IST,

IST,

അറിയിപ്പുകൾക്കായി സബ്സ്ക്രൈബ് ചെയ്യുക

Foreword

The term strategy originates from the Greek word “Strategos”, which means “General”. Just as a General lays out a plan to chart a path towards victory by optimising resources and strengths, Utkarsh is intended to be a living document that sets out the course that the Bank adopts to deliver excellence in its work..

Utkarsh 2.0 lays out the specific features of this journey in terms of values, mission, vision, and associated building blocks (milestones). It is crafted by and for each department in its pursuit of the Bank’s overarching goals. It builds upward from an ensemble of milestones and encompasses the timeframe 2023-25.

Against the backdrop of a challenging global and domestic environment, Utkarsh 2.0 commences from 2023, when India assumes the G-20 Presidency.

Like Utkarsh 2022, Utkarsh 2.0 sets out strategies and milestones under six visions which will guide the Bank along this roadmap to achieve its goals. We are guided in the endeavour by the light shone by the words of Mahatma Gandhi, means are more important than the end; it is only with the right means that the desired end will follow1.

Shaktikanta Das

Governor

Reserve Bank of India

December 30, 2022

Utkarsh embodies progress. Initiated in 2019, Utkarsh 2022 became a medium-term strategy document guiding the Bank’s progress towards realisation of delineated milestones by navigating turbulent tides created by the COVID-19 pandemic and geopolitical hostilities. It was a comprehensive endeavour to broaden the strategy horizon of the Annual Action Plans that was followed in the Bank earlier to a longer time frame of three years.

Utkarsh 2.0 addresses the period 2023-25. It harnesses the strengths of Utkarsh 2022 by retaining the six vision statements as well as core purpose, values, and mission. Collectively they create a strategic guiding path. Utkarsh 2.0’s roadmap has 60 strategies which would culminate in the desired outcomes.

Utkarsh 2.0 seeks to enhance public trust in, and credibility of, the Bank. The strategy framework includes new ways and touch points for outreach, ease of information dissemination through effective user interfaces, establishing significance at national and international fora, and strengthening transparency and accountability in internal governance. This would create an enabling digital, physical, ethical and governance infrastructure within the Bank for attaining the envisaged goals.

Efficient monitoring with intermittent stock taking and course correction, where required, would be the hallmarks of Utkarsh 2.0 as the strategic path for the Bank to sustain its journey towards excellence. In the words of George Bernard Shaw: “Progress is impossible without change, and those who cannot change their minds cannot change anything2.

“You cannot cross the sea merely by standing and staring at water” ~ Rabindranath Tagore3

INTRODUCTION and STRUCTURE of UTKARSH 2.0

I.1 Strategy plays a crucial role in shaping the future of an organisation. It aids in fulfilling the mission and vision, thereby leading to overall organisational development and progress. Central banks around the world have formulated medium-term strategy frameworks.

I.2 In the past, the Bank had Annual Action Plans under which the work to be taken up during a year was laid out and monitored for progress and completion. The exercise, however, did not provide a single point of reference so as to have a bird’s eye view of the functioning of the Bank. Moreover, an annual plan was perceived to be too short a period for pursuing strategic objectives.

I.3 Accordingly, it was decided to formulate a longer-term dynamic strategy framework that could capture and respond to the rapidly emerging features of the economic, social, and technological ecosystem. Utkarsh 2022, the medium-term strategy framework of the Bank, was approved by the Central Board of Directors and launched in July 2019. The implementation of Utkarsh 2022 was steered by a high-level Strategy Sub-Committee of the Bank’s Central Board of Directors.

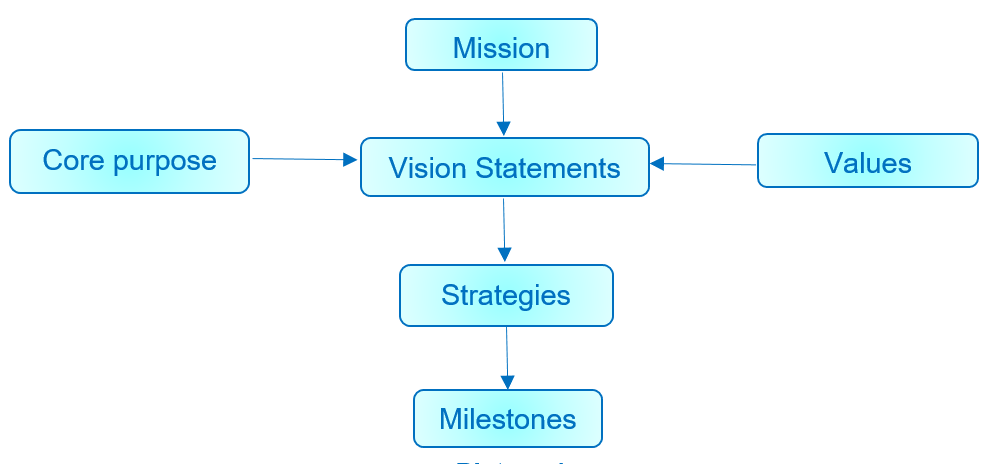

I.4 Utkarsh 2.0, the Strategy Framework being put in place for the period 2023-25, sets out the priorities, activities, and desired outcomes under each of the objectives of the Bank for the period between 2023 and 2025. The framework for Utkarsh 2.0 has been recast to make it sharper and to ensure that there are no overlapping terminologies. It is built on similar lines as Utkarsh 2022 and will carry forward the current agenda while proactively addressing future challenges. While simplifying the structure to avoid redundancy, the revised structure consists of three layers, viz., Visions, Strategies and Milestones which will assist in the focused monitoring (Chart II.1).

Chart II.1: Revised Structure

Mission, Core Purpose and Values

I.5 The Mission in Utkarsh is to promote:

- The economic and financial well-being of the people of India in terms of price and financial stability;

- Fair and universal access to financial services; and

- A robust, dynamic, and responsive financial intermediation infrastructure

I.6 The core purpose in Utkarsh is to foster monetary and financial stability keeping in mind the objective of growth and to ensure the development of an efficient and inclusive financial system. This reflects the Bank’s commitment to the nation to:

- foster confidence in the internal and external value of the Rupee and contribute to macro-economic stability;

- regulate markets and institutions under its ambit to ensure financial system stability and consumer protection;

- promote the integrity, efficiency, inclusiveness and competitiveness of the financial and payment systems;

- ensure efficient management of the currency as well as banking services to the Government and banks; and

- support balanced and equitable economic development of the country.

I.7 Through the values embodied in Utkarsh, the Bank commits itself to the following shared values that guide organisational decisions and employee actions (Table I.1):

Vision statements

I.8 The visions of the strategy framework are enumerated below (Table I.2):

| Table I.2: Vision Statements | |

| Vision | |

| Vision 1 | Excellence in the Performance of its Functions |

| Vision 2 | Strengthened Trust of Citizens and Institutions in the Reserve Bank of India |

| Vision 3 | Enhanced Relevance and Significance in National and Global Roles |

| Vision 4 | Transparent, Accountable and Ethics-Driven Internal Governance |

| Vision 5 | Best-in-class and Environment-friendly Digital and Physical Infrastructure |

| Vision 6 | Innovative, Dynamic, and Skilled Human Resources |

“Don’t take rest after your first victory because if you fail in the second, more lips are waiting to say that your first victory was just luck” – A.P.J. Abdul Kalam4.

Utkarsh 2.0

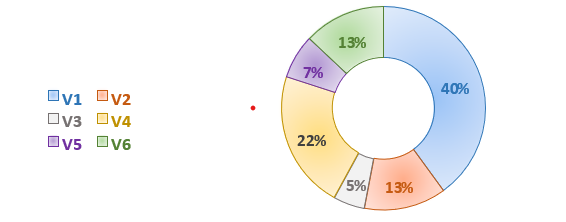

II.1 As earlier, a bottom-up approach was followed while formulating Utkarsh 2.0. A summary of the Vision-wise strategies is given below (Chart II.1 and Table II.1).

| Chart II.1: Vision-wise bifurcation of strategies under Utkarsh 2.0 | |||||||

|

|||||||

Source: RBI

| Table II.1: Number of strategies under each Vision | |||||||

| Vision 1 | Vision 2 | Vision 3 | Vision 4 | Vision 5 | Vision 6 | Total | |

| No. of Strategies | 24 | 8 | 3 | 13 | 4 | 8 | 60 |

Vision 1: Excellence in the Performance of its Functions

II.2 The objective of the Bank’s vision is to achieve excellence in executing its functions including formulation of monetary policy, regulating and supervising the financial system, managing foreign exchange, issuing currency and regulating and supervising payment and settlement systems. An abiding endeavour has been to strive for improvement and innovation in disposition of these functions because of which the Bank has evolved as a “full service central bank”5. The reputation of the Bank is critically dependent on the timely and excellent discharge of its functions.

II.3 Vision 1, therefore, is significant under the strategy framework. It has 24 strategies. The focus is not only to perform all the functions tasked to the Bank, but to perform them consistently well. The strategies under Vision 1 are given below (Table II.2).

| Table II.2: Vision 1 – Excellence in the Performance of its Functions | |

| Sl No | Strategies |

| 1 | Revamping currency management through (i) efficiency in procurement and distribution; (ii) high quality currency notes; (iii) research and development |

| 2 | Robust execution of the reserve management function. |

| 3 | Enhancing standards of research and publications for policy purposes. |

| 4 | Enhancing efficiency and automation of the ‘Banker to Government’ function. |

| 5 | Resilient financial intermediation - Creating the ecosystem and refining the regulatory framework. |

| 6 | Rationalise and Simplify Regulations pertaining to banks and non-banks. |

| 7 | Convergence - prudential regulations with international standards. |

| 8 | Align – Know Your Customer instructions with Financial Action Task Force. |

| 9 | Create a resilient financial intermediation ecosystem; refining the regulatory and supervisory framework for its robust and strong sustenance. |

| 10 | Strengthening resilience, integrity and efficiency of our financial market infrastructures with focus on deepening digital payments. |

| 11 | Enriching the Bank's policies and functions through statistical analysis, forward looking surveys, information management and ‘state-of-the-art’ data-intensive policy research. |

| 12 | Review of the regulatory architecture under FEMA, 1999 to simplify regulatory compliance and improve ease of doing business. |

| 13 | Promoting Internationalisation of Rupee through review of regulations under Foreign Exchange Management Act, 1999. |

| 14 | Creating a resilient financial intermediation ecosystem; refining the financial inclusion framework for its robust and strong sustenance. |

| 15 | Developing an appropriate framework for managing FinTech ecosystem in the country. |

| 16 | Phased introduction of Central Bank Digital Currency. |

| 17 | Adoption of emerging SupTech solutions for effective supervision and efficient implementation of regulations. |

| 18 | Facilitation in development of RegTech solutions for Regulated Entities. |

| 19 | Ensuring robustness and resilience of Bank-regulated financial markets and Bank's liquidity management framework. |

| 20 | Strengthening the resilience and efficiency of the financial markets and market infrastructure. |

| 21 | Creating and monitoring resilient ecosystem for financial stability. |

| 22 | Enhancing the effectiveness of public debt management. |

| 23 | Broadening and widening the Government Securities market in India. |

| 24 | Strengthening the monetary policy framework and operating procedure. |

Vision 2: Strengthened Trust of Citizens and Institutions in the Reserve Bank of India

II.4 An important pillar for effective delivery of the Bank’s functions is the trust of all stakeholders. The perception of citizens and other market participants that the Bank is capable of and is doing the right things at the right time and in the right manner is important for enhancing the reputation of the Bank as a public institution. It is in this context that continuous efforts are made to strengthen the trust of citizens and institutions in it by improving the transparency of functions, better and effective communication and reach, constant engagement with all relevant stakeholders, enhanced consumer awareness and efficient grievance redress mechanisms.

II.5 Towards this objective, the Bank proposes to ensure its presence in all the states; ensure that complaints against its regulated entities are heard and redressed in a time-bound manner; and the compliance culture among the regulated entities is improved through expeditious discharge of the enforcement function.

II.6 Dissemination of information to the public goes a long way in reinforcing trust and assuaging apprehensions. The Bank will have an informative, well-designed and constantly evolving website. Feedback will be obtained, and the impact of the Bank’s public awareness initiatives will be assessed. This Vision has 8 strategies. The strategies under Vision 2 are given below (Table II.3).

Vision 3: Enhanced Relevance and Significance in National and Global roles

II.7 The Bank has an important role to play in national and global fora such as the International Monetary Fund, the Bank for International Settlements, the Financial Stability Board, the G-20 and the like. Vision 3 sharpens and augments the Bank’s focus on international financial diplomacy and participation in formulation of global regulatory standards in a proactive manner. The Bank will also continue its initiatives in articulating its stance and views on major global economic and regulatory policy issues, highlighting India’s specific characteristics.

II.8 The Bank shall maintain strong engagement with the committees under the Bank for International Settlements and host associations in the context of the Basel process and payment system initiatives. It will broaden its economic analysis and research to include new themes. The Bank will engage with central banks in the innovation space to explore the practical implications of new technological trends. The Bank’s brand equity will be enhanced by internationalising Bank’s Payments Stack across all dimensions.

II.9 The strategies under Vision 3 are given below (Table II.4).

Vision 4: Transparent, Accountable and Ethics-Driven Internal Governance

II.10 Internal governance contains an organisation’s formal set of structures, communication lines, procedures and rules to ensure that its moral code is followed. It includes values, beliefs and practices that guide and inform the actions of all the employees in an organisation. The key pillars of sound internal governance are integrity, transparency, trust, accountability mechanism, ethical conduct and sound processes and practices. Sound internal governance has the potential of attracting the best talent and motivating existing employees to give their best.

II.11 Openness and accountability are increasingly recognised as fundamental qualities of good governance. The Bank shall continue to strive to achieve transparent, accountable and ethics driven internal governance by strengthening its strategy framework and business continuity management, upgrading internal control measures, assessing emerging risks and adopting international best practices of enterprise risk management.

II.12 Through this vision, the Bank documents its values, including its commitment to integrity, fairness, transparency, and ethical conduct. The Bank shall also undertake periodical evaluation of the policies and update them considering the feedback received and the evolving scenarios in which it must operate. Adherence to accountability mechanisms will be reviewed at regular intervals.

II.13 The strategies under Vision 4 are given below (Table II.5).

| Table II.5: Vision 4 – Transparent, Accountable and Ethics-Driven Internal Governance | |

| Sl No | Strategies |

| 1 | Strengthening corporate strategy, budget management and business continuity framework. |

| 2 | Enabling uniform understanding of rules and regulations to improve compliance. |

| 3 | Greater convergence in risk assessment done by the audit and risk functions. |

| 4 | Leveraging of Audit Management and Risk Monitoring System Application for effective risk assurance. |

| 5 | Comprehensive and robust Reserve Bank Internal Audit. |

| 6 | Comprehensive coverage of various audits in Audit Management and Risk Monitoring System. |

| 7 | Complete review and revamping of internal processes related to construction projects. |

| 8 | Aligning Cyber Security controls with global best practices. |

| 9 | Assessment of Liquidity Risk of the Bank. |

| 10 | Assessment of Emerging Risks in the Bank. |

| 11 | Fostering of Risk culture in the Bank. |

| 12 | Adopting international best practices of Enterprise Risk Management. |

| 13 | Periodic review of aspects of internal governance. |

Vision 5: Best-in-class and Environment-friendly Digital and Physical Infrastructure

II.14 The physical and digital environment is essential for a financial system to function well and for an employee to perform his / her duties efficiently. From a financial sector perspective, it includes a robust infrastructure for markets to operate at ease and in a non-disruptive manner. From the employee perspective, it includes not only the office premises but also the IT setup, the residential arrangements and so on.

II.15 Integrating architectural excellence and aesthetic appeal with green ratings in the premises of the Bank, while ensuring the highest level of cleanliness and physical security and automating processes, achieving the integration of information, and ensuring dissemination through a robust Information Technology (IT) system will enable the Bank to move towards best-in-class and environment friendly digital as well as physical infrastructure.

II.16 The strategies under Vision 5 are given below (Table II.6).

| Table II.6: Vision 5 – Best-in-class and Environment-friendly Digital and Physical Infrastructure | |

| Sl No | Strategies |

| 1 | Building sustainable Information and Communication Technology infrastructure, adapting to emerging technologies through implementation of NextGen applications with focus on resilience, reliability, security; and Upgradation of existing applications / infrastructure to enhance accessibility, usability and inclusion. |

| 2 | Enabling ease of doing business with respect to Human Resources (HR) processes. |

| 3 | Automating processes, achieving integration of information, and ensuring dissemination through a robust Information Technology system, based on the best environment-friendly practices |

| 4 | Integrating architectural excellence and aesthetic appeal with green ratings in the Bank’s premises while ensuring the highest level of cleanliness and physical security. |

Vision 6: Innovative, Dynamic and Skilled Human Resources

II.17 Human resources are the prime drivers of any organisation and they play the most important role in defining its success. The constantly changing environment in which the Bank operates, and the changing needs of the economy require the staff to be competent and equipped with cutting-edge skills. Skilled and dynamic human resources are the foundation and pillars which will enable the Bank to excel in performance of its role effectively.

II.18 The world of human resource management is changing in terms of demographic shifts, work from home culture in a volatile environment requiring constant innovation. The strategy framework strives to create an innovative, dynamic and skilled human resources; use technology and data analytics in promoting research-based decision making; build a proficient and facilitative employee interface for effective communication; positive workplace experience, and enhanced employee engagement; establish a listening oriented organisation culture to promote better employer-employee relationship; and capacity building through a robust online training mechanism focused on continuous learning.

II.19 The strategies under Vision 6 are given below (Table II.7).

| Table II.6: Vision 5 – Best-in-class and Environment-friendly Digital and Physical Infrastructure | |

| Sl No | Strategies |

| 1 | Re-skilling and leveraging on technology for building dynamic human resources. |

| 2 | Using technology and data analytics in promoting research-based decision making by the workforce. |

| 3 | Building a proficient and facilitative employee interface for effective communication, positive workplace experience, and enhanced employee engagement. |

| 4 | Establishing a listening-oriented organisational culture to promote better employer-employee relationship. |

| 5 | In-house counselling facility for employees. |

| 6 | Capacity building through a robust online training mechanism developed with the help of the Bank’s training establishments and focused on continuous learning. |

| 7 | Enhance and update the vocabulary for the users of banking glossary in view of the emerging new age banking ecosystem. |

| 8 | Promote the Use of राजभाषा |

“Tomorrow belongs only to the people who prepare for it today” ~ Malcolm X6.

Conclusion

III.1 As we embark upon the journey of realising Utkarsh 2.0 and thereby the Bank’s medium-term strategies and milestones, continuous evaluation and constant engagement with relevant stakeholders will be required. Utkarsh 2.0 leverages the learnings from the existing medium-term strategy framework but with a simplified structure and well-defined milestones. Utkarsh 2.0 enables the Bank to be in readiness not just to respond to the changing socio-economic environment, but also proactively anticipate and act.

III.2 The vision of excellence in the performance of its functions envisages strengthening the regulatory landscape for the well-being of the financial sector while the visions of strengthened trust of citizens in the Bank along with transparent, accountable and ethics-driven internal governance provide the wherewithal for sustaining excellence within the Bank.

III.3 Regional Offices’ perspectives are an integral part of the six visions. This is reflective of inclusiveness in the strategic approach of the Bank, incorporating a ‘feel’ of the states and a knowledge of regional realities in the collection of market intelligence, ensuring localised supervision, and providing last mile customer service. Regional offices provide meaningful inputs defining micro-aspects in the macro-strategic approach7.

III.4 India’s success story in digital payments is acknowledged globally. Steps towards creating a world class digital infrastructure and enabling global spread of the Bank’s payments stack is part of the vision to establish India as a leader in this domain.

III.5 With India’s G-20 presidency during the period of Utkarsh 2.0, it confers a unique opportunity to showcase our accomplishments in the realm of digital payments and strive towards broad basing of acceptance of the Indian Rupee in bilateral and multilateral trade. The current geopolitical scenario has created an opportunity where concomitant efforts from economic and financial sector towards realising our potential in international fora would augur well and thus it forms part of our strategy framework.

III.6 In this age of data, the Bank plays the dual role of data collection as well as information dissemination. With this comes the responsibility of reliability of data collected to create meaningful and accurate information. Therefore, adoption of Artificial Intelligence (AI) and Machine Learning (ML) driven tools for data analysis and information creation will be an integral part of Utkarsh 2.0.

III.7 The achievement of the milestones under the Utkarsh 2.0 will strengthen the regulatory landscape for the well-being of the financial sector and enhance the trust of citizens in the Bank. The strategy framework will also make the Bank a listening oriented, transparent organisation equipped with best-in-class and environment friendly digital and physical infrastructure. This will also contribute to better employer-employee relationship. Robust internal governance, effective risk assurance, fostering of risk culture will be the cornerstones of the Bank’s tryst with excellence. As such, Utkarsh 2.0 will act as the pole star helping the Bank to constantly evolve in sync with the ever-changing world. In the words of Mahatma Gandhi, “You must be the change you wish to see in the world8.

1Our progress towards the goal will be in exact proportion to the purity of our means.” Selections from Gandhi, (1957), pp. 36-7

2Everybody’s Political What’s What (1944)

3The King of the Dark Chamber - play by Rabindranath Tagore, August 20, 2013. Original in Bengali titled Raja translated to English by Rabindranath Tagore

4Speech at IIM Shillong, July 27, 2015

5“It was originally set up as a shareholder's bank, which was nationalised later in 1949. Since then, its role has evolved over time from supporting the planned development of the economy to a full service central bank.” Shri Shaktikanta Das, Governor, Reserve Bank of India on Evolving Role of Central Banks in June, 2019.

6Speech at Organisation for Afro-American Unity Founding Forum, Audobon Ballroom, June 28, 1964

7“When we listen and celebrate what is both common and different, we become wiser, more inclusive, and better as an organisation” ~ Pat Wadors

8“If we could change ourselves, the tendencies in the world would also change. As a man changes his own nature, so does the attitude of the world change towards him.” The Collected Works of Mahatma Gandhi, Volume 13, Chapter 153, page 241, published in 1913.

പേജ് അവസാനം അപ്ഡേറ്റ് ചെയ്തത്: ഫെബ്രുവരി 19, 2024