IST,

IST,

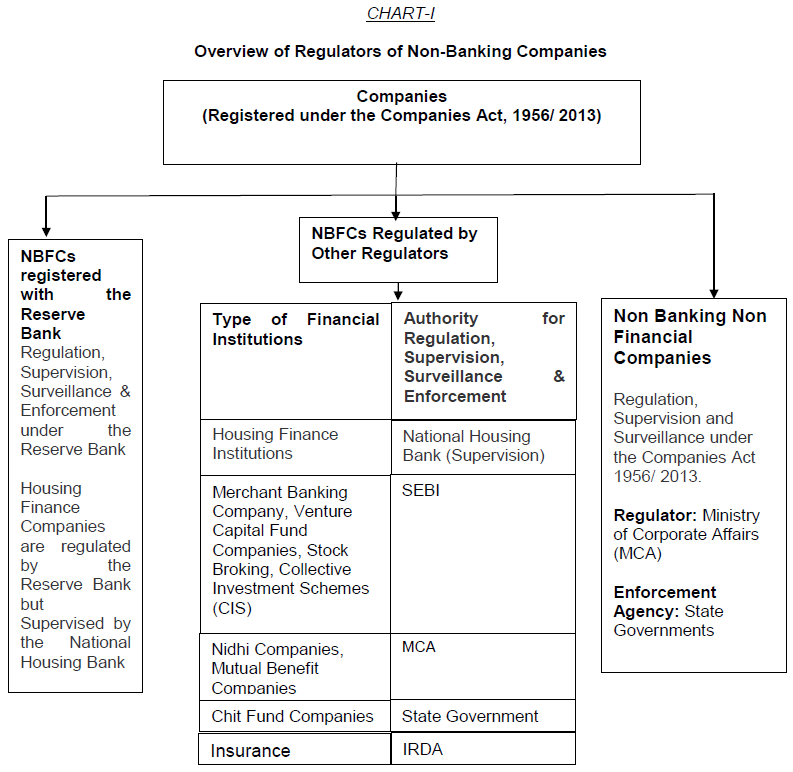

All you wanted to know about NBFCs

G. Other/ miscellaneous aspects

NBFC-IFCs can lend to/ invest in InvITs subject to adherence to applicable regulatory guidelines including exposure norms applicable to them. NBFC-IFCs can also lend to/ invest in other trust funds subject to compliance with the criterion of deployment of minimum 75 per cent of total assets towards infrastructure lending and other applicable regulations.

FAQs on Non-Banking Financial Companies

Depositor Awareness

Indian Currency

F) COINS

Customers aggrieved with the services provided by the banks and a related grievance not resolved to the satisfaction of the customers, or not replied to within a period of 30 days by the bank may approach the RBI Ombudsman under ‘The Reserve Bank - Integrated Ombudsman Scheme, 2021’. Complaints can be filed online on https://cms.rbi.org.in and also through the dedicated e-mail or sent in physical mode to the ‘Centralised Receipt and Processing Centre’ set up at Reserve Bank of India, 4th Floor, Sector 17, Chandigarh - 160017 with the bank/ postal receipts as proof for necessary action.

FAQs on Non-Banking Financial Companies

Depositor Awareness

RNBCs

Nomination facility

All you wanted to know about NBFCs

H. Other/ miscellaneous aspects

Disclaimer: These FAQs are issued by the Reserve Bank for information and general guidance purposes only. The Reserve Bank will not be held responsible for actions taken and/or decisions made on the basis of the same. For clarifications or interpretations, if any, one may be guided by the relevant circulars and notifications issued from time to time.

| Related Press Release | |

| May 31, 2013 | Check before Depositing Money with Financial Entities: RBI Advisory |

पेज अंतिम अपडेट तारीख: