IST,

IST,

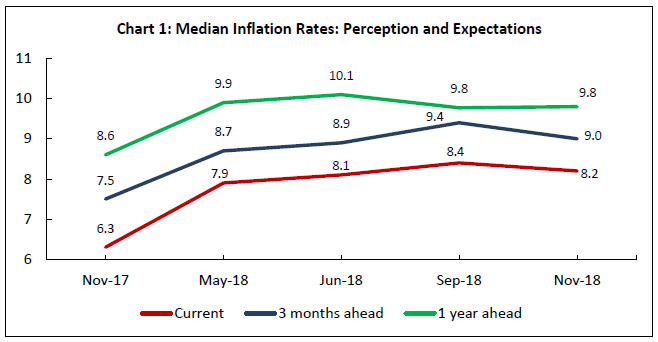

Households’ Inflation Expectations Survey

Today, the Reserve Bank released the results of the November 2018 round of the Inflation Expectations Survey of Households (IESH)1 2. The survey was conducted in 18 cities and the results are based on responses from 5,802 urban households covering various occupational categories. Highlights: i. The proportion of respondents expecting general prices to rise at more than the current rate in the next three months fell marginally in relation to the September 2018 round (Tables 1 a and b). ii. For the one year ahead horizon, expectations were broadly unchanged. iii. In quantitative terms also, three months ahead median inflation expectations eased by 40 basis points (bps) from the September 2018 round; however, their one year ahead expectations remained unchanged (Chart 1, Table 2). iv. The gap between current perceptions and short-term inflation expectations narrowed but the difference between current perceptions and medium term expectations widened in the November 2018 round of the survey relative to the preceding round. Note: Please see the excel file for time series data.

1 The survey is conducted at regular intervals by the Reserve Bank of India. It provides useful directional information on near-term inflationary pressures and also supplements other economic indicators. However, these expectations are formed by the respondents and may reflect their own consumption pattern. Hence, these should not be treated as benchmarks for official measures of inflation. 2 As approved by the Technical Advisory Committee on Surveys (TACS), a two-stage probability sampling scheme was implemented in place of quota sampling from the September 2018 round onwards. Consequent changes in reporting the results of the survey are stated in the footnote to the respective tables. Further, city-wise sample size was revised in proportion to number of households of each city as per Census 2011, keeping the overall sample size 6,000. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

പേജ് അവസാനം അപ്ഡേറ്റ് ചെയ്തത്: