IST,

IST,

Annual Report on Banking Ombudsman Scheme, 2016-17

|

The Banking Ombudsman Scheme (BOS), a flagship program of the Reserve Bank, has evolved as an important pillar of the grievance redressal mechanism available to the customers of banks. Considering that the Scheme is a speedy, effective and inexpensive means for complaint redressal, the Reserve Bank has continuously fine-tuned the BOS, to suit the emerging requirements of the customers. In this context, several measures have been introduced during 2016-17, to enhance consumer protection. The scope of the Scheme has been expanded by adding new grounds of complaints viz. mis-selling of financial products through banks and deficiency in banking services provided through mobiles have been included as grounds for lodging complaints. Further, the pecuniary limit of the BO for passing an award now stands doubled at Rs. two million while the grounds for filing an appeal against the decision of the BO have been expanded to enhance the opportunity available to the aggrieved customer. In order to deepen and widen the reach of the Scheme, five new offices of BO (OBOs) were operationalized during the year, raising the total number of OBOs to 20. In 2016-17, the OBOs handled over 1,36,000 complaints of which 92 per cent were disposed within the year. The complaints received by OBOs increased by 27 per cent in 2016-17 as compared to a rise of 21 per cent in the previous year. This rising trend, while reflecting the increasing awareness about the BOS, also underlines the need for banks to strengthen their internal grievance redressal mechanism. In this context, in the recent past 34 banks, on RBI’s advice, had appointed Internal Ombudsman (IO) to ensure that all rejected or partially redressed complaints are reviewed independently before these are escalated to the BO, by the complainant. The banks have since been advised to state, in their communications to the complainants, that their grievance has been examined by the IO. However, the rising number of complaints received at the OBOs reflects a need for strengthening the implementation of the IO Scheme. Further, in order to bring the complainant, the bank / branches and the RBI together on the same platform, the Reserve Bank has embarked upon a project for developing a web-based application for lodging and processing of complaints. This will increase the speed and transparency of processing of complaints at all levels. In conclusion, having worked as BO in the very early stages of the Scheme, I am particularly pleased to note that the BOS has come a long way towards fulfilling its mandate which is adequately reflected in this Annual Report of 2016-17.

(B. P. Kanungo) Vision and Goals of the Vision • To act as a visible and credible dispute resolution agency for common persons utilizing banking services. Goals • To ensure redress of grievances of users of banking services in an inexpensive, expeditious and fair manner that provides impetus to improve customer services in the banking sector on a continuous basis. • To provide policy feedback/suggestions to Reserve Bank of India towards framing appropriate and timely guidelines for banks to improve the level of customer service and to strengthen their internal grievance redress systems • To enhance awareness of the Banking Ombudsman Scheme. • To facilitate quick and fair (non-discriminatory) redress of grievances through use of IT systems, comprehensive and easily accessible database and enhanced capabilities of staff through capacity building. Background Banking Ombudsman Scheme, 1995 was notified by the Reserve Bank of India on June 14, 1995 under Section 35 A of the Banking Regulation Act, 1949. The Scheme is administered and funded by the Reserve Bank of India and is applicable to Scheduled Commercial Banks, Scheduled Primary Urban Co-operative Banks and the Regional Rural Banks (RRBs). There are 20 Banking Ombudsman (BO) covering all States and Union Territories. Volume and cost of handling complaints • The volume of complaints received in the Office of Banking Ombudsman (OBO) increased from 1,02,000 in 2015-16 to 1,30,000 in 2016-17 i.e. a rise of 27.45% which was higher than the increase of 21 per cent in the previous year. Out of 1,36,000 complaints (approx..) handled by the OBOs in 2016-17 (including the complaints brought forward from previous year), 92 per cent were disposed within the year as against the disposal of 95% of the 1,06,000 complaints handled in the previous year. Thus, a total of 1,25,000 complaints were disposed in 2016-17 as against 1,01,000 disposed in 2015-16. • The average cost of handling a complaint was Rs.3,780 during 2016-17 which was lower than the average cost of Rs.4396 during 2015-16 on account of 27% increase in the number of complaints received during 2016-17. Categories of complaints • Failure to meet commitments, non-observance of fair practices code, BCSBI Codes together accounted for 34 % of the complaints received. • ATM/Credit and Debit card complaints together represented 18.9% of complaints. • Pension payment related complaints accounted for 6.5% of total complaints while the remaining categories including loans and advance and remittance which were all below 5% of total complaints. Measures taken in 2016-17 Considering that the Scheme is a speedy, effective and inexpensive means for complaint redressal, the Reserve Bank has continuously fine-tuned the BOS, to suit the emerging requirements of the customers. In this context, several measures have been introduced during 2016-17, to enhance consumer protection. These are summarized below:

Way Forward The rising trend of complaints, while reflecting the increasing awareness about the BOS, also underlines the need for banks to strengthen their internal grievance redressal mechanism. In this context, in the recent past 34 banks, on RBI’s advice, had appointed Internal Ombudsman (IO) to ensure that all rejected or partially redressed complaints are reviewed independently before these are escalated to the BO, by the complainant. However, the rising number of complaints received at the OBOs reflects a need for strengthening the implementation of the IO Scheme so that the IOs act as effective filters before a complainant feels the need to approach the BO. Keeping in view the need to develop the capability to handle the rising number of complaints while improving the efficiency of the redresssal system, the Reserve Bank has embarked upon a project for developing a web-based application for lodging and processing of complaints. It is envisaged that all the stakeholders i.e. the complainant, the bank/ branches and the OBO will be able to access the platform for faster transmission of complains and actions taken thereon. This would increase the speed and transparency of processing of complaints at all levels. 1. The Banking Ombudsman Scheme 2006 The Banking Ombudsman Scheme has been in operation for the last 22 years. RBI introduced the Scheme in the year 1995 as a cost free grievance redressal mechanism to safeguard the interests of common bank customer. The Scheme is administered through twenty offices with specific jurisdiction, covering all 29 States and seven Union Territories and applicable to all commercial banks, regional rural banks and scheduled primary co-operative banks. The Offices of the Banking Ombudsman (OBO) are being funded and manned by the officers and staff of the Reserve Bank. Consumer Education and Protection Department acts as nodal department that facilitates the implementation of the BO Scheme (BOS). In view of the dynamic nature of banking and to ensure that the Scheme remains updated, it has been revised periodically. The Scheme, so far, has been revised five times since its inception, the latest being in July 2017. The improvements through the above revision in the BO Scheme are given in the Box No I. The enlarged scope of the Scheme coupled with increased awareness among the common persons about it as a result of continuous publicity measures and outreach programmes initiated by RBI and the OBOs, have resulted in increasing the volume of complaints, from 38,000 in the year 2006-07 to 130,000 in 2016-17. The increasing volume of complaints combined with the need for enhancing the reach of the BO Scheme, the RBI, during 2016-17 opened new OBOs at Dehradun, Jammu, Raipur, Ranchi and additional OBO at New Delhi, taking the number of OBOs from 15 to 20. Revised areas of jurisdiction is given in the Annex I of this report. During the year, the twenty OBOs received 130987 complaints. A detailed analysis of the complaints handled by the OBOs during the year is given in the ensuing chapter.

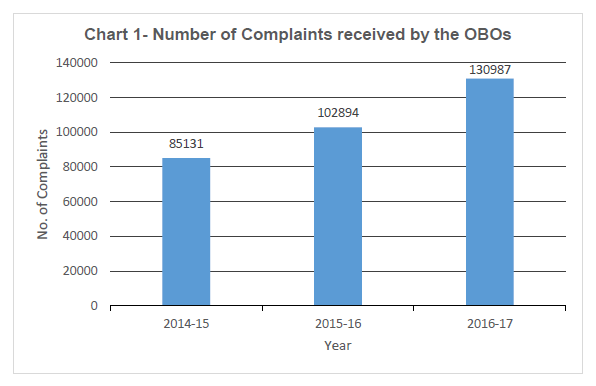

2.1 Comparative position of complaints received by twenty offices of Banking Ombudsman (OBOs) during the last three years is given in Table 1, Chart 1.

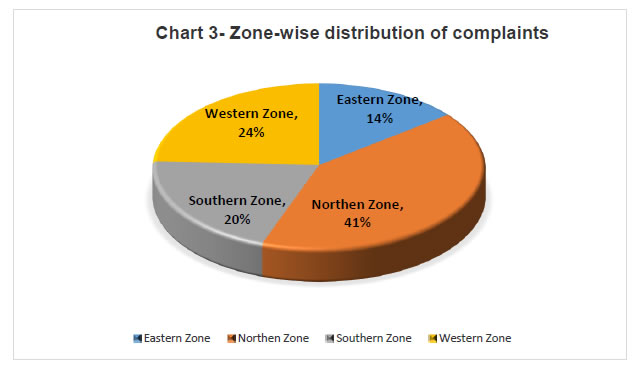

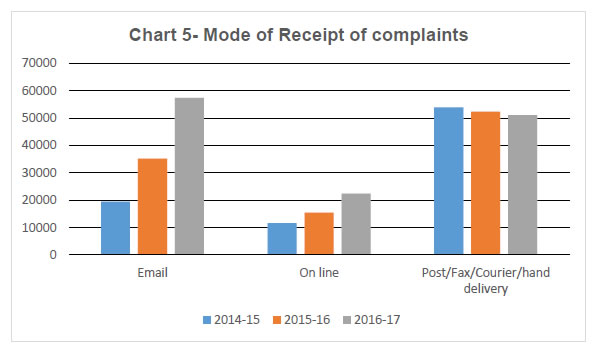

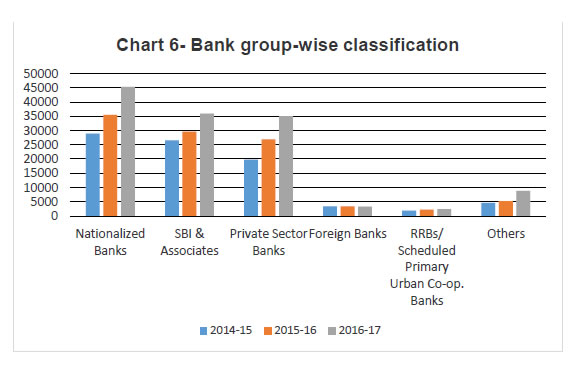

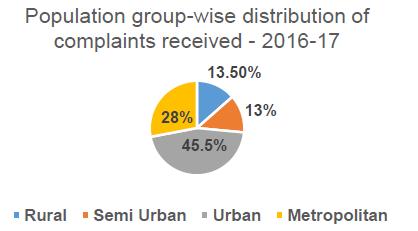

Compared to previous year, complaints increased by 21% in 2015-16 and 27 % in the year 2016-17. Increasing awareness about the BO Scheme and increasing customer base dominated by young generation bank customers’ aware about their rights, are some of the reasons for increase in volume of complaints received in the OBOs. OBO-wise receipt of complaints 2.2 Comparative position of complaints received by OBOs during the last three years is given in Table 2 and Chart 2. OBO New Delhi received the highest number of complaints (24837) with 19% of the total complaints received. Four metro centres OBOs viz. New Delhi I, Chennai, Kolkata, Mumbai and two non-metro centres viz. OBO Ahmedabad and Chandigarh put together, accounted for 58 % of the total complaints received. OBO Ahmedabad, Chandigarh and Kolkata recorded more than 50% increase in complaints received compared to previous year. Zone-wise distribution of complaints 2.3. Zone-wise distribution of complaints is shown in Table 3 and Chart 3. Northern Zone accounted for 41% of total complaints received. Eastern, Southern and Western Zones accounted for 14%, 20% and 24% respectively. Year-on-year basis, complaints increased by 33% in Eastern and Western zone, 30% in Northern Zone and 14% in Southern Zone. Population group-wise distribution of complaints received 2.4 Population group-wise distribution of complaints during the last three years is given in Table 4 and Chart 4. As may be seen from the table above, the share of complaints from Metropolitan areas has shown a linear decline of 35% of total complaints in 2014-15 to 31% in 2015-16 and further to 28% during 2016-17. Similarly the share of complaints in urban areas increased from 36% in 2014-15 to 42% in 2015-16 and 45.5% in 2016-17. The declining trend in metros and semi urban areas is outstripped by the rise of complaints in the urban areas. Urban and Metropolitan areas contributed 73.5% of the total complaints. Year-on-year basis, Rural Population Group recorded phenomenal increase of 41%, whereas, complaints from urban areas increased by 39%, Metropolitan areas by 13% and in Rural and Semi-urban areas 13% respectively.  Modes of Receipt of complaints 2.5 Complaints are received in the OBOs through various modes viz., hand delivery, post, courier, fax or e-mail. Complaints can also be lodged online through the CTS which is accessible from the website of RBI. Comparative position of complaints received through various modes during the last three years is indicated in Table 5 and Chart 5. It can be seen that complainants are preferring electronic mode (Email/Online) for lodging complaints. The complaints lodged through Email and through the online CTS increased from 49% in 2015-16 to 61% in 2016-17. During the last three years proportion of complaints lodged through physical mode has declined from 63% in 2014-15 to 51% in 2015-16 and further to 39%2016-17. Year-on-year basis, the proportion of complaints lodged through Email has increased substantially by 63% followed by Online 45%. Complainant group-wise classification 2.6 The individual bank customers constitute the single largest complainants group under BOS. During the year, 93% of complaints were received from individual customers including senior citizens. Break-up of complaints received from various complainant groups is given in Table 6. Bank group-wise classification 2.7 Bank-group wise classification of complaints received by OBOs during the last three years is indicated in Table 7 and Chart 6. Public Sector Banks accounted for 62% of the total complaints out of which 27% complaints were against SBI & Associates although the share of complaints during 2014-15 to 2015-16 decreased from 31% to 29% and further to 27% in 2016-17. Complaints of Private Sector Banks showed the rising trend during the last three years. Private Sector Banks accounted for 26.5% whereas Foreign Banks accounted for 2.5% of complaints received. Regional Rural Banks and Scheduled Urban Co-operative Banks accounted for 2% of the complaints. 7% of the complaints were against other non-bank entities not covered under the Scheme. The detailed bank-wise (Scheduled Commercial Banks) and complaint category-wise break-up of complaints received during the year 2016-17 is given at Annex V. 3. Nature of Complaints Handled 3.1 The grounds for lodging a complaint with OBO have been specified under Clause 8 of the BOS 2006. There are 30 grounds of complaints as per the BOS 2006. Complaints received under these grounds are grouped into broad categories indicated in the table below. The Table 8 and Chart 7 indicate the proportion of complaints received under these categories to the total complaints received during the last three years.

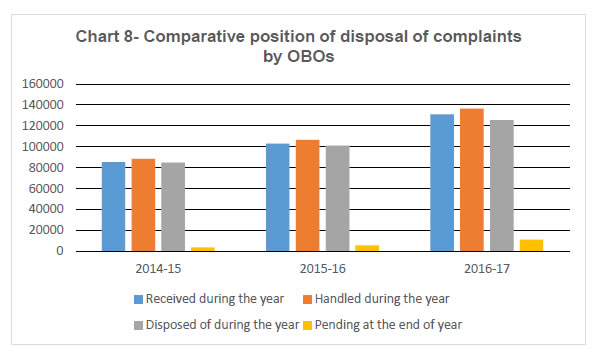

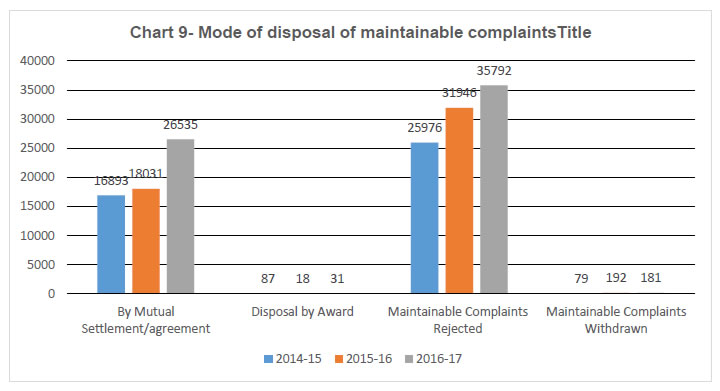

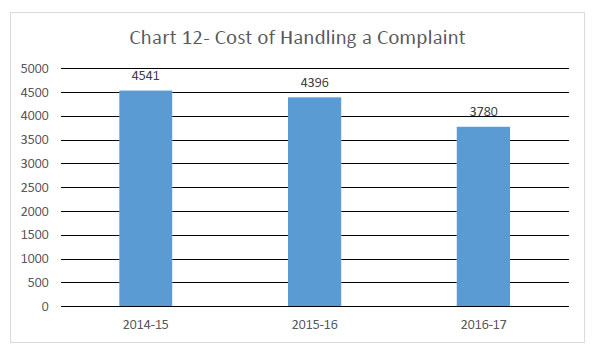

3.2 Failure to meet commitments /Non observance of fair practices code/BCSBI Codes accounting for 33.9% of total complaints remained the major category of complaints in the year 2016-17 as was the case in the previous two years. Training of the frontline staff on the Fair Practices Code of BCSBI, regulatory instructions, and monitoring by the Top Management will help to bring down the complaints under this category. 3.3 As reflected in the above table, there is a decline in the number in the credit card related complaints as well as their percentage share of these complaints. At the same time there is a perceptible rise in the number of ATM /debit card related complaints which increased by 12.5% during the year under review. Card related complaints (Debit and Credit) comprised 18.9% of total complaints and accounted for the second highest number of complaints. Out of a total of 24731 card related complaints, 16434 complaints pertained to ATM/Debit Cards (12.5% of total complaints received). Non-dispensation/short dispensation of cash in ATM withdrawals were the major causes of complaints under this category. Complaints related to Credit Cards constituted 6.4% of total complaints received during 2016-17. 3.4 Pension related complaints constituted 6.5% of the total complaints. Delayed payment, errors in calculations, difficulties in converting the pension to family pension on demise of pensioner, non-cooperation of staff etc. were the area of grievance under this category. 3.5 'Levy of charges without prior notice' comprised 5.5% of total complaints received. Levying charges for non-maintenance of minimum balance, processing fees, pre-payment penalties, cheque collection charges were some of the major reasons of complaints in this area. 3.6 Delay in credit, non-credit of proceeds to parties accounts, non-payment of deposit or non-observance of the RBI directives, if any, applicable to rate of interest on deposits in savings, current or other accounts maintained with a bank, etc., were the major reasons for complaints related to ‘Deposit Accounts’ which accounted for 5.5% of total complaints received. 3.7 Complaints on ‘loans and advances’ at 4.2 % of the complaints received mainly pertained to delay in sanction, disbursement, non observance of prescribed time schedule for disposal of loan applications and non-acceptance of application without valid reasons. 3.8 Non-payment or delay in payment of inward remittances, non-payment or inordinate delay in the payment or in the collections of collection of cheques, drafts, bills etc. were the major reasons for complaints received under the category of ‘Remittances’ which represented 2.5% of total complaints. 3.9 ‘Others’ category of complaints includes those pertaining to non-adherence with prescribed working hours, delay in providing banking facilities, refusal/delay in accepting payment towards taxes as required by RBI/Government, refusal/delay in issuing/servicing or redemption of government securities, non-adherence to RBI directives, etc. These complaints constituted 17.7% of the total complaints. 3.10 ‘Out of Subject’ is the category of complaints which are not on the grounds of complaints specified under Clause 8 of the BOS. 4.8% of the complaints received during the year fell under this category. 4.1 During the year OBOs handled 1,36,511 complaints, including 5,524 complaints pertaining to last year. As on June 30, 2017, OBOs managed to dispose 92% of the complaints handled during the year. Table 9 and Chart 8 below indicate a comparative position of disposal of complaints by OBOs. Compared to previous years, complaints increased by 11% in 2014-15, 21% in 2015-16 and 27 % in the year 2016-17. Although the rate of disposal declined from 95% to 92% during the year, the actual number of complaints handled increased by 28%. OBO wise position of complaints disposed during the year 2016-17 is indicated in Table 10 below: Disposal of complaints 4.2 The complaints which do not fall under the grounds of complaint specified in Clause 8 of the BOS and those complaints, where procedure for filing the complaint is not adhered to as laid down in Clause 9 of the BOS, are ‘Non-Maintainable’ complaints. All other complaints are classified as ‘Maintainable’ complaints and are dealt in accordance with the provisions of the BOS 2006. Non-Maintainable complaints are returned to the complainants stating the reason. Lack of awareness about the applicability of the Scheme is an important reason for this non-maintainable and maintainable complaints being in the same range. Maintainable Complaints 4.3 The redressal process under the Scheme envisages settlement of dispute by conciliation and mutual agreement. This is evident from the Clause 7(2) of the Scheme which states that "The Banking Ombudsman shall receive and consider complaints relating to the deficiencies in banking or other services filed on the grounds mentioned in clause 8 irrespective of the pecuniary value of the deficiency in service complained and facilitate their satisfaction or settlement by agreement or through conciliation and mediation between the bank concerned and the aggrieved parties or by passing an Award as per the provisions of the Scheme". The initial efforts of the BO is to try to settle the dispute by mutual agreement. Only in extreme cases where conciliation efforts fail, the BO resorts to giving a decision or passing an Award. Table 11 and Chart 9 below indicate the mode of disposal of Maintainable complaints. 42.43% of the maintainable complaints were resolved by mutual settlement whereas Awards were passed only in 0.05% of cases. 57.23% maintainable complaints were rejected after examination whereas 0.29% complaints were withdrawn by the complainants. Grounds for rejection of Maintainable complaints 4.4 The grounds for rejection of Maintainable complaints and their proportion to total complaints received during the year are indicated in the Table 12 and Chart 10. 4.5. First Resort Complaints: Bank is the first touch point for the complainant for resolution of his grievance. Clause 9 (3) of the BOS stipulates that, " No complaint to the Banking Ombudsman shall lie unless:- (a) the complainant had, before making a complaint to the Banking Ombudsman, made a written representation to the bank and the bank had rejected the complaint or the complainant had not received any reply within a period of one month after the bank received his representation or the complainant is not satisfied with the reply given to him by the bank". In terms of this Clause the complainant must first approach his bank for redressal of his grievance. However, a large number of complainants approach the OBO without first approaching the bank. These complaints are termed First Resort Complaint (FRC) and returned to the complainant with suitable advice. However, a copy of the complaint is also forwarded to concerned bank for suitable resolution. 24% of the complaints received in the OBOs during the year were FRCs. FRCs received online through the complaint form placed on the website of RBI are directly forwarded to the concerned bank for suitable action. During the year, 20077 FRCs received through this mode were forwarded to the banks concerned. The software used in OBOs for processing of complaints has the facility to forward FRCs received in the OBO physical form, to concerned banks online by attaching scanned copy of the complaint. OBOs forwarded 3713 FRCs to concerned banks through this module during the year. Awards Issued 4.6 BOs issued 31 Awards during the year. Of these, 20 have been implemented as on June 30, 2017. Out of 11 Awards remaining unimplemented, in five cases, banks have preferred appeal before the Appellate Authority, two Awards have lapsed and four Awards remained unimplemented as on June 30, 2017. OBO-wise position of Awards issued during the year 2016-17 is indicated in Table 13 below: Age –wise classification of pending complaints 4.7 Table 14 and Chart 11 below indicate age-wise classification of pending complaints. At the end of the year, 11,192 (8%) complaints were pending at all OBOs. Out of these, 3.10% complaints were pending for less than one month, 2.35% complaints were pending between one to two months, 1% complaints were pending between two to three months and 1.55% complaints were pending beyond three months. 5.1 The expenditure incurred on running the BOS is fully borne by the RBI from the year 2006. This includes revenue expenditure and capital expenditure incurred on administration of the BOS. The revenue expenditure includes establishment items like salary and allowances of the staff attached to OBOs and non-establishment items such as rent, taxes, insurance, law charges, postage and telegram charges, printing and stationery expenses, publicity expenses, depreciation and other miscellaneous items. The capital expenditure items include furniture, electrical installations, computers/related equipment, telecommunication equipment and motor vehicle. Average cost incurred for handling a complaint under the BOS 2006 is indicated in Table 15 and Chart 12.

The aggregate cost of running the BOS has increased from ₹ 452 million in 2015-16 to ₹ 495 million in 2016-17. The volume of complaints increased by 27.30% during this period, the average cost of handling a complaint has declined from ₹ 4396/- to ₹ 3780/-. BO Office wise 'Per-Complaint Cost’ for the year 2016-17 is given in Table 16 6. Appeals against the Decisions of the BOs 6.1 The BOS provides an option of appeal to both the parties in terms of Clause 14 of the BOS 2006. Any party aggrieved by an Award issued by the BO under clause 12 or by rejection of a complaint for the reasons referred to in sub clauses (d) to (g) of clause 13, can prefer an appeal before the Appellate Authority designated under the Scheme within 30 days of the date of receipt of communication of Award or rejection of complaint. The Deputy Governor-in-Charge of the Consumer Education and Protection Department is the designated Appellate Authority (AA). The secretarial assistance to the AA is provided by the Consumer Education and Protection Department (CEPD). Position of appeal handled by the Appellate Authority during the year 2016-17 is given in Table 17 below. 6.2 During the year 15 appeals were received against the decisions of BOs and including 3 appeals pending at the beginning of the year, the Appellate Authority handled 18 appeals during the year of which the Appellate Authority disposed 11 appeals. The OBO wise position of appeals received during the year 2016-17 is given in Table 18. 7. Complaints received through Centralised Public Grievance Redress and Monitoring System (CPGRAMS) The Department of Administrative Reforms and Public Grievances of Government of India has developed a web based application CPGRAMS for citizens to lodge online complaints. Government Departments and banks are sub-ordinate offices under this system to receive and redress complaints forwarded through this portal. CEPD, RBI is the Nodal Office for RBI. Twenty OBOs are sub-ordinate offices. Comparative position of complaints handled by OBOs through this portal is given in Table 19 below. 8. Applications received under Right to Information Act, 2005 The Banking Ombudsmen have been designated as the Central Public Information Officers under the Right to Information Act 2005 to receive applications and furnish information relating to complaints handled by the OBOs. During the year 20 OBOs received 616 applications under RTI Act. The OBO wise position of RTI applications is indicated in the Table 20. 9. Other Important Developments 9.1. Annual Conference of Banking Ombudsmen 2017 9.1 The Annual Conference of Banking Ombudsmen was held at Mumbai on on July 25, 2017. The Conference was attended by Managing Directors and Senior Executives of major Commercial Banks, Indian Banks’ Association, Banking Codes and Standards Board of India, Banking Ombudsmen and heads of concerned regulatory and supervisory departments of the Reserve Bank. The Deputy Governor (DG), Shri Mundra in his keynote address, touched upon the recent initiatives of the RBI in the area of grievance redressal. He mentioned that the Banking Ombudsman Scheme had been amended in July 2017 to, inter alia, include deficiencies in mobile and electronic banking as well as mis-selling of third party investment products by banks as eligible grounds for lodging complaint under the BO Scheme. In order to deepen and widen the reach of the BO Scheme, DG mentioned that the RBI had opened five new BO offices and if required, opening of few more BO offices could be considered over time. Drawing attention to a large number of complaints on mis-selling, DG pointed out that the underlying reasons were the challenging targets set for employees, incentive linked quotas, lack of training and fast rotation of frontline staff. These along with the lack of co-ordination between back and front office, impacted customer protection and made it inconvenient for the complainants to easily approach the appropriate authorities for redressal. He therefore urged that the commitment of the Top Managements of banks should also percolate down the line so that the customers received efficient services as well as due care at all touch points. With regard to complaint management, he said that the banks should seek to study the patterns and undertake root cause analysis of complaints, which would be possible by adopting end-to-end automation of the grievance redressal mechanism and deployment of latest analytical tools. Delineating the changing profile of banking, DG stated that the new generation of customers were more technology savvy and the choices available to them, including the channels, had also increased exponentially. A scenario was thus emerging wherein customers would be able to silently walk out from one institution to another, in case of any dissatisfaction with the services. This, he said, would be further accentuated with the possibility of portability of accounts. In this context, the DG urged the banks to work towards Account Number portability as it will be a far-reaching step towards enhancing competition and improving customer service. DG also broached the issue of the rising trend of loss of cheques from drop boxes and the lack of alacrity shown by banks in redressing such complaints. In such cases, he said that the customer must be compensated immediately. The DG therefore urged the banks to explore the possibility of creating a common account and compensate the customers immediately from this pool, without waiting for recovery of the amount from insurance etc. Stressing upon the importance of the Banking Correspondents (BCs) in the light of the recent RBI guidelines making the BC equivalent to banking outlet, the DG exhorted banks to pay close attention to services rendered by BCs especially in rural and semi-urban areas and take precautions to curb mis-selling of products and address the problem of illiterate customers getting duped by aggressive marketers of financial products. He also impressed upon the banks to move away from seeking ‘negative confirmation’ from customers in respect of legal agreements that often have several fine prints, and instead obtain ‘positive confirmations’ from the customers that they have read and understood the terms and conditions of the product / service. Touching upon the tenets of the Charter of Customer Rights, DG urged banks and the IBA to work towards evolving a common platform to provide a comparative and transparent view of various products and services to help the customer in selecting the option/s best suitable to them. Speaking on the occasion, Smt. Surekha Marandi, Executive Director (ED), emphasised on the need for coordination between RBI and banks on the issue of educating the customers for ensuring cyber hygiene as a form of protection in view of increasing use of mobile banking. Shri Rajeev Rishi, Chairman IBA, said that having an institution of the Internal Ombudsman within banks was a good idea and promised to have a fresh look on issues involved in setting up a Common Minimum Framework to be provided by all the banks with regard to the office of the IOs. Shri A C Mahajan, Chairman, BCSBI flagged important findings of the Code Compliance Survey conducted by the BCSBI. He mentioned that although there was an improvement in compliance, no bank was fully Code Compliant. During the conference, a need for setting up a common interbank platform in coordination with the cyber police for registering complaints of victims of cybercrimes at a single touch point was emphasized for better inter-agency collaboration against cybercrimes. The misleading product information being displayed by some financial sector players particularly with regard to interest rates was discussed in the context of the need for standardization of the format for display of the important aspects of product information such as rate of interest, periodicity of yields, various charges etc. 9.2 Half yearly meeting with Principal Nodal Officers of banks Half yearly meeting with Principal Nodal Officers (PNO) of Scheduled Commercial Banks for the period ended June 2016 was held in two phases on September 29, and 30, 2016 at RBI Mumbai. PNOs of major Scheduled Commercial Banks, representatives from Indian Banks Association and Banking Codes and Standards Board of India, heads of the regulatory and supervisory departments of the Bank and four Banking Ombudsman viz. BO Mumbai, BO New Delhi, BO Chennai, BO Kolkata also participated in the meeting. During the meeting, the PNOs were advised to work towards making their internal grievance redressal mechanism more responsive and robust through ongoing root cause analysis of complaints and take corrective measures. It was said that banks should own up their customers and try to resolve the complaints within the bank itself, so that a minimum number of complaints are escalated to the BOs. The need to handhold of customers especially in the area of electronic banking and its security aspects and to spread awareness about Banking Ombudsman Scheme and BCSBI Codes was also impressed upon the Nodal Officers. Special campaign on the investment needs of Senior Citizens and providing such products which match the requirements and profile of this class of customers was highlighted during the discussion by the RBI. Representatives from IBA, BCSBI, heads of regulatory and supervisory departments of the RBI and Banking Ombudsmen present, had interaction with PNOs. 9.3 Special Camps conducted by the Offices of Banking Ombudsmen to ascertain the problems faced by Senior Citizens/pensioners With a view to ascertain the problems faced by senior citizens/pensioners in their dealings with banks and the need for any further regulatory intervention, RBI had advised all OBOs to arrange special camps of senior citizens/pensioners in their jurisdictions. All the OBOs arranged these camps and have submitted their findings to the RBI. 9.4 Meeting with Internal Ombudsmen of banks The meeting with Mumbai based Internal Ombudsmen (IOs) of banks was held at Reserve Bank of India, Mumbai on May 22, 2017. Smt S Marandi, Executive Director (ED), RBI chaired the meeting which was attended by the IOs of 13 Mumbai based banks. Representatives of Indian Banks’ Association, Banking Codes and Standards Board of India and Banking Ombudsman Mumbai, were also present at the meeting. In the meeting, ED stated that even after a period of two years since setting up of this mechanism and the issue of Standard Operating Procedure (SOP) by the RBI, the implementation of the IOs in the banks was not at the desired level. Banks were following diverse practices which were at times of variance with the SOP. In a few banks the infrastructure provided to the IOs was not adequate. ED stressed upon an urgent need to frame an industry-wide common minimum framework including compensation for the IOs. While drawing the IBA's attention to this action points of the last year's IO Conference, the ED urged IBA to take steps for setting up such industry-wide framework. As regards the impact of IO mechanism on complaints received in the offices of Banking Ombudsmen, ED expressed concerns over the fact that during the last two years, no visible impact of IO mechanism could be seen as the number of complaints in the offices of Banking Ombudsmen had gone up considerably during this period. ED emphasized the need for a coordinated effort by all stake holders to make this initiative effective. 9.5 Regional Conferences of Banking Ombudsmen Regional Conferences of BOs are held twice a year, once in each half year. The regions and the lead OBO of the region for the purpose have been identified as follows:

Systemic issues observed, important decisions taken, regulatory instructions on various customer service issues, suggestions for improving the BO Scheme/OBO/Customer Services etc. are discussed in these Conferences. 9.6 Awareness and Consumer Education Raising the level of awareness about BO Scheme especially in rural and semi-urban areas is one of the important aspects of the functioning of the OBO. During the year OBOs took several initiatives to improve awareness about the BO Scheme. Major initiatives taken by the OBOs are given below. • Ahmedabad: The OBO organised Town hall Event at Bhavnagar, Customer Awareness Programme at Vapi and an exclusive meeting with senior citizens and pensioners. The participants of these events were briefed about the salient features of the Banking Ombudsman Scheme 2006. In the open house sessions during these events queries raised by the participants were clarified. • Bhopal : Awareness programmes were held at Gwalior, Khandwa and a Town Hall Meeting was held at Jabalpur. The participants were briefed about the salient features of the Banking Ombudsman Scheme and initiatives taken by the Reserve Bank of India for improvement in customer services. OBO published advertisements on BOS in local newspapers and also arranged broadcast of ‘Jingles’ on the BOS on Prasar Bharti (AIR) in Madhya Pradesh and Chhattisgarh. • Bengaluru: A Town Hall meeting was organized at Udupi, Udupi District. Besides, explaining the salient features of the Banking Ombudsman Scheme specially printed pamphlets explaining the Scheme in local language were distributed and also given to banks for onward distribution at branches. On-the-spot grievances were also redressed with the help of the bankers concerned. • Bhubaneswar: The OBO organized two Town Hall Events at Nayagarh and Balasore and 11 public awareness camps at different centers in the State. Most of the camps were held in semi-urban areas at district level, from where the receipt of complaints was less. Apart from this a special camp for senior citizens was organized to address the issues faced by them. The advertisements on the BOS were published in English, Hindi and local language in leading local newspapers and also telecast on DD Odia channel during the live broadcast of Rath Yatra (Cart Festival) at Puri. • Chandigarh: In addition to two Town hall Events organised at Rampur Panchayat, District Sirmaur (Himachal Pradesh) and Bathinda, Punjab, the OBO organised awareness Programmes at various placed in Himachal Pradesh, Punjab and Haryana. The office participated in live telecast on Doordarshan as well as Radio programs (Radio Jingle) broadcasted by All India Radio wherein BO scheme was explained. A stall was put up at the International Lavi Mela, Rampur where the participants mostly from rural areas were made aware and briefed on BOS; grounds and procedure of filing complaint, jurisdiction and powers of BO, simplified KYC norms etc. With a view to assess the impact of awareness / outreach programmes on the complaints being received, the OBO initiated an Impact Analysis. • Chennai: The office organised six Awareness Programmes at Tiruchendur, Tenkasi, Theni, Harur, Yanam Special camp for senior citizens in Chennai and Town Hall Event at Kumbakonam, in co-ordination with the lead banks of the respective districts. The animation CD on Banking Ombudsman Scheme prepared by the Office was displayed to the audience during these programmes. • Dehradun The Office organised a Town Hall Event at Dehradun for senior citizen and pensioners, Awareness programme at Kathgodam and Rudrapur for entrepreneurs and other bank account holders. The participants were briefed on Banking Ombudsman Scheme; grounds and procedure of filing complaint, jurisdiction and powers of BO, customer service aspects relating to deposit accounts, loan accounts, nomination facilities; reporting of credit information to CIBIL etc. and were advised to be extra vigilant/alert while using their credit/debit cards for transactions at ATMs as also for online transactions • Guwahati The OBO published advertisements in English, Hindi, Bengali, Assamese and other local languages about the Banking Ombudsman Scheme and its functioning in various Newspapers / magazines in all the seven States under its jurisdiction. A spot advertisement on BOS was telecast on Doordarshan. An advertisement on Banking Ombudsman Scheme 2006 was aired on AIR. The OBO organised a special camp for senior citizens and pensioners, a Town Hall Event at Shillong (Meghalaya) and Awareness Programme at ‘Sualkuchi’, Assam, at ‘Udaipur’, Tripura, at ‘Naharkatia’ Assam, at ‘Sihphir’, Aizawl and ‘Yaripok’, Imphal. • Hyderabad Two Town Hall events, one each in the states of Andhra Pradesh and Telangana were organised to interact with various stake holders and create awareness about the scheme. A special meeting was also arranged for getting insight into senior citizens’ issues. The office pursued a multi-pronged outreach strategy to create awareness which included targeted action like participation in exhibitions, FLARE UP programs by RBI Hyderabad, distribution of pamphlets/FAQ on the scheme etc. • Jaipur The OBO organized Town Hall Events at Udaipur city, Vallabhnagar (semi-urban), Bhinder (village), Neemrana and Behror of Alwar District Rajasthan. The special camp to understand issues and difficulties relating to banking services, faced by Senior Citizens for was organised at Jaipur. • Jammu The Office conducted two awareness programmes at Basholi and Bani. The OBO put up a stall at University of Jammu during a Town Hall event arranged by FIDD, RBI where the information about the BO Scheme was shared with large number of visitors and printed material providing full details of the Scheme was distributed. OBO tried to reach out to the people through fliers/ pamphlets / printed material, about the BO Scheme, inserted inside the leading newspapers of Jammu and its peripheral areas. • Kanpur: The OBO, through advertisements in Newspapers (both Hindi and English), All India Radio, electronic media (Door Darshan) and also direct interactions with members of public in customer education programmes, Banker Customer meets, exhibitions, fairs, etc., to spread awareness about the BO Scheme among people, especially in remote areas. OBO organized a Town Hall Event at Mughal Sarai (UP) and customer education/awareness campaigns in different areas of Uttar Pradesh and Uttarakhand. • Kolkata: The OBO organized two Town Hall Meetings and seven Outreach Programmes. The venue of these programmes were selected based on analysis done to identify places from where fewer or no complaints were received. Apart from this, a Senior Citizens’ Meet and a sensitization programme on Credit Card transactions were organized at Kolkata. OBO also published advertisements regarding the BO Scheme in major newspapers, in Bengali, Hindi and in English. • Mumbai: A town hall event was organized at Nagpur and Awareness Programmes were organised at Sewagram, Wardha and Alibaug. The participants were sensitized about the dos and don’ts while using credit/debit cards, making ATM and/or online transactions. The occasion was also used to interact with the local bankers wherein they were impressed upon to provide better service to their customers. An interactive programme with senior citizens/pensioners/old incapacitated persons who are customers of banks, was also organized in Mumbai. • New Delhi: The office followed multi-pronged approach which included, conduct of outreach programme, issue of advertisements in newspapers, sending staff/officers to various meetings/Town Halls events organized by other departments. It served the dual purpose of disseminating of financial literacy as well as of conveying the expectations of the Office from the banks for effective and expeditious disposal of complaints. The office organised outreach programmes in Delhi and Haryana, a special camp for senior citizens and pensioners at Delhi and an outreach programme at Lingaya’s University. • New Delhi II The OBO organised outreach programmes, published advertisements in newspapers, deputed staff to various meetings/Town Halls organized by other banks/institutions to increase the visibility of the Scheme in the area of its jurisdiction. It organised a Special camp in Gururgram district of Haryana for senior citizens and pensioners. • Patna OBO organized seven awareness programmes including two Town Hall Meetings. The focus of these outreach initiatives were the vulnerable class of bank customers and people in smaller towns and rural centres. Special Pension Camp was organised for the benefit of pensioners and Senior Citizens. The OBO issued advertisements about the BO Scheme in leading newspapers in English and Hindi. During Rajgir Mahotav at Rajgir, information regarding BO Scheme was disseminated amongst the public through distribution and displays of posters. An advertisement on the BO Scheme using a short jingle was aired on Radio • Raipur A Town Hall Meeting was conducted in Raipur City. The salient features of the BO Scheme were explained to the participants and queries raised by the participants were answered. Banks were advised to give special attention to resolve the complaints of the senior citizens, pensioners and those pertaining to ATM transactions. • Ranchi A special meeting with Senior Citizens/ Pensioners was organized with a view to understand various issues and difficulties faced and to disseminate information and salient features of the BO Scheme. The operationalisation of OBO at Ranchi was advertised through the English and Hindi newspapers wherein the Scheme was briefly furnished along with the contact details of the OBO for the benefit of the general public. • Thiruvananthapuram: Outreach events were conducted at places from where the number of complaints being received was relatively lower. The events were highly interactive and not only were doubts raised clarified but even complaints, where possible, were redressed on the spot. 9.7 Skill building OBOs arranged training programmes for their staff in coordination with external institutions like IDRBT, NPCI, etc. OBOs also deputed their staff to the training programmes conducted by the Zonal Training Centre, RBI, New Delhi and Reserve Bank Staff College, Chennai. 10. Consumer Protection and Awareness Initiatives by Reserve Bank of India 10.1 Some of the important initiatives taken by RBI in the area of consumer protection are discussed in the following paras. 10.2. Opening of new Offices of Banking Ombudsman Considering the significant increase in banking network during the recent past and the large jurisdiction being covered by some of the OBOs, RBI has opened four new OBOs at Dehradun, Jammu, Raipur, Ranchi and the second OBO at New Delhi. The area of operation of these new OBOs is as indicated below. All the new OBOs have started their operations.

10.3 Amendment to the Banking Ombudsman Scheme 2006 The Reserve Bank has released a Notification dated June 16, 2017 amending the Banking Ombudsman Scheme 2006. The amended Scheme has come into force from July 1, 2017. Under these amendments the scope of the Scheme has been widened to include, inter alia, deficiencies arising out of sale of insurance/ mutual fund/ other third party investment products by banks. A customer would also be able to lodge a complaint against the bank for its non-adherence to RBI instructions with regard to Mobile Banking/ Electronic Banking services in India. The pecuniary jurisdiction of the BO to pass an Award has been increased from existing rupees one million to rupees two million. Compensation not exceeding Rs.0.1 million can also be awarded by the BO to the complainant for loss of time, expenses incurred as also, harassment and mental anguish suffered by the complainant. The procedure for complaints settled by agreement under the Scheme has also been revised. Appeal has now been allowed for the complaints closed under Clause 13 (c) of the existing Scheme relating to rejection of complaints which was not available earlier. The amended Scheme is available on the Reserve Bank's website at /en/web/rbi/complaints/lodge-a-complaint-against-rbi 10.4 Limiting Liability of Customers in Unauthorised Electronic Banking Transactions: The RBI issued directions to banks limiting the liability of Customers in unauthorised electronic banking transactions. In terms of these directions, a customer shall be liable for the loss occurring due to unauthorised transactions in the following cases: I. Where the loss is due to negligence by a customer, such as where he has shared the payment credentials, the customer will bear the entire loss until he reports the unauthorised transaction to the bank. Any loss occurring after the reporting of the unauthorised transaction shall be borne by the bank. II. In cases where the responsibility for the unauthorised electronic banking transaction lies neither with the bank nor with the customer, but lies elsewhere in the system and when there is a delay on the part of the customer in notifying the bank of such a transaction, the per transaction liability of the customer has been restricted to the transaction value or the amount specified in the Circular whichever is lower depending upon the type of account and the time taken for notifying the bank of such a transaction. 10.5 Standardisation of commonly used forms in banks In the backdrop of many requests to standardise commonly used forms by bank customers, a Committee consisting of representatives of regulatory departments of RBI and Indian Banks Association was constituted to identify such forms and to standardise the formats for use across banks. The Committee shortlisted ten forms and standardised their formats. IBA advised the member banks to bring the standardised forms in use from January 1, 2017. 10.6 The Ombudsman Scheme for Non-Banking Financial Companies The Reserve Bank is in the process of setting up an Ombudsman Scheme for Non-Banking Finance Companies. NBFCs are regulated under Chapter III-B of the RBI Act, 1934. Section 45 L of the RBI Act empowers the Reserve Bank to, inter alia, give directions to Financial Institutions. The Ombudsman Scheme for NBFCs is proposed to be operationalised by the Reserve Bank under Section 45 L of the RBI Act 10.7 Complaint Management System The Reserve Bank has initiated the work for setting up a complaint management system (CMS) with a view to harnessing the benefits of information technology (IT) for managing the increasing volume of complaints being received by it. The web-based CMS will replace the existing complaint tracking system (CTS) used in the offices of Banking Ombudsmen. CMS will help the Reserve Bank not only to manage the complaints more efficiently but also provide a robust management information system. It will also help to integrate the grievance redressal mechanism in the Bank by bringing the offices of Banking Ombudsman, as well as CEPCs and banks on the CMS platform for facilitating better coordination and effectiveness. Name, Address and Area of Operation of Banking Ombudsmen

Important Notifications Relating to Customer Service issued by the RBI in 2016-17