IST,

IST,

Sixth Bi-monthly Monetary Policy Statement, 2017-18 Resolution of the Monetary Policy Committee (MPC) Reserve Bank of India

On the basis of an assessment of the current and evolving macroeconomic situation at its meeting today, the Monetary Policy Committee (MPC) decided to:

Consequently, the reverse repo rate under the LAF remains at 5.75 per cent, and the marginal standing facility (MSF) rate and the Bank Rate at 6.25 per cent. The decision of the MPC is consistent with the neutral stance of monetary policy in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth. The main considerations underlying the decision are set out in the statement below. Assessment 2. Since the MPC’s last meeting in December 2017, global economic activity has gained further pace with growth impulses becoming more synchronised across regions. Among advanced economies (AEs), the Euro area expanded at a robust pace, supported by consumption and investment. Economic optimism alongside falling unemployment and low interest rates are supporting the recovery. The US economy lost some momentum with growth slowing down in Q4 of 2017 even as manufacturing activity touched a multi-month high in December. The Japanese economy continued to grow as manufacturing activity gathered pace in January on strong external demand, providing fillip to the already bullish business confidence. 3. Economic activity accelerated in emerging market economies (EMEs) in the final quarter of 2017. The Chinese economy grew above the official target, driven by strong domestic consumption and robust exports. However, some downside risks to growth remain, especially from easing fixed asset investment and surging debt levels. In Russia, strong private consumption, rising oil prices and high exports are supporting economic activity, although weak investment and economic sanctions are weighing on its growth prospects. In Brazil, data on household spending and unemployment were positive in Q4. However, recovery remains vulnerable to political uncertainty, which has dampened consumer confidence. South Africa continues to face challenges on both domestic and external fronts, including high unemployment and declining factory activity. 4. Global trade continued to expand, underpinned by strong investment and robust manufacturing activity. Crude oil prices touched a three-year high as production cuts by the OPEC coupled with falling inventories weighed on the global demand-supply balance. Bullion prices touched a multi-month high on a weak US dollar. Inflation remained contained in most AEs, barring the UK, on subdued wage pressures. Inflation was divergent in key EMEs due to country-specific factors. 5. Financial markets have become volatile in recent days due to uncertainty over the pace of normalisation of the US Fed monetary policy in view of January payrolls data showing rapidly accelerating wage growth and better than expected employment. The volatility index (VIX) has climbed to its highest level since Brexit. Equity markets have witnessed a sharp correction, both in AEs and EMEs. Bond yields in the US have hardened sharply, adding to the upward pressures seen during January, with concomitant rise in bond yields in other AEs and EMEs. Forex markets have become volatile as well. Until this episode of recent volatility, global financial markets were buoyed by investor appetite for risk, corporate tax cuts by the US, and stable economic conditions. Equity markets had gained significantly in January, driven by robust Chinese growth, uptick in commodity prices, and positive corporate sentiment in general. In currency markets, the US dollar had touched a multi-month low on February 1 on fiscal risks and improving growth prospects in other AEs. 6. On the domestic front, the real gross value added (GVA) growth as per the first advance estimates (FAE) released by the Central Statistics Office (CSO) is estimated to decelerate to 6.1 per cent in 2017-18 from 7.1 per cent in 2016-17 due mainly to slowdown in agriculture and allied activities, mining and quarrying, manufacturing, and public administration and defence (PADO) services. 7. Information available after the release of FAE by the CSO has, however, been generally positive. Manufacturing output boosted the growth of index of industrial production (IIP) in November. After a period of prolonged weakness, cement production registered robust growth in November-December, which along with continuing healthy growth in steel production led to acceleration of infrastructure goods production in November. The manufacturing purchasing managers’ index (PMI) expanded for the sixth consecutive month in January led by new orders. Assessment of overall business sentiment in the Indian manufacturing sector improved in Q3 as reflected in the Reserve Bank’s Industrial Outlook Survey (IOS). However, core sector growth decelerated in December due to contraction/deceleration in production of coal, crude oil, steel and electricity. Acreage in the case of wheat, oilseeds and coarse cereals was lower than last year. As a result, the shortfall in area sown for rabi crops increased to (-)1.5 per cent as on February 2 as compared with (-)1.0 per cent on December 29, 2017. 8. In the services sector, some of the high frequency indicators improved. Commercial vehicle sales growth touched an eight-year high in December. Cargo carried by sea, rail and air also registered higher growth in November, but showed mixed performance in December. Other indicators such as domestic and international air passenger traffic and foreign tourist arrivals grew at a fast pace in November-December. The services PMI expanded sequentially in December and January on the back of higher business activity. 9. Retail inflation, measured by the year-on-year change in the consumer price index (CPI), increased for the sixth consecutive month in December on account of a strong unfavourable base effect. After rising abruptly in November, food prices reversed partly in December, reflecting mainly the seasonal moderation, albeit muted, in prices of vegetables along with continuing decline in prices of pulses. Cereals inflation moderated with prices remaining steady in December. However, inflation in some components of food – eggs; meat and fish; oils and fats; and milk – increased. Fuel and light group inflation, which showed a sharp increase in November, softened somewhat in December, driven by moderation in electricity, LPG and kerosene inflation. 10. CPI inflation excluding food and fuel increased further in November and December, largely on account of increase in housing inflation following the implementation of higher house rent allowances (HRA) for government employees under the 7th central pay commission (CPC) award. Inflation also picked up in health and personal care and effects. Reflecting incomplete pass-through to domestic petroleum product prices, inflation in transport and communication remained muted in December. Inflation also slowed down in clothing and footwear, household goods and services, recreation, and education. 11. Households’ inflation expectations, measured by the Reserve Bank’s survey of households, remained elevated for both three-month ahead and one-year ahead horizons even as inflation expectation for one-year ahead horizon moderated marginally. Firms responding to the Reserve Bank’s Industrial Outlook Survey (IOS) continued to report input price pressures and increase in selling prices in Q3. This is also confirmed by manufacturing and services firms polled by PMI. Organised sector wage growth remained firm, while the rural wage growth decelerated. 12. The liquidity in the system continues to be in surplus mode, but it is moving steadily towards neutrality. The weighted average call rate (WACR) traded 12 basis points (bps) below the repo rate during December-January as against 15 bps below the repo rate in November. On some days in December and January, the system turned into deficit due to slow down in government spending and large tax collections, which necessitated injection of liquidity by the Reserve Bank. During the two weeks beginning December 16, 2017, the Reserve Bank injected average daily net liquidity of ₹ 388 billion into the system. For December as a whole, however, the Reserve Bank absorbed ₹ 316 billion (on a net daily average basis). As the system turned into deficit again in the fourth week of January, the Reserve Bank injected average net liquidity of ₹ 145 billion. For January, on the whole, the Reserve Bank absorbed ₹ 353 billion (on a net daily average basis). 13. Merchandise exports bounced back in November and December. While petroleum products, engineering goods and chemicals accounted for three-fourths of this growth, exports of readymade garments contracted. During the same period, merchandise import growth accelerated sequentially with over one-third of the growth emanating from petroleum (crude and products) due largely to high international prices. Gold imports increased – both in value and volume terms – in December, after declining in the preceding three months. Pearls and precious stones, electronic goods and coal were major contributors to non-oil non-gold import growth. With import growth exceeding export growth, the trade deficit for December was US$ 14.9 billion. 14. Even though the current account deficit narrowed sharply in Q2 of 2017-18 on a sequential basis, it was higher than its level a year ago, mainly due to widening of the trade deficit. While net foreign direct investment (FDI) inflows moderated in April-October 2017 from their level a year ago, net foreign portfolio investment (FPI) inflows were buoyant in 2017-18 (up to February 1). India’s foreign exchange reserves were at US$ 421.9 billion on February 2, 2018. Outlook 15. The December bi-monthly resolution projected inflation in the range of 4.3-4.7 per cent in the second half of 2017-18, including the impact of increase in HRA. In terms of actual outcomes, headline inflation averaged 4.6 per cent in Q3, driven primarily by an unusual pick-up in food prices in November. Though prices eased in December, the winter seasonal food price moderation was less than usual. Domestic pump prices of petrol and diesel rose sharply in January, reflecting lagged pass-through of the past increases in international crude oil prices. Considering these factors, inflation is now estimated at 5.1 per cent in Q4, including the HRA impact. 16. The inflation outlook beyond the current year is likely to be shaped by several factors. First, international crude oil prices have firmed up sharply since August 2017, driven by both demand and supply side factors. Second, non-oil industrial raw material prices have also witnessed a global uptick. Firms polled in the Reserve Bank’s IOS expect input prices to harden in Q4. In a scenario of improving economic activity, rising input costs are likely to be passed on to consumers. Third, the inflation outlook will depend on the monsoon, which is assumed to be normal. Taking these factors into consideration, CPI inflation for 2018-19 is estimated in the range of 5.1-5.6 per cent in H1, including diminishing statistical HRA impact of central government employees, and 4.5-4.6 per cent in H2, with risks tilted to the upside (Chart 1). The projected moderation in inflation in the second half is on account of strong favourable base effects, including unwinding of the 7th CPC’s HRA impact, and a softer food inflation forecast, given the assumption of normal monsoon and effective supply management by the Government. 17. Turning to the growth outlook, GVA growth for 2017-18 is projected at 6.6 per cent. Beyond the current year, the growth outlook will be influenced by several factors. First, GST implementation is stabilising, which augurs well for economic activity. Second, there are early signs of revival in investment activity as reflected in improving credit offtake, large resource mobilisation from the primary capital market, and improving capital goods production and imports. Third, the process of recapitalisation of public sector banks has got underway. Large distressed borrowers are being referenced for resolution under the Insolvency and Bankruptcy Code (IBC). This should improve credit flows further and create demand for fresh investment. Fourth, although export growth is expected to improve further on account of improving global demand, elevated commodity prices, especially of oil, may act as a drag on aggregate demand. Taking into consideration the above factors, GVA growth for 2018-19 is projected at 7.2 per cent overall – in the range of 7.3-7.4 per cent in H1 and 7.1-7.2 per cent in H2 – with risks evenly balanced (Chart 2). 18. The MPC notes that the inflation outlook is clouded by several uncertainties on the upside. First, the staggered impact of HRA increases by various state governments may push up headline inflation further over the baseline in 2018-19, and potentially induce second-round effects. Second, a pick-up in global growth may exert further pressure on crude oil and commodity prices with implications for domestic inflation. Third, the Union Budget 2018-19 has proposed revised guidelines for arriving at the minimum support prices (MSPs) for kharif crops, although the exact magnitude of its impact on inflation cannot be fully assessed at this stage. Fourth, the Union Budget has also proposed an increase in customs duty on a number of items. Fifth, fiscal slippage as indicated in the Union Budget could impinge on the inflation outlook. Apart from the direct impact on inflation, fiscal slippage has broader macro-financial implications, notably on economy-wide costs of borrowing which have already started to rise. This may feed into inflation. Sixth, the confluence of domestic fiscal developments and normalisation of monetary policy by major advanced economies could further adversely impact financing conditions and undermine the confidence of external investors. There is, therefore, need for vigilance around the evolving inflation scenario in the coming months. 19. There are also mitigating factors. First, capacity utilisation remains subdued. Second, oil prices have moved both ways in the recent period and can potentially soften from current levels based on production response. Third, rural real wage growth is moderate. 20. Accordingly, the MPC decided to keep the policy repo rate on hold and continue with the neutral stance. The MPC reiterates its commitment to keep headline inflation close to 4 per cent on a durable basis. 21. The MPC notes that the economy is on a recovery path, including early signs of a revival of investment activity. Global demand is improving, which should help strengthen domestic investment activity. The focus of the Union Budget on the rural and infrastructure sectors is also a welcome development as it would support rural incomes and investment, and in turn provide a further push to aggregate demand and economic activity. On the downside, the deterioration in public finances risks crowding out of private financing and investment. The Committee is of the view that the nascent recovery needs to be carefully nurtured and growth put on a sustainably higher path through conducive and stable macro-financial management. 22. Dr. Chetan Ghate, Dr. Pami Dua, Dr. Ravindra H. Dholakia, Dr. Viral V. Acharya and Dr. Urjit R. Patel voted in favour of the monetary policy decision. Dr. Michael Debabrata Patra voted for an increase in the policy rate of 25 basis points. The minutes of the MPC’s meeting will be published by February 21, 2018. 23. The next meeting of the MPC is scheduled on April 4 and 5, 2018. Jose J. Kattoor Press Release: 2017-2018/2146 |

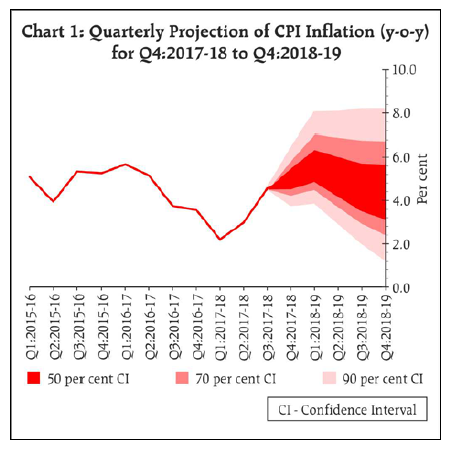

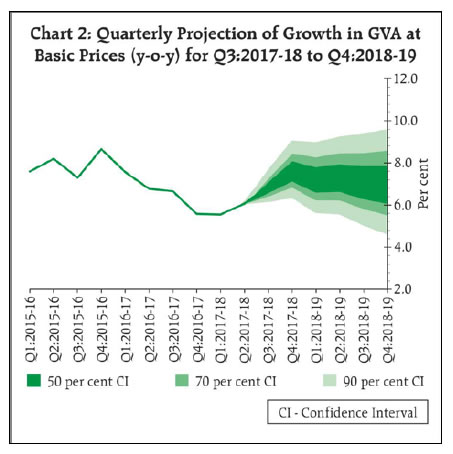

पेज अंतिम अपडेट तारीख: