IST,

IST,

Monetary Policy Statement, 2021-22 Resolution of the Monetary Policy Committee (MPC) December 6-8, 2021

On the basis of an assessment of the current and evolving macroeconomic situation, the Monetary Policy Committee (MPC) at its meeting today (December 8, 2021) decided to:

The reverse repo rate under the LAF remains unchanged at 3.35 per cent and the marginal standing facility (MSF) rate and the Bank Rate at 4.25 per cent.

These decisions are in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth. The main considerations underlying the decision are set out in the statement below. Assessment Global Economy 2. Since the MPC’s meeting during October 6-8, 2021, surges of infections across geographies, emergence of the Omicron variant, the persistence of supply chain disruptions and elevated energy and commodity prices continue to weigh on global economic activity. Global merchandise trade is slowing after a sharp rebound from the pandemic due to the disruptions in port services and turnaround time, elevated freight rates and the global shortage of semiconductor chips, which could dampen future manufacturing output and trade. The composite global purchasing managers’ index (PMI), however, improved to a four-month high in November, with services continuing to perform better than manufacturing for eight consecutive months. 3. Commodity prices remain elevated across the board, though there has been some softening since late October and further drop towards end-November following uncertainties from the new COVID-19 variant, among others. Headline inflation in several advanced economies (AEs) and emerging market economies (EMEs) has soared, prompting a number of central banks to continue tightening and others to bring forward policy normalisation. With the US Federal Reserve commencing tapering of its monthly asset purchases and the possibility of faster taper, renewed bouts of volatility and heightened uncertainties have unsettled global financial markets. Bond yields which had risen in most countries, responding to inflation and monetary policy actions, eased from the last week of November. The US dollar has been trading higher in recent weeks against both AE and EME currencies. Domestic Economy 4. On the domestic front, data released by the National Statistical Office (NSO) on November 30, 2021 showed that real gross domestic product (GDP) expanded by 8.4 per cent year-on-year (y-o-y) in Q2:2021-22, following a growth of 20.1 per cent during Q1:2021-22. With the recovery gaining momentum, all constituents of aggregate demand entered the expansion zone, with exports and imports markedly exceeding their pre-COVID-19 levels. On the supply side, real gross value added (GVA) increased by 8.5 per cent y-o-y during Q2:2021-22. 5. Available data for Q3:2021-22 indicate that the momentum of economic activity is gaining further traction, aided by expanding vaccination coverage, the rapid subsiding of new infections and release of pent-up demand. Rural demand exhibited resilience – tractor sales improved in October over the same month of 2019 (pre-pandemic level), while motorcycle sales are slowly inching towards their pre-pandemic levels. Continued direct transfers under PM Kisan scheme are supporting rural demand. The demand for work under the Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA) moderated in November from a year ago, suggesting a pickup in farm labour demand. Supported by favourable soil moisture content and good reservoir storage levels, rabi sowing was 6.1 per cent higher than a year ago as on December 3, 2021. 6. Urban demand and contact-intensive services activities are rebounding on improving consumer optimism, supported by festival demand. High-frequency indicators such as electricity demand, railway freight traffic, port cargo, toll collections, and petroleum consumption registered robust growth in October/November over the corresponding months of 2019. Automobile sales, steel consumption and air passenger traffic still remained below 2019 levels even though they gained momentum in October as supply side shortages eased. Investment activity is exhibiting modest signs of improvement – production of capital goods remained above pre-pandemic levels for the third month in a row during September, while import of capital goods in October rose at double-digit pace over its level two years ago. Prints of manufacturing and services PMIs for November 2021 suggested continued improvement in economic activity. Exports grew in November for the ninth month in a row, along with a surge in non-oil non-gold imports on the back of reviving domestic demand. 7. Headline CPI inflation, which has been on a downward trajectory since June 2021, edged up to 4.5 per cent in October from 4.3 per cent in September on account of a spike in vegetable prices – due to crop damage from heavy rainfalls in October in several states, and fuel inflation – driven up by international prices of liquefied petroleum gas and kerosene. In fact, fuel inflation at 14.3 per cent in October surged to an all-time high. Core inflation or CPI inflation excluding food and fuel remained elevated at 5.9 per cent during September-October with continuing upside pressures stemming from clothing and footwear, health, and transportation and communication sub-groups. 8. Liquidity conditions remained in large surplus, with daily absorptions through the fixed rate reverse repo and the variable rate reverse repo (VRRR) operations under the liquidity adjustment facility (LAF) averaging ₹8.6 lakh crore in October-November. Reserve money (adjusted for the first-round impact of the change in the cash reserve ratio) expanded by 7.9 per cent (y-o-y) on December 3, 2021. Money supply (M3) and bank credit by commercial banks grew y-o-y by 9.5 per cent and 7.0 per cent respectively, as on November 19, 2021. India’s foreign exchange reserves increased by US$ 58.9 billion in 2021-22 (up to December 3, 2021) to US$ 635.9 billion. Outlook 9. The inflation trajectory, going forward, will be conditioned by a number of factors. The flare-up in vegetables prices due to heavy rains in October and November is likely to reverse with the winter arrivals. Rabi sowing is progressing well and is set to exceed last year’s acreage. Recent pro-active supply side interventions by the Government continue to restrain the pass-through of elevated international edible oil prices to domestic retail inflation. Crude prices have seen a significant correction in recent period. Cost-push pressures from high industrial raw material prices, transportation costs, and global logistics and supply chain bottlenecks continue to impinge on core inflation. The slack in the economy is muting the pass-through of rising input costs to output prices. Taking into consideration all these factors, CPI inflation is projected at 5.3 per cent for 2021-22; 5.1 per cent in Q3; 5.7 per cent in Q4:2021-22, with risks broadly balanced. CPI inflation for Q1:2022-23 is projected at 5.0 per cent and for Q2 at 5.0 per cent (Chart 1). 10. The recovery in domestic economic activity is turning increasingly broad-based, with the expanding vaccination coverage, slump in fresh COVID-19 cases and rapid normalisation of mobility. Rural demand is expected to remain resilient. The spurt in contact-intensive activities and pent-up demand will continue to bolster urban demand. The government’s infrastructure push, the widening of the performance-linked incentive scheme, structural reforms, recovering capacity utilisation and benign liquidity and financial conditions provide conducive conditions for private investment demand. The Reserve Bank’s surveys point to improving business outlook and consumer confidence. On the other hand, volatile commodity prices, persisting global supply disruptions, new mutations of the virus and financial market volatility pose downside risks to the outlook. Taking all these factors into consideration and assuming no resurgence in COVID-19 infections in India, the projection for real GDP growth is retained at 9.5 per cent in 2021-22 consisting of 6.6 per cent in Q3; and 6.0 per cent in Q4:2021-22. Real GDP growth is projected at 17.2 per cent for Q1:2022-23 and at 7.8 per cent for Q2 (Chart 2).  11. The impact of the recent spike in vegetables prices on food inflation prints is expected to dissipate as the usual softening of prices in the winter sets in. The partial roll back of Central excise and State Value Added Taxes (VAT) on petrol and diesel in November have eased retail selling prices and will have second round effects over a period of time. Crude oil has seen some correction but remains volatile. Core inflation will need to be closely monitored and held in check. For a sustained lowering of core inflation, continuing the normalisation of excise duties and VATs alongside measures to address other input cost pressures assume critical importance, more so as demand improves. The domestic recovery is gaining traction, but activity is just about catching up with pre-pandemic levels and will have to be assiduously nurtured by conducive policy settings till it takes root and becomes self-sustaining. In particular, private investment has to lead the revival of the economy, along with the strong impetus being provided by exports. Private consumption, despite strong recovery in Q2:2021-22, remains below its pre-pandemic level and demand for contact-intensive services could potentially face headwinds if authorities take pre-emptive steps to contain the fallout of Omicron. Downside risks remain significant rendering the outlook highly uncertain, especially on account of global spillovers, the potential resurgence in COVID-19 infections with new mutations, persisting shortages and bottlenecks and the widening divergences in policy actions and stances across the world as inflationary pressures persist. A tightening of global financial conditions poses risks to global economic activity and to India’s prospects as well. Against this backdrop, the MPC has judged that the ongoing domestic recovery needs sustained policy support to make it more broad-based. Considering it appropriate to wait for growth signals to become solidly entrenched while remaining watchful on inflation dynamics, the MPC decided to keep the policy repo rate unchanged at 4 per cent and to continue with an accommodative stance as long as necessary to revive and sustain growth on a durable basis and continue to mitigate the impact of COVID-19 on the economy, while ensuring that inflation remains within the target going forward. 12. All members of the MPC – Dr. Shashanka Bhide, Dr. Ashima Goyal, Prof. Jayanth R. Varma, Dr. Mridul K. Saggar, Dr. Michael Debabrata Patra and Shri Shaktikanta Das – unanimously voted to keep the policy repo rate unchanged at 4.0 per cent. 13. All members, namely, Dr. Shashanka Bhide, Dr. Ashima Goyal, Dr. Mridul K. Saggar, Dr. Michael Debabrata Patra and Shri Shaktikanta Das, except Prof. Jayanth R. Varma, voted to continue with the accommodative stance as long as necessary to revive and sustain growth on a durable basis and continue to mitigate the impact of COVID-19 on the economy, while ensuring that inflation remains within the target going forward. Prof. Jayanth R. Varma expressed reservations on this part of the resolution. 14. The minutes of the MPC’s meeting will be published on December 22, 2021. 15. The next meeting of the MPC is scheduled during February 7-9, 2022. (Yogesh Dayal) Press Release: 2021-2022/1322 |

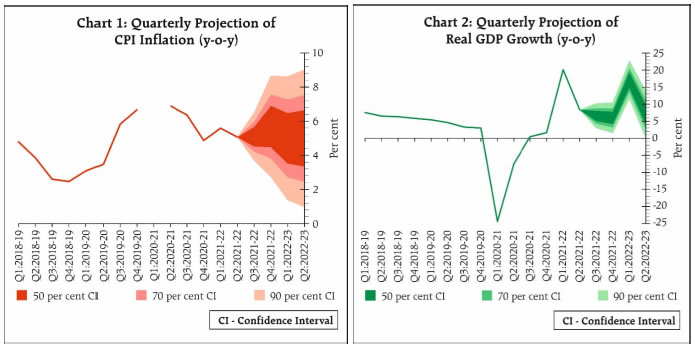

ପେଜ୍ ଅନ୍ତିମ ଅପଡେଟ୍ ହୋଇଛି: