IST,

IST,

Core Investment Companies

B. Registration and related matters:

Ans: Yes, CICs presently registered with the Bank but fulfilling the criteria for ‘Unregistered CICs’ as defined under para 6 of the Master Direction DoR(NBFC).PD.003/03.10.119/2016-17 date August 25, 2016 can seek voluntary deregistration. Both audited balance sheet and auditor’s certificate are required to be submitted for the purpose.

Portfolio Investment Positions (PIP) by Counterpart Economy (formerly CPIS) – India

Some important definitions and concepts

Ans: Debt securities with original maturity of more than one year is classified as long-term debt securities. These include bonds, debentures, and notes that usually give the holder the unconditional right to a fixed cash flow or contractually determined variable money income.

FAQs on Non-Banking Financial Companies

Mutual benefit financial companies (nidhis)

Annual Return on Foreign Liabilities and Assets (FLA) under FEMA 1999

Procedure for submission of the FLA return

Ans: Please follow the below given step to revise the FLA return for a previous year:

Visit https://flair.rbi.org.in/fla/faces/pages/login.xhtml → Login to FLAIR → Click on MENU tab on the left-hand side of the homepage → ONLINE FLA FORM → FLA ONLINE FORM → “Please click here to get the approval to fill revised FLA form for current year after due date /previous year” → select "Year" and click on  → Click “Request”.

→ Click “Request”.

Your request status will be visible in the table below available on the screen. After sending request to RBI through FLA portal, entities need to wait for at least one working day for approval. Entities can check the status of their request in “Multiple Year Enable Screen” under menu on the left corner. Once approved by DSIM, RBI, the entity can revise FLA return for selected year.

Domestic Deposits

II. Deposits of Non-Residents Indians (NRIs)

Retail Direct Scheme

Nomination related queries

Business restrictions imposed on Paytm Payments Bank Limited vide Press Releases dated January 31 and February 16, 2024

Merchants using Paytm Payments Bank to receive payments

Government Securities Market in India – A Primer

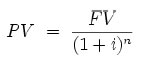

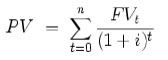

The time value of money functions related to calculation of Present Value (PV), Future Value (FV), etc. are important mathematical concepts related to bond market. An outline of the same with illustrations is provided in Box II below.

| Time Value of Money Money has time value as a Rupee today is more valuable and useful than a Rupee a year later. The concept of time value of money is based on the premise that an investor prefers to receive a payment of a fixed amount of money today, rather than an equal amount in the future, all else being equal. In particular, if one receives the payment today, one can then earn interest on the money until that specified future date. Further, in an inflationary environment, a Rupee today will have greater purchasing power than after a year. Present value of a future sum The present value formula is the core formula for the time value of money. The present value (PV) formula has four variables, each of which can be solved for: Present Value (PV) is the value at time=0  The cumulative present value of future cash flows can be calculated by adding the contributions of FVt, the value of cash flow at time=t  An illustration Taking the cash flows as;

Assuming that the interest rate is at 10% per annum; The discount factor for each year can be calculated as 1/(1+interest rate)^no. of years The present value can then be worked out as Amount x discount factor The PV of ₹100 accruing after 3 years:

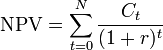

The cumulative present value = 90.91+82.64+75.13 = ₹ 248.69 Net Present Value (NPV) Net present value (NPV) or net present worth (NPW) is defined as the present value of net cash flows. It is a standard method for using the time value of money to appraise long-term projects. Used for capital budgeting, and widely throughout economics, it measures the excess or shortfall of cash flows, in present value (PV) terms, once financing charges are met. Formula Each cash inflow/outflow is discounted back to its present value (PV). Then they are summed. Therefore  Where In the illustration given above under the Present value, if the three cash flows accrues on a deposit of ₹ 240, the NPV of the investment is equal to 248.69-240 = ₹ 8.69 |

External Commercial Borrowings (ECB) and Trade Credits

G. ALL-IN-COST

Foreign Investment in India

Answer: There are no restrictions under FEMA for investment in Rights shares issued at a discount by an Indian company under the provisions of the Companies Act, 2013. The offer on rights basis to the persons resident outside India shall be:

-

in case of shares of a company listed on a recognized stock exchange in India, at a price, as determined by the company; and

-

in case of shares of a company not listed on a recognized stock exchange in India, at a price, which is not less than the price at which the offer on right basis is made to resident shareholders.

Indian Currency

C) Different Types of Bank Notes and Security Features of banknotes

The details are as under:

i. Ashoka Pillar Banknotes:

The first banknote issued by independent India was the one rupee note issued in 1949. While retaining the same designs the new banknotes were issued with the symbol of Lion Capital of Ashoka Pillar at Sarnath in the watermark window in place of the portrait of King George.

The name of the issuer, the denomination and the guarantee clause were printed in Hindi on the new banknotes from the year 1951. The banknotes in the denomination of ₹1000, ₹5000 and ₹10000 were issued in the year 1954. Banknotes in Ashoka Pillar watermark Series, in ₹10 denomination were issued between 1967 and 1992, ₹20 denomination in 1972 and 1975, ₹50 in 1975 and 1981, and ₹100 between 1967-1979. The banknotes issued during the above period, contained the symbols representing science and technology, progress, orientation to Indian Art forms. In the year 1970, banknotes with the legend "Satyameva Jayate", i.e., truth alone shall prevail were introduced for the first time. In October 1987, ₹500, banknote was introduced with the portrait of Mahatma Gandhi and the Ashoka Pillar watermark.

ii. Mahatma Gandhi (MG) Series 1996

The details of banknotes issued in MG Series – 1996 is as under:

| Denomination | Month and year of introduction |

| ₹5 | November 2001 |

| ₹10 | June 1996 |

| ₹20 | August 2001 |

| ₹50 | March 1997 |

| ₹100 | June 1996 |

| ₹500 | October 1997 |

| ₹1000 | November 2000 |

All the banknotes of this series bear the portrait of Mahatma Gandhi on the obverse (front) side, in place of symbol of Lion Capital of Ashoka Pillar, which has also been retained and shifted to the left side next to the watermark window. This means that these banknotes contain Mahatma Gandhi watermark as well as Mahatma Gandhi's portrait.

iii. Mahatma Gandhi series – 2005 banknotes

MG series 2005 banknotes were issued in the denomination of ₹10, ₹20, ₹50, ₹100, ₹500 and ₹1000 and contain some additional/new security features as compared to the 1996 MG series. The year of introduction of these banknotes is as under:

| Denomination | Month and year of Introduction |

| ₹50 and ₹100 | August 2005 |

| ₹500 and ₹1000 | October 2005 |

| ₹10 | April 2006 |

| ₹20 | August 2006 |

The Legal tender of banknotes of ₹500 and ₹1000 of this series was subsequently withdrawn w.e.f. the midnight of November 8, 2016.

iv. Mahatma Gandhi (New) Series (MGNS) – Nov 2016

The Mahatma Gandhi (New) Series, introduced in the year 2016, highlights the cultural heritage and scientific achievements of the country. The banknotes in the series are more wallet friendly, being of reduced dimensions and hence expected to incur less wear and tear. For the first time, designs for banknotes has been indigenously developed on themes reflecting the diverse history, culture and ethos of the country as also its scientific achievements. The colour scheme is sharp and vivid to make the banknotes distinctive.

The first banknote from the new series was introduced on November 8, 2016 in a new denomination i.e. ₹2000 with the theme of Mangalyaan. Subsequently, banknotes in this series in denomination of ₹500, ₹200, ₹100, ₹50, ₹20, and ₹10 have also been introduced.

All you wanted to know about NBFCs

B. Entities Regulated by RBI and applicable regulations

The resolution of stressed assets are subject to the provisions of (a) the Prudential Framework for Resolution of Stressed Assets as contained in para 18 and (b) norms on restructuring of advances as contained in para 22, 23, 24 and 25 of the Master Direction – Reserve Bank of India (Non-Banking Financial Company – Scale Based Regulation) 2023 (as amended from time to time). The acquisition of shares due to conversion of debt into equity during a restructuring process will be exempted from regulatory ceilings on capital market exposures.

Core Investment Companies

B. Registration and related matters:

Ans: Yes, company which is a CIC and has achieved the balance sheet size of ₹ 100 crore as per its last audited annual financial statement is required to apply to the Bank for registration as a CIC, subject to its meeting the other conditions for being identified as a CIC.

Portfolio Investment Positions (PIP) by Counterpart Economy (formerly CPIS) – India

Some important definitions and concepts

Ans: Debt securities with original maturity of one year or less is classified as short-term debt securities. Examples of short-term securities are treasury bills, negotiable certificates of deposit, bankers’ acceptances, promissory notes, and commercial paper.

FAQs on Non-Banking Financial Companies

Mutual benefit financial companies (nidhis)

Annual Return on Foreign Liabilities and Assets (FLA) under FEMA 1999

Some Useful Definitions

Ans: Direct investment is a category of international investment in which a resident entity in one economy [Direct Investor (DI)] acquires a lasting interest in an enterprise resident in another economy [Direct Investment Enterprise (DIE)]. It consists of two components, viz., Equity Capital and Other Capital.

Domestic Deposits

II. Deposits of Non-Residents Indians (NRIs)

Retail Direct Scheme

Nomination related queries

Business restrictions imposed on Paytm Payments Bank Limited vide Press Releases dated January 31 and February 16, 2024

Merchants using Paytm Payments Bank to receive payments

Government Securities Market in India – A Primer

The price of a bond is nothing but the sum of present value of all future cash flows of the bond. The interest rate used for discounting the cash flows is the Yield to Maturity (YTM) (explained in detail in question no. 24) of the bond. Price can be calculated using the excel function ‘Price’ (please refer to Annex 6).

Accrued interest is the interest calculated for the broken period from the last coupon day till a day prior to the settlement date of the trade. Since the seller of the security is holding the security for the period up to the day prior to the settlement date of the trade, he is entitled to receive the coupon for the period held. During settlement of the trade, the buyer of security will pay the accrued interest in addition to the agreed price and pays the ‘consideration amount’.

An illustration is given below;

For a trade of ₹ 5 crore (face value) of security 8.83% 2023 for settlement date Jan 30, 2014 at a price of ₹100.50, the consideration amount payable to the seller of the security is worked out below:

Here the price quoted is called ‘clean price’ as the ‘accrued interest’ component is not added to it.

Accrued interest:

The last coupon date being Nov 25, 2013, the number of days in broken period till Jan 29, 2014 (one day prior to settlement date i.e. on trade day) are 65.

| The accrued interest on ₹100 face value for 65 days | = 8.83 x (65/360) |

| = ₹1.5943 |

When we add the accrued interest component to the ‘clean price’, the resultant price is called the ‘dirty price’. In the instant case, it is 100.50+1.5943 = ₹102.0943

| The total consideration amount | = Face value of trade x dirty price |

| = 5,00,00,000 x (102.0943/100) | |

| = ₹ 5,10,47,150 |

पेज अंतिम अपडेट तारीख: