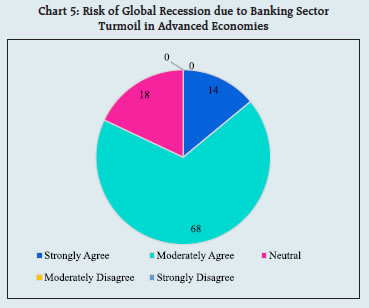

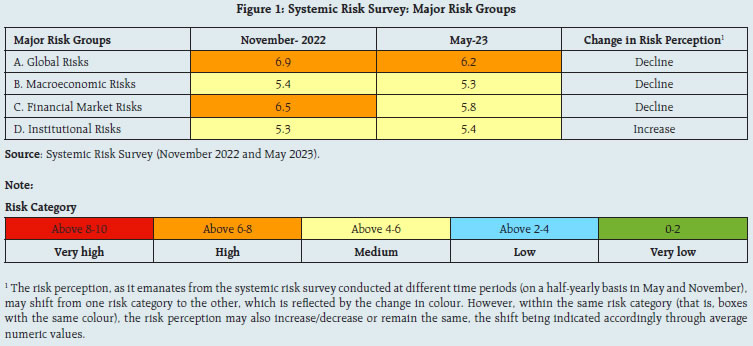

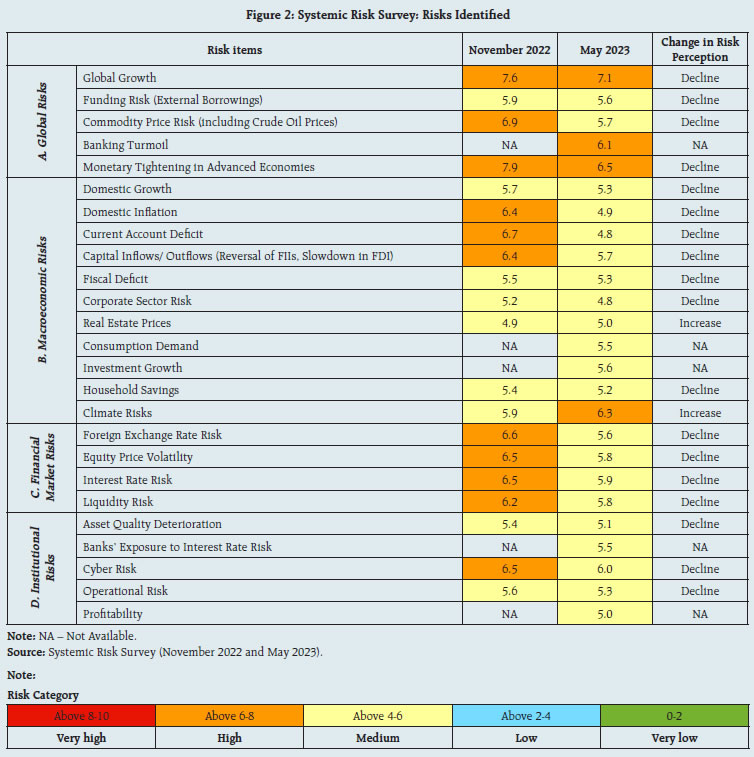

In the 24th round of the Systemic Risk Survey, risk perception from global, macroeconomic and financial market categories of systemic risk receded. Global spillovers remained in the ‘high’ risk category. Financial market risk declined from ‘high’ to ‘medium’ risk category. Macroeconomic risk remained in the ‘medium’ risk category and was perceived to have moderated. Going forward, respondents’ perception of risk to financial stability included: tightness of global financial conditions; global growth slowdown; rise in commodity prices; reversal of capital flows; increase in climate risks and geo-political risks. | The 24th round of the Reserve Bank’s Systemic Risk Survey (SRS) was conducted in May 2023 to capture the perceptions of experts, including market participants and academicians, on major risks faced by the Indian financial system. In addition to its regular format, this round of the survey also tries to capture the risk of global recession from the recent banking sector turmoil in key advanced economies. The feedback from 50 respondents is encapsulated below: -

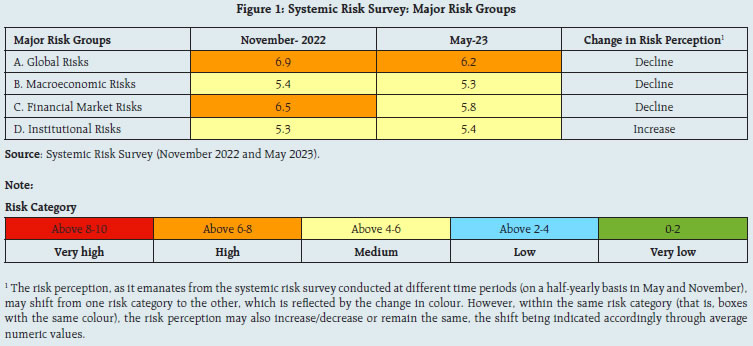

Risk perception across global, macroeconomic and financial market categories of systemic risk receded whereas it recorded a marginal uptick for institutional risks. Risks from global spillovers remained in the ‘high’ risk category. Financial market risks declined from ‘high’ risk to the ‘medium’ risk category. Macroeconomic risks remained in the ‘medium’ category, and were perceived to have moderated (Figure 1). -

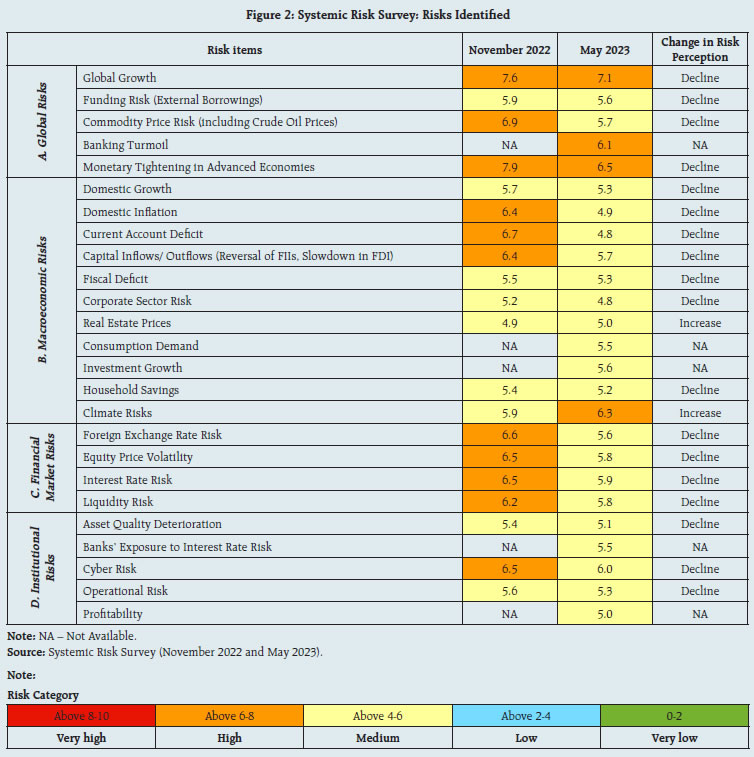

Major drivers of global risks such as risks to global growth, commodity price risk and risk emanating from monetary tightening in advanced economies were perceived to have declined (Figure 2). -

All the drivers of financial market risk, i.e., foreign exchange rate risk, equity price volatility, interest rate risk and liquidity risk were gauged to have decelerated from ‘high’ to ‘medium’ risk category (Figure 2).

-

Decline in risk perception on domestic growth and inflation, fiscal deficit, current account deficit, and capital flows resulted in moderation in overall macroeconomic risks. However, macroeconomic risk resulting from climate change was perceived to have amplified (Figure 2). -

Cyber risk, a major institutional risk declined from ‘high’ risk category to ‘medium’ risk category. -

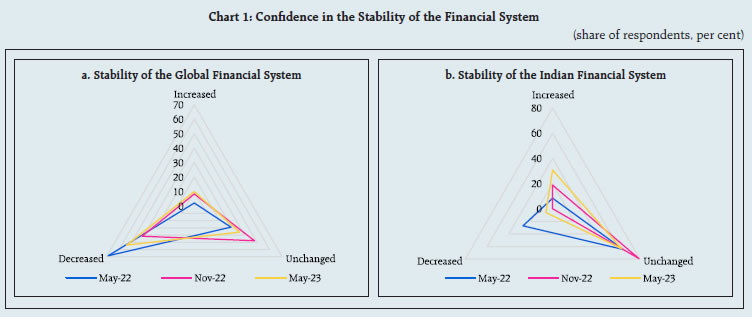

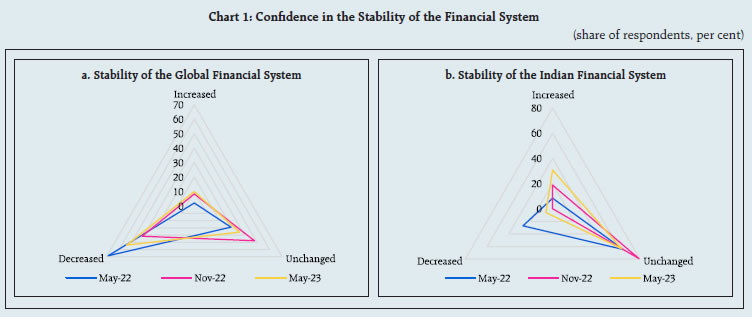

54 per cent of the respondents reported that their confidence in the stability of the global financial system has declined over the last six months (Chart 1 a). In contrast, 94 per cent of the respondents placed similar or higher confidence in the Indian financial system (Chart 1 b).  -

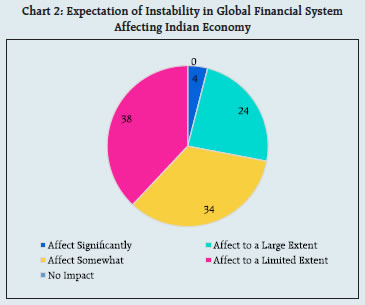

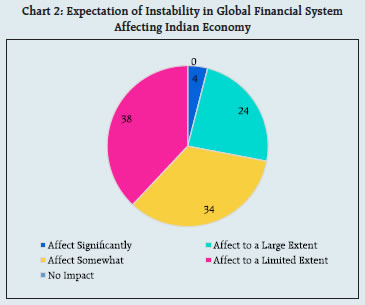

Around three-fourths of the respondents expected some impact or a limited impact on the Indian economy from global spillovers (Chart 2). -

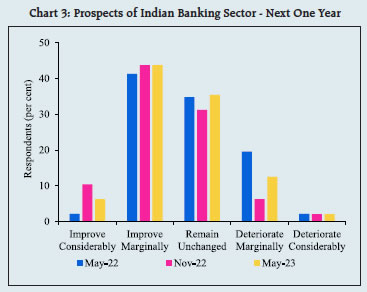

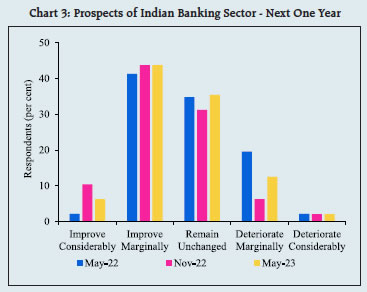

More than 50 per cent of the respondents assessed that the prospects of the Indian banking sector have improved marginally or considerably and another 35 per cent of the respondents expected it to remain unchanged over a one-year horizon (Chart 3). -

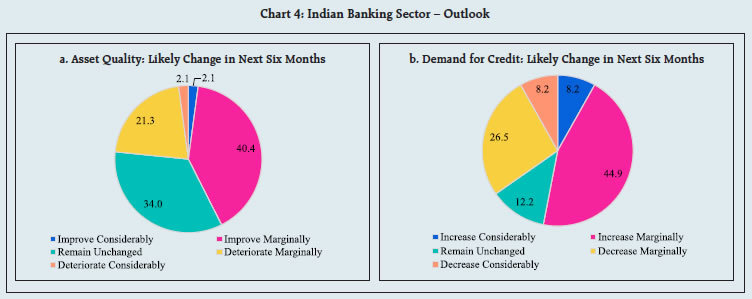

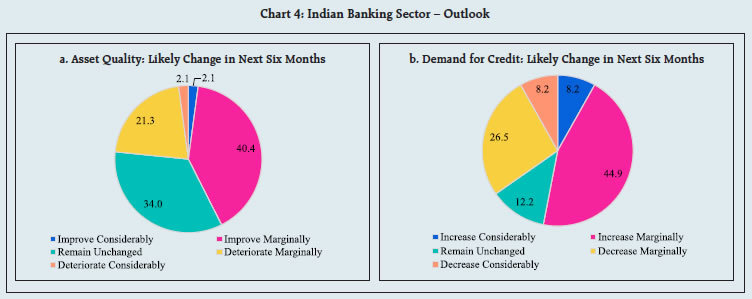

43 per cent of the respondents expected marginal to considerable improvement in asset quality of the Indian banking sector over the next six months, and another 34 per cent expected it to remain unchanged. Improved corporate earnings in major sectors, improvement in credit profile of corporates, prospects of economic recovery, and improved monitoring and risk assessment by banks were considered as contributing factors (Chart 4 a). -

A majority (53 per cent) of the respondents expected marginal to considerable improvement in credit demand and another 12 per cent of the respondents expected it to remain unchanged over the next six months, owing to factors, such as, public investment in the infrastructure sector, improvement in corporate lending, increase in working capital demand by corporates, increase in consumption and investment demand, pick up in domestic economy particularly manufacturing sector, and decline in inflation (Chart 4 b).

Risks to Financial Stability Going forward, respondents identified the following major risks to financial stability: -

Global growth slowdown; -

Tightness of financial conditions and interest rate risk; -

Rise in commodity (including oil) prices; -

Slowdown in FDI flows and reversal of FII flows; -

Geo-political risk; and -

Increase in climate risk. |

IST,

IST,