IST,

IST,

Challenges in Liability Management: Maintaining the Balance - Keynote address delivered by Shri M. Rajeshwar Rao, Deputy Governor, Reserve Bank of India - January 17, 2025 - at Mint Annual BFSI Summit & Awards 2025, Mumbai

Shri M. Rajeshwar Rao, Deputy Governor, Reserve Bank of India

delivered-on जाने 17, 2025

|

At the outset, I would like to thank the organisers for inviting me to this 17th edition of the Mint BFSI Summit & Awards. I am delighted to get this opportunity to engage with you during this event. As a regulator for banks and non-banking financial companies (NBFCs), I thought this could be an occasion to reflect on a less debated area for the regulated entities - their liabilities management and the challenges. In flagging the mismatch between deposit and credit growth, Governor Das had previously drawn our attention to the rising challenge in this area. So, I thought of wading in with a few thoughts for your consideration. Introduction 2. The core function of banking involves accepting deposits, which are usually short-term, and funding loans, which generally have longer maturities. Maturity transformation is thus an inherent feature of financial intermediation and banks are strongly exposed to the associated risks. As a result, strategic management of assets and liabilities is crucial to optimise profitability, improve liquidity and protect the bank against various risks. Historically, regulatory frameworks, including the Basel I and II, placed a greater emphasis on the asset side of the balance sheet, focusing on credit risk management and capital adequacy. This focus arises from the belief that credit defaults and asset deterioration pose the main threats to a bank's solvency. Liquidity and funding risks, primarily stemming from liabilities, were largely viewed as an issue that banks could manage themselves without requiring any regulatory oversight and intervention. 3. The Global Financial Crisis (GFC) of 2008, during which banks faced vulnerabilities on both sides of the balance sheet, challenged this approach resulting in profound changes to the banking sector’s regulatory framework. During the crisis, many banks experienced liquidity crisis leading to insolvencies despite adherence to capital requirements, highlighting the fragility of funding structures reliant on short-term liabilities. This underscored the systemic importance of liquidity management and the need for regulatory oversight beyond asset-side vulnerabilities. The policy response was a paradigm shift that led to prescribing comprehensive global liquidity standards viz. Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR) which targeted short-term and medium-term liquidity resilience. 4. It is now well understood that liability management is crucial not only for the stability and solvency of a regulated entity (RE) but is also as a key factor influencing its return on capital and growth trajectory. From the earnings perspective, the spread on interest earned on loans and the cost of funds determines the bank’s net income and profitability2. The cost of liabilities thus has a direct impact on Net Interest Margins (NIMs) and earnings ratios. For instance, the share of current and savings account (CASA) deposits in total deposits, the mix of retail versus wholesale funding and the duration of liabilities play a key role in determining the funding cost and, therefore, profitability of banks. Further, the stability of funding is the key to resilience during any crisis. In this context, let me dwell briefly on the evolution of liability management in India, changing trends in liability structure, entity-specific challenges, and regulatory expectations. Evolution of ALM in India 5. As you all are aware, Indian banking underwent a strategic transformation with the broader economic reforms of the 1990s. The deregulation of interest rates and greater global integration made the risks encountered by financial institutions more complex and significant, requiring strategic management. Accordingly, the guidelines on Asset-Liability Management (ALM) for financial institutions were first issued in February 1999 with further additions in late 2000s, covering the interest rate and liquidity risks along with prudential limits and disclosure framework. 6. The Indian Prudential Framework incorporated the Basel Committee on Banking Supervision (BCBS) Principles for Sound Liquidity Risk Management in 2012, followed by the adoption of two minimum standards for funding liquidity viz. LCR and NSFR. Recognizing that the LCR calibrations overlooked intraday liquidity and the increasing interdependencies within the financial system could lead to liquidity disruptions affecting payment and settlement processes, guidelines for monitoring intraday liquidity were introduced. To mitigate the concentration risk and to curtail systemic implications of uncontrolled liability of larger banks, the Reserve Bank had very early on put in place limits on Inter-Bank Liabilities (IBL) for commercial banks (2007) and interbank deposit limits for urban cooperative banks (UCBs) (2009). Scheduled Commercial Banks (SCBs) (excluding small finance banks, payments banks and regional rural banks) have been permitted to set Board approved limits for borrowing in Call and Notice Money Markets, within the prudential limits for IBL. Such liability-based concentration limits are unique to India and reflect the Reserve Bank’s early cognizance of these risks. Liability Structure and Growth 7. Deposits continue to be the primary source of funds for SCBs, amounting to ₹217 lakh crore, which represented 77 per cent of total liabilities at the end of FY 2024. In contrast, capital funds (i.e., capital, reserves & surplus) and borrowings, each constituted around 9 per cent of liabilities3. The comparison of data between FY 2016 to FY 2024 indicates that the deposits have grown at an annual rate4 of around 10 per cent, aligning with the overall balance sheet growth, and their contribution to total liabilities has remained stable at around 77 per cent (Charts 1 and 25). Meanwhile, borrowings have grown at a slower rate3 of 7 per cent as a result of which its share in total liabilities has decline from 11 per cent to 9 percent. On the other hand, Capital Funds have grown at close to 13 per cent and its share has increased progressively from 7.6 per cent to 9.3 per cent, indicating the deleveraging of banks’ balance sheets, boosted by higher profitability and capital raising efforts.  8. Maturity wise, during the same period, the contribution of term deposits has declined from 65.8 per cent of total deposits to 60.9 per while the shares of savings and current account deposits have increased from 25.3 per cent and 8.9 per cent to 29.2 per cent and 9.9 per cent, respectively. Consequently, CASA ratio has improved from 34.2 per cent to 39.1 per cent. This trend may have contributed to the improvement in Net Interest Margins (NIMs) of SCBs, which has increased from 2.6 per cent in FY 2015-16 to 3.3 per cent in FY 2023-24 (Chart 36).  9. Apart from deposits, banks raise liabilities in the form of debt capital instruments such as Additional Tier 1 (AT1) bonds and Tier 2 bonds. Furthermore, banks are permitted to issue domestic Long-Term Bonds to finance infrastructure and affordable housing loans and can also raise funds in overseas markets under the ECB route. 10. For Non-Banking Financial Companies (NBFCs), borrowings are a significant source of funding, amounting to ₹ 34.46 lakh crore or 68 per cent of total liabilities as at end-March 2024. Within borrowings, debentures and borrowings from banks are the main contributors (Charts 4 and 57). This makes NBFC’s liabilities more market-driven and sensitive to interest rate changes compared to banks.  Changing Trends and Challenges 11. Banks are at the forefront of providing credit to productive sectors of the economy by channelizing household savings, which currently comprise approximately two-thirds of India’s gross savings. Recent trends indicate a shift in household preference to financial assets for saving purposes leading to movement of these savings beyond traditional bank deposits towards capital market assets (Charts 6 and 78). This shift is driven by several factors, including targeted efforts to deepen the financial sector, the growth of digital public infrastructure that offers convenient and frictionless access to capital markets, changing investment preferences due to demographic shifts, increased financial awareness, and the recent period of sustained high returns yielded by equity markets. Additionally, the rise of alternative asset classes, search for higher yields and portfolio diversification have further fuelled this trend. Over the past decade9, the number of subscribers and the assets under management (AUM) of mutual funds, pension and provident funds, and insurers have risen significantly, a trend likely to accentuate further. While this trend may not alter the aggregate funding available for banks, it may change the character of deposits having implications on cost of funds and margins for banks.  12. Although CASA deposits have improved over the longer term as previously mentioned, there has been a recent shift, with share of CASA deposits declining and that of term deposits, especially in higher interest rate buckets, increasing10. This has implications for bank NIMs and profitability. Lately, banks have also increased their reliance on short term funding through Certificates of Deposits (CDs) and the average CD outstanding had reached levels last seen in 201211. Banks must, however, take cognizance of the fact that the higher reliance on short term liabilities can have its own repercussions if market conditions deteriorate. 13. Banks adopt distinct liability sourcing strategies based on their competitive strengths, market positioning, and business priorities. Large banks with an extensive branch network may have access to low-cost, stable retail deposits. While the banks with a more pronounced urban presence may target affluent customer segments, offering high-value deposit products tailored to high-net-worth individuals (HNIs) and corporate clients. Additionally, some banks with advanced technology stacks leverage digital platforms to enhance customer acquisition and streamline liability sourcing, providing a competitive edge in attracting both retail and corporate deposits. On the other hand, differentiated banks are seen to have a higher reliance on inter-bank deposits and wholesale funding. This diversity in funding profiles presents unique challenges in ALM, as each business strategy introduces its own complexities in managing liquidity, cost of funds, and risk alignment. 14. ‘Institutionalisation’ of deposits, which I referred to earlier, will bring along specific challenges for the ALM for banks. A reduced reliance on retail deposits, coupled with a greater share of funding from institutional sources will likely result in increased funding costs, which in turn negatively affects profitability. The quest to maintain the margins can lead to eventual transmission of increased funding cost to interest rate on loans. This would either constrain growth of loan book or may force the lenders to dilute the underwriting standards and lend to riskier borrowers to maintain earnings ratios. Banks must stay alert to the risks of certain practices that may seem less evident during strong economic growth but could lead to serious consequences during economic downturns. Banks heavily reliant on wholesale funding are more vulnerable to rollover risks and outflows in times of economic stress. Therefore, effective liability management is crucial for mitigating these risks. 15. Another issue pertains to deposit growth of certain banks not keeping pace with their loan growth, which has raised regulatory concerns about the risks associated with higher dependency on wholesale funding for credit disbursement. Such imbalances are viewed as indicators of potential structural liquidity vulnerabilities. While regulators monitor these trends as a macroeconomic gauge to assess systemic risks in the banking sector, it is crucial to recognise that for individual banks these indicators alone are insufficient to fully capture liquidity risk. From a short-term liquidity perspective, tools like the LCR offer a more nuanced view by considering factors such as deposit stability, depositor behaviour, and the dynamics between retail and wholesale funding. The relationship between these indicators is multifaceted and often contradictory, making it essential to avoid relying on any single measure in isolation and necessitating a holistic assessment of the ALM profile of banks. 16. Contrary to banks, the liability profile of NBFCs12 is shaped by their primary activities, regulatory requirements, and the types of assets they finance. Historically, crises have demonstrated that NBFCs’ over-reliance on short-term funding to support long-duration assets, such as infrastructure and housing loans, can result in significant liquidity constraints, deterioration in investor confidence, and credit rating downgrades, thereby constricting their ability to access capital markets. Consequently, NBFCs became heavily dependent upon bank funding, both direct lending and banks’ subscriptions to debentures & Commercial Papers (CPs), leading to funding concentration. Recognizing the increasing dependency of NBFCs on bank borrowings, the RBI increased the risk weights of bank exposures to NBFCs by 25 percentage points in November 2023 which has helped in moderating the YoY growth in bank borrowings by NBFCs. To offset this, NBFCs have increased funding through CPs13 and non-convertible debentures (NCDs)14. 17. While accessing international markets can reduce NBFCs’ reliance on the domestic banking system and provide a broader range of funding options, it also exposes them to additional risks, particularly unhedged currency exposures, which can lead to volatility in funding costs and potential liquidity strains due to exchange rate fluctuations. NBFCs should integrate forex hedging into their ALM framework and closely monitor currency exposure to mitigate funding cost volatility. The liquidity transformation of assets through securitization to free up resources for on-lending can also serve as an important tool to improve the ALM structure. Regulatory Expectations 18. Now, let me flag a few key issues that are being extensively debated globally on the ALM practices employed by banks and NBFCs and the regulatory expectations on these issues. 19. First, the rise of innovative products and technologies in banking has enhanced consumer flexibility in accessing funds & managing cash flows, significantly transforming customer behaviour. Further, the evolving dynamics of information dissemination through traditional and social media can profoundly influence customer behaviour, potentially escalating and amplifying a crisis. These factors present heightened challenges and banks needs to be watchful and carefully review their modelling assumptions on stability of deposits and customer behaviour to better predict deposit retention, withdrawal patterns, pre-payments, and interest rate sensitivities. 20. Second, the Liability-Driven Investment (LDI) crisis in the UK demonstrated the inherent vulnerabilities in highly interconnected financial structure, where the failure of one segment can precipitate cascading liquidity challenges across multiple sectors. Traditional liability management models, often based on historical data, may not adequately capture the risks posed by unprecedented market conditions. Consequently, regulated entities must develop more sophisticated stress-testing methodologies that evaluate their ability to withstand extreme scenarios, including those that involve the amplification of shocks across interconnected financial networks. 21. The final point is the importance of contingency funding plans (CFPs). In general, REs must have formal CFPs commensurate with their complexity, risk profile, scope of operations and their role in the financial system. Among others, it must clearly articulate the available potential contingency funding sources and the amount of funds that can be derived from these sources. It is important to note that the lender of last resort (LOLR) function of central banks is regarded as (implicit) insurance for banks against liquidity shocks that money market participants are unwilling or unable to absorb. The value of this insurance increases with banks’ exposure to liquidity risk, which increases moral hazard. Banks need to recognize that, to address this moral hazard, the central banks retain discretion to decide whether to extend emergency liquidity assistance to specific institutions. This assistance is intended as a safety net for the entire financial system through judicious use of public funds and is often accompanied by supervisory intervention and conditionalities. Therefore, the LOLR function should not be regarded as a routine component of contingency funding. 22. As far as NBFCs are concerned, while they play a key role in enhancing access to credit and supporting economic growth, their activities also involve a significant amount of maturity, liquidity, and credit transformation. Most NBFCs, unlike banks, do not have access to public deposits, as the regulatory approach over the years has been to disincentivise the deposit taking activities of the NBFCs. Compared to the more stable retail sources of funding available to banks given their access to official backstops and their deposit franchises, NBFCs will continue to be dependent on banks and capital markets for their funding. It is imperative for NBFCs to diversify their funding sources while optimizing borrowing costs and mitigating associated risks for a sustainable growth path. Conclusion 23. Today, we collectively aspire for a ‘Viksit Bharat’ by 2047, the centenary of our independence. This ambition demands consistent and sustainable economic growth combined with a systemic capacity for resilience. In order to achieve the ambitious economic growth target under this vision, the financial assets and bank assets would need to achieve a consistent and high paced growth over the next two decades, which would require a corresponding increase in liabilities and capital for the financial sector. This brings forth the need to address some of the emerging challenges as customer behaviour and preferences are undergoing profound changes while global ecosystems and external factors such as third-party dependencies and technology shifts are growing increasingly complex, reshaping the business landscape. Collectively, these dynamics are creating a challenging environment for REs who would need to recalibrate their approach and business strategies. This is not just about managing risks but also seizing opportunities to optimize funding structures, enhance stability, and support economic growth. The road to a “Viksit Bharat” by 2047 will depend significantly on how well the financial system adapts to these trends and manages the complexities of resource raising and liability management. Thank you. 1 Keynote address delivered by Shri M. Rajeshwar Rao, Deputy Governor at Mint Annual BFSI Summit & Awards 2025 on January 17, 2025 at Mumbai. Inputs provided by Akhilesh Gokhale, Tony Mammen and Shashank Srivastava are gratefully acknowledged. 2 The other main driver of profits is the provision requirement which is dependent on the asset quality. 3 Borrowings include inter alia borrowings from RBI, other banks, institutions and agencies, capital instruments (Perpetual Debt Instruments and Tier 2 debt), and other bonds and debentures. The remaining liabilities (4.2 per cent) are composed of other liabilities and provisions. 4 Cumulative Annual Growth Rate (CAGR). 5 Source: RBI Reports on Trend and Progress of Banking in India, 2016 to 2024. 6 Source: RBI Reports on Trend and Progress of Banking in India, 2016 to 2024. 7 Source: RBI Report on Trend and Progress of Banking in India 2023-24. 8 Source: RBI Quarterly Data Release on Household Financial Savings, RBI Staff Calculations. Note: (i) Charts 6 and 7 include select components of household financial assets; (ii) Chart 6 provides the CAGR of Flow of Household Financial Assets. 9 For example, the mutual fund industry’s AUM has grown from ₹ 10 trillion in 2014 to ₹ 66.93 trillion as on December 31, 2024, more than 6-fold increase in 10 years. The total number of accounts/folios as on December 31, 2024 stood at 22.50 crore. [Source: Association of Mutual Funds of India (AMFI) website] 10 Term deposits formed 82 per cent of incremental deposits mobilised in H1:2024- 25. Source: RBI Financial Stability Report December 2024. 11 Average CDs outstanding in FY 2023-24 was ₹ 4.18 lakh crore. Source: RBI Database on Indian Economy (DBIE), RBI Staff Calculations 12 NBFCs regulated by the Reserve Bank are a group of heterogeneous financial entities operating with diverse business strategies viz. investment credit, infrastructure finance, micro-finance, factoring, core investment, housing finance, non-operative financial holding, account aggregator, peer-to-peer lending, and primary dealing activities. 13 Outstanding CPs for NBFCs have increased by 26.2 per cent in FY 2023-24 (Source: RBI Report on Trend and Progress of Banking in India 2023-24) 14 Outstanding unsecured debentures for NBFCs have increased by 16.2 per cent in FY 2023-24 (Source: RBI Report on Trend and Progress of Banking in India 2023-24) |

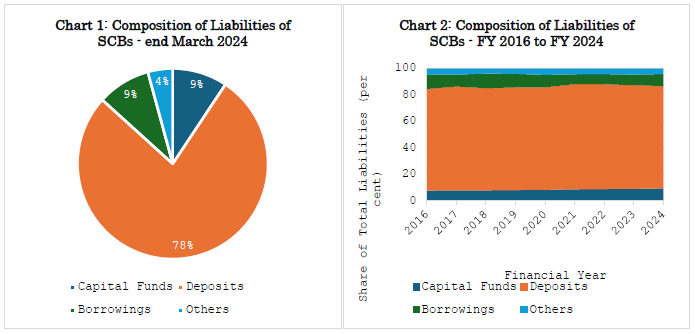

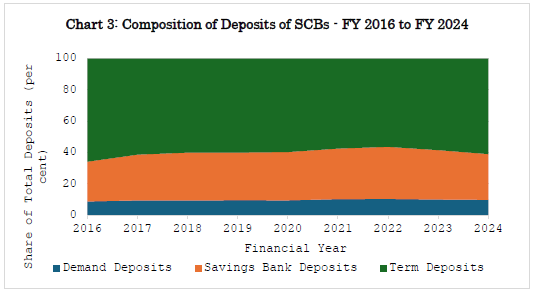

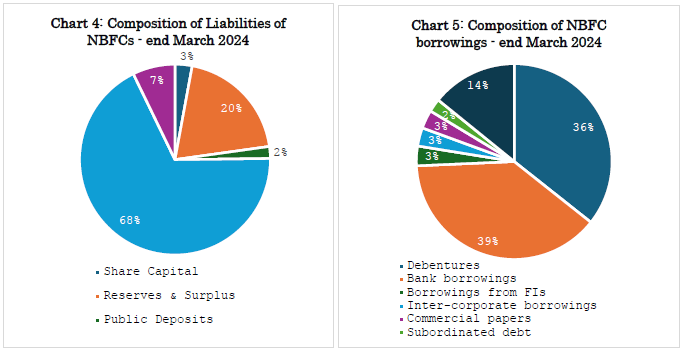

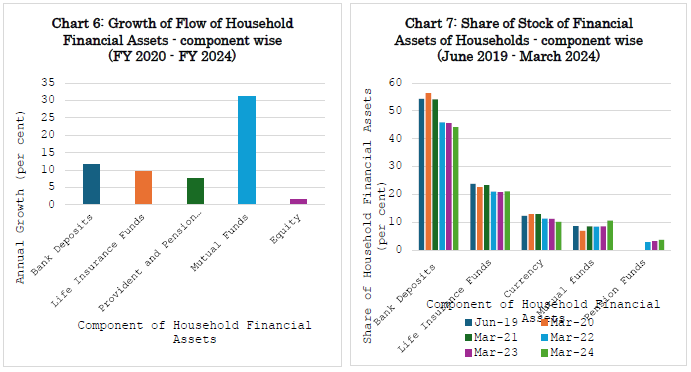

पेज अंतिम अपडेट तारीख: