IST,

IST,

Annex-1 : Systemic Risk Survey

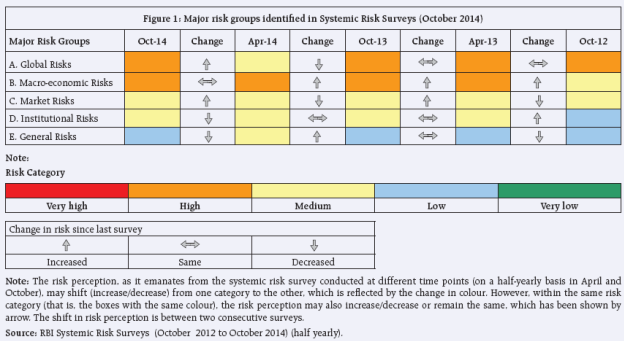

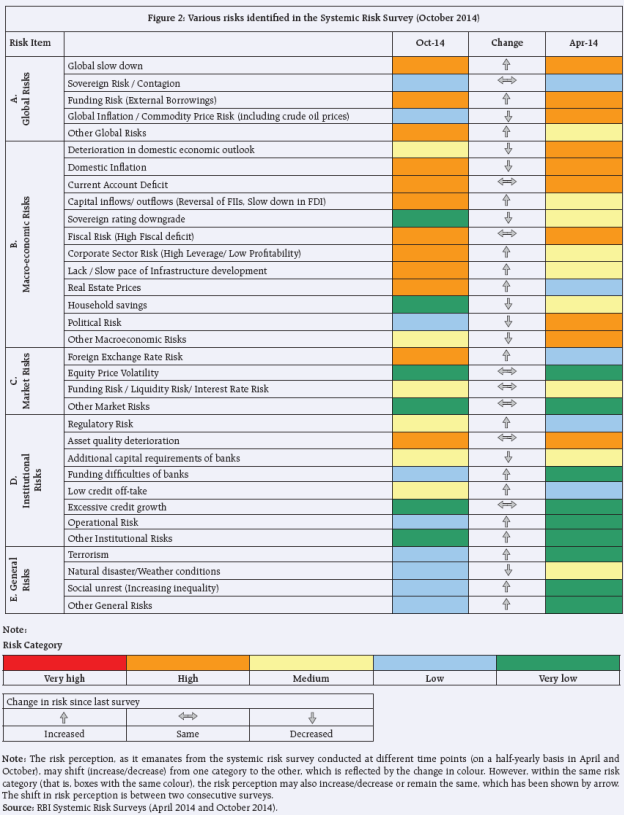

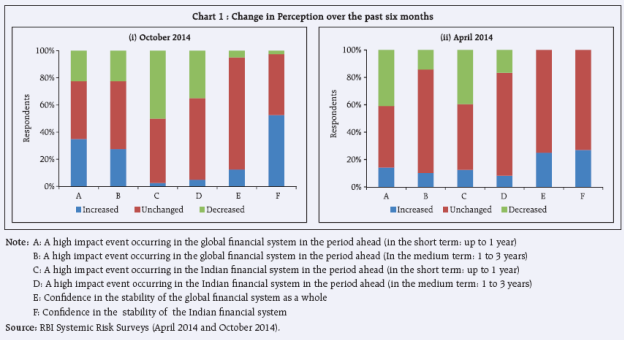

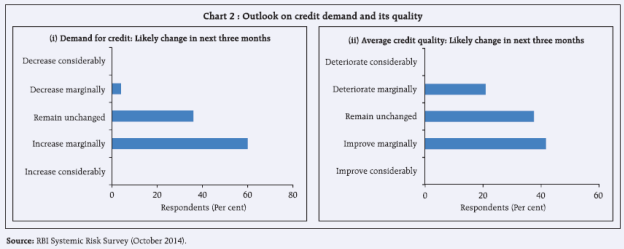

The Systemic Risk Survey (SRS), the 7th in the series was conducted in October 20141 to capture the perceptions of experts, including market participants, on the major risks that the financial system is facing. The results indi-cate that global risks and macroeconomic risks continue to be perceived as major risks affecting the financial system. Perceptions about global risks, which tapered a bit during the last survey rose once again while the same about market risks continued to be in the medium risk category, though they too looked up. General risks that had been viewed as high in the last survey mainly on account of the then prevailing uncertainties about weather conditions, were viewed as low in the current round of the survey. Institutional risks continued to fall in the medium risk category, though moderated (Figure 1). Within global risks, sovereign risks remain unchanged, while the risk of a global slowdown increased marginally. Further, the global inflation risk showed a downward trend though global funding risks remained in an elevated mode. Within the macroeconomic risk category, risks from deterioration in the domestic economic outlook receded into the medium risk category with a distinct improvement in the sovereign rating front against the backdrop of po-litical stability being in place. Surprisingly, perceptions about risks on account of CAD and fiscal deficit remained unchanged while the same about risks from domestic inflation and household savings lowered. Though the overall outlook has improved, risks emanating from the slow pace of infrastructure development, capital flows, real estate prices and the corporate sector went up to the high risk category. Among institutional risks, the asset quality of banks continued to be a concern while regulatory risk, operational risk and the risk of low credit-off-take increased comparatively. With regard to general risks, risk perceptions emanating from terrorism and social unrest have increased (Figure 2). In the current survey, participants felt that there is an increased possibility of a high impact event occurring in the global financial system in the period ahead (short to medium term) while their confidence in the global financial system has marginally deteriorated. However, the possibility of an occurrence of a high impact event in the Indian financial system in the period ahead (short to medium term) is perceived to be low with survey participants expressing higher confidence in the Indian financial system (Chart 1). On the issue of likely changes in demand for credit in the next three months, a majority of the stakeholders were of the view that it may increase but marginally. A majority of the respondents felt that the average quality of credit may improve marginally or is likely to remain unchanged in the next three months (Chart 2). 1These surveys are conducted on a half-yearly basis. The first survey was conducted in October 2011. |

पेज अंतिम अपडेट तारीख: