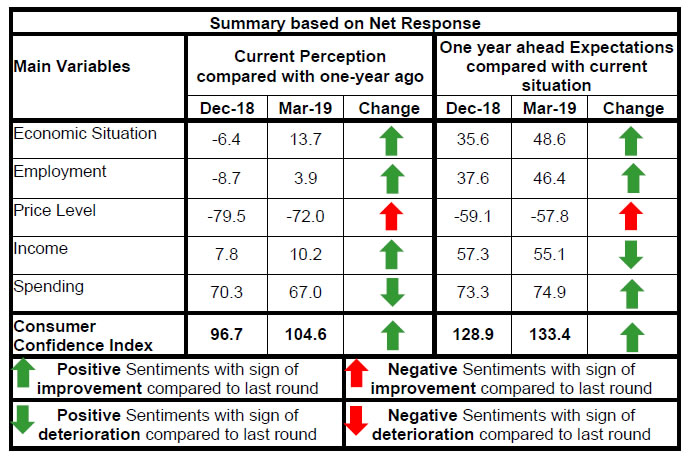

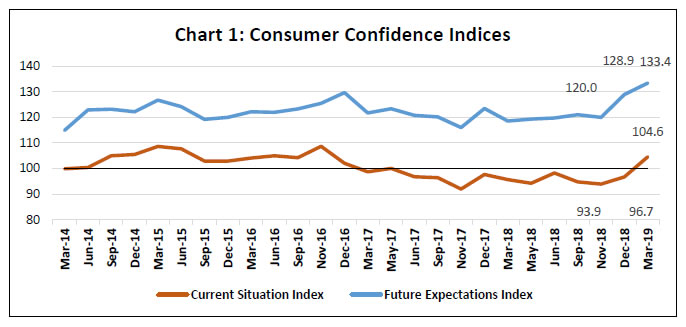

Today, the Reserve Bank released the results of the March 2019 round of its Consumer Confidence Survey (CCS)1. The survey was conducted in 13 major cities – Ahmedabad; Bengaluru; Bhopal; Chennai; Delhi; Guwahati; Hyderabad; Jaipur; Kolkata; Lucknow; Mumbai; Patna; and Thiruvananthapuram - and obtained 5,343 responses on households’ perceptions and expectations on the general economic situation, the employment scenario, the overall price situation and their own income and spending. Highlights: I. Consumer confidence improved for the second consecutive quarter in the March 2019 round. II. While the current situation index (CSI)2 returned to optimistic territory after a gap of two years, the future expectations index (FEI) touched 133.4, an all-time high in the survey’s history. III. The gains were largely driven by increased optimism about the general economic situation and the employment scenario (Chart 1). Note: Please see the excel file for time series data IV. Improvements seen in the December 2018 round in sentiments on the general economic situation gained traction in the March 2019 round, with both the current perceptions and expectations for the year ahead showing a marked rise (Table 1). V. The employment scenario, which had been the major worry for households for some time, entered the optimistic zone for the first time since the November 2016 round (Table 2). VI. Respondents perceived an improvement in the price situation during the last one year and also expected improvement in the next one year (Tables 3 and 4). VII. There is a gradual improvement in the households' sentiment on income as well – while 25 per cent of the respondents believed that their income was higher on a year-on-year basis in the March 2018 round, this share rose to 30 per cent in the recent round; expectations for the future have brightened in the last few rounds (Table 5). VIII. A marginal fall in the proportion of respondents reporting increase in overall spending over the past one year may be reflective of moderation in the price situation. However, the sentiment on discretionary spending is less upbeat than a year ago (Table 6, 7 and 8). | Table 1: Perceptions and Expectations on General Economic Situation | | (Percentage responses) | | Survey Round | Current Perception | One year ahead Expectation | | Improved | Remained Same | Worsened | Net Response | Will Improve | Will Remain Same | Will Worsen | Net Response | | Mar-18 | 34.9 | 23.4 | 41.7 | -6.8 | 49.7 | 22.8 | 27.5 | 22.2 | | May-18 | 32.5 | 19.6 | 47.9 | -15.4 | 50.6 | 22.1 | 27.4 | 23.2 | | Jun-18 | 36.4 | 21.9 | 41.8 | -5.4 | 50.4 | 23.0 | 26.6 | 23.8 | | Sep-18 | 33.7 | 22.1 | 44.3 | -10.6 | 53.2 | 16.7 | 30.2 | 23.0 | | Nov-18 | 33.2 | 21.6 | 45.2 | -12.0 | 53.6 | 15.3 | 31.2 | 22.4 | | Dec-18 | 36.7 | 20.2 | 43.1 | -6.4 | 59.9 | 15.8 | 24.3 | 35.6 | | Mar-19 | 46.2 | 21.3 | 32.5 | 13.7 | 66.4 | 15.8 | 17.8 | 48.6 |

| Table 2: Perceptions and Expectations on Employment | | (Percentage responses) | | Survey Round | Current Perception | One year ahead Expectation | | Improved | Remained Same | Worsened | Net Response | Will Improve | Will Remain Same | Will Worsen | Net Response | | Mar-18 | 31.2 | 26.0 | 42.8 | -11.6 | 50.8 | 24.3 | 24.9 | 26.0 | | May-18 | 32.1 | 24.0 | 43.9 | -11.8 | 51.0 | 24.4 | 24.6 | 26.5 | | Jun-18 | 34.7 | 26.4 | 38.9 | -4.1 | 50.9 | 25.8 | 23.4 | 27.5 | | Sep-18 | 35.2 | 19.3 | 45.5 | -10.3 | 54.1 | 17.0 | 29.0 | 25.1 | | Nov-18 | 33.9 | 18.9 | 47.2 | -13.3 | 53.5 | 16.1 | 30.4 | 23.1 | | Dec-18 | 35.6 | 20.1 | 44.3 | -8.7 | 60.3 | 17.1 | 22.7 | 37.6 | | Mar-19 | 41.1 | 21.7 | 37.2 | 3.9 | 65.3 | 15.9 | 18.9 | 46.4 |

| Table 3: Perceptions and Expectations on Price Level | | (Percentage responses) | | Survey Round | Current Perception | One year ahead Expectation | | Increased | Remained Same | Decreased | Net Response | Will Increase | Will Remain Same | Will Decrease | Net Response | | Mar-18 | 87.1 | 9.2 | 3.7 | -83.5 | 81.9 | 11.0 | 7.1 | -74.8 | | May-18 | 87.9 | 8.7 | 3.3 | -84.6 | 82.7 | 11.0 | 6.4 | -76.3 | | Jun-18 | 89.1 | 7.9 | 3.0 | -86.0 | 82.8 | 11.8 | 5.4 | -77.4 | | Sep-18 | 88.3 | 8.5 | 3.2 | -85.1 | 80.1 | 12.0 | 7.9 | -72.2 | | Nov-18 | 88.3 | 7.8 | 3.8 | -84.5 | 80.2 | 11.6 | 8.2 | -72.0 | | Dec-18 | 84.3 | 10.9 | 4.8 | -79.5 | 71.6 | 15.9 | 12.5 | -59.1 | | Mar-19 | 77.8 | 16.4 | 5.8 | -72.0 | 68.7 | 20.5 | 10.9 | -57.8 |

| Table 4: Perceptions and Expectations on Rate of Change in Price Level (Inflation)* | | (Percentage responses) | | Survey Round | Current Perception | One year ahead Expectation | | Increased | Remained Same | Decreased | Net Response | Will Increase | Will Remain Same | Will Decrease | Net Response | | Mar-18 | 81.0 | 12.4 | 6.6 | -74.4 | 81.5 | 12.5 | 6.1 | -75.4 | | May-18 | 80.4 | 12.7 | 6.9 | -73.5 | 79.2 | 15.4 | 5.5 | -73.7 | | Jun-18 | 81.8 | 10.5 | 7.7 | -74.2 | 79.4 | 13.7 | 6.9 | -72.5 | | Sep-18 | 80.8 | 13.2 | 6.1 | -74.7 | 79.8 | 14.2 | 6.1 | -73.7 | | Nov-18 | 80.0 | 13.9 | 6.1 | -73.9 | 75.9 | 18.0 | 6.1 | -69.8 | | Dec-18 | 77.9 | 15.2 | 6.9 | -71.0 | 76.3 | 17.3 | 6.4 | -69.9 | | Mar-19 | 72.5 | 20.0 | 7.6 | -64.9 | 72.9 | 20.8 | 6.3 | -66.6 | | *Applicable only for those respondents who felt price has increased/price will increase. |

| Table 5: Perceptions and Expectations on Income | | (Percentage responses) | | Survey Round | Current Perception | One year ahead Expectation | | Increased | Remained Same | Decreased | Net Response | Will Increase | Will Remain Same | Will Decrease | Net Response | | Mar-18 | 24.5 | 50.1 | 25.4 | -0.9 | 48.6 | 39.6 | 11.9 | 36.8 | | May-18 | 27.6 | 47.8 | 24.6 | 3.0 | 51.4 | 38.2 | 10.4 | 41.0 | | Jun-18 | 27.1 | 50.8 | 22.1 | 5.0 | 51.3 | 38.0 | 10.7 | 40.5 | | Sep-18 | 28.3 | 48.3 | 23.4 | 4.9 | 59.1 | 33.1 | 7.8 | 51.3 | | Nov-18 | 29.9 | 49.5 | 20.5 | 9.4 | 59.0 | 34.3 | 6.7 | 52.3 | | Dec-18 | 29.8 | 48.2 | 22.0 | 7.8 | 63.5 | 30.4 | 6.2 | 57.3 | | Mar-19 | 30.1 | 50.0 | 19.9 | 10.2 | 60.8 | 33.4 | 5.7 | 55.1 |

| Table 6: Perceptions and Expectations on Spending | | (Percentage responses) | | Survey Round | Current Perception | One year ahead Expectation | | Increased | Remained Same | Decreased | Net Response | Will Increase | Will Remain Same | Will Decrease | Net Response | | Mar-18 | 83.1 | 14.9 | 2.1 | 81.0 | 85.2 | 12.3 | 2.5 | 82.8 | | May-18 | 82.6 | 14.8 | 2.7 | 79.9 | 84.8 | 12.6 | 2.6 | 82.2 | | Jun-18 | 83.8 | 14.1 | 2.0 | 81.8 | 86.5 | 11.3 | 2.2 | 84.4 | | Sep-18 | 78.4 | 18.2 | 3.5 | 74.9 | 81.2 | 15.7 | 3.1 | 78.1 | | Nov-18 | 73.0 | 23.9 | 3.1 | 69.9 | 77.6 | 19.0 | 3.4 | 74.2 | | Dec-18 | 73.8 | 22.7 | 3.5 | 70.3 | 77.3 | 18.7 | 4.0 | 73.3 | | Mar-19 | 70.1 | 26.8 | 3.1 | 67.0 | 77.5 | 19.9 | 2.6 | 74.9 |

| Table 7: Perceptions and Expectations on Spending- Essential Items | | (Percentage responses) | | Survey Round | Current Perception | One year ahead Expectation | | Increased | Remained Same | Decreased | Net Response | Will Increase | Will Remain Same | Will Decrease | Net Response | | Mar-18 | 83.8 | 13.7 | 2.5 | 81.3 | 85.2 | 11.6 | 3.2 | 82.0 | | May-18 | 85.2 | 11.8 | 3.0 | 82.2 | 85.1 | 11.2 | 3.7 | 81.4 | | Jun-18 | 86.6 | 11.1 | 2.3 | 84.3 | 87.5 | 10.0 | 2.5 | 85.0 | | Sep-18 | 83.6 | 13.1 | 3.4 | 80.2 | 84.2 | 13.1 | 2.7 | 81.5 | | Nov-18 | 83.4 | 13.4 | 3.2 | 80.2 | 84.1 | 12.5 | 3.3 | 80.8 | | Dec-18 | 82.4 | 14.5 | 3.1 | 79.3 | 83.5 | 13.0 | 3.4 | 80.1 | | Mar-19 | 78.6 | 18.2 | 3.2 | 75.4 | 83.4 | 14.3 | 2.3 | 81.1 |

| Table 8: Perceptions and Expectations on Spending- Non-Essential Items | | (Percentage responses) | | Survey Round | Current Perception | One year ahead Expectation | | Increased | Remained Same | Decreased | Net Response | Will Increase | Will Remain Same | Will Decrease | Net Response | | Mar-18 | 56.0 | 31.4 | 12.6 | 43.4 | 62.8 | 28.0 | 9.2 | 53.7 | | May-18 | 52.3 | 32.5 | 15.1 | 37.2 | 58.7 | 31.0 | 10.3 | 48.4 | | Jun-18 | 55.4 | 32.9 | 11.7 | 43.8 | 62.7 | 28.0 | 9.3 | 53.4 | | Sep-18 | 44.0 | 34.3 | 21.7 | 22.3 | 49.2 | 33.3 | 17.5 | 31.7 | | Nov-18 | 39.1 | 37.6 | 23.3 | 15.8 | 44.5 | 35.9 | 19.6 | 24.9 | | Dec-18 | 38.4 | 37.5 | 24.1 | 14.3 | 46.1 | 33.0 | 20.9 | 25.2 | | Mar-19 | 36.3 | 43.3 | 20.4 | 15.9 | 46.1 | 37.6 | 16.3 | 29.8 |

|  IST,

IST,