IST,

IST,

Issues in Infrastructure Financing in India

Shri N.S. Vishwanathan, Deputy Governor, Reserve Bank of India

delivered-on नोव्हें 28, 2016

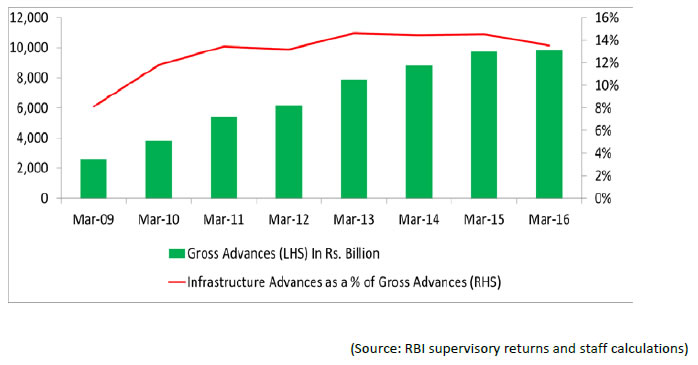

I am happy to be here at ASSOCHAM’s Sixth International Summit on Infrastructure financing. Infrastructure plays a crucial role in economic development of a country. In India, too like many other countries, Infrastructure development is a critical aspect of our growth strategy and therefore, the sector gets the importance from all stakeholders commensurate with that role. As you may be aware, Government has announced the target of Rs 25 trillion (US$ 376.53 billion) investment in infrastructure over a period of three years, which will include Rs 8 trillion (US$ 120.49 billion) for developing 27 industrial clusters and an additional Rs 5 trillion (US$ 75.30 billion) for road, railway and port connectivity projects. It is also instructive to note here that only recently, in 2016, India jumped 19 places in World Bank's Logistics Performance Index (LPI) 2016, to rank 35th amongst 160 countries. Infrastructure like ports, roads and airports together form one of the six parameters for this index. In the journey of a country’s progress towards economic prosperity, infrastructure plays a crucial role and obviously, the need for an effective and efficient system that provides financial resources to this sector is just as important. It is therefore only timely that ASSOCHAM is organizing this event. India’s financial system is dominated by banks. NBFCs too play a part in infrastructure financing. There are NBFCs that specialize in financing infrastructure and certain sector specific NBFCs in the Government Sector. Of course, banks are the predominant providers of finance to the infrastructure sector. The flow of bank finance to infrastructure sector has clocked high growth rates. The outstanding bank credit to the infrastructure sector, which stood at Rs. 95 billion in March 2001, increased to Rs.9,853 billion in March 2016, a compound annual growth rate (CAGR) of 39.31 percent over the last 15 years. This of course covers the period of excessive exuberance when it was fashionable to lend for road projects, power and the like, without the requisite due-diligence. A look at the data:  This phenomenal growth brought in its wake certain undesirable consequences, like high stressed assets. More of this later. A few economic characteristics differentiate infrastructure assets from other asset classes. These characteristics also make it more difficult to match investment demand and financing supply: Firstly, infrastructure projects are often complex and involve a large number of parties. Infrastructure often comprises natural monopolies such as highways or water supply, and hence governments want to retain the ultimate control to prevent an abuse of monopoly power. This requires complex legal arrangements to ensure proper distribution of payoffs and risk-sharing to align the incentives of all parties involved. Secondly, infrastructure projects are long term and are therefore subject to various risks including those due to changes in policies, delays in clearances, etc. Every event that delays the implementation of a project leads to cost and time overruns that in turn have a bearing on the techno-economic viability of the project or would necessitate revision in the price of the end-product. Very often the infrastructure products are meant to serve public good which imposes a limitation on ability to determine their price. Thirdly, where debt financing is dominated by the banking system, the fundamental problem posed by the asset-liability mismatch is critical. In India, the dominance of PSBs may partly offset this risk because the perceived assurance of government backing provides the requisite flow of deposits. Because of these reasons, there are always challenge in financing infrastructure. At the same time, infrastructure sector will be a key driver for the Indian economy. Given the high priority that the Government is according to the infrastructure sector, there is no gainsaying the enormous potential for financing the sector. As per an estimate, India needs Rs 31 trillion (US$ 454.83 billion) to be spent on infrastructure development over the next five years, with 70 per cent of funds needed for power, roads and urban infrastructure segments. It is essential that the stakeholders take the right steps to participate in this move and also make a decent return from this opportunity. Let me quickly recall here some of the important measures that the RBI has taken to help flow of funds to infrastructure:

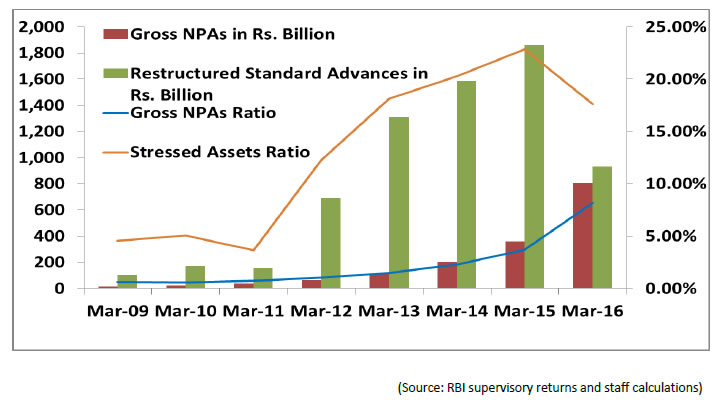

The Reserve bank has provided additional toolkits to banks to deal with stressed assets. A series of measures were announced after the framework for dealing with stressed assets was put out in February 2014. The mandatory need to form JLF in SMA22 exposures, determining a Corrective Action Plan or alternative measures to deal with a stressed asset, application of the flexible restructuring scheme in existing cases, the SDR, S4A etc., were part of the toolkits provided to banks. Additional time for completion of project was given where there was a change in management. We have recently reduced the threshold for applying these toolkits to the existing cases to cover a larger number of entities. Construction sector, which executes the projects for the infrastructure sector has also been recently brought within the purview of the flexible restructuring scheme, so that they are in a position to deal with stress. I alluded to the stressed assets scenario in the infrastructure sector. The gross NPAs of the infrastructure sector is about 8 percent of the total advances to that sector and accounts for nearly 13 percent of the NPAs of the banking sector. Total stressed assets including restructured standard assets of infrastructure sector was approximately 17 percent of the total banking sector exposure to the sector and about 21 percent of the total stressed assets. It is only appropriate that we take a look at this a little closely.  There are several reasons for the higher level of stressed assets in the infrastructure sector. Firstly, there is a need to properly structure the projects and their financing. These are long gestation projects that need to have a proper mix of equity and loan funding. The time lines for completion of project needs to be assessed realistically upfront, so that the date of DCCO is not artificially fixed without regard to the normal time taken for executing such projects. While a conservative estimate of the completion time will reduce the project cost, it can potentially sow the seeds for stress in the form of time and cost overruns. If one takes a close look at the reasons for extending the time for achieving DCCO, many are anticipatable and would not be good enough to be considered force majeure. Second, in many cases, the repayment schedule was not drawn commensurate with cash flows. There was the prevarication to recover the loan in a much shorter time frame than the project’s revenues would permit. This invariably stressed the entity, very often leading to repayments being managed through fresh borrowings and the like. This in turn, adds to the cost and builds stress. We have addressed this by making clear that banks can recover the loans over 85 percent of the economic life of the project so that further stress is not built because of how the repayment schedules were drawn in the past. Third, there were some force majeure factors like change in policies, non-availability of raw material, and the like. So what should be done to harness this potential opportunity both to contribute to the nation building and at the same time make it a win-win for all? I think the answer lies in avoiding the pitfalls of the earlier experience.

Way Forward A paper on Infrastructure financing by BIS states as under: “On financing side, challenges remain. Currently, infrastructure finance is dominated by direct equity investments and bank loans. Boosting infrastructure finance will require the broadening of the potential group of investors and the tapping of the vast financial resources of capital markets. This, in turn, necessitates a broader mix of financial instruments. Both infrastructure funds and bonds have great potential. The better and more widespread securitisation of bank loans seems desirable to diversify risks. It may also assist the development of transparent capital market instruments. For emerging markets, financial market development, trusted legal frameworks, and the development of a long-term investor base are pertinent” This is what we should work for. Hopefully, banks would soon move towards credit enhancement, so that other players are willing to subscribe to bonds issued by corporates executing infrastructure projects. It is also necessary that those with long maturity liabilities are encouraged to provide funds to the infrastructure projects. This apart, I feel there is a huge potential to raise money by way of issue of green bonds. India’s commitment to the Paris Climate Accord, makes it all the more important to work towards implementing infrastructure projects that are environmentally sustainable because it is both the need of the hour and there could be alternative sources for raising funds for projects that are environment friendly. We will have to set benchmarks for evaluation/rating of the emission prevention/avoidance/reduction that a project brings and harness the financing potential for such projects. Let me end by once again thanking ASSOCHAM for giving me the opportunity to share my thoughts on the subject and I am sure that the deliberations during the day will throw up new and actionable ideas to facilitate flow of funds for the infrastructure sector. 1 Chief Guest’s address delivered by Shri N. S. Vishwanathan, Deputy Governor, Reserve Bank of India at 6th National Summit organised by ASSOCHAM on ’ Infrastructure Finance - Building a New India’ in Mumbai on November 15, 2016. 2 Special Mention Account 2 – where principal and/or interest is overdue for more than 60 days |

पेज अंतिम अपडेट तारीख: