IST,

IST,

RBI WPS (DEPR): 14/2011: Recent Global Crisis and the Demand for Gold by Central Banks: An Analytical Perspective

| RBI Working Paper Series No. 14 Abstract 1When India purchased 200 tonnes of gold under the International Monetary Fund's limited gold sales programme, it was interpreted inter alia that it may further inflate the gold price when the price was already ruling high. This motivated us to examine the general trend among the central banks’ demand for gold during recent global financial crisis. In that context, whether India’s purchase of gold was a reserve management strategy or otherwise and whether it affected the gold price trend is examined in this study. In the course of analysis, several related issues such as optimum size of gold in the foreign reserves and rationale of central banks buying gold with special reference to the global crisis are also addressed. The study found that central banks in most of the EMEs and advanced economies had either bought fresh stock of gold or stopped selling their existing stock of gold in the wake of the ‘recent global crisis’. This was strongly supported by economic rationale to hold sizable reserves of gold especially during ‘heightened uncertainty’. India’s purchase did not, apparently, have any impact on the gold price trend and to stock up gold is in line with the global trend. JEL Classification: E5, E58, F31, G01. Keywords : Central Banks, Central Banking Policies, Foreign Exchange Reserves, Global Financial Crisis. ‘…in the 2500 years that gold has fulfilled a monetary role, it has proved an asset worthy of the trust that investors have placed in it over the long term, providing shelter from the unforeseen and the unforeseeable…’ James E Burton, Jill Leyland, Katherine Pulvermacher Introduction Ever since global financial crisis erupted, there seems to be a perceptible escalation in gold price. Although a number of reasons have been conjectured, the augmentations of the official reserves of gold across many countries have been widely perceived as one of the important cause for spiralling gold price. This is corroborated by the recent gold investment digest (WGC, 2010) which reported that after two decades, a steady source of supply to the gold market, in 2010, central banks had become ‘net buyers of gold’. India also officially purchased 200 tonnes of gold from IMF in October 2009, which placed its position ahead of Russia to ninth place (Bloomberg, 2009). However, with continuous purchase of gold by many central banks during 2010, Russia progressed to eighth position, while India was pushed to eleventh position (WGC, 2010). Besides, it was reported that India’s purchase of gold was among the factors that impacted gold price in the world market and also boosted the price expectations (commodityonline, 2009). However, Subramanian (2010), stated India’s acquisition of gold, from the IMF is seen with some national pride, as a reversal of the early 1990s decision to mortgage gold. Similarly, India’s purchase of gold was also viewed with the rationale that the uncertainty of the major reserve currencies, (viz., the dollar and euro) spurred central banks, including India and China, to buy gold. The Reserve Bank had stated that gold was bought with the intent to diversify its foreign exchange reserve, which is not uncommon among the central banks. In this background of widely divergent observations, attempt is made to examine (i) whether Reserve Bank’s purchase of gold is an aberration or a strategy to diversify its foreign reserves, (ii) the global trend of gold in official reserves among the central banks, especially during and post global crisis (iii) whether RBI’s purchase of gold influenced the escalating gold price trend and (iv) to trace the economic rationale for central banks to prefer buying gold, especially during crisis. Accordingly, Section I presents some stylized facts on gold at global vis-a-vis India. Section II traces the historical background, in brief, on the role of gold under different monetary regimes. Section III dwells on the forex reserve management by central banks, objectives and the place of gold in the overall foreign reserves and importance of gold as part of reserves. Section IV analyses the trend of central banks buying gold across the world in the wake of global financial crisis. Section V dwells on the position of gold in India’s foreign exchange reserves and the optimum level of gold in the forex reserves. Finally, Section VI presents concluding observations. Gold – Some Stylised Facts It may be of particular interest to note that, though there has been a dip in the private demand for gold at both global and Indian level during the crisis years 2008 and 2009, gold as part of the official reserves increased both at global level and at Indian level. As against this, before the crisis period, there was a declining trend in the official reserves position at the global level. During 2009, the sharp decline in the private demand for gold was more pronounced in the jewellery segment mainly due to sharp increase in gold price.

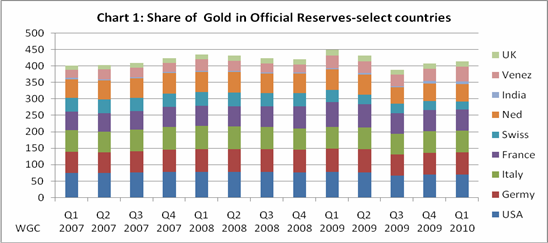

Section II Gold Standard Gold standard means that the monetary authority holds sufficient gold reserves (i.e.,100 per cent) to convert all of the representative money, it has issued, into gold at a promised exchange rate. In other words, the gold standard is a legal enactment to the effect that the legal tender of a country shall be convertible on demand into a specified quantity of gold (Jones, 1933). However, originally, gold standard referred to actual circulation of monetary units in terms of gold. Under the gold standard, currency units were defined in terms of a given quantity of gold and were typically convertible into gold (and/or silver, in the case of a bimetallic system) as pointed out by Sachs et al. (1993). The monetary unit was kept at a fixed gold value either by the direct convertibility of the paper or tokens into gold (Hawtrey, 1919). The inter war period made an innovation into a ‘gold exchange standard’ wherein the member countries would make their currencies convertible in gold but to use foreign exchange – the currencies of key reserve countries, such as the UK and the US as a substitute of gold (Bordo et al., 2001). Under this system gold was not in local circulation and yet prices were expressed in gold. Goldenweiser (1929) pointed out that prior to the First World War, India and Philippines were having gold exchange system. In the post-war readjustment, the world reinvented gold standard which Goldenweiser (1929) described as the ‘gold reserve standard’ which is relatively independent of the specific legal provisions about convertibility of notes or the availability of gold for export. Therefore, Bernanke et al., (1990) referred this as ‘gold reserve system’ aimed at economizing gold as against the gold standard which required a huge gold reserves to maintain convertibility at the gold parity since each citizen has the right to convert his bank notes into gold at anytime (Bernholz P, 2002). Thus, the phrase "gold standard" included a variety of standards which had the common feature of ‘stable relationship’, fluctuating only within the gold points, between a country's currency and its gold (Goldenweiser, 1929). The critical point of the system was the credibility of the official commitment to gold and such commitment was international. It is stated that the ‘gold standard’ had always encountered practical hardship to put into operation. At any point of time the total demand for gold was much greater than its limited supply, and hence the quantity of gold available in the world was smaller to sustain the ever growing modern-day economic activities among the countries. For instance, though Britain had a de facto gold standard from 1717 (Burton et al., 2006), it adopted the system in 1816, against the advice of David Ricardo and ever since Britain adopted gold standard it had been struggling with no great success to maintain it (Michell, 1951). However, Jones, (1933) had stated that it had served England for nearly a century and during the last three decades of the nineteenth century one country after another joined the gold standard group. India (was on a gold exchange standard allied to sterling) in 1898 and the United States was de facto in 1834, while by de jure in 1900 under Gold Standard Act. The gold standard was nearly universal in operation at the outbreak of war in 1914 (Hawtrey, 1919). It was also seen that the gold standard gave uniformity to the monetary unit, not only in time, but in space too. In the literature, the period from 1880 to 1914 has been widely referred to as the ‘classical gold standard’. The central banks were the prime holders of gold. On the eve of the first world war, central banks held over 8,000 m.t.2 (an early estimate by Joseph Kitchin that they held 7,120 m.t. does not seem to include official stocks in Japan, India or South America) as pointed out by Green (1999). However, with the outbreak of war, the gold standard was abandoned by almost every country including the UK and the rest of the British Empire. Treasury notes replaced the circulation of the gold sovereigns and gold half sovereigns. Although in contemporary world it is impossible to maintain the gold standard, this system had the advantage of more stable ‘inflation management’ than discretionary paper money regimes. The gold standard ensured long-term price stability; high levels of inflation were seldom existed and “hyperinflation impossible” as the money supply can only grow at the rate of gold supply. For instance, the monetary expansion from 1897 to 1914, that was experienced worldwide was a reflection of increased gold output (Aghevli, 1975). High levels of inflation under a gold standard was seen exceptional such as during and post war periods due to large scale devastation on the economies. Gold- Fixed and Floating Rate Exchange System The Bretton Woods Conference of 1944 established an international fixed exchange rate regime in which currencies were pegged to the US dollar, which was based on the ‘gold standard’. Mundell (1983) viewed that the Bretton Woods System of ‘pegged-but adjustable exchange rates’ is best understood as a ‘gold-exchange standard’ (or more precisely as a gold-dollar standard). In fact, he referred to it as ‘gold-convertible dollar standard’. However, in 1971 when the gold holdings of the United States fell steeply, it led to the suspension of gold convertibility for the dollar resulting in ‘break down of Bretton Woods System’. Subsequently, Smithsonian Agreement (1971) among the Group of 10 major countries was an effort to revise the Bretton Woods system albeit, it failed. With the adoption of floating exchange rate system by the US, followed by the rest of the developed world, gold lost its sheen as a reserve asset. It was anticipated that foreign-reserve requirements would be reduced substantially and more so the gold/ bullion stock, in principle. Williamson (1976) concurs that tautologically it is true that the use of official reserves would be eliminated under a system of freely floating exchange rates. However, in practice, this proved to be the reverse as many countries had still chosen to intervene in the foreign-exchange market and with the increase in exchange rate volatility, countries felt it is inevitable to hold more foreign exchange reserves including a sizable part of it in gold. On the contrary, it was widely perceived that a higher level of reserves will enhance the credibility of the central bank's exchange rate policy, at least among EMEs. Experiences across countries also revealed that flexible exchange rates based on discretionary paper money standards showed high short-term variability and also medium-term swings around purchasing power parities with diversions of upto 30 per cent and lasting from five to twelve years (Berholz, 2002). From the macroeconomic management perspective, such wide fluctuations are not accepted as a good signpost; therefore interventions with various degrees, in the foreign exchange market have been common among the countries. As a result, foreign exchange reserves with the central banks, irrespective of fixed or flexible exchange rate regime, is considered as necessary. Gold is an essential part of foreign reserves, partly because of historical reasons and partly due to its ‘universal acceptance’ and ‘international liquidity character’. In a nutshell, Starr et al., (2007) concluded that gold remains important as central bank reserve, as a hedge against risks, and as a barometer of geopolitical uncertainty. Section III In view of the discussion in section II, reserves management becomes a key function of the central banks. In a number of occasions the portfolio choices faced by a typical asset manager and those faced by a forex reserves manager are not qualitatively too different as revealed by experiences. For, forex reserve managers, essentially, stated to rely heavily on the ‘portfolio theory’ to get a cue for the best decisions. At the same time, it needs to be underscored that the canvass of central banker is much broader and the choices faced by the central bankers are qualitatively arduous, this is so, because they are entrenched in wider set of trade-offs. Unlike a private sector portfolio, the forex reserves portfolio cannot be considered in seclusion. It is a part of the broader set of assets and liabilities of the country and is held to perform a set of economy-wide functions, viz., insuring against sudden withdrawals of foreign capital, exchange rate management and so on. Other key factors underpinning the appropriate level of reserves include the openness of the economy, as measured by the ratio of the value of foreign trade to the level of gross domestic product; the quantum of international capital flows and more importantly the types and maturity of such flows; capital market restrictions; the magnitude of its foreign debt; and the cost of holding reserves. The forex reserves get accumulated as a ‘by-product’ in the process of adjustment of the stock, while accumulation can also be a ‘conscious attempt’ to build the stock up in order to meet potential objectives as outlined below. Objectives of Reserve Management Central banks hold reserves3 for the following key reasons which are interlinked. The most important reason being it facilitates to intervene in the forex market to ensure orderliness. It helps in meeting transaction purposes, such as to finance foreseeable foreign-exchange demands of the economy. In the run up to the recent crisis, it proved to serve as a buffer against financial shocks. It is needless to emphasise its relevance for payments obligations for foreign trade and services. However, the more important aspect, in the case of emerging economies, has been that it acts as bedrock of investors’ confidence in the country’s ability to meet its foreign exchange commitments. To support domestic monetary policy liquidity management operations also considered a key objective as pointed out by a study. A quick survey of literature reveals that the major reserve management objectives of central banks, in general, are put in the order of their importance, viz., safety, liquidity and return. The blend and ordering of these interrelated objectives will, however, depend on country-specific factors, such as the country’s exchange rate regime, its credit worthiness and its degree of vulnerability to external shocks as well as the range of domestic instruments available for monetary operations. Even for the same central bank, the ordering can vary depending upon the macroeconomic and financial market conditions. It may also be added that, international reserves play a qualitatively different and more important precautionary and monetary role in EMEs than advanced economies (Bery, 2011). Pihalman et al. (2010) put the above objectives in the form of umbrella of “self-insurance” against financial shocks and sudden stops in the access to international capital markets. Previous international financial crises have shown that holding and managing sufficient reserves of foreign currency, and disclosing adequate information on them to markets, helps a country prevent and weather external crises (Kunzel et al., 2009). Sachs et al. (1996) stated that even with fundamentals in the vulnerable zone, high reserves could have a powerful effect in protecting against crises. Therefore, the high cost of reserve holdings does not necessarily imply that developing nations are being irrational (Rodrik, 2005). Importance of Gold as Part of Reserves It is clear from the above that one of the key objectives of reserve management stresses the precautionary/ insurance function of holding of the foreign exchange reserves, at times of emergency. With the possible partial exception of the ‘war chest’ motive, this objective is redefined, in the ‘contemporary central banking’ as serving ‘liquidityfunction’ (Claudio et al., 2008). The role of forex reserves as ‘defence’ against potential financial crisis has been considered an ‘overwhelming function’ among the EMEs especially in the post Asian currency crisis scenario. The forex reserves can be more effective in providing such ‘insurance’ if their value is highest precisely when the probability of occurring a crisis environment is highest (Claudio et al., 2008). Experience reveals holding adequate forex reserves reduce the chances of occurring external crisis and certainly help reducing the cost of managing such an event if it occurs. In order to maximise the insurance aspect, countries typically adopt the strategy of diversifying their forex reserve portfolio into world’s key currencies, viz., US dollar, euro, sterling, Japanese yen and Swiss franc among others. In a scenario where the probability of occurrence of a crisis becomes real, adoption of a strategy of ‘optimum allocation’ across asset classes and currencies becomes even more critical. Here the guiding principle would be to invest in assets/ currencies that are likely to rise in value when other market instruments fall, thereby strengthening the reserve manager’s cache to safeguard against any exigencies. Going by previous experience, especially the past crisis situations, gold’s inclusion in the portfolio did make difference. Lee (2004), in this context, listed out the precautionary demand for reserves under three types of considerations: (a) the ability to finance underlying payments imbalances; (b) the ability to provide liquidity in the face of run on the currency; and (c) the preventive function of reducing the probability of run on the currency. From EMEs’ perspective such as India, Reddy (2006) cited that, official reserves have to reflect the potential market infirmities in the private sector that are needed as a cushion when markets get suddenly risk averse and hence, safety and liquidity should normally have higher orders of priority in the management of reserves. Reddy further cautioned that the comfort level of reserves should not be viewed with respect to the current situation alone but should also reckon the assessment of the emerging risks. Also, Rodrik (2005) is of the view that greater liquidity that reserves provide presumably reduces the likelihood of financial crises, and may also reduce the cost of foreign borrowing in normal times. It is in these contexts, gold being an asset of “safe haven”, its value tend to appreciate at times of stress (Burton et al., 2006) and hence becomes critical to be part of reserves. Though treasuries closely compete with gold, they are subject to the macroeconomic policies and performances of the issuing country and also the credit rating of the issuing country.4 Gold occupies a special position in the foreign reserves of central banks as it is widely stated to be held for reasons of diversification. Moreover, the unique property of gold believed to be its ability to enhance the credibility of the central bank when it holds adequately and this has been proved time and again. Further, gold is no one’s liability; unlike any currency, its value is not greatly affected by particular country’s economic policies including one of those having huge official reserves of gold. As a result of these attributes, it has been considered as a strong defence against any contingencies. Interestingly, gold still remains the most generally acceptable means of international settlement, and therefore it is still a convenient, useful, and necessary part of the reserves of central banks and monetary authorities (Brown, 1949). Greenspan (1999), while addressing to members of US Congress in 1999 remarked that ‘…. gold still represents the ultimate form of payment in the world...’ Besides the above, literature also points out that people, generally, like their country hold sizeable gold reserves. Section IV The period between mid-2007 and 2009 have been the most tumultuous in financial markets’ recent history as the world economy plunged into ‘Great Recession’ a la Volcker (2009) since the ‘Great Depression’. It resulted in banks collapse, equity markets tumbled across the globe, trade shrunk, capital flows dried up, growth slumped and credit spreads escalated sending investors fleeing for the cover of traditional safe haven assets such as government bonds and gold (Green, 2009). Most notably, the unique feature of the ‘Great Recession’ was that, it virtually put even the long trusted financial institutions, to ‘acid test’ on their competence of ‘liquid portfolio’ management. Moreover, brought to the fore the extraordinary vulnerability of the global financial system to disruptions in wholesale funding markets (IMF, 2011B). Even century old financial institutions were reduced to rubble. It is distressing to note that, even after the lapse of three years, the global recovery remains elusive and heavily reliant on monetary and fiscal stimulus for whatever little growth it has, making a quick reversal in the fiscal situation unlikely (IMF, 2010). Downside risks were increasing and continued to do so in early Financial Year 2011 (IMF, 2011A). In fact, symptoms of excessive risk taking are evident in a few advanced and a number of emerging market economies (IMF, 2011B). The IMF estimated that advanced economies’ debt/GDP ratios will exceed 100 per cent of GDP in 2014, some 35 percentage points higher than when the crisis began. As a result, sovereign bond issuance is likely to remain at historically high levels in the coming years and further sovereign downgrades seem likely (WEO, 2010). Accordingly, adding to the woes, some of the prominent European countries’ (i.e., GIIPS)5 sovereign bonds debacle shook the confidence of investors and institutions in the sovereign bond market. Over and above, the latest and biggest in the series of events that contributed to the uncertainty in global markets was the recent downgrading of the U.S credit rating from ‘AAA to AA+’. While on the other, the gold market remained liquid throughout the financial crisis and, even at the height of liquidity strains in all other markets (Green, 2009). This reflects the depth and breadth of the gold market, as well as the flight-to-quality tendencies exhibited by investors. Because, gold holds its values even at the adverse market conditions (Baur et al., 2010). A study estimates that the daily turnover volumes in the gold market to be larger than even the UK Gilt and German Bund markets. Despite recession following crisis, gold price soared by 25 per cent in 2009 to US$ 1,087.5 /oz registering the ninth consecutive annual increase. It further continued to increase to reach US$ 1,410/oz by end of December 20106 (further up by more than 24 per cent). Baur et al. (2010) stated since the beginning of the financial crisis in July 2007 to March 2009, the nominal gold price has risen by 42 per cent. Thus gold has proved to be the sole reliable instrument, which bears no counterparty or credit risk, and is a permissible reserve asset, practically, in every central bank in the world. In view of this, many central banks either stopped selling or turned out to be net buyers of gold (Table 4) during the global crisis. Incidentally, it may be underscored that countries opting to buy gold, especially during economic crisis and uncertainty are not new as such trends were observed even during the earlier occasions of crisis. The credit and economic crisis triggered fresh demand for the precious metal, similar to what were experienced during other major global crises, for instance, even the U.S. opted for steady purchases of gold in the 1930s and 1940s (Green, 2009). WGC (2010) also reported that the central banks became net buyers of gold for the first time in 21 years.7 In the first half of 2011, central banks were net buyers of over 155 tonnes of gold, almost double the 87 tonnes of net purchases in 2010 (WGC, 2011) – signalling the end of an era in which the official sector had been a source of significant supply to the gold market. The Central Bank of Philippines is well known for active buying of gold even from the open market. Therefore, its gold reserve is subject to fluctuation as it buys up domestic production and later sells in the market. The Philippines was also a net purchaser in both 2008 and 2009, in contrast to being a net seller in the years 2003 to 2007. The Philippines central bank has stated explicitly that it holds gold for its diversification, security and inflation hedge benefits. Venezuela, also periodically buys gold from the domestic production but for many years it had used gold in such a way that it did not entail increasing its formal gold reserves. However, it also bought from domestic production adding to its gold reserves during and after the global financial crisis (2009 and 2010). Similarly, Qatar reported to have added 12 tonnes to its reserves during 2007. The Governor of the Saudi Arabian Monetary Agency (SAMA) has, confirmed that the increase of 180 tonnes in the country’s gold reserves announced earlier did not represent a recent purchase of gold, but rather a reclassification of gold it already owned into the category of official reserves. Germany and France were among the prominent EU countries for big sale of gold but ostensibly slowed down their sale during and post crisis. Some of the Central Commonwealth Independent States (CIS) countries such as Russia, Ukraine, Belarus and Kazakhstan are also prominent in purchasing gold in the recent years. The Central Bank of the Russian Federation bought almost at regular intervals some quantity of gold thereby bringing the total of Russia’s gold reserves to 664 tonnes (businessworld.com). In 2011, Russia has planned to buy 100 tons as reported by Bloomberg.com (2011). China being the world’s top producer of gold overtaking South Africa, revealed that it had stacked up its own government holdings of gold to 1,054 tonnes from 600 tonnes when it last reported its holdings in 2003 thus increasing its gold reserves by as much as 76 per cent since 2003 as reported by the official Xinhua News in April 2009. Incidentally, China do not permit export of gold ingots, only jewellery are permitted, leaving plentiful supplies for the domestic market (financialpost.com). Ever since the global crisis which impacted the US dollar strongly, China is reported to be converting its sizable forex reserves into gold (commodityonline.com). China has further aggressive programme to buy gold as an alternative asset (Subramanian, 2010). Mexico bought 93.3 metric tons since January 2011, increasing its holdings from just around 6.9 metric tons to 100 metric tons in recent months. Mexico’s purchase formed part of the central bank’s ordinary investment activities, and the gold represents about 4 per cent of the nation’s international reserves as reported by the Banco de Mexico. It further clarified that these purchases are part of the “regular policy of the Bank in regards to investment and diversification”. The Bank of Thailand also purchased 15.6 tonnes of gold in July 2010. With the country’s foreign currency reserves growing rapidly in recent years, this purchase helped to restore the proportion of gold in Thailand’s total reserve portfolio. Along with India, Bangladesh and Sri Lanka also bought gold from IMF at around the same time. South Korea's central bank became the latest official sector buyer, announcing the purchase of 25 tonnes, its first foray into the gold market in more than a decade (Reuters, 2011). It is amply clear from the above survey, the series of events in recent years, notably the unsettled global financial crisis, followed by the GIIPS debt crisis and the recent downgrading of sovereign credit rating of the U.S. have tipped the balance away from net selling of gold by the official sectors towards net buying. Seen from that perspective, two aspects become palpable. Firstly, the increasing uncertainty due to global financial crisis and aftermath pushed central banks, both advanced and emerging economies to stock up gold. Secondly, India’s recent purchase of gold is no exception and is in line with global trend. Thus the recent global macroeconomic and financial crisis has only reinforced the importance of gold as part of official reserves in the balance sheets of central banks around the world. The IMF’s latest Annual Report (2010) also revealed that the market value of gold reserves increased by 25.2 per cent, largely due to substantially higher gold prices in 2009. There is also a perception that ‘…the strategies of reserve managers have changed in the last couple of years since the global financial crisis...’(Natalie, 2011). Further, she stated that there is much more ‘emphasis now on risk-management strategies, as opposed to yield enhancement…’ Although central banks do not always publish the reasons for their reserves management decisions and even when reasons are publicly announced they are unlikely to fully reflect the long deliberations that go into develop policy (WGC). Pihalman and Han (2010) however, stated that central banks reveal ‘...slowly, but surely more and more information about their reserves management activities typically in their annual reports...’ Nonetheless, it is not always extremely hard to surmise the reasons for such accumulation. Thus, the global financial crisis and the series of events following the crisis have clearly resulted in increased uncertainty and the corresponding increase in the demand for gold. More central banks are buying the precious metal to hedge against the euro and dollar debt crises (Deutsche Welle, 2011). Further, with down grading of the US credit rating and the consequent global uncertainty, there are views that buying trend of gold will continue upwards as long the debt problems in Europe and the US remain unsolved Eugen Weinberg (2011) and Natalie (2011). The demand for gold is also coming from emerging-market nations that are accumulating foreign-exchange reserves according to Natalie (2011). Size of Gold Holdings by Central Banks As pointed out earlier, practically all central banks around the world hold a portion of their official reserves in gold. Chart 1 exhibits select central banks having a sizable proportion of their foreign reserves in the form of gold. With global financial crisis and the consequent fresh purchases/ non-selling of the existing stock, the proportion of official reserves of gold in the total reserves have increased (Table 2 and Chart 1). The physical stock of official gold held by emerging and developing economies also sharply increased by 13.4 per cent in 2009, while the stock held by advanced economies declined marginally, by 0.5 per cent. Further, gold constituted 20.1 per cent of the reserves of advanced economies, which hold 80.5 per cent of the world’s gold reserves, and 3.2 per cent of the reserves of emerging and developing economies.

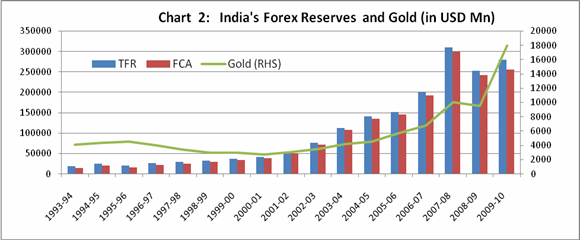

It is worth being underlined that besides the central banks, a number of other international/ multilateral bodies also hold huge amount of gold reserves (Table 3). Were Central Banks the Major Sellers of Gold? Earlier, central banks in Europe were holding as much as 70 to 90 per cent of their foreign exchange reserves in gold and some central banks such as, Swiss National Bank’s gold’s percentage was high at 82 per cent, even as late as end of 1980 (WGC). However, ever since the fall of Bretton Woods, central banks found gold had lost its sheen and therefore were rushing to sell the yellow metal in the open market. After the Jamaica Agreement in 1976 which demonetised gold as an international reserve asset, IMF too sold half of its gold holdings and returned the other half to its members (Lakshmi, 2007). These persistent sales depressed the price of gold sharply and the fear of a further fall in price shrunk demand as well. There was chaos and uncertainty in the gold market when central banks around the world were selling huge quantity of gold at the same time, so much so leading to a virtual crash in the gold prices. By August 1999, the price had slid to $250 per ounce (Subramanian, 2010). This was the trigger point for the central banks to get into agreement upon sales quotas. A key raison d'être of Central Banks Gold Agreement (CBGA) is that the on-market sales be carefully phased over time so that gold-dumping and the consequent price crashing would be avoided. This Agreement is also known as “Washington Agreement”, and the practice is continued by central banks till now (Box:1). Incidentally, though IMF is not a signatory to the Agreement, it complies with the Agreement and all the sales of gold by IMF also become part of the overall quota of CBGA. Overall, central banks alone have supplied an average of 400 to 500 tonnes per year to the market since 1989 to 2007 (WGC, 2011). However, the trend seems to have reversed by the recent global financial crisis. Box 1: Central Banks Gold Agreement (CBGA) The first CBGA was signed in September 1999 for five years, wherein 15 signatories viz., European Central Bank, other central banks of the then Eurosytem, Sweden, Switzerland and the UK agreed to limit their collective gold sales. They also agreed not to increase their gold leasings and their use of futures and options during this period. CBGA-1 was in operation till September 26, 2004 covering a total sale of 2000 tonnes of gold. The Agreement was renewed for a further period of five years in 2004 which was called CBGA-2. Greece, became a signatory later, while the UK, having no plans to sell gold was not a signatory. Slovenia in 2007, Cyprus and Malta in 2008 and Slovakia in 2009 became members. The CBGA- 2 (September 27, 2004 - September 26, 2009) provided for a maximum of 500 tonnes to be sold in each agreement year and accordingly, the total sales were 1,883 tonnes. The CBGA-3 commenced a five year period from September 2009 and provides for a maximum of 400 tonnes to be sold in each agreement year. This includes 403.3 tonnes sale by the IMF. Incidentally, IMF was also the only significant seller to date. Fund’s sales of 212 tonnes of gold in 2009 were completed, which include India’s purchase of 200 tonnes. These transactions were off-market transactions, and therefore did not constitute net selling to the private sector (Table 4). The remaining were sold in market channel as reported by WGC (2010). Section V In 1990, when India faced external sector crisis, the foreign currency assets depleted to less than three weeks’ imports. With financial liberalisation and opening up of economy, the foreign currency reserves rose due to capital inflows, while the quantum of gold remained more or less constant over the years. With no fresh purchases of gold, its proportion fell sharply until the addition of 200 tonnes in the late 2009. India Pledged Gold in 1991 The foreign exchange crisis in August 1990 was mainly aggravated by the loss of remittances from the Middle East countries due to ‘Gulf War’ (RBI, 1991). The additional burden of oil imports due to sharp oil price hike as a consequence of Gulf crisis added fuel to fire. Besides the above, recessionary trend in the West had depressed the demand for India’s exports. All these gave sufficient indications that the net resource transfer on account of official and private credit to be negative in 1990-91 i.e., the fresh inflows were paltry to meet the obligations on account of amortization and interest payments. By 1991, the size of the India’s debt was US $ 71,557 million (Basu, 1993), while, the level of foreign exchange reserves fell to US$1.2 billion in July 1991 (International Food Policy Research Institute, 2005). Reddy (2005) stated that in June 1991 the foreign exchange reserves fell to a level equal to barely a week’s imports. This distressed situation compelled the Reserve Bank to pledge gold with the Bank of England to raise loans. This was not, however, unprecedented among countries to pledge gold to meet exigencies. For instance, Lakshmi (2007) pointed out that Italy pledged gold with Bundesbank and secured a $2 billion loan and Romania used gold as collateral to secure a loan to repay external debt in 1974. Russia, when encountered with financial crisis in 1998 sold off 33 per cent of its gold reserves. In 2001, Russia again sold its gold holdings to generate funds to tackle the series of natural disasters that had befallen on the country. India redeemed the pledged gold after repaying the loans. In May 1991, the Government had leased 19.99 tonnes of gold, out of its stock of confiscated gold to the State Bank of India (SBI), which, in turn, sold 18.36 tonnes in the international market with a repurchase option. SBI repurchased gold in November-December 1991. Subsequently, the 18.36 tonnes of gold was sold by the Government to the RBI. The balance of 1.63 tonnes of gold had been returned by the SBI to the Government. The gold involved in both the transactions, adding up to 65.27 tonnes, was kept abroad (RBI, 1991). This gold continued to be deposited abroad earns some returns. The physical holding of gold reduced by about 39 tonnes and the stock stood at 358 tonnes in 1998 and this is due to the repayment on maturity of gold backed bonds issued in 1993 (Lakshmi, 2007). This level almost continued till as recently as the new transaction took place. Thus it is clear, when the country was facing external sector crisis gold holdings came in a big way to help, as gold is regarded as ‘universally accepted currency’. India’s Purchase of Gold in 2009 When the Reserve Bank bought 200 metric tons of gold at US $ 1045 /ounz for a total amount of US $ 6.7 billion, Bloomberg News reported that Green Timothy had stated that the Indian transaction is “…the biggest single central-bank purchase that we know about for at least 30 years in such a short period…” At the same time, there was a view that, with the dollar getting further weaker (at that point of time) the RBI’s move to buy gold was seen as a forward looking and a diversification effort. The Economist (2009) reported that ‘…every central bank with a large holding of American debt is worried about capital losses if the dollar continues to weaken...’ this holds good even in the case of India and China. The Reserve Bank, as part of its transparent policy made it clear that it was attempting to rebalance its reserves composition with the purchase of 200 tonnes of gold. In fact, this is in line with the strategy adopted by most of the central banks around the world as pointed out earlier. Correspondingly, Chart 2 reveals that the gold reserve was fairly flat for a fairly long time and then a moderate increase mainly due to increase in gold price, while the foreign currency and total foreign reserves showed a sharp increase. The value of gold reserves showed a sharp increase only since mid 2008-09.

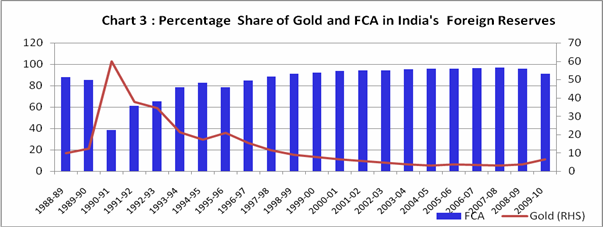

Back in the mid-1970s, gold accounted for around 20 to 25 per cent of total reserves and later on it came down in the range of 5 per cent to 12 per cent till 1989-90. However, in 1990-91 the percentage share of gold in the total foreign reserves shot up to as high as 60 per cent. This was mainly due to revaluation of gold in line with the gold price in the international market in mid-October 19908 besides dwindling of the foreign currency reserves. However, the strong liberalisation on the external sector and the corresponding forex inflows led to build up of foreign exchange reserves. With no matching addition to the physical gold stock, the percentage share of gold in the total foreign reserves, reached to less than 4 per cent in 2007 and 2008. The fresh addition of 200 tonnes of gold to the stock in late 2009 increased the share of gold in the foreign exchange reserves to around 6.5 per cent (Chart 3).

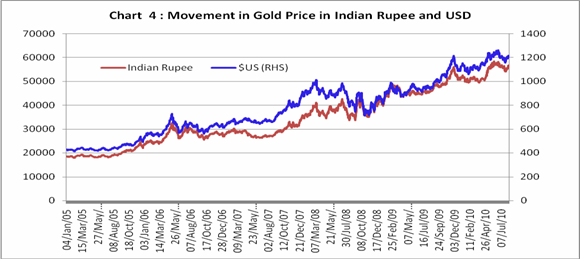

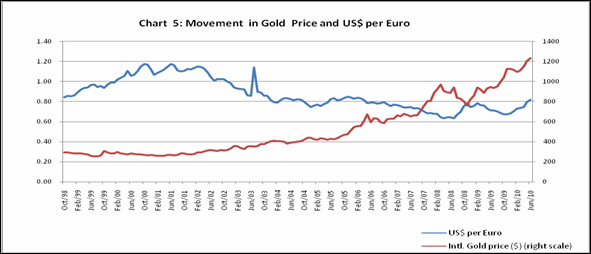

Optimum Level of Gold in the Foreign Exchange Reserves Traditionally, the adequacy of foreign exchange reserves was measured in terms of the ‘import cover of say three to four months’ of country’s imports. This has been holistically followed by the multilateral bodies such as IMF and World Bank as well, to measure the adequacy of foreign exchange reserves with a particular country. However, with huge capital flows, across the globe, in the form of FDI and portfolio type, such a measure proved to be inadequate and the upshot was the currency crises in the 1990s which challenged the validity of this measure. Then came the ‘Guidotti-Greenspan’ rule which entailed countries to hold ‘liquid reserves’ equal to their short term foreign liabilities (maturing within a year), and later when IMF endorsed, this rule came to be known as ‘Guidotti-Greenspan-IMF’ rule. De Beaufort Wijinholds and Kapteyn (2001) proposed a new criterion of ‘reserve adequacy’ for the emerging market economy which incorporates both short term external debt and a measure of the scope for capital flight (part of M2) modified by a “probability factor” captured by a country risk index. Yet, it is significant to note that for the ‘international reserves’, there is no widely accepted benchmark of ‘adequacy’ in the current state of global monetary system (Bery, 2011). IMF (2001) is also of the view that there are no universally applicable measures for assessing the adequacy of reserves. This is more so when it comes to optimum level of gold as a part of foreign reserves. A study by Wozniak (2008) pointed out that ‘portfolio optimizer models’ are used to show that the ‘efficient frontier’ of a typical developing or emerging market economy’s central bank can be enhanced by adding gold. The empirical study pointed out that an allocation between 2.4 per cent and 8.5 per cent to gold is found to be optimal for a central bank with around a 5 per cent risk tolerance. At a risk tolerance of 8.3 per cent, the allocation to gold increases substantially to 29 per cent. Nonetheless, there is no universally accepted norm of gold allocation as optimum level, among the central banks as it depends upon a combination of factors, including the legacy of the past, its investment policy objectives and guidelines, its existing asset mix, its risk appetite, its tactical view on market trends and its liquidity requirements. Central banks’ actual portfolios will differ widely based on their risk and return expectations, and constraints. Therefore, in practice, the allocations of emerging and developing countries that already hold gold in their portfolios vary widely. It may be cited that the European Central Bank recommends its member banks to hold 15 per cent of their reserves in gold (Financial Post, 2009). For international reserves held in the form of gold, the opportunity cost is given directly by the yield foregone if these assets would have been invested in other high yielding securities. It may however, be noted that international reserves held in the forms of interest-yielding assets will possess a smaller degree of liquidity than the reserves held in the form of gold or demand deposits. Moreover, even the best of securities are subject to high level of market risk and the macroeconomic policy measures. We may, therefore, well regard the premium earned on these assets as a payment for liquidity sacrificed (Heller, 1966). Did India’s purchase of gold affect the general gold price trend? When India bought gold, it was viewed that, it will only result in further escalation in price when the gold price was already high (Bloomberg). Further, it also reported that India and Russia's central banks helped to push gold price to nearly $1,200 an ounce. On the contrary, our analysis of gold price reveals hardly any significant aberration in the global price movement when the Reserve Bank bought gold (Chart 4). This is despite the fact that India’s purchase transaction is the single largest in the last 30 years and which is equivalent to 8 per cent of global gold mine output 9. This is mainly because India’s purchase transaction was not from the open market. Furthermore, generally reaction of gold to news about economic fundamentals was relatively small, compared to their effects on markets for Treasury Bonds and foreign exchange (Brodsky and Gary, 1980). On the other hand, a recent IMF study (Shaun, et al, 2009) finds that ‘...gold prices react to specific scheduled announcements in the United States and the Euro Area (such as indicators of activity or interest rate decisions) in a manner consistent with its traditional role as a safe-haven and store-of value…’ It however, finds that gold prices tend to be counter-cyclical, with the price rising when there is a downside surprise in the data, suggesting that gold is seen as a safe-haven during ‘bad times’. In fact this phenomenon was observed even during the recent global financial crisis as pointed out in the preceding section that a large number of central banks resorting to buying gold during the crisis. The gold price soared in recent years when practically all economies around the world were in trouble. More so, when the major economies were under Great Recession. In India, gold price showed steady increase in tandem with the world gold price movement rather than it is other way round.

Economic Rationale for holding Gold as part of Reserve by the Central Banks Gold as a metal itself has several ‘unique properties’ that makes it attractive to humans for centuries. It is both a commodity and a monetary asset virtually indestructible that ensures almost always recovered and recycled as revealed by the centuries of experience. It is interesting to note that so far, whatever the quantity of physical gold excavated from the earth, almost the entire quantity is available with the mankind as stated by WGC. Which essentially means that consumption of gold, in the economic sense, is only shift in ownership from one party to another, while the stock of gold at the global level remains largely unvarying. As gold mine production is also relatively inelastic for fairly long period, the recycled gold (or scrap) becomes the important potential source of easily traded supply when needed. Based on the global experience, the key considerations are as under: Safety and Liquidity considerations Safety and liquidity consideration constitutes a ‘critical objective’ of foreign exchange reserve management, then comes the return consideration. The emerging markets particularly in Asia, have chosen to self insure by accumulating large stocks of official reserves, particularly in the wake of Asian crisis of 1997. India is no exception to this strategy. Though foreign exchange reserves is nothing but the claims on other countries or foreign institutions’ instruments, that are subject to several risks more prominent being market and exchange rate risks, central banks hold them to meet several exigencies, besides to stabilise the external value of its own currency. The recent global crisis proved an important testimony of the protective value of such reserve accumulation. Gold becomes an essential element of foreign reserves because of its unique abilities to meet the above requirements. It is in this context, central banks rely upon gold, for instance, the Swedish Riksbank stated to have relied heavily upon its gold reserves for liquidity at the height of the crisis, using gold to finance temporary liquidity assistance. Therefore, gold comes as an obvious choice, as gold’s liquidity is underpinned by its diverse range of buyers and sellers who have differing trading motivations and who react differently to price movements. It was observed that as the price increased consistently the valuation gain of gold was quite substantial in the balance sheets of central banks even during the height of crisis. For instance, in the case of India, the valuation gain works out to around US$ 2.32 billion as at end December 2010 on its purchase of 200 tons of gold. Gold a good Diversifier Emphasizing the importance of diversification aspects alongside the liquidity, Eichengreen (2005) writes that “…it may pay to hold reserves in the most liquid market, which tends to be the market in which everyone else holds reserves, but market liquidity is not all that matters. It may be worth tolerating a bit less market liquidity in return for the benefits of greater diversification...” In fact, Jeffrey (1989) empirically proved that gold returns are generally independent of those on other assets; this suggests that gold can play an important role in a diversified portfolio. In a study, tests of four hypothetical portfolios of varying risk showed that the addition of gold in each case increases average return, while reducing standard deviation. Therefore, it is suggested that if an investor, for the purpose of diversification, is looking for an asset which is largely uncorrelated with the market, gold will serve that purpose marginally better than even the mutual funds (Blose, 1996). Natalie (2009) also concluded in her study that gold proved a far superior diversifier when compared with many other financial products as well (Table 5). An econometric analysis by Baur et al. (2010) for a sample period from 1979 to 2009 demonstrated that gold is both a hedge and a safe haven for major European stock markets and the US. Gold as Hedging Instrument against Inflation One of the most remarkable qualities of gold is its ability to hold its real value and therefore to act as inflation hedge Burton et al. (2006). The four most commonly purchased inflation hedge are gold, commodities, real estate and inflation-linked bonds. However, due to gold’s unique hedging properties, inflation had been tackled traditionally by gold for centuries and much before other hedges like commodities, real estate came to be recognized. If gold prices rise faster than the general price level (and even compared with the prices of financial investments), investment in gold is seen as a superior hedge against inflation and preferred for that reason Vaidyanathan (1999). One of the WGC studies stated that gold’s history as a monetary asset makes it an attractive store of value in periods of high inflation or rising inflation expectations. Empirically, Ghosh et al. (2002) have validated that gold can be regarded as a long-run inflation hedge. Aggarwal (1992) is of the view that gold may be an inflation hedge in the long-run but it is also characterized by significant short-run price volatility. Blose (1996) found that gold tends to move in the same direction as inflation, and bonds tend to move inversely to inflation. Natalie (2009) in her empirical study established that gold always performed high during high inflation years. The study also bought out that gold not only performed best in terms of real returns during the high inflation years, it also delivered a better risk /return profile. Gold’s relationship with inflation is best illustrated by contrasting the performance of the gold price during high inflation years with its performance in moderate and low inflation periods. In the Indian context, Mani and Vuyyuri (2004) in their study, for the period from 1978-79 to 1999-2000, found that the price of gold have shown upward trend establishing gold can act as a store of value and therefore the inflation hedge. Interestingly, Brown and John (1987) were of the view that gold may be a long-term inflation hedge, but not a short-term store of value. They further pointed out that gold may be predominantly a hedge against something other than inflation, viz., political instability. However, Ghosh et al. (2002) who studied 100 years data for American economy concluded that the real price of gold increased on average by only 0.3 per cent per year in this hundred-year period. In that context, they firmly stated that at least for American investors, long-run investment in gold may be an effective long-run inflation hedge. Similarly, Kolluri (1981) has studied the period from 1968 to 1980 for the industrialised countries, has also concluded that gold was a good inflation hedge, and stated that an increase of 1 percentage point in anticipated inflation resulted in an increase of 5 per cent in the capital gain on gold. For greater detailed survey of literature on ‘gold as an inflation hedge’ Burton et al. (2006) can be referred. Referring to inflation hedge character of gold Greenspan (1966) stated that ‘…in the absence of the gold standard, there is no way to protect savings from confiscation through inflation…’ Movement in Gold Price vs US Dollar A detailed study by Capie et al. (2004) explored the extent of relationship between gold and the exchange rates of various major currencies against the US Dollar to examine if gold acts as a hedge against US Dollar by taking into account the trade weighted pound between 1971 and 2002. The study also gave a particular focus on hedging properties of gold during economic crisis and political turmoil, and concluded that compared with weekly changes in exchange rates, gold price tends to overshoot. It has been widely perceived that the movement of gold price and US dollar are inverse, for instance Subramanian (2010) points out that evidently there was a growing inverse relationship between the values of gold and the US Dollar. In the context of the recent global financial crisis, he further noted that there was an uneasy balance for some months and the balance came under severe stress around mid-2008 when the financial crisis erupted. An additional reason for some central banks to consider buying gold is the recent decline in the value of US dollar against the world’s main trading currencies and feared that it may decline further. Between the end of 2001 and the end of 2009 the US currency lost 38 per cent of its value against the euro, while its effective rate fell by 32 per cent. The U.S dollar declined every year during this period with the exception of 2005 and 2008. The dollar remains the mainstay of the reserves portfolio of advanced, emerging and developing economies. Gulati et al. (1982) who studied on the international gold price movements during 1972 to 1982 are of the view that uncertainty in the expected value of currencies as well as general uncertainty in the economic environment may be expected, in part, to create greater investment demand for gold, raising the gold price. Thus, besides the need to diversify away from the dollar, gold has a reputation as a dollar hedge. Arguably a diversified portfolio is more important in a time of crisis. However, the diversification argument for gold is more broad-based than that. These stem from the fact that its value is determined by a set of different factors, vis-a-vis currencies and government securities markets which depend on macroeconomic policies including the variations in central banks’ monetary policies. For instance, the repetitive quantitative easing can lead to inflation and erode the value of fiat currencies. The price of gold therefore behaves in a completely different way from the prices of currencies or the exchange rates between currencies. Thus, gold can provide investors with a ‘natural hedge’ against dollar weakness and is easily demonstrated and it is also an effective diversifier (Burton et al., 2006). For instance, between June 2007 and June 2009, when the world economy was showing signs of bottoming out, the gold price increased by 43 per cent in dollar terms. This compares better with increases between 3 per cent and 9 per cent (local currency terms) in the main sovereign bonds held by central banks (WGC). In view of these, Paranjape, (2005) is of the firm view that gold is the only asset that gives the average Indian a hedge against currency depreciation. During the recent global financial crisis, particularly, when Lehman Brothers collapsed the liquidity constraints in the wholesale market for dollars and the FX swap market were most pronounced. Under these circumstances, fund managers who faced huge redemptions and/or margin calls turned to gold as an “asset of last resort” to stay solvent as pointed out by the World Gold Council reports. As the dollar is the world’s main trading currency and which also offers a wide range of financial instruments, has excellent liquidity, practically all central banks across the world continue to accumulate as reserves in their balance sheets. However, the dollar’s value is susceptible to US economic policies;10 it did lose its value over the last decade against both the euro and gold in recent years (Chart 5). Burton (2006) also concluded that in the face of a decline in the dollar exchange rate, gold price in local currency would not decline by as much as the pure exchange rate calculation would suggest.

Source: gold price, WGC and for exchange rates of US $ and Euro RBI publications. It may be cited that ‘…gold invariably moves inversely with the US dollar and also rises in value when international inflation gathers momentum. Thus, there are strong reasons for holding a reasonable proportion of Indian foreign exchange reserves in gold…’ (Financial Express, 2006). Between 2001 and 2009, the gold price increased from USD 276.5/oz to US 1087.5/ oz, a cumulative rise of 293 per cent or an average compounded annual return of 18.7 per cent, five of those 8 years were marked by gains of 20 per cent or more. Unlike other assets, gold appears to react positively to negative shocks according to Baur et al. (2010). Concluding Observations It is clear from the above analysis that in the wake of global crisis and the consequent heightened uncertainty, there has been high demand for gold from the central banks across the globe. It was found that central banks had either bought more gold or stopped selling their existing stock and India is no exception. In India’s case, while foreign reserves increased substantially over the years, the physical stock of gold as part of official reserves, however, remained stable. Eventually, gold’s proportion in the total foreign reserves sharply came down. In fact, even with the latest purchase of gold by the Reserve Bank, gold accounted to just around 7.9 per cent11 of the forex reserves. This is very small when compared with a sizable holding by a number of central banks in advanced countries and even some EMEs as pointed out above. In that context, India’s purchase of gold as a diversification strategy is fully justified and is in line with the global trend and still there is scope to increase its holding. What constitutes the ‘optimum level of gold’ for India is, of course a difficult question to address and unfortunately even international experience is scarce on this question. However, there is strong economic rationale to hold sufficient quantity of gold as part of official reserves, especially during the uncertainty such as the recent global financial crisis going by the historical experience. India’s recent purchase of 200 tonnes of gold, apparently, did not cause any aberration on the international gold price trend, probably, as gold was not bought from the open market. Similar method can be followed even in future, preferably in smaller quantities. Further, as India is a depository of huge private gold holdings, this can be channelled into official reserves especially those available in the form of coins and biscuits. This will also provide opportunity for the private holders to liquidate gold without much loss as presently banks are not permitted to buy back gold from the public. In the context of increased degree of uncertainty, especially when the U.S dollar became subject to tough challenges when U.S. attempted to salvage its economy by pumping in with heavy stimulus packages, there was a fear that it may accelerate the process of depreciation of the dollar. This in turn threatened the safety of many country’s dollar-denominated assets. Over and above, the recent downgrading of the U.S credit rating from ‘AAA to AA+’ coupled with the ongoing ‘government debt crisis’ among select European countries pushed up the demand for gold from central banks in general. In these situations, gold continued to maintain its value and therefore it is considered to act as a hedge against loss of wealth. Thus, the recent global financial crisis, only reiterated that gold as part of foreign exchange reserves continued to play a key role in the macroeconomic management devoid of its erstwhile purely monetary role. @ Working as Assistant Adviser, Department of Economic and Policy Research (DEPR), Reserve Bank of India. 1The Author would like to thank the anonymous referees for their comments and the final referee in particular. The views expressed here are of Author’s own and not of the institution to which he belongs. The usual disclaimer applies. The authors can be reached at akarunagaran@rbi.org.in 2 m.t refers to metric tonnes. 3 Foreign reserve include foreign currencies, foreign treasuries, gold, SDR at IMF according to COFER, IMF. 4 Recent experience being the downgrading of the U.S. credit rating from ‘AAA to AA+’ by the Standard & Poor. 5 GIIPS represents Greece, Italy, Ireland, Portugal and Spain; they were also referred to as PIIGS. 6 The gold price traded higher at $1714 per ounce in reaction to the news that Standard & Poor’s downgraded the United States credit rating to AA+ from AAA (Traynor, 2011) stripping the U.S. of the top rating it held for 70 years (goldalert.com). 7 During the first five months of 2011, the central-bank buying amounted to 15 per cent of global mining production during the same period as reported by Kitco news, August 4, 2011. 8 The Annual Report of RBI 1990-91 stated that the value of gold was only Rs. 281 crore by end-September 1990 which jumped up to Rs. 6,585 crore by end-December 1990 and by June 1991 it reached Rs.7,411 crore closely reflecting the international market price for gold due to revaluation. Till then gold was conservatively valued at Rs.84.39 per 10 grammes. 9 As reported by the ACA Precious Metal LLC of Chicago. 10 In fact even the rating by a credit rating agency can affect the country’s currency. The recent experience of downgrading of US credit rating from ‘AAA to AA+’ by the Standard & Poor. References Aggarwal R. and Soenen, L. A. (1988): ‘The nature and efficiency of the gold Market’. The Journal of Portfolio Management, Vol. 14, pp. 18-21. Aggarwal, R., (1992): ‘Gold Markets’ in Newman, P., Milgate, M., Eatwell, J. (eds.) The New Palgrave Dictionary of Money and Finance (Vol 2), Basingstoke, Macmillan, pp. 257-258. Aghevli Bijan (1975): ‘The Balance of payments and Money Supply under the Gold Standard Regime: US 1879 to 1914’ American Economic Review, vol 65 (1), March. Ambrose Evans-Pritchard (2009): ‘China, Bernanke and the Price of Gold’, The Telegraph. London. Basu Kaushik (1993): ‘Structural Reform in India 1991-1993, Experience and Agenda’ Economic and Political Weekly, Volume 33-2, February. Baur D G and Brian M. Lucey (2006): ‘Is Gold a Hedge or a Safe Haven? An Analysis of Stocks, Bonds and Gold’, IIIS Discussion Paper No. 198, Institute for International Integration Studies, Dublin. Baur D G and Thomas K. McDermott (2010): ‘Is Gold a Safe Haven? International Evidence’, Journal of Banking & Finance, 34 (2010), pp 1886–1898, Elsevier. Bernanke Ben and Harold James (1990): ‘The Gold standard, Deflation and Financial Crisis in the Great Depression’ : An international Comparison’ in (editd) R Glenn Hubbard Financial Markets and Financial Crises, National Bureau of Economic Research. University of Chicago Press. Bernholz Peter (2002): ‘Advantages and Disadvantages of holding Gold Reserves by Central Banks-With Special Reference to the Swiss National Bank’, Swiss Journal of Economics and Statistics, Vol. 138 pp 99-113 June Berger, H J De Haan S. Effinger (1991): ‘Central Bank Independence : An Update on Theory and Evidence’ Journal of Economic Surveys. 15 (1). P 3-40. Blose, Laurence E (1996): ‘Gold Price Risk and the Returns on Gold Mutual Funds’, Journal of Economics and Business. 48: pp. 499-513 Brown William Adams, Jr. (1949): ‘Gold as a Monetary Standard, 1914-1919’, The Journal of Economic History, Vol. 9, Supplement: The Tasks of Economic History (1949), pp. 39-49. Burton E James, Jill Leyland, Katharine Pulvermacher (2006): ‘Gold and Inflation’ in the handbook of Inflation Hedging Investments (Ed.) Greer Robert, pp 159-177, Mc-Graw Hill, New York. Capie, Forrest, Terrance T Mills and Geoffrey Wood (2004): Gold as a Hedge Against the US Dollar, (www.research.gold.org/research.). Cassel Gustav (1923): ‘The Restoration of Gold Standard’, Economica, No 9, November pp 171-186, The London school of Economics and Political Science, Blackwell Publishing. Claudio Borio, Jannecke Ebbesson, Gabirelle Galati and Alexandra Heath (2008): ‘FX Reserve Management: Elements of a Framework’, BIS Working Paper, BIS, March. Commodityonline.com December 10, 2010. De Beaufort Wijnholds and Arend Kapteyn (2001): ‘Reserve Adequacy in Emerging Market Economies’ IMF Working Paper No 01/143, IMF, Washington DC. Deutsche Welle (2011): ‘Central banks and major investors join gold rush’. Available at http://www.dw-world.de/dw/article/0,,15292029,00.html Eichengreen, Barry (2005): ‘Sterling’s Past, Dollar’s Future: Historical Perspectives on Reserve Currency Competition’ National Bureau of Economic Research (Cambridge, MA) Working Paper No. 11336, May. Financial Express (2006): ‘Tarapore for Increasing Gold Component in Forex Reserves’. November 28. Ghosh, Dipak, Levin, E. J., Macmillan, Peter and Wright, R. E. (2002): ‘Gold as an Inflation Hedge’, Discussion Paper Series No 0021, Department of Economics, University of St. Andrews. Goldenweiser E A (1929): ‘The Gold reserve Standard’, The Journal of American Statistical Association, Vol. 24, No. 165, Supplement: Proceedings of the American Statistical Association (March, 1929), pp. 195-200, American Statistical Association Greenspan Alan (1967): ‘Gold and Economic Freedom’, in Ayn Rand (ed), The Capitalism: Unknown Ideal, New American Library. Greenspan Alan (1999): Remarks to US Congress on Gold (accessible at (http://www.usagold.com/gildedopinion/greenspan-gold-1999.html) Green Timothy (1999): “Central Bank Gold Reserves: An Historical Perspective since 1845”, Research Study No 23, World Gold Council. Gulati I. S and Ashoka Mody (1982): International Gold Price Movements, 1972-1982, Economic and Political Weekly, Vol. 17, No. 46/47 (Nov. 13-20,), pp. 1861-1870. Hawtrey R. G. (1919): ‘The Gold Standard’ The Economic Journal, Vol. 29, No. 116. pp. 428-442, Blackwell Publishing for the Royal Economic Society. Heinz Robert Heller (1966): Optimal International Reserves, The Economic Journal Vol. 76, No. 302. June, pp. 296-311, Blackwell Publishing. International Food Policy Research Institute (IFPRI, 2005): Indian Agricultural and Rural Development – Strategic Issues and Policy Options, Washington. International Monetary Fund (2001): Guidelines for Foreign Exchange Reserve Management, September, IMF, Washington. ------------------------------------- (2010): World Economic Outlook April 2010, IMF, Washington. ------------------------------------- (2011A): Annual Report. IMF Washington. ---------------------------------------- (2011B): World Economic Outlook September 2011, IMF, Washington. Jones J H, (1933): The Gold Standard, The Economic Journal, Vol. 43, No. 172, pp. 551-574, Blackwell Publishing for the Royal Economic Society Juan Carlos Artigas (2010): Linking Global Money Supply to Gold and Future inflation, World Gold Council, February. (www.research.gold.org/research). Kavalis Nikos (2006): “Commodity Prices and the Influence of the US Dollar”, Gold Report available at (www.research.gold.org/research.) January 2006. Kolluri, Bharat R (1981): Gold as a hedge against inflation: An Empirical investigation Quarterly Review of Economics and Business, Vol 21(4) (winter) pp 13-24. Kunzel Peter, Yinqiu Lu, Christian Mulder and Jukka Pihlman (2009): ‘Reserves Prove Their Usefulness as Global Economic Crisis Bites’ IMF Monetary and Capital Markets Department. Lakshmi K (2007): ‘Should India add more Gold to its Foreign Exchange Reserves’? available at SSRN: http://ssrn.com/abstract=977127 Lee, J. (2004): “Insurance Value of International Reserves: An Option Pricing Approach,” paper presented at West Coast Japan Economic Seminar, September 24 (University of California at Santa Cruz). Mani Ganesh and Srivyal Vuyyuri (2004): Gold Pricing in India: An Econometric Analysis, accessed through http://ssrn.com/id=715841 Mundell, Robert (1983): “International Monetary Options,” Cato Journal 3, pp.189-210. Mundell, Robert (1994): “Prospects for the International Monetary System,” Research Study No. 8, New York: World Gold Council. Natalie Dempster (2009A): Gold as a Tactical Inflation Hedge and Long-Term Strategic Asset, Report, World Gold Council (www.research.gold.org/research.). Natalie Dempster (2009B): Structural Change in Reserve Asset Management, WGC publication series (www.research.gold.org/research.). Natalie Dempster (2010): Importance of Gold in Reserve Management, World Gold Council (www.research.gold.org/research.). Newby Elisa (2007): “Macroeconomic Implications of Gold Reserve Policy of the Bank of England during the Eighteenth Century”. Centre for Dynamic Macroeconomic Analysis Working Paper Series, WP0708. Paranjape Avinash (2005): ‘Benefits of Holding Gold’, Economic and Political Weekly, Vol. 40, No. 48 (Nov. 26 - Dec. 2, 2005), pp. 4958+5132. Pihlman Jukka and Han van der Hoorn (2010): ‘Procyclicality in Central Bank Reserve Management: Evidence from the Crisis’ IMF Working Paper, IMF Washington. June. Reddy Y V (2005): Overcoming Challenges in a Globalising Economy: Managing India’s External Sector, Monthly Bulletin, RBI. Reserve Bank of India (1991): Annual Report Reserve Bank of India (2010): Annual Report Reuters (2011): ‘Is central bank buying the sell signal for gold?’ Report, August 2. Rodrik Dani (2006): ‘The Social Cost of Foreign Exchange Reserves’, Harvard University, NBER Working paper No 11952. Available at http://www.nber.org Sachs D Jeffrey and Felipe B. Larrain (1993): Macroeconomics in the Global Economy, Englewood Cliffs, New Jersey: Prentice Hall. Shaun K. Roache and Marco Rossi (2009): “The Effects of Economic News on Commodity Prices: Is Gold Just Another Commodity? IMF Working Paper, July 2009, IMF. Washington. Starr Martha and Ky Tran (2007): ‘Determinants of the Physical Demand for Gold: Evidence from Panel Data’, Working Paper Series, Department of Economics, American University, Washington. Subramanian K (2010): ‘The IMF and its Gold Sale’, Economic and Political Weekly, Vol xlv no 4: pp 17-20, January 23, 2010 Traynor Ben (2011): ‘Gold Hits $1,714 after US Downgrade, ECB Action’ August 8, 2011, available at http://www.resourceinvestor.com/News/2011/8/Pages/Gold-Prices-Hit-1714-after-US-Downgrad-ECB-Action.aspx Vaidyanathan A (1999): ‘Consumption of Gold in India: Trends and Determinants’, Economic and Political Weekly, Volume 34 (8), February 22-26. pp. 471-476. Volcker Paul (2009): ‘We’re in a Great Recession’, The Wall Street Journal, April 18, 2009. Westminister Mint (2009): IMF Sells India 200 tonnes of Gold to India, November 3. Why central banks hold 25,000 tons gold reserves published on : March 20, 2009 available at http://www.goldtraderasia.com/gold-news/Mar-09/200309-Why-central-banks-hold-25000-tons-gold-reserves.htm Williamson John (1976): ‘Exchange-Rate Flexibility and Reserve Use’ The Scandinavian Journal of Economics, Vol. 78, No. 2, Proceedings of a Conference on Flexible Exchange Rates and Stabilization Policy, pp. 327-339, June Blackwell Publishing World Gold Council (2001): Conference on Gold Proceedings, the Euro, the Dollar and Gold. Berlin, November. Wozniak Rozanna (2008): Gold as a Strategic Asset for UK Investors, WGC Report, WGC. World Gold Council: Various reports on gold | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

പേജ് അവസാനം അപ്ഡേറ്റ് ചെയ്തത്: