IST,

IST,

Monetary Policy Statement, 2024-25 Resolution of the Monetary Policy Committee February 5 to 7, 2025

|

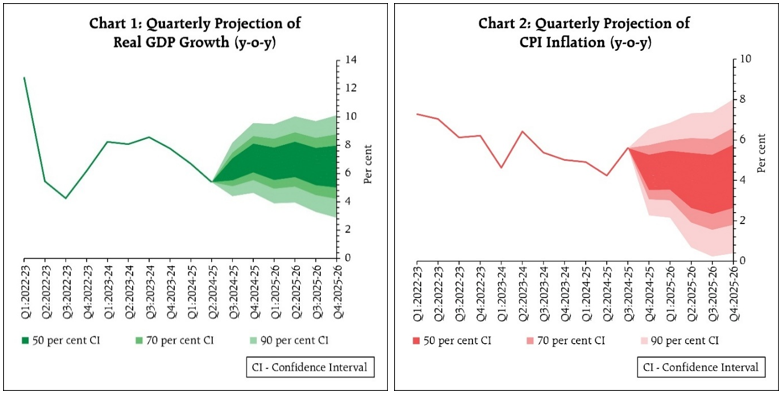

Monetary Policy Decisions The Monetary Policy Committee (MPC) held its 53rd meeting from February 5 to 7, 2025 under the chairmanship of Shri Sanjay Malhotra, Governor, Reserve Bank of India. The MPC members Dr. Nagesh Kumar, Shri Saugata Bhattacharya, Prof. Ram Singh, Dr. Rajiv Ranjan, and Shri M. Rajeshwar Rao attended the meeting. After assessing the current and evolving macroeconomic situation, the MPC unanimously decided to:

These decisions are in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth. Growth and Inflation Outlook 2. The global economy is growing below the historical average even though high frequency indicators suggest resilience amidst continued expansion in world trade. The world economic landscape remains challenging with slower pace of disinflation, lingering geopolitical tensions and policy uncertainties. The strong dollar, inter alia, continues to strain emerging market currencies and enhance volatility in financial markets. 3. On the domestic front, as per the First Advance Estimates (FAE), real gross domestic product (GDP) is estimated to grow at 6.4 per cent (y-o-y) in 2024-25 supported by a recovery in private consumption. On the supply side, growth is supported by the services sector and a recovery in agriculture sector, while tepid industrial growth is a drag. 4. Looking ahead, healthy rabi prospects and an expected recovery in industrial activity should support economic growth in 2025-26. Among the key drivers on the demand side, household consumption is expected to remain robust aided by the tax relief in the Union Budget 2025-26. Fixed investment is expected to recover, supported by higher capacity utilisation levels, healthy balance sheets of financial institutions and corporates, and Government’s continued emphasis on capital expenditure. This is corroborated by positive business sentiments highlighted in the Reserve Bank’s enterprise surveys and PMIs. Resilient services exports will continue to support growth. However, headwinds from geo-political tensions, protectionist trade policies, volatility in international commodity prices and financial market uncertainties, continue to pose downside risks to the outlook. Taking all these factors into consideration, real GDP growth for 2025-26 is projected at 6.7 per cent with Q1 at 6.7 per cent; Q2 at 7.0 per cent; and Q3 and Q4 at 6.5 per cent each (Chart 1 ). The risks are evenly balanced. 5. Headline inflation softened sequentially in November-December 2024 from its recent peak of 6.2 per cent in October. The moderation in food inflation, as vegetable price inflation came off from its October high, drove the decline in headline inflation. Core inflation remained subdued across goods and services components and the fuel group continued to be in deflation. 6. Going ahead, food inflation pressures, absent any supply side shock, should see a significant softening due to good kharif production, winter-easing in vegetable prices and favourable rabi crop prospects. Core inflation is expected to rise but remain moderate. Continued uncertainty in global financial markets coupled with volatility in energy prices and adverse weather events presents upside risks to the inflation trajectory. Taking all these factors into consideration, CPI inflation for 2024-25 is projected at 4.8 per cent with Q4 at 4.4 per cent. Assuming a normal monsoon next year, CPI inflation for 2025-26 is projected at 4.2 per cent with Q1 at 4.5 per cent; Q2 at 4.0 per cent; Q3 at 3.8 per cent; and Q4 at 4.2 per cent (Chart 2 ). The risks are evenly balanced. Rationale for Monetary Policy Decisions 7. The MPC noted that inflation has declined. Supported by a favourable outlook on food and continuing transmission of past monetary policy actions, it is expected to further moderate in 2025-26, gradually aligning with the target. The MPC also noted that though growth is expected to recover from the low of Q2:2024-25, it is much below that of last year. These growth-inflation dynamics open up policy space for the MPC to support growth, while remaining focussed on aligning inflation with the target. Accordingly, the MPC unanimously voted to reduce the policy repo rate by 25 basis points to 6.25 per cent. 8. At the same time, excessive volatility in global financial markets and continued uncertainties about global trade policies coupled with adverse weather events pose risks to the growth and inflation outlook. This calls for the MPC to remain watchful. Accordingly, the MPC unanimously voted to continue with a neutral stance. This will provide MPC the flexibility to respond to the evolving macroeconomic environment. 9. The minutes of the MPC’s meeting will be published on February 21, 2025. 10. The next meeting of the MPC is scheduled during April 7 to 9, 2025.

(Puneet Pancholy) Press Release: 2024-2025/2094 |

ପେଜ୍ ଅନ୍ତିମ ଅପଡେଟ୍ ହୋଇଛି: