IST,

IST,

II. Recent Economic Developments (Part 1 of 3)

Introduction

2.1 The Indian economy continued to exhibit strong growth during 2004-05 with a noticeable improvement in macroeconomic fundamentals. Industrial growth gathered momentum, led by the manufacturing sector. A noteworthy aspect is the momentum gained in the growth of the capital goods sector signalling building up of capacity which should augur well for future growth prospects. Merchandise export growth has been quite robust, indicative of the growing global competitiveness of the Indian economy. Corporate results continue to be good and various business expectation surveys point to a reasonable optimism regarding growth. Non-food credit has recorded a strong and a fairly broad-based growth, indicative of a revival in the investment activity. Services sector continued its high growth path. An encouraging sign within the favourable macroeconomic environment is the incipient improvement in the Government finances. Notwithstanding the setback emanating from a less than satisfactory South-West monsoon, the Indian economy is poised for strong growth during the fiscal 2004-05 and is expected to remain one of the fastest growing economies in the world.

2.2 Although there has been an increase in the headline inflation in recent months, it is largely supply induced, driven mainly by external factors. More recently, the pressure of high international oil prices seems to have eased somewhat, although the problem of overhang of liquidity remains. Despite a large order of increase in oil imports, the balance of payments position remained comfortable. The current account is expected to remain in surplus for the fourth consecutive year enabled by continued strong inflows from private remittances. Capital flows remained buoyant, reflecting mainly foreign investors' growing confidence in the Indian economy. Foreign exchange reserves recorded a substantial increase on top of last year's record accretion. Financial markets have generally exhibited orderly conditions, notwithstanding some hardening of yields across the spectrum.

2.3 Against this brief overview, this Chapter provides an analytical account of macroeconomic developments during 2004-05 so far. Section I covers the developments in the real sector while Section II covers the Central and State Governments finances. Section III dwells on monetar y and credit developments and the behaviour of inflation. Developments in the financial markets and the external sector are discussed in Sections IV and V, respectively. Concluding observations are presented in Section VI.

I. REAL SECTOR

National Income

2.4 The Indian economy recorded a strong growth performance during 2003-04. The recovery in agriculture from the previous year's drought was the main driver of the overall growth of the economy. This was supported by simultaneous and well-distributed firming-up of activity in industry and services. Industrial production benefited from buoyant external demand. Accordingly, the real GDP growth accelerated to 8.2 per cent during 2003-04 from 4.0 per cent in 2002-03. The growth in the industrial sector was led by manufacturing and 'electricity, gas and water supply'. The services sector also experienced an acceleration in growth rate mainly driven by the sub-sectors, namely, 'trade, hotels, transpor t and communication' and 'community, social and personal services' (Table 2.1 and Chart II.1).

2.5 The Indian economy entered the fiscal year 2004-05 on an optimistic note. The India Meteorological Department (IMD) forecasted a normal South-West monsoon during the year. The SouthWest monsoon had in fact set in ahead of schedule. Based on the assumption of a normal monsoon, sustained growth of the industrial sector and good performance of exports, the Reserve Bank (RBI) had, in its Annual Policy Statement for the year 2004-05 (May 2004), projected a real Gross Domestic Product (GDP) growth rate of 6.5 to 7.0 per cent. A number of other institutions also projected growth rates close to this range. However, the erratic behaviour of the South-West monsoon (temporally as well as spatially) and the uncertain global oil price movements prompted most of these institutions to revise downward their growth forecasts over the course of the year. The Reserve Bank, in its Mid-Term Review of Annual Policy Statement (October 2004), also revised downward its projection of the economy's growth rate to 6.0 to 6.5 per cent (Table 2.2).

|

Table 2.1: Real Gross Domestic Product |

||||||||||

|

(Per cent) |

||||||||||

|

Sector |

1998-99 |

1999-00 |

2000-01 |

2001-02 P |

2002-03 QE |

2003-04 RE |

||||

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

||||

|

Growth Rate |

||||||||||

|

1. |

Agriculture and Allied Activities |

6.2 |

0.3 |

-0.1 |

6.5 |

-5.2 |

9.1 |

|||

|

1.1 |

Agriculture |

6.9 |

-0.1 |

-0.4 |

6.7 |

-6.0 |

.. |

|||

|

2. |

Industry |

3.2 |

4.1 |

6.5 |

3.5 |

6.2 |

6.8 |

|||

|

2.1 |

Mining and Quarrying |

2.8 |

3.3 |

2.4 |

2.2 |

8.8 |

4.4 |

|||

|

2.2 |

Manufacturing |

2.7 |

4.0 |

7.4 |

3.6 |

6.2 |

7.3 |

|||

|

2.3 |

Electricity, Gas and Water Supply |

7.0 |

5.2 |

4.3 |

3.6 |

3.8 |

5.5 |

|||

|

3. |

Services |

8.1 |

9.9 |

5.6 |

6.4 |

7.2 |

8.5 |

|||

|

3.1 |

Construction |

6.2 |

8.0 |

6.7 |

3.1 |

7.3 |

6.2 |

|||

|

3.2 |

Trade, Hotels, Transport and Communication |

7.7 |

8.5 |

6.8 |

8.7 |

7.0 |

11.2 |

|||

|

3.3 |

Financing, Insurance, Real Estate and Business |

Services |

7.4 |

10.6 |

3.5 |

4.5 |

8.8 |

6.8 |

||

|

3.4 |

Community, Social and |

Personal Services |

10.4 |

12.2 |

5.2 |

5.6 |

5.8 |

6.0 |

||

|

4. |

GDP at factor cost |

6.5 |

6.1 |

4.4 |

5.8 |

4.0 |

8.2 |

|||

|

Sectoral Composition |

||||||||||

|

1. |

Agriculture and Allied Activities |

26.4 |

25.0 |

23.9 |

24.1 |

22.0 |

22.1 |

|||

|

2. |

Industry |

22.0 |

21.6 |

22.0 |

21.5 |

22.0 |

21.7 |

|||

|

3. |

Services |

51.6 |

53.4 |

54.1 |

54.4 |

56.1 |

56.2 |

|||

|

4. |

Total |

100.0 |

100.0 |

100.0 |

100.0 |

100.0 |

100.0 |

|||

|

Memo: |

||||||||||

|

Real GDP at factor cost at 1993-94 prices (Rupees crore) |

10,82,748 |

11,48,368 |

11,98,592 |

12,67,833 |

13,18,321 |

14,26,701 |

||||

|

..Not Available. |

||||||||||

2.6 Notwithstanding this downward revision, as noted before, India will continue to be one of the fastest growing economies among the major emerging market economies during 2004-05 (Table 2.3).

2.7 Real GDP growth at 7.4 per cent in the first quarter of 2004-05 was along expected lines. The growth was driven by the buoyancy in industry and services. The prime movers were manufacturing, 'trade, hotels, transport and communication' and 'community, social and personal services' (Table 2.4).

Saving and Investment

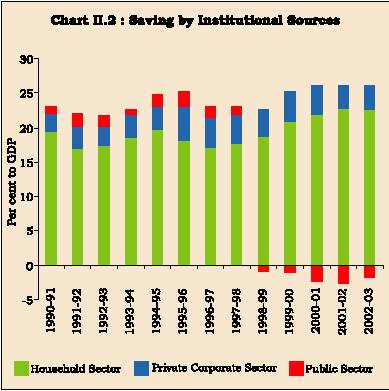

2.8 The savings rate improved marginally to 24.2 per cent in 2002-03 although it still remains below the peak of 25.1 per cent achieved in 1995-96, a year coterminous with the phase of high growth in the Indian economy (Table 2.5 and Chart II.2). The improvement in savings rate during 2002-03 was entirely due to the reduced public sector dis-savings, reflecting improved Government finances. There was a marginal decline in the household financial savings

|

Table 2.2: Growth in Real Gross Domestic Product, 2004-05 : Forecasts for India |

|||

|

(Per cent) |

|||

|

Agency |

Initial |

Revised / Latest |

Date of Projection |

|

1 |

2 |

3 |

4 |

|

Asian Development Bank |

7.4 |

6.5 |

(End September 2004) |

|

Centre for Monitoring Indian Economy |

6.3 |

6.2 |

(Mid-October 2004) |

|

Confederation of Indian Industry |

6.6 - 7.0 |

6.5 |

(Early November 2004) |

|

Credit Rating Information Services of India Limited |

6.2 |

5.6 |

(End November 2004) |

|

National Council of Applied Economic Research |

7.1 |

6.5 - 6.7 |

(Early August 2004) |

|

Investment and Credit Rating Agency |

6.4 |

6.3 |

(End November 2004) |

|

International Monetary Fund |

6.8 |

6.4 |

(September 2004) |

|

Reserve Bank of India |

6.5 - 7.0 |

6.0 - 6.5 |

(October 2004) * |

|

Memo: |

|||

|

Range |

6.2 - 7.4 |

5.6 - 6.7 |

|

|

* Mid-Term Review of Annual Policy Statement, 2004-05. |

|||

rate primarily on account of a sharp decline in deposits with non-banking companies. The savings rate of the private corporate sector continued its declining trend.

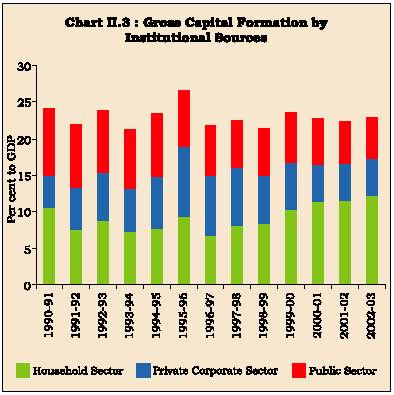

2.9 There was also an improvement in the investment rate in 2002-03, mainly due to an increase in the household sector investment (Chart II.3). The increase in the investment rate, however, was lower than that in the savings rate. Consequently, the overall saving-investment surplus increased further during 2002-03 and this was mirrored in the current account surplus of the balance of payments. The surplus of the private corporate sector continued to finance the resource gap of the public sector, although the resource gap of public sector declined marginally during the year (Table 2.6).

|

Table 2.3: Output Growth: Cross-Country Comparison |

||||||||||

|

(Per cent) |

||||||||||

|

Country |

Average |

1996 |

1997 |

1998 |

1999 |

2000 |

2001 |

2002 |

2003 |

2004 P |

|

1996-2004 |

||||||||||

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

|

World |

3.8 |

4.1 |

4.2 |

2.8 |

3.7 |

4.7 |

2.4 |

3.0 |

3.9 |

5.0 |

|

Advanced economies |

2.8 |

3.0 |

3.4 |

2.7 |

3.5 |

3.9 |

1.2 |

1.6 |

2.1 |

3.6 |

|

Emerging Market and |

5.0 |

5.6 |

5.3 |

3.0 |

4.0 |

5.9 |

4.0 |

4.8 |

6.1 |

6.6 |

|

developing Countries |

||||||||||

|

Argentina |

1.5 |

5.5 |

8.1 |

3.8 |

-3.4 |

-0.8 |

-4.4 |

-10.9 |

8.8 |

7.0 |

|

Bangladesh |

5.2 |

5.0 |

5.3 |

5.0 |

5.4 |

5.6 |

4.8 |

4.9 |

5.4 |

5.5 |

|

Brazil |

2.0 |

2.7 |

3.3 |

0.1 |

0.8 |

4.4 |

1.3 |

1.9 |

-0.2 |

4.0 |

|

Chile |

3.9 |

7.4 |

6.6 |

3.2 |

-0.8 |

4.5 |

3.4 |

2.2 |

3.3 |

4.9 |

|

China |

8.4 |

9.6 |

8.8 |

7.8 |

7.1 |

8.0 |

7.5 |

8.3 |

9.1 |

9.0 |

|

India |

5.9 |

7.5 |

5.0 |

5.8 |

6.7 |

5.4 |

3.9 |

5.0 |

7.2 |

6.4 @ |

|

Indonesia |

2.4 |

8.0 |

4.5 |

-13.1 |

0.8 |

4.9 |

3.5 |

3.7 |

4.1 |

4.8 |

|

Malaysia |

4.6 |

10.0 |

7.3 |

-7.4 |

6.1 |

8.9 |

0.3 |

4.1 |

5.3 |

6.5 |

|

Mexico |

3.7 |

5.2 |

6.8 |

5.0 |

3.6 |

6.6 |

-0.2 |

0.8 |

1.3 |

4.0 |

|

Pakistan |

3.9 |

2.9 |

1.8 |

3.1 |

4.0 |

3.4 |

2.7 |

4.4 |

6.2 |

6.3 |

|

Philippines |

3.8 |

5.8 |

5.2 |

-0.6 |

3.4 |

4.4 |

1.8 |

4.3 |

4.7 |

5.2 |

|

Sri Lanka |

4.3 |

3.8 |

6.4 |

4.7 |

4.3 |

6.0 |

-1.5 |

3.9 |

5.9 |

5.0 |

|

Thailand |

2.6 |

5.9 |

-1.4 |

-10.5 |

4.4 |

4.8 |

2.1 |

5.4 |

6.8 |

6.2 |

|

@ RBI’s projection for the financial year 2004-05, as indicated in the

Mid-Term Review of Annual Policy Statement, 2004-05 is 6.0-6.5 per cent. |

||||||||||

|

Table 2.4: Quarterly Sectoral Growth Rates of Real Gross Domestic Product |

||||||||||

|

(Per cent) |

||||||||||

|

Sector |

2002-03 |

2003-04 |

2004-05 |

|||||||

|

Q1 |

Q2 |

Q3 |

Q4 |

Q1 |

Q2 |

Q3 |

Q4 |

Q1 |

||

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

|

|

1. |

Agriculture and Allied Activities |

0.6 |

-2.9 |

-9.8 |

-6.3 |

0.1 |

6.8 |

16.5 |

10.5 |

3.4 |

|

2. |

Industry |

4.8 |

6.7 |

6.7 |

6.7 |

6.0 |

6.3 |

6.8 |

7.9 |

7.6 |

|

2.1 Mining and Quarrying |

11.8 |

10.1 |

7.6 |

6.3 |

2.3 |

2.0 |

3.6 |

9.0 |

6.1 |

|

|

2.2 Manufacturing |

4.0 |

6.7 |

6.9 |

7.3 |

6.6 |

7.4 |

7.5 |

7.6 |

8.0 |

|

|

2.3 Electricity, Gas and Water Supply |

4.3 |

3.9 |

4.8 |

2.2 |

4.8 |

2.9 |

4.8 |

9.5 |

6.3 |

|

|

3. |

Services |

7.2 |

7.9 |

6.8 |

6.8 |

7.2 |

10.0 |

9.1 |

7.6 |

8.9 |

|

3.1 Construction |

7.1 |

9.5 |

7.4 |

5.5 |

5.9 |

6.4 |

4.8 |

7.6 |

3.6 |

|

|

3.2 Trade, Hotels, Transport and |

||||||||||

|

Communication |

6.4 |

7.4 |

6.5 |

7.7 |

7.3 |

9.9 |

13.3 |

13.8 |

11.0 |

|

|

3.3 Financing, Insurance, Real |

||||||||||

|

Estate and Business Services |

9.6 |

9.8 |

8.6 |

7.5 |

5.7 |

6.4 |

6.5 |

8.5 |

7.0 |

|

|

3.4 Community, Social and |

||||||||||

|

Personal Services |

6.2 |

6.4 |

5.6 |

5.1 |

9.4 |

15.2 |

5.3 |

-3.1 |

9.3 |

|

|

4. |

GDP at factor cost |

5.1 |

5.5 |

2.0 |

3.7 |

5.3 |

8.6 |

10.5 |

8.2 |

7.4 |

|

Source : Central Statistical Organisation. |

||||||||||

Agriculture

2.10 Prospects for agriculture were bright in the beginning of the year in view of an optimistic forecast of a normal South-West monsoon by the IMD coupled with an ahead-of-schedule onset of the South-West monsoon. Thereafter, however, the monsoon was erratic with prolonged weakness/break over different parts of the country during late June, most of July (the main sowing month), late August and early September. The impact of deficient rainfall was acute during June 1 to July 28, 2004, when the deviation of the actual from the normal turned out to be 15 per cent. There was, however, a turnaround in rainfall during August and to some extent in September 2004. This provided respite from the moisture stress for late sown crops, besides replenishing the reservoirs.

|

Table 2.5: Gross Domestic Saving and Investment |

||||||||

|

(Per cent of GDP at current market prices) |

||||||||

|

Item |

1998-99 |

1999-00 |

2000-01 |

2001-02 P |

2002-03 QE |

|||

|

1 |

2 |

3 |

4 |

5 |

6 |

|||

|

1. |

Gross Domestic Saving (GDS) (1.1+1.2+1.3) |

21.5 |

24.2 |

23.7 |

23.5 |

24.2 |

||

|

1.1 |

Household Sector |

18.8 |

20.9 |

21.9 |

22.7 |

22.6 |

||

|

a) Financial Assets |

10.4 |

10.6 |

10.7 |

11.1 |

10.3 |

|||

|

b) Physical Assets |

8.4 |

10.3 |

11.3 |

11.6 |

12.3 |

|||

|

1.2 |

Private Corporate Sector |

3.7 |

4.4 |

4.1 |

3.5 |

3.4 |

||

|

1.3 |

Public Sector |

-1.0 |

-1.0 |

-2.3 |

-2.7 |

-1.9 |

||

|

2. |

Saving-Investment Balance |

-1.1 |

-1.1 |

-0.6 |

0.3 |

0.9 |

||

|

3. |

Gross Domestic Capital Formation (GDCF)# |

22.6 |

25.3 |

24.4 |

23.1 |

23.3 |

||

|

4. |

Gross Capital Formation (GCF) |

(4.1+4.2+4.3) |

21.4 |

23.7 |

22.6 |

22.3 |

22.8 |

|

|

4.1 |

Household Sector |

8.4 |

10.3 |

11.3 |

11.6 |

12.3 |

||

|

4.2 |

Private Corporate Sector |

6.4 |

6.5 |

5.1 |

4.9 |

4.8 |

||

|

4.3 |

Public Sector |

6.6 |

6.9 |

6.3 |

5.8 |

5.7 |

||

|

#Adjusted for errors and omissions. |

||||||||

2.11 The spatial distribution of rainfall during the South-West monsoon was uneven with 23 out of 36 meteorological sub-divisions recording normal rainfall and 13 receiving deficient/scanty rainfall. While none of the sub-divisions experienced severe drought conditions (wherein the seasonal rainfall deficiency exceeds 50 per cent), Himachal Pradesh, West Uttar Pradesh, Punjab, West Rajasthan, Vidarbha and Telengana experienced moderate drought conditions (with the seasonal rainfall deficiency between 25 and 50 per cent). Among the broad regions, North-West India was the worst affected with a seasonal rainfall deficiency of 22 per cent. Seasonal rainfall deficiency in Central India, North-East India and South Peninsula was 11 per cent, 6 per cent and 15 per cent, respectively. Of the 524 meteorological districts, 25 per cent of the districts experienced moderate drought, while 7 per cent of the districts experienced severe drought conditions during the season.

|

Table 2.6: Saving-Investment Balance |

|||||||

|

(Per cent of GDP at current market prices) |

|||||||

|

Item |

1990-91 |

1994-95 |

1999-00 |

2000-01 |

2001-02 P |

2002-03 QE |

|

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

|

|

Saving-Investment Balance (GDS-GDCF) |

-3.2 |

-1.2 |

-1.1 |

-0.6 |

0.3 |

0.9 |

|

|

Private Sector Balance* |

7.3 |

8.5 |

8.5 |

9.7 |

9.7 |

8.9 |

|

|

Public Sector Balance* |

-8.2 |

-7.0 |

-8.0 |

-8.6 |

-8.6 |

-7.5 |

|

|

Current Account Balance |

-3.1 |

-1.0 |

-1.0 |

-0.8 |

0.2 |

0.8 |

|

|

*Private and Public investments refer to gross capital formation (GCF),

unadjusted for errors and omissions. |

|||||||

2.12 The cumulative area-weighted rainfall during the South-West monsoon (June 1 to September 30, 2004) was 13 per cent below the Long Period Average (LPA) as compared with two per cent above the LPA during the last season. However, as the total area of the sub-divisions experiencing drought conditions was only 18 per cent, the year was not declared as an all-India drought year. This is also evident from the fact that the number of sub-divisions experiencing deficient/scanty rainfall during the South-West monsoon 2004 was 13 as compared with 21 during 2002, which was declared as a drought year. A positive development has been the satisfactory progress of the North-East monsoon so far (Table 2.7).

|

Table 2.7: Cumulative Rainfall |

||||||

|

Category |

No. of Sub-Divisions |

|||||

|

South-West Monsoon |

North-East Monsoon |

|||||

|

(June 1 to Sept. 30) |

(Oct. 1 to Dec. 8) |

|||||

|

2002 |

2003 |

2004 |

2002 |

2003 |

2004 |

|

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

|

Excess |

1 |

7 |

0 |

3 |

8 |

12 |

|

Normal |

14 |

26 |

23 |

7 |

9 |

8 |

|

Deficient |

19 |

3 |

13 |

12 |

4 |

15 |

|

Scanty/no rain |

2 |

0 |

0 |

14 |

15 |

1 |

|

Memo: |

||||||

|

Cumulative rainfall during the season |

- 19 |

+ 2 |

- 13 |

.. |

+ 3 |

- 4 |

|

Live Water Storage* |

53 |

59 |

64 |

41 |

51 |

54 |

|

* As per cent of Full Reservoir Level; the data are as on October 1 during

South-West monsoon season Source : India Meteorological Department. |

||||||

Kharif 2004

2.13 The crop production prospects during the kharif season, as a consequence, have been somewhat subdued. Given the fact that there is little scope for increasing the area under crops and any increase in production has to come through only by way of increasing the productivity levels, strategies were drawn for kharif 2004. These included: promotion of cropping system approach for augmenting the productivity of field crops as a whole as against the individual crop approach; ensuring timely pre-positioning of inputs like seeds, fertilisers, pesticides and improved implements in adequate quantities; adoption of timely and adequate weed control measures; and encouraging the cultivation of pulses and oilseeds as inter-crop in rainfed farming systems.

2.14 According to the First Advance Estimates of the Ministry of Agriculture (September 18, 2004), the production of foodgrains during kharif 2004-05 is placed at 100.3 million tonnes, a decline of around 10 per cent over that achieved in the preceding year. This decline is mainly due to the slippage in the production of coarse cereals. Among non-foodgrains, while the production of sugarcane and cotton is expected to remain closer to the previous year's level, the output of oilseeds is likely to receive a setback (Table 2.8).

|

Table 2.8: Season-wise Agricultural Production |

||||||||

|

(Million Tonnes) |

||||||||

|

Crop |

Kharif |

Rabi |

||||||

|

2002-03 2003-04 |

2004-05 |

2002-03 |

2003-04 |

2004-05 |

||||

|

A |

A.E.@ |

A.E. $ |

A |

A.E. @ |

Target |

|||

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

||

|

Rice |

63.7 |

73.9 |

71.1 |

9.0 |

13.1 |

.. |

||

|

Wheat |

.. |

.. |

.. |

65.1 |

72.1 |

.. |

||

|

Coarse cereals |

20.0 |

31.8 |

24.5 |

5.3 |

6.0 |

.. |

||

|

Pulses |

4.1 |

6.3 |

4.7 |

7.0 |

8.9 |

.. |

||

|

Total Foodgrains |

87.8 |

112.1 |

100.3 |

86.4 |

100.0 |

111.3 |

||

|

Oilseeds |

9.1 |

17.0 |

15.5 |

6.0 |

8.1 |

.. |

||

|

Sugarcane |

281.6 |

236.2 |

235.5 |

|||||

|

Cotton* |

8.7 |

13.8 |

13.9 |

|||||

|

Jute & Mesta** |

11.4 |

11.2 |

10.8 |

|||||

|

.. Not Available. |

||||||||

Rabi 2004

2.15 The revival of the South-West monsoon towards the end of the season and the satisfactory progress of the North-East monsoon together with a rabi strategy announced by the Government are expected to lead to a recovery in rabi production. The total live water storage as on December 10, 2004 in the 71 major reservoirs1 was 54 per cent of the Full Reservoir Level (FRL), higher than that in the corresponding period of preceding year. This is expected to recoup the losses in kharif production to some extent (Table 2.9). Incidentally, the contribution of kharif crops in the overall production has been coming down in the recent years. The Ministry of Agriculture has set the target for foodgrains production during the rabi 2004-05 at 111.3 million tonnes. A series of measures have been announced to increase rabi production, which include: launching of a nation-wide campaign to provide seeds of new varieties of crops, other inputs, and timely information so that farmers are able to make best use of moisture present in the soil; crop-specific strategies with a renewed emphasis on ensuring timely and adequate availability of inputs; propagation of soil ameliorants; promotion of water saving devices; promotion of zero-till seed drills, seed-cum-fertiliser drills, strip drills and raised bed planter in rice-wheat cropping system; promotion of integrated weed, pest, and disease management system; monitoring the progress of States in their work plans under Macro-Management Scheme; and promotion of Technology Missions on various crops. Reinvigorating the flow of credit to agriculture continues to be an important constituent of the overall strategy to

|

Table 2.9: Crop-wise Targets/Achievements |

|||||||||

|

(Million Tonnes) |

|||||||||

|

Crop |

2002-03 |

2003-04 |

2004-05 |

||||||

|

T |

A |

T |

A.E @ |

T |

|||||

|

1 |

2 |

3 |

4 |

5 |

6 |

||||

|

Rice |

93.0 |

72.7 |

93.0 |

87.0 |

93.5 |

||||

|

Wheat |

78.0 |

65.1 |

78.0 |

72.1 |

79.5 |

||||

|

Coarse cereals |

33.0 |

25.3 |

34.0 |

37.8 |

36.8 |

||||

|

Pulses |

16.0 |

11.1 |

15.0 |

15.2 |

15.3 |

||||

|

Total Foodgrains |

220.0 |

174.2 |

220.0 |

212.1 |

225.1 |

||||

|

Oilseeds |

27.0 |

15.1 |

24.7 |

25.1 |

26.2 |

||||

|

Sugarcane |

320.0 |

281.6 |

320.0 |

236.2 |

270.0 |

||||

|

Cotton* |

15.0 |

8.7 |

15.0 |

13.8 |

15.0 |

||||

|

Jute & Mesta** |

12.0 |

11.4 |

12.0 |

11.2 |

11.8 |

||||

|

* In million bales of 170 kilograms each. |

|||||||||

augment the agricultural production. The initiatives in this direction included: announcing a package to double the flow of credit to agriculture; advising the States to closely monitor credit disbursements and the progress of the recently announced debt-restructuring package; deputing teams to States to take stock of availability of inputs including credit distribution; rewarding the States achieving the targets with additional plan outlay; and, honouring the officials showing good results with cash and office facilities. Furthermore, States were advised to enhance the coverage under Kisan Credit Card (KCC) Scheme, besides allowing them to expand the scope of KCC to include the component of consumption credit and term loans for investment purposes in agriculture and allied activities.

Procurement, Off-take and Stocks of Foodgrains

2.16 The procurement of foodgrains (mainly rice, wheat and some coarse cereals) during 2004-05 (upto end-November 2004) was higher by around three million tonnes over the comparable period of the previous year. The off-take during April-September 2004, however, was lower by eight million tonnes over the preceding year. The decline was mainly due to a sharp fall in the off-take under Open Market Sales (OMS) which could be attributed to the comfortable supply situation in different parts of the country. Although the total stocks of foodgrains with the Food Corporation of India and other Government agencies as on October 1, 2004 were lower than the previous year, they continued to be higher than the buffer stock norms (Table 2.10).

|

Table 2.10: Management of Foodstocks |

||||||||||

|

(Million Tonnes) |

||||||||||

|

Year/Month |

Opening Stock |

Foodgrains |

Foodgrains Off-take |

Closing |

Buffer Stock |

|||||

|

of Foodgrains |

Procurement |

Stock |

Norms # |

|||||||

|

PDS |

OWS |

OMS - Domestic |

Exports |

|||||||

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

||

|

2003 |

||||||||||

|

April |

32.8 |

13.1 |

1.6 |

0.9 |

0.2 |

0.8 |

41.3 |

15.8 |

||

|

May |

41.3 |

3.7 |

2.0 |

1.6 |

0.01 |

0.9 |

39.8 |

|||

|

June |

39.8 |

0.9 |

1.7 |

2.5 |

0.2 |

1.3 |

35.2 |

|||

|

July |

35.2 |

0.2 |

2.3 |

1.4 |

0.01 |

2.2 |

30.5 |

24.3 |

||

|

August |

30.5 |

0.2 |

1.9 |

0.8 |

0.01 |

0.9 |

27.9 |

|||

|

September |

27.9 |

0.2 |

2.2 |

1.0 |

0.01 |

0.9 |

23.7 |

|||

|

October |

23.7 |

6.4 |

1.8 |

0.7 |

0.01 |

0.9 |

22.1 |

18.1 |

||

|

November |

22.1 |

2.4 |

2.1 |

0.7 |

0.01 |

0.6 |

25.4 |

|||

|

December |

25.4 |

2.9 |

1.9 |

0.7 |

0.2 |

0.5 |

25.0 |

|||

|

2004 |

||||||||||

|

January |

25.0 |

2.3 |

2.4 |

0.9 |

0.2 |

0.4 |

24.0 |

16.8 |

||

|

February |

24.0 |

2.6 |

1.9 |

1.1 |

0.1 |

0.5 |

22.8 |

|||

|

March |

22.8 |

2.1 |

2.4 |

1.2 |

0.1 |

0.4 |

20.7 |

|||

|

April |

20.7 |

15.7 |

2.0 |

0.5 |

0.0 |

0.3 |

32.4 |

15.8 |

||

|

May |

32.4 |

3.1 |

2.2 |

0.6 |

0.0 |

0.1 |

32.3 |

|||

|

June |

32.3 |

1.3 |

2.3 |

1.0 |

0.0 |

0.1 |

30.6 |

|||

|

July |

30.6 |

0.5 |

2.3 |

1.0 |

0.0 |

0.1 |

27.2 |

24.3 |

||

|

August |

27.2 |

0.2 |

2.3 |

1.0 |

0.0 |

0.01 |

23.0 |

|||

|

September |

23.0 |

0.2 |

2.2 |

1.0 |

0.0 |

0.1 |

20.3 |

|||

|

October |

20.3 |

6.5 |

.. |

.. |

.. |

.. |

.. |

18.1 |

||

|

November |

.. |

2.7 |

.. |

.. |

.. |

.. |

.. |

|||

|

Memo: |

||||||||||

|

2003-04 |

April - September |

27.1 * |

11.7 |

8.2 |

0.6 |

7.0 |

||||

|

2004-05 |

April - September |

30.2 * |

13.2 |

5.1 |

0.1 |

1.0 |

||||

|

.. Not Available. |

||||||||||

Industry

2.17 Industrial growth has strengthened further during 2004-05 so far (up to October 2004) (Chart II.4 and Table 2.11). The growth was led by all the three sectors, namely manufacturing, mining and electricity. The electricity sector showed an impressive growth mainly due to higher generation in thermal and hydro power plants on the back of higher demand emanating both from agriculture and industrial sectors. Higher growth in mining was largely contributed by the coal sector, which, in turn, was due to higher demand from the industrial sector and lesser interruption in mining activities during the monsoon.

2.18 During April-October 2004, 14 manufacturing industry groups (according to 2-digit level classification) recorded positive growth (Table 2.12). Notably, two industries, machinery and equipment, and chemicals and chemical products, constituting around 24 per cent of weight in the Index of Industrial Production (IIP) recorded more than 17 per cent growth up to October 2004.

|

Table 2.11: Index of Industrial Production - Monthly Growth |

||||||||

|

(Per cent) |

||||||||

|

Month / Weight |

General |

Electricity |

Mining & Quarrying |

Manufacturing |

||||

|

(100.00) |

(10.17) |

(10.47) |

(79.36) |

|||||

|

2003-04 |

2004-05 |

2003-04 |

2004-05 |

2003-04 |

2004-05 |

2003-04 |

2004-05 |

|

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

|

April |

4.2 |

8.9 |

1.9 |

10.3 |

6.3 |

9.1 |

4.3 |

8.8 |

|

May |

6.4 |

6.8 |

5.2 |

3.1 |

4.7 |

5.3 |

6.7 |

7.5 |

|

June |

6.7 |

7.3 |

5.4 |

4.5 |

5.7 |

2.7 |

6.9 |

8.1 |

|

July |

6.6 |

8.5 |

-1.4 |

13.7 |

2.9 |

4.2 |

8.0 |

8.4 |

|

August |

5.7 |

8.0 |

1.2 |

7.4 |

1.3 |

4.4 |

6.7 |

8.4 |

|

September |

7.5 |

8.8 |

6.0 |

7.7 |

4.5 |

4.9 |

8.0 |

9.2 |

|

October |

6.2 |

10.1 |

2.6 |

3.8 |

2.4 |

4.7 |

7.1 |

11.3 |

|

November |

8.2 |

.. |

4.8 |

.. |

5.2 |

.. |

8.9 |

.. |

|

December |

7.4 |

.. |

5.4 |

.. |

5.6 |

.. |

7.8 |

.. |

|

January |

8.0 |

.. |

6.1 |

.. |

8.7 |

.. |

8.2 |

.. |

|

February |

8.3 |

.. |

12.9 |

.. |

10.7 |

.. |

7.6 |

.. |

|

March |

8.1 |

.. |

10.6 |

.. |

5.1 |

.. |

8.1 |

.. |

|

April-October |

6.2 |

8.4 |

2.9 |

7.1 |

3.9 |

5.0 |

6.8 |

8.8 |

|

.. Not Available. |

||||||||

2.19 In terms of the use-based classification, all sectors, viz., basic, capital, intermediate and consumer goods registered higher growth during April-October 2004 as compared with the corresponding period of the previous year. However, consumer non-durables sector slowed down due to a decline in production mainly of food products and some industries in the basic chemicals and chemical products sector. On the other hand, consumer durables sector exhibited strong performance on account of increased demand both from rural and urban segments enabled by a significant increase in the retail credit. The improved growth performance of intermediate goods sector can be attributed to the surge in imports and higher capacity utilisation. The performance of the basic goods sector improved

|

Table 2.12: Growth of Manufacturing Industries (2-digit level Classification) - April-October 2004 |

|||||||

|

Above 20 per cent |

11-20 per cent |

0-10 per cent |

Negative |

||||

|

1 |

2 |

3 |

4 |

||||

|

1. |

Machinery and equipment |

1. |

Basic chemicals and |

1. |

Cotton textiles (8.7) |

1. |

Jute and other vegetable |

|

other than transport |

chemical products except |

2. |

Textiles products |

fibre textiles (-3.2) |

|||

|

equipment (24.6) |

products of petroleum and |

(including wearing apparels) (8.6) |

2. |

Food products (-3.7) |

|||

|

2. |

Other manufacturing |

coal (17.3) |

3. |

Beverages, tobacco and |

3. |

Wood and wood products, |

|

|

industries (21.0) |

related products (7.1) |

furniture and fixtures (-10.8) |

|||||

|

4. |

Metal products and parts (6.6) |

||||||

|

5. |

Wool, silk and man-made |

||||||

|

fibre textiles (5.5) |

|||||||

|

6. |

Leather and leather & fur |

||||||

|

products (4.7) |

|||||||

|

7. |

Rubber, plastic, petroleum |

||||||

|

and coal products (4.1) |

|||||||

|

8. |

Transport equipment and parts (3.2) |

||||||

|

9. |

Paper and paper products (2.1) |

||||||

|

10. |

Basic metal and alloy (0.8) |

||||||

|

11. |

Non-metallic mineral products (0.0) |

||||||

|

Note:Figures

in brackets are growth rates. |

|||||||

|

Table 2.13: Sectoral Contribution to IIP Growth |

|||||||||

|

(Per cent) |

|||||||||

|

Industry Group |

Weight |

Growth |

Relative Contribution |

||||||

|

in IIP |

|||||||||

|

April-March |

April-October |

April-March |

April-October |

||||||

|

2002-03 |

2003-04P |

2003-04P |

2004-05P |

2002-03 |

2003-04P |

2003-04P |

2004-05P |

||

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

|

Basic Goods |

35.57 |

4.9 |

5.4 |

4.3 |

5.4 |

27.4 |

25.0 |

22.6 |

21.1 |

|

Capital Goods |

9.26 |

10.5 |

13.1 |

9.2 |

15.1 |

16.2 |

18.0 |

13.7 |

17.1 |

|

Intermediate Goods |

26.51 |

3.9 |

6.3 |

5.2 |

7.6 |

19.3 |

25.4 |

24.0 |

25.9 |

|

Consumer Goods (a+b) |

28.66 |

7.1 |

7.1 |

8.4 |

10.0 |

37.0 |

31.0 |

39.7 |

35.9 |

|

a) Consumer Durables |

5.36 |

-6.3 |

11.5 |

7.7 |

15.9 |

-8.9 |

11.9 |

9.2 |

14.3 |

|

b) Consumer Non-durables |

23.30 |

12.0 |

5.7 |

8.6 |

8.1 |

45.9 |

19.2 |

30.4 |

21.6 |

|

IIP |

100.00 |

5.7 |

6.9 |

6.2 |

8.4 |

100.0 |

100.0 |

100.0 |

100.0 |

|

P : Provisional. |

|||||||||

despite a slowdown in the growth of steel sector. For the second consecutive year, the industrial recovery has been mainly driven by intermediate goods and capital goods sectors and, therefore, their relative contribution to the overall industrial growth increased. It also signifies the building up of capacity and better prospects for expansion in investments (Table 2.13).

2.20 A noteworthy aspect of the present phase of industrial upturn is that the growth in capital goods sector is very robust indicating the positive nature of the growth momentum. The capital goods sector registered a growth of 13.1 per cent in 2003-04, which is the highest growth achieved during any financial year since the revision of the IIP in 1993-94. The recovery in the capital goods sector has been underway since May 2002 after a negative performance for more than a year. The demand for capital goods is on the rise due to capacity creation taking place across the basic goods, consumer goods and intermediate goods sectors.

Infrastructure

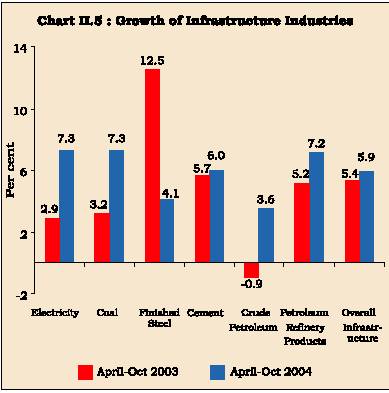

2.21 The subdued performance of the infrastructure industries during 2003-04 has been reversed during the current financial year due to better performance of electricity, coal and petroleum sectors. During April-October 2004, the overall growth of infrastructure industries accelerated to 5.9 per cent from 5.4 per cent in the corresponding period of 2003. All the core infrastructure industries, except finished steel, recorded higher growth as compared with the previous year. Both electricity and coal registered a high growth of 7.3 per cent. Increased power generation in thermal and hydro power plants and improved plant load factor at thermal power plants led to higher generation ofelectricity. Crude petroleum output made a turnaround during April-October 2004. The finished steel sector witnessed a steep deceleration in output, mainly due to higher input prices, supply bottlenecks in coking coal and a fall in the exports of steel (Chart II.5).

Services Sector

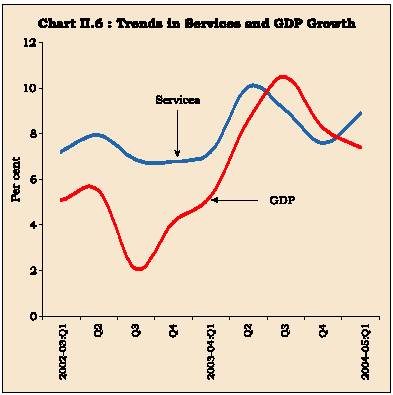

2.22 Services sector, as the main source of growth for the economy, sustained its momentum during the first quarter of the current financial year. According to the Central Statistical Organisation, the services recorded a growth of 8.9 per cent during April-June 2004 as compared with 7.2 per cent during April-June 2003 (Chart II.6 and Table 2.4). This was mainly led by the ‘trade, hotels, transport and communication’ sector (11

per cent) and ‘community, social, and personal services’ sectors (9.3 per cent). The expansion in the trade sector can be attributed to the increase in both exports and imports. Transport sector benefited from a number of factors such as the building up of new highways; the cut in customs duty on the inputs of auto components, which boosted the production of tractors and commercial vehicles; increase in cargo handled at major ports and harbours; and increase in freight and passenger traffic of railways. The growth of hotel industry was facilitated by a record increase in tourist inflows into the country. Lower tariffs in the cellular segment due to intense competition among the operators and higher penetration into the rural areas have led to substantial growth in the telecommunication sector.

|

Table 2.14: Performance of the Industrial Sector – Selective Indicators |

||||||||

|

(Growth in Per cent) |

||||||||

|

Year |

IIP |

Manufacturing |

Capital |

Consumer |

Non-Food |

Import of |

Export of |

|

|

IIP |

Goods |

Goods |

Credit |

Capital |

Manufactured |

|||

|

Goods |

Goods |

|||||||

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

|

|

1994-95 |

9.1 |

9.1 |

9.2 |

12.1 |

29.8 |

22.5 |

22.5 |

|

|

1995-96 |

13.0 |

14.1 |

5.4 |

12.8 |

22.5 |

44.1 |

16.4 |

|

|

1996-97 |

6.1 |

7.3 |

11.4 |

6.2 |

10.9 |

1.9 |

3.6 |

|

|

1997-98 |

6.7 |

6.7 |

5.8 |

5.5 |

15.1 |

3.4 |

7.9 |

|

|

1998-99 |

4.1 |

4.4 |

12.6 |

2.2 |

13.0 |

16.3 |

-2.8 |

|

|

1999-00 |

6.7 |

7.1 |

6.9 |

5.7 |

16.5 |

-8.2 |

15.2 |

|

|

2000-01 |

5.0 |

5.3 |

1.8 |

8.0 |

14.9 |

5.1 |

15.6 |

|

|

2001-02 |

2.7 |

2.9 |

-3.4 |

6.0 |

13.6 |

15.4 |

-2.8 |

|

|

2002-03 |

5.7 |

6.0 |

10.5 |

7.1 |

18.6 |

38.6 |

20.6 |

|

|

2003-04 |

6.9 |

7.3 |

13.1 |

7.1 |

18.4 |

20.5 |

18.3 |

|

|

2003-04 (April - October) |

6.2 |

6.8 |

9.2 |

8.4 |

17.1 |

30.7 |

@ |

7.1 @ |

|

2004-05 (April - October) |

8.4 |

8.8 |

15.1 |

10.0 |

26.1 |

30.1 |

@ |

28.6 @ |

|

@ Pertains to April - July period. |

||||||||

2.23 Despite slowdown in global IT spending, jobless recovery in major markets and protectionist tendencies exhibited by the prominent developed markets, India continues to attract a large share of offshore business from major markets like the United States, European countries and Asia-Pacific regions. During the year 2003-04, Indian software and services exports generated revenues to the tune of US $ 12.5 billion by registering a spectacular growth of 30.5 per cent. This reflects the ability of the Indian firms to execute larger and more complex projects as well as high value added services.

Industrial Outlook

2.24 The continued broad-based recovery in industrial growth since April 2002 indicates that the industry is consolidating its performance and gathering momentum to move to a high growth trajectory. The current phase of industrial rebound could be attributed to improved investment climate, expanding external demand, improved domestic demand, ease in availability of finance and increasing capacity additions in the industrial sector. The robust performance of the capital goods sector coupled with the increased imports of capital goods indicate the possibility of capacity expansion in a large number of industries and point to a promising outlook for the industrial sector (Table 2.14). Export growth of manufactured goods has continued to remain strong.

Export of engineering goods, constituting about one-fifth of the total merchandise exports of the country, has been a fast growing sector in the industrial production. The liberalisation measures announced in the new foreign trade policy towards imports and exports of various industrial goods are expected to provide a further fillip to the industrial growth. The pick up in the core infrastructure sector growth during the current financial year so far is likely to continue through the rest of the year, which may give further boost to the industrial growth.

2.25 Business expectation surveys support an upbeat outlook. According to the 'Industrial Outlook Survey' of the Reserve Bank, the expectations on overall business situation for the quarter October-December 2004 show a higher level of confidence (47.4 per cent) as compared with the previous quarter (44.4 per cent). The Business Expectation Index (BEI) for October-December 2004 stands at 121.5 points, marking a rise of 1.3 per cent over the previous quarter. While the Confederation of Indian Industry’s (CII's) Business Confidence Index for October 2004-March 2005 at 64.8 points exhibits a decline of 1.2 points as compared with April-September 2004, its Business Outlook Survey for October 2004-March 2005 reveals improved capacity utilisation and higher capital investment in the ensuing period.

II. FISCAL SITUATION

Central Government Finances

Union Budget 2004-05

2.26 The Union Budget (Regular) for 2004-05 was presented to the Parliament on July 8, 2004 against the backdrop of sound macroeconomic fundamentals as reflected in the highest GDP growth over the past 15 years and robust balance of payments position.

The Union Budget seeks to carry forward the process of fiscal consolidation while sustaining the growth momentum with a renewed thrust on welfare programmes. Fiscal prudence, transparency, accountability and credibility have been institutionalised against the backdrop of implementation of fiscal rules. The Budget adopted a forward-looking approach providing, for the first time, a medium-term fiscal outlook. The Government's commitment to prudent financial policies was demonstrated by notifying the Fiscal Responsibility and Budget Management (FRBM) Act, 2003 and the FRBM Rules, 2004 with effect from July 5, 2004. The FRBM Rules lay down a road map towards elimination of revenue deficit and a reduction of fiscal deficit to a level not more than three per cent of GDP by end-March 2008.

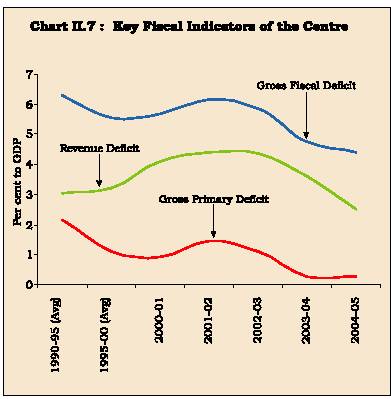

2.27 In accordance with the FRBM Rules, 2004, the Union Budget, 2004-05 adopted a strategy of revenue-led and front loaded fiscal consolidation for 2004-05. The emphasis has been on withdrawing the various exemptions and rationalising the tax structure so as to eliminate subjectivity in the tax system. Given the downward rigidities characterising the revenue expenditure, the attainment of the goals set out in the FRBM Rules depends on the realisation of the revenue buoyancy. The revenue deficit is budgeted to decline by nearly 24 per cent in 2004-05 as compared with a decline of around 7 per cent in the previous year. The reduction in revenue deficit is more than twice the envisaged reduction of 0.5 per cent of GDP per annum in the FRBM Rules, 2004, and is based mainly on the expectations of a higher growth in tax receipts. As a proportion of GDP, Gross Fiscal Deficit (GFD) is also set to decline by 0.4 percentage point to 4.4 per cent in 2004-05 with the revenue deficit constituting 55.4 per cent of GFD in 2004-05. Primary deficit, as a proportion of GDP, is however, expected to remain unchanged (Table 2.15 and Chart II.7).

|

Table 2.15: Key Deficit Indicators of the Union Government |

|||||

|

(Rupees crore) |

|||||

|

Item |

2002-03 |

2003-04 |

2004-05 |

Variation |

(Per cent) |

|

(Accounts) |

(RE) |

(BE) |

|||

|

2003-04 |

2004-05 |

||||

|

1 |

2 |

3 |

4 |

5 |

6 |

|

Gross Fiscal Deficit |

1,45,072 |

1,32,103 |

1,37,407 |

-8.9 |

4.0 |

|

(5.9) |

(4.8) |

(4.4) |

|||

|

Revenue Deficit |

1,07,880 |

99,860 |

76,171 |

-7.4 |

-23.7 |

|

(4.4) |

(3.6) |

(2.5) |

|||

|

Gross Primary Deficit |

27,268 |

7,548 |

7,907 |

-72.3 |

4.8 |

|

(1.1) |

(0.3) |

(0.3) |

|||

|

RE : Revised Estimates. |

|||||

2.28 A series of measures announced in the Union Budget are expected to boost the tax revenue by about 25 per cent during 2004-05. These measures, inter alia, are: imposition of an education cess of two per cent, the introduction of Securities Transaction Tax (STT), a wider coverage of services under the tax net, an increase in the service tax rate and a special drive for collection of tax arrears. As a proportion of GDP, gross tax revenue is expected to increase by one percentage point to 10.2 per cent over the previous year’s level.

2.29 Aggregate expenditure adjusted for National Small Savings Fund (NSSF) repayments is projected to grow by 11.7 per cent mainly on account of a strong growth in capital expenditure as compared with 6.8 per cent in 2003-04. Growth in revenue expenditure during 2004-05 is expected to decelerate, reflecting a sharp reduction of 45.9 per cent in petroleum subsidies. Furthermore, growth in interest payments is also expected to decelerate in 2004-05 in the absence of any prepayment premium for retiring debt (Table 2.16).

|

Table 2.16: Important Fiscal Parameters of the Union Government |

|||||||

|

(Rupees crore) |

|||||||

|

Item |

2002-03 |

2003-04 |

2004-05 |

Percentage Variation |

|||

|

(Accounts) |

(RE) |

(BE) |

|||||

|

2003-04 |

2004-05 |

||||||

|

1 |

2 |

3 |

4 |

5 |

6 |

||

|

I |

Total Receipts (1+2) |

4,14,162 |

4,74,255 |

4,77,829 |

14.5 |

0.8 |

|

|

(16.8) |

(17.1) |

(15.3) |

|||||

|

1 |

Revenue Receipts |

2,31,748 |

2,63,027 |

3,09,322 |

13.5 |

17.6 |

|

|

(9.4) |

(9.5) |

(9.9) |

|||||

|

i. |

Tax Revenue (Net) |

1,59,425 |

1,87,539 |

2,33,906 |

17.6 |

24.7 |

|

|

(6.5) |

(6.8) |

(7.5) |

|||||

|

ii. |

Non-Tax Revenue |

72,323 |

75,488 |

75,416 |

4.4 |

-0.1 |

|

|

(2.9) |

(2.7) |

(2.4) |

|||||

|

2 |

Capital Receipts |

1,82,414 |

2,11,228 |

1,68,507 |

15.8 |

-20.2 |

|

|

(7.4) |

(7.6) |

(5.4) |

|||||

|

II |

Total Expenditure (1+2)=(3+4) |

4,14,163 * |

4,74,255 * |

4,77,829 |

14.5 |

0.8 |

|

|

(16.8) |

(17.1) |

(15.3) |

|||||

|

1 |

Revenue Expenditure |

3,39,628 |

3,62,887 |

3,85,493 |

6.8 |

6.2 |

|

|

(13.8) |

(13.1) |

(12.3) |

|||||

|

of which: Interest Payments |

1,17,804 |

1,24,555 |

1,29,500 |

5.7 |

4.0 |

||

|

(4.8) |

(4.5) |

(4.1) |

|||||

|

2 |

Capital Expenditure |

74,535 * |

1,11,368 * |

92,336 |

49.4 |

-17.1 |

|

|

(3.0) |

(4.0) |

(3.0) |

|||||

|

3. |

Non-Plan Expenditure |

3,02,708 |

3,52,748 |

3,32,239 |

16.5 |

-5.8 |

|

|

(12.3) |

(12.7) |

(10.6) |

|||||

|

4. |

Plan Expenditure |

1,11,455 |

1,21,507 |

1,45,590 |

9.0 |

19.8 |

|

|

(4.5) |

(4.4) |

(4.7) |

|||||

|

Memo : |

(Expenditure net of NSSF repayments) |

||||||

|

IIa. |

Total Expenditure |

4,00,397 |

4,27,653 |

4,77,829 |

6.8 |

11.7 |

|

|

(16.2) |

(15.4) |

(15.3) |

|||||

|

2a. |

Capital Expenditure |

60,769 |

64,766 |

92,336 |

6.6 |

42.6 |

|

|

(2.5) |

(2.3) |

(3.0) |

|||||

|

* Includes NSSF repayments. |

|||||||

2.30 The Finance Bill, 2004 giving effect to the tax proposals was passed by the Parliament in August 2004 with certain amendments such as changes in the proposals relating to income tax and the STT. Marginal relief was provided to income tax assesses by ensuring that an individual having total income exceeding Rs. one lakh was not left with a post tax income below Rs. one lakh. The STT is being levied at moderated and varied rates based on the type of transactions.

Developments during April-October 2004

2.31 During the current fiscal so far (April-October 2004), the Union Government finances have shown signs of improvement. This was mainly on account of higher revenue receipts which, in turn, were due to a sharp growth in corporate tax collections in the wake of the industrial recovery, sizeable contribution from service tax and better personal income tax collections. Notwithstanding the significant growth in tax revenues, the proportion of revenue receipts to its full year budget estimates was lower than that in the previous year. Non-debt capital receipts declined over the corresponding period of the preceding year reflecting lower loan recoveries from the State Governments. Aggregate expenditure constituted 48.9 per cent of the budget estimates and this ratio was lower than that in the corresponding period of the previous year. Growth in revenue expenditure decelerated on account of lower subsidies and lower grants-in-aid to States/UTs. Capital expenditure registered a decline reflecting the discharge of liabilities to the NSSF in the previous year, which has not been done during the current year so far. The decline in the capital expenditure was also on account of lower disbursements of loans and advances in the current fiscal year (Table 2.17).

|

Table 2.17: Finances of the Centre during 2004-05 |

||||||||||

|

(Rupees crore) |

||||||||||

|

Item |

2003-04 |

2004-05 |

April-October |

|||||||

|

(BE) |

(BE) |

|||||||||

|

Amount |

Percentage to BE |

Growth Rate (Per cent) |

||||||||

|

(Amount) |

(Amount) |

|||||||||

|

2003-04 |

2004-05 |

2003-04 |

2004-05 |

2003-04 |

2004-05 |

|||||

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

||

|

I. |

Revenue Receipts (1+2) |

2,53,935 |

3,09,322 |

1,20,190 |

1,32,790 |

47.3 |

42.9 |

9.9 |

10.5 |

|

|

1. |

Tax Revenue (Net) |

1,84,169 |

2,33,906 |

79,589 |

93,568 |

43.2 |

40.0 |

12.7 |

17.6 |

|

|

2. |

Non-Tax Revenue |

69,766 |

75,416 |

40,601 |

39,222 |

58.2 |

52.0 |

4.7 |

-3.4 |

|

|

II. |

Aggregate Expenditure (1+2) |

4,38,795 |

4,77,829 |

2,53,770 |

2,33,615 |

57.8 |

48.9 |

30.4 |

-7.9 |

|

|

1. |

Revenue Expenditure |

3,66,227 |

3,85,493 |

1,91,046 |

1,96,669 |

52.2 |

51.0 |

15.0 |

2.9 |

|

|

of which |

||||||||||

|

Interest Payments |

1,23,223 |

1,29,500 |

60,355 |

63,116 |

49.0 |

48.7 |

4.8 |

4.6 |

||

|

Defence |

44,347 |

43,517 |

21,835 |

22,633 |

49.2 |

52.0 |

7.9 |

3.7 |

||

|

Major Subsidies |

48,930 |

42,214 |

30,526 |

28,366 |

62.4 |

67.2 |

36.2 |

-7.1 |

||

|

2. |

Capital Expenditure |

72,568 |

92,336 |

62,724 |

36,946 |

86.4 |

40.0 |

119.8 |

-41.1 |

|

|

III. |

Revenue Deficit |

1,12,292 |

76,171 |

70,856 |

63,879 |

63.1 |

83.9 |

24.9 |

-9.8 |

|

|

IV. |

Fiscal Deficit |

1,53,637 |

1,37,407 |

85,978 |

62,135 |

56.0 |

45.2 |

23.2 |

-27.7 |

|

|

V. |

Primary Deficit |

30,414 |

7,907 |

25,623 |

-981 |

84.2 |

-12.4 |

110.4 |

-103.8 |

|

|

Memo: |

||||||||||

|

Gross Tax Revenue |

2,51,527 |

3,17,733 |

1,12,363 |

1,36,238 |

44.7 |

42.9 |

8.9 |

21.2 |

||

|

Of which |

||||||||||

|

Corporation Tax |

51,499 |

88,436 |

20,931 |

25,409 |

40.6 |

28.7 |

34.3 |

21.4 |

||

|

Income Tax |

44,070 |

50,929 |

17,358 |

26,874 |

39.4 |

52.8 |

1.8 |

54.8 |

||

|

Customs Duties |

49,350 |

54,250 |

27,843 |

30,744 |

56.4 |

56.7 |

8.1 |

10.4 |

||

|

Union Excise Duties |

96,791 |

1,09,199 |

41,229 |

46,243 |

42.6 |

42.3 |

0.2 |

12.2 |

||

|

BE : Budget Estimates. |

||||||||||

2.32 Revenue deficit during April-October 2004 was lower than its level in the corresponding period of 2003. Nonetheless, at 83.9 per cent of its budgeted level for the full fiscal, it was higher than that in the corresponding period of 2003. GFD was lower than previous year and continued to remain below revenue deficit on account of debt-swap receipts during the first seven months of 2004-05. GFD constituted 45.2 per cent of the budget estimates. While 27.4 per cent of the GFD was financed through draw down of cash balances, 61 per cent was financed through incremental internal debt and 12.9 per cent through incremental external assistance.

State Finances2

2.33 The unrelenting strain on the finances of the State Governments over the years is reflected in their persistent and growing fiscal imbalances. This deterioration in State finances has adversely affected their current and prospective developmental and welfare-oriented functions. In this milieu, a positive development has been the growing recognition of the urgent need for fiscal consolidation. A number of State Governments have initiated a wide spectrum of reforms in order to arrest the deterioration in their financial position. The process of reforms at the sub-national level is being driven by a unique twin-track strategy blending the Medium Term Fiscal Restructuring Policy (MTFRP) and an autonomous approach in the form of fiscal responsibility/legislation.

2.34 The State budgets for 2004-05 seek to carry forward the reform process initiated in the recent past. The States have laid emphasis on fiscal rectitude and institutional reforms. The major initiatives of the States include perseverance with fiscal reforms, i.e., revenue augmentation and expenditure containment, reforms in tax administration, improvement in the recovery of user charges, restructuring of the State PSUs, enhancing transparency in budgetary operations, emphasis on infrastructure development and reduction and management of States' debt. All the major deficit indicators of the State Governments during 2004-05 are expected to be substantially lower than their levels in the previous year (Table 2.18). A part of the envisaged correction would, however, reflect the reduction in (revenue and capital) expenditures on the power sector consequent to an upsurge in the previous year. The sharp increase in expenditure on the power sector in the previous year occurred in conjunction with the issue of power bonds to the Central PSUs under the One-Time Settlement Scheme for the dues of the State Electricity Boards.

2.35 The States' own tax as well as own non-tax revenues, as a ratio to GDP, would remain unchanged in 2004-05 from their previous year's level. Current transfers from the Centre (comprising sharable tax revenue and grants), as a ratio to GDP, would record a marginal decline in 2004-05 from the levels in the past (Table 2.19).

2.36 The total expenditure, both revenue and capital components, as a ratio to GDP, is expected to be lower in 2004-05 than that in the previous year, although still higher than that in the first half of the 1990s. As noted earlier, a part of the fiscal correction during 2004-05 is envisaged through compression in expenditure on the power sector, which is recorded

|

Table 2.18: Major Deficit Indicators of State Governments |

|||||||||||

|

(Rupees crore) |

|||||||||||

|

Item |

Average |

2002-03 |

2003-04 |

2003-04 |

2004-05 |

Percentage variation |

|||||

|

BE |

RE |

BE |

|||||||||

|

1990-95 |

1995-00 |

2000-02 |

Col.7/6 |

Col.8/7 |

|||||||

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

||

|

Gross Fiscal Deficit |

1,02,058 |

1,16,110 |

1,40,407 |

1,12,251 |

20.9 |

-20.1 |

|||||

|

(2.8) |

(3.5) |

(4.2) |

(4.1) |

(4.2) |

(5.1) |

(3.6) |

|||||

|

Revenue Deficit |

55,173 |

48,824 |

72,240 |

48,259 |

48.0 |

-33.2 |

|||||

|

(0.7) |

(1.7) |

(2.6) |

(2.2) |

(1.8) |

(2.6) |

(1.5) |

|||||

|

Primary Deficit |

32,092 |

33,443 |

56,682 |

20,604 |

69.5 |

-63.6 |

|||||

|

(1.6) |

(1.4) |

(1.1) |

(1.3) |

(1.2) |

(2.0) |

(0.7) |

|||||

|

BE :Budget Estimates. |

|||||||||||

|

Table 2.19: Total Receipts of State Governments |

|||||||||||

|

(Rupees crore) |

|||||||||||

|

Item |

Average |

2002-03 |

2003-04 |

2003-04 |

2004-05 |

Percentage variation |

|||||

|

BE |

RE |

BE |

|||||||||

|

1990-95 |

1995-00 |

2000-02 |

Col.7/6 |

Col.8/7 |

|||||||

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

||

|

Total Receipts (1+2) |

4,23,819 |

4,77,313 |

5,39,635 |

5,42,295 |

13.1 |

0.5 |

|||||

|

(16.1) |

(15.2) |

(16.6) |

(17.2) |

(17.4) |

(19.5) |

(17.4) |

|||||

|

1. |

Total Revenue Receipts (a+b) |

2,77,389 |

3,30,688 |

3,27,302 |

3,67,428 |

-1.0 |

12.3 |

||||

|

(12.1) |

(10.9) |

(11.3) |

(11.2) |

(12.1) |

(11.8) |

(11.8) |

|||||

|

(a) |

States own Revenue |

1,76,479 |

2,04,804 |

2,03,114 |

2,30,991 |

-0.8 |

13.7 |

||||

|

(7.3) |

(6.9) |

(7.1) |

(7.1) |

(7.5) |

(7.3) |

(7.4) |

|||||

|

States own tax |

1,42,006 |

1,64,838 |

1,62,700 |

1,82,982 |

-1.3 |

12.5 |

|||||

|

(5.4) |

(5.3) |

(5.6) |

(5.8) |

(6.0) |

(5.9) |

(5.9) |

|||||

|

States own non tax |

34,473 |

39,966 |

40,414 |

48,009 |

1.1 |

18.8 |

|||||

|

(1.8) |

(1.6) |

(1.5) |

(1.4) |

(1.5) |

(1.5) |

(1.5) |

|||||

|

(b) |

Central Transfers |

1,00,910 |

1,25,884 |

1,24,188 |

1,36,437 |

-1.3 |

9.9 |

||||

|

(4.9) |

(4.0) |

(4.2) |

(4.1) |

(4.6) |

(4.5) |

(4.4) |

|||||

|

Shareable taxes |

56,457 |

64,049 |

65,044 |

77,343 |

1.6 |

18.9 |

|||||

|

(2.6) |

(2.4) |

(2.4) |

(2.3) |

(2.3) |

(2.3) |

(2.5) |

|||||

|

Central Grants |

44,453 |

61,835 |

59,144 |

59,094 |

-4.4 |

-0.1 |

|||||

|

(2.3) |

(1.6) |

(1.8) |

(1.8) |

(2.3) |

(2.1) |

(1.9) |

|||||

|

2. |

Capital Receipts (a+b) |

1,46,430 |

1,46,625 |

2,12,333 |

1,74,867 |

44.8 |

-17.6 |

||||

|

(4.0) |

(4.2) |

(5.3) |

(5.9) |

(5.3) |

(7.7) |

(5.6) |

|||||

|

(a) |

Loans from Centre@ |

26,348 |

33,634 |

32,203 |

33,852 |

-4.3 |

5.1 |

||||

|

(1.2) |

(1.0) |

(1.0) |

(1.1) |

(1.2) |

(1.2) |

(1.1) |

|||||

|

(b) |

Other Capital Receipts |

1,20,082 |

1,12,991 |

1,80,130 |

1,41,015 |

59.4 |

-21.7 |

||||

|

(2.9) |

(3.2) |

(4.3) |

(4.9) |

(4.1) |

(6.5) |

(4.5) |

|||||

|

@With the change in the system of accounting with effect from 1999-2000,

States’ share in small savings which |

|||||||||||

under 'Economic Services'. Consequently, the ratio of developmental expenditure to GDP would decline in 2004-05 whereas the non-developmental expenditure to GDP ratio would remain unchanged at its previous year’s level (Table 2.20).

2.37 Small savings would continue to be the major source of financing of the States' GFD in 2004-05. The shares of market borrowings and 'others' including loans from banks and financial institutions are budgeted to decline in 2004-05 from the revised estimates of 2003-04 (Table 2.21).

2.38 Effective April 1, 2004, the formula-based aggregate normal Ways and Means Advances (WMA) limit for each State Government has been enhanced by 13.5 per cent to Rs. 8,140 crore on the basis of higher average revenue receipts in the previous three years. Since July 2004, the weekly average utilisation of WMA and Overdraft (OD) has been lower than that in the corresponding period of the previous year, (Chart II.8). The weekly average utilisation of WMA and OD during November 2004 was Rs.3,943 crore as compared with Rs.6,128 crore in the corresponding period of the previous year. The frequency of resort to overdrafts has also been, in general, lower during 2004-05 so far than that in the (full) previous year. During 2004-05 so far (up to December 8, 2004), 13 State Governments have resorted to overdraft as compared with 19 State Governments during 2003-04 (April-March).

ପେଜ୍ ଅନ୍ତିମ ଅପଡେଟ୍ ହୋଇଛି: