IST,

IST,

Households’ Inflation Expectations Survey

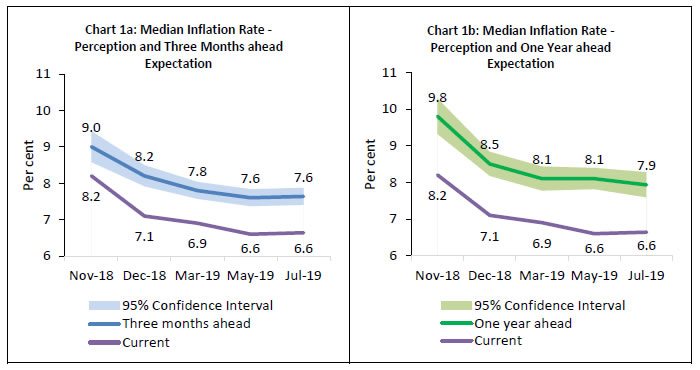

Today, the Reserve Bank released the results of the July 2019 round of the Inflation Expectations Survey of Households (IESH)1. The survey was conducted in 18 major cities and the results are based on responses from 5,870 urban households. Highlights: i. Three months ahead median inflation expectations of households remained unchanged at 7.6 per cent i.e., the same as in the May 2019 round of the survey; one year ahead median inflation expectations moderated by 20 basis points to 7.9 per cent (Chart 1a, 1b, Table 2). ii. Fewer households expect inflation to rise over the year ahead than in May 2019. (Table 1b). Note: Please see the excel file for time series data.

1 The survey is conducted at bi-monthly intervals by the Reserve Bank of India. It provides directional information on near-term inflationary pressures as expected by the respondents and may reflect their own consumption patterns. Hence, they should be treated as households’ sentiments on inflation. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

പേജ് അവസാനം അപ്ഡേറ്റ് ചെയ്തത്: