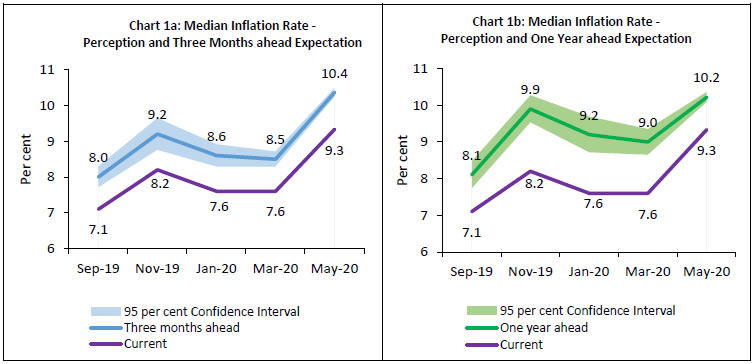

Today, the Reserve Bank released the results of the May 2020 round of the Inflation Expectations Survey of Households (IESH)1. In view of the Covid-19 pandemic, the survey was conducted through telephonic interviews during May 5-17, 2020 in 18 major cities. The results are based on responses from 5,761 urban households. Highlights: i. Households’ median inflation perception and expectations increased sharply in May 2020 as compared with the March 2020 round of the survey [Charts 1a and 1b]. ii. Inflation expectation over three-month horizon exceeded that for the next year ahead period in quantitative terms [Charts 1a and 1b; Table 3]. iii. Three months and one year ahead median inflation expectations rose by 190 and 120 basis points, respectively, over the previous round [Table 3]. iv. Expecting increasing price pressure on food products, more households expect general prices and inflation to rise over three months horizon as compared to previous round [Table 1a]. However, the prices of all product groups, especially cost of housing, are expected to ease over a year ahead period [Table 1b].

Note: Please see the excel file for time series data. | Table 1(a): Product-wise Expectations of Prices for Three Months ahead | | (Percentage of Respondents) | | Survey period ended | May-19 | Nov-19 | Jan-20 | Mar-20 | May-20 | | General | Estimate | SE | Estimate | SE | Estimate | SE | Estimate | SE | Estimate | SE | | Prices will increase | 78.3 | 1.01 | 80.7 | 0.90 | 83.2 | 0.87 | 83.3 | 0.79 | 85.3 | 0.73 | | Price increase more than current rate | 50.0 | 1.22 | 52.4 | 1.22 | 56.1 | 1.16 | 52.5 | 1.10 | 56.0 | 1.02 | | Price increase similar to current rate | 25.6 | 1.01 | 23.4 | 0.96 | 23.4 | 0.91 | 25.6 | 0.99 | 23.5 | 0.89 | | Price increase less than current rate | 2.8 | 0.32 | 4.9 | 0.55 | 3.6 | 0.37 | 5.2 | 0.56 | 5.8 | 0.49 | | No changes in prices | 18.4 | 0.96 | 17.3 | 0.84 | 14.4 | 0.81 | 14.9 | 0.76 | 12.4 | 0.69 | | Decline in prices | 3.3 | 0.35 | 1.9 | 0.26 | 2.4 | 0.31 | 1.8 | 0.25 | 2.3 | 0.32 | | Food Product | | | | | | | | | | | | Prices will increase | 78.5 | 0.87 | 81.8 | 0.80 | 81.7 | 0.80 | 81.9 | 0.81 | 84.6 | 0.75 | | Price increase more than current rate | 48.5 | 1.13 | 54.8 | 1.14 | 56.0 | 1.11 | 55.4 | 1.02 | 58.6 | 1.00 | | Price increase similar to current rate | 24.7 | 0.94 | 21.0 | 0.85 | 20.1 | 0.85 | 20.0 | 0.88 | 20.0 | 0.82 | | Price increase less than current rate | 5.4 | 0.46 | 6.0 | 0.54 | 5.5 | 0.45 | 6.5 | 0.56 | 6.0 | 0.49 | | No changes in prices | 15.0 | 0.77 | 12.3 | 0.65 | 11.2 | 0.67 | 12.4 | 0.68 | 10.7 | 0.64 | | Decline in prices | 6.5 | 0.47 | 5.9 | 0.48 | 7.2 | 0.50 | 5.7 | 0.43 | 4.7 | 0.45 | | Non- Food Product | | | | | | | | | | | | Prices will increase | 75.8 | 0.91 | 75.3 | 0.93 | 77.8 | 0.91 | 77.8 | 0.87 | 76.7 | 0.88 | | Price increase more than current rate | 45.2 | 1.15 | 48.0 | 1.14 | 51.4 | 1.15 | 50.8 | 1.00 | 49.5 | 0.99 | | Price increase similar to current rate | 25.3 | 0.91 | 21.1 | 0.86 | 21.2 | 0.88 | 20.8 | 0.89 | 20.8 | 0.82 | | Price increase less than current rate | 5.4 | 0.44 | 6.1 | 0.53 | 5.3 | 0.43 | 6.2 | 0.50 | 6.4 | 0.50 | | No changes in prices | 18.1 | 0.81 | 20.5 | 0.83 | 17.7 | 0.82 | 17.7 | 0.79 | 17.8 | 0.79 | | Decline in prices | 6.0 | 0.47 | 4.3 | 0.39 | 4.4 | 0.39 | 4.5 | 0.42 | 5.5 | 0.49 | | Household Durables | | | | | | | | | | | | Prices will increase | 61.3 | 1.12 | 55.2 | 1.09 | 60.3 | 1.02 | 64.5 | 1.02 | 55.1 | 1.04 | | Price increase more than current rate | 37.0 | 1.12 | 35.4 | 1.06 | 37.9 | 1.03 | 42.3 | 1.03 | 33.6 | 0.96 | | Price increase similar to current rate | 19.9 | 0.85 | 15.2 | 0.73 | 17.5 | 0.76 | 17.2 | 0.80 | 16.4 | 0.76 | | Price increase less than current rate | 4.3 | 0.41 | 4.6 | 0.44 | 4.8 | 0.43 | 5.0 | 0.44 | 5.1 | 0.44 | | No changes in prices | 27.2 | 1.01 | 29.1 | 0.93 | 26.8 | 0.91 | 24.2 | 0.90 | 29.7 | 0.94 | | Decline in prices | 11.5 | 0.64 | 15.8 | 0.73 | 12.9 | 0.65 | 11.2 | 0.63 | 15.2 | 0.76 | | Cost of Housing | | | | | | | | | | | | Prices will increase | 70.9 | 1.06 | 68.5 | 1.09 | 69.7 | 1.04 | 71.0 | 1.07 | 48.6 | 1.01 | | Price increase more than current rate | 46.9 | 1.13 | 48.3 | 1.19 | 48.4 | 1.10 | 49.5 | 1.10 | 30.2 | 0.93 | | Price increase similar to current rate | 19.8 | 0.83 | 16.4 | 0.77 | 17.3 | 0.74 | 17.4 | 0.78 | 13.6 | 0.69 | | Price increase less than current rate | 4.2 | 0.39 | 3.8 | 0.41 | 4.0 | 0.40 | 4.2 | 0.39 | 4.8 | 0.45 | | No changes in prices | 21.7 | 0.96 | 24.0 | 0.99 | 22.0 | 0.95 | 22.1 | 0.96 | 30.3 | 0.93 | | Decline in prices | 7.3 | 0.52 | 7.4 | 0.53 | 8.3 | 0.54 | 6.9 | 0.52 | 21.1 | 0.83 | | Cost of Services | | | | | | | | | | | | Prices will increase | 68.6 | 1.03 | 65.8 | 1.05 | 72.5 | 0.98 | 70.8 | 0.99 | 68.3 | 0.97 | | Price increase more than current rate | 42.6 | 1.14 | 43.6 | 1.14 | 46.4 | 1.13 | 46.2 | 1.02 | 43.2 | 0.99 | | Price increase similar to current rate | 21.7 | 0.89 | 17.7 | 0.79 | 21.1 | 0.81 | 19.3 | 0.84 | 19.3 | 0.79 | | Price increase less than current rate | 4.3 | 0.41 | 4.5 | 0.46 | 4.9 | 0.43 | 5.2 | 0.44 | 5.9 | 0.46 | | No changes in prices | 27.7 | 0.99 | 29.5 | 1.01 | 23.4 | 0.90 | 25.9 | 0.94 | 27.4 | 0.93 | | Decline in prices | 3.8 | 0.37 | 4.7 | 0.43 | 4.1 | 0.38 | 3.3 | 0.34 | 4.4 | 0.42 | Note:

1. The table provides estimates and standard errors for qualitative responses.

2. Constituent items may not add up to the corresponding total, due to rounding off. |

| Table 1(b): Product-wise Expectations of Prices for One Year ahead | | (Percentage of Respondents) | | Survey period ended | May-19 | Nov-19 | Jan-20 | Mar-20 | May-20 | | General | Estimate | SE | Estimate | SE | Estimate | SE | Estimate | SE | Estimate | SE | | Prices will increase | 86.3 | 0.77 | 89.1 | 0.71 | 88.1 | 0.74 | 89.2 | 0.65 | 85.6 | 0.73 | | Price increase more than current rate | 58.5 | 1.19 | 64.0 | 1.25 | 63.6 | 1.13 | 60.7 | 1.07 | 57.1 | 1.00 | | Price increase similar to current rate | 24.9 | 1.03 | 21.5 | 0.96 | 21.4 | 0.88 | 24.8 | 1.00 | 23.8 | 0.88 | | Price increase less than current rate | 3.0 | 0.32 | 3.6 | 0.44 | 3.2 | 0.37 | 3.7 | 0.42 | 4.7 | 0.43 | | No changes in prices | 10.2 | 0.70 | 8.9 | 0.64 | 9.5 | 0.67 | 9.0 | 0.62 | 11.9 | 0.67 | | Decline in prices | 3.5 | 0.37 | 2.0 | 0.28 | 2.4 | 0.30 | 1.8 | 0.26 | 2.5 | 0.33 | | Food Product | | | | | | | | | | | | Prices will increase | 83.1 | 0.76 | 86.2 | 0.74 | 84.8 | 0.73 | 85.6 | 0.73 | 77.3 | 0.86 | | Price increase more than current rate | 50.4 | 1.19 | 58.9 | 1.24 | 56.0 | 1.14 | 55.6 | 1.10 | 46.9 | 1.01 | | Price increase similar to current rate | 27.6 | 0.97 | 22.4 | 0.90 | 24.3 | 0.93 | 24.3 | 0.93 | 24.2 | 0.88 | | Price increase less than current rate | 5.1 | 0.43 | 5.0 | 0.49 | 4.5 | 0.40 | 5.7 | 0.49 | 6.3 | 0.51 | | No changes in prices | 11.4 | 0.64 | 9.4 | 0.61 | 9.8 | 0.59 | 10.3 | 0.64 | 15.7 | 0.74 | | Decline in prices | 5.5 | 0.43 | 4.4 | 0.39 | 5.4 | 0.42 | 4.1 | 0.37 | 6.9 | 0.52 | | Non- Food Product | | | | | | | | | | | | Prices will increase | 81.3 | 0.81 | 81.0 | 0.82 | 81.6 | 0.80 | 82.3 | 0.81 | 73.3 | 0.92 | | Price increase more than current rate | 49.7 | 1.18 | 53.5 | 1.23 | 53.1 | 1.14 | 53.6 | 1.08 | 42.6 | 0.99 | | Price increase similar to current rate | 26.8 | 0.99 | 22.6 | 0.92 | 23.5 | 0.88 | 23.4 | 0.92 | 23.9 | 0.87 | | Price increase less than current rate | 4.9 | 0.44 | 4.9 | 0.51 | 5.1 | 0.44 | 5.3 | 0.47 | 6.8 | 0.51 | | No changes in prices | 13.7 | 0.72 | 15.5 | 0.72 | 14.1 | 0.72 | 14.2 | 0.73 | 20.7 | 0.84 | | Decline in prices | 5.0 | 0.43 | 3.6 | 0.36 | 4.3 | 0.39 | 3.4 | 0.36 | 6.0 | 0.49 | | Household Durables | | | | | | | | | | | | Prices will increase | 68.8 | 1.04 | 65.4 | 1.00 | 68.0 | 0.96 | 70.8 | 1.02 | 59.6 | 1.03 | | Price increase more than current rate | 42.9 | 1.14 | 42.7 | 1.16 | 44.0 | 1.10 | 46.6 | 1.09 | 34.8 | 0.99 | | Price increase similar to current rate | 21.9 | 0.88 | 18.1 | 0.80 | 20.0 | 0.80 | 19.8 | 0.86 | 19.1 | 0.79 | | Price increase less than current rate | 4.0 | 0.40 | 4.6 | 0.46 | 4.0 | 0.40 | 4.4 | 0.42 | 5.7 | 0.47 | | No changes in prices | 21.5 | 0.91 | 22.5 | 0.84 | 21.2 | 0.84 | 19.7 | 0.87 | 28.4 | 0.93 | | Decline in prices | 9.7 | 0.59 | 12.1 | 0.62 | 10.7 | 0.60 | 9.5 | 0.59 | 12.1 | 0.67 | | Cost of Housing | | | | | | | | | | | | Prices will increase | 79.8 | 0.84 | 80.0 | 0.92 | 77.8 | 0.89 | 79.9 | 0.90 | 59.7 | 1.00 | | Price increase more than current rate | 54.3 | 1.05 | 57.1 | 1.20 | 54.7 | 1.09 | 56.5 | 1.03 | 36.9 | 0.98 | | Price increase similar to current rate | 21.9 | 0.84 | 19.1 | 0.85 | 19.0 | 0.83 | 19.6 | 0.82 | 17.3 | 0.77 | | Price increase less than current rate | 3.6 | 0.37 | 3.9 | 0.41 | 4.1 | 0.39 | 3.8 | 0.39 | 5.5 | 0.46 | | No changes in prices | 14.3 | 0.77 | 13.9 | 0.76 | 15.0 | 0.77 | 14.5 | 0.78 | 25.1 | 0.89 | | Decline in prices | 5.9 | 0.45 | 6.1 | 0.48 | 7.2 | 0.50 | 5.5 | 0.47 | 15.2 | 0.73 | | Cost of Services | | | | | | | | | | | | Prices will increase | 80.9 | 0.83 | 80.9 | 0.87 | 82.5 | 0.79 | 81.4 | 0.85 | 74.4 | 0.91 | | Price increase more than current rate | 50.3 | 1.12 | 53.7 | 1.23 | 54.6 | 1.15 | 53.0 | 1.09 | 44.6 | 0.98 | | Price increase similar to current rate | 25.3 | 0.94 | 22.3 | 0.86 | 23.0 | 0.87 | 23.3 | 0.90 | 23.1 | 0.85 | | Price increase less than current rate | 5.3 | 0.49 | 4.9 | 0.51 | 4.9 | 0.44 | 5.0 | 0.44 | 6.7 | 0.50 | | No changes in prices | 15.5 | 0.77 | 15.9 | 0.77 | 14.6 | 0.72 | 16.0 | 0.81 | 22.1 | 0.87 | | Decline in prices | 3.6 | 0.36 | 3.2 | 0.36 | 2.9 | 0.33 | 2.7 | 0.30 | 3.5 | 0.38 | Note:

1. The table provides estimates and standard errors for qualitative responses.

2. Constituent items may not add up to the corresponding total, due to rounding off. |

| Table 2: Inflation Expectations of Various Groups: May 2020 | | | Current Perception | Three Months ahead Expectation | One Year ahead Expectation | | Mean | Median | Mean | Median | Mean | Median | | Estimate | SE | Estimate | SE | Estimate | SE | Estimate | SE | Estimate | SE | Estimate | SE | | Overall | 9.6 | 0.09 | 9.3 | 0.28 | 10.6 | 0.09 | 10.4 | 0.06 | 9.7 | 0.12 | 10.2 | 0.07 | | Gender-wise | | | | | | | | | | | | | | Male | 9.7 | 0.11 | 9.5 | 0.33 | 10.6 | 0.11 | 10.4 | 0.08 | 9.6 | 0.14 | 10.2 | 0.09 | | Female | 9.5 | 0.14 | 9.2 | 0.32 | 10.6 | 0.14 | 10.3 | 0.09 | 9.7 | 0.18 | 10.2 | 0.12 | | Category-wise | | | | | | | | | | | | | | Financial Sector Employees | 9.6 | 0.39 | 9.1 | 0.88 | 10.6 | 0.43 | 10.1 | 0.62 | 9.8 | 0.51 | 9.7 | 0.91 | | Other Employees | 9.5 | 0.16 | 8.8 | 0.27 | 10.6 | 0.16 | 10.3 | 0.11 | 9.8 | 0.20 | 10.2 | 0.12 | | Self Employed | 9.8 | 0.16 | 9.6 | 0.41 | 10.6 | 0.16 | 10.4 | 0.11 | 9.7 | 0.20 | 10.2 | 0.16 | | Homemaker | 9.4 | 0.16 | 8.9 | 0.29 | 10.5 | 0.16 | 10.2 | 0.10 | 9.4 | 0.20 | 10.0 | 0.29 | | Retired Persons | 9.8 | 0.39 | 9.8 | 0.66 | 10.7 | 0.39 | 10.5 | 0.34 | 9.6 | 0.45 | 10.2 | 0.56 | | Daily Workers | 10.1 | 0.23 | 10.0 | 0.23 | 11.1 | 0.22 | 10.8 | 0.28 | 10.2 | 0.28 | 10.6 | 0.20 | | Other category | 9.3 | 0.23 | 8.6 | 0.49 | 10.3 | 0.22 | 10.2 | 0.14 | 9.9 | 0.25 | 10.3 | 0.16 | | Age Group-wise | | | | | | | | | | | | | | Up to 25 years | 9.1 | 0.17 | 8.4 | 0.34 | 10.4 | 0.17 | 10.2 | 0.12 | 9.8 | 0.21 | 10.2 | 0.14 | | 25 to 30 years | 9.5 | 0.18 | 9.1 | 0.40 | 10.6 | 0.17 | 10.3 | 0.14 | 9.9 | 0.21 | 10.2 | 0.19 | | 30 to 35 years | 9.3 | 0.19 | 8.7 | 0.37 | 10.3 | 0.19 | 10.2 | 0.18 | 9.3 | 0.23 | 9.4 | 0.55 | | 35 to 40 years | 9.6 | 0.18 | 9.2 | 0.40 | 10.6 | 0.18 | 10.3 | 0.12 | 9.5 | 0.21 | 9.9 | 0.36 | | 40 to 45 years | 10.0 | 0.20 | 10.0 | 0.29 | 10.9 | 0.19 | 10.5 | 0.15 | 10.2 | 0.24 | 10.6 | 0.16 | | 45 to 50 years | 9.7 | 0.22 | 9.4 | 0.45 | 10.7 | 0.22 | 10.4 | 0.13 | 9.7 | 0.26 | 10.2 | 0.34 | | 50 to 55 years | 9.8 | 0.28 | 9.7 | 0.54 | 10.6 | 0.28 | 10.4 | 0.20 | 9.8 | 0.34 | 10.2 | 0.28 | | 55 to 60 years | 9.7 | 0.30 | 9.3 | 0.54 | 10.7 | 0.28 | 10.4 | 0.23 | 9.6 | 0.35 | 10.1 | 0.36 | | 60 years and above | 10.0 | 0.32 | 10.1 | 0.32 | 11.0 | 0.32 | 10.8 | 0.51 | 10.2 | 0.39 | 10.6 | 0.39 | | City-wise | | | | | | | | | | | | | | Ahmedabad | 10.5 | 0.34 | 10.3 | 0.26 | 11.6 | 0.33 | 11.5 | 0.79 | 9.8 | 0.48 | 10.5 | 0.68 | | Bengaluru | 9.8 | 0.28 | 10.1 | 0.25 | 10.6 | 0.28 | 10.4 | 0.24 | 10.2 | 0.34 | 10.5 | 0.31 | | Bhopal | 11.1 | 0.64 | 10.9 | 1.16 | 11.7 | 0.62 | 12.0 | 1.68 | 9.7 | 0.82 | 10.8 | 1.50 | | Bhubaneswar | 8.5 | 0.79 | 7.7 | 1.73 | 10.3 | 0.72 | 9.7 | 1.40 | 9.8 | 0.92 | 9.3 | 1.94 | | Chennai | 10.6 | 0.39 | 10.4 | 0.15 | 11.6 | 0.35 | 11.2 | 0.86 | 11.5 | 0.42 | 12.0 | 1.33 | | Delhi | 8.2 | 0.23 | 6.9 | 0.50 | 9.1 | 0.23 | 8.2 | 0.30 | 8.3 | 0.27 | 8.1 | 0.31 | | Guwahati | 9.6 | 0.57 | 9.5 | 1.30 | 10.0 | 0.60 | 9.6 | 1.16 | 8.4 | 0.94 | 7.7 | 1.28 | | Hyderabad | 10.3 | 0.37 | 10.3 | 0.27 | 12.1 | 0.34 | 13.1 | 1.11 | 12.0 | 0.41 | 14.0 | 1.11 | | Jaipur | 10.1 | 0.57 | 9.9 | 0.66 | 10.8 | 0.52 | 10.7 | 0.59 | 8.7 | 0.65 | 9.3 | 0.99 | | Kolkata | 10.8 | 0.30 | 10.4 | 0.18 | 11.5 | 0.29 | 11.3 | 0.88 | 10.9 | 0.35 | 10.9 | 0.62 | | Lucknow | 8.8 | 0.43 | 8.8 | 0.57 | 9.9 | 0.49 | 10.2 | 0.57 | 9.7 | 0.49 | 10.3 | 0.31 | | Mumbai | 10.0 | 0.23 | 9.0 | 0.37 | 10.9 | 0.23 | 10.3 | 0.19 | 8.8 | 0.32 | 9.3 | 0.61 | | Nagpur | 8.4 | 0.42 | 7.9 | 0.66 | 10.1 | 0.47 | 9.9 | 0.46 | 9.2 | 0.64 | 9.7 | 0.72 | | Patna | 9.4 | 0.50 | 9.7 | 0.31 | 10.9 | 0.69 | 11.1 | 0.69 | 11.0 | 0.76 | 11.6 | 1.14 | | Thiruvananthapuram | 6.3 | 0.65 | 5.2 | 0.33 | 8.1 | 0.82 | 6.6 | 0.64 | 8.5 | 0.86 | 7.4 | 0.79 | | Chandigarh | 8.1 | 0.54 | 8.3 | 0.58 | 8.0 | 0.54 | 8.0 | 0.69 | 7.5 | 0.60 | 7.9 | 0.82 | | Ranchi | 7.8 | 0.53 | 7.0 | 0.66 | 8.7 | 0.60 | 8.0 | 0.88 | 7.5 | 0.72 | 7.2 | 0.72 | | Raipur | 8.7 | 0.63 | 7.9 | 0.79 | 10.4 | 0.63 | 9.9 | 0.74 | 10.2 | 0.79 | 10.1 | 0.72 | | Note: The table provides estimates and standard errors for quantitative responses. |

| Table 3: Household Inflation Expectations – Current Perception, Three Months and One Year Ahead Expectations | | | Current Perception | Three Months ahead Expectation | One Year ahead Expectation | | Mean | Median | Mean | Median | Mean | Median | | Estimate | SE | Estimate | SE | Estimate | SE | Estimate | SE | Estimate | SE | Estimate | SE | | May-19 | 7.8 | 0.10 | 6.6 | 0.15 | 8.6 | 0.10 | 7.6 | 0.12 | 8.4 | 0.12 | 8.1 | 0.16 | | Nov-19 | 9.1 | 0.10 | 8.2 | 0.17 | 9.8 | 0.11 | 9.2 | 0.23 | 9.7 | 0.12 | 9.9 | 0.19 | | Jan-20 | 8.7 | 0.11 | 7.6 | 0.19 | 9.5 | 0.11 | 8.6 | 0.16 | 9.3 | 0.13 | 9.2 | 0.25 | | Mar-20 | 8.4 | 0.09 | 7.6 | 0.12 | 9.2 | 0.10 | 8.5 | 0.11 | 9.1 | 0.11 | 9.0 | 0.18 | | May-20 | 9.6 | 0.09 | 9.3 | 0.28 | 10.6 | 0.09 | 10.4 | 0.06 | 9.7 | 0.12 | 10.2 | 0.07 | | Note: The table provides estimates and standard errors for quantitative responses. |

| Table 4: Households Expecting General Price Movements in Coherence with Movements in Price Expectations of Various Product Groups: Three Months Ahead and One Year Ahead | | (Percentage of Respondents) | | Survey period ended | Food | Non-Food | Households durables | Housing | Cost of services | | Three Months Ahead | | May-19 | 66.4 | 65.4 | 56.8 | 62.0 | 66.2 | | Nov-19 | 64.7 | 65.1 | 51.0 | 60.7 | 63.1 | | Jan-20 | 66.1 | 66.2 | 53.4 | 59.3 | 64.5 | | Mar-20 | 65.4 | 64.6 | 55.8 | 61.1 | 64.7 | | May-20 | 63.3 | 59.8 | 46.5 | 42.6 | 57.3 | | One Year Ahead | | May-19 | 71.6 | 71.3 | 62.7 | 70.7 | 72.5 | | Nov-19 | 73.9 | 70.9 | 57.8 | 69.7 | 72.3 | | Jan-20 | 72.2 | 70.9 | 60.3 | 67.8 | 72.8 | | Mar-20 | 71.9 | 71.8 | 63.2 | 69.9 | 72.3 | | May-20 | 62.3 | 59.5 | 50.9 | 50.3 | 62.3 | | Note: Figures are based on sample observations |

| Table 5(a): Cross-tabulation of Number of Respondents by Current Inflation Perception and Three Months Ahead Inflation Expectations: May 2020 | | Three Months Ahead Inflation Rate (per cent) | | Current Inflation Rate (per cent) | | <1 | 1-<2 | 2-<3 | 3-<4 | 4-<5 | 5-<6 | 6-<7 | 7-<8 | 8-<9 | 9-<10 | 10-<11 | 11-<12 | 12-<13 | 13-<14 | 14-<15 | 15-<16 | >=16 | No idea | Total | | <1 | 14 | 3 | 5 | 1 | 1 | 4 | 1 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 31 | | 1-<2 | 0 | 19 | 10 | 6 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 35 | | 2-<3 | 0 | 6 | 80 | 56 | 38 | 16 | 6 | 4 | 3 | 0 | 3 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 213 | | 3-<4 | 1 | 2 | 4 | 97 | 40 | 76 | 21 | 7 | 5 | 0 | 3 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 256 | | 4-<5 | 0 | 1 | 4 | 8 | 122 | 68 | 73 | 17 | 9 | 1 | 6 | 0 | 1 | 0 | 0 | 0 | 1 | 1 | 312 | | 5-<6 | 5 | 2 | 10 | 26 | 19 | 368 | 99 | 148 | 87 | 12 | 130 | 0 | 6 | 0 | 0 | 15 | 4 | 0 | 931 | | 6-<7 | 1 | 1 | 0 | 6 | 4 | 10 | 131 | 56 | 51 | 19 | 26 | 5 | 5 | 0 | 0 | 1 | 0 | 0 | 316 | | 7-<8 | 0 | 0 | 2 | 1 | 4 | 8 | 7 | 167 | 50 | 54 | 59 | 6 | 9 | 0 | 3 | 7 | 2 | 0 | 379 | | 8-<9 | 1 | 1 | 0 | 0 | 1 | 12 | 8 | 0 | 150 | 36 | 112 | 8 | 24 | 9 | 1 | 9 | 7 | 0 | 379 | | 9-<10 | 0 | 0 | 0 | 1 | 0 | 1 | 2 | 0 | 3 | 74 | 39 | 20 | 33 | 6 | 4 | 11 | 2 | 0 | 196 | | 10-<11 | 1 | 0 | 0 | 2 | 2 | 42 | 5 | 9 | 18 | 12 | 436 | 35 | 159 | 37 | 8 | 249 | 120 | 1 | 1136 | | 11-<12 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 12 | 6 | 7 | 4 | 6 | 4 | 0 | 40 | | 12-<13 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 1 | 0 | 4 | 1 | 34 | 14 | 11 | 29 | 8 | 0 | 103 | | 13-<14 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 2 | 2 | 6 | 11 | 0 | 21 | | 14-<15 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 13 | 4 | 11 | 0 | 29 | | 15-<16 | 0 | 0 | 0 | 0 | 0 | 2 | 1 | 2 | 0 | 0 | 13 | 1 | 4 | 1 | 0 | 89 | 152 | 0 | 265 | | >=16 | 2 | 0 | 2 | 0 | 1 | 7 | 0 | 4 | 0 | 1 | 36 | 0 | 3 | 2 | 0 | 38 | 1017 | 6 | 1119 | | Total | 25 | 35 | 117 | 204 | 232 | 615 | 354 | 415 | 377 | 209 | 869 | 88 | 285 | 78 | 46 | 464 | 1340 | 8 | 5761 | | Note: Figures are based on sample observations |

| Table 5(b): Cross-tabulation of Number of Respondents by Current Inflation Perception and One Year Ahead Inflation Expectations: May 2020 | | One Year Ahead Inflation Rate (per cent) | | Current Inflation Rate (per cent) | | <1 | 1-<2 | 2-<3 | 3-<4 | 4-<5 | 5-<6 | 6-<7 | 7-<8 | 8-<9 | 9-<10 | 10-<11 | 11-<12 | 12-<13 | 13-<14 | 14-<15 | 15-<16 | >=16 | No idea | Total | | <1 | 12 | 6 | 4 | 2 | 1 | 3 | 0 | 0 | 1 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 31 | | 1-<2 | 9 | 10 | 4 | 7 | 2 | 3 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 35 | | 2-<3 | 18 | 2 | 62 | 42 | 34 | 24 | 12 | 7 | 3 | 0 | 8 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 213 | | 3-<4 | 34 | 0 | 4 | 55 | 34 | 62 | 26 | 12 | 13 | 2 | 11 | 0 | 1 | 0 | 0 | 1 | 1 | 0 | 256 | | 4-<5 | 33 | 0 | 7 | 7 | 89 | 47 | 60 | 19 | 26 | 2 | 9 | 1 | 5 | 1 | 0 | 3 | 3 | 0 | 312 | | 5-<6 | 121 | 1 | 6 | 10 | 9 | 255 | 65 | 120 | 89 | 20 | 170 | 4 | 18 | 7 | 2 | 21 | 11 | 2 | 931 | | 6-<7 | 40 | 0 | 0 | 5 | 4 | 4 | 90 | 40 | 45 | 19 | 42 | 7 | 11 | 1 | 1 | 4 | 3 | 0 | 316 | | 7-<8 | 60 | 1 | 2 | 4 | 4 | 3 | 5 | 113 | 48 | 35 | 60 | 2 | 14 | 0 | 11 | 10 | 6 | 1 | 379 | | 8-<9 | 57 | 0 | 0 | 1 | 1 | 5 | 3 | 4 | 85 | 30 | 92 | 23 | 35 | 8 | 6 | 13 | 16 | 0 | 379 | | 9-<10 | 25 | 0 | 0 | 0 | 0 | 0 | 0 | 2 | 0 | 45 | 31 | 24 | 19 | 10 | 15 | 18 | 7 | 0 | 196 | | 10-<11 | 158 | 0 | 0 | 1 | 0 | 22 | 5 | 7 | 9 | 4 | 282 | 33 | 112 | 37 | 20 | 223 | 221 | 2 | 1136 | | 11-<12 | 3 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 13 | 1 | 4 | 6 | 4 | 9 | 0 | 40 | | 12-<13 | 8 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 1 | 0 | 0 | 1 | 27 | 8 | 16 | 21 | 20 | 0 | 103 | | 13-<14 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 4 | 3 | 4 | 9 | 0 | 21 | | 14-<15 | 5 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 1 | 0 | 0 | 0 | 6 | 0 | 16 | 0 | 29 | | 15-<16 | 39 | 0 | 0 | 0 | 0 | 1 | 0 | 1 | 0 | 1 | 13 | 2 | 1 | 1 | 0 | 51 | 153 | 2 | 265 | | >=16 | 156 | 0 | 0 | 0 | 0 | 7 | 0 | 1 | 1 | 0 | 27 | 0 | 0 | 1 | 1 | 27 | 892 | 6 | 1119 | | Total | 778 | 20 | 89 | 134 | 178 | 436 | 267 | 326 | 322 | 158 | 747 | 111 | 244 | 82 | 87 | 400 | 1369 | 13 | 5761 | | Note: Figures are based on sample observations |

|  IST,

IST,