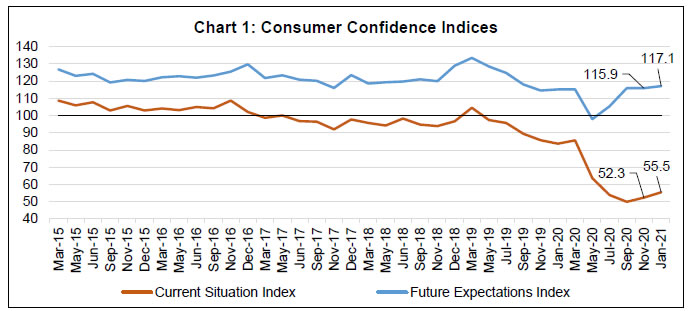

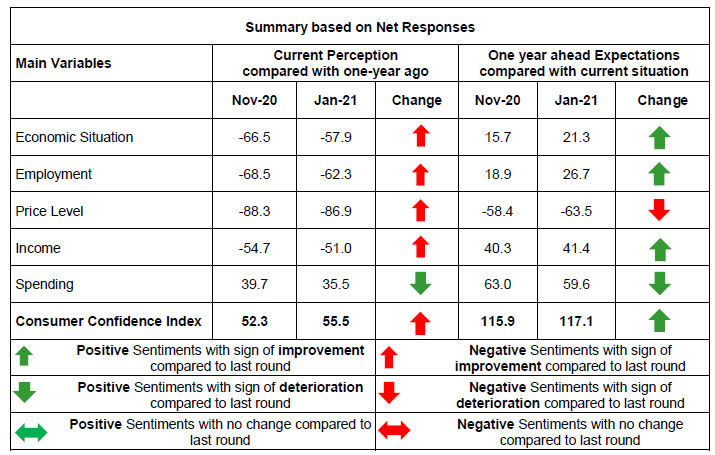

Today, the Reserve Bank released the results of the January 2021 round of its Consumer Confidence Survey (CCS)1. In view of the Covid-19 pandemic, the survey was conducted through field interviews, wherever possible, and telephonic interviews elsewhere, during January 02 to January 11, 2021 in thirteen major cities, viz., Ahmedabad; Bengaluru; Bhopal; Chennai; Delhi; Guwahati; Hyderabad; Jaipur; Kolkata; Lucknow; Mumbai; Patna; and Thiruvananthapuram. Perceptions and expectations on general economic situation, employment scenario, overall price situation and own income and spending have been obtained from 5,351 households across these cities2. Highlights: I. Consumers perceived that the current economic situation was significantly worse when compared to a year ago, but it improved from November 2020 round of the survey. II. The current situation index (CSI)3 continued to improve from its all-time low registered in September 2020 (Chart 1). III. Weak sentiments emanated from downbeat perception on the major parameters, viz., general economic situation, employment scenario, price levels and household incomes, when compared to a year ago (Tables 1, 2, 3 and 5). IV. Going forward, consumers expect improvement in general economic situation and employment conditions during the next one year. Note: Please see the excel file for time series data V. Overall spending remains in positive territory on the back of buoyant essential spending; over 70 per cent of respondents expect non-essential spending to remain similar or decline over the next one year (Table 6, 7 and 8). VI. After reaching the historical low in May 2020 round around the peak of Covid-19 related lockdown and restrictions, the future expectations index (FEI) increased for four successive quarters and stood at 117.1 in January 2021.

| Table 1: Perceptions and Expectations on the General Economic Situation | | (Percentage responses) | | Survey Round | Current Perception | One year ahead Expectation | | Improved | Remained Same | Worsened | Net Response | Will Improve | Will Remain Same | Will Worsen | Net Response | | Jan-20 | 27.1 | 18.0 | 54.9 | -27.8 | 48.8 | 14.3 | 36.9 | 11.9 | | Mar-20 | 28.4 | 19.3 | 52.3 | -23.9 | 49.8 | 15.6 | 34.7 | 15.1 | | May-20 | 14.4 | 11.2 | 74.4 | -60.0 | 39.6 | 9.0 | 51.4 | -11.7 | | Jul-20 | 11.9 | 10.3 | 77.8 | -65.9 | 44.3 | 13.5 | 42.2 | 2.1 | | Sep-20 | 9.0 | 11.4 | 79.6 | -70.6 | 50.1 | 15.1 | 34.8 | 15.3 | | Nov-20 | 11.0 | 11.5 | 77.5 | -66.5 | 50.9 | 13.9 | 35.2 | 15.7 | | Jan-21 | 14.3 | 13.6 | 72.2 | -57.9 | 52.6 | 16.1 | 31.3 | 21.3 |

| Table 2: Perceptions and Expectations on Employment | | (Percentage responses) | | Survey Round | Current Perception | One year ahead Expectation | | Improved | Remained Same | Worsened | Net Response | Will Improve | Will Remain Same | Will Worsen | Net Response | | Jan-20 | 24.6 | 17.8 | 57.7 | -33.1 | 48.4 | 16.3 | 35.4 | 13.0 | | Mar-20 | 25.2 | 19.1 | 55.7 | -30.5 | 48.8 | 17.1 | 34.1 | 14.7 | | May-20 | 19.2 | 13.4 | 67.4 | -48.2 | 41.5 | 11.1 | 47.4 | -5.9 | | Jul-20 | 13.0 | 8.9 | 78.1 | -65.1 | 48.6 | 13.3 | 38.2 | 10.4 | | Sep-20 | 10.1 | 8.1 | 81.7 | -71.6 | 54.1 | 14.3 | 31.6 | 22.5 | | Nov-20 | 11.0 | 9.5 | 79.5 | -68.5 | 52.0 | 14.9 | 33.1 | 18.9 | | Jan-21 | 13.1 | 11.5 | 75.4 | -62.3 | 55.3 | 16.1 | 28.6 | 26.7 |

| Table 3: Perceptions and Expectations on Price Level | | (Percentage responses) | | Survey Round | Current Perception | One year ahead Expectation | | Increased | Remained Same | Decreased | Net Response | Will Increase | Will Remain Same | Will Decrease | Net Response | | Jan-20 | 90.6 | 7.6 | 1.9 | -88.7 | 76.9 | 12.9 | 10.2 | -66.7 | | Mar-20 | 87.2 | 10.3 | 2.6 | -84.6 | 78.1 | 14.2 | 7.7 | -70.4 | | May-20 | 79.1 | 17.5 | 3.4 | -75.8 | 75.8 | 14.8 | 9.4 | -66.4 | | Jul-20 | 79.7 | 16.7 | 3.6 | -76.2 | 71.6 | 18.3 | 10.1 | -61.5 | | Sep-20 | 82.9 | 14.6 | 2.5 | -80.4 | 69.5 | 20.5 | 10.0 | -59.5 | | Nov-20 | 89.7 | 9.0 | 1.4 | -88.3 | 70.5 | 17.4 | 12.1 | -58.4 | | Jan-21 | 88.6 | 9.6 | 1.7 | -86.9 | 73.2 | 17.1 | 9.7 | -63.5 |

| Table 4: Perceptions and Expectations on Rate of Change in Price Level (Inflation)* | | (Percentage responses) | | Survey Round | Current Perception | One year ahead Expectation | | Increased | Remained Same | Decreased | Net Response | Will Increase | Will Remain Same | Will Decrease | Net Response | | Jan-20 | 84.9 | 11.2 | 4.0 | -80.9 | 80.3 | 14.7 | 5.0 | -75.3 | | Mar-20 | 80.8 | 15.7 | 3.5 | -77.3 | 75.6 | 20.3 | 4.1 | -71.5 | | May-20 | 74.8 | 18.6 | 6.6 | -68.2 | 73.4 | 19.5 | 7.1 | -66.3 | | Jul-20 | 79.8 | 15.6 | 4.5 | -75.3 | 76.4 | 18.6 | 5.0 | -71.4 | | Sep-20 | 83.0 | 13.1 | 3.9 | -79.1 | 75.9 | 19.6 | 4.6 | -71.3 | | Nov-20 | 88.3 | 8.9 | 2.8 | -85.5 | 78.3 | 16.7 | 4.9 | -73.4 | | Jan-21 | 83.5 | 13.4 | 3.1 | -80.4 | 77.7 | 17.2 | 5.0 | -72.7 | | *Applicable only for those respondents who felt price has increased/price will increase. |

| Table 5: Perceptions and Expectations on Income | | (Percentage responses) | | Survey Round | Current Perception | One year ahead Expectation | | Increased | Remained Same | Decreased | Net Response | Will Increase | Will Remain Same | Will Decrease | Net Response | | Jan-20 | 21.9 | 51.2 | 26.9 | -5.0 | 51.9 | 38.9 | 9.2 | 42.7 | | Mar-20 | 22.7 | 52.4 | 24.9 | -2.2 | 52.0 | 40.2 | 7.8 | 44.2 | | May-20 | 12.6 | 34.0 | 53.4 | -40.8 | 39.5 | 39.1 | 21.4 | 18.1 | | Jul-20 | 8.3 | 28.9 | 62.8 | -54.5 | 43.5 | 39.3 | 17.2 | 26.3 | | Sep-20 | 8.9 | 28.4 | 62.7 | -53.8 | 53.2 | 36.7 | 10.0 | 43.2 | | Nov-20 | 8.4 | 28.5 | 63.1 | -54.7 | 51.0 | 38.3 | 10.7 | 40.3 | | Jan-21 | 9.9 | 29.2 | 60.9 | -51.0 | 51.3 | 38.8 | 9.9 | 41.4 |

| Table 6: Perceptions and Expectations on Spending | | (Percentage responses) | | Survey Round | Current Perception | One year ahead Expectation | | Increased | Remained Same | Decreased | Net Response | Will Increase | Will Remain Same | Will Decrease | Net Response | | Jan-20 | 76.3 | 20.5 | 3.2 | 73.1 | 78.7 | 17.3 | 4.0 | 74.7 | | Mar-20 | 72.6 | 24.0 | 3.4 | 69.2 | 75.8 | 20.7 | 3.5 | 72.3 | | May-20 | 56.1 | 31.0 | 12.9 | 43.2 | 64.3 | 27.0 | 8.7 | 55.6 | | Jul-20 | 48.1 | 34.7 | 17.2 | 30.8 | 60.2 | 29.2 | 10.6 | 49.6 | | Sep-20 | 47.2 | 31.8 | 21.1 | 26.1 | 65.3 | 27.5 | 7.2 | 58.1 | | Nov-20 | 55.6 | 28.5 | 15.9 | 39.7 | 69.1 | 24.9 | 6.1 | 63.0 | | Jan-21 | 53.3 | 28.9 | 17.8 | 35.5 | 66.4 | 26.7 | 6.8 | 59.6 |

| Table 7: Perceptions and Expectations on Spending- Essential Items | | (Percentage responses) | | Survey Round | Current Perception | One year ahead Expectation | | Increased | Remained Same | Decreased | Net Response | Will Increase | Will Remain Same | Will Decrease | Net Response | | Jan-20 | 85.3 | 12.2 | 2.6 | 82.7 | 83.7 | 12.9 | 3.4 | 80.3 | | Mar-20 | 83.0 | 14.6 | 2.4 | 80.6 | 82.1 | 15.0 | 2.9 | 79.2 | | May-20 | 69.3 | 20.9 | 9.8 | 59.5 | 73.0 | 20.6 | 6.4 | 66.7 | | Jul-20 | 64.0 | 23.9 | 12.1 | 51.9 | 69.4 | 22.9 | 7.7 | 61.7 | | Sep-20 | 61.4 | 23.9 | 14.7 | 46.7 | 71.9 | 22.8 | 5.3 | 66.6 | | Nov-20 | 68.7 | 20.0 | 11.3 | 57.4 | 75.6 | 19.2 | 5.2 | 70.4 | | Jan-21 | 68.6 | 20.0 | 11.4 | 57.2 | 73.6 | 21.6 | 4.8 | 68.8 |

| Table 8: Perceptions and Expectations on Spending- Non-Essential Items | | (Percentage responses) | | Survey Round | Current Perception | One year ahead Expectation | | Increased | Remained Same | Decreased | Net Response | Will Increase | Will Remain Same | Will Decrease | Net Response | | Jan-20 | 28.0 | 37.3 | 34.6 | -6.6 | 34.3 | 37.8 | 27.9 | 6.4 | | Mar-20 | 27.7 | 42.0 | 30.3 | -2.6 | 32.4 | 43.5 | 24.1 | 8.3 | | May-20 | 13.9 | 39.6 | 46.4 | -32.5 | 22.0 | 42.4 | 35.6 | -13.6 | | Jul-20 | 9.2 | 29.4 | 61.4 | -52.2 | 22.2 | 37.9 | 39.9 | -17.7 | | Sep-20 | 10.7 | 29.5 | 59.8 | -49.1 | 31.3 | 37.4 | 31.4 | -0.1 | | Nov-20 | 11.2 | 27.9 | 60.9 | -49.7 | 28.7 | 37.3 | 34.0 | -5.3 | | Jan-21 | 13.3 | 27.1 | 59.7 | -46.4 | 27.5 | 36.7 | 35.8 | -8.3 |

|  IST,

IST,