IST,

IST,

Furthering Digital Payments

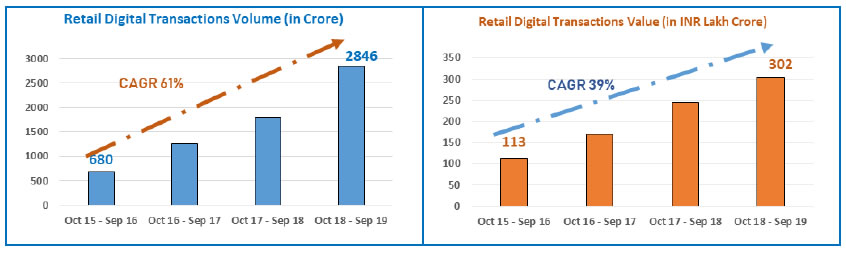

In pursuance of its vision to promote digital payments, Reserve Bank’s endeavour has been to establish state of the art payment systems that are efficient, convenient, safe, secure and affordable. The efforts have resulted in a rapid growth in the retail digital payment systems as below:  2. Digital payments constituted a high 96% of total non-cash retail payments during the period October 2018 to September 2019. During the same period, the National Electronic Funds Transfer (NEFT) and Unified Payments Interface (UPI) systems handled 252 crore and 874 crore transactions with year on year growth of 20% and 263%, respectively. This rapid growth in the payment systems, inter-alia, has been facilitated by a series of measures taken by the Reserve Bank of India. 3. To further empower every citizen with an Exceptional (e) Payment Experience, and provide her access to a bouquet of options, the Reserve Bank proposes to take the following steps:

4. The benchmarking exercise undertaken by the Reserve Bank reveals a high position enjoyed by the country in various parameters in the payment systems. Reserve Bank has facilitated acceptance of RuPay cards in Bhutan and will actively engage with the payment system regulators in other jurisdictions and share its experience to derive synergies and reduce the cost and time taken for inward remittances, especially in key remittance corridors. (Yogesh Dayal) Press Release: 2019-2020/1142 |

पेज अंतिम अपडेट तारीख: