IST,

IST,

Report of the Internal Working Group to Review the Liquidity Management Framework

|

Letter of Transmittal Shri Sanjay Malhotra July 30, 2025 Dear Sir, Report of the Internal Working Group to Review the Liquidity Management Framework We are pleased to submit the report of the Internal Working Group (IWG) to Review the Liquidity Management Framework. The IWG was set up to assess the effectiveness of the existing Liquidity Management Framework with a focus on various aspects, including the continuation of Weighted Average Call Rate (WACR) as the operating target for monetary policy, efficacy of existing instruments for liquidity management, eligibility criteria for participation in the Reserve Bank’s liquidity operations, among others. We thank you for entrusting this responsibility to the IWG and hope that the recommendations of the Group will help in the evolution of a more effective Liquidity Management Framework. Yours faithfully, Sd/-

The Internal Working Group places on record its deep gratitude to Shri T. Rabi Sankar, Deputy Governor, for his continuous guidance and encouragement. The Group sincerely appreciates the valuable suggestions shared by the officials of the Reserve Bank, viz., Shri Jayant Kumar Dash, former Executive Director, RBI, Shri Muneesh Kapur, former Executive Director, RBI, Ms. Dimple Bhandia, CGM, FMRD, Dr. (Smt.) Praggya Das, former Adviser-in-Charge, MPD, Shri Rakesh Tripathy, CGM, IDMD, and Shri Manoranjan Padhy, CGM, DoR. The Group is also grateful for the insightful inputs received from bankers and economists. The Group wishes to place on record its profound appreciation for the exceptional dedication and significant contributions of the core team from the Financial Markets Operations Department (FMOD) comprising Shri T. Kiran Kumar, GM, Shri Satish Chandra Rath, GM, Shri Amarendra Acharya, Director, Shri Mohammad Shadan Khan, former AGM, Shri Sabyasachi Sarangi, AGM, Shri Rahul Mehra, AGM, Shri Shreyas K, AGM and Shri Anish Kumar Banka, AGM, in providing comprehensive research and secretarial assistance to the Group. The Group is also thankful to Shri Dipak Chaudhari, Asst. Adviser, Shri Mukund Raman Ayyar, AGM, Shri Raumil Suthar, Manager, Shri Venkata Rohit Kumar Alluri, Manager, Ms. Vejaya Agrawaal, Manager and Ms. Twinkal Jain, Manager of FMOD for providing critical data inputs and extending their support in the editorial process.

Liquidity management is the operating procedure of monetary policy, primarily aiming to align the targeted money market rate to the policy rate, to achieve the first step in monetary policy transmission. An effective Liquidity Management Framework (LMF) facilitates the maintenance of appropriate liquidity in the banking system and fosters money market development. The Reserve Bank's LMF has undergone a process of continuous refinement over the past two decades, driven by the dynamic nature of the macroeconomic and financial environment. The Reserve Bank’s current LMF, implemented in February 2020, has been operative for more than five years, with a brief pause during the COVID-19 pandemic. This period has provided valuable insights into the LMF's effectiveness during episodes of global shocks such as COVID-19, the war in Ukraine and the global monetary tightening cycle. Moreover, during this period, there have also been certain domestic structural changes, including increased digital payments, the operationalisation of a 24x365 payments system and adoption of “Just-in-Time” release of Centrally Sponsored Schemes funds. These developments have significantly influenced the liquidity management paradigm. In addition, capital flows have continued to exhibit large volatility with significant implications for system liquidity. In view of the factors discussed above, the Reserve Bank constituted an Internal Working Group (IWG) to evaluate the current LMF and suggest appropriate changes for effective transmission of monetary policy. The recommendations made by the Group in this report along with their rationale are summarised below. I. WACR as the operating target I.1 Under the existing LMF, the overnight Weighted Average Call Rate (WACR) is the target rate for liquidity operations. The share of the call money market in total overnight money market volume has dwindled over the years1, which has raised the question on its efficacy as the operating target of monetary policy. Therefore, the IWG examined this issue by considering the following. I.2 To achieve monetary policy transmission, it is essential that entities participating in the target segment have access to central bank’s liquidity facilities, that is Liquidity Adjustment Facility (LAF)2 in case of the Reserve Bank. Further, it is vital that entities leveraging these facilities engage in lending and borrowing activities across various overnight money market segments, driven by considerations of cost and risk, thereby facilitating rate convergence across overnight money market segments. The participants in the call money market include banks and standalone primary dealers (SPDs), both of which not only have access to the Reserve Bank’s LAF but also are under the regulatory purview of the Reserve Bank. In other words, the Reserve Bank has the maximum lever over WACR as compared to any other overnight money market rate. I.3 The Group noted that using the uncollateralised rate as the operating target also has other advantages like it directly influences short-term interest rates and clearly conveys the central bank's stance on liquidity and interest rates. The uncollateralised rate better reflects credit/counterparty risk that is not masked by collateral. Central banks being the sole supplier of reserves have more control over this rate. A stable and predictable uncollateralised rate facilitates a more effective transmission of monetary policy, as it anchors other interest rates across maturities. I.4 Further, it is observed that WACR and rates in the overnight collateralised segments (Triparty Repo and Market Repo) display a high degree of correlation among them and are in close alignment across time horizons. WACR is also found to be effective in transmitting signals to other market rates like treasury bills (T-bills), commercial papers (CPs), certificate of deposits (CDs) and government securities (G-secs) etc. It is equally pertinent to note that while the collateralised market segment accounts for significant portion of the total overnight money market volume, it features a notable presence of non-bank entities such as mutual funds, insurance companies and pension funds, whose transactions in the overnight money market segments do not reflect the dynamics of inter-bank market for reserves and these entities are not regulated by the Reserve Bank. I.5 Considering the aforementioned factors, the Group recommends continuation of overnight Weighted Average Call Rate as the operating target. The Reserve Bank may, however, continue to keep track of rates in other overnight segments to ensure orderly evolution of money market rates and smoothen transmission. II. Corridor System II.1 The LAF under the current LMF is based on the corridor system, with the policy repo rate in the middle of the corridor, the Marginal Standing Facility (MSF) rate (25 basis points above the policy repo rate) as the ceiling and the Standing Deposit Facility (SDF) rate (25 basis points below the policy repo rate) as the floor. While widening the corridor can encourage relatively higher inter-bank activity, it may lead to increased day-to-day volatility in the short-term market rates. On the other hand, a narrow corridor may provide the advantage of better anchoring of short-term market rates but comes at the cost of reduced incentives for banks to indulge in inter-bank trading. II.2 In view of the above considerations, the Group recommends continuation of the existing corridor system with policy repo rate at the middle of the corridor. The corridor would remain symmetric, with SDF rate and MSF rate, which are 25 basis points away from the policy repo rate, acting as the lower and upper bounds of the corridor, respectively. III. Operational Toolkit of the Liquidity Management Framework III.1 Under the existing LMF, the 14-day Variable Rate Repo/Reverse Repo (VRR/VRRR) auction is the main operation to manage transient/short-term liquidity needs, supported by fine-tuning operations of overnight to 13 days tenors. An empirical analysis shows that while repo operations across tenors were generally over-subscribed, there was a general reluctance of banks to part with their surplus liquidity in 14-day main reverse repo operations, preferring instead, utilisation of the SDF facility on a daily basis. While fine-tuning VRRR auctions saw relatively higher participation, the increased number of fine-tuning operations, in general, leads to uncertainty about the Reserve Bank’s liquidity operations. The major reason for lower participation of banks in VRRR main operations is the limited information that banks have on the frictional factors like changes in Government of India (GoI) cash balances, posing challenges in liquidity forecast for a longer tenor. III.2 The challenges faced by banks in forecasting the liquidity position for a 14-day period and resultant lower participation in 14-day main operations, undermines the efficacy of 14-day operations in managing transient liquidity. The Group is of the view that intra-fortnight variations in the system liquidity due to frictional factors like changes in government balances can be better managed through shorter tenor operations instead of 14-day operations. Therefore, the Group recommends that 14-day VRR/VRRR auctions may be discontinued as the main operation. Instead, the transient liquidity may be managed primarily through 7-day repo/ reverse repo operations and other operations of tenors from overnight up to 14-days at the discretion of the Reserve Bank based on its assessment of the system liquidity requirement. III.3 Further, to reduce uncertainty in the market about the tenor, quantum and timing of the repo/reverse repo operations, the Group felt that it is desirable for the Reserve Bank to provide sufficient advance notice to market participants, at least by one day, while conducting any such liquidity operation. III.4 The Group observed that there may be situations in which the evolving liquidity conditions may warrant conduct of liquidity operations on the same day of announcement. The Group recommends that in such circumstances, the Reserve Bank may conduct repo/reverse repo operations announced on the same day. III.5 As regards the mechanism for repo and reverse repo operations, the Group noted that the variable rate auctions provide the advantage of better price signaling and consequent efficient allocation of reserves among the market participants. It is viewed that, for liquidity management purpose, variable rate liquidity operations are more appropriate tools than fixed rate operations as the former contains useful market signals about liquidity conditions. In view of the above, the Group recommends continuation of variable rate auction mechanism for conducting repo and reverse repo operations under the LAF. III.6 The repo/reverse repo operations of tenor overnight to 14-days are expected to handle the changes in system liquidity due to frictional factors. However, in some scenarios, the liquidity mismatches may extend for a longer term. For handling such liquidity mismatches, the Group recommends that the repo/reverse repo operations of appropriately longer tenor may be conducted through variable rate auctions. The availability of such instruments would provide the necessary liquidity assurance to the market and would also help in minimising frequency and quantum of shorter tenor operations. III.7 The Group noted that the set of instruments in the extant LMF, viz., Open Market Operations (OMOs), long-term VRR/VRRR operations and Foreign Exchange (FX) swap auctions, are sufficient for managing durable liquidity in the system and hence does not recommend any change at this stage. IV. Standalone Primary Dealers Standalone Primary Dealers (SPDs) are heavily dependent on overnight segment of the money market to meet their funding requirements. They have been the largest borrowers in the call money market contributing about three-fourth of the total borrowing. The Group noted that SPDs have already been allowed to participate in all repo operations irrespective of tenor with effect from March 26, 2025. The Group also felt that SPDs may not be given access to MSF, as hitherto, as unlike banks they have neither reserve requirements nor unforeseen payment obligations beyond market hours. V. Averaging of Reserve Requirement Averaging of reserve requirement over the maintenance period allow banks to use excess reserves from one day to offset shortfall on other days. In the context of 24x365 payment systems, which has resulted in banks building up precautionary reserve balances, there is a view that some reduction in the 90 per cent daily maintenance requirement is warranted as it may provide further room for banks to effectively manage their liquidity over the maintenance period. However, lowering daily Cash Reserve Ratio (CRR) maintenance requirement may induce higher volatility in money market rates, especially during end of fortnights, which may not be desirable. It has also been observed that banks rarely maintain daily reserve balances below 95 per cent of the prescribed CRR. In view of the above, the Group recommends the Reserve Bank to retain the extant daily minimum requirement of 90 per cent of the prescribed CRR. I.1. Liquidity management is the operating procedure of monetary policy.3 Specifically, liquidity management operations are intended to transmit the impulse of monetary policy action to the call money market, which is the market for bank reserves (deposits placed by banks with the central bank). Since the successful conduct of monetary policy requires effective liquidity management operations, the Liquidity Management Framework (LMF) needs to be carefully designed and deployed. I.2. The current LMF of the Reserve Bank was implemented in February 2020 and has been in operation for more than five years, with a brief suspension in April 2020 due to COVID-19-induced disruptions. Normal liquidity management was restored in a phased manner starting from January 2021. In these five years, the Reserve Bank has gained valuable insights from operations under the LMF during episodes of global shocks such as the COVID-19, the war in Ukraine and the global monetary tightening cycle., including policy rate hikes in India. I.3. During this period, there have also been certain structural changes which have influenced the liquidity management paradigm of market participants in a significant manner. Functioning of a 24x365 payments system4 requires banks to be in readiness for settlement of large payment obligations. Moreover, capital flows have continued to exhibit large volatility with significant implications for the system liquidity. The flows arising on account of GoI transactions impact the banking system liquidity on a daily basis. The adoption of “Just-in-Time” release of funds under Centrally Sponsored Schemes in July 20235 has added another dimension to liquidity management by banks. I.4. In view of factors discussed above, and to give effect to insights gained from implementation of the current LMF, it was considered appropriate and timely to review the existing framework. Accordingly, the Reserve Bank constituted an Internal Working Group (IWG) (hereinafter ‘the Group’) to evaluate the current LMF and suggest changes appropriate to the evolving financial and technological environment for effective transmission of monetary policy. The composition of the IWG is as under:

i. Assess the effectiveness of the existing Liquidity Management Framework (LMF) in meeting its objectives and suggest changes ii. The Group may, inter-alia, critically examine,

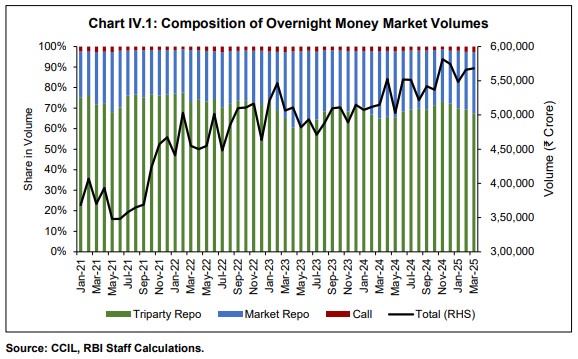

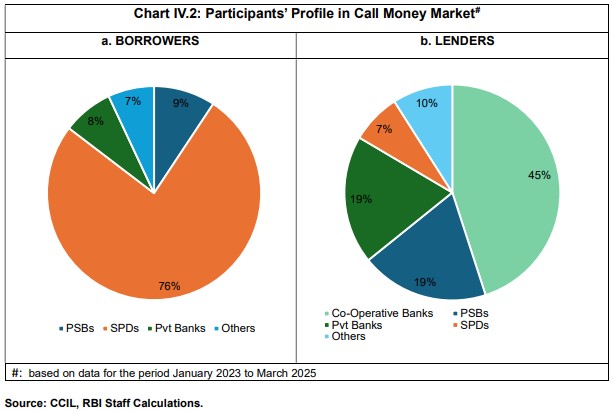

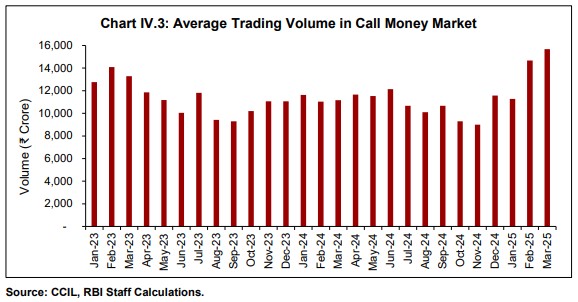

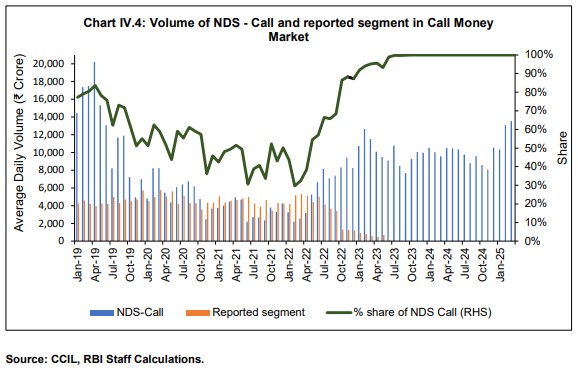

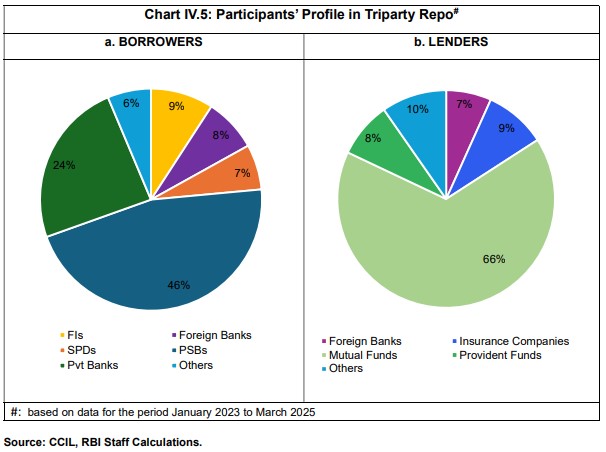

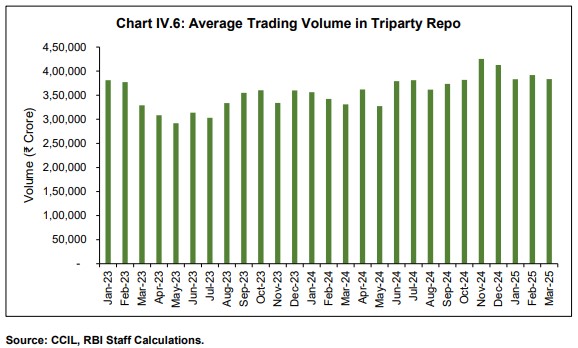

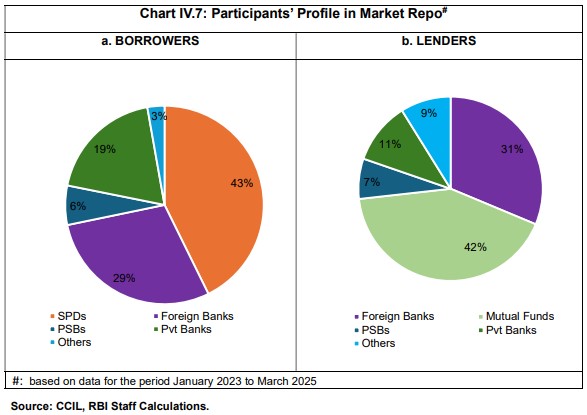

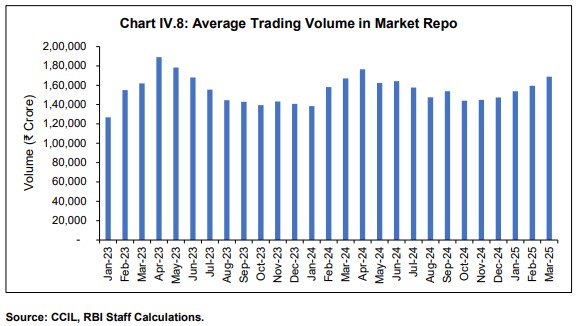

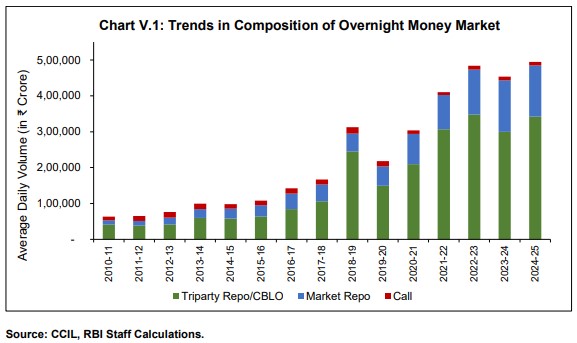

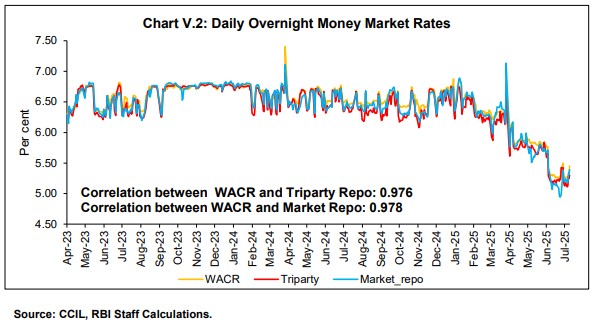

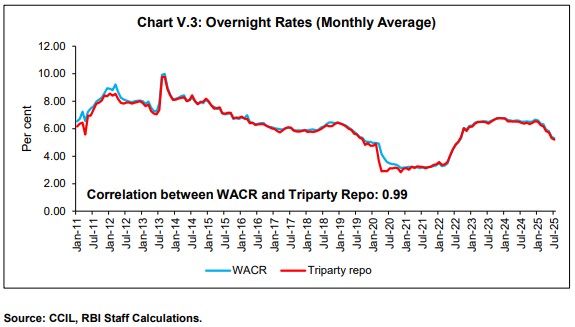

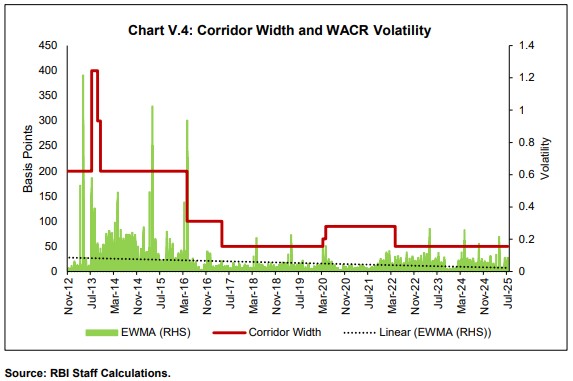

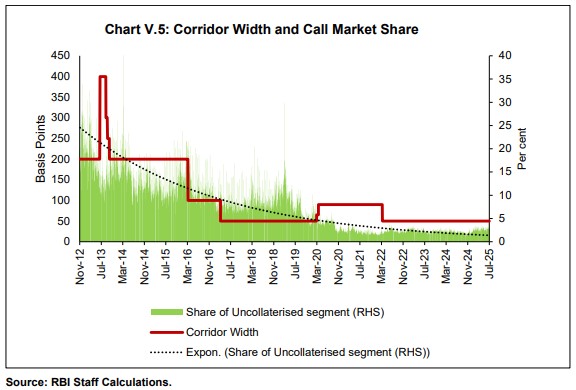

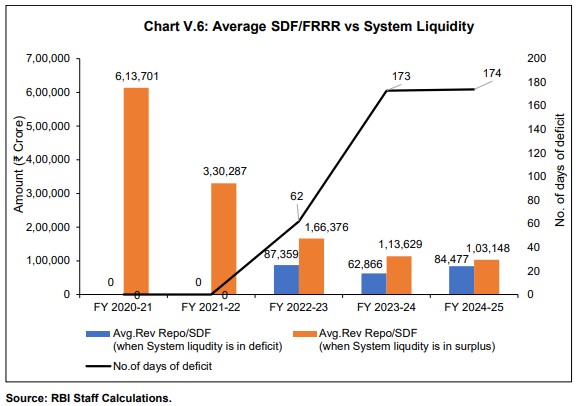

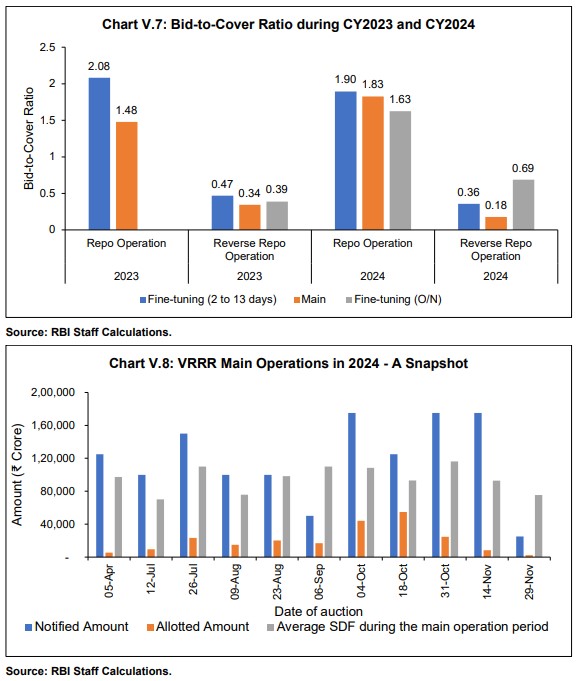

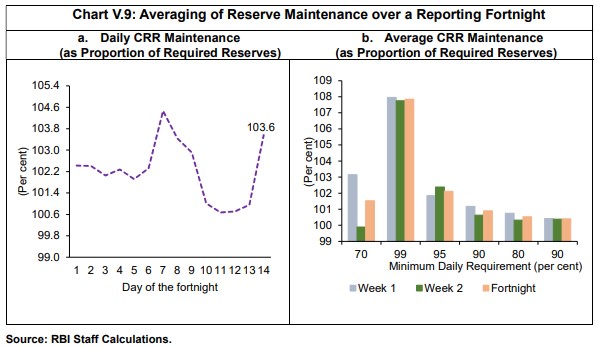

II. Evolution of Liquidity Management Framework Over the past two decades, the Reserve Bank’s LMF has continuously evolved in response to the changing macroeconomic and financial environment. II.1. The LMF of the Reserve Bank has evolved through progressive refinements since 1999 in response to changing domestic conditions and global developments. In April 1999, an Interim LAF was introduced under which liquidity was injected against collateral of GoI securities at various interest rates, but surplus liquidity was absorbed at a fixed rate. The transition from the Interim LAF to a full-fledged LAF took place in June 2000. II.2. A new operating framework for monetary policy was implemented in May 2011 to enhance the effectiveness and stability of the monetary system. The framework recommended repo rate as the single policy rate and suggested overnight WACR as the operating target of monetary policy. To manage market liquidity and interest rates effectively, an interest rate corridor of (+/-) 100 basis points (bps) around the repo rate was introduced, with the MSF rate set at 100 bps above the repo rate and the reverse repo rate set at 100 bps below it. The framework aimed to fully accommodate liquidity demand at fixed repo rate, maintaining an indicative comfort zone of (+/-) 1 per cent of the Net Demand and Time Liabilities (NDTL) of the banking system. Additionally, the framework facilitated transmission of changes in repo rate through WACR to the term structure of interest rates, thereby influencing broader financial conditions and economic activities. II.3. The LMF was revamped in September 2014 offering banks assured liquidity access equivalent to 1 per cent of their NDTL on an average. It included provisions for overnight fixed-rate repos up to 0.25 per cent of NDTL, while remaining liquidity needs were met through conduct of four 14-day variable rate term repo auctions during the reporting fortnight. Additionally, the introduction of variable rate fine-tuning repo and reverse repo auctions allowed the Reserve Bank to manage liquidity conditions more precisely and respond dynamically to market needs. II.4. Further refinements in the LMF were carried out in April 2016 and April 2017. The changes included progressive narrowing of the interest rate corridor around the policy repo rate from (+/) 100 bps to (+/-) 50 bps and further to (+/-) 25 bps to provide more control over short-term interest rates and reduce money market volatility. The framework also aimed to progressively lower the ex-ante system-level liquidity deficit, bringing it closer to a neutral position over the medium term. Additionally, the minimum daily maintenance requirement of the CRR was reduced from 95 per cent to 90 per cent with effect from the fortnight beginning April 16, 2016, granting banks greater flexibility in managing their daily liquidity needs. II.5. The Reserve Bank announced a revised LMF in February 2020. The framework retained the liquidity management corridor with WACR as the operating target and retained the corridor width at 50 bps. The main tool for managing transient liquidity was a 14-day term repo/reverse repo operation, aligned with the CRR maintenance cycle, while daily fixed rate repos and fortnightly term repos were withdrawn. Fine-tuning operations supported the main liquidity operation to address any unanticipated liquidity changes. Instruments included fixed rate reverse repo, MSF, variable rate repo/reverse repo auctions, OMOs and FX swaps. The minimum daily CRR maintenance requirement remained at 90 per cent. SPDs were allowed to participate only in overnight liquidity management operations. They were, however, not granted access to the MSF. The framework emphasized transparency through dissemination of flow and stock impact of liquidity operations and publication of a quantitative assessment of durable liquidity conditions with a fortnightly lag. II.6. SDF, which was operationalised with effect from April 8, 2022, replaced the erstwhile Fixed Rate Reverse Repo (FRRR) as the floor of the LAF corridor. Further, SPDs were allowed to participate in all repo operations irrespective of tenor with effect from March 26, 20256. III. Guiding Principles of Liquidity Management Operations III.1. Liquidity management, as stated in the introduction, is the operating procedure of monetary policy. Its primary objective is to ensure that the targeted money market rate remains aligned to the policy rate. Liquidity management thus focuses on the first step in monetary policy transmission. Liquidity operations are aimed at aligning the target rate to the policy rate. The objective of this transmission of policy impulse to overnight market rates is that further transmission to other interest rates in the economy (term money market rates, G-sec yields, corporate bond yields, bank deposit and lending rates etc.) happens efficiently. If the transmission to overnight rates is incomplete, then the transmission to other market interest rates would also be less than optimal. III.2. In a growing economy like India, while the need for reserves by the banking system tends to be on an upward trajectory owing to the secular growth in NDTL, challenges to the liquidity management stem from certain structural factors discussed earlier such as 24x365 payments, increased volatility in government balances considering the introduction of “Just-in-Time” release of funds, the Reserve Bank’s forex operations, etc. Given the nature of these factors, there is a significant degree of uncertainty about their impact on the system liquidity. III.3. It is desirable that banking system liquidity should not remain in excessive deficit or surplus for extended period. Excessive surpluses or deficits give rise to imbalances such as banks holding on to their funds rather than lending in the market or can generate structural constraints like shortage of collateral in the system. If that happens because of unavoidable reasons, durable liquidity operations should be resorted to, and the liquidity position be brought back to manageable levels. For instance, during COVID-19 pandemic, in an attempt to ensure normal functioning of the financial markets, various liquidity measures were adopted by the Reserve Bank to infuse long-term liquidity into the system. These extraordinary liquidity measures resulted in prolonged period of surplus system liquidity7, reaching up to 6 per cent of NDTL of the banking system8. Subsequently, surplus liquidity infused into the system was gradually withdrawn over time while ensuring there was no major impact on financial markets. III.4. The effectiveness of the LMF is premised on existence of an active overnight money market. The LMF should incentivise banks to trade among themselves rather than with the central bank because the transmission process crucially depends on market forces working efficiently. That is, it should address shortage or excess liquidity at the system level, not that of individual entities, as the latter would effectively mean that the Reserve Bank is acting as a market maker. The LMF should also facilitate the development of money markets so as to achieve efficient transmission of monetary policy. III.5. Selecting an appropriate design of the LMF and defining an appropriate target rate are crucial for monetary policy operations to achieve its objective. III.5.1. Broadly two types of LMFs are prevalent globally, viz., corridor system and floor system. In a corridor system, the central bank maintains standing facilities on either side of the corridor viz., a deposit facility wherein participants can deposit their excess reserves at the end of the day and a lending facility wherefrom participants can borrow reserves in times of need. Therefore, the deposit rate and the lending rate under the standing facilities effectively become the floor and the ceiling of the corridor respectively, with the policy rate in between. The central bank modulates the quantum of available liquidity in the system to keep the overnight rates within the corridor and aligned to the policy rate. On the other hand, in a floor system, the central bank is required to maintain only a deposit facility to act as the floor and the policy rate is defined at the floor rate. By supplying abundant liquidity, the central bank can maintain the overnight rates at the deposit rate thereby aligning the market rates to the policy rate. III.5.2. With regard to the operating target, the choice should be based on “first principles” of liquidity management rather than being determined by the phase of the liquidity cycle (easy vis-à-vis tight) or convenience of market participants. As the central bank supplies reserves through the LMF, the target rate should preferably be from a market that trades in reserves. The target rate should also have a strong correlation to the other segments of the money market and one that influences the benchmark rates. Further, all the participants in the target money market should have access to the central bank’s liquidity facilities (LAF in the case of the Reserve Bank) so that the effect of monetary policy actions can be transmitted seamlessly. III.6. In the Indian context, the Reserve Bank’s LMF is currently a corridor system with WACR as the target rate. The mechanics of the LMF that ensure that the target rate is aligned to the policy repo rate in the Indian context is explained below. III.7. The first step in achieving this objective is to define upper and lower limits within which the target rate is to be kept. Liquidity operations then need to ensure that the target rate remains within the policy corridor. At the lower end of the corridor is the floor rate – the rate at which the Reserve Bank absorbs surplus funds from the banking system, currently the SDF rate which replaced the FRRR with effect from April 8, 2022. At the upper end of the corridor is the ceiling rate - the rate at which the Reserve Bank assures provision of funds to the banking system, currently the MSF rate. III.8. How is the target rate, which is a market determined rate, contained within the corridor? This is achieved by assuring the banking system that, (a) if the system is in liquidity deficit, the Reserve Bank shall meet the deficit up to a certain limit, at the ceiling rate9 and (b) if the system is in liquidity surplus, the Reserve Bank shall absorb the surplus at the floor rate. This assurance ensures that no market participant would lend in the money market below the floor rate or borrow in the money market above the ceiling rate. Subject to participants not being constrained by their ability to tap MSF, the policy corridor serves the purpose of constraining volatility in the targeted money market segment rate within the width of the corridor, currently 50 bps. III.9. Having ensured that the target rate is contained within the policy corridor, the next step is to align it to the policy rate. A simple method is to provide market participants incentive to transact amongst each other, while conducting appropriate liquidity operations to maintain adequate liquidity at the systemic level. As long as there is an assurance from the Reserve Bank of provision of liquidity as per the systemic needs, there is very little incentive for any bank in the system to borrow at significantly higher rates in the market. In other words, the target rate will not deviate significantly from the policy repo rate. Thus, the objective of LMF will be achieved. III.10. Certainty of liquidity management operations in a broad sense and provision of required liquidity to the banking system by the Reserve Bank are the key principles of the LMF. Clear communication aimed at increasing certainty about liquidity conditions and providing assurance to market participants, should be an underlying factor in the design of the LMF. Further, minimizing the number of operations to bring in more clarity about the conduct of liquidity operations would also be an important factor in improving the efficiency of monetary policy transmission. IV. An Overview of the Money Market IV.1. The money market is a key component of the financial system as it is the fulcrum of monetary operations conducted by the central bank in its pursuit of monetary policy objectives. It is a market for short-term funds with maturity ranging from overnight to one year and includes financial instruments that are deemed to be close substitutes of money. IV.2. The overnight money market in India is the most liquid money market segment with an average daily volume of over ₹5 lakh crore. It comprises the uncollateralized (call) and collateralized (repo) segments. In terms of overall market comparison, the triparty repo segment constitutes the largest share with around 70 per cent of the money market volumes while the market repo and the call money market segments constitute around 28 per cent and 2 per cent of the money market volumes, respectively (Chart IV.1).  IV.3. The call money market is an uncollateralised market for bank reserves. In addition, SPDs are also permitted to participate in this market. The participant profile in the call money market indicates that SPDs are the major borrowers, while co-operative banks are the major lenders (Chart IV.2.a and Chart IV.2.b).  IV.3.1. Monthly Volume: During the period January 2023 to March 2025, the average daily trading volumes in the call money market have ranged from ₹9,000 crore to ₹15,000 crore (Chart IV.3).  IV.3.2. Trading venue and settlement: The primary trading venue for call money market transactions is the Negotiated Dealing System-Call (NDS-Call) platform. All call money market transactions are settled bilaterally. With increasing participation of co-operative banks as lenders in the call money market, a larger share of trades was taking place outside the NDS-Call. Prior to 2021, these trades were also taking place at relatively lower rates, thus impacting the WACR. To address this and to improve transparency in the market, all call money market participants were mandated to obtain membership of the NDS-Call platform in 2021. This has resulted in gradual reduction and elimination of reported trades and currently all market participants are undertaking call trades on the NDS-call platform leading to better alignment of rates in the call money market (Chart IV.4).  Triparty Repo in Government Securities IV.4. The triparty repo segment is a collateralised segment and the largest segment of the money market with major participation by non-bank lenders such as mutual funds, insurance companies and provident funds. The participant profile in the triparty repo market indicates that public sector banks are largest borrowers followed by private sector banks, while mutual funds are major lenders (Chart IV.5.a and IV.5.b).  IV.4.1. Monthly Volume: The average daily volume in the triparty repo segment has been around ₹3.5 - ₹4 lakh crore during the period January 2023 to March 2025 (Chart IV.6).  IV.4.2. Trading venue and settlement: The trading venue for triparty repo transactions is Triparty Repo Dealing System (TREPS), an anonymous order matching platform. All triparty repo transactions are settled through the Clearing Corporation of India Ltd. (CCIL). IV.5. The market repo segment is also a collateralised segment. Transactions in market repo are undertaken predominantly on Clearcorp Repo Order Matching System (CROMS) which also facilitates trading in special repos. Similar to the triparty repo segment, the market repo segment has participation by major non-bank lenders such as mutual funds, insurance companies, provident funds. etc., while SPDs and foreign banks are the largest borrowers (Chart IV.7.a and IV.7.b).  IV.5.1. Monthly Volume: The average daily volume during the period January 2023 to March 2025, shows a uniform trend of daily average of around ₹1.5 lakh crore (Chart IV.8).  IV.5.2. Trading venue and settlement: The primary trading venue for market repo transactions is CROMS, an anonymous order matching platform. All market repo transactions are settled through CCIL. V. Liquidity Management Framework – Issues and Recommendations V.1. Drawing insights from the experience gained during the tenure of the current LMF and developments in the money market, this chapter presents an analytical review of various issues of the current LMF and suggests recommendations wherever required. V.2. Under the existing LMF, the WACR is the operating target of monetary policy. The objective of liquidity management operations is to align the target rate to the policy repo rate. Pursuant to the recommendation of the “Working group on Operating Procedure of Monetary Policy” (Chairman: Deepak Mohanty, RBI, 2011), the WACR was recommended to be the operating target of monetary policy of the Reserve Bank. Since then, the LMF has undergone major changes in 2014 and 2020, however, WACR has continued to remain the operating target. Since 2011, volumes in call money market, which is uncollateralised, have reduced from 16 per cent to about 2 per cent of total overnight money market volumes during 2022-2025 (Chart V.1). This change indicates a shift in liquidity management preference of market participants towards collateralised borrowing/lending aided by regulatory policies. The participation base in call money market has also changed with the share of scheduled commercial banks reducing over time accompanied by a significant increase in the share of SPDs. V.3. Domestically, this shift in the trends has been influenced by increasing participation of non-bank lenders (especially mutual funds) in secured overnight money markets. Regulatory changes have also left banks with a larger holding of excess Statutory Liquidity Ratio (SLR) securities which can be used to meet their funding needs in collateralised market, with lower associated capital and other regulatory costs. It may, however, be noted that shift in money market volumes towards collateralised segments is a universal phenomenon during the post-Global Financial Crisis era. Despite this, most central banks continue to have unsecured inter-bank rate as their operating target.10  V.4. For the central bank’s liquidity management operations to be effective, there are broadly two considerations regarding the operating target:

V.5. The consideration at V.4.(a) mentioned above is imperative to ensure that rates in the overnight money market segment reflect, to the extent possible, the impact of central bank’s operations. The operating target should be the one which the monetary authority can effectively control, allowing it to achieve its broader objectives. The participants in the call money market in India include banks and SPDs, both of which are regulated by the Reserve Bank and have access to the LAF11. Therefore, the Reserve Bank has the maximum lever over WACR as compared to any other overnight money market rate. V.6. Further, the rationale for using the uncollateralised rate as the operating target also stems from its ability to directly influence short-term interest rates and provide a clear signal of the central bank's stance on liquidity and interest rates. This approach has several advantages, viz., (i) the uncollateralised rate provides a better assessment of credit/counterparty risk that is not masked by collateral; (ii) central banks have more control over the uncollateralised overnight rate as they are the sole supplier of bank reserves; (iii) targeting the uncollateralised rate provides a clear signal to financial markets about the central banks’ desired level of interest rates; (iv) a stable and predictable uncollateralised rate facilitates a more effective transmission of monetary policy since all other rates across the term structure are priced off the uncollateralised rate; and (v) communicating policy changes through the uncollateralised rate are less prone to misinterpretations. Overall, the uncollateralised rate serves as a readily observable indicator of the effectiveness of monetary policy and provides a mechanism for the central bank to guide market participants' expectations about future interest rate movements. WACR and Other Money Market Rates – An Analysis V.7. It is observed that WACR and rates in collateralised segments (Triparty repo and Market repo) broadly move in tandem, thus emphasising consideration at V.4.(b) as mentioned above. Generally, WACR has remained above triparty repo and market repo rates with average daily spreads at 7 bps and 4 bps, respectively, during the period April 2023 to July 2025 (Table V.1 & Chart V.2). However, these spreads have shown some variability over time with a standard deviation of 8 bps each.  V.8. An analysis with a longer horizon (from 2011) shows that the triparty repo rate is broadly aligned with the WACR with an equally high correlation (Chart V.3).  V.9. The high correlation between WACR and collateralised rates (Chart V.2 and Chart V.3) suggests that signals from the former are effectively transmitted to secured overnight rates. WACR is also found to be effective in transmitting signals to other market rates like Treasury bills (T-Bills), CPs, CDs and G-secs as suggested by contemporaneous correlations between these rates (Table V.2). V.10. Considering the significant increase in market share of collateralised overnight money market segments, there is a view that collateralised money market rates may also be considered for the operating target. However, as these segments feature a notable presence of non-bank entities such as mutual funds, insurance companies and pension funds, transactions in these segments may not reflect the dynamics of inter-bank market for reserves and also these entities are not regulated by the Reserve Bank. Further, based on consideration V.4.(a) mentioned above, it may necessitate provision of access of Reserve Bank’s liquidity facilities under the LAF to non-bank entities like mutual funds, insurance companies, provident funds, All India Financial Institutions (AIFIs) etc. As this measure could have far reaching implications for the financial system as a whole, it requires a comprehensive examination separately. V.11. Further, it is also observed that the variability in triparty repo and market repo is generally higher than in WACR (Table 1). Larger variability may lead to less accurate signals and may also necessitate increased frequency and volume of Reserve Bank’s liquidity operations. V.12. In view of the above, the Group recommends that the overnight Weighted Average Call Rate may continue as the operating target of monetary policy. The call money market reflects transaction dynamics of market for reserves and is the only market segment containing the Reserve Bank’s regulated entities only, with most of them having access to the LAF. The Reserve Bank may, however, continue to keep track of rates in other overnight segments to ensure orderly evolution of money market rates and smoothen transmission. Accordingly, the Reserve Bank’s liquidity management operations may take into account movement in secured rates to ensure better alignment of overnight rates with the policy repo rate. If market participants efficiently exploit arbitrage opportunities, interest rates across different markets will align automatically. V.13. The LAF under the current LMF is based on the corridor system, with the policy repo rate in the middle of the corridor. The MSF rate acts as the ceiling (25 bps above the policy repo rate) while the SDF rate acts as the floor (25 bps below the policy repo rate) of the corridor. V.14. Reducing the volatility in the inter-bank money market rate while achieving the interest rate target is both an objective and a challenge for efficient liquidity management. Widening the corridor can encourage relatively higher inter-bank activity as the opportunity cost of holding excess reserves or being short of required reserves is higher, thereby nudging banks to manage their liquidity pro-actively12. However, a wider corridor may lead to increased day-to-day volatility in the short-term market rates, which may also impart volatility to the longer end of the term structure of interest rates. On the other hand, a narrow corridor may provide the advantage of better anchoring of short-term market rates but comes at the cost of reduced incentives for banks to indulge in inter-bank trading. V.15. A comparison of LMFs of countries operating under the corridor system suggests that corridors are typically wider in most emerging markets while the advanced countries tend to have narrow corridors (Annex). As emerging countries are often more susceptible to large capital flow shocks, a wider corridor system is more suitable for them as it offers the desired flexibility to operate the LMF both in conditions of liquidity deficit and surplus. However, a wider corridor entails more volatility in money-market rates. V.16. Among advanced economies, the European Central Bank (ECB), the Bank of Canada (BoC), the Reserve Bank of New Zealand (RBNZ), and the Reserve Bank of Australia (RBA) were the pioneers of the symmetric corridor system around the year 2000. The Norges Bank implemented monetary policy through a relatively pure version of a floor system until October 2011; thereafter, it shifted to a quota-based system – a compromise between a floor system and a corridor system. Central banks like the BoC and the RBNZ adopted the floor system in 2020. V.17. In the recent period, the Bank of England (BoE), the BoC, the ECB, and the RBA have all announced plans to reduce reserves until borrowing from the central bank picks up and market rates are marginally above the interest rate paid by the central bank on deposits, essentially returning to a corridor system, although they do not refer to it as the “corridor” (Nelson, 2024). The new ‘soft’ floor framework with a narrower spread can be characterised as a hybrid system, combining the smallest possible central bank balance sheet with both structural and fine-tuning operations. Its main objective is to allow for effective control of short-term money market rates in transition from a situation of abundant excess liquidity to one of less ample liquidity (Höflmayr and Kläffling, 2024). V.18. The global shift towards reducing corridor width reflects central banks' efforts to refine liquidity management and enhance monetary policy transmission. The ECB announced a new operational framework, effective September 2024, aimed at transitioning from excess to less ample liquidity. Under this framework, the main refinancing operations (MRO) rate was positioned 15 bps above the floor i.e., deposit facility rate (DFR), instead of 50 bps prior to this new framework. The marginal lending facility (MLF) rate which acts as the ceiling continued to remain 25 bps above the MRO rate. This adjustment effectively narrowed the corridor width from 75 bps to 40 bps, helping to anchor market rates closer to the DFR and mitigate liquidity-driven volatility. V.19. Similarly, the RBA announced in April 2024 its shift from an excess reserves system to an ample reserves framework. According to the RBA, the move towards ample reserves, which lies somewhere between the prevailing ‘floor’ system with excess reserves and the pre-pandemic ‘corridor’ system with scarce reserves, eliminates the need for precise reserve estimations and reduces money market fluctuations. V.20. In the Indian context, the LAF interest rate corridor was symmetric with a width of 200 bps at its inception in May 2011 and continued to be so till mid-July 2013. Consequent to the volatility wrought by the taper tantrum on domestic financial markets, the Reserve Bank widened the corridor asymmetrically to 400 bps in mid-July 2013 (with the ceiling 300 bps above the policy rate and the floor 100 bps below the policy rate). With the return of normalcy, the corridor width was gradually restored to its pre-crisis level by end-October 2013. Subsequently, the corridor was narrowed from 200 bps to 100 bps in April 2016 and further to 50 bps in April 2017, while maintaining its symmetricity. Following the financial market dislocations consequent to the outbreak of the covid pandemic, the corridor was asymmetrically widened to 90 bps in two stages with the FRRR rate 65 bps below and the MSF rate 25 bps above the policy repo rate, respectively. The width was restored to 50 bps after the introduction of the SDF at 25 bps below the policy repo rate on April 8, 2022, which reinstated the symmetricity of the corridor. V.21. Corroborating the experience of the euro area, volatility of the inter-bank overnight uncollateralised call rate – as measured by the exponential weighted moving average (EWMA)13 of the WACR – moderated with the progressive narrowing of the corridor (Chart V.4).14 The narrowing of the corridor, however, was coincidental with the declining share of call money in the total overnight money market volume (Chart V.5).   V.22. The Group, therefore, recommends continuation of the existing corridor system with policy repo rate at the middle of the corridor. The corridor would remain symmetric, with SDF and MSF, which are 25 bps on either side of the policy repo rate, acting as the lower and upper bounds of the corridor system, respectively. Skewness in Liquidity Distribution V.23. In last few years, it is observed that even on days when system liquidity remained in deficit, some banks parked significant amount of funds with the Reserve Bank under the SDF (Chart V.6). While this is reflective of skewness in the distribution of liquidity in the system and reluctance on the part of banks in trading among themselves, it is also an indication that the Reserve Bank might actually be functioning as a market maker to banks. While some banks were found to be borrowing through repo auctions and/or MSF window, some other banks were parking their surplus liquidity under the SDF on the same day.  V.24. Another important factor contributing towards higher amount under the SDF is the fact that banks tend to maintain precautionary balances to meet any unforeseen payment obligations arising beyond market hours due to availability of payment systems on a 24x365 basis. Any excess amount after meeting payment obligations is then parked under the SDF. This behaviour was exacerbated because there was no funding avenue for banks as the money market used to close at 5:00 PM. The Group noted that the extension of timings of the call money market up to 7:00 pm with effect from July 1, 2025, based on the recommendation of “Report of the Working Group on Comprehensive Review of Trading and Settlement Timings of Markets Regulated by the Reserve Bank” (Chairman: Shri Radha Shyam Ratho, RBI, 2025), would help in reducing banks’ precautionary demand for reserves to meet any unforeseen payment obligations. Operational Toolkit of the Liquidity Management Framework V.25. In the extant LMF, the 14-day Variable Rate Repo/Reverse Repo (VRR/VRRR) auction, which coincides with CRR maintenance cycle, is the main liquidity operation to handle transient liquidity. Additionally, fine-tuning operations which include VRR/VRRR operations of tenors overnight to 13 days, conducted at the discretion of the Reserve Bank, provide the flexibility to handle liquidity mismatches that may occur during the 14-day period. V.26. An analysis of the bid-to-cover ratios of variable rate liquidity operations conducted over the past two years shows a stark difference in participation of banks in the VRR and VRRR main operations (Chart V.7). During the calendar year 2024, the Reserve Bank conducted 25 main operations (14 VRR and 11 VRRR operations) and 147 fine-tuning operations (56 VRR and 91 VRRR). While VRR auctions (both main and fine-tuning) were generally over-subscribed, indicating preference of banks for any additional liquidity from the Reserve Bank, the VRRR auctions generally saw lower participation from banks. V.27. Further analysis of the bid-to-cover ratios of VRRR operations shows that VRRR main operations saw muted response from banks with the average bid-to-cover ratio of only 0.18 during the calendar year 2024. On the other hand, comparatively higher average bid-to-cover ratios in VRRR fine-tuning operations and large SDF balances were observed over the period of VRRR main operations (Chart V.7 and Chart V.8). This shows a clear preference of banks to deposit their excess reserves with the Reserve Bank for overnight/shorter tenors rather than participating actively in the 14-day main operation, despite holding excess reserves over the period of the main operation, thus foregoing a spread of up to 24 bps in the process15. V.28. The major reason for lower participation of banks in VRRR main auctions is the limited information that banks have on the frictional factors like changes in GoI cash balances, because of which they are unable to forecast liquidity for 14 days. This marked reluctance of banks to part with surplus liquidity for longer tenors was also one of the reasons that the Reserve Bank had to conduct a relatively higher number of fine-tuning VRRR operations to absorb excess liquidity from the system.  V.29. A large number of fine-tuning operations, in general, increase the uncertainty about the Reserve Bank’s liquidity operations. Further, as fine-tuning operations are conducted at the discretion of the Reserve Bank, there is uncertainty in the market about the quantum and timing of operations. Consequently, it is observed that when fine-tuning operations were announced at a short notice i.e., on the same day of the operation, the short-term market rates adjusted to ex-ante liquidity conditions without accounting for Reserve Bank’s operations and may have resulted in further lowering the participation in fine-tuning operations. V.30. Unlike VRRR auctions, higher average bid-to-cover ratios observed in both main and fine-tuning VRR auctions conducted during the last two calendar years indicate that banks actively participated in these auctions, irrespective of tenors (Chart V.7). It is pertinent to mention here that bid-to-cover ratio in VRR auctions inter-alia depends on total notified amount of auctions vis-à-vis the prevailing liquidity conditions. For instance, a VRR auction with a significantly lower (higher) notified amount than the actual liquidity requirement of the banking system may result into a higher (lower) bid-to-cover ratio. V.31. From an analysis of VRR auctions conducted during the period January 16, 2025 to March 31, 2025, when the system liquidity was largely in deficit, it is observed that daily VRR auctions16 saw higher participation than the 14-day VRR main operations. While the average bid-to-cover ratio for daily VRR operations conducted during the said period was 0.80, it was 0.55 for VRR main operations. Banks’ preference to borrow funds in daily VRRs over 14-day VRR main operations can be attributed to frictional factors discussed earlier, which make it difficult for them to forecast liquidity over 14-day period. V.32. As discussed in the previous section, challenges faced by banks in forecasting the liquidity position for the entire fortnight results into their lower participation in 14-day main operations, thus undermining the efficacy of 14-day operations in managing transient liquidity. Moreover, frictional factors like changes in GoI cash balances on account of quarterly advance tax receipts, monthly goods and services tax (GST) receipts, salary and pension related expenditure, etc. lead to significant variations in the system liquidity within the fortnight. Such intra-fortnight variations in the system liquidity can be better managed through shorter tenor operations instead of 14-day operations. Further, the choice of tenor of operations should ensure the optimum level of system liquidity which enables alignment of the operating target to the policy repo rate, to the extent possible. V.33. Therefore, the Group recommends that 14-day VRR/VRRR auctions may be discontinued as the main operation. Instead, the transient liquidity may be managed primarily through 7-day repo/ reverse repo operations and other operations of tenors from overnight up to 14-days at the discretion of the Reserve Bank based on its assessment of the system liquidity requirement. V.34. Further, to reduce uncertainty in the market about the tenor, quantum and timing of the repo/reverse repo operations, the Group felt that it is desirable for the Reserve Bank to provide sufficient advance notice to market participants, at least by one day, while conducting any such liquidity operation. The Group has also noted the implementation of standard time window from 9:30 AM to 10:00 AM for pre-announced operations as per the recommendations of the “Report of the Working Group on Comprehensive Review of Trading and Settlement Timings of Markets Regulated by the Reserve Bank” (Chairman: Shri Radha Shyam Ratho, RBI, 2025). V.35. The Group observed that there may be situations in which the evolving liquidity conditions may warrant conduct of liquidity operations on the same day of announcement. The Group recommends that in such circumstances, the Reserve Bank may conduct repo/reverse repo operations announced on the same day. Variable or Fixed Rate operations V.36. Liquidity management operations are generally conducted either at a fixed-rate on full-allotment basis or through variable rate auctions for a specific quantum decided by the central bank. In the case of fixed-rate full allotment-based liquidity operations, liquidity operations of a particular day would be determined by requirement of each bank, while variable rate auctions allow the central bank to conduct liquidity operations based on its assessment of the system liquidity. V.37. While the former approach provides assurance to each individual bank about their day-to-day liquidity requirement, the latter depends on the assessment/forecasting of system liquidity by the central bank and hinges on an efficient money market for equilibrating the supply and demand of reserves in the system. However, in the former approach, unlimited liquidity from the central bank on fixed-rate full allotment basis has moral hazard issues and would also adversely impact the inter-bank activity in the overnight segment. V.38. Although the LAF operations are not meant for price discovery, bids received in variable rate auctions can be a good signal for assessing the true extent of funds required from (to be deployed with) the central bank. Moreover, variable rate auctions provide the central bank enough flexibility to decide on auction cut-offs and the amount which would make liquidity management more nimble and agile rather than being constrained by the fixed rate. V.39. In view of the above, the Group recommends continuation of variable rate auction mechanism for conducting repo and reverse repo operations under the LAF. As liquidity provided or absorbed would be based on requirement of the entire banking system rather than that of individual banks, it is likely to encourage inter-bank activity during the tenor of the auction. V.40. Further, repo/reverse repo operations of tenor overnight to 14-days are expected to handle changes in system liquidity due to frictional factors. However, in some scenarios, the liquidity mismatches may extend for a longer term. For handling such liquidity mismatches, the Group recommends that the repo/reverse repo operations of appropriately longer tenor may be conducted through variable rate auctions. The availability of such instruments would provide the necessary liquidity assurance to the market and would also help in minimising frequency and quantum of shorter tenor operations. V.41. The Reserve Bank meets the demand for durable reserves by altering the Net Domestic Assets (NDA) and Net Foreign Assets (NFA) on its balance sheet. While the outright forex operations may be conducted with a different objective, it affects the system liquidity on a durable basis. The extant LMF includes an array of instruments to address durable liquidity surplus or deficit. OMOs along with other instruments such as the long-term variable rate repo/reverse repo operations and FX swap auctions are used to inject/absorb system liquidity on a durable basis. The Group noted that instruments under the extant LMF are sufficient for meeting the durable liquidity needs of the system and hence, does not recommend any change at this stage. V.42. SPDs are highly leveraged institutions which also depend on the overnight segment of money market to meet a part of their funding requirements. Given that WACR continues to be the operating target of the monetary policy, it is imperative that all members of the call money market also have access to the Reserve Bank’s liquidity facilities for effective monetary policy transmission. SPDs are the largest borrowers in the call money market contributing about three-fourths of the total borrowing. V.43. Recognising their important role in the primary and secondary market for Government securities, SPDs were allowed to participate directly in all overnight liquidity management operations, except in the MSF. Besides, SPDs have also been provided with Standing Liquidity Facility (SLF) to borrow funds from the Reserve Bank against eligible Government securities, at the policy repo rate, repayable within a period of 90 days. From March 2025, they have also been allowed access to all repo operations irrespective of tenor. V.44. While SPDs have recently been allowed to participate in all repo operations irrespective of tenor, given the limited stock of free Government securities with them, they are able to participate in the overnight repo auctions only when these are announced well in advance (i.e., at least one day prior to the auction date). Also, as the overnight variable rate auctions are conducted based on the assessment of evolving liquidity conditions, there is uncertainty regarding their timing and quantum which further makes it difficult for SPDs to plan their participation in these auctions. Therefore, giving advance notice of operations of the Reserve Bank will enable SPDs to improve their participation in LAF operations. V.45. The MSF has been made available to banks to meet any unanticipated shortfall in maintenance of their daily cash reserve requirements. With RTGS/NEFT available 24x365, banks may have unforeseen payment obligations beyond market hours. However, the Group does not see any unforeseen liquidity requirements for SPDs after the close of market. Further, any emergency liquidity needs can be met by SPDs in the now extended call market timings with effect from July 01, 2025. Therefore, there may not be any need to extend MSF or provide another similar overnight emergency funding facility to SPDs. Averaging of Reserve Requirement V.46. Mandatory reserve requirement in the form of CRR and payments system obligations are major determinants for demand for reserves on any particular day. The averaging of reserve requirement over the maintenance period allows banks to use excess reserves from one day to offset shortfall on other days.  V.47. In India, the daily minimum reserve requirement was prescribed with a view to providing flexibility to banks in choosing an optimum strategy of holding reserves depending upon their intra-fortnight cash flows. Within the reporting fortnight, banks flexibly optimise their daily maintenance levels based on a cost-benefit analysis of interest rate expectations vis-à-vis rates on standing facilities (Chart V.9.a). The daily minimum reserve requirement was enhanced from 70 per cent of NDTL (effective since December 2002) to 99 per cent in July 2013 but subsequently reduced to 95 per cent in September 2013 and further to 90 per cent in April 2016. During COVID-19 pandemic, it was lowered to 80 per cent in March 2020 in view of hardships faced by banks due to social distancing of staff and consequent strain on reporting requirements but subsequently reverted to 90 per cent by September 2020. If the daily minimum requirement is very high, it constrains the flexibility of banks during the reserve maintenance period. For instance, the intra-fortnightly variation (across weeks) in reserve maintenance was negligible when the daily minimum was prescribed at 99 per cent after the taper tantrum as compared with significant frontloading of reserve maintenance in the first week vis-à-vis the second week when daily minimum balance was set at 70 per cent (Chart V.9.b). V.48. Empirical evidence shows that banks build precautionary reserve balances to honor payment obligations of 24x365 payment systems in India, which may have pushed neutral system liquidity higher. In this connection, there is a view that some reduction in the 90 per cent daily maintenance requirement is warranted as it may provide further room for banks to effectively manage their liquidity over the maintenance period. However, on the flip side, reducing the minimum daily balance requirement from the extant 90 per cent may induce larger volatility in WACR, especially at the end of fortnights. Increased volatility in the operating target adversely affects the smooth transmission of monetary policy. The resultant increased variability in the daily CRR maintenance of individual banks may also pose challenges to the Reserve Bank’s liquidity forecasting. It has also been observed that banks rarely maintain daily reserve balances below 95 per cent of the prescribed CRR. Thus, the extant 90 per cent requirement is not a binding constraint on banks. V.49. The Group recognises that the present minimum requirement of maintaining 90 per cent of the prescribed CRR on a daily basis has helped avoid bunching of reserve requirement by individual banks. Accordingly, the Group recommends the Reserve Bank to retain the extant daily minimum requirement of 90 per cent of the prescribed CRR. VI. Summary of Recommendations VI.1. The Group recommends that the overnight Weighted Average Call Rate may continue as the operating target of monetary policy. The Reserve Bank may, however, continue to keep track of rates in other overnight money market segments to ensure orderly evolution of money market rates and smoothen transmission. (Para V.12.) VI.2. The Group recommends continuation of the existing corridor system with policy repo rate at the middle of the corridor. The corridor would remain symmetric, with SDF and MSF, which are 25 bps on either side of the policy repo rate, acting as the lower and upper bounds of the corridor system, respectively. (Para V.22.) VI.3. The Group recommends that 14-day VRR/VRRR auctions may be discontinued as the main operation. Instead, the transient liquidity may be managed primarily through 7-day repo/ reverse repo operations and other operations of tenors from overnight up to 14-days at the discretion of the Reserve Bank based on its assessment of the system liquidity requirement. (Para V.33.) VI.4. To reduce uncertainty in the market about the tenor, quantum and timing of the repo/reverse repo operations, the Group felt that it is desirable for the Reserve Bank to provide sufficient advance notice to market participants, at least by one day, while conducting any such liquidity operation. (Para V.34.) VI.5. The Group observed that there may be situations in which the evolving liquidity conditions may warrant conduct of liquidity operations on the same day of announcement. The Group recommends that in such circumstances, the Reserve Bank may conduct repo/reverse repo operations announced on the same day. (Para V.35.) VI.6. The Group recommends continuation of variable rate auction mechanism for conducting repo and reverse repo operations under the LAF. (Para V.39.) VI.7. For handling liquidity mismatches of longer term, the Group recommends that the repo/reverse repo operations of appropriately longer tenor may be conducted through variable rate auctions. (Para V.40.) VI.8. The Group noted that instruments under the extant LMF are sufficient for meeting the durable liquidity needs of the system and hence, does not recommend any change at this stage. (Para V.41.) VI.9. The Group recommends the Reserve Bank to retain the extant daily minimum requirement of 90 per cent of the prescribed CRR. (Para V.49.) Annex: Monetary Policy Operating Frameworks – Cross-country Perspectives

1 The share of the call money market in the overnight money market volume has declined from 16 per cent in FY 2010-11 to 2 per cent in FY 2024-25. 2 The Reserve Bank’s LAF consists of SDF, MSF, repo and reverse repo operations. 3 BIS Markets Committee compendium (https://www.bis.org/mc/currency_areas/in.htm) 4 RTGS was made available 24x365 with effect from December 14, 2020 5 https://doe.gov.in/files/public-finance-state-cna-sna-document/Letter_Dated_13_07_202_To_ALL_Chief_Secretaries_Principal_Secretaries.pdf 6 In terms of the Reserve Bank’s press release “Participation of Standalone Primary Dealers in Variable Rate Repo operations” 7 System Liquidity as defined by net borrowing under LAF adjusted for excess reserves maintained by banks. 8 During COVID-19 pandemic, various liquidity measures including Long Term Repo Operations (LTROs), Targeted LTROs (TLTROs), Special LTROs (SLTROs), G-sec Acquisition Programme (G-SAP) etc., were adopted by the Reserve Bank to infuse long-term liquidity into the system, in an attempt to ensure normal functioning of financial markets. 9 Presently, eligible banks can draw funds under MSF against their excess SLR holdings and additionally up to two per cent of their respective NDTL outstanding at the end of the second preceding fortnight by dipping into the prescribed SLR , in terms of the Master Direction - Reserve Bank of India [Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR)] Directions - 2021 issued by Department of Regulation of the Reserve Bank. 10 Only four major central banks (Canada, Brazil, Mexico, and Switzerland) have shifted to overnight secured rate (repo) as the operating target. 11 Currently, SPDs have access only to SDF, overnight reverse repo operations and all repo operations, irrespective of tenor. 12 A wider corridor is indicative of tighter monetary policy implying that central bank standing facilities are costly. For a detailed discussion on the optimal width of the corridor, see Chapter 4 on Operating Procedure of Monetary Policy of Report on Currency and Finance, 2020-21. 13 As a volatility measure, the EWMA is an improvement over simple variance as it assigns greater weight to more recent observations. Thus, EWMA expresses volatility as a weighted average of past volatility where the weights are higher for more recent observations. 14 Moreover, lower volatility in the overnight rates reduces term premium and hence lower medium and longer-term rates (Carpenter and Demiralp, 2011). 15 In the existing LAF corridor, the SDF rate is 25 bps lower than the policy repo rate. Further, banks can place their bids at rates lower than the policy repo rate while participating in VRRR auctions, i.e., if repo rate is at 5.50 per cent, banks can bid up to 5.49 per cent. Thus, parking excess reserves under SDF instead of participating in VRRR auctions may result in an opportunity cost of up to 24 bps. 16 As announced vide the press release “RBI to conduct Daily Variable Rate Repo (VRR) Auctions” dated January 15, 2025, the Reserve Bank conducted variable rate repo (VRR) auctions from January 16, 2025 on all working days in Mumbai with reversal taking place on the next working day. These auctions were discontinued with effect from June 11, 2025, vide the press release dated June 9, 2025. 17 Reserve Bank of Australia’s reserve requirements are not a Required Reserve Ratio (they are not set as a per cent of the financial institution’s liabilities). The reserve requirements are set annually as an Australian Dollar (AUD) amount per financial institution with the aim of ensuring that each institution has sufficient funds to settle AUD transactions after business hours. The amount is set taking into account the historical pattern of each institution’s AUD transactions. 18 Longer terms may be offered if warranted by market conditions 19 Two weeks for demand deposits / 1 week for savings and time deposit 20 Extra rounds of reverse repo as required 21 All details pertaining to the Bank of Japan are as per the information available on the BIS website except the policy rate, operating target and the corridor width which have been updated as per the recent policy decision made on January 25, 2025. 23 MSBs: Monetary Stabilisation Bonds, issued by Bank of Korea, used as a structural adjustment tool whose policy effects are long lasting. 24 MSA: Monetary Stabilisation Account, introduced in October 2010, is a market-friendly term deposit facility. It is mainly used to fine-tune the reserve levels and to cope with unexpected changes in reserve supply and demand. 25 Outright transactions are conducted only limitedly, since they are employed to provide or absorb liquidity permanently, and they therefore directly affect long term market rates. For this reason, securities transactions focus mainly on Repurchase Agreement (RP) transactions (mostly with 7-day maturities). Meanwhile, following the revision of the Bank of Korea Act in August 2011, the Bank can operate a securities lending and borrowing facility, which is enabling the Bank to not only enhance the efficiency of the liquidity management through flexible expansion of the volume of its RP sales, but also cope more effectively in the case of financial turmoil such as a credit crunch. 26 The Bank Negara Malaysia (BNM) can issue central bank bills; Bank Negara Monetary Notes (up to 3 years) and Bank Negara Interbank bills (up to 1 year). 27 1D: Fixed rate; >1D: Variable rate, indexed with the policy rate 28 In an explanatory note published in August 2022 the Bank of England set out that it was minded to use a variant of the extant floor system. 29 Discount window, FIMA repo facility, Standing repo facility |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

പേജ് അവസാനം അപ്ഡേറ്റ് ചെയ്തത്: