IST,

IST,

Monetary Policy Report - April 2021

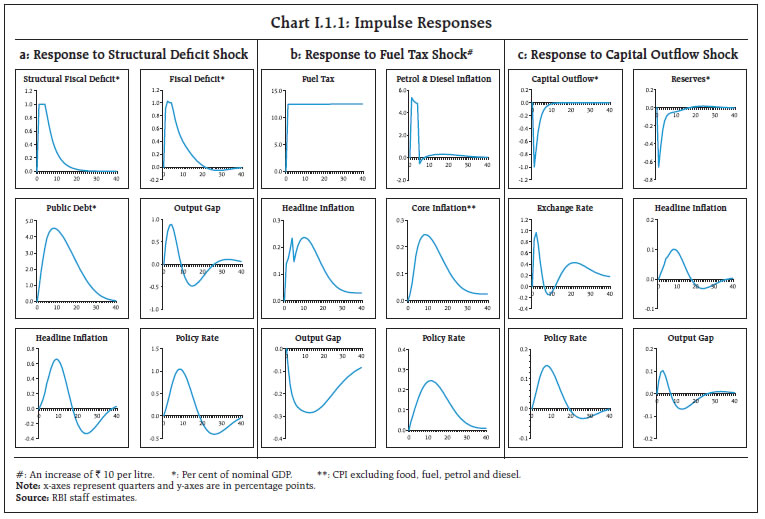

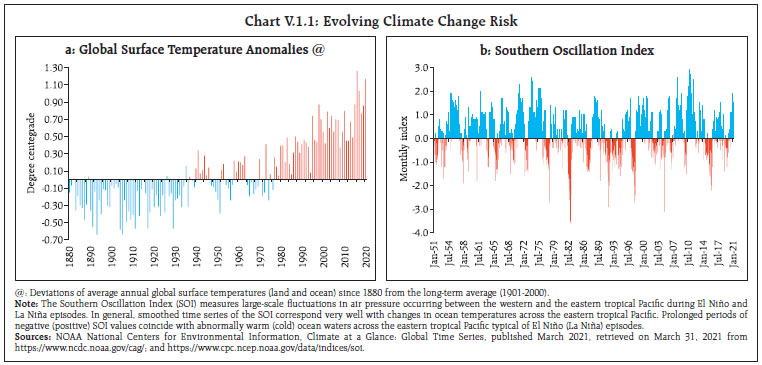

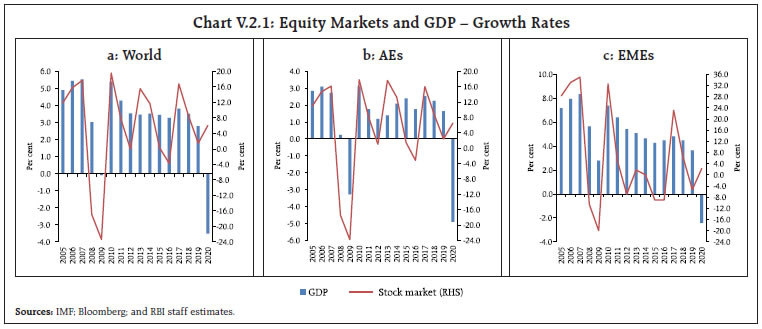

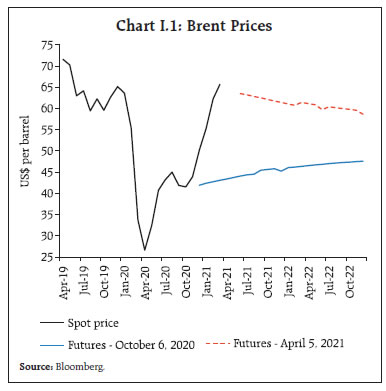

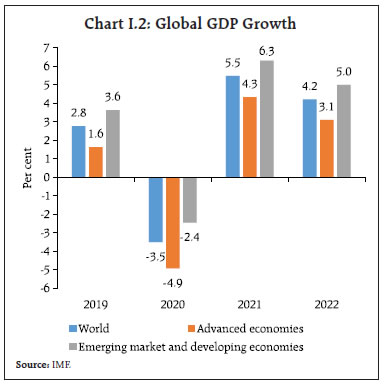

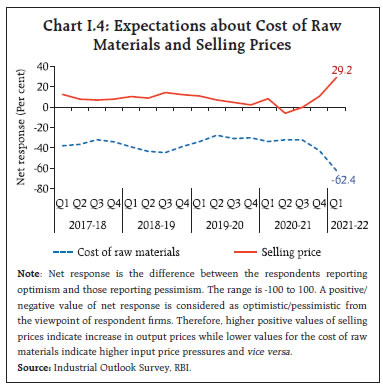

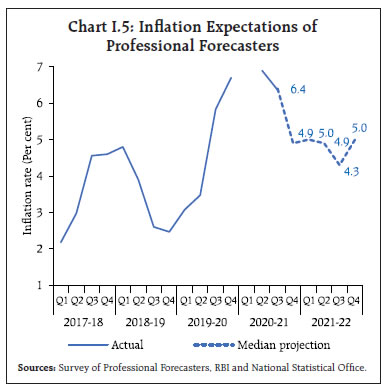

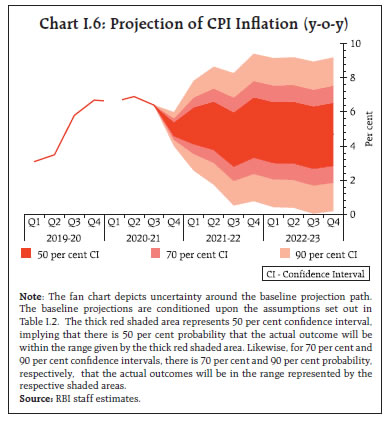

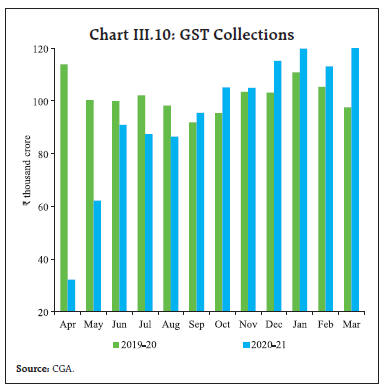

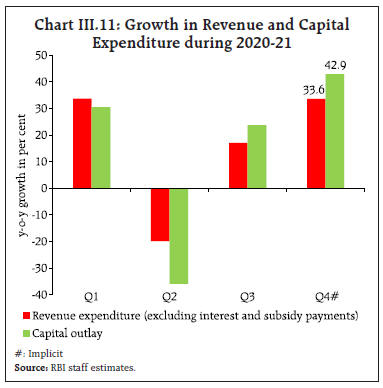

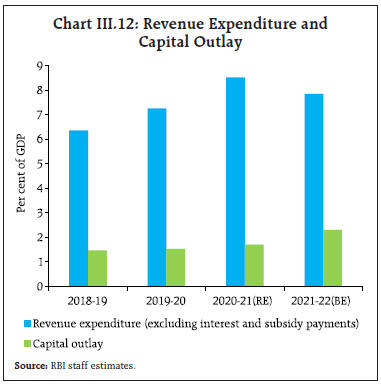

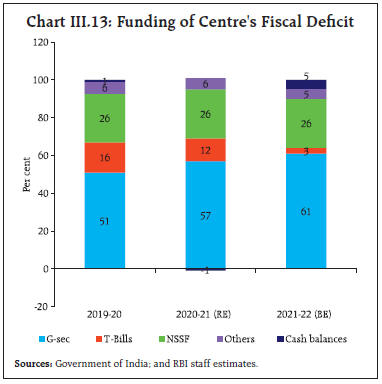

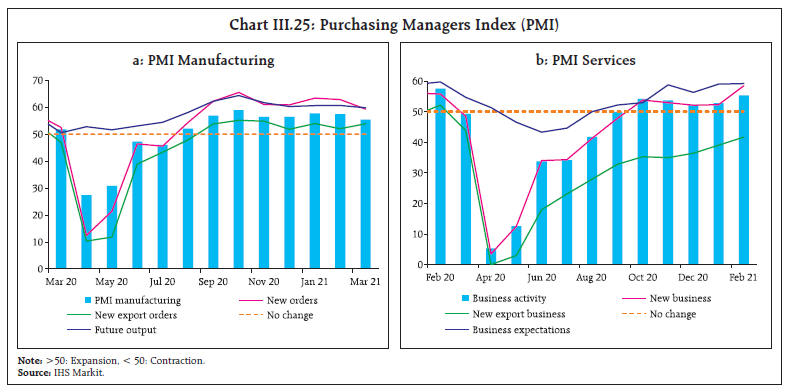

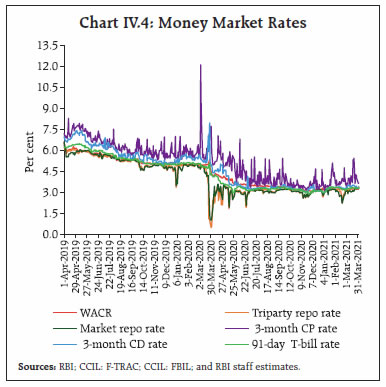

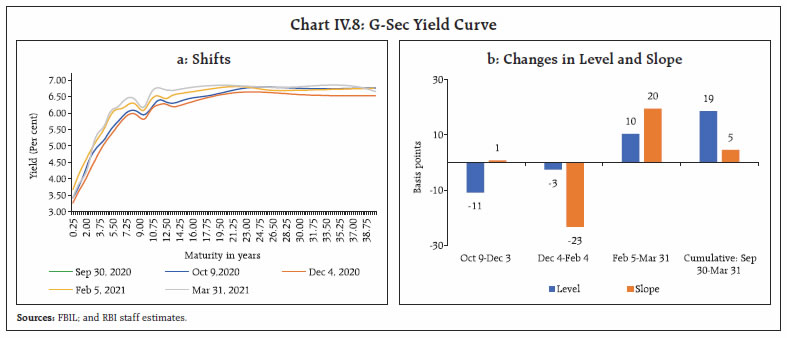

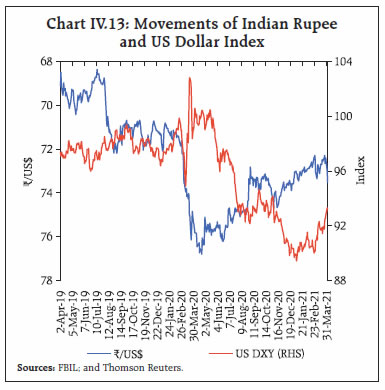

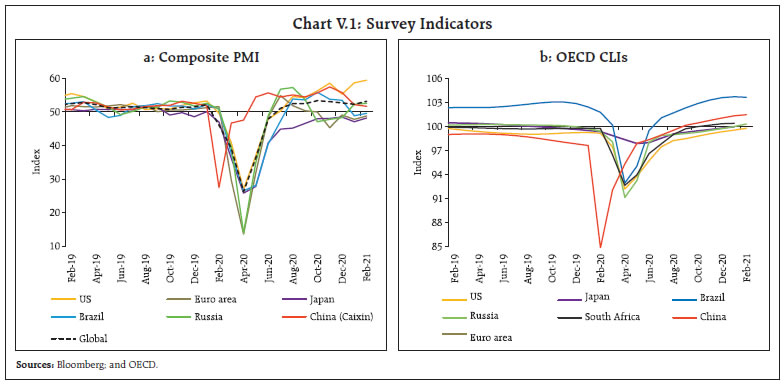

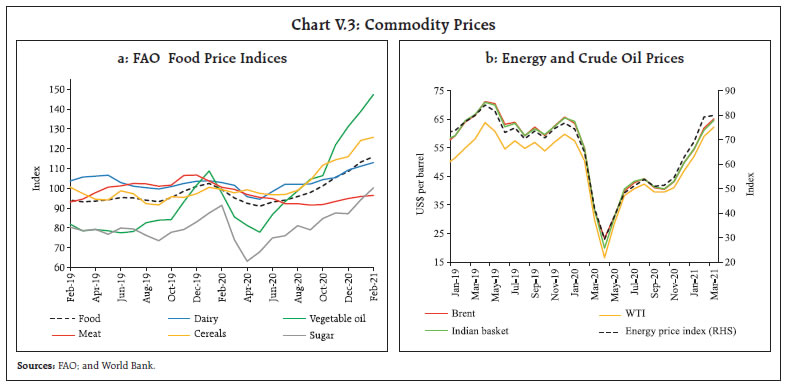

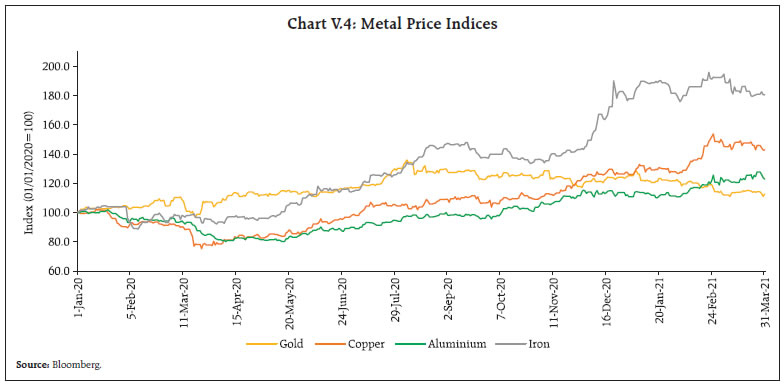

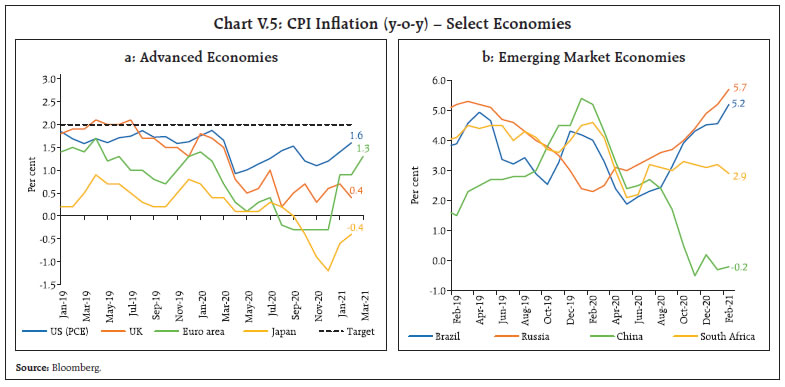

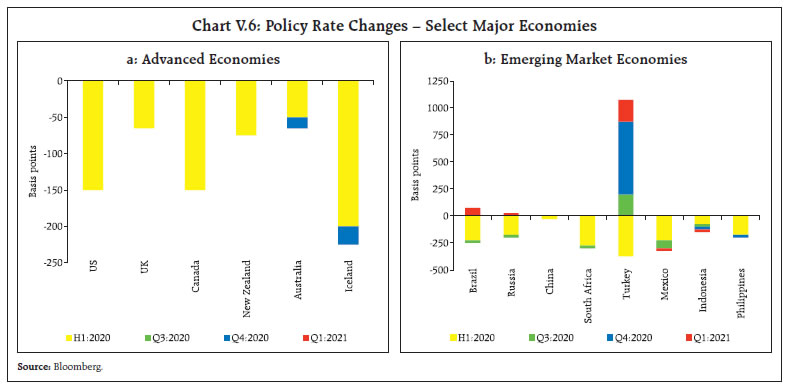

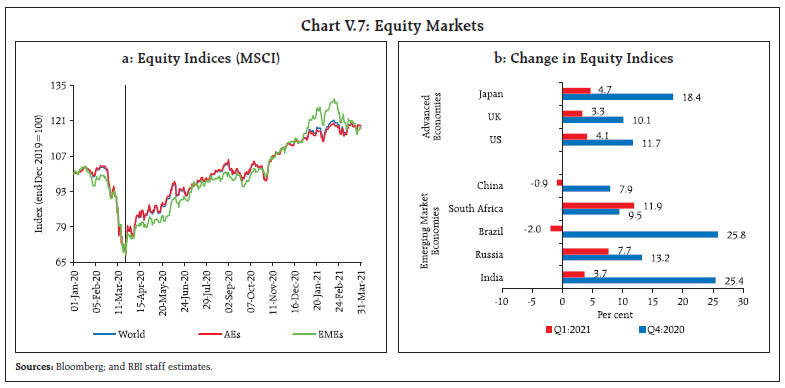

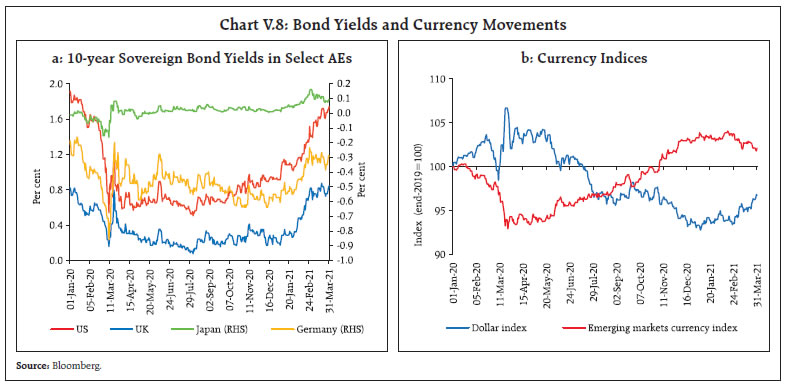

The rebound from the COVID-19 induced slump has been sharper than anticipated and economic activity is expected to rebound strongly in 2021-22. Headline consumer price index (CPI) inflation receded into the tolerance band beginning December 2020. Core inflation pressures remain elevated, reflecting pass-through from higher crude oil and non-oil commodity prices, high fuel and other taxes post-COVID and increased operating costs. The evolving COVID-19 trajectory and progress on vaccination remain the key drivers of economic activity and inflation, globally and in India. Section 45-ZA of the RBI Act, 1934 requires that the Central Government shall, in consultation with the Reserve Bank of India (RBI), determine the inflation target in terms of consumer price index (CPI), once in every five years. Accordingly, in a notification on March 31, 2021, the Central Government, in consultation with the RBI, retained the inflation target at 4 per cent (with the upper tolerance level of 6 per cent and the lower tolerance level of 2 per cent) for the 5-year period April 1, 2021 to March 31, 2026. The experience with successfully maintaining price stability and the gains in credibility for monetary policy since the institution of the inflation targeting framework in 2016 would be reinforced by the retention of the target and the tolerance band.1 The experience during the COVID-19 period has testified to the flexibility of the framework to respond to sharp growth-inflation trade-offs and extreme supply-side shocks. I.1 Key Developments since the October 2020 MPR Since the release of the Monetary Policy Report (MPR) in October 2020, domestic economic activity has turned out to be better than anticipated on the back of a turnaround in gross fixed capital formation and a much shallower contraction in private consumption than in the preceding quarters of the financial year. The global economy is pulling out of the loss of momentum in Q4:2020, driven by multiple vaccine approvals, the launch of inoculation drives in many countries and the extension of monetary and fiscal stimuli. On the other hand, new mutants of the COVID-19 virus, second/third waves of infections, renewed lockdowns in many countries and uneven access to vaccines across countries continue to weigh on the outlook. The resurgence of commodity price inflation, supported by abundant global liquidity, has fuelled reflation trade in global financial markets. Despite the promise of continued accommodative monetary policies by central banks, bond yields have firmed up from very low levels, spurred by inflation concerns and expectations of stronger growth. Amidst stretched valuations, equity prices have become sensitive to the hardening of yields. In turn, exchange rates have become volatile, with capital outflows from emerging economies in early March interrupting their earlier ebullience on risk-on sentiments. Crude oil prices jumped sharply on production cuts by the Organization of the Petroleum Exporting Countries (OPEC) plus and on anticipation of stronger demand. Non-oil commodity prices have risen substantially across the board, putting upward pressures on inflation in commodity importing countries. Gold prices eased from the highs reached in August 2020 on a stronger US dollar and expectations of economic recovery. While inflation is expected to remain subdued in advanced economies (AEs) and most of the emerging market economies (EMEs) on account of negative output gaps, the large fiscal and monetary stimuli and elevated commodity prices have raised inflation concerns over longer horizons in advanced economies and in the nearer-term in the case of EMEs. Turning to the domestic economy, the gross domestic product (GDP) shrugged off the contractions of preceding quarters and moved into expansion zone in Q3:2020-21 (+ 0.4 per cent, year-on-year). High frequency indicators point to the growth momentum gaining strength in Q4 although the surge in COVID-19 infections in a few states in March 2021 imparts uncertainty to the assessment. The outlook for the agriculture sector remains bright, with higher rabi sowing, above normal north-east monsoon and adequate reservoir levels. Inflation receded into the tolerance band beginning December 2020 after breaching the upper threshold of 6 per cent for six consecutive months (June-November 2020). The late winter easing of vegetable prices that caused this softening has dissipated, however. In its February 2021 print, headline inflation firmed up again, with upside pressures getting generalised across constituents of core inflation. Monetary Policy Committee: October 2020-March 2021 During October 2020-March 2021, the Monetary Policy Committee (MPC) met thrice. In the October 2020 meeting, the MPC noted that the revival of the economy from the unprecedented COVID-19 pandemic assumed the highest priority in the conduct of monetary policy. High inflation was seen as easing with the unlocking of the economy, restoration of supply chains and normalisation of activity. Hence, the MPC decided to look through the inflation spike and unanimously voted to keep the policy repo rate unchanged. It also voted to continue with the accommodative stance as long as necessary – at least during the current financial year and into the next financial year – to revive growth on a durable basis and mitigate the impact of COVID-19 on the economy, while ensuring that inflation remained within the target going forward. In the run up to the December 2020 meeting, CPI inflation had increased to 7.6 per cent in October 2020 with food inflation surging to double digits across protein-rich items, edible oils, vegetables and spices on multiple supply shocks. Core inflation had remained sticky and was seen to firm up as economic activity normalised and demand picked up. At the same time, with the signs of economic recovery being far from broad-based and still dependent on sustained policy support, the MPC decided to maintain status quo on the policy rate and continue with the accommodative stance set out in the October resolution. By the time the MPC met in February 2021, CPI inflation had declined to 4.6 per cent in December 2020 on the back of a larger than anticipated deflation in vegetable prices. The MPC noted the sharp correction in food prices but was concerned that some pressures persisted, and core inflation remained elevated. As the recovery was still to gather firm traction and continued policy support remained crucial, the MPC unanimously decided to keep the policy repo rate unchanged and maintain its accommodative stance. The MPC’s voting pattern reflects the individual members’ assessments, expectations and policy preferences (Table I.1). The MPC’s unanimous vote on the policy rate in all the three meetings during October 2020-March 2021 was a reflection of the unprecedented pandemic and an unambiguous consensus on continued policy support. Macroeconomic Outlook Chapters II and III analyse macroeconomic developments during October 2020-March 2021. Turning to the outlook, the evolution of key macroeconomic and financial variables over the past six months warrants revisions in the baseline assumptions (Table I.2). First, global crude oil prices have hardened notably since November 2020 on the back of production cuts by the OPEC and non-OPEC allies (OPEC plus) and expected revival in demand with vaccine rollouts. Reflecting these developments as well as the attack on Saudi Arabia’s oil facilities, Brent crude crossed US$ 70 per barrel in early March. Prices, however, corrected to around US$ 65 in the second half of March over concerns of demand faltering on rising COVID-19 infections and increase in crude stockpiles. Taking into account these developments, crude prices (Indian basket) are assumed at US$ 64.6 per barrel for 2021-22 in the baseline, 58 per cent above the October MPR baseline for 2020-21 (Chart I.1). Second, the nominal exchange rate (the Indian rupee or INR vis-à-vis the US dollar) has moved in a range of INR 72-75 per US dollar since October 2020. The INR remained under depreciating pressure till mid-November 2020 due to COVID-related uncertainty, risk aversion and capital outflows. Subsequently, the INR appreciated, riding on the domestic recovery gaining traction, decline in the number of new infections, vaccine rollout, and the measures announced in the Union Budget 2021-22 to revive the economy. The INR depreciated sharply in late February on elevated global financial market volatility following the spike in sovereign bond yields in the US and other major AEs. Taking these developments into account, the exchange rate is assumed at INR 72.6 per US dollar for 2021-22 in the baseline.  Third, global economic activity has improved relative to the outlook in October 2020 with vaccine rollouts and easing of lockdown restrictions, although it remains uneven across countries and sectors. The International Monetary Fund (IMF) in its January 2021 World Economic Outlook (WEO) update projected the global economy to expand by 5.5 per cent in 2021 (Chart I.2); the outlook remains heavily contingent upon the progress with COVID-19 containment measures and the scale and speed of the vaccination programme. The World Trade Organization’s (WTO) trade barometers suggest a moderation in global merchandise and services trade volumes from the marked improvement in Q4:2020. After breaching the upper tolerance threshold of 6.0 per cent for six consecutive months (June-November 2020), CPI inflation fell in December 2020 and eased further in January 2021 to 4.1 per cent on the back of a sharp correction in vegetable prices and softening of cereal prices. It rebounded to 5.0 per cent in February, however, driven primarily by base effects. Core inflation pressures remained elevated, with inflation excluding food and fuel at 6.0 per cent in February reflecting pass-through to retail prices from higher crude oil and non-oil commodity prices, high fuel and other taxes post-COVID and increased operating costs (Chapter II). Looking ahead, three months and one year ahead median inflation expectations of urban households rose by 80 basis points (bps) and 10 bps, respectively in the March 2021 round of the Reserve Bank’s survey2 in tandem with higher food and oil prices. The proportion of respondents expecting the general price level to increase by more than the current rate also increased for both three months and one year ahead horizons vis-à-vis the previous round (Chart I.3).  Manufacturing firms polled in the January-March 2021 round of the Reserve Bank’s industrial outlook survey3 expected further input cost pressures from raw materials in Q1:2021-22; moreover, positive sentiments on profit margins rose on the back of higher selling prices, suggesting a return of pricing power (Chart I.4). The IHS Markit’s purchasing managers’ index (PMI) survey for the manufacturing sector also reported strong increase in input prices in March 2021 along with higher output prices; for the services sector, input cost inflation was at an eight-year high while selling prices remained stable in February, reflecting efforts to boost sales.   Professional forecasters surveyed4 by the Reserve Bank in March 2021 expected CPI inflation to ease from 4.9-5.0 per cent in H1:2021-22 to 4.3 per cent in Q3 and revert to 5.0 per cent in Q4 (Chart I.5). Taking into account the initial conditions, signals from forward-looking surveys and estimates from structural and other time-series models, CPI inflation is projected to average 5.0 per cent in Q4:2020-21, 5.2 per cent in Q1:2021-22 and Q2, 4.4 per cent in Q3, and 5.1 per cent in Q4, with risks broadly balanced (Chart I.6). The 50 per cent and the 70 per cent confidence intervals for headline inflation in Q4:2021-22 are 3.3-6.9 per cent and 2.4-7.8 per cent, respectively.   For 2022-23, assuming a normalisation of supply chains on the back of vaccine rollout, a normal monsoon and no major exogenous or policy shocks, structural model (Box I.1) estimates indicate that inflation will move in a range of 4.5-4.8 per cent. The 50 per cent and the 70 per cent confidence intervals for Q4:2022-23 are 2.9-6.5 per cent and 1.9-7.5 per cent, respectively. There are a number of upside and downside risks to the baseline inflation forecasts. The major upside risks include supply chain disruptions persisting for a longer period, rise in global crude oil and other commodity prices beyond what is currently in the baseline, and stronger pass-through of input costs amidst improvement in demand conditions and return of pricing power. Persistent structural demand-supply imbalances in key food items such as pulses, edible oils and fats, and eggs, meat and fish could also keep inflation elevated. The downside risks are mostly associated with a weaker than anticipated global and domestic demand in the case of another wave of infections and new mutants of the virus, fall in crude oil prices on weak demand and an early normalisation of supply chains. Prospects of a good rabi crop on top of a bumper kharif harvest in 2020-21 and effective supply management could keep food prices softer than in the baseline. The rebound from the COVID-19 induced slump has been sharper than anticipated. Real GDP growth turned positive in Q3:2020-21 and a further strengthening is expected to have occurred in Q4:2020-21. Going forward, rural demand is likely to remain resilient on good prospects for the agriculture sector. Urban demand and demand for contact-intensive services is also expected to strengthen with the spread of vaccination. The fiscal stimulus under AtmaNirbhar 2.0 and 3.0 schemes and increased capital outlays and the investment-enhancing proposals in the Union Budget 2021-22 will likely accelerate public investment and crowd-in private investment. While the domestic financial conditions are expected to remain supportive in view of the guidance from RBI that systemic liquidity would continue to remain comfortable over the ensuing year, the risks of spillovers from volatility in global financial markets remain elevated.

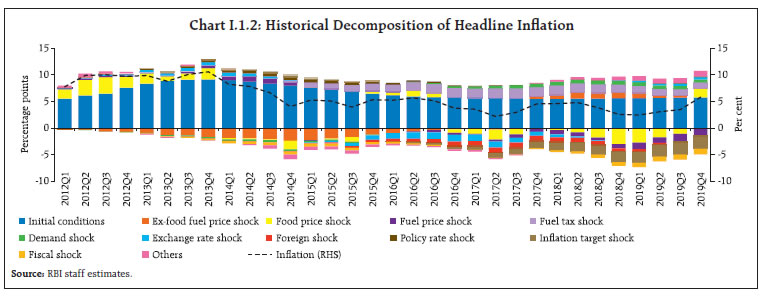

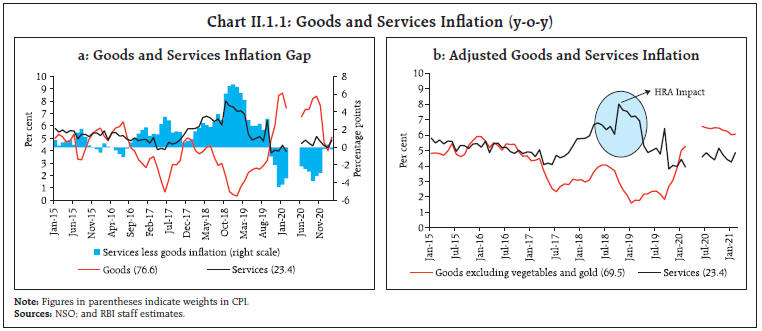

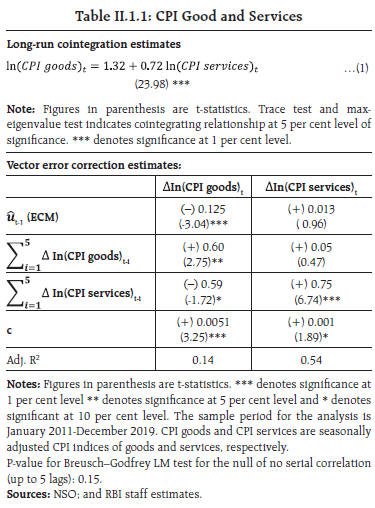

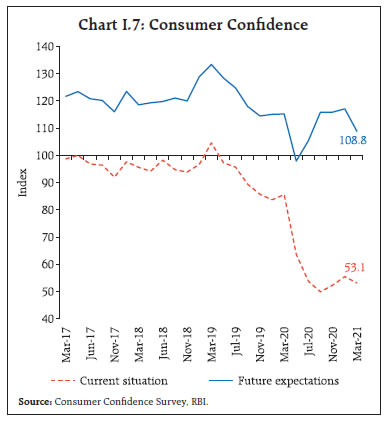

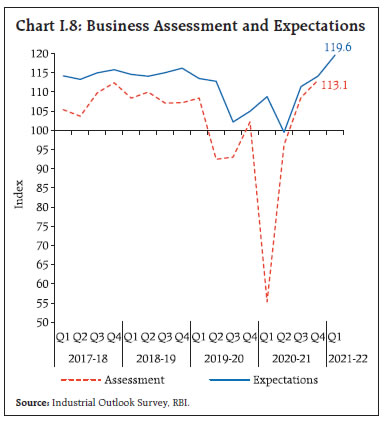

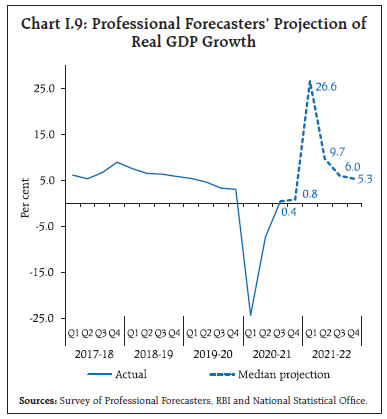

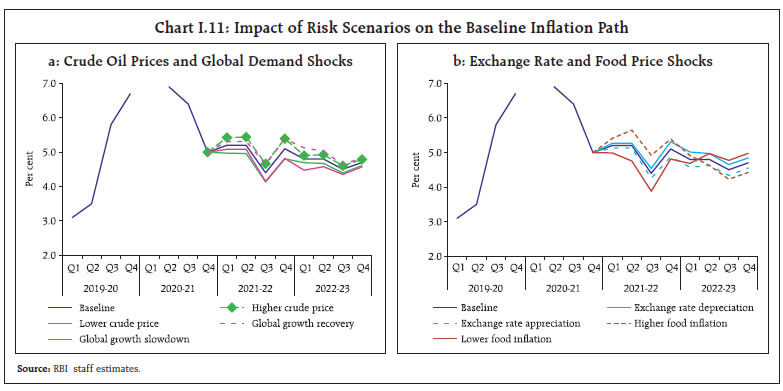

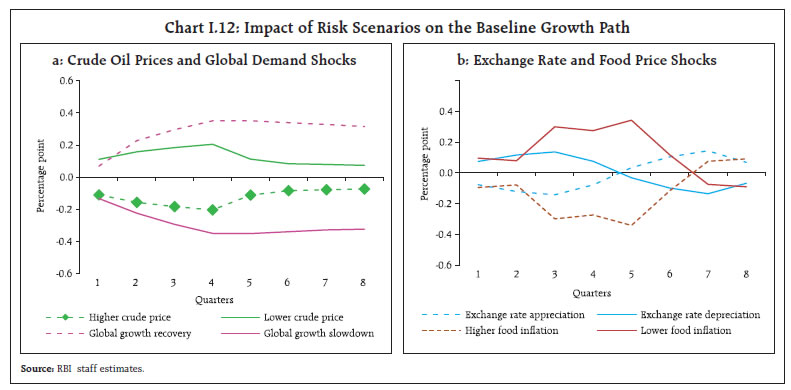

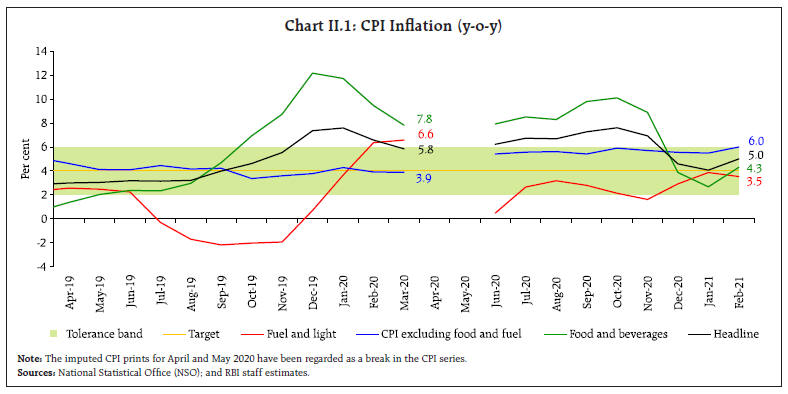

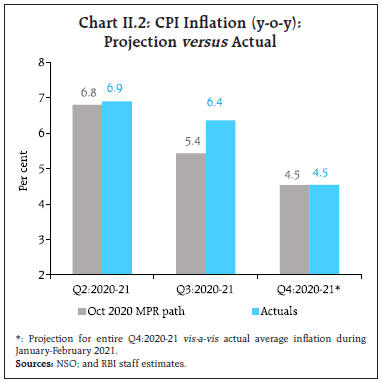

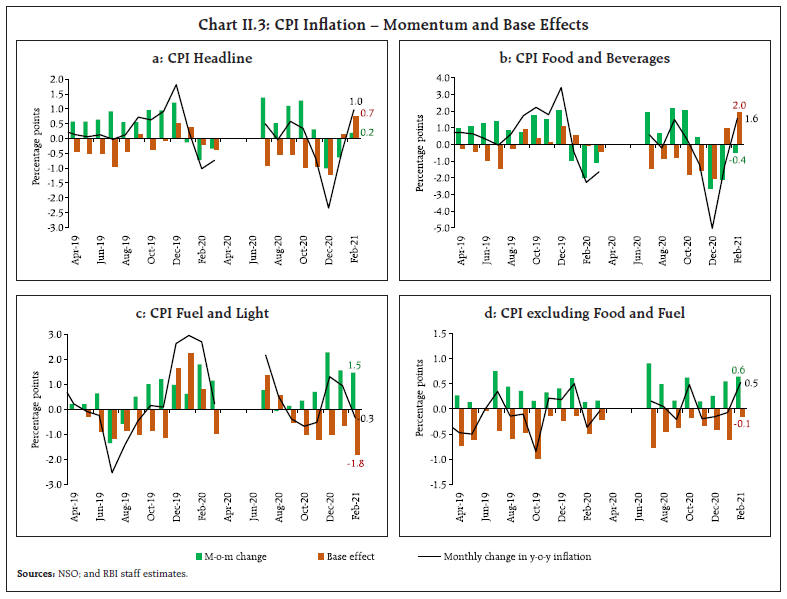

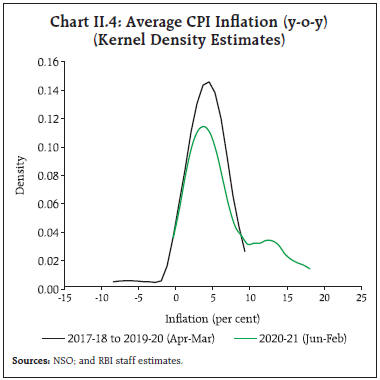

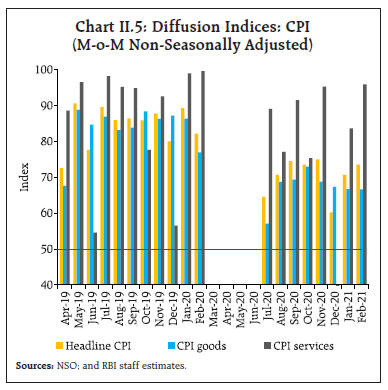

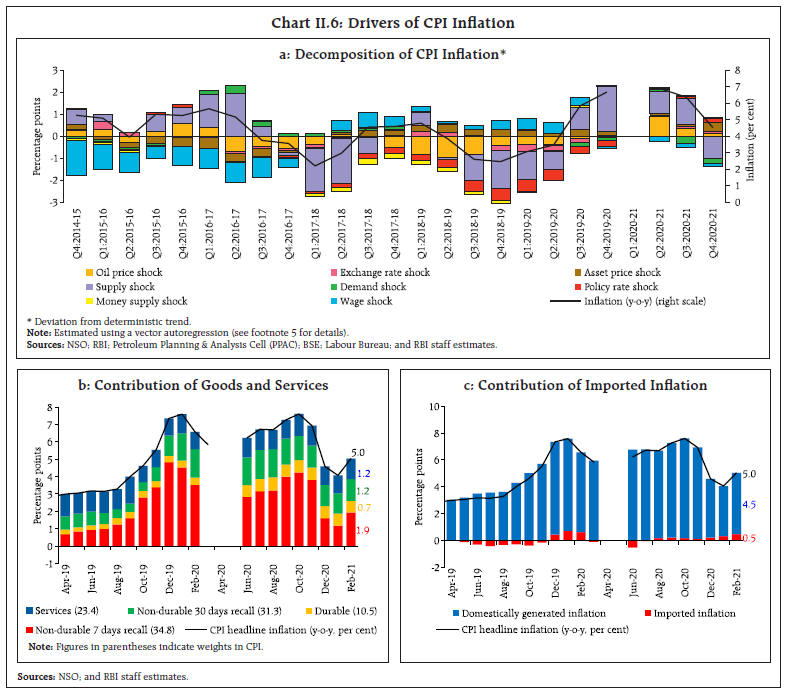

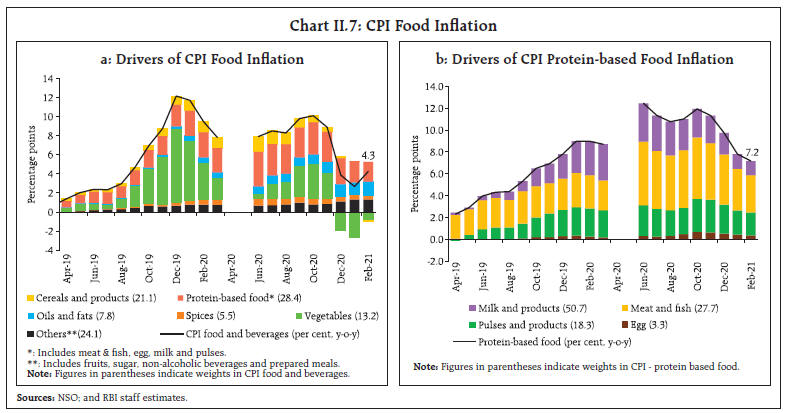

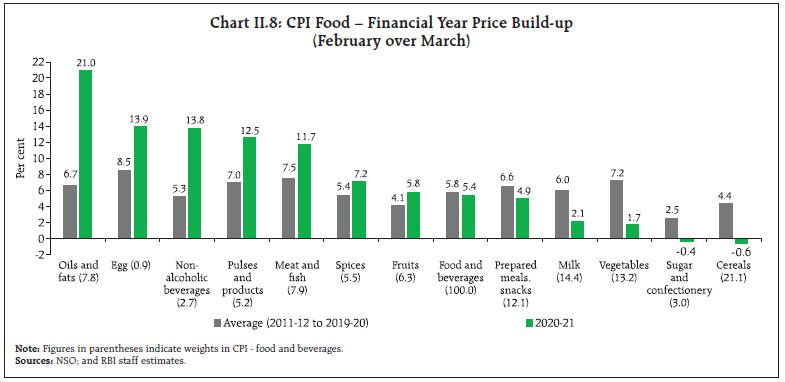

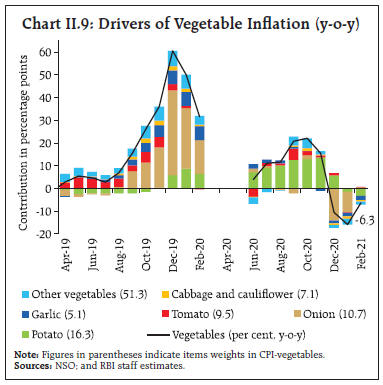

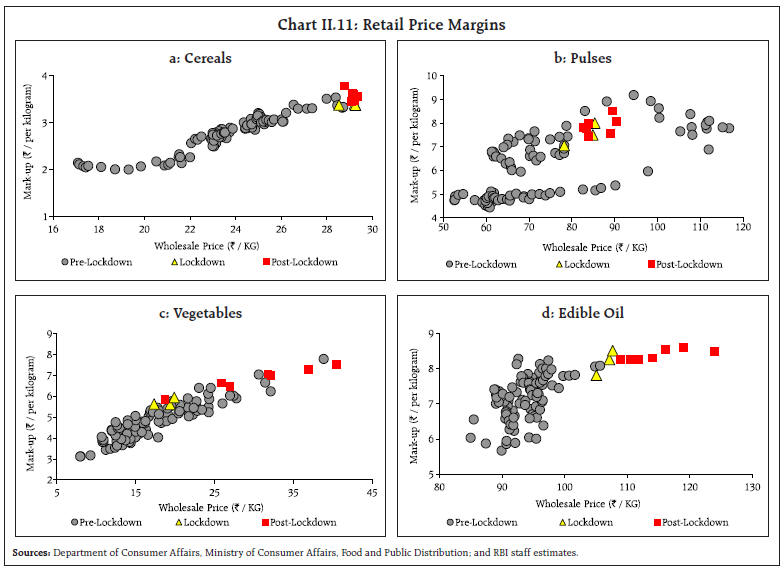

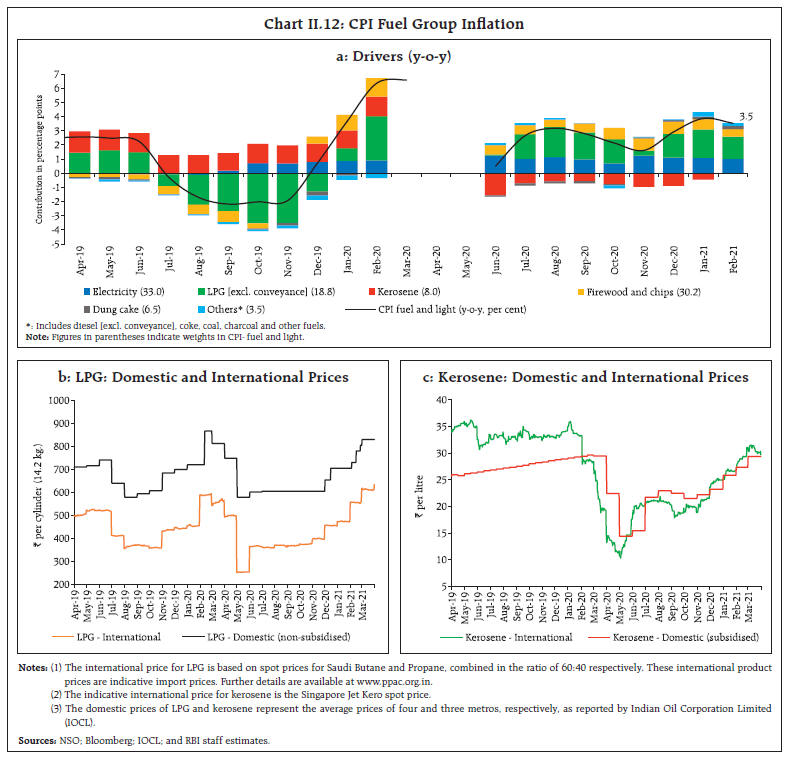

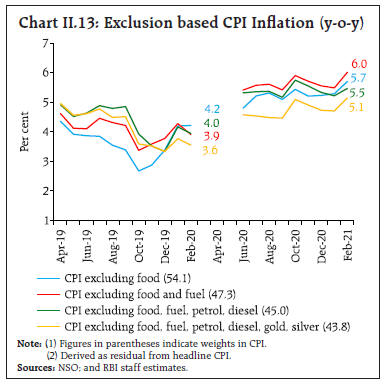

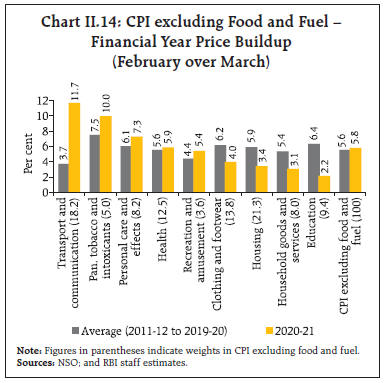

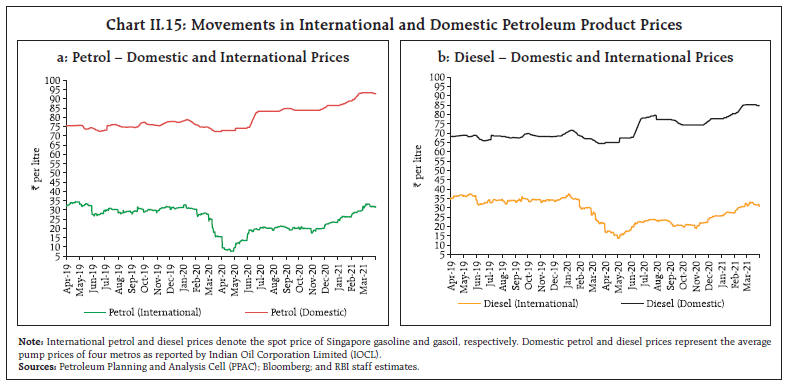

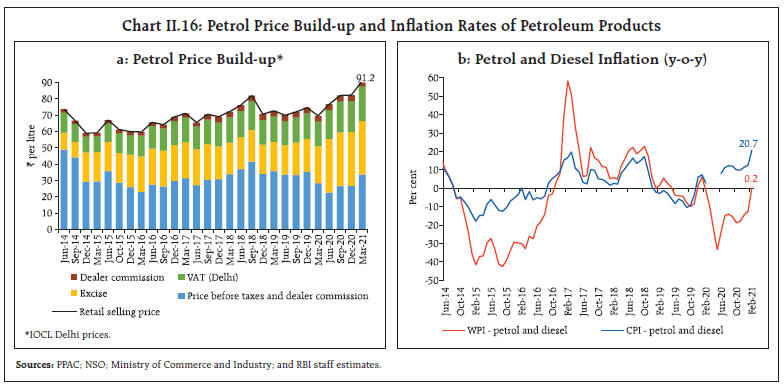

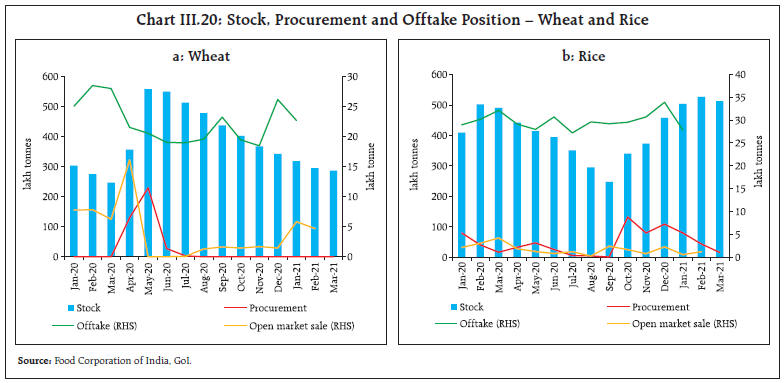

Turning to the forward-looking surveys, consumer confidence5 for the year ahead dipped, although it was still in the optimistic zone, in the March 2021 round, driven by lower expectations on the general economic situation, the employment scenario and income conditions (Chart I.7).  Sentiments in the manufacturing sector for the quarter ahead strengthened further in the January-March 2021 round of the Reserve Bank’s industrial outlook survey, reflecting optimism on production, order books, capacity utilisation, employment conditions and the overall business situation (Chart I.8). Surveys by other agencies also indicate optimism on future business expectations (Table I.3). According to the purchasing managers’ survey for March 2021, the one year ahead business expectations of firms in the manufacturing sector exhibit confidence; optimism of firms in the services sector strengthened to a one-year high in February. Professional forecasters polled in the March 2021 round of the Reserve Bank’s survey expected a sharp uptick in real GDP growth in Q1:2021-22, driven by base effects before tapering in subsequent quarters (Chart I.9 and Table I.4).   Overall, economic activity is gathering strength, supported by the recovery in both demand and supply channels, sustained rollout of the vaccination programme, growth-enhancing proposals in the Union Budget and highly accommodative monetary conditions. Taking into account the baseline assumptions, the survey indicators, and model forecasts, real GDP growth6 is projected to pick up from (-) 8.0 per cent in 2020-21 to 10.5 per cent in 2021-22 – with a quarterly path of 26.2 per cent in Q1, 8.3 per cent in Q2, 5.4 per cent in Q3, and 6.2 per cent in Q4 – with risks evenly balanced (Chart I.10 and Table I.4). For 2022-23, assuming a normal monsoon, and no major exogenous or policy shocks, the structural model estimates indicate real GDP growth at 6.8 per cent, with quarterly growth rates in the range of 6.2-7.3 per cent. There are upside as well as downside risks to the baseline growth path. A faster decline in COVID-19 infections helped by a rapid vaccination drive, large pent-up demand for contact-intensive services, and stronger global demand provide an upside to the baseline growth path. The uncertainty associated with the spread of COVID-19, including new mutants of the virus, deviation of the south-west monsoon from the baseline assumption of a normal monsoon, and elevated crude oil prices and global financial market volatility pose downside risks.  The baseline projections of inflation and growth are conditional on the assumptions of key domestic and international macroeconomic and financial conditions described in the previous sections. The inherent uncertainties associated with such assumptions have exacerbated due to the COVID-19 pandemic and could have a significant bearing on the inflation and growth trajectories. This section explores plausible alternative scenarios to assess the balance of risks around the baseline projections. (i) Global Growth Uncertainties The COVID-19 pandemic induced the severest global recession in decades in 2020. Global growth is expected to recover to 5.5 per cent in 2021, reflecting base effects, the expected moderation in new infections, the rollout of the vaccination programme and large monetary and fiscal support. However, the uncertainty about the pandemic’s spread and its containment continues to pose high risks to the global outlook on both sides. A faster spread of mutated coronavirus variants across the world and an unequal access to vaccines across countries can result in a shallower and delayed global recovery. A surge in global bond yields – as experienced in February 2021 on reflation trade – could induce large global financial market volatility, disorderly adjustment in asset prices and disrupt global demand. In such a scenario, if global recovery is 100 bps below the baseline, domestic growth and inflation could be lower by around 40 bps and 30 bps, respectively, from the baseline trajectories. Conversely, success in containing the spread of new mutants, widespread and equitable distribution of vaccines across the world, and additional policy stimulus could provide a boost to global economic activity. In this scenario, assuming that global growth surprises by 100 bps on the upside, domestic growth and inflation could edge higher by around 40 bps and 30 bps, respectively (Charts I.11a and I.12a). (ii) International Crude Oil Prices International crude oil prices have risen sharply on production cuts and hopes of demand revival. For a net energy importer like India, the dynamics of international crude price movements have significant macroeconomic implications. A quicker containment of COVID-19 inducing higher global growth than the baseline and a faster closing of the global output gap along with sustained production cuts by the OPEC plus could lead to a sharper increase in international crude oil prices. Assuming crude oil price to be 10 per cent above the baseline, domestic inflation and growth could be higher by 30 bps and weaker by around 20 bps, respectively, over the baseline. Conversely, crude oil prices could soften if the recovery is more subdued owing to a faster spread of virus mutations, the delays in vaccination or improved supplies of shale gas. As a result, if the price of the crude falls by 10 per cent relative to the baseline, inflation could ease by around 30 bps with a boost of 20 bps to growth (Charts I.11a and I.12a).  (iii) Exchange Rate The INR has exhibited two-way movements over the past six months, reflecting both global and domestic factors. Looking ahead, heightened volatility in global financial markets, especially a snapback in global sovereign bond yields – as observed in February 2021 – could lead to a broader risk aversion to EME assets and net capital outflows. In such a scenario, should the INR depreciate by 5 per cent from the baseline, inflation could move up by around 20 bps while GDP growth could be higher by around 15 bps through increased net exports (Charts I.11b and I.12b). On the other hand, given India’s relatively better growth outlook and expectations of strong capital inflows, there could be INR appreciation. If the INR appreciates by 5 per cent relative to the baseline, inflation and GDP growth could moderate by around 20 bps and 15 bps, respectively, vis-à-vis the baseline.  (iv) Food Inflation Food inflation has softened since December 2020, largely led by the sharp fall in prices of vegetables and moderation in prices of cereals. Going forward, the bumper kharif harvest, record rabi sowing, further easing of supply chains and effective supply management measures could moderate food inflation by 100 bps below the baseline. Conversely, the recent hardening of global food prices and domestic demand-supply gaps in key food items like pulses, edible oils and fats, and eggs, fish and meat could lead to persistent upward pressures of around 100 bps on food inflation. Higher inflation expectations could then add to sustained pressures on headline inflation. The baseline assumes a normal south-west monsoon in 2021 and any deviations in the actual outturn on either side would be a critical factor in determining the food as well as headline inflation (Charts I.11b and I.12b). Domestic economic activity is widely expected to rebound strongly in 2021-22. Rapid vaccination drive, large pent-up demand, investment enhancing measures by the government and better external demand provide an upside to the baseline growth path while surge in infections, new mutants, deviation of the south-west monsoon from the baseline assumption of a normal monsoon, higher crude oil and non-oil commodity prices and global financial market volatility impart downside risks to the baseline growth path. Lingering supply chain disruptions, rising global crude oil prices and stronger pass-through of input costs could push headline inflation above the baseline. There is also the probability of softer international crude oil prices on the back of a weaker than anticipated global demand, bountiful foodgrains production and effective supply management coming together to ease inflation more than anticipated. The evolving COVID-19 trajectory and progress on vaccination remain the key drivers of economic activity and inflation, globally and in India. _________________________________________________________ 1 Report on Currency and Finance 2020-21: Reviewing the Monetary Policy Framework, Reserve Bank of India, February 2021.2 The Reserve Bank’s inflation expectations survey of households is conducted in 18 cities and the results of the March 2021 survey are based on responses from 5,955 households. 3 The results of the January-March 2021 round of the industrial outlook survey are based on responses from 967 companies. 4 31 panellists participated in the March 2021 round of the Reserve Bank’s survey of professional forecasters. 5 The survey is conducted by the Reserve Bank in 13 major cities and the March 2021 round is based on responses from 5,372 respondents. 6 The Central government in February 2021 decided to bring the off-budget part of food subsidies on-budget, which has resulted in GDP contraction (-8.0 per cent) being notably higher than that (-6.5 per cent) in gross value added (GVA) in 2020-21. This budgetary treatment would especially depress reported GDP growth for Q4:2020-21 (see Chapter III). In 2020-21, inflation breached the upper tolerance band of 6 per cent for six consecutive months in the post-lockdown period (June-November 2020) due to a series of cost-push shocks – supply chain disruptions; weather shocks; higher crude oil and other commodity prices; and higher taxes. The sharp correction during December-January was reversed on adverse base effects in February. Core inflation remained sticky at elevated levels. Costs of farm and industrial inputs recovered with the gradual unlocking of the economy and rural wage growth moderated although it remained higher than in the pre-lockdown period. In the months following the publication of the October 2020 MPR, inflationary pressures got accentuated and headline inflation1 remained above the upper tolerance threshold. Core inflation also stayed sticky at elevated levels. During December 2020-January 2021, however, there was a sharp correction and inflation eased significantly, moving closer to the target, only to reverse to 5.0 per cent in February 2021, primarily due to adverse base effects. Core inflation (CPI inflation excluding food and fuel) surged to a 28-month high of 6.0 per cent in February 2021 under the combined effects of rising industrial raw material prices, record high petroleum product prices and the higher cost of doing business in the post-lockdown period (Chart II.1). The Reserve Bank of India (RBI) Act enjoins the RBI to set out deviations of actual inflation outcomes from projections, if any, and explain the underlying reasons thereof. The October 2020 MPR had projected moderation in CPI inflation from 6.8 per cent in Q2:2020-21 to 5.4 per cent in Q3 and 4.5 per cent in Q4. In Q3, actual inflation was 100 basis points (bps) above projection (Chart II.2). A sharp, unanticipated increase in food inflation – double-digit inflation in eggs, meat and fish (due to fragmented supply chains), pulses (tight demand supply balance), edible oils (high international prices), and vegetables (unseasonal rains) – led to this substantial overshoot. Retail price margins for food also increased, with the persistence of supply chain disruptions. International crude oil prices (Indian basket) jumped from the baseline assumption of US$ 40.9 per barrel for H2:2020-21 to US$ 61.2 per barrel by February 2021. Gold prices remained elevated in Q3:2020-21 over COVID-19 concerns, supported by highly accommodative monetary policies in the major advanced economies. Cost-push pressures also impinged on core inflation more than anticipated. In Q4 (January-February), the correction in food prices resulted in actual inflation aligning with the projection (Chart II.2).   The sharp upward movement of inflation to a peak of 7.6 per cent in October 2020 came about from a pick-up in price momentum in food as well as in the core category.2 Thereafter, strong favourable base effects brought about a moderation in headline inflation to 6.9 per cent in November 2020, more than offsetting positive momentum in all these components. In December 2020, a negative momentum in headline inflation due to a sharp decline in food prices, along with favourable base effects, resulted in headline inflation declining by 2.3 percentage points. In January 2021, headline inflation moderated further due to a large negative momentum engendered by food prices. In February 2021, an adverse base effect of around 70 bps resulted in a substantial pick-up in inflation (Chart II.3). Reflecting broad-based price pressures, the distribution of CPI group/sub-group inflation in 2020-21 was centred at 4.9 per cent, higher than the sub-4 per cent levels seen in recent years (Chart II.4). With several sub-groups exhibiting double-digit inflation, the inflation distribution also exhibited a fat tail, pushing mean headline inflation in excess of 6.0 per cent. The diffusion indices of price changes in CPI items on a non-seasonally adjusted basis3 increased in January-February 2021, indicative of price pressures across the CPI basket (Chart II.5).4  The relative role of various demand and supply shocks impinging upon the inflation dynamics can be captured through vector autoregression (VAR) estimates and historical decomposition.5 The high inflation episode in Q3:2020-21 was predominantly due to supply shocks. In Q4, supply side factors turned benign pulling down headline inflation. On the other hand, easy monetary conditions and the firming up of asset and crude oil prices contributed positively to the deviation of inflation from trend levels in Q3 and Q4. Muted demand conditions and moderation in rural wage growth pulled down inflation in Q3 and Q4, offsetting these effects (Chart II.6a).  High volatility in perishable goods (non-durable goods with a 7-day recall6) from supply shocks in both directions had a significant bearing on the inflation trajectory. With the surge in vegetable prices, the contribution of perishables to overall inflation increased to 55.3 per cent during September-November 2020 from 46.8 per cent in June-August 2020. Subsequently, as vegetable prices corrected, perishables’ contribution decreased sharply to 32.0 per cent during December 2020-January 2021. In February 2021, following the lower rate of deflation in the prices of vegetables, perishables’ share increased to 38.6 per cent. Reflecting the increase in prices of protein-based food, edible oils and other food items, the contribution of semi-perishable goods (non-durable goods with a 30-day recall) remained elevated (Chart II.6b). Imported components contributed 0.5 percentage points to headline inflation in February 2021, driven by gold, silver, edible oils and higher domestic taxes on petroleum products (Chart II.6c).  Food Group Food inflation rose sharply to 10.1 per cent in October 2020 and remained above 6 per cent for 14 consecutive months till November 2020. It moderated quickly in the subsequent months to 2.7 per cent in January 2021 before picking up to 4.3 per cent in February 2021. These large variations were primarily driven by movements in prices of vegetables (Chart II.7). The softening of inflation in respect of cereals and products, milk and sugar and confectionery also aided the easing in food inflation. On the other hand, there were upward pressures from oils and fats, non-alcoholic beverages, prepared meals and snacks and fruits. Despite a sizeable moderation, inflation in five out of twelve food sub-groups was still in double digits in February 2021. Seven of the twelve sub-groups recorded increases above the historical average (Chart II.8). Rural and urban food inflation exhibited broadly similar movements, with no significant difference between month-over-month changes in prices of food and its sub-groups in rural and urban areas.7  In the case of cereals (weight of 9.7 per cent in the CPI and 21.1 per cent in the food and beverages group), a bumper kharif rice production and record buffer stocks – around 6.7 times the norms for rice and 2.1 times for wheat as on March 16, 2021 – led to easing in inflation to (-)0.3 per cent in February 2021 from 7.9 per cent in June 2020. Higher rabi sowing has kept the price pressures subdued despite higher procurement and exports of both rice and wheat.  Inflation in prices of vegetables (weight of 6.0 per cent in the CPI and 13.2 per cent in the food and beverages group) rose steeply to a peak of 22.1 per cent in October 2020 and then corrected rapidly to move into deflation during December 2020-February 2021, driven primarily by a large fall in onion, tomato and potato prices (Chart II.9). Potato price inflation reached a peak of 107.0 per cent in November 2020. Higher imports and fresh arrivals of early rabi production in the market led to a sharp easing in prices during December 2020-February 2021, with a deflation of (-) 21.3 per cent in February 2021.   Inflation in onion prices, which was in negative territory during August-September 2020, witnessed substantial price pressures during September-November 2020 as excess rainfall in major producing regions of Madhya Pradesh, Gujarat, Karnataka and Maharashtra damaged the kharif crop and impacted late kharif production, resulting in lower market arrivals. To contain the escalation in prices, the Government imposed an export ban on onions in September 2020 (removed in January 2021), increased imports, released buffer stocks and imposed stock holding limits on wholesalers and retailers. These steps, along with fresh arrivals, led to onion prices moving into deflation during November 2020-January 2021. Onion prices picked up again in February 2021, however, due to drop in arrivals on account of unseasonal rainfall in January 2021 in Maharashtra. In the case of the third key vegetable, i.e., tomatoes, low arrivals from the key producing regions in Karnataka and Maharashtra on the back of excess rainfall pushed inflation to a peak of 54.5 per cent in September 2020. Thereafter, with an increase in fresh arrivals, prices eased beginning October 2020. In protein-based food items, inflation in pulses (weight of 2.4 per cent in the CPI and 5.2 per cent in the food and beverages group) was in double digits throughout 2020-21. To improve domestic supplies, the government eased restrictions and issued licenses for imports, reduced import duties on masur, released 2 lakh tonnes of tur (arhar) from the buffer stock and extended the time limit for import of tur under the import quota of 4 lakh tonnes for 2020-21. Reflecting these measures, as well as the arrival of kharif pulses and favourable base effects, pulses inflation moderated to 12.5 per cent in February 2021 from 18.3 per cent in October 2020. The production of pulses at 244 lakh tonnes in 2020-21 (second advance estimates for 2020-21) is expected to augment the domestic availability and improve the stock-use ratio (Chart II.12). Pulses inflation can thus be expected to moderate in the coming months, given the past relationship between production/stocks and prices8, although pressures may persist in some items like tur and urad. Among animal protein-rich items, inflation in egg, meat and fish also remained in double digits during most of 2020-21. It eased during November 2020 - February 2021, largely due to the fall in prices of chicken from improved supplies and a decline in demand due to bird flu during January 2021. Prices of mutton and pork, however, remained high due to supply bottlenecks and higher demand for protein-based food items.  Prices of milk and products (weight of 6.6 per cent in the CPI and 14.4 per cent in the food and beverages group) remained muted in H2:2020-21, reflecting a quick restoration of supply chains of the well-established system of cooperatives amidst lower demand from the bulk segment. Prices of sugar and confectionery (weight of 1.4 per cent in the CPI and 3.0 per cent in the food and beverages group) eased during September 2020 - February 2021 on the back of expectations of a bumper crop and higher domestic production even as international sugar prices increased due to concerns over lower global availability in 2020-21.9 Prices of oils and fats (weight of 3.6 per cent in the CPI and 7.8 per cent in the food and beverages group) remained one of the major pressure points throughout the year. Higher demand for mustard oil coupled with elevated international prices10 (particularly palm oil and soybean oil) resulted in oils and fats inflation peaking at around 20 per cent in December 2020-February 2021. The government reduced the basic customs duty (BCD) on crude palm oil from 37.5 per cent to 27.5 per cent effective November 27, 2020 and then revised it to 32.5 per cent [including the Agricultural Infrastructure Development Cess (AIDC)] effective February 2, 2021. Mustard oil and refined oil were the highest contributors to elevated edible oil inflation. Retail Margins Average retail price margins over wholesale prices increased across all the major sub-groups (cereals, vegetables, edible oils and pulses) during the post-lockdown period, pulling up headline inflation. The margins were higher in edible oils, vegetables and pulses than in the other two sub-groups (Chart II.11).11  CPI Fuel Group Inflation in fuel prices initially moderated from 3.2 per cent in August 2020 to 1.6 per cent in November 2020, due to a decline in LPG and PDS kerosene prices and favourable base effects. Fuel inflation then increased to 3.5 per cent in February 2021, led by prices of LPG, kerosene and dung cake (Chart II.12a). The movements in LPG inflation largely reflected the lagged impact of international prices (Chart II.12b). PDS-kerosene prices were in deflation throughout 2020-21, as international prices to which they are linked have been below pre-COVID levels since April 2020 (Chart II.12c). CPI excluding Food and Fuel CPI inflation excluding food and fuel, or core inflation, remained sticky and hovered between 5.4 per cent and 6.0 per cent during September 2020 to February 2021. Excluding petrol, diesel, gold and silver also, core inflation remained elevated (between 4.5 per cent and 5.1 per cent) over this period (Chart II.13). While the price build-up in the core categories was similar to the historical average, considerable variation was observed across subgroups: transport and communication, pan, tobacco and intoxicants, personal care and effects, health and recreation and amusement exhibited substantially higher build-up than the long-term average whereas clothing and footwear, housing, household goods and services and education exhibited subdued build-ups (Chart II.14).  In H2:2020-21, crude oil prices (Indian basket) jumped by nearly 50 per cent – from around US$ 41 per barrel in September 2020 to US$ 61 per barrel in February 2021. This sharp rise in international prices, along with the non-reversal of the substantial post-lockdown hike in excise duties and value added taxes (VATs), resulted in domestic petrol and diesel pump prices reaching historical highs by February 2021 (Chart II.15b). The combined share of central excise and states’ value added tax (VAT) in petrol prices has risen from ₹22 per litre (31 per cent) in mid-2014 and ₹38 per litre (54 per cent) in March 2020 to ₹53 per litre (61 per cent) in February 2021 (Chart II.16a). While the WPI measures basic prices less trade discounts, thereby leaving out indirect taxes, retail prices are inclusive of taxes. CPI petrol and diesel inflation has been in double digits since July 2020 and was at 20.7 per cent in February 2021; in contrast, WPI petrol and diesel prices were in sharp double digit deflation for most part of the financial year, with February 2021 seeing a reading of only 0.2 per cent (Chart II.16b).   Compared to pre-COVID levels, measures of core inflation remain elevated, indicative of significant cost-push pressures across sectors in the post-lockdown period. Price inflation in the goods component, i.e., excluding food, fuel, petrol, diesel, gold and silver (with a weight of 20.7 per cent in CPI) rose to 5.8 per cent in February 2021 from 4.7 per cent in August 2020, driven by health care goods – particularly medicines, clothing and footwear goods and transportation goods like motor vehicles (Chart II.17a). Core services inflation (weight of 23.0 per cent in CPI) rose from 4.0 per cent in August 2020 to 5.0 per cent in November 2020, primarily due to higher prices of recreation, education, transportation and communications services. Subsequently, core services inflation moderated to 4.3 per cent in January-February 2021 as inflation in prices of communication dropped sharply due to favourable base effects along with some moderation in education and recreation services inflation. Housing inflation, which primarily includes rental charges, at 3.2 per cent during November 2020 - February 2021 was lower than the pre-COVID levels; however, it was the second largest contributor to core services inflation (Chart II.17b).    In sum, headline inflation dynamics in the post-lockdown period were primarily driven by goods inflation. Services inflation is the more durable component of the CPI and drives goods inflation over time (Box II.1).

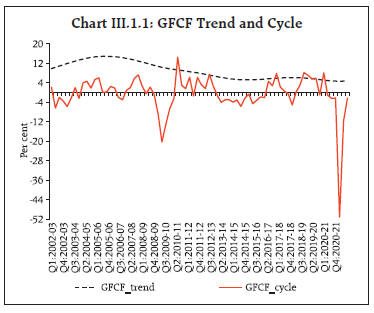

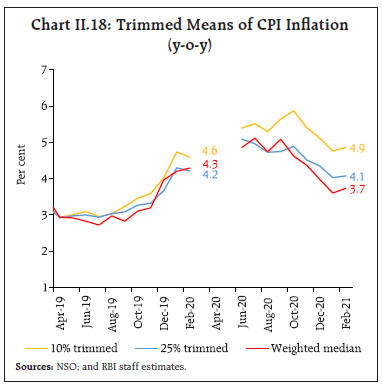

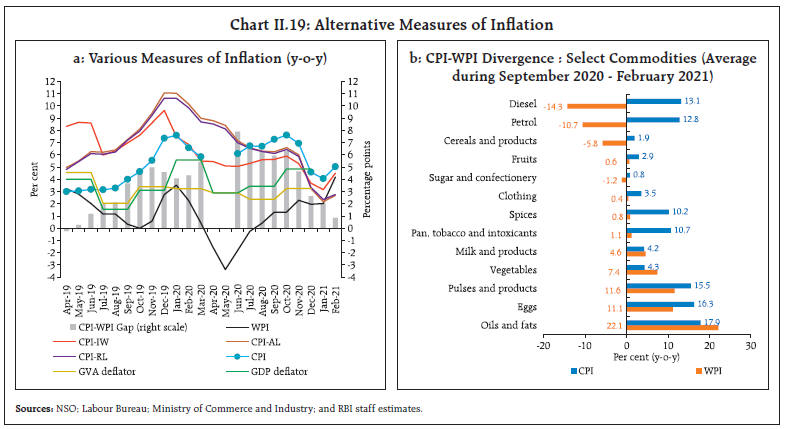

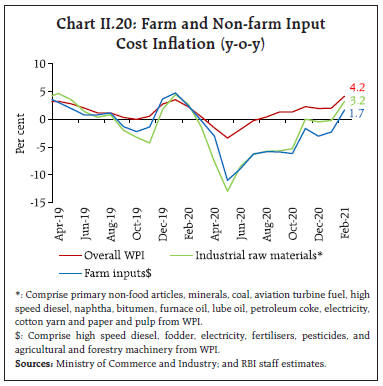

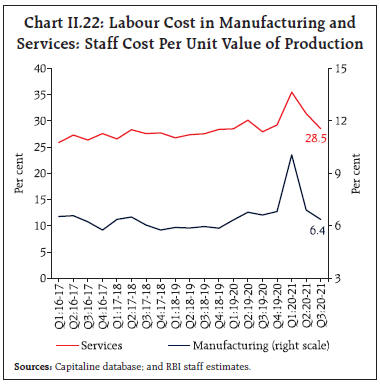

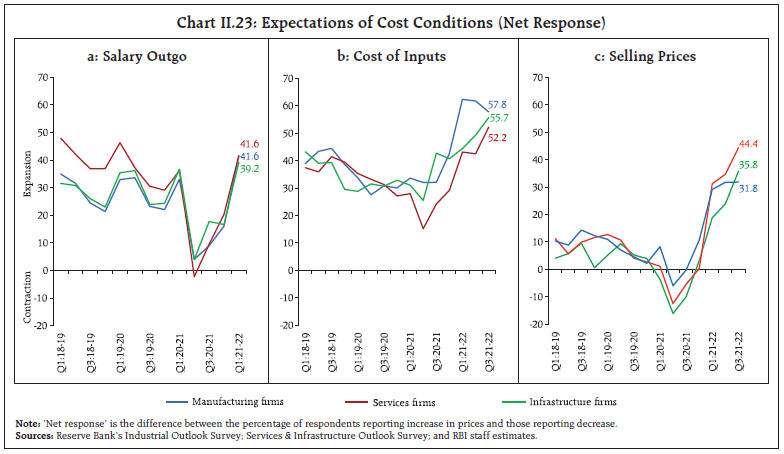

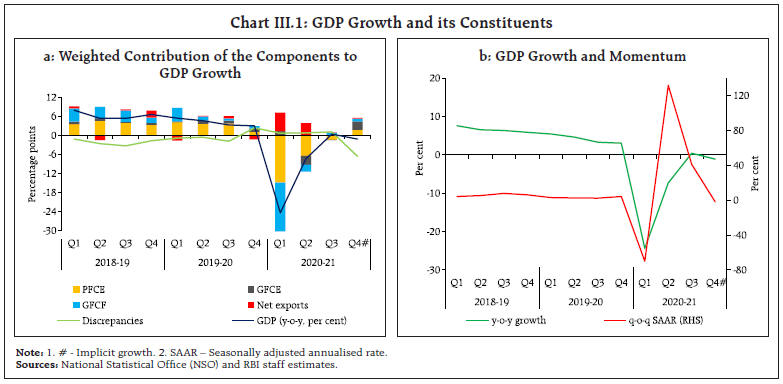

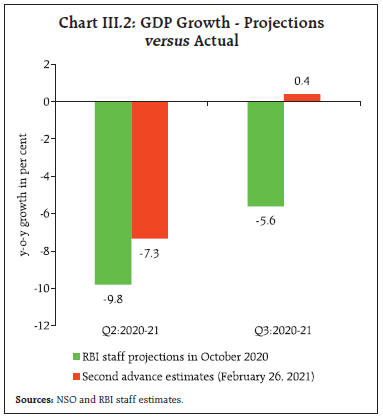

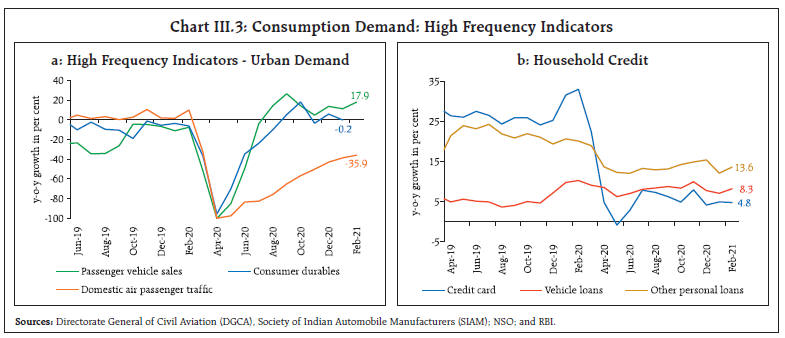

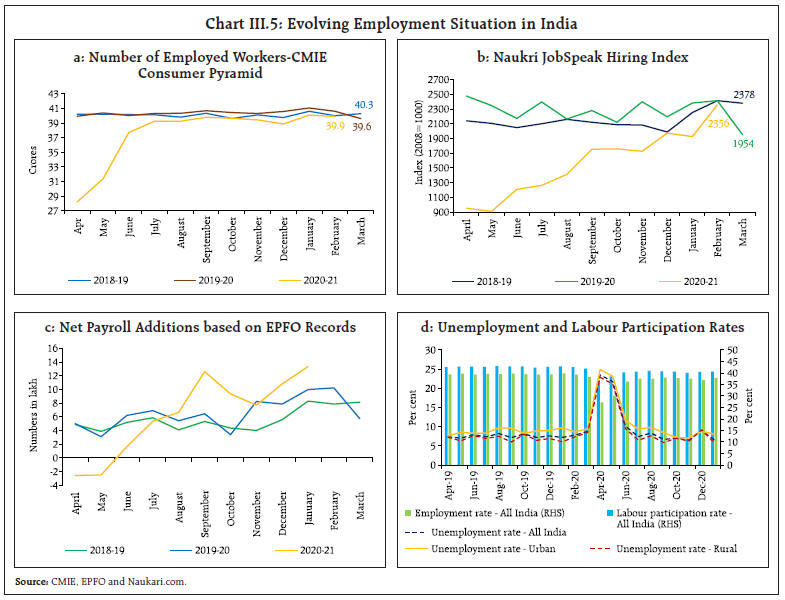

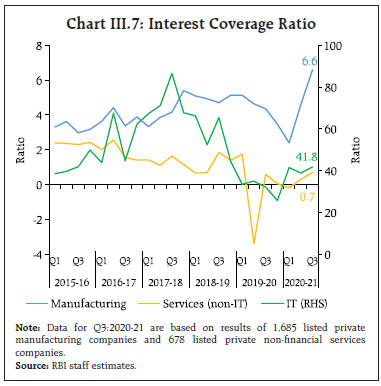

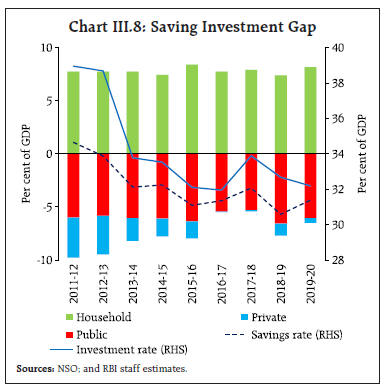

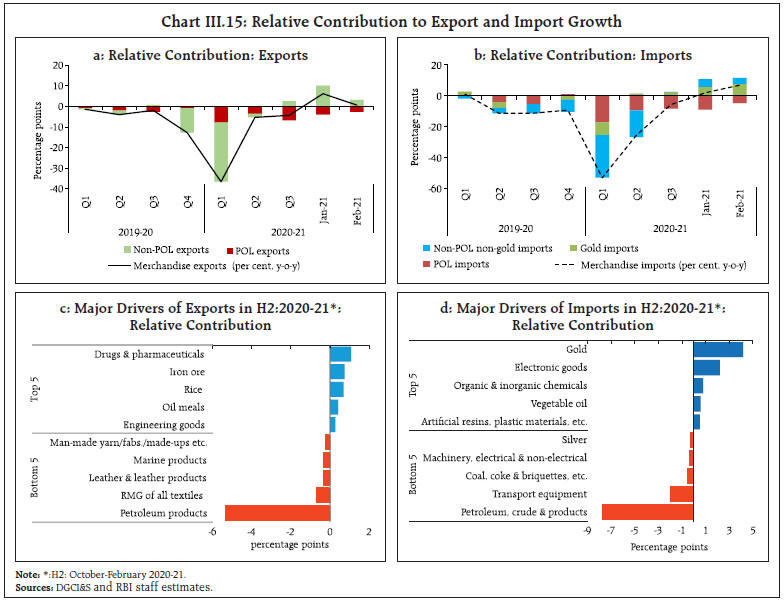

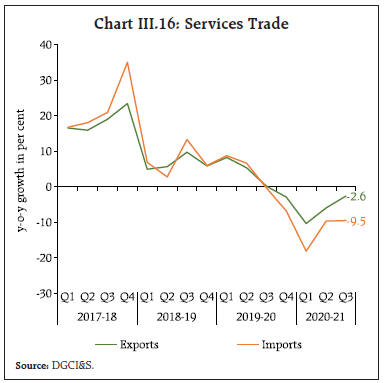

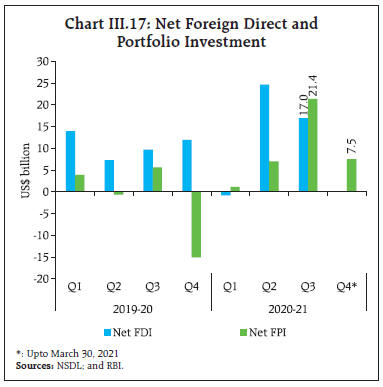

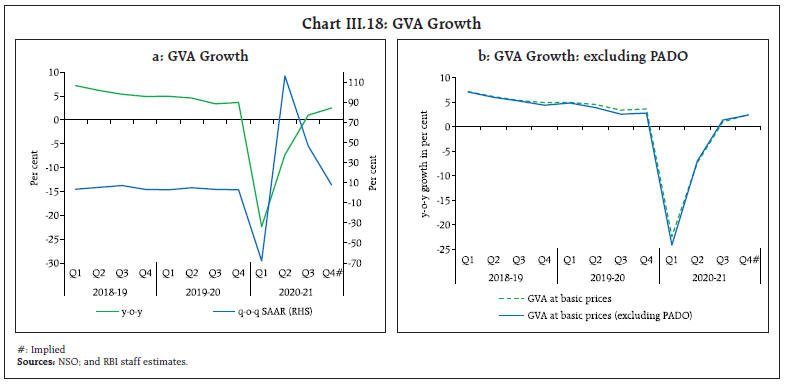

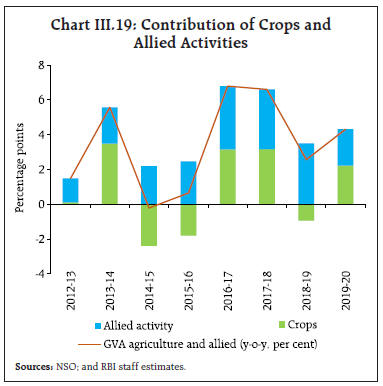

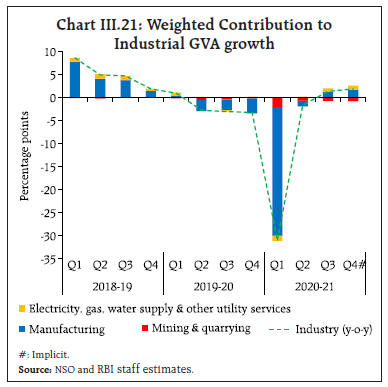

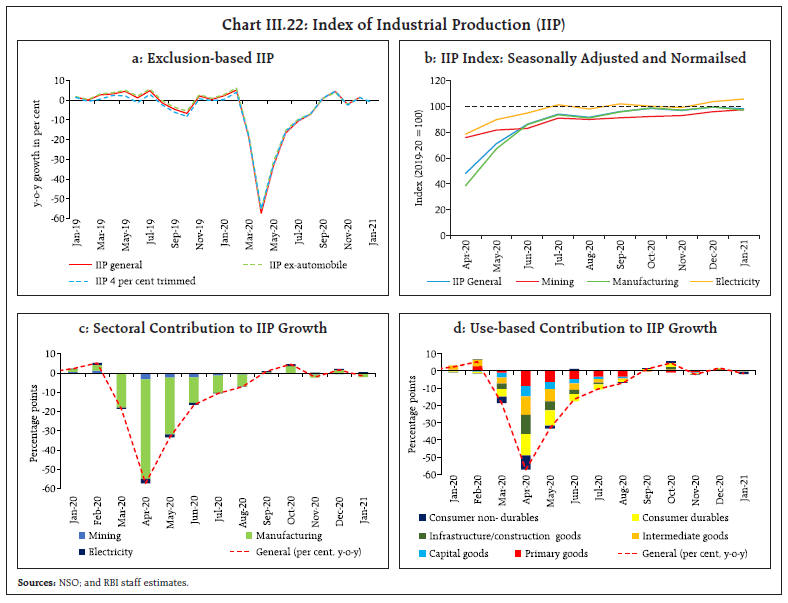

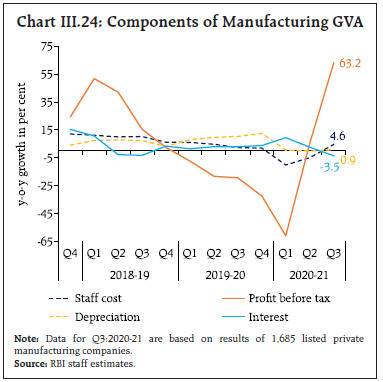

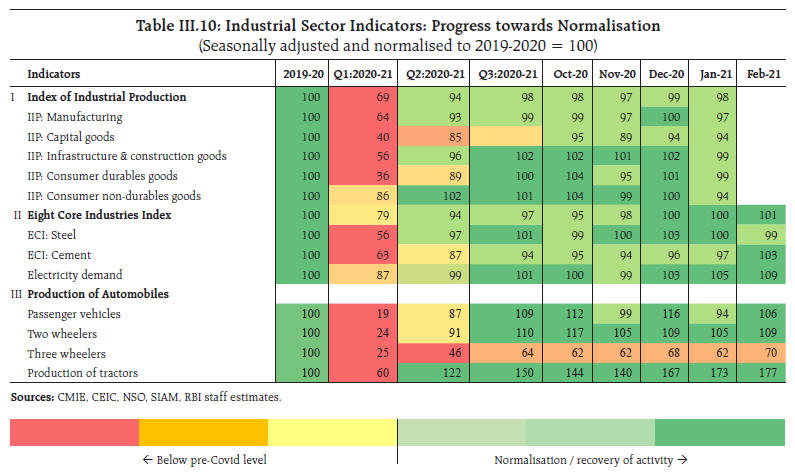

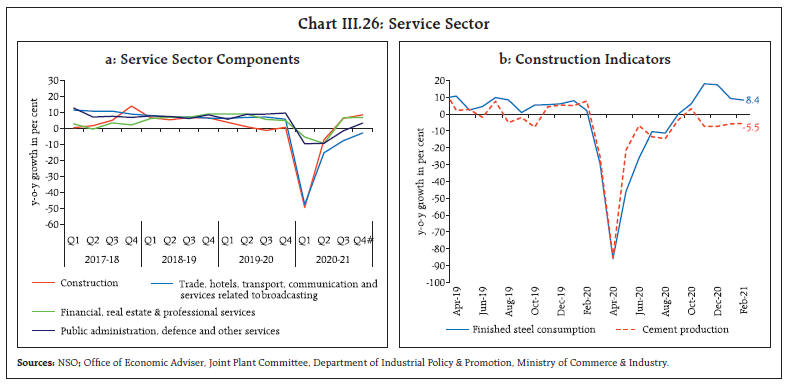

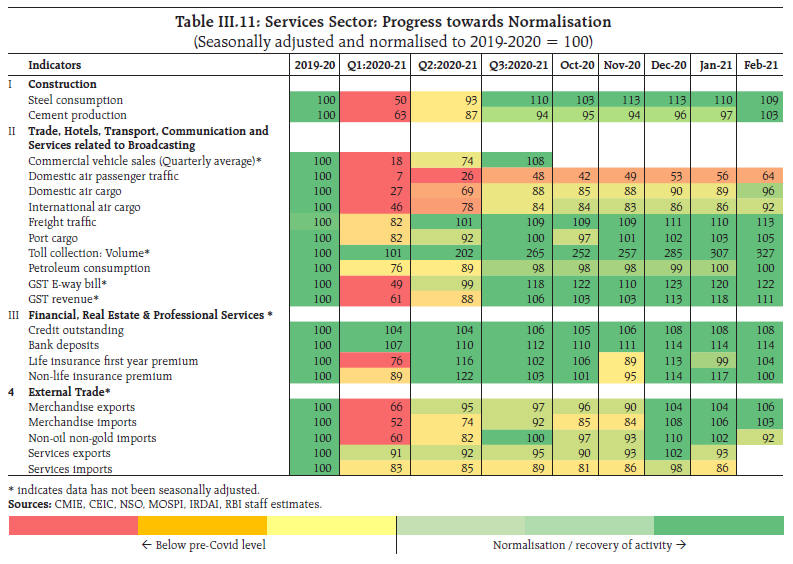

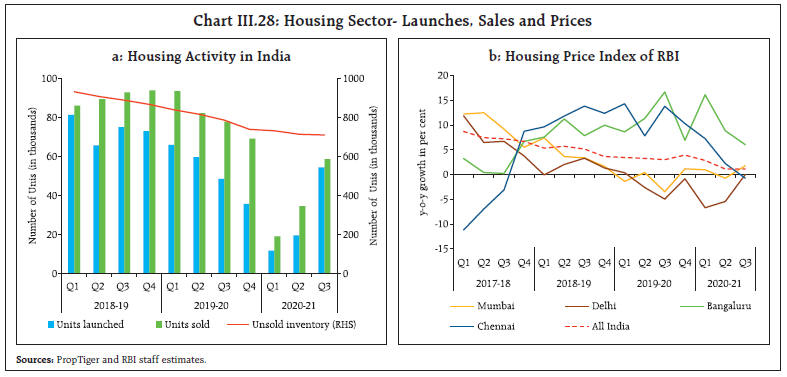

In addition to exclusion-based measures, trimmed means of inflation provide a measure of underlying inflation dynamics and are computed by statistically eliminating items with extremely positive and negative inflation. The trimmed mean indicators showed easing of inflation over the period under review in view of the omission of a few large outliers – such as vegetables, pulses, edible oils, transport fare, and pan, tobacco and intoxicants – in either direction. In contrast, exclusion-based measures, which capture persistent trends in inflation by eliminating ex-ante identified idiosyncratic and volatile components, suggest stickiness in inflation (Charts II.13 and II.18). Other Measures of Inflation Inflation measured by sectoral CPIs for agricultural labourers (CPI-AL) and rural labourers (CPI-RL) remained below headline CPI inflation in H2:2020-21. Lower inflation in food items along with their higher weight in CPI-AL and CPI-RL and subdued inflation in fuel, and clothing and footwear groups contributed to the relatively lower inflation prints for CPI-AL and CPI-RL. Inflation in terms of CPI for industrial workers (CPI-IW) though their gap narrowed. also remained below the headline CPI during H2.13 The price build-up in CPI-IW for clothing, housing and miscellaneous groups was lower relative to the headline CPI; that of fuel, and pan, tobacco and intoxicants groups was higher; and the fall in food prices was muted.14  WPI inflation also remained below CPI inflation in H2:2020-21, although it has quickly inched up close to CPI inflation in recent months (Charts II. 19a). From its trough in May 2020, WPI inflation charted a V-shaped uptrend in view of a sharp rise in fuel and non-food commodity prices. In contrast, WPI food inflation decelerated continuously from September 2020 and fell into negative territory in January 2021 before moving up in February 2021 to 3.3 per cent. Average WPI food inflation during September 2020 to February 2021 at 3.7 per cent was way lower than average CPI food inflation at 6.6 per cent, with inflation across major food sub-groups, except vegetables, milk and products, oils and fats, recording lower prints in the WPI than in the CPI. The largest deviation between CPI and WPI emanated from inflation in petroleum products, especially in petrol and diesel, reflecting the wedge due to tax components. Similarly, tax implications were visible in prices for pan, tobacco and intoxicants – while CPI for these items remained in double digits (average 10.7 per cent), inflation in WPI beverages, and tobacco products averaged 0.2 and 2.5 per cent, respectively, during September 2020 to February 2021 (Chart II.19b).  Inflation measured in terms of gross value added (GVA) and gross domestic product (GDP) deflators clocked a pick-up from Q1:2020-21 to Q3, broadly in alignment with WPI inflation. The measures of cost inflation – farm inputs and industrial raw materials derived from WPI – moved higher with the gradual unlocking of the economy, albeit with transient dips (Chart II.20). The firming up of global crude oil prices during H2:2020-21 impacted the prices of inputs such as high-speed diesel, naptha, aviation turbine fuel, and furnace oil. Minerals and non-food articles also generally rose during October 2020-February 2021. Prices of fibres emerged out of deflation in January 2021 in line with a pick-up in raw cotton and raw silk prices. Reflecting this, inflation in cotton yarn price registered sharp uptick.  Within farm sector inputs, fodder price inflation remained elevated in double digits, during October 2020 to February 2021 due to the damage from excess rains during September-October 2020. Inflation in fertilisers remained muted in line with subdued cost of raw materials such as natural gas. Prices of electricity – a key constituent of both industrial and farm inputs – remained in deflation on an average during H2, barring a transient spike in November. Inflation in prices of agricultural machinery and implements recorded a modest increase during November 2020-February 2021. Nominal rural wages for both agricultural and non-agricultural labourers hardened during H1:2020-21, reflecting labour shortages during the lockdown period and the hike in wages by ₹20 under the Mahatma Gandhi National Rural Employment Guarantee (MGNREGA) scheme effective April 1, 2020. As the unlock phase progressed and labour availability improved, wage growth moderated in H2 although it remained higher than in the pre-lockdown period (Chart II.21). Growth in the value of production in Q3:2020-21 for listed firms in the manufacturing and services sectors outpaced the rise in staff costs. As a result, unit labour costs (measured as a ratio of staff cost to value of production) decreased during Q3:2020-21, reverting towards pre-COVID levels. Unit labour costs moderated from 6.9 per cent in Q2:2020-21 to 6.4 per cent in Q3:2020-21 for firms in the manufacturing sector and from 31.4 per cent to 28.5 per cent respectively, for the services sector firms (Chart II.22). Manufacturing, services and infrastructure firms polled in Reserve Bank’s enterprise surveys15 reported an increase in salary outgo in Q4:2020-21, with expectations of a further rise in Q1:2021-22 as the level of employment is likely to gradually edge up. Input costs were also expected to intensify further in Q1 and continue in Q2 and Q3 of 2021-22 with the pace of increase moderating a tad for the manufacturing sector. The surveyed firms reported passing through the costs to their selling prices in Q4:2020-21. Selling prices are expected to gain further traction in Q1:2021-22 and remain firm in Q2 and Q3 for all the three sectors (Chart II.23).   Manufacturing firms polled for the purchasing managers’ index (PMI) reported an increase in input prices in Q3:2020-21, with a further firming up in Q4 from higher costs of chemicals, metals, minerals, cotton and plastic; higher cost pressures were passed through to the clients resulting in an increase in selling prices. PMI services firms also reported continued increase in input prices in Q3 and Q4, driven by fuel, with the sharpest increase reported in prices of consumer services. Despite an increase in input costs, services sector firms reported lower selling prices in efforts to boost sales.  In 2020-21, inflation breached the upper tolerance band of 6 per cent for six consecutive months in the post-lockdown period (June-November 2020) due to a series of cost-push shocks – supply chain disruptions; weather shocks; higher crude oil and other commodity prices; and higher taxes. Inflationary pressures persisted despite a bumper kharif harvest. The increase in petrol and diesel prices is showing up in trade and transport costs, taxi and auto fares, and its second-round effects could push-up the prices of goods and services further in a broad-based manner, with firms regaining pricing power. Effective supply measures and tax rationalisation are critical to help anchor inflation expectations. If inflation remains close to the target on a durable basis, it can then provide monetary policy the space to adequately support the nascent recovery. _________________________________________________________ 1 Headline inflation is measured by year-on-year changes in all-India consumer price index – combined (CPI-C). 2 A change in CPI year-on-year (y-o-y) inflation between any two months is the difference between the current month-on-month (m-o-m) change in the price index (momentum) and the m-o-m change in the price index 12 months earlier (base effect). For more details, see Box I.1 of the MPR, September 2014. 3 In view of the non-availability of CPI item level data for the period March-May 2020, the diffusion indices have been constructed with item level indices without seasonal adjustment. 4 The CPI diffusion index, a measure of dispersion of price changes, categorises items in the CPI basket according to whether their prices have risen, remained stagnant or fallen over the previous month. A reading above 50 for the diffusion index signals a broad expansion or generalisation of price increases and a reading below 50 signals broad-based price decline. 5 Historical decomposition estimates the contribution of each shock to the movements in inflation over the sample period (Q4:2010-11 to Q4:2020-21) based on a vector autoregression (VAR) with the following variables (represented as the vector Yt) –crude oil prices; exchange rate (INR per US$), asset price (BSE Sensex), CPI; the output gap; rural wages; the policy repo rate; and money supply (M3). All variables other than policy repo rate are growth rates. The VAR can be written in reduced form as: Yt =c + A Yt-1 + et ; where et represents a vector of shocks. Using Wold decomposition, Yt can be represented as a function of its deterministic trend and sum of all the shocks et. This formulation facilitates decomposition of the deviation of inflation from its deterministic trend into the sum of contributions from various shocks. 6 The CPI weighting diagrams use the modified mixed reference period (MMRP) data based on the 2011-12 Consumer Expenditure Survey conducted by the National Sample Survey Office (NSSO). Under MMRP, data are collected on expenditure incurred for frequently purchased items – edible oil, eggs, fish, meat, vegetables, fruits, spices, beverages, processed foods, pan, tobacco and intoxicants – during the last seven days; for clothing, bedding, footwear, education, medical (institutional), durable goods, during the last 365 days; and for all other food, fuel and light, miscellaneous goods and services including non-institutional medical services, rents and taxes, data relate to the last 30 days. 7 Based on modified z-test (accounting for autocorrelation) on difference of rural and urban m-o-m changes of seasonally adjusted series. 8 The bumper harvests during 2016-17 and 2017-18 of 231 lakh tonnes and 254 lakh tonnes, respectively, and the consequent higher stock-use ratios coincided with record 29 consecutive months of deflation during December 2016 to April 2019. 9 Domestic sugar mills produced 278 lakh tonnes of sugar during 2021 sugar season (till March 31, 2021) as compared with 233 lakh tonnes in the corresponding period of the previous year. 10 International edible oil prices firmed up due to labour shortages in palm oil plantations in Indonesia and Malaysia, drought in Argentina affecting soybean production, and increased Chinese demand. 11 The analysis is based on daily price data on wholesale and retail prices from the Department of Consumer Affairs (DCA) for four major sub-groups – cereals, vegetables, edible oils and pulses – for January 2012 to December 2020 (excluding data for January-February 2021 due to changes in price collection mechanism and item varieties by DCA). The overall period has been divided into three phases, viz., pre-lockdown (January 2012 to February 2020), lockdown (March 2020 to May 2020) and post-lockdown (June 20 to December 2020). Item level retail and wholesale prices are aggregated at respective sub-group using item level CPI weights. 12 In July 2017 house rent allowances (HRA) of central government employees were increased under the 7th Central Pay Commission awards. The impact of this lingered for more than two years as state governments also implemented changes for their employees in a staggered manner. 13 The Labour Bureau revised the base year of CPI for industrial workers (CPI-IW) from 2001 to 2016 in September 2020, based on the Working-Class Family Income & Expenditure Survey (WCFI&ES). The series covers 88 centres (78 in the earlier series), uses geometric mean for aggregation of price quotations (instead of arithmetic mean in the earlier series), and covers a larger number of items (463 items as against 392). 14 Inflation for major groups of CPI-IW cannot be worked out as the linking factor released by the Labour Bureau is only for headline index and not at the group level; therefore, the discussion is based on price build-ups. 15 Industrial Outlook Survey; and Services and Infrastructure Outlook Survey. After the unprecedented contraction in Q1, real gross domestic product (GDP) recorded sequential upturn in Q2 and regained positive territory in Q3 with the ambit of the recovery broadening to encompass a wider spectrum of sectors, supported by a significant decline in COVID-19 infections. The recent increase in COVID infections, if not contained, could push back the normalisation process and impede the broader revival of economic activity. Economic activity in India in H2:2020-21 turned out to be more resilient than anticipated in the October 2020 MPR, supported by a significant decline in new COVID-19 infections from the mid-September 2020 peak and the rollout of the vaccination drive from mid-January 2021. After the unprecedented contraction in Q1, real gross domestic product (GDP) recorded sequential upturn in Q2 and regained positive territory in Q3 with the ambit of the recovery broadening to encompass a wider spectrum of sectors since then. On the supply side too, the sustained resilience of agriculture and allied activities was complemented by manufacturing and services sector activity gaining some momentum. As a result, real gross value added (GVA) recorded positive growth in Q3 and is expected to be positive in Q4 also. Real GDP contracted by 8.0 per cent in 2020-21, according to the National Statistical Office’s (NSO) second advance estimates (SAE), although some slack can be attributed to on-budgeting of past subsidy payments in Q4 (Chart III.1a and Table III.1). The recovery in H2:2020-21 was on the back of revival in government expenditure and fixed investment and easing of the contraction in private consumption. Quarter-on-quarter seasonally adjusted annualised (qoq-SAAR) growth rates, however, moderated in Q3 and Q4 suggesting some flattening of momentum (Chart III.1b).  GDP Projections versus Actual Outcomes The October 2020 Monetary Policy Report (MPR) projected GDP growth at (-) 9.8 per cent for Q2:2020-21, (-) 5.6 per cent for Q3 and 0.5 per cent for Q4, with risks tilted to the downside. Actual outcomes in terms of the NSO’s SAE overshot these projections by 250 and 600 basis points in Q2 and Q3, respectively (Chart III.2), which may be largely attributed to faster than anticipated reduction in new COVID-19 infections in the country. The upside surprise in Q2 and Q3 largely stemmed from a better-than-expected performance in gross fixed capital formation. Data for Q4:2020-21 are expected on May 31, 2021.  III.1.1 Private Final Consumption Expenditure Private final consumption expenditure (PFCE) – the mainstay of aggregate demand, severely dented during the pandemic – revived in H2:2020-21 as spending expanded from essential commodities and services towards discretionary items on the back of gradual relaxation of restrictions. The contraction in real PFCE moderated to 2.4 per cent in Q3 from 11.3 per cent in Q2. Spending on transport, hotels and restaurants, recreation and culture, which together contribute around 20 per cent to PFCE, also began improving in Q4. Several high frequency indicators of private consumption crossed pre-COVID levels, attesting to a broad-based momentum. Drilling down further reveals a divergence between urban and rural demand, with the former suffering the maximum damage and taking longer time to recover due to the loss of employment and heightened uncertainty. Some coincident and proximate high frequency indicators show that urban consumption started inching up from Q3:2020-21 and gained further strength in Q4 with the easing of restrictions. Passenger vehicle sales remained robust since August and posted double-digit growth in January and February 2021, partly reflecting shifting of preferences towards own vehicles over public transportation in the wake of the pandemic. The production of consumer durables, that had collapsed during H1, got revitalised and surpassed pre-COVID levels in December 2020 (Chart III.3a). Credit card outstanding and other personal loans, however, remained subdued (Chart III.3b). Domestic air passenger traffic, is still tepid and around two-third of pre-COVID-19 levels, reflecting lackluster activity related to tourism and entertainment, and with business meetings increasingly preferring the virtual mode.  Rural consumption recouped quickly and remained resilient on the back of record kharif production, sustained employment under the Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA), and cash transfers under PM Kisan Samman Nidhi Yojana and other schemes. The households that sought employment under the MGNREGA scheme were 63 per cent higher in Q3:2020-21 and remained elevated in Q4. Indicators of rural demand – improved rabi acreage during 2020-21; higher production of fertilisers; and accelerated tractor sales during November-February – augur well for a brighter outlook. Motorcycle sales have remained in expansion zone since August 2020 (Chart III.4). The consumer non-durables output witnessed expansion in December 2020, before contracting in January 2021. Unemployment rates in both rural and urban areas recorded declines during H2 and supported private consumption. The labour force participation rate improved considerably in H2 vis-à-vis H1 but remains below pre-COVID levels. Nonetheless, the available data from different sources indicate that employment conditions have improved considerably in H2 (Chart III.5).   III.1.2 Gross Fixed Capital Formation The upturn in fixed investment gained traction during H2:2020-21, although it continues to be weighed down by surplus capacity and uncertainty surrounding the outlook. Congenial financial conditions are expected to continue supporting the recovery in fixed investment (Box III.1). Gross fixed capital formation (GFCF) expanded by 2.6 per cent on year-on-year basis in Q3 and is estimated to rise by 2.8 per cent in Q4. For the full year 2020-21, GFCF is estimated to have contracted by 12.4 per cent, given the sharp downturn in H1. The share of GFCF in aggregate GDP inched up to 32.8 per cent in H2 from 28.5 per cent in H1 and 31.9 per cent in H2:2019-20. Real estate and construction activity gained some momentum from Q3 – particularly in rural and semi-urban areas and affordable segments in urban areas – benefitting from lower mortgage rates, favourable pricing and a slash in stamp duty across several states. Among its proximate coincident indicators, steel consumption rose at a robust pace in January and February 2021 on top of double-digit growth in the preceding two months. Investment in machinery and equipment is also recovering as reflected by imports of capital goods remaining in the positive zone since December 2020 (Chart III.6a). The production of capital goods attained positive territory in December 2020 but shrank in January 2021. The capacity utilisation (CU) in the manufacturing sector improved to 66.6 per cent in Q3 from the previous quarter (Chart III.6b). Seasonally adjusted CU also increased to 65.2 per cent in Q3 from 64.4 per cent in the previous quarter.