IST,

IST,

Banks Must build a Structure to provide Superior and Efficient Customer Service

Dr. (Smt.) Deepali Pant Joshi, Executive Director, Reserve Bank of India

delivered-on മേയ് 20, 2014

Respected Shri Mahajan, Smt Rama Bijapurkar, member, Governing Council, Banking Standards Codes and Standards Board of India (BCSBI), Shri N Raja, CEO, BCSBI and banker colleagues. At the very outset, I thank Shri Mahajan, Chairman, BCSBI for the kind invitation to address Principal Code Compliance Officers of the BCSBI, this afternoon. I attach a great deal of value to this interaction. The day long deliberations will provide you the opportunity to

The Banking Codes and Standards Board of India is an autonomous and independent body set up by the Reserve Bank. BCSBI is mandated to evolve Codes and Standards for banks to follow while dealing with their customers so as to ensure that the customers are enabled certain minimum standards of customer service. BCSBI has developed two sets of Codes for member banks viz.

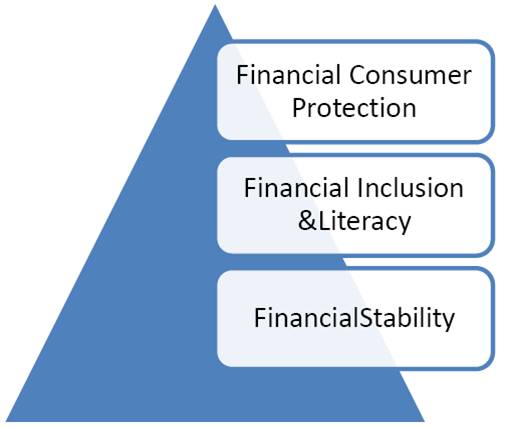

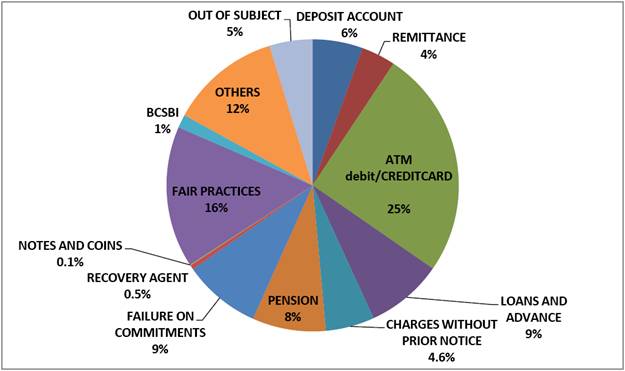

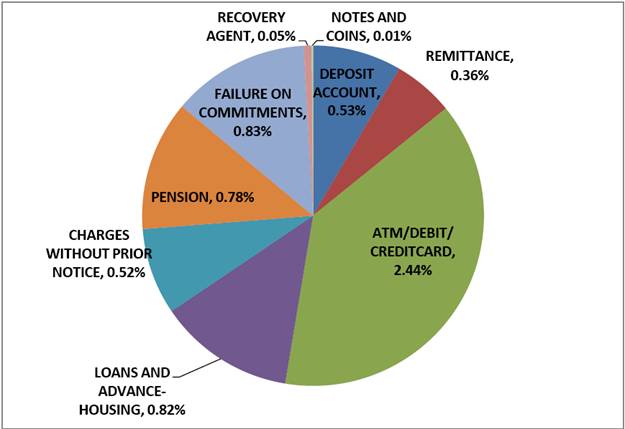

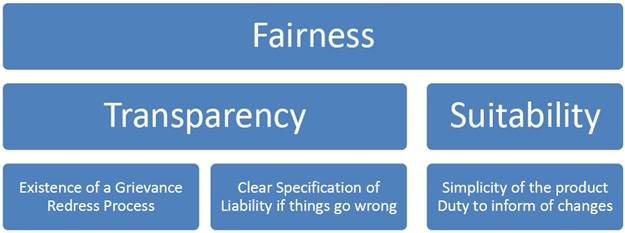

These Codes are periodically reviewed and revised in order to reflect the extant regulatory guidelines, contemporary developments in the banking sector and evolving customer expectations. Consumer confidence and trust in a well-functioning market for financial services promotes financial stability, growth efficiency and innovation over the long term.  Financial consumer protection, when reinforced with financial inclusion and financial literacy, will lead to enhanced financial stability. We have had a great thrust on financial inclusion; as a result, several new consumers of banking products have come into the banking system. We have to ensure adequate customer protection for these new users of banking services. We have to help them through financial education, literacy and awareness to use the diverse range of products and services offered by the banks. Awareness of the customer has to be increased. With greater awareness of customers, must come, heightened responsibility of the provider of financial services. Please appreciate that today RBI, BCSBI and banks are all working under a greater lens of public scrutiny and under Right To Information. Implementing the consumer protection framework in such an environment necessitates that banks have complete knowledge of products and services offered and treat their customers fairly. This idea by itself does not mean much to the customers unless it is set against metrics enshrined in standards and codes. Through customer protection initiatives banks must ensure adequate protection of rights of their individual, vulnerable, small customers. As Dr Raghuram Rajan expressed in his Seminal Report, A Hundred Small Steps - Report of the Committee on Financial Sector Reforms and I quote “Consumer protection is important. Not every household is fully cognisant of the transactions they enter into. While the line between excessive paternalism and appropriate individual responsibility is always hard to draw in a developing country like ours, it may well veer to a little more paternalism in interactions between financial firms and less sophisticated households”. In his much acclaimed book “Fault Lines”, the Governor has addressed the issue of multiple fault lines caused by a sophisticated, amoral and competitive financial sector. We need to guard against such fault lines by ensuring that our banking sector which has done well so far continues to do so. We have a banking system which abides by the laws, which is sensitive and empathetic to the needs of customers and has a robust grievance redress mechanism. The Pan India Banking Ombudsman Scheme functions as an inexpensive, swift grievance redress mechanism. Banking Ombudsman has to work through the processes of conciliation mediation and adjudication. Here, the nodal officer has an important role to play. The rules require that the banks must first examine the complaint and try to resolve it. It is necessary for the nodal officer to give a swift revert on the complaint to the Banking Ombudsman. It is also essential for the nodal officer to do a root cause analysis and drill down to the specific cause of the complaint to ensure that the same is addressed. For every complaint that is received, there may be several such irritants across branches, or there may even be a systemic issue underlying the complaints which may be serious. All the member banks have adopted these codes, drawn up in consultation with the member banks through IBA. At ground level, the position of code implementation is not satisfactory. Complaints received by Banking Ombudsman Offices across the country and also through interactions with customers in Town Hall meetings by both Banking Ombudsmen and BCSBI clearly reflect the need to raise the benchmark for customer service through more effective implementation of these codes. BCSBI monitors and assesses the compliance with its codes and standards. These assessments bring into sharp focus the flagrant violations of the code and shortcomings in code implementation. This aspect merits serious attention by PCCOs. 10% of the member banks rated by BCSBI in 2012-13 have good rating, with 52% earning Above Average and 38% earning Average/Below Average ratings. These clearly show that a number of banks need to tone up their code implementation and thereby fulfill their commitments to their customers in terms of the codes. According to the category-wise data on complaints sourced from all 15 offices of Banking Ombudsmen, majority of complaints were regarding credit/ debit cards fallowed by non-observance of the fair practices code, deposits account, failure of commitments made under the BCSBI code and pensions. There is serious concern on the number of complaints, though the disposal rate may be 95%. I find that there are several violations of the BCSBI codes. This is not a situation of comfort for the RBI and difficult to comprehend as the banks have voluntarily accepted the codes formulated by the BCSBI. Complaints received in the offices of Banking Ombudsmen: 2012-2013:  Complaints regarding Non-adherence to BCSBI Codes: 2012-2013  In a sense, BCSBI is functioning as a self-regulatory organization. There is a need to improve customer services in public sector banks across all spheres of banking and particularly in areas related to deposits accounts, loan and advances, failure of commitments made, non-adherence to the BCSBI code and pension. In addition, services related to credit/debit cards, which have been subject to frequent complaints from customers in recent years, need to be improved across all banks groups. With the advent of technology, there is a need to further strengthen customer service in areas of net and mobile banking to enhance customer confidence in these technologies. There is a further need to improve the customer data base, which apart from facilitating banks to acquaint themselves with the whereabouts of the customers, would help them to prevent incidents of fraud/money-laundering. Complaints related to unauthorized fund transfers, fraudulent withdrawals from ATMs using duplicate cards, phishing E-mails aimed at extracting personal information have registered significant increase in recent times. Going forward, there is a need for building up a robust mechanism to prevent incidents of fraud in areas of mobile/net banking and electronic fund transfer. Treating customers fairly, “TCF”, also must ensure that there is a clear specification of liability, if things go wrong. Simplicity of the product sold must be ensured and there is a duty to inform the customer about the features of the product. Mis-selling will invite consequences. Banks must help customers fully understand the features, benefits, risks and costs of the financial products they buy, minimize sale of unsuitable products by encouraging best practice before, during and after the sale The sense of protection which consumers expect and experience while dealing with banks is the benchmark against which we need to evaluate our customer care and customer service policulture of customer-centricity and sensitivity to the needs of the customers especially those belonging to the vulnerable sections of the society. The market forces, competition, technology will continue to help banks achieve better penetration and extend their reach, but these attributes must also result in better, affordable and easy access to banks and banking. As Dr. Rajan puts it, we need a frugal model. We all need to enshrine basic rights for all financial services consumers by way of a Charter of bank customers’ rights. FSLRC has expressed that all financial laws and regulations must protect the interests of the consumers. It recommends a framework for customer protection against mis-selling and defrauding through the fine print stealth banking etc. We must protect customers against unfair contract terms, unjust conduct and protection of personal information through fair disclosure and redress of consumer complaints by financial services providers. Annual Policy Statement released on April 1, 2014 by Dr Rajan, Governor RBI has clearly spelt out that consumer protection is an integral aspect of financial inclusion. The Reserve Bank proposes to frame comprehensive consumer protection regulations based on domestic experience and global best practices. The banks that have internalized the codes enunciated by the BCSBI may not have much difficulty in adapting to the new statutory framework. The statutory framework also comes with explicit rights, the customers enjoy and the implicit duties that are cast on the banker. The Nachiket Mor Committee on Comprehensive Financial Services for Small Businesses and Low Income Households has pointed out and I quote “When the fact is considered that imbalances in information, expertise and power between the buyer and seller of financial products will only be exacerbated in the future then it becomes clear that, existing approaches to customer protection have severe limitations. The ‘Caveat Emptor’ principle has led to fundamental flaws in our present consumer protection architecture. From the principle of “Caveat Emptor”’, Let the Buyer beware, we have to move to the principle ‘Caveat Venditor’, Latin for ‘Let the Seller Beware’. It is a counter to ‘Caveat Emptor’ and suggests that seller can also be deceived in a market transaction. This forces the seller to take responsibility for the product and discourages sellers from purveying products of inferior quality. The principle vests the burden of proving that the shortcoming, deficiency of service was absent, on the seller of the product. So what should be the framework governing customer protection?  We need to enshrine these principles in a Customer’s Charter of Rights and duties of banks towards their customers. ‘Caveat Venditor’ will necessitate these. Last but not the least; banks must focus on improving the skillsets of staff and front-line managers who are face of the bank for the customers. With increasing competition, banks that survive and succeed will be the ones that provide quality service. Research studies have repeatedly shown that customers are willing to pay for quality service. Banks that wish to stay ahead must therefore systematically build a structure that aims at providing total quality service which is superior and efficient. I wish your deliberations all success and close with the hope that, these will have an impact far beyond immediate issue. Thank you for a patient hearing. |

പേജ് അവസാനം അപ്ഡേറ്റ് ചെയ്തത്: