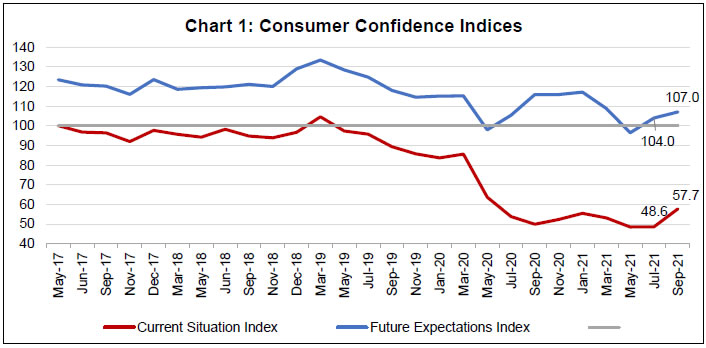

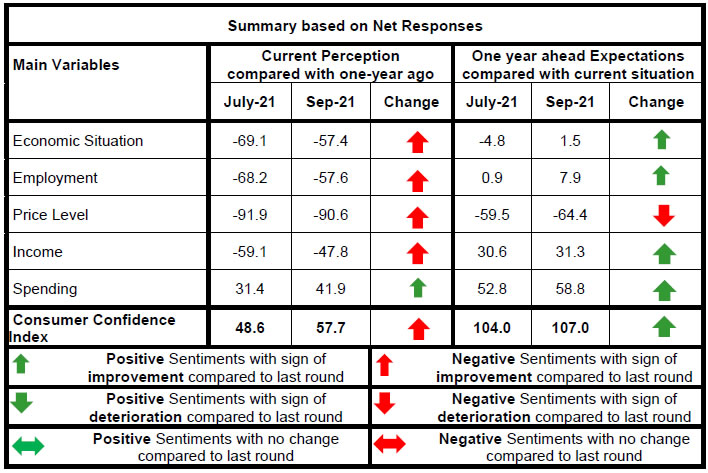

Today, the Reserve Bank released the results of its Consumer Confidence Survey (CCS)1 for the September 2021 round. With the gradual withdrawal of COVID-19 related restrictions in most states, the survey was conducted through physical interviews, during August 29 to September 7, 2021 in 13 major cities, viz., Ahmedabad; Bengaluru; Bhopal; Chennai; Delhi; Guwahati; Hyderabad; Jaipur; Kolkata; Lucknow; Mumbai; Patna; and Thiruvananthapuram. The survey obtained current perceptions (vis-à-vis a year ago) and one year ahead expectations on general economic situation, employment scenario, overall price situation and own income and spending from 5,237 households across these cities2. Highlights: I. Consumers reflected lower pessimism on the prevailing general economic situation, employment scenario as well as household income and expenditure; the current situation index (CSI)3 for September 2021 improved when compared with the earlier survey rounds conducted after May 2020 (Chart 1 and Tables 1, 2, 5 and 6). II. Consumer confidence for one year ahead period sustained the momentum witnessed in the July 2021 survey round; the future expectations index (FEI) improved further in September 2021, aided by higher optimism on general economic situation and employment scenario. Note: Please see the excel file for time series data. III. Households reported a rise in overall expenditure, largely due to higher expenditure on essential items; the pessimism on current and future discretionary spending, however, reduced in the latest survey round (Tables 7 and 8).

| Table 1: Perceptions and Expectations on the General Economic Situation | | (Percentage responses) | | Survey Round | Current Perception | One year ahead Expectation | | Improved | Remained Same | Worsened | Net Response | Will Improve | Will Remain Same | Will Worsen | Net Response | | Sep-20 | 9.0 | 11.4 | 79.6 | -70.6 | 50.1 | 15.1 | 34.8 | 15.3 | | Nov-20 | 11.0 | 11.5 | 77.5 | -66.5 | 50.9 | 13.9 | 35.2 | 15.7 | | Jan-21 | 14.3 | 13.6 | 72.2 | -57.9 | 52.6 | 16.1 | 31.3 | 21.3 | | Mar-21 | 12.1 | 11.9 | 76.0 | -63.9 | 44.0 | 17.3 | 38.7 | 5.3 | | May-21 | 6.5 | 12.1 | 81.4 | -75.0 | 33.2 | 15.3 | 51.5 | -18.3 | | Jul-21 | 9.4 | 12.1 | 78.5 | -69.1 | 39.7 | 15.8 | 44.5 | -4.8 | | Sep-21 | 14.9 | 12.9 | 72.3 | -57.4 | 41.6 | 18.3 | 40.1 | 1.5 |

| Table 2: Perceptions and Expectations on Employment | | (Percentage responses) | | Survey Round | Current Perception | One year ahead Expectation | | Improved | Remained Same | Worsened | Net Response | Will Improve | Will Remain Same | Will Worsen | Net Response | | Sep-20 | 10.1 | 8.1 | 81.7 | -71.6 | 54.1 | 14.3 | 31.6 | 22.5 | | Nov-20 | 11.0 | 9.5 | 79.5 | -68.5 | 52.0 | 14.9 | 33.1 | 18.9 | | Jan-21 | 13.1 | 11.5 | 75.4 | -62.3 | 55.3 | 16.1 | 28.6 | 26.7 | | Mar-21 | 12.9 | 11.8 | 75.3 | -62.4 | 46.7 | 17.3 | 36.0 | 10.7 | | May-21 | 7.2 | 10.8 | 82.1 | -74.9 | 35.4 | 16.1 | 48.5 | -13.0 | | Jul-21 | 10.3 | 11.3 | 78.4 | -68.2 | 42.2 | 16.5 | 41.3 | 0.9 | | Sep-21 | 14.9 | 12.7 | 72.4 | -57.6 | 45.0 | 17.8 | 37.1 | 7.9 |

| Table 3: Perceptions and Expectations on Price Level | | (Percentage responses) | | Survey Round | Current Perception | One year ahead Expectation | | Increased | Remained Same | Decreased | Net Response | Will Increase | Will Remain Same | Will Decrease | Net Response | | Sep-20 | 82.9 | 14.6 | 2.5 | -80.4 | 69.5 | 20.5 | 10.0 | -59.5 | | Nov-20 | 89.7 | 9.0 | 1.4 | -88.3 | 70.5 | 17.4 | 12.1 | -58.4 | | Jan-21 | 88.6 | 9.6 | 1.7 | -86.9 | 73.2 | 17.1 | 9.7 | -63.5 | | Mar-21 | 93.8 | 5.0 | 1.2 | -92.6 | 75.0 | 14.4 | 10.6 | -64.4 | | May-21 | 90.6 | 7.8 | 1.6 | -89.0 | 73.9 | 16.4 | 9.7 | -64.3 | | Jul-21 | 93.1 | 5.6 | 1.3 | -91.9 | 71.3 | 16.9 | 11.8 | -59.5 | | Sep-21 | 92.3 | 6.1 | 1.7 | -90.6 | 74.7 | 15.0 | 10.3 | -64.4 |

| Table 4: Perceptions and Expectations on Rate of Change in Price Level (Inflation)* | | (Percentage responses) | | Survey Round | Current Perception | One year ahead Expectation | | Increased | Remained Same | Decreased | Net Response | Will Increase | Will Remain Same | Will Decrease | Net Response | | Sep-20 | 83.0 | 13.1 | 3.9 | -79.1 | 75.9 | 19.6 | 4.6 | -71.3 | | Nov-20 | 88.3 | 8.9 | 2.8 | -85.5 | 78.3 | 16.7 | 4.9 | -73.4 | | Jan-21 | 83.5 | 13.4 | 3.1 | -80.4 | 77.7 | 17.2 | 5.0 | -72.7 | | Mar-21 | 88.8 | 8.5 | 2.7 | -86.1 | 81.1 | 14.3 | 4.5 | -76.6 | | May-21 | 87.2 | 10.3 | 2.5 | -84.7 | 79.3 | 16.7 | 4.0 | -75.3 | | Jul-21 | 87.9 | 10.4 | 1.7 | -86.3 | 79.7 | 16.3 | 4.0 | -75.8 | | Sep-21 | 88.4 | 9.0 | 2.6 | -85.8 | 81.9 | 13.8 | 4.4 | -77.5 | | *Applicable only for those respondents who felt price has increased/price will increase. |

| Table 5: Perceptions and Expectations on Income | | (Percentage responses) | | Survey Round | Current Perception | One year ahead Expectation | | Increased | Remained Same | Decreased | Net Response | Will Increase | Will Remain Same | Will Decrease | Net Response | | Sep-20 | 8.9 | 28.4 | 62.7 | -53.8 | 53.2 | 36.7 | 10.0 | 43.2 | | Nov-20 | 8.4 | 28.5 | 63.1 | -54.7 | 51.0 | 38.3 | 10.7 | 40.3 | | Jan-21 | 9.9 | 29.2 | 60.9 | -51.0 | 51.3 | 38.8 | 9.9 | 41.4 | | Mar-21 | 7.9 | 30.5 | 61.6 | -53.7 | 46.4 | 40.7 | 13.0 | 33.4 | | May-21 | 8.4 | 33.1 | 58.5 | -50.1 | 42.5 | 42.1 | 15.5 | 27.0 | | Jul-21 | 6.8 | 27.4 | 65.9 | -59.1 | 44.5 | 41.6 | 13.9 | 30.6 | | Sep-21 | 10.4 | 31.4 | 58.2 | -47.8 | 44.2 | 42.9 | 12.9 | 31.3 |

| Table 6: Perceptions and Expectations on Spending | | (Percentage responses) | | Survey Round | Current Perception | One year ahead Expectation | | Increased | Remained Same | Decreased | Net Response | Will Increase | Will Remain Same | Will Decrease | Net Response | | Sep-20 | 47.2 | 31.8 | 21.1 | 26.1 | 65.3 | 27.5 | 7.2 | 58.1 | | Nov-20 | 55.6 | 28.5 | 15.9 | 39.7 | 69.1 | 24.9 | 6.1 | 63.0 | | Jan-21 | 53.3 | 28.9 | 17.8 | 35.5 | 66.4 | 26.7 | 6.8 | 59.6 | | Mar-21 | 56.6 | 24.9 | 18.4 | 38.2 | 67.0 | 25.3 | 7.7 | 59.3 | | May-21 | 50.6 | 30.3 | 19.2 | 31.4 | 60.5 | 29.9 | 9.6 | 50.9 | | Jul-21 | 51.9 | 27.7 | 20.5 | 31.4 | 62.1 | 28.7 | 9.3 | 52.8 | | Sep-21 | 58.1 | 25.7 | 16.2 | 41.9 | 65.7 | 27.5 | 6.9 | 58.8 |

| Table 7: Perceptions and Expectations on Spending- Essential Items | | (Percentage responses) | | Survey Round | Current Perception | One year ahead Expectation | | Increased | Remained Same | Decreased | Net Response | Will Increase | Will Remain Same | Will Decrease | Net Response | | Sep-20 | 61.4 | 23.9 | 14.7 | 46.7 | 71.9 | 22.8 | 5.3 | 66.6 | | Nov-20 | 68.7 | 20.0 | 11.3 | 57.4 | 75.6 | 19.2 | 5.2 | 70.4 | | Jan-21 | 68.6 | 20.0 | 11.4 | 57.2 | 73.6 | 21.6 | 4.8 | 68.8 | | Mar-21 | 71.1 | 16.0 | 12.9 | 58.2 | 74.6 | 20.0 | 5.4 | 69.2 | | May-21 | 63.2 | 22.3 | 14.5 | 48.7 | 68.1 | 24.6 | 7.3 | 60.8 | | Jul-21 | 66.2 | 19.0 | 14.8 | 51.4 | 71.0 | 22.1 | 7.0 | 64.0 | | Sep-21 | 72.2 | 16.7 | 11.0 | 61.2 | 73.4 | 21.3 | 5.4 | 68.1 |

| Table 8: Perceptions and Expectations on Spending- Non-Essential Items | | (Percentage responses) | | Survey Round | Current Perception | One year ahead Expectation | | Increased | Remained Same | Decreased | Net Response | Will Increase | Will Remain Same | Will Decrease | Net Response | | Sep-20 | 10.7 | 29.5 | 59.8 | -49.1 | 31.3 | 37.4 | 31.4 | -0.1 | | Nov-20 | 11.2 | 27.9 | 60.9 | -49.7 | 28.7 | 37.3 | 34.0 | -5.3 | | Jan-21 | 13.3 | 27.1 | 59.7 | -46.4 | 27.5 | 36.7 | 35.8 | -8.3 | | Mar-21 | 11.9 | 29.5 | 58.5 | -46.6 | 24.7 | 38.3 | 37.1 | -12.4 | | May-21 | 8.7 | 31.5 | 59.7 | -51.0 | 22.2 | 40.7 | 37.1 | -14.9 | | Jul-21 | 8.4 | 27.2 | 64.4 | -56.0 | 21.5 | 37.9 | 40.6 | -19.2 | | Sep-21 | 9.2 | 29.7 | 61.0 | -51.8 | 23.4 | 38.7 | 37.9 | -14.5 |

|  IST,

IST,