IST,

IST,

The Long Shadow of Federal Reserve’s Actions: Monetary Policy and Uncertainty Spillovers to India

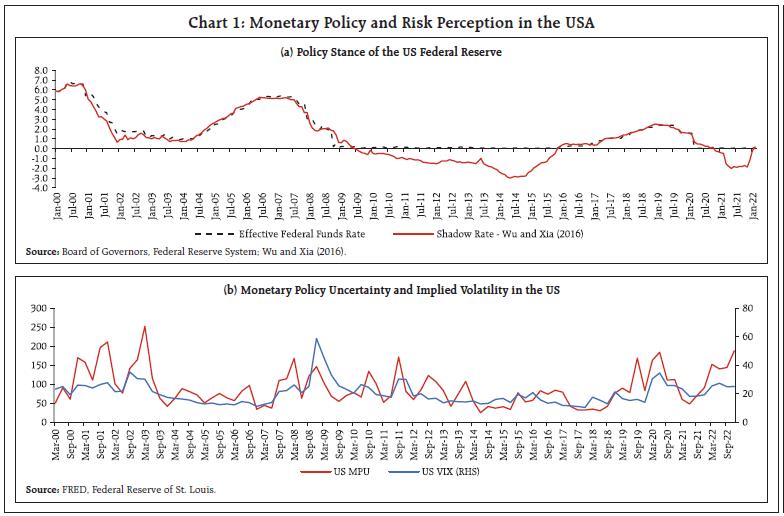

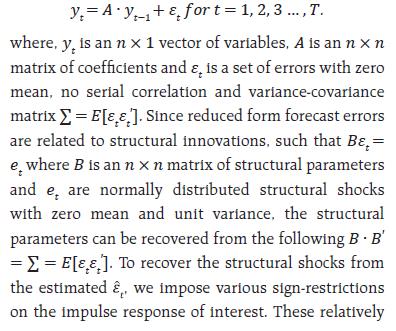

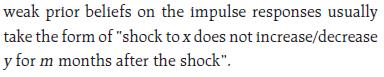

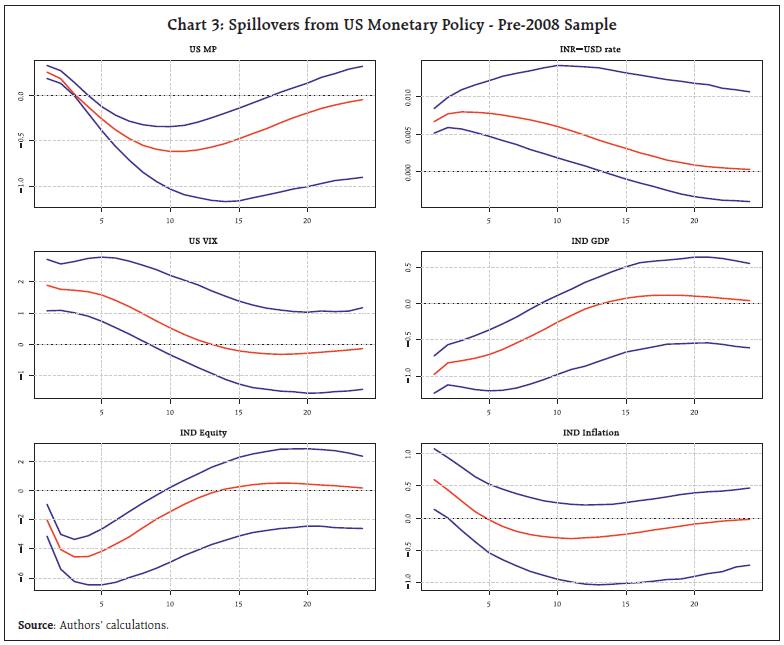

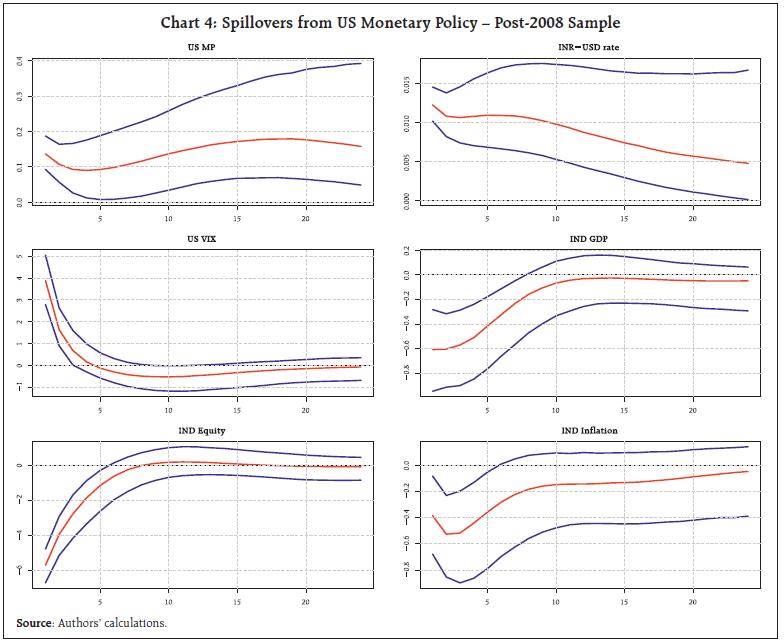

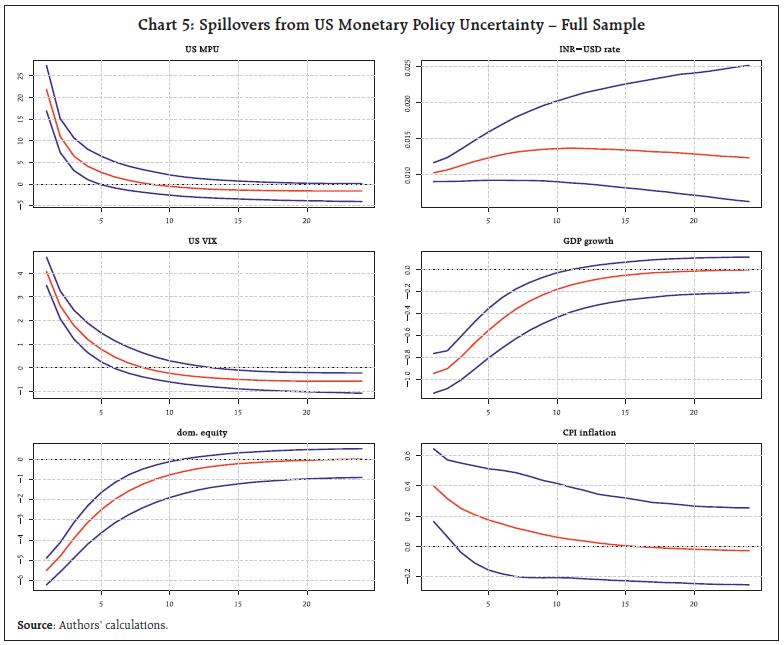

by Bhanu Pratap^ and Thangzason Sonna^ This study analyses the transmission of global monetary policy shocks to the Indian economy. Using a sign-restricted vector autoregression (SRVAR) framework to identify US monetary policy (MP) shocks, we find that surprise changes in US monetary policy strongly influences domestic output and inflation. Underlining the time-varying nature of such shocks, US MP surprises were found to have a cost-push effect in the pre-2008 period compared to a significant demand-pull effect after 2008. Moreover, US MP uncertainty also tends to lower domestic aggregate demand. These findings indicate important implications for major central banks in setting their monetary policy stance. I. Introduction In a world of interconnected financial markets and globalized finance, transmission of shocks from one market or region to another takes place almost instantaneously. Such financial market linkages give rise to connected economies where macroeconomic fundamentals, such as business cycles and inflation, move in tandem. Furthermore, changes in macroeconomic policy stance in one country/region, especially those harbouring international financial centres, also seem to send ripple effects across borders. The current global situation, in the aftermath of once-in-a-century pandemic, underlines the complexity of such macroeconomic and policy developments that can have cross-border implications. While economic recovery was getting entrenched, sustained inflationary pressures have forced the withdrawal and reversal of ultra-accommodative monetary policy by systemically important central banks. With the potential to undo all gains, a mammoth geopolitical shock in the form of the Ukraine-Russia war shook the world accelerating the shift to a tighter monetary policy regime. Central Banks, led by the US Federal Reserve (US Fed) and European Central Bank (ECB), embarked on an aggressive and synchronized policy tightening which reflected a policy stance aimed at bringing down inflation and maintaining their credibility (RBI, 2023). Financial markets in India are now closely interwoven with the global financial system such that the synchronicity between global and Indian economy has become stronger over the last decade. In the past, such as during the “taper tantrum” episode, India witnessed significant fluctuations in capital flows, excessive exchange rate pressures, financial market volatility and slowdown in GDP growth, cross-border trade, and domestic investments. In this backdrop, this study analyses the impact of monetary policy actions of the US Fed on the Indian economy. Actions of the US Fed have a significant bearing on the global economy with its influence on financial conditions across the globe. Additionally, uncertainty around US monetary policy also seems to affect emerging market economies (EMEs). While much of the empirical literature uses cross-country panel data to analyse policy spillovers between advanced and EMEs, analysing country-specific transmission of global policy shocks is important given the considerable heterogeneity across emerging economies and the need to design appropriate policies. Our study, therefore, aims to add to the literature on the transmission of global spillovers to the Indian economy by shedding light on the impact of US Federal Reserve’s policy stance on domestic macroeconomic fundamentals, namely output growth and inflation. In doing so, we utilize quarterly macro-financial data on the US and Indian economy for the period 1997-2019. We identify US monetary policy shocks using a sign-restricted vector autoregression (SRVAR) model and use impulse response analysis to shed light on US MP spillovers. Our findings suggest that the Indian economy has been prone to significant spillovers from changes in the stance of monetary policy in the US; however, the nature of impact has changed over the years. In particular, we find that prior to the global financial crisis (GFC) of 2008, US monetary policy shocks led to lower domestic output growth and an increase in inflation, indicative of a cost-push effect on the domestic economy in line with an exchange rate channel of global spillovers. In the post-2008 period, however, surprise changes in US monetary policy seem to lower domestic aggregate demand leading to lower growth and inflation in India. However, the overall impact of US Fed’s policy in the post-2008 period -- an era synonymous with the pursuit of unconventional monetary policy -- has been relatively lower and less persistent. Finally, we also find evidence for spillovers due to uncertainty surrounding monetary policy in the US. This suggests that it is not only the actions of US Fed but also the uncertainty around those actions that can have a bearing on the domestic economy. The paper has been organised into five sections. After this brief introduction, Section II provides a short summary of global and Indian literature on policy spillovers. Section III describes our data and the empirical methodology. In section IV, we present our main results based on impulse responses and variance decomposition derived from the SRVAR model. Finally, based on the main findings, we conclude in Section V by drawing policy implications and contours for future research. II. Brief Review of Literature Financial spillovers are said to occur when fluctuations in the price of an asset in one country (or region) trigger changes in the prices of the same asset or other assets in another country (or region). The conventional channels through which financial spillovers are typically deemed to occur involve direct and indirect changes in financial prices; cross-border balance sheet exposures; information or confidence effects (including fundamentals-driven changes in expectations); trade linkages; and spillovers related to monetary and fiscal policy (D’Auria et al., 2014; Agenor et al., 2018; Agenor and Pereira da Silva, 2022). These channels may be interlinked and work simultaneously to cause an impact that is different from what could be achieved if each channel works independently. The impact of cross-border spillovers is most often heterogeneous depending on structural characteristics of the source and the host economy. The impact of cross-border financial spillovers is thus contingent upon the type of shock that generates fluctuations in asset prices in the source country; the economic channels, real and/or financial, through which the shock is transmitted internationally; the amplification or mitigation mechanisms operating in the source and recipient countries; the nature of macroeconomic and macroprudential policy regime in source and recipient countries; and the scope for policymakers in recipient countries to respond in a timely fashion (Agenor et al., 2018; RBI, 2010). II.1 Global Context The pre-eminence of advance economy (AE) monetary policy in influencing global financial cycle, particularly with the US Fed at the pilot seat, has been well researched and documented (Rey, 2015 and 2018; Rajan and Mishra, 2015). Since the US dollar serves as a global reserve currency, the impact of monetary policy actions by other systematically important central banks on financial conditions in emerging markets have been marginal compared with that by the US Fed. The literature has also observed that the intensity of these effects are heterogenous over time and across countries – stronger in the post-GFC period and larger for countries that are perceived as riskier investments (IMF, 2021). Studies have observed that the US monetary policy shocks affect the global economy primarily through global asset prices and capital flows. The US dollar, as the dominant currency of the international monetary system, consigns a special role to US monetary policy (Miranda-Agrippino and Rey, 2020; Jordà et al., 2019; Habib and Venditti, 2019). Often, contractions in US monetary policy are followed by significant deleveraging of global financial intermediaries, especially in the EMEs, a rise in aggregate risk aversion, a contraction in global asset prices and in global credit, a widening of corporate bond spreads, and a retrenchment in gross capital flows. Studies have also shown that US monetary policy shocks transmit across border almost irrespective of the exchange rate regime of the recipient country (Dees and Galesi, 2021; Georgiadis, 2017). During the 2013 “taper tantrum” episode, mere announcement by the then US Fed Chairman Ben S. Bernanke on the possibility of tapering of asset purchases by the US Fed not only led to an increase in domestic interest rates but also raised emerging market yields, caused portfolio outflows, and depreciated emerging market currencies1. Almost all the changes in emerging market domestic yields can be accounted for by changes in the term premium suggesting that the perceived riskiness of holding emerging market bonds rises after a surprise tightening of US monetary policy (IMF, 2021). This is consistent with the finding that countries with higher sovereign risk are relatively more sensitive to cross-border spillovers (Adrian et al., 2013). These findings suggest that perception of risk i.e., the risk channel has emerged as an important channel in the transmission of the spillovers. On the other hand, the release of good news about the US economy, even as it is accompanied by expectations of tighter US monetary policy, is relatively benign for financial conditions in emerging markets (IMF, 2021). Considering this line of thought, recent studies show that all instances of increases in US interest rate do not lead to financial crisis in EMEs (for example, see Hoek et al., 2021). This differential impact of U.S. monetary policy changes on EMEs has been ascribed to two key factors. First, reason for the increase in US policy rate. From an EME perspective, if the rise in US interest rates is driven by improved growth prospects, then the impact is likely to be benign as benefits from higher US GDP leading to an increased export demand and investor confidence will outweigh the costs from higher interest costs. However, ‘hawkish’ policy changes i.e., rate increases driven by worries about inflation are likely to be highly disruptive for EMEs. Second, the impact is conditional on domestic vulnerabilities, such that financial conditions in economies susceptible to macroeconomic weaknesses tend to be more sensitive to a given rise in U.S. interest rates (Hoek et al., 2020). On the contrary, there have also been studies which found that better fundamentals did not provide insulation, particularly, in the case of the “taper talk” of 2013. A more important determinant has been the size of the country’s financial market, such that countries with larger markets experienced more pressure on the exchange rate, foreign reserves, and equity prices (Eichengreen and Gupta, 2015). On the other hand, AEs with strong manufacturing sector are particularly sensitive to spillovers due to the international trade channel through commodity prices and global value chains (Miranda-Agrippino et al., 2020). Lastly, there has been a growing interdependence between AEs and EMEs as well. Typically, spillovers running from AEs to the rest of the world are referred as global spillovers while those emanating from the rest of the world and impacting AEs are commonly referred as global spillbacks. Seen this way, the quantum of global spillbacks over the past 25 years are about one-fifth of the global spillovers running from AEs to EMEs. However, such spillback effects have increased significantly over time because of the evolving interdependence between these two blocks (Arezki and Yang, 2020)2. II.2 Indian context In the recent past, several empirical studies on the impact of US monetary policy spillovers have been done in the Indian context. These studies have analysed the transmission of cross-border spillovers to India dissecting important channels for such transmission and the policy experience in receiving and dealing with global spillovers. For instance, according to Patra et al. (2016a), quantitative easing (QE) by the US Fed had significantly altered monetary conditions in India, particularly, QE1 that had the largest impact. They conclude that QE-related spillovers worked mainly through the portfolio rebalancing channel followed by the liquidity channel. Further, assessing the impact of unconventional monetary policies on domestic transmission of monetary policy, Patra et al. (2016b) observe that monetary policy transmission through money and credit markets tends to remain unaffected by global spillovers. Transmission through debt market, however, was impacted. The study also observed that Indian foreign exchange and equity markets were highly sensitive to global spillovers but there was no strong evidence of domestic monetary policy losing traction because of such spillovers. Similarly, Mohanty and Banerjee (2021) observe that US monetary tightening adversely affects the net worth of domestic firms and reduces domestic credit relative to external credit. They also find that contractionary US monetary policy, mainly working through the financial channel of the exchange rate, leads to a significant downturn in the domestic credit and business cycle in India. Using high-frequency financial market data in a time-varying parameter model framework, Lakdawala (2021) finds that US monetary policy decisions has a significant effect on Indian equity markets with this effect getting stronger over time. The study also identified both surprise changes in the policy rate as well as uncertainty - announcements about large scale asset purchases (QEs) - to be the channel through which the spillovers are transmitted. The study also found that Indian stock response to US monetary policy was uniformly sensitive to portfolio decisions of foreign institutional investors, as also exchange rate being sensitive to US monetary policy and the global financial cycle working through volatility and risk aversion. The current policy environment, especially in the advanced world, reflects the dilemma of policymakers in terms of nurturing economic growth or tackling the unprecedented inflationary bout. Maintaining a fine policy balance is likely to be tricky in the current policy landscape amidst heightened uncertainty. Policymakers in the advanced world must also tread with caution with their choice of delivering macroeconomic and financial stability at home vis-à-vis generating spillovers for the rest of the world. III. Data and Empirical Methodology III.1 Data We use quarterly data on the US and the Indian economy for our analysis. For the domestic block, economic activity is proxied by gross domestic product (GDP) by expenditure in constant prices whereas consumer price index for all items is taken as a measure of inflation. Both are measured in year-on-year percentage change terms. We also include the Nifty 50 index of the National Stock Exchange (NSE) and nominal exchange rate of the Indian Rupee against the US Dollar in the domestic block of our empirical model. For the foreign block, the implied stock market volatility in the form of US CBOE VIX index is taken as a proxy for risk perception in the US. On the monetary policy front, the federal funds rate remained near zero from December 2008 to December 2015, as well as during the Covid-19 pandemic period. In both these instances, the US Fed relied on unconventional policy tools, such as large-scale asset purchases under the quantitative easing programmes and forward guidance, to influence long-term interest rates and provide stimulus to the economy. Given the zero lower bound on policy rate, literature suggests using shadow policy rates to characterize the stance of monetary policy of the US Fed. In this context, Wu and Xia (2016) propose a shadow rate to summarize the US Fed’s monetary policy stance. The proposed shadow rate, constructed using one-month forward rates for ¼, ½, 1, 2, 5, 7 and 10 years hence, is not bounded below by 0 per cent. Since the shadow rate accounts for the overall stance of monetary policy, including the period of unconventional monetary policy during 2008-2015, we use the shadow interest rate of Wu and Xia (2016) as a proxy for monetary policy stance of the US Fed (Chart 1a). Finally, to account for uncertainty related to US monetary policy, we leverage the news-based US monetary policy uncertainty indicator proposed by Baker et al. (2016). Increases in uncertainty around monetary policy generally leads to heightened risk perception in the US (see Chart 1b).  The data is sourced from the Federal Reserve Economic Database (FRED) of the Federal Reserve Bank of St. Louis, CEIC Database and Wu and Xia (2016). Details of the variables and data used in our study have been provided in Table 1. III.2 Sign-restricted Vector Autoregression (SRVAR) Model To understand the transmission of monetary policy shocks from advanced economies (AEs), in particular the US, we use a sign-restricted vector autoregression model (SRVAR) model. Illustratively, consider the reduced-form VAR (1) model with n endogenous variables specified as follows:   In our case, a quarterly data sample for period 1997Q1-2019Q4 is used to estimate the SRVAR model for the Indian economy. We estimate the model using Markov chain Monte Carlo (MCMC) sampling technique with 5000 draws taken from the posterior, 1000 burn-in draws and 4000 subdraws to generate impulse responses on which the penalty algorithm is applied. The optimal length is selected using the Bayesian Information Criterion (BIC). Imposing minimal sign restrictions to identify monetary policy shocks from the US, we choose to remain agnostic about the response of key macroeconomic fundamentals of the domestic economy. Our identification method based on sign-restrictions uses the Uhlig (2005) penalty function approach implemented within a Bayesian framework3. In line with existing literature, we assume that a US monetary policy shock leads to an increase in the US VIX index, a fall in domestic equity markets and a depreciation of the rupee-dollar exchange rate. We also assume that the monetary policy shock remains in effect until four quarters after the shock while remaining agnostic to the directional responses of domestic output and prices. The sign-restrictions to identify US monetary policy shocks in our model are summarized in Table 2. Spillovers arising due to domestic monetary and fiscal decisions in systematically important countries, such as the US, affect financial markets, bank credit and the real economy in other economies. Even if these changes are optimal from the perspective of the US domestic economy, they may have undesirable effects on foreign economies. It has been argued that the actions of US Fed, whether intended or unintended, has played a major role in propagating credit and asset price booms in the global economy. Similarly, various forms of ultra-accommodative monetary policy pursued by major central banks since the GFC have exerted significant spillovers on other countries by influencing their interest rates and credit conditions. In this section, we present our results on the impact of US monetary policy shocks on the Indian economy using impulse response analysis and forecast error variance decomposition from our SRVAR model. IV.1 Spillovers from US Monetary Policy Based on the Uhlig (2005) penalty function approach, the dynamic responses of domestic macroeconomic variables to monetary policy shocks in the US are provided below in Chart 2. The chart shows the median estimate for impulse responses of domestic economic activity and inflation (solid red line) to a one standard deviation shock to US policy rate. The blue lines indicate the 68 per cent confidence bands. These results correspond to estimation over the full data sample i.e., from 1997Q1 to 2019Q4. It is evident from the impulse responses that the domestic economy faces an immediate decline in output due to a contractionary US monetary policy shock. The effect is found to persist for almost 12 quarters. The decrease in output is accompanied by an increase in domestic inflation, however, the effect is not statistically significant. The data also suggests that a contractionary US monetary policy shock leads to an increase in global risk aversion (VIX index), which in turn causes domestic equity prices to fall alongside a depreciation of the domestic currency.  Next, we divide our sample into two subsample period, from 1997Q1 to 2007Q4 and from 2008Q1 to 2019Q4. The former period reflects the period prior to the GFC and use of mainly conventional policy instruments. The latter period, on the other hand, is characterized by the use of both conventional and unconventional policy tools by the US Fed. Note that, Wu and Xia (2016) use monthly data from 2008-09 to 2013-14 to estimate the effects of unconventional monetary policies on the US economy. However, given data constraints, we estimate our model over a larger subsample which includes a period of ultra-accommodative monetary policy stance followed by a calibrated normalisation of policy in the US. We estimate our model separately for these two subsamples and present the impulse responses below. Chart 3 and 4 present the impulse responses over the two subsamples, 1997Q1:2007Q4 and 2008Q1:2019Q4, respectively. Estimates from the pre-2008 sample suggests that a contractionary US monetary policy shock leads to a decline in domestic output and an increase in inflation. Further, we find that responses of domestic output and inflation, in addition to being statistically significant, are larger for the pre-2008 sample as compared to the full sample. The response of domestic output, however, is less persistent in this case as it is rendered statistically insignificant after 8-9 quarters. The fall in output coupled with an increase in inflation, suggests that the cross-border transmission of US monetary policy shocks were driven by the exchange rate channel in the pre-2008 period (see Caldara et al., 2022). Given that majority of global trade is invoiced in US dollar, depreciation of the domestic currency can lead to an increase in cost of capital for Indian firms. Moreover, crude oil, which acts as an intermediate good, would also get costlier leading to an instantaneous ratcheting up of costs. Overall, such an increase in cost of capital for domestic firms highlights the cost-push effects of an unanticipated tightening of US monetary policy. On the other hand, in case of post-2008 sample, we find that US monetary policy shocks cause a decline in domestic economic activity as well as domestic inflation. The fall in output growth and inflation is statistically significant and persistent, with output growth and inflation continuing to decrease for more than four quarters. As suggested in the literature, US monetary policy spillovers to EMEs, especially those from unconventional policies, have been primarily driven by the financial channel. This channel captures the tightening of long-term interest rates in the US that accompanies policy tightening by the US Fed. Higher long-term yields allows global investors to switch from foreign assets to US assets, thereby hardening foreign financial conditions followed by a reduction in GDP and inflation in EMEs. The responses of domestic output growth and inflation in the post-GFC period, therefore, supports the transmission of global policy spillovers through the financial channel. Overall, our results indicate that US monetary policy after the GFC seems to affect aggregate demand in the domestic economy.  The impulse responses presented in Chart 3 and Chart 4 underline the changing nature and transmission of US monetary policy shocks to the Indian economy. In case of pre-2008 period, synonymous with the use of conventional monetary policy tools in the US, unanticipated changes in the US Fed’s policy stance reduced output growth and increased domestic inflation, thereby exhibiting a cost-push shock to the domestic economy through the exchange rate channel. In the post-2008 period, marked by the pursuit of unconventional monetary policies in the US, policy spillovers to India take the form of an aggregate demand shock leading to a decrease in domestic output growth and inflation in line with the financial channel of global spillovers. IV.2 Spillovers from US Monetary Policy Uncertainty Cross-border policy spillovers can also be driven by market participants’ perception of changes in economic fundamentals and the stance of monetary policy in the source country. It can also be driven by policy announcements (or lack thereof) rather than the actual realisation of these changes. Such changes in policy perception can be captured by indicators that measure uncertainty around economic policy. Therefore, to ascertain the impact of uncertainty around monetary policy in the US, we estimate our SRVAR model by replacing US shadow interest rate with the news-based US monetary policy uncertainty (MPU) index proposed by Baker et al. (2016). We impose similar sign restrictions as earlier and estimate the model over the full data sample. The resulting impulse response to a one standard deviation shock to US MPU are given in Chart 5.  As observed in Chart 5, unanticipated increases in US monetary policy uncertainty leads to a fall in domestic output growth along with a rise in domestic inflation. The effect of the shock on domestic GDP growth and inflation are also larger and more persistent as compared to US monetary policy shocks discussed in the previous subsection. This suggests that heightened uncertainty in the context of US monetary policy is akin to a negative supply-side shock for the Indian economy which shows in the form of accelerated inflation along with a persistent decline in output growth. Overall, global monetary policy uncertainty tends to worsen the inflation-output trade-off for domestic monetary policy.  The global economic system today is staring in the eyes of a deadly storm amidst a global pandemic that has affected millions of lives and livelihoods, a bounce back of high inflation, heightened uncertainty due to geopolitical tensions and a rollback of ultra-accommodative policy support across the globe. In this scenario, matters for emerging market economies are further complicated by the fact that they not only have to support domestic economy but must also safeguard themselves against spillovers from AEs. Our study uses quarterly macro-financial data on the US and Indian economy to shed light on the effects of US monetary policy actions as well as monetary policy uncertainty on the domestic economy. Importantly, we show that monetary policy actions (or uncertainty) of the US Fed can have detrimental effects on the domestic business cycle. In the context of the sharp policy tightening being observed across the globe, our paper suggests that major central banks should be wary of the negative impact of their policy actions as well as communication. In the globalized world of today, destabilization in one region or group of countries can derail the process of global economic recovery from the pandemic. Thus, the global economy would be better served if major central banks strive to minimize disruptions caused by their policy actions through transparent communication on the future path of their policy. References Adrian, T., Crump, R. K. & Moench, E. (2013). Pricing the Term Structure with Linear Regressions. Journal of Financial Economics, Pages 110-138, October. Agénor, P. R., Alper, K., & da Silva, L. P. (2018). External shocks, financial volatility and reserve requirements in an open economy. Journal of International Money and Finance, 83, 23-43. Arezki, R., & Liu, Y. (2020). On the (Changing) asymmetry of global spillovers: Emerging markets vs. advanced economies. Journal of International Money and Finance, 107, 102219. Baker, S. R., Bloom, N., & Davis, S. J. (2016). Measuring economic policy uncertainty. The quarterly journal of economics, 131(4), 1593-1636. Banerjee, S., & Basu, P. (2016). Indian economy during the era of quantitative easing: A dynamic stochastic general equilibrium perspective. In Monetary Policy in India (pp. 549580). Springer, New Delhi. Banerjee, S., & Mohanty, M. S. (2021). US monetary policy and the financial channel of the exchange rate: evidence from India. BIS Working Paper No. 945, Monetary and Economic Department, Bank for International Settlements, Geneva, Switzerland. Danne, Christian, 2015. “VARsignR: Estimating VARs using sign restrictions in R,” MPRA Paper 68429, University Library of Munich, Germany. D’Auria, F., Linden, S., Monteiro, D., & Zeugner, S. (2014). Cross-border spillovers in the euro area. Quarterly Report on the Euro Area (QREA), 13(4), 7-22. Dées, S., & Galesi, A. (2021). The Global Financial Cycle and US monetary policy in an interconnected world. Journal of International Money and Finance, 115, 102395. Eichengreen, B., & Gupta, P. (2015). Tapering talk: The impact of expectations of reduced Federal Reserve security purchases on emerging markets. Emerging Markets Review, 25, 1-15. Eichengreen, B., Gupta, P., & Choudhary, R. (2022). The Taper This Time. Indian Public Policy Review, 3(1 (Jan-Feb)), 1-17. Georgiadis, G. (2017). To bi, or not to bi? Differences between spillover estimates from bilateral and multilateral multi-country models. Journal of International Economics, 107, 118. Habib, M. M. & Venditti, F. (2019). The Global Capital Flows Cycle: Structural Drivers and Transmission Channels. Working Paper Series, European Central Bank, May. Hoek, J., Kamin, S. B., & Yoldas, E. (2020). When is bad news good news? US monetary policy, macroeconomic news, and financial conditions in emerging markets. International Finance Discussion Paper No. 1269, Board of Governors of the Federal Reserve System, USA. Hoek, J., Yoldas, E., & Kamin, S. (2021). Are Rising US Interest Rates Destabilizing for Emerging Market Economies?. FEDS Notes June 2021, Board of Governors of the Federal Reserve System, USA. IMF (2021). World Economic Outlook, April 2021. International Monetary Fund, Washington, USA. Jordà, Ò., Schularick, M., Taylor, A. M., & Ward, F. (2019). Global financial cycles and risk premiums. IMF Economic Review, 67(1), 109-150. Lakdawala, A. (2021). The growing impact of US monetary policy on emerging financial markets: Evidence from India. Journal of International Money and Finance, 119, 102478. Miranda-Agrippino, S., & Rey, H. (2020). US monetary policy and the global financial cycle. The Review of Economic Studies, 87(6), 2754-2776. Miranda-Agrippino, S., Nenova, T. & Rey, H. (2020). Global Footprints of Monetary Policy. Discussion Papers, Centre for Macroeconomics (CFM). Patra, M. D., Khundrakpam, J. K., Gangadaran, S., Kavediya, R., & Anthony, J. M. (2016). Responding to QE taper from the receiving end. Macroeconomics and Finance in Emerging Market Economies, 9(2), 167-189. Patra, M. D., Pattanaik, S., John, J., & Behera, H. K. (2016). Monetary policy transmission in India: Do global spillovers matter?. Reserve Bank Occasional Papers, 37(1&2), Reserve Bank of India, Mumbai, India. Patra, M.D. (2022). Taper 2022: Touchdown in Turbulence. Keynote Address at the IMC Chamber of Commerce and Industry, Mumbai, March 11, 2022, Reserve Bank of India, Mumbai. Pierre-Richard, A., & Pereira da Silva Luiz, A. (2022). Financial spillovers, spillbacks, and the scope for international macroprudential policy coordination. International Economics and Economic Policy, 79-127. RBI. (2010). Report on Currency and Finance, Reserve Bank of India, Mumbai, India. RBI. (2023). Monetary Policy Statement delivered by Governor Shri Shaktikantha Das, Reserve Bank of India on February 08, 2023 in Mumbai, India. Rey, H. (2013). Dilemma not Trilemma: The Global Financial Cycle and Monetary Policy Independence. Proceedings - Economic Policy Symposium - Jackson Hole, Federal Reserve of Kansas City Economic Symposium, Pages 285-333. Rey, H. (2018). National Monetary Authorities and the Global Financial Cycle. Lecture delivered at the Sixteenth LK Jha Memorial Lecture, Reserve Bank of India, Mumbai. Uhlig, H. (2005). What are the effects of monetary policy on output? Results from an agnostic identification procedure. Journal of Monetary Economics, 52(2), 381-419. ^ The authors are from the Department of Economic and Policy Research. * The authors would like to thank the editorial board and an anonymous reviewer for helpful comments and suggestions on the paper. The views expressed in this paper are those of the authors and do not necessarily represent the views of the Reserve Bank of India. 1 See Chairman Ben S. Bernanke’s testimony before the Joint Economic Committee, U.S. Congress, Washington, D.C., on May 22, 2013: https://www.federalreserve.gov/newsevents/testimony/bernanke20130522a.htm. 2 For instance, while there are large spillover effects on China from major AEs, there are also spillback effects to these economies from China given that it is a major component of the global supply chain. Therefore, any mishap in China, as seen repeatedly during the Covid-19 pandemic, can create global supply bottlenecks. 3 Model estimation and identification was implemented using the VARsignR package (Danne, 2015). |

पेज अंतिम अपडेट तारीख: