IST,

IST,

Governor’s interaction during Governor’s Series Talk at Frontiers of Central Banking in Asia with Krishna Srinivasan, Director, Asia and Pacific Department, IMF in the Annual Meetings of IMF and the World Bank Group, at Marrakech on October 13, 2023 (Edited)

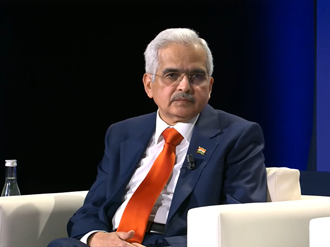

Shri Shaktikanta Das, Governor, Reserve Bank of India

delivered-on ऑक्टो 13, 2023

Welcome to the 2023 Annual Meetings Governor Series Talk. I am Krishna Srinivasan, Director of the Asia Pacific Department of the International Monetary Fund. Today, I am honored and privileged to welcome Governor, Shaktikanta Das of the RBI. We will be talking about the frontiers of central banking in Asia. Governor Das requires no introduction, but I will do my obligatory piece here. Governor Das took over the helm of the RBI in 2018 at a critical moment for both India and the world and since then, he has been guiding monetary policy and banking regulation in the world's fifth-largest economy. During the COVID-19 pandemic, he took bold and timely actions to mitigate the impact of the pandemic and to save lives and livelihoods. He is passionate about digital technology and fintech, both geared towards increasing access of the layman or a common person to finance and promote financial literacy. Needless to say, given his track record, he received this year, the Central Bank Governor of the Year Award from the Central Banking Ceremony. Before joining the Reserve Bank of India, Governor Shaktikanta Das had an impressive career in the Indian Civil Service. So, Governor Das, it is a pleasure to have you here. Shaktikanta Das: Krishna Srinivasan: Governor, let us begin with what you have seen in Asia. In Asia, inflation started rising much later than in other regions of the world. When it started rising, it rose much less and now it is declining faster than other parts of the world. Was that the experience in India too? And if so, how would you explain that? Shaktikanta Das: Coming to the inflation scenario in India, yes, by and large, what you say is right. In the context of India, the primary reason for that was the COVID time response of both the monetary authority that is the Reserve Bank of India, and the Government from the fiscal side. The responses of both fiscal and monetary authorities were very calibrated and targeted. There was no excessive fiscal expansion, compared to other countries. The Government did enhance the fiscal targets substantially during that time. The Government went for a higher fiscal deficit. So, it was not excessive fiscal support in comparison to many of the advanced economies. On the monetary side, we took very calibrated measures during that period. We provided very strong support to the financial markets with a commitment to see that the financial markets function normally and that normal activities go on in the financial markets. We undertook a number of measures, for example, we pumped in liquidity, and we reduced the policy repo rates by 215 basis points on top of a few rate hikes which we had done earlier. On liquidity, we did the adjustment of rates by reducing the rates; we also provided support to the lenders, to the banking companies as well as to the non-bank lenders, by first offering a moratorium of six months followed by a resolution framework with regard to the loans which were under stress. All these responses were very calibrated. Just to give one example, we injected liquidity, but almost every liquidity injection measure was accompanied by an end date, by announcing a sunset date. So, when we gave liquidity, it was given for one year or three years. Further, the lending standards, i.e., the collateral standards were not diluted. It was the banks that availed the credit, and the collateral standards were not diluted or compromised. The banks, right from day one, knew very well that they had to return this much quantum of liquidity, say, after one year or after three years. So, they were able to plan their liquidity management better. So, that is just one example which I am giving. The monetary and fiscal responses in India were very calibrated and targeted. The supply side management and the steps taken by the Government simultaneously, during that period did help to keep the inflation under check. Due to the combination of all these factors, the inflation spike in India came a little later. In fact, without the war in Ukraine, our inflation would have been very much within our target range. Our inflation target as many of you would know is 4% with a tolerance band of 2% on either side. In February 2022 when we did the monetary policy statement, our projection of inflation (average) for the next financial year 2022-23, i.e., from April 2022 to March 2023, was 4.5%, very close to our target of 4%. But then the war commenced. With that, the commodity prices just hit the roof, particularly the prices of crude oil. Then the supplies of wheat and other cereals were affected. The international prices of these cereals went up. Despite India being surplus in wheat, its domestic prices also went up because we are also linked to the international market as India exports quite a bit of wheat. The edible oil prices – India imports a substantial quantum of edible oil from that region, the UK and Russia – also got disrupted. I would say, but for the unexpected onset of the war in Ukraine, our inflation would have been very much under control. To come back to your point, inflation did set in India at a later stage primarily because of the commencement of the war. But we could control it better because of the calibrated and targeted measures which we, both fiscal and monetary authorities, i.e., the Reserve Bank and the Finance Ministry, had undertaken. Krishna Srinivasan: Shaktikanta Das: Krishna Srinivasan: Shaktikanta Das: The top 100 non-bank lenders were being monitored at my level on a weekly basis. We tried to inject liquidity and ensured that there was no other failure of a major non-bank lender. We did it by active supervision, by working with them and by commencing a correction in the regulatory architecture for non-bank lenders because earlier it was a kind of a light touch regulation. We moved towards a greater focus on prescribing regulatory standards and making the regulations stricter, especially for the larger ones. That was 2019; 2020 was COVID, 2021 was the Delta wave, 2022 was the Ukraine war, and 2023 has not ended. Too many things are happening all around. That is the kind of crisis, which we have gone through. But in all this, what has enabled us to manage this situation is that we have always been proactive. We have tried to identify the problem and we acted before the problem actually occurred. For example, when COVID was just setting in, and there was a lack of clarity in everybody's mind as to what this virus was all about, and what kind of damage it would cause, we; very proactively and with some boldness on the part of a central bank which is supposed to be very conservative; announced a moratorium on repayment of loans to banks and to non-bank lenders. We were very clear that we would do it for six months, but we announced it in two phases. First, we gave it for three months because we thought we would see how the virus plays out and how it behaves, and if required, we gave it for another three months. This came even before there was a demand from the market asking for this kind of relief. We did it proactively and then we came out with a resolution package. I mentioned you about it earlier, a COVID-19 resolution package to address the problem of stress in the banks. When we came out with the resolution framework, it was not a kind of open-ended framework, where it was free for all for the banks to restructure the loans any way they wanted. We formed a committee and the committee prescribed certain financial and operational parameters which the lender has to achieve post-restructuring of a particular loan. When you restructure a loan, we said the period of restructuring should not be more than two years and these are the financial and operational parameters which the borrower has to achieve. In other words, it also entailed a kind of responsibility on the part of the borrower himself to bring some additional capital and to do some internal business corrections. Our actions have by and large been proactive, we have also been quite innovative. We came out with a lot of measures. During that period, this was already a work in progress, but we almost completely recast the regulatory architecture for the financial sector. We came out with new governance guidelines for the banking sector and made it mandatory for banks to have risk management at a particular level, and to have a Chief Risk Management Officer at a particular level. We issued guidelines for the functioning of the Risk Management Committee and the Audit Committees of the Board. So, we carried out big governance reforms. We issued guidelines for governance reforms in the banks, both public and private sector that is both government and non-government banks. We came out with a scale-based regulation for non-banking lenders depending on the size and complexity. We categorise them into four categories because you have very small non-bank lenders, and you have big non-bank lenders which sometimes are as large as a mid-sized commercial bank. We have come out with new lending guidelines for digital lenders. We have also come out with new guidelines for asset reconstruction companies, for core investment companies. So, we have come out with new regulatory guidelines for various sub-sectors in the financial sector and we have recast their regulatory architecture, completely. The process of supervision also has been substantially tightened and it is very active today. We no longer wait for the symptoms to warn us. We have now early warning exercises. We do a deep dive into the business models of banks or non-bank lenders and try to identify which are the potential areas of risks and we sensitise them. We do not do micromanagement. Krishna Srinivasan: Shaktikanta Das: Our foreign exchange reserves have almost been increased by 70% to 80%. Our reserves stand at around US$600 billion as against less than US$400 billion at the beginning of 2019. It was a conscious decision to build up the reserves buffer as an insurance against spillover risks. If you have capital inflows today there will be a day when there will be capital outflows. In such situations, every country, especially emerging market economies, always faces the consequences of spillovers of actions or what is happening all around. The spillovers are felt maximum by emerging markets and developing economies (EMDEs). Ultimately, these economies have to look after themselves. India with a huge population and with the size of our economy, we have to be self-reliant, we have to be self-dependent, and we have to have our strong reserves. So, with that objective, we have been building up very strong reserves and that has given great confidence to the market that whatever the challenge, India will be able to meet its external sector obligations. This is something which did help us even this time around after the Ukraine war when the US dollar suddenly became very strong and all the emerging market currencies depreciated. The Indian rupee did not depreciate as much because the market had confidence that India would be able to meet its obligations. Even during this period, we were intervening in the market. I am saying it openly. I will not hesitate to say for a moment that we do intervene in the market, but our intervention is both ways. Sometimes, we buy dollars, sometimes we sell dollars, it depends on which way the market is moving. But our objective is not to fix the rupee at a particular level. We do not have a particular level of the Indian rupee in our mind vis-a-vis the dollar. We do not have a specific exchange rate in mind with regard to our currency market intervention. What we are attempting to do, and this has been the Reserve Bank’s philosophy and approach over the last several decades. Our approach and our focus, our emphasis is to prevent excessive volatility of the exchange rate. Because once you are able to provide stability to your currency you are able to achieve a kind of orderly depreciation or appreciation depending on where the market moves or the overall global and domestic situation. It has to be an orderly movement of the currency and there should not be excessive volatility. That is what we have ensured. This is one area where it is necessary for agencies and others who do labelling of market intervention. It is a time to rethink, to put somebody on the watch list or to call the country a manipulator or to call the country’s currency a stabilized currency. There is a need for rethinking and there has to be a two-sided appreciation of the challenges. We have to get out of our one-sided approach and interpretation of such concepts. I will stop here. Krishna Srinivasan: Shaktikanta Das: Krishna Srinivasan: Shaktikanta Das: Krishna Srinivasan: When you talk about meeting monetary policy objectives, when I raise this issue with other central bank governors, one issue they bring up is the close coordination between the central bank and the fiscal authorities. I, sitting in Washington, feel that that coordination has worked very well in the Indian context. Can you talk a little bit about how do you see that? Shaktikanta Das: We have been able to deal with the problem of inflation effectively, because of close coordination and understanding, and close engagement between the Government and the Reserve Bank. The latest consumer inflation number for September 2023, which was released just about an hour ago, has come to 5%. The consumer inflation had reached its peak at 7.8% in April 2022, and then it slowly came down. In the Q1:2023-24, we were able to achieve 4.6%, but then there were some extreme weather events, vegetable prices went up and the inflation again crossed 7%. But thereafter, thanks to the effective measures and the active engagement between the Government and the Reserve Bank, we did not do a knee-jerk reaction of doing something on the rate side. When the inflation went up, we knew that the vegetable prices have gone up and it is a temporary spike, and it will moderate after two months. We did not increase the rates. We had already taken a pause with regard to the interest rates. We continued with our pause. But we were directly engaged with the Government and the Government undertook certain measures. So, the effective coordination between the Government and the Reserve Bank; Reserve Bank communication on interest rates, and Reserve Bank communication on inflation, all have worked together to ensure that the inflation which again went up due to a spike in vegetable prices, the Government took several measures to see that the vegetable prices do moderate and they have moderated. The Reserve Bank gave confidence to the markets through its communication also. I must mention that for any central bank especially given the uncertainty that every country today faces, central bank communication has become much more important. The latest print has come to 5% and it is exactly in line with our internal projections. If I remember correctly, we had given a projection of 6.4% for the Q2:2023-24 and the inflation number for Q2 comes exactly at 6.4%. Our internal number for September 2023 is also what it has finally come to be, 5%. The active coordination between the fiscal and monetary authorities has helped us and this is something which I would like to emphasise, not just when we are facing a crisis, even in normal times, there is a need for constant engagement and coordination between fiscal and monetary authorities, because both the agencies are ultimately working for the economy. So, there has to be a conversation, there has to be engagement and there has to be coordination. We, as a monetary policy authority, also need Government support on so many things. We need certain laws, which govern the financial sector, to be amended. We also depend on the Government to carry out those amendments and I am happy to share and mention here that whatever amendments etc., we have wanted, we have always got excellent cooperation and support from the government. So, it is very important at all times, I am quite open about it. There is a perception that the central bank must have autonomy, the central bank does have autonomy. Autonomy means autonomy in decision-making. Autonomy does not mean that you stop conversations with each other. Krishna Srinivasan: Shaktikanta Das: Coming to CBDCs, why I am saying it is very important because there are now several new animals or birds, whatever you call them, they are floating around under various names. Some call them stablecoins; some call them cryptocurrencies. Our point of view is that let us be very careful in interpreting and understanding what consequences they have. On stablecoins, the basic fundamental question that arises is whether governments and central banks are comfortable with private currency. Currency is a sovereign function that the sovereign delegates to the Central Bank in countries like India. Are we comfortable with private currency? These new technology products, which are coming and styling themselves as a great innovation, what are their financial consequences, their negative consequences for domestic financial stability, for global financial stability, for the domestic monetary system, for the global monetary order, all that needs to be understood. What are the potential threats like terror financing, and money laundering? The central bank itself will lose control over the monetary system. There are lots of challenges and these are highly risky. We do not want that kind of thing. On such matters, whether it is stablecoins or cryptocurrencies or whatever you call it, we need to fully understand what are the risks before legitimising them. We need to know, before entering the water, how many sharks are there inside the water. That is how I would put it in a very commonplace language and very bluntly. CBDC is important. The world is moving towards technology and CBDCs have a major role because CBDCs can facilitate efficient, cost-effective and faster payments across jurisdictions. CBDC can provide a solution for cross-border transactions. Even today, bank-to-bank transactions do take time. According to the latest estimates of the World Bank and others, remittances still cost about an average of 6%, which is very high, it needs to go down in today's technology era. So CBDC can provide a solution to make cross-border payments faster, more efficient and cost-effective. In India, the Reserve Bank started the wholesale CBDC pilot project in November 2022 and the retail mode was started in December 2022. In the wholesale, initially, we started with secondary market trading in government securities. Now we are extending it to overnight money markets, that is the wholesale segment. In the retail segment, we have now millions of customers who are enrolled on the pilot project. Almost every major bank has been onboarded. The trials are going on. It is a learning experience for us and the learning process has been very satisfactory. Every day, there are new challenges which come. We try to understand what is the problem. We are taking it forward. We are in active discussion with other countries also which are carrying out similar efforts. It is going to be one year of our CBDC pilot project. The learnings have been excellent and more than what it was one year ago. We are even more convinced that CBDC can prove to be the most effective and efficient mode for cross-border payments in particular, other than, of course, domestic transactions. In India, we have also enrolled into this CBDC pilot project fruit shops, and small vegetable vendors, etc. We, in India, have made our CBDC and the UPI interoperable. It is a common interoperable QR code and the same QR code is interoperable with the CBDC. So naturally, the efficiency of the system improves. Krishna Srinivasan: I do not know how much time I have, we can continue this conversation. I want to leave some time for questions from the audience. So maybe I can open up the floor right now. We have a question right here in the front. Could you please introduce yourself and keep your question brief? Tunde Adetunji: Krishna Srinivasan: Tunde Adetunji: Shaktikanta Das: That is one of the major milestones which the Indian Presidency has achieved. So, we do recognize. But other than sharing our experience, and how we have done it, I see a very limited role for us. Ultimately, it is for your authorities to come and discuss with us and pick up some experiences and some takeaways from that. It is essentially for a multilateral forum like the IMF with which we also work very closely. It is global safety nets or global stability, macroeconomic stability, and monetary stability; these are all issues for the IMF. So, the IMF is the right forum and we do have an active engagement with the IMF. You have to look at bilaterally gaining experiences from countries, including India. There are other countries also which are doing very well and also engage with the IMF. Krishna Srinivasan: Shaktikanta Das: |

पेज अंतिम अपडेट तारीख: