. (2014). Measuring the ''World'' Real Interest Rate. NBER Working Paper No. 19887, National Bureau of Economic Research, February. Laubach, T., & Williams, J. C. (2001). Measuring the Natural Rate of Interest. url: www.federalreserve.gov/pubs/feds/2001/200156/200156pap.pdf. Laubach, T., & Williams, J. C. (2003). Measuring the Natural Rate of Interest. The Review of Economics and Statistics, 85(4), pp. 1063-1070. Manasse, P., Roubini, N., & Schimmelpfennig, A. (2003). Predicting Sovereign Debt Crises. IMF Working Paper 03/221. Mendes, R. R. (2014). The Neutral Rate of Interest in Canada. Bank of Canada Discussion Paper 2014-15, September. Me´sonnier, J. S., & Renne, J. P. (2007). A Time-varying ‘‘Natural’’ Rate of Interest for the Euro area. European Economic Review, 51, pp. 1768–1784. Neiss, K., & Nelson, E. (2001). The Real Interest Rate Gap as an Inflation Indicator. Bank of England Working Paper No. 130, April. Orphanidies, A., & Williams, J. C. (2002). Robust Monetary Policy Rules with Unknown Natural Rates. Brookings Papers on Economic Activity, 2002(2), pp. 63-146. Patra, M. D., & Kapur, M. (2012). A Monetary Policy Model for India. Macroeconomics and Finance in Emerging Market Economies, 5 (1), pp. 16-39. Perrelli, R., & Shaun, K. R. (2014). Time-Varying Neutral Interest Rate – The Case of Brazil. IMF Working Paper, No. WP/14/84, May. Rogoff, K. (2006). Impact of Globalisation on Monetary Policy. In The New Economic Geography: Effects and Policy Implications, Federal Reserve Bank of Kansas City. Smets, F. (2002). Output Gap Uncertainty: Does it matter for the Taylor Rule? Empirical Economics, 27, pp.113–129. Stock, J. H. (1994). Unit roots, Structural Breaks and Trends. In: Engle, R., Mcfadden, D. (Eds.), Handbook of Econometrics, vol. 4. Elsevier, Amsterdam, pp. 2739-2841. Stock, J. H., & Watson, M. W. (1998). Median Unbiased Estimation of Coefficient Variance in a Time-varying Parameter Model. Journal of the American Statistical Association, 93, 349–58. Summers, L. H. (2014). U.S. Economic Prospects: Secular Stagnation, Hysteresis, and the Zero Lower Bound. Business Economics, 49 (2), pp. 65-73. Taylor, J. B.(1993). Discretion versus Policy Rules in Practice. Carnegie Rochester Conference Series on Public Policy, 39, pp. 195-214. Thornton, H. (1802). An Enquiry into the Nature and Effects of the Paper Credit of Great Britain. Printed for J. Hatchard, bookseller to the Queen, London. Trehan, B., & Tao W. (2007). Time-varying Equilibrium Real Rates and Monetary Policy Analysis. Journal of Economic Dynamics and Control, 31(5), pp. 1584-1609. Turner, P. (2014). The World Long-term Interest Rate, Exchange Rates and Macro-Prudential Policies. Presentation at the Conference of Central Bank of Argentina, Buenos Aires, Nov.18, 2014. Wellink, N. (2011). Basel III and Impact on Financial Markets. BIS Central Bankers’ Speeches, Amsterdam, 14 April. Wicksell, K. (1898). Interest and Prices. London, Macmillan (translation by R.F. Kahn published in 1936). Williams, J. C. (2015). The Decline in the Natural Rate of Interest. FRB San Francisco manuscript, forthcoming in Business Economics., url: Woodford, M. (2000). A Neo-Wicksellian Framework for the Analysis of Monetary Policy. Working Paper, Princeton University, September. Yellen, J. L. (2015). Normalizing Monetary Policy: Prospects and Perspectives. Speech delivered at a research conference, San Francisco, California, url: http://www.federalreserve.gov/newsevents/speech/yellen20150327a.htm.  |

പേജ് അവസാനം അപ്ഡേറ്റ് ചെയ്തത്: