IST,

IST,

Minutes of the Monetary Policy Committee Meeting, August 4 to 6, 2021

[Under Section 45ZL of the Reserve Bank of India Act, 1934] The thirtieth meeting of the Monetary Policy Committee (MPC), constituted under section 45 Z B of the Reserve Bank of India Act, 1934, was held from August 4 to 6, 2021. 2. The meeting was attended by all the members – Dr. Shashanka Bhide, Senior Advisor, National Council of Applied Economic Research, Delhi; Dr. Ashima Goyal, Professor, Indira Gandhi Institute of Development Research, Mumbai; Prof. Jayanth R. Varma, Professor, Indian Institute of Management, Ahmedabad; Dr. Mridul K. Saggar, Executive Director (the officer of the Reserve Bank nominated by the Central Board under Section 45ZB(2)(c) of the Reserve Bank of India Act, 1934); Dr. Michael Debabrata Patra, Deputy Governor in charge of monetary policy – and was chaired by Shri Shaktikanta Das, Governor. Dr. Shashanka Bhide, Dr. Ashima Goyal and Prof. Jayanth R. Varma joined the meeting through video conference. 3. According to Section 45 Z L of the Reserve Bank of India Act, 1934, the Reserve Bank shall publish, on the fourteenth day after every meeting of the Monetary Policy Committee, the minutes of the proceedings of the meeting which shall include the following, namely:

4. The MPC reviewed the surveys conducted by the Reserve Bank to gauge consumer confidence, households’ inflation expectations, corporate sector performance, credit conditions, the outlook for the industrial, services and infrastructure sectors, and the projections of professional forecasters. The MPC also reviewed in detail staff’s macroeconomic projections, and alternative scenarios around various risks to the outlook. Drawing on the above and after extensive discussions on the stance of monetary policy, the MPC adopted the resolution that is set out below. Resolution 5. On the basis of an assessment of the current and evolving macroeconomic situation, the Monetary Policy Committee (MPC) at its meeting today (August 6, 2021) decided to:

Consequently, the reverse repo rate under the LAF remains unchanged at 3.35 per cent and the marginal standing facility (MSF) rate and the Bank Rate at 4.25 per cent.

These decisions are in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth. The main considerations underlying the decision are set out in the statement below. Assessment Global Economy 6. Since the MPC’s meeting during June 2-4, 2021 the pace of global recovery appears to be moderating with the resurgence of infections in several parts of the world, especially from the delta variant of the virus. In June and July, global purchasing managers’ indices (PMIs) slipped from the highs scaled in May. The growing consensus is that the recovery is occurring on a diverging two-track mode. Countries that are ahead in vaccination and have been able to provide or maintain policy stimulus are rebounding strongly. Growth in other economies remains subdued and vulnerable to new waves of infections. There has been a slowing of momentum in global trade volumes in Q2:2021, with elevated shipping charges and logistics costs posing headwinds. 7. There has been a considerable hardening of commodity prices, particularly of crude oil. The latest agreement within the Organisation of Petroleum Countries (OPEC) plus to raise oil production for a likely restoration of output to the pre-pandemic levels by September 2022 imparted transient softening to spot and future crude prices from the recent peak in early July. Headline inflation has ratcheted up in several advanced economies (AEs) as well as most emerging market economies (EMEs), prompting a few central banks in EMEs to tighten monetary policy. In contrast, sovereign bond yields have softened across AEs as markets seem to have acquiesced to the views of central banks that inflation is largely transitory. In EMEs, bond yields remain relatively high on inflation concerns and country-specific factors. In the foreign exchange market, EME currencies have depreciated in the wake of portfolio outflows since mid-June as risk appetite ebbed, while the US dollar has strengthened. Domestic Economy 8. On the domestic front, economic activity picked up pace in June-July as some states eased pandemic containment measures. As regards agriculture, the south-west monsoon regained intensity in mid-July after a lull; the cumulative rainfall up to August 1, 2021 was one per cent below the long-period average. The pace of sowing of kharif crops picked up in July along with some high frequency indicators of rural demand, notably tractor and fertiliser sales. 9. Reflecting large base effects, industrial production expanded in double digits year-on-year (y-o-y) in May 2021 on top of the massive jump in April, but it was still 13.9 per cent below its May 2019 level. The manufacturing purchasing managers’ index (PMI) that had dropped into contraction to 48.1 in June for the first time in 11 months, rebounded well into expansion zone with a reading of 55.3 in July. High-frequency indicators – e-way bills; toll collections; electricity generation; air traffic; railway freight traffic; port cargo; steel consumption, cement production; import of capital goods; passenger vehicle sales; two wheeler sales –posted strong growth in June/July, reflecting adaptations to COVID related protocols and easing of containment. Services PMI remained in contractionary zone due to COVID-19 related restrictions, though the pace eased to 45.4 in July from 41.2 in June 2021. Initial quarterly results of non-financial corporates for Q1:2021-22 show healthy growth in sales, wage growth and profitability led by information technology firms. 10. Headline CPI inflation plateaued at 6.3 per cent in June after having risen by 207 basis points in May 2021. Food inflation increased in June primarily due to an uptick in inflation in edible oils, pulses, eggs, milk and prepared meals and a pick-up in vegetable prices. Fuel inflation moved into double digits during May-June 2021 as inflation in LPG, kerosene, and firewood and chips surged. After rising sharply to 6.6 per cent in May, core inflation moderated to 6.1 per cent in June, driven by softening of inflation in housing, health, transport and communication, recreation and amusement, footwear, pan, tobacco and other intoxicants (as the effects of the one-off post-lockdown taxes imposed a year ago waned), and personal care and effects (due to sharp reduction in inflation in gold). 11. System liquidity remained ample, with average daily absorption under the LAF increasing from ₹5.7 lakh crore in June to ₹6.8 lakh crore in July and further to ₹8.5 lakh crore in August so far (up to August 4, 2021). Auctions for a cumulative amount of ₹40,000 crore in Q2:2021-22 so far under the secondary market government securities acquisition programme (G-SAP) evened liquidity across illiquid segments of the yield curve. Reserve money (adjusted for the first-round impact of the changes in the cash reserve ratio) expanded by 11.0 per cent y-o-y on July 30, 2021 driven by currency demand. As on July 16, 2021, money supply (M3) and bank credit by commercial banks grew by 10.8 per cent and 6.5 per cent, respectively. India’s foreign exchange reserves increased by US$ 43.1 billion in 2021-22 (up to end-July) to US$ 620.1 billion. Outlook 12. Going forward, the revival of south-west monsoon and the pick-up in kharif sowing, buffered by adequate food stocks should help to control cereal price pressures. High frequency indicators suggest some softening of price pressures in edible oils and pulses in July in response to supply side interventions by the Government. Input prices are rising across manufacturing and services sectors, but weak demand and efforts towards cost cutting are tempering the pass-through to output prices. With crude oil prices at elevated levels, a calibrated reduction of the indirect tax component of pump prices by the Centre and states can help to substantially lessen cost pressures. Taking into consideration all these factors, CPI inflation is now projected at 5.7 per cent during 2021-22: 5.9 per cent in Q2; 5.3 per cent in Q3; and 5.8 per cent in Q4 of 2021-22, with risks broadly balanced. CPI inflation for Q1:2022-23 is projected at 5.1 per cent (Chart 1). 13. Domestic economic activity is starting to recover with the ebbing of the second wave. Looking ahead, agricultural production and rural demand are expected to remain resilient. Urban demand is likely to mend with a lag as manufacturing and non-contact intensive services resume on a stronger pace, and the release of pent-up demand acquires a durable character with an accelerated pace of vaccination. Buoyant exports, the expected pick-up in government expenditure, including capital expenditure, and the recent economic package announced by the Government will provide further impetus to aggregate demand. Although investment demand is still anaemic, improving capacity utilisation and congenial monetary and financial conditions are preparing the ground for a long-awaited revival. Firms polled in the Reserve Bank surveys expect expansion in production volumes and new orders in Q2:2021-22, which is likely to sustain through Q4. Elevated levels of global commodity prices and financial market volatility are, however, the main downside risks. Taking all these factors into consideration, projection for real GDP growth is retained at 9.5 per cent in 2021-22 consisting of 21.4 per cent in Q1; 7.3 per cent in Q2; 6.3 per cent in Q3; and 6.1 per cent in Q4 of 2021-22. Real GDP growth for Q1:2022-23 is projected at 17.2 per cent (Chart 2).  14. Inflationary pressures are being closely and continuously monitored. The MPC is conscious of its objective of anchoring inflation expectations. The outlook for aggregate demand is improving, but still weak and overcast by the pandemic. There is a large amount of slack in the economy, with output below its pre-pandemic level. The current assessment is that the inflationary pressures during Q1:2021-22 are largely driven by adverse supply shocks which are expected to be transitory. While the Government has taken certain steps to ease supply constraints, concerted efforts in this direction are necessary to restore supply-demand balance. The nascent and hesitant recovery needs to be nurtured through fiscal, monetary and sectoral policy levers. Accordingly, the MPC decided to keep the policy repo rate unchanged at 4 per cent and continue with an accommodative stance as long as necessary to revive and sustain growth on a durable basis and continue to mitigate the impact of COVID-19 on the economy, while ensuring that inflation remains within the target going forward. 15. All members of the MPC – Dr. Shashanka Bhide, Dr. Ashima Goyal, Prof. Jayanth R. Varma, Dr. Mridul K. Saggar, Dr. Michael Debabrata Patra and Shri Shaktikanta Das – unanimously voted to keep the policy repo rate unchanged at 4.0 per cent. 16. All members, namely, Dr. Shashanka Bhide, Dr. Ashima Goyal, Dr. Mridul K. Saggar, Dr. Michael Debabrata Patra and Shri Shaktikanta Das, except Prof. Jayanth R. Varma, voted to continue with the accommodative stance as long as necessary to revive and sustain growth on a durable basis and continue to mitigate the impact of COVID-19 on the economy, while ensuring that inflation remains within the target going forward. Prof. Jayanth R. Varma expressed reservations on this part of the resolution. 17. The minutes of the MPC’s meeting will be published on August 20, 2021. 18. The next meeting of the MPC is scheduled during October 6 to 8, 2021.

Statement by Dr. Shashanka Bhide 19. The revival of economic activity seen in Q4: FY2020-21 was disrupted in the first two months of Q1: FY2021-22 by the surge of second wave of the Covid-19 pandemic. Sharp rise in infections and fatalities due to the pandemic during April-May 2021 compared to the same period in the previous year also led to imposition of restrictions on economic activities across states. As the second wave began to subside, some of the high frequency indicators of the economic activity have also shown revival in June and July 2021. 20. While pick-up in the pace of vaccinations against the disease enables return to more stable working conditions, uncertainties are highlighted by the continued potential for the emergence of new infections as the economic activity picks up unless the people’s Covid appropriate behaviour becomes a norm. Likelihood of emergence of new variants of the virus and its impact is also posing a challenge to achieve sustained recovery of the economy. 21. The global experience so far has highlighted the need for faster vaccination coverage and adoption of preventive measures by the population to achieve greater control over the spread of the disease. In the economies of the US and UK where the activity bounced back in 2021, sustaining the pace of this recovery has come under pressure with the rise in the Covid infections. 22. Impact of the pandemic on the nature and extent of economic recovery has been illustrated by the experience of the past two waves. The resilience of formal sector on the supply side and higher income segment on the demand side appear to be greater than the informal or lower income segment. Recovery of the contact intensive sectors of the economy – such as travel by public transport, hospitality and tourism - is slow and weak. Both – staying afloat and recovery – have required accommodative monetary, fiscal and financial sector policy support. These interventions are critical in restoring business and consumer confidence. 23. The negative impact of the pandemic in Q1: FY 2021-22 has been significant. The outlook surveys by the RBI covering manufacturing, services and infrastructure enterprises conducted during April-June 2021 find the perceptions of overall business conditions to be unfavourable in all three sectors. The survey of industry finds that a larger proportion of manufacturing enterprises experienced decline in capacity utilisation in Q1: FY 2021-22 than those who experienced rise in capacity utilisation. However, the survey finds that enterprises expect the situation to improve in Q2: 2021-22 with respect to capacity utilisation. The production levels, employment and financing conditions are also expected to improve in Q2: FY 2021-22 compared to the assessment for Q1, consistent with the expectation of improvement in capacity utilisation in Q2: FY 2021-22. Expectation of improvement in profit margins is more widely shared among the respondents in Q2: FY 2021-22 in all the sectors compared to the assessment for Q1. Overall, firms in the manufacturing, services and infrastructure sectors expect improvement in demand conditions in Q2: FY2021-22. Moreover, the investment intentions remain muted for the current financial year with fewer firms planning fresh investments as compared to the previous year. 24. The consumer confidence survey by RBI polled during June 28-July 9 in the major urban centres of the country shows lesser pessimism in the perception of general economic conditions compared to the findings of the survey of May. On the other hand, the expectations for one-year ahead are also characterised by larger proportion of the respondents who do not expect the general conditions to improve compared to those who expect otherwise. Household income situation is seen to have deteriorated in July compared to the assessment in May 2021. However, one-year-ahead income situation is expected to improve but the optimism is yet to reach the level seen in January 2021. Expectations on overall spending recover slightly, with improvement in spending on ‘essential items’. Improvement in household income following the recovery of employment conditions is necessary to spur consumer sentiments. 25. In the case of industry, based on IIP data, while manufacturing output has shown high growth year-on-year basis in April-May 2021, on a low base in which the national level movement restrictions were effected, on month over month basis, there was a decline in growth rate. In the case of mining and electricity pattern is the same. 26. The high frequency indicators such as domestic air passenger traffic, passenger vehicle sales, motor cycle sales, tractor sales and consumption of finished steel and production of cement point to improvement in economic activity in June over the levels in May. In the case of GST collections and e-way bills, the year-on-year growth rate during May-June 2021 remains strong but over a weak base. The unemployment rate and labour participation rate, broader indicators of the economic activity tracked in the CMIE’s household surveys, show improvement in the level of economic activity in June and July, with data available up to the week of 21 July 2021. Merchandise exports show sequential growth during the period April-June 2021. However, the year-on-year growth of non-food credit, another indicator of the economic activity at a broader level, was 6.2 per cent in early July not significantly higher than the growth seen a year ago. 27. The South-West monsoon, a key determinant of the performance of agriculture, has not been close to the long-period average in the current year up to July across all the different regions. The area sown in the Kharif season up to July 30th was 4.7 per cent lower than in the previous year, with cotton, oilseeds and coarse cereals areas declining at a higher rate than the overall crop area. The reservoir levels are, however, reported to be higher than in the previous year, leaving potentially improved availability of water for irrigation that supports improved crop yields. 28. The overall picture that emerges points to signs of nascent stage of recovery from the initial shock of the second wave of the pandemic during April-May 2021. 29. Recent assessment of the year-on-year growth of GDP at constant prices in FY2021-22 by a number of professional forecasting organisations, which were made in the month of July, has ranged from 8.8 to 10 per cent. Further, the median real GDP growth forecast of Survey of Professional Forecasters (SPF) conducted by RBI in July 2021 is 9.2 per cent. The SPF assessment of GDP growth is a downward revision from 9.8 per cent obtained by the survey carried out in May 2021, which itself was a downward revision from 11.0 per cent from the earlier round of March 2021. The successive reductions in the recent two rounds reflect the impact of the second wave of Covid-19. An important upward revision in the July 2021 SPF is in the external sector: merchandise exports and merchandise imports are projected to increase at a higher rate than in the May 2021 round of the survey. 30. Taking into the various factors, the projected GDP year-on-year growth rate of 9.5 per cent for FY 2021-22 is within the range of forecasts available in July including the SPF July 2021. The present projections are unchanged from the overall GDP growth projection in the June meeting of MPC, although quarterly projections of 21.4% (Q1), 7.3% (Q2), 6.3% (Q3) and 6.1% (Q4) reflect an upward revision in Q1 and downward revisions in the remaining three quarters. 31. Even as there are signs of economic recovery from the disruption to the growth momentum achieved in Q4: FY2020-21, the conditions impacting inflation are a concern. The global commodity prices impact the overall domestic price situation. One of the key drivers of present inflation is the fuel prices. The year-on-year inflation in CPI for fuel is up from 4.4 per cent in March 2021 to 12.7 per cent in June 2021. The sharp rise in the prices of fuels used for transportation, feed into the core inflation through transportation services prices. Similar is the impact of other prices affected by international commodity price rise such as the metals. While these may be one-time effects, prices would remain elevated unless the external shock is reversed. Although the sequential month-on-month momentum has moderated in June in the case of food and fuel and declined in the core components, the inflation rate remains elevated. In the case of CPI food, the year-on-year rate has remained above 5 per cent in May and June. Vegetables and edible oils are contributing to the sequential momentum and going forward, prospects of Kharif output would affect the price pattern. Finally, price adjustments to account for pandemic induced altered supply-side conditions may also emerge as the demand conditions improve. These may be one-time effects on prices. The households’ expectations captured in the RBI’s Inflation Expectations Survey of urban households conducted during June 28-July 9, 2021 reflect an increase of 0.5 percentage points in inflation expectations 3-months ahead. The pace of increase is lower than that observed in the previous survey of May 2021. 32. The projected year-on-year CPI inflation rate for the Q2-Q4 quarters of FY 2021-22 at 5.9, 5.3 and 5.1 per cent is higher than the projections in June, mainly on account of the higher fuel and items other than food and fuel. The FY 2021-22 CPI inflation is projected at 5.7 per cent. 33. With faster expansion of vaccination program, better health care infrastructure and measures by the public to prevent the spread of Covid infections, the rise in consumer sentiments can be expected to be sustained and supportive of the expansion of supplies. All policy measures are needed to achieve normalisation of economic activities and moderation of inflationary pressures. 34. I vote in favour of keeping the policy repo rate unchanged at 4.0 per cent. I also vote in favour of continuing with the accommodative stance as long as necessary to revive and sustain growth on a durable basis and continue to mitigate the impact of COVID-19 on the economy, while ensuring that inflation remains within the target going forward. Statement by Dr. Ashima Goyal 35. A global conviction seems to have firmed up that the inflation spike is due to Covid-19 related supply bottlenecks and therefore is temporary. US ten year G-secs rates have softened. Research finds inflation to be more in Covid-19 affected products. 36. Oil, global commodity and semi-conductor prices are actually showing signs of reversal. Domestic inflation has also marginally fallen in June compared to May, and its momentum softened considerably, as second wave lockdowns were eased. There may be more reversals in future. Signs of second-round inflation pass through are still limited. The August RBI inflation forecasts may be an overestimate. 37. The MPC has a difficult job as it battles both the slowdown and the inflation Covid-19 has triggered. Even so, marginal moderation in inflation has twice this year provided just in time relief—pointing again towards supply-side causation and volatility. 38. Advanced economy central banks emphasize the dangers of premature tightening: ECB plans to maintain its stimulus in the form of ultra-low interest rates until inflation durably reaches its 2% target. The US fed is targeting average inflation and wants it to rise above target to compensate for being below for long; in India the aim should be to provide support until the investment cycle starts durably. As long as inflation is in the tolerance band, it can gradually be brought down to target. 39. According to Taylor rules estimated for India a persistent rise in expected inflation above the tolerance band or rise after closing of output gap, require policy rates to rise. But optimal policy can differ. No mechanical formula is adequate, especially in these unusual times. Output gap is especially difficult to measure under the Covid-19 shock—there is a requirement to recreate jobs, alleviate sectoral distress as well as pull out of a decade long investment slowdown. There is uncertainty regarding a possible third wave and global slowdown as delta and other variants spread, or of the reverse—an aggressive revenge spending and export boom. 40. Moreover, currently we have a fiscal contraction, contrary to most countries. But here monetary policy is not at the zero bound and has space to keep real interest rates low. The equilibrium real rate does become negative under temporary output shocks. But real rates should not fall below the equilibrium rate. Wholesale price inflation is higher than consumer inflation giving lower real rates to firms, but it helps them less if the inflation is due to cost shocks. 41. If, however, indirect taxes impart persistence to inflation, this could de-anchor inflation expectations and pose challenges for monetary policy. Research shows that while temporary commodity spikes are looked through, a persistent rise tends to affect inflation expectations. The volatility of Indian fuel prices is much lower than international and average rise is more, since taxes are not decreased as much when international oil prices rise, as they are increased when oil prices fall. A persistent rise in Indian fuel prices is at odds with inflation targeting. 42. Although household inflation expectations are naive and much in excess of realized inflation, the direction of change is instructive. While household 3-month and 1-year inflation expectations continue to increase, current perceptions are stabilizing. The latter fell in September 2020 as the first wave clearly moderated. Expectations also fell later in November. This cycle may repeat, since the uncertainty associated with expectations rose sharply in May 2020 with the onset of Covid-19 and has remained high since. 43. These aspects and the June softening in inflation momentum indicate it is better to wait and watch inflation, inflation expectations and growth outcomes. Inflation has been above target for many months but the rise is due to multiple supply shocks associated with the prolongation of Covid-19. Sustained rise above the tolerance band has not yet exceeded the three quarters time given to the MPC. The reputation and responsiveness of an inflation targeting regime, as well as supply-side support from the government, may be adequate to prevent de-anchoring of inflation expectations despite these multiple shocks. 44. Therefore, I vote for status quo on the repo rate and policy stance. 45. Whenever normalization starts, it should be very gradual and aligned to growth recovery and inflation paths. Since stance affects only repo rate actions, other normalization can start even in an accommodative stance. This is only my view—the MPC does not vote on liquidity actions. In 2009 it was decided to first reduce excess liquidity and this is what markets expect. But in its normalization, the US Fed stopped balance sheet expansion, announced on October 29, 2014, but did not reverse its size—this worked well in keeping markets calm after the taper-on shock and in helping recovery. Since excess liquidity is absorbed at the reverse repo, M3 growth cannot be excessive unless demand revives. A rise in the price of money can restrain its growth. The definition of the stance is consistent with some durable liquidity surplus continuing in a tight/neutral stance. 46. India had excessively tight financial conditions in much of the past decade. Some slack is required to lubricate the economy so payments percolate to low income segments. Banks are now unable to adequately supply the needs of an increasingly diverse financial sector, so schemes targeting liquidity to different sectors need to continue. Moreover, India is subject to large negative liquidity shocks from rise in currency holding, government cash balances and foreign capital outflows1. Surplus durable liquidity can help to absorb and counter these, especially as the US Fed exits accommodation. 47. Some G-SAP support may also have to continue until fiscal consolidation is adequate. But this consolidation is happening faster than expected as tax revenues are buoyant. Despite a rise in short-rates, long-term spreads may still fall with less than anticipated government borrowing and as there is more conviction on the inflation target. Government cash balances are already large. If, however, expected inflation raises G-secs rates by 1%, and the public debt GDP ratio is about 100%, government interest payments will rise by 1% of GDP. Compared to that, a cut in fuel taxes would sacrifice about 0.5% of GDP in revenues and have many other benefits such as anchoring inflation expectations, reviving demand as well as enabling a fair sharing of the burden of oil price shocks. Statement by Prof. Jayanth R. Varma 48. In the last several meetings, my statements have expressed the belief that the balance of risk and reward is in favour of monetary accommodation. As the pandemic continues to mutate, it appears to me that the balance of risk and reward is gradually shifting, and this merits a hard look at the accommodative stance. 49. First, Covid-19 is beginning to look more and more like tuberculosis which kills a very large number of people every year without inflicting major damage to the economy; in other words, it is beginning to resemble a neutron bomb. The ability of monetary policy to mitigate a human tragedy of this nature is very limited as compared to its ability to contain an economic crisis. Related to this is the lengthening of the time horizon of the pandemic. Global experience (particularly countries like Israel which are witnessing rising case counts despite very high levels of vaccination) suggests that vaccination is insufficient to stamp out the pandemic though it might reduce its severity. The possibility that Covid-19 will haunt us (though with lower mortality) for the next 3-5 years can no longer be ruled out. Keeping monetary policy highly accommodative for such a long horizon is very different from doing so for what was earlier expected to be a relatively short crisis. 50. Second, monetary policy has very broad effects on the entire economy, and this was appropriate in the early phase of the pandemic which caused generalized economic distress. More recently, however, the ill effects of the pandemic have been concentrated in narrow pockets of the economy. At the industry level, contact intensive services have suffered heavily, while many other industries are now operating above pre-Covid levels. At the firm level, MSMEs have suffered severely, while large businesses have prospered. At the household level, the pandemic has been devastating for weaker sections of the society, while the affluent have weathered it reasonably well. Geographically also, the pandemic has done its worst damage in around 100-200 districts spread across a relatively small number of states. Monetary policy is much less effective than fiscal policy for providing targeted relief to the worst affected segments of the economy. Indeed, monetary accommodation appears to be stimulating asset price inflation to a greater extent than it is mitigating the distress in the economy. 51. Third, inflationary pressures are beginning to show signs of greater persistence than anticipated earlier. There are indications that inflationary expectations may be becoming more widely entrenched. Most worrying of all, there is now a reduced degree of confidence that demand side inflationary pressures would remain quiescent. After averaging above 6% in 2020-21, inflation is forecast to be well above 5% in 2021-22, and is not expected to drop below 5% even in the first quarter of 2022-23 according to RBI projections. While there is some comfort that inflation is forecast to be below the upper end of the tolerance band, it is important to emphasize that the inflation target for the MPC is 4% and not 6% or even 5%. The tolerance band is designed to allow for forecast errors, implementation shortfalls and measurement issues. Treating 5% as the target would significantly increase the risk of inflation targeting failures. (While I have seen some commentary suggesting that there may be a case for raising the inflation target during the pandemic, that decision clearly lies with the government and not with the MPC.) 52. In this context, I believe that the current level of the reverse repo rate is no longer appropriate. I am conscious of the fact that the MPC’s mandate is supposed to be restricted to the policy rate or the repo rate. Unfortunately, the monetary policy statement of this meeting (as in the past several meetings) contains the line: “Consequently, the reverse repo rate under the LAF remains unchanged at 3.35 per cent”. I have for some time now being arguing that if the reverse repo rate does not fall within the remit of the MPC, then the announcement of this rate should be in the Governor’s statement and not in the MPC’s statement, but this view has not found favour with the rest of the MPC. Hence, I have no choice but to express my disagreement with the level of the reverse repo rate. A gradual normalization of the width of the corridor is warranted. In my view, a phased normalization of the corridor would increase the ability of the MPC to keep the repo rate at 4% for a longer period, and this should in my view be a greater priority for the MPC than maintaining an ultra-low reverse repo rate for some more time. 53. At a time when the economic recovery is still nascent, it is extremely important that monetary policy serves as an anchor of macroeconomic stability. That would reduce the inflation risk premium as well as the term premium and help stabilize long term interest rates. As I have argued in my past statements, a low long term interest rate is more important for inducing an investment led growth than a low short term rate. In this light, I fear that the forward guidance and monetary stance are becoming counter productive. By creating the erroneous perception that the MPC is no longer concerned about inflation and is focused exclusively on growth, the MPC may be inadvertently aggravating the risk that inflationary expectations will be disanchored. In that scenario, rising risk premia could cause long term rates to rise. Easy money today could lead to high interest rates tomorrow. On the other hand, by demonstrating its commitment to the inflation target with tangible action, the MPC will be able to anchor expectations, reduce risk premia, and sustain lower long term interest rates for longer thereby aiding the economic recovery. For these reasons, I am not in favour of the decision to keep the reverse repo rate at 3.35%, and vote against the accommodative stance. 54. On the other hand, I vote for maintaining the repo rate at 4% for the following reasons. Economic growth was unsatisfactory long before the pandemic, and even if the economic ill effects of the pandemic abate to some extent, substantial monetary accommodation is warranted. Persistent high inflation means that the monetary accommodation has to be somewhat restrained, and, therefore, I argued above for raising money market rates towards the repo rate of 4% from the current ultra-low level of 3.35%. The repo rate of 4% corresponds to a negative real rate in the range of 1-1.5% based on forward looking inflation forecasts. In my view, this level of rates is currently appropriate for reviving economic growth without excessive risk of an inflationary spiral. Needless to say, the MPC needs to remain data driven so that it can respond rapidly and adequately to any unforeseen shocks that may arise in future. Statement by Dr. Mridul K. Saggar 55. The policy trade-offs that I highlighted at the June MPC meetings are no less relevant today. However, the policy balance needs to be reviewed after appraising the recent information on inflation and growth. 56. The trepidation reflected in my June MPC statement, when I stated that the risks of breaching the upper tolerance level are not insignificant, materialised in its dreaded form when May inflation data was released in June. There were three important facets of that data. First, the headline inflation crossed the upper tolerance level, raising the prospects that inflation could stay above the tolerance band for most part of the year. Second, the momentum in May was high with 1.65 per cent month-over-month (m-o-m) increase being about 2½ times of what can be considered normal for the month. Third, price increases were generalised across commodities that month. Of the 299 commodities for which item-level price data is made available by NSO on a monthly basis, as many as 240 commodities witnessed price increase during the month, which was the highest ever for the flexible inflation targeting period. 57. The latest available CPI numbers for June released in July, however, turned out to be antithetical, telling a very different story. First, the headline inflation surprised on the downside and stayed at 6.3 per cent with price levels dropping for several groups. It showed that May price spike may have been caused by fresh supply-side disruptions in the second wave and the month’s inflation number may have been biased upwards contaminated by data collection difficulties. Second, the momentum in June with a m-o-m increase of just 0.56 per cent was distinctly below the average momentum seen for the month. Third, the general increase in prices seen in May did not sustain in June and fewer items witnessed price increases during the month than is witnessed on an average. Moreover, the momentum in WPI that was exceptionally high during February-April 2021 has also receded during May-June 2021 reducing the risks of high passthrough ahead by producers to consumers at a retail level. 58. Interpreting inflation trends have turned difficult with these mixed trends and some fuzziness in data. However, going forward, three considerations are important. First, in terms of baseline forecast, post the correction in price levels witnessed in June, inflation is projected to stay above the target, but within the tolerance bands. Second, with inflation averaging 6.23 per cent since December 2019 and breaching the upper tolerance level in 13 of those 19 months, inflation persistence remains a concern even though the supply-side shock in May could have large transitory component. Even though the nature of inflation is cost-push, persistence of inflation is worrisome, especially as inflation expectations are getting impacted partly by the adaptive expectations but also in part due to inertial element in this inflation that needs to be closely watched. The third aspect, that can have an overriding consideration in policy decision at hand, is that this inflation is not from the demand side. Aggregate demand remains sub-normal and fragile. The extended price pressures are emanating from second round effects of a very large cost-push shock which to a sizable part has been passthrough from global commodity prices across energy, metal and mineral space, though mineral prices have seen a sharp correction over last two weeks. The effects have been magnified as on May 6, 2020, excise duty on petrol and diesel was hiked by 44 per cent and 69 per cent, respectively and has not been reversed in face of fiscal constraints. Model based estimates suggest the excise duty hike itself may have pushed headline inflation higher by 60-80 bps, adding to cost push inflation. 59. Growth recovery remains fragile accentuated by the dent caused by the second wave and continued uncertainties about pandemic driven by distance to herd immunity and virus mutations. Risks that recovery can falter ahead remain on number of counts. First, at the start of our meetings, cumulative rainfall deficiency in monsoon, has been just 1 per cent. However, the spatial and temporal distribution of monsoon this season has been sub-par. While sowing deficiency that was large in early July has been largely bridged, some adverse impact on yields and outturn can emerge. These risks can magnify if climate changes cause a repeat of weather disruptions as has often happened of late with unseasonal rains affecting some horticulture crops. Second, the IIP in Q1 of 2021-22 is likely to remain below the pre-pandemic average for fiscal year 2019-20 as is already known to be the case for the output level of eight core industries with its June levels still 3.8 per cent below the pre-pandemic fiscal year average for 2019-20. Third, the high frequency indictors also have similar story. Over two-thirds of high frequency indicators remain below pre-pandemic levels. Fourth, services sector is particularly vulnerable. Services PMI at 45.4 in July remains in contraction zone implying two months after the second wave, services activity is still perceived to be falling m-o-m. Fifth, informal sector particularly requires policy support, with emerging evidence of added scaring from the second wave. Sixth, capacity utilization rates are still abysmally low with OBICUS seasonally adjusted capacity utilisation rate of 67.6 per cent in Q4 not only being markedly lower than the long-term average (from start of the survey in Q1:2008-09 till the pre-pandemic period ending Q4:2019-20) of 74.6 but is also below the all-time pre-pandemic low. In Q1:2021-22, the second wave of Covid-19 infections would have again brought the capacity utilisation rates further down from this low as is also the indication from the Industrial Outlook Survey. 60. It is not unusual for central banks to set policies based more on current conditions than forecasts in times of crisis or extreme uncertainties. Currently, risk of policy errors on either side remains given the large uncertainty on growth and inflation as well as policy trade-offs attached to it. Relying exclusively on forward-looking policies increases these risks, especially with extant wide probability distribution attached to inflation forecasts and lack of good information on distributional aspects of growth that affects the bottom of the pyramid disproportionately, the importance of which I explained in my last MPC statement. Inflation is currently elevated above target and as a baseline is expected to recede. However, the probability distribution of the projections over a one-year horizon, as provided in the resolution fan charts, even at 50 per cent confidence level leaves the possibility of inflation breaching the upper tolerance level or falling below the lower tolerance level. In these circumstances, policy can respond with agility should need arise. If newer supply-side disturbances or elongation of imported commodity price inflation occurs it can impel a reassessment. However, currently these risks seem to have diminished, though not waned, with Kharif sowing deficiency getting bridged and global commodity price cycle showing signs of thawing on back of anticipated cyclical slowdown of the Chinese economy and possibility that the US economy, dented by the third wave, may not overheat. On the other side, the possibility of prolonged disinflationary impulse on back of sustained demand weakness cannot be ruled out altogether. 61. The MPC’s current mandate is to set the policy repo rate and the stance of the monetary policy. Getting the timing and sequence of policy change wrong and inviting policy reversals later can result in costly increase in output and inflation volatility. Therefore, at this stage status quo would be better option awaiting further clarity from near-term incoming data. Changing repo rate at this stage will not be effective and apt from sequencing viewpoint. So, I vote for keeping repo rate unchanged and continuing the accommodative stance. 62. Policy focus to revive growth on a durable basis needs to continue and should entail consideration to avoid inflation risks that may emanate when credit demand improves, likely ahead of output gap closing. This arduous task needs to be carried without endangering sustainable recovery in growth. Narrative economics plays an important role in difficult times as even animal spirits are characterised by fat tails and can produce endogenous business cycle movements. However, averting markets becoming opiated to slush liquidity designed as temporary crisis measure is critical to facilitate unwinding when the time comes. Gradual adjustments that are non-disruptive are possible within the accommodative stance. Therefore, I vote with the resolution. Statement by Dr. Michael Debabrata Patra 63. With infections plateauing and vaccination underway on a national scale, people are stepping out of isolation and workplaces are filling up. Power consumption is recovering, freight traffic has shown pandemic-proofing, air travel is rebounding, and all payment modes have registered an uptick in volumes. In my opinion, these indicators are foretelling a revival of business and consumer confidence. This window must be utilised to reinvigorate the interrupted recovery even while preparing for a possible third wave. Absorptive capacity of the economy is rising again, and this is reflected in higher imports and utilisation of capital flows from abroad to supplement domestic saving and push up the investment rate - gross capital formation has risen to 31.3 per cent in January-March 2021, with two-thirds of net foreign capital inflows received by India during that quarter being absorbed domestically. Yet, even as near-term prospects have brightened, aggregate demand conditions are taking more time to heal. 64. Amidst the extreme uncertainty encircling the path of the pandemic, monetary policy authorities have sought to impart some certainty by a commitment to a stance of accommodation extending into the future. With the upsurge of inflation worldwide, this effort to anchor expectations is under scrutiny. In some countries, markets have acquiesced with the authorities’ view that inflation pressures are transitory and do not warrant a change in the policy stance. In others, central banks have pre-emptively tightened the policy stance despite assessing inflation as transitory. This is a razor’s edge dilemma and responding to it, in my view, involves a judgment call that puts both foresightedness and inflation fighting credibility on the line. 65. My vote in this meeting is to maintain the policy rate at 4 per cent and continue with the accommodative stance as adopted so far. In my view, monetary policy has an inherently domestic orientation and the stance of policy is predominantly shaped by country-specific exigencies. In India, my assessment is that headline inflation may persist at current elevated levels at least through the second quarter of 2021-22 before easing in the third quarter when the kharif harvest arrives in markets. There are demand-supply mismatches as in the case of protein-rich food items, edible oils and pulses, which are being addressed by specific supply measures, and there are indications that these price pressures are softening. On the other hand, underlying or core inflation may remain stubborn for longer due to disruptions caused by the pandemic, overlaid with increases in margins and taxes. The high flux in elevated international crude prices remains a risk to inflation and to the terms of trade. It is important to cushion the economy from this volatility through policy interventions. 66. The economy is struggling to regain the momentum that had gathered in the second half of 2020-21. As mentioned earlier, a solidly entrenched increase in aggregate demand is yet to take shape. Although it seems meaningful to compare progress with a pre-pandemic year, it needs to be noted that in 2019-20, a cyclical downturn had matured over 2 and a half years, taking down real GDP growth to its lowest in the 2011-12 based series of national accounts. Thus, there is substantial slack in resource utilisation in the economy which needs to be drawn in to get economic activity back to normalcy. The highest priority now is to revive growth along a sustainable trajectory that becomes compatible with the inflation target as the pandemic recedes. The price that has to be paid for this policy choice is inflation in the upper reaches of but within the tolerance band in this exceptional, pandemic ravaged year of 2021-22, as against the overshoot above the upper tolerance band in 2020-21. So far, inflation outcomes are tracking this projected path. Statement by Shri Shaktikanta Das 67. Since the outbreak of the pandemic, all the meetings of the MPC have been held under challenging circumstances. This one was no less, given the nuancing required at this critical juncture – to continue to foster growth which is nascent even as there is a sharp spike in inflation almost across the globe. 68. The MPC has prioritised revival of growth and mitigation of the impact of the pandemic while ensuring that inflation expectations remain anchored, as its guiding principle. Last year, when inflation rose sharply to 7.3 per cent in September and further to 7.6 per cent in October 2020, our assessment pointed to exogenous and largely temporary supply shocks driving the inflation process. Under these conditions, the MPC decided to moderate irrational expectations building up at that time of a possible reversal of the monetary policy stance through time-specific guidance. The MPC took a call to look through the supply shocks driven inflation and sought a convergence of expectations all around that monetary policy would continue to remain accommodative in support of growth and not respond to the supply side pressures on inflation. In hindsight, our prognosis turned out to be correct as inflation ebbed to around 4.1 per cent by January 2021 and was at an average of 4.9 per cent in Q4:2020-21. The forward guidance given during October-February 2020-21 was helpful in anchoring market expectations; navigating the recovery from the crisis; and strengthening the pace of monetary policy transmission. 69. The resurgence in inflation in May and June above the upper threshold has reignited the debate on the appropriate monetary policy response. The gains in monetary policy credibility since the adoption of inflation targeting have helped the MPC to respond effectively to growth-inflation trade-offs posed by an exceptional shock like the COVID-19 pandemic. The flexible inflation targeting (FIT) framework allows adequate flexibility to the MPC to deal with unanticipated shocks to the economy in the conduct of its monetary policy. The Reserve Bank’s whatever it takes approach, bolstered by careful guidance on all aspects in the conduct of monetary policy, has been an important facilitator for the cusp of recovery that we are witnessing at the present juncture. 70. Our own assessment of the resurgence in inflation in India since the June 2021 policy is that it is driven largely by adverse supply-side drivers impinging on food, fuel and core groups due to multifarious disruptions caused by the pandemic. Many of current price shocks are likely to be one-off or transitory. Weak demand conditions and low pricing power are limiting the extent of their pass-through to output prices. 71. The inflation forecast given by the MPC shows that headline inflation will remain within the tolerance band – albeit closer to the upper tolerance level. The economy is slowly returning back to normalcy from the biggest shock in 100 years. The MPC’s projection of 9.5 per cent GDP growth for the current year would mean that the size of the economy in 2021-22 will be moderately higher than 2019-20. There is still considerable slack in the economy. Domestic demand is picking up, but at a slow pace. Several supply side measures have been taken by the Government to deal with the inflationary pressures; however, more needs to be done. The daily new COVID-19 infections are sticky at around 40,000 cases per day. Possibility of a third wave looms somewhere in the horizon. On the whole, the economy still requires support in terms of maintaining congenial financial conditions and fiscal boosters. At such a critical juncture, can we really pull the rug and the let the economy tumble? The need of the hour is twofold: first, continue the monetary policy support to the economy; and second, remain watchful of any durable inflationary pressures and sustained price momentum in key components so as to bring back the CPI inflation to 4 per cent over a period of time in a non-disruptive manner. 72. Managing the economy and the financial markets since the beginning of the pandemic has thrown up several challenges with crosscurrents and conflicting objectives. Under such circumstances, macroeconomic policies have to be carefully nuanced by making judicious policy choices. Continued policy support with a focus on revival and sustenance of growth is indeed the most desirable and judicious policy option at this moment. I, therefore, vote to keep the policy rate unchanged and continue with the accommodative stance as spelt out by the MPC in its June 2021 meeting. In parallel, close monitoring of the inflation dynamics will have to continue so as to anchor the inflation expectations. (Yogesh Dayal) Press Release: 2021-2022/722 1 See Charmal, V. and Goyal, A. 2021. ‘Liquidity management and monetary transmission: empirical analysis for India’, Journal of Economic Studies, Published online ahead-of–print July 13. https://doi.org/10.1108/JES-07-2020-0359 | ||||||||||||||||

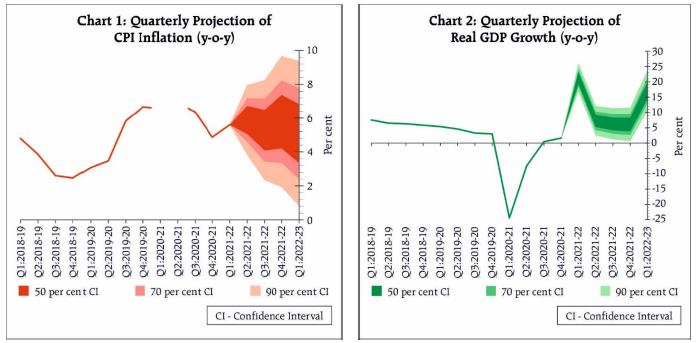

पेज अंतिम अपडेट तारीख: