new private sector banks), with the increase being more pronounced

in respect of public sector banks. The maturity pattern of loans and advances

and investments of all bank groups remained broadly the same during 2007-08 as

in the previous year. The share of loans and advances with up to one year maturity

increased marginally in the case of all bank groups, barring foreign banks. Similar

trend was observed in investments across all bank groups. On the whole, assets

depicted a synchronous pattern with the liabilities. At end-March 2008, in general,

public sector banks and old private sector banks had higher proportion of both

liabilities and assets under longer maturity bucket. Furthermore, within the asset

portfolio, while the maturity profile of loans and advances was nearly similar

for all bank groups, barring foreign banks, investment pattern of new private

sector banks and foreign banks was more tilted towards shorter term maturity profile.

3. Off-Balance Sheet Operations

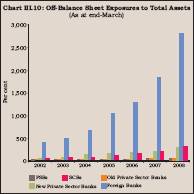

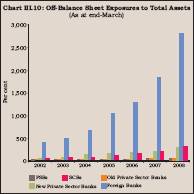

3.55 In line with the trend observed in recent years, SCBs continued to expand

their off-balance sheet (OBS) exposures. During 2007-08, off-balance sheet exposures

increased sharply by 88.4 per cent on the top of an increase of 80.2 per cent

during 2006-07. As a result, the total off-balance sheet exposure of SCBs at end-March

2008 was more than three times the size of their consolidated balance sheet as

compared with more than two times at end-March 2007 (Chart III.10).

Leveraged positions in derivatives as a means of diversifying income, improvements

in technology (trading and information services) and increasing use of derivatives

as tools for risk mitigation appear to have contributed to the growth in OBS exposures.

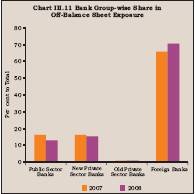

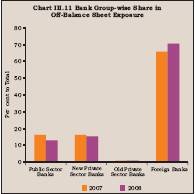

3.56 Among the bank groups, the off-balance sheet exposure of foreign banks

was at 2,830.5 per cent of their total assets, followed by new private sector

banks (301.8 per cent), public sector banks (61.5 per cent) and old private sector

banks (57.1 per cent) (Appendix Table III.14).

3.57 Of the total off-balance

sheet exposures of SCBs, foreign banks constituted the largest share (70.8 per

cent), followed by new private sector banks (15.6 per cent) and public sector

banks (12.9 per cent) (Chart III.11)

4.

Financial Performance of Scheduled Commercial Banks

3.58 Financial performance of SCBs during 2007-08 was shaped by the movements

in deposits interest rates across all maturities and lending interest rates along

with growth in the volume of their activities. Reflecting hardening of interest

rates, interest income increased sharply. Although deposit interest rates softened

between end-March 2007 and end-March 2008, deposits contracted at higher interest

rates at different points of time led to increase in interest expenditure. On

the whole, net interest income declined in relation to assets. Non-interest income,

however, grew significantly. Operating expenses of banks were contained. As a

result, profits of banks increased considerably during the year. Overall, return

on assets improved during the year, though return on equity declined marginally

as banks enlarged their capital base partly by raising resources from the capital

market and partly by ploughing back of profits.

Table

III.20: Movements in Deposit and Lending Interest Rates |

(Per

cent) | Interest

Rates | March | March | March | June | October |

| 2006 | 2007 | 2008 | 2008 | 2008 |

1 | 2 | 3 | 4 | 5 | 6 |

Deposit Rates | | | | | |

Public Sector Banks | | | | | |

a) | Up

to 1 year | 2.25-6.50 | 2.75-8.75 | 2.75-8.50 | 2.75-9.00 | 2.75-10.25 |

b) | 1

year up to 3 years | 5.75-6.75 | 7.25-9.50 | 8.25-9.25 | 8.25-9.50 | 8.75-10.60 |

c) | Over

3 years | 6.00-7.25 | 7.50-9.50 | 8.00-9.00 | 8.00-9.35 | 8.50-9.75 |

Private Sector Banks | | | | | |

a) | Up

to 1 year | 3.50-7.25 | 3.00-9.00 | 2.50-9.25 | 3.00-8.75 | 3.00-10.50 |

b) | 1

year up to 3 years | 5.50-7.75 | 6.75-9.75 | 7.25-9.25 | 8.00-9.50 | 9.00-11.00 |

c) | Over

3 years | 6.00-7.75 | 7.75-9.60 | 7.25-9.75 | 8.00-10.00 | 8.25-11.00 |

Foreign Banks | | | | | |

a) | Up

to 1 year | 3.00-5.75 | 3.00-9.50 | 2.25-9.25 | 3.00-9.25 | 3.50-12.15 |

b) | 1

year up to 3 years | 4.00-6.50 | 3.50-9.50 | 3.50-9.75 | 3.50-9.75 | 3.50-10.50 |

c) | Over

3 years | 5.50-6.50 | 4.05-9.50 | 3.60-9.50 | 3.60-9.50 | 3.60-11.00 |

BPLR | | | | | | |

Public Sector Banks | 10.25-11.25 | 12.25-12.75 | 12.25-13.50 | 12.50-14.00 | 13.75-14.70 |

Private Sector Banks | 11.00-14.00 | 12.00-16.50 | 13.00-16.50 | 13.00-17.00 | 13.75-17.75 |

Foreign Banks | 10.00-14.50 | 10.00-15.50 | 10.00-15.50 | 10.00-15.50 | 10.00-17.00 |

Actual Lending Rates* | | | | | |

Public Sector Banks | 4.00-16.50 | 4.00-17.00 | 4.00-17.75 | 4.00-18.00 | - |

Private Sector Banks | 3.15-20.50 | 3.15-25.50 | 4.00-24.00 | 4.00-25.00 | - |

Foreign Banks | 4.75-26.00 | 5.00-26.50 | 5.00-28.00 | 5.00-25.50 | - |

- : Not Available | | | | | |

* : Interest rate on non-export

demand and term loans above Rs.2 lakh excluding lending rates at the extreme five

per cent on both sides. | Interest Rate Scenario

3.59 Lending rates of SCBs across various bank groups

showed a generally upward movement during the year (Table III.20).

Deposit rates across bank groups showed a general decline during 2007-08, though

foreign and private sector banks marginally increased their rates in some of the

maturitybuckets. Public sector banks reduced the maximum rate on term deposits

of all maturities (25 to 50 basis points), while they increased the minimum rates

for deposits of 1 to 3 years (100 basis points). Private sector banks increased

the maximum rates for deposits up to one year (by 25 basis points) and over three

years (by 15 basis points), while they reduced their interest rate on for deposits

of one to three maturity (by 50 basis points). The minimum rates for deposits

up to one year and over three years were reduced (by 50 basis points each) by

private sector banks, while they were increased for deposits of one to three years

(by 50 basis points). Foreign banks, on the other hand, reduced their minimum

rates for deposits up to 1 year (by 75 basis points) and over 3 years (by 45 basis

points). Interest rates offered by public sector banks on deposits of maturity

of one year to three years were placed in the range of 8.25-9.25 per cent in March

2008 as compared with the range of 7.25-9.50 per cent a year ago, while those

on deposits of maturity of above three years were placed in the range of 8.00-9.00

per cent in March 2008 as compared with the range of 7.50-9.50 per cent a year

ago. Similarly, interest rates offered by private sector banks on deposits of

maturity of one year to three years were placed in the range of 7.25-9.25 per

cent in March 2008 as compared with 6.75-9.75 per cent in March 2007, while those

on deposits of maturity above three years were placed in the range of 7.25-9.75

per cent in March 2008 as compared with 7.75-9.60 per cent in March 2007. Interest

rates offered by foreign banks on deposits of maturity of one year to three years

were placed in the range of 3.50-9.75 per cent in March 2008 as compared with

3.50-9.50 per cent in March 2007. 3.60 During the first half of 2008-09,

both the lending and deposits rates, in general, hardened. Interest rates of PSBs

on deposits of maturity of one to three years were placed in the range of 8.25-9.50

per cent in June 2008 as compared with 8.25-9.25 per cent in March 2008 and further

moved up to the range of 8.75-10.60 per cent in October 2008. The deposit rates

of private sector banks on deposits of maturity of one to three years and above

three years firmed up further to 9.00-11.00 per cent and 8.25-11.00 per cent,

respectively, in October 2008 as compared with 7.25-9.25 per cent and 7.25-9.75

per cent, respectively, in March 2008.

3.61 The range of benchmark

prime lending rates (BPLRs) of PSBs and private sector banks hardened somewhat

during 2007-08. Overall, there was an increase of around 75 basis points in the

BPLR of public sectors during 2007-08 as compared with that in the previous year

(Chart III.12). The BPLR of PSBs and private sector banks

were placed in the range of 12.25-13.50 per cent and 13.00-16.50 per cent, respectively,

in March 2008 as compared with 12.25-12.75 per cent and 12.00-16.50 per cent,

respectively, in March 2007.The range of BPLRs of foreign banks, however, remained

unchanged at 10.00-15.50 per cent during this period. The range of actual lending

rates on demand and term loans (other than export credit) for the SCBs widened

to the range of 4.00-28.00 per cent in March 2008 from the range of 3.15-26.50

per cent in March 2007 (Table III.20).

3.62 The share of sub-BPLR lending in total lending of commercial banks, excluding

export credit and small loans, declined from 78 per cent at end-March 2007 to

about 76 per cent at end-March 2008. The band of BPLRs of private sector banks

and foreign banks was much wider than that of public sector banks. BPLRs of more

than half of private sector banks were in the range of 13.00-15.00 per cent at

end-March 2008, while those of other private sector banks in the range of 15.25-16.50

per cent. As regards foreign banks, BPLRs of twelve banks were in the range of

10.00-13.00 per cent. BPLRs of nine other foreign banks were in the range of 13.25-14.00

per cent and another seven in the range of 14.25-15.50 per cent.

3.63 Yields

in the Government securities market during 2007-08 hardened somewhat in the first

quarter, partly in response to global trends, CRR hikes, increase in market stabilisation

scheme (MSS) ceiling and issuance under the MSS. Yields softened after July 2007

on account of easy liquidity conditions, lower inflation, global trends in yields

and expectations of a rate cut by RBI in the beginning of 2008. Yields, however,

moved up after March 2008 on account of higher inflation(Table

III.21). The money market remained largely orderly during 2007-08, barring

occasional spells of volatility on account of large changes in capital flows and

cash balances of the Central Government with the Reserve Bank. Call rates, which

ruled easy from April 2008, edged up somewhat during May 2008, reflecting a decline

in the surplus liquidity in the banking system due to the cumulative impact of

a three-stage hike in the cash reserve ratio (CRR). CDs continued to be a preferred

alternative for mobilising resources by some banks during 2007-08 and thereafter

due to the flexibility of their timing and returns (Details given in Chapter 7).

Table

III.21: Structure of Interest Rates* |

(Per

cent) | Instrument | March

2006 | March

2007 | March

2008 | October

2008 | 1 | 2 | 3 | 4 | 5 |

I. | Debt

market | | | | |

| 1. | Government

Securities Market | | | | |

| | 5

-Year | 7.24 | 7.97 | 7.70 | 7.42 |

| | 10

-Year | 7.53 | 7.97 | 7.93 | 7.45 |

II. | Money

Markets | | | | |

| 2. | Call

Borrowing (Average) | 6.57 | 14.07 | 7.37 | 9.90 |

| 3. | Commercial

papers | | | | |

| | WADR

61 - 90 days | 8.72 | 11.65 | 10.79 | 16.27 |

| | WADR

91-180 days | 8.54 | 11.81 | 10.01 | 12.57 |

| | Range | 6.69-9.25 | 10.25-13.00 | 9.50-14.25 | 11.55-16.90 |

| 4. | Certificates

of deposit | | | | |

| | Range | 6.50-8.94 | 10.23-11.90 | 9.00-10.75 | 8.92-21.00 |

| | WADR

Overall | 8.62 | 10.75 | 10.00 | 12.57 |

| | 3

Months | 8.72 | 11.35 | 10.73 | 10.45 |

| | 12

Months | 8.65 | 10.59 | 9.97 | 10.26 |

| 5. | Treasury

Bills | | | | |

| | 91

days | 6.11 | 7.98 | 7.36 | 9.06 |

| | 364

days | 6.42 | 7.98 | 7.35 | 9.18 |

* : As at end-month.

WADR

- Weighted Average Discount Rate. |

Cost

of Deposits and Return on Advances

3.64 Though the deposit

rates showed a marginal decline between end-March 2007 and end-March 2008, the

cost of deposits of SCBs increased by one percentage point as compared with that

during the previous year. This essentially reflected the average cost of contracting

deposits of different types and different maturities at different points in time.

Thus, the rise in cost of deposits during 2007-08 partly reflected the increase

in deposit rate during the previous year. Though the cost of deposits increased

across all bank groups, the increase was more pronounced in the case of new private

sector banks (1.2 percentage points). Owing to higher lending rates, return of

advances of SCBs showed a significant improvement of one percentage point during

the year with the improvement being observed across all bank groups. The increase

was significantly higher in the case of new private sector banks (1.7 percentage

points). Return on investments by SCBs, however, declined marginally during 2007-08

from the previous year’s level mainly reflecting the prevailing financial

markets conditions. The decline in return on investments was observed across all

bank groups, barring new private sector banks which showed an increase of 0.8

percentage points. The improvement in the overall return on funds was lower than

the increase in the cost of funds, leading to a decline of around 20 basis points

in the spread (returns of funds over cost of funds) of banks during 2007-08

(Table III.22).

Income

3.65 Overall

income of SCBs during 2007-08 increased at a significantly higher rate of 34.3

per cent as compared with 24.4 per cent increase in the previous year. The income

to assets ratio improved to 8.5 per cent after remaining unchanged at 7.9 per

cent in the previous two years (Appendix Table III.15). Reflecting the higher

lending rates, interest income of SCBs during 2007-08 increased by 33.6 per cent

as compared with 25.0 per cent in the previous year (Table III.23).

‘Other income’ of SCBs during 2007-08 increased by 37.8 per cent as

compared with 21.7 per cent during the previous year, reflecting the increasing

diversification of sources of income by banks.

Table

III.22: Cost of Funds and Returns on Funds - Bank Group-wise

| (Per

cent) | Indicator | Public

Sector | Old

Private | New

Private | Foreign | Scheduled |

| Banks | Sector

Banks | Sector

Banks | Banks | Commercial

Banks |

| 2006-07 | 2007-08 | 2006-07 | 2007-08 | 2006-07 | 2007-08 | 2006-07 | 2007-08 | 2006-07 | 2007-08 |

1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 |

1. | Cost

of Deposits | 4.5 | 5.4 | 4.9 | 5.7 | 4.7 | 5.9 | 3.1 | 3.8 | 4.4 | 5.4 |

2. | Cost

of Borrowings | 2.8 | 3.6 | 3.4 | 4.6 | 3.1 | 3.1 | 4.7 | 4.5 | 3.3 | 3.7 |

3. | Cost

of Funds | 4.4 | 5.3 | 4.8 | 5.7 | 4.5 | 5.5 | 3.5 | 4.0 | 4.3 | 5.3 |

4. | Return

on Advances | 7.7 | 8.6 | 8.6 | 9.6 | 8.3 | 10.0 | 8.7 | 9.8 | 7.9 | 8.9 |

5. | Return

on Investments | 7.1 | 6.8 | 7.0 | 6.5 | 5.7 | 6.5 | 7.5 | 7.1 | 6.9 | 6.7 |

6. | Return

on Funds | 7.5 | 8.0 | 8.0 | 8.6 | 7.4 | 8.7 | 8.2 | 8.7 | 7.6 | 8.2 |

7. | Spread

(6-3) | 3.1 | 2.7 | 3.2 | 2.9 | 2.9 | 3.2 | 4.7 | 4.8 | 3.2 | 3.0 |

Notes :1.Cost of Deposits

= Interest Paid on Deposits/Deposits.

2.Cost of Borrowings = Interest Paid

on Borrowings/Borrowings.

3.Cost of Funds = (Interest Paid on Deposits + Interest

Paid on Borrowings)/(Deposits + Borrowings).

4.Return on Advances = Interest

Earned on Advances /Advances.

5.Return on Investments = Interest Earned on

Investments /Investments.

6.Return on Funds = (Return on Advances + Return

on Investments)/(Investments + Advances). |

Table

III.23: Important Financial Indicators of Scheduled Commercial Banks

| (Amount

in Rs. crore) | Item | 2005-06 | 2006-07 | 2007-08 |

| Amount | Per

cent to | Amount | Per

cent to | Amount | Per

cent to |

|

| Assets |

| Assets |

| Assets |

1 | 2 | 3 | 4 | 5 | 6 | 7 |

1. | Income | 2,20,756 | 7.9 | 2,74,716 | 7.9 | 3,68,886 | 8.5 |

| a) | Interest

Income | 1,85,388 | 6.7 | 2,31,675 | 6.7 | 3,09,570 | 7.2 |

| b) | Other

Income | 35,368 | 1.3 | 43,041 | 1.2 | 59,315 | 1.4 |

2. | Expenditure | 1,96,174 | 7.0 | 2,43,514 | 7.0 | 3,26,160 | 7.5 |

| a) | Interest

Expended | 1,07,161 | 3.8 | 1,42,420 | 4.1 | 2,08,001 | 4.8 |

| b) | Operating

Expenses | 59,201 | 2.1 | 66,319 | 1.9 | 77,220 | 1.8 |

| | of

which : Wage Bill | 33,461 | 1.2 | 36,148 | 1.0 | 39,806 | 0.9 |

| c) | Provision

and | | | | | | |

| | Contingencies | 29,812 | 1.1 | 34,775 | 1.0 | 40,939 | 0.9 |

3. | Operating

Profit | 54,394 | 2.0 | 65,977 | 1.9 | 83,665 | 1.9 |

4. | Net

Profit | 24,582 | 0.9 | 31,203 | 0.9 | 42,726 | 1.0 |

5. | Net

Interest Income/Margin (1a-2a) | 78,227 | 2.8 | 89,255 | 2.6 | 1,01,570 | 2.3 |

Note: The

number of scheduled commercial banks was 85 in 2005-06, 82 in 2006-07 and 79 in

2007-08. |

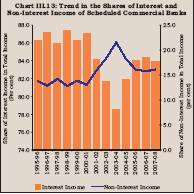

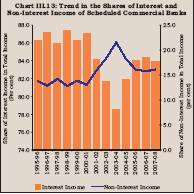

3.66 The relative contribution of interest

and non-interest income in total income of SCBs showed significant variations

in recent years. The share of interest income, which had declined to a low level

of 78.5 per cent in 2003-04, increased during the following three years. In 2007-08,

however, it declined marginally to 83.9 per cent as compared with 84.3 per cent

in the previous year (Chart III.13). The share of non-interest

incomes showed a corresponding increase.

3.67

There was a discernible change in the relative contribution of interest and non-interest

income to total income during 2007-08. Non-interest sources contributed 17.3 per

cent to incremental income of SCBs as compared with 14.2 per cent during the previous

year. The interest component showed a corresponding decline during 2007-08 (Chart

III.14). Non-interest income in relation to total assets increased from 1.2

per cent in 2006-07 to 1.4 per cent in 2007-08.

3.68

The composition of non-interest income of SCBs has undergone some changes in recent

years, particularly in terms of fee based income (Box III.2).

Income from trading, which increased significantly during 2001-02 to 2003-04,

declined in recent years.

3.69 Among bank-groups, income of new private

sector banks grew at the highest rate (45.8 per cent) during 2007-08, followed

by foreign banks (40.0 per cent), public sector banks (30.9 per cent) and old

private sector banks (28.8 per cent). The interest income to total assets ratio

of new private sector banks and SBI group improved during the year, while it declined

in the case of other bank groups [Appendix Table III.17(A to G)]. Expenditure

3.70 Expenditure of SCBs increased by 33.9 per cent during 2007-08 as compared

with 24.1 per cent in the previous year. Among the major components of expenditure

of SCBs, reflecting the impact of deposits contracted at different interest rates,

interest expended increased sharply by 46.0 per cent as compared with 32.9 per

cent in the previous year. Non-interest or operating expenses increased by 16.4

per cent as compared with 12.0 per cent in the last year. Provisioning made increased

marginally (Table III.24).

3.71 In relation to assets,

interest expenses increased to 4.8 per cent of total assets from 4.1 per cent

in 2006-07. Operating expenses as percentage of total assets, however, declined

marginally to 1.8 per cent in 2007-08 as compared with 1.9 per cent in the previous

year (Appendix Table III.25). As a result, banks’ burden

(excess of non-interest expenditure over non-interest income) declined significantly

to 0.4 per cent of total assets in 2007-08 as compared with 0.7 per cent in 2006-07

and 0.9 per cent in 2005-06. The efficiency ratio (operating expenses as percentage

of net interest income plus non-interest income) improved to 48.0 per cent during

2007-08 from 50.1 per cent in 2006-07, reflecting the rise in non-interest income

and decline in operating expenses, which combined together outweighed the decline

in net interest income (in relation to total assets). Box

III.2: Sources of Non-interest Income of Scheduled Commercial Banks With

the increased competition brought about by financial liberalisation, banks began

to diversify their activities and as such non-interest income of banks acquired

greater significance in the income portfolio of banks in India. An analysis of

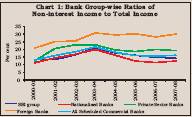

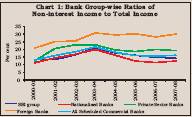

data on scheduled commercial banks (excluding regional rural banks) from 2000-01

to 2007-08 suggests that the ratio of non-interest income to total income of scheduled

commercial banks increased from 13.0 per cent in 2000-01 to 21.6 per cent in 2003-04.

The ratio, however, declined thereafter to 15.7 per cent in 2006-07, before showing

a marginal increase in 2007-08 to 16.1 per cent (Chart 1).

The

share of non-interest income in total income was the highest in respect of foreign

banks in each of the single year from 2000-01 to 2007-08, indicating their large

exposure to off-balance sheet items. On the other hand, the share of non-interest

income was the lowest in respect of nationalised banks.

Sources of non-interest

income of SCBs comprise: (i) commission, exchange, and brokerage; (ii) profit

on sale of investments; (iii) profit on exchange transaction; and (iv) miscellaneous

income. The miscellaneous income of banks includes profit on revaluation of investments,

profit on sale of fixed assets such as buildings. Of these, while profit on exchange

transactions and miscellaneous income showed more or less a steady trend, commission,

exchange and brokerage, and profit on sale of investments showed a divergent trend.

The share of commission, exchange and brokerage declined sharply during 2003-04,

in which year, however, the share of profit on sale of investments increased commensurately.

During 2006-07, when the commission, exchange and brokerage increased sharply,

that of profit on sale of investments showed a sharp decline (Chart

2).

References:

1. Reserve Bank of India (2008a), Statistical Tables Relating to Banks in India

1979-2007.

———— (2008b), Annual Accounts of Scheduled

Commercial Banks, 2007-08.

Table

III.24: Variation in Income-Expenditure of

Scheduled Commercial

Banks | (Amount

in Rs. crore) | Item | 2006-07 | 2007-08 |

| Absolute | Per

cent | Absolute | Per

cent | 1 | 2 | 3 | 4 | 5 |

1. | Income

(a+b) | 53,961 | 24.4 | 94,169 | 34.3 |

| a) | Interest

Income | 46,287 | 25.0 | 77,895 | 33.6 |

| b) | Other

Income | 7,673 | 21.7 | 16,274 | 37.8 |

2. | Expenses

(a+b+c) | 47,340 | 24.1 | 82,646 | 33.9 |

| a) | Interest

Expenses | 35,259 | 32.9 | 65,581 | 46.0 |

| b) | Other

Expenses | 7,118 | 12.0 | 10,901 | 16.4 |

| c) | Provisioning | 4,963 | 16.6 | 6,164 | 17.7 |

3. | Operating

Profit | 11,583 | 21.3 | 17,688 | 26.8 |

4. | Net

Profit | 6,621 | 26.9 | 11,523 | 36.9 |

Source : Balance

Sheets of respective banks. | 4.1 per cent in 2006-07.

Operating expenses as percentage of total assets, however, declined marginally

to 1.8 per cent in 2007-08 as compared with 1.9 per cent in the previous year

(Appendix Table III.25). As a result, banks’ burden (excess of non-interest

expenditure over non-interest income) declined significantly to 0.4 per cent of

total assets in 2007-08 as compared with 0.7 per cent in 2006-07 and 0.9 per cent

in 2005-06. The efficiency ratio (operating expenses as percentage of net interest

income plus non-interest income) improved to 48.0 per cent during 2007-08 from

50.1 per cent in 2006-07, reflecting the rise in non-interest income and decline

in operating expenses, which combined together outweighed the decline in net interest

income (in relation to total assets).

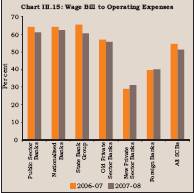

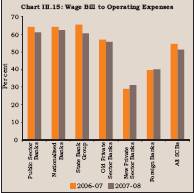

3.72 Wages by SCBs increased at

a somewhat higher rate of 10.1 per cent in 2007-08 as compared with 8.0 per cent

in the previous year. In terms of percentage to total assets, however, the wage

bill of SCBs declined marginally to 0.9 per cent as compared with 1.0 per cent

in 2006-07. A similar decline was also observed in the ratio of wage bill to operating

expenses during 2007-08 (Chart III.15). Continuing the trend,

the wage bill to operating expenses ratio was the lowest in respect of new private

sector banks (31.2 per cent) in 2007-08, followed by foreign banks (39.9 per cent),

notwithstanding some increase in the ratio over the previous year. The wage bill

to operating ratio of other bank groups showed a marginal decline during 2007-08,

essentially reflecting the reduction in expenditure on wages due to continued

emphasis on technological updgradation.

Net Interest Income

3.73 The difference between

interest income and interest expenses, i.e., net interest income, is

an important indicator of efficiency of the intermediation process by banks. Lower

net interest income in relation to assets is an indicator of higher efficiency.

Continuing the trend that began in 2004-05, net interest income (spread) of SCBs

as percentage of total assets declined to 2.3 per cent in 2007-08 from 2.6 per

cent in the previous year. Among the bank groups, net interest margin of foreign

banks and private banks increased, while that of PSBs declined during 2007-08

(Appendix Table III.23).

Operating Profits 3.74

Reflecting the buoyant growth in non-interest income on the one hand and a relatively

subdued growth in operating expenses on the other, operating profits of SCBs increased

by 26.8 per cent in 2007-08 as compared with an increase of 21.3 per cent in 2006-07.

Though the operating profits increased across all bank groups, the increase was

more pronounced in respect of new private sector and foreign banks. The operating

profits to total assets ratio during 2007-08 remained almost unchanged at the

previous year’s level of 1.9 per cent. At the individual bank level, the

operating profits to assets ratio showed large variations. The ratio varied between

11.1 per cent and (-)0.7 per cent in respect of foreign banks, between 2.8 per

cent to 0.8 per cent in the case of private sector banks (barring Sangli Bank

and Lord Krishna Bank which were merged during the year) and between 2.4 per cent

to 0.8 per cent for public sector banks (Appendix Table III.19).

Provisions

and Contingencies

3.75 Provisions and contingencies of

SCBs during 2007-08 grew at a marginally higher rate of 17.7 per cent as compared

with 16.6 per cent in the previous year. While provisions for loans during 2007-08

were higher by 5.3 per cent, provisions for depreciation in value of investments

declined by 11.6 per cent. Bank-group wise, provisions and contingencies as percentage

of total assets increased for private sector and foreign banks, while they declined

for PSBs.

Net Profit

3.76

Net profits of SCBs showed a significant increase of 36.9 per cent during 2007-08

as compared with 26.9 per cent in the previous year despite the larger increase

in provisions and contingencies (Table III.25).

Return

on Assets

3.77 Return on assets (RoA)

is an indicator of efficiency with which banks deploy their assets. During 2007-08,

the net profits to assets ratio of SCBs improved moderately to 1.0 per cent from

0.9 per cent in 2006-07. Though net profits as percentage of total assets improved

across all bank groups, the improvement was more pronounced in the case of old

private sector banks (Chart III.16). Foreign banks continued

to show the highest returns on assets.

Table

III.25: Operating Profit and Net Profit - Bank Group-wise |

(Amount

in Rs. Crore) | Bank

Group | Operating

Profit | Net

Profit |

| 2006-07 | Percentage | 2007-08 | Percentage | 2006-07 | Percentage | 2007-08 | Percentage |

|

| Variation |

| Variation |

| Variation |

| Variation |

1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

Scheduled Commercial Banks | 65,977 | 21.3 | 83,665 | 26.8 | 31,203 | 26.9 | 42,726 | 36.9 |

Public Sector Banks | 42,655 | 12.3 | 50,441 | 18.3 | 20,152 | 21.8 | 26,592 | 32.0 |

Nationalised Banks | 27,456 | 24.0 | 31,663 | 15.3 | 12,950 | 29.2 | 16,856 | 30.2 |

State Bank Group | 14,292 | -4.9 | 17,444 | 22.1 | 6,572 | 10.3 | 9,006 | 37.0 |

Other Public Sector Bank | 907 | 13.2 | 1,333 | 47.0 | 630 | 12.4 | 729 | 15.7 |

Old Private Sector Banks | 3,021 | 33.8 | 3,605 | 19.3 | 1,122 | 29.6 | 1,978 | 76.3 |

New Private Sector Banks | 10,682 | 42.2 | 15,632 | 46.3 | 5,343 | 30.0 | 7,544 | 41.2 |

Foreign Banks | 9,619 | 44.5 | 13,988 | 45.4 | 4,585 | 49.4 | 6,612 | 44.2 |

Source : Balance

sheets of respective banks. |

Return

on Equity

3.78 Return on equity (RoE), an indicator of

efficiency with which capital is used by banking institutions, declined to 12.5

per cent as at end-March 2008 from 13.2 per cent at end-March 2007, reflecting

mainly the impact of increase in resources raised from the capital market during

the year and reserves and surplus (Chart III.17).

5.

Soundness Indicators

3.79 A sound and efficient banking

system is a sine qua non for maintaining financial stability. Therefore,

considerable emphasis has been placed on strengthening the capital requirements

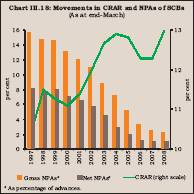

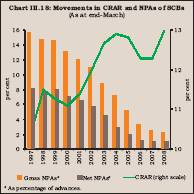

in recent years. The capital to risk-weighted assets ratio (CRAR) of SCBs, a measure

of the capacity of the banking system to absorb unexpected losses, improved further

to 13.0 per cent at end-March 2008 from 12.3 per cent at end-March 2007. Asset

quality of SCBs also improved consistently in the past few years as reflected

in the decline in non-performing assets (NPAs) as percentage of total advances.

During 2007-08, while overall gross NPAs of SCBs declined to 2.3 per cent of gross

advances from 2.5 per cent in the previous year, net NPAs as percentage of net

advances remained at the previous year’s level of 1.0 per cent. Thus, in

terms of the two crucial soundness indicators, viz., capital and asset

quality, the Indian banking sector showed further improvement during 2007-08

(Chart III.18).

Asset

Quality

3.80 The trend of improvement in

the asset quality of banks continued during the year. Indian banks recovered a

higher amount of NPAs during 2007-08 than that during the previous year. Though

the total amount recovered and written-off at Rs.28,283 crore in 2007-08 was higher

than Rs.26,243 crore in the previous year, it was lower than fresh addition of

NPAs (Rs.34,420 crore) during the year. As a result, the gross NPAs of SCBs increased

by Rs.6,136 crore in 2007-08. This is the first time since 2001-02 that gross

NPAs increased in absolute terms (Table III.26). In this context,

it may be noted that banks had registered rapid credit growth during the previous

three years. Some slippage in NPAs, therefore, could be expected. Besides, some

other developments such as hardening of interest rates might have also resulted

in increased NPAs. Banks had extended housing loans at floating interest rates.

The hardening of interest rates might have made the repayment of loans difficult

for some borrowers, resulting in some increase in NPAs in this sector. It may

be noted that the increase in gross NPAs was more noticeable in respect of new

private sector and foreign banks, which have been more active in the real estate

and housing loans segments. Gross NPAs (in absolute terms) of nationalised banks

and old private sector banks continued to decline during the year. Gross NPAs

of State Bank group showed an increase. Notwithstanding increase in gross NPAs

of the banking sector, gross NPAs as percentage of gross advances declined further

to 2.3 per cent at end-March 2008 from 2.5 per cent a year ago. The NPAs ratio

(gross NPAs to gross advances) of new private sector banks increased significantly

during the year, while that of foreign banks increased marginally. The NPAs ratio

of all other bank groups declined.

Table

III.26: Movements in Non-performing Assets - Bank Group-wise

| (Amount

in Rs. crore) | Item | Scheduled | Public | Nationalised | State | Old

Private | New

Private | Foreign |

| Commercial | Sector | Banks | Bank | Sector | Sector | Banks |

| Banks | Banks | (20*) | Group | Banks | Banks | (28) |

| (79) | (28) |

| (8) | (15) | (8) |

|

1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

Gross NPAs | | | | | | | |

As at end-March 2007 | 50,299 | 38,968 | 26,292 | 12,676 | 2,810 | 6,286 | 2,233 |

Addition during the year | 34,420 | 24,093 | 14,617 | 9,476 | 1,249 | 6,412 | 2,664 |

Recovered during the year | 28,090 | 22,466 | 15,791 | 6,675 | 1,501 | 2,272 | 1,849 |

Written off during the year | 193 | 0 | 0 | 0 | 1 | 0 | 191 |

As at end-March 2008 | 56,435 | 40,595 | 25,117 | 15,478 | 2,557 | 10,426 | 2,856 |

Net NPAs | | | | | | | |

As at end-March 2007 | 20,207 | 15,324 | 8,965 | 6,359 | 831 | 3,136 | 913 |

As at end-March 2008 | 24,733 | 17,836 | 9,328 | 8,508 | 740 | 4,906 | 1,250 |

Memo: | | | | | | | |

Gross Advances | | | | | | | |

(end-March 2008) | 25,07,885 | 18,19,074 | 12,18,554 | 6,00,521 | 1,13,404 | 4,12,441 | 1,62,966 |

Net Advances | | | | | | | |

(end-March 2008) | 24,77,039 | 17,97,504 | 12,03,782 | 5,93,722 | 1,11,670 | 4,06,733 | 1,61,132 |

Gross NPAs/Gross Advances Ratio | | | | | | | |

End-March 2007 | 2.5 | 2.7 | 2.7 | 2.6 | 3.1 | 1.9 | 1.8 |

End-March 2008 | 2.3 | 2.2 | 2.1 | 2.6 | 2.3 | 2.5 | 1.9 |

Net NPAs/Net Advances

Ratio | | | | | | | |

End-March 2007 | 1.0 | 1.1 | 0.9 | 1.3 | 1.0 | 1.0 | 0.7 |

End-March 2008 | 1.0 | 1.0 | 0.8 | 1.4 | 0.7 | 1.2 | 0.8 |

* : Includes IDBI Bank Ltd.

Note : Figures in parentheses are the number of banks.

Source

: Balance sheets of respective banks. | 3.81

Among the various channels of recovery available to banks for dealing with bad

loans, the SARFAESI Act and the debt recovery tribunals (DRTs) have been the most

effective in terms of amount recovered. The amount recovered as percentage of

amount involved was the highest under the SARFAESI Act, followed by DRTs (Table

III.27).

3.82 In the case of direct agricultural advances, the recovery

rate (percentage of recovery to demand) declined to 79.7 per cent for the year

ended June 2007 from 80.1 per cent a year ago (Table III.28).

3.83 The Reserve Bank has so far issued certificate of registration (CoR)

to eleven securitisation companies/reconstruction companies (SCs/RCs), of which

six have commenced their operations. At end-June 2008, the book value of total

amount of assets acquired by SCs/RCs registered with the Reserve Bank was at Rs.41,414

crore, showing an increase of 45.1 per cent during the year (July 2007 to June

2008). While security receipts subscribed to by banks/FIs amounted to Rs.8,319

crore, security receipts redeemed amounted to Rs.1,299 crore (Table

III.29). Movements in Provisions for Non-performing

Assets

3.84 Provisioning for non-performing assets tends

to follow a cyclical pattern. In the expansionary phase of business cycle, impairment

to balance sheets of banks tends to be relatively lower requiring lower provisioning

even as credit increases at a faster pace. The downturn phase of business cycle,

on other hand, increases the possibility of credit losses, leading to higher provisioning

requirements. The higher provisioning in the downturn phase may, thus, put pressure

on the credit availability and accentuate the contraction phase of business cycle.

3.85 Provisioning made during 2007-08 was higher than write-back of excess

provisioning during the year. Still, however, net NPAs increased during the year

due to increase in gross NPAs. Among bank groups, provisions made during the year

were higher than write-back of excess provisions for new private sector banks

and foreign banks whereas they were lower for public sector banks and old private

sector banks. Thus, the cumulative provisions at end-March 2008 were higher than

their respective levels a year ago in respect of new private sector and foreign

banks whereas they were lower for public sector and old private sector banks.

Cumulative provisions as percentage of NPAs declined marginally to 52.4 per cent

at end-March 2008 from 56.1 per cent at end-March 2007. Bank-group wise, the ratio

was the highest for old private sector banks (64.9 per cent), followed by PSBs,

new private sector banks and foreign banks (Table III.30 and

Appendix Table

III.24).

Table

III.27: NPAs recovered by SCBs through various Channels |

(Amount

in Rs. crore) | Recovery

Channel | 2006-07 | 2007-08 |

|

| No.

of cases | Amount | Amount | Col.

(4) as % | No.

of cases | Amount | Amount | Col.(8)

as % |

|

| referred | involved | Recovered | of

Col. (3) | referred | involved | Recovered | of

Col.(7) | 1 |

| 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

i) | Lok

Adalats | 160,368 | 758 | 106 | 14.0 | 186,535 | 2,142 | 176 | 8.2 |

ii) | DRTs | 4,028 | 9,156 | 3,463 | 37.8 | 3,728 | 5,819 | 3,020 | 51.9 |

iii) | SARFAESI

Act | 60,178# | 9,058 | 3,749 | 41.4 | 83,942# | 7,263 | 4,429 | 61.0 |

# :Number of notices issued.

|

Table

III.28: Recovery of Direct Agricultural |

Advances of PSBs |

(Amount

in Rs. crore) | Year | Demand | Recovery | Overdues | Percentage |

ended June | | | | of

Recovery | | | | | to

Demand | 1 | 2 | 3 | 4 | 5 |

2004 | 33,544 | 25,002 | 8,542 | 74.5 |

2005 | 45,454 | 35,733 | 9,721 | 78.6 |

2006 | 46,567 | 37,298 | 9,269 | 80.1 |

2007 | 73,802 | 58,840 | 14,958 | 79.7 |

Table

III.29: Details of Financial Assets

Securitised by SCs/RCs |

(Rs.

crore) | Item | End-June | End-June |

| 2007 | 2008 |

1 | 2 | 3 |

1. | Book

Value of Assets Acquired | 28,544 | 41,414 |

2. | Security

Receipts issued | 7,436 | 10,658 |

3. | Security

Receipts subscribed by | | |

| (a) | Banks | 6,894 | 8,319 |

| (b) | SCs/RCs | 408 | 1,647 |

| (c) | FIIs | - | - |

| (d) | Others(QIBs) | 134 | 692 |

4. | Amount

of Security Receipts | | |

| completely

redeemed | 660 | 1,299 |

3.86 Notwithstanding an increase in the fresh accretions to gross

NPAs (Rs.34,420 crore) of SCBs during 2007-08, gross NPAs as percentage of gross

advances declined during the year. The net NPA ratio (net NPAs as percentage of

net advances) declined in respect of public sector and old private sector banks,

while it increased in respect of new private sector banks and foreign banks. The

net NPAs to net advances ratio at end-March 2008 was highest (1.2 per cent) in

respect of new private sector banks, followed by public sector, foreign and old

private sector banks at 1.0 per cent, 0.8 per cent and 0.7 per cent, respectively

(Table III.31 and Appendix

Table III.27 and III.28).

3.87 The net NPAs to net advances ratio

at end-March 2008 of 75 banks (76 last year) out of 79 (82 last year) was less

than 2 per cent. The net NPAs ratio of only one foreign bank was higher than 5

per cent (Table III.32). During 2007-08, the net NPA ratio

of six banks each in the public sector and private sector improved (Appendix Table

III.27 and III.28).

3.88 Apart from decline in the NPA ratios, the improvement

in asset quality of SCBs during 2007-08 was also reflected in the different loan

asset categories. The share of ‘sub-standard’ loans showed a marginal

increase to 1.1 per cent from 1.0 per cent in the previous year. However, the

shares of loans in ‘doubtful’ and ‘loss’ categories, which

represent lower quality of assets than sub-standard assets, continued to decline

during 2007-08. Among these two categories (‘loss’ and ‘doubtful’),

while NPAs in ‘loss’ category continued to show decline in absolute

terms, NPAs in ‘doubtful’ category showed a marginal increase in 2007-08.

More or less a similar trend was observed across all bank groups, barring new

private sector banks in whose case the NPAs in all the three categories, viz.,

sub-standard, doubtful and loss increased during the year (Table

III.33).

Table

III.30: Movements in Provisions for Non-performing Assets - Bank Group-wise

| (Amount

in Rs. crore) | Item | Scheduled | Public | Nationalised | State | Old

Private | New

Private | Foreign |

| Commercial | Sector | Banks | Bank | Sector | Sector | Banks |

| Banks | Banks | (20*) | Group | Banks | Banks | (28) |

| (79) | (28) |

| (8) | (15) | (8) |

|

1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

Provisions for NPAs | | | | | | | |

As at end-March 2007 | 28,188 | 22,139 | 15,851 | 6,288 | 1,807 | 3,087 | 1,152 |

Add :Provisions made during the year | 15,240 | 9,810 | 6,541 | 3,269 | 416 | 3,846 | 1,166 |

Less :Write-off, write back of excess during

the year | 13,750 | 10,769 | 8,006 | 2,763 | 564 | 1,574 | 841 |

As at end-March 2008 | 29,678 | 21,180 | 14,387 | 6,793 | 1,659 | 5,359 | 1,478 |

Memo: | | | | | | | |

Gross NPAs | 56,435 | 40,595 | 25,117 | 15,478 | 2,557 | 10,426 | 2,856 |

Outstanding Provisions to Gross NPAs (per

cent) | | | | | | | |

End-March 2007 | 56.1 | 56.8 | 57.4 | 49.6 | 66.0 | 49.1 | 51.1 |

End-March 2008 | 52.6 | 52.2 | 57.3 | 43.9 | 64.9 | 51.4 | 51.7 |

* : Includes IDBI Bank Ltd.

Note:Figures in parentheses indicate the number of banks in that

group at end-March 2008.

Source :Balance sheets of respective

banks. |

Table

III.31: Gross and Net NPAs of Scheduled Commercial Banks - Bank Group-wise

| (As

at end-March) | (Amount

in Rs. crore) | Bank

Group/Year | Gross | Gross

NPAs | Net | Net

NPAs |

| Advances | Amount | Per

cent to | Per

cent to | Advances | Amount | Per

cent to | Per

cent to |

|

|

| Gross | total |

|

| Net | total |

|

|

| Advances | Assets |

|

| Advances | Assets |

1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

Scheduled Commercial Banks | | | | | | | | |

2005 | 11,52,682 | 59,373 | 5.2 | 2.5 | 11,15,663 | 21,754 | 1.9 | 0.9 |

2006 | 15,51,491 | 51,097 | 3.3 | 1.8 | 15,16,812 | 18,543 | 1.2 | 0.7 |

2007 | 20,12,510 | 50,486 | 2.5 | 1.5 | 19,81,237 | 20,101 | 1.0 | 0.6 |

2008 | 25,07,885 | 56,435 | 2.3 | 1.3 | 24,77,039 | 24,734 | 1.0 | 0.6 |

Public Sector Banks | | | | | | | | |

2005 | 8,77,825 | 48,399 | 5.5 | 2.7 | 8,48,912 | 16,904 | 2.0 | 1.0 |

2006 | 11,34,724 | 41,358 | 3.6 | 2.1 | 11,06,288 | 14,566 | 1.3 | 0.7 |

2007 | 14,64,493 | 38,968 | 2.7 | 1.6 | 14,40,146 | 15,145 | 1.1 | 0.6 |

2008 | 18,19,074 | 40,595 | 2.2 | 1.3 | 17,97,504 | 17,836 | 1.0 | 0.6 |

Old Private Sector Banks | | | | | | | | |

2005 | 70,412 | 4,200 | 6.0 | 3.1 | 67,742 | 1,859 | 2.7 | 1.4 |

2006 | 85,154 | 3,759 | 4.4 | 2.5 | 82,957 | 1,375 | 1.7 | 0.9 |

2007 | 94,872 | 2,969 | 3.1 | 1.8 | 92,887 | 891 | 1.0 | 0.6 |

2008 | 1,13,404 | 2,557 | 2.3 | 1.3 | 1,11,670 | 740 | 0.7 | 0.4 |

New Private Sector Banks, | | | | | | | | |

2005 | 1,27,420 | 4,582 | 3.6 | 1.6 | 1,23,655 | 2,353 | 1.9 | 0.8 |

2006 | 2,32,536 | 4,052 | 1.7 | 1.0 | 2,30,005 | 1,796 | 0.8 | 0.4 |

2007 | 3,25,273 | 6,287 | 1.9 | 1.1 | 3,21,865 | 3,137 | 1.0 | 0.5 |

2008 | 4,12,441 | 10,426 | 2.5 | 1.4 | 4,06,733 | 4,907 | 1.2 | 0.7 |

Foreign Banks | | | | | | | | |

2005 | 77,026 | 2,192 | 2.8 | 1.4 | 75,354 | 639 | 0.8 | 0.4 |

2006 | 98,965 | 1,928 | 1.9 | 1.0 | 97,562 | 808 | 0.8 | 0.4 |

2007 | 1,27,872 | 2,263 | 1.8 | 0.8 | 1,26,339 | 927 | 0.7 | 0.3 |

2008 | 1,62,966 | 2,857 | 1.8 | 0.8 | 1,61,133 | 1,250 | 0.8 | 0.3 |

Source : Balance

sheets of respective banks. |

Table

III.32: Distribution of Scheduled Commercial Banks by Ratio of Net NPAs to Net

Advances | (Number

of banks) | Bank

Group | As

at end-March |

| 2004 | 2005 | 2006 | 2007 | 2008 |

1 | 2 | 3 | 4 | 5 | 6 |

Public Sector Banks | 27 | 28 | 28 | 28 | 28 |

Up to 2 per cent | 11 | 19 | 23 | 27 | 28 |

Above 2 and up to 5 per cent | 13 | 7 | 5 | 1 | 0 |

Above 5 and up to 10 per cent | 3 | 2 | 0 | 0 | 0 |

Above 10 per cent | 0 | 0 | 0 | 0 | 0 |

Old Private Sector Banks | 20 | 20 | 20 | 17 | 15 |

Up to 2 per cent | 2 | 4 | 11 | 15 | 15 |

Above 2 and up to 5 per cent | 9 | 12 | 7 | 1 | 0 |

Above 5 and up to 10 per cent | 7 | 4 | 2 | 1 | 0 |

Above 10 per cent | 2 | 0 | 0 | 0 | 0 |

New Private Sector Banks | 10 | 9 | 8 | 8 | 8 |

Up to 2 per cent | 4 | 5 | 6 | 7 | 7 |

Above 2 and up to 5 per cent | 5 | 3 | 2 | 1 | 1 |

Above 5 and up to 10 per cent | 0 | 1 | 0 | 0 | 0 |

Above 10 per cent | 1 | 0 | 0 | 0 | 0 |

Foreign Banks | 33 | 31 | 29 | 29 | 28 |

Up to 2 per cent | 22 | 23 | 25 | 27 | 25 |

Above 2 and up to 5 per cent | 2 | 2 | 0 | 1 | 2 |

Above 5 and up to 10 per cent | 3 | 2 | 0 | 0 | 1 |

Above 10 per cent | 6 | 4 | 4 | 1 | 0 |

Sector-wise NPAs

3.89 The sector-wise analysis of

NPAs of public and private sector banks indicates that the NPAs in the priority

sector increased by 11.1 per cent during 2007-08 (4.8 per cent in the previous

year) mainly due to increase in NPAs in the agriculture sector (32.1 per cent)

and in the non-priority sector (10.3 per cent). At the aggregate level, the share

of priority sector NPAs in total NPAs at 54.4 per cent was broadly same as in

the previous year (54.0 per cent) [Table III.34, Appendix

Table III.29 (A) and 29

(B); and Appendix

Table 30 (A) and 30

(B)].

Table

III.33: Classification of Loan Assets - Bank Group-wise |

(As

at end-March) | (Amount

in Rs. crore) | Bank

Group | Standard | Sub-Standard | Doubtful | Loss | Total |

| Total |

| Assets | Assets | Assets | Assets | Gross |

| Gross |

|

|

|

|

|

|

|

|

| NPAs |

| Advances |

| Amount | Per | Amount | Per | Amount | Per | Amount | Per | Amount | Per | Amount |

|

| cent |

| cent |

| cent |

| cent |

| cent |

|

|

|

|

|

|

|

|

|

|

|

|

|

1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

Scheduled Commercial Banks | | | | | | | | | | | |

2004 | 8,37,130 | 92.9 | 21,026 | 2.3 | 36,247 | 4.0 | 7,625 | 0.9 | 64,898 | 7.2 | 9,02,027 |

2005 | 10,93,523 | 94.9 | 14,016 | 1.2 | 37,763 | 3.3 | 7,382 | 0.6 | 59,161 | 5.1 | 11,52,684 |

2006 | 14,99,431 | 96.7 | 14,826 | 1.0 | 30,105 | 2.0 | 7,016 | 0.4 | 51,947 | 3.3 | 15,51,378 |

2007 | 19,61,877 | 97.5 | 20,010 | 1.0 | 24,408 | 1.2 | 6,215 | 0.3 | 50,633 | 2.5 | 20,12,510 |

2008 | 24,51,217 | 97.7 | 26,541 | 1.1 | 24,507 | 1.0 | 5,619 | 0.2 | 56,668 | 2.3 | 25,07,885 |

Public Sector Banks | | | | | | | | | | | |

2004 | 6,10,435 | 92.2 | 16,909 | 2.5 | 28,756 | 4.4 | 5,876 | 0.9 | 51,541 | 7.8 | 6,61,975 |

2005 | 8,30,029 | 94.6 | 11,068 | 1.3 | 30,779 | 3.5 | 5,929 | 0.7 | 47,796 | 5.4 | 8,77,825 |

2006 | 10,92,607 | 96.2 | 11,453 | 1.0 | 25,028 | 2.2 | 5,636 | 0.5 | 42,117 | 3.7 | 11,34,724 |

2007 | 14,25,519 | 97.3 | 14,275 | 1.0 | 19,873 | 1.4 | 4,826 | 0.3 | 38,974 | 2.7 | 14,64,493 |

2008 | 17,78,476 | 97.8 | 17,290 | 1.0 | 19,291 | 1.1 | 4,018 | 0.2 | 40,598 | 2.2 | 18,19,074 |

Old Private Sector Banks | | | | | | | | | | | |

2004 | 53,516 | 92.4 | 1,161 | 2.0 | 2,727 | 4.7 | 504 | 0.9 | 4,392 | 7.6 | 57,908 |

2005 | 66,212 | 94.0 | 784 | 1.1 | 2,868 | 4.0 | 549 | 0.8 | 4,201 | 6.0 | 70,413 |

2006 | 81,414 | 95.6 | 710 | 0.8 | 2,551 | 3.0 | 479 | 0.6 | 3,740 | 4.4 | 85,154 |

2007 | 91,903 | 96.9 | 760 | 0.8 | 1,783 | 1.9 | 425 | 0.4 | 2,969 | 3.1 | 94,872 |

2008 | 1,10,847 | 97.7 | 816 | 0.7 | 1,346 | 1.2 | 395 | 0.3 | 2,557 | 2.3 | 1,13,404 |

New Private Sector Banks | | | | | | | | | | | |

2004 | 1,13,560 | 95.0 | 1,966 | 1.6 | 3,665 | 3.0 | 321 | 0.3 | 5,952 | 5.0 | 1,19,512 |

2005 | 1,22,577 | 96.2 | 1,449 | 1.1 | 3,061 | 2.4 | 334 | 0.3 | 4,844 | 3.8 | 1,27,421 |

2006 | 2,28,504 | 98.3 | 1,717 | 0.7 | 1,855 | 0.8 | 460 | 0.2 | 4,032 | 1.8 | 2,32,536 |

2007 | 3,19,002 | 98.1 | 3,608 | 1.1 | 2,147 | 0.7 | 516 | 0.2 | 6,271 | 1.9 | 3,25,273 |

2008 | 4,02,013 | 97.5 | 6,473 | 1.6 | 3,106 | 0.8 | 849 | 0.2 | 10,428 | 2.5 | 4,12,441 |

Foreign Banks | | | | | | | | | | | |

2004 | 59,619 | 95.1 | 990 | 1.6 | 1,099 | 1.8 | 924 | 1.5 | 3,013 | 4.8 | 62,632 |

2005 | 74,705 | 97.0 | 715 | 1.0 | 1,035 | 1.3 | 570 | 0.7 | 2,320 | 3.0 | 77,025 |

2006 | 96,907 | 98.0 | 946 | 1.0 | 670 | 0.7 | 441 | 0.5 | 2,057 | 2.0 | 98,965 |

2007 | 1,25,453 | 98.1 | 1,367 | 1.1 | 605 | 0.5 | 447 | 0.3 | 2,419 | 1.9 | 1,27,872 |

2008 | 1,59,882 | 98.1 | 1,962 | 1.2 | 764 | 0.5 | 358 | 0.2 | 3,084 | 1.9 | 1,62,966 |

Note : Constituent

items may not add up to the total due to rounding off.

Source : Off-site

returns (Balance sheet returns) submitted by respective banks. |

Table

III.34: Sector-wise NPAs - Bank Group-wise* |

(Rs.

crore) | Sector | Public

Sector | Old

Private | New

Private | All

SCBs |

| Banks | Sector

Banks | Sector

Banks |

|

|

| 2006-07 | 2007-08 | 2006-07 | 2007-08 | 2006-07 | 2007-08 | 2006-07 | 2007-08 |

1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

A. Priority Sector | 22,954 | 25,287 | 1,416 | 1,338 | 1,468 | 2,080 | 25,838 | 28,705 |

i) Agriculture | 6,506 | 8,268 | 249 | 243 | 612 | 1,225 | 7,367 | 9,735 |

ii) Small Scale Industries | 5,843 | 5,805 | 490 | 359 | 155 | 292 | 6,488 | 6,456 |

iii) Others | 10,604 | 11,214 | 677 | 737 | 702 | 563 | 11,983 | 12,514 |

B. Public Sector | 490 | 299 | 0 | 0 | 3 | 0 | 493 | 299 |

C. Non-Priority Sector | 15,158 | 14,163 | 1,553 | 1,219 | 4,800 | 8,339 | 21,510 | 23,721 |

Total (A+B+C) | 38,602 | 39,749 | 2,969 | 2,557 | 6,271 | 10,419 | 47,841 | 52,725 |

* : Excluding foreign banks.

Source : Based on off-site returns submitted by banks (pertaining

to domestic opertaions only). | Movements

in Provisions for Depreciation on Investments

3.90 The

provisions for depreciation on investments declined by 11.6 per cent at end-March

2008 from their level at end-March 2007 as a result of lower provisions made during

the year than the write-offs and write-back of excess provisions. The reduction

in provisions was despite the increase in investments during the year (Table

III.35).

Capital Adequacy

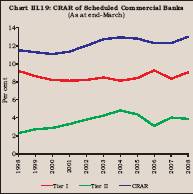

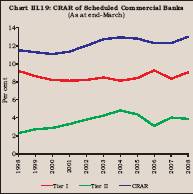

3.91

The overall CRAR of all SCBs improved to 13.0 per cent at end-March 2008 from

12.3 per cent a year ago, reflecting a relatively higher growth rate in capital

funds maintained by banks than risk-weighted assets. While the growth in risk-weighted

assets moderated in line with overall deceleration in credit growth during 2007-08,

capital funds increased at a higher rate on account of raising of resources by

banks from the capital market and increase in resources required for ensuing implementation

of Basel II norms. Thus, the CRAR of the banking system at 13.0 per cent was significantly

above the stipulated minimum of 9.0 per cent (Table III.36).

3.92 As a result of resources raised by banks from the capital market during

2007-08 and increase in reserves, the Tier I capital ratio of SCBs improved to

9.1 per cent at end-March 2008 from 8.3 per cent a year ago. However,the Tier

II capital declined marginally to 3.9 per cent at end-March 2008 from 4.0 per

cent a year ago (Chart III.19). Tier I CRAR was more than

the present stipulated requirement of 4.5 per cent and also above the 6.0 per

cent norm prescribed in the final guidelines for implementation of Basel II released

by the Reserve Bank on April 27, 2007.

Table

III.35: Movements in Provisions for Depreciation on Investment - Bank Group-wise |

(Amount

in Rs. crore) | Item |

| Scheduled | Public | Nationalised | State | Old

Private | New

Private | Foreign |

|

| Commercial | Sector | Banks | Bank | Sector | Sector | Banks |

|

| Banks | Banks |

| Group | Banks | Banks |

|

|

| (79) | (28) | (20*) | (8) | (15) | (8) | (28) |

1 |

| 2 | 3 | 4 | 5 | 6 | 7 | 8 |

Provision for Depreciation

on Investment | | | | | | | |

As at end-March 2007 | 11,492 | 8,904 | 6,616 | 2,288 | 321 | 819 | 1,448 |

Add : Provision made during

the year | 3,229 | 2,539 | 1,691 | 848 | 67 | 427 | 196 |

Less : Write-off, write-back

of excess | | | | | | | |

| during

the year | 4,566 | 3,881 | 2,120 | 1,762 | 72 | 317 | 296 |

As at end-March 2008 | 10,155 | 7,561 | 6,187 | 1,374 | 316 | 929 | 1,349 |

*: Includes IDBI Bank Ltd. | | | | | | | |

Note : Figures

in parentheses indicate the number of banks for 2007-08.

Source :

Balance sheets of respective banks. |

Table

III.36: Scheduled Commercial Banks -

Component-wise CRAR |

(Amount

in Rs. crore) | Item

/ End-March | 2006 | 2007 | 2008 |

1 | 2 | 3 | 4 |

A. | Capital

Funds (i+ii) | 2,21,363 | 2,96,191 | 4,06,835 |

| i) | Tier

I Capital | 1,66,538 | 2,00,386 | 2,83,339 |

| | of

which: | | | |

| | Paid-up

Capital | 25,142 | 29,462 | 41,178 |

| | Unallocated/Remittable | | | |

| | Surplus | 11,075 | 20,387 | 23,846 |

| | Deductions

for Tier-I | | | |

| | Capital | 11,271 | 13,662 | 21,933 |

| | | | | |

| ii) | Tier-II

Capital | 54,825 | 95,794 | 1,23,496 |

| | of

which: | | | |

| | Discounted

Subordinated Debt 43,214 | 63,834 | 73,297 |

| | | | | |

B. | Risk-weighted

Assets | 17,97,207 | 24,12,236 | 31,28,093 |

| of

which: | | | |

| Risk-weighted

Loans and | | | |

| Advances | 12,38,163 | 17,17,810 | 21,66,234 |

| | | | | |

C. | CRAR

(A as per cent of B) | 12.3 | 12.3 | 13.0 |

| of

which: | | | |

| Tier

I | 9.3 | 8.3 | 9.1 |

| Tier

II | 3.1 | 4.0 | 3.9 |

Source: Based

on off-site returns submitted by banks. |

3.93 During 2007-08, the improvement in CRAR was observed across all bank groups.

The improvement was, however, more pronounced in respect of new and old private

sector banks, followed by SBI and associates. As at end-March 2008, the CRAR of

nationalised banks at 12.5 per cent was below the industry average (13.0 per cent),

while that of all other groups was above the industry level (Table

III.37).

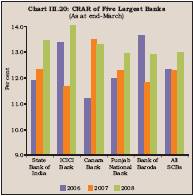

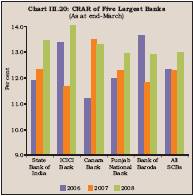

3.94 The CRAR of the five largest banks showed an improvement

during 2007-08 barring a marginal decline in the CRAR of Canara Bank. All the

five banks, however, maintained a CRAR of more than 12 per cent. Of the five largest

SCBs, four are in the public sector, while ICICI Bank is in the private sector

(Chart III.20).

Table

III.37: Capital Adequacy Ratio - Bank Group-wise |

(Per

cent) | Bank

Group/End-March | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 |

1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

Scheduled Commercial Banks | 11.1 | 11.4 | 12.0 | 12.7 | 12.9 | 12.8 | 12.3 | 12.3 | 13.0 |

Public Sector Banks | 10.7 | 11.2 | 11.8 | 12.6 | 13.2 | 12.9 | 12.2 | 12.4 | 12.5 |

Nationalised Banks | 10.1 | 10.2 | 10.9 | 12.2 | 13.1 | 13.2 | 12.3 | 12.4 | 12.1 |

SBI Group | 11.6 | 12.7 | 13.3 | 13.4 | 13.4 | 12.4 | 11.9 | 12.3 | 13.2 |

Old Private Sector Banks | 12.4 | 11.9 | 12.5 | 12.8 | 13.7 | 12.5 | 11.7 | 12.1 | 14.1 |

New Private Sector Banks | 13.4 | 11.5 | 12.3 | 11.3 | 10.2 | 12.1 | 12.6 | 12.0 | 14.4 |

Foreign Banks | 11.9 | 12.6 | 12.9 | 15.2 | 15.0 | 14.0 | 13.0 | 12.4 | 13.1 |

Source : Based

on off-site returns submitted by banks. | 3.95

At the individual bank level, the CRAR of all SCBs was above the prescribed requirement

of 9 per cent at end-March 2008. While the CRAR of as many as 77 banks was Rs.30,455

crore during 2007-08 as against Rs.1,066 crore during 2006-07. In view of good

performance of banking scrips in the secondary market, strong financial results

of banks, the need to raise capital in the face of the ensuing Basel II norms

and tightening of prudential norms for sensitive sectors, five banks entered the

capital market with six issues during 2007-08. Out of six issues, five were equity

issues, of which two were floated by public sector banks for Rs.17,552 crore (including

premium) and four issues by private sector banks (including one debt issue) for

Rs.12,903 crore (including premium on equity issues) (Table III.39).

Table

III.38: Distribution of Scheduled Commercial Banks by CRAR |

(Number

of banks) | Bank

Group | 2006-07 | 2007-08 |

| Below | Between | Between | Between | 12

per | Below | Between | Between | Between | 12

per | | 4

per | 4-9

per | 9-10

per | 10-12

per | cent | 4

per | 4-9

per | 9-10

per | 10-12 | cent |

| cent | cent | cent | cent | &

above | cent | cent | cent | per

cent | &

above | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 |

Nationalised Banks | - | - | - | 8 | 12 | - | - | - | 11 | 9 |

State Bank Group | - | - | - | 3 | 5 | - | - | - | 2 | 6 |

Old Private Sector Banks | 1 | - | 2 | 5 | 9 | - | - | 1 | 3 | 11 |

New Private Sector Banks | - | - | - | 4 | 4 | - | - | - | 2 | 6 |

Foreign Banks | - | - | - | 7 | 22 | - | - | 1 | 3 | 24 |

Total | 1 | - | 2 | 27 | 52 | - | - | 2 | 21 | 56 |

- : Nil/Negligible | | | | | | | | | | |

* : Includes data for IDBI

Bank Ltd. | | | | | | | | |

Source: Balance

sheets of respective banks |

Table

III.39: Public Issues by the Banking Sector |

(Rs.

crore) | Year | Public

Sector Banks | Private

Sector Banks |

| Total |

| Grand

Total |

| Equity | Debt | Equity | Debt | Equity |

| Debt |

|

1 | 2 | 3 | 4 | 5 | 6 |

| 7 | 8 |

2004-05 | 3,336 | - | 4,108 | 1,478 | 7,444 | | 1,478 | 8,922 |

2005-06 | 5,413 | - | 5,654 | - | 11,067 | | - | 11,067 |

2006-07 | 782 | - | 284 | - | 1,066 | | - | 1,066 |

2007-08 | 17,552 | - | 12,403 | 500 | 29,955 | | 500 | 30,455 |

2007 (April-Oct) | 816 | - | 10,063 | 500 | 10,879 | | 500 | 11,379 |

2008 (April-Oct) | - | - | - | - | - | | - | - |

-: Nil/Negligible | | | | | | | | |

3.97 Total premium raised by public sector banks was Rs.17,367 crore

and that by private sector banks was Rs.12,179 crore (Table III.40).

3.98 Resources raised by banks through debt issues in the private placement

market during 2007-08 declined by 15.5 per cent to Rs.26,199 crore (Table

III.41).During April-September 2008, resources mobilised by public sector

banks declined considerably by 58.3 per cent to Rs.4,558 crore, while resource

mobilisation by private sector banks increased substantially by 203.0 per cent

to Rs.2,251 crore.

Performance of Banking Stocks in the Secondary

Market

3.99 During 2007-08, the banking stocks as represented

by the Bankex (comprising 18 banking scrips) underperformed the BSE Sensex, the

broad-based index - the BSE 500, and other major sectoral indices, except IT and

consumer durables. Banking stocks, however, performed better than the BSE Sensex,

BSE 500 and the sectoral indices like capital goods and consumer durables during

the current financial year so far (up to December 08, 2008) (Table

III.42). Slowdown in GDP growth, particularly industrial growth and sharp

rise in domestic inflation appeared to have adversely affecting the banking stocks.

Banking sector stock also came under pressure due to concerns over the global

financial turmoil.

Table

III.40: Resources Raised by Banks

through Public Issues -

2007-08 | Bank

Face Value | Issue

Price | Size

of issue (Rs. crore) |

| (Rs.) | (Rs.) | Amount | Premium | Total |

1 | 2 | 3 | 4 | 5 | 6 |

Public Sector Bank | | | | | |

Central Bank of India | 10 | 92 | 80 | 736 | 816 |

State Bank of India | 10 | 1,580 | 105 | 16,631 | 16,736 |

A. Sub-total | | - | 185 | 17,367 | 17,552 |

Private Sector Banks | | | | | |

ICICI Bank Ltd. | 10 | 940 | 107 | 9,956 | 10,063 |

ICICI Bank Ltd. | | | | | |

(Debt Issue) | - | - | 500 | - | 500 |

Federal Bank of India | 10 | 250 | 85 | 2,056 | 2,141 |

Dhanalakshmi Bank Ltd. | 10 | 62 | 32 | 167 | 199 |

B. Sub-total | - | - | 724 | 12,179 | 12,903 |

Total (A+B) | - | - | 909 | 29,546 | 30,455 |

-: Not Applicable.

Source

: Securities and Exchange Board of India (SEBI). |

3.100 Banking stocks also showed significantly higher volatility during 2007-08

than volatility in the BSE Sensex (Table III.43). However,

during 2008-09 so far (up to December 08, 2008), volatility in BSE Sensex exceeded

that of BSE Bankex.

3.101 Notwithstanding the under-performance at

the industry level, at an individual bank level, the stocks of public

Table

III.41: Resources Raised by Banks

through Private Placements |

(Amount

in Rs. crore) | Category | Public

Sector | Private

Sector | Total |

| Banks | Banks |

|

|

| No.

of | Amount | No.

of | Amount | No.

of | Amount |

| Issues |

| Issues |

| Issues |

|

1 | 2 | 3 | 4 | 5 | 6 | 7 |

2006-07 | 26 | 6,639 | 64 | 24,355 | 90 | 30,994 |

2007-08 | 10 | 2,090 | 58 | 24,109 | 68 | 26,199 |

2007 (April-Sept) | 6 | 743 | 21 | 10,924 | 27 | 11,687 |

2008 (April-Sept) | 6 | 2,251 | 12 | 4,558 | 18 | 6,809 |

Source: Merchant

Bankers and Financial Institutions. | |