IST,

IST,

India's Balance of Payments (BoP) during First Quarter (April-June 2006) of 2006-07

The preliminary data on India's balance of payments (BoP) for the first Quarter (Q1) of 2006-07 i.e., April-June 2006, are compiled. Full details of BoP data are set out in the attached Statements in the standard format of presentation. It may be mentioned that in recognition of growing importance of services, new reporting arrangements were put in place in 2004-05, wherein a number of new purpose codes were introduced with a view to collecting data separately for a number of services (such as business services, financial services and communication services), which were earlier included under miscellaneous items (shown as Table 3). These data have been included in the standard format of presentation of BoP data for financial year 2004-05, 2005-06 and Q1 of 2006-07. The BoP developments during the Q1 of 2006-07 along with the revised data for the full financial year i.e. April-March 2004-05 are set out in the following paragraphs.

April-June 2006

The major items of the BoP for Q1 of 2006-07 are presented in Table 1 below.

|

Table 1: India's Balance of Payments: April-June 2006 |

||

|

(US $ million) |

||

|

Items |

April-June |

April-June |

|

|

2006P |

2005PR |

|

1 |

2 |

3 |

|

Exports |

28,245 |

24,150 |

|

Imports |

46,729 |

37,754 |

|

Trade Balance |

-18,484 |

-13,604 |

|

Invisibles, net |

12,385 |

10,048 |

|

Current Account Balance |

-6,099 |

-3,556 |

|

Capital Account* |

12,477 |

4,803 |

|

Change in Reserves# (-) indicates increase. |

-6,378 |

-1,247 |

|

*: Including errors and omissions. |

||

Merchandise Trade

- India’s Merchandise exports, on a BoP basis, posted a growth of 17 per cent in Q1 of 2006-07 as compared with 35.4 per cent in the corresponding quarter of the previous year.

- Import payments showed moderation in Q1 (23.8 per cent growth) representing mainly a strong base effect as imports grew by 64.5 per cent in the corresponding quarter of 2005-06.

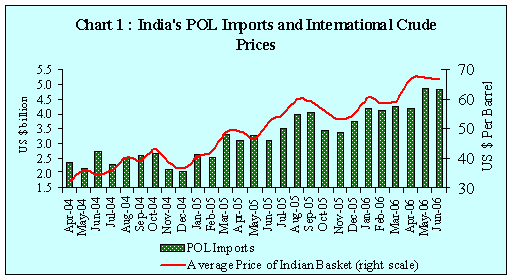

- The average price of the Indian basket of international crude (a mix of Dubai and Brent varieties) rose to US $ 66.8 per barrel in Q1 of 2006-07 from US $ 49.3 per barrel in the corresponding quarter of the previous year (Chart 1).

- The month-wise movement in exports as per Directorate General of Commercial Intelligence and Statistics (DGCI&S) data is presented in Chart 2.

- According to the data released by DGCI&S, while the growth in oil imports accelerated from 31.0 per cent in April-June 2005 to 44.9 per cent in April-June 2006, non-oil imports witnessed a deceleration (9.1 per cent) as against an increase of 52.9 per cent over the corresponding period of the previous year. Non-oil imports, excluding gold and silver during the quarter recorded an increase of 17.3 per cent (53 per cent in the corresponding period of the previous year).

Trade Deficit

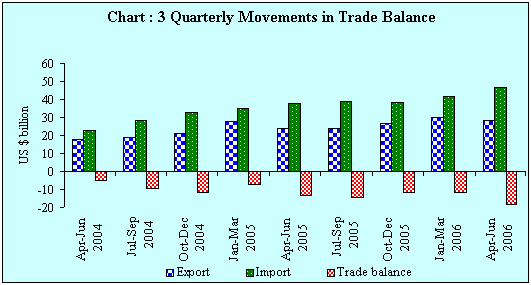

- On BoP basis, the growth in imports outstripping the pace of export growth, the merchandise trade deficit increased to US $ 18.5 billion in Q1 of 2006-07 (US $ 13.6 billion in Q1 of 2005-06) (Chart 3).

Invisibles

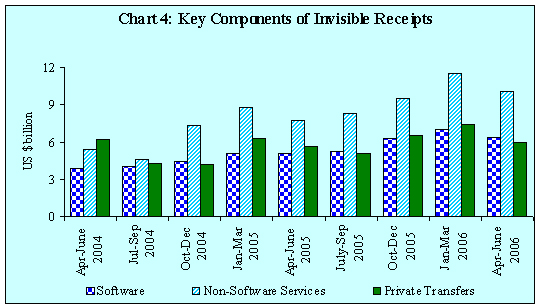

- Maintaining the pace of growth in travel earnings, business and professional services, software services and remittances, invisible receipts rose by 22.6 per cent (Table 2 and Chart 4).

|

Table 2 : Details of Invisible Gross Receipts and Payments |

||||

|

|

|

|

(US $ million) |

|

|

Items |

Invisible Receipts |

Invisible Payments |

||

|

|

April-June 2006 |

April-June 2005 |

April-June 2006 |

April-June 2005 |

|

1 |

2 |

3 |

4 |

5 |

|

I. Services |

16,554 |

12,849 |

8,979 |

7,477 |

|

Travel |

1,708 |

1,466 |

1,629 |

1,288 |

|

Transportation |

1,738 |

1,469 |

1,998 |

1,638 |

|

Insurance |

240 |

199 |

135 |

193 |

|

Govt. not included elsewhere |

57 |

62 |

85 |

79 |

|

Software Services |

6,385 |

5,103 |

438 |

250 |

|

Non Software Misc Services |

6,426 |

4,550 |

4,694 |

4,029 |

|

II. Transfers |

6,032 |

5,697 |

297 |

194 |

|

III. Income (i+ii) |

1,552 |

1,140 |

2,477 |

1,967 |

|

(i) Investment Income |

1,487 |

1,107 |

2,278 |

1,802 |

|

(ii) Compensation of Employees |

65 |

33 |

199 |

165 |

|

Total (I+II+III) |

24,138 |

19,686 |

11,753 |

9,638 |

- Software exports were recorded at US $ 6.4 billion in the Q1 of 2006-07 as compared with US $ 5.1 billion in the corresponding quarter of the previous year. The miscellaneous receipts, net of software, were recorded at US $ 6.4 billion in Q1 of 2006-07 as against US $ 4.6 billion in the Q 1 of 2005-06 (Table 3).

|

Table 3 : Break up of Non-Software Miscellaneous Receipts and Payments |

||||

|

(US $ million) |

||||

|

|

Receipts |

Payments |

||

|

|

April-June 2006 |

April-June 2005 |

April-June 2006 |

April-June 2005 |

|

Communication Services |

517 |

318 |

108 |

85 |

|

Construction |

83 |

477 |

235 |

126 |

|

Financial |

725 |

269 |

317 |

290 |

|

News Agency |

98 |

142 |

42 |

30 |

|

Royalties, Copyrights & License Fees |

28 |

35 |

221 |

162 |

|

Business Services |

4,548 |

1,906 |

2,470 |

1,283 |

|

Others |

427 |

1,403 |

1,301 |

2,053 |

|

Total |

6,426 |

4,550 |

4,694 |

4,029 |

- Receipts on account of Business Services were recorded at US $ 4.5 billion in Q1 of 2006-07 as against US $ 1.9 billion in the corresponding quarter of the previous year.

- Invisible payments grew at 21.9 per cent partly reflecting continuing pace of outbound tourist traffic from India and rising payments towards transportation.

Current Account Deficit

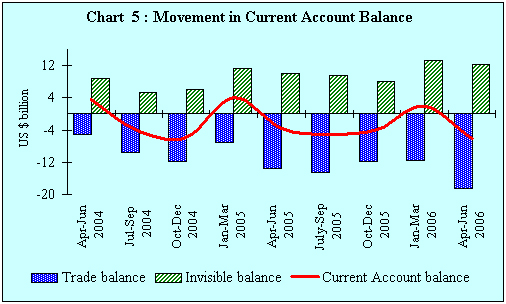

- Notwithstanding a higher net invisibles surplus of US $ 12.4 billion, large merchandise trade deficit led to a higher current account deficit of US $ 6.1 billion than the corresponding quarter of the previous year (US $ 3.6 billion) (Chart 5 ).

Capital Account

- In the capital account, net inflows under external commercial borrowings, foreign direct investment and banking capital recorded steady increase resulting in higher net capital flows. (Table 4).

- The increase in banking capital was on account of higher inflow under NRI deposits and drawdown of foreign assets of commercial banks.

|

Table 4 : Net Capital Flows in April-June 2006 |

||

|

|

|

(US $ million) |

|

Items |

April-June 2006 |

April-June 2005 |

|

1 |

2 |

3 |

|

Foreign Direct Investment |

1,727 |

1,198 |

|

Portfolio Investment |

-527 |

972 |

|

External Assistance |

23 |

212 |

|

External Commercial Borrowings |

3,560 |

1,091 |

|

Banking Capital |

5079 |

782 |

|

Of which : NRI Deposits |

1,231 |

-108 |

|

Short-term Credits |

417 |

-151 |

|

Others* |

1,584 |

324 |

|

Total |

11,863 |

4,428 |

|

* Include rupee debt service and leads and lags in export receipts. |

||

Reserve Accretion

- Accretion to foreign exchange reserves at US $ 6.4 billion was higher than US $ 1.2 billion recorded during the corresponding quarter of the previous year. Taking into account the valuation gain of US $ 4.9 billion, foreign exchange reserves recorded an increase of US $ 11.3 billion during April-June 2006 as against a decline of US $ 3.1 billion during the corresponding period of the previous year.

Revisions in the BoP Data for 2004-05

According to the Revisions Policy for BoP data, the data for 2004-05 have been revised taking into account the latest available data. The revised quarterly and annual data for 2004-05 are set out in the attached statement.

It may be mentioned that the preliminary data for 2005-06 would be revised in December 2006, in accordance with the Revisions Policy for BoP data.

P.V.Sadanandan

Manager

Press Release : 2006-2007/449

पेज अंतिम अपडेट तारीख: