IST,

IST,

Report of the Working Group on FinTech and Digital Banking

The Working Group gratefully acknowledges the support and guidance received from Deputy Governor, Shri. N.S. Vishwanathan. The Chairman is grateful for the contributions made by the individual members of the Working Group for completing the task entrusted to it. In particular, he wishes to place on record the excellent work done by the Member-Secretary, Shri Prasant K. Seth, General Manager, RBI in compiling the Group's Report. The Group wishes to specially acknowledge the contribution of Shri S.S. Barik, CGM-In-Charge, DBR in providing necessary support to the Working Group. The Group also wishes to acknowledge the contribution by Shri Talakona Jagadeesh Kumar, Assistant General Manager, DBR, in providing assistance to the Working Group for drafting the Report. The Group also wishes to thank Shri Rajat Gandhi, M/s Faircent Technologies, Mr. Lishoy Bhaskaran and Mr. Mohamed Galib, M/s Backwaters Technology and Ms. Theresa Karunakaran, Deutsche Bank, for sharing their valuable experience and market perspective on working of various FinTech products. Background, Terms of Reference, Methodology and Members of the Group Background In view of the growing significance of FinTech innovations and their interactions with the financial sector as well as the financial sector entities, the Financial Stability and Development Council - Sub Committee (FSDC-SC) in its meeting held on April 26, 2016 decided to set up a Working Group to look into and report on the granular aspects of FinTech and its implications so as to review and reorient appropriately the regulatory framework and respond to the dynamics of the rapidly evolving FinTech scenario. Given the wide ranging issues involved, Reserve Bank of India set up an inter-regulatory Working Group (WG) to look into and report on the granular aspects of FinTech and its implications for the financial sector so as to review and reorient appropriately the regulatory framework and respond to the dynamics of the rapidly evolving FinTech scenario. The Group included representatives from RBI, SEBI, IRDA, and PFRDA, from select financial entities regulated by these agencies, rating agencies such as CRISIL and FinTech consultants / companies. Terms of Reference of the Working Group

Methodology/Approach The WG reviewed globally published material on the subject, the FinTech developments worldwide, the approaches adopted by various regulators, evolving views of international standard-setting bodies, and interacted with some FinTech entities/start-ups/sponsors operating in India as payment system provider, platform lender, block chain/digital ledger provider, etc. and took on board their views and concerns, including impact on the broader financial market1. These helped inform some of the views of the WG on aspects to be kept in mind while conceptualizing, designing and implementing the regulatory framework / structure for FinTech in the near future. Members of the Working Group The WG comprised:

a. Financial services, including banking services, are at the cusp of a revolutionary change driven by technological and digital innovations. A rapidly growing number of financial entities and technology firms are experimenting with related technological and financial solutions as well as new products in the financial services field which either modifies the way financial intermediation takes place or leads to disintermediation. b. FinTech is broadly an omnibus term used to describe emerging technological innovations in the financial services sector, with ever increasing reliance on information technology. Commencing as a term referring to the back end technology used by large financial institutions, it has expanded to include technological innovation in the financial sector, including innovations in financial literacy and education, retail banking, investments, etc. Technological innovation is considered to be one of the most influential developments affecting the global financial sector in the near future. Innovations related to payments, lending, asset management and insurance pose a challenge to business models and strategies of financial institutions; yet, these also bring opportunities for both the incumbent market participants and newcomers. At the same time, innovation can create new risks for individual financial institutions, consumers of financial services, as well as the financial system as a whole. c. FinTech or digital innovations have emerged as a potentially transformative force in the financial markets. A recent FSB study highlighted some of the potential benefits of FinTech, including efficiency improvements, risk reduction and greater financial inclusion. It also identified some of the key challenges associated with FinTech, such as difficulty of regulating an evolving technology with different use cases, monitoring activity outside the regulated sector, identifying and monitoring new risks arising from the technology. d. Financial innovation has become a focal point for a lot of attention, and some jurisdictions have decided to take a more active approach in facilitating this innovation. To do this, they have taken a variety of regulatory and supervisory initiatives such as regulatory sandboxes, innovation hubs, innovation incubators or accelerators, etc. e. The regulatory uncertainty surrounding FinTech could potentially hamper development. As a result, international standard setting bodies (BCBS, FSB, CPMI, WBG, etc.) including regulatory authorities of different jurisdictions are taking steps to actively monitor FinTech developments both domestically and in cooperation with international organizations. f. Key Recommendations

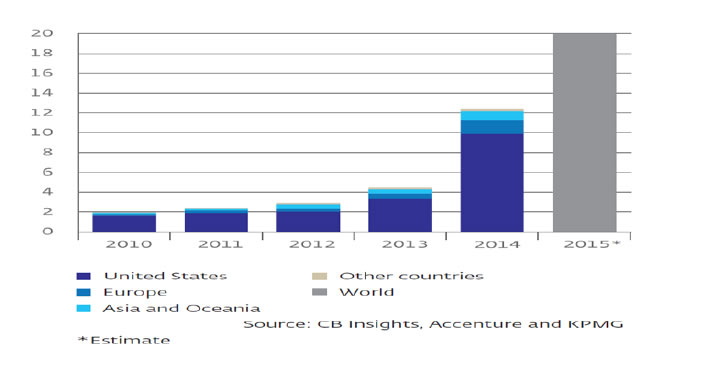

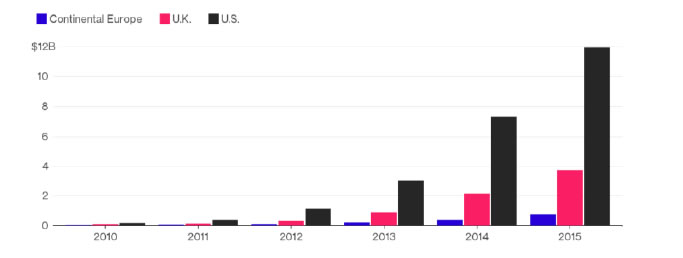

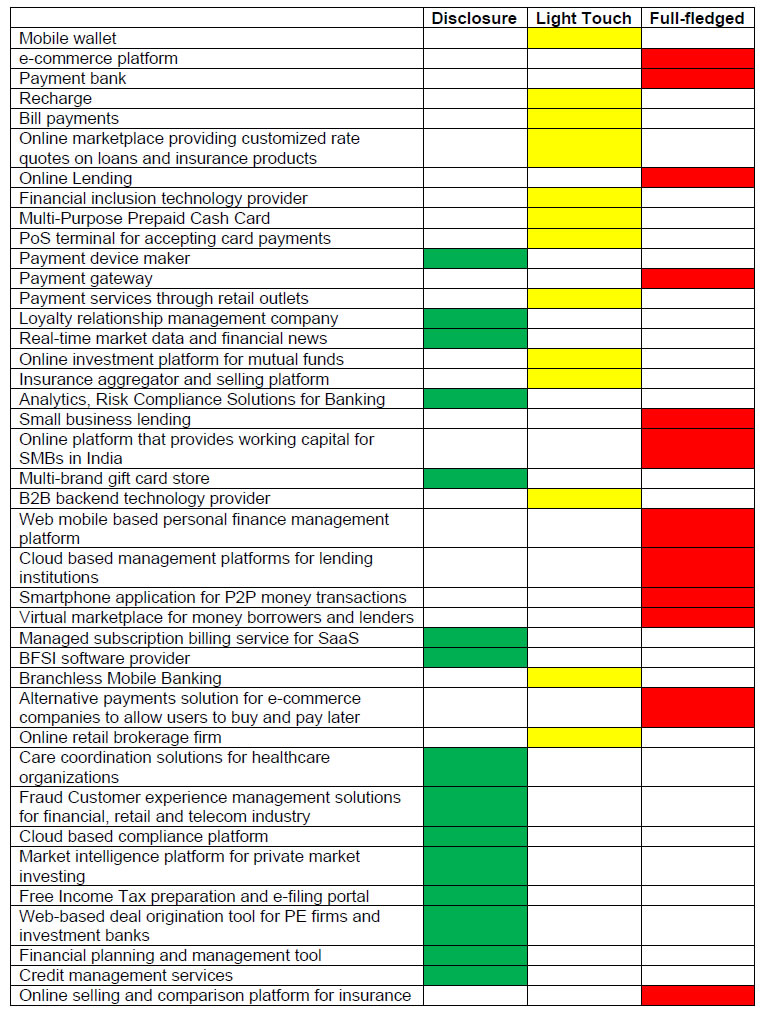

1.1 FinTech and Financial Market disruptions The term “FinTech” is a contraction of the words “finance” and “technology”. It refers to the technological start‑ups that are emerging to challenge traditional banking and financial players and covers an array of services, from crowd funding platforms and mobile payment solutions to online portfolio management tools and international money transfers. Some of the major FinTech products and services currently used in the market place are Peer to Peer (P2P) lending platforms, crowd funding, block chain technology, distributed ledgers technology, Big Data, smart contracts, Robo advisors, E-aggregators, etc. These FinTech products are currently used in international finance, which bring together the lenders and borrowers, seekers and providers of information, with or without a nodal intermediation agency. FinTechs are attracting interest both from users of banking services and investment funds, which see them as the future of the financial sector. Even retail groups and telecom operators are looking for ways to offer financial services via their existing networks. This flurry of activities raises questions over what kind of financial landscape will emerge in the wake of the digital transformation. Financial institutions are seeking to increase their knowledge in relation to technological innovation, both through partnerships with tech companies and by investing in or acquiring such companies. Despite this, there are wide differences in the preparedness of market participants for these changes in practice. 1.2 FinTech: Definitions and scope 1.2.1 What is FinTech? FinTech is an umbrella term coined in the recent past to denote technological innovation having a bearing on financial services. FinTech is a broad term that requires definition and currently regulators are working on bringing out a common definition. According to Financial Stability Board (FSB), of the BIS, “FinTech is technologically enabled financial innovation that could result in new business models, applications, processes, or products with an associated material effect on financial markets and institutions and the provision of financial services”. This definition aims at encompassing the wide variety of innovations in financial services enabled by technologies, regardless the type, size and regulatory status of the innovative firm. The broadness of the FSB definition is useful when assessing and anticipating the rapid development of the financial system and financial institutions, and the associated risks and opportunities. FinTech innovations have the potential to deliver a range of benefits, in particular efficiency improvements and cost reductions. Technological developments are also fundamentally changing the way people access financial services and increasing financial inclusion. There is large investment in FinTech sector by venture capital Funds. During 2014 around USD 12 billion was invested in FinTech companies, and in 2015 the same is estimated around USD 20 billion2.  2. FinTech and its impact on global Financial Services 2.1 FinTech innovations, products and technology 2.1.1 There is no commonly accepted taxonomy for FinTech innovations. In order to get a sense of the broad nature of the ongoing developments in this area, the WG categorized some of the most prominent FinTech innovations into five main groups through its scoping exercise. Though this does not represent a comprehensive review of all FinTech innovations, it highlights those regarded as potentially having the greatest effects on financial markets3. 2.1.2 A simple categorization of some of the most prominent FinTech innovations into groups according to the areas of financial market activities where they are most likely to be applied is as under:

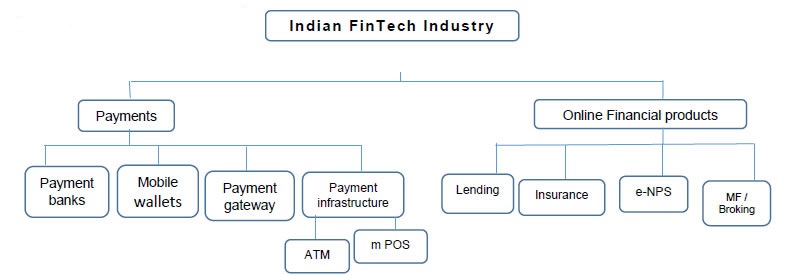

2.1.3 Payments, clearing and settlement services Innovations in this category are targeted at improving the speed and efficiency of payments, clearing, and settlement, reducing cost and changing the ways people access financial services and conduct financial transactions. Some of the innovations in areas of payments, clearing and settlements in the financial markets are as follows: 2.1.3.1 Mobile and web-based payment applications The majority of developments in the areas of payments are based on mobile technology by providing wrappers over existing payments infrastructure. Examples include Apple Pay, Samsung Pay, and Android Pay, which sit on top of existing card payment infrastructure enabling the user’s mobile devices to act as their credit/debit cards. There are also mobile payments built on new payment infrastructure, for example mobile phone money services, such as M-Pesa in Kenya and IMPS in India, which provide payment services. While such innovation facilitates the entrance of new users to the financial system, it may also move the provision of some payment services to non-banking companies that are not regulated as financial entities. There are a number of web-based and mobile-based payment applications that primarily focus on the customer experience and often aim to better integrate payment transactions within the commerce value chain. These service providers usually do not offer banking services other than payments, and they normally do not apply for banking licenses. The services can be offered by the payer’s own payment service provider (PSP) or by third party services (TPS), where an innovative service provider links payers and merchants by using the payer’s online banking credentials but without necessarily involving the payer’s PSP in the scheme or solution or by using the card payment infrastructure (Alipay, PayPal). 2.1.3.2 Digital currencies (DCs) Digital currencies (DCs) are digital representations of value, currently issued by private developers and denominated in their own unit of account. They are obtained, stored, accessed, and transacted electronically and neither denominated in any sovereign currency nor issued or backed by any government or central bank4. Digital currencies are not necessarily attached to a fiat currency, but are accepted by natural or legal persons as a means of exchange and can be transferred, stored or traded electronically. DC schemes comprise two key elements: (i) the digital representation of value or ‘currency’ that can be transferred between parties; and (ii) the way in which value is transferred from a payer to a payee. Privately issued DCs, such as Bitcoin, facilitate peer-to-peer exchange, possibly at lower cost for end-users and with faster transaction times, especially across borders. DC schemes are also known as ‘crypto currencies’ due to their use of cryptographic techniques. It is reported that there are hundreds of crypto currencies currently in use with an aggregate market capitalization of around USD 6.5bn5. However, only a very small fraction of these currencies are traded on a daily basis. Crypto currencies derive their value solely from the expectation that others will be willing to exchange it for sovereign currency or goods and services. DC schemes may allow for the issuance of a limited or unlimited number of units. In most digital currency schemes, distributed ledger technology allows for remote peer-to-peer exchanges of electronic value. The various DC schemes differ from each other in a number of ways; they have different rules for supplying the currency; they differ in the way in which transactions are verified. The implications of DCs for financial firms, markets and system will depend on the extent of their acceptability among users. If use of DCs were to become widespread, it would likely have material implications for the business models of financial institutions. DCs could potentially lead to a disintermediation of some existing payment services infrastructure. At the moment, DCs schemes are not widely used or accepted, and they face a series of challenges that could limit their future growth. As a result, their influence on financial services and the wider economy is negligible today, and it is possible that in the long term they may remain a product for a limited user base on the fringes of mainstream financial services. The regulatory perimeter around DCs is a complicated issue and regulation may depend on the definition of DCs in particular jurisdictions. The cross-border reach of DC schemes may make it difficult for national authorities to enforce laws. 2.1.3.3 Distributed ledgers Technology Distributed ledger technologies (DLT) provide complete and secure transaction records, updated and verified by users, removing the need for a central authority. These technologies allow for direct peer-to-peer transactions, which might offer benefits, in terms of efficiency and security, over existing technological solutions. The impetus behind the development and adoption of distributed ledger technology are the potential benefits. The major benefits are reduced cost; faster settlement time; reduction in counterparty risk; reduced need for third party intermediation; reduced collateral demand and latency; better fraud prevention; greater resiliency; simplification of reporting, data collection, and systemic risk monitoring; increased interconnectedness; and privacy. Distributed ledger technology is an innovation with potentially broad applications in financial market infrastructures (FMIs) and in the economy as a whole. Its most common use at present is for digital currencies, but firms are stepping up their R&D activities for other uses including securities trading, smart contracts, and land and credit registries. If widely adopted, distributed ledger technology can pose new challenges for regulation. Though there are no imminent concerns, constant monitoring of developments in the application of the distributed ledger technology to financial services and systems is prudent given the significant potential of the technology. 2.1.3.4 Block chain Technology Block chain is a distributed ledger in which transactions (e.g. involving digital currencies or securities) are stored as blocks (groups of transactions that are performed around the same point in time) on computers that are connected to the network. The ledger grows as the chain of blocks increases in size. Each new block of transactions has to be verified by the network before it can be added to the chain. This means that each computer connected to the network has full information about the transactions in the network. Block chain potentially has far-reaching implications for the financial sector, and this is prompting more and more banks, insurers and other financial institutions to invest in research into potential applications of this technology. Frequently cited benefits of Block chain are its transparency, security and the fact that transactions are logged in the network. Some of the disadvantages currently include the lack of coordination and the scalability of this technology. One of the best-known applications of Block chain technology at the present time is bitcoin. Transactions in this virtual currency are largely anonymous. This creates ethical risks for financial institutions dealing with users of this currency, because they are unable to (fully) verify their identity. It has also been observed that market participants in other securities markets are exploring the usage of Block chain or Distributed Database technology to provide various services such as clearing and settlement, trading, etc. Indian securities market may also see such developments in near future and, therefore, there is a need to understand the benefits, risks and challenges such developments may pose. 2.1.4 Deposits, lending and capital raising services Alternative models of lending and capital raising are gaining prominence, potentially changing the market dynamics of traditional lenders and affecting the role of traditional intermediaries. A few examples of the products offered by FinTechs are as under: 2.1.4.1 Peer-to-peer (P2P) lending Peer-to-peer (P2P) lenders connect lenders and borrowers, using advanced technologies to speed up loan acceptance. These technologies are designed to increase the efficiency and reduce the time involved in access to credit. While P2P lending originally involved direct matching of individual lenders and borrowers on a one-to-one basis, it has evolved into a form of marketplace lending where institutional and high net worth individual investors lend into a pool that borrowers can access. P2P lending has grown rapidly over the past decade but remains small outside of the United States, the United Kingdom, and China. P2P lending is estimated to have recorded 123% compound annual growth (CAGR) globally from 2010-2014. Further, global market for P2P lending is expected to grow at a CAGR of 60 per cent to USD 1 trillion by 2025 from USD 9 billion in 20146.  Depending on the structure, P2P may involve simple matching, deposit taking, or management of a collective investment scheme. Since P2P lending companies operate entirely online, they can run with lower overhead and provide services more cheaply than traditional financial institutions. As a result, lenders often earn higher returns compared to savings and investment products offered by banks, while borrowers can borrow money at lower interest rates. The most common form of P2P loan is an unsecured personal loan, but start-up and small-business loans are also becoming important. The principal benefit of P2P lending for borrowers is the fast and convenient access to funding, while for investors it is the potential for high returns. In their current form, P2P platforms are different from banks, because they do not take positions in loans and do not generally perform maturity and liquidity transformation like banks. P2P platforms more directly match the risk appetite of lenders with the risk profile of borrowers. These factors are likely to make P2P platforms less systemically important than banks of comparable size. The default of a bank can have systemic effects because of the many credit inter linkages that a bank builds during its business of intermediating credit markets. This creates the possibility of contagion should a single bank fail. The risk of such a contagion is likely to be much less with the failure of a P2P platform because they do not have the same network of credit inter-linkages. This would be true even if a P2P platform was very large. In sum, P2P lending does not currently pose a systemic risk, and it is not clear whether it would if the sector grew significantly larger. 2.1.4.2 Crowd funding Crowd funding is a way of raising debt or equity from multiple investors via an internet-based platform. Securities and Exchange Board of India (SEBI) has released a paper and defined crowd funding as “solicitation of funds (small amount) from multiple investors through a web-based platform or social networking site for a specific project, business venture or social cause.” Some jurisdictions have chosen to enact special legislative regimes to determine the conditions under which this service can be made available to retail investors. The platform matches borrowers / issuers with savers/investors. Platform providers offer a range of information about the potential borrowers/issuers, ranging from credit ratings (for most peer-to-peer loan arrangements) to business model to verification of information and AML checks of firms that want to raise equity capital. Though SEBI had come out with a draft regulation on the subject, it has not issued the final guidelines. 2.1.5 Market provisioning services Advances in computing power are facilitating faster and cheaper provision of information and services to the market. A few of these innovations are discussed below: 2.1.5.1 Smart contracts Smart contracts are computer protocols that can self-execute, self-enforce, self-verify, and self-constrain the performance of a contract. Development of smart contracts in relation to financial services could have a large impact on the structure of trade finance or derivatives trading, especially more bespoke contracts, and could also be integrated into Robo-advice wealth management services. The widespread adoption of smart contracts in financial services could be facilitated by the establishment of distributed ledger technology. 2.1.5.2 E-Aggregators E-Aggregators provide internet-based venues for retail customers to compare the prices and features of a range of financial (and non-financial) products such as standardised insurance, mortgages, and deposit account products. They can also be firms that provide services that allow users to aggregate and analyse their data on their payment patterns, across separate accounts and products (example-Yodlee). E-Aggregators also provide an easy way to switch between providers and may become a major distributor for a variety of financial products. Reserve Bank of India has issued directions regarding Account Aggregators which requires that no entity other than a company can undertake the business of an Account Aggregator, no company shall commence or carry on the business as an Account Aggregator without obtaining a certificate of registration from the RBI and every company seeking registration with the RBI as Non-Banking Financial Company - Account Aggregator shall have a net owned fund of not less than ₹ two crore or such higher amount, as the RBI may specify. Provided that, entities being regulated by other financial sector regulators and aggregating only those accounts relating to the financial assets of that particular sector will be excluded from the registration requirement. 2.1.5.3 Cloud computing Cloud-based IT services can deliver internet-based access to a shared pool of computing resources that can be quickly and easily deployed. Infrastructure, Platform, Service and Mobile backend as a service are offered under cloud based services. The use of these services is an important enabler for new entrants to the financial services arena to set up quickly and with low start-up cost, with easy options to expand their capability as the firm grows. Depending on the type of services of the cloud service availed, it can potentially pose several challenges including the ability of jurisdictional enforcement authorities to effectively ensure security of data. 2.1.5.4 Big data As more business activity is digitised, new sources of information are becoming available. Combining these data sources with the availability of increased computing power is delivering faster, cheaper, and more comprehensive analysis for better informed decision-making. For example, wider use of increasingly large datasets could deliver material improvements in credit risk assessments. Financial institutions may desire to monetize aggregated data by selling them or bundling them with other products and services offered. 2.1.5.5 Artificial Intelligence (AI) & Robotics Companies looking to achieve a competitive edge through AI need to work through the implications of machines that can learn, conduct human interactions, and engage in other high-level functions at an unmatched scale and speed. They need to identify what machines do better than humans and vice versa, develop complementary roles and responsibilities for each, and redesign processes accordingly. AI often requires, for example, a new structure, of both centralized and decentralized activities, that can be challenging to implement. Finally, companies need to embrace the adaptive and agile ways of working and setting strategy that are common at startups and AI pioneers. All companies might benefit from this approach, but it is mandatory for AI-enabled processes, which undergo constant learning and adaptation for both man and machine. 2.1.6 Investment management services Automated systems have the potential to transform the business of investment management. Few commonly used applications in investment management services are discussed as under: 2.1.6.1 Robo advice “Robo-advice” is the provision of financial advice by automated, money management providers, thereby disintermediating human financial advisors and reducing costs. It can offer more investor choice, especially for low and middle income investors who do not have access to the wealth management divisions of the banks. Robo Advisors are said to be currently handling assets under management estimated at $20bn7 and such business is growing rapidly. They use client information and algorithms to develop automated portfolio allocation and investment recommendations that are meant to be tailored (to a greater or lesser degree) to the individual client. Robo advisors are regulated just like independent advisors who set up offices and meet clients on a regular basis in USA. They typically register with the U.S. Securities and Exchange Commission and are deemed "fiduciaries" who must put their clients' interests above their own. 2.1.6.2 E-Trading Electronic trading has become an increasingly important part of the market landscape, notably in fixed income markets. It has enabled a pickup of automated trading in the most liquid market segments. Innovative trading venues and protocols, reinforced by changes in the nature of intermediation, have proliferated, and new market participants have emerged. This, in turn, has had implications for the process of price discovery and for market liquidity. It could also lead market structures to evolve from over-the-counter to a structure where all-to-all transactions can take place. The development of e-trading platforms contributes to improving the efficiency of market orders and to reducing average trading costs8. 2.2. FinTech and its impact on global financial services 2.2.1 Innovation and technology have brought about a radical change in traditional financial services. The world has seen the emergence of more than 12,000 start-ups and massive global investment of USD 19 billion in 20159 in the FinTech space. The global FinTech software and services sector is expected to boom as a USD 45 billion10 opportunity by 2020, growing at a compounded annual growth rate of 7.1% as per NASSCOM. 2.2.2 Technological innovations compel banks to modify their way of doing business and earnings models. Banks currently perform activities in several market segments, viz., payments services, raising deposits, lending, and investments, etc. These are segments where technological innovations will result in more high-grade products at lower prices. If banks do not adopt them quick enough, innovation by rivals may put their business models under pressure. Loss of consumer contact and fragmentation of the value chain could then diminish banks’ ability to profit from the cross-selling market. 2.2.3 Global Technology players, viz., Apple, Google and Facebook that adopt innovations effectively and carry technological innovation and new services across the financial value chains. These companies displace existing financial institutions by exploiting their scale and innovative capacity. 2.2.4 Technological innovation brings opportunities and risks. FinTech can increase efficiency and diversity by boosting competition within the financial sector. This effect will reduce market concentration and may lead to better services for consumers, in particular as new technological processes often result in greater user-friendliness. This is in particular relevant for the Indian banking sector. Moreover, innovative new entrants provide an incentive for established financial institutions to become more competitive and focus more on their customers. 2.2.5 A more diverse financial sector also reduces systemic risk by increasing the heterogeneity between the risk profiles of market participants. In addition to creating new opportunities, FinTech also carries potential risks for the financial sector. These include risks to the profitability of incumbent market players as well as risks related to cyber-attacks. 2.2.6 As the rise of FinTech leads to more and more IT interdependencies between market players (banks, FinTech, and others) and market infrastructures, IT risk events could escalate into a full-blown systemic crisis. 2.2.7 The entrance of new FinTech players has not only increased the complexity of the system but has also introduced heightened IT risks for these players who typically have limited expertise and experience in managing IT risks. 3. FinTech and its impact on Indian Financial Services 3.1 FinTech innovations, products and technology India’s FinTech sector may be young but is growing rapidly, fueled by a large market base, an innovation-driven startup landscape and friendly government policies and regulations. Several startups populate this emerging and dynamic sector, while both traditional banking institutions and non-banking financial companies (NBFCs) are catching up. This new disruption in the banking and financial services sector has had a wide-ranging impact. In India, FinTech has the potential to provide workable solutions to the problems faced by the traditional financial institutions such as low penetration, scarce credit history and cash driven transaction economy. If a collaborative participation from all the stakeholders, viz., regulators, market players and investors can be harnessed, Indian banking and financial services sector could be changed dramatically. FinTech service firms are currently redefining the way companies and consumers conduct transactions on a daily basis. The Indian FinTech industry grew 282% between 2013 and 2014, and reached USD 450 million in 2015. At present around 400 FinTech companies are operating in India and their investments are expected to grow by 170% by 2020. The Indian FinTech software market is forecasted to touch USD 2.4 billion by 2020 from a current USD 1.2 billion11, as per NASSCOM. The transaction value for the Indian FinTech sector is estimated to be approximately USD 33 billion in 2016 and is forecasted to reach USD 73 billion12 in 2020. The broad FinTech products/services offered in Indian financial markets are as under  3.1.1 Peer-to-Peer (P2P) Lending Services These companies use alternative credit models and data sources to provide consumers and businesses with faster and easier access to capital, providing online services to directly match lenders with borrowers who may be individuals or businesses. Examples are Lendbox, Faircent, i2iFunding, Chillr, Shiksha Financial, Gyan Dhan, and Market Finance. 3.1.2 Personal Finance or Retail Investment Services Fintech companies are also growing around the need to provide customized financial information and services to individuals, that is, how to save, manage, and invest one’s personal finances based on one’s specific needs. Examples are FundsIndia.com, Scripbox, Policy Bazaar, and Bank Bazaar. 3.1.3 Miscellaneous Software Services Companies are offering a range of cloud computing and technology solutions, which improve access to financial products and in turn increase efficiency in day to day business operations. The scope of FinTech is rapidly diversifying at both macro and micro levels, from providing online accounting software to creating specialized digital platforms connecting buyers and sellers in specific industries. Examples include Catalyst Labs in the agriculture sector, AirtimeUp which provides village retailers the ability to perform mobile top ups, ftcash that enables SMEs to offer payments and promotions to customers through a mobile based platform, Profitbooks (online accounting software designed for non-accountants), StoreKey, and HummingBill. 3.1.4 Equity Funding Services This includes crowdfunding platforms that are gaining popularity as access to venture capital is often difficult to secure. These services are particularly targeted at early stage business operations. Examples include Ketto, Wishberry, and Start51. 3.1.5 Crypto currency India being a more conservative market where cash transactions still dominate, usage of digital financial currency such as ‘bitcoin’ has not seen much traction when compared to international markets. There are, however, a few bitcoin exchange startups present in India – Unocoin, Coinsecure, and Zebpay. 3.1.6 Developments in Block chain Technology in India Block chain, a seemingly unassuming data structure, and a suite of related protocols, has recently caught the attention and spurred efforts of a number of domestic firms. IDRBT has taken the initiative of exploring the applicability of BCT to the Indian Banking and Financial Industry by publishing a White Paper detailing the technology, concerns, global experiences and possible areas of adoption in the financial sector in India. In order to gain first-hand experience of the implementation, the Institute has also attempted a Proof-of-Concept (PoC) on the applicability of BCT to a trade finance application with active participation of NPCI, banks and solution provider, the details of which are presented in the White Paper13. The results of the PoC have been quite encouraging, giving comfort and confidence in the implementability of BCT in the Indian financial sector. The PoC provided a good insight into the workings of the Blockchain eco-system demonstrating the following key aspects:

The IDRBT White paper has suggested a phased adoption of BCT by the Indian banking system, the stages of which are as follows: i. Intra-bank usage of BCT Banks may setup a private Blockchain for their internal purposes. This not only helps them to train human resources in the technology, but also benefits by enabling efficient asset management, opportunities for cross-selling, etc. ii. Inter-bank usage of BCT Proof-of-Concept implementation and testing may be carried out in the following order of increasing application complexity – mainly because of the number of stakeholders involved in the transaction. Centralized KYC: Secure, distributed databases of client information shared between institutions helps reduce duplicative efforts in customer onboarding. Secure codification of account details could enable greater transparency, efficiency in transaction surveillance and simplify audit procedures. Cross-Border Payments: BCT enables real-time settlement while reducing liquidity and operational costs. Transparent and immutable data on BCT reduces fraudulent transactions. Smart contracts eliminate operational errors by capturing obligations among FIs to ensure that appropriate funds are exchanged. BCT allows direct interaction between sender and beneficiary banks, and enables low value transactions due to reduction in overall costs. Syndication of loans: Underwriting activities can be automated, leveraging financial details stored on the distributed ledger. KYC requirements can also be automatically enforced in real-time. BCT can provide a global cost reduction opportunity within the process execution and settlement sub-processes of syndicated loans. Trade Finance: BCT usage for Trade finance enables automation of LC creation, payment against documents, development of real-time tools for enforcing AML and customs activities, and associated cost savings. Capital markets: BCT brings the following advantages in the clearing and settlement processes: reducing or eliminating trade errors, streamlining back office functions, and shortening settlement times. Further areas where BCT can be applied advantageously in BFSI sector would be Supply-chain finance, Bill discounting, Monitoring of consortium accounts, Servicing of securities and Mandate management system. Use cases of BCT banking operations in India A few banks in India in the recent past have reported successful use of BCT in their operations, especially in the areas of trade finance, international remittances, etc. and reported that this has potential to be used in larger scale in many operations of their bank. Unlike regular trade transactions where documents are authorized and physically transferred, in a block chain transaction all parties can view the authorization live. A key feature is that the records cannot be tampered and any changes can be introduced only by creating a fresh entry. Besides eliminating the need for moving paper across countries, the transaction eliminates the need for financial messaging between banks and introduces the convenience of instant cross-border remittances for retail customers. Examples- SBI, Axis Bank, ICICI Bank, etc. 3.1.7 Developments in Payments landscape in India Fintech enablement in India has been seen primarily across payments, lending, security/biometrics and wealth management. The modes of payments in India have leapfrogged from cash to alternate modes of payments registering phenomenal growth. The innovations have happened in all spheres - from common USSD channel access through NUUP, Immediate Payment Service (IMPS) – initiation of transactions through various options for real-time payments to end customer, with the latest being the Unified Payments Interface (UPI). Some of the developments in this regard are discussed below. 3.1.7.1 Fast Payments Leveraging on the high mobile density in India, with a population of more than one billion, many PSPs utilize mobile payment apps to link underlying payment instruments with mobile phone numbers for fast payments via the Immediate Payment Service (IMPS) or for issuance of m-wallets. The Unified Payment Interface (UPI) developed by NPCI provides complete interoperability for merchant payments as well as P2P payments. The UPI enables users to link their bank accounts with their mobile phone numbers through an application provided by the payment service providers (PSPs) and obtain a virtual address which can be used for making and receiving payments. Introduction of UPI has the potential to revolutionize digital payments and take India closer towards being a “Less Cash” society. 3.1.7.2 Process Innovation With the nation-wide implementation of Aadhaar, providing a unique identification number to all residents of India, NPCI has launched an Aadhar Enabled Payment System (AEPS) that is a safe and convenient channel enabling micropayments with every transaction validated by biometric authentication. In a further impetus to digital innovations, Unique Identification Authority of India (UIDAI) in collaboration with TCS plans to roll out an Android-based Aadhaar-Enabled Payment System (AEPS). The application can be downloaded by merchants on a smartphone and would require a fingerprint scanner to use it. The application is intended to facilitate undertaking transactions without any Card or PIN. 3.1.7.3 Wallets The traditional modes to make payments include cheque, electronic payment modes viz., NEFT, RTGS, etc. and card (debit and credit) payments. The need for prepaid payment instruments in the form of physical card or e-wallet was felt to give non-bank customers the facility to use electronic modes of payments and give existing bank customers a safeguard measure that limits the extent to which they are exposed. The emergence of bank (State Bank Buddy, Citi MasterPass, ICICI Pockets) and non-bank (PayTM, Mobikwik, Oxigen, Citrus Pay, etc.) payment wallets in India has changed the landscape of payments. Many start-ups have entered the space to simplify mobile money transfer, such as Chillr application, which provides peer-to-peer money transfer without using bank account details. Several leading banks have launched their own digital wallets leveraging NPCI’s IMPS platform. These digital wallets are integrated with social media features as well. Digital Innovators are also promoting the Online to Offline (O2O) model to facilitate digital payments at local stores. 3.1.7.4 BHIM (Bharat Interface for Money) BHIM is a mobile app developed by NPCI, based on the Unified Payment Interface (UPI) and was launched on 30 December 2016. It is intended to facilitate e-payments directly through banks and as part of the drive towards cashless transactions. BHIM allow users to send or receive money to other UPI payment addresses or scanning QR code or account number with IFSC code or MMID (Mobile Money Identifier) Code to users who do not have a UPI-based bank account. BHIM allows users to check current balance in their bank accounts and to choose which bank account to use for conducting transactions, although only one can be active at any time. Users can create their own QR code for a fixed amount of money, which is helpful in merchant transactions. 3.2 Innovations in digital banking and investment services in India 3.2.1 Innovation in retail financial services The form of Retail Financial Services is completely dictated by consumers and as they evolve so will retail financial services. Hence innovation is not a luxury anymore, it's a necessity. More importantly we are also seeing the advent of nimble startups, which are slowly and steadily changing how retail financial services are delivered to the consumers and hence putting pressure on traditional banks to take notice and align their functioning accordingly. It is therefore extremely important for banks to innovate in the retail financial services space in tune with the changing times or else there is a grave risk of their becoming less relevant to existing customers. 3.2.2 Innovation in Mobile Banking Services Mobile banking companies have come a long way. Innovation in mobile banking has grown in sophistication, using advanced technologies such as touch and voice capabilities and machine learning algorithms. Mobile banking innovators focus on enabling customers to bank the way they want to with minimum limitations, using mobile banking apps. 3.2.3 Innovation in Financial Services though Digital Banking 3.2.3.1 Customers are rapidly adopting technology in their daily lives driven by the growth in internet and mobile penetration, availability of low cost data plans and shift from offline to online commerce. Banks are keeping abreast of their evolving needs and behavior and have enabled access to a wide range of banking and financial services through different digital platforms. Banks in India are putting in place robust foundations for digital infrastructure and are innovating using digital technologies across all channels to deliver the power of speed and convenience to all customer segments across urban and rural markets. Some incumbents, in order to defend market share, have encouraged the development of a whole ecosystem of digital banking products and services built upon their infrastructure. To cater to the fast changing expectations of customers, constant development of new products and services and enhancements, a dedicated focus on digital innovation is of prime importance. Innovation objectives to be identified early on and well-articulated by banks aspiring for a leadership position in the entire value chain. There was a time when cost leadership and service range leadership offered differentiation; however, the way to maintain sustainable leadership going forward will be 'experience leadership' through customer-driven Innovation. 3.2.3.2 Banks thus need to have dedicated resources, both people as well as infrastructure, to form an agile innovation unit, with a view to position themselves at the forefront of digital innovations amidst changing customer expectations and sea-change in the competitive landscape. 3.2.3.3 Now that digital innovation practice has reached a critical mass, banks are shifting gears to create a stronger innovation culture via the Internal Social Collaboration platform and adopting cutting edge technologies like Artificial Intelligence, Block Chain and Internet of Things (IOT), among others. Customers are taken into a new world of multi-channel banking, where they can access services from home, at the office, or on-the-go through Mobile Banking, SMS Banking, Phone Banking, ATMs and Net Banking. 3.2.3.4 Managing investments for Private Banking clients is now simpler and faster. Clients can now easily access research reports both online and on mobile via the apps, capitalize on investment opportunities quickly through Net Banking and Mobile Banking, and track investments using investment tracking apps. The focus on making customers accomplish more comes with the assurance that the services are secure and protected. Banks have set up a Digital Security infrastructure which works with other teams to monitor and set up new security enhancements. 3.2.3.5 Some banks in India are proposing to form a block chain consortium along with other global banks such as SBI, Citi, Deutsche, JP Morgan, Nomura, HSBC, UBS, Barclays, Bank of America, BNP, RBS, Macquarie, Westpac, etc. 3.2.3.6 Some of the banks are also collaborating with Indian IT service providers in areas of voice enabled system for the customers to open new accounts on the basis of Aadhaar authentication. 3.2.3.7 Banks are also collaborating with IT service providers for e-Sign(digital signature) facility to help digitally signing the loan documents. This will help in faster approval process, lesser paper work and lesser paper storage space. 3.2.3.8 Some of the innovations and related initiatives taken by Indian banks in collaboration with FinTech start-ups/academia and other service providers in the recent past are SBI FinTech IPDaaS Software Developed with IIT-KGP; Zing HR using Microsoft AI; Digital Village; cross border remittances, etc. Such start-ups are listed in Annex-1. 3.2.4 Innovations in branch banking through Intelligent Robotic Assistant AI and robotics have the potential to transform data analytics and customer experience in banking. Until recently, application of robotics was unheard of in banking and was considered for application primarily in the manufacturing & medical sectors. With use of Intelligent Robotic Assistant (IRA), robotics are being brought into the mainstream of customer service and support. IRA is designed to assist branch staff in large branches, which have high footfalls, by guiding customers to carry out their banking transactions. AI is becoming an integral part of the banking system, functions, processes and customer interactions. Both Robotics and AI will help banks manage both internal and external customers much more effectively and help reduce operational costs exponentially in the future. The potential of AI and Robotics based solutions is enormous and will revolutionize the way people do banking. Digital transformation and innovation in the BFSI space will ride on three pillars - BlockChain, Artificial Intelligence and Internet of Things. It is said that 'technology becomes truly useful when it becomes invisible'. With the onset of interconnected devices riding on a self-learning and evolving AI and BlockChain keeping a track of each and every transaction, banking will no longer be just apps, websites or physical branches. Widespread adoption of biometric authentication and AI based voice enabled financial services and advisory may make banking relatively 'invisible'. However, a strong caveat here is that ideas are not good enough. There has to be a strong focus on execution. Buzz words on innovation have to progress to functional use cases, and be implemented to create true value. With the change that banking has seen in the last 20 years, it is difficult to say how it'll look like in the future. Although the essence of banking, which is collecting money from those who have surplus savings and using it to lend to those who need it, will remain unchanged, what the customers and the bank staff will experience may be transformed by FinTech. It is believed that banking will not be just about saving, spending or servicing transactions. It will be about banks acting as the alter ego of their customers, aiming to maximize their wealth and meet their financial needs seamlessly. Financial advisory, Investment Management, facilitating commerce on both borrower and lender side will take center stage and, taking a futuristic view, the entire value chain will be about “Automation (Blockchain – Robotics Process Automation), Experience (Artificial Intelligence, NLP & Language support) and Assistance (Humanoids, Holographic Banking & Robo-advisory). 3.2.5 Innovation in Investment services Technology plays an important role and brings efficiency in terms of cost, reduction in turnaround time, increasing the reach, anytime availability to the clients, etc. Towards this the mutual funds industry has adopted technology and the use of same is increasing day by day. Product manufacturers, i.e. individual mutual funds/asset management companies (AMCs) are providing online facilities by which investors can subscribe, redeem and monitor their portfolio by logging onto their websites. AMCs have integrated the online processes with payment systems which enable investors to make seamless payment. Some of the AMCs have also developed mobile applications for investors to access their portfolio through smart phones. Further, Mutual Fund Distributors (MFDs) have also adopted technology in distribution of mutual funds. There are distributors such as Scripbox, FundsIndia, MyUniverse, ArthaYantra, etc, who operate only in the online space and cater to the tech savvy investors. The processes like onboarding of investors, risk profiling, analysis of their portfolio, recommendation of schemes, asset allocation, rebalancing of portfolio etc. are online and driven by technology. With an objective to use technology in an innovative manner so that an investor can transact seamlessly in a presence-less and paperless manner, SEBI has engaged with various stakeholders of industry to leverage the advancement in technology and digitalize the whole process of investment in securities market. After involving UIDAI and all stakeholders, SEBI has issued instructions on Aadhaar based e-KYC, which has made onboarding of a new investor in securities market (especially in mutual funds) totally paperless and presence-less. 3.3 Scope for Growth of FinTech and digital banking in India India has a large untapped market for financial service technology startups as 40 percent of the population are currently not connected to banks and 87 percent of payments are made in cash. With mobile usage expected to increase to 64 percent in 2018 from 53 percent currently, and internet penetration steadily climbing, the growth potential for FinTech in India cannot be overstated. Moreover, by some estimates, as much as 90 percent of small businesses are not linked to formal financial institutions. These gaps in access to institutions and services offer important scope to develop FinTech solutions (such as funding, finance management) and expand the market base. 4. Regulatory Initiatives: Recent global regulatory Initiatives on FinTech 4.1 Global experiences on regulatory actions FinTech or digital innovations have emerged as a potentially transformative force in the financial markets. A recent FSB study highlighted some of the potential benefits of FinTech, including efficiency improvements, risk reduction and greater financial inclusion. The study also identified some of the key challenges associated with FinTech, such as difficulty of regulating an evolving technology with different use cases, monitoring activity outside the regulated sector, and identifying and monitoring new risks arising from the technology. The developments in increasing digitization in banking present regulatory and supervisory challenges for several reasons. First, financial technology is increasing the channels for provision of finance, both from banks and non-banks (e.g. platform-based lending). Second, technological innovation is affecting existing bank business models, which in turn could undermine their overall business strategies. Third, the rise of FinTech may lead to fundamentally different bank risk profiles. In this regard, best practices and principles for the management and supervision of risks arising from financial technology are much needed. Financial innovation has become a focal point for a lot of attention from regulators, and some jurisdictions have decided to take a more active approach in facilitating this innovation. To do this, they have put in place a variety of regulatory and supervisory initiatives such as regulatory sandboxes, innovation hubs or teams, innovation incubators or accelerators, etc. Regulatory uncertainty surrounding FinTech could potentially hamper its development. As a result, international standard setting bodies (BCBS, FSB, CPMI, WBG, etc.) including regulatory authorities of different jurisdictions are taking steps to actively monitor FinTech developments both domestically and in cooperation with international organizations. Some developments in this regard are as under: 4.1.1 Basel Committee on Banking Supervision (BCBS): BCBS has set up a Task Force on FinTech (TFFT) to identify and assess the risks arising from the digitalisation of finance with a focus on the impact of financial technology on banks’ business models, the provision of finance and systemic risk, as well as associated supervisory challenges. The Task Force has been mandated to investigate the impact of FinTech on banks and the implications for banking regulation and supervision. The work of the TFFT will involve initial mapping of the FinTech industry and technologies, in order to gain a general understanding of the major innovations and how banks are adopting new technologies. The second phase will involve a scenario-analysis of the potential impact of FinTech on the banking industry, as well as ‘deep dive’ case studies of specific technologies and their banking application. The third phase will aim to assess risks for banks and any implications for supervision, with a view to making recommendations on how the Committee should proceed, based on the information collected. 4.1.2 Financial Stability Board (FSB) FSB has set up a task force named Financial Innovations Network (FIN) for the assessment of FinTech, inter alia recommending that innovations be examined through the lens of authorities’ and Secretarial Standards Board’ (SSB) responsibilities. BCBS and the FSB have conducted a joint survey of their members’ FinTech-related activities, including the use of regulatory sandboxes and innovation hubs. FSB has considered the financial stability implications of distributed ledger technology, and continues to work in this area, jointly with Committee on Payments and Market Infrastructures (CPMI), to identify key issues that market participants and policymakers need to address. FSB is conducting an in-depth study of the financial stability implications of peer to peer lending with the BIS’ Committee on the Global Financial System. FSB is currently undertaking a study of the key elements underlying the broad swath of FinTech innovations and examining the financial stability implications of those elements. That work has identified three elemental 'promises' common to a broad range of FinTech innovations14: (i) greater access to and convenience of financial services, (ii) greater efficiency of financial services, and (iii) to push toward a more decentralised financial system, in which FinTech firms may be disintermediating traditional financial institutions. 4.1.3 Committee on Payments and Market Infrastructures (CPMI) CPMI is also looking at digital innovations as well as “FinTech” developments and their implications for payments and market infrastructures. The CPMI is continuing to monitor developments and evolution of digital currency schemes and their wider implications. To focus its activities, the CPMI has established a dedicated Working Group to look at the impact of digital innovations and to analyse the implications of such innovations on payment services and systems, having particular regard to the technical and infrastructure aspects of products and services based on innovative technologies, such as block chain and distributed ledgers. 4.1.4 European Commission The European Commission in November 2016 launched a Task Force on Financial Technology (TFFT) that aims to assess and make the most of innovation in this area, while also developing strategies to address the potential challenges that FinTech poses. The work of this Task Force builds on the Commission's goal to develop a comprehensive strategy on FinTech. 4.1.5 World Bank Group The World Bank participates actively in SSB work streams relevant to FinTech. The WBG works with national authorities to put in place enabling frameworks for adoption of technology, market entry/level playing fields, and expansion of financial access – as technical, policy, or financing partner IFC: investments, risk-sharing, also dialogue with private sector players in this space e.g. through SME Finance Forum.15 4.2 Regulatory Sandboxes / Innovation Hub 4.2.1 Innovation Hubs Support, advice or guidance provided to regulated or unregulated firms in navigating the regulatory framework or identifying supervisory, policy or legal issues and concerns is generally termed as ‘innovation hub’. Some of the key benefits of having an innovation hub are:

4.2.2 Regulatory Sandbox Live or virtual testing of new products or services, in a (controlled) testing environment, with or without any ‘regulatory relief’ is termed a ‘sandbox’. The testing environment could be available to regulated or unregulated firms, or both. Regulator provides the appropriate regulatory support by relaxing specific legal and regulatory requirements, which the sandbox entity will otherwise be subject to, for the duration of the sandbox. 4.2.3 Benefits of Sandbox Sandboxes appear to offer a number of benefits. Users of a sandbox can test the product’s viability without the need for a larger and more expensive roll out. If the product appears to have the potential to be successful, the product might then be authorized and brought to the broader market more quickly. Finally, if concerns are unearthed while the product is in the sandbox, appropriate modifications can be made before the product is launched more broadly. 4.2.3.1 The objective of Sandbox Sandbox should help to encourage more FinTech experimentation within a well-defined space and duration where regulators will provide the requisite regulatory support, so as to increase efficiency, manage risks better and create new opportunities for consumers. 4.2.3.2 Eligible Applicant for Sandbox Regulators need to specify the target audience which may include existing financial institutions, FinTech firms, and professional services firms partnering with or providing support to such businesses, etc. The applicant should clearly understand the objective and principles of the sandbox. 4.2.3.3 Criteria for joining the sandbox The proposed financial service to be launched under the sandbox should include new or emerging technology, or use existing technology in an innovative way. The proposed financial service should address a problem, or bring benefits to consumers or the industry. The criteria should also specify the following parameters:

4.2.3.4 Boundary conditions for the sandbox and evaluation criteria When a sandbox operates in the production environment, it must have a well-defined space and duration for the proposed financial service to be launched, within which the consequences of failure can be contained. The appropriate boundary conditions should be clearly defined, for the sandbox to be meaningfully executed while sufficiently protecting the interests of consumers and maintaining the safety and soundness of the industry. Regulators creating the sandbox should specify the following:

4.2.3.5 Exit Strategy An acceptable exit and transition strategy should be clearly defined in the event that the proposed financial service has to be discontinued, or can proceed to be deployed on a broader scale after exiting the sandbox. There should also be an exit plan to ensure a smooth exit from the market in case sandbox participant fails. 4.2.3.6 Consumer protection The sandbox entity should ensure that any existing obligation to its customers of the financial service under experimentation must be fully fulfilled or addressed before exiting or discontinuing the sandbox. 4.2.3.7 Regulatory requirements to be followed by the Sandbox applicants Applicants for sandbox must comply the following regulatory requirements to ensure the interests of consumer and safety and soundness of the financial sector:

4.2.3.8 Facilities generally granted to sandbox participants Possible regulatory relaxation that may be considered by the regulators for sandbox are as under: 4.2.3.8.1 Quantitative prudential requirements

4.2.3.8.2 Corporate governance

4.2.3.8.3 Risk management

4.2.4 Regulatory Sandbox/Innovation hubs created in other jurisdictions: 4.2.4.1 Australia Australian Securities and Investments Commission (ASIC) released a detailed regulatory framework during May 2016 on innovation hub/sandbox allowing eligible FinTech businesses to test certain specified services without holding an Australian financial services (AFS) or credit licence. This allows eligible businesses to notify the regulator and then commence testing without an individual application process. There are five elements in the said framework as discussed under:

4.2.4.1.1 Eligibility criteria for Sandbox The FinTech entities willing to provide financial services are exempted from licensing subject to the following conditions:

4.2.4.1.2 Boundary conditions Boundary conditions for participants in the sandbox are: - Have no more than 100 retail clients (unlimited wholesale clients) - Plan to test for no more than 12 months - Have total customer exposure of no more than USD 5 million - Have a maximum annual rate of interest at 24% - Have adequate compensation arrangements - Have dispute resolution processes in place - Meet disclosure and conduct requirements 4.2.4.1.3 Consumer protection: FinTech entities are required to maintain adequate compensation arrangement and register with an External Dispute Resolution (EDR) scheme in order to provide consumers with an outlet to settle disputes with sandbox business. The entities need to comply with key consumer protection provisions in the financial services and credit laws. FinTechs are required to tell their clients that: (a) they do not hold a licence; (b) the service they will provide is being tested under the FinTech licensing exemption (c) some of the normal protections associated with receiving services from a licensee will not apply. 4.2.4.1.4 Dispute resolution framework To rely on the FinTech licensing exemption, FinTechs must also have in place a dispute resolution system that consists of: (a) Internal dispute resolution (IDR) procedures (b) Member of one or more ASIC-approved external dispute resolution (EDR) schemes. 4.2.4.1.5 ASIC Role: ASIC retains the right to refuse or withdraw relief and may give a person a written notice that they cannot rely on the FinTech licensing exemption, due to concerns about poor conduct while relying on the exemption; failure to meet one or more of the conditions of relief; or previous misconduct. 4.2.4.1.6 Next step after the testing period After the 12-month testing period ends, FinTechs are required to cease their operations, unless granted an AFS or credit licence; or have entered into an arrangement to provide services on behalf of an AFS or credit licensee; given the individual relief extending the testing period. Further, after the end of the testing period, FinTechs will no longer be able to offer financial services or engage in credit activities unless they comply with the law like other businesses. 4.2.4.1.7 FinTech set up in ASIC ASIC has created the Innovation Hub/Sandbox with 2-3 staff sourced from its various functions. 4.2.4.1.8 International co-operation/MOU and agreement ASIC has an innovation hub agreement with the UK's FCA Innovation Hub during March 2016. ASIC has also entered into an agreement with Singapore's MAS to help innovative business to expand in each other’s market faster during June 2016. 4.2.4.2 Financial Conduct Authority (FCA), UK, Regulatory Sandbox FCA, UK has introduced a regulatory sandbox during June 2016. The sandbox aims to create a ‘safe space’ in which businesses can test innovative products, services, business models and delivery mechanisms in a live environment without immediately incurring all the normal regulatory consequences of engaging in the activity in question. The proposal is directed at authorised and unauthorised firms of both small and large scale. The sandbox contributes to achieving the FCA’s competition objective by lowering barriers to entry (e.g. reducing time-to-market for innovative ideas), enabling greater access to finance for innovators, and enabling more products to be tested and potentially introduced to the market. Currently the FCA sandbox is running on a cohort approach. There was a two month period (May to June 2016) for firms to apply to the first cohort which aims to carry out testing activities around October 2016. The selection process is a competitive process. Based on the eligibility criteria, FCA may select the appropriate firms to join the sandbox. After a firm is chosen to enter the sandbox, FCA would work on a detailed testing proposal and the issuance of one or more of the tools the sandbox offers. Currently there are no extra charges or fees for firms which want to use the sandbox. Standard fees however might apply for the authorisations process. Deposit taking is excluded from the sandbox proposal and restricted authorisation option is not available to firms looking for a banking license. The sandbox may be useful for firms who are not currently authorised that need to become authorised before being able to test their innovation in a live environment. The second cohort was opened for applications from around November 2016 to mid-January 2017. 4.2.4.2.1 Eligibility criteria for Sandbox The key requirements for applying the sandbox are that is the applicant has a genuine innovation that addresses a consumer need. To conduct a regulated activity in the UK, the firm must be authorised or registered by the FCA, unless certain exemptions apply. Firms who are accepted into a cohort will need to apply for the relevant authorisation or registration in order to be able to test. The FCA has set up a tailored authorisation process to work closely with firms accepted into the sandbox to enable them to meet these requirements. Any authorisation or registration will be restricted to allow firms to test only their ideas as agreed with the FCA. The process should make it easier for firms to meet their requirements and reduce the cost and time to get the test up and running. The evaluation criteria by FCA for FinTech entities are as under:

4.2.4.2.2 FCA Role: The FCA Sandbox offers four different tools to create the safe space for firms as listed under:

For non-FCA authorized firms, FCA has set up a limited authorization process that allows firms to meet the requirements necessary for sandbox purposes only. Upon successful completion of the sandbox, such firms can apply to have their limited FCA authorizations converted into full authorizations. Technology businesses that seek to provide services to FCA authorized firms can also apply for the sandbox and the above tools if they need clarity around applicable rules before testing. 4.2.4.2.3 Consumer Protection Safeguards exist against potential customer detriment when innovative financial products or services are tested in real life situations. Approaches taken to protect consumers include:

4.2.4.2.4 Next Step on completion of testing period Following completion of sandbox testing, the FCA will work with participants to determine the most appropriate strategy for next steps. 4.2.4.2.5 International co-operation/MOU and agreement FCA Innovation Hub has an innovation hub agreement with the ASIC, Australia Innovation Hub during March 2016. The UK (HM Treasury and the FCA) and Singapore (MAS) concluded a “FinTech Bridge” agreement. The agreement will enable the regulators to “refer” FinTech firms to each other. According to the FCA and the MAS, the agreement also sets out how the regulators plan to share and use information on financial services innovation in their respective markets. 4.2.4.3 Monetary Authority of Singapore (MAS), Singapore MAS has introduced a regulatory sandbox during June 2016. Financial institutions (FIs) in Singapore are free to launch new solutions without first seeking its guidance, as long as they are satisfied with their own due diligence and there is no breach of legal and regulatory requirements. MAS published its final “regulatory sandbox” guidelines during November 16, 2016 to encourage and enable experimentation of solutions that utilise technology innovatively to deliver financial products or services. The Sandbox would be deployed and operated by the applicant, with MAS providing the appropriate regulatory support by relaxing specific legal and regulatory requirements, which the applicant would otherwise be subject to, for the duration of the Sandbox. The guidelines aim to improve the clarity, flexibility and transparency of the regulatory sandbox. The Sandbox is applicable to both FIs and FinTech companies. 4.2.4.3.1 Objective of Sandbox MAS aims to transform Singapore into a smart financial centre by encouraging the adoption of innovative and safe technology in the financial sector. To this end, the sandbox can help to encourage more FinTech experimentation within a well-defined space and duration where MAS will provide the requisite regulatory support, so as to increase efficiency, manage risks better, create new opportunities and improve people’s lives. 4.2.4.3.2 FinTech set up The MAS formed the FinTech and Innovation Group (FTIG) in August 2015 in order to drive the Smart Financial Centre initiatives. The FTIG is led by a Chief FinTech Officer and consists of three offices, namely Payments & Technology Solutions Office, Technology Infrastructure Office and Technology Innovation Lab. The group is responsible for formulating regulatory policies and developing strategies to facilitate the use of technology and innovation to better manage risks, enhance efficiency, and strengthen competitiveness in the financial sector. 4.2.4.3.3 Criteria for joining the sandbox The major criteria for evaluation to join the sandbox are as under: a. The proposed financial service includes new or emerging technology, or uses existing technology in an innovative way b. The proposed financial service addresses a problem, or brings benefits to consumers or the industry c. The applicant has the intention and ability to deploy the proposed financial service in Singapore on a broader scale after exiting the sandbox d. The test scenarios and expected outcomes of the sandbox experimentation should be clearly defined e. The sandbox entity should report to MAS on the test progress based on an agreed schedule f. The appropriate boundary conditions should be clearly defined, for the sandbox to be meaningfully executed while sufficiently protecting the interests of consumers and maintaining the safety and soundness of the industry g. Significant risks arising from the proposed financial service should be assessed and mitigated h. An acceptable exit and transition strategy should be clearly defined 4.2.4.3.4 Time frame for regulatory approval MAS will review the application and inform the applicant of its potential suitability for a sandbox within 21 working days after receiving the required information. 4.2.4.3.5 Boundary conditions for the sandbox and evaluation criteria Given that the sandbox would operates in the production environment, it must have a well-defined space and duration for the proposed financial service to be launched, within which the consequences of failure can be contained. The appropriate boundary conditions set by MAS are as under: