IST,

IST,

Annual Return on Foreign Liabilities and Assets (FLA) under FEMA 1999

Some Useful Definitions

Ans: The other capital component (receivables and payables, except equity and participating preference shares investment) of direct investment covers the outstanding liabilities or claims arising due to borrowing and lending of funds, investment in debt securities, trade credits, financial leasing, share application money etc., between direct investors and DIEs and between two DIEs that share the same direct Investor. Non-participating preference shares owned by the direct investor are treated as debt securities & should be included in ‘other capital’.

Domestic Deposits

II. Deposits of Non-Residents Indians (NRIs)

Retail Direct Scheme

Nomination related queries

Business restrictions imposed on Paytm Payments Bank Limited vide Press Releases dated January 31 and February 16, 2024

Aadhar enabled Payment System (AePS)

Government Securities Market in India – A Primer

24.1 An investor who purchases a bond can expect to receive a return from one or more of the following sources:

-

The coupon interest payments made by the issuer;

-

Any capital gain (or capital loss) when the bond is sold/matured; and

-

Income from reinvestment of the interest payments that is interest-on-interest.

The three yield measures commonly used by investors to measure the potential return from investing in a bond are briefly described below:

i) Coupon Yield

24.2 The coupon yield is simply the coupon payment as a percentage of the face value. Coupon yield refers to nominal interest payable on a fixed income security like G-Sec. This is the fixed return the Government (i.e., the issuer) commits to pay to the investor. Coupon yield thus does not reflect the impact of interest rate movement and inflation on the nominal interest that the Government pays.

Coupon yield = Coupon Payment / Face Value

Illustration:

Coupon: 8.24

Face Value: ₹100

Market Value: ₹103.00

Coupon yield = 8.24/100 = 8.24%

ii) Current Yield

24.3 The current yield is simply the coupon payment as a percentage of the bond’s purchase price; in other words, it is the return a holder of the bond gets against its purchase price which may be more or less than the face value or the par value. The current yield does not take into account the reinvestment of the interest income received periodically.

Current yield = (Annual coupon rate / Purchase price) X100

Illustration:

The current yield for a 10 year 8.24% coupon bond selling for ₹103.00 per ₹100 par value is calculated below:

Annual coupon interest = 8.24% x ₹100 = ₹8.24

Current yield = (8.24/103) X 100 = 8.00%

The current yield considers only the coupon interest and ignores other sources of return that will affect an investor’s return.

iii) Yield to Maturity

24.4 Yield to Maturity (YTM) is the expected rate of return on a bond if it is held until its maturity. The price of a bond is simply the sum of the present values of all its remaining cash flows. Present value is calculated by discounting each cash flow at a rate; this rate is the YTM. Thus, YTM is the discount rate which equates the present value of the future cash flows from a bond to its current market price. In other words, it is the internal rate of return on the bond. The calculation of YTM involves a trial-and-error procedure. A calculator or software can be used to obtain a bond’s YTM easily (please see the Box III).

| YTM Calculation YTM could be calculated manually as well as using functions in any standard spread sheet like MS Excel. Manual (Trial and Error) Method Manual or trial and error method is complicated because G-Secs have many cash flows running into future. This is explained by taking an example below. Take a two year security bearing a coupon of 8% and a price of say ₹ 102 per face value of ₹ 100; the YTM could be calculated by solving for ‘r’ below. Typically, it involves trial and error by taking a value for ‘r’ and solving the equation and if the right hand side is more than 102, take a higher value of ‘r’ and solve again. Linear interpolation technique may also be used to find out exact ‘r’ once we have two ‘r’ values so that the price value is more than 102 for one and less than 102 for the other value.

Spread Sheet Method using MS Excel In the MS Excel programme, the following function could be used for calculating the yield of periodically coupon paying securities, given the price. YIELD (settlement,maturity,rate,price,redemption,frequency,basis) Wherein; Settlement is the security's settlement date. The security settlement date is the date on which the security and funds are exchanged. Maturity is the security's maturity date. The maturity date is the date when the security expires. Rate is the security's annual coupon rate. Price is the security's price per ₹100 face value. Redemption is the security's redemption value per ₹100 face value. Frequency is the number of coupon payments per year. (2 for Government bonds in India) Basis is the type of day count basis to use. (4 for Government bonds in India which uses 30/360 basis) |

External Commercial Borrowings (ECB) and Trade Credits

G. END-USES

Foreign Investment in India

Answer: The following persons can acquire capital instruments on the stock exchanges:

-

FPIs registered with SEBI

-

NRIs

-

Other than (a) and (b) above, a person resident outside India, can acquire capital instruments on stock exchange, subject to the condition that the investor has already acquired and continues to hold the control of such company in accordance with SEBI (Substantial Acquisition of Shares and Takeover) Regulations and subject to conditions specified in Annex I of the Master Direction – Foreign Investment in India.

Indian Currency

C) Different Types of Bank Notes and Security Features of banknotes

Both old and new design notes usually circulate together for a while. The old design notes are then gradually withdrawn from circulation when they become unfit to be re-issued.

All you wanted to know about NBFCs

B. Entities Regulated by RBI and applicable regulations

The regulations would be applicable and the type of encumbrance created is immaterial.

Coordinated Portfolio Investment Survey – India

Contact Details for query related to CPIS

Ans: Queries/clarifications on CPIS may be sought from the RBI at the following address:

International Investment Position Division (IIPD)

Department of Statistics and Information Management (DSIM)

Reserve Bank of India

C-9/5 th Floor, Bandra - Kurla Complex, Bandra East

Mumbai, Maharashtra – 400 051

Email: cpis@rbi.org.in

Core Investment Companies

D. Miscellaneous:

Ans: Anything that has to be repaid to any other legal entity/ person will be an outside liability.

FAQs on Non-Banking Financial Companies

Classification of NBFCs into sub-groups

Domestic Deposits

II. Deposits of Non-Residents Indians (NRIs)

Annual Return on Foreign Liabilities and Assets (FLA) under FEMA 1999

Some Useful Definitions

Ans: An enterprise is said to have a centre of economic interest and to be a resident unit of a country (economic territory) when the enterprise is engaged in a significant amount of production of goods and/or services in that centre or when it owns land or buildings located in that centre. The enterprise must maintain at least one production establishment in the country and must plan to operate the establishment indefinitely or over a long period of time.

Retail Direct Scheme

Nomination related queries

Business restrictions imposed on Paytm Payments Bank Limited vide Press Releases dated January 31 and February 16, 2024

Money Transfer through UPI/ IMPS

External Commercial Borrowings (ECB) and Trade Credits

G. END-USES

Government Securities Market in India – A Primer

Day count convention refers to the method used for arriving at the holding period (number of days) of a bond to calculate the accrued interest. As the use of different day count conventions can result in different accrued interest amounts, it is appropriate that all the participants in the market follow a uniform day count convention.

For example, the conventions followed in Indian market are given below.

Bond market: The day count convention followed is 30/360, which means that irrespective of the actual number of days in a month, the number of days in a month is taken as 30 and the number of days in a year is taken as 360.

Money market: The day count convention followed is actual/365, which means that the actual number of days in a month is taken for number of days (numerator) whereas the number of days in a year is taken as 365 days. Hence, in the case of T-Bills, which are essentially money market instruments, money market convention is followed.

In some countries, participants use actual/actual, some countries use actual/360 while some use 30/actual. Hence the convention changes in different countries and in different markets within the same country (eg. Money market convention is different than the bond market convention in India).

Foreign Investment in India

Indian Currency

C) Different Types of Bank Notes and Security Features of banknotes

Central banks the world over change the design of their banknotes and introduce new security features primarily to make counterfeiting difficult and to stay ahead of counterfeiters. India also follows the same policy.

All you wanted to know about NBFCs

B. Entities Regulated by RBI and applicable regulations

No, the definition of “companies in the group” is only for the purpose of determining the applicability of prudential norms on multiple NBFCs in a group.

Coordinated Portfolio Investment Survey – India

Updated: डिसें 01, 2023

Special instructions for banks

Ans: No, investments made by branches of your bank located outside India should not be included in CPIS.

Core Investment Companies

D. Miscellaneous:

Ans: The period of 10 years was specified as a prudential measure not necessarily in alignment with a provision of the Companies Act. Moreover, the issue here is not public deposits but Outside Liabilities.

FAQs on Non-Banking Financial Companies

Classification of NBFCs into sub-groups

Retail Direct Scheme

Investment and Account holdings related queries

While the primary auctions are conducted generally on specified days of the week as given in the table below, these days may differ due to holidays or other considerations. Half yearly indicative calendars are published on RBI website for Government of India’s dated securities and Sovereign Gold Bonds whereas quarterly indicative calendars are published for Treasury Bills and State Development loans. For details visit /en/web/rbi

| S. No. | Government security | Primary auction usually held on |

| 1 | Government of India Treasury Bills (T-Bills) | Wednesdays |

| 2 | Government of India dated securities (dated G-Sec) | Fridays |

| 3 | State Development Loans (SDLs) | Tuesdays |

| 4 | Sovereign Gold Bonds (SGB) | Weekly windows announced by RBI in its press release |

Annual Return on Foreign Liabilities and Assets (FLA) under FEMA 1999

Some Useful Definitions

Ans:

Foreign Subsidiary: An Indian entity is called as a Foreign Subsidiary if a non-resident investor owns more than 50% of the voting power/equity capital OR where a non-resident investor and its subsidiary(s) combined own more than 50% of the voting power/equity capital of an Indian enterprise.

Foreign Associate: An Indian entity is called as Foreign Associate if non-resident investor owns at least 10% and no more than 50% of the voting power/equity capital OR where non-resident investor and its subsidiary(s) combined own at least 10% but no more than 50% of the voting power/equity capital of an Indian enterprise.

Special Purpose Vehicle: A special purpose Vehicle (SPV) is a legal entity (usually a limited company of some type or, sometimes, a limited partnership) created to fulfil narrow, specific or temporary objectives. SPV have little or no employment, or operations, or physical presence in the jurisdiction in which they are created by their parent enterprises, which are typically located in other jurisdictions (economies). They are often used as devices to raise capital or to hold assets and liabilities and usually do not undertake significant production.

Domestic Deposits

III. Advances

Business restrictions imposed on Paytm Payments Bank Limited vide Press Releases dated January 31 and February 16, 2024

Money Transfer through UPI/ IMPS

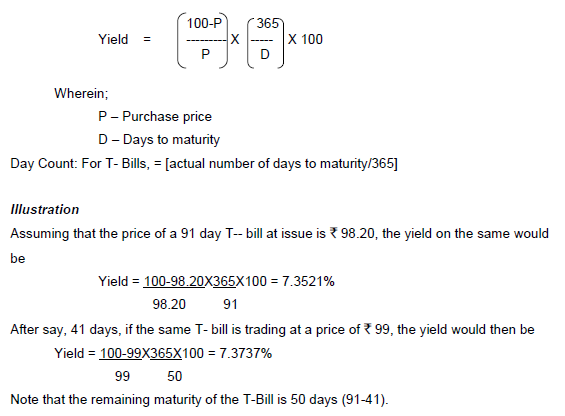

Government Securities Market in India – A Primer

It is calculated as per the following formula

External Commercial Borrowings (ECB) and Trade Credits

G. END-USES

Foreign Investment in India

Indian Currency

C) Different Types of Bank Notes and Security Features of banknotes

The security features in MG Series 2005 and MG (New) Series banknotes are as under:

i. Security Thread: The silver-coloured machine-readable security thread in ₹10, ₹20 and ₹50 denomination banknotes is windowed on front side and fully embedded on reverse side. The thread fluoresces in yellow on both sides under ultraviolet light. The thread appears as a continuous line from behind when held up against light. ₹100 and above denomination banknotes have machine-readable windowed security thread with colour shift from green to blue when viewed from different angles. It fluoresces in yellow on the reverse and the text will fluoresce on the obverse under ultraviolet light.

ii. Intaglio Printing: The portrait of Mahatma Gandhi, Reserve Bank seal, Guarantee and promise clause, Ashoka Pillar emblem, RBI’s Governor's signature and the identification mark for the visually impaired persons are printed in intaglio in denominations ₹100 and above.

iii. See through register: On the left side of the note, a part of the numeral of each denomination is printed on the obverse (front) and the other part on the reverse. The accurate back-to-back registration makes the numeral appear as one when viewed against light.

iv. Water Mark and electrotype watermark: The banknotes contain the portrait of Mahatma Gandhi in the watermark window with a light and shade effect and multi-directional lines. An electrotype mark showing the denominational numeral in each denomination banknote also appears in the watermark widow and these can be viewed better when the banknote is held against light.

v. Colour Shifting Ink: The numeral 200, 500 & 2000 on the ₹200, ₹500, and ₹2000* banknotes are printed in a colour-shifting ink. The colour of these numerals appears green when the banknotes are held flat but would change to blue when the banknotes are held at an angle.

vi. Fluorescence: The number panels of the banknotes are printed in fluorescent ink. The banknotes also have dual-coloured optical fibres. Both can be seen when the banknotes are exposed to ultra-violet lamp.

vii. Latent Image: In the banknotes of ₹20 and above in the MG-2005 Series, the vertical band next to the (right side) Mahatma Gandhi’s portrait contains a latent image, showing the denominational value. The value can be seen only when the banknote is held horizontally, and light allowed to fall on it; otherwise, this feature appears only as a vertical band. In the MG (New) Series banknotes, the latent image exists in denominations ₹100 and above.

viii. Micro letterings: This feature appears at different places on the banknotes and can be seen better under a magnifying glass.

ix. Additional Features introduced since 2015:

• New Numbering Pattern

The numerals in both the number panels of the banknotes are in ascending size from left to right while the first three alpha-numeric characters (prefix) will remain constant in size.

• Angular Bleed Lines and Increase in the size of Identification Marks

Angular Bleed Lines have been introduced in banknotes - 4 lines in 2 blocks in ₹100, 4 angular bleed lines with two circles in between in ₹200, 5 lines in 3 blocks in ₹500, 7 in ₹2000*. In addition, the size of the identification marks in denominations ₹100 and above have been increased by 50 percent.

Information about the above security features present in the Indian banknotes denomination-wise is also available on the website www.rbi.org.in>>press releases. Alternately, information can also be accessed from https://website.rbi.org.in/web/rbi/-/notifications/master-circular-detection-and-impounding-of-counterfeit-notes-11610.

*₹2000 denomination notes continue to be legal tender. For more details, please refer to our press release 2023-2024/851 dated September 01, 2023 (https://rbi.org.in/web/rbi/-/press-releases/withdrawal-of-%E2%82%B92000-denomination-banknotes-status-56301).

All you wanted to know about NBFCs

B. Entities Regulated by RBI and applicable regulations

Yes, prior approval would be required in all cases of acquisition/ transfer of shareholding of 26 per cent or more of the paid up equity capital of an NBFC.

Coordinated Portfolio Investment Survey – India

Updated: डिसें 01, 2023

Special instructions for banks

Ans: Yes, it should be included.

Core Investment Companies

D. Miscellaneous:

Ans: The term used in the CIC Master Direction is block sale and not block deal which has been defined by SEBI. In the context of the Master Direction, a block sale would be a long term or strategic sale made for purposes of disinvestment or investment and not for short term trading. Unlike a block deal, there is no minimum number/value defined for the purpose.

Domestic Deposits

III. Advances

An illustrative list of Intermediary Agencies is as under;

-

State Sponsored organizations for on-lending to Weaker Sections@

-

Distributors of agricultural inputs/ implements.

-

State Financial Corporations (SFCs)/ State Industrial Development Corporations (SIDCs) to the extent they provide credit to weaker sections.

-

National Small Industries Corporation (NSIC).

-

Khadi and Village Industries Commission (KVIC)

-

Agencies involved in assisting the decentralized sector.

-

Housing and Urban Development Corporation Ltd. (HUDCO)

-

Housing Finance Companies approved by National Housing Bank (NHB) for refinance.

-

State sponsored organization for SCs/STs (for purchase and supply of inputs to and/or marketing of output of the beneficiaries of these organizations).

-

Micro Finance Institutions/ Non-Government Organizations (NGOs) on lending to SHGs.

@ ‘Weaker Sections’ in Priority Sector includes following:

-

Small and marginal farmers with land holdings of 5 acres and less, landless labourers, tenant farmers and share-croppers;

-

Artisans, village and cottage industries where individual credit requirements do not exceed Rs.25,000/-.

-

Small and marginal farmers, sharecroppers, agricultural and non-agricultural labourers, rural artisans and families living below the poverty lines are the beneficiaries. The family income should not exceed Rs.11,000/- per annum.

-

Scheduled Castes and Scheduled Tribes.

-

Beneficiaries are persons whose family income from all sources does not exceed Rs.7200/- per annum in urban or semi urban areas or Rs.6400/- per annum in rural areas. They should not own any land or the size of their holding does not exceed one acre in the case of irrigated land and 2.5 acres in the case of unirrigated land (land holding criteria do not apply to SC/ST).

-

Beneficiaries under Scheme of Liberation and Rehabilitation of Scavengers (SLRs).

-

Advances granted to Self-Help Groups (SHGs) for reaching the rural poor.

FAQs on Non-Banking Financial Companies

Time frame for compliance of regulations

Retail Direct Scheme

Investment and Account holdings related queries

G-Secs are credit risk free instruments in domestic currency. However, there are market risks if you sell before maturity. You may refer to ‘Government Securities Market- A primer’, published on RBI website, to understand various risks associated with government securities.

Annual Return on Foreign Liabilities and Assets (FLA) under FEMA 1999

Some Useful Definitions

Ans: Participating preference shares are those shares which have one or more of the following rights:

(a) To receive dividend, out of surplus profit after paying the dividend to equity shareholders.

(b) To have share in surplus assets remaining after the entire capital is paid in case of winding up of the company.

On the other hand, non-participating preference shares are those shares which do not have any of the above said rights.

Business restrictions imposed on Paytm Payments Bank Limited vide Press Releases dated January 31 and February 16, 2024

Paytm Payments Bank Business Correspondent

External Commercial Borrowings (ECB) and Trade Credits

G. END-USES

Government Securities Market in India – A Primer

27.1 Duration (also known as Macaulay Duration) of a bond is a measure of the time taken to recover the initial investment in present value terms. In simplest form, duration refers to the payback period of a bond to break even, i.e., the time taken for a bond to repay its own purchase price. Duration is expressed in number of years. A step by step approach for working out duration is given in the Box IV below.

| Calculation for Duration First, each of the future cash flows is discounted to its respective present value for each period. Since the coupons are paid out every six months, a single period is equal to six months and a bond with two years maturity will have four time periods. Second, the present values of future cash flows are multiplied with their respective time periods (these are the weights). That is the PV of the first coupon is multiplied by 1, PV of second coupon by 2 and so on. Third, the above weighted PVs of all cash flows is added and the sum is divided by the current price (total of the PVs in step 1) of the bond. The resultant value is the duration in no. of periods. Since one period equals to six months, to get the duration in no. of year, divide it by two. This is the time period within which the bond is expected to pay back its own value if held till maturity. Illustration: Taking a bond having 2 years maturity, and 10% coupon, and current price of ₹101.79, the cash flows will be (prevailing 2 year yield being 9%):

Duration in number of periods = 379.28/101.79 = 3.73 Duration in years = 3.73/2 = 1.86 years |

More formally, duration refers to:

-

The weighted average term (time from now to payment) of a bond's cash flows or of any series of linked cash flows.

-

The higher the coupon rate of a bond, the shorter the duration (if the term of the bond is kept constant).

-

Duration is always less than or equal to the overall life (to maturity) of the bond.

-

Only a zero coupon bond (a bond with no coupons) will have duration equal to its maturity.

What is Modified Duration?

27.2 Modified duration (MD) is a modified version of Macaulay Duration. It refers to the change in value of the security to one per cent change in interest rates (Yield). The formula is

Illustration

In the above example given in Box IV, MD = 1.86/(1+0.09/2) = 1.78

Duration is useful primarily as a measure of the sensitivity of a bond's market price to interest rate (i.e., yield) movements. It is approximately equal to the percentage change in price for one percent change in yield. For example the duration is the approximate percentage by which the value of the bond will fall for a 1% per annum increase in market interest rate. So, a 15-year bond with a duration of 7 years would fall approximately 7% in value if the interest rate increased by 1% per annum. In other words, duration is the elasticity of the bond's price with respect to interest rates. This ignores convexity explained in para 24.7

What is PV 01?

27.3 PV01 describes the actual change in price of a bond if the yield changes by one basis point (equal to one hundredth of a percentage point). It is the present value impact of 1 basis point (0.01%) (1%=100 bps) movement in interest rate. It is often used as a price alternative to duration (a time measure). Higher the PV01, the higher would be the volatility (sensitivity of price to change in yield).

Illustration

From the modified duration (given in the illustration under 27.2), we know that the security value will change by 1.78% for a change of 100 basis point (1%) change in the yield. In value terms that is equal to 1.78*(101.79/100) = ₹ 1.81.

Hence the PV01 = 1.81/100 = ₹0.018, which is 1.8 paise. Thus, if the yield of a bond with a Modified Duration of 1.78 years moves from say 9% to 9.05% (5 basis points), the price of the bond moves from ₹101.79 to ₹101.70 (reduction of 9 paise, i.e., 5x1.8 paise).

What is Convexity?

27.4 Calculation of change in price for change in yields based on duration works only for small changes in yields. This is because the relationship between bond price and yield is not strictly linear. Over large variations in yields, the relationship is curvilinear i.e., the reduction in option free bond price is less than the change calculated based only on duration for yield increase, and increase in option free bond price will be more than the change calculated based only on duration for yield decrease. This is measured by a concept called convexity, which is the change in duration of a bond due to change in the yield of the bond.

Foreign Investment in India

Indian Currency

C) Different Types of Bank Notes and Security Features of banknotes

In addition to the security features listed above, banknotes issued after introduction of MG series-2005 have the year of printing on the reverse of the banknotes which is not present in the pre-2005 series.

All you wanted to know about NBFCs

B. Entities Regulated by RBI and applicable regulations

Reserve Bank of India has deregulated interest rates to be charged to borrowers by NBFCs. The rate of interest to be charged by the company is governed by the terms and conditions of the loan agreement entered into between the borrower and the NBFCs. However, the NBFCs have to be transparent and the rate of interest and manner of arriving at the rate of interest to different categories of borrowers should be disclosed to the borrower or customer in the application form and communicated explicitly in the sanction letter and on their websites, Key Facts Statement, etc., to enable the borrower to take an informed decision.

Coordinated Portfolio Investment Survey – India

Updated: डिसें 01, 2023

Special instructions for banks

Ans: No, it should not be included, as it will be considered as resident to resident transaction.

Core Investment Companies

D. Miscellaneous:

Ans: Adjusted net worth (ANW) is a concept akin to capital requirement wherein the ANW should not be less than 30% of the risk weighted assets (RWA). In cases where asset size is aggregated, all the CICs within the group will be registered as CIC and ANW will be applicable individually.

Annual Return on Foreign Liabilities and Assets (FLA) under FEMA 1999

Some Useful Definitions

Ans: If the Indian entity has issued the shares to non-resident entities under the FDI scheme in India, then it is a FDI and should be reported under the Foreign Direct Investment in India (Liabilities) of the return.

FAQs on Non-Banking Financial Companies

Credit Rating

- The NBFCs in the category of equipment leasing and hire purchase finance companies having Rating of less than the Investment Grade as mentioned below are no longer entitled to accept fresh public deposits :

Name of rating agencies | Level of minimum investment |

EL/HP Cos. | LC/ICs |

CRISIL | A- (A MINUS) |

ICRA | A- (A MINUS) |

CARE | BBB (FD) |

DCR India | BBB- (BBB minus) |

The Loan and Investment Companies having Rating of less than `A are no longer entitled to accept fresh deposits.

It may be added that A- is not equivalent to A; AA- is not equivalent to AA and AAA- is not equivalent to AAA.

Retail Direct Scheme

Investment and Account holdings related queries

The returns on Government securities are dependent on various features of the securities. You may refer to ‘Government Securities Market- A primer’, published on RBI website, to understand the factors affecting the returns on government securities.

पेज अंतिम अपडेट तारीख: