IST,

IST,

IV. Price Situation

|

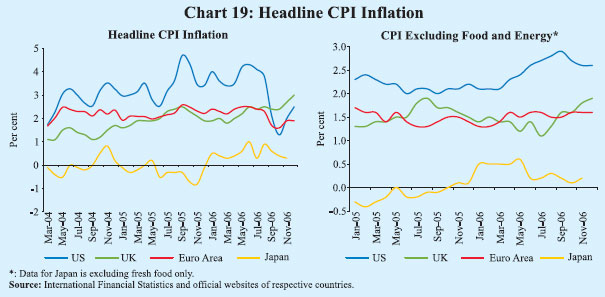

Headline inflation in major advanced economies eased during September-October 2006-07 in tandem with the softening of international crude oil prices. However, inflation again increased during November-December 2006 and core inflation still remains at elevated levels in many economies. Many central banks continued with pre-emptive monetary tightening to mitigate the second round effects, especially in the face of continuing strong demand. Several central banks such as the European Central Bank (ECB), the Bank of England, the Reserve Bank of Australia and the South African Reserve Bank have raised their policy rates since end-September 2006. The US Fed, however, has left its rates unchanged since end-June 2006 in view of slowing down of economic activity. In India, prices of primary food articles and manufactured products posed upward pressures on headline inflation during the quarter. Wholesale price inflation was 6.0 per cent as on January 13, 2007 as compared with 4.1 per cent at end-March 2006. Pre-emptive monetary and fiscal measures along with the moderation in fuel prices could have helped to some extent in containing inflationary expectations, although underlying inflationary pressures remain. Measures of consumer price inflation remain at elevated levels, mainly reflecting the impact of food prices. Global Inflation Headline inflation in major advanced economies eased during September-October 2006 on the back of base effects as well as the sharp decline in international crude oil prices but again rose during November-December 2006 (Chart 19). Consumer price inflation in the OECD countries moderated from 3.2 per cent in June 2006 to 1.7 per cent in October 2006 before rising to 2.1 per cent in November 2006. Amongst major economies, headline inflation in the US eased from 4.3 per cent in June 2006 to 1.3 per cent in October 2006 before increasing to 2.5 per cent in December 2006. Similarly, in the euro area, inflation which remained above the target of ‘below but close to 2.0 per cent’ till August 2006, moderated to 1.6 per cent in October 2006 before increasing again to 1.9 per cent in December 2006. Notwithstanding some moderation in headline inflation, core inflation still remains firm in major economies. CPI inflation (excluding food and energy) was 2.6 per cent in the US in December 2006 (2.2 per cent a year ago) and 2.2 per cent in November 2006 (1.9 per cent a year ago) in the OECD countries. Many central banks have, therefore, continued to tighten monetary policies in order to contain inflation and inflationary expectations, especially in view of continued strength of demand and possible stronger pass-through of past increases in oil prices.

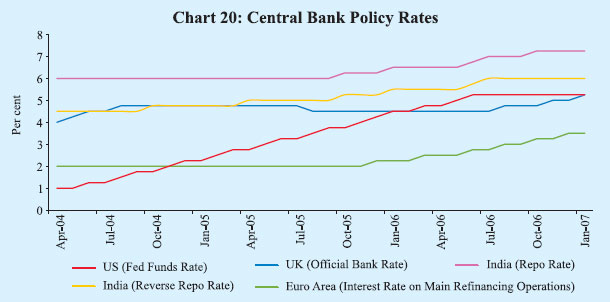

The US Fed has paused at each of its three meetings held since end-June 2006, after having raised its target federal funds rate by 425 basis points since the tightening began in June 2004 (Chart 20 and Table 25). Economic growth has moderated from its strong pace earlier this year, partly reflecting a cooling of the housing market. Although core inflation has remained elevated in recent months, and the high level of resource utilisation has the potential to sustain inflation pressures, the Fed sees inflation pressures likely to moderate over time, reflecting reduced impetus from energy prices, contained inflation expectations, and the cumulative effects of monetary policy actions and other factors restraining aggregate demand. The Federal Open Market Committee has indicated that the

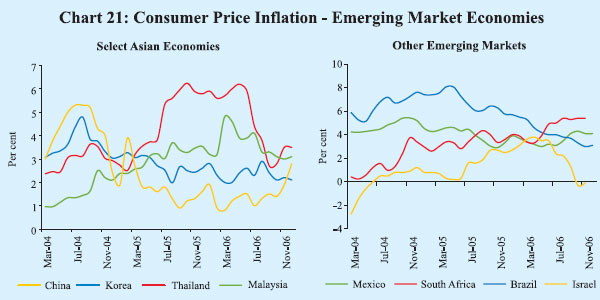

extent and timing of any additional firming, that may be needed to address the inflation risks, will depend on the evolution of the outlook for both inflation and economic growth, as implied by incoming information. In the euro area, notwithstanding some easing in inflation from August 2006, risks to the price outlook are seen on the upside due to the possibility of stronger pass-through of past oil price rises, the possibility of renewed oil price increases, additional increases in administered prices and indirect taxes and stronger than currently expected wage developments. The European Central Bank (ECB), therefore, raised the key policy rate by 25 basis points each in October and December 2006 – a total increase of 150 basis points since the tightening began in December 2005 – to keep medium to long-term inflation expectations in the euro area anchored to levels consistent with price stability. In the UK, CPI Inflation increased from 2.4 per cent in September 2006 to 3.0 per cent in December 2006. In view of strong economic activity, limited spare capacity, rapid growth of broad money and credit, continued rise in asset prices and expectations about inflation remaining above the target in the near term, the Bank of England raised its policy rate by 25 basis points each in August 2006, November 2006 and January 2007 to 5.25 per cent. The Reserve Bank of Australia raised its policy rate further by 25 basis points in November 2006 to 6.25 per cent – a total increase of 75 basis points since May 2006 – in response to strong economic activity and underlying inflation pressures. In Japan, the Bank of Japan (BoJ) has kept the uncollateralised overnight call rate (adopted as the operating target of monetary policy since March 2006) unchanged since July 14, 2006, when the rate was increased by 25 basis points. Inflation remains relatively modest in several economies in Asia, reflecting both pre-emptive monetary tightening over the past 18 months as well as appreciation of the exchange rates. However, there is an emerging concern regarding excess liquidity arising particularly from large external capital flows. Consumer price inflation in China increased to 2.8 per cent in December 2006 from 1.9 per cent a year ago (Chart 21). Real GDP growth remains strong, although it exhibited some deceleration in the second half of 2006 from the pace recorded in the first half of 2006. Nonetheless, growth during the calendar year

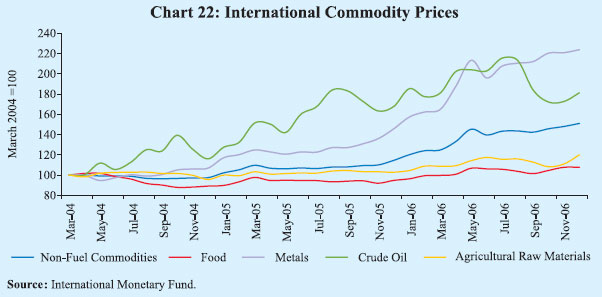

2006 at 10.7 per cent exceeded that of 10.4 per cent in the previous year. Growth in fixed investment decelerated in 2006, but still remains large. In view of stronger growth in money supply and credit, the People's Bank of China increased the benchmark 1-year lending rate by 27 basis points each in April 2006 and August 2006. It has also raised the cash reserve ratio by 200 basis points since July 2006 in four steps - 50 basis points each effective July 5, 2006, August 15, 2006, November 15, 2006 and January 15, 2007 - to 9.5 per cent. Since the beginning of 2006, the Government has also introduced a series of industrial structure adjustments and trade policies - such as terminating/lowering the export tax rebate for non-ferrous metals and scraps - to curb the export of high energy-consuming and high-polluting sectors and resources. In response to the sharp rise in foreign investment in the real estate sector and the purchase of housing by overseas institutions and individuals, measures were taken by the authorities in July 2006 to regulate foreign investment in China's real estate market. The Monetary Policy Committee of the People's Bank of China has suggested that measures should be taken to strengthen macro-management, maintain continuity and stability of various macroeconomic policies, boost domestic demand, control investment growth at a reasonable level and improve investment structure. The Committee has indicated that efforts will be made to keep money and credit growth at an appropriate level and promote optimal credit structure. The managed floating exchange rate regime will be further improved in a self-initiated, controllable and gradual manner to give market supply and demand a fundamental role in the formation of RMB exchange rate and keep RMB exchange rate broadly stable at an adaptive and equilibrium level. In Korea, exports continue to show steady growth, while private consumption is exhibiting a slowdown in the pace of its expansion. Real GDP growth moderated to 4.0 per cent in the quarter ended December 2006 from 4.8 per cent in the preceding quarter and 5.3 per cent a year ago. Consumer price inflation and core inflation both remain stable. The Bank of Korea has, therefore, kept its policy rate unchanged at 4.5 per cent since August 2006 (after having raised the rates by 125 basis points since the tightening began in October 2005). However, monetary and credit aggregates, and financial institutions liquidity have witnessed a sharp growth, led by inflows of foreign funds. The Bank of Korea, therefore, decided to increase the average reserve requirement ratio by widening the difference in reserve requirement ratios between short-term and long-term deposits. The reserve requirement ratio on demand deposits and money market deposit accounts was increased from 5.0 per cent to 7.0 per cent, effective December 23, 2006. The cash reserve ratio on time deposits, instalment savings deposits, mutual instalment deposits, housing instalment deposits, and certificates of deposits was kept unchanged at 2.0 per cent, while long-term time and savings deposits were exempted from the existing 1.0 per cent requirement. Following this adjustment, the average reserve requirement ratio has risen from 3.0 per cent to 3.8 per cent. As a result of the adjustment in the cash reserve ratio, the Bank of Korea expects that the pace of liquidity expansion will slow. It also expects that the short-term bias of financial institutions' deposit structures will lessen, as incentives for long-term deposits are strengthened in response to the widened gap between reserve requirement ratios on long-term and short-term deposits. In Thailand, latest economic indicators point towards a slowdown in domestic demand. In particular, consumption and investment in the first two months of the fourth quarter of 2006 showed a continued moderation from the previous quarter. Real GDP growth was 4.7 per cent in the quarter ended September 2006 as compared with 5.3 per cent a year ago. Inflationary pressures are also expected to moderate, particularly from lower oil prices, significantly reducing the chances that core inflation will exceed the target band over the next two years. On balance, inflationary pressures have moderated, while the risks to growth have increased. Therefore, Thailand lowered the 1-day repurchase rate from 4.94 per cent to 4.75 per cent, effective January 17, 2007. From this day, the 1-day repurchase rate replaced the 14-day repurchase rate as the policy rate. Thailand had earlier raised the policy rate by 275 basis points between June 2005 and June 2006. In order to discourage speculative short-term capital flows and to help maintain stability in the Thai baht with the objective of sustaining long-run growth in the Thai economy, the Bank of Thailand (BoT) on December 18, 2006 decided to impose unremunerated reserve requirement (URR) of 30 per cent on short-term capital flows. However, on December 19, 2006, the BoT exempted investments in stock markets from the URR. Foreign exchange transactions related to current account activities, including transactions related to exchange of goods, services, income, transfers and aid are also exempted from the URR. Foreign direct investment (defined as investments by non-residents in resident entities where the investor owns at least 10 per cent of the equity capital and has managerial power) is also exempt from the URR. Foreign currencies bought or exchanged against baht for the following transactions are subject to the URR: (i) investments in debt securities transacted from December 19, 2006 onwards; and, (ii) foreign currency borrowings transacted from December 19, 2006 onwards. In Indonesia, economic activity, after showing some weakening in early 2006 as a result of falling public purchasing power in the wake of the October 2005 fuel price hike, has gradually regained momentum. Growth in 2006 was driven primarily by rapidly expanding exports and also by consumption. From the second half of 2005 to April 2006, the tightening of monetary policy pursued by Bank Indonesia succeeded in curbing rising inflation expectations. Inflation, which had reached 18.4 per cent in November 2005, eased sharply to 6.6 per cent in December 2006 with the easing of oil prices and the base effect. In Indonesia, the policy rate has, therefore, been cut by 325 basis points since May 2006 to 9.50 per cent to support growth. The Bank Indonesia had earlier raised policy rates by 425 basis points during July-December 2005. Amongst other emerging economies, South Africa raised the policy rates further by 50 basis points each in October and December 2006 to 9.0 per cent (a total increase of 200 basis points since June 2006) to contain inflationary pressures emanating from volatility in oil prices and from food and services prices. Turkey has kept rates unchanged since August 2006 on the back of slowdown in domestic demand and moderation in inflation expectations. Turkey had earlier increased its policy rate by 425 basis points during June-July 2006 on concerns over the possible pass-through effect of the exchange rate movements arising from the volatility in international financial markets. On the other hand, in view of weak economic activity, Brazil has reduced policy rates on twelve occasions (by 650 basis points) since September 2005 to 13.25 per cent on November 29, 2006. The Bank of Israel has cut its policy rate by 100 basis points since October 2006 - 25 basis points each in October and November 2006 and 50 basis points in December 2006 - to support growth, after having raised rates by 200 basis points between October 2005 and August 2006. Global Commodity Prices Non-fuel commodity prices rose during the third quarter of 2006-07 led by metals and food prices. Metals prices, barring copper, firmed up further on the back of robust demand in emerging economies, especially China (Chart 22). Amongst food items, prices of wheat and edible oils rose, reflecting a shortfall in global production. Crude oil prices, on the other hand, have eased in recent months.

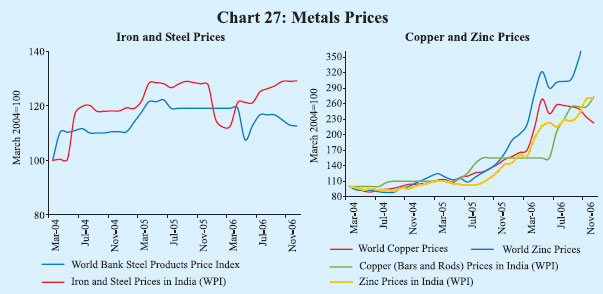

International crude oil prices (WTI) eased sharply from the peak of US $ 78.4 a barrel in July 2006 to around US $ 60 a barrel in the second half of September 2006 and further to below US $ 60 a barrel in early October 2006 on the back of signs of slowdown of the US economy, increased US stocks and easing of tension over Iran’s nuclear programme (Table 26). After remaining below US $ 60 a barrel in early November 2006, prices edged up to around US $ 62-63 a barrel in December 2006 on the back of the fall in US product inventories and production cuts by the Organisation of the Petroleum Exporting Countries (OPEC). The OPEC reduced crude oil production by 1.2 million barrels per day (mb/d) effective November 1, 2006 to support prices. In its meeting held on December 14, 2006, the OPEC decided to reduce output by a further 0.5 mb/d effective February 1, 2007 to balance supply and demand. Prices, however, eased further to reach US $ 51 a barrel in January 2007 on the back of mild winter in the US and rise in the US stocks. It is, however, uncertain as to whether the current level of oil prices will be sustained in view of limited spare global crude oil production capacity and tight supply-demand balance (Table 27). Prices increased sharply on January 23, 2007 to US $ 55 a barrel. Metals prices, except copper, recorded further gains during the third quarter of 2006-07 on the back of robust demand and supply constraints amidst speculative investor interest. As a result, prices of aluminium, tin and zinc during December 2006 were higher by about 25 per cent, 66 per cent and 142 per cent, respectively, over their levels a year ago. Prices of copper fell by 12 per cent during the quarter

ended December 2006 on reports of rising stocks; nonetheless, prices were still 46 per cent higher than a year ago. International steel prices, which edged higher during June-July 2006, softened in October-December 2006 (Table 28).

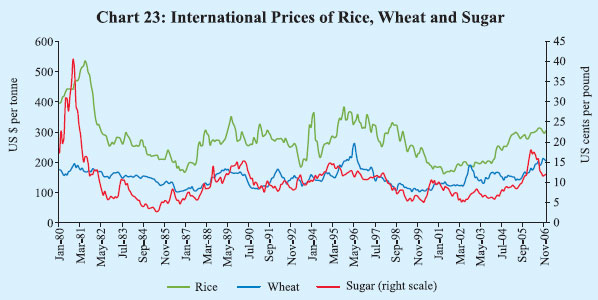

Food prices firmed up led by wheat and oilseeds/edible oils. According to the latest assessment by the Food and Agriculture Organisation (FAO), global wheat production is expected to decline by 5.2 per cent in 2006-07 on the back of hot and dry weather/drought affecting crops in Australia, Argentina and Brazil. As a result, wheat stocks are expected to fall by 15.8 per cent by the end of 2006-07 season. Rice production is also expected to decline, though only marginally by 0.2 per cent resulting in a drawdown of stocks by 0.6 per cent. In view of these developments, wheat prices have firmed up since the second half of 2005. Notwithstanding some easing in November-December 2006, wheat prices in December 2006 were still higher by about 24 per cent on a year-on-year basis (Chart 23). Rice prices exhibited some softness from August 2006 but again firmed up in December 2006. Prices in December 2006 were higher by about 8 per cent on a year-on-year basis. The recent rise in international prices of wheat and rice comes after a period of some softness in the late 1990s. International prices of rice had eased from 1997 onwards to stabilise at around US $ 200 per tonne during 2000-2003. Since then, prices have edged higher to cross US $ 300, but still remain lower than the levels touched in the mid-1990s. Similarly, prices of wheat, after remaining largely range-bound between 1998 and 2004, have edged higher from mid-2005. Prices of oilseeds and edible oils have edged up sharply in recent months, inter alia, due to lower production coupled with strong consumption demand, including demand for non-food uses such as fuels and as feedstock for biodiesel production. On a year-on-year basis, soybean, soybean oil and palm oil prices in December 2006 were higher by 12 per cent, 30 per cent and 34 per cent, respectively. On the other hand, international sugar prices have eased sharply since August 2006 on forecasts of higher global production during 2006-07. According to the International Sugar Organisation, global sugar production is

estimated to increase by 5.8 million tonnes to 158 million tonnes during 2006-07 (October-September) season, exceeding global consumption by 5.8 million tonnes. A record crop in Brazil, the world’s largest producer, significant growth in output in the Far East along with likely higher production in India is expected to more than offset the contraction in EU output. Sugar prices have declined by almost 33 per cent from the recent peak touched in February 2006. Global cotton prices remained broadly unchanged during the quarter ended December 2006. Inflation Conditions in India Taking into account the real, monetary and global factors having a bearing on domestic prices, the Reserve Bank in its Annual Policy Statement for 2006-07 (April 2006) noted that containing inflationary expectations would continue to pose a challenge to monetary management and the policy endeavour would be to contain the year-on-year inflation rate for 2006-07 in the range of 5.0-5.5 per cent. Against the backdrop of widespread and simultaneous monetary policy tightening by several countries in early June 2006 following marked and heightened volatility in the international financial markets, and in the light of the prevailing domestic monetary and credit environment, the LAF reverse repo and repo rates were increased effective June 9, 2006 by 25 basis points each to 5.75 per cent and 6.75 per cent, respectively. In its First Quarter Review of the Annual Statement on Monetary Policy (July 2006), the Reserve Bank observed that containing inflation in the range of 5.0-5.5 per cent warrants appropriate priority in policy responses. Accordingly, the Reserve Bank raised the reverse repo rate and the repo rate by 25 basis points each to 6.00 per cent and 7.00 per cent, respectively, on July 25, 2006 while continuing to keep the Bank Rate and cash reserve ratio unchanged. In the Mid-Term Review of the Annual Policy Statement for 2006-07 (October 2006), the Reserve Bank observed that recent developments, in particular, the combination of high growth and consumer inflation coupled with escalating asset prices and tightening infrastructural bottlenecks underscore the need to reckon with dangers of overheating and the implications for the timing and direction of monetary policy setting. The Mid-term Review further noted that while there is no conclusive evidence of potential overheating in the Indian economy at the current juncture, the criticality of monitoring all available indications that point to excess aggregate demand is perhaps more relevant now than ever before. In the Mid-term Review, the repo rate was increased by 25 basis points to 7.25 per cent while keeping the reverse repo rate unchanged at 6.00 per cent. On a review of the macroeconomic and monetary conditions, the Reserve Bank on December 8, 2006 announced a hike of 50 basis points in the cash reserve ratio (CRR) in two tranches to 5.5 per cent (Table 29 and Box 1).

The conduct of monetary policy in India has been guided by the objectives of maintaining price stability and ensuring adequate flow of credit to the productive sectors of the economy for sustaining overall economic growth. The relative emphasis between price stability and growth, however, has changed depending on the underlying macroeconomic conditions. Monetary policy in India, thus, strives for a judicious balance between price stability and growth. The policy reverse repo rate was cut by 150 basis points between March 2002 and August 2003 to support growth after inflation had been brought down to an average of around five per cent from the long-term average of 8-9 per cent during the 1970s and 1980s. With the recovery of economic activity, and on signs of emerging inflationary pressures, the process of withdrawal of monetary accommodation was initiated in a phased and pre-emptive manner beginning September 2004 with the increase in the cash reserve ratio by 50 basis points in two stages and the hike in reverse repo rate in October 2004. The reverse repo rate has been increased by 150 basis points since then, while the repo rate has been increased by 125 basis points. The LAF corridor - the gap between the repo rate and the reverse repo rate - has been varied in response to the evolving macroeconomic situation. The gap, which was 200 basis points in March 2003, was reduced to 100 basis points in April 2005 before increasing to 125 basis points in October 2006. The cash reserve ratio has been raised by 100 basis points since September 2004. Thus, monetary policy accommodation has been withdrawn since September 2004 in a phased manner to contain inflation and stabilise inflation expectations. Monetary policy affects its final goals with long and variable lags but on a cumulative basis, thus warranting a forward looking approach. Further, effective monetary policy has as much to do with inflation expectations as the actual Box 1: Cash Reserve Ratio (CRR) The Reserve Bank in its Mid-Term Review of Annual Policy Statement for the year 2006-07 (October 31, 2006) noted, inter alia, that: “Furthermore, containing inflation expectations in the current environment and consolidating gains achieved so far in regard to stability would warrant appropriate, immediate measures and willingness to take recourse to all possible measures in response to evolving circumstances promptly. The objective is to continue to maintain conditions of stability that contribute to sustaining the momentum of growth on an enduring basis. Towards this objective, the monetary policy stance and measures will need to be in a process of careful rebalancing and timely adjustment”. Subsequent to the announcement of the Mid-term Review, there were a number of significant developments, particularly on the domestic front. These included: 1. Real GDP growth at 9.2 per cent during July-September 2006 and 9.1 per cent in the first half of 2006-07. A seasonal decline in prices of food articles could moderate the inflation pressures but the WPI inflation excluding food articles remains at elevated levels. The reduction in prices of petrol and diesel in end-November 2006 will moderate inflation, but the overall impact on inflation expectations requires to be monitored and moderated. The external sector continues to be strong and current account deficit is likely to be close to the trend, and will continue to be accommodated by net capital flows. However, it is necessary to recognize the challenges emanating from capital flows and consequent impact on increasing liquidity. In view of the above, the Reserve Bank, on December 8, 2006, decided to increase the cash reserve ratio (CRR) of the scheduled commercial banks, regional rural banks (RRBs), scheduled state co-operative banks and scheduled primary (urban) co-operative banking system by 50 basis points of their net demand and time liabilities (NDTL) in two stages –25 basis points each effective from fortnights beginning December 23, 2006 and January 6, 2007. As a result of the increases in CRR on liabilities to banking system, an amount of about Rs.13,500 crore of resources of banks would be absorbed. outcome of inflation. It may be seen that monetary policy was tightened even when inflation was at relatively low level (Table 29). Pre-emptive monetary policy actions by the Reserve Bank since September 2004, supported by supply-side and fiscal measures, have helped in containing inflation and anchoring inflation expectations while evidently supporting the growth momentum. In response to evolving circumstances, the stance of monetary policy has changed from time to time (Box 2). Box 2: Stance of Monetary Policy in India since April 2003 Statement on Monetary and Credit Policy for the year 2003-04 (April 2003) and Mid-term Review (November 2003)

2004-05

Mid-term Review of Annual Policy for the Year 2004-05 (October 2004)

2005-06

First Quarter Review of Annual Statement on Monetary Policy for the Year 2005-06 (July 2005)

Mid-term Review of Annual Policy Statement for the year 2005-06 (October 2005)

Third Quarter Review of Annual Statement on Monetary Policy for the Year 2005-06 (January 2006)

Annual Policy Statement for the Year 2006-07 (April 2006)

First Quarter Review of Annual Statement on Monetary Policy for the Year 2006-07 (July 2006)

Mid-term Review of Annual Policy Statement for the Year 2006-07 (October 2006)

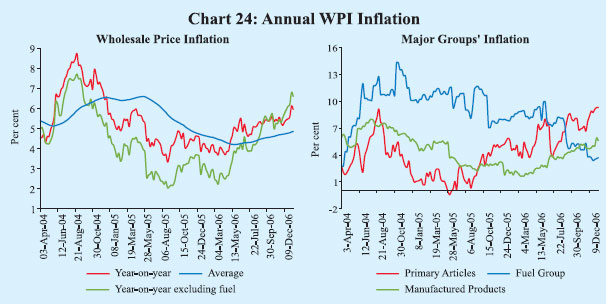

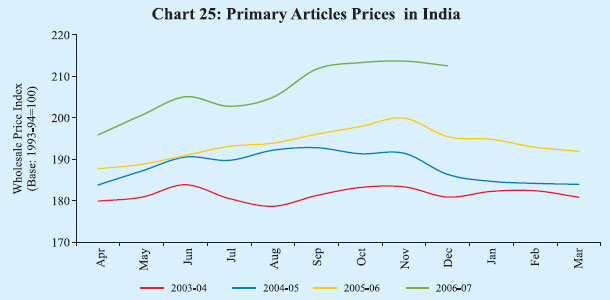

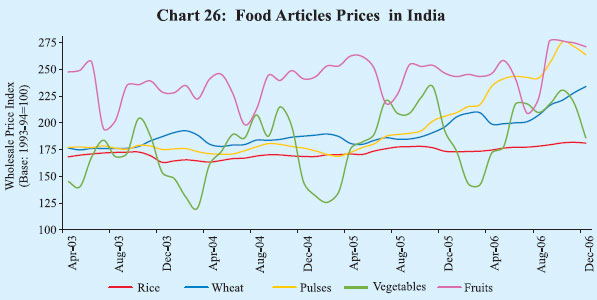

Inflation movements in 2006-07 have been driven by primary food articles and manufactured products prices. The impact of mineral oils, the major driver of inflation over the past two years, petered out by early September 2006 on the back of the base effect. Headline inflation, based on movement in the wholesale price index (WPI), increased to 6.0 per cent as on January 13, 2007 from 4.1 per cent at end-March 2006 and 4.2 per cent a year ago. WPI inflation has moved in a range of 3.7-6.1 per cent during 2006-07 so far (Chart 24 and Table 30). The average WPI inflation rate (average of the 52 weeks) for the week ended January 13, 2007 was 4.9 per cent, higher than that of 4.7 per cent a year ago. The y-o-y inflation, excluding the fuel group, at 6.6 per cent was above the headline inflation rate of 6.0 per cent as on January 13, 2007. Among the major groups, prices of primary articles led by wheat, pulses, fruits, milk and oilseeds posed upward pressures on inflation (Chart 25). Wheat prices have remained firm on the back of low stocks and high international prices. Domestic wheat stocks were 6.0 million tonnes as on November 1, 2006 as against the buffer stock norm of 11 million tonnes. On a year-on-year basis, wheat prices have increased by 14.7 per cent as on January 13, 2007 (global wheat prices, as noted earlier, increased by about 24 per cent, y-o-y, in December 2006). Prices of pulses also edged higher (25.4 per cent) from last year's level, reflecting stagnant domestic production as well as higher demand (Chart 26). Fruits and milk prices have increased by 12.0 per cent and 7.6 per cent, respectively. Prices of oilseeds witnessed a sharp turnaround - an increase of 21.0 per cent, y-o-y, as against a decline of 11.9 per cent a year ago - which could be attributed to lower domestic production as well as firm global prices. On the other hand, prices of vegetables increased moderately by 0.8 per cent, y-o-y, as compared with 28.9 per cent a

year ago. Overall, prices of primary articles have increased by 10.3 per cent since end-March 2006 (6.4 per cent a year ago) and, on a y-o-y basis, by 9.3 per cent (5.6 per cent a year ago). Accordingly, on a y-o-y basis, the contribution of primary articles to headline inflation increased to about 34 per cent as on January 13, 2007 from 29 per cent a year ago.

In order to contain the price rise in primary commodities so as to stabilise inflation expectations, the Government undertook a number of fiscal measures such as (i) allowing the State Trading Corporation (STC) to tender overseas for 55 lakh tonnes of wheat to supplement domestic availability; (ii) permitting private traders to import wheat initially at 5 per cent duty from June 27, 2006 and then at zero duty from September 9, 2006; (iii) allowing import of pulses at zero duty from June 8, 2006 and a ban on their exports from June 27, 2006; (iv) exempting sugar from customs duty from June 22, 2006 and a ban on their exports; and (v) reduction in customs duty on palm oils by 10 percentage points to 70-80 per cent in August 2006. The Government also announced a hike of

Rs.100 per quintal in the minimum support price (MSP) for wheat to increase domestic procurement to meet the requirements of the public distribution system in the ensuing season. Fuel prices dominated the inflation outcome till end-August 2006, notwithstanding the incomplete pass-through of higher international crude oil prices. Apart from raising domestic petrol and diesel prices by Rs.4 and Rs.2 per litre, respectively, in June 2006, the Government also announced the following measures: (i) reduction in customs duty on petrol and diesel to 7.5 per cent from the existing 10.0 per cent; and (ii) issuance of oil bonds worth Rs.28,000 crore (over and above Rs.11,500 crore issued during 2005-06) to oil marketing companies to compensate for their under-recoveries in domestic operations. The Government has so far issued oil bonds worth Rs.14,150 crore in the current fiscal year in three tranches. Following the reduction in international crude oil prices, domestic prices of petrol and diesel were reduced by Rs.2 per litre (around 4 per cent) and Re. 1 per litre (around 3 per cent), respectively, on November 29, 2006. Reflecting the base effect as well as cuts in prices of petrol, diesel and other freely-priced products such as naphtha and furnace oil, fuel group inflation moderated to 3.7 per cent on January 13, 2007 from a peak of 9.9 per cent on June 17, 2006 and 7.9 per cent a year ago. While evaluating movements in fuel group inflation, it may be noted that the pass-through of higher international oil prices has been restricted to petrol and diesel. Domestic prices of liquefied petroleum gas (LPG) and kerosene have remained unchanged since November 2004 and April 2002, respectively, on grounds of societal concerns. Manufactured products inflation increased to 5.6 per cent as on January 13, 2007 from 1.7 per cent at end-March 2006 and 2.2 per cent a year ago. Manufactured products inflation during 2006-07 has been led by edible oils, metals, cement and electrical machinery. Non-ferrous metal prices have broadly moved in line with international trends (Chart 27). Illustratively, domestic prices of copper and zinc have increased, y-o-y, by about 84 per cent and 76 per cent, respectively, as on January 13, 2007. Iron and steel prices have increased by 11.4 per cent, y-o-y, in contrast to a decline of 2.6 per cent a year ago. Domestic prices of cement increased by 17.9 per cent, y-o-y, as on January 13, 2007 on top of an increase of 12.9 per cent a year ago, reflecting strong domestic demand emanating from construction activity. Other manufactured items contributing to higher y-o-y inflation were electrical machinery (increase of 11.3 per cent as compared with an increase of 1.9 per cent a year ago), edible oils (increase of 11.2 per cent in contrast to a decline of 5.9 per cent a year ago) and grain mill products (increase of 17.7 per cent as compared with an increase of 13.0 per cent a year ago). Domestic sugar prices have eased in recent months in line with global trends.

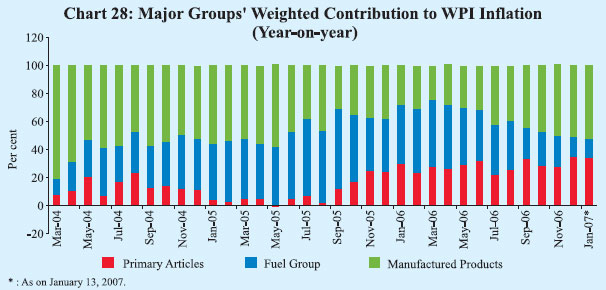

Competitive pressures, productivity gains as well as strong corporate profitability have provided firms the flexibility to absorb a part of higher input prices into their profit margins. Furthermore, pre-emptive monetary actions by anchoring inflation expectations have contained the second order effects of past increases in oil prices. In order to reduce cost of manufacturing and infrastructure development, the Government took fiscal measures on January 22, 2007 in the form of reduction in customs duties on select items such as inorganic chemicals, non-ferrous metals, cement, capital goods and project imports. In brief, primary articles' contribution to the overall y-o-y inflation on January 13, 2007 increased to 34 per cent (from 29 per cent a year ago) mainly due to higher prices of wheat, pulses, fruits, milk and oilseeds (Chart 28).

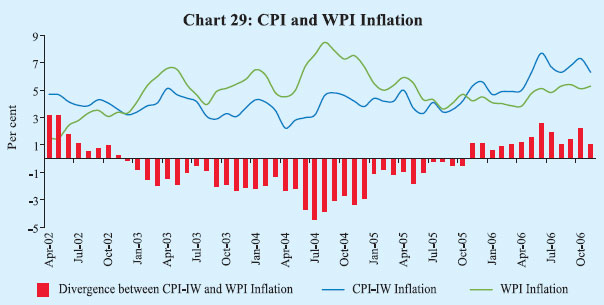

Manufactured products group's contribution was higher at 52 per cent (30 per cent a year ago) largely on account of increase in prices of edible oils/oil cakes, metals, cement and electrical machinery. The contribution of fuel prices to the y-o-y headline inflation, on the other hand, declined to 14 per cent from 41 per cent a year ago. Consumer Price Inflation Various measures of consumer price inflation were placed higher in the range of 6.3-8.9 per cent during November/December 2006. Consumer price inflation has remained higher than the WPI inflation since November 2005, reflecting the higher order of increase in food prices as well as the higher weight of food items in the CPI (Chart 29 and Table 31).

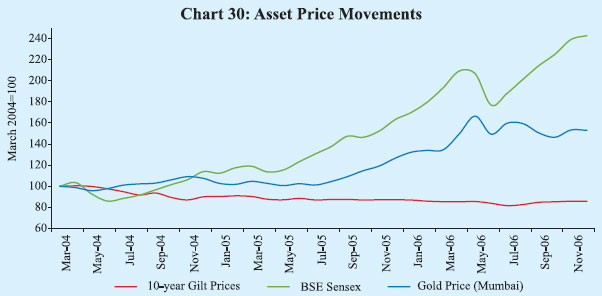

Disaggregated data for CPI-Industrial Workers (CPI-IW), available up to November 2006, indicate that food group inflation increased from 6.6 per cent in November 2005 (y-o-y) to 7.8 per cent in November 2006 (y-o-y). This, in turn, was due to sharp increases of 14.5 per cent and 21.4 per cent, respectively, in prices of cereals and pulses. Higher prices of meat, fish and eggs, and oils and fats also contributed to food group inflation. Prices of fuel and light increased by 6.6 per cent y-o-y in November 2006 as against a decline of 5.5 per cent a year ago. On the other hand, housing inflation, reflecting rents on housing, decelerated from 11.7 per cent in November 2005 to 7.1 per cent in November 2006 (Table 32). Asset Prices Asset prices remained buoyant during the quarter October-December 2006. Domestic equity markets recorded further gains during the third quarter of 2006-07 on the back of renewed buying interest by the FIIs, strong growth prospects and better corporate results. Stock markets reached record highs with the BSE Sensex touching 14218 on January 18, 2007. The BSE Sensex

was 14041 as on January 23, 2007, 24.5 per cent higher over end-March 2006 levels (Chart 30). Domestic gold prices have increased by about seven per cent since end-March 2006 mirroring movements in international prices. International gold prices, after rising to US $ 715 per ounce on May 12, 2006, witnessed a sharp correction and fell to US $ 559 as on June 14, 2006 in consonance with the trends in various commodities in the international market on concerns over rising global inflation. Prices initially recovered to US $ 664 per ounce as on July 19, 2006 but again fell to below US $ 600 in the second week of September 2006 as headline inflation in major economies eased in tandem with softening of international crude oil prices. Since then prices have been range-bound. Gilt prices have declined and yields have increased in 2006-07 so far. Gilt prices initially fell during the first quarter of 2006-07 in tandem with major economies on the back of concerns over domestic inflation in view of higher oil prices and the hike in the reverse repo rate. Gilt prices, however, rose during July-November 2006, inter alia, reflecting softening of international crude oil prices. Gilt prices fell and yields rose during December 2006 and January 2007 in view of some tightness in domestic liquidity conditions.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

पेज अंतिम अपडेट तारीख: