IST,

IST,

Report on Monitoring of Financial Conglomerates

The financial sector in India has undergone significant liberalisation in all the four segments - banking, non-banking finance, securities and insurance and each of these sectors has grown significantly accompanied by a process of restructuring among the market intermediaries. The financial landscape is increasingly witnessing (i) entry of some of the bigger banks into other financial segments like merchant banking, insurance, etc. which has made them financial 'conglomerates'; (ii) emergence of several new players with diversified presence across major segments and (iii) possibility of some of the non-banking institutions in the financial sector acquiring large enough proportions to have a systemic impact.

From a regulatory perspective, above developments have led to an appreciation of the limitations of the segmental approach to supervision in addressing the following potential risks associated with conglomeration :

1. The moral hazard associated with the ‘Too-Big-To-Fail’ position of many

financial conglomerates;

2. Contagion or reputation effects on account of the 'holding out' phenomenon;

3. Concerns about regulatory arbitrage, non-arm’s length dealings, etc. arising out of Intra-group Transactions and Exposures (ITEs) both financial and non-financial.

As a proactive stance to address these issues so that the gains on financial stability are further strengthened, the Governor had announced in the Mid-term Review of Monetary and Credit Policy for the year 2003-04 about the decision taken in consultation with the Chairman, Securities and Exchange Board of India (SEBI) and Chairman, Insurance Regulatory and Development Authority (IRDA) for establishment of a special monitoring system for Systemically Important Financial Intermediaries (SIFI).

Accordingly, an inter-regulatory Working Group had been constituted with members drawn from RBI (Smt. Shyamala Gopinath, Convenor), SEBI (Shri M.S.Sahoo) and IRDA (Shri Prabodh Chander).

The working Group was mandated to propose a list of SIFIs based on set criteria and advise on a monitoring/reporting system encompassing the following:

(i) a reporting system for SIFIs on financial matters of common interest to RBI, SEBI and IRDA;

(ii) the reporting of intra-group transactions of a Financial Conglomerate; and

(iii) the exchange of relevant information among RBI, SEBI and IRDA.

During the course of deliberations the group recognised that there are systemically important institutions, which do not have sectoral linkages and are supervised by a financial regulator. Given the terms of reference the Group, therefore, decided to focus on "Financial Conglomerate" having cross-sectoral presence. Financial Conglomerate is also a term internationally used, commonly understood and well defined.

Present Status in India

The first step towards consolidated supervision of banking entities in India was the issuance of guidelines by RBI on consolidated supervision to the banks in February 2003 based on the report of the committee set up under Shri Vipin Malik, Director on the Central Board, Reserve Bank of India. Consolidated supervision is exercised through Consolidated Financial Statements (CFS), Consolidated Prudential Reports (CPR); and application of certain prudential regulations like capital adequacy, large exposures / risk concentration etc. on group basis.

International Scenario

The supervisory responses in different countries to provide an inclusive regulatory/supervisory paradigm with a holistic supervisory focus in respect of institutions having direct or indirect cross-linkages across financial segments have been varied and still evolving. The Group observed that internationally there is no uniform approach on supervising the financial conglomerates The structures adopted/being adopted range from a unified regulatory agency (UK) to a coordinating agency (Netherlands) and in some cases a focused supervision of conglomerates within the sectoral regulatory framework through enhanced inter-regulatory coordination (USA). Conglomerate Supervision, though definitionally not distinct from Consolidated Supervision, has a more focused approach, being an adjunct or corollary to the broader supervisory canvas of the latter.

The Proposed Framework

The new framework is being proposed as a complementary strand to the already existing regulatory structure - supervision of individual entities by respective regulators viz. RBI, SEBI, IRDA and the system of Consolidated Prudential Reporting recently introduced in regard to banks. The basic building blocks of the new framework will be:

- identification of Financial Conglomerates that would be subjected to focused regulatory oversight;

- capturing intra-group transactions and exposures (which are not being captured as of now) amongst ‘group entities’ within the identified financial conglomerate and large exposures of the groups to outside counterparties;

- identifying a designated entity within each group that would collate data in respect of all other group entities and furnish the same to its regulator (principal regulator for the group);

- formalising a mechanism for inter-regulatory exchange of information.

The proposed framework covers the segments under the jurisdiction of RBI, SEBI, IRDA, and NHB and in due course the segment covered by Pension Fund Regulatory and Development Authority would also be included.

Criteria for identifying a Financial Conglomerate:

A group would be designated as a 'Financial Conglomerate' if :

(i) any group entity coming under the jurisdiction of specified regulators and having a significant presence in the respective financial market segment; and

(ii) the group is having operations in at least one more financial market segment.

Group : An arrangement involving two or more entities related to each other through any of the following relationships : Subsidiary – parent (defined in terms of AS 21), Joint venture (defined in terms of AS 23), Associate ( defined in terms of AS 27),Promoter-promotee, a related party (defined in terms in AS 18) Common brand name, and investment in equity shares 20% and above.

Group entity : any entity involved in the above arrangement.

Specified Regulator : RBI, SEBI, IRDA and NHB for the present.

Significant presence in the respective financial market segment :

| Financial market segment | Significant presence |

| Bank | Included in the top 70% of the segment in terms of asset base |

| Insurance Company | Turnover more than Rs.100 crore; |

| Mutual Fund | Included in the top 70% of the segment in terms of asset under management (AUM); |

| NBFC (deposit taking) | Included in the top 70% of the segment in terms of deposit base; |

| NBFC (non-deposit taking) | Asset base more than Rs.2000 crore; |

| Primary Dealer | Included in the top 70% of the segment in terms of total turnover |

The framework would also cover entities having an overseas parent or holding company (e.g. Foreign banks) and satisfying the specified criteria. Further, broking arms of all identified groups and Housing Finance Companies belonging to the identified groups will be included within the framework for reporting purposes.

The Group has decided that the following specific entities will be kept out of the framework for the present : RRBs, Depositories, SPVs (including trusts), ARCs and associates of SBI. The cluster of financial conglomerates thus identified, as well as the criteria for identifying them, would be subject to periodic review.

The Group has also recommended that the exemption of a particular entity within an identified group from reporting for any reason may be considered on a case-to-case basis. The 'exclusion list' may also be subject to periodic review.

Reporting Framework : The new reporting framework has been developed for tracking the following :

1. Any unusual trend in respect of intra-group transactions manifest in major markets

- Aggregate volumes in respect of all intra-group transactions during the reporting period manifest in major markets,

- Fund based (equity, loans, deposits/placements and others);

- Non-fund based (Guarantees, derivatives, etc.)

- Details of individual intra-group transactions above threshold levels – Rs.1.00 crore for fund based and Rs.10.00 crore for non-fund based;

2. Build up of any disproportionate exposure (both fund based as well as non-fund based) of any entity to other group entities;

- Outstanding positions in respect of each entity vis-à-vis every other group entity as on the reporting date.

3. Any group-level concentration of exposure to various financial market segments and outside counterparties;

- Outstanding positions in respect of each entity in major markets.

4. Direct/indirect cross-linkages amongst group entities

- Crossholdings;

- Intra-group advisory and service arrangements;

- Commonality of directors and senior executives;

Prudential limits/firewalls for ITEs : The Group has not recommended, to begin with, any threshold levels in regard to intra-group transactions. Thresholds for case to case approval could be considered a year later after gaining experience and having sufficient database.

However, the Group, has recommended capturing of individual intra-group transactions beyond threshold levels as part of the proposed reporting format. The threshold for fund based transactions have been recommended as Rs. 1.00 crore while for non-fund based transactions as Rs. 10.00 crore. The Group has also stressed on the need for specifying exposure ceilings in respect of intra-group exposures.

Inter-regulatory exchange of information :

The framework envisages periodic sharing of information amongst regulators on (i) concerns arising out of analysis of data received as part of the proposed format; and (ii) any other information outside the reporting format that might have a bearing on the group as a whole.

Ensuring internal controls and risk management systems : Since the 'conglomerate' focus is still to concretise in the overall regulatory/supervisory process, the Group has recommended that the respective regulators could mandate internal controls and ceilings for intra-group transactions and exposures at individual level through Board approved policies in regard. Subsequently, the same could be extended to the conglomerate level.

Operational framework :

At present, there is no legislative framework in place for inter-regulatory coordination. The Group recommends that one of the existing Technical Committees consisting of all the three regulators may function as a standing inter-regulatory forum to address all issues arising out the proposed framework.

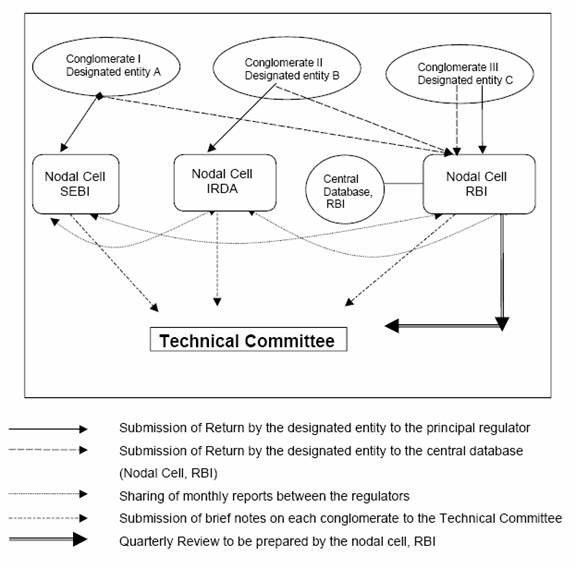

The framework envisages furnishing of the required data by the ‘designated entity’ in respect of each identified financial conglomerate to its own regulator (the principal regulator) at monthly/quarterly intervals. It also requires each regulator to establish a nodal cell at its end for facilitating data flow as also for analysing the Returns being received from the conglomerates. Central database would be maintained at the nodal cell RBI to address issues arising out of data dis-aggregation. The modalities of electronic data submission and the database issues needed to be addressed in this regard. The primary responsibility of analysing the Return and initiating any action thereon, if required, would lie with the Principal Regulator. Post-analysis, the principal regulator would share with the other regulators the analysis of the data submitted. The salient features of the analysis and any unusual trend would be discussed by the Technical Committee which could recommend further course of action. A quarterly review report would be prepared on the functioning of the entire mechanism and put up to the top management of all the three regulators which would be placed before the Standing Committee referred to above.

Chapter 1

1.1 The financial sector in India has undergone significant liberalisation in all the four segments - banking, non-banking finance, securities and insurance and each of these sectors has grown significantly accompanied by a process of restructuring among the market intermediaries. This has refined market micro structure, modernised operations, and broadened investment choices unleashing competition among the intermediaries, who are restructuring themselves for their survival and growth. The financial landscape is increasingly witnessing (i) entry of some of the bigger banks into other financial segments like merchant banking, insurance, etc. which has made them financial 'conglomerates'; (ii) emergence of several new players with diversified presence across major segments and (iii) possibility of some of the non-banking institutions in the financial sector acquiring large enough proportions to have a systemic impact.

1.2 The emergence of multi-segmental groups and associated cross-linkages has brought to the fore following supervisory concerns :

1. The moral hazard associated with the ‘Too-Big-To-Fail’ position of many financial conglomerates;

2. Contagion or reputation effects on account of the 'holding out' phenomenon;

3. Concerns about regulatory arbitrage, non-arm’s length dealings, etc. arising out of Intra-group Transactions and Exposures (ITEs) - both financial and non-financial.

1.3 As a proactive stance to address these concerns and also to further consolidate the gains on financial stability, the Governor, Reserve Bank of India (RBI) had announced in the Mid-term Review of Monetary and Credit Policy for the year 2003-04 about the decision taken in consultation with the Chairman, Securities and Exchange Board of India (SEBI) and Chairman, Insurance Regulatory and Development Authority (IRDA) for establishment of a special monitoring system for Systemically Important Financial Intermediaries (SIFIs).

Accordingly, an Inter-Regulatory Working Group was constituted with following members:

- Smt. Shyamala Gopinath - Convener

Executive Director

Reserve Bank of India(RBI)

Mumbai. - Shri Prabodh Chander

Executive Director

Insurance Regulatory and Development Authority (IRDA)

Hyderabad. - Shri M.S. Sahoo

Chief General Manager

Securities and Exchange Board of India (SEBI)

Mumbai.

The Working Group was mandated to identify SIFIs based on set criteria and advise on a monitoring/reporting system encompassing the following:

(i) a reporting system for SIFIs on financial matters of common interest to RBI, SEBI and IRDA;

(ii) the reporting of intra-group transactions of SIFIs; and

(iii) exchange of relevant information among RBI, SEBI and IRDA.

4. During the course of deliberations the group recognised that there are systemically important institutions, which do not have cross sectoral linkages and are supervised by a financial regulator. Given the terms of reference the Group, therefore, decided to focus on "Financial Conglomerate" which has linkages with other segments of the financial market. The Financial Conglomerate is also a term internationally used, commonly understood and well defined.

5. The Group has finalised its recommendations after extensive deliberations, also involving a few banks at the draft stage for their feedback. The Group also benefited substantially from the consultations with senior functionaries of the RBI. Chief General Managers of key regulatory/supervisory departments of RBI viz. Department of Banking Operations and Development, Department of Banking Supervision, Department of Non-banking Supervision and Department of Internal Debt Management were present in all the meetings as special invitees and their inputs were of immense help in designing the overall framework. Smt. Usha Thorat, Executive Director, RBI also participated in the deliberations of the Group and provided valuable insights at all stages.

1.5 The Report of the Working Group is organized in five chapters. After the introduction in Chapter I, Chapter II gives a conceptual background including the practices being adopted internationally by other regulators/supervisors in this regard and the present status in India regarding implementation of consolidated supervision. Chapter III elaborates on the issues addressed by the Working Group and the details of the contours of the framework being proposed while Chapter IV explains the operational aspects in regard to the proposed framework. The next chapter benchmarks the supervisory framework, as existing currently as well as the proposed mechanism, against the Principles of Intra-Group Transactions and Exposures suggested by the Joint Forum, Bank for International settlement (BIS).

1.6 The Group also wishes to place on record its appreciation of the excellent support and contributions made by Smt. Meena Hemchandra, Chief General Manager, Shri K. Gopalakrishnan, General Manager and Shri Vaibhav Chaturvedi, Manager of Department of Banking Supervision of RBI; Shri Prabhas Kumar Rath, Research Officer of SEBI and Shri Aroop Chatterji and Shri R.S.Jagpal, Deputy Directors of IRDA.

Chapter 2

2.1 The emergence and growth of conglomerates has been largely driven by the potential of such entitles to benefit from the economies of scale and scope and to capture synergies across complementary financial services/business lines. These economies result in improved operational efficiency and effectiveness due to lower costs, reduced prices, and improved innovation in products and services. However, from a supervisory perspective, the conglomerates give rise to a few concerns on account of the cross-segmental linkages inherent within them.

2.2 Potential Risks from conglomerate operations

Typically conglomerates undertake a range of financial activities, including commercial banking, investment banking and insurance, both within their home economy and abroad. They will also be major players in wholesale financial markets, for example, as market makers in foreign exchange and OTC derivatives. In this role they will both provide liquidity to other market participants as well as being major takers of funds. They may also be an important part of the local payment and settlements infrastructure. As such, in normal times they will be an important resource for other financial intermediaries and end-users as facilitators of financial transactions and as a channel or counterparty for mitigating risk. But in others, through their linkages with domestic financial institutions and their prominent role in markets, they also have the potential to be a source of domestic financial instability.

- Sheer size and complexity of the conglomerates : First, there is the moral hazard associated with the ‘Too-Big-To-Fail’ position of many financial conglomerates. In addition, it becomes more difficult to manage and understand the operation of a firm as the organization grows. While both these issues are not unique to financial conglomerates, these issues tend to come to sharp focus because financial conglomerates tend to be large.

- Holding-out phenomenon : A second aspect of financial conglomerates is that financial difficulties in one subsidiary in a segment could have contagion or reputation effects on another subsidiary in a different segment on account of the 'holding out' phenomenon, especially when using the same brand name. If these entities can expect support when needed, a moral hazard problem arises, as they could be tempted to take on more risk than they would otherwise have done. These possible contagion and cross-segment moral hazard risks form an argument for supervisory intervention at the level of a financial conglomerate.

- A third set of issues prompting supervisory focus relates to the concerns about regulatory arbitrage, non-arm’s length dealings, etc. arising out of ITEs - both financial and non-financial, that may further get accentuated by the non-transparency of such intra-group channels. In general, supervisory concerns arise when the ITEs:

- result in capital or income being inappropriately transferred from the regulated entity;

- are on terms or under circumstances which parties operating at arm’s length would not allow and may be disadvantageous to a regulated entity;

- can adversely affect the solvency, the liquidity and the profitability of individual entities within a group;

- are used as a means of supervisory arbitrage, thereby evading capital or other regulatory requirements altogether.

The intra-group transactions between group entities within a financial conglomerate may significantly impact on the financial performance and capital adequacy position of the individual entities involved. Internal lending may also increase the risk of contagion. Intra-group transactions may involve conflicts of interest between the parties concerned.

2.3 Regulatory and Supervisory Responses : International Scenario

2.3.1 From a regulatory perspective, the increasing tendency towards conglomeration has led to an appreciation of the limitations of the segmental approach to supervision since such supervisory approaches reflect only the traditional business activities and perspectives within each segment not incorporating the increasing cross-segmental risk transfers and cross-segmental investments. A network of complex and overlapping managerial and operational structures within a single conglomerate further accentuate the problem. On the other hand, improved diversification and risk-spreading arising out of this would also raise issues regarding risk management and risk based supervision that may not be easy to address in a sectoral regulatory paradigm. As brought out in the 'Core Principles of Banking Supervision' of Basle Committee on Banking Supervision (BCBS) as well, an essential element of banking supervision is the ability of the supervisors to supervise the banking group on a consolidated basis that goes beyond accounting consolidation. It implies a group-wide approach to supervision whereby all risks run by a banking group are taken into account, wherever they are booked; both accounting consolidation and consolidated supervision are key aspects of the supervision of banking groups.

2.3.2 The lead in trying to develop a framework for supervision of financial conglomerates was taken by the BCBS, which together with International Association of Insurance Supervisors (IAIS) and International Organization of Securities Commissioners (IOSCO), had formed the Joint Forum on Financial Conglomerates (Joint Forum) in 1996, a working group that has researched and prescribed supervisory standards for financial conglomerates.

Important Joint Forum Papers

Capital Adequacy Principles

Measurement techniques and principles have been outlined to facilitate the assessment of capital adequacy on a group-wide basis for financial conglomerates. The principles do not replace existing sectoral rules for the assessment of capital adequacy but should be used to complement existing approaches. Illustrations of situations that can be faced by supervisors in practical applications of the measurement techniques are provided.

Principles for Supervisory Information Sharing

This paper provides to supervisors involved in the oversight of regulated financial institutions residing in financial conglomerates guiding principles with respect to supervisory information sharing. Guiding principles are set-out with a reference to the Ten Key Principles on information Sharing issued by the G-7 Finance Ministers in 1998.

Intra-Group Transactions and Exposures Principles

This paper provides banking, securities and insurance supervisors principles for ensuring through the regulatory and supervisory process the prudent management and control of intra-group transactions and exposures by financial conglomerates.

Risk Concentrations Principles

This paper provides to banking, securities and insurance supervisors principles for ensuring through the regulatory and supervisory process the prudent management and control of risk concentrations in financial conglomerates.

2.3.3 In definitional terms, there is no clear cut distinction made between consolidated supervision and conglomerate supervision. Both the terms connote an inclusive regulatory/supervisory paradigm with a holistic supervisory focus in respect of institutions having direct or indirect cross-linkages across financial segments. However, the supervisory approaches differ. The supervisory structures adopted/being adopted by different countries to provide this holistic focus have acquired varied contours ranging from a unified regulatory agency to a coordinating agency and in some cases a focused supervision of conglomerates within the framework of sectoral regulatory agencies through enhanced inter-regulatory coordination.

2.3.4 The model of the single integrated supervisory authorities - with competence over banking, investment and insurance activities - spread from the Scandinavian area and got a fillip with the establishment of FSA by UK in 1998. At the end of 2002, at least 46 countries had adopted the model of unified or integrated supervision by either establishing a single supervisor for their entire financial sector or by centralizing in one agency the powers to supervise at least two of their main financial intermediaries (such as banking with insurance, banking with securities or securities with insurance).

Table 2.1: Countries with a Single Supervisor, Semi- integrated Supervisory Agencies and Multiple Supervisors

| Single Supervisor for the Financial System | Agency Supervising two Types of Financial Intermediaries | Multiple Supervisors (at least one for banks, one for securities firms and one for insurers) | ||

| Banks and securities firms | Banks and insurers | Securities firms and insurers | ||

| 1. Austria 2. Bahrain** 3. Bermuda** 4. Cayman Islands** 5. Denmark 6. Estonia 7. Germany 8. Gibraltar 9. Hungary 10. Iceland 11. Ireland 12. Japan 13. Latvia 14. Maldives** 15. Malta 16. Nicaragua 17. Norway 18. Singapore** 19. South Korea 20. Sweden 21. UAE 22. UK | 23. Dominican Republic 24. Finland 25. Luxembourg 26. Mexico 27. Switzerland 28. Uruguay | 29. Australia 30. Belgium 31. Canada 32. Colombia 33. Ecuador 34. El Salvador 35. Guatemala 36. Kazakhstan 37. Malaysia 38. Peru 39. Venezuela | 40. Bolivia 41. Chile 42. Egypt 43. Mauritius 44. Slovakia 45. South Africa 46. Ukraine | 47. Argentina 48. Bahamas 49. Barbados 50. Botswana 51. Brazil 52. Bulgaria 53. China 54. Cyprus 55. Egypt 56. France 57. Greece 58. Hong Kong 59. India 60. Indonesia 61. Israel 62. Italy 63. Jordan 64. Lithuania 65. Netherlands 66. New Zealand 67. Panama 68. Philippines 69. Poland 70. Portugal 71. Russia 72. Slovenia 73. Sri Lanka 74. Spain 75. Thailand 76. Turkey 77. USA |

** The single supervisor is also the monetary authority.

In several other countries, steps have been taken to strengthen cooperation between the existing supervisory bodies. In the Netherlands, a Council of Financial Supervisors was established in 1999 to supplement the existing forms of co-operation between the three supervisory authorities. In France also co-operation between the different authorities has been strengthened. Australia has adopted an "objective based" supervisory architecture with a distinction between prudential supervision, market integrity and systemic stability. Some regulatory regimes, however, have adopted or are in the process of adopting an exclusive supervisory framework for identified conglomerates, the most prominent among them being USA, European Union and Australia.

A brief overview of the approaches being adopted by a few major countries are given below:

- The U. S. approach to the supervision of diversified financial groups falls under the "umbrella supervision" through which the Federal Reserve has supervisory oversight authority and responsibility for bank holding companies, including financial holding companies (FHCs). In addition to this overall supervisory framework, the Federal Reserve closely monitors inter-affiliate transactions and the attendant risks.

- The Financial services authority (FSA) is currently in the process of updating its arrangements for the prudential supervision of financial conglomerates. It has recently issued proposals (Consultation Paper on 'Financial Groups Directive') to implement the EU Financial Conglomerates Directive in the UK. The new regime will apply extra prudential requirements at the mixed financial group level, covering the quality of group systems and controls and the adequacy of capital across the conglomerate.

- Australia Prudential Regulatory Authority (APRA), Australia which is already a combined supervisor for both credit institutions (banks and other deposit takers) and insurance companies has brought out a comprehensive policy framework for the Prudential Supervision of Conglomerate Groups consisting of only Authorised Deposit-Taking Institutions.

- In Canada, there is no specific supervisory framework for conglomerates; they are supervised on the same basis as other financial institutions by the Office of the Superintendent of the Financial Institutions (OSFI). As for monitoring related party transactions, all federally regulated financial institutions are subject to the self dealing regime based on the guidelines issued by OSFI which limits their ability to transact with related parties.

It may be observed from the above that the main focus of monitoring ITEs is an adjunct or corollary to the process of consolidated supervision. Details of the supervisory framework in place in regard to conglomerate supervision in the above countries is given in Annexure I.

2.3.5 Inspite of the variations in the approaches and structures, most of the supervisory regimes encompass the following elements, in varying degrees, in respect of monitoring of conglomerates :

- quantitative techniques,

- risk concentration,

- intra-group transactions and exposures,

- internal controls & risk management and

- inter-regulatory coordination.

2.4 Present status in India

The first step towards consolidated supervision of banking entities in India was the issuance of guidelines by RBI to the banks in February 2003 based on the report of the committee set up under Shri Vipin Malik, Director on the Central Board of RBI. Consolidated supervision as exercised at present is mandated for all groups where the controlling entity is a bank.

By implication, the following are excluded from the framework at present:

- groups where a non-bank entity (financial or non-financial) is the parent; and

- foreign banks/other financial entities operating in India where the parent would be an overseas entity;

The system at present has the following components:

a) Consolidated Financial Statements (CFS): These are intended for public disclosure. All banks coming under the purview of consolidated supervision of RBI, are required to prepare and disclose CFS in terms of Accounting Standard (AS) 21 and other related Accounting Standards prescribed by the Institute of Chartered Accountants of India (ICAI).

b) Consolidated Prudential Reports (CPR): This is necessary for supervisory assessment of risks which may be transmitted to banks (or other supervised entities) by other group members. CPR is confined to all groups where the controlling entity is a bank. If the bank is a parent company within a group, the bank should submit Consolidated Prudential Reports for the entities under its control excluding group companies which are engaged in (a) insurance business and (b) businesses not pertaining to financial services. Apart from the consolidated Balance Sheet and P&L Statement, the CPR requires reporting of select financials of the 'consolidated bank' and the exposure levels to large borrowers/borrower groups, capital market, forex market and Unsecured Guarantees and Unsecured Advances at a 'consolidated level'.

The existing format focuses on capturing some exposure parameters at the 'group' level, However, intra-group transactions and exposures are not being captured. Exposures to some important market segments such as debt, inter-bank, etc. as well as non-fund based exposures are also not being monitored currently. Consequently, it is not possible to evaluate the overall risks, and the possible transfer thereof, within the group structure.

c) Application of certain prudential regulations like capital adequacy, large exposures / risk concentration etc. on group basis. A Consolidated bank should maintain a minimum Capital to Risk-weighted Assets Ratio (CRAR) as applicable to the parent bank on an ongoing basis. In case of any shortfall in the capital adequacy ratio of any of the subsidiaries (prescribed by their respective regulators), the parent should maintain capital in addition to its own regulatory requirements to cover the shortfall. Risks inherent in deconsolidated entities (i.e., entities which are not consolidated in the Consolidated Prudential Reports) in the group need to be assessed and any shortfall in the regulatory capital in the deconsolidated entities should be deducted (in equal proportion from Tier 1 and Tier 2 capital) from the consolidated bank’s capital in the proportion of its equity stake in the entity.

It may be mentioned here that in respect of banks, the guidelines on capital adequacy mandate that any equity investment in subsidiaries must be deducted from the Tier I Capital of the bank for calculation of CRAR.

d) Risk concentration: Consolidated banks should also adhere to the following prudential limits on-

i) Single & Group borrower exposures: Exposure by the consolidated bank to a single borrower/ debtor should not exceed 15% of its capital funds. Exposure by the consolidated bank to a borrower/ debtor group should not exceed 40% of its capital funds (extendable upto 50% if the additional exposure is for infrastructure projects).

ii) Capital market exposures: The consolidated bank’s aggregate exposure to capital markets should not exceed 2 per cent of its total on-balance-sheet assets (excluding intangible assets and accumulated losses) as on March 31 of the previous year. Within the total limit, investment in shares, convertible bonds and debentures and units of equity-oriented mutual funds should not exceed 10 percent of consolidated bank’s net worth.

iii) Exposures by way of unsecured guarantees and unsecured advances: As applicable to banks.

Chapter 3

3.1 The Working Group proposes a new framework for monitoring the identified financial conglomerates as a complementary strand to the already existing regulatory structure - supervision of individual entities by respective regulators viz. RBI, SEBI, IRDA and the system of Consolidated Prudential Reporting recently introduced in regard to banks. The proposed framework for monitoring of financial conglomerates differs from the existing CPR framework for consolidated supervision in the basic thrust of approach. While the CPR framework focuses on the stock approach - 'after the event' - and is focussed on the consolidated financial position of the group, the approach in the former is more granular and is an exercise enabling the supervisor to modulate and fine tune the supervisory approach comprehensively on the basis of emerging situations.. The specific aspects in respect of which the proposed framework attempts to strengthen and expand on the existing CPR mechanism are briefly enumerated below :

| Existing CPR Framework | Proposed Framework for Financial Conglomerates |

| »Restricted to only those groups where the parent/controlling entity is a bank. | Aimed at focused monitoring of ‘identified’ conglomerates across the major financial market segments irrespective of the nature of activity of the parent entity. |

| »Excludes insurance sector. | Includes all major financial market segments including insurance. |

| »A few exposures captured only at consolidated level; ITEs are not captured. | A new reporting format primarily for capturing ITEs, besides all possible exposure indicators at both individual as well as group levels manifest in major markets. |

| »Does not envisage any inter-regulatory information sharing. | The issue has been duly addressed in the proposed framework which envisages periodic inter-regulatory exchange of information in respect of identified conglomerates. |

| Does not cover non-financial linkages having a bearing on governance. | Covers non-financial linkages such as commonality of directors common services and branding. |

3.2 The basic building blocks of the new framework are:

- identifying Financial Conglomerates that would be subjected to focused regulatory oversight;

- capturing intra-group transactions and exposures (which are not being captured now) amongst entities within the identified financial conglomerate and large exposures of the groups to other financial conglomerate as well as outside counterparties;

- identifying a designated entity within each financial conglomerate that would collate data in respect of all other group entities and furnish the same to its regulator (principal regulator for the group); and

- formalising a mechanism for inter-regulatory exchange of information.

3.3 Scope of the proposed framework

3.3.1 The financial market segments to be covered under the framework

The regulatory jurisdiction of the three regulators viz. RBI, SEBI and IRDA covers a considerable portion of the financial system. The constitution of a statutory pension funds regulator is in the process and, once formally constituted, it could be co-opted within the existing framework.

The first task before the Group was to decide the contours of the proposed framework viz. the financial intermediaries to be covered within the framework. The major financial intermediaries that the above three jurisdictions encompass and that have been considered for inclusion are:

Banks

Development Financial Institutions RBI

Primary Dealers

Non-banking Finance Companies

Insurance Companies - both life as well as non-life IRDA

Mutual Funds SEBI

Brokers (specified) SEBI

Housing Finance Companies (specified) NHB

There are various other capital market intermediaries such as depositories, merchant bankers, trustees, etc. which are regulated by SEBI. But the Group decided against the inclusion of the above entities as these are (i) already regulated by SEBI; (ii) would be least likely to cause cross-sectoral exposures as these are largely service-providers though the activities of these institutions may give rise to serious concerns in regard to operational risks; and (iii) no public funds are involved.

As regards stock brokers, the Group was of the view that these need not be kept as part of the framework since a very large number of brokers would come within the criteria set out for identification of a financial conglomerate. Further, they have stringent capital adequacy requirements, have to adhere to limits on gross positions and are also subjected to margin maintenance. The Group, therefore, decided to keep them outside the purview of the proposed framework as a separate segment. However, broking arms of all identified groups have been included. Similarly Housing Finance Companies belonging to the identified groups have been included.

3.3.2 Identification of a Financial Conglomerate

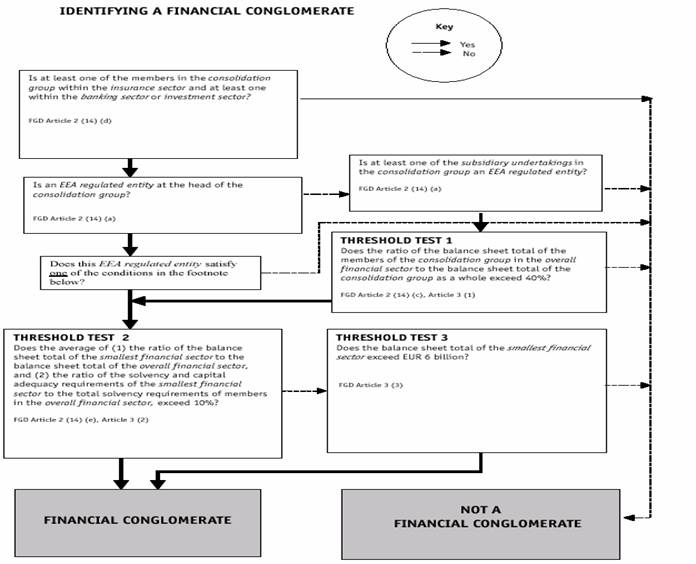

A Financial Conglomerate is broadly defined internationally as a conglomerate whose regulated entities engage to a significant extent in at least two of the principal financial segment. In regard to quantification of this definition, however, country practices vary with each one adopting its own methodology. In the USA, for example, Large Complex Banking Organisations, which are subjected to risk-focused supervision program, are identified based on a multiple set of parameters including the size of the organization, the extent of international operations, participation in large-value payment and settlement systems, and the extent of custody operations, fiduciary activities, and trading activities. FSA, on the other hand, has quantified the criteria stipulating that a group will be a financial conglomerate if "at least 40% of its business is financial and at least 10% or Euro 6 billion of its financial business is in each of the insurance and the combined banking/investment sectors".

In the Indian context, however, having a set of quantifiable 'blanket' criteria to identify a conglomerate cannot be adopted as of now as most of the financial groups required to be covered by the new framework still have a significant presence in only a single segment (mostly banking) that dominates their consolidated operations. Also, certain segments, specially insurance, are heavily dominated by public sector companies that dwarf the new entrants in terms of size. Any 'blanket' quantitative threshold limit/s, therefore, would in all probability tend to exclude certain groups. However, the future could see the emergence of conglomerates in true sense. Till that time it is considered appropriate to identify a financial conglomerate based on segment-specific parameters.

The other issue in identifying a financial conglomerate relates to defining related parties or affiliates. Accounting Standard 18 prescribed by ICAI defines a related party as a party having the ability to control the other party or exercise significant influence over the other party in making financial and/or operating decisions.

However, for the purpose of capturing risks inherent in an entity by virtue of its being part of a larger group, the concept of ‘related party’ may have to be considered at a broader level. In particular, the issue of ‘common branding’ could involve reputational risks amongst group entities that may otherwise be having an 'arms-length' relationship.

The Group, therefore, proposes the following criteria for identifying a Financial Conglomerate, subject to the explanations/exceptions that follow:

A group would be designated as a ''Financial Conglomerate" if :

(i) any group entity coming under the jurisdiction of specified regulators and having a significant presence in the respective financial market segment; and

(ii) the group is having operations in at least one more financial market segment.

Group:

An arrangement involving two or more entities related to each other through any of the following relationships:

Subsidiary – parent (defined in terms of AS 21), Joint venture (defined in terms of AS 23), Associate (defined in terms of AS 27), Promoter-promotee

A related party (defined in terms in AS 18)

Common brand name

Investment in equity shares - 20% and above

Group entity: any entity involved in the above arrangement

Specified Regulator: RBI, SEBI and IRDA for the present. The Pension Fund Regulatory Authority may be included subsequently.

Significant presence in the respective financial market segment:

| Financial market segment | Significant presence |

| Bank | Included in the top 70% of the segment in terms of asset base |

| Insurance Company | Turnover more than Rs.100 crore |

| Mutual Fund | Included in the top 70% of the segment in terms of asset under management |

| NBFC (deposit taking) | Included in the top 70% of the segment in terms of deposit base |

| NBFC (non-deposit taking) | Asset base more than Rs.2000 crore |

| Primary Dealer | Included in the top 70% of the segment in terms of total turnover |

It may be clarified that the above framework also covers entities having an overseas parent or holding company (e.g. Foreign banks) and satisfying the specified criteria.

Further, it has been decided by the Group that the following specific entities would be kept out of the framework for the present:

- Regional Rural banks - Inter-linkages with other entities are not

considered to be significant. - Depositories - Systemically important from operational risk perspective but no significant cross-linkage and are regulated by SEBI

- Asset Reconstruction Companies - Still in the development stage; could be included in future.

- SPVs for securitisation deals – Though there are supervisory concerns in regard to the operations of SPVs, these were not included in the framework since these are in the form of trusts.

- Associates of SBI

One of the key issues deliberated upon by the Group was the treatment to be given to cross-border relationships - the feasibility and necessity of including these within the new framework. Such entities could broadly be categorized in two:

(i) A constituent (subsidiary/JV/associate) of a domestic group (identified as financial conglomerate) having overseas operations : it was decided all such entities would be incorporated in the reporting framework if they fulfil the relevant materiality criteria.

(ii) An entity which is part of an overseas group, but operating in domestic markets: In respect of all such entities, it was decided that for reporting purposes, all transactions of financial nature between the domestic entity/ies as well as transactions with overseas parent/holding company/ reporting office booked in the domestic entities’ books will have to be included.

There are other standalone financial institutions/intermediaries which may have systemic implications in view of large exposures of other intermediaries such as banks (eg. HUDCO) but are not within the purview of this Group and will need to be addressed separately. It is also important to note that the population of financial conglomerates is fluid and can change as a result of developments affecting a banking organisation or changes in the industry as a whole. The cluster of Financial Conglomerate thus identified, as well as the criteria for identifying them, may be subject to periodic review.

The Group recommends that the exemption of a particular entity for reporting for any reason may be considered on a case-to-case basis. The 'exclusion list' may also be subject to periodic review.

3.4 Monitoring Intra-group Transactions and Exposures:

3.4.1 The proposed reporting format:

The new reporting framework has been developed for tracking the following:

- large intra-group transactions manifest in major markets viz. equity, loans, debt, repo, inter-bank, call money, derivatives, etc. carried out for any purpose (trading or investment);

- build up of any disproportionate exposure (both fund based as well as non-fund based) of any entity to other group entities;

- any group-level concentration of exposure to various financial market segments and counterparties outside the group; and

- information available with any supervisor regarding an entity coming under its jurisdiction that may have a wider bearing.

3.4.1.1 Determining the data which is essential for monitoring the ITEs.

As one of the key objectives of the new framework is 'capturing ITEs manifest in all markets', the Group attempted to identify a set of parameters that could reflect the ITEs arising out of:

(i) direct/indirect crossholdings;

(ii) all transactions, having financial implication or otherwise in major markets,

- Fund based (equity, loans, deposits/placements and others);

- Non-fund based (Guarantees, derivatives, etc.)

(iii) any intra-group advisory and service arrangements.

(iv) Commonality of directors and senior executives.

In respect of (ii) above, the Group suggests a matrix format to capture all transactions and exposures pair-wise. Further, both the aggregate volume of transactions during the reporting period as well as the outstanding positions as at the end of reporting period will have to be furnished.

In addition to capturing transactions between two group entities during the reporting period at an aggregate level, all individual transactions above specified thresholds will have to be reported individually. Since there is no uniform definition of 'regulatory capital' across all sectors, it would not be possible to keep the threshold as a percentage of regulatory capital for all entities, as is being done in some countries such as Canada. The Group, therefore, decided on keeping absolute thresholds to begin with - Rs. 1.00 crore for fund-based transactions and Rs. 10.00 crore for non-fund based transactions. The same could be revisited subsequently based on experience.

As regards the exposures of each individual entity to various markets, the same are being tracked by the respective regulators; but it was considered desirable to capture the aggregate exposure at the group level. The Group, therefore, proposes to incorporate this aspect in the new reporting mechanism. The total volume of transactions undertaken by each material entity during the reporting period and the outstanding position in respect of each entity would have to be reported individually. For aggregating the exposure at group level, however, all intra-group transactions would have to be netted off. This would give only a broad indication about the size of exposure concentration at the group level in each market not highlighting the actual risks inherent in those exposures. Risk measurement and management models at a 'group level' have not been considered for the present given the need for existing framework to stabilise.

The Group further recommends furnishing of data in respect of top 20 exposures to counterparties outside the group in respect of each group entity with the objective of tracking concentration of the groups’ exposure to outside counterparties. The responsibility of identifying and furnishing details to the principal regulator in such cases would lie with the designated entity (explained in para 3.4.1.3).

3.4.1.2 Periodicity of the report

The Group recommends differential periodicities for the different parameters - transaction related parameters may be reported at monthly intervals (to begin with) while the other stock parameters (important financial indicators, commonality of back office and other service arrangements, etc.) may be reported on a quarterly basis.

3.4.1.3 Deciding about the "designated entity" within each identified group

To avoid multiplicity of interfaces between the regulator/s and the regulated entities, it is proposed that a designated entity within the respective groups/conglomerates may be assigned the responsibility of furnishing data (as per the formats finalized) in respect of all the financial subsidiaries/associates constituting the conglomerate to its regulator (which may be termed as the Principal Regulator for the group).

It was decided that in respect of all conglomerates having a bank, the bank may be the designated entity. For non-bank conglomerates, the designated entity may be the one having a significant presence in the respective financial market segment (as defined above).

3.4.1.4 Electronic data interchange

As per the proposed framework, the 'designated entity' would submit the periodic reports to the 'principal regulator'. It is further suggested that a complete database in respect of all the information received from all the conglomerates be maintained at the nodal cell, RBI to address issues arising out of data dis-aggregation. Each designated entity for the conglomerates may, therefore, also submit the above Return to the nodal cell at RBI as well. The modalities of electronic data submission and the database issues need to be addressed. The group flags this as an isssue for further development.

However, it is clarified that the primary responsibility of analyzing the furnished data would lie with the 'principal regulator'. The analysis by the principal regulator would basically involve the tracking of the parameters set out in para 3.4.1. Subsequent to this, however, any material information may have to be shared by the 'principal regulator' with other regulators.

The detailed operational flow is covered separately in the next chapter.

3.4.2 Prudential limits/firewalls for ITEs:

Internationally, almost all supervisory regimes have prescribed some form or the other of firewalls in varying degrees:

- Funding firewalls place restrictions on intra-group financial transactions seeking to avoid contagion on the assets side of the balance sheet

- Separate identity firewalls prohibiting the joint marketing of financial products, banning the use of similar business names etc to prevent contagion between the affiliates of a group; and

- Separate management firewalls to maintain the principle of corporate separateness and avoid conflicts of interest.

This issue had also been raised by the Committee on Consolidated Supervision which had recommended that the regulator should set limits on connected lending transactions, particularly, on those that are not conducted on an arms-length basis. The Group, however, recommends, threshold levels in regard to intra-group transactions for the purpose of reporting only. Thresholds for case to case approval could be considered a year later after gaining experience and having sufficient database.

In respect of ceilings on intra-group exposures, currently there are no uniform practices across various segments. The investment regulations prescribed by IRDA for insurance companies cap the investments made by an insurance company in its own group companies at 5% of its controlled funds/assets. The exposure norms mandated by RBI in respect of banks, however, do not specifically recommend the treatment to be given to intra-group borrowings. The Group, therefore, recommends prescribing intra-group exposure ceilings within the existing exposure limits.

3.5 Inter-regulatory exchange of information

Apart from the above report on intra-group transactions and exposures that may be submitted by the market entities, a mechanism for exchange of other information in respect of the identified groups between the three regulators need to be put in place. The regulator/s within whose jurisdiction any of the group entities operates may share information about those entities with the principal regulator. The contents of the periodic/event-driven exchanges are given in Annexure III:

3.7 Ensuring internal controls and risk management systems

The issue of ensuring adequate risk management processes by the conglomerates had also been broached upon by the earlier committee on Consolidated Supervision which had recommended that the financial conglomerates must have limits and controls in place to manage their intra-group transactions and exposures.

However, since the 'conglomerate' focus is still to concretise in the overall regulatory/supervisory process, the respective regulators could ensure effective oversight by both the board and senior management of each regulated entity at individual level. They could mandate all regulated entities to have formal policies in regard to intra-group transactions. The same could be extended to the conglomerate level at a later stage depending on the level of preparedness of the entities.

Chapter 4

4.1 At present, there is no legislative framework in place for inter-regulatory coordination. The Group recommends that one of the existing Technical Committees consisting of all the three regulators may function as a standing inter-regulatory forum to address all issues arising out the proposed framework.

4.2 The recommendations for operationalising the proposed framework are as under:

- The initial cluster of conglomerates and the reporting entities within the conglomerates that may be subjected to the proposed framework has been identified by the Working Group. However, the constitution of the framework, and the criteria themselves, may be subject to yearly review by the above Technical Committee.

- The 'designated entity' in respect of each identified conglomerate has been identified by the Working Group. The responsibility of collating the data from all other group entities and submitting the same to their regulator (the principal regulator) in the prescribed format may lie with the 'designated entity'.

- It may be the responsibility of the Principal Regulator to notify the name of the "Designated Entity" and also that of reporting entities in respect of each of the identified conglomerate.

- Each regulator may establish a nodal cell at its end to undertake all the responsibilities in regard to all Financial Conglomerate coming under its purview including facilitating data flow and analysing the formats being received from the designated entity.

- The new Return devised for this purpose (Annexure II) may be submitted at monthly/quarterly intervals by the designated entity to the principal regulator as well as to the nodal cell, RBI that would be maintaining the database.

- The salient features of the analysis and any unusual trend, which needs regulatory coordination, may be discussed by the Technical Committee which could recommend further course of action. A quarterly review report may be prepared on the functioning of the entire mechanism and placed before the Technical Committee. It is suggested that this responsibility may be taken up by RBI.

Role of each regulator under the proposed framework:

Each regulator may have overall responsibility for the Financial Conglomerate coming under its purview. The specific tasks would include:

1. Receiving monthly/quarterly returns from the designated entity for the

Financial Conglomerate coming under their purview;

2. Analysing the information received;

3. Sharing with other regulators any issues arising out of the above

analysis that require supervisory coordination;

4. Putting up summary analysis notes before the Technical Committee in

respect of all Financial Conglomerate coming under their purview;

5. Exchanging with other regulators any additional information in respect

of the Financial Conglomerate under its purview arising outside the reporting framework.

In addition to the above, RBI may also maintain the central database. It may also be responsible for preparing quarterly review reports on the functioning of the entire mechanism.

Chapter 5

The Proposed Framework vis-a-vis the Joint Forum Principles on ITEs

5.1 In this chapter, an attempt has been made to map the proposed supervisory framework vis-à-vis the Joint Forum principles on ITEs:

I. Supervisors should take steps, directly or through regulated entities, to provide that conglomerates have adequate risk management processes in place, including those pertaining to ITEs, for the conglomerate as a whole. Where necessary the supervisors should consider appropriate measures, such as reinforcing these processes with supervisory limits.

There are no specific risk management guidelines for conglomerates as yet. However, the framework of Risk Based Supervision put in place by RBI in respect of banks does take into account 'group risk' as one of the key risk areas for the risk profiling of a bank.

The Group proposes that the issues of Board-approved policies for ITEs and prudential ceilings for intra-group exposures be addressed by each of the regulators.

II. Supervisors should monitor material ITEs of the regulated financial entities on a timely basis, as needed, through regular reporting or by other means to help form a clear understanding of the ITEs of the financial conglomerate.

The reporting mechanism currently in place does not capture intra-group transactions and exposures. The CPR framework focuses on capturing exposures only at a consolidated level, ignoring the intra-group transactions and exposure levels. This was, therefore, a key mandate for the present Working Group prompting a format to be devised for the purpose. The proposed reporting format has been designed with a primary focus on capturing all intra-group transactions and exposures manifest in major financial markets.

III. Supervisors should encourage public disclosure of ITEs.

AS 18 requires disclosure of related party transactions in the financial statements of each reporting entity. However, it does not apply to consolidated financial statements as the consolidated financial statements present information about the holding and its subsidiaries as a single reporting enterprise.

Further, it is mandatory for only the following entities:

(i) Enterprises whose equity or debt securities are listed /in the process of being listed on a recognised stock exchange in India;

(ii) All other commercial, industrial and business reporting enterprises, whose turnover for the accounting period exceeds Rs. 50 crore.

The proposed framework does not envisage any additional public disclosures; the information sought from the conglomerates would be purely for supervisory purposes. The issue of any additional disclosure requirements need to be addressed by a proper forum involving representatives from ICAI apart from the respective regulators.

IV. Supervisors should liaise closely with one another to ascertain each other’s concerns and coordinate as deemed appropriate any supervisory action relative to ITEs within the group.

As of now, there is no formalized mechanism in place for inter-regulatory exchange of information in respect of conglomerates in general or ITEs in particular. Even at the broader level, the present arrangements for coordination are mostly aimed at resolving policy issues and in monitoring exposures and flow of funds to capital market.

The proposed framework, being specifically focused on the identified conglomerates, envisages a formalised exchange of information in respect of the entities concerned involving a range of parameters.

V. Supervisors should deal effectively and appropriately with material ITEs that are considered to have a detrimental effect on the regulated entities, either directly or through an overall detrimental effect on the group.

As of now, the supervisors do not have the legal authority to prohibit detrimental intra-group transactions and exposures. The earlier committee on Consolidated Supervision had commented in this regard that 'such authority needs to be specifically sought and obtained, as a part of the evolution of the consolidated supervisory policy'.

The proposed framework, though not specifically and comprehensively dealing with the issue, provides a mechanism for capturing all ITEs that could serve as a useful database for identifying 'detrimental ITEs' and any future policy guidelines in this regard. The regulatory tools in this regard could include prohibiting movements of capital or income outright, requiring collateralisation, limiting transfers, requiring prior approval by supervisors, and restricting specific types of transfers.

Sd/- Shyamala Gopinath (Convenor) | |

Sd/- Prabodh Chander (Member) | Sd/- M.S.Sahoo (Member) |

Date : May 19, 2004

Country Practices in respect of Conglomerate Supervision

(Based on the replies received from other regulators and the material available on the websites)

1. United States

The Gramm – Leach–Bliley Act of 1999 eliminated the separation of financial activities, allowing U.S. banking organizations with well-capitalized and well-managed bank subsidiaries to engage in both securities and insurance underwriting activities through separate subsidiaries. Banking organizations are now allowed to own securities and insurance companies and vice versa.

The U.S. approach to the supervision of diversified financial groups falls under the "umbrella supervision" through which the Federal Reserve has supervisory oversight authority and responsibility for bank holding companies, including bank holding companies that operate as financial holding companies (FHCs). Importantly, the Federal Reserve’s role as umbrella supervisor concentrates on a consolidated or group-wide analysis of the organization and is not meant to extend traditional bank-like supervision throughout an FHC.

The Federal Reserve’s role as umbrella supervisor is streamlined in various aspects by its interactive relationship with the other banking regulatory agencies and functional regulators, including insurance, securities, and commodities regulators. The Federal Reserve’s interaction with the other banking regulators – the Office of the Comptroller of the Currency (the OCC), the Federal Deposit Insurance Corporation (FDIC), and the Office of Thrift Supervision (OTS) – continues in the manner that has been long-established. The Federal Reserve’s relationships with functional regulators depend upon the extent to which a FHC is engaged in functionally regulated activities and is influenced by already established working arrangements. The Federal Reserve relies to the fullest extent possible on reports that are filed with the other banking or functional regulators or self-regulatory organizations, publicly available information, or externally audited financial statements.

In addition to this overall supervisory framework, the Federal Reserve closely monitors inter-affiliate transactions and the attendant risks. The scope of this function is spelled out in Regulation W (12 CFR 223), and is further complemented by the Form Y-8 reporting requirements, as well as the on-site examination and inspection processes.

In 1999, the Fed Reserve had initiated a Risk-Focused Supervision program for Large Complex Banking Organisations. These organizations typically have significant on and off-balance-sheet risk exposures, offer a broad range of products and services at the domestic and international levels, are subject to multiple supervisors in the United States and abroad, and participate extensively in large-value payment and settlement systems.The fundamental goals of the Federal Reserve’s supervisory process for LCBOs are to maintain an accurate and current assessment of each banking organization’s financial and managerial strength and to respond in a timely fashion to any emerging problem.

A number of measures are employed as guidelines for determining whether a particular banking organization should be included in the LCBO supervision program. These measures take into account the size of the organization, the extent of international operations, participation in large-value payment and settlement systems, and the extent of custody operations, fiduciary activities, and

trading activities. Since the establishment of the LCBO program, the number of institutions that are considered LCBOs has been in the range of twenty-five to thirty companies. In addition, there are a number of banking organizations that do not meet enough of the criteria to be considered LCBOs but have sufficient size or complexity in some of their activities to be covered by the program to a certain extent. It may be important to mention here that the Fed does not publish the list of names of LCBOs.

Transactions with affiliates: The Fed Reserve has proposed a rule (Regulation W), effective from April 1, 2003, to implement comprehensively sections 23A and 23B of the Federal Reserve Act concerning statutory restrictions on transactions between a member bank and its affiliates.

Section 23A prohibits a bank from initiating a "covered transaction" with an affiliate if, after the transaction,

(i) the aggregate amount of the bank’s covered transactions with that particular affiliate would exceed 10 percent of the bank’s capital stock and surplus, or

(ii) the aggregate amount of the bank’s covered transactions with all affiliates would exceed 20 percent of the bank’s capital stock and surplus.

Covered transactions include loans and other extensions of credit to an affiliate, investments in the securities of an affiliate, purchases of assets from an affiliate, and certain other transactions that expose the bank to the risks of its affiliates. Section 23A requires all covered transactions between a bank and its affiliate to be on terms and conditions consistent with safe and sound banking practices.

Section 23B requires that certain transactions, including all covered transactions, be on market terms and conditions. In addition to covered transactions, the Market Terms Requirement applies to:

(i) any sale of assets by the bank to an affiliate;

(ii) any payment of money or furnishing of services by the bank to an affiliate;

(iii) any transaction in which an affiliate acts as agent or broker for the bank or any other person if the bank is a participant in the transaction; and

(iv) any transaction by the bank with a third party if an affiliate has a financial interest in the third party or an affiliate is a participant in the transaction.

2.6.2. European Union

The European Union had passed The 'Financial Groups Directive' in December 2002 for implementation by the member States that laid down the rules for 'supplementary supervision' of financial conglomerates, identified on the basis of set criteria. The Financial Groups Directive would require the introduction (from financial years beginning in 2005) of additional prudential supervision of those groups which straddle the insurance and banking/investment business sectors significantly. The aim of this Directive is to ensure the stability of European financial markets, to establish common prudential standards for the supervision of financial conglomerates throughout Europe, and to introduce level playing fields and legal certainty between financial institutions.

The proposal introduces effective EU-legislation to address the supervisory concerns about intra-group transactions and risk exposures in a financial conglomerate. It recognizes the difficulties in introducing quantitative limits in this area, and suggests an adequate and effective regulatory approach for intra-group transactions and risk exposures to be built on the following three pillars:

- an internal management policy with effective internal control and

management systems; - reporting requirements to supervisors; and

- effective supervisory enforcement powers.

United Kingdom: The Financial Services Authority, UK subsequently came out with a Consultation Paper on the issue setting out proposals to implement the above Directive. The salient features of the proposed framework are as under :

Objective: to introduce a new prudential regime for financial conglomerates, that is groups with significant activities in the banking and investment sectors on the one hand, and the insurance sector on the other hand by :

- setting out to measure Capital Adequacy for the conglomerate as a whole;

- requiring that financial conglomerates have enough capital to meet a capital adequacy test;

- requiring financial conglomerates to have adequate systems and controls to monitor intra-group exposures and risk concentrations across sectors;

Criteria for inclusion of a Group as 'Conglomerate': A group will be a financial conglomerate if at least 40% of its business is financial and at least 10% or Euro 6 billion of its financial business is in each of the insurance and the combined banking/investment sectors. These will be subject to extra prudential requirements at the mixed financial group level, covering the quality of their systems and controls and the adequacy of capital across the conglomerate.

The conditions are that the EEA regulated entity at the head of the consolidation group:

(1) is a parent undertaking of a member of the consolidation group in the overall financial sector;

(2) has a participation in a member of the consolidation group that is in the overall financial sector; or

(3) has a consolidation Article 12(1) relationship with a member of its consolidation group that is in the overall financial sector.

Reporting requirements: The decision on detailed reporting requirements – including the definition of which transactions and exposures are significant – is left to the coordinator, after consultation with the other relevant competent authorities and the conglomerate itself. For the present, the FSA proposes to:

- implement the requirements by retaining the definitions of significance in the current sectoral requirements; and

- require financial conglomerates to provide an additional annual summary report giving an overview of these; and

- include in the summary any significant transactions and exposures of the mixed financial holding company parent as defined by the rules of the most important sector of the group.

The internal management information systems supporting the report must be adequate to allow the group to measure, monitor and control these exposures across the sectors. Also, the report must be adequate to communicate to the coordinating supervisor an overview of the major features of the group’s overall position. The report would broadly cover:

- Calculation of supplementary capital adequacy requirements in accordance with one of the four technical calculation methods;

- Identification of significant risk concentration levels

- Identification of significant intra-group transactions

But rather than specifying a standard format for each financial conglomerate to use, each financial conglomerate for which the FSA is the coordinator will need to discuss with the FSA the form of the information to be reported. When reviewing the risk concentration levels, the FSA will in particular monitor the possible risk of contagion in the financial conglomerate, the risk of a conflict of interests, the risk of circumvention of sectoral rules, and the level or volume of risks.

Even currently, the FSA mandates the reporting of intra-group transactions between companies in a banking or investment firm group, and between companies within a financial and insurance conglomerate through a Regulation. The regulation requires that Intra-group transactions in excess of one million euro occurring in a quarter, or several transactions of the same kind over the same quarter with an aggregate value in excess of one million euro must be reported to the Financial Supervision Authority on a quarterly basis. It covers the following transactions:

a) services produced within the group or conglomerate, agreements to share costs, and agreements on management or other administration of a company within the group or conglomerate

b) regular payments

c) leases for real estate, flats, land or assets

d) ordinary transactions of a real estate company within a group or conglomerate (eg housing service charges and rents)

e) ordinary market investments, including overnight deposits, money market instruments and mutual funds

f) securities intermediation within a group or conglomerate

g) mutual reinsurance or other intra-group insurance arrangements.

3. Canada

There is no specific supervisory framework for conglomerates; they are supervised on the same basis as other financial institutions by the Office of the Superintendent of the Financial Institutions. OSFI had developed its Supervisory Framework in 1999 around the risk-based approach, which is used to identify significant activities that will be reviewed during the course of an on-site examination.

As for monitoring related party transactions, all federally regulated financial institutions are subject to the self dealing regime based on the guidelines issued by OSFI which limits their ability to transact with related parties.The self dealing regime does however allow financial institutions to enter into transactions with related parties when those transactions are nominal or immaterial.

The materiality criteria prescribed by OSFI are given in the table below. It divides related party transactions into 11 categories based on the nature of the transaction and the degree of risk associated with it. Each category has a transaction threshold and an aggregate threshold. There are also specific rules for determining the materiality of a transaction and for aggregating transactions.

Materiality criteria for different transactions

| Type of Transaction | Transaction Threshold | Aggregate Threshold |

| A. CREDIT TRANSACTIONS | ||

| 1. Commercial and corporate credit transactions; investments in securities |

Greater of $250,000 or 1/10 of 1% of regulatoryCapital | 1/2 of 1% of regulatory capital per financial year |

|

2. Non-business loans to individuals (excluding officers) | $250,000 |

None |

|

B. NON-CREDIT TRANSACTIONS | ||

|

3. Retail transactions (deposits, credit cards, mutualfunds, travellers cheques, etc.) |

None |

None |

| 4. Taking and realizing on security interests in securitiesof related parties from unrelated third parties | None |

1/2 of 1% of regulatory capital per financial year if held for 90 days after realization |

| 5. Fees for non-credit financial services to entities |

Greater of $200,000 or 1/50 of 1% of regulatoryCapital | 1/8 of 1% of regulatory capital per financial year (may be aggregated by transaction type) |

| 6. Receipt of deposits (all forms of interest bearing anddiscount notes, deposits, GICs, etc.) | 1% of regulatory capital per deposit | N/A |

| 7. Actively traded products (fx, T-bills, BAs, etc.) |

None |

None |

|

8. Intermediated asset transactions in active markets | None |

None |

| 9. Purchase and sale of goods and services; lease of realestate (category involves non-depreciable assets) | Greater of $200,000 or 1/50 of 1% of regulatory Capital |

1/8 of 1% of regulatory capital per financial year |

| 10. Liquid asset transactions, purchase or sale of real estate, capitalized leases (category involves depreciable assets) |

Greater of $225,000 or 1/25 of 1% of regulatory Capital | 1/4 of 1% of regulatory capital per financial year |

| 11. Consulting or professional services contracts with directors, officers and spouses |

$100,000 |

$250,000 per financial year |

Financial institutions are not required to file specific reports with OSFI detailing related party/intra-group transactions.OSFI's approval, however, is required in respect of their materiality criteria. OSFI also has the power to request any information it considers relevant when assessing a particular institution i.e. exposures/related party transactions, can be called for by OSFI if felt necessary.

4. Australia