VI. Financial Regulation and Supervision - ആർബിഐ - Reserve Bank of India

VI. Financial Regulation and Supervision

VI . FINANCIAL REGULATION AND SUPERVISION The banking system in India remained largely unaffected by the financial crisis, while several banks and financial institutions in the advanced countries failed or had to be bailed out with large sovereign support. The financial soundness indicators for the banking system in India during 2008-09 showed stability and strength; every bank in the system remained above the minimum regulatory capital requirement. Stress test findings suggested the resilience of the financial system, in the face of the severe external contagion from the global financial crisis. As at end-March 2009, all Indian scheduled commercial banks had migrated to the simpler approaches available under the Basel II framework. Post-crisis changes that may be necessary to strengthen the regulatory and supervisory architecture would be based on the evolving international consensus as well as careful examination of their relevance to the India-specific context. The time schedule for implementation of advanced approaches under Basel II has been notified and an inter-disciplinary Financial Stability Unit has been set up to monitor and address systemic vulnerabilities. VI.1 Indian banks and financial institutions exhibited resilience in the midst of a severe global financial crisis. Notwithstanding the growing financial integration and globalisation, the banking system in India had no direct exposure to the sub-prime assets that triggered the crisis in the advanced economies. The indirect exposure of banks in this regard was also insignificant. Much before the crisis started in the advanced economies, the Reserve Bank had taken a number of measures which contributed to strengthening the resilience in the Indian banking system. These included prudential regulations for limiting the exposure of the banking system to sensitive sectors and appropriately rebalancing the risk weights of different assets. Necessary provisioning norms were prescribed and there has been a sustained emphasis on CAMELS parameters for supervision of Indian banks and financial institutions. The Committee on Financial Sector Assessment undertook single-factor stress tests for end-September 2008, which revealed that the Indian banking system could withstand significant shocks arising from large potential changes in credit quality, interest rate and liquidity conditions. It was assessed that even under the worst case scenario, the capital to risk-weighted assets ratio (CRAR) of Indian banks would remain above the regulatory minimum. Notwithstanding the resilience of Indian banks and financial institutions to the international financial crisis, when the global economic crisis started to dampen the domestic growth prospects, the Reserve Bank had to take a number of policy measures aimed at preserving and promoting financial stability, while supporting faster economic recovery. VI.2 The regulatory and supervisory initiatives taken by the Reserve Bank during 2008-09 with regard to banks and other financial institutions are presented in this Chapter. A distinguishing feature of the various policy initiatives to strengthen the banking system and thereby promote financial stability is that some of these initiatives were a part of the ongoing policy efforts and not a response to the sequence of events that led to the global financial crisis. In addition to prudential regulations, steps were taken to improve customer service, enhance supervision and strengthen the anti-money laundering measures in the banking sector. VI.3 For UCBs, further regulatory measures were taken in order to reap the gains accruing from the path laid down by the vision document for the sector through the MoUs and the Task Force for UCBs arrangement. During 2008-09, the Reserve Bank continued its regulatory focus on systemically important non-deposit taking NBFCs. A spate of measures was taken to address the liquidity concerns arising for the sector in the wake of the international financial crisis. Measures Taken Before the Global Crisis VI.4 Regulation of non-banking entities is being progressively strengthened and the process had started before the onset of the global financial crisis. NBFCs owned by foreign banks and regulated by the Reserve Bank, were brought under the Group concept, to contain the regulatory arbitrage. An elaborate prudential framework was put in place for NBFCs-ND-SI. Consolidated supervision of banking groups was introduced in 2003 and has been constantly strengthened thereafter. VI.5 To limit the growth of bank-led financial conglomerates (FCs), banks’ equity investment in individual financial subsidiaries has been limited to 10 per cent of paid-up capital and reserves of the bank and aggregate investment has been limited to 20 per cent of paid-up capital and reserves. Banks’ non-banking activities are also limited by law and any significant strategic equity investments by banks require the Reserve Bank’s prior approval. VI.6 Prudential regulations have been consistently strengthened. Major steps taken include limits on capital market exposures of banks, prescription of 50 per cent margin for advances against shares, limits on lending and borrowing in call money market, limit on inter-bank liabilities and restrictions on investment in unlisted and unrated non-SLR securities. The provisioning requirements for sub-standard and doubtful assets have been progressively aligned with best international practices, diminution in fair value of restructured accounts is required to be provided for and net appreciation in trading and available for sale book is not permitted to be recognised. The dividend payout ratio in case of banks is not allowed to exceed 40 per cent and dividend can be paid only out of current year’s profit. Securitisation profits cannot be booked upfront to contain perverse incentives. VI.7 In order to ensure higher quality of regulatory capital, existing capital adequacy guidelines require that Tier I capital of banks should be at least 6 per cent of risk-weighted assets by March 31, 2010. Tier III capital for market risk has not been introduced, as it is short-term. VI.8 Further, when there was very rapid credit growth from 2004-05 onwards, risk weights and provisioning for banks’ exposure to rapidly growing or sensitive sectors (such as commercial real estate, consumer loans and capital market), even when classified as standard assets, were progressively increased since 2005-06 as a counter-cyclical measure. Banks were also encouraged to maintain floating provisions which could be drawn down in extraordinary circumstances. VI.9 To ensure adequate liquidity buffers with individual banks, banks were required to invest 25 per cent of their NDTL in government securities to maintain SLR (reduced to 24 per cent of NDTL in November 2008). The framework for monitoring and reporting of liquidity position of individual banks was improved by way of introduction of more granular liquidity buckets within the 1-14 segment (i.e., next day, 2-7 days, 8-14 days). Table 6.1 shows that Indian banking system continues to remain healthy.

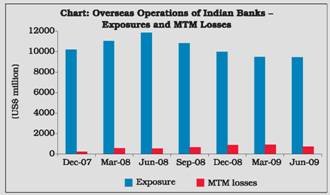

Measures Taken During the Global Crisis VI.10 The measures taken by the Reserve Bank during 2008-09 broadly include counter-cyclical moderation of capital and provisioning norms which had been enhanced earlier and provision of adequate rupee/foreign exchange liquidity to enable the banks to continue to lend for viable economic activities. The prudential measures are discussed in detail in subsequent paragraphs of this Chapter. The measures relating to liquidity and credit delivery are discussed in relevant Chapters. REGULATORY FRAMEWORK FOR THE INDIAN FINANCIAL SYSTEM VI.11 In the overall architecture for the regulation and supervision of the financial system in India, the Reserve Bank’s regulatory and supervisory purview extends to a large segment of financial institutions, including commercial banks, cooperative banks, non-banking financial institutions and various financial markets. At end-March 2009, there were 801 commercial banks (excluding RRBs); 4 local area banks; 86 RRBs; 1,721 UCBs; 4 development finance institutions; 12,739 NBFCs (of which 336 NBFCs were permitted to accept/hold public deposits) and 182 primary dealers (PDs) [of which 11 were banks undertaking PD business as a departmental activity, known as bank-PDs, and 7 were non-bank entities, also referred to as standalone PDs]. The Board for Financial Supervision (BFS) has been mandated to ensure integrated oversight over the financial institutions that are under the purview of the Reserve Bank. Board for Financial Supervision (BFS) VI.12 The BFS, constituted in November 1994, remains the principal guiding force behind the Reserve Bank’s supervisory and regulatory initiatives. It reviews the inspection findings in respect of commercial banks/UCBs and periodic reports on critical areas of functioning of banks such as reconciliation of accounts, fraud monitoring, overseas operations and banks under monthly monitoring. In addition, the BFS also reviews the micro and macro prudential indicators, banking outlook and interest rate sensitivity analysis. It also issues a number of directions with a view to strengthening the overall functioning of individual banks and the banking system. The BFS held eight meetings during the period July 2008 to June 2009. In these meetings, it considered, inter alia, the performance and the financial position of banks and financial institutions during 2008-09. It reviewed 70 inspection reports (27 of public sector banks, 16 of private sector banks, 20 of foreign banks, 4 of local area banks and 3 of financial institutions). Some of the important issues deliberated upon by the BFS during 2008-09 are highlighted in this section. VI.13 In the wake of the global financial crisis, the BFS was apprised of the exposure of Indian banks to tainted assets and also the safeguards available within the Indian banking system on account of the regulatory measures initiated to strengthen the risk management and liquidity management systems of banks. The BFS was informed that an in-depth examination of investment portfolio of banks was being done as part of the Annual Financial Inspection (AFI). The BFS also enhanced its focus on monitoring the mark-to-market (MTM) losses in credit derivatives and other investment portfolios of overseas operations of banks in India on a monthly basis (Box VI.1). VI.14 In response to concerns in some quarters regarding risks associated with foreign exchange derivatives, detailed information was called for in structured formats by the Reserve Bank from certain select banks which were operating at the top-end of the system-level exposures. Based on a dialogue process with these banks regarding, inter alia, the ‘suitability and appropriateness’ principles and risk management policies, a comprehensive report was placed before the BFS. In this context, stress tests of the credit portfolio of commercial banks in India were also carried out to assess the resilience of banks under various stress scenarios such as increasing the NPA level and provisioning requirements for standard, sub-standard and doubtful assets as at end-March 2008. The analysis was carried out at the aggregate and individual bank level and the results indicated that the CRAR would not decline below the stipulated minimum level under any of the adopted scenarios. Box VI.1 Falling asset prices in the international markets exerted severe stress on the balance sheets of many international banks, on account of their significant exposure to such assets. Large off-balance sheet exposures magnified their stress levels further. In this context, it was felt necessary by the Reserve Bank to keep track of the quality of exposures of overseas operations of Indian banks for timely action and super visor y intervention, if required. Consequently, the Reserve Bank held discussions with select major banks with overseas operations to assess the quality of their overseas exposures. The assessment revealed that the banks did not have any direct exposure to the US sub-prime market. Some banks, however, had indirect exposure through their overseas branches and subsidiaries to the US sub-prime markets in the form of structured products, such as collateralised debt obligations (CDOs) and other investments. Some of the banks, with exposures to credit derivatives, had to book MTM losses on account of widening of credit default swap (CDS) spreads. The assessment, however, showed that such exposures were not very significant, and banks had made adequate provisions to meet the MTM losses on such exposures. Besides, the banks also maintained high levels of capital adequacy ratio. The Reserve Bank’s assessment suggested that, the risks to the banking sector associated with MTM losses, appeared to be limited and manageable. As the financial crisis persisted and started spreading beyond the US, a need was felt to continuously monitor the exposures of the overseas operations of the Indian banks to detect adverse signals impacting the quality of the banks’ overseas exposures. Accordingly, a monthly reporting system was introduced in September 2007 capturing Indian banks’ overseas exposure to credit derivatives and investments such as Asset Backed Commercial Papers (ABCP) and Mortgage Backed Securities (MBS). An analysis of the information so collected reveals that the exposures of Indian banks through their overseas branches in credit derivatives and other investments are gradually coming down from the June 2008 level (Chart). Their MTM losses, however, gradually increased up to March 2009, reflecting the impact of the sustained fall in the value of the assets in their portfolios. After the direct impact of the global financial crisis through MTM losses was assessed to be insignificant for Indian banks, the focus shifted to the possible asset quality concerns arising from weakening growth prospects as certain sectors in the economy clearly came under the influence of falling external demand due to the global recession and subsequent deceleration in domestic private demand. The asset quality of banks’ exposures to the sectors perceived to be under stress became a matter of supervisory concern. A credit risk stress test of banks’ exposure to seven such sectors (chemicals/dyes/paints etc., leather and leather products, gems and jewellery, construction, automobiles, iron and steel and textiles), accounting for 15.4 per cent of gross advances and 12.2 per cent of gross NPAs, was carried out to assess the impact on banks’ capital adequacy due to an assumed rise in NPAs. The stress tests were run under two scenarios, viz., 300 per cent and 400 per cent increases in NPAs in the seven sectors simultaneously. The additional provisioning requirements, assuming the rise in NPAs were adjusted from existing regulatory capital and risk-weighted assets, were estimated to arrive at the adjusted capital adequacy. The results of the stress tests revealed the inherent strength of the banks to withstand sizeable deterioration in asset quality in the identified sectors. The capital adequacy ratio of only two banks accounting for around 3 per cent of total assets of the banking system was assessed to drop below the prescribed minimum level under both the stress scenarios.

The assessment of MTM losses and stress test results, thus, further validated the resilience of the Indian banking system to the shocks and concerns emanating from the global economic crisis. VI.15 During the period under reference, the BFS issued several directions for enhancing the quality of regulation and supervision of financial institutions and some of the important directions were as follows: (i) need for evaluation by the Reserve Bank, for robustness and efficacy, of the statistical scoring and loss forecasting models deployed by banks for managing retail credit portfolios; (ii) fine-tuning and making more dynamic the process for selection of branches for the AFIs, by including additional parameters for branch-selection; (iii) prohibiting subsidiaries of banks from undertaking activities which the bank itself was not permitted to undertake as per the provisions of the Banking Regulation Act, 1949; (iv) submission of confirmation report and compliance certificate with regard to adherence to the Reserve Bank's guidelines on outsourcing arrangements entered into by banks; (v) sensitising the banks that the principles for sale/purchase of NPAs, issued in October 2007, were laid down as a broad criteria only to be adopted while entering into compromise settlements and not meant to be rigid or restrictive (hence, banks could enter into these settlements based on the circumstances/facts of each case and their commercial judgement and should be able to justify the decision taken); and (vi) recording of intent of holding the investments, for a temporary period or otherwise, at the time of investment in a subsidiary, associate and joint venture, for the purpose of consolidation. VI.16 The BFS also accorded its approval to certain important proposals aimed at enhancing the regulatory provisions/intent and supervisory focus. Some of them were as follows: (i) prescribing the extent of admissible liability towards Tier I and Tier II instruments in the scheme of merger/amalgamation of banks as and when such cases arose; (ii) a one-time measure designed to help banks to clear their large number of small value outstanding nostro entries originated up to March 31, 2002 while concurrently directing the banks to concentrate on follow-up effort on the high value entries that were still outstanding and to leverage technology to avoid building up of unreconciled balances. COMMITTEE ON FINANCIAL SECTOR ASSESSMENT VI.17 The work on a comprehensive self-assessment of India’s financial sector, particularly focussing on stability assessment, stress testing and compliance with all financial standards and codes started in September 2006 by the Committee on Financial Sector Assessment (CFSA), chaired by Dr. Rakesh Mohan. Shri Ashok Chawla, Shri Ashok Jha and Dr. D. Subbarao as Secretary, Economic Affairs, Government of India, were the Co-Chairmen of the CFSA at different points of time. In March 2009, the Government and the Reserve Bank jointly released the Report of the CFSA (Box VI.2). The CFSA followed a forward-looking and holistic approach to self-assessment, based on three mutually reinforcing pillars – financial stability assessment and stress testing; legal, infrastructural and market development issues; and an assessment of the status of implementation of international financial standards and codes. VI.18 Overall, the CFSA found that the Indian financial system was essentially sound and resilient, and that systemic stability was, by and large, robust. India was broadly compliant with most of the standards and codes, though gaps were noted in the timely implementation of bankruptcy proceedings. The CFSA also carried out single-factor stress tests for credit and market risks, liquidity ratio and scenario analyses. These tests showed that there were no significant vulnerabilities in the banking system. Though NPAs could rise during the current economic slowdown, given the strength of the banks’ balance sheets, the rise was not likely to pose any systemic risk. VI.19 Since risk assessment is a continuous process and stress tests need to be conducted taking into account the macroeconomic linkages as also the second round effects and contagion risks, consequent to the announcement in the Annual Policy Statement for 2009-10, an interdisciplinary Financial Stability Unit was set up to monitor and address systemic vulnerabilities. Box VI.2 The CFSA presented its assessment of India’s financial sector along with a set of recommendations meant for the medium-term of about five years. The key assessments and recommendations under major heads are summarised below. Sustainability of Macroeconomic Growth India’s growth in the recent period was primarily contributed by high domestic demand, productivity, credit growth and high levels of savings and investment. In the wake of the crisis, India could face deceleration in its macroeconomic growth in the short-term; however, growth of 8.0 per cent was sustainable in the medium-term. India would need to focus on revival of growth in agriculture, address quick restoration of the fiscal reform path, continue financial sector consolidation/development and address the infrastructure deficit. While fuller capital account convertibility was desirable, it should be concomitant with macroeconomic and market developments. Financial Institutions Commercial Banks The stress testing of the financial institutions revealed that banks were generally in a position to absorb significant shocks due to credit, liquidity and market risks, though there were some concerns relating to liquidity risk due to increasing illiquidity in banks’ balance sheets. There was, therefore, a need to strengthen liquidity management. The CFSA highlighted risk management as a priority area and noted that the counter-cyclical prudential norms imposed by the Reserve Bank had paid dividends in recent times. It highlighted the growing requirement of appropriate accounting and disclosure norms, particularly with regard to derivatives transactions. Co-operative Sector While the financial position of UCBs had improved, stress tests conducted for this sector revealed that these entities would remain vulnerable to credit risk. The financial indicators of the rural co-operatives threw up some cause for concern. Noting the dual control over co-operatives and rural banks, the CFSA stressed the need for better governance in these institutions. NBFCs The CFSA noted that NBFCs were important players in financial markets with broadly satisfactory financials. Development of the corporate bond market could ease the funding constraints of this sector. Further strengthening of prudential regulations of NBFCs was also suggested. Housing Finance Companies (HFCs) The CFSA recommended that a National Housing Price Index and a Housing Starts Index were priorities for the growing and important segment of HFCs. Insurance Sector For further development of the insurance sector, the CFSA suggested, inter alia, that the supervisory powers of IRDA be improved and an effective policy for group-wide supervision be put in place. Financial Markets The CFSA recommended, inter alia, further improvements in infrastructure, risk management and transparency/ disclosure in equity, foreign exchange and government securities markets. On the issue of development of markets for credit derivatives and asset securitisation products, the Committee noted that it should be pursued in a gradual manner, by sequencing reforms and putting in place appropriate safeguards before introduction of such products. Financial Infrastructure Regulatory Structure The CFSA felt that the existence of multiple regulators was consistent with the current stage of financial development in India, but stressed the need for further improvement in regulatory coordination. The Reserve Bank could, in the interest of financial stability, be armed with sufficient supervisory powers and monitoring functions in respect of financial conglomerates. Liquidity Infrastructure Systems and procedures should be developed for smoothing out volatility in liquidity and call money rates arising out of quarterly tax payments. The introduction of auction of Central Government surplus balances with the Reserve Bank in a non-collateralised manner could be considered, though with appropriate caution. Payments and Settlement Infrastructure The current low utilisation of the electronic payments infrastructure could be increased with the use of technology to make the facilities more accessible to customers, thereby optimising the use of this infrastructure and achieving greater financial inclusion. Others The Committee also discussed insolvency regime, corporate governance and safety nets, among others. Development Issues in the Socio-economic Context A stability assessment of the financial sector should also address broader development aspects in the socio-economic context, which affect social stability and have an indirect bearing on financial stability. Financial inclusion is one of the major determinants of economic growth. Higher economic growth and infrastructure, in turn, play a crucial role in promoting financial inclusion. In order to achieve the objective of growth with equity, it was imperative that infrastructure was developed in tandem with financial inclusion, to facilitate and enhance credit absorptive capacity. COMMERCIAL BANKS Operational Developments VI.20 Indian banks continued to expand their presence overseas during 2008-09. Between July 2008 and June 2009, Indian banks opened 20 branches/subsidiaries/representative offices overseas (Table 6.2). At end-June 2009, 20 Indian banks (14 public sector banks and 6 private sector banks) had presence abroad with a network of 221 offices (141 branches, 52 representative offices, 7 joint ventures and 21 subsidiaries) in 52 countries. Several foreign banks opened branches and representative offices in India during 2008-09 (Table 6.3). At end-June 2009, 32 foreign banks were operating in India with 293 branches. Besides, 43 foreign banks were also operating in India through representative offices. There were 73 banks under liquidation all over India as on June 30, 2009. The matter regarding early completion of liquidation proceedings is being followed up with official/Court liquidators. Regulatory Initiatives VI.21 Policy measures taken by the Reserve Bank during 2008-09 were driven by the twin objectives of continued strengthening of the prudential standards for the banking system in order to make it more resilient and align these with the international best practices while ensuring customer protection, and deliver a counter-cyclical prudential prescription to complement the fiscal policy measures initiated by the Government to fight the downturn in the economy. Basel II Implementation VI.22 Foreign banks operating in India and Indian banks having operational presence outside India migrated to the simpler approaches available under the Basel II framework with effect from March 31, 2008. Other commercial banks (excluding local area banks and RRBs) also migrated to these approaches from March 31, 2009. Thus, the standardised approach for credit risk, basic indicator approach for operational risk and standardised duration approach for market risk (as slightly amended under the Basel II framework) have been implemented for banks in India. Taking into consideration the need for upgradation of risk management framework as also the capital efficiency likely to accrue to the banks by adoption of the advanced approaches envisaged under the Basel II framework and the emerging international trend in this regard, it was considered desirable to lay down a timeframe for implementation of the advanced approaches in India (Table 6.4). This would enable the banks to plan and prepare for their migration to the advanced approaches for credit risk and operational risk, as also for the internal models approach (IMA) for market risk. VI.23 Banks were advised to undertake an internal assessment of their preparedness for migration to advanced approaches, in the light of the criteria envisaged in the Basel II document and take a decision, with the approval of their Boards, whether they would like to migrate to any of the advanced approaches. The banks deciding to migrate to the advanced approaches were advised to approach the Reserve Bank for necessary approvals, in due course, as per the stipulated time schedule. If the result of a bank’s internal assessment indicated that it was not in a position to apply for implementation of advanced approaches by the above-mentioned dates, it could choose a later date suitable to it based upon its preparation. Banks, at their discretion, would have the option of adopting the advanced approaches for one or more of the risk categories, as per their preparedness, while continuing with the simpler approaches for other risk categories, and it would not be necessary to adopt the advanced approaches for all the risk categories simultaneously. Banks would, however, need to acquire prior approval of the Reserve Bank for adopting any of the advanced approaches. Risk Management VI.24 In the wake of the current crisis, the risk management models based on normal distribution were found inadequate to cope with the rapidly changing events. It is widely believed that more robust risk management systems, grounded in appropriately designed stress tests, could have helped prevent the build-up of leverage that became unsustainable. Thus, there is an imperative need to strengthen the risk management systems/models by incorporating imaginative stress testing practices to avoid recurrence of such events and preserve national and global financial stability (Box VI.3). NPA Management VI.25 The three legal options available to banks for resolution of NPAs, viz., the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 (SARFAESI Act, 2002), Debt Recovery Tribunals (DRTs) and Lok Adalats, have led to a steady increase in the adjudication and recovery of disputed amounts (Table 6.5). Box VI.3 Stress testing is a multi-dimensional risk management tool with numerous and varied potential applications. It involves the use of a range of techniques, both quantitative and qualitative, to evaluate a bank’s financial position under exceptional but plausible scenarios of varying severity. Stress test findings could assist in forward looking decision making. Globally, banks are increasingly relying on statistical models such as Value at Risk (VaR) for their risk management frameworks. These models are, however, based mainly on limited historical data and simplistic assumptions and therefore, cannot capture sudden, dramatic, high magnitude and long duration events. To overcome the limitations of risk management models, stress testing is being used as a supplementary tool to quantify “tail risks”, i.e., the risk of losses under abnormal market conditions and re-assess modeling assumptions, particularly those in relation to volatility and correlation. It is especially important after long periods of favourable economic and financial conditions, when fading memory of negative conditions could lead to complacency and neglect as well as under-pricing of risk. It is also a key risk management tool during periods of expansion, when innovations may lead to new products that could grow rapidly and for which limited or no loss data may be available. Stress testing is useful in a bank’s risk management framework and decision making process on account of the following: • It provides a means for estimating a bank’s risk exposures under stressed conditions and enables it to develop or choose appropriate strategies for mitigating such risks. • It helps a bank in identifying hidden risks and risk concentrations across multiple business lines or units. • It enables a bank to better shape its risk profile through a forward-looking assessment of the risks it may be exposed to and facilitates monitoring of changes in the profile over time. • It allows the Board of Directors and senior management to determine whether a bank’s risk exposure or profile corresponds to its risk appetite and risk tolerance. • It enables the bank management to integrate business strategy, risk management and liquidity and capital planning decisions in an improved way. Considering the importance of stress testing in any risk management framework, the Basel Committee on Banking Supervision issued in May 2009 the paper titled “Principles for Sound Stress Testing Practices and Supervision”. The paper presents sound principles for the governance, design and implementation of stress testing programmes in banks. It says that stress testing should form an integral part of the overall risk governance and risk management culture of a bank. Stress testing should be actionable, with the results from stress testing analyses impacting decision making at the appropriate management level, including strategic business decisions of the Board and senior management. Board and senior management involvement in the stress testing programme is essential for its effective operation. A bank should operate a stress testing programme that promotes risk identification and control, provides a complementary risk perspective to other risk management tools, improves capital and liquidity management and enhances internal and external communication. Though stress testing and scenario analysis play an important role in any risk management framework, they have certain limitations such as subjective selection of scenarios, skill of the modeler, uncertain probabilities of the events concerned and use of a small number of parameters. Stress testing, therefore, by itself cannot address all risk management weaknesses, but as part of a comprehensive approach, it has a useful role in aiding timely policy intervention to strengthen the resilience of individual banks and the financial system. References 1. Basel Committee on Banking Supervision (2009). “Principles for Sound Stress Testing Practices and Supervision”, Bank for International Settlements, May 20. 2. Haldane A.G. (2009). “Why Banks Failed the Stress Test”, Bank of England (speech), February 13. 3. Duguay P. (2009). “Financial Stability through Sound Risk Management”, Bank of Canada (remarks), January 8. Restructuring of Advances VI.26 The guidelines on restructuring of advances were revised in August 2008 in accordance with the recommendations of the Working Group to review and align the existing guidelines on restructuring of advances [other than under corporate debt restructuring (CDR) mechanism] on the lines of provisions under the revised CDR mechanism. The main features of the guidelines, which are uniformly applicable across all sectors, are: (i) Retention of asset classification status on restructuring is an exception rather than a rule. It is, however, available to all borrowers who meet specified conditions, except to the borrowers of three categories, viz., consumer and personal advances, advances classified as capital market exposure and advances classified as commercial real estate exposures (subject to modifications carried out subsequently); (ii) The CDR mechanism would be available to the borrowers engaged in activities other than industrial advances as well, albeit subject to the same terms and conditions as applicable to industrial advances. There is no change in the institutional framework for restructuring under the CDR mechanism; (iii) The linkage of asset classification benefit with moratorium has been dispensed with considering certain natural checks built in the guidelines against extension of longer moratorium; (iv) Banks should make provision for diminution in the fair value of the loan (both principal and interest cash flows) rather than for economic loss arising from reduction in rate of interest alone, as done hitherto; a simpler mechanism to compute the diminution in fair value at a flat rate of 5 per cent would be available to borrowers with outstanding amounts below Rs.1 crore; (v) The unrealised income represented by the Funded Interest Term Loan (FITL)/debt or equity instrument should not be taken to the profit and loss account but credited into an account styled as ‘Sundry Liabilities Account (Interest Capitalisation)’ [SLA(IC)]. Only on repayment in case of FITL or sale/redemption proceeds of the debt/equity instruments, the amount received would be recognised in the profit and loss account, while simultaneously reducing the balance in the ‘SLA(IC)’; (vi) The terms – ‘satisfactory performance during the specified period of one year after restructuring’, ‘repeated restructuring’ and ‘secured advances’ were clarified; (vii) In the case of infrastructure projects, in order to become entitled for the asset classification benefit, the period within which the viability had to be established was increased from 7 years to 10 years, and the period within which the loan had to be repaid was increased from 10 years to 15 years. In the case of housing loans, individual banks, with the approval of their Boards, were permitted to decide on the repayment period required for restructured loans; (viii) One of the conditions for availing special asset classification benefit in terms of guidelines on restructuring of advances is that the account should be fully secured. This condition would not be applicable in the case of infrastructure projects, provided the cash flows generated from these projects were adequate for repayment of the advance, the financing bank(s) had in place an appropriate mechanism to escrow the cash flows and also had a clear and legal first claim on these cash flows. Credit Information Companies VI.27 The Reserve Bank had invited applications from companies interested in continuing/ commencing business of credit information in April 2007 A High Level Advisory Committee (HLAC) under the Chairmanship of Dr. R.H. Patil was set up for screening the applications and recommending the names of the companies to which certificates of registration (CoRs) could be granted. The Government announced the FDI policy for credit information companies (CICs) in March 2008. The Reserve Bank announced in November 2008 that FDI up to 49 per cent in CICs would be considered in cases: (a) where the investor was a company with an established track record of running a credit information bureau in a well regulated environment; (b) no shareholder in the investor company held more than 10 per cent voting rights in that company; and (c) preferably, the company was a listed company on a recognised stock exchange. Keeping in view the provisions of the CICs (Regulation) Act, 2005 as well as the directives issued by the Reserve Bank, the HLAC had recommended the names of four applicants which the Reserve Bank could consider for granting CoRs. Accordingly, the Reserve Bank, in April 2009, issued ‘in-principle approval’ to four companies to set up CICs. Approval for Offering Complex Financial Products VI.28 Indian banks were advised in December 2008 that if their foreign branches/subsidiaries were transacting in any financial products, which were not available in the Indian market, but on which no specific prohibition was placed by the Reserve Bank, prior approval would not be required only if these were plain-vanilla financial products. The foreign branches/subsidiaries dealing with such products, however, must have adequate knowledge, understanding and risk management capability for handling such products. Such products were to be appropriately captured and reported in the extant off-site returns. Banks would have to obtain prior approval in case their foreign branches/subsidiaries proposed to handle such products. Unhedged Foreign Exchange Exposure of Clients VI.29 Banks had been advised in December 2003 to have a policy, which explicitly recognised and took into account risks arising on account of unhedged foreign exchange exposures of their clients. It was also advised that foreign currency loans above a specified limit could be extended only on the basis of a well laid out policy of banks’ Boards with regard to the hedging of such loans. It was further advised in December 2008 that the Board’s policy should cover unhedged foreign exchange exposure of all clients, including SMEs, which should take into account exposure from all sources, including ECBs. Banks were advised to monitor and review on a monthly basis the unhedged portion of the foreign currency exposures of clients with large foreign currency exposures and the unhedged exposure of SMEs. In all other cases, banks were advised to put in place a system to monitor and review such positions on a quarterly basis. Counter-cyclical Prudential Norms VI.30 Banks’ loans and advances portfolio often move pro-cyclically, growing faster during an expansionary phase and vice versa. During times of expansion and accelerated credit growth, there is a tendency to underestimate the level of inherent risk and the converse holds during times of recession. This tendency is not effectively addressed by capital adequacy and specific provisioning requirements since they capture risk ex-post, not ex-ante. It is, therefore, necessary to build up capital and provisioning buffers during a cyclical boom, which could be used to cushion banks’ balance sheets in the event of a downturn in the economy or deterioration in credit quality on account of other reasons. In order to ensure that asset quality was maintained in the light of high credit growth, risk weights and provisioning requirements on standard advances for banks’ exposures to the sectors showing above average growth had been progressively raised during the last 3-4 years, as a counter-cyclical measure. However, with the global financial crisis starting to affect Indian economy from September 2008 onwards, the Reserve Bank reduced the enhanced risk weights and provisioning requirements to the normal level. VI.31 Risk weight for all unrated claims, long-term as well as short-term, regardless of the amount of claim, on the corporates was reduced from 150 per cent to 100 per cent in November 2008. Risk weight on the claims secured by commercial real estate and exposure to NBFCs-ND-SI was reduced to 100 per cent from 125 per cent. VI.32 Prior to the unfolding of the global crisis, to ensure that asset quality was maintained in the light of high credit growth, the general provisioning requirement for standard advances in specific sectors, i.e., personal loans, capital market exposures and commercial real estate loans had been increased from 0.4 per cent to 2.0 per cent, and to 1.0 per cent for residential housing loans beyond Rs.20 lakh in January 2007. To mitigate the impact of the current economic slowdown, as a counter-cyclical measure, the provisioning requirement for standard assets was reduced with effect from November 15, 2008, to a uniform level of 0.4 per cent, except in the case of direct advances to the agricultural and the SME sectors, which continue to attract provisioning of 0.25 per cent. The revised norms were made effective prospectively and thus, the provisions already held were not to be reversed. Similar instructions were issued to UCBs. VI.33 In December 2008, in view of the growing concern of possible increase in stress in the Indian banking system, certain modifications were made to the guidelines on restructuring of advances (issued in August 2008) as a one-time measure and for a limited period of time, i.e., up to June 30, 2009. The special regulatory treatment for asset classification (i.e., retention of the asset classification status of the account as obtaining at the time of restructuring), was extended to commercial real estate exposures restructured for the first time and in the case of exposures (other than commercial real estate, capital markets and personal/consumer loans), which were viable but were facing temporary cash flow problems and needed a second restructuring. Accounts which were standard as on September 1, 2008 but slipped into the NPA category subsequently, were treated as standard on restructuring provided banks took them up for restructuring on or before March 31, 2009 and the restructuring package was put in place within the prescribed quick implementation time schedule. The condition of full security cover for availing the special regulatory treatment was waived in case of cash credit accounts which had been rendered unsecured due to fall in inventory prices, subject to banks making provisions as prescribed. It was emphasised that the relaxations effected to the guidelines on restructuring of advances by the Reserve Bank were aimed at providing an opportunity to banks and borrowers to preserve the economic value of units and should not be considered as means to evergreen the advances. Floating Provisions VI.34 Floating provisions made by the banks could not be reversed by credit to the profit and loss account but could only be utilised for making specific provisions under extraordinary circumstances with the prior approval of the Reserve Bank. Until such utilisation, these provisions could be netted off from gross NPAs to arrive at net NPAs, or alternatively, they could be treated as part of the Tier II capital within the overall ceiling of 1.25 per cent of total risk weighted assets. The former option was, however, removed with effect from April 1, 2009. Further, it was decided to allow banks to utilise, at their discretion, the floating provisions held for ‘advances’ portfolio, to the extent of meeting such interest/charges waived under the Agricultural Debt Waiver and Debt Relief Scheme, 2008. Unsecured Loans VI.35 In order to enhance transparency and ensure correct reflection of the unsecured advances in banks’ balance sheets, it was advised that for determining the amount of unsecured advances that could be presented in schedule 9 of the published balance sheet, the rights, licenses, authorisations charged to the banks as collateral in respect of projects (including infrastructure projects) financed by them, should not be reckoned as tangible security. Hence, such advances would be reckoned as unsecured. Off-balance Sheet Exposures VI.36 For the purpose of computing credit exposure and also for computing capital adequacy, banks were advised in August 2008 to compute their credit exposures/credit equivalent, arising on account of the interest rate and foreign exchange derivative transactions and gold, using the ‘current exposure method’. The credit exposures computed would attract provisioning requirement as applicable to the loan assets in the ‘standard’ category of the concerned counterparties. In October 2008, banks were advised that the overdue receivables representing positive MTM value of a derivative contract would be treated as NPAs, if these remained unpaid for 90 days or more, and all other funded facilities of the client would be treated as NPA following the principle of borrower-wise classification. The principle of borrower-wise asset classification would apply to all overdues arising from forward contracts, plain vanilla swaps and options and other complex derivatives with the exception of complex derivative contracts entered into during the period between April 2007 and June 2008. Anti Money Laundering Measures VI.37 The Prevention of Money Laundering (Amendment) Act, 2009 [PMLA] received the assent of the President on March 6, 2009. The amendment sought, inter alia, to include payment system operators and ‘authorised persons’ as defined in Foreign Exchange Management Act, 1999 within the prevention of money laundering framework. The reporting guidelines for banks were updated during the year by the Reserve Bank, the salient features of which include: (i) All cash transactions, where forged or counterfeit Indian currency notes were used as genuine, should be reported by the Principal Officer to the Financial Intelligence Unit – India (FIU-IND) immediately in the prescribed format – counterfeit currency report (CCR). (ii) The background including all documents/office records/memorandums pertaining to all complex, unusually large transactions and all unusual patterns of transactions, which had no apparent economic or visible lawful purpose should, as far as possible, be examined and the findings at the branch as well as the Principal Officer level should be properly recorded. These records should be preserved for ten years as required under the PMLA, 2002. (iii) It is likely that in some cases transactions are abandoned/aborted by customers on being asked to give some details or to provide documents. It was clarified that banks should report all such attempted transactions in suspicious transactions reports (STRs), even if not completed by customers, irrespective of the amount of the transaction. (iv) While making STRs, banks should be guided by the definition of ‘suspicious transaction’ as contained in rule 2(g) of rules notified under PMLA, 2002. STRs should be made if there was reasonable ground to believe that the transaction involved proceeds of crime, irrespective of the amount of the transaction and/or the threshold limit envisaged for predicate offences in part B of schedule of PMLA, 2002. (v) In the context of creating KYC/anti-money laundering awareness among the staff and for generating alerts for suspicious transactions, banks were advised to consider the indicative list of suspicious activities contained in the IBA’s Guidance Note for Banks, 2005. Customer Service VI.38 During the year, many important initiatives were taken for improving customer service in banks. In order to make available all current instructions on the subject at one place, several important instructions relating to customer service were compiled in the form of a Master Circular, which was issued on November 3, 2008. VI.39 Based on the experience gained in running the Banking Ombudsman Scheme, 2006, a revision to the Scheme was effected in February 2009. The salient features of the amendments include widening of the scope of the Scheme to consider deficiencies arising out of internet banking services, enabling customers to lodge complaints against banks for their non-adherence to the provisions of the Fair Practices Code for Lenders or the Code of Bank’s Commitment to Customers and non-observance of the Reserve Bank’s guidelines on engagement of recovery agents. The Reserve Bank also asked all banks to place a copy of the Banking Ombudsman Scheme, 2006, on their websites, for wider dissemination. VI.40 Banks were reported to be levying high service charges for collection of outstation cheques and for use of certain electronic remittance/transfer of funds services. To reduce the complaints in this regard, instructions were issued in October 2008 for uniform service charges for electronic payment products and also charges for collection of outstation cheques. VI.41 The Committee on Customer Services (Chairman: Shri H. Prabhakar Rao) submitted its report in April 2008 and covered matters relating to currency management, Government business, inclusive of payment of pension and taxes and foreign exchange services (Box VI.4). VI.42 Banks were advised in August 2008 to conduct an annual review of accounts in which there were no operations for more than one year and procedures for tracing the customers, ascertaining the reasons for inactivity in the account and labelling the account as inoperative/dormant where there were no transactions for over a period of two years, and payment of interest on savings bank account were prescribed. Since one of the objectives of the segregation of the inoperative accounts was to reduce the risk of frauds, the transaction should be monitored by banks at a higher level both from the point of view of preventing fraud and making an STR. VI.43 As display of customer-friendly information by banks in their branches is one of the modes of imparting financial education, commercial banks were advised to put the important aspects or mandatory instructions relating to ‘customer service information’, ‘interest rates’, ‘service charges’, ‘grievance redressal’ and ‘others’ on a comprehensive notice board and make the detailed information available in booklets/ brochures. VI.44 During the year, instructions were issued to banks to ensure that their branches invariably accepted cash over the counter from all customers who desired to do so; to ensure that all information relating to charges/fees for processing were invariably disclosed in the loan application forms and to inform the ‘all-in-cost’ to the customers to enable them to compare the rates charged with other alternative sources of finance; to indicate the name of the nominee in the passbook/statement of account with the consent of the customer; and to provide ramps in ATMs /bank branches and also to make at least one-third of new ATMs installed as talking ATMs with Braille keypads. VI.45 At present, interest on savings bank accounts is calculated on the minimum balances held in the accounts during the period from the tenth day to the last day of each calendar month. In view of the present satisfactory level of computerisation and extensive networking in commercial banks, and in line with the announcement in the Annual Policy Statement for 2009-10, it is proposed that the payment of interest on savings bank accounts by SCBs would be on a daily product basis with effect from April 1, 2010. Box VI.4 The Reserve Bank had set up the Committee on Customer Services (Chairman: Shri H. Prabhakar Rao) to look into customer services provided by the Reserve Bank directly or through banks/institutions with a view to maximising general public satisfaction. The major recommendations made by the Committee include: Payment of Government Pension through Public Sector Banks: • Branch manager should interact with a cross-section of pensioners serviced at the branch on a quarterly basis. • Banks should follow-up actively and ensure that, wherever possible, pensioners who had retired earlier convert their pension accounts to joint accounts. Nominations should invariably be taken. • Banks should organise regular training sessions for bank personnel dealing with pension matters in consultation with the concerned Government Department. • Banks should establish a Centralised Pension Payment Cell (CPPC) to take over back-office work relating to disbursement of Government pension. Collection of Taxes by Agency Banks (Online Tax Accounting System - OLTAS): • All banks were advised to ensure that all concerned staff were appropriately trained to the requirements of the OLTAS and were also sensitised to the needs of the individual assessees. • All bank branches authorised to accept payment of income tax should clearly and prominently display the fact by way of a notice/board. • Banks were advised to put up notices in their branches asking assessees to quote correct PAN number, assessment year and other details in the challan. Further, an easy to read/comprehend list of “Do’s and Don’ts” is required to be put up as a notice for the guidance of customers. • Banks should strictly follow the process of verification of the PAN number of existing assessees to eliminate any incorrect entry by the assessees. • Banks should provide blank printed challans for the convenience of the assessees who could not obtain pre-verified, pre-printed challans over the internet. • Tax collecting bank branches should invariably give paper token in acknowledgement of the receipt of the cheque. • All banks should set up e-payment facilities in a time-bound manner. Issue and Operations of ‘Savings Bonds’: • Instructions were issued to banks to ensure that every branch conducting Government business of volume above a specified amount (say Rs.25 lakh) was covered by concurrent audit. The scope of the concurrent audit should be prescribed to include various aspects of servicing of savings bonds with specific reference to the customer service related aspects. • Each bank was asked to automate the processing related to the servicing of savings bonds to ensure the timely servicing of the bonds. • Banks were advised to actively make efforts to obtain the bank accounts details of the investors in order to migrate to electronic servicing of interest and maturity proceeds of the savings bonds through the electronic clearing service and the national electronic funds transfer. • Banks were advised to obtain the opinion and views of the investors on the quality of the services rendered by the authorised agencies by means of a survey or questionnaires. Additionally, the Reserve Bank took the following initiatives: • Frequently Asked Questions (FAQs) relating to pension disbursement by the public sector banks under the Central Government pension schemes were hosted on the Reserve Bank’s website in June 2008. • A checklist relating to pension payments/Government business for use of internal inspection of bank branches was forwarded to banks advising them to issue instructions to their internal auditors/inspectors to bestow due attention to adherence to the items of work listed therein and comment on the quality of customer service in their report. • Efforts were made to extend the electronic payment network to more locations in the country so that every investor could opt for receiving interest and repayment proceeds of Saving Bonds directly into his/her account. VI.46 Detailed instructions were issued to banks in July 2008 on their credit card operations covering aspects such as issue of unsolicited cards, insurance cover to credit card holders, safeguards against misuse of lost/stolen cards, educating customers on the implications of paying only the ‘minimum amount due’ on credit cards, excessive interest/other charges, escalation of unresolved complaints, reporting to Credit Information Bureau of India Ltd./CICs, registration of telemarketers, wrongful billing and redressal of grievances. VI.47 With a view to enhancing awareness about the Codes evolved by the Banking Codes and Standards Board of India, the BCSBI launched a quarterly newsletter titled “Customer Matters”, which was distributed to each branch of each member bank. The BCSBI invited suggestions from members of the public, Banking Ombudsmen, various bodies representing interests of banks' customers, and has now completed the process of review of the Code of Bank’s Commitment to Customers, in collaboration with the IBA. Public grievance is an effective tool through which the BCSBI carries out its ongoing monitoring of banks’ compliance with the Code provisions. The BCSBI, by design and mandate, is not a redressal agency to arbitrate on a dispute between an individual and his/her bank but grievances ventilated by individuals sometimes throw up issues on systemic deficiencies. They enable the BCSBI to monitor Code compliances at system or bank-specific level. Supervisory Initiatives VI.48 An Internal Working Group constituted to lay down the road map for adoption of a suitable framework for cross-border supervision and supervisory co-operation with overseas regulators submitted its Report in January 2009. The recommendations of the Group are being examined for initiating further action. An Inter-departmental Group is also examining additional areas/issues which need to be brought under the supervisory focus, including modalities for on-site supervision of overseas branches and subsidiaries of Indian banks. The Group is expected to submit its Report shortly. Keeping in view the systemic importance of financial conglomerates (FCs), efforts are being initiated to strengthen the FC monitoring system further by introducing certain prudential measures such as group-wide capital adequacy requirements, safe conduct of Intra-Group Transactions and Exposures (ITEs) and management of risk concentrations, governance systems in FCs including ‘fit and proper’ principles and risk management systems, supervisory co-operation and information-sharing amongst the sectoral regulators. VI.49 Banks were advised to be extremely cautious while continuing relationships with respondent banks located in countries with poor KYC standards and countries identified as ‘uncooperative’ in the fight against money laundering and terrorist financing. The anti-money laundering (AML)/combating financing of terrorism (CFT) guidelines issued by the Reserve Bank are in consonance with the Financial Action Task Force (FATF) recommendations. Increased disclosure requirements have been emphasised on the part of tax payers and financial institutions for transactions involving uncooperative jurisdictions. The Reserve Bank would continue to incorporate the latest international best practices in its regulations. Off-Site Returns VI.50 Off-site supervision, introduced in 1995, has steadily become an integral component of the Reserve Bank’s financial stability architecture, providing early warning on weaknesses at the bank level as well as the system level. In order to maintain its effectiveness, changes have been continually incorporated into the off-site surveillance system in alignment with the evolving international practices as also the country-specific needs. VI.51 As part of the policy decision to receive all regulatory returns through a secured online returns filing system (ORFS), the existing periodic prudential off-site returns submitted by banks are being migrated to the ORFS in a phased manner. After migrating the fortnightly return on liquidity (statement of structural liquidity) from February 2008, four more returns, viz., report on sensitivity to interest rate - both rupee and foreign exchange, report on maturity and position and report on subsidiaries/joint ventures/associates, were successfully migrated to ORFS from January 2009. A new return on capital adequacy as per Basel II was developed using extensible Business Reporting Language (XBRL) and integrated with the existing ORFS. The benefits of ORFS include ease of compilation, speedy submission, monitoring of receipts, scope for incorporating changes in the returns and maintenance of the system. Monitoring of Frauds VI.52 The fraud monitoring function of the Reserve Bank has assumed greater significance in recent years as there has been an increase in the number of frauds involving larger amounts. Frauds have been noticed in traditional as also new areas, such as housing loans, credit cards, internet banking and outsourcing business (Table 6.6). VI.53 The complexity of cases is increasingly exposing banks to greater operational risk. The Reserve Bank, as part of its supervisory process, has been sensitising banks from time to time about common fraud-prone areas, modus operandi of frauds and the measures to be taken to prevent/ reduce the incidence of frauds. VI.54 During the year 2008-09, 102 caution advices were issued to banks by the Reserve Bank (through secured e-mail) in respect of unscrupulous borrowers who perpetrated frauds of amounts exceeding Rs.25 lakh, so that banks could exercise due care while considering sanction of credit facilities to them. With a view to putting in place some deterrent action against entities such as builders, warehouse owners, chartered accountants, lawyers and valuers of properties, who do not have any contractual relationship with banks, it was decided that banks could inform the IBA about the names of such entities so that the IBA could prepare a caution list for circulation amongst banks. A circular was issued to banks in March 2009 in this regard.