IST,

IST,

Minutes of the Monetary Policy Committee Meeting, August 6 to 8, 2024

|

[Under Section 45ZL of the Reserve Bank of India Act, 1934] The fiftieth meeting of the Monetary Policy Committee (MPC), constituted under Section 45ZB of the Reserve Bank of India Act, 1934, was held during August 6 to 8, 2024. 2. The meeting was attended by all the members – Dr. Shashanka Bhide, Honorary Senior Advisor, National Council of Applied Economic Research, Delhi; Dr. Ashima Goyal, Emeritus Professor, Indira Gandhi Institute of Development Research, Mumbai; Prof. Jayanth R. Varma, Professor, Indian Institute of Management, Ahmedabad; Dr. Rajiv Ranjan, Executive Director (the officer of the Reserve Bank nominated by the Central Board under Section 45ZB(2)(c) of the Reserve Bank of India Act, 1934); Dr. Michael Debabrata Patra, Deputy Governor in charge of monetary policy – and was chaired by Shri Shaktikanta Das, Governor. 3. According to Section 45ZL of the Reserve Bank of India Act, 1934, the Reserve Bank shall publish, on the fourteenth day after every meeting of the Monetary Policy Committee, the minutes of the proceedings of the meeting which shall include the following, namely:

4. The MPC reviewed the surveys conducted by the Reserve Bank to gauge consumer confidence, households' inflation expectations, corporate sector performance, credit conditions, the outlook for the industrial, services and infrastructure sectors, and the projections of professional forecasters. The MPC also reviewed in detail the staff's macroeconomic projections, and alternative scenarios around various risks to the outlook. Drawing on the above and after extensive discussions on the stance of monetary policy, the MPC adopted the resolution that is set out below. Resolution 5. On the basis of an assessment of the current and evolving macroeconomic situation, the Monetary Policy Committee (MPC) at its meeting today (August 8, 2024) decided to:

Consequently, the standing deposit facility (SDF) rate remains unchanged at 6.25 per cent and the marginal standing facility (MSF) rate and the Bank Rate at 6.75 per cent.

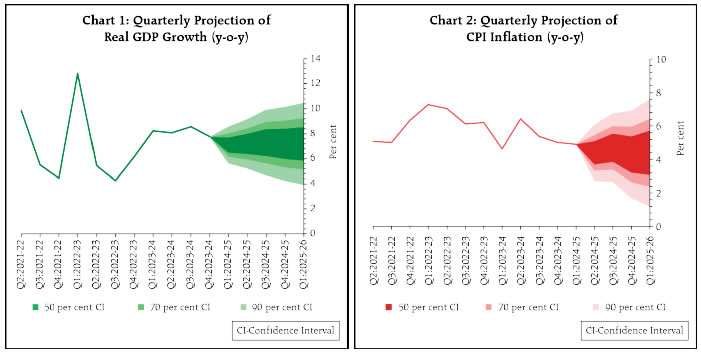

These decisions are in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth. Assessment and Outlook 6. The global economic outlook remains resilient although with some moderation in pace. Inflation is retreating in major economies but services price inflation persists. International prices of food, energy and base metals have eased since the last policy meeting. With varying growth-inflation prospects, central banks are diverging in their policy paths. This is creating volatility in financial markets. Amidst recent global sell offs in equities, the dollar index has weakened, sovereign bond yields have eased sharply and gold prices have soared to record highs. 7. Domestic economic activity continues to sustain its momentum. After a weak and delayed start, the cumulative southwest monsoon rainfall has picked up with improving spatial spread. By August 7, 2024, it was 7 per cent above the long period average. This has supported kharif sowing, with total area sown as on August 2, being 2.9 per cent higher than a year ago. Industrial output registered an expansion of 5.9 per cent (y-o-y) in May 2024. Core industries rose by 4.0 per cent in June, against 6.4 per cent in May. Other high frequency indicators released during June-July 2024 indicate expansion of services sector activity, ongoing revival of private consumption, and signs of pickup in private investment activity. Merchandise exports, non-oil non-gold imports, services exports and imports expanded during April-June. 8. Going forward, the Indian Meteorological Department's (IMD) projection of above normal southwest monsoon and healthy kharif sowing will support improving rural demand. The sustained momentum in manufacturing and services suggests steady urban demand. High frequency indicators of investment activity as evident in strong expansion in steel consumption, high capacity utilisation, healthy balance sheets of banks and corporates, and the Government's continued thrust on infrastructure spending, point to a robust outlook. Improving world trade prospects could support external demand. Headwinds from geopolitical tensions, volatility in international commodity prices and geoeconomic fragmentation, however, pose risks to the outlook. Taking all these factors into consideration, real GDP growth for 2024-25 is projected at 7.2 per cent with Q1 at 7.1 per cent; Q2 at 7.2 per cent; Q3 at 7.3 per cent; and Q4 at 7.2 per cent. Real GDP growth for Q1:2025-26 is projected at 7.2 per cent (Chart 1). The risks are evenly balanced. 9. Headline inflation increased to 5.1 per cent in June 2024 after remaining steady at 4.8 per cent during April-May 2024. Worsening of food inflation pressures – driven primarily by a sharp increase in prices of vegetables, pulses and edible oils along with a pick-up in inflation across cereals, milk, fruits and prepared meals – pushed up headline inflation. The fuel group remained in deflation, reflecting the cumulative impact of the sharp cuts in LPG price in August 2023 and March 2024. Core (CPI excluding food and fuel) inflation at 3.1 per cent in May-June touched a new low in the current CPI series, with core services inflation also at its lowest in the series. 10. Headline inflation has moderated from its peak but unevenly. Looking ahead, food price momentum has remained elevated in July. In Q2:2024-25, though favourable base effects are large, the sharper uptick in price momentum relative to earlier expectations is likely to result in a shallower softening of CPI headline inflation. Inflation is expected to edge up in Q3 as favourable base effects taper off. The steady progress in monsoon, pick-up in kharif sowing, adequate buffer stocks of foodgrains and easing global food prices are positives for containing food price pressures. Adverse climate events remain an upside risk to food inflation. Crude oil prices continue to be volatile on demand concerns and geopolitical tensions. The revision in mobile tariff rates is likely to lead to an increase in core inflation. Manufacturing, services and infrastructure firms surveyed by the Reserve Bank expect a pickup in selling prices in the second half of this year. Households' inflation expectations have also gone up and consumer confidence has weakened. Assuming a normal monsoon, CPI inflation for 2024-25 is projected at 4.5 per cent with Q2 at 4.4 per cent; Q3 at 4.7 per cent; and Q4 at 4.3 per cent. CPI inflation for Q1:2025-26 is projected at 4.4 per cent (Chart 2). The risks are evenly balanced.  11. The MPC expects domestic growth to hold up on the strength of investment demand, steady urban consumption and rising rural consumption. Risks from volatile and elevated food prices remain high, which may adversely impact inflation expectations and result in spillovers to core inflation. There are also indications of core inflation bottoming out. Accordingly, the MPC decided to remain watchful on how these forces play out, going forward. The MPC stays resolute in its commitment to aligning inflation to the 4 per cent target on a durable basis. In these circumstances, the MPC decided to keep the policy repo rate unchanged at 6.50 per cent in this meeting. The MPC reiterates the need to continue with the disinflationary stance, until a durable alignment of the headline CPI inflation with the target is achieved. Enduring price stability sets strong foundations for a sustained period of high growth. Hence the MPC also considers it appropriate to continue with the disinflationary stance of withdrawal of accommodation to ensure that inflation progressively aligns to the target, while supporting growth. 12. Dr. Shashanka Bhide, Dr. Rajiv Ranjan, Dr. Michael Debabrata Patra and Shri Shaktikanta Das voted to keep the policy repo rate unchanged at 6.50 per cent. Dr. Ashima Goyal and Prof. Jayanth R. Varma voted to reduce the policy repo rate by 25 basis points. 13. Dr. Shashanka Bhide, Dr. Rajiv Ranjan, Dr. Michael Debabrata Patra and Shri Shaktikanta Das voted to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns to the target, while supporting growth. Dr. Ashima Goyal and Prof. Jayanth R. Varma voted for a change in stance to neutral. 14. The minutes of the MPC's meeting will be published on August 22, 2024. 15. The next meeting of the MPC is scheduled during October 7 to 9, 2024. Voting on the Resolution to keep the policy repo rate unchanged at 6.50 per cent

Statement by Dr. Shashanka Bhide 16. Subsequent to the June 2024 meeting of the MPC, there is cautious optimism around the growth estimate of GDP of around 7 per cent in 2024-25. In July 2024, the Economic Survey for 2023-24 by the Ministry of India, projected a GDP growth of 6.5-7.0 per cent for 2024-25. The IMF, in its July update of the World Economic Outlook raised India's GDP growth projection to 7 per cent from 6.8 per cent indicated in its April 2024 assessment. The latest round of RBI's Survey of Professional Forecasters conducted in July 2024 presents a median forecast of 7 per cent, up from 6.8 per cent projected in May 2024. These estimates are lower than the growth estimate of 7.2 per cent provided in the MPC resolution of June meeting. The YOY real GDP growth in 2023-24 exceeded 8 per cent in the first three quarters, dropping to 7.8 per cent in Q4. In 2023-24, growth of personal consumption expenditure and exports of goods and services experienced slower growth relative to gross fixed capital formation. While a favourable south-west monsoon and lower inflation rate may support higher personal consumption growth, sustained momentum of GFCF and export growth would also be crucial for the high growth in 2024-25. 17. At the global level, IMF's WEO July 2024 Update has retained the pace of economic growth at 3.2 per cent, projected previously in April. The volume of world trade in goods and services, has been projected to rise at a marginally faster pace in 2024 than previously projected, after near stagnation in 2023. These reflect a stable external demand environment for India, although uncertainty emanating from slower than expected pace of disinflation and the geopolitical conflicts have persisted. 18. In the domestic economy, growth stimulus, particularly on investment through central government expenditure on infrastructure development has been preserved. In the central government budget for 2024-25, the budget estimate for 'effective capital expenditure' increased by about 20 per cent in nominal value over the provisional actuals for 2023-24, marginally higher than the increase in 2023-24 (provisional actuals) over the actual spending in the previous year. In the case of private investment, that includes corporate and household sector investment, the favourable policy incentives, emerging new opportunities in the economy and improved longer term growth prospects would be the key drivers of accelerated spending. The high frequency indicators of some of the investment activity such as consumption of finished steel and import of capital goods for April-June 2024 reflect rising level of investment activity; but output of cement in April-June and IIP for capital goods in April-May point to contraction or modest improvement. FDI inflows during April-mid July show significant increase as compared to the same period in 2023-24. The latest RBI's survey of enterprises reflects greater optimism of improved demand conditions in H2:2024-25 over H1. 19. A major push on consumption spending growth is expected to come from the improved agricultural prospects supported by a favourable monsoon this year and the moderating inflation rate. While the monsoon rainfall is expected to be at the normal level and exceeding the level in the previous year, nature of its distribution during the monsoon period and across regions would be of critical for raising agricultural sector's growth substantially from its estimated GVA growth of 1.4 per cent in 2023-24. The sale of 2-wheelers and tractors in May-June 2024 either exceeding or matching the levels seen in the same period in 2023 is a positive indication that rural demand would be strengthened by a favourable monsoon this year. 20. The indicators of urban demand such as the number of domestic air passengers and passenger vehicle sales for April-June 2024 exceed the levels YOY basis, but the pace of growth has been lower. The pace of vehicle loans in April-June 2024 has declined, compared to the previous year but remains in double digits. The latest consumer confidence survey of urban households conducted by RBI reflects weaker sentiments. A major factor affecting both rural and urban consumption would be the moderate headline inflation rate. 21. Merchandise exports and imports registered positive growth in April-June compared to negative YOY growth in the previous year. The service exports and imports also rose in April-June this year YOY basis, although there was a decline in exports and imports in June over May. 22. The purchasing manager indices (PMIs) for manufacturing and services declined in June from a high in May but remain in expansion zone. The indicators of broader level of economic activity, GST collections, E-way bills and non-food bank credit growth at close to double digit rates YOY in April-June 2024 reflect a strong growth momentum. 23. The outlook for growth in the current year, therefore, has both the positive features that may help maintain the momentum of 2023-24 and downside risks associated with both domestic and external factors. Considering these factors, the GDP growth projection for 2024-25 has been retained at 7.2 per cent, unchanged from the June MPC meeting. The quarterly estimates for GDP in 2024-25 are 7.1, 7.2, 7.3 and 7.2 in Q1-Q4, respectively. A significant driver of growth in the current year is likely to be consumption growth. 24. Since July 2023, food inflation has remained at significantly high level compared to the other two broad components of the headline inflation. From its peak of 10.6 per cent in July 2023, food inflation (CPI for food and beverages) has declined over a 12- month period, ranging from 7.6-8.4 per cent between January and June 2024. The headline inflation has declined from 5.1 per cent in July 2023 to 4.8 per cent in May and then risen to 5.1 per cent in June 2024. A progressive decline in food inflation would be necessary to achieve the 4 per cent headline inflation which can be sustained. 25. Favourable monsoon aiding agricultural growth this year would ease the supply side pressures to bring down the prevailing high food inflation. Appropriate supply management strategies would always be needed to minimise the sharp changes in the prices of perishable commodities. The evolution of price trends in the non-food categories also need to be monitored even as the food inflation declines. The latest RBI survey of urban households reflects an upturn in 3 months- ahead and 1 year-ahead headline inflation rate, a continuation of the pattern seen in the previous round of the survey. The survey of enterprises indicates expectation of increased growth in output prices in Q2:2024-25 in the case of enterprises in the service and infrastructure sectors as input cost pressures also rise. However, in the manufacturing sector, growth in selling prices is expected to ease in Q2. A 'Business Inflation Expectations Survey' of panel business leaders conducted in June 2024 registered a marginal uptick in the one-year ahead consumer price index, while survey also estimated a marginal decline in the cost- based one-year ahead inflation rate relative to the previous round of the survey.1 The divergence in the cost-based inflation and consumer price inflation expectations may reflect the pressures of food prices in the latter. The international food and energy prices outlook has reflected stable or downward movement but risks from geo-political conflicts disrupting supply chains are significant. Taking into account these factors, and assuming a favourable monsoon rainfall, the average headline inflation rate for 2024-25 is projected at 4.5 per cent, the same as in the MPC meeting of June. With the actual reading of 4.9 per cent inflation in Q1, projections for the remaining three quarters of 2024-25 are Q2 at 4.4 per cent, Q3 at 4.7 per cent and Q4 at 4.3 per cent. The projected headline inflation in Q1:2025-26 is at 4.4 per cent. 26. The overall macroeconomic outlook is one of fairly strong growth and moderating inflation trend. The setting for monetary policy is, however, marked by the risks to the projected patterns of both inflation and growth. In both the cases, risks faced are common: those associated with the monsoon and climate conditions, external demand and price conditions, and financial conditions. Under a favourable monsoon and climate scenario, food inflation is expected to moderate significantly and effective supply management policies provide an effective framework to address price spikes limited to a few commodities. However, persistent food inflation may require core inflation to soften sufficiently to maintain the headline close to the target. High food inflation would therefore hit growth adversely as it affects consumption and require restrictive monetary policy to soften core inflation, especially when faced with significant spillovers of persistent food price pressures to core components. The average sequential month-over-month momentum of headline inflation is likely to be high during July-September. Therefore, at this juncture it is necessary to maintain the priority on achieving inflation target objectives. 27. Accordingly, I vote

Statement by Dr. Ashima Goyal 28. Global uncertainties continue. The Fed in indicating a cut in its September meeting, pointed out that since monetary policy acts with a lag they can't afford to wait until they reach their inflation target before cutting. That lag may be responsible for the sharply adverse August jobs report that has stoked recession fears and created market volatility. That a series of small signals were ignored, may have led to a critical large one. Monetary policy needs to act well in time. Spillovers led the global manufacturing PMI into contraction zone in July at 49.7. 29. In India food inflation has risen, but the heat wave has had less than the expected effect, although household inflation expectations, which are sensitive to supply shocks, have risen marginally. Vegetable inflation is transient, less than last year and is already correcting with the good monsoon. Supply chains seem to be improving. That Delhi now gets tomatoes from Karnataka as well as Himachal Pradesh has reduced the price spike compared to last year. Core inflation is at 3.1% and even if it rises should get anchored at the target, especially as global commodity prices are softening. The conservative view tends to build in mean reversion, but the mean is likely to have changed. Average Indian inflation is lower and trending down. 30. Although RBI inflation projections are rising after falling due to base effects, they fall again. So the overall trend into next year is downwards. The Q1 FY26 projection is 4.4%. Many analysts expect 4% headline inflation by summer next year as the base effect and good monsoon sharply reduces food inflation, implying the expected real policy rate is 2.5%. Since Indian inflation is not well measured, and could be over or under-estimated, too much precision with regard to a target is unproductive. 31. An EM is subject to many shocks, so it is better if forward guidance on rates is data-based, communicating only the reaction function. Even so, lags in action imply it is necessary to be forward-looking and take decisions based on expected future variables. 32. A view sometimes expressed is that government actions affect growth, not those of central banks (CBs). But then why would the MPC have growth as an objective? Since growth in economies in transition especially, is non-steady state and non-linear, excess monetary tightening can trigger a switch to a lower growth path so that the growth sacrifice is large. 33. There are some negative signals for Indian growth also. Early results of listed private manufacturing companies show sales and profits softened in Q1 FY25. Consumer confidence fell and the business expectations index has been moderating since Q4 FY24. The RBI Q1 FY25 growth forecast has been reduced. 34. Overall Indian growth is resilient, but it is still below potential. The Q1 FY25 softening in government expenditure was an election phenomenon and will reverse, while the good monsoon is likely to reverse the heat wave related softening in consumer expenditure. 35. Many experts had expected India to revert to low pre-pandemic growth. But growth has been robust at an average of 8.3% for 3 years now—this is beyond base effects. Something is different, including macroeconomic policy, which effectively smoothed shocks. Rising diversity and scale have also increased shock absorbing capacity. 36. Since this is my last MPC meeting I would like to record here my appreciation of policy-making in this period that helped India overcome major external shocks and set it on a path of high growth with stability. It was a privilege to watch its working from close quarters. 37. But continued vigilance is the price of success. I will flag some of the principles (marked P) that in my view were responsible for outperformance and the risks in departing from these. 38. Real variables were kept near equilibrium. This is an indicator of countercyclical smoothing of shocks (P1). Large deviations of real rates can make growth volatile, as happened in the 2010s. 39. Another major factor that worked well for India in the last 3 years was good monetary-fiscal coordination (P2). The budget shows a conservative fiscal deficit target overachieved, infrastructure spending maintained and other ongoing supply-side improvements (P3) that will reduce inflation currently as well as over time. These are essential for non-inflationary growth in India. Of course, it is always possible to do more and further raise potential output. In particular, it is important to shift from interventions that distort resource allocation to those that improve productivity in agriculture. 40. With fiscal policy doing its part, monetary policy must also keep the repo rate as low as is consistent with reaching the inflation target. It is not that reforms must come before monetary action. In a dynamic economy both can act together. This type of coordination is compatible with CB independence and credible anchoring of inflation expectations (P4) since action is conditional on inflation outcomes. 41. Svensson had warned long ago that flexibility (P5) in inflation targeting (IT) is very important for its social acceptance.2 Interest rates affect many groups in opposing ways. A low positive repo is also called for since it balances (P6) these differing interests. It worked well in the last few years also reducing core inflation to historic lows. Deviations can lead to protests in a democracy and eventually dilute IT and undermine coordination. As the real repo rises, we are beginning to see such comments, for example in the current Economic Survey. 42. This is unfortunate since the inflation target can serve as a fair benchmark for contesting groups. Trend inflation in any sector should not rise above the target, although spikes can be looked through as expectations remain anchored. Those proposing a higher trend price rise should, in time, become aware that as aggregate inflation rises real gains tend to be lost. 43. There is a view that the neutral real policy rate (NIR) rises with growth. But this holds only for departures from steady-state growth and need not apply if higher transitional growth is absorbing hitherto excluded workers with low productivity and consumption.3 The other important country-relevant issue that a current estimation must include is falling risk premia (P7) due to fiscal, monetary and regulatory actions that are reducing levels and spreads in interest rates. For example, lower volatility in the FX market is reducing interest differentials required with the rest of the world. 44. A clear counter-factual to conservative estimations based on methods developed for advanced economies (AEs) is China, whose sustained high catch-up growth was supported by low real interest rates. 45. With a few exceptions market analysts that are most articulate about policy rates are mainly interested in the nominal level and its changes in order to guide their clients' market positions. They will accept any estimate of NIR policy-makers give them, since commitment to a NIR value helps them make predictions. 46. The real rate affects the real sector. It is the MPC, whose mandate covers all groups, that has to be concerned about 'correct' real rates in order to balance interests, respond to pressing priorities and seize opportunities. The first priority for India is to create more productive jobs in order to utilize the demographic dividend as well as to prevent possible political instability. 47. Even if growth is high, it has to rise to its full potential. A falling trend and low core inflation indicates growth is below potential,4 implying real rates are above the NIR and there is scope to reduce the repo rate and raise growth. This simple guide cuts through complexities in the estimation of NIR. The MPC must make sure, if the approach to target is long and slow, the real policy rate does not deviate too far from the NIR during that period. 48. Credit eventually creates deposits through rising incomes and savings, but in the meanwhile banks should maintain adequate liquidity buffers. We are seeing market rates coming down as liquidity improves with government spending. The call money rate is also near the repo rate. This should be maintained. Adequate liquidity is required along with prudential policies that create good incentives for the financial sector (P8), especially since the sources of liquidity are limited for many parts of India's financial sector leading to liquidity hoarding. Balance requires that over-strictness is avoided. 49. In view of the above arguments I vote for a 25 bps cut in the repo rate and a change in the stance to neutral. These are necessary to lower risks of departure from the principles outlined above, which have contributed to policy successes in the last 3 years. Statement by Prof. Jayanth R. Varma 50. For the last several meetings, I have been expressing concerns about the unacceptable growth sacrifice induced by a monetary policy that is excessively restrictive. The majority of the MPC however do not share this concern, perhaps because they think that the Indian economy is already growing at close to its potential growth rate. I think that such a view reflects (a) an unwarranted pessimism about the growth potential of the economy and (b) an overly sanguine expectation about growth in ensuing quarters. I disagree with both prongs of this assessment. 51. Multiple policy measures during the last few years including digitalization, tax reforms, and a step up in infrastructure investment have in my view boosted the potential growth rate of the Indian economy to at least 8 per cent. A confluence of demographic and economic factors present India with a rare opportunity to accelerate its growth over the next decade or more. It is one of the tasks of monetary policy to ensure that this opportunity is not squandered by excessively high real interest rates. In this context it is depressing that India's projected growth rates for 2024-25 and 2025-26 (despite being among the highest growth rates of any large economy in the world), are significantly lower than the potential growth rate of the Indian economy, and also well below what is needed at the current stage of our demographic transition to meet the aspirations of the new entrants into the workforce. 52. At the same time, the majority of the MPC is, in my view, too sanguine about growth in ensuing quarters. Data from various RBI surveys show multiple early warning signals that growth may be already slowing down. Expectations of robust growth depend heavily on an expectation that private capital investment will pick up soon. However, we have been hoping for this revival for many quarters now, and hope is not a strategy. 53. The RBI's projections show inflation bouncing up and down from quarter to quarter, but the trend line is clearly downward, and the projected inflation for the first quarter of 2025-26 is 4.4 per cent. On a forward looking basis, the current repo rate of 6.5 per cent translates into a real rate of 2.1 per cent. This is well above what is needed to drive inflation to the target of 4 per cent. It is true that disinflation has been protracted, and therefore restrictive monetary policy has to be maintained for a few more quarters. But a real interest rate of 1.5 per cent is sufficiently restrictive in this environment. This means that a reduction of over 50 basis points in the repo rate is needed within a short span of time, but it makes sense to move cautiously in this direction. I therefore vote to reduce the repo rate by 25 basis points, and to change the stance to neutral. Statement by Dr. Rajiv Ranjan 54. Since the last monetary policy committee meeting, risks to the global economic outlook have increased, while the domestic economy continue to exhibit resilience. Domestically, risks to inflation are higher than risks to growth at the margin. Let me elaborate on each of these. 55. Even though Q1:2024-25 growth projections have been slightly revised downwards, I am now more confident of overall growth holding up in 2024-25 mainly on three counts. First, consumption, which was lagging during 2023-24 will recover in the current year led by rural consumption on the back of better progress of the monsoon, higher sowing and moderating inflation. Higher FMCG sales in the rural areas during the last two quarters bears testimony to this trend. Second, the Union Budget 2024-25 is growth positive with provisions for higher capital and revenue expenditure. Capital expenditure is budgeted to grow by 17.1 per cent (on top of 28.2 per cent in 2023-24), while revenue expenditure excluding interest payments and subsidies is budgeted to grow by 7.4 per cent (1.2 per cent last year) with an absolute increase of about ₹82,244 crore from the Interim Budget estimates. Fiscal consolidation via higher receipts and medium-term debt reduction path as envisaged in the budget will be growth positive in the long run.5 Third, investment activity is picking up as witnessed from improving capacity utilisation, pick up in investment intentions, and continued buoyancy in steel consumption and capital goods imports. Strong FDI flows at the start of the year are also positive from capex cycle viewpoint. Thus, the growth of the Indian economy is likely to be sustained by all growth drivers working in tandem. The large divergence between gross value added (GVA) and GDP growth is expected to narrow down substantially in the current fiscal as central government subsidies are budgeted to contract moderately compared to a large contraction seen in the previous year. 56. On the other hand, inflation outlook remains uncertain. The upturn in headline inflation in June to 5.1 per cent has been on account of a substantial pick-up in price momentum to around 1.3 per cent (from 0.5 per cent in May) though it was considerably offset by a favourable base effect of around 1.1 per cent. The surge in headline CPI price momentum was driven by the food component even as core (CPI excluding food and fuel) inflation collapsed to a new low in the current CPI series. High frequency food price indicators point to continuing strong food price momentum in July, though large favourable base effects are likely to more than offset it leading to a softening in inflation. Further, core inflation has also likely bottomed out in June, primarily as the impact of the mobile-tariff revision is likely to get reflected in CPI core inflation numbers in July. As a result, there has been changes to the quarterly path of inflation projections with Q2 projections being revised upwards, even as full year CPI inflation projection has been retained at 4.5 per cent. 57. In the recent period, food inflation has remained persistently elevated, averaging 8 per cent since July 2023 and has contributed to around 75 per cent of the headline inflation during April-June 2024. Such persistent food inflation pressures cannot be ignored considering the high share of food in household consumption basket and risk of its spillovers to non-food core CPI components. In this scenario, monetary policy should continue to remain actively disinflationary to ensure that inflation and inflation expectations remains durably aligned to the target rate. 58. The old debate of 'core versus headline' that was well settled when in 2016 we had adopted the flexible inflation targeting framework with headline as our target in line with international best practices has resurfaced with persistent divergence between food inflation that has remained elevated and subdued core inflation.6 As long as food constitutes an important segment of the consumer basket and food inflation shows signs of persistence, one cannot ignore food in the CPI basket given the common perception of households to look at food prices while evaluating inflation. Moreover, the likely indirect spill overs from the interrelation of prices over time and across sectors for both households and firms remains important.7 Recent cross-country evidence indicates an increase in the size and significance of inflation persistence post pandemic, thus, slowing down the disinflation journey even after energy price shocks and supply disruptions have abated.8 All this complicates the central bankers' task and demands caution in policy conduct. Any adjustment of the goalpost, apart from undermining central bank's hard-earned credibility, may have to bear the wrath of the markets, thus wiping out all the good work done so far. 59. Developments on the global front further add to the uncertainty as the outlook is evolving at a fast pace amidst ongoing geopolitical tensions and various data releases leading to changing perceptions about global economic prospects adding to financial market volatility. Some countries have embarked on easing cycle as their growth has started exhibiting withering signs and headline inflation has started softening, despite core inflation ruling above the headline inflation. On the other hand, a few countries are waiting for supply shocks to abate and favourable economic conditions to emerge before pivoting towards a rate cut cycle, despite low core inflation. There is also a third set of countries that are hiking their benchmark rates due to their country-specific factors. Under these circumstances, it is important that we define our own policy path based on prevailing domestic growth-inflation dynamics. We cannot let down our guards against inflation at this juncture, when supply shocks are proving to be so persistent. 60. Going ahead, however, some positive developments are envisaged. Headline CPI inflation is projected to continue on the disinflation path towards the target rate, though gradually, with inflation projections indicating a significant moderation by Q4 of the financial year. Steady progress in monsoon with a favourable La Nina; higher kharif sowing; a likely favourable rabi season on the back of good soil moisture conditions; and softening global food prices may lead to a more than anticipated decline in food inflation pressures over the course of the year. This could open up the window for monetary policy to change its course. At the current juncture, however, more clarity and definiteness are needed - on food inflation outlook; spillovers of food price pressures to core inflation; domestic demand; and global risks. Till then, I will prefer to stay the course and remain cautious and watchful for these uncertainties to play out. Resilient growth gives us the space to remain focussed on inflation and maintain status quo till some of these risks are mitigated and the trade-offs are minimised. Accordingly, I vote for status quo on both stance and rate in this policy. Statement by Dr. Michael Debabrata Patra 61. The wedge between headline and food inflation has been widening, and stalling the alignment of the former with the target. Taking into account double digit inflation in salient food categories such as cereals, pulses, spices and vegetables for several months, empirical evidence points to a rise in the time varying persistence of food inflation, i.e., it is taking longer to revert to its trend after a shock. There is also evidence of the time varying trend of food inflation increasing, negating the gains made through core disinflation. 62. Higher trend food inflation is spilling over into inflation expectations of households and consumer confidence. In the case of the former, even their current perceptions have now started rising along with outer-term expectations. The recent assessment of the neutral rate of interest suggests that the disinflationary stance of monetary policy is appropriate, especially in view of the persisting positive gap between actual inflation outcomes and the target. Potential output is now rising faster than its pre-pandemic pace; even so, a positive output gap has opened up – actual output is running ahead of potential output - warranting vigil on aggregate demand developments. 63. Monetary policy is an instrument for modulating aggregate demand. Food price shocks may originate outside the realm of monetary policy and initially manifest themselves in supply mismatches, but when their effects stay in the inflation formation process, they can propagate through second order effects and get generalised to which monetary policy cannot be insensitive. Persistently rising prices are always and everywhere a reflection of too much demand chasing too less supply even if it is a supply shortfall that starts the price spiral. It is the remit of monetary policy to adjust demand conditions to the state of supply because this accumulation of price pressures threatens the outlook for both inflation and growth. The monetary policy committee (MPC) of the RBI has committed to align inflation durably to the target. That is not yet achieved; any faltering from this commitment could undermine the prospects of the Indian economy. Hence, I vote for keeping the policy rate and the stance of withdrawal of accommodation unchanged in this resolution. Statement by Shri Shaktikanta Das 64. Global economic activity has remained stable since the last meeting of the MPC in June 2024. Incoming data, however, presents a mixed picture with signs of slowing growth momentum in certain major economies. Inflation is on a softening path, but persistence in services prices is imparting downward rigidity. With changing growth- inflation dynamics, several central banks have become less restrictive by way of rate cuts and forward guidance. At the same time, there are a few others who have hiked their interest rates. Market expectations are constantly varying on the pace and timing of policy pivots by central banks, resulting in financial market volatility. 65. In this mixed global backdrop, India is treading on a steady growth path driven primarily by domestic factors. High frequency indicators suggest that momentum of activity witnessed during Q4:2023-24 continued during Q1:2024-25, though with some slowdown in corporate profits, lower general government expenditure and core industries output. Kharif sowing is progressing well thanks to the south-west monsoon. Improving reservoir levels augur well for the rabi output. Manufacturing and services activity remain buoyant. 66. The pickup in agricultural activity is expected to further boost rural consumption. Urban consumption continues to be steady. Budget allocation for government capex remains robust. Private corporate investment is also gaining steam with capacity utilisation reaching its highest level in 11 years. Healthy balance sheets of banks and corporates provide a congenial environment for private sector investments to gather pace. Indications of capacity creation in a few industries and growing investment intentions are getting visible.9 Improving global trade volume is expected to provide support to external demand. 67. Since the last bi-monthly policy review, headline inflation has seen upward movement in June to 5.1 per cent, as food inflation pressures increased and offset the impact of subdued core (CPI excluding food and fuel) inflation and deflation in the fuel group. 68. Going forward, headline inflation in July and Q2 of the current financial year are expected to be lower, given their base effect advantage; but with food inflation pressures showing little signs of abatement in the near-term, and household inflation expectations picking up, monetary policy has to remain vigilant to potential spillovers of food price pressures to the core components. This is critical for the 'last mile of disinflation' and anchoring of inflation expectations. Food inflation may soften due to good monsoon, steady improvement in kharif sowing, rising reservoir levels and a likely favourable rabi season output. Uncertainty, however, comes from frequent recurrence of adverse weather events, resurgence of geo-political tensions and financial market volatility. Further, core inflation might just have bottomed out. 69. The calibrated increase in policy repo rate by 250 basis points since May 2022 and subsequent change of stance to withdrawal of accommodation has facilitated gradual disinflation over 2022-23. With a forecast of 4.5 per cent headline inflation for 2024-25, the present policy repo rate is broadly in balance and avoids costly sacrifice of domestic economic activity. 70. At this stage, when durable disinflation to the target is still a work in progress, the issue of equilibrium natural interest rate is premature. Policy making in the real world cannot be based on an abstract, theoretical and model specific construct which is unobservable and time varying. Hence, any justification for policy easing based on so called high real rates can be misleading. 71. Introduction of flexible inflation targeting (FIT) in 2016 was a major structural reform. Over the last 8 years, it has gained in credibility and facilitated positive outcomes for the economy, despite the huge global shocks. Its credibility needs to be preserved and sustained. 72. Inflation is gradually trending down, but the pace is slow and uneven. Durable alignment of inflation to the target of 4.0 per cent is still some distance away. Persistent food inflation is imparting stickiness to headline inflation. Inflation expectations need to be kept anchored. Spillovers of food inflation to core have to be avoided. At such a crucial juncture, steady growth impulses are allowing monetary policy to unambiguously focus on supporting a sustained descent of inflation to the target. The best contribution that monetary policy can make for sustainable growth is to maintain price stability. Taking all these factors into consideration, I vote for keeping the policy repo rate unchanged at 6.5 per cent and continuing with the stance of withdrawal of accommodation. (Puneet Pancholy) Press Release: 2024-2025/949 1 Misra Centre for Financial Markets and Economy, IIMA. https://www.iima.ac.in/faculty-research/centers/Misra-Centre-for-Financial-Markets-and-Economy/BIES. 2 Svensson, L.E.O (2000), 'Open-economy inflation targeting', Journal of International Economics, vol. 50, pp. 155-83. 3 Goyal, A., 2009. `The natural interest rate in emerging markets', in: Dutta, B., Roy, T. and Somanathan, E. (Eds.), New and Enduring Themes in Development Economics. World Scientific Publishers. 4 There is a literature that uses realized inflation to estimate potential growth, for example, Svensson, L. E.O. Woodford, M. 2003. 'Indicator variables for optimal policy', Journal of Monetary Economics, Volume 50, Issue 3, Pages 691-720. 5 Higher RBI dividends have been utilised partly to reduce fiscal deficit and partly directed towards higher revenue expenditure. 6 For details, please refer Report of the Expert Committee to Revise and Strengthen the Monetary Policy Framework (Chairman: U.R. Patel, January 2014). 7 The Pass-Through from Inflation Perceptions to Inflation Expectations by Stefanie Huber, Daria Minina, Tobias Schmidt :: SSRN (August 2023); How euro area firms' inflation expectations affect their business decisions (europa.eu) (July 2024) 8 https://doi.org/10.17016/2380-7172.3562 (July 2024) 9 As per RBI Surveys, manufacturers' investment intentions for 2024-25 improved, with most firms planning similar or higher investments compared to last year. Funds raised for capex purpose by the private corporates during Q1:2024-25 through different channels (banks/FIs, ECBs, IPOs) remained strong. |

पेज अंतिम अपडेट तारीख: