Today, the Reserve Bank released data on the performance of the private corporate sector during the second quarter of 2019-20 drawn from abridged quarterly financial results of 2,696 listed non-government non-financial (NGNF) companies. Data pertaining to Q2:2018-19 and Q1:2019-20 are also presented in the tables to enable comparison. Furthermore, sources and uses of funds during H1:2019-20 and H1:2018-19 are presented, based on the abridged half-yearly (unaudited) balance sheets of 1,539 listed private manufacturing companies. The data can be accessed at the web-link https://dbie.rbi.org.in/DBIE/dbie.rbi?site=statistics#!2_42. Highlights Sales -

Demand conditions facing the manufacturing sector weakened, with contraction in nominal sales in Q2:2019-20 that became broad based across industries; pharmaceutical companies, however, exhibited resilience and recorded higher sales (Table 2A and Table 5A). -

Sales growth (y-on-y) moderated in the services sector (both IT and non-IT), especially in real estate, wholesale and retail trade companies (Table 2A and Table 5A). Expenditure -

Softening of commodity prices resulted in lower input costs (i.e., cost of raw materials), which partly offset the decline in sales of manufacturing companies (Table 2A). -

Growth in staff cost decelerated across all major sectors (Table 2A). Operating profit -

Operating profit of the manufacturing sector contracted by 11.8 per cent, mainly due to the production slowdown (Table 2A). -

Non-IT services companies, especially in telecommunication, real estate and transport and storage services, registered sharp declines in operating profit (Table 2A and Table 5A). Interest -

Interest expenses of manufacturing companies increased marginally whereas interest expense of non-IT services companies increased sharply, partly due to inclusion of lease payment obligations under this head as per the new accounting norms1 (Table 2A). -

The interest coverage ratio (ICR) of the manufacturing sector moderated to 4.62 on account of lower profits; however, the ICR of non-IT services companies slipped into negative territory due to losses recorded by these companies (Table 2B). Pricing power -

The operating profit margin dipped marginally for manufacturing companies, though their net profit margin increased, largely on account of lower tax provisions (Table 2B). -

IT companies maintained pricing power as reflected in stable profit margins; non-IT services companies, however, registered a contraction in profit margins due to heavy losses recorded by telecommunication companies (Table 2B). Sources and Uses of Funds - Funds mobilised by listed private manufacturing companies during H1:2019-20, were mainly used for fixed assets formation and deleveraging (reduction of debt). These companies were investing in financial instruments such as investment and extending loans and advances during the last couple of years in the face of subdued demand. This shift in Investment was found to be broad based (Table 6).

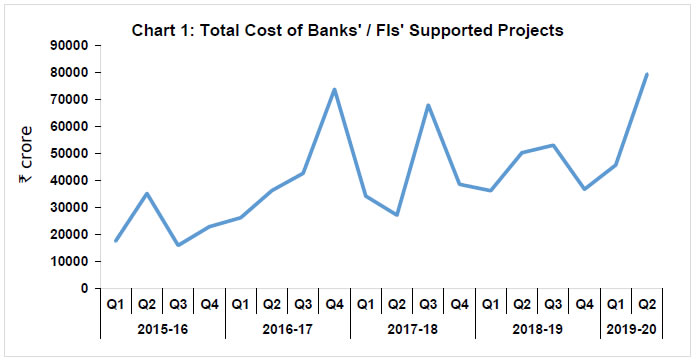

Box 1: Investment Intentions of the Private Corporate Sector Project finance data furnished by 34 major banks/financial institutions (FIs), which are actively involved in financing of projects, also points to a modest pick-up in investment appetite. The total cost of sanctioned projects, inclusive of financial assistance from banks/FIs, has increased steadily since Q1:2019-20 to ₹79,525 crore in Q2:2019-20. The pick-up has largely been due to a few mega projects (i.e., projects whose cost exceeds ₹5,000 crore) in power, airport, metro rail and gas distribution sectors. It needs to be mentioned, however, that these data relate to sanctioning and not to actual disbursements of financial support. Notes: -

These estimates do not cover the projects below ₹10 crore or those with private ownership below 51 per cent or those undertaken by central and state governments, trusts or educational institutions. -

The above estimates of envisaged investments are based on reporting of project finance by major banks/FIs; some ex ante investment intentions may not fructify in terms of amount and/or timing of investment. -

The estimates for 2018-19 and 2019-20 are provisional and firmer estimates will be presented later in the related annual article in the RBI Bulletin. |

| List of Tables | | Table No. | Title | | 1 | A | Performance of Listed Non-Government Non-Financial Companies | Growth Rates | | B | Select Ratios | | 2 | A | Performance of Listed Non-Government Non-Financial Companies – Sector-wise | Growth Rates | | B | Select Ratios | | 3 | A | Performance of Listed Non-Government Non-Financial Companies according to Size of Paid-up-Capital | Growth Rates | | B | Select Ratios | | 4 | A | Performance of Listed Non-Government Non-Financial Companies according to Size of Sales | Growth Rates | | B | Select Ratios | | 5 | A | Performance of Listed Non-Government Non-Financial Companies according to Industry | Growth Rates | | B | Select Ratios | | 6 | Sources and Uses of Funds for Listed Private Manufacturing Companies | | Explanatory Notes | | Glossary | Notes: -

The coverage of companies in different quarters varies, depending on the date of declaration of results; this is, however, not expected to significantly alter the aggregate position. -

Sources and uses of funds are derived from the changes in liabilities and assets from two successive half-yearly abridged financial statements of companies. -

Explanatory notes detailing the compilation methodology, and the glossary (including revised definitions and calculations that differ from previous releases) are appended. Ajit Prasad

Director Press Release: 2019-2020/1468

|

IST,

IST,