IST,

IST,

Non-Banking Financial Institutions (Part 1 of 6)

Introduction 6.1 Non-banking financial institutions (NBFIs) are an important part of the Indian financial system. A wide range of financial institutions (FIs) have evolved in the Indian financial system over the years, with a view to providing medium to long-term finance to different sectors of the economy. The NBFIs at present consist of a heterogenous group of institutions, catering to a wide range of financial requirements. The major intermediaries that are included in the NBFI group are development finance institutions (DFIs) (which are mostly Government-owned and have been the traditional providers of long-term project loans), insurance companies, non-banking financial companies (NBFCs), primary dealers (PDs) and capital market intermediaries such as mutual funds.

6.2 As on March 31, 2008 there were four development finance institutions regulated

by the Reserve Bank, viz., EXIM Bank, National Bank for Agriculture and

Rural Development (NABARD), National Housing Bank (NHB) and Small Industries Development

Bank of India (SIDBI). During 2007-08, two institutions, viz., IFCI Ltd.

and Tourism Finance Corporation of India (TFCI) Ltd, which are registered as NBFCs

with the Reserve Bank and were earlier exempted from NBFC regulations and as such

were being regulated as FIs, were restored to NBFC regulations. During 2007-08,

the Reserve Bank continued with the regulatory initiatives to further strengthen

the FIs. While financial assistance sanctioned by FIs accelerated sharply during

2007-08, the disbursements witnessed a modest deceleration. Concomitantly, their

balance sheets also expanded at a significantly higher rate. Though the net interest

income as well as non-interest income witnessed a sharp growth, the sharp rise

in operating expenses resulted in lower operating profits for the FIs. Asset quality

of FIs remained satisfactory during the year. The capital adequacy ratio, in general,

continued to be significantly higher than the minimum prescribed. 6.4 The NBFCs-ND have inter-linkages with financial markets, banks and other financial institutions. They have witnessed substantial growth in number, product variety and size in recent years. In order to address the systemic concerns arising from minimal regulation in the case of non-deposit taking NBFCs, NBFCs-ND with asset size of Rs.100 crore and above have been classified as systemically important NBFCs (NBFCs-ND-SI) and these are now being subjected to limited regulations. A system of monthly reporting on important parameters such as capital market exposure has been introduced. A system of asset-liability management (ALM) reporting and additional disclosures in the balance sheet was also introduced. With a view to further strengthening their resilience, their CRAR has been enhanced to 12 per cent to be reached by March 31, 2009 and further to 15 per cent by March 31, 2010. In order to address the issue of their funding requirements, NBFCs-ND-SI have been permitted to augment their capital funds by issuance of perpetual debt instruments (PDI) in rupees, subject to certain conditions. In October 2008, the issue of transient liquidity strain being faced by NBFCs-ND-SI was addressed and as a temporary measure, they were also permitted to raise short-term foreign currency borrowings, under the approval route, subject to certain conditions. On November 1, 2008, the facility of liquidity support, which was earlier introduced for mutual funds, was extended to NBFCs also and banks were allowed to avail liquidity support under the liquidity adjustment facility (LAF) through relaxation in the maintenance of statutory liquidity ratio (SLR) to the extent of up to 1.5 per cent of their net deposit and time liabilities (NDTL). On November 15, 2008, the Reserve Bank announced that this special term repo facility would continue till end-March 2009. 6.5 The assets/liabilities of NBFCs (excluding residuary non-banking companies (RNBCs)) expanded at a much higher rate during 2007-08 as compared with that during 2006-07. Financial performance of NBFCs continued to improve during 2007-08. Both fund-based income (79.8 per cent) and fee-based income (56.6 per cent) increased sharply. As a result, notwithstanding the rise in expenditure, the operating profits and net profits also witnessed a sharp rise. 6.6 In order to strengthen the market infrastructure of the

Government securities market and make it vibrant, liquid and broad-based, the

primary dealers (PDs) system in the Government securities market was introduced

by Reserve Bank in 1995. The PD system has developed substantially over the years

and presently it serves as an effective conduit for conducting open market operations.

Of the 19 PDs in existence at present, nine PDs are stand-alone non-bank entities.

Lehman Brothers Fixed Income Securities Private Limited (LBFISL), was authorised

to undertake PD business with effect from November 1, 2007. However, following

the filing of a petition under Chapter 11 of the US Bankruptcy code by Lehman

Brothers Holdings Inc., LBFISL was advised by the Reserve Bank not to declare

any interim dividend or remit any amount to its holding company or any other group

company without prior approval. Further, they have been advised not to undertake

transactions in Government securities as a PD in the primary market. 6.8 The present chapter is organised into four sections. The regulatory and supervisory initiatives, business operations and financial performance of financial institutions are set out in Section 2. Section 3 focuses on the policy developments and the financial performance of NBFCs. The final section of the Chapter deals with the policy developments relating to primary dealers and their operations. 2. Financial Institutions 6.9 A wide range of financial institutions (FIs)

have evolved in the Indian financial sector over the years, with a view to meeting

the medium to long-term funding requirements of the different sectors of the economy.

Based on the major activity undertaken by them, FIs are classified into three

broad categories. First, there exist the term-lending institutions viz.,

EXIM Bank, whose main activity is direct lending by way of term loans and investments.

Second, there are refinance institutions such as National Bank for Agriculture

and Rural Development (NABARD), Small Industries Development Bank of India (SIDBI)

and National Housing Bank (NHB), which mainly extend refinance to banks as well

as NBFIs. In the third category are the investment institutions such as LIC, which

deploy their assets largely in marketable securities. State/regional level institutions

are a distinct group and comprise of various State Financial Corporations (SFCs),

State Industrial and Development Corporations (SIDCs) and North Eastern Development

Finance Corporation Ltd. (NEDFi). Some of these FIs have been notified as Public

Financial Institutions by the Government of India under Section 4A of the Companies

Act, 1956. Regulatory Initiatives for Financial Institutions 6.11 In continuation with the policy initiatives undertaken by the Reserve Bank in recent years for progressive upgradation of the regulatory norms for FIs in convergence with the norms across the financial sector, a number of measures were undertaken during 2007-08. Exposure of SIDBI to SFCs 6.12 A sizeable portion of exposure of SIDBI is by way of refinance to SFCs. In view of the poor financial health of SFCs, which is likely to have spillover effect on the financial health of SIDBI, measures were taken to strengthen the regulatory focus of SIDBI over SFCs and the risk management guidelines, particularly, with regard to its exposure to SFCs. The risk weight in respect of SIDBI's exposure to SFCs was raised from 100 per cent to 125 per cent. SIDBI was instructed to make full provisions in respect of SFCs that had defaulted even after restructuring/extension of one-time settlement (OTS) package. SIDBI was also instructed not to sanction refinance to SFCs that continued to show negative net worth. However, on a review, based on the information received from the Government of India that four State Governments had committed to provide funds to the SFCs in their jurisdiction in a time bound manner to make the net worth of the concerned SFCs positive, it was decided that SIDBI could provide refinance to those SFCs, as long as the concerned State Governments kept their commitments. Furthermore, SIDBI was advised to follow the norms applicable to banks in asset classification and provisioning in respect of its exposure to SFCs (it involved a change to "borrower-wise" classification from that of "facility-wise" classification applicable to FIs). SIDBI was also advised to ensure that all SFCs follow uniform accounting standards similar to those followed by banks. Valuation of non-SLR securities issued by the Government of India 6.13 The Government of India has, from time to time, issued several special securities which do not qualify for meeting the SLR requirements of banks. Such Government securities are governed by a separate set of terms and conditions and entail a higher degree of illiquidity spread. At present, such special securities comprise of oil bonds, fertiliser bonds, bonds issued to the erstwhile Unit Trust of India, IFCI Ltd., Food Corporation of India, Industrial Investment Bank of India Ltd., the erstwhile Industrial Development Bank of India and the erstwhile Shipping Development Finance Corporation. Currently, the guidelines issued by Fixed Income Money Market and Derivatives Association of India (FIMMDA) regarding the valuation of such non-SLR/Debt securities provide that such securities be valued by applying a mark-up of 50 basis points (bps) above the corresponding yield on Government of India securities. The issue of valuation of such special securities was reexamined and in June 2008 FIs were advised that, for the limited purpose of valuation, all special securities issued by the Government of India, directly to the beneficiary entities, which do not carry SLR status, may be valued at a spread of 25 bps above the corresponding yield on Government of India securities from the financial year 2008–09. Prudential guidelines on capital adequacy 6.14 The method of calculation of Tier I capital by financial institutions was reviewed in the light of the international best practices and FIs were advised that while complying with the capital adequacy norms, the deferred tax assets (DTA) associated with accumulated losses and the DTA (excluding DTA associated with accumulated losses), net of deferred tax liabilities (DTL) should be deducted from Tier I. Where the DTL is in excess of the DTA (excluding DTA associated with accumulated losses), the excess shall neither be adjusted against DTA associated with accumulated losses nor added to Tier I capital. Refinance Facility to SIDBI and NHB 615 With a view to enhancing credit delivery to the employment intensive micro and small enterprises (MSE) sector, it was decided on December 6, 2008 to provide refinance of Rs.7,000 crore to SIDBI. Similar refinance facility of Rs.4,000 crore for NHB is being worked out. (Refer Chapter II, Box II.2 for details). Operations of Financial Institutions 6.16 Financial assistance sanctioned by FIs accelerated sharply during 2007-08 as against the deceleration witnessed during the previous year. The acceleration in sanctions was accounted for mainly by investment institutions (especially LIC). Notwithstanding the acceleration in sanctions, the disbursements slowed down during the year, especially by LIC (Table VI.1 and Appendix Table VI.1).

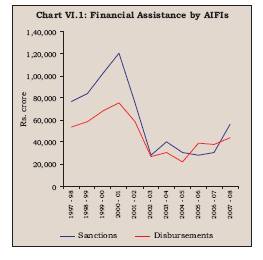

6.17 On balance thus, even though, both financial assistance sanctioned and disbursed by FIs increased during 2007-08, the increase was more pronounced in respect of sanctions (86.2 per cent) than the disbursements (14.6 per cent) (Chart VI.1). Assets and Liabilities of FIs 6.18 The combined balance sheets of select FIs (NABARD, NHB, SIDBI and EXIM Bank) during 2007-08 expanded sharply by 19.5 per cent. On the liabilities side, the resources raised by way of bonds and debentures (which form a major constituent with a share of 32.5 per cent in the total liabilities) declined by 3.5 per cent during 2007-08. However, deposits and borrowings recorded a sharp increase of 54.1 per cent and 56.7 per cent, respectively. On the assets side, loans and advances continued to expand, while the investment portfolio continued to decline (9.3 per cent). Cash and bank balances as well as other assets, registered a sharp turnaround during the year (Table VI.2).

Resources Mobilised by FIs 6.19 Resources raised by FIs during 2007-08 were considerably higher than those during the previous year. While the long-term resources raised witnessed a sharp rise during 2007-08 as compared with that a year ago, the short-term resources raised declined. Resources raised in foreign currency increased significantly. EXIM Bank mobilised the largest amount of resources, followed by NABARD and NHB (Table VI.3 and Appendix Table VI.2).

6.20 Resources raised by FIs from the money market during 2007-08 were higher than those raised during 2006-07. FIs, utilised 22.9 per cent of the umbrella limit sanctioned to them; the utilisation was 17.3 per cent during the previous year (Table VI.4).

Sources and Uses of Funds

Cost and Maturity of Borrowings 6.22 The weighted average cost of rupee resources raised by financial institutions increased substantially during 2007-08, reflecting the general hardening of interest rates in the domestic market (Table VI.6 and Appendix Table VI.4). The weighted average maturity of long-term resources raised by other all-India financial institutions, barring NHB, decreased.

Lending

Interest Rates

Financial Performance of Financial Institutions 6.24 Net interest income of FIs increased by 19.7 per cent to Rs.2,642 crore during 2007-08 from Rs.2,208 crore during 2006-07. In line with the trend in the previous years, non-interest income of FIs increased significantly by 71.8 per cent during the year. However, in contrast with the decline in the previous year, the operating expenses of FIs registered a sharp rise of 46.6 per cent during the year, even though the wage bill declined substantially by 32.7 per cent. The operating profit recorded an increase of 30.1 per cent during the year. The net profit of FIs also increased, even though provision for taxation declined (Table VI.8).

6.25 Interest income as a percentage of working funds declined for NABARD, while it increased for other FIs. The non-interest income as a percentage of working funds increased for all the FIs. Operating profit as a percentage of working funds improved for all FIs except SIDBI. Return on average assets declined for all the FIs, except NHB. The return on average assets was highest for SIDBI followed by NABARD, EXIM Bank and NHB. Net profit per employee was more than Rs.1 crore in case of EXIM Bank during 2007-08 (Table VI.9).

Soundness Indicators Asset Quality 6.26 In absolute terms, net NPAs of EXIM Bank and NABARD declined during 2007-08, while that of SIDBI increased sharply (Table VI.10). In terms of net NPA to net loans ratio, the asset quality of EXIM Bank improved sharply, while that of NABARD improved marginally. Although the net NPAs to net loans ratio increased in respect of SIDBI at end-March 2008 as compared with end-March 2007, the ratio was quite low otherwise. Significantly, in continuation of the trend witnessed during last few years, NHB did not have any NPAs.

6.27 Reflecting the improvement in asset quality, NPAs in the sub-standard and doubtful category of all FIs constituted a very small share. Also none of the FIs had any assets in the ‘loss’ category (Table VI.11).

Capital Adequacy 6.28 The capital adequacy ratio of all the FIs continued to be significantly higher than the minimum stipulated norm of 9 per cent (Table VI.12). The CRAR of SIDBI increased significantly to 41.8 per cent at end-March 2008 as compared with 37.5 per cent at end-March 2007. The CRAR of NHB also improved marginally, while that of EXIM Bank and NABARD declined marginally during the year.

3.Non-Banking Financial Companies

6.29 The non-banking financial companies (NBFCs) flourished in India in the decade

of the 1980s against the backdrop of a highly regulated banking sector. While

the simplified sanction procedures and low entry barriers encouraged the entry

of a host of NBFCs, factors like flexibility, timeliness in meeting credit needs

and low operating cost provided the NBFCs with an edge over the banking sector.

The flourishing NBFC sector, however, also raised some regulatory concerns. An

amendment to the Reserve Bank of India Act, 1934 was, therefore, carried out in

1997, which authorised the Reserve Bank to determine policies, and issue directions

to NBFCs regarding income recognition, accounting standards, NPAs, capital adequacy,

etc. The amended Act, inter alia, provided for compulsory registration

of all NBFCs into three broad categories, viz., (i) NBFCs accepting public

deposit; (ii) NBFCs not accepting/holding public deposit; and (iii) core investment

companies (i.e., those acquiring shares/securities of their group/ holding/subsidiary

companies to the extent of not less than 90 per cent of total assets and which

do not accept public deposit). Regulatory and Supervisory Initiatives 6.31 Until some years back, the prudential norms applicable to banking and non-banking financial companies were not uniform. Moreover, within the NBFC group, the prudential norms applicable to deposit taking NBFCs (NBFCs-D) were more stringent than those for non-deposit taking NBFCs (NBFCs-ND). Since the NBFCs-ND were not subjected to any exposure norms, they could take large exposures. The absence of capital adequacy requirements resulted in high leverage by the NBFCs. Since 2000 however, the Reserve Bank has initiated measures to reduce the scope of ‘regulatory arbitrage’ between banks, NBFCs-D and NBFCs-ND (Box VI.1). Advertisement in Electronic Media 6.32 On April 4, 2007, NBFCs were advised that it is possible that the advertisement released by NBFCs accepting deposits purely for promoting their business may attract deposits. Therefore, in order to ensure transparency in the interest of depositors in the context of such advertisements, a provision was incorporated in the Non-Banking Financial Companies Acceptance of Public Deposits (Reserve Bank) Directions, 1998, in terms of which companies are required to state that they have a valid Certificate of Registration issued by the Reserve Bank. However, the Reserve Bank does not accept any responsibility or guarantee about the present position as to the financial soundness of the company or for the correctness of any of the statements or representations made or opinions expressed by the company and for repayment of deposits/discharge of the liabilities by the company. Amendments to NBFC Regulations - Ceiling on Rate of Interest 6.33 The maximum interest rate payable on public deposits by NBFCs was revised to 12.5 per cent per annum on and from April 24, 2007. It was also clarified that this was the maximum permissible rate an NBFC can pay on its public deposits and they may offer lower rates. The new rate of interest would be applicable to fresh public deposits and renewals of matured public deposits. The ceiling rate of interest of 12.5 per cent per annum was also applicable to the deposits accepted/renewed by miscellaneous non-banking companies (chit fund companies). Unsolicited Commercial Communications-National Do Not Call Registry 6.34 With a view to protecting the right to privacy of the members of public and to curb the complaints relating to unsolicited commercial communications being received by customers/non-customers, the Telecom Regulatory Authority of India (TRAI) framed the Telecom Unsolicited Commercial Communications (UCC) Regulations for curbing UCC. Further, the Department of Telecommunications (DoT) has issued relevant guidelines for telemarketers alongwith the registration procedure on June 6, 2007. The Reserve Bank announced on November 26, 2007 that the instructions would be equally applicable to NBFCs and accordingly they have been advised: (i) not to engage telemarketers who do not have any valid registration certificate from DoT, Government of India, as telemarketers; (ii) to furnish the list of telemarketers engaged by them alongwith the registered telephone numbers being used by them for making telemarketing calls to TRAI; and (iii) to ensure that all agents presently engaged by them register themselves with DoT as telemarketers. FIMMDA Reporting Platform for Corporate Bond Transactions 6.35 SEBI has permitted FIMMDA to set up its reporting platform for corporate bonds. It has also been mandated to aggregate the trades reported on its platform as well as those reported on BSE and NSE with appropriate value addition. The FIMMDA platform has gone live with effect from September 1, 2007. All NBFCs were required to report their secondary market transactions in corporate bonds in the OTC market on FIMMDA’s reporting platform with effect from September 1, 2007. Detailed operational guidelines in this regard were issued separately by FIMMDA. Monitoring of Frauds in NBFCs 6.36 In March 2008 all deposit taking NBFCs (including RNBCs) were advised that the extant instructions with regard to monitoring of frauds were revised and as such cases of ‘negligence and cash shortages’ and ‘irregularities in foreign exchange transactions’ were to be reported as fraud if the intention to cheat/defraud was suspected/proved. However, in cases where fraudulent intention was not suspected/ proved at the time of detection but involve cash shortages of more than ten thousand rupees and cases where cash shortages more than five thousand rupees were detected by management/auditor/inspecting officer and not reported on the occurrence by the persons handling cash, then such cases may also be treated as fraud and reported accordingly. Guidelines on Registration, Operations, Prudential Norms and Investment Directions for Mortgage Guarantee Companies 6.37 Mortgage Guarantee Companies were notified as NBFCs by the Reserve Bank with the prior approval of the Central Government on January 15, 2008 in exercise of the powers conferred under Section 45 I (f)(iii) of the Reserve Bank of India Act, 1934. The guidelines on registration, operations, prudential norms and investment directions applicable to these companies were placed on the Reserve Bank's website on February 15, 2008. According to these guidelines, a mortgage guarantee company was required to: (i) obtain a certificate of registration from the Reserve Bank before commencing business of mortgage guarantee; (ii) have a minimum net owned fund of Rs.100 crore at the time of commencement of business; (iii) have a diversified share holding; (iv) maintain minimum capital adequacy ratio of 10 per cent of which at least 6 per cent was to be Tier I capital; (v) not accept public deposits, not avail external commercial borrowings and adhere to prescribed prudential norms; (vi) create and maintain a contingency reserve by transfer of 40 per cent of the premium or fee earned or 25 per cent of the profit after provision or tax, whichever is higher; (vii) make good the guarantee liability without demur on the happening of trigger event1. Moreover, these companies were directed not to provide mortgage guarantee for a housing loan with 90 per cent and above loan to value (LTV) ratio. 6.38 Major features of the prudential norms for the mortgage guarantee companies are: (i) an asset acquired from creditor institution on the happening of the trigger event shall straightway be classified as non-performing asset; (ii) income on an asset taken over from creditor is required to be recognised only on a cash basis, other income would be recognised in accordance with directions applicable to non-deposit taking NBFCs; and (iii) the premium or fee on the mortgage guarantee contracts should be treated as income in the profit and loss account in accordance with the accounting standards issued by the Institute of Chartered Accountants of India. 6.39 The investment directions for mortgage guarantee companies are: (i) the company should frame a policy in line with the investment directions issued by the Reserve Bank; (ii) the company should invest only in government securities, securities of corporate bodies/public sector undertakings guaranteed by Government, fixed deposit/ certificates of deposit/bonds of scheduled commercial banks/PFIs; listed and rated debentures/bonds of corporates; fully debt oriented mutual fund units; unquoted Government securities and Government guaranteed bonds; (iii) the company should hold not less than 25 per cent of the total investment portfolio in Central/State Government securities and the remaining investments with a ceiling of 25 per cent in any one of the above categories; and (iv) all investment should be marked to market. NDS-OM: Extension of Indirect Access to Other Entities 6.40 When the Order Matching segment on the Negotiated Dealing System (NDS-OM) for trading in Government securities was launched in August 2005, direct access was granted only to banks and PDs. Subsequently, the access was extended to other NDS members such as insurance companies, mutual funds and large provident funds. To widen the reach of the NDS-OM, in May 2007, indirect access through the constituents’ subsidiary general ledger (CSGL) route was extended to certain qualified entities, viz., deposit-taking NBFCs, provident funds, pension funds, mutual funds, insurance companies, co-operative banks, RRBs and the trusts maintaining gilt accounts with NDS members. The indirect access was extended to the systemically important non-deposit taking NBFCs in November 2007. These entities could place orders on the NDS-OM through its direct members, i.e., banks and PDs, using the CSGL route. Such trades get settled through the CSGL account and current account of the NDS-OM members. In May 2008, following the announcement made in the Annual Policy Statement for 2008-09, this indirect access was extended to other segments of investors such as other non-deposit taking NBFCs, corporates and FIIs. Guidelines for Securitisation Companies (SCs) and Reconstruction Companies (RCs) 6.41 The SCs and RCs are special purpose vehicles established under the SARFAESI Act to securitise and reconstruct financial assets. The Reserve Bank evolved guidelines on various regulatory and supervisory issues relating to SCs and RCs (Box VI.2). Treatment of Deferred Tax Assets (DTA) and Deferred Tax Liabilities (DTL) for Computation of Capital 6.42 As creation of deferred tax assets (DTA) or DTL gives rise to certain issues impacting the balance sheet of the company, NBFCs were advised on July 31, 2008 regarding the regulatory treatment to be given to these issues. As per these guidelines, the balance in DTL account will not be eligible for inclusion in Tier I or Tier II capital for capital adequacy purpose as it is not an eligible item of capital. DTA will be treated as an intangible asset and should be deducted from Tier I capital. NBFCs were advised to ensure compliance with these guidelines from the accounting year ending March 31, 2009. Prevention of Money Laundering Act, 2002 –Obligation of NBFCs 6.43 It was reiterated in August 2008 that NBFCs, as a part of transaction monitoring mechanism, are required to put in place an appropriate software application to throw alerts when the transactions are inconsistent with risk categorisation and updated profile of customers. In the case of NBFCs, where all the branches are not yet fully computerised, the Principal Officer of the NBFC should cull out the transaction details from branches which are not computerised and suitably arrange to feed the data into an electronic file with the help of the editable electronic utilities of cash transaction report (CTR) and suspicious transaction reports (STR) as have been made available by Financial Intelligence Unit-India (FIU-IND) on their website. It was further clarified that cash transaction reporting by branches/offices of NBFCs to their Principal Officer should invariably be submitted on a monthly basis and the Principal Officer, in turn, should ensure to submit CTR for every month to FIU-IND within the prescribed time schedule. Facility of Liquidity Support for NBFCs 6.44 On October 15, 2008 the Reserve Bank announced, purely as a temporary measure, that banks may avail of additional liquidity support exclusively for the purpose of meeting the liquidity requirements of mutual funds (MFs) to the extent of up to 0.5 per cent of their NDTL. Further, it was decided, on a purely temporary and ad hoc basis, subject to review, to extend this facility and allow banks to avail liquidity support under the LAF through relaxation in the maintenance of SLR to the extent of up to 1.5 per cent of their NDTL. This relaxation in SLR is to be used exclusively for the purpose of meeting the funding requirements of NBFCs and MFs. Banks can apportion the total accommodation allowed above between MFs and NBFCs flexibly as per their business needs. Policy Initiatives for NBFCs-ND-SI 6.45 The number, product variety and size of NBFCs-ND-SI have witnessed substantial growth in recent years and as a result the operations of these companies have increasingly assumed systemic implications. As a response to these developments, the 'minimal regulatory regime' that existed for these companies has been transformed into 'limited regulatory regime' by the Reserve Bank. In line with the growing focus on NBFCs-ND-SI in recent years, certain important policy initiatives were undertaken in 2007-08. Guidelines on Capital Adequacy, Liquidity and Disclosure Norms for NBFC-ND-SI 6.46 The Reserve Bank reviewed the guidelines relating to NBFCs-ND-SI. In terms of the final guidelines, placed on the Reserve Bank's website on August 1, 2008, the minimum capital to risk-weighted assets ratio (CRAR) for each NBFC-ND-SI was raised from the existing 10 per cent to 12 per cent to be reached by March 31, 2009 and further to 15 per cent by March 31, 2010. The NBFCs-ND-SI are required to make additional disclosures relating to CRAR, exposure to the real estate sector and maturity pattern of assets and liabilities in their balance sheet from the year ending March 31, 2009. In view of the possibility of leveraged investments, and asset-liability mismatches resulting from use of short-term sources to fund NBFC activities, a system of reporting for NBFCs-ND-SI was introduced with effect from the period ended September 30, 2008. However, to enable the NBFCs to fine tune the system, the first return for the period ended September 2008 is required to be submitted by the first week of January 2009. Issuance of Perpetual Debt Instruments 6.47 Taking into consideration the need for enhanced funds for increasing business and meeting regulatory requirements, NBFCs-ND-SI were permitted to augment their capital funds by issue of Perpetual Debt Instruments (PDI). PDIs may be issued in Indian rupees only and the aggregate amount to be raised by issue of such instruments has to be within the overall limits of Tier I and Tier II. The aggregate amount is allowed to be raised in tranches. However, the minimum investment by a single investor in each such issue/tranche has to be Rs 5 lakh. The PDI is eligible to be treated as Tier I capital up to 15 per cent of total Tier I capital as on March 31 of the previous year. The amount of PDI in excess of amount admissible as Tier I can qualify as Tier II capital, subject to certain conditions. The interest payable to the investors on PDI may be either at a fixed rate or at a floating rate referenced to a market determined rupee interest benchmark rate. NBFCs-ND-SI can issue PDI as plain vanilla instruments only. However, NBFCs-ND-SI may issue PDI with a 'call option'. Access to Short-Term Foreign Currency Borrowings 6.48 As a temporary measure, NBFCs-ND-SI were permitted to raise short- term foreign currency borrowings under the approval route, subject to certain conditions like eligibility of borrowers and lenders, end-use of funds, maturity, etc. The maximum amount should not exceed 50 per cent of the net owned funds (NOF) or USD 10 million (or its equivalent), whichever is higher. The all-in-cost ceiling has been fixed at not exceeding 6 months Libor + 200 bps. The borrowings should be fully swapped into rupees for the entire maturity. Profile of NBFCs (including RNBCs) 6.49 Total number of NBFCs registered with the Reserve Bank, consisting of NBFCs-D (deposit-taking NBFCs), RNBCs, mutual benefit companies (MBCs), miscellaneous non-banking companies (MNBCs) and Nidhi companies, declined from 12,968 at end-June 2007 to 12,809 at end-June 2008 (Table VI.13). The number of NBFCs-D declined from 401 at end-June 2007 to 364 at end-June 2008, mainly due to the exit of many NBFCs from deposit taking activity. The number of RNBCs declined to two at end-March 2008.

6.50 Of the 364 deposit-taking NBFCs, 335 NBFCs filed annual return for the year ended March 2008 by the cut-off date of September 30, 2008. Even though the public deposits declined by Rs.304 crore in 2007-08 over the previous year, partly reflecting the decline in number of reporting NBFCs, total assets increased significantly by Rs.23,019 crore (32.1 per cent), while net owned funds increased by Rs.3,974 crore (48.0 per cent) during the same period (Table VI.14). The rise in total assets and net owned funds reflected partly the restoration of IFCI Ltd. and TFCI Ltd. to the NBFC category. The share of public deposits held by RNBCs in the total deposits of all NBFCs remained constant at 91.6 per cent in 2007-08 as compared with 2006-07. However, the share of RNBCs in total assets of NBFCs declined to 25.8 per cent at end-March 2008 from 32.3 per cent at end-March 2007.

6.51 The ratio of deposits of reporting NBFCs to the aggregate deposits of scheduled commercial banks dropped to 0.73 per cent at end-March 2008 from 0.92 per cent at end-March 2007 mainly due to the decline in deposits of reporting NBFCs. The share of NBFC deposits in broad liquidity aggregate (L3) also declined during the period (Chart VI.2). Operations of NBFCs (excluding RNBCs) 6.52 Total assets/liabilities of NBFCs (excluding RNBCs) expanded at a much higher rate of 44.8 per cent during 2007-08 compared with 28.4 per cent during 2006-07 (Table VI.15). Borrowings, which is the major source of funds for NBFCs, increased by 55.3 per cent during the year, while public deposits declined by 1.9 per cent indicating the continuing shift in the pattern of resources raised. On the assets side, hire purchase assets witnessed a deceleration, while loans and advances witnessed a sharp rise during 2007-08. Total investments of NBFCs decelerated mainly due to deceleration in investments in approved securities. Other investments, which had declined during 2006-07, increased sharply by 33.1 per cent during 2007-08.

6.53 Among NBFC groups, asset finance companies (AFCs) held the largest share in total assets/liabilities (64.1 per cent), followed by loan companies (27.5 per cent), hire purchase companies (7.5 per cent) and investment companies (0.6 per cent) (Table VI.16). The increase in assets / liabilities of AFCs was mainly on account of reclassification of NBFCs, which was initiated in December 2006 and the process of which is still continuing. On the other hand, the increase in assets / liabilities of loan companies was mainly on account of restoration of IFCI Ltd. and TFCI Ltd. from FIs category to the loan category of NBFCs. The share of equipment leasing companies declined to below 1 per cent subsequent upon the re-classification of NBFCs in 2006-07. The relative significance of various NBFC groups reflected largely the pattern of their borrowings as deposits constituted a small share (2.9 per cent) of their total liabilities. Of the total deposits held by all NBFCs, asset finance companies held the largest share in total deposits of NBFCs (56.7 per cent), followed distantly by hire purchase companies with a 26.2 per cent share and by loan companies with a share of 15.8 per cent (Table VI.16).

Deposits Profile of Public Deposits of Different Categories of NBFCs 6.54 Continuing the trend of the previous year, public deposits held by all groups of NBFCs taken together, declined moderately during 2007-08. This trend is indicative of the shift in preference of NBFCs from public deposits to bank loans/ debentures. The decline in public deposits was mainly evident in the case of equipment leasing companies and hire purchase companies, mainly due to reclassification of some of these companies as asset finance companies. Concomitantly, deposits of asset finance companies increased by 522.4 per cent. The deposits of loan companies also increased by 174.3 per cent, mainly reflecting the inclusion of IFCI Ltd. and TFCI Ltd. in this category (Table VI.17). Size-wise Classification of NBFCs Deposits 6.55 Deposits held by NBFCs ranged from less than Rs.0.5 crore to above Rs.50 crore (Table VI.18). The deposits held by NBFCs in all deposit-groups declined during 2007-08, except in the deposit-class 'more than Rs.2 1 Trigger event is defined as the classification of the account of the borrower as non-performing asset in the books of the creditor institution. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

पेज अंतिम अपडेट तारीख: