| CONTENTS |

| S.No. |

Particulars |

| 1. |

Select abbreviations |

| 2. |

Foreword |

| 3. |

Executive Summary |

| 4. |

Chapter 1 - Complaints received by Ombudsmen during July 1, 2020 to March 31, 2021 |

| 5. |

Chapter 2 - The Banking Ombudsman Scheme (BOS), 2006: Activities during July 1, 2020 to March 31, 2021 |

| |

Receipt of complaints |

| |

Mode of receipt of complaints |

| |

Population group-wise distribution of complaints |

| |

Zone-wise distribution of complaints |

| |

Complainant group-wise classification of complaints |

| |

Bank group-wise classification of complaints |

| |

Nature of complaints handled |

| |

Disposal of complaints |

| |

Mode of disposal of maintainable complaints |

| |

Turn Around Time (TAT) of complaints |

| |

Grounds for rejection of maintainable complaints |

| |

Age-wise classification of pending complaints |

| |

Awards issued |

| |

Appeals against the decisions of Banking Ombudsmen (BOs) |

| 6. |

Chapter 3 - The Ombudsman Scheme for Non-Banking Financial Companies (OSNBFC), 2018: Activities during July 1, 2020 to March 31, 2021 |

| |

Receipt of complaints |

| |

Cost of handling a complaint |

| |

Mode of receipt of complaints |

| |

Complainant group-wise classification of complaints |

| |

NBFC category-wise complaints received |

| |

Nature of complaints received |

| |

Disposal of complaints |

| |

Mode of disposal of maintainable complaints |

| |

Appeals against the decisions of the NBFC Ombudsmen (NBFCOs) |

| 7. |

Chapter 4 - Ombudsman Scheme for Digital Transactions (OSDT), 2019: Activities during July 1, 2020 to March 31, 2021 |

| |

Receipt of complaints |

| |

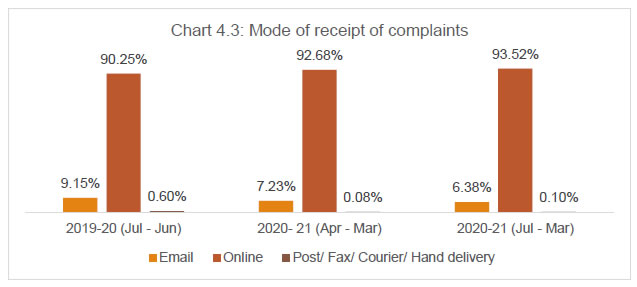

Mode of receipt of complaints |

| |

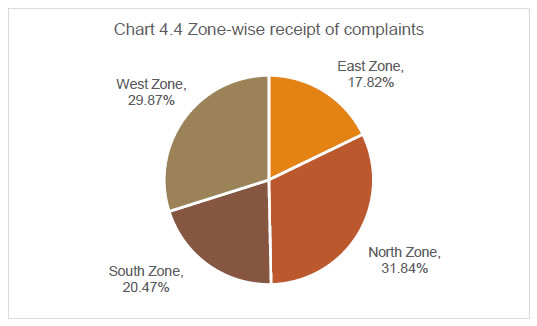

Zone-wise distribution of complaints |

| |

Complainant group-wise classification |

| |

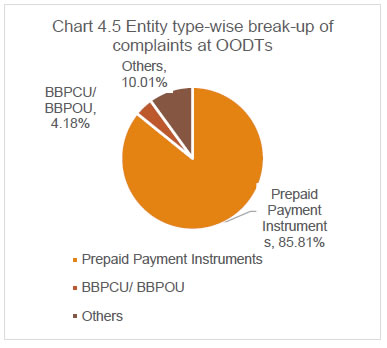

Entity type-wise classification |

| |

Nature of complaints handled |

| |

Disposal of complaints |

| |

Mode of disposal of maintainable complaints |

| |

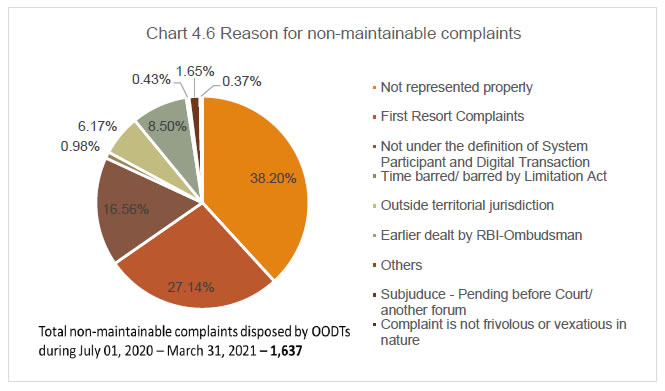

Grounds for rejection of maintainable complaints |

| |

Age-wise classification of pending complaints |

| |

Appeals against the decisions of Ombudsmen for Digital Transactions (ODTs) |

| 8. |

Chapter 5 - Complaints received through Centralised Public Grievance Redress and Monitoring System (CPGRAMS) and applications under Right to Information (RTI) Act, 2005 |

| |

CPGRAMS |

| |

RTI Act, 2005 |

| 9. |

Chapter 6 - Other developments |

| |

Regulations: Important regulatory measures taken by the Reserve Bank |

| |

Circular on strengthening of grievance redress mechanism in banks |

| |

Root Cause Analysis (RCA) of major areas of complaints |

| |

Status of implementation of the action plan set out in ‘Utkarsh 2022’ for the year, July 1, 2020 to March 31, 2021 |

| |

Framework for financial education for greater customer awareness |

| |

Extension of BOS, 2006 to Financially Sound Well-Managed (FSWM) Urban Co-operative Banks (UCBs) |

| |

Review of Ombudsman Schemes for updation and effective implementation, including through convergence |

| |

Awareness generation activities of Consumer Education and Protection Department (CEPD) and Ombudsmen |

| |

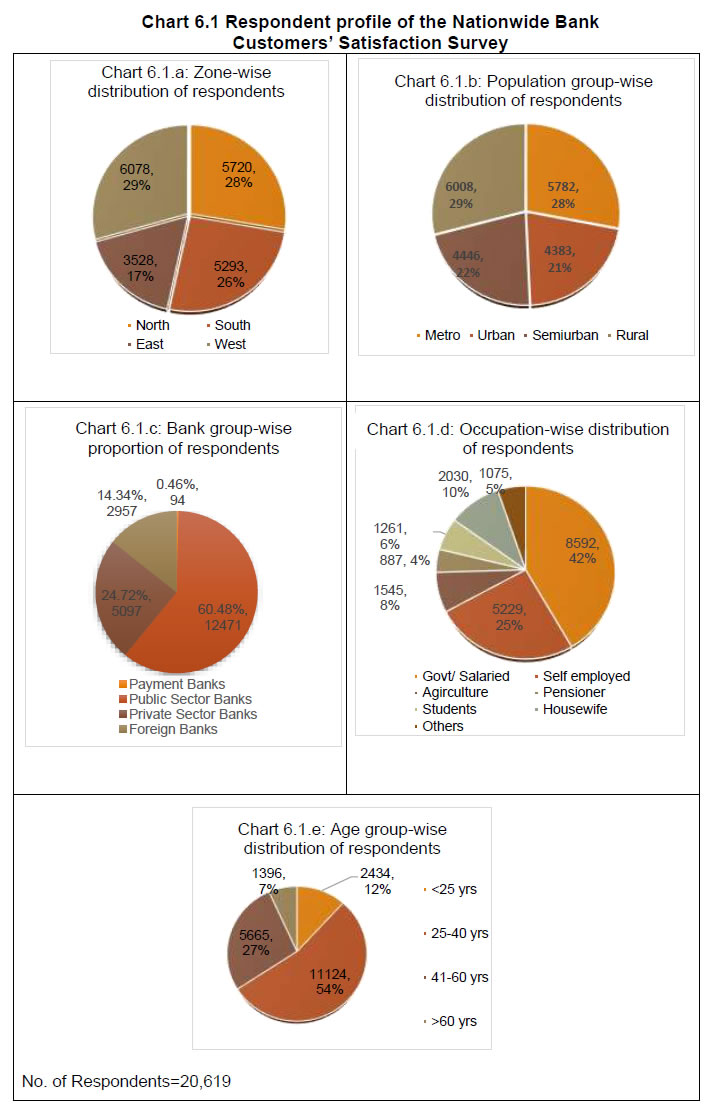

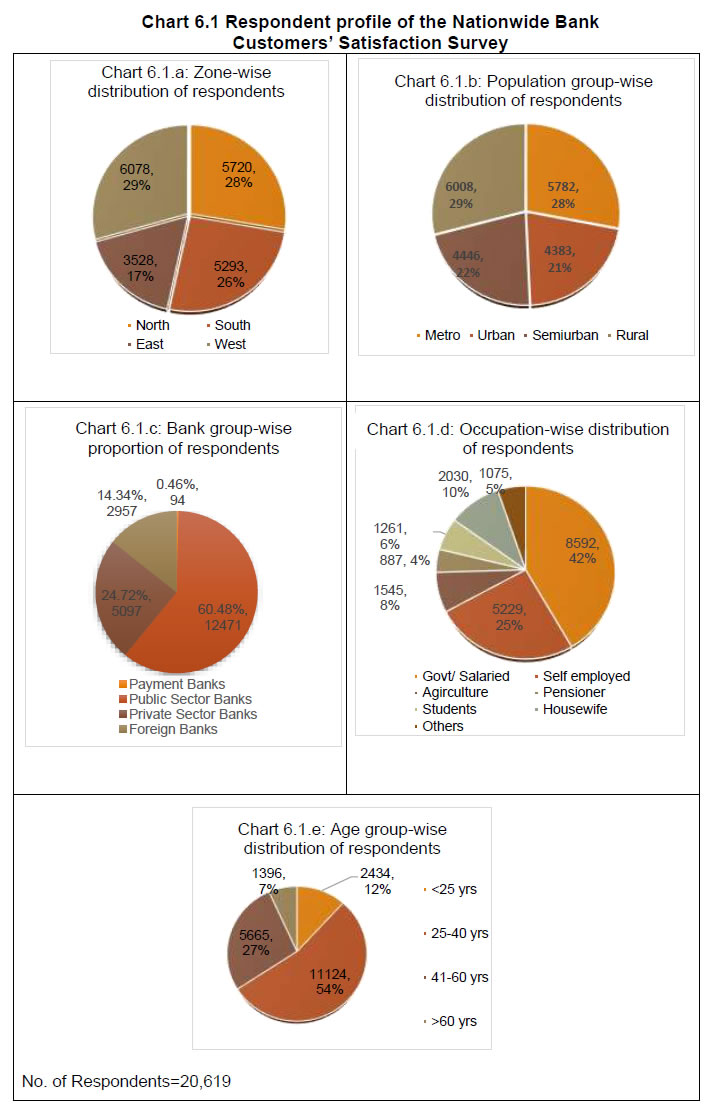

Nationwide Bank Customers’ Satisfaction Survey |

| |

Winding down of Banking Codes and Standards Board of India (BCSBI) |

| |

Way forward |

| 10. |

Appendices |

| APPENDICES |

| Appendix No. |

Appendix Title |

| Appendix 2.1 |

OBO-wise receipt of complaints in the last two years |

| Appendix 2.2 |

OBO-wise position of customer complaints handled in the last two years |

| Appendix 2.3 |

OBO-wise cost for the year July 1, 2020 to March 31, 2021 |

| Appendix 2.4 |

Mode of receipt of complaints during July 1, 2020 to March 31, 2021 |

| Appendix 2.5 |

Population group-wise distribution of complaints received during July 1, 2020 to March 31, 2021 |

| Appendix 2.6 |

Nature of complaints across population groups received during July 1, 2020 to March 31, 2021 |

| Appendix 2.7 |

Zone-wise distribution of complaints received during July 1, 2020 to March 31, 2021 |

| Appendix 2.8 |

Complainant group-wise classification of complaints received during July 1, 2020 to March 31, 2021 |

| Appendix 2.9 |

Bank group-wise classification of complaints received during July 1, 2020 to March 31, 2021 |

| Appendix 2.10 |

OBO-wise position of complaints disposed during July 1, 2020 to March 31, 2021 |

| Appendix 2.11 |

OBO-wise break-up of maintainable complaints disposed during July 1, 2020 to March 31, 2021 |

| Appendix 2.12 |

TAT of complaints disposed during July 1, 2020 to March 31, 2021 - category-wise |

| Appendix 2.13 |

Age-wise classification of pending complaints as on March 31, 2021 |

| Appendix 2.14 |

Bank-wise maintainable complaints and their mode of disposal, including through passing of Awards during July 1, 2020 to March 31, 2021 |

| Appendix 3.1 |

Complaints received by ONBFCOs during July 1, 2020 to March 31, 2021 |

| Appendix 3.2 |

Cost of handling a complaint ONBFCO-wise during July 1, 2020 to March 31, 2021 |

| Appendix 3.3 |

Mode of receipt of complaints at ONBFCOs during July 1, 2020 to March 31, 2021 |

| Appendix 3.4 |

Complainant group-wise receipt of complaints at ONBFCOs during July 1, 2020 to March 31, 2021 |

| Appendix 3.5 |

ONBFCO-wise position of complaints during July 1, 2020 to March 31, 2021 |

| Appendix 3.6 |

ONBFCO-wise position of maintainable complaints disposed during July 1, 2020 to March 31, 2021 |

| Appendix 3.7 |

Entity-wise list of maintainable complaints disposed during July 1, 2020 to March 31, 2021 |

| Appendix 4.1 |

Office-wise receipt of complaints by OODTs during July 1, 2020 to March 31, 2021 |

| Appendix 4.2 |

Mode of receipt of complaints by OODTs during July 1, 2020 to March 31, 2021 |

| Appendix 4.3 |

Zone-wise receipt of OODT complaints during July 1, 2020 to March 31, 2021 |

| Appendix 4.4 |

Complainant group-wise receipt of complaints at OODTs during July 1, 2020 to March 31, 2021 |

| Appendix 4.5 |

Office-wise receipt and disposal of complaints received at OODTs during July 1, 2020 to March 31, 2021 |

| Appendix 4.6 |

OODT-wise distribution of maintainable complaints disposed during July 1, 2020 to March 31, 2021 |

| Appendix 4.7 |

System Participant-wise distribution of maintainable complaints disposed during July 1, 2020 to March 31, 2021 |

| Appendix 4.8 |

Position of complaints pending as on March 31, 2021 at OODTs |

| Appendix 5.1 |

Position of complaints received through CPGRAMS during July 1, 2020 to March 31, 2021 |

| Appendix 5.2 |

Applications received by OBOs under RTI Act, 2005 during July 1, 2020 to March 31, 2021 |

| Appendix 6.1 |

Important notifications relating to Customer Service issued by the RBI during July 1, 2020 to March 31, 2021 |

| Appendix 6.2 |

Number of awareness programmes conducted during July 1, 2020 to March 31, 2021 |

SELECT ABBREVIATIONS

| AA |

Appellate Authority |

BO |

Banking Ombudsman |

| ADR |

Alternate Dispute Resolution |

BOS |

Banking Ombudsman Scheme |

| AFA |

Additional Factor of Authentication |

BSBDA |

Basic Savings Bank Deposit Account |

| AI |

Artificial Intelligence |

CDD |

Customer Due Diligence |

| APBS |

Aadhaar Payment Bridge System |

CEPC |

Consumer Education and Protection Cell |

| ARC |

Asset Reconstruction Company |

CEPD |

Consumer Education and Protection Department |

| ATM |

Automated Teller Machine |

CIBIL |

Credit Information Bureau of India Limited |

| BBPCU |

Bharat Bill Payment Central Unit |

CIC |

Credit Information Company |

| BBPOU |

Bharat Bill Payment Operating Unit |

CKYCR |

Central KYC Records Registry |

| BBPS |

Bharat Bill Payment System |

CMS |

Complaint Management System |

| BC |

Business Correspondent |

CNP |

Card Not Present |

| BCSBI |

Banking Codes and Standards Board of India |

CPGRAMS |

Centralised Public Grievance Redress and Monitoring System |

| CRPC |

Centralised Receipt and Processing Center |

GoI |

Government of India |

| CTS |

Cheque Truncation System |

HFC |

Housing Finance Company |

| DG |

Deputy Governor |

IMPS |

Immediate Payment System |

| DLA |

Digital Lending Application |

IO |

Internal Ombudsman |

| DO |

Dealing Official |

IRDAI |

Insurance Regulatory and Development Authority of India |

| DRBIO |

Deputy RBI Ombudsman |

IVRS |

Interactive Voice Response System |

| DSA |

Direct Selling Agent |

IWG |

Internal Working Group |

| ECS |

Electronic Clearing Service |

KYC |

Know Your Customer |

| EMI |

Equated Monthly Instalment |

MITC |

Most Important Terms and Conditions |

| FB |

Foreign Bank |

NACH |

National Automated Clearing House |

| FIDD |

Financial Inclusion and Development Department |

NBFC |

Non-Banking Financial Company |

| FPC |

Fair Practices Code |

NBFCO |

NBFC Ombudsman |

| FRC |

First Resort Complaint |

NEFT |

National Electronic Funds Transfer |

| FSWM |

Financially Sound and Well Managed |

NETC |

National Electronic Toll Collection |

| NHB |

National Housing Bank |

PML |

Prevention of Money Laundering |

| NPCI |

National Payments Corporation of India |

PPI |

Prepaid Payment Instrument |

| OBO |

Office of Banking Ombudsman |

PSO |

Payment System Operator |

| ODR |

Online Dispute Resolution |

QR |

Quick Response |

| ODT |

Ombudsman for Digital Transactions |

RBI |

Reserve Bank of India |

| ONBFCO |

Office of the NBFC Ombudsman |

RBIO |

Reserve Bank of India Ombudsman |

| OODT |

Office of Ombudsman for Digital Transactions |

RCA |

Root Cause Analysis |

| ORBIO |

Office of Reserve Bank of India Ombudsman |

RE |

Regulated Entity |

| OSDT |

Ombudsman Scheme for Digital Transactions |

RRB |

Regional Rural Bank |

| OSNBFC |

Ombudsman Scheme for NBFCs |

RTGS |

Real Time Gross Settlement |

| Pvt.SB |

Private Sector Bank |

RTI |

Right to Information |

| PB |

Payment Bank |

SBI |

State Bank of India |

| PD |

Primary Dealer |

SCB |

Scheduled Commercial Bank |

| PIN |

Personal Identification Number |

SEBI |

Securities and Exchange Board of India |

| PMAY |

Pradhan Mantri Awas Yojana |

SFB |

Small Finance Bank |

| SMS |

Short Message Service |

S-UCB |

Scheduled Urban Cooperative Bank |

| TAT |

Turn Around Time |

UPI |

Unified Payments Interface |

| TRAI |

Telecom Regulatory Authority of India |

Y-o-Y |

Year-on-Year |

| UCB |

Urban Cooperative Bank |

|

|

Foreword

M K Jain

M K Jain

Deputy Governor and Appellate Authority During the period under reference, the Covid 19 pandemic intensified the unprecedented challenges posed to the real and financial sector since its outbreak. The banking sector remained resilient supported by the extraordinary measures taken by the Central Bank and Government. Customer protection and expeditious grievance redressal assumed far greater significance during this difficult time.

On an annualised basis, a spurt of 22.27 percent was witnessed in the number of complaints received under the three Ombudsman Schemes in operation. However, during the same period, the pan India disposal rate improved to 96.59 percent from 92.52 percent in the previous year, despite the inconceivable constraints emerged from the pandemic and associated lockdown.

A vision for a simple, efficient and inclusive ombudsman framework culminated in the Reserve Bank - Integrated Ombudsman Scheme 2021 (RB-IOS) which has since been launched by the Hon’ble Prime Minister of India on November 12, 2021. The Scheme has adopted a “One Nation – One Ombudsman” approach, for all customers of RBI regulated entities. It will ensure that all customers have one platform, one email and one address to lodge, track and monitor their complaints anytime and from anywhere. The Scheme has done away with the jurisdiction of each ombudsman office. A Centralised Receipt and Processing Centre has been set up at RBI, Chandigarh for receipt and initial processing of physical and email complaints.

This Annual Report is, therefore, the last in the series under the three separate Ombudsman Schemes of RBI and thus, carries an element of legacy. I hope all stakeholders will find it useful.

(M K Jain)

EXECUTIVE SUMMARY

The Annual Report for the transition year 2020-21 has been prepared for the nine-month period, i.e., July 1, 2020 to March 31, 2021, in alignment with the change in the Financial Year of the Reserve Bank from ‘July – June’ to ‘April – March' with effect from July 1, 2020. Due to this transition, the number of complaints received during July 1, 2020 to March 31, 2021 under the Ombudsman Schemes of RBI stood at 3,03,107 complaints and fell short of the total number of complaints received during July 1, 2019 to June 30, 2020 (3,30,543) by 27,436 complaints (8.30%). On an annualized basis, the volume of complaints received under the Ombudsman Schemes has gone up by 22.27%. The overall disposal rate under the three Schemes has also improved to 96.59% as compared to 92.52% in the previous reporting period.

Banking Ombudsman Scheme (BOS)

2. The BOS was notified by RBI in 1995 under Section 35A of the Banking Regulation Act, 1949. As on date, Scheduled Commercial Banks (SCBs), Scheduled Primary Urban Co-operative Banks (UCBs), Regional Rural Banks (RRBs), Small Finance Banks (SFBs) and Payment Banks (PBs) are covered under the Scheme. It is administered by RBI through 22 Offices of Banking Ombudsman (OBOs) covering all states and union territories.

3. A brief analysis of the complaints handled under BOS during July 1, 2020 to March 31, 2021 is as follows:

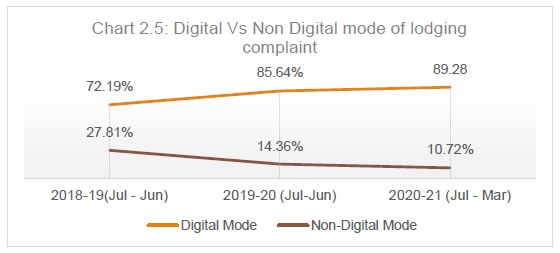

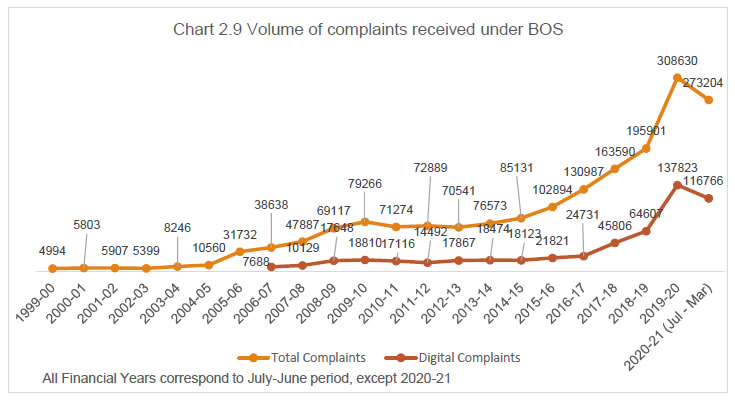

i. During the transition year July 1, 2020 to March 31, 2021, the OBOs received 2,73,204 complaints, as compared to 3,08,630 complaints during the previous year (July 1, 2019 to June 30, 2020). Of these, 89.28% were received electronically i.e., through the online portal Complaint Management System (CMS) and through email, as against 85.64% in the previous year.

ii. The disposal rate improved significantly from 92.36% during July 1, 2019 to June 30, 2020 to 96.67% during July 1, 2020 to March 31, 2021, a five-year high, despite the volume of complaints handled being higher than the previous year on an annualized basis, and the human resources remaining the same, which can be attributed to end-to-end digitization of complaint processing in CMS.

iii. Complaints related to (a) ATM/debit cards and (b) mobile/electronic banking (c) credit cards (d) failure to meet commitments and (e) non-observance of Fair Practices Code (FPC) were the top five grounds of complaints received at the OBOs. The share of ATM/debit card complaints, mobile/electronic banking and credit card complaints to total complaints received during July 1, 2020 to March 31, 2021 stood at 17.40%, 12.98% and 12.36% respectively. The corresponding percentage of complaints against these grounds during July 1, 2019 to June 30, 2020 were 21.97%, 13.38% and 9.30%, respectively.

iv. Complaints relating to credit cards, failure to meet commitments, and Direct Selling Agents (DSAs) and recovery agents increased during July 1, 2020 to March 31, 2021 vis-à-vis July 1, 2019 to June 30, 2020, with complaints related to DSAs and recovery agents registering a surge of over 60.66%.

v. Of the total maintainable complaints, the share of complaints resolved by mutual agreement i.e. through intervention of OBOs, conciliation/mediation, increased marginally from 72.34% during July 1, 2019 to June 30, 2020 to 72.73% during July 1, 2020 to March 31, 2021.

vi. The number of Appeals received against the decisions and Awards of the Banking Ombudsmen (BOs) decreased from 63 during July 1, 2019 to June 30, 2020 to 23 during July 1, 2020 to March 31, 2021. Of these, 10 Appeals were against Awards passed by the BOs and the remaining 13 were made by customers against rejection of their complaints by the BOs.

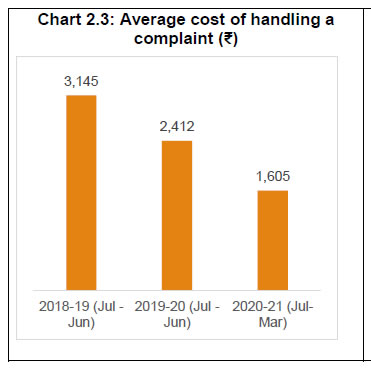

vii. The average cost of handling a complaint under the BOS decreased by 33.46%, from ₹2,412/- during July 1, 2019 to June 30, 2020 to ₹1,605/- during July 1, 2020 to March 31, 2021. The reduction in cost was on account of the increased volume of complaints handled by the same human resources, supported by the end-to-end digitization of complaint processing in CMS.

Ombudsman Scheme for Non-Banking Financial Companies (OSNBFC)

4. The OSNBFC was notified by RBI under Section 45L of the RBI Act, 1934 on February 23, 2018. The Scheme is applicable to (a) Non-Banking Financial Companies (NBFCs) which are authorised to accept deposits (NBFCs-D); and (b) Non-deposit taking NBFCs (NBFCs-ND) having customer interface, with an asset size of ₹100 crore and above, as on the date of the audited balance sheet of the previous financial year. The Scheme is administered through the Offices of the NBFC Ombudsman (ONBFCOs) in four metro centers viz. Chennai, Kolkata, Mumbai, and New Delhi for handling complaints received in the respective zones.

5. A brief analysis of the complaints handled by ONBFCOs during July 1, 2020 to March 31, 2021 is as follows:

i. The receipt of complaints at ONBFCOs stood at 26,957 during July 1, 2020 to March 31, 2021 increasing from 19,432 complaints received during July 1, 2019 to June 30, 2020. Thus, an increase of 38.72% was witnessed, despite the current period being short by a quarter. Of the complaints received during July 1, 2020 to March 31, 2021, 93.66% were received electronically, i.e. through CMS or email.

ii. Complaints related to non-adherence to FPC constituted 54.75% of the complaints received, followed by those related to non-observance of RBI directions (11.13%), and levy of charges without notice (9.44%).

iii. The disposal rate stood at 95.51% during July 1, 2020 to March 31, 2021 as compared to 95.34% July 1, 2019 to June 30, 2020.

iv. Of the total maintainable complaints, 73.69% were resolved through mutual settlement/ agreement i.e. through intervention of the ONBFCOs, conciliation/ mediation.

v. One Appeal was received against the decision of the NBFC Ombudsman (NBFCO) during July 1, 2020 to March 31, 2021.

Ombudsman Scheme for Digital Transactions (OSDT)

6. The OSDT was notified by RBI under Section 18 of the Payment and Settlement Systems Act, 2007 on January 31, 2019. The Scheme is applicable to Non-bank System Participants1 (issuers of Pre-paid Payment Instruments (PPIs)) regulated by the RBI. The Offices of Ombudsman for Digital Transactions (OODTs) function from all the existing 22 OBOs, and handle complaints of customers in their respective territorial jurisdictions.

7. A brief analysis of complaints handled by OODTs during July 1, 2020 to March 31, 2021 is as follows:

i. The number of complaints received at OODTs rose from 2,481 during July 1, 2019 to June 30, 2020 to 2,946 during July 1, 2020 to March 31, 2021 of which 99.90% were received through electronic means.

ii. Fund transfers/Unified Payments Interface (UPI)/BBPS/Bharat QR Code, mobile/electronic fund transfer and non-reversal of debit due to wrong beneficiary transfer by System Participant were the top three grounds of complaint under OSDT, 2019 with share in total complaints at 51.15%, 22.57%, and 8.18%, respectively.

iii. The disposal rate of complaints stood at 99.13% during July 1, 2020 to March 31, 2021. Of the maintainable complaints, 57.54% were disposed through mutual settlement/ agreement through intervention of the OODTs.

iv. No Appeal was received against the decisions and Awards of the Ombudsmen for Digital Transactions (ODTs) during July 1, 2020 to March 31, 2021.

Developments during the year

8. During the year, Consumer Education and Protection Department (CEPD) undertook the following initiatives for strengthening grievance redress systems:

i. A comprehensive framework for strengthening of grievance redress mechanism in banks was instituted in January 2021 comprising of:

a. Enhanced disclosures on complaints;

b. Recovery of cost of redress of complaints from banks;

c. Intensive review of grievance redress mechanism of banks.

ii. Root Cause Analysis (RCA) of the complaints received in RBI during July 1, 2020 to March 31, 2021 was undertaken to identify the major concerns and systemic issues, their root causes, and to formulate remedial measures to address the concerns.

iii. A review of the Ombudsman Schemes for updation and effective implementation, including through convergence was conducted by an In-house Committee. The recommendations covering, inter alia, convergence of the three Schemes into the Reserve Bank Integrated Ombudsman Scheme (RB-IOS), 2021, bringing all Regulated Entities (REs) with retail customer interface under the ambit of the converged Scheme, setting up of the Centralised Receipt and Processing Center (CRPC) for the receipt and initial processing of complaints, setting up of a Contact Center, revamping CMS, measures for reduction in Turn Around Time (TAT) for disposal of complaints, and improving effectiveness in resolution of consumer complaints were taken up for implementation.

iv. Education and awareness campaigns were undertaken through print and electronic media for the benefit of customers of REs/ members of public.

v. The RBI Ombudsmen conducted 15 Townhall events and 139 awareness programmes during the year. These events were focused on avenues of grievance redress and consumer protection issues.

Way forward

9. During the period under review, groundwork for the launch of RB-IOS, 2021, along with accompanying changes in the CMS have been carried out. RB-IOS, 2021 will replace the three existing Ombudsman Schemes: the BOS, the OSNBFC and, the OSDT.

10. During the year April 1, 2021 to March 31, 2022, efforts towards implementation of framework for financial education shall be made. Along with the launch of the RB-IOS, 2021 and the setting-up of CRPC, the capabilities of CMS shall be enhanced for more efficient redress and Interactive Voice Response System (IVRS) content has been enriched. A Contact Center will be set up at CRPC for better user engagement. The education and awareness efforts with a focus on consumer protection issues will be intensified. During the coming year, assessment shall be carried out as required under the circular on strengthening of grievance redress mechanism in banks dated January 27, 2021. Efforts shall be made towards consolidation of regulatory guidelines on Consumer Protection and Customer Service.

Chapter 1

Complaints received by Ombudsmen during July 1, 2020 to March 31, 2021

|

With the alignment of the Reserve Bank’s accounting year with the Government of India’s (GoI) financial year (April-March), the report for the transition year 2020-21 has been prepared for a period of nine months (July 1, 2020 to March 31, 2021). During this period, 3,03,107 complaints were received under the three Ombudsman Schemes of RBI. The overall disposal rate stood at 96.59%.

|

1.1 The Alternate Dispute Resolution (ADR) mechanism in RBI comprises of the Ombudsman framework with 22 OBOs, 4 ONBFCOs and 22 OODTs and 30 Consumer Education and Protection Cells (CEPCs). The complaints that are not covered under the three Ombudsman Schemes are presently being handled by the CEPCs.

1.2 Some highlights on the complaints handled by the Offices of the RBI Ombudsman (ORBIOs) during July 1, 2020 to March 31, 2021 are as follows:

1.3 The total volume of complaints received under all the three Ombudsman Schemes stood at 3,03,107 during the nine-month period (July 1, 2020 to March 31, 2021) as compared to 3,30,543 complaints received during July 1, 2019 to June 30, 2020. The office-wise number of complaints during the transition period is given in Table 1.1.

| Table 1.1 – Office-wise distribution of complaints received by ORBIOs during July 1, 2020 to March 31, 2021 |

| Ombudsman Office |

BOS |

OSDT |

OSNBFC |

Total complaints 2020-21 (Jul-Mar) |

Annualized 2020-21 (12 months) |

| East Zone |

| Bhubaneshwar |

5,678 |

114 |

|

5,792 |

7,723 |

| Guwahati |

2,678 |

43 |

|

2,721 |

3,628 |

| Kolkata |

11,817 |

176 |

2,047 |

14,040 |

18,720 |

| Patna |

12,560 |

162 |

|

12,722 |

16,963 |

| Ranchi |

3,797 |

30 |

|

3,827 |

5,103 |

| Total |

36,530 |

525 |

2,047 |

39,102 |

52,136 |

| % share to All India |

13.37% |

17.82% |

7.59% |

12.90% |

|

| North Zone |

| Chandigarh |

28,019 |

93 |

|

28,112 |

37,483 |

| Dehradun |

6,324 |

33 |

|

6,357 |

8,476 |

| Jaipur |

17,636 |

207 |

|

17,843 |

23,791 |

| Jammu |

1,368 |

21 |

|

1,389 |

1,852 |

| Kanpur |

21,169 |

173 |

|

21,342 |

28,456 |

| New Delhi-I |

18,767 |

245 |

|

19,012 |

25,349 |

| New Delhi-II |

16,057 |

104 |

10,712 |

26,873 |

35,831 |

| New Delhi-III |

8,416 |

62 |

|

8,478 |

11,304 |

| Total |

1,17,756 |

938 |

10,712 |

1,29,406 |

1,72,541 |

| % share to All India |

43.10% |

31.84% |

39.74% |

42.69% |

|

| South Zone |

| Bengaluru |

13,535 |

242 |

|

13,777 |

18,369 |

| Chennai |

16,098 |

124 |

5,845 |

22,067 |

29,423 |

| Hyderabad |

17,088 |

225 |

|

17,313 |

23,084 |

| Thiruvananthapuram |

5,678 |

12 |

|

5,690 |

7,587 |

| Total |

52,399 |

603 |

5,845 |

58,847 |

78,463 |

| % share to All India |

19.18% |

20.47% |

21.68% |

19.41% |

|

| West Zone |

| Ahmedabad |

17,223 |

112 |

|

17,335 |

23,113 |

| Bhopal |

12,377 |

259 |

|

12,636 |

16,848 |

| Mumbai-I |

18,629 |

173 |

|

18,802 |

25,069 |

| Mumbai-II |

15,215 |

292 |

8,353 |

23,860 |

31,813 |

| Raipur |

3,075 |

44 |

|

3,119 |

4,159 |

| Total |

66,519 |

880 |

8,353 |

75,752 |

1,01,003 |

| % share to All India |

24.35% |

28.97% |

30.99% |

24.99% |

|

| All India Total |

2,73,204 |

2,946 |

26,957 |

3,03,107 |

4,04,143 |

1.4 The number of complaints received electronically i.e., through email/online mode stood at 89.77%. A total of 1,85,092 complaints were found to be maintainable under the three Ombudsman Schemes, of which, 72.67% were resolved through mutual settlement/ agreement. A total of 65 Awards were issued by the Ombudsmen and 24 Appeals were received across the three schemes.

1.5 On an annualized basis, the total number of complaints received during the year under the three Ombudsman Schemes stood at 4,04,143, showing an increase of 22.27% over the previous year.

1.6 The average cost of handling a complaint under the three Ombudsman Schemes during July 1, 2020 to March 31, 2021 stood at ₹1,599/- per complaint.

1.7 Detailed analysis of the complaint receipt and disposal is presented in Chapters 2, 3 and 4.

Chapter 2

The Banking Ombudsman Scheme (BOS), 2006 (as amended upto July 1, 2017):

Activities during July 1, 2020 to March 31, 2021

|

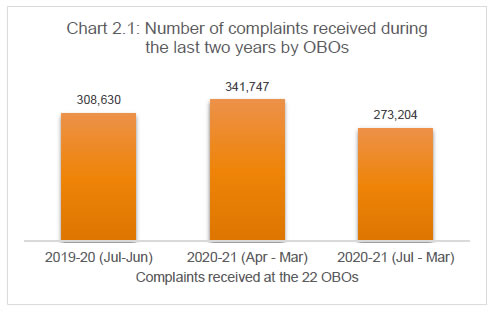

The number of complaints received at the 22 OBOs during 2020-21 i.e. July 1, 2020 to March 31, 2021 stood at 2,73,204 complaints, compared to 3,08,630 complaints received during July 1, 2019 to June 30, 2020. As the transition year 2020-21 comprised of nine months, for the purpose of Year-on-Year (Y-o-Y) comparisons in absolute terms, the report compares the data for the period April 1, 2020 to March 31, 2021 as against the numbers reported in the previous financial year, i.e., July 1, 2019 to June 30, 2020. Accordingly, on a Y-o-Y comparison, the number of complaints received by the OBOs during April 1, 2020 to March 31, 2021 was 3,41,747. This marks an increase of 10.73% over July 1, 2019 to June 30, 2020. The rate of disposal of complaints improved from 92.36% during July 1, 2019 to June 30, 2020 to 96.67% during July 1, 2020 to March 31, 2021. Complaints relating to digital modes of transactions were the highest, constituting 42.74% of the total complaints received. Majority (72.73%) of the maintainable complaints were resolved through mutual settlement/conciliation/ mediation. During July 1, 2020 to March 31, 2021, 59 Awards were issued against banks by the BOs. Twenty-three Appeals were received against the decisions of the BOs, of which 10 Appeals were against Awards passed by the BOs and the remaining 13 were made by customers against rejection of their complaints by the BOs.

|

Receipt of complaints

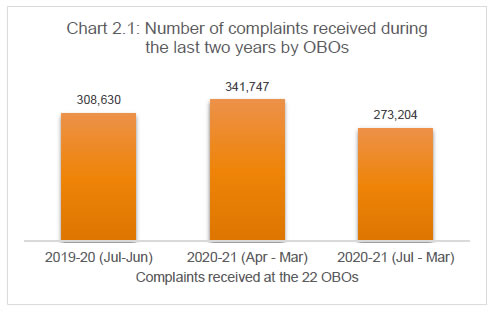

2.1 During July 1, 2020 to March 31, 2021, 2,73,204 complaints were received at the OBOs. As the transition year 2020-21 comprised of nine months, for the purpose of Year-on-Year (Y-o-Y) comparisons in absolute terms, the report compares the data for the period April 1, 2020 to March 31, 2021 as against the numbers reported in the previous financial year, i.e., July 1, 2019 to June 30, 2020. Accordingly, on a Y-o-Y basis, an increase of 10.73% was recorded in the receipt of complaints during April 1, 2020 to March 31, 2021 compared to the previous year July 1, 2019 to June 30, 2020. The year-wise number of complaints received at OBOs in last two years is given in Chart 2.1.

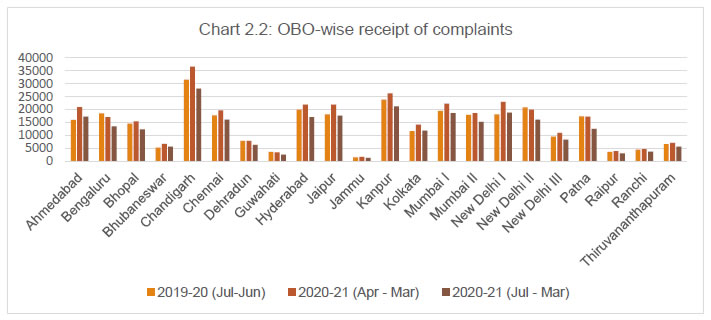

2.2 The OBO-wise receipt of complaints, given at Appendix 2.1, shows that OBO, Chandigarh received the maximum number of complaints (28,019) during July 1, 2020 to March 31, 2021, accounting for 10.26% of the total complaints; followed by OBO, Kanpur (21,168) and OBO-I, New Delhi (18,767) accounting respectively for 7.75% and 6.87% of total complaints received by the 22 OBOs.

2.3 A comparative position of complaints received by OBOs during July 1, 2020 to March 31, 2021 against July 1, 2019 to June 30, 2020 is given in Chart 2.2.

2.4 The number of complaints handled by the OBOs during July 1, 2020 to March 31, 2021 stood at 3,02,4912 against 3,20,699 handled during July 1, 2019 to June 30, 2020. The position of customer complaints handled by OBOs during the periods, July 1, 2019 to June 30, 2020 and July 1, 2020 to March 31, 2021 is given at Appendix 2.2.

2.5 During July 1, 2020 to March 31, 2021, in line with the trend observed over the last three years, the average cost of handling a complaint improved from ₹2,412/- to ₹1,605/- as depicted in Chart 2.3 and Table 2.1.

| Table 2.1 - Cost of handling a complaint |

| Year → |

2018-19 (Jul – Jun) |

2019-20 (Jul - Jun) |

2020-21 (Jul- Mar) |

| Total Cost (₹ Crore) |

63.55 |

77.36 |

48.55 |

| No of complaints handled |

2,02,083 |

3,20,699 |

3,02,491 |

| Average cost per complaint (₹) |

3,145 |

2,412 |

1,605 |

2.6 The OBO-wise cost of handling a complaint during July 1, 2020 to March 31, 2021 is given at Appendix 2.3. The average cost of redress has improved significantly on account of end-to-end digitization of complaint processing in CMS which has enabled deployment of staff across offices eliminating physical constraints. However, considering the other fixed costs involved, the offices having lesser inflow of complaints continue to incur higher cost of handling a complaint. The variance in costs across offices will be reduced to a large extent with the launch of RB-IOS, 2021 which is drawn on ‘One Nation One Ombudsman’ approach.

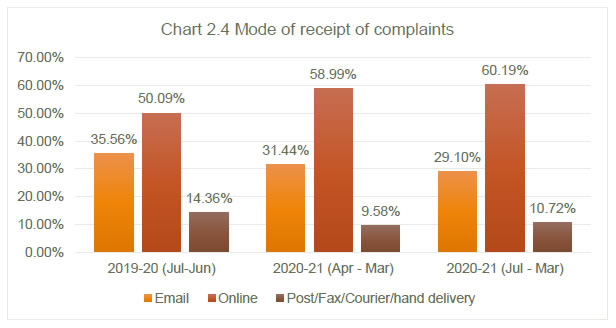

Mode of receipt of complaints

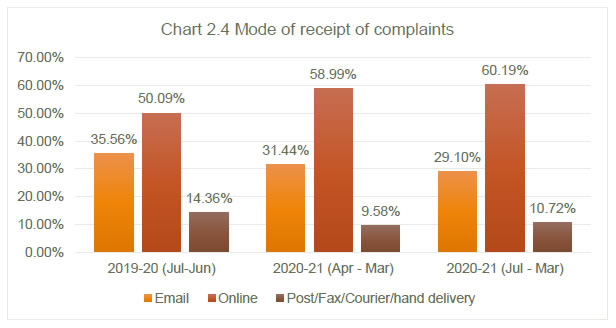

2.7 Complaints were received in the OBOs predominantly through online modes i.e., the CMS, including receipt of complaints through the Centralized Public Grievance Redress and Monitoring System (CPGRAMS)3, the GoI portal for receipt and monitoring of complaints from the public. The other modes of receipt were e-mails, hand delivery, post, courier and fax. With the launch of CMS in June 2019, physical lodgment of complaints declined from 14.36% of the total complaints received during July 1, 2019 to June 30, 2020 to 10.72% of the total complaints received during July 1, 2020 to March 31, 2021. A comparative position of the various modes through which the complaints were received during the last two years is given at Appendix 2.4 and depicted in Chart 2.4 below:

2.8 CMS has eased the complaint lodging process compared to the earlier portal, reflecting a steady increase in the volume of complaint being lodged through CMS. This is also attributed to intensive awareness campaigns undertaken by the RBI. During July 1, 2020 to March 31, 2021, 89.28% of the complaints were filed using the digital mode, of which 29.09% were through e-mails and 60.19% were using CMS. The trend of percentage of digital versus non-digital modes of lodgment of complaints for the last three years is given in Chart 2.5 below.

Population group-wise distribution of complaints

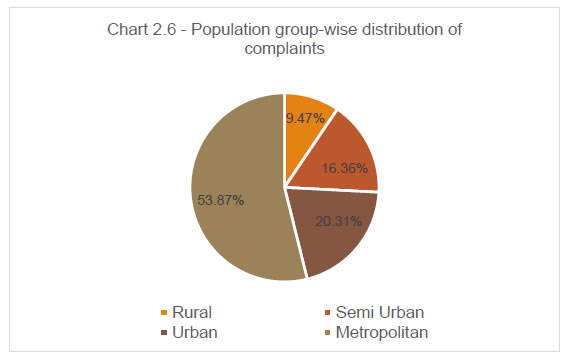

2.9 On a Y-o-Y basis, the number of complaints received from metropolitan areas increased by 20.13% over the previous year. Complaints from rural areas saw a rise of 6.20% while complaints from semi-urban and urban areas were up marginally by 0.77% and 0.45%, respectively. The population group-wise distribution of complaints received during July 1, 2020 to March 31, 2021 is given in Chart 2.6 below and in Appendix 2.5.

2.10 Under each of the grounds of complaint listed under the BOS, the maximum number of complaints were received from metropolitan centres, followed by urban, semi-urban and rural centres, in general, as given in Appendix 2.6.

Zone-wise distribution of complaints

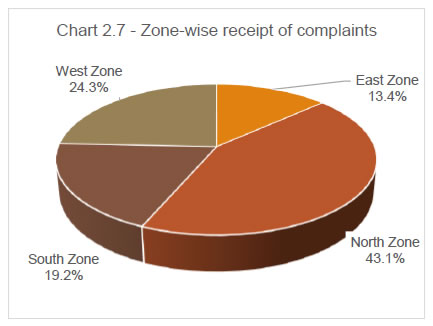

2.11 Continuing the trend and owing to huge volume of complaints received at OBOs of Chandigarh and New Delhi, the North zone accounted for the maximum share of complaints (43.10%) in 2020-21, followed by the West zone (24.35%) and the South zone (19.18%). East zone (13.37%) continued with least share of complaints. In terms of growth of complaints, the West zone registered the highest Y-o-Y growth at 13.51%, followed by North zone (12.65%) and East zone (9.00%). South zone witnessed growth of 4.73%. The zone-wise distribution of complaints received during July 1, 2020 to March 31, 2021 is depicted in Chart 2.7 below and Appendix 2.7.

Complainant group-wise classification of complaints

2.12 Individual customers (excluding senior citizens) accounted for 82.68% of complainants during July 1, 2020 to March 31, 2021, followed by individual business (3.63%), senior citizens (2.92%) and limited companies (2.20%). Appendix 2.8 provides the complainant group-wise classification of complaints.

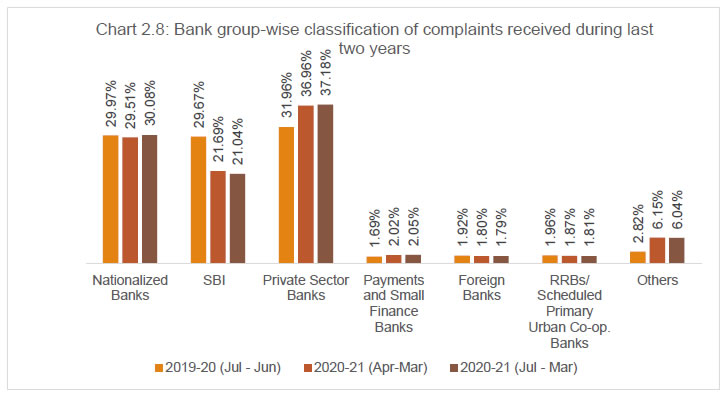

Bank group-wise classification of complaints

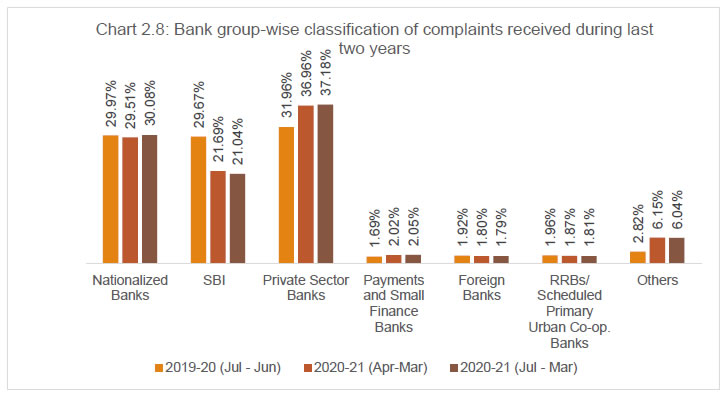

2.13 The bank group-wise classification of complaints received by OBOs during the last two years is indicated in Chart 2.8

2.14 The share of total complaints received against SBI declined from 29.67% during July 1, 2019 to June 30, 2020 to 21.04% during July 1, 2020 to March 31, 2021 which is accompanied by rise in the share of Private Sector Banks (Pvt.SBs) from 31.96% during July 1, 2019 to June 30, 2020 to 37.18% during July 1, 2020 to March 31, 2021. The RRBs and Scheduled Primary UCBs together, in line with their smaller presence, accounted for 1.81% of the total complaints, while complaints against the PBs and SFBs stood at 2.05% this year. The share of complaints against FBs declined from 1.92% during July 1, 2019 to June 30, 2020 to 1.79% during July 1, 2020 to March 31, 2021 and complaints against entities that are not covered under the BOS, 2006 increased from 2.82% during July 1, 2019 to June 30, 2020 to 6.04% during July 1, 2020 to March 31, 2021. The bank group-wise classification of complaints received is detailed at Appendix 2.9.

Nature of complaints handled

2.15 Clause 8 of the BOS, 2006 specifies the grounds under which a customer can file a complaint before a BO. Table 2.2 categorizes complaints received on the grounds of deficiency in banking services as specified under Clause 8 of the BOS.

| Table 2.2 – Category-wise distribution and share of complaints received at OBOs during last two years |

| Complaint Category |

2019-20

(Jul – Jun) |

2020-21*

(Apr - Mar) |

2020-21

(Jul – Mar) |

| ATM / debit cards |

67,800 |

60,203 |

47,546 |

| 21.97% |

17.62% |

17.40% |

| Mobile / electronic banking |

41,310 |

44,385 |

35,458 |

| 13.38% |

12.99% |

12.98% |

| Credit cards |

28,713 |

40,721 |

33,762 |

| 9.30% |

11.92% |

12.36% |

| Failure to meet commitments |

25,036 |

35,999 |

29,090 |

| 8.11% |

10.53% |

10.65% |

| Non-observance of FPC |

36,215 |

33,898 |

27,849 |

| 11.73% |

9.92% |

10.19% |

| Levy of charges without prior notice |

18,558 |

20,949 |

16,514 |

| 6.01% |

6.13% |

6.04% |

| Loans and advances |

16,437 |

20,218 |

16,043 |

| 5.33% |

5.92% |

5.87% |

| Non-adherence to BCSBI Codes |

14,194 |

14,490 |

9,935 |

| 4.60% |

4.24% |

3.64% |

| Deposit accounts related |

8,778 |

8,580 |

6,881 |

| 2.84% |

2.51% |

2.52% |

| Pension payments |

6,307 |

4,966 |

3,990 |

| 2.04% |

1.45% |

1.46% |

| Remittances |

4,045 |

3,394 |

2,676 |

| 1.31% |

0.99% |

0.98% |

| DSAs and recovery agents |

1,406 |

2,440 |

2,259 |

| 0.46% |

0.71% |

0.83% |

| Para banking |

1,117 |

1,236 |

1,027 |

| 0.36% |

0.36% |

0.38% |

| Notes and coins |

514 |

332 |

253 |

| 0.17% |

0.10% |

0.09% |

| Others |

29,204 |

39,686 |

31,688 |

| 9.46% |

11.61% |

11.60% |

| Out of purview of BOS |

8,996 |

10,250 |

8,233 |

| 2.91% |

3.00% |

3.01% |

| Total |

3,08,630 |

3,41,747 |

2,73,204 |

Note: Figures in % indicate the percentage to total complaints of the respective years

* Includes data pertaining to April 1, 2020 to June 30, 2020 which overlaps with the last quarter of the year, July 1, 2019 to June 30, 2020 |

2.16 During July 1, 2020 to March 31, 2021, complaints related to ATM/debit cards were the highest, followed by those related to mobile/ electronic banking, and credit cards.

2.17 The share of ATM/debit card related complaints to total complaints declined from 21.97% during July 1, 2019 to June 30, 2020 to 17.40% during July 1, 2020 to March 31, 2021. Of the ATM/debit card complaints, a major sub-category was ‘Account debited but cash not dispensed by ATMs’ with a share of 53.07% (Table 2.3).

| Table 2.3 Breakup of ATM/ Debit Card complaints |

| Sub-category |

2019-20

(Jul – Jun) |

2020-21*

(Apr-Mar) |

2020-21

(Jul – Mar) |

| Non-payment of cash / account debited but cash not dispensed by ATMs |

31,832 |

31,904 |

25,235 |

| 10.31% |

9.34% |

9.24% |

| Debit in account without use of the card or details of the card |

15,752 |

10,966 |

8,504 |

| 5.10% |

3.21% |

3.11% |

| Use of stolen / cloned cards |

7,511 |

5,187 |

3,929 |

| 2.43% |

1.52% |

1.44% |

| Account debited more than once for one withdrawal in ATMs or for POS transaction |

2,687 |

2,286 |

1,829 |

| 0.87% |

0.67% |

0.67% |

| Short payment of cash / less or excess amount of cash dispensed by ATMs |

1,613 |

1,267 |

1,017 |

| 0.52% |

0.37% |

0.37% |

| Others |

8,405 |

8,593 |

7,032 |

| 2.72% |

2.51% |

2.57% |

| Sub-total |

67,800 |

60,203 |

47,546 |

| 21.97% |

17.62% |

17.40% |

| Total complaints received |

3,08,630 |

3,41,747 |

2,73,204 |

Note: Figures in % indicate percentage to total number of complaints of respective years

* Includes data pertaining to April 1, 2020 to June 30, 2020 which overlaps with the last quarter of the year, July 1, 2019 to June 30, 2020 |

2.18 The share of complaints relating to digital transactions (mobile/electronic banking, ATM/debit cards and credit cards) declined slightly from 44.65% during July 1, 2019 to June 30, 2020 to 42.74% during July 1, 2020 to March 31, 2021.

2.19 Complaints relating to ‘loans and advances’ constituted 5.87% of the total complaints received and generally pertained to delay in sanction, disbursement, non-observance of prescribed time schedule for disposal of loan applications, non-acceptance of application without valid reason, etc.

2.20 During July 1, 2020 to March 31, 2021, 1.46% of the total complaints received were related to ‘pension payments’ as compared to 2.04% in the previous year. This decline is seen in absolute number as well. The BOs emphasize upon the banks to deal with grievances of the pensioners in a more sensitive manner. Continuous efforts are being made for improving the services for the senior citizens.

2.21 During July 1, 2020 to March 31, 2021, 3.01% of the complaints were ‘out of purview’ of the BOS, 2006 and the share of such complaints stood at 2.91% during July 1, 2019 to June 30, 2020.

2.22 Complaints under the category ‘others’ increased from 9.46% during July 1, 2019 to June 30, 2020 to 11.60% during July 1, 2020 to March 31, 2021 as detailed in Table 2.4.

| Table 2.4 – Break-up of complaints in ‘others’ category |

| Sub-category |

2019-20

(Jul - Jun) |

2020-21*

(Apr - Mar) |

2020-21

(Jul – Mar) |

| i. Non-adherence to RBI directives on: |

|

|

|

| I. Banking or other services |

3,944 |

6,727 |

5,076 |

| 1.28% |

1.97% |

1.86% |

| II. Interest rates (loans and advances) |

1,946 |

2,435 |

1,943 |

| 0.63% |

0.71% |

0.71% |

| III. Any other direction or instruction as may be specified by the RBI on loans and advances and other matters |

15,002 |

17,396 |

13,800 |

| 4.86% |

5.09% |

5.05% |

| ii. Non-adherence to prescribed working hours |

945 |

1,131 |

898 |

| 0.31% |

0.33% |

0.33% |

| iii. Refusal to accept or delay in accepting payment towards taxes as required by RBI/ Govt. |

429 |

398 |

340 |

| 0.14% |

0.12% |

0.12% |

| iv. Refusal to issue or delay in issuing or failure to service or delay in servicing or redemption of Government securities |

355 |

501 |

405 |

| 0.12% |

0.15% |

0.15% |

| v. Other matters specified by RBI |

6,583 |

11,098 |

9,226 |

| 2.13% |

3.25% |

3.38% |

| Sub-total |

29,204 |

39,686 |

31,688 |

| 9.46% |

11.61% |

11.60% |

| Total number of complaints received |

3,08,630 |

3,41,747 |

2,73,204 |

Note: Figures in % indicate percentage to total complaints of the respective years

* Includes data pertaining to April 1, 2020 to June 30, 2020 which overlaps with the last quarter of the year, July 1, 2019 to June 30, 2020 |

2.23 The growth in the volume of complaints over the years is shown in Chart 2.9. As may be observed, the rate of growth of complaints in OBOs has risen sharply over the last four years.

Disposal of complaints

2.24 Table 2.5 indicates a comparative position of disposal of complaints by OBOs.

| Table 2.5 - Comparative position of disposal of complaints by OBOs |

| Number of Complaints |

2019-20

(Jul – Jun) |

2020-21

(Jul - Mar) |

| Received during the year |

3,08,630 |

2,73,204 |

| Brought forward from previous year |

12,069 |

24,498 |

| Complaints received by email before June 30, 2020 but registered as complaints after July 1, 2020 and complaints transferred from CEPCs on or later than July 1, 2020 |

- |

4,789 |

| Handled during the year |

3,20,699 |

3,02,491 |

| Disposed during the year |

2,96,201 |

2,92,409 |

| Rate of Disposal (%) |

92.36% |

96.67% |

| Carried forward to the next year |

24,498 |

10,082 |

| Complaints pending for less than one month (30 days) |

6,086 |

6,543 |

| Complaints pending for one to two months |

3,223 |

1,864 |

| Complaints pending for two to three months |

1,833 |

848 |

| Complaints pending for more than three months |

13,356 |

827 |

2.25 Table 2.5 indicates that the disposal of complaints rose by 4.31% during July 1, 2020 to March 31, 2021. This efficiency improvement can be attributed to end-to-end digitization of complaint processing in CMS and efforts put in by the OBOs. The OBO-wise position of complaints disposed during July 1, 2020 to March 31, 2021 is given at Appendix 2.10.

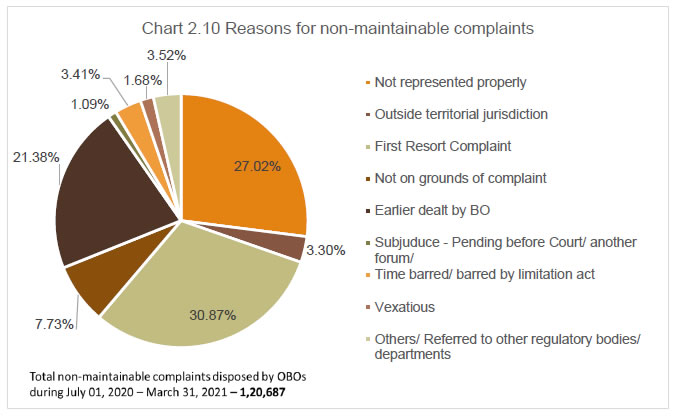

2.26 The pendency percentage improved from 7.64% during July 1, 2019 to June 30, 2020 to 3.33% during July 1, 2020 to March 31, 2021, with 10,082 complaints pending at the end of the year. It is worth noting that the volume of complaints handled and disposed have improved despite the pandemic and consequent periods of lockdowns in different parts of the country. The non-maintainable4 complaints fell to 39.90% of the total complaints handled during July 1, 2020 to March 31, 2021 as compared to 45.76% during July 1, 2019 to June 30, 2020. The reasons for complaints found non-maintainable during July 1, 2020 to March 31, 2021 are given in Chart 2.10.

2.27 It is observed that complaints were disposed of as non-maintainable largely due to i) the complaint being First Resort Complaints (FRCs); (ii) complaints not being represented properly; and iii) complaints having already been dealt with by the BO.

2.28 FRCs are those complaints which are received by the OBOs without the complainant having approached the concerned bank first. These complaints were sent to the respective banks for direct disposal at their end. Complainants were, however, advised through closure letters that they could approach the OBOs again in case they are not satisfied with the decision of the bank.

Mode of disposal of maintainable complaints

2.29 ‘Maintainable’ complaints are those that are made to the BO, relating to the grounds of complaint specified in Clause 8 of the BOS, 2006, as amended upto July 1, 2017 and are in line with the requirements laid down in the Scheme. The Scheme envisages settlement of complaints by agreement through conciliation and/or mediation. If the parties fail to arrive at an agreement, the BO gives a decision, which includes passing an Award against the bank. The OBO-wise distribution of maintainable complaints is given at Appendix 2.11

2.30 Table 2.6 depicts the mode of disposal of maintainable complaints under the BOS, 2006. The share of maintainable complaints disposed by way of mutual settlement/agreement increased marginally from 72.34% during July 1, 2019 to June 30, 2020 to 72.73% during July 1, 2020 to March 31, 2021

| Table 2.6 - Mode of disposal of maintainable complaints |

| Disposal of maintainable complaints |

2019-20

(Jul - Jun) |

2020-21

(Jul - Mar) |

| By Mutual Settlement/ Agreement |

1,25,836 |

1,24,900 |

| 72.34% |

72.73% |

| Disposal by Award |

68 |

59 |

| 0.04% |

0.03% |

| Maintainable Complaints Rejected |

47,873 |

46,566 |

| 27.52% |

27.12% |

| Maintainable Complaints Withdrawn |

181 |

197 |

| 0.10% |

0.11% |

| Total |

1,73,958 |

1,71,722 |

| Note: Figures in % indicate the percentage to maintainable complaints disposed during the respective periods. |

Turn Around Time (TAT) of complaints

2.31 The time taken by BOs to dispose a complaint declined significantly from 95 days during July 1, 2019 to June 30, 2020 to 55 days during July 1, 2020 to March 31, 2021. The TAT pertaining to all the complaint categories showed a substantial decline, which is mainly due to resolving of the technical glitches faced during the initial period of CMS transition, i.e., during June to December 2019, and stabilization of CMS during January to March 2020. The CMS aided in uninterrupted operations throughout the year, despite the pandemic. The ground-wise TAT is given at Appendix 2.12.

Grounds for rejection of maintainable complaints

2.32 The grounds for rejection of maintainable complaints and their proportion to total complaints received over the past two years are indicated in Table 2.7.

| Table 2.7- Grounds for rejection of maintainable complaints |

| Ground for rejection |

No. of complaints rejected |

2019-20

(Jul - Jun) |

2020-21

(Jul - Mar) |

| Not on grounds of complaint (Clause 8) - Clause 13(a) |

46,237 |

44,994 |

| 96.58% |

96.62% |

| Not in accordance with provisions of Clause 9 (3) - Clause 13(b) |

983 |

946 |

| 2.05% |

2.03% |

| Beyond pecuniary jurisdiction of BO - Clause 12 (5) & (6) - Clause 13(c) |

147 |

142 |

| 0.31% |

0.30% |

| Requiring elaborate documentary and oral evidence - Clause 13 (d) |

28 |

50 |

| 0.06% |

0.11% |

| Complaints without sufficient cause - Clause 13(e) |

195 |

23 |

| 0.41% |

0.05% |

| Not pursued by the complainants - Clause 13(f) |

27 |

81 |

| 0.06% |

0.17% |

| No loss/ damage/ inconvenience to the complainant - Clause 13 (g) |

44 |

11 |

| 0.09% |

0.02% |

| The complaint pertains to the same cause of action, for which any proceedings before any court, tribunal or arbitrator or any other forum is pending – Clause 13(2) |

212 |

319 |

| 0.44% |

0.69% |

| Total maintainable complaints rejected |

47,873 |

46,566 |

| Note: Figures in % indicate percentage to total maintainable complaints rejected during the respective periods. |

2.33 As seen in Table 2.7 above, the maximum rejections were on the ground that the complaint was ‘not on the grounds of complaint (Clause 8)’ or ‘not filed in accordance with required provisions of Clause 9 (3)’, accounting for 98.65% of the rejected maintainable complaints during July 1, 2020 to March 31, 2021.

Age-wise classification of pending complaints

2.34 Although the BOS, 2006 does not specify any time limit for resolution of complaints by OBOs, efforts are made to resolve the same within two months. However, due to reasons such as non-submission and/or delay in submission of complete information by complainants/banks, the time taken for resolution may get extended in some cases. The BOs and the Principal Nodal Officers (PNOs) of banks are advised/sensitized to ensure that complaints are resolved within 60 days. The age-wise classification of the number of pending complaints as on March 31, 2021 is detailed at Appendix 2.13.

Awards issued

2.35 During the year, 59 Awards were issued by BOs of which 57 were implemented within the stipulated time. The bank-wise mode of disposal of complaints, including passing of Awards and their implementation is given in Appendix 2.14.

Appeals against the decisions of the BOs

2.36 The Deputy Governor (DG) -in-Charge of CEPD, RBI is designated as the Appellate Authority (AA)5 as per the provisions of BOS, 2006. The CEPD provides the secretariat to the AA. During the year, 23 Appeals were received during July 1, 2020 to March 31, 2021 as compared to 63 Appeals during July 1, 2019 to June 30, 2020. Of these, 13 Appeals were received from complainants whereas 10 were filed by the banks. With 47 Appeals pending from the previous year, the AA handled 70 Appeals during July 1, 2020 to March 31, 2021. Twenty-six Appeals were disposed during July 1, 2020 to March 31, 2021 and 44 were pending at the close of the period under review.

2.37 The position of Appeals handled by the AA during the last two years and the OBO-wise position of Appeals received during July 1, 2020 to March 31, 2021 is given in Tables 2.8 and 2.9, respectively.

| Table 2.8 - Position of Appeals as on March 31, 2021 |

| Particulars |

2019-20

(Jul- Jun) |

2020-21

(Jul - Mar) |

| Appeals pending at the beginning of the year |

72 |

47 |

| Appeals received during the year from complainants |

34 |

13 |

| Appeals received during the year from banks |

29 |

10 |

| Total Appeals handled during the year |

135 |

70 |

| Appeals disposed during the year |

88 |

26 |

| Appeals pending at the end of the year |

47 |

44 |

| Mode of Disposal |

| Appeals remanded to the BO |

4 |

2 |

| Appeals withdrawn / settled / infructuous |

14 |

5 |

| Appeals rejected |

43 |

9 |

| Appeals allowed |

27 |

10 |

| Appeals Disposed |

| i. In favour of complainant appellant |

29 |

10 |

| ii. In favour of banks |

21 |

5 |

| iii. Neither in favour of complainant appellant nor in favour of banks (Remanded back to BO / infructuous) |

38 |

11 |

| Table 2.9 – OBO-wise position of Appeals received during July 1, 2020 to March 31, 2021 |

| OBO |

No of Appeals received in 2020-21 (Jul – Mar) |

| Ahmedabad |

1 |

| Bangalore |

0 |

| Bhopal |

2 |

| Bhubaneswar |

0 |

| Chandigarh |

3 |

| Chennai |

6 |

| Dehradun |

3 |

| Guwahati |

1 |

| Hyderabad |

0 |

| Jaipur |

0 |

| Jammu |

0 |

| Kanpur |

2 |

| Kolkata |

0 |

| Mumbai-I |

1 |

| Mumbai-II |

0 |

| New Delhi-I |

3 |

| New Delhi-II |

0 |

| New Delhi-III |

0 |

| Patna |

0 |

| Raipur |

1 |

| Ranchi |

0 |

| Thiruvananthapuram |

0 |

| Total |

23 |

Chapter 3

The Ombudsman Scheme for Non-Banking Financial Companies (OSNBFC), 2018:

Activities during July 1, 2020 to March 31, 2021

|

The number of complaints received by the four ONBFCOs during July 1, 2020 to March 31, 2021 stood at 26,957 complaints as compared to 19,432 received during July 1, 2019 to June 30, 2020. As the transition year 2020-21 comprised of nine months, for the purpose of Y-o-Y comparisons in absolute terms, the report compares the data for the period April 1, 2020 to March 31, 2021 as against the numbers reported in the previous financial year, i.e., July 1, 2019 to June 30, 2020. The number of complaints received during April 1, 2020 to March 31, 2021 was 36,951, registering an increase of 90.16% over July 1, 2019 to June 30, 2020. Complaints relating to non-adherence to FPC were the highest, constituting 54.75% of the total complaints received. Majority (73.69%) of the maintainable complaints were resolved through conciliation/ mediation. During the year, six Awards were issued by NBFCOs. One Appeal was received against the decision of the NBFCO.

|

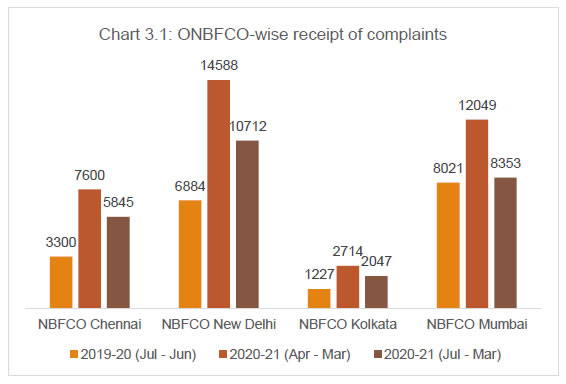

Receipt of complaints

3.1 The OSNBFC is administered through four ONBFCOs located at Chennai, Kolkata, Mumbai, and New Delhi, which handle complaints of South, East, West and North zones, respectively covering the entire country.

3.2 During July 1, 2020 to March 31, 2021, 26,957 complaints were received at the ONBFCOs. As the transition year 2020-21 comprised of nine months, for the purpose of Y-o-Y comparisons in absolute terms, the report compares the data for the period April 1, 2020 to March 31, 2021 as against the numbers reported in the previous financial year, i.e., July 1, 2019 to June 30, 2020. The receipt of complaints during April 1, 2020 to March 31, 2021 showed a 90.16% increase over the previous year July 1, 2019 to June 30, 2020. The year-wise number of complaints received at ONBFCOs in last two years is given in Appendix 3.1.

3.3 Of the 26,957 complaints received by the ONBFCOs during July 1, 2020 to March 31, 2021, ONBFCO, New Delhi accounted for the maximum (39.74%), followed by ONBFCO, Mumbai (30.99%), ONBFCO, Chennai (21.68%) and ONBFCO, Kolkata (7.59%). A comparison of the number of complaints received by the respective ONBFCOs during the last two years is given in Chart 3.1.

Cost of handling a complaint

3.4 During the year July 1, 2020 to March 31, 2021, under the OSNBFC, 2018, the average cost of handling a complaint stood at ₹1,692/-. Cost of handling a complaint ONBFCO-wise is detailed at Appendix 3.2.

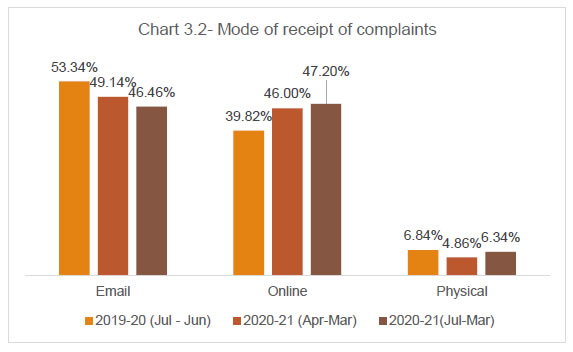

Mode of receipt of complaints

3.5 The ONBFCOs receive complaints through various modes, viz. through the CMS portal, e-mail, post/ registered post, hand delivery, courier, fax, etc. The number of complaints received through different modes during the previous two years is indicated in Appendix 3.3 and Chart 3.2.

3.6 During July 1, 2020 to March 31, 2021, 12,724 (47.20%) complaints were received through CMS and CPGRAMS. Complaints received through e-mail stood at 12,523 (46.46%) while physical sources like post/courier/fax/hand delivery accounted for 1,710 complaints (6.34%). Electronic mode accounted for the 93.66% of the total complaints received.

Complainant group-wise classification of complaints

3.7 Individual customers constituted the largest segment (52.30%) of complainants during July 1, 2020 to March 31, 2021, while 0.34% of the total complaints were lodged by senior citizens. The complainant group-wise classification of complaints is given at Appendix 3.4.

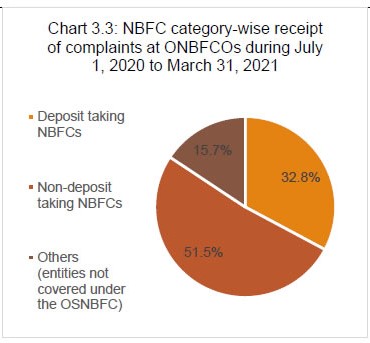

NBFC category-wise complaints received

3.8 Of the total complaints received during July 1, 2020 to March 31, 2021, 8,841 (32.80%) complaints were against NBFCs-D, while 13,890 (51.53%) complaints were against NBFCs-ND. Complaints against entities not covered under the OSNBFC, at 4,226, accounted for 15.68% of the complaints lodged at the ONBFCOs. Such complaints were forwarded to the regulators concerned like National Housing Bank (NHB), Securities and Exchange Board of India (SEBI), Insurance Regulatory and Development Authority of India (IRDAI), etc. The NBFC category-wise classification of complaints received by ONBFCOs during the last two years is indicated at Table 3.1 and Chart 3.3 below:

| Table 3.1 NBFC category-wise receipt of complaints during July 1, 2020 to March 31, 2021 |

| NBFC Category |

Complaints |

% Share |

| Deposit taking NBFCs |

8,841 |

32.80% |

| Non-deposit taking NBFCs |

13,890 |

51.53% |

| Others (entities not covered under the OSNBFC) |

4,226 |

15.68% |

| Total |

26,957 |

100% |

Nature of complaints received

3.9 Clause 8 of the OSNBFC, 2018, specifies 13 grounds regarding deficiency in NBFC services against which a customer can file a complaint before the NBFCO. The complaints received under various grounds of deficiency in services of NBFCs are furnished in Table 3.2 below:

| Table 3.2: Category-wise distribution of complaints |

| Complaint category |

2019-20

(Jul – Jun) |

2020-21*

(Apr - Mar) |

2020-21

(Jul - Mar) |

| Non-adherence to FPC |

7,052 |

17,915 |

14,758 |

| 36.29% |

48.48% |

54.75% |

| Non-observance of RBI directions |

3,607 |

6,114 |

2,999 |

| 18.56% |

16.55% |

11.13% |

| Levy of charges without prior notice |

1,628 |

3,189 |

2,544 |

| 8.38% |

8.63% |

9.44% |

| Non-transparency in contract/ loan |

1,704 |

1,833 |

1,280 |

| 8.77% |

4.96% |

4.75% |

| Delay in repayment of deposits |

395 |

536 |

406 |

| 2.03% |

1.45% |

1.51% |

| Delay in release of securities/ documents |

268 |

417 |

354 |

| 1.38% |

1.13% |

1.31% |

| No communication about loan sanctioned |

399 |

375 |

314 |

| 2.05% |

1.01% |

1.16% |

| Delay in payment of interest |

232 |

386 |

259 |

| 1.19% |

1.04% |

0.96% |

| Non-understandable or no adequate notice on terms and conditions |

82 |

145 |

114 |

| 0.42% |

0.39% |

0.42% |

| Non-understandable or non-issuance of sanction letter/ terms |

49 |

85 |

67 |

| 0.25% |

0.23% |

0.25% |

| Not covered under Clause 8 of the Scheme |

474 |

1,169 |

962 |

| 2.44% |

3.16% |

3.57% |

| Others |

3,542 |

4,787 |

2,900 |

| 18.23% |

12.95% |

10.76% |

| Total |

19,432 |

36,951 |

26,957 |

Note: Figures in % indicate percentage share to total complaints received

* Includes data pertaining to April 1, 2020 to June 30, 2020 which overlaps with the last quarter of the year, July 1, 2019 to June 30, 2020 |

3.10 During July 1, 2020 to March 31, 2021, complaints pertaining to non-adherence to FPC constituted the largest share i.e., 54.75% of the complaints received, followed by non-observance of RBI directions to NBFCs at 11.13% and levy of charges without prior notice (9.44%).

3.11 Complaints under the category ‘others’, at 10.76%, also took a significant share of the total complaints received. The break-up for the ‘others’ category is detailed in Table 3.3.

| Table 3.3: Break-up of complaints in ‘others’ category |

| Sub-Category |

2019-20

(Jul – Jun) |

2020-21*

(Apr - Mar) |

2020-21

(Jul - Mar) |

| Failure on commitments |

855 |

899 |

489 |

| 4.40% |

18.78% |

16.86% |

| Loans & Advances |

286 |

381 |

231 |

| 1.47% |

7.96% |

7.97% |

| Delay in presentation of Post-dated Cheques |

76 |

122 |

81 |

| 0.39% |

2.55% |

2.79% |

| Recovery agent related |

65 |

38 |

28 |

| 0.33% |

0.79% |

0.97% |

| Non-adherence to BCSBI Code |

58 |

39 |

23 |

| 0.30% |

0.81% |

0.79% |

| Other matters specified by RBI |

2,202 |

3,308 |

2,048 |

| 11.33% |

69.10% |

70.62% |

| Sub-total |

3,542 |

4,787 |

2,900 |

| 18.23% |

12.95% |

10.76% |

| Total number of complaints received |

19,432 |

36,951 |

26,957 |

Note: Figures in % indicate percentage share to 'others'

* Includes data pertaining to April 1, 2020 to June 30, 2020 which overlaps with the last quarter of the year, July 1, 2019 to June 30, 2020 |

Disposal of Complaints

3.12 During July 1, 2020 to March 31, 2021, ONBFCOs handled 29,351 complaints, as against 19,468 complaints handled during July 1, 2019 to June 30, 2020. Out of 29,351 complaints 28,032 complaints were disposed by the end of the year, achieving a disposal rate of 95.51%. The position of complaints handled by ONBFCOs is tabulated in Table 3.4 below:

| Table 3.4: Position of customer complaints handled by ONBFCOs |

| Particulars |

2019-20

(Jul – Jun) |

2020-21

(Jul – Mar) |

| Complaints brought forward from the previous year |

36 |

908 |

| Complaints received during the year |

19,432 |

26,957 |

| Complaints of 2019-20 transferred from CEPCs during 2020-21 and email complaints received before June 30, 2020 but converted into complaints later than June 30, 2020 |

- |

1,486 |

| Total number of complaints handled during the year |

19,468 |

29,351 |

| Complaints disposed during the year |

18,560 |

28,032 |

| Percentage of disposal |

95.34% |

95.51% |

| Complaints pending at the end of the year |

908 |

1,319 |

| Complaints pending for less than one month |

380 |

659 |

| Complaints pending for one to two months |

187 |

365 |

| Complaints pending for two to three months |

60 |

98 |

| Complaints pending for more than three months |

281 |

197 |

3.13 The status of complaints received and disposed under the OSNBFC, 2018 office- wise during July 1, 2020 to March 31, 2021 is given at Appendix 3.5.

3.14 Complaints that are not on the grounds specified in Clause 8 of the OSNBFC, complaints where the procedure for filing the complaint as laid down in Clause 9 and 9A of the OSNBFC is not followed or complaints received against entities not registered with RBI, etc. are classified as ‘non-maintainable’ complaints. Of the complaints handled during July 1, 2020 to March 31, 2021, 11,832 (40.31%) of the complaints were disposed as maintainable. The NBFCO-wise position of maintainable complaints disposed is given in Appendix 3.6.

Mode of disposal of maintainable complaints

3.15 The mode of disposal of maintainable complaints is indicated in Table 3.5 below:

| Table 3.5- Mode of disposal of maintainable complaints by ONBFCOs |

| Mode of disposal |

2019-20

(Jul - Jun) |

2020-21

(Jul - Mar) |

| Mutual settlement/ agreement |

4,045 |

8,719 |

| |

71.12% |

73.69% |

| Complaints withdrawn |

1 |

0 |

| |

0.02% |

0% |

| Awards issued |

0 |

6 |

| |

0% |

0.05% |

| Rejected |

1,641 |

3,107 |

| |

28.85% |

26.26% |

| Total maintainable complaints |

5,687 |

11,832 |

| Note: Figures in % indicate percentage to maintainable complaints |

3.16 During July 1, 2020 to March 31, 2021, a major portion of the maintainable complaints disposed (73.69%) was closed under Clause 11 of the OSNBFC, which states that the grievances raised by the complainant have been resolved by the NBFC through mutual settlement/agreement with the intervention of the Ombudsman. Further, 26.26% of the complaints were rejected; and 6 Awards were issued during the year, July 1, 2020 to March 31, 2021.

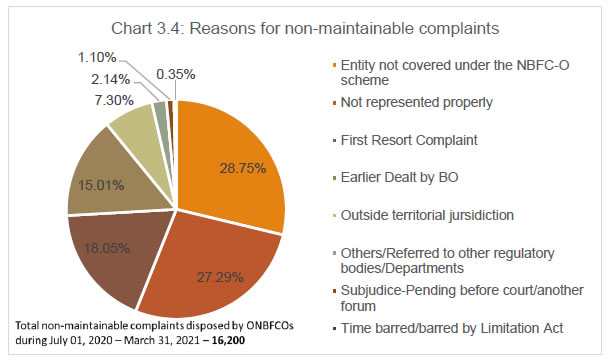

3.17 The non-maintainable complaints formed a sizeable portion (55.19%) of the complaints handled during July 1, 2020 to March 31, 2021. The grounds under which the complaints were determined as non-maintainable are given in Chart 3.4. It may be observed that complaints were determined as non-maintainable largely due to i) entity not being covered under the OSNBFC (ii) complaints not being represented properly or (iii) the complaints being FRCs.

3.18 The NBFC-wise list of maintainable complaints disposed during the year July 1, 2020 to March 31, 2021 is given in Appendix 3.7.

Appeals against the decisions of NBFCOs

3.19 The OSNBFC provides an appellate mechanism under which, the complainant as well as the NBFC, can Appeal against the decision or Award of the Ombudsman, to the AA designated under the Scheme. Appeal can be made against the closure of a complaint provided it has been closed under the appealable clauses of the Scheme, for the reasons referred to in Sub Clauses (c) to (f) of Clause 13; and against an Award under Clause 12 of the Scheme. The DG-in-Charge of the CEPD is the designated AA. The secretarial assistance to the AA is provided by the CEPD. During July 1, 2020 to March 31, 2021, one Appeal was received, which was under process, at the end of the year, as detailed in Table 3.6.

| Table 3.6: Position of Appeals – ONBFCOs |

| Particulars |

2020-21

(Jul - Mar) |

| Appeals pending at the beginning of the year |

1 |

| Appeals received during the year from complainants |

1 |

| Appeals received during the year from NBFCs |

0 |

| Total Appeals handled during the year |

2 |

| Appeal disposed during the year |

1 |

| Pending at the end of the year |

1 |

| Mode of Disposal: |

| Appeals remanded |

0 |

| Appeals withdrawn/ settled/ infructuous |

0 |

| Appeals rejected |

1 |

| Appeals allowed |

0 |

| Appeals Disposed: |

| In favour of complainants |

1 |

| In favour of NBFCs |

0 |

| Neither in favour of complainants nor in favour of NBFCs (remanded back /infructuous) |

0 |

Chapter 4

Ombudsman Scheme for Digital Transactions (OSDT), 2019:

Activities during July 1, 2020 to March 31, 2021

|

The number of complaints received by the 22 OODTs during July 1, 2020 to March 31, 2021 was 2,946, compared to 2,481 complaints received during July 1, 2019 to June 30, 2020. As the year 2020-21 was observed with just nine months, for the ease of Y-o-Y comparison in absolute terms, the report compares the data for the period April 1, 2020 to March 31, 2021 as against July 1, 2019 to June 30, 2020. Accordingly, on a Y-o-Y comparison, the number of complaints received during April 1, 2020 to March 31, 2021 was 3,594 registering an increase of 44.86% over July 1, 2019 to June 30, 2020. The rate of disposal of complaints stood at 99.13% during July 1, 2020 to March 31, 2021. Complaints pertaining to fund transfers/ UPI/ BBPS/ Bharat QR Code constituted the largest share of complaints i.e. 51.15%. The majority (57.54%) of maintainable complaints were resolved through mutual agreement/ conciliation /mediation. Complaints relating to digital modes of transactions were the highest, constituting 93.52% of the total complaints received. During the year, no Awards were issued under the OSDT. No Appeal was received against the decisions of the ODTs.

|

4.1 The OSDT, 2019 is administered through the 22 offices where the OBOs are situated.

Receipt of complaints

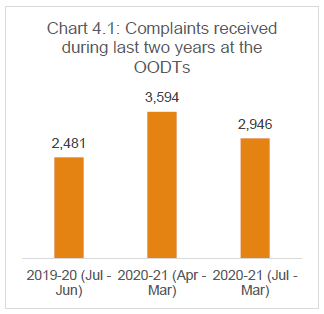

4.2 During July 1, 2020 to March 31, 2021, 2,946 complaints were received at the OODTs. The transition year 2020-21 comprised of nine months. Therefore, for the purpose of Y-o-Y comparisons in absolute terms, the report compares the data for the period April 1, 2020 to March 31, 2021 as against the numbers reported in the previous financial year, i.e., July 1, 2019 to June 30, 2020. The receipt of complaints during April 1, 2020 to March 31, 2021, showed a 44.86% increase over the previous year when compared to July 1, 2019 to June 30, 2020. The year-wise number of complaints received at OODTs in last three years is given in Chart 4.1 and Table 4.1.

| Table 4.1 - Number of complaints received by OODTs during last two years |

| |

2019-20

(Jul-Jun) |

2020-21*

(Apr-Mar) |

2020-21

(Jul-Mar) |

| No. of OODTs |

22 |

22 |

22 |

| Complaints received |

2,481 |

3,594 |

2,946 |

| * Includes data pertaining to April 1, 2020 to June 30, 2020 which overlaps with the last quarter of the year, July 1, 2019 to June 30, 2020 |

4.3 During July 1, 2020 to March 31, 2021, 3,203 complaints were handled by OODTs, of which, 99.13% complaints were disposed at the end of the year. The position of customer complaints handled by OODTs is tabulated in Table 4.2 below:

| Table 4.2 - Position of customer complaints handled by OODTs |

| Particulars |

2019-20

(Jul – Jun) |

2020-21

(Jul - Mar) |

| Complaints brought forward from previous year |

53 |

230 |

| Complaints received by email before June 30, 2020 but registered as complaints after July 1, 2020 and complaints transferred from CEPCs on or later than July 1, 2020 |

- |

27 |

| Complaints received |

2,481 |

2,946 |

| Total number of complaints handled |

2,534 |

3,203 |

| Complaints disposed |

2,304 |

3,175 |

| Rate of disposal (%) |

90.92% |

99.13% |

| Complaints pending at the end of the year |

230 |

28 |

| Complaints pending for less than one month |

31 |

18 |

| Complaints pending for one to two months |

20 |

3 |

| Complaints pending for two to three months |

23 |

2 |

| Complaints pending for more than three months |

156 |

5 |

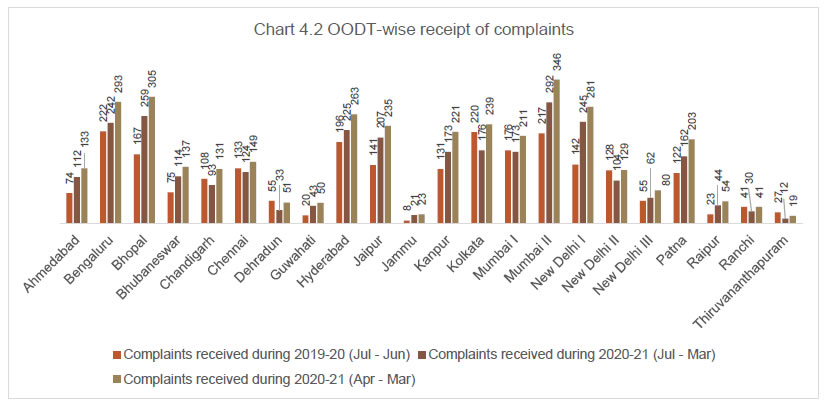

4.4 Of the 2,946 complaints received by the OODTs, OODT-II, Mumbai received the maximum number of complaints (292), which accounted for 9.91% of the total complaints received by the OODTs, followed by OODT, Bhopal (259) and OODT-I, New Delhi (245). OODT, Thiruvananthapuram (12) received the least share of complaints with 0.41%. office-wise receipt of complaints at OODTs is given at Appendix 4.1.

4.5 A comparative position of complaints received by OODTs during the last two years is given in Chart 4.2.

Mode of receipt of complaints

4.6 During July 1, 2020 to March 31, 2021, 99.90% (2,943) of the complaints were lodged through digital mode using the CMS portal/ email/ CPGRAMS. This reflects the tech-savvy nature of the users of digital financial products who are more comfortable in filing their complaints online as compared to other modes. Only three complaints were received through the physical mode during the year. A comparative position of the various modes through which the complaints were received during July 1, 2020 to March 31, 2021 is depicted in Chart 4.3, with details provided at Appendix 4.2.

Zone-wise distribution of complaints

4.7 The North zone accounted for the maximum complaints (31.84%) during July 1, 2020 to March 31, 2021, followed by the West zone (29.87%) and the South zone (20.47%). The East zone accounted for the least share i.e. 17.82% of the total complaints received. The zone-wise distribution of complaints received is given at Appendix 4.3 and depicted in Chart 4.4 below.

Complainant group-wise classification

4.8 Individual customers constituted the largest segment (76.75%) of complainants during July 1, 2020 to March 31, 2021. Senior citizens accounted for 0.81% of the total complaints. The complainant group-wise classification of complaints is given at Appendix 4.4.

Entity type-wise classification

4.9 The entity type-wise classification of complaints received by OODTs during July 1, 2020 to March 31, 2021 is indicated in Chart 4.5 and Table 4.3 below.

4.10 In tune with the size of their network and business, PPIs had the highest share of complaints accounting for 85.81% of the total complaints, followed by Bharat Bill Payment Central Unit (BBPCU)/ Bharat Bill Payment Operating Unit (BBPOU) with 4.18% share in total complaints. Other entities accounted for 10.01% of total complaints.

| Table 4.3: Entity type-wise break-up of complaints received at OODTs during July 1, 2020 to March 31, 2021 |

| Entity |

2020-21

(Jul- Mar) |

| Prepaid Payment Instruments |

2,528 |

| 85.81% |

| BBPCU/ BBPOU |

123 |

| 4.18% |

| Others |

295 |

| 10.01% |

| Note: Figures in % indicate percentage to total complaints |

Nature of complaints handled

4.11 Clause 8 of the Scheme specifies the grounds on which a customer can file a complaint before the Ombudsman. Table 4.4 categorizes complaints received on the grounds of deficiency in digital banking services as specified under Clause 8 of the OSDT, 2019.

| Table 4.4 – Category-wise distribution of complaints |

| Category |

2019-20

(Jul - Jun) |

2020-21*

(Apr - Mar) |

2020-21

(Jul - Mar) |

| Fund Transfers/ UPI/ BBPS/ Bharat QR Code |

1,089 |

1,775 |

1,507 |

| 43.89% |

49.39% |

51.15% |