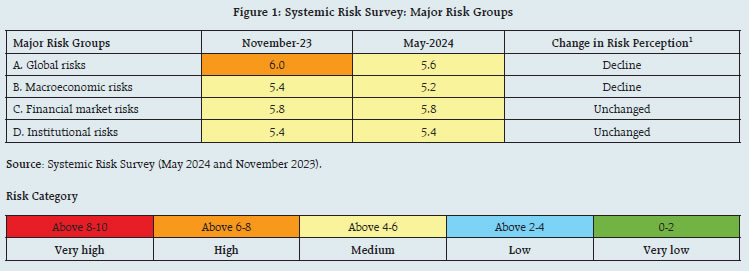

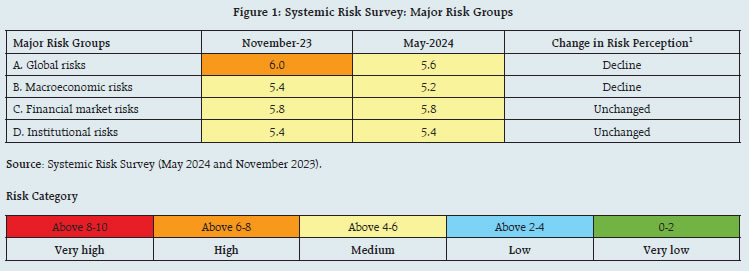

| In the latest round of the half yearly systemic risk survey (SRS), all major groups were in the medium risk category. Risk perceptions relating to global spillovers receded while macroeconomic risks declined marginally. Going forward, respondents’ perceptions of risk to financial stability included: geopolitical risks; tight global financial conditions; and capital outflows and exchange rate pressures. |

The 26th round of the Reserve Bank’s Systemic Risk Survey (SRS) was conducted during May 2024 to solicit perceptions of experts, including market participants, on major risks faced by the Indian financial system. In addition to its regular questions, this round of the survey also captures respondents’ views on (i) impact of the ‘higher for longer’ policy rate scenario on macro-financial stability in H2:2024; and (ii) sustainability of the sharp increase in domestic credit growth witnessed in the last two years. The feedback from 44 respondents is presented below.

-

The panellists perceived that global spillover risks have receded sharply to the ‘medium’ risk category. Assessment of macroeconomic risks witnessed a marginal decline whereas risks emanating from financial markets and institutional risks remained unchanged. Overall, all major risk groups are perceived to be in the ‘medium’ risk category (Figure 1).

-

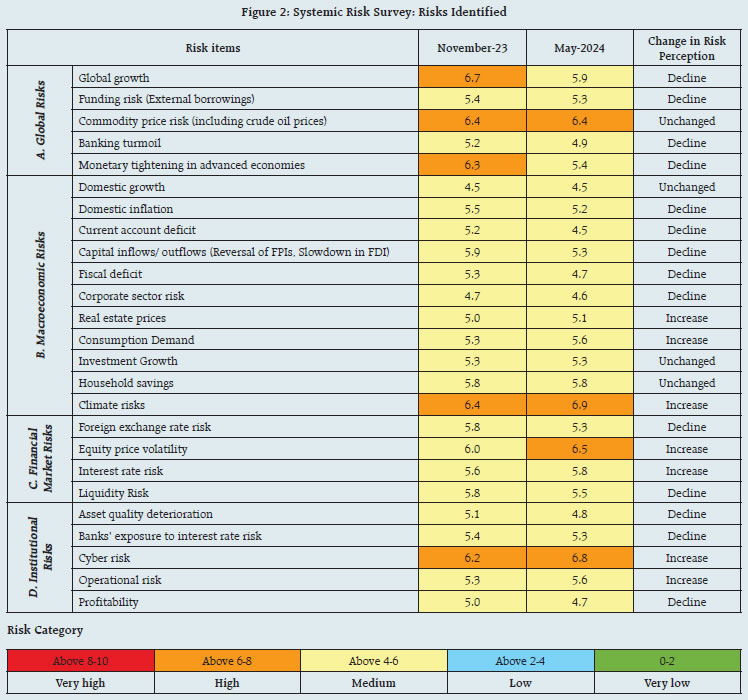

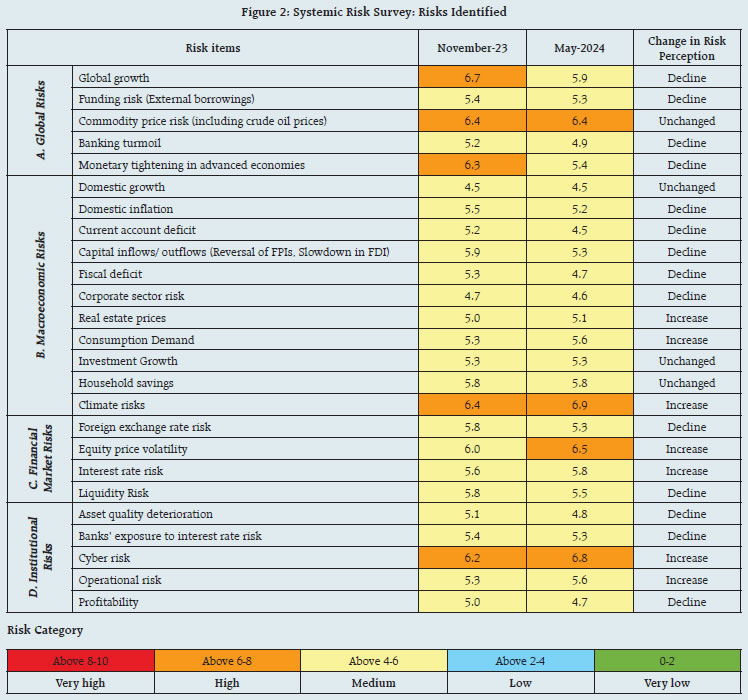

In terms of global risks, global growth, funding risk, banking turmoil and risk emanating from monetary tightening in advanced economies were perceived to have moderated, whereas the perception on commodity price risk has remained at an elevated level (Figure 2).

-

In case of domestic risks, climate risk has moved up within the ‘high’ risk category and risk to consumption demand inched up. Other key risks (viz., domestic inflation, current account balance, capital flows and fiscal deficit) are assessed to have declined and provided support to domestic macro-financial stability. Risk emerging from domestic growth and investment growth was perceived to have remained unaltered (Figure 2).

-

Among drivers of financial market risks, foreign exchange rate risk and liquidity risk were gauged to have moderated while risk emanating from equity price volatility and interest rate risk picked up (Figure 2). Risk from equity price volatility was perceived to have moved from the ‘medium’ to the ‘high’ risk category.

-

Among drivers of institutional risks, cyber risk is assessed to have risen within the ‘high’ risk category. Risk emanating from asset quality deterioration and banks’ exposure to interest rate risk eased while operational risk increased.

-

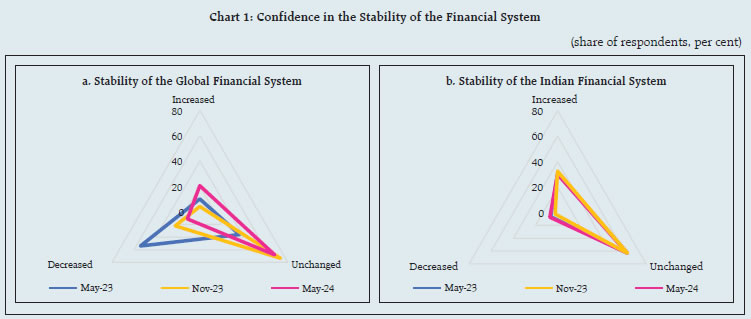

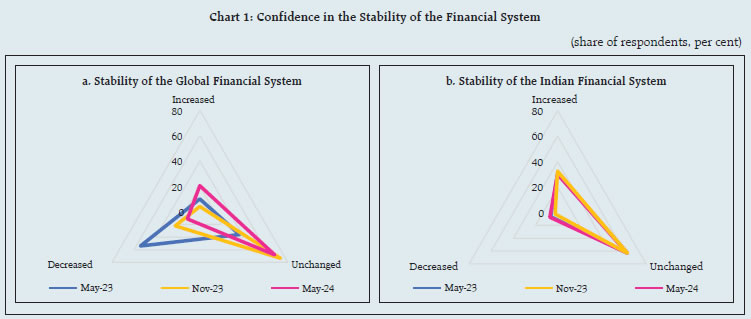

About one fifth of the respondents reported higher confidence in the stability of the global financial system from the previous survey round (Chart 1a).

-

Around one third expressed higher confidence in the Indian financial system while another 63 per cent felt there was no change (Chart 1b).

-

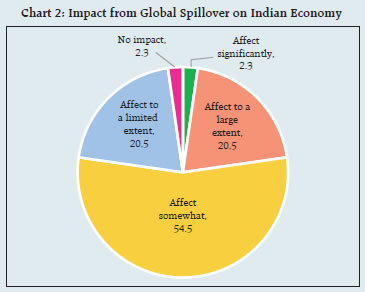

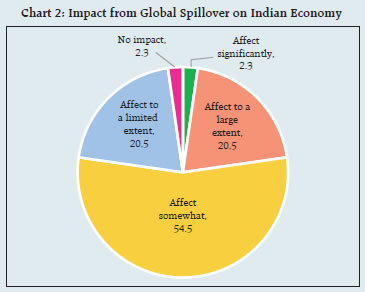

75 per cent of the panellists expected that the Indian economy will be impacted somewhat/to a limited extent by instability in the global financial system in H2:2024 (Chart 2).

-

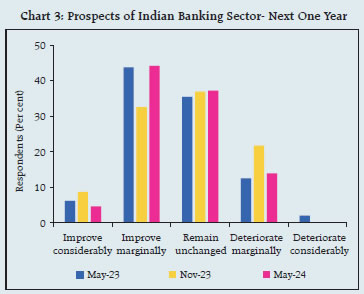

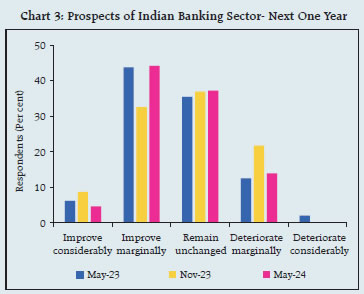

Nearly 90 per cent of the respondents assessed better or similar prospects for the Indian banking sector over a one-year horizon (Chart 3).

-

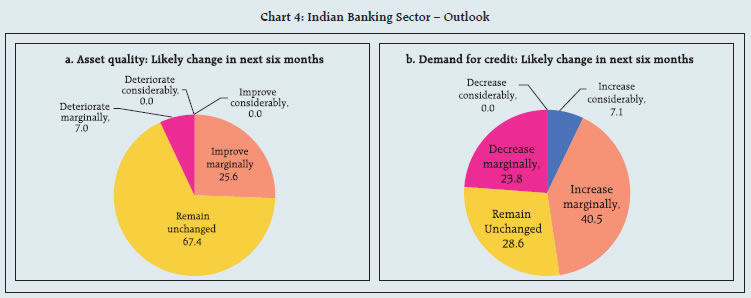

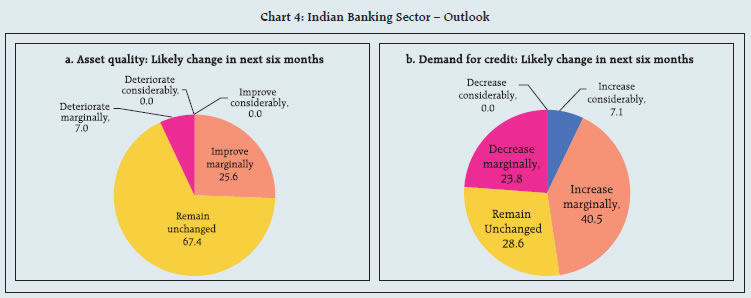

Most of the respondents (67.4 per cent) expected the quality of banking sector assets to remain unchanged over the next six months, whereas over 25.6 per cent expected it to marginally improve due to higher economic growth, healthy corporate balance sheet, slower increase in slippage ratio and recent prudential measures (Chart 4a).

-

About 47.6 per cent of the respondents expected higher credit demand during H2:2024 owing to factors such as higher GDP growth, pickup in manufacturing sector activity, government spending and credit demand from real estate and infrastructure. Another one fourth of panellists assessed credit demand to remain unchanged (Chart 4b).

-

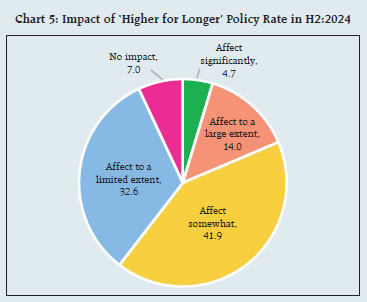

Nearly three fourths of the panellists expected that the Indian economy will be impacted somewhat/to a limited extent by the ‘higher for longer’ policy rate stance of systemic central banks (Chart 5).

-

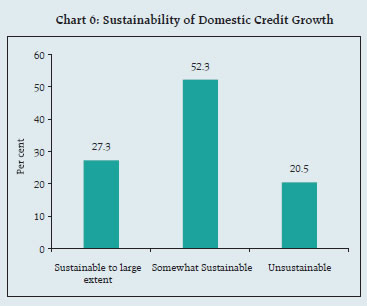

27.3 per cent of the panellists perceived credit acceleration witnessed in the last two years as largely sustainable and another 52.3 per cent felt that it was somewhat sustainable (Chart 6). Some of the respondents, however, expressed concerns over consumer loan quality, cost of funds and asset quality.

Risks to Financial Stability

Going forward, respondents identified the following major risks to financial stability in the near term:

-

Geopolitical risks;

-

Tightening of global financial conditions and interest rate risk;

-

Capital outflows and exchange rate;

-

Rise in commodity (including oil) prices;

-

Increase in climate risks;

-

Cyber risk; and

-

Global growth slowdown.

|

IST,

IST,