IST,

IST,

Report of the Working Group on Operating Procedure of Monetary Policy

Executive Director March 11, 2011 Dr. Subir Gokarn Deputy Dear Dr. Gokarn, We are glad to submit the Report of the Working Group on Operating Procedure of Monetary Policy. Yours sincerely,

The RBI announced the constitution of the Working Group to review the framework of the operating procedure of monetary policy in India (Chairman: Shri Deepak Mohanty) in the First Quarter Review of Monetary Policy for 2010-11. On the basis of a survey of country practices and technical evaluation of the evolution of the current monetary operations in the RBI, the Group makes the following key recommendations:

The operating procedure of monetary policy in India has evolved over the years from regulation and direction of credit to liquidity management in a market environment. Earlier monetary policy was conducted largely through direct instruments of monetary control such as prescribing deposit and lending rates of commercial banks, selective credit control over sensitive commodities, sector-specific standing facilities, statutory liquidity ratio (SLR) and the cash reserve ratio (CRR), though the Bank Rate was used as a general instrument of interest rate policy. 1.2 By the mid-1980s, the monetary policy operating framework began to witness a noticeable shift with the introduction of flexible monetary targeting approach following the recommendations of the Chakravarty Committee (1985) and money market reforms following the recommendations of the Vaghul Committee (1987). This process was speeded up with the initiation of financial sector reforms in the early 1990s. The process of deregulation of interest rates, which began in the early 1990s, was largely completed by October 1997, except for a few categories. Similarly, the selective credit control operations were largely phased out by 1994 and most sector-specific refinance facilities were withdrawn by 2002. Also, the use of CRR as an instrument of monetary control was progressively de-emphasised and the liquidity management in the system was increasingly undertaken through open market operations (OMOs), both outright and repos. The termination of automatic monetisation of budget deficit of the Government of India and the introduction of the Ways and Means Advance (WMA) system in 1997, and eventually the phasing out of the practice of participation by the RBI in primary auction of government securities in April 2006 equipped the RBI to conduct monetary policy operations in a market-based framework. 1.3 In this process, the Liquidity Adjustment Facility (LAF) introduced in June 2000 emerged as the principal operating instrument for modulating short-term liquidity. Consequently, the repo rate (the rate at which banks borrow funds from the RBI against collateral) and the reverse repo rate (the rate at which banks place their funds with the RBI and receive collateral) emerged as the key instruments for signaling the monetary policy stance. These instruments, along with the CRR, OMOs and market stabilisation scheme (MSS) have served the Indian monetary and financial system well. However, India’s increasing integration with the global economy, large volatility in capital flows and sharp fluctuations in government cash balances have posed several challenges to liquidity management by the RBI. 1.4 Against this backdrop, the need was felt to revisit the operating procedure of monetary policy. Accordingly, as announced in the first Quarter Review of Monetary Policy for 2010-11 on July 27, 2010, the RBI constituted a Working Group to review the framework of the operating procedure of monetary policy with the following members:

Terms of Reference of the Working Group 1.5 The Working Group was assigned the following terms of reference: i) to survey the operating procedures of major central banks; ii) to review the current operating procedure of monetary policy in India, in particular, the Liquidity Adjustment Facility (LAF); iii) to examine the operation of the LAF with regard to:

iv) to assess the role of the Bank Rate; v) to examine the role of standing facilities such as the export credit refinance; and vi) to suggest changes to the current operating procedure of monetary policy in India in the light of international practices and domestic experience, with particular reference to:

Chapterisation 1.6 The Report is organised in five chapters, including this introductory chapter. Chapter II provides a survey of operating procedures of monetary policy in select countries, both advanced and emerging markets. Chapter III reviews the evolution of the operating procedure of monetary policy in India. Chapter IV discusses the issues that have arisen with regard to the current operating procedure of monetary policy in India and suggests changes in the existing operating procedure. Chapter V sets out the major recommendations of the Group. Acknowledgements 1.7 The Working Group places on record its deep appreciation of excellent technical work by A. B. Chakraborty, Jeevan Kumar Khundrakpam, Abhiman Das, Deepak Mathur, Bhupal Singh, Dipika Das, Sangita Misra, Samir Ranjan Behera, Sanjay Singh, Asish Thomas George, Joice John and G. V. Nadhanael, which forms a part of the report of the Group. 1.8 The Group acknowledges with thanks the suggestions received from analysts, economists, banks, market participants and the members of general public in response to the Press Release issued on September 13, 2010 soliciting comments on the terms of reference of the Group and the consultations by IBA, CCIL and FIMMDA. II. Survey of Operating Procedures of Monetary Policy in Select Central Banks The operating procedures of monetary policy in major advanced and emerging market economies have evolved over time. While there are significant differences in the operating procedures of different countries, some broad features can be identified. First, monetary policy is conducted with a single policy rate. Second, the policy rate is set within a corridor charted by (i) a standing collateralised marginal lending facility available throughout the day at a rate higher than the Policy rate that provides the upper bound; and (ii) a standing uncollateralised deposit facility at a rate lower than the Policy rate that provides the lower bound to the corridor. Although in the US there is no standing deposit facility, the interest rate paid on excess reserves provides a floor and the discount rate provides the ceiling. The policy rate is the key lending rate of the central bank. It is generally the repo rate though the nomenclature varies from country to country (Table II.1). The spreads around the policy rate for determination of the corridor is generally fixed such that any change in the policy rate automatically gets translated into corresponding changes in the discount/standing facility rates. Table II.1: Policy Rates of Select Central Banks

2.2 The standing marginal lending facility rate constitutes the ceiling of the formal corridor. At this rate, which is higher than the policy rate, market participants have the freedom to draw funds from the central bank against eligible collateral at their discretion. This facility is generally used when overnight rates have the tendency to increase significantly above the policy rate. On the other hand, the standing deposit facility offers market participants an opportunity to deposit their residual surplus that they could not deploy in the market even at a rate significantly lower than the Policy Rate. 2.3 While the corridor width generally remains fixed, in the wake of the recent global crisis, many major central banks reduced the corridor spread to help lubricate their financial markets, along with sharp reductions in their policy rates. Empirical evidence suggests that notwithstanding the width of the formal corridor charted by the two standing facilities, the overnight interest rate varied around the policy rate in a narrow corridor (Table II.2). This is because under the normal circumstance, the central bank could calibrate its liquidity management through its regular and fine-tuning operations in such a manner that overnight rates are generally aligned around its Policy Rate. It is only during the recent crisis period that the spread rose. 2.4 The Group noted that in India the spread was high at about 13 per cent with the reverse repo rate as the operating policy rate and about 24 per cent with the repo rate as the operating policy rate, reflecting large swings in liquidity (Table II.2). Table II.2: Spread around the Policy Rate

Width of Corridor 2.5 An important consideration here is the optimum width of the corridor. This depends on several factors including the structure of the money market. In India, the turnover in the overnight money market has increased significantly in recent years and stood at, on average, 1.2 per cent of GDP during 2008-09 and 2009-10. At the same time, the RBI has an important presence in the money market through the liquidity adjustment facility (LAF) window. The average volume in the LAF window stood at, on average, 0.9 per cent of GDP during this period. A too-narrow corridor could increase the reliance of banks on the RBI and thus hamper the growth of the money market. On the other hand, too wide a corridor could give scope for volatility in the overnight interest rate which could impair the transmission of monetary policy. The Group, therefore, felt that the guiding principle in the determination of the width of the corridor should be such that it should stabilise the overnight money market interest rate while facilitating the development of the money market so that the reliance of banks on RBI facilities comes down over time. 2.6 A survey on the width of the corridor in major developed and emerging market countries shows that it generally varied from 50 basis points to 200 basis points (Table III.3). During the crisis period, the ECB reduced the corridor width from 200 bps to 100 bps in October 2008; it has since raised the corridor width to 150 bps. From the cross-country data, the Group observed that the width of the corridor generally remained unchanged except under crisis conditions. From among the countries studied, the spread around the policy rate was generally symmetric except in the case of New Zealand. Table II.3: Corridor of Standing Facilities for Short-term Liquidity Management

2.7 The width of the liquidity adjustment facility (LAF) corridor in India varied between 100 and 300 bps (Chart II.1 and Table II.4). The RBI Policy documents did not explicitly spell out the reasons for the change in corridor width except in recent policies. But data for the 10-year period broadly show four distinct phases – a broader corridor (April 2001 to March 2004) followed by a narrower corridor (March 2004 to June 2008), then a move towards a broader corridor (June 2008 to early November 2008) and again towards a narrower corridor since early November 2008. Chart II.1: LAF Corridor Width: India

Instruments and Frequency of Operation 2.8 The cross-country survey shows that central banks use various instruments to stabilise short-term interest rates around the Policy Rate. These are: (i) open market operations (repo and outright), both overnight and longer term, (ii) forex swaps, (iii) central bank bills and (iv) transfer of public entity deposits at the central bank to or from the banking system. The use of these instruments, however, is very country-specific and depends on several factors, including the design of operating procedures (Table II.5). However, the most dominant feature is the long-term repo operations of varying maturity starting generally from one month onward. At the same time, OMOs are supplemented by fine-tuning operations conducted generally on the concluding day of the reserve maintenance period, often for overnight maturity, when averaging of reserve balances cannot be done. Table II.5: Main and Other Discretionary Operations

2.9 The overnight operations are generally conducted at a fixed rate tender at the Policy Rate to clearly signal the stance of monetary policy. The longer-term repo operations and fine-tuning operations are conducted at a variable rate tender essentially as liquidity management operations. 2.10 Notwithstanding country-specific differences, the Group observed that the following stylised features could be identified from the survey. First, all central banks have a single Policy Rate. Second, around the Policy Rate, there is a corridor formed generally by two standing facilities, viz., (a) a standing collateralised marginal lending facility available throughout the day at a penal rate that provides the upper bound to the corridor; and (b) a standing uncollateralised deposit facility at a rate lower than the Policy Rate that provides the lower bound of the corridor. Third, the target variable (usually the overnight interest rate) remains close to the policy rate. Consequently, the average absolute spread of the overnight rate relative to the Policy Rate remains low. The standing marginal lending facility and the standing deposit facility represent two safety valves for keeping conditions in the inter-bank market stable. Fourth, the overnight/ minimum maturity operations from the central bank are generally conducted at a fixed rate tender at the policy rate, while the longer-term repo operations and fine-tuning operations are conducted at a variable rate tender. The longer-term operations and fine-tuning operations are viewed essentially as liquidity management operations. III. Evolution of the Operating Procedure of The operating procedure of monetary policy in India has evolved over time. For analytical convenience, the period since 1935 to date can be divided broadly into four phases, viz.,(i) formative phase (1935-1950), (ii) development phase (1951-1990), (iii) early reform phase (1991-1997), and (iv) liquidity adjustment facility phase (1998 onwards). Formative Phase (1935-1950) 3.2 In the formative years during 1935-1950, the emphasis was on administering the supply of and demand for credit in the economy. The Bank Rate, reserve requirements and open market operations were the monetary policy instruments for regulating the credit availability. As the RBI followed a passive interest rate policy, the Bank Rate was used only once in November 1935 when it was reduced from 3.5 per cent to 3.00 per cent. Further, although the RBI was vested with adequate powers to resort to selective credit control, the need for it was not felt due to the prevalence of price stability. Development Phase (1951-1990) 3.3 During the development phase from 1951 to 1990, the role of monetary and credit policy was emphasised as an instrument for maintaining price stability and regulation of investment and business activity. During this period, the conduct of monetary policy was influenced significantly by the need to support plan financing and promote savings for its deployment to sectors in accordance with plan priorities. The large plan financing led to the RBI accommodating deficit financing of the government through the issue of ad hoc Treasury Bills from the beginning of Second Five-Year Plan. This led to the conduct of monetary policy becoming a process of passive accommodation of budget deficits by the early 1960s. Consequently, several quantitative control measures were introduced to contain inflationary pressures while ensuring credit to preferred sectors. 3.4 Selective credit control began to be actively used by the mid-1950s. With a view to influencing the demand for and use of credit, the quota-cum-slab stipulating minimum lending rates was introduced in October 1960. The credit authorisation scheme (CAS) was introduced in 1965 to ration bank credit. Further, ‘social control’ measures were introduced by the Government in December 1967 to enhance the flow of credit to priority sectors like agriculture, small sector industries and exports. During this period, the Bank Rate was used relatively more actively by raising it successively from 3.5 per cent in 1957 to 6 per cent by 1965, before lowering it to 5 per cent in 1968 (Appendix Table AT.1). 3.5 With the nationalisation of the major commercial banks in July 1969, the conduct of monetary policy began to focus mainly on credit planning, with non-food credit as the policy indicator. Banks were provided funds through standing facilities such as ‘general refinance’ and ‘export refinance’ to facilitate developmental financing as per credit plans. Among the policy instruments, the SLR was used for raising resources for the government plan expenditure from banks. The level of SLR was progressively increased from the statutory minimum of 25 per cent in February 1970 to 38.5 per cent by September 1990 (Appendix Table AT.1). The CRR was mainly used to neutralise the inflationary impact of deficit financing and was gradually raised from its statutory minimum of 3 per cent in September 1962 to 15 per cent by July 1989 (Appendix Table AT.1). During this period, the Bank Rate had a limited role in monetary policy operations, as it was ineffective due to the increasing prescription of differential rates for various sector-specific refinance facilities and the lack of a genuine bill market. 3.6 Against this backdrop, it was considered necessary to comprehensively review the functioning of the monetary system and carry out the necessary changes in the institutional set-up and framework of monetary policy. This led to two landmark Reports, viz., (i) the Committee to Review the Working of the Monetary System (Chairman: Prof. S. Chakravarty, 1985) which made comprehensive recommendations for the adoption of monetary targeting and the development of the Indian money market; and (ii) the Working Group on Money Market (Chairman: Shri N. Vaghul, 1987) which led to introduction of a number of money market instruments such as inter-bank participation certificates (1988), certificates of deposit (1989) and Commercial Paper (1990). Based on the recommendations of the Chakravarty Committee, a flexible monetary targeting framework with feedback from the real sector and with broad money as the nominal anchor evolved by the mid-1980s. Under this framework, reserve money was the operating target and the CRR was the key operating instrument. However, the efficient functioning of the market continued to remain hindered by a number of other structural rigidities in the system such as the skewed distribution of liquidity and the prevalence of administered deposit and lending rates, besides the persistence of fiscal dominance. Early Reform Phase (1991-1997) 3.7 Following another landmark Report – Report of the Committee on Financial System (Chairman: Shri M. Narasimham, 1991) – the process of financial liberalisation implemented in the early 1990s led to a structural shift in the financing paradigm for the government and commercial sectors. Liquidity absorption began to be carried out through reverse repos (then called repos) introduced in 1992. The government market borrowing through auctions since 1992-93 led to development of a secondary market in government securities and the market determination of interest rates. Furthermore, the exchange rate began to have a bearing on monetary management with exchange rate liberalisation – the rupee became fully convertible on the current account in 1994 – and the opening up of the economy. By the second half of the 1990s, liquidity management operations by the RBI moved away from direct instruments to indirect instruments. The CRR was brought down from 15 per cent of net demand and time liabilities (NDTL) of banks during July 1989-April 1993 to 9.5 per cent by November 1997. The SLR was reduced to the statutory minimum of 25 per cent by October 1997. Liquidity Adjustment Facility Phase (1998 onwards) Introduction of Interim Liquidity Adjustment Facility (ILAF) 3.8 In 1998, the Committee on Banking Sector Reforms (Narasimham Committee II) recommended the introduction of a Liquidity Adjustment Facility (LAF) under which the RBI should conduct auctions periodically. Accordingly, the RBI introduced an Interim Liquidity Adjustment Facility (ILAF) in April 1999 to minimise volatility in the money market by ensuring the movement of short-term interest rates within a reasonable range. Under the ILAF, the Bank Rate acted as the refinance rate (i.e., the rate at which the liquidity was to be injected) and liquidity absorption was done through the fixed reverse repo rate announced on a day-to-day basis. An informal corridor of the call rate thus emerged with the Bank Rate as the ceiling and the reverse repo rate as the floor rate, thereby minimising the volatility in the money market. ILAF was expected to promote stability in money market activities and ensure that interest rates moved within a reasonable range. 3.9 With the introduction of ILAF in April 1999, the general refinance facility1 was withdrawn and replaced by a collateralised lending facility (CLF) for scheduled commercial banks. The entitlement under CLF was fixed at up to 0.25 per cent of the fortnightly average outstanding aggregate deposits in 1997-98 for two weeks at the Bank Rate. Additional collateralised lending facility (ACLF) for an equivalent amount of CLF was made available at the Bank Rate plus 2 per cent. CLF and ACLF availed for periods beyond two weeks were subjected to a further penal rate of 2 per cent (i.e., Bank Rate plus 4 per cent) for an additional two-week period. The Export Credit Refinance (ECR) facility for scheduled commercial banks was provided at the Bank Rate. Liquidity support to Primary Dealers (PDs) against collateral of government securities based on bidding commitment and other parameters – termed as Level I support – was given at the Bank Rate with a repayment period of 90 days. Additional liquidity support – termed as Level II support – at the Bank Rate plus 2 per cent against collateral of government securities was also made available for a period not exceeding two weeks. 3.10 It is important to note that during the phase of ILAF, the standing lending facilities for banks included CLF, ACLF and ECR; and for PDs, it was Level I and Level II liquidity support. Also, the entitlement and the rate at which these facilities were available were different. Therefore, there were multiple standing lending facilities available at multiple rates. These rates were administered in nature which were rationalised subsequently. Transition to Full-fledged LAF 3.11 The transition from ILAF to a full-fledged LAF began in June 2000 and was undertaken in three stages. In the first stage, with effect from June 5, 2000, fixed rate reverse repo gave way to variable rate reverse repo auctions. Also, the ACLF to banks and Level II support to PDs were replaced by variable rate repo auctions of same day settlement. As a result, unlike in the ILAF where the rates of interest and amount for refinancing were fixed, in the LAF both were varied to respond to day-to-day liquidity conditions. In the second stage, beginning in May 2001, the CLF and ECR for banks and Level I liquidity support for PDs were divided into two parts of approximately 2:1 ratio, viz., a normal facility at the Bank Rate and a backstop facility at a variable rate at 1 per cent above the repo rate, i.e., at a market-related rate. Incidentally, as at end-May 2001, the repo rate stood higher at 8.75 per cent compared to the Bank Rate at 7 per cent. Some minimum liquidity support to PDs was continued but at an interest rate linked to the variable rate in the daily repo auctions as determined by the RBI from time to time. 3.12 Subsequently, the CLF was withdrawn in October 2002. The apportionment of ECR as normal and backstop facilities was also gradually modified by increasing the proportion of backstop facilities which was financed at variable market-based rates linked to the repo rate. The ratio of normal to backstop facilities was changed from 2:1 to 1:1 in November 2002 and further to 1:2 in December 2003. Finally, with effect from March 29, 2004, with the repo rate unified to the Bank Rate at 6 per cent, the entire quantum of ECR and liquidity support to PDs was made available at the repo rate, thereby completely de-linking the standing facilities to banks from the Bank Rate. Thus, the repo rate emerged as the lending rate of the RBI for all practical purposes. As a result, the importance of the Bank Rate as a monetary policy instrument waned. Current Operating Procedure 3.13. Subsequently, the LAF scheme was revised, taking into account the recommendations of the Internal Group on LAF and suggestions from market participants and experts. Accordingly, the 1-day reverse repo was phased out, and in its place the 7-day fixed rate reverse repo on a daily basis and the 14-day variable rate reverse repo on a fortnightly basis were introduced in March 2004. Repo operation was, however, retained on an overnight basis. Also, the repo rate was scaled down to 6 per cent and aligned with the Bank Rate under the revised LAF scheme. Accordingly, a single liquidity injection facility available at a single rate was introduced by merging the normal facility and backstop facility. 3.14 In order to restore flexibility in liquidity management, the RBI reintroduced the 1-day fixed rate reverse repo in August 2004 while continuing with 7-day and 14-day reverse repos and overnight fixed rate repos. Eventually, in order to have greater flexibility in liquidity management, the 7-day fixed rate and the 14-day variable rate reverse repos were phased out and the LAF was operated through overnight fixed rate repo and reverse repo effective from November 1, 2004. With effect from October 29, 2004, the nomenclature of repo and reverse repo was interchanged as per international usage. 3.15 The third stage of full-fledged LAF began with the full computerisation of the Public Debt Office (PDO) and the introduction of the Real Time Gross Settlement (RTGS) system enabling repo operations mainly through electronic transfers and the operation of LAF at different times of the same day. Around this time in 2005-06, the economy witnessed strong and sustained credit demand, lower accretion of forex reserves, build-up of the centre’s cash balances with the RBI and the redemption of India Millennium Deposits (IMDs). All these led to the injection of liquidity by the RBI. During this time, in order to fine-tune the management of day-to-day liquidity and in response to suggestions from market participants, the Second LAF (SLAF) was introduced on a daily basis in November 2005. SLAF is now used periodically, depending on liquidity conditions, rather than as a regular facility. 3.16 The Group noted that the operating framework has undergone several changes over the years with the widening and deepening of the money market and changes in the institutional mechanism and technology. Under the current operating framework in effect from November 2004, all liquidity injections are made at the fixed repo rate and liquidity absorption at the fixed reverse repo rate, with the two rates intended to act as the upper and lower bound of the corridor, respectively. IV. Operating Procedures of Monetary Policy in India: The liquidity adjustment facility (LAF) has emerged as the key element of the present operating procedure of monetary policy. It has generally helped in steering the desired trajectory of interest rates in response to evolving market conditions. The Group noted that while the system, on the whole, has worked well, some issues – both policy and operational – have arisen from changes in the market microstructure and liquidity conditions, which have had a bearing on the smooth functioning of the framework. In light of the current experience and keeping in view international best practices, the Group recommends certain changes in the operating framework. Monetary Transmission 4.2 At the heart of the operating framework is the nature of monetary transmission. The pertinent question is whether the interest rate channel of monetary transmission is working. The empirical exercise carried out by the Group suggests that though the impact of the interest rate channel of monetary transmission varies across the segments of the financial market, it is the strongest in the money market. The Group, therefore, recommends that the LAF with some modifications should continue as the key instrument in the operating framework of the RBI. 4.3. Monetary transmission is substantially more effective in a deficit liquidity situation than in a surplus liquidity situation. An empirical exercise carried out by the Group suggests that under deficit liquidity conditions, money market rates respond immediately to a policy rate shock (Technical Appendix I). For example, a 100 basis points (bps) change in the repo rate causes around 80 bps change in the weighted average call rate over a month. However, the strength of the response is relatively small in a surplus liquidity situation: a 100 bps change in the reverse repo rate, which is the operational rate in a surplus liquidity situation, causes around 25 bps change in the weighted average call rate over a month. Given the substantially superior strength of monetary transmission in a deficit liquidity condition, the Group recommends that the RBI should operate the modified LAF in a deficit liquidity mode to the extent feasible. This is also consistent with international best practices as in most countries, market participants, on a net basis, depend on the central bank for reserves. 4.4. While recommending that the LAF should operate in a deficit mode, the Group examined what the magnitude of liquidity should be. The Group noted that the RBI has articulated a net liquidity level of (+)/(-) one per cent of net demand and time liabilities (NDTL) of banks as ideal for effective monetary transmission. The Group recognises that the RBI has an internal mechanism for liquidity assessment on a daily basis. Similarly, money market participants make their own assessment of liquidity. However, it is difficult to exactly predict liquidity on a daily basis. Hence, the Group recommends that the RBI should accommodate frictional liquidity changes in the LAF window within reasonable bands consistent with effective monetary transmission. A simulation exercise carried out by the Group showed that at a liquidity deficit of one per cent of NDTL, the weighted average of money market rates exceeded the repo rate, on average, by around 15 bps. Similarly, with a liquidity surplus of one per cent of NDTL, the weighted average of money market rates was lower by about 20 bps. But when the liquidity deficit increased beyond one per cent of NDTL, the impact on the weighted average of money market rates was non-linear. For example, for a deficit at 1.25 per cent of NDTL, the deviation in weighted average of money market rates was 40 bps which rose to 75 bps for deficits at 1.5 per cent of NDTL and became unbounded at higher deficit levels (Technical Appendix II). The Group was of the view that the objective of the LAF should be to stabilise short-term interest rates around the chosen policy rate for the smooth transmission of monetary policy. The Group, therefore, recommends that the liquidity level in the LAF should be contained around (+)/(-) one per cent of NDTL. If the liquidity surplus/deficit persists beyond (+)/(-) one per cent of NDTL, the RBI should use alternative instruments to supplement the LAF operations for effective monetary transmission. Policy Rate 4.5. The present LAF framework is such that the operating policy rate alternates between the repo rate and the reverse repo rate, depending on the prevailing liquidity condition. In a surplus liquidity condition, the reverse repo rate becomes the operating policy rate. In a deficit liquidity situation, the repo rate becomes the policy rate. The Group was of the view that going by international best practices, it is unconventional to have two policy rates. These two rates were supposed to provide the corridor for overnight interest rates to settle in between. However, in practice, the call rates more often are either above or below the corridor, depending on the liquidity situation, thus defeating the very purpose of the corridor. Moreover, the shift in the policy rate from one rate to another does create confusion in the minds of market participants. In addition, it poses a major communication challenge to clearly articulate the stance of monetary policy, particularly in a situation when liquidity alternates between the surplus mode and the deficit mode in quick succession. As indicated above, central banks generally follow a corridor approach and they have a single policy rate as the system mostly operates in a deficit mode. As the Group suggests that the RBI operate the LAF in a deficit mode, it recommends the repo rate as the single policy rate. Further, the Group recommends that the repo rate should operate within a corridor so that the overnight interest rate moves around the repo rate in a narrow informal bound. This will entail redesigning the corridor. Bank Rate 4.6. Ideally the corridor should have a discount rate at the upper bound and an uncollateralised deposit facility at the lower bound. The RBI in its tool kit has the Bank Rate which is essentially a discount rate. Under Section 49 of the RBI of India Act, the Bank Rate has been defined as “the standard rate at which it [the Reserve Bank] is prepared to buy or re-discount bills of exchange or other commercial paper eligible for purchase under this Act”. While the Bank Rate was an important instrument of monetary control, its importance declined once the LAF system was instituted and progressively refinance facilities were provided at the repo rate. It is now used for calculating penalty on default in the cash reserve ratio (CRR) and the statutory liquidity ratio (SLR) as required by Section 42(3) of the Reserve Bank of India Act, 1934 and Section 24 of the Banking Regulation Act, 1949, respectively. Against this backdrop, it was not felt necessary to revise the Bank Rate. The Bank Rate has not been changed since April 2003 when it was last revised to 6 per cent, even as the policy rates have moved in either direction quite significantly. Thus, for all practical purposes, the Bank Rate as an instrument of monetary management has become dormant. The Group recommends that the Bank Rate be activated as a discount rate with a spread over the repo rate. Once the policy rate changes, the Bank Rate should change automatically with a fixed spread over the repo rate. Constituents of the Corridor 4.7 The prescription of the Bank Rate by itself will not make it active unless there are liquidity facilities linked to the Bank Rate. The Group recommends the institution of a collateralised Exceptional Standing Facility (ESF) at the Bank Rate up to one per cent of the NDTL of banks carved out of their required SLR portfolio. This facility is not entirely new. In the recent episode of liquidity tightness, the RBI has been providing additional liquidity up to 1 to 2 per cent of NDTL but on an ad hoc basis at the repo rate. The Group’s recommendation is to have the facility on a standing basis. The advantages of this facility are four-fold. First, it will provide an upper bound to the policy rate corridor. Second, it will provide a safety valve against unanticipated liquidity shocks. Third, it will help stabilise the overnight interest rate around the repo rate in a liquidity deficit situation. Fourth, it will enhance the liquidity attribute of the SLR portfolio without compromising its prudential nature. 4.8 Under sub-section (8) of Section 24 of the Banking Regulation Act, 1949, the RBI is allowed to waive payment of the penal interest on account of default in the maintenance of the SLR by a banking company2. The RBI has used this sub-section on several occasions in the recent period to enable banks to avail of funds from the RBI under the LAF due to the tight liquidity situation. Banks availing of this facility have to seek a waiver of the penal interest for any shortfall in maintenance of SLR arising out of availment of additional liquidity support under the LAF. The idea of a standing lending facility is to enable banks to obtain funding from the central bank when all other options have been exhausted. Furthermore, the idea of liquidity facility up to one per cent of NDTL by waiving the penalty for the SLR default is to ensure that interest rates in the overnight inter-bank market do not spike for want of eligible collateral with some banks. The Group, therefore, recommends that the RBI should grant general exemption from payment of penal interest rate for the proposed ESF. Under Section 53 of the BR Act, the Central Government, on the recommendation of the RBI, can exempt the banking company or a class of banking companies from any or all of the provisions of the BR Act by issuing a notification. The Group, therefore, recommends that the RBI may write to the Central Government requesting it to grant general exemption from penal interest rate for the proposed ESF. 4.9 While the upper bound to the corridor could be provided by the ESF proposed by the Group, it is not feasible to establish a standing uncollateralised deposit facility which will be treated as uncollateralised borrowing by the RBI and this is not permitted under Section 17(4) of the Reserve Bank of India Act, 1934. Notwithstanding the Group’s recommendation that LAF should operate in a deficit liquidity mode, it is recognised that liquidity could turn into surplus from time to time. Hence, there is need for a floor to contain volatility in the overnight interest rate in the event of significant unanticipated movements in liquidity. The Group, therefore, recommends that the reverse repo facility at which the RBI absorbs liquidity from the system should constitute the lower bound of the corridor. However, the reverse repo rate should not act as a policy rate as at present. It should be determined as a negative spread over the repo rate. Moreover, as the Group envisages the reverse repo facility more in the nature of a standing deposit facility, the reverse repo rate should be such that it does not incentivise market participants to place their funds with the RBI. This needs to be kept in view while designing width of the corridor. Width of the Corridor 4.10 The Group notes that the RBI has already articulated that the width of the corridor should be based on the following two considerations. First, it should not be so wide as to induce volatility in short-term money market rates. Second, it should not be so narrow that it retards the development of the short-term money market by taking away the incentive from market participants to deal among themselves before approaching the central bank. 4.11 The operation of the LAF during April 2001 to February 2011 indicates that the repo and reverse repo rates were changed either separately or together 39 times, leading to changes in the corridor width 26 times. The RBI’s policy documents did not explicitly set out the reasons for changes in the width of the corridor except in the July 2010 policy, which indicated that “the corridor width was narrowed to 100 bps to contain interest rate volatility”. The Working Group concurs with this position as its own empirical work associates a wider corridor with greater overnight interest rate volatility. Having said that, the issue is what the ideal width of the corridor should be. 4.12 An empirical exercise carried out by the Working Group showed a positive significant correlation of corridor width with weighted average overnight call rate. Controlling for liquidity, a wider corridor was associated with greater volatility in the overnight interest rate. In India, the corridor width has varied between 100 and 300 bps. An international survey suggests a corridor width of 50 to 200 bps. Calibration of the corridor width with overnight call money rate with a probability distribution function reveals that the ideal corridor width should be in the range of 150–170 bps with a 90 per cent confidence interval and 180-190 bps with a 95 per cent confidence interval. Additional calibration by controlling liquidity at (+)/(-) one per cent of NDTL, the Group’s recommended liquidity level, the corridor width works out to 150 bps at 90 per cent confidence interval and 180 bps at 95 per cent confidence interval (Technical Appendix III). The Group also examined the effect of corridor width on weighted average call money rate volatility using a GARCH model which indicated that a corridor width in the range of 150–175 bps could be optimal (Technical Appendix IV). Considering these estimates and keeping in view the optimality at containing liquidity within (+)/(-) one per cent of NDTL, the Group recommends 150 bps for the corridor width. 4.13 International experience suggests that the width of the corridor generally remains fixed, but the recent global financial crisis saw countries changing the width of the corridor. It has also been argued recently that the constant width of the corridor is a waste of a good instrument (Goodhart, 2009)3. Just as the spread between commercial banks deposit and lending rates is a measure of the cost of bank intermediation, the spread between the parameters of the corridor is measure of the cost of central bank intermediation. This spread should narrow in the move from pre-crisis peace-time to war-time crisis conditions. 4.14 The Group recommends that in the normal circumstance, the width of the corridor should not be changed. Frequent changing of the width may create uncertainty and may also make it difficult to keep the target rate aligned to the policy rate. More importantly, it may be difficult to communicate such a change. However, in extraordinary situations, when there is a need to incentivise or disincentivise market participants from accessing the standing lending facility or parking funds with the RBI, the width of the corridor could be changed. Placement of Policy Rate in the Corridor 4.15 International evidence suggests that for most countries, except New Zealand, the policy rate is placed symmetrically at the centre of the corridor. In fact, for most of these countries, the corridor bounds are indicative as the overnight interest rate fluctuates in a narrow informal corridor around the policy rate as these systems operate in a deficit mode. 4.16 While the Group envisages the LAF to operate in a deficit mode for effective monetary transmission, the likelihood of the system moving to a surplus mode is significant, given the robust growth prospects of the Indian economy in the medium term. The Group recognised that if capital inflows are far above the absorptive capacity of the economy and impart significant volatility to the exchange rate, the RBI could intervene in keeping with the stated objective of monetary policy. In such a situation, liquidity could turn into a surplus mode. In order not to provide an incentive to banks to place their surplus funds in the LAF window of the RBI, the Group recommends an asymmetric corridor with the spread between the policy repo rate and reverse repo rate twice as much as the spread between the policy repo rate and the Bank Rate. That is, with a corridor width of 150 bps, the Bank Rate should be at ‘repo rate plus 50 bps’ and the reverse repo rate should be at ‘repo rate minus 100 bps’. This will ensure that market participants have an incentive to deal among themselves before approaching the RBI. 4.17 The Group recommends that the repo rate should be the active policy rate to be changed by the RBI to unambiguously signal the stance of monetary policy to achieve the macroeconomic objectives of growth with price stability. The repo rate will be based on fixed price daily auctions. However, the RBI should reserve the right as at present to accept partially or fully the tenders in the daily auctions. The Bank Rate and the reverse repo rate will change automatically with a fixed spread as and when the repo rate changes. The RBI at its discretion could conduct simultaneous auctions for longer period if the liquidity situation so warrants. However, such actions should be at variable prices as they will be for purely liquidity management rather than for signaling the policy rate. Operating Target 4.18 The overnight call money rate has been the operating target of monetary policy as the monetary transmission is the fastest to this segment. However, in the past few years, the turnover in the uncollateralised (inter-bank money market) segment has declined sharply, while that in the overnight collateralised market segment, viz., the CBLO and market repo, has increased (Chart IV.1). In this context, the Group examined whether the call money rate is still the appropriate target.

4.19 It is sometimes argued that a decline in the share of the call/notice money market in the total turnover of the money market could be due to limits fixed by the RBI on the unsecured borrowing and lending in the overnight market. However, an analysis of the data suggests that borrowing by banks in October 2010 constituted 1 per cent of the limit fixed by the RBI. Likewise, lending by banks constituted 6 per cent of the total limit sanctioned by the RBI. The Group, therefore, is of the view that prudential limits as prescribed by the RBI have not constrained the growth of the call money market; rather it has increased the stability of the money market with an increasing share of the collateralised segment. 4.20 The substantial growth of the collateralised market vis-à-vis the uncollateralised market reflects the result of the deliberate policy attempt to mitigate risk in the wholesale financial market by increased use of collateral. The increasing use of collateral has also been motivated by the need to reduce funding costs as borrowing under the collateralised is cheaper than that under the uncollateralised market. This phenomenon, however, is not unique to India. The volume of collateralised transactions has also increased markedly in major markets such as in the US, the UK, the Euro area and Japan. 4.21 Given the reduced share of the call money market in the overnight money market, the Group examined the relative merits of the overnight call money rate vis-à-vis the overnight money market rate, computed as the weighted average of call money, CBLO and market repo rates as the operating target. The empirical evidence suggests that the transmission of policy rate to the overnight call money rate is stronger than the overnight money market rate. Further, the stability properties of these two rates are not significantly different. Moreover, the correlation between the overnight call money rate and the collaterallised money market rate was high at 0.9. In addition, the call money market is a pure inter-bank market and, hence, better reflects the net liquidity situation. The Group, therefore, recommends that the weighted average overnight call money rate should continue to be the operating target of monetary policy of the RBI. Revised LAF Framework 4.22 The recommended revised LAF framework is illustrated below (Chart IV.2). Chart IV.2: Revised LAF Framework

Timing and Frequency of LAF 4.23 The Group noted that the RBI is currently conducting LAF twice a day. This has provided flexibility to market participants and has helped contain volatility in the overnight market. The Group, therefore, recommends that the Reserve Bank should conduct second LAF (SLAF) on a regular basis. Instruments for Liquidity Management 4.24 In order to keep the liquidity in the LAF window at the optimal level of (+)/(-) one per cent of NDTL for effective monetary transmission, the RBI needs to have instruments at its disposal to manage excessive liquidity deficit/surplus conditions. The role of the LAF window is to deal with frictional liquidity deficit/surplus. Liquidity of a more durable nature needs to be managed with other instruments. The Group recommends that the RBI should continue to use the MSS and the CRR to deal with the surplus liquidity situation arising out of large capital inflows. 4.25 The MSS can be used in specific cases of high capital flows. The CRR cannot be used frequently as a liquidity instrument as it has a strong monetary signaling impact. Hence, the OMO of outright sale/purchase will continue to be the key instrument of monetary management. Recent experience suggests that the response to the RBI OMO purchase was less than expected even under high liquidity shortage conditions. In fact, market participants preferred to access the RBI’s LAF window rather than meet their liquidity needs through the OMO. One of the considerations in banks’ inadequate response to OMO purchases by the RBI was the possibility of valuation losses as the bulk of the securities are held under HTM category. The Group, therefore, recommends that the RBI should incentivise banks to progressively mark-to-market their SLR portfolio to improve the effectiveness of OMO as an instrument of liquidity management. The Group recognises that in due course, the accounting standard shall get aligned with the international financial reporting standards (IFRS). 4.26 While the RBI has been enabled by the Government to manage excess liquidity surplus arising out of capital inflows, a corresponding instrument is not available with the RBI if liquidity arises out of a sharp increase in the government cash balance. In recent months, high liquidity deficit has persisted in the LAF window despite the RBI’s preference for liquidity within (+)/(-) one per cent of NDTL as government cash balances have remained high. 4.27 Given the impact that government cash balances have on liquidity management, there is a need for closer co-ordination between the RBI and the fiscal authority. In this context, the Group understands that the issue of auctioning of government cash balances is under consideration of the Government and the RBI. The Group, therefore, recommends that a scheme of auctioning of Government surplus cash balances at the discretion of the RBI be put in place in consultation with the Government to address a major source of volatility in frictional liquidity in the system. Collateral 4.28 The RBI holds Special Bonds (oil bonds), apart from government securities, in its portfolio. Oil bonds are treated as non-SLR securities. With effect from July 27, 2010, government securities obtained under reverse repo are not reckoned for the purpose of SLR of banks. The Group, therefore, recommends that the collateral pool for reverse repo operation under the LAF could be extended to oil bonds issued by the Government to oil marketing companies and held by the RBI or any other security as notified by the RBI from time to time. Liquidity Forecast 4.29 To ensure that the operating target does not deviate from the policy rate, liquidity forecast plays a crucial role. The Group learnt that liquidity forecast in the RBI is made on a weekly basis up to four weeks ahead. A quick back-testing analysis of these liquidity forecasts for the period January 2009 to December 2010 shows that the liquidity projections during the past two years have been satisfactory. The one-week-ahead forecasts show a relatively lower margin of error compared with the forecasts for the subsequent weeks. However, the discrepancy in liquidity forecast has increased, reflecting large swings in government cash balances. The Group also learnt that the RBI had put in the public domain the generic form of a liquidity forecasting model in June 2002. The predictive power of the model has not been satisfactory for the system in a deficit mode. Dissemination of Liquidity Forecast 4.30 The Group noted that several central banks disseminate liquidity forecasts, such as the ECB (weekly), Bank of England (daily), Bank of Japan (daily and monthly), Bank of Canada (daily) and Reserve Bank of Australia (daily). The dissemination of forecasts is intended primarily to facilitate the liquidity management of banks and, in countries such as Japan, to help convey policy intentions revealed by comparing the forecast with the amount of liquidity actually provided or withdrawn. However, following the global financial crisis, some advanced countries have stopped disseminating information on liquidity forecasts, such as the US Federal Reserve, Bank of England (suspended since August 2009), Riksbank, and Swiss National Bank and among EMEs, Brazil and the Bank of Korea. Any decision on dissemination of liquidity forecast has to take into account the pros and cons associated with it. While the dissemination of forecasts helps market participants to make better assessments on the factors affecting liquidity and on the possible direction and quantum of central bank intervention, any inaccurate assessments may increase uncertainty in financial markets. 4.31 Considering the pros and cons of disseminating information on liquidity forecasts, the Group recommends that: (i) the weekly forecasting methodology should be improved; and (ii) the liquidity forecasting model should be re-examined. Pending further improvement in liquidity forecast, the weekly internal liquidity forecasts of the RBI may not be published. However, the Group is of the view that there is a need to place additional information in the public domain to improve the liquidity assessment by market participants. At present, the RBI publishes the information on banks’ cash balances with the RBI with a lag of three days. As government cash balances have been a major source of uncertainty in liquidity, the dissemination of this information will help improve the liquidity assessment by market participants. The Group, therefore, recommends that information on government cash balances should also be placed in the public domain with a minimum time lag as part of the daily morning press release under “Money Market Operations” and published in the Weekly Statistical Supplement of the RBI Bulletin as is being done in the case of banks’ cash balances with the RBI. Maintenance of the CRR 4.32 An area of uncertainty in liquidity forecast is the pattern of CRR maintenance by banks. At present, banks, on average, are required to maintain 100 per cent of the required CRR during the fortnight with a daily minimum maintenance of 70 per cent. However, banks frontload their CRR balances with the RBI in the first week of the reporting Friday, the front loading being higher in deficit liquidity situations (Chart IV.3). This accentuates the liquidity stress. But at the system level, banks tend to maintain over 80 per cent of their required balance throughout the maintenance period. Chart IV.3: Average Daily CRR Maintenance during Surplus and Deficit Periods

4.33 As actual reserve requirements maintained by banks are much higher than the current minimum requirement of 70 per cent, the Group recommends that the minimum level of reserves to be maintained on any day by banks with the RBI during a fortnight be raised from 70 per cent to 80 per cent of the required CRR. This will improve liquidity forecasting. Seamless Movements of Funds and Securities 4.34 Interest rate in the uncollateralised segment is expected to be higher than that in the collateralised segment due to the credit risk involved in the former. However, interest rates in the overnight inter-bank call money market deviate from the operating policy rate significantly even if the interest rate in the collateralised segments, i.e., the CBLO and market repo, remains close to the operating policy rate. There are two reasons for this: (i) difficulty in providing sufficient collateral by some banks and (ii) settlement of securities and funds under different segments occurring at different times, necessitating the use of intra-day liquidity or the need for additional securities (Table IV.1). Table IV.1: Settlement Cycle of Money Market Transactions

4.35 A significant part of T+0 market borrowings takes place before 12 noon by market participants based on estimated flows/CRR balances. However, as RTGS is open for customers till 4.30 PM on normal days and until 7.30 PM for transactions between banks, the closing CRR balances undergo changes requiring banks to borrow or lend in different short-term money market segments (overnight inter-bank, CBLO and market repo) on a T+0 basis to avoid CRR default/inefficient CRR management. The Group, therefore, recommends that the T+0 transactions for short-term money market segments (CBLO and market repo) should be extended up to the cut-off time for customers in RTGS (i.e., 4.30 PM) so that the banking system could square off their CRR position efficiently. V. Recommendations of the Working Group The major observations and recommendations of the Working Group are set out below. Effectiveness of Monetary Transmission 5.2 The empirical exercise carried out by the Group found that the interest rate channel of monetary transmission has the strongest impact on the money market in the existing liquidity adjustment facility (LAF) framework. It, therefore, recommends that the LAF with some modifications should continue as the key element in the operating framework of the RBI (Para 4.2). 5.3 Empirical evidence also suggests the superior strength of monetary transmission in a deficit liquidity condition. Thus, the Group recommends that the RBI should operate the modified LAF in a deficit liquidity mode to the extent feasible (Para 4.3). 5.4 Recognising the difficulty in precise prediction of liquidity on a daily basis, the Group recommends that the RBI should accommodate frictional liquidity changes in the LAF window within reasonable bands, consistent with effective monetary transmission. Further, the exercise conducted by the Group found the impact of liquidity deficit on call rate is non-linear when the deficit increased beyond one per cent of NDTL. Hence, the Group recommends that the liquidity level in the LAF should be contained around (+)/(-) one per cent of NDTL. If the liquidity surplus/deficit persists beyond (+)/(-) one per cent of NDTL, the RBI should use alternative instruments to supplement the LAF operations (Para 4.4). Need for a Single Policy Rate 5.5 The Group was of the view that, going by international best practices, it is unconventional to have two policy rates. As the Group suggests that the RBI operate the LAF in a deficit mode, it recommends the repo rate as the single policy rate. Further, the repo rate should operate within a corridor so that the overnight interest rate moves around the repo rate in a narrow informal bound (Para 4.5). Reactivation of Bank Rate 5.6 The Group recommends that the Bank Rate be activated as a central bank discount rate with a spread over the repo rate. Thus, once the policy rate changes, the Bank Rate should change automatically with a fixed spread over the repo rate (Para 4.6). Institution of Exceptional Standing Facility 5.7 To facilitate the activation of the Bank Rate, the Group recommends the institution of a collateralised Exceptional Standing Facility (ESF) at the Bank Rate up to one per cent of NDTL of banks carved out of their required SLR portfolio (Para 4.7). 5.8 To ensure that interest rates in the overnight inter-bank market do not spike for want of eligible collateral with some banks, the Group recommends that the RBI should grant general exemption from penal interest rate for the proposed ESF. The Group recommends that the RBI may write to the Central Government requesting it to grant general exemption for penal interest rate for the proposed ESF under Section 53 of the Banking Regulation Act, 1949 (Para 4.8). 5.9 The Group recommends that a reverse repo facility, which is in the nature of a standing facility and a negative spread over the repo rate at which the RBI will absorb liquidity from the system should constitute the lower bound of the corridor (Para 4.9). Width of the Corridor 5.10 The Group, based on exercises conducted on the optimum width of the corridor, recommends 150 basis points for the corridor width which, under normal circumstances, should not be changed (Paras 4.12 and 4.14). Placement of Policy Rate in the Corridor 5.11 In order not to incentivise banks to place their surplus funds in the LAF window of the RBI, the Group recommends an asymmetric corridor with the spread between the policy repo rate and reverse repo rate twice as much as the spread between the repo rate and the Bank Rate (Para 4.16). 5.12 The Group recommends that the repo rate should be the active policy rate to be changed by the RBI to unambiguously signal the stance of monetary policy to achieve the macroeconomic objectives of growth with price stability. The RBI at its discretion could conduct simultaneous auctions for longer period if the liquidity situation so warrants. However, such actions should be at variable prices as they will be for purely liquidity management rather than for signaling the policy rate (Para 4.17). Operating Target 5.13 As the empirical evidence examined by the Group suggests that the transmission of policy rate to the overnight call money rate is stronger than overnight money market rates, it recommends that the weighted average overnight call money rate should continue to be the operating target of the RBI (Para 4.21). Timing and Frequency of LAF 5.14 The Group recommends that the Reserve Bank should conduct second LAF (SLAF) on a regular basis (Para 4.23). Instruments of Liquidity Management 5.15 Persistent liquidity in excess of (+)/(-) one per cent of the NDTL should be managed through other instruments such as outright OMO, CRR and MSS (Para 4.24). 5.16 To improve the effectiveness of OMO as an instrument of liquidity management, the Group recommends that the RBI should incentivise banks to progressively mark-to-market their SLR portfolio. The Group recognises that in due course, the accounting standard shall get aligned with the international financial reporting standards (IFRS) (Para 4.25). 5.17 Given the international experience and the India-specific situation of government cash balances having a significant impact on liquidity management, the Group recommends that a scheme of auctioning of government surplus cash balances at the discretion of the RBI be put in place in consultation with the Government (Para 4.27). Collateral 5.18 Given that government securities under reverse repo are not reckoned for the SLR of banks, the Group recommends that the collateral pool for reverse repo operation under the LAF could be extended to oil bonds issued by the Government to oil marketing companies and held by the RBI (Para 4.28). Liquidity Forecast 5.18 Considering the pros and cons of disseminating information on liquidity forecasts, the Group recommends that: (i) the weekly forecasting methodology be improved; and (ii) the liquidity forecasting model be re-examined. To help improve the liquidity assessment by market participants, the Group recommends that information on government cash balances should also be put in the public domain with the minimum time lag as part of the daily morning press release under “Money Market Operations” and published in the Weekly Statistical Supplement of the RBI Bulletin (Para 4.31). Maintenance of the CRR 5.19 As actual reserve requirements maintained by banks are much higher than the minimum requirement of 70 per cent, the Group recommends that the minimum level of reserves to be maintained on any day by banks with the RBI during a fortnight be raised from the present 70 per cent to 80 per cent of the required CRR (Para 4.33). Seamless Movements of Funds and Securities 5.20 Interest rates in the overnight inter-bank call money market deviate significantly from the operating policy rate even if the interest rate in the collateralised segments remains close to the operating policy rate due to: (i) difficulty in providing sufficient collateral by some banks; and (ii) the settlement of securities and funds under different segments occurring at different times. The Group, therefore, recommends that the T+0 transactions for short-term money market segments (CBLO and market repo) should be extended up to the cut-off time for customers in RTGS (i.e., 4.30 PM) so that the banking system could square off their CRR position efficiently (Paras 4.34 and 4.35).

Technical Appendix I Objective: To analyse the dynamic effects of monetary policy shocks on financial markets. Variables: (i) Policy rates: Repo, Reverse Repo (rt); (ii) corridor width (wt), (iii) overnight money market rate: Call money, weighted average of call money, CBLO and market repo rates (omt); (iv) CD/CP rates (mt) and (v) bond market: 91-day t-bill rate (gt). Data period and Frequency: Effects are studied separately in liquidity deficit (Net LAF is negative between December 2006 and November 2008) and liquidity surplus (Net LAF is positive between April 2001 and December 2006, and December 2008 and May 2010) conditions using weekly data. Methodology: Structural vector autoregressive (SVAR) approach and impulse response function. The identification conditions are:

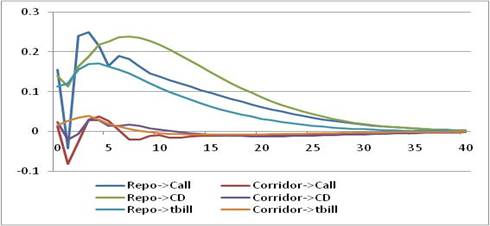

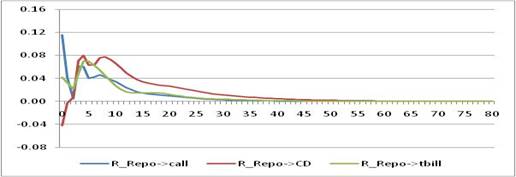

Results: 1. In deficit situation (period is December 2006 –November 2008) with call money rate as the overnight rate. Chart TA1-1: Impulse Response Function

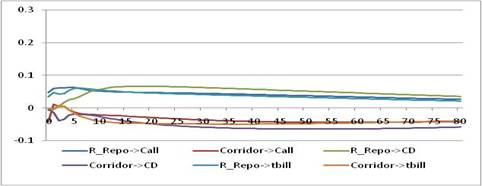

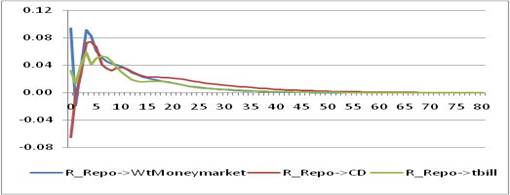

2. In deficit situation (period is December 2006 to November 2008) with weighted money market rate as the overnight rate. Chart TA1 2: Impulse Response Function

3. In surplus situation (period is April 2001 to November 2006) with call money rate as the overnight rate. Chart TA1-3: Impulse Response Function

4. In surplus situation (period is April 2001 to November 2006) with weighted money market rate as the overnight rate. Chart TA1-4: Impulse Response Function

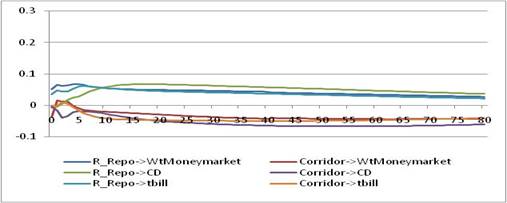

5. In surplus situation (period is December 2008 to May 2010) with call money rate as the overnight rate. Here SVAR is worked out without corridor width since it remained unchanged during this period. Chart TA1-5: Impulse Response Function

6. In surplus situation (period is December 2008 to May 2010) with weighted average money market rate as the overnight rate. Here SVAR is worked out without corridor width since it remained unchanged during this period. Chart TA1-6: Impulse Response Function

Comment: The empirical exercise suggests that though the impact of the interest rate channel of monetary transmission varies across the segments of the financial market, it is the strongest in the money market. The monetary transmission is substantially more effective in a deficit liquidity situation than in a surplus liquidity situation. A 100 basis points change in the repo rate causes a change of around 80 basis points in the weighted average call rate over a month. On the other hand, a change of 100 basis points in the reverse repo rate, which is the operating policy rate in a surplus liquidity situation, causes a change of around 25 basis points in the weighted average call rate over a month. Technical Appendix II Objective: To identify the threshold level of liquidity deficit and surplus.

Where ON_MR is the weighted average of money market rates Data period and Frequency: Effects are studied separately during two periods – January 2006 to March 2007 and September 2007 to October 2010 – and separately for liquidity deficit and surplus conditions in each of these periods using weekly data. Methodology: Fitting a fractional polynomial regression equation. Results 1. During the period from January 2006 to March 2007 Chart TA2-1: Polynomial Fit

Deficit condition Y = 0.266 – 1.92*(LN(X+1.39) + 0. 233)+ 0.939* ((X+1.39)^2– 0.628) Surplus condition Y = 0.015 – 0.178*(X-0.283) + 0.203*(X*LN(X) – 0.320) 2. During the period from September 2007 to October 2010 Chart TA2-2: Polynomial Fit

Deficit condition Y=-0.007 – 2.66 *((X+2.35) – 1.63) + 0.69* ((X+2.35)^2– 2.66) Surplus condition Y=0.287 + 0.041 * (X^– 0.5-0.833) + 0.253*(X– 1.44) Comment: At liquidity deficit of one per cent of NDTL, the weighted average money market rate exceeded the repo rate on an average of around 15 basis points. Similarly, with a liquidity surplus of one per cent of NDTL, the weighted average money market rate was lower by about 20 basis points. But when the liquidity deficit increased beyond one per cent of NDTL, the impact on weighted average money market rate was non-linear. For deficit at 1.25 per cent of NDTL, the deviation in weighted average money market rate was 40 basis points which rose to 75 basis points for deficits at 1.5 per cent of NDTL and became unbounded at higher deficit levels.Technical Appendix III Objective : To identify the corridor width based on the past movements of money market rates. Variables: Weighted average call money rates, Weighted O/N money market rates. Rates are adjusted by subtracting it from the mid-point of policy rates (Repo and Reverse Repo). Data period and Frequency: Daily data from January 2009 to October 2010, which is further verified using longer time series (October 2007 to October 2010). We consider all those days where the liquidity level inside +/- 1 per cent of NDTL. Methodology: Estimating the empirical distribution and corresponding 90 and 95 per cent confidence intervals of past money market rates. Results

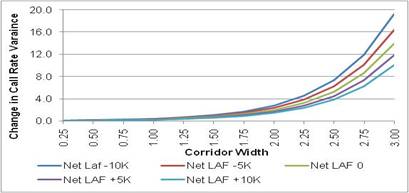

From the inverse cumulative distribution function, we derive the estimated range of call rate movements as: (a) 180 basis points with 95 per cent confidence interval (b) 153 basis points with 90 per cent confidence interval and overnight money market rate movements as: (a) 197 basis points with 95 per cent confidence interval (b) 170 basis points with 90 per cent confidence interval. Comment: Controlling for liquidity, a wider corridor is associated with greater volatility in the overnight interest rate. Calibration of the corridor width with overnight call money rate with a probability distribution function reveals that the ideal corridor width could be in the range of 150-170 basis points with a 90 per cent confidence interval and 180-190 basis points with a 95 per cent confidence interval.Technical Annex IV Objective: To identify the effect of corridor width on money market rate volatility. Variables: Weighted average call money rates and Corridor width (Repo rate – Reverse repo rate) Data period and Frequency: Weekly from January 2005 to October 2010. Methodology: A standard GARCH on Call Rate is defined as follows: callt = a0 + ut where call is the call money rate, corri is the corridor width and LAF is net LAF. Results

The effect of corridor width is positive and significant in defining the variance in weighted average call money rate. For different net LAF situations, the effect of corridor width on the variance of weighted average call money rate is given in the chart below. Chart TA4-1: Corridor width and Call rate variance

Comment: Volatility in weighted average call money rate increases sharply beyond a corridor width of around 175 bps for various liquidity scenarios, indicating that the optimum corridor width could be in the range of 150 – 175 basis points.

1The general refinance facility was introduced on April 26, 1997. The limit was fixed at 1 per cent of banks’ fortnightly average outstanding aggregate deposits in 1996-97. 2Clause (8) of Section 24 of the BR Act, 1949 reads as under: 3Goodhart, Charles (2009), “Liquidity Management”. Paper prepared for the Federal Reserve Bank of Kansas City Symposium at Jackson Hole, August, http://kcfed.org/publicat/sympos/2009/papers/Goodhart.09.11.09.pdf. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

पेज अंतिम अपडेट तारीख: